Form 20-F PagSeguro Digital Ltd. For: Dec 31

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended December 31, 2018

Commission File Number 1-38353

PAGSEGURO DIGITAL LTD.

(Exact name of registrant as specified in its charter)

The Cayman Islands

(Jurisdiction of incorporation or organization)

Av. Brigadeiro Faria Lima, 1384, 4º andar, parte A

São Paulo, SP, 01451-001, Brazil

(Address of principal executive offices)

Eduardo Alcaro

+55 11 3038 8123 – [email protected]

Av. Brigadeiro Faria Lima, 1384, 4º andar, parte A

São Paulo, SP, 01451-001, Brazil

(Name, telephone, e-mail and/or facsimile

number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Class A common shares, par value US$0.000025 |

New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

As of December 31, 2018, there were 162,168,013 Class A common shares (including treasury shares), par value of US$0.000025 per share, and 165,620,861 Class B common shares, par value of US$0.000025 per share, outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes ☐ | No ☒ |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934.

| Yes ☐ | No ☒ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes ☒ | No ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

| Yes ☒ | No ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | Non-accelerated Filer ☒ | Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | IFRS ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

| Item 17 ☐ | Item 18 ☐ |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Yes ☐ | No ☒ |

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

3 | |||

| 3 | ||||

| 3 | ||||

| 32 | ||||

| 65 | ||||

| 65 | ||||

| 86 | ||||

| 92 | ||||

| 96 | ||||

| 98 | ||||

| 98 | ||||

| ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

120 | |||

| ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

121 | |||

| 121 | ||||

| ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

121 | |||

| 122 | ||||

| 123 | ||||

| 123 | ||||

| 123 | ||||

| 123 | ||||

| ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

124 | |||

| ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

124 | |||

| 124 | ||||

| 125 | ||||

| 126 | ||||

| 126 | ||||

| 126 | ||||

| 126 | ||||

| 128 | ||||

| 131 | ||||

i

Table of Contents

This annual report contains information that constitutes forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, principally under the captions “Item 3. Key Information—Risk Factors, “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects.”

These estimates and forward-looking statements are based mainly on our current expectations and estimates of future events and trends that affect or may affect our business, financial condition, results of operations, cash flow, liquidity, prospects and the trading price of our Class A common shares. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to many significant risks, uncertainties and assumptions and are made in light of information currently available to us.

These statements appear throughout this annual report and include statements regarding our intent, belief or current expectations in connection with:

| • | the inherent risks related to the digital payments market, such as the interruption or failure of our computer or information technology systems; |

| • | our ability to innovate and respond to technological advances and changing customer demands; |

| • | the maintenance of tax incentives; |

| • | our ability to attract and retain qualified personnel; |

| • | general economic, political and business conditions in Brazil, particularly in the geographic markets we serve as well as any other countries we may serve in the future and their impact on our business, notably with respect to inflation; |

| • | labor disputes, employee strikes and other labor-related disruptions, including in connection with negotiations with unions; |

| • | management’s expectations and estimates concerning our future financial performance and financing plans and programs; |

| • | our interest rates and our level of debt and other fixed obligations; |

| • | inflation, appreciation, depreciation and devaluation of the real; |

| • | expenses, ability to generate cash flow, and ability to achieve, and maintain, future profitability; |

| • | our ability to anticipate market needs and develop and introduce new and enhanced products and service functionality to adapt to changes in our industry; |

| • | our anticipated growth and growth strategies and our ability to effectively manage that growth; |

| • | the impact of increased competition in our market, innovation by our competitors, and our ability to compete effectively; |

| • | our ability to successfully enter new markets and manage our expansion; |

| • | our ability to further penetrate our existing client base to grow our ecosystem; |

| • | our expectations concerning relationships with third parties and key suppliers; |

| • | our ability to maintain, protect and enhance our brand and intellectual property; |

| • | the sufficiency of our cash and cash equivalents and cash generated from operations to meet our working capital and capital expenditure requirements; |

| • | our compliance with applicable regulatory and legislative developments and regulations and legislation that currently apply or become applicable to our business; |

| • | other factors that may affect our financial condition, liquidity and results of operations; and |

| • | other risk factors discussed under “Item 3. Key Information—Risk Factors.” |

1

Table of Contents

The words “believe,” “understand,” “may,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “seek,” “intend,” “expect,” “should,” “could,” “forecast” and similar words are intended to identify forward-looking statements. You should not place undue reliance on such statements, which speak only as of the date they were made. We do not undertake any obligation to update publicly or to revise any forward-looking statements after we file this annual report because of new information, future events or other factors. Our independent public auditors have neither examined nor compiled the forward-looking statements and, accordingly, do not provide any assurance with respect to such statements. In light of the risks and uncertainties described above, the future events and circumstances discussed in this annual report might not occur and are not guarantees of future performance. Because of these uncertainties, you should not make any investment decision based upon these estimates and forward-looking statements.

A glossary of industry and other defined terms is included in this annual report, beginning on page 133.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

The following references in this annual report have the meanings shown below:

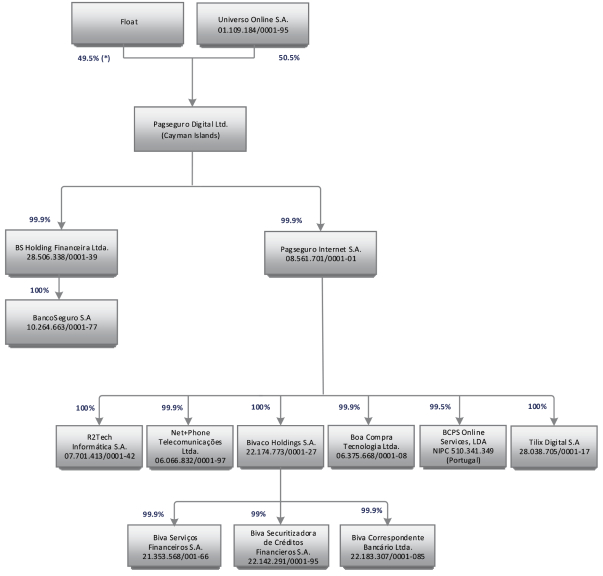

| • | “PagSeguro Digital” or the “Company” mean PagSeguro Digital Ltd. PagSeguro Digital Ltd. is an exempted company with limited liability incorporated under the laws of the Cayman Islands. |

| • | “PagSeguro Brazil” means Pagseguro Internet S.A., our operating company, a sociedade anônima incorporated in Brazil. Pagseguro Internet S.A. is substantially wholly-owned by PagSeguro Digital Ltd. |

| • | “We,” “us” and “our” mean PagSeguro Digital, PagSeguro Brazil and PagSeguro Brazil’s subsidiaries on a consolidated basis. |

| • | “PagSeguro” means our digital payments business, which is operated by PagSeguro Brazil. |

| • | “UOL” means Universo Online S.A., the controlling shareholder, of PagSeguro Digital. For more information regarding UOL, see “Item 7. Major Shareholders and Related Party Transactions.” |

The term “Brazil” refers to the Federative Republic of Brazil and the phrase “Brazilian government” refers to the federal government of Brazil. “Central Bank” refers to Banco Central do Brasil. References in this annual report to “real,” “reais” or “R$” refer to the Brazilian real, the official currency of Brazil and references to “U.S. dollar,” “U.S. dollars” or “US$” refer to U.S. dollars, the official currency of the United States.

This annual report contains various illustrations of our products and services. For convenience, we have translated the text in those illustrations into English. The actual products and services are generally presented to our customers in Portuguese only.

Effect of Rounding

Certain amounts and percentages included in this annual report, including in the section of this annual report entitled “Item 5. Operating and Financial Review and Prospects” have been rounded for ease of presentation. Percentage figures included in this annual report have not been calculated in all cases on the basis of the rounded figures but on the basis of the original amounts prior to rounding. For this reason, certain percentage amounts in this annual report may vary from those obtained by performing the same calculations using the figures in our audited consolidated financial statements. Certain other amounts that appear in this annual report may not sum due to rounding.

2

Table of Contents

Market and Industry Data

This annual report contains data related to economic conditions in the market in which we operate. The information contained in this annual report concerning economic conditions is based on publicly available information from third-party sources that we believe to be reasonable. Data and statistics regarding the Brazilian Internet, payment solutions and e-commerce markets are based on publicly available data published by the Brazilian Association of Credit Card and Services Companies (Associação Brasileira de Empresas de Cartões de Crédito e Serviços, or ABECS); comScore, a cross-platform measurement company that measures audiences, brands and consumer behavior, and provides market and analytical data to clients; Datafolha, a research institute and affiliate of UOL created by Grupo Folha, which conducts statistical surveys, election polling and opinion and market surveys for the market at large; the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística, or IBGE); the World Bank; SEBRAE; Neoway Business Solutions; Webshoppers; and eMarketer; among others. We also make statements in this annual report about our competitive position and the size of the Brazilian digital payments and e-commerce markets.

Although we have no reason to believe any of this information or these reports are inaccurate in any material respect and believe and act as if they are reliable, neither we nor our agents have independently verified it. Governmental publications and other market sources, including those referred to above, generally state that their information was obtained from recognized and reliable sources, but the accuracy and completeness of that information is not guaranteed. In addition, the data that we compile internally and our estimates have not been verified by an independent source. Except as disclosed in this annual report, none of the publications, reports or other published industry sources referred to in this annual report were commissioned by us or prepared at our request. Except as disclosed in this annual report, we have not sought or obtained the consent of any of these sources to include such market data in this annual report.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our IPO, (b) in which we have total annual revenues of at least US$1.07 billion or (c) in which we are deemed to be a large accelerated filer and (2) the date on which we have issued more than US$1.0 billion in non-convertible debt during the prior three-year period. As an emerging growth company, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to, exemptions from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and any Public Company Accounting Oversight Board, or PCAOB, rules, including any future audit rule promulgated by the PCAOB (unless the Securities and Exchange Commission, or SEC, determines otherwise). Accordingly, the information about us available to you will not be the same as, and may be more limited than, the information available to shareholders of a non-emerging growth company.

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

Selected Financial and Operating Data

PagSeguro Digital Ltd., our Cayman Islands company, was incorporated on July 19, 2017 for an indefinite term. Prior to the contribution of Pagseguro Internet S.A. to it on January 4, 2018, PagSeguro Digital Ltd. had not commenced operations and had only nominal assets and liabilities.

Following our IPO on January 23, 2018, PagSeguro Digital began reporting consolidated financial information to shareholders, and PagSeguro Brazil no longer presents consolidated financial statements. PagSeguro Brazil prepares and presents individual financial statements in accordance with Brazilian GAAP, as applicable to payment institutions authorized by the Central Bank.

The following tables summarize financial data for PagSeguro Digital at and for each of the years ended December 31, 2018, 2017, 2016, 2015 and 2014, derived from our audited consolidated financial statements. The selected consolidated financial data as of and for the year ended December 31, 2018, 2017, 2016, 2015 and 2014 derive from our year-end financial statements audited by PricewaterhouseCoopers Auditores Independentes, with offices at Av. Francisco Matarazzo 1400, Torre Torino, São Paulo, SP, Brazil 05001-903, Caixa Postal 61005. These audited consolidated financial statements were prepared in accordance with IFRS, as issued by the IASB. PagSeguro Digital maintains its books and records in reais.

3

Table of Contents

You should read this information in conjunction with the following other information included elsewhere in this annual report:

| • | our audited consolidated financial statements and related notes; and |

| • | the information under “Item 5. Operating and Financial Review and Prospects.” |

The following tables present our selected financial and operating data as of and for each of the periods indicated.

STATEMENT OF OPERATIONS DATA

| For the Years Ended December 31, | ||||||||||||||||||||||||

| 2018 | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||

| (US$)(1) | (R$) | (R$) | (R$) | (R$) | (R$) | |||||||||||||||||||

| (in millions, except amounts per share and %) | ||||||||||||||||||||||||

| Net revenue from transaction activities and other services |

585.1 | 2,267.1 | 1,224.3 | 480.0 | 268.2 | 160.1 | ||||||||||||||||||

| Net revenue from sales |

96.7 | 374.6 | 471.9 | 260.6 | 176.5 | 48.2 | ||||||||||||||||||

| Financial income |

365.1 | 1,414.5 | 818.6 | 392.4 | 219.5 | 115.8 | ||||||||||||||||||

| Other financial income |

71.9 | 278.5 | 8.6 | 5.3 | 10.7 | 1.8 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenue and income |

1,118.7 | 4,334.7 | 2,523.4 | 1,138.4 | 674.9 | 325.8 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Cost of sales and services |

(553.5 | ) | (2,144.7 | ) | (1,324.4 | ) | (623.7 | ) | (382.5 | ) | (142.5 | ) | ||||||||||||

| Selling expenses |

(90.7 | ) | (351.4 | ) | (245.8 | ) | (199.9 | ) | (162.6 | ) | (81.4 | ) | ||||||||||||

| Administrative expenses |

(150.1 | ) | (581.7 | ) | (153.2 | ) | (84.5 | ) | (61.1 | ) | (51.3 | ) | ||||||||||||

| Financial expenses |

(8.1 | ) | (31.2 | ) | (104.5 | ) | (68.3 | ) | (29.7 | ) | (11.1 | ) | ||||||||||||

| Other (expenses) income, net |

(2.1 | ) | (8.1 | ) | (12.0 | ) | (6.7 | ) | 1.3 | (3.3 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Profit before Income Taxes |

314.2 | 1,217.6 | 683.5 | 155.4 | 40.3 | 36.2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Current income tax and social contribution |

(46.7 | ) | (180.9 | ) | (215.0 | ) | (7.4 | ) | (2.6 | ) | (9.9 | ) | ||||||||||||

| Deferred income tax and social contribution |

(32.6 | ) | (126.3 | ) | 10.3 | (20.1 | ) | (2.2 | ) | 1.0 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income Tax and Social Contribution |

(79.3 | ) | (307.2 | ) | (204.7 | ) | (27.6 | ) | (4.8 | ) | (8.9 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Income for the Year |

235.0 | 910.4 | 478.8 | 127.8 | 35.5 | 27.2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Attributable to: |

||||||||||||||||||||||||

| Owners of PagSeguro Digital |

234.7 | 909.3 | 478.8 | 127.2 | 35.1 | 26.0 | ||||||||||||||||||

| Non-controlling interests |

0.3 | 1.1 | — | 0.6 | 0.4 | 1.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Basic earnings per common share – R$ |

0.7388 | 2.8625 | 1.8254 | 0.4849 | 0.1338 | 0.0990 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Diluted earnings per common share – R$ |

0.7376 | 2.8582 | 1.8254 | 0.4849 | 0.1338 | 0.0990 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | For convenience purposes only, amounts in reais for the year ended December 31, 2018 have been translated to U.S. dollars using a rate of R$3.8748 to US$1.00, the commercial selling rate for U.S. dollars at December 31, 2018 as reported by the Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or at any other exchange rate. See “—Exchange Rates” below for further information about recent fluctuations in exchange rates. |

OPERATING DATA

| At and For the Years Ended December 31, | ||||||||||||||||||||||||

| 2018(1) | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||

| Operating Statistics: |

||||||||||||||||||||||||

| Active merchants at year-end (in millions) |

— | 4.1 | 2.8 | 1.4 | 0.9 | 0.5 | ||||||||||||||||||

| TPV (in billions) |

US$19.7 | R$76.1 | R$38.5 | R$14.1 | R$7.4 | R$3.7 | ||||||||||||||||||

| Average spending per active merchant |

US$5,675 | R$21,988 | R$18,013 | R$12,401 | R$11,046 | R$10,449 | ||||||||||||||||||

| (1) | For convenience purposes only, amounts in reais for the year ended December 31, 2018 have been translated to U.S. dollars using a rate of R$3.8748 to US$1.00, the commercial selling rate for U.S. dollars at December 31, 2018 as reported by the Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or at any other exchange rate. See “—Exchange Rates” below for further information about recent fluctuations in exchange rates. |

4

Table of Contents

BALANCE SHEET DATA

The following table presents key line items from PagSeguro Digital’s consolidated balance sheet data:

| At December 31, | ||||||||||||||||||||||||

| 2018 | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||

| (US$)(1) | (R$) | (R$) | (R$) | (R$) | (R$) | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Current Assets |

||||||||||||||||||||||||

| Cash and cash equivalents |

713.1 | 2,763.1 | 66.8 | 80.0 | 6.9 | 1.2 | ||||||||||||||||||

| Financial investments |

— | — | 210.1 | 131.2 | — | — | ||||||||||||||||||

| Note receivables |

2,091.6 | 8,104.7 | 3,522.3 | 1,715.5 | 1,110.0 | 665.9 | ||||||||||||||||||

| Receivables from related parties |

— | — | 124.7 | 300.8 | 55.9 | 84.3 | ||||||||||||||||||

| Inventories |

22.9 | 88.6 | 61.6 | 21.0 | 41.2 | 16.1 | ||||||||||||||||||

| Taxes recoverable |

16.9 | 65.7 | 14.4 | 17.7 | 5.8 | 6.7 | ||||||||||||||||||

| Other receivables |

5.2 | 20.1 | 28.0 | 4.5 | 21.0 | 4.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Current Assets |

2,849.7 | 11,042.1 | 4,028.0 | 2,270.8 | 1,240.8 | 778.6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-Current Assets |

||||||||||||||||||||||||

| Judicial deposits |

0.4 | 1.5 | 0.9 | 0.5 | 0.4 | 0.5 | ||||||||||||||||||

| Prepaid expenses |

0.2 | 1.0 | 0.1 | 0.1 | 0.4 | — | ||||||||||||||||||

| Deferred income tax and social contribution |

— | — | 37.0 | 8.3 | 6.7 | 8.1 | ||||||||||||||||||

| Property and equipment |

17.3 | 67.1 | 10.9 | 4.6 | 3.8 | 1.9 | ||||||||||||||||||

| Intangible assets |

78.9 | 305.6 | 158.9 | 86.1 | 48.6 | 28.5 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Non-Current Assets |

96.8 | 375.2 | 207.8 | 99.7 | 59.9 | 39.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| TOTAL ASSETS |

2,946.5 | 11,417.3 | 4,235.8 | 2,370.4 | 1,300.7 | 817.6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| At December 31, | ||||||||||||||||||||||||

| 2018 | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||

| (US$)(1) | (R$) | (R$) | (R$) | (R$) | (R$) | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Current Liabilities |

||||||||||||||||||||||||

| Payables to third parties |

1,116.0 | 4,324.2 | 3,080.6 | 1,304.0 | 683.1 | 369.9 | ||||||||||||||||||

| Trade payables |

42.6 | 165.2 | 92.4 | 61.7 | 35.3 | 3.5 | ||||||||||||||||||

| Payables to related parties |

7.9 | 30.8 | 39.1 | 76.2 | 92.4 | — | ||||||||||||||||||

| Derivative financial instruments |

— | — | — | 6.6 | — | — | ||||||||||||||||||

| Borrowings |

— | — | — | 205.2 | — | — | ||||||||||||||||||

| Salaries and social charges |

19.1 | 73.9 | 34.3 | 20.3 | 13.7 | 0.4 | ||||||||||||||||||

| Taxes and contributions |

20.7 | 80.1 | 52.1 | 6.9 | 3.0 | 2.8 | ||||||||||||||||||

| Provision for contingencies |

1.8 | 7.0 | 4.6 | 0.7 | — | 1.6 | ||||||||||||||||||

| Dividends payable and interest on own capital |

— | — | — | 22.2 | 3.2 | 3.1 | ||||||||||||||||||

| Other payables |

7.6 | 29.5 | 15.9 | 15.2 | 1.8 | 4.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Current Liabilities |

1,215.7 | 4,710.8 | 3,319.0 | 1,719.2 | 832.5 | 385.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-Current Liabilities |

||||||||||||||||||||||||

| Deferred income tax and social contribution |

34.1 | 132.1 | 42.8 | 24.4 | 6.3 | 5.4 | ||||||||||||||||||

| Provision for contingencies |

— | — | 3.6 | — | — | 0.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Non-Current Liabilities |

34.1 | 132.1 | 46.4 | 24.4 | 6.3 | 5.7 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| TOTAL LIABILITIES |

1,249.8 | 4,842.9 | 3,365.4 | 1,743.5 | 838.8 | 391.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| TOTAL EQUITY |

1,696.7 | 6,574.4 | 870.4 | 626.9 | 461.9 | 426.6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| TOTAL LIABILITIES AND EQUITY |

2,946.5 | 11,417.3 | 4,235.8 | 2,370.4 | 1,300.7 | 817.6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | For convenience purposes only, amounts in reais for the year ended December 31, 2018 have been translated to U.S. dollars using a rate of R$3.8748 to US$1.00, the commercial selling rate for U.S. dollars at December 31, 2018 as reported by the Central Bank. These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or at any other exchange rate. See “—Exchange Rates” below for further information about recent fluctuations in exchange rates. |

5

Table of Contents

NON-GAAP FINANCIAL MEASURES

We present non-GAAP financial measures when we believe that the additional information is useful and meaningful to investors. These non-GAAP financial measures are provided to enhance investors’ overall understanding of our current financial performance and its prospects for the future. Specifically, we believe the non-GAAP financial measures provide useful information to both management and investors by excluding certain expenses, gains and losses, as the case may be, that may not be indicative of our core operating results and business outlook.

These measures may be different from non-GAAP financial measures used by other companies. The presentation of this non-GAAP financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered separately from, or as a substitute for, our financial information prepared and presented in accordance with IFRS. Non-GAAP financial measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with IFRS. These measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP financial measures.

Reconciliation of Non-GAAP Financial Measures

The following table presents a reconciliation of our non-GAAP financial measures to the most directly comparable GAAP measures for the year ended December 31, 2018:

| For the Twelve Months Ended December 31, |

||||

| 2018 | ||||

| (in millions of reais, except for amounts per share) |

||||

| Total revenue and income |

4,334.7 | |||

| Less: Foreign exchange gain on IPO and follow-on offering primary share proceeds |

(131.3 | ) | ||

|

|

|

|||

| Non-GAAP total revenue and income(1) |

4,203.4 | |||

|

|

|

|||

| Total expenses |

(3,117.1 | ) | ||

| Less: Share-based long-term incentive plan (LTIP) |

419.3 | |||

| Less: Tax related to remittance of IPO and follow-on primary share proceeds (IOF tax) |

18.0 | |||

|

|

|

|||

| Non-GAAP total expenses(2) |

(2,679.8 | ) | ||

|

|

|

|||

| Profit before taxes |

1,217.6 | |||

| Plus: Total non-GAAP Adjustments |

306.0 | |||

|

|

|

|||

| Non-GAAP profit before taxes(3) |

1,523.6 | |||

|

|

|

|||

| Income tax and social contribution |

(307.2 | ) | ||

| Less: Income tax and social contribution on non-GAAP adjustments |

(148.7 | ) | ||

|

|

|

|||

| Non-GAAP deferred income tax(4) |

(455.9 | ) | ||

|

|

|

|||

6

Table of Contents

| For the Twelve Months Ended December 31, |

||||

| 2018 | ||||

| (in millions of reais, except for amounts per share) |

||||

| Net income |

910.4 | |||

| Plus: Total non-GAAP adjustments |

157.3 | |||

|

|

|

|||

| Non-GAAP net income(5) |

1,067.7 | |||

|

|

|

|||

| Basic earnings per common share—R$ |

2.8625 | |||

| Diluted earnings per common share—R$ |

2.8582 | |||

|

|

|

|||

| Non-GAAP basic earnings per common share—R$(6) |

3.3578 | |||

| Non-GAAP diluted earnings per common share—R$(6) |

3.3527 | |||

|

|

|

|||

| (1) | Non-GAAP total revenue and income excludes a foreign exchange gain on our January 2018 IPO proceeds and June 2018 follow-on offering proceeds in the amount of R$131.3 million in the year ended December 31, 2018, which relates to the impact of exchange rate variation on the conversion from U.S. dollars into Brazilian reais of the proceeds from our IPO and our June 2018 follow-on offering. We exclude this foreign exchange variation from our non-GAAP measures primarily because it is unusual income. The foreign exchange gain on our January 2018 IPO proceeds and June 2018 follow-on offering proceeds is included within Other financial income. Other financial income in the amount of R$278.4 million is therefore adjusted by excluding the foreign exchange gain on our January 2018 IPO proceeds and June 2018 follow-on offering proceeds, resulting in non-GAAP Other financial income in the amount of R$147.2 million. |

| (2) | Non-GAAP total expenses excludes: |

| (a) | Stock-based compensation expenses in the total amount of R$419.3 million, consisting of expenses for equity awards under the LTIP. We exclude stock-based compensation expenses from our non-GAAP financial measures primarily because they are non-cash expenses and they depend on our stock price and the exchange rate from U.S. dollars into Brazilian reais at the time of the vesting of the equity awards. The related employer payroll taxes depend on our stock price and the exchange rate from U.S. dollars into Brazilian reais at the time of the exercises and the vesting date of the equity awards, over which management has limited to no control, and as such management does not believe these expenses correlate to the operation of our business. The total of stock-based compensation expenses is allocated between Cost of sales and services, Administrative expenses and Selling expenses. Excluding the stock-based compensation expenses, Cost of sales and services in the amount of R$2,144.7 million is adjusted by R$58.8 million resulting in non-GAAP Cost of sales and services of R$2,084.9 million; Administrative Expenses in the amount of R$581.7 million is adjusted by R$359.2 million resulting in non-GAAP Administrative expenses of R$222.5 million; and Selling expenses in the amount of R$351.4 million is adjusted by R$0.3 million resulting in non-GAAP Selling expense of R$351.1 million. |

| (b) | Tax related to remittance of January 2018 IPO proceeds and June 2018 follow-on offering proceeds (IOF tax) in the amount of R$18.0 million in the year ended December 31, 2018, which represents the impact of Brazilian IOF tax (currency remittance tax) payable when we remitted the proceeds from our sale of new shares in our IPO and our June 2018 follow-on offering from the Cayman Islands to Brazil. We exclude this IOF tax on the remittance of January 2018 IPO proceeds and June 2018 follow-on offering proceeds from our non-GAAP measures primarily because it is an unusual expense. The IOF tax is fully allocated to Financial expenses. Financial expenses in the amount of R$31.2 million is therefore adjusted by excluding the IOF tax, resulting in non-GAAP Financial expenses in the amount of R$13.2 million. |

| (3) | Non-GAAP Profit before taxes is equal to the sum of the adjustments described in footnotes (1) and (2) above. |

| (4) | Non-GAAP Income tax and social contribution consists of income tax at the rate of 34% calculated on the non-GAAP adjustments described in footnotes (1) and (2) above, other than the foreign exchange gain on our January 2018 IPO proceeds and June 2018 follow-on offering proceeds of R$131.3 million, which is not taxable, and the tax benefits related to other non-GAAP adjustments. |

| (5) | Non-GAAP Net income is equal to the sum of the adjustments described in footnotes (1), (2) and (4) above. |

| (6) | Non-GAAP Basic earnings per common share and non-GAAP Diluted earnings per common share reflect the adjustments to non-GAAP Net income, which is allocated in full to Owners of the Company. |

7

Table of Contents

Financial Information U.S. Dollars

We have translated some of the real amounts included in this annual report into U.S. dollars. You should not construe these translations as representations by us that the amounts actually represent these U.S. dollar amounts or could be converted into U.S. dollars at the rates indicated. Unless otherwise indicated, we have translated real amounts into U.S. dollars using a rate of R$3.8748 to US$1.00, the commercial selling rate for U.S. dollars at December 31, 2018 as reported by the Central Bank. See “—Exchange Rates” below for more information regarding the real/U.S. dollar exchange rate.

RISK FACTORS

Risks Relating to Our Business and Industry

If we cannot keep pace with rapid technological developments to provide new and innovative products and services, and address the rapidly evolving market for transactions on mobile devices, the use of our products and services and, consequently, our revenues could decline.

Rapid, significant and disruptive technological changes continue to impact the industries in which we operate, including developments in payment card tokenization, mobile payments, social commerce (i.e., e-commerce through social networks), authentication, virtual currencies, distributed ledger or blockchain technologies, near field communication and other proximity or contactless payment methods, virtual reality, machine learning and artificial intelligence.

For instance, mobile devices are increasingly used for e-commerce transactions and payments. A significant and growing portion of our customers access our platforms through mobile devices, including for regular online shopping as well as for in-person transactions. In the year ended December 31, 2018, 61% of our customers accessed our platforms through mobile devices, compared with 44% in the year ended December 31, 2017. We may lose customers if we are not able to continue to meet our customers’ mobile and multi-screen experience expectations. Different mobile devices and platforms use a wide variety of technical and other configurations, which increase the challenges involved in providing payments in the mobile environment. In addition, a number of other companies with significant resources and a number of innovative startups have introduced products and services focusing on mobile markets. We cannot guarantee that we will be able to continue to meet customer expectations in the mobile environment or increase our volume of mobile transactions.

We cannot predict the effects of technological changes on our business. In addition to our own initiatives and innovations, we rely in part on third parties for the development of and access to new technologies. We expect that new services and technologies applicable to the industries in which we operate will continue to emerge and may be superior to, or render obsolete, the technologies we currently use in our products and services. Developing and incorporating new technologies into our products and services may require substantial expenditures, take considerable time, and ultimately may not be successful. In addition, our ability to adopt new products and services and develop new technologies may be inhibited by industry-wide standards, payment networks, changes to laws and regulations, resistance to change from consumers or merchants, third-party intellectual property rights, or other factors. Our success will depend on our ability to develop and incorporate new technologies, address the challenges posed by the rapidly evolving market for mobile transactions through our platforms and adapt to technological changes and evolving industry standards; if we are unable to do so in a timely or cost-effective manner, our business could be harmed.

8

Table of Contents

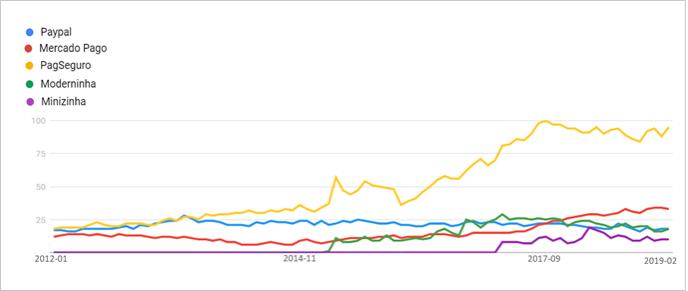

Substantial and increasingly intense competition, both within our industry and from other payment methods, may harm our business.

We compete in markets characterized by vigorous competition, changing technology, changing customer needs, evolving industry standards and frequent introductions of new products and services. We compete with existing providers of digital payment solutions, in-person payments via POS, free digital accounts, prepaid cards and acquisition activities. In the online digital payments market, we compete primarily with international online payment services, such as PayPal, and regional players, such as MercadoPago from MercadoLibre and MoIP/Wirecard. In the POS payments market, we compete primarily with international players, such as SumUp/Payleven, and regional players, such as MercadoPago from MercadoLibre. As is the case with the digital payments industry in general, we also compete with other means of payment, both digital and traditional, including cash, checks, money orders and electronic bank deposits.

We expect competition to intensify in the future as existing and new competitors introduce new services or enhance existing services. We compete against many companies to attract customers, and some of these companies have greater financial resources and substantially larger bases of customers than we do, which may provide them with significant competitive advantages. These companies may devote greater resources than we do to the development, promotion and sale of products and services, and they may be more effective in introducing innovative products and services that hinder our growth. Competing services tied to established banks and other financial institutions may offer greater liquidity and create greater consumer confidence in the safety and efficiency of their services than PagSeguro. Mergers and acquisitions by or among these companies may lead to even larger competitors with more resources. We also expect new entrants to offer competitive products and services. For example, established banks and other financial institutions currently offer online payments and those which do not yet provide such services could quickly and easily develop them. Certain merchants have longstanding exclusive, or nearly exclusive, relationships with our competitors to accept payment cards and other services that we offer. These relationships may make it difficult or cost prohibitive for us to conduct material amounts of business with them. If we are unable to differentiate ourselves from and successfully compete with our competitors, our business will suffer serious harm.

We may also face pricing pressures from competitors. Certain competitors are able to offer lower prices to merchants for similar services by cross-subsidizing their digital payments services using other services they offer. This competition may mean we need to reduce our pricing, which could reduce our profits. As they grow, merchants may demand more customized and favorable pricing from us, and competitive pressures may require us to agree to this, further reducing our profits. If market conditions require us to increase the discounts or incentives we provide, our business could suffer serious harm.

Interruption or failure of our information technology and communications systems could impair our operations, which could damage our reputation and harm our results of operations.

Our success and ability to process payments and provide high quality customer service depend on the efficient and uninterrupted operation of our computer and information technology systems. Any failure of our computer systems and information technology to operate effectively or to integrate with other systems, performance inadequacy or breach in security may cause interruptions in the availability of our sites, delays in product fulfilment and reduced efficiency of our operations. Any failures, problems or security breaches may mean that fewer customers are willing to purchase the products we offer in the future. Factors that could occur and significantly disrupt our operations include: system failures and outages caused by fire, floods, earthquakes, power loss, telecommunications failures, sabotage, vandalism, terrorist attacks and similar events, software errors, computer viruses, worms, physical or electronic break-ins and similar disruptions from unauthorized tampering with our computer systems and data centers; in addition, security breaches related to the storage and transmission of proprietary information or customer information, such as credit card numbers or other personal information. Also, if too many customers access our sites within a short period of time due to any reason, we have experienced in the past and may in the future experience system interruptions that make our sites unavailable or prevent us from efficiently completing payment transactions, which may reduce the attractiveness of our products and services. We cannot assure you that such events will not occur. While we have backup systems and contingency plans for certain aspects of our operations and business processes, our planning does not account for all possible scenarios.

9

Table of Contents

Specifically, we have contracted with one party, UOL Diveo, to provide us with Internet data centers to host our sites and keep them operational, and we rely on it and its operational, privacy and security procedures and controls and its ability to keep our sites operational. UOL Diveo is controlled by our parent company UOL and is therefore an affiliate of our company. Failure by UOL Diveo to adequately keep our sites operational, including any prolonged or unscheduled service disruption that affects our customers’ ability to utilize our sites, could result in the loss of sales and customers and/or increased costs, which could materially affect our reputation or results of operations. In addition, we rely in part on UOL Diveo to advise us of any security breaches. If UOL Diveo does not provide notice on a timely basis, our reputation and results of operations may be harmed. We may not be able to timely replace UOL Diveo, or find a replacement on a cost-efficient basis, in the event of disruptions, failures to provide services or other issues with it that may harm our business. For more information on our agreement with UOL Diveo, see “Item 7. Major Shareholders and Related Party Transactions—Related Party Transactions.”

Any disruptions or service interruptions that affect our sites could damage our reputation, require us to spend significant capital and other resources and expose us to a risk of loss or litigation and possible liability. Some of our agreements with third-party service providers do not require those providers to indemnify us for losses resulting from any disruption in service. Any of the above disruptions could seriously harm our results of operations.

Our business is subject to cyberattacks and security and privacy breaches.

Our business involves the collection, storage, processing and transmission of customers’ personal data, including financial information. In addition, a significant number of our customers authorize us to bill their payment card or bank accounts directly for all transaction and other fees charged by us. We have built our reputation on the premise that our platform offers customers a secure way to make payments. An increasing number of organizations, including large merchants and businesses, other large technology companies, financial institutions and government institutions, have disclosed breaches of their information security systems, some of which have involved sophisticated and highly targeted attacks, including on portions of their websites or infrastructure.

The techniques used to obtain unauthorized, improper or illegal access to our systems, our data or our customers’ data, to disable or degrade service, or to sabotage systems are constantly evolving, may be difficult to detect quickly and often are not recognized until launched against a target. Unauthorized parties may attempt to gain access to our systems or facilities through various means, including, among others, hacking into our systems or those of our customers, partners or vendors, or attempting to fraudulently induce our employees, customers, partners, vendors or other users of our systems into disclosing user names, passwords, payment card information or other sensitive information, which may in turn be used to access our information technology systems. Certain efforts may be supported by significant financial and technological resources, making them even more sophisticated and difficult to detect. Although we have developed systems and processes that are designed to protect our data and customer data and to prevent data loss and other security breaches, and expect to continue to expend significant additional resources to bolster these protections, these security measures cannot provide absolute security. Our information technology and infrastructure may be vulnerable to cyberattacks or security breaches, and third parties may be able to access our customers’ personal or proprietary information and card data that are stored on or accessible through those systems. Our security measures may also be breached due to human error, malfeasance, system errors or vulnerabilities, or other irregularities. Any actual or perceived breach of our security could interrupt our operations, result in our systems or services being unavailable, result in improper disclosure of data, materially harm our reputation and brand, result in significant legal and financial exposure, lead to loss of customer confidence in, or decreased use of, our products and services, and adversely affect our business and results of operations. In addition, any breaches of network or data security at our customers, partners or vendors (including data center and cloud computing providers) could have similar negative effects. Actual or perceived vulnerabilities or data breaches may lead to claims against us.

In addition, under card rules and our contracts with our card processors, if there is a breach of card information that we store, we could be liable to the payment card issuers for their cost of issuing new cards and related expenses. We also expect to spend significant additional resources to protect against security or privacy breaches, and may be required to address problems caused by breaches. Additionally, while we maintain insurance policies, we do not maintain insurance policies specifically for cyber-attacks and our current insurance policies may not be adequate to reimburse us for losses caused by security breaches, and we may not be able to collect fully, if at all, under these insurance policies.

10

Table of Contents

Currently, several rules, such as the Federal Constitution, the Consumer Protection Code and the Internet Civil Registry regulate personal data processing in Brazil. Efforts to protect personal data created and/or made available in our systems may not guarantee that these protections are fully adequate and that they fully comply with the rules established by the current legislation. Failure to comply with certain provisions of applicable law, especially as regards (i) providing clear information on the data processing operations we perform, (ii) respect for the purpose of the original data collection; (iii) legal deadlines for the storage and exclusion of user data, and (iv) the adoption of legally required security standards for the preservation and inviolability of the processed personal data, can give rise to penalties, such as fines and even temporary or permanent suspension of our personal data processing activities.

Data protection and privacy laws in Brazil are changing to take into account cultural and local consumer attitudes towards personal data protection. There can be no guarantee that we will have sufficient financial resources to comply with any new regulations or successfully compete in the context of a shifting regulatory environment.

In 2017, Law No. 13,709/2018, the General Data Protection Act (Lei Geral de Proteção de Dados), or GDPA, was signed, which will come into force in August 2020 and will change personal data protection in Brazil. The GDPA establishes a new legal framework covering personal data processing, including client, supplier and employee data. The GDPA establishes, among others, personal data owners’ rights, the legal basis for personal data protection, requirements for obtaining consent from data owners, obligations and requirements related to security incidents, data leaks and data transfers, as well as the creation of the National Data Protection Authority.We have begun initial preparations to comply with the GDPA ahead of its August 2020 effective date, however we may have difficulty adapting our systems and processes to the new legislation due to the legislation’s complexity. In the event of non-compliance with the GDPA, we may be subject to penalties including information disclosure to authorities, elimination of personal data and a fine, per infraction, of up to 2% (subject to an upper limit of R$50,000,000) of our billings in Brazil during the last fiscal year, excluding taxes.

The GDPA and other laws and regulations that may be passed in the future may be interpreted and applied differently over time and from jurisdiction to jurisdiction. It is possible they will be interpreted and applied in ways that will materially and adversely affect our business. Any failure to comply with (i) our privacy policies, (ii) any regulatory requirements or orders, (iii) or other local, state, federal, or international privacy or consumer protection-related laws and regulations could materially and adversely affect our business.

Our services must integrate with a variety of operating systems and networks, and the hardware that enables merchants to accept payment cards must interoperate with mobile networks offered by telecom operators and third-party mobile devices utilizing those operating systems. If we are unable to ensure that our services or hardware interoperate with such networks, operating systems and devices, our business may be seriously harmed.

We are dependent on the ability of our products and services to integrate with a variety of operating systems and networks, as well as web browsers that we do not control. Any changes in these systems or networks that degrade the functionality of our products and services, impose additional costs or requirements on us, or give preferential treatment to competitive services, including their own services, could seriously harm the levels of usage of our products and services. We also rely on bank platforms to process some of our transactions. If there are any issues with or service interruptions in these bank platforms, users may be unable to have their transactions completed, which would seriously harm our business.

In addition, our hardware interoperates with mobile networks offered by telecom operators and mobile devices developed by third parties. Changes in these networks or in the design of these mobile devices may limit the interoperability of our hardware with such networks and devices and require modifications to our hardware. If we are unable to ensure that our hardware continues to interoperate effectively with such networks and devices, or if doing so is costly, our business may be seriously harmed.

11

Table of Contents

Our business depends on a strong and trusted brand, and any failure to maintain, protect and enhance our brand would harm our business.

We have developed a strong and trusted brand, highly linked to the reputation and public image of UOL, our controlling shareholder, which has contributed significantly to the success of our business. Our brand is predicated on the idea that sellers and buyers will trust us and find value in building and growing their businesses with our products and services. Maintaining, protecting and enhancing our brand are critical to expanding our base of sellers, buyers and other third-party partners, as well as increasing engagement with our products and services. This will depend largely on our ability to maintain trust, be a technology leader, and continue to provide high-quality and secure products and services. Any negative publicity about our industry, our company or UOL, our controlling shareholder, the quality and reliability of our products and services, our risk management processes, changes to our products and services, our ability to effectively manage and resolve seller and buyer complaints, our privacy and security practices, litigation, regulatory activity, the experience of sellers and buyers with our products or services, and changes in the public opinion of UOL, could harm our reputation and the confidence in and use of our products and services. Harm to our brand can arise from many sources, including failure by us or our partners to satisfy expectations of service and quality; inadequate protection of sensitive information; compliance failures and claims; litigation and other claims; employee misconduct; and misconduct by our partners, service providers or other counterparties. If we do not successfully maintain a strong and trusted brand, our business could be seriously harmed.

Our business is subject to extensive government regulation and oversight and our status under these regulations may change. Violation of or compliance with present or future regulation could be costly, expose us to substantial liability and force us to change our business practices, any of which could seriously harm our business and results of operations.

In December 2014, PagSeguro Brazil applied for authorizations from the Central Bank relating to three of our digital payments activities, and those authorizations were formally approved on October 17, 2018. The activities involved are the PagSeguro digital account, our issuance of PagSeguro prepaid cards, and our activities as an acquirer. We applied for these authorizations because those businesses began to be regulated by Brazilian Federal Law No. 12,865/2013. PagSeguro Brazil also applied in February 2019 to the Central Bank for authorization to conduct activities as a payment institution in order to act as an issuer of post-paid cards within third-party payment schemes. This authorization was formally approved on March 16, 2019.

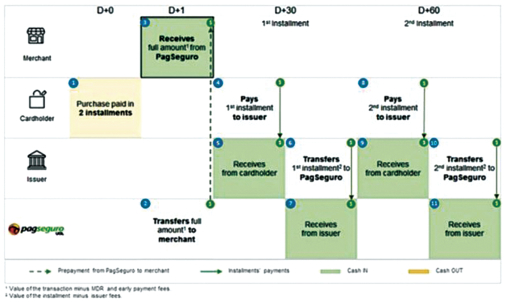

In addition, the early payment of receivables feature that we offer merchants makes up a significant portion of our activities. Law No. 12,865/2013 prohibits payment institutions such as PagSeguro Brazil from performing activities that are restricted to financial institutions. There is some debate under Brazilian law as to whether providing early payment of receivables to merchants could be characterized as “lending,” which is an activity that is restricted to financial institutions. Similarly, there is some debate as to whether the discount rates applicable to this early payment feature should be considered as “interest,” in which case the limits set by the Brazilian Usury Law would apply to these rates. If new laws are enacted or the courts’ interpretation of this activity changes, either preventing us from providing this feature or limiting the fees we usually charge, our financial performance could be negatively affected. For further information regarding these regulatory matters, see “Item 4. Information on the Company—Regulation—Regulation of the digital payments industry in Brazil.”

Furthermore, if we are found to be in violation of any current or future regulations, we could be (i) required to pay substantial fines (including per transaction fines) and disgorgement of our profits, (ii) required to change our business practices or (iii) subjected to insolvency procedures such as an intervention by the Central Bank and the out-of-court liquidation of PagSeguro Brazil. We could also be subject to private lawsuits. Any of these consequences could seriously harm our business and results of operations.

We are subject to costs and risks associated with increased or changing laws and regulations affecting our business, including those relating to the sale of consumer products. Specifically, developments in data protection and privacy laws could harm our business, financial condition or results or operations.

We operate in a complex regulatory and legal environment that exposes us to compliance and litigation risks and that could materially affect our results of operations. These laws may change, sometimes significantly, as a result of political, economic or social events. Some of the federal, state or local laws and regulations that affect us include: those relating to consumer products, product liability or consumer protection; those relating to the manner in which we advertise, market or sell products; labor and employment laws, including wage and hour laws; tax laws or interpretations thereof; data protection and privacy laws and regulations; and securities and exchange laws and regulations. For instance, data protection and privacy laws are developing to take into account the changes in cultural and consumer attitudes towards the protection of personal data. There can be no guarantee that we will have sufficient financial resources to comply with any new regulations or successfully compete in the context of a shifting regulatory environment. Any additional privacy laws or regulations could seriously harm our business, financial condition or results of operations.

12

Table of Contents

Changes in tax laws, tax incentives, benefits or differing interpretations of tax laws may harm our results of operations.

Changes in tax laws, regulations, related interpretations and tax accounting standards in Brazil, the Cayman Islands or the United States may result in a higher tax rate on our earnings, which may significantly reduce our profits and cash flows from operations. For example, in 2015 the Brazilian government increased the rate of PIS/COFINS tax (which is a social contribution on gross revenues) from 0% to 4.65% on financial income realized by Brazilian companies that are taxed under the non-cumulative regime (which is the tax regime that applies to us). In addition, our results of operations and financial condition may decline if certain tax incentives are not retained or renewed. For example, Brazilian Law No. 11,196 currently grants tax benefits to companies that invest in research and development, which significantly reduces our annual income tax expense. If the taxes applicable to our business increase or any tax benefits are revoked and we cannot alter our cost structure to pass our tax increases on to customers, our financial condition, results of operations and cash flows could be seriously harmed. Our payment processing activities are also subject to a Municipal Tax on Services (Imposto Sobre Serviços, or ISS). Any increases in ISS rates would also harm our profitability.

In addition, Brazilian government authorities at the federal, state and local levels are considering changes in tax laws in order to cover budgetary shortfalls resulting from the recent economic downturn in Brazil. If these proposals are enacted they may harm our profitability by increasing our tax burden, increasing our tax compliance costs, or otherwise affecting our financial condition, results of operations and cash flows. Tax rules in Brazil, particularly at the local level, change regularly, and it is common for taxpayers to challenge such changes, which may result in additional tax assessments and penalties for our company.

In this sense, we are involved in tax proceedings based on differences of interpretation between us and the Brazilian tax authorities regarding tax laws and regulations. For further information, see “Item 8. Financial Information—Tax and Social Security Proceedings.”

Our financial success is sensitive to the method consumers choose to make payments, since these methods differ in profitability. Our profitability could be harmed if the proportion of our business funded using less profitable methods goes up.

We pay transaction fees to card schemes, banks and other intermediaries that vary according to the method chosen by consumers to fund payment transactions. These transaction fees are higher when consumers fund payments using credit cards, and lower when consumers fund payments with debit cards. Transaction fees are nominal when customers fund payment transactions by digital transfer of funds from bank accounts, and we pay no fees when customers fund payment transactions from an existing PagSeguro account balance. Our financial success is therefore sensitive to changes in the proportion of our business funded by consumers using credit and debit cards, which would increase our costs if we were unable to adjust the rates we charge our customers accordingly. Consumers may resist funding payments by digital transfer from bank accounts because of the incentives offered by credit cards, for example, or general concerns about providing bank account information to a third party.

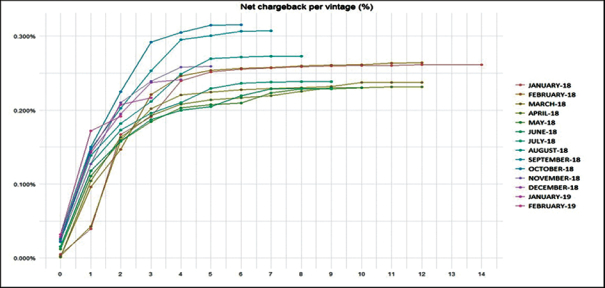

Failure to deal effectively with fraud, fictitious transactions, bad transactions or negative customer experiences would increase our loss rate and harm our business, and could severely diminish merchant and consumer confidence in and use of our services.

We incur losses and expenses due to claims from consumers that merchants have not performed or that their goods or services do not match the merchant’s description. We seek to recover these losses and expenses from the merchant, but may not be able to recover them in full when the merchant is unwilling or unable to pay. We also incur losses and expenses from claims that the consumer did not authorize the purchase, from consumer fraud and from erroneous transmissions. In addition, if the losses we incur related to card transactions become excessive, they could potentially result in a loss of our right to accept cards for payment. In the event that we were unable to accept cards, the number of transactions processed through our platform would decrease substantially and our business would be harmed. We are also subject to the risk of fraudulent activity by merchants, consumers of products purchased through our platform, or third parties handling our user information. We take measures to detect and reduce the risk of fraud, but these measures need to be continually improved and may not be effective against new and continually evolving forms of fraud or in connection with new product offerings. If these measures do not succeed, our business could be harmed.

13

Table of Contents

We rely on third parties in many aspects of our business, which creates additional risk.

We rely on third parties in many aspects of our business, including, among others:

| • | networks, banks, payment processors, and payment gateways that link us to the payment card and bank clearing networks to process transactions; |

| • | third parties that provide certain outsourced customer support and product development functions, which are critical to our operations; and |

| • | third parties that provide facilities, infrastructure, components and services, including data center facilities and cloud computing. |

The third parties that we rely on to process transactions may fail or refuse to process transactions adequately. Any of the third parties we use may breach their agreements with us, refuse to renew these agreements on commercially reasonable terms, take actions that degrade the functionality of our services, impose additional costs or requirements on us, or give preferential treatment to competing services. Financial or regulatory issues, labor issues, or other problems that prevent these third parties from providing services to us or our customers could harm our business. If our service providers do not perform satisfactorily, our operations could be disrupted, which could result in customer dissatisfaction, damage our reputation, and harm our business.

In particular, we rely on UOL, our largest shareholder, and its subsidiaries for a number of business services, particularly: data storage services; telecommunications services; internet security services; software development, maintenance and management; and call center, marketing, corporate, litigation and back-office services. UOL and its subsidiaries also provide us with advertising and media space and resell cloud services to us. For further details of these services, see “Item 7. Major Shareholders and Related Party Transactions—Related Party Transactions.”

Our failure to manage the assets underlying our customer funds properly could harm our business.

Our ability to manage and account accurately for the assets underlying our customer funds requires a high level of internal controls. As our business continues to grow and we expand our product offerings, we must continue to strengthen our internal controls accordingly. Our success requires significant public confidence in our ability to handle large and growing transaction volumes and amounts of customer funds. Any failure to maintain the necessary controls or to manage the assets underlying our customer funds accurately could severely diminish customer use of our products and/or result in penalties and fines, which could harm our business.

The e-commerce market in Brazil is developing, and the expansion of our business depends on the continued growth of e-commerce, as well as increased availability, quality and usage of the Internet in Brazil.

Our future revenues from digital payments depend substantially on consumers’ widespread acceptance and use of the Internet as a way to conduct commerce. Rapid growth in the use of the Internet (particularly as a way to provide and purchase products and services) is a relatively recent phenomenon in Brazil and we cannot assure you that this acceptance and usage will continue or increase. Furthermore, if the penetration of Internet access in Brazil does not increase quickly, it may limit our potential growth, particularly in regions with low levels of Internet quality and access and/or low levels of income.

Internet penetration in Brazil may never reach the levels seen in more developed countries for reasons that are beyond our control, including the lack of necessary network infrastructure or delayed development of enabling technologies, performance improvements and security measures. The infrastructure for the Internet in Brazil may not be able to support continued growth in the number of users, their frequency of use or their bandwidth requirements. Delays in telecommunication and infrastructure development or other technology shortfalls may impede improvements in Internet reliability in Brazil. If telecommunications services are not sufficiently available to support the growth of the Internet in Brazil, response times could be slower, which would reduce Internet usage and harm our services. In addition, even if Internet penetration in Brazil increases, this may not lead to growth in e-commerce due to a number of factors, including lack of confidence by users in online security.

14

Table of Contents

Furthermore, the price of Internet access and Internet-connected devices, such as personal computers, tablets, mobile phones and other portable devices, may limit our growth, particularly in parts of Brazil with low levels of income. Income levels in Brazil are significantly lower than in the United States and other more developed countries, while prices of both portable devices and Internet access in Brazil are higher than in those countries. Income levels in Brazil may decline and device and access prices may increase in the future.

Any of these factors could limit our ability to generate revenues in future.

Our quarterly results of operations and operating metrics may fluctuate and are unpredictable and subject to seasonality, which could result in the price of our Class A common shares being unpredictable or declining.

Our quarterly results of operations may vary significantly and are not necessarily an indication of future performance. These fluctuations may be due to a variety of factors, some of which are outside of our control and may not fully reflect the underlying performance of our business. In addition, we operate in a somewhat seasonal industry, which tends to experience relatively fewer transactions in the first quarters of the year, increased activity as the year-end holiday shopping season initiates, and fewer transactions after the year-end holidays. In addition, businesses operating in Brazil, such as ours, tend to experience relatively fewer transactions during certain international sporting events, such as the soccer World Cup.

Factors that may cause fluctuations in our quarterly results of operations include our ability to attract and retain customers; the timing, effectiveness and costs of expansion and upgrades of our systems and infrastructure, as well as the success of those expansions and upgrades; the outcomes of legal proceedings and claims; our ability to maintain or increase revenue, gross margins and operating margins; our ability to continue introducing new services and to continue convincing customers to adopt additional offerings; increases in and timing of expenses that we may incur to grow and expand our operations and to remain competitive; period-to-period volatility related to fraud and risk losses; system failures resulting in the inaccessibility of our products and services; changes in the regulatory environment, including with respect to security, privacy or enforcement of laws and regulations by regulators, including fines, orders, or consent decrees; changes in global business or macroeconomic enforcement of laws and regulations by regulators, including fines, orders, or consent decrees; changes in global business conditions; general retail buying patterns; and the other risks described in this annual report. Future fluctuations in quarterly results may mean that our business is less predictable and may harm the trading price of our Class A common shares.

Our business could be harmed if we are unable to forecast demand for our products accurately or to manage our product inventory adequately.

With the goal of increasing our transaction business and POS device sales, we invest broadly in our POS unit technology. Our products, such as the Moderninha and the Minizinha, often require investments with long lead times. An inability to forecast the success of a particular product correctly could harm our business. We must forecast inventory needs and expenses and place orders sufficiently in advance with our third-party suppliers and contract manufacturers based on our estimates of future demand for particular products. Our ability to forecast demand for our products accurately could be affected by many factors, including an increase or decrease in demand for our products or for our competitors’ products, unanticipated changes in general market conditions, and the change in economic conditions.

If we underestimate demand for a particular product, our contract manufacturers and suppliers may not be able to deliver sufficient quantities of that product to meet our requirements, and we may experience a shortage of that product available for sale or distribution. The shortage of a popular product could seriously harm our brand, our seller relationships, the acquisition of additional sellers and our total transaction business. If we overestimate demand for a particular product, we may have excess inventory for that product and the excess inventory may become obsolete or out of date. Inventory levels in excess of demand may lead us to write down or write off the inventory or sell excess inventory at further discounted prices, which could harm our profit and our business.

15

Table of Contents

Some of the key components of our POS devices are sourced from a limited number of suppliers. We are therefore at risk of shortage, price increases, changes, delay or discontinuation of key components, which could disrupt and harm our business.

Some of the key components used to manufacture our POS devices, such as the chip and pin reader, come from limited sources of supply. In addition, we currently rely on one manufacturer to manufacture, test and assemble a significant amount of our POS devices. The agreements for the components used to manufacture our POS devices are entered into directly by the manufacturer of our POS devices and we do not have agreements with these suppliers.

Due to reliance of our POS manufacturers on these components, we are subject to the risk of shortages and long lead times in the supply of certain products. If our manufacturers cannot find alternative sources of supply, we could be subject to components shortages or delays or other problems in product assembly. In addition, various sources of supply-chain risk, including strikes or shutdowns, or loss of or damage to our products while they are in transit or storage, could limit the supply of our POS devices. Any interruption or delay in component supply, any increases in component costs, the inability of our manufacturers to obtain these parts or components from alternate sources at acceptable prices and within a reasonable amount of time, and/or difficulties in fulfilling obligations in connection with the warranties we provide for our POS devices, would harm our ability to provide our POS devices or other services to our merchants on a timely basis. This could hurt our relationships with our customers, prevent us from acquiring new customers, and seriously harm our business.

We are subject to anticorruption, anti-bribery and anti-money laundering laws and regulations.