Form 20-F KNOT Offshore Partners For: Dec 31

Exhibit 4.22

Dated 28 June 2019

KNOT SHUTTLE TANKERS 34 AS

KNOT SHUTTLE TANKERS 35 AS

as joint and several Borrowers

with

KNUTSEN NYK OFFSHORE TANKERS AS

as Guarantor

arranged by

MUFG BANK, LTD.

acting as Mandated Lead Arranger and Bookrunner

with

THE FINANCIAL INSTITUTIONS LISTED IN SCHEDULE 1

acting as Original Lenders

THE FINANCIAL INSTITUTIONS LISTED IN SCHEDULE 2

acting as Hedging Banks

and

MUFG BANK, LTD.

acting as Agent

USD192,100,000 FACILITY AGREEMENT |

HFW

www.hfw.com

TABLE OF CONTENTS

Clause | | Page |

| | |

1. | DEFINITIONS AND INTERPRETATION | 1 |

2. | THE FACILITIES | 22 |

3. | PURPOSE | 22 |

4. | CONDITIONS OF UTILISATION | 23 |

5. | UTILISATION | 24 |

6. | EXTENT OF LIABILITY | 26 |

7. | REPAYMENT | 28 |

8. | PREPAYMENT AND CANCELLATION | 29 |

9. | INTEREST | 33 |

10. | INTEREST PERIODS | 34 |

11. | CHANGES TO THE CALCULATION OF INTEREST | 35 |

12. | FEES | 36 |

13. | TAX GROSS UP AND INDEMNITIES | 36 |

14. | INCREASED COSTS | 40 |

15. | OTHER INDEMNITIES | 41 |

16. | MITIGATION BY THE LENDERS | 42 |

17. | COSTS AND EXPENSES | 42 |

18. | SECURITY | 43 |

19. | GUARANTEE AND INDEMNITY | 44 |

20. | REPRESENTATIONS | 47 |

21. | INFORMATION UNDERTAKINGS | 52 |

22. | FINANCIAL COVENANTS | 54 |

23. | GENERAL UNDERTAKINGS | 57 |

24. | VESSEL UNDERTAKINGS – PRE-DELIVERY | 63 |

25. | VESSEL UNDERTAKINGS – POST-DELIVERY | 64 |

26. | EVENTS OF DEFAULT | 69 |

27. | CHANGES TO THE LENDERS | 72 |

28. | CHANGES TO THE OBLIGORS | 76 |

29. | ROLE OF THE AGENT, THE BOOKRUNNER, THE MANDATED LEAD ARRANGER AND THE REFERENCE BANKS | 78 |

30. | CONDUCT OF BUSINESS BY THE FINANCE PARTIES | 85 |

31. | SHARING AMONG THE FINANCE PARTIES | 85 |

32. | PAYMENT MECHANICS | 86 |

33. | SET-OFF | 88 |

34. | NOTICES | 88 |

35. | CALCULATIONS AND CERTIFICATES | 91 |

36. | PARTIAL INVALIDITY | 91 |

37. | REMEDIES AND WAIVERS | 91 |

38. | AMENDMENTS AND WAIVERS | 91 |

39. | COUNTERPARTS | 93 |

40. | CONFLICT | 93 |

41. | DISCLOSURE OF INFORMATION AND CONFIDENTIALITY | 93 |

42. | CONFIDENTIALITY OF FUNDING RATES AND REFERENCE BANK QUOTATIONS | 94 |

43. | "KNOW YOUR CUSTOMER" CHECKS | 95 |

44. | CONTRACTUAL RECOGNITION OF BAIL-IN | 96 |

45. | GOVERNING LAW | 96 |

46. | ENFORCEMENT | 96 |

SCHEDULE 1 THE ORIGINAL LENDERS | 98 | |

SCHEDULE 2 THE ORIGINAL HEDGING BANKS | 99 | |

SCHEDULE 3 CONDITIONS PRECEDENT AND SUBSEQUENT | 100 | |

SCHEDULE 4 FORM OF UTILISATION REQUEST | 107 | |

SCHEDULE 5 FORM OF TRANSFER CERTIFICATE | 108 | |

SCHEDULE 6 FORM OF COMPLIANCE CERTIFICATE | 110 | |

SCHEDULE 7 FORM OF ACCESSION LETTER | 111 | |

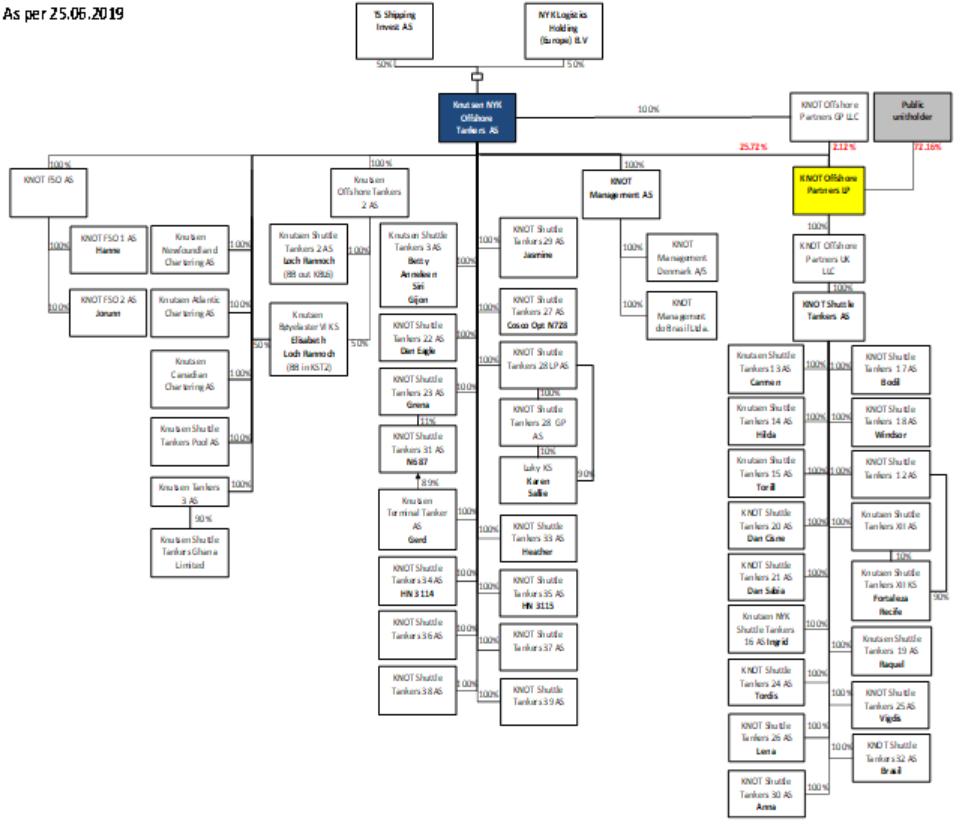

SCHEDULE 8 STRUCTURE CHART | 114 | |

SCHEDULE 9 REPAYMENT SCHEDULE | 115 | |

SCHEDULE 10 FORM OF DROP DOWN CONFIRMATION LETTER | 116 | |

THIS AGREEMENT is made on 28 June 2019

BETWEEN

(1) | KNOT SHUTTLE TANKERS 34 AS, a company incorporated under the laws of Norway with Norwegian registration no. 921 065 698 having its registered office at Smedasundet 40, N-5529 Haugesund, Norway (Borrower A) and KNOT SHUTTLE TANKERS 35 AS, a company incorporated under the laws of Norway with Norwegian registration no. 821 065 852 having its registered office at Smedasundet 40, N-5529 Haugesund, Norway (Borrower B) as joint and several borrowers (together the Borrowers and each individually a Borrower); |

(2) | KNUTSEN NYK OFFSHORE TANKERS AS, a company incorporated under the laws of Norway with Norwegian registration no. 995 221 713 having its registered office at Smedasundet 40, N-5529 Haugesund, Norway as guarantor (KNOT); |

(3) | MUFG BANK, LTD., acting through its office at 25 Ropemaker Street, London, EC2Y 9AN, United Kingdom as mandated lead arranger (in that capacity, the Mandated Lead Arranger) and bookrunner (in that capacity, the Bookrunner); |

(4) | THE FINANCIAL INSTITUTIONS whose names and Facility Offices are listed in Schedule 1 as lenders (the Original Lenders); |

(5) | THE FINANCIAL INSTITUTIONS whose names and Facility Offices are listed in Schedule 2 as hedging banks (the Original Hedging Banks); and |

(6) | MUFG BANK, LTD., acting through its office at 25 Ropemaker Street, London, EC2Y 9AN, United Kingdom as facility agent and security agent for the other Finance Parties and the Hedging Banks (the Agent). |

IT IS AGREED as follows:

SECTION 1

INTERPRETATION

1. | DEFINITIONS AND INTERPRETATION |

1.1 | Definitions |

In this Agreement:

Accession Letter means an accession letter signed and presented to the Agent by the Borrowers, KNOT and KNOP in respect of the Drop Down and the replacement of KNOT by KNOP and KNOT ST as Guarantors in respect of Borrower A and/or Borrower B substantially in the form set out in Schedule 7 (Form Of Accession Letter).

Account Bank means DNB Bank ASA, Norwegian registration no. 984 851 006, a banking institution organised under the laws of Norway acting through its office at Solheimsgaten 7C, N-5058 Bergen, Norway.

Account Pledges means together the Borrower A Account Pledge and the Borrower B Account Pledge, and Account Pledge means either of them.

Accounts means together:

(a) | the Borrower A Account; and |

(b) | the Borrower B Account, |

and Account means either of them.

Affiliate means, in relation to any person, a Subsidiary of that person or a Holding Company of that person or any other Subsidiary of that Holding Company.

1

Aggregate Project Cost means, in respect of a Vessel, the sum of the contract amount payable to the Shipyard pursuant to the relevant Shipbuilding Contract, including variation orders, and other documented capital expenditures related to supervision, buyer's supplies, the cost of delivering the Vessel to the Charterer under the Charter (including but not limited to the costs of transportation to the location of delivery of the Vessel under Charter) and finance. This amount is estimated to be approximately USD113,000,000 per Vessel.

Agreement means this facility agreement, as it may be amended, supplemented and varied in writing from time to time, including its schedules.

Approved Ship Registry means the Norwegian Ordinary Ship Registry (NOR), the Norwegian International Ship Registry (NIS), the Danish International Ship Registry (DIS), the ship registries of Malta, the United Kingdom, the Isle of Man, Bermuda, Panama or Liberia, or any other ship registry as approved in writing by the Agent (on behalf of all Lenders).

Approved Shipbroker means Fearnleys AS, Clarkson Platou AS and Lorentzen & Stemoco or such other firm of internationally reputable shipbrokers acceptable to the Agent (on behalf of all Lenders).

Authorisation means an authorisation, consent, approval, resolution, licence, exemption, filing, notarisation or registration.

Available Commitment means a Lender's Commitment in respect of a Tranche minus:

(a) | the amount of its participation in any outstanding Loans utilised under that Tranche; and |

(b) | in relation to any proposed Utilisation, the amount of its participation in any Loans that are due to be made utilised under that Tranche on or before the proposed Utilisation Date. |

Available Facility means, in respect of a Tranche, the aggregate for the time being of each Lender's Available Commitment in relation to that Tranche.

Availability Period means, in respect of a Tranche, the period from and including the date of this Agreement to and including:

(a) | 31 March 2021 in respect of the Pre-Delivery Tranche A and the Post-Delivery Tranche A; and |

(b) | 31 May 2021 in respect of the Pre-Delivery Tranche B and the Post-Delivery Tranche B. |

Bail-In Action means the exercise of any Write-down and Conversion Powers.

Bail-In Legislation means:

(a) | in relation to an EEA Member Country which has implemented, or which at any time implements, Article 55 BRRD, the relevant implementing law or regulation as described in the EU Bail-In Legislation Schedule from time to time; and |

(b) | in relation to any state other than such an EEA Member Country or (to the extent that the United Kingdom is not such an EEA Member Country) the United Kingdom, any analogous law or regulation from time to time which requires contractual recognition of any Write-down and Conversion Powers contained in that law or regulation. |

Basel II Accord means the "International Convergence of Capital Measurement and Capital Standards, a Revised Framework" published by the Basel Committee on Banking Supervision in June 2004 as updated prior to, and in the form existing on, the date of this Agreement, excluding any amendment thereto arising out of the Basel III Accord.

Basel II Approach means, in relation to any Finance Party, either the Standardised Approach or the relevant Internal Ratings Based Approach (each as defined in the Basel II Accord) adopted by that Finance Party (or any of its Affiliates) for the purposes of implementing or complying with the Basel II Accord.

2

Basel II Regulation means:

(a) | any law or regulation implementing the Basel II Accord (including the relevant provisions of directive 2013/36/EU (CRD IV) and regulation 575/2013 (CRR) of the European Union) to the extent only that such law or regulation re-enacts and/or implements the requirements of the Basel II Accord but excluding any provision of such law or regulation implementing the Basel III Accord; and |

(b) | any Basel II Approach adopted by a Finance Party or any of its Affiliates. |

Basel III Accord means, together:

(a) | the agreements on capital requirements, a leverage ratio and liquidity standards contained in "Basel III: A global regulatory framework for more resilient banks and banking systems", "Basel III: International framework for liquidity risk measurement, standards and monitoring" and "Guidance for national authorities operating the countercyclical capital buffer" published by the Basel Committee on Banking Supervision in December 2010, each as amended, supplemented or restated; |

(b) | the rules for global systemically important banks contained in "Global systemically important banks: assessment methodology and the additional loss absorbency requirement - Rules text" published by the Basel Committee on Banking Supervision in November 2011, as amended, supplemented or restated; and |

(c) | any further guidance or standards published by the Basel Committee on Banking Supervision relating to "Basel III". |

Basel III Regulation means any law or regulation implementing the Basel III Accord (including CRD IV and CRR) save to the extent that such law or regulation re-enacts a Basel II Regulation.

Borrower A Account Pledge means an agreement dated on or about the date hereof for the pledge of the Borrower A Account, entered or to be entered into between Borrower A and the Agent (on behalf of the Finance Parties and the Hedging Banks) in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks).

Borrower A Account means USD account no. NO45 1250 0585 267, held in the name of Borrower A with the Account Bank.

Borrower A Factoring Agreement means a Norwegian law factoring agreement in the amount of USD230,520,000 dated on or about the date hereof between Borrower A and the Agent (on behalf of the Finance Parties and the Hedging Banks) in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks), to be registered against Borrower A with the Norwegian Registry of Movable Property (in Norwegian, Løsøreregisteret).

Borrower A Hedging Agreement Security means a deed or other instrument creating security over Borrower A's rights under the Hedging Agreements to which it is or is to become a party to be entered into between Borrower A and the Agent (on behalf of the Finance Parties and the Hedging Banks) in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks).

Borrower A Mortgage means a first priority mortgage in the amount of USD230,520,000 (and deed of covenants or declaration of pledge collateral thereto (if applicable)), to be executed and recorded by Borrower A against Vessel A in favour of the Agent (on behalf of the Finance Parties and the Hedging Banks) in the relevant Approved Ship Registry, in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks).

Borrower A Pre-Delivery Assignment Agreement means an agreement dated on or about the date hereof for the assignment of all present and future rights under and in connection with the Shipbuilding Contract A and the Refund Guarantee A, entered into between Borrower A and the Agent (on behalf of the Finance Parties and the Hedging Banks) in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks).

3

Borrower A Post-Delivery Assignment Agreement means an agreement dated on or about the Delivery Date of Vessel A for the assignment of the Earnings, the Insurances and any Requisition Compensation in respect of Vessel A, entered or to be entered into between Borrower A and the Agent (on behalf of the Finance Parties and the Hedging Banks) in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks).

Borrower A Share Pledge means an agreement for the charge/pledge of 100% of the shares in Borrower A dated on or about the date hereof or on or about a Drop Down Date (as the case may be) in agreed form between (a) KNOT or KNOP (or a Subsidiary of KNOP) (as the case may be, prior to and as from the relevant Drop Down Date respectively) and (b) the Agent (on behalf of the Finance Parties and the Hedging Banks).

Borrower B Account Pledge means an agreement dated on or about the date hereof for the pledge of the Borrower B Account, entered or to be entered into between Borrower B and the Agent (on behalf of the Finance Parties and the Hedging Banks) in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks).

Borrower B Account means USD account no. NO45 1250 0585 275, held in the name of Borrower B with the Account Bank.

Borrower B Factoring Agreement means a Norwegian law factoring agreement in the amount of USD230,520,000 dated on or about the date hereof between Borrower B and the Agent (on behalf of the Finance Parties and the Hedging Banks) in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks), to be registered against Borrower B with the Norwegian Registry of Movable Property (in Norwegian, Løsøreregisteret).

Borrower B Hedging Agreement Security means a deed or other instrument creating security over Borrower B's rights under the Hedging Agreements to which it is or is to become a party to be entered into between Borrower B and the Agent (on behalf of the Finance Parties and the Hedging Banks) in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks).

Borrower B Mortgage means a first priority mortgage in the amount of USD230,520,000 (and deed of covenants or declaration of pledge collateral thereto (if applicable)), to be executed and recorded by Borrower B against Vessel B in favour of the Agent (on behalf of the Finance Parties and the Hedging Banks) in the relevant Approved Ship Registry, in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks).

Borrower B Pre-Delivery Assignment Agreement means an agreement dated on or about the date hereof for the assignment of all present and future rights under and in connection with the Shipbuilding Contract B and the Refund Guarantee B, entered into between Borrower B and the Agent (on behalf of the Finance Parties and the Hedging Banks) in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks).

Borrower B Post-Delivery Assignment Agreement means an agreement dated on or about the Delivery Date of Vessel B for the assignment of the Earnings, the Insurances and any Requisition Compensation in respect of Vessel B, entered or to be entered into between Borrower B and the Agent (on behalf of the Finance Parties and the Hedging Banks) in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks).

Borrower B Share Pledge means an agreement for the charge/pledge of 100% of the shares in Borrower B dated on or about the date hereof or on or about a Drop Down Date (as the case may be) in agreed form between (a) KNOT or KNOP (or a Subsidiary of KNOP) (as the case may be, prior to and as from the relevant Drop Down Date respectively) and (b) the Agent (on behalf of the Finance Parties and the Hedging Banks).

Break Costs means the amount (if any) by which:

(a) | the interest (excluding the Margin) which a Lender should have received for the period from the date of receipt of all or any part of its participation in a Loan or Unpaid Sum to the last day of the current Interest Period in respect of that Loan or Unpaid Sum, had the principal amount or Unpaid Sum received been paid on the last day of that Interest Period; |

4

exceeds:

(b) | the amount which that Lender would be able to obtain by placing an amount equal to the principal amount or Unpaid Sum received by it on deposit with a leading bank in the Relevant Interbank Market for a period starting on the Business Day following receipt or recovery and ending on the last day of the current Interest Period. |

Business Day means a day (other than a Saturday or Sunday) on which banks and foreign exchange markets are open for general business in London, New York City, Tokyo and Oslo.

Change of Control means:

(a) | if one or both Borrowers are owned by KNOT: |

(i) | if KNOT does not own or is not able to vote for (directly or indirectly) all of the shares in the Borrowers or, following the Drop Down of one of the Borrowers only, the Borrower not owned by KNOP; or |

(ii) | if TS Shipping Invest AS (or a 100% owned subsidiary of TS Shipping Invest AS) and NYK Logistics Holding (Europe) B.V. (or Nippon Yusen Kabushiki Kaisha or another 100% subsidiary of Nippon Yusen Kabushiki Kaisha) each does not own or is not able to vote for (directly or indirectly) for 50% the shares in KNOT; and/or |

(b) | if one or both Borrowers are owned by KNOP: |

(i) | if TS Shipping Invest AS (or a 100% owned subsidiary of TS Shipping Invest AS) and NYK Logistics Holding (Europe) B.V. (or Nippon Yusen Kabushiki Kaisha or another 100 % subsidiary of Nippon Yusen Kabushiki Kaisha) each does not own or is not able to vote for (directly or indirectly) for 50% the shares in KNOT; |

(ii) | if KNOP does not own or is not able to vote for (directly or indirectly) all of the shares in the Borrowers or, following the Drop Down of one of the Borrowers only, the Borrower not owned by KNOT; |

(iii) | if KNOP does not own or is not able to vote for (directly or indirectly) all of the shares in KNOT ST; |

(iv) | if KNOT does not own or is not able to vote for (directly or indirectly) all of the shares in the General Partner (being the general partner in KNOP); |

(v) | the General Partner ceases to be to general partner of KNOP; |

(vi) | if KNOT does not own at least 25% of all the common and general partner units in KNOP (capital and voting rights to be subject to the limitations on voting rights relating to election of board members, amendments and certain other matters as set out in the limited partnership agreement entered into in relation to KNOP); or |

(vii) | if any person or group of persons acting in concert (other than KNOT and/or any of its wholly owned Subsidiaries) acquires, legally or beneficially, and either directly or indirectly, more than 33.33% of the common and general partner units or voting rights in KNOP, |

(paragraphs (i) – (vii) being a KNOP Change of Control).

Charterer means Equinor Shipping Inc., a company incorporated under the laws of the United States of America having its registered office at 120 Long Ridge Road, Suite 3E01, Stamford, CT 06902, United States of America, a company within the Equinor ASA group.

Charterparty A means the time charterparty agreement dated 26 September 2018 entered into between Borrower A and the Charterer for the chartering of Vessel A for a period of 7 years from the Delivery Date of Vessel A at a daily time charter rate of minimum USD45,800 per day.

5

Charterparty B means the time charterparty agreement dated 26 September 2018 entered into between Borrower B and the Charterer for the chartering of Vessel B for a period of 5 years from the Delivery Date of Vessel B at a daily time charter rate of minimum USD45,800 per day.

Charterparties means together Charterparty A and Charterparty B, and Charterparty means either of them.

Classification Society means, in respect of a Vessel, DNV GL or such other classification society which is a member of the International Association of Classification Societies as may be approved in writing by in the Agent (acting upon instructions from the Majority Lenders).

Code means the US Internal Revenue Code of 1986.

Commitment means, in respect of a Tranche or Facility:

(a) | in relation to an Original Lender, the amount set opposite its name in respect of that Tranche or Facility in Schedule 1 (The Original Lenders) and the amount of any other Commitment in respect of that Tranche or Facility transferred to it under this Agreement; and |

(b) | in relation to any other Lender, the amount of any Commitment transferred to it under this Agreement in respect of that Tranche or Facility, |

to the extent not cancelled, reduced or transferred by it under this Agreement.

Compliance Certificate means a certificate substantially in the form set out in Schedule 6 (Form of Compliance Certificate).

Default means an Event of Default or any event or circumstance specified in Clause 26 (Events of Default) which would (with the expiry of a grace period, the giving of notice, the making of any determination under the Finance Documents or any combination of any of the foregoing) be an Event of Default.

Delivery Date means, in respect of a Vessel, the date of delivery of that Vessel from the Shipyard to the relevant Borrower pursuant to the relevant Shipbuilding Contract, scheduled to be on 30 June 2020 for Vessel A and on 31 August 2020 for Vessel B.

Disruption Event means either or both of:

(a) | a material disruption to those payment or communications systems or to those financial markets which are, in each case, required to operate in order for payments to be made in connection with the Facility (or otherwise in order for the transactions contemplated by the Finance Documents to be carried out) which disruption is not caused by, and is beyond the control of, any of the Parties; or |

(b) | the occurrence of any other event which results in a disruption (of a technical or systems-related nature) to the treasury or payments operations of a Party preventing that, or any other Party: |

(i) | from performing its payment obligations under the Finance Documents; or |

(ii) | from communicating with other Parties in accordance with the terms of the Finance Documents, |

and which (in either such case) is not caused by, and is beyond the control of, the Party whose operations are disrupted.

DOC means in relation to the Manager of a Vessel a valid document of compliance issued to such company pursuant to paragraph 14.2 of the ISM Code.

Drop Down means the acquisition by KNOP (or a Subsidiary of KNOP) of 100% of the shares in a Borrower.

6

Drop Down Date means the date on which a Drop Down actually takes place, as determined in accordance with Clause 28.2 (KNOP and KNOT ST as replacement Guarantors).

Earnings means all moneys whatsoever which are now or later become, payable (actually or contingently) to a Borrower in respect of and/or arising out of the use of or operation of a Vessel, including (but not limited to):

(a) | all freight, hire and passage moneys payable to that Borrower, including (without limitation) payments of any nature under any contract or any other agreement for the employment, use, possession, management and/or operation of that Vessel; |

(b) | any claim under any guarantees related to hire payable to that Vessel as a consequence of the operation of that Vessel; |

(c) | any compensation payable to that Borrower in the event of any requisition of that Vessel or for the use of that Vessel by any government authority or other competent authority; |

(d) | remuneration for salvage, towage and other services performed by that Vessel payable to that Borrower; |

(e) | demurrage and retention money receivable by that Borrower in relation to that Vessel; |

(f) | all moneys which are at any time payable under the Insurances in respect of loss of earnings from that Vessel; |

(g) | if and whenever that Vessel is employed on terms whereby any moneys falling within paragraphs (a) to (f) above are pooled or shared with any other person, that proportion of the net receipts of the relevant pooling or sharing arrangement which is attributable to that Vessel; and |

(h) | any other money which arise out of the use of or operation of that Vessel and moneys whatsoever due or to become due to that Borrower from third parties in relation to that Vessel. |

Environmental Claim means any claim, proceeding, formal notice or investigation by any person or company in respect of any Environmental Law or Environmental Permits.

Environmental Law means any applicable law or regulation which relates to:

(a) | the pollution or protection of the environment or to the carriage of material which is capable of polluting the environment; |

(b) | harm to or the protection of human health; |

(c) | the conditions of the workplace; or |

(d) | any emission or substance capable of causing harm to any living organism or the environment. |

Environmental Permits means any permit, licence, consent, approval and other and other authorisation and the filing of any notification, report or assessment required under any Environmental Law for the operation of business conducted on or from the properties owned or used by an Obligor.

EU Bail-In Legislation Schedule means the document described as such and published by the Loan Market Association (or any successor person) from time to time.

Event of Default means any event or circumstance specified as such in Clause 26 (Events of Default).

Existing Shipyard means Korea Shipbuilding & Offshore Engineering Co., Ltd. (formerly known as Hyundai Heavy Industries, Co., Ltd.), a company organised and existing under the laws of the Republic of Korea, having its registered office at Hyundai Building 75, Yulgo-ro, Jongno-gu. Seoul, Korea.

FA Act means the Norwegian Financial Agreements Act of 25 June 1999 No. 46 (in Norwegian, finansavtaleloven).

7

Facilities means together the Pre-Delivery Facility and the Post-Delivery Facility, and Facility means either of them.

Facility Office means:

(a) | in respect of an Original Lender or Original Hedging Bank, the office through which it will perform its obligations under this Agreement or the relevant Hedging Agreement, as the case may be, being the office specified against its name in Schedule 1 (The Original Lenders) or Schedule 2 (The Original Hedging Banks); |

(b) | in respect of any other Lender or Hedging Bank, the office through which it will perform its obligations under this Agreement or the relevant Hedging Agreement, as the case may be, as notified to the Agent in writing on or before the date it becomes a Lender or Hedging Bank; or |

(c) | in respect of any other Finance Party, the office in the jurisdiction in which it is resident for tax purposes, |

or, in each such case, as the case may be, or such other office as may be selected by it and notified to the Agent in accordance with Clause 27.8 (Change of Facility Office).

Facility Period means the period commencing on the date of this Agreement and ending on the date on which the Agent notifies the Borrowers, the other Finance Parties and the Hedging Banks that:

(a) | all amounts which have become due for payment by the Borrowers under the Finance Documents and the Hedging Agreements have been paid; |

(b) | no amount is owing or has accrued (without yet having become due for payment) under any of the Finance Documents and the Hedging Agreements; |

(c) | none of the Obligors have any future or contingent liability under any provision of this Agreement, the other Finance Documents and the Hedging Agreements; and |

(d) | the Agent, the Lenders and the Hedging Banks do not consider that there is a significant risk that any payment or transaction under a Finance Document or a Hedging Agreement would be set aside, or would have to be reversed or adjusted, in any present or possible future proceeding relating to a Finance Document or a Hedging Agreement or any asset covered (or previously covered) by a Security created by a Finance Document or a Hedging Agreement. |

Factoring Agreements means together the Borrower A Factoring Agreement and the Borrower B Factoring Agreement, and Factoring Agreement means either of them.

FATCA means:

(a) | sections 1471 to 1474 of the Code or any associated regulations; |

(b) | any treaty, law or regulation of any other jurisdiction, or relating to an intergovernmental agreement between the US and any other jurisdiction, which (in either case) facilitates the implementation of any law or regulation referred to in paragraph (a) above; or |

(c) | any agreement pursuant to the implementation of any treaty, law or regulation referred to in paragraphs (a) or (b) above with the US Internal Revenue Service, the US government or any governmental or taxation authority in any other jurisdiction. |

FATCA Application Date means:

(a) | in relation to a "withholdable payment" described in section 1473(1)(A)(i) of the Code (which relates to payments of interest and certain other payments from sources within the US), 1 July 2014; or |

(b) | in relation to a "passthru payment" described in section 1471(d)(7) of the Code not falling within paragraphs (a) above, the first date from which such payment may become subject to a deduction or withholding required by FATCA. |

8

FATCA Deduction means a deduction or withholding from a payment under a Finance Document required by FATCA.

FATCA Exempt Party means a Party that is entitled to receive payments free from any FATCA Deduction.

Fee Letter means any fee letter dated on or about the date of this Agreement from the Agent to the Borrowers and KNOT setting out any of the fees referred to in Clause 12.3 (Other fees).

Final Maturity Date means:

(a) | in respect of the Pre-Delivery Tranche A, the earlier of the Delivery Date of Vessel A and 31 March 2021; |

(b) | in respect of the Pre-Delivery Tranche B, the earlier of the Delivery Date of Vessel B and 31 May 2021; |

(c) | in respect of the Post-Delivery Tranche A, the date falling 60 Months after the Utilisation Date of the Post-Delivery Tranche A; and |

(d) | in respect of the Post-Delivery Tranche B, the date falling 60 Months after the Utilisation Date of the Post-Delivery Tranche B. |

Finance Document means this Agreement (including the Guarantees), any Security Document, any Fee Letter, any Manager's Undertaking, any Accession Letter, any Letter of Quiet Enjoyment, any other document designated as such by the Agent and the Borrowers and, as long as there is an Event of Default which is continuing and for the purposes of Clause 31 (Sharing among the Finance Parties), Clause 32 (Payment mechanics) and Clause 33 (Set-off) only, Finance Document shall also include any Hedging Agreement to which a Borrower to whom that Event of Default relates is a party.

Finance Party means the Agent, the Mandated Lead Arranger, the Bookrunner, a Lender or, as long as there is an Event of Default which is continuing and for the purposes of Clause 31 (Sharing among the Finance Parties), Clause 32 (Payment mechanics) and Clause 33 (Set-off) only, Finance Party shall also include the Hedging Banks under any Hedging Agreement to which a Borrower to whom that Event of Default relates.

Financial Indebtedness means any indebtedness for or in respect of:

(a) | moneys borrowed; |

(b) | any amount raised by acceptance under any acceptance credit facility or dematerialised equivalent; |

(c) | any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument; |

(d) | the amount of any liability in respect of any lease or hire purchase contract which would, in accordance with the relevant GAAP, be treated as a finance or capital lease; |

(e) | receivables sold or discounted (other than any receivables to the extent they are sold on a non-recourse basis); |

(f) | any amount raised under any other transaction (including any forward sale or purchase agreement) of a type not referred to in any other paragraph of this definition having the commercial effect of a borrowing; |

(g) | any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value (or, if any actual amount is due as a result of the termination or close-out of that derivative transaction, that amount) of any derivative transaction, only the marked to market value shall be taken into account); |

(h) | any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or |

9

documentary letter of credit or any other instrument issued by a bank or financial institution; and

(i) | the amount of any liability in respect of any guarantee or indemnity for any of the items referred to in paragraphs (a) to (h) above. |

Flag State means, in respect of a Vessel, such state or territory (being the state or territory of an Approved Ship Registry) in which the relevant Borrower's ownership title of that Vessel is from time to time registered in accordance with the provisions of the Finance Documents.

Funding Rate means any individual rate notified by a Lender to the Agent pursuant to paragraph (a)(ii) of Clause 11.4 (Cost of funds).

GAAP means:

(a) | in relation to the Borrowers, KNOT ST and KNOT, generally accepted accounting principles in Norway, including IFRS; and |

(b) | in relation to KNOP, generally accepted accounting principles in the United States of America, including IFRS. |

General Partner means KNOT Offshore Partners GP LLC, a company incorporated under the laws of the Marshall Islands and having its principal office at 2 Queen's Cross, Aberdeen, Aberdeenshire, AB15 4YB, United Kingdom being the general partner in KNOP.

Group means:

(a) | prior to any Drop Down Date, the KNOT Group; |

(b) | from the Drop Down Date in respect of one of the Borrowers only, the KNOT Group and the KNOP Group; and |

(c) | from the Drop Down Date in respect of both Borrowers, the KNOP Group. |

Guarantees means the guarantee liabilities of each Guarantor pursuant to Clause 19 (Guarantee and indemnity), and Guarantee means any of them.

Guarantor means:

(a) | prior to any Drop Down Date, KNOT; |

(b) | from the Drop Down Date in respect of one of the Borrowers only, KNOT (guaranteeing the Loan or Loans relating to the Vessel owned by KNOT's Subsidiary only) and (2) KNOP and KNOT ST jointly and severally (guaranteeing the Loan or Loans relating to the Vessel owned by KNOP's Subsidiary only); and |

(c) | from the Drop Down Date in respect of both Borrowers, KNOP and KNOT ST jointly and severally. |

Hedging Agreement means any transaction or hedging arrangement which is:

(a) | entered or to be entered into between a Borrower and a Hedging Bank pursuant to a Hedging Master Agreement made between them (including any schedule thereto or confirmation thereunder); and |

(b) | made solely for the purpose of hedging the interest rate in relation to a Loan to which the relevant Borrower's Vessel relates and/or for hedging that Borrower's currency exposure in relation to the daily operation of its Vessel. |

Hedging Agreement Securities means together the Borrower A Hedging Agreement Security and the Borrower B Hedging Agreement Security, and Hedging Agreement Security means either of them.

10

Hedging Bank means an Original Hedging Bank or any bank or financial institution which becomes a Hedging Bank in accordance with Clause 27.11 (Assignments and transfers by the Hedging Banks).

Hedging Master Agreement means any hedging master agreement entered into or to be entered into by a Borrower and a Hedging Bank as the basis for any Hedging Agreement between those Parties.

Holding Company means, in relation to a company or corporation, any other company or corporation in respect of which it is a Subsidiary.

IFRS means international accounting standards within the meaning of the IAS Regulation 1606/2002 to the extent applicable to the relevant financial statements.

Insurances means, in relation to a Vessel, all policies and contracts of insurance (which expression includes all entries of that Vessel in a protection and indemnity or war risk association) which are from time to time during the Security Period in respect of that Vessel in place or taken out or entered into by or for the benefit of the relevant Borrower (whether in the sole name of that Borrower or in the joint names of that Borrower and any other person) in respect of that Vessel or otherwise in connection with that Vessel and all benefits thereunder (including claims of whatsoever nature and return of premiums).

Interest Period means, in relation to a Loan, each period determined in accordance with Clause 10 (Interest Periods) and, in relation to an Unpaid Sum, each period determined in accordance with Clause 9.3 (Default interest).

Interpolated Screen Rate means, in relation to LIBOR for any Loan, the rate (rounded to the same number of decimal places as the two relevant Screen Rates) which results from interpolating on a linear basis between:

(a) | the applicable Screen Rate for the longest period (for which that Screen Rate is available) which is less than the Interest Period of that Loan; and |

(b) | the applicable Screen Rate for the shortest period (for which that Screen Rate is available) which exceeds the Interest Period of that Loan, |

each as of 11.00 a.m. in London on the Quotation Day for USD.

Intra-Group Indebtedness means, in respect of a Group, intercompany loans, deposits or equity contributions within that Group.

ISDA Novation Agreements means:

(a) | the novation agreement to be made between Borrower A, KNOT and MUFG Securities EMEA plc (as hedging bank) pursuant to which rate swap transactions dated 12 April 2019 and 29 May 2019 (as evidenced by confirmations dated 12 April 2019 and 30 May 2019 from MUFG Securities EMEA plc to KNOT) and entered into pursuant to an ISDA Master Agreement dated 12 April 2019 between MUFG Securities EMEA plc and KNOT are to be novated from and out of the name of KNOT into the name of Borrower A; and |

(b) | the novation agreement to be made between Borrower B, KNOT and MUFG Securities EMEA plc (as hedging bank) pursuant to which rate swap transactions dated 12 April 2019 and 29 May 2019 (as evidenced by confirmations dated 12 April 2019 and 30 May 2019 from MUFG Securities EMEA plc to KNOT) and entered into pursuant to an ISDA Master Agreement dated 12 April 2019 between MUFG Securities EMEA plc and KNOT are to be novated from and out of the name of KNOT into the name of Borrower B. |

ISM Code means the International Safety Management Code for the Safe Operation of Ships and for Pollution Prevention.

ISPS Code means the International Ship and Port Facility Security (ISPS) Code as adopted by the International Maritime Organization's (IMO) Diplomatic Conference of December 2002.

ISSC means, in respect of a Vessel, an International Ship Security Certificate issued by the

11

Classification Society confirming that that Vessel is in compliance with the ISPS Code.

KNOP means KNOT Offshore Partners L.P., a master limited partnership listed on the New York Stock Exchange having its registered office at 2 Queen's Cross, Aberdeen, Aberdeenshire, AB15 4YB, United Kingdom.

KNOP Group means KNOP and its Subsidiaries.

KNOT Group means KNOT and its Subsidiaries.

KNOT ST means KNOT Shuttle Tankers AS, a company incorporated under the laws of Norway with Norwegian registration no. 998 942 829 having its registered office at Smedasundet 40, N-5529 Haugesund, Norway.

Lender means:

(a) | any Original Lender; and |

(b) | any bank, financial institution, trust, fund or other entity which has become a Party in accordance with Clause 27 (Changes to the Lenders), |

which in each case has not ceased to be a Party in accordance with the terms of this Agreement.

Letter of Quiet Enjoyment means, in respect of a Vessel, a letter of quiet enjoyment entered or to be entered into between the Agent, the Charterer and the relevant Borrower in respect of the Charterer's quiet enjoyment of that Vessel under the relevant Charterparty, in form and substance satisfactory to the Charterer and the Agent (on behalf of the Lenders), if required by the relevant Charterer and the relevant Borrower is contractually obliged to procure the same.

LIBOR means, in relation to any Loan:

(a) | the applicable Screen Rate; |

(b) | (if no Screen Rate is available for the Interest Period of that Loan) the Interpolated Screen Rate for that Loan; or |

(c) | if: |

(i) | no Screen Rate is available for USD; or |

(ii) | no Screen Rate is available for the Interest Period of that Loan and it is not possible to calculate an Interpolated Screen Rate for that Loan, |

the Reference Bank Rate,

as of, in the case of paragraph (a) above, 11.00 a.m. London time and in the case of paragraph (c) above, 12.00 noon London time on the Quotation Day for USD and for a period equal in length to the Interest Period of that Loan and, if that rate is less than zero, LIBOR shall be deemed to be zero.

Loan means a loan made or to be made under a Facility or the principal amount outstanding for the time being of that loan.

Majority Lenders means:

(a) | if there are no Loans then outstanding, a Lender or Lenders whose Commitments aggregate more than 662/3% of the Total Commitments (or, if the Total Commitments have been reduced to zero, aggregated more than 662/3% of the Total Commitments immediately prior to the reduction); or |

(b) | at any other time, a Lender or Lenders whose participations in the Loans then outstanding aggregate more than 662/3% of all the Loans then outstanding. |

12

Management Agreement means any agreement made or to be made between a Borrower and a Manager for the technical and/or commercial management of a Vessel.

Manager means KNOT Management AS or one of its Affiliates acceptable to the Agent.

Manager's Undertaking means an undertaking to be provided by the Manager in favour of the Agent in form and substance satisfactory to the Agent (on behalf of the Finance Parties and the Hedging Banks).

Margin means 1.75% per annum.

Market Value means the fair market value of a Vessel, being the mean average of valuations of that Vessel obtained from 2 Approved Shipbrokers, with or without physical inspection of that Vessel (as the Agent may require) on the basis of a sale for prompt delivery for cash at arm's length on normal commercial terms as between a willing buyer and a willing seller, on an "as is, where is" basis, free of any existing charter or other contract of employment and/or pool arrangement.

Material Adverse Effect means any event or occurrence that in the reasonable opinion of the Lenders has or would have materially adversely affected or could adversely affect:

(a) | the business, condition (financial or otherwise), operations, performance, assets or prospects of an Obligor or the Group taken as a whole since the date at which its latest audited financial statements were prepared; or |

(b) | the ability of an Obligor to perform its obligations under the Finance Documents or the Hedging Agreements; or |

(c) | the validity or enforceability of, or the effectiveness or ranking of any Security granted or purporting to be granted pursuant to, any Finance Document or Hedging Agreement; or |

(d) | the right or remedy of a Finance Party or a Hedging Bank in respect of a Finance Document or a Hedging Agreement. |

Month means a period starting on one day in a calendar month and ending on the numerically corresponding day in the next calendar month, except that:

(a) | if the numerically corresponding day is not a Business Day, that period shall end on the next Business Day in that calendar month in which that period is to end if there is one, or if there is not, on the immediately preceding Business Day; |

(b) | if there is no numerically corresponding day in the calendar month in which that period is to end, that period shall end on the last Business Day in that calendar month. |

The above rules will only apply to the last Month of any period.

Mortgages means together the Borrower A Mortgage and the Borrower B Mortgage, and Mortgage means either of them.

New Shipyard means Hyundai Heavy Industries Co., Ltd., a company organised and existing under the laws of the Republic of Korea, having its registered office at 1000, Bangeojinsunhwan-doro, Dong-gu, Ulsan, 44032, Korea.

Norwegian Companies Act means the Norwegian Limited Liability Companies Act of 13 June 1997 No. 44 (in Norwegian, aksjeloven).

Obligors means the Borrowers, KNOT (as long as it is a Guarantor), KNOP (as long as it is a Guarantor) and KNOT ST (as long as it is a Guarantor), and Obligor means any of them.

Original Financial Statements means:

(a) | in relation to each Borrower, the audited financial statements (being the audited financial statements for the financial year ending 31 December 2019) delivered to the Agent pursuant |

13

to Clause 21.2(a) (Financial statements); and

(b) | in relation to KNOT, its audited financial statements for its financial year ended 31 December 2018. |

Outstanding Indebtedness means the aggregate of all sums of money at any time and from time to time owing to the Finance Parties under or pursuant to the Finance Documents.

Party means a party to this Agreement.

Post-Delivery Assignment Agreements means together the Borrower A Post-Delivery Assignment Agreement and the Borrower B Post-Delivery Assignment Agreement, and Post-Delivery Assignment Agreement means either of them.

Post-Delivery Facility means the post-delivery term loan facility made available under this Agreement as described in Clause 2.2 (The Post-Delivery Facility).

Post-Delivery Security Period means, in respect of a Vessel, the period from the Delivery Date of that Vessel until the end of the Security Period relating to it.

Post-Delivery Tranche A means the lesser of (a) USD96,050,000 and (b) 85% of the Aggregate Project Cost of Vessel A made or to be made under the Post-Delivery Facility relating to the acquisition by Borrower A of Vessel A, or the principal amount outstanding for the time being of that tranche.

Post-Delivery Tranche B means the lesser of (a) USD96,050,000 and (b) 85% of the Aggregate Project Cost of Vessel B made or to be made under the Post-Delivery Facility relating to the acquisition by Borrower B of Vessel B, or the principal amount outstanding for the time being of that tranche.

Post-Delivery Tranches means together the Post-Delivery Tranche A and the Post-Delivery Tranche B, and Post-Delivery Tranche means any of them.

Pre-Delivery Assignment Agreements means together the Borrower A Pre-Delivery Assignment Agreement and the Borrower B Pre-Delivery Assignment Agreement, and Pre-Delivery Assignment Agreement means either of them.

Pre-Delivery Facility means the pre-delivery term loan facility made available under this Agreement as described in Clause 2.1 (The Pre-Delivery Facility).

Pre-Delivery Security Period means, in respect of a Vessel, the period from the first Utilisation Date until the Delivery Date of that Vessel.

Pre-Delivery Tranche A means USD42,500,000 made or to be made under the Pre-Delivery Facility relating to the acquisition by Borrower A of Vessel A, available for utilisation in the maximum of 3 Loans as per the relevant milestones in the Shipbuilding Contract A as set out in paragraph (a) of Clause 5.3 (Utilisation Dates) or the principal amount outstanding for the time being of that tranche.

Pre-Delivery Tranche B means USD42,500,000 made or to be made under the Pre-Delivery Facility relating to the acquisition by Borrower B of Vessel B, available for utilisation in the maximum of 3 Loans as per the relevant milestones in the Shipbuilding Contract B as set out in paragraph (b) of Clause 5.3 (Utilisation Dates) or the principal amount outstanding for the time being of that tranche.

Pre-Delivery Tranches means together the Pre-Delivery Tranche A and the Pre-Delivery Tranche B, and Pre-Delivery Tranche means either of them.

Quotation Day means, in relation to any period for which an interest rate is to be determined, 2 Business Days before the first day of that period unless market practice differs in the Relevant Interbank Market in which case the Quotation Day will be determined by the Agent in accordance with market practice in the Relevant Interbank Market (and if quotations would normally be given by leading banks in the Relevant Interbank Market on more than one day, the Quotation Day will be the last of those days).

Reference Bank Quotation means any quotation supplied to the Agent by a Reference Bank.

14

Reference Bank Rate means the arithmetic mean of the rates (rounded upwards to four decimal places) as supplied to the Agent at its request by the Reference Banks as the rate at which the relevant Reference Bank could borrow funds in the London interbank market in USD for the relevant period were it to do so by asking for and then accepting interbank offers for deposits in reasonable market size in that currency and for that period.

Reference Banks means those Lenders who, in accordance with paragraph (a) of Clause 29.17 (Role of Reference Banks), agree to be appointed as Reference Banks and such other banks as may (with their consent) be appointed as Reference Banks by the Agent in consultation with the Borrowers.

Refund Guarantee A means the refund guarantee (titled "Our Letter of Guarantee No. M04KC18127700018") dated 21 December 2018 in the maximum amount of USD44,085,520 executed by the Refund Guarantor in favour of Borrower A guaranteeing the Existing Shipyard's obligation to refund to Borrower A the pre-delivery instalments paid by Borrower A to the Existing Shipyard under Shipbuilding Contract A should they become due to be refunded under such Shipbuilding Contract and which, pursuant to the Refund Guarantee Confirmation relating to Vessel A, is to amended to guarantee the refund obligations of the New Shipyard to Borrower A under Shipbuilding Contract A upon the Shipbuilding Contract Novation Agreement relating to Vessel A becoming effective.

Refund Guarantee B means the refund guarantee (titled "Our Letter of Guarantee No. M04KC18127700025") dated 21 December 2018 in the maximum amount of USD44,085,520 executed by the Refund Guarantor in favour of Borrower B guaranteeing the Existing Shipyard's obligation to refund to Borrower B the pre-delivery instalments paid by Borrower B to the Existing Shipyard under Shipbuilding Contract B should they become due to be refunded under such Shipbuilding Contract and which, pursuant to the Refund Guarantee Confirmation relating to Vessel B, is to amended to guarantee the refund obligations of the New Shipyard to Borrower B under Shipbuilding Contract B upon the Shipbuilding Contract Novation Agreement relating to Vessel B becoming effective.

Refund Guarantee Confirmation means:

(a) | in relation to Refund Guarantee A, the acknowledgement and consent substantially in the form appended to the Shipbuilding Contract Novation Agreement for Vessel A issued or to be issued by the Refund Guarantor in favour of Borrower A confirming that Refund Guarantee A remains valid and continues to guarantee the New Shipyard's refund obligations under Shipbuilding Contract A on the same basis as if the New Shipyard had originally been a party to Shipbuilding Contract A in place of the Existing Shipyard; and |

(b) | in relation to Refund Guarantee B, the acknowledgement and consent substantially in the form appended to the Shipbuilding Contract Novation Agreement for Vessel B issued or to be issued by the Refund Guarantor in favour of Borrower B confirming that Refund Guarantee B remains valid and continues to guarantee the New Shipyard's refund obligations under Shipbuilding Contract B on the same basis as if the New Shipyard had originally been a party to Shipbuilding Contract B in place of the Existing Shipyard. |

Refund Guarantees means together the Refund Guarantee A and the Refund Guarantee B, and Refund Guarantee means either of them.

Refund Guarantor means Industrial Bank of Korea of IBK Tower 16 FL, 82 Eulji-ro, Jung-gu, Seoul, South Korea.

Relevant Event of Default means any Event of Default other than an Event of Default occurring under Clause 26.2 (Non-payment).

Relevant Interbank Market means the London interbank market.

Relevant Nominating Body means any applicable central bank, regulator or other supervisory authority or a group of them, or any working group or committee sponsored or chaired by, or constituted at the request of, any of them or the Financial Stability Board.

15

Relevant Person means:

(a) | each member of the Group; and |

(b) | each of its directors, officers, employees, agents and representatives. |

Repeating Representations means each of the representations set out in Clause 20 (Representations).

Replacement Benchmark means a benchmark rate which is:

(a) | formally designated, nominated or recommended as the replacement for the Screen Rate by: |

(i) | the administrator of the Screen Rate (provided that the market or economic reality that such benchmark rate measures is the same as that measured by the Screen Rate); or |

(ii) | any Relevant Nominating Body, |

and if replacements have, at the relevant time, been formally designated, nominated or recommended under both paragraphs, the Replacement Benchmark will be the replacement under paragraph (ii) above;

(b) | in the opinion of the Majority Lenders and the Borrowers, generally accepted in the international syndicated loan markets as the appropriate successor to the Screen Rate; or |

(c) | in the opinion of the Majority Lenders and the Borrowers, an appropriate successor to the Screen Rate. |

Representative means any delegate, agent, manager, administrator, nominee, attorney, trustee or custodian.

Requisition Compensation means all sums of money or other compensation from time to time payable in respect of any requisition for title of other compulsory acquisition, requisition, expropriation or similar of a Vessel by any governmental entity.

Restricted Asset means any asset derived from any transaction with a Restricted Party or in which any Restricted Party has any legal or beneficial interest.

Restricted Party means a person that is:

(a) | listed on any Sanctions List or targeted by Sanctions (whether designated by name or by reason of being included in a class of person); or |

(b) | located in or incorporated under the laws of any country or territory that is the target of comprehensive, country- or territory-wide Sanctions; or |

(c) | directly or indirectly owned or controlled by, or acting on behalf, at the direction or for the benefit of, a person referred to in (a) and/or (b) above. |

Sanctions means all laws, regulations and orders concerning any trade, economic or financial sanctions or embargoes or restrictive measures which are administered, enacted or enforced at any time by any Sanctions Authority to which the relevant Obligor, a Relevant Person and/or the relevant Finance Party is subject or compliance with which is reasonable in the ordinary course of business of such person or, in the case of a Finance Party, is required due to internal compliance and regulation.

Sanctions Authority means the Norwegian State, the United Nations, the European Union, the member states of the European Union, the United States of America, the United Kingdom, Japan and any authority acting on behalf of any of them in connection with Sanctions.

Sanctions List means (a) the lists of Sanctions designations and/or targets maintained by any Sanctions Authority and/or (b) any other Sanctions designation or target listed and/or adopted by a

16

Sanctions Authority, in all cases, from time to time.

Screen Rate means the London interbank offered rate administered by ICE Benchmark Administration Limited (or any other person which takes over the administration of that rate) for USD for the relevant period displayed (before any correction, recalculation or republication by the administrator) on page LIBOR01/LIBOR02 of the Thomson Reuters Screen (or any replacement Thomson Reuters page which displays that rate) or on the appropriate page of such other information service which publishes that rate from time to time in place of Thomson Reuters. If such page or service ceases to be available, the Agent may specify another page or service displaying the relevant rate after consultation with the Borrowers and the Lenders.

Screen Rate Replacement Event means, in relation to the Screen Rate:

(a) | the methodology, formula or other means of determining the Screen Rate has, in the opinion of the Majority Lenders and the Borrowers, materially changed; or |

(b)

(i)

(A) | the administrator of the Screen Rate or its supervisor publicly announces that such administrator is insolvent; or |

(B) | information is published in any order, decree, notice, petition or filing, however described, of or filed with a court, tribunal, exchange, regulatory authority or similar administrative, regulatory or judicial body which reasonably confirms that the administrator of the Screen Rate is insolvent, |

provided that, in each case, at that time, there is no successor administrator to continue to provide the Screen Rate; or

(ii) | the administrator of the Screen Rate publicly announces that it has ceased or will cease, to provide the Screen Rate permanently or indefinitely and, at that time, there is no successor administrator to continue to provide the Screen Rate; or |

(iii) | the supervisor of the administrator of the Screen Rate publicly announces that the Screen Rate has been or will be permanently or indefinitely discontinued; or |

(iv) | the administrator of the Screen Rate or its supervisor announces that the Screen Rate may no longer be used; or |

(c) | the administrator of the Screen Rate determines that the Screen Rate should be calculated in accordance with its reduced submissions or other contingency or fallback policies or arrangements and either: |

(i) | the circumstances or events leading to such determination are not (in the opinion of the Majority Lenders and the Borrowers) temporary; or |

(ii) | the Screen Rate is calculated in accordance with any such policy or arrangement for a period no less than 3 months; or |

(d) | in the opinion of the Majority Lenders and the Borrowers, the Screen Rate is otherwise no longer appropriate for the purposes of calculating interest under this Agreement. |

Security means a mortgage, charge, pledge, lien or other security interest securing any obligation of any person or any other agreement or arrangement having a similar effect.

Security Assets means:

(a) | the Vessels; |

(b) | the Earnings; |

17

(c) | the Insurances; |

(d) | the Accounts; |

(e) | any Requisition Compensation; |

(f) | the Shipbuilding Contracts; |

(g) | the Refund Guarantees; |

(h) | the shares in each Borrower; and |

(i) | the rights of each Borrower under the Hedging Agreements. |

Security Document means each document listed in Clause 18 (Security) and any other document agreed between the Parties to be a Security Document.

Security Period means, in relation to a Vessel, the period from its Delivery Date until the earlier of:

(a) | the date on which the Loans relating to that Vessel are prepaid in full under Clause 8.5 (Mandatory prepayment – Total Loss or sale of a Vessel) together with all other sums then due and payable under the Finance Documents following the sale or Total Loss of that Vessel; |

(b) | any date on which (with the approval of the Lenders and the Hedging Banks) the relevant Mortgage and all other Security Documents relating to that Vessel are released without being replaced by a new Mortgage and any other relevant Security Documents; and |

(c) | the last day of the Facility Period. |

Share Pledges means together the Borrower A Share Pledge and the Borrower B Share Pledge, and Share Pledge means either of them.

Shareholder Loans means shareholder loans and/or loans from other companies within the Group and/or loans from other Affiliates.

Shipbuilding Contract A means the shipbuilding contract dated 26 September 2018 originally made between Borrower A and the Existing Shipyard for the construction of Vessel A and which is to be novated from and out of the name of the Existing Shipyard to and into the name of the New Shipyard pursuant to the Shipbuilding Contract Novation Agreement relating to Vessel A.

Shipbuilding Contract B means the shipbuilding contract dated 26 September 2018 originally made between Borrower B and the Existing Shipyard for the construction of Vessel B and which is to be novated from and out of the name of the Existing Shipyard to and into the name of the New Shipyard pursuant to the Shipbuilding Contract Novation Agreement relating to Vessel B.

Shipbuilding Contract Novation Agreement means:

(a) | in relation to Vessel A, the novation agreement made or to be made between Borrower A, the Existing Shipyard and the New Shipyard pursuant to which Shipbuilding Contract A is to be novated out of the name of the Existing Shipyard into the name of the New Shipyard; and |

(b) | in relation to Vessel B, the novation agreement made or to be made between Borrower B, the Existing Shipyard and the New Shipyard pursuant to which Shipbuilding Contract B is to be novated out of the name of the Existing Shipyard into the name of the New Shipyard. |

Shipbuilding Contracts means together the Shipbuilding Contract A and the Shipbuilding Contract B (in each case as novated by the relevant Shipbuilding Contract Novation Agreement), and Shipbuilding Contract means either of them.

Shipyard means:

| (a) | at any time prior to the novation of the Shipbuilding Contracts pursuant to the Shipbuilding |

18

Contract Novation Agreements, the Existing Shipyard; and

(b) | at all times thereafter, the New Shipyard. |

SMC means, in respect of a Vessel, a valid safety management certificate issued for that Vessel issued by the Classification Society pursuant to paragraph 13.7 of the ISM Code.

SMS means a safety management system for a Vessel developed and implemented in accordance with the ISM Code and including the functional requirements duties and obligations that follow from the ISM Code.

Subsidiary means an entity of which a person has direct or indirect control (whether through the ownership of voting capital, by contract or otherwise) or owns directly or indirectly more than 50% of the shares and for this purpose an entity shall be treated as controlled by another if that entity is able to direct its affairs and/or to control the composition of the board of directors or equivalent body.

Tax means any tax, levy, impost, duty or other charge or withholding of a similar nature (including any penalty or interest payable in connection with any failure to pay or any delay in paying any of the same).

Total Commitments means the aggregate of the Commitments, being USD277,100,000 at the date of this Agreement.

Total Loss means, in relation to a Vessel:

(a) | the actual, constructive, compromised, agreed, arranged or other total loss of that Vessel; |

(b) | the requisition for title or compulsory acquisition of that Vessel by any government or other competent authority; |

(c) | the capture, seizure, destruction, abandonment, condemnation, arrest, detention or confiscation of that Vessel by any government or by persons acting or purporting to act on behalf of any government or public authority, unless that Vessel is released and returned to the possession of the relevant Borrower within 30 days after the capture, seizure, arrest, detention or confiscation in question; or |

(d) | any piracy, hijacking or theft of that Vessel, unless that Vessel is released and restored to the relevant Borrower within 30 days after the occurrence of such incident. |

Total Loss Date means:

(a) | in the case of an actual total loss of a Vessel, the date on which it occurred or, if that is unknown, the date when that Vessel was last heard of; |

(b) | in the case of a constructive, compromised, agreed or arranged total loss of a Vessel, the earlier of (i) the date on which a notice of abandonment is given to the insurers (provided a claim for total loss is admitted by such insurers) or, if such insurers do not forthwith admit such a claim, at the date at which either a total loss is subsequently admitted by the insurers or a total loss is subsequently adjudged by a competent court of law or arbitration panel to have occurred or, if earlier, the date falling 3 Months after notice of abandonment of that Vessel was given to the insurers and (ii) the date of compromise, arrangement or agreement made by or on behalf of the relevant Borrower with that Vessel's insurers in which the insurers agree to treat that Vessel as a total loss; or |

(c) | in the case of any other type of total loss, on the date (or the most likely date) on which it appears to the Agent that the event constituting the total loss occurred. |

Total Post-Delivery Commitments means the aggregate of the Commitments relating to the Post-Delivery Facility being USD192,100,000 at the date of this Agreement.

Total Pre-Delivery Commitments means the aggregate of the Commitments relating to the Pre-Delivery Facility being USD85,000,000 at the date of this Agreement.

19

Tranches means together the Pre-Delivery Tranches and the Post-Delivery Tranches, and Tranche means any of them.

Transaction Documents means each Shipbuilding Contract, each Refund Guarantee, each Charterparty and each Management Agreement, together with the other documents contemplated herein or therein or otherwise designated as a Transaction Document by the Agent and the Borrowers, and Transaction Document means any of them.

Transfer Certificate means a certificate substantially in the form set out in Schedule 5 (Form of Transfer Certificate) or any other form agreed between the Agent and the Borrowers.

Transfer Date means, in relation to a transfer, the later of:

(a) | the proposed Transfer Date specified in the relevant Transfer Certificate; and |

(b) | the date on which the Agent executes the relevant Transfer Certificate. |

UK Bail-In Legislation means (to the extent that the United Kingdom is not an EEA Member Country which has implemented or implements Article 55 BRRD) Part I of the United Kingdom Banking Act 2009 and any other law or regulation applicable in the United Kingdom relating to the resolution of unsound or failing banks, investment firms or other financial institutions or their affiliates (otherwise than through liquidation, administration or other insolvency proceedings).

US means the United States of America.

US Tax Obligor means:

(a) | a Borrower which is resident for tax purposes in the US; or |

(b) | an Obligor some or all of whose payments under the Finance Documents are from sources within the US for US federal income tax purposes. |

Unpaid Sum means any sum due and payable but unpaid by an Obligor under the Finance Documents.

Utilisation means a utilisation of a Facility.

Utilisation Date means the date of a Utilisation, being the date on which the relevant Loan is to be made.

Utilisation Request means a notice substantially in the form set out in Schedule 4 (Form Of Utilisation Request).

VAT means:

(a) | any tax imposed in compliance with the Council Directive of 28 November 2006 on the common system of value added tax (EC Directive 2006/112); |

(b) | value added tax as provided for in the Norwegian Value Added Tax Act of 19 June 2009 no. 58 (in Norwegian, Merverdiavgiftsloven); or |

(c) | any other tax of a similar nature. |

Vessel A means a newbuilding DP2 shuttle tanker with the Shipyard's hull no. 3114, with a contract price of USD105,713,800 and estimated delivery in June 2020, to be registered in the name of Borrower A with an Approved Ship Registry upon delivery.

Vessel B means a newbuilding DP2 shuttle tanker with the Shipyard's hull no. 3115, with a contract price of USD105,713,800 and estimated delivery in August 2020, to be registered in the name of Borrower B with an Approved Ship Registry upon delivery.

Vessels means together Vessel A and Vessel B, and Vessel means either of them.

20

Write-down and Conversion Powers means:

(a) | in relation to any Bail-In Legislation described in the EU Bail-In Legislation Schedule from time to time, the powers described as such in relation to that Bail-In Legislation in the EU Bail-In Legislation Schedule; and |

(b) | in relation to any other applicable Bail-In Legislation or UK Bail-In Legislation: |

(i) | any powers to cancel, transfer or dilute shares issued by a person that is a bank or investment firm or other financial institution or affiliate of a bank, investment firm or other financial institution, to cancel, reduce, modify or change the form of a liability of such a person or any contract or instrument under which that liability arises, to convert all or part of that liability into shares, securities or obligations of that person or any other person, to provide that any such contract or instrument is to have effect as if a right had been exercised under it or to suspend any obligation in respect of that liability or any of the powers that are related to or ancillary to any of those powers; and |

(ii) | any similar or analogous powers under that Bail-In Legislation or UK Bail-In Legislation. |

1.2 | Construction |

(a) | Unless a contrary indication appears, any reference in this Agreement to: |

(i) | the Agent, the Mandated Lead Arranger, the Bookrunner, any Finance Party, any Lender or any Party shall be construed so as to include its successors in title, permitted assigns and permitted transferees to, or of, its rights and/or obligations under the Finance Documents; |

(ii) | a Hedging Bank shall be construed so as to include its successors in title, permitted assigns and permitted transferees to, or of, its rights and/or obligations under any Hedging Agreement; |

(iii) | the Charterer shall be construed so as to include its successors in title under any Charter; |

(iv) | assets includes present and future properties, revenues and rights of every description; |

(v) | a Finance Document, Transaction Document or any other agreement or instrument is a reference to that Finance Document, Transaction Document or other agreement or instrument as amended, novated, supplemented, extended or restated; |

(vi) | a group of Lenders includes all the Lenders; |

(vii) | indebtedness includes any obligation (whether incurred as principal or as surety) for the payment or repayment of money, whether present or future, actual or contingent; |

(viii) | a person includes any individual, firm, company, corporation, government, state or agency of a state or any association, trust, joint venture, consortium, partnership or other entity (whether or not having separate legal personality); |

(ix) | a regulation includes any regulation, rule, official directive, request or guideline (whether or not having the force of law) of any governmental, intergovernmental or supranational body, agency, department or of any regulatory, self-regulatory or other authority or organisation; |

(x) | a provision of law is a reference to that provision as amended or re-enacted; |

(xi) | words importing the singular shall include the plural and vice versa; and |

(xii) | a time of day is a reference to Bergen time unless specified otherwise. |

21

(b) | Section, Clause and Schedule headings are for ease of reference only. |

(c) | Unless a contrary indication appears, a term used in any other Finance Document or in any notice given under or in connection with any Finance Document has the same meaning in that Finance Document or notice as in this Agreement. |

(d) | Each Hedging Agreement shall operate subject to the terms of this Agreement and accordingly, in the event of any inconsistency between the terms of a Hedging Agreement and this Agreement, the terms of this Agreement will prevail. |

(e) | A Default is continuing if it has not been remedied or waived and an Event of Default is continuing if it has not been waived. |

1.3 | Currency symbols and definitions |

$, USD and dollars denote the lawful currency of the United States of America.

1.4 | Third party rights |

(a) | Unless expressly provided to the contrary in that Finance Document, a person who is not a party to a Finance Document may not enforce any of its terms under the Contracts (Rights of Third Parties) Act 1999. |

(b) | The consent of any third party to whom rights have been provided under a Finance Document is not required, unless otherwise specifically required under the terms of any Finance Document, to rescind, vary, amend or terminate a Finance Document at any time. |

SECTION 2

THE FACILITIES

2. | THE FACILITIES |

2.1 | The Pre-Delivery Facility |

Subject to the terms of this Agreement, the Lenders make available to the Borrowers a senior secured USD pre-delivery term loan facility in an aggregate amount equal to the Total Pre-Delivery Commitments.

2.2 | The Post-Delivery Facility |

Subject to the terms of this Agreement, the Lenders make available to the Borrowers a senior secured USD post-delivery term loan facility in an aggregate amount equal to the Total Post-Delivery Commitments.

2.3 | Finance Parties' and Hedging Banks' rights and obligations |

(a) | The obligations of each Finance Party and each Hedging Bank under the Finance Documents are several. Failure by a Finance Party or a Hedging Bank to perform its obligations under the Finance Documents or the Hedging Agreements does not affect the obligations of any other Party under the Finance Documents or the Hedging Agreements. No Finance Party or Hedging Bank is responsible for the obligations of any other Finance Party or Hedging Bank under the Finance Documents and the Hedging Agreements. |

(b) | The rights of each Finance Party and each Hedging Bank under or in connection with the Finance Documents and the Hedging Agreements are separate and independent rights and any debt arising under the Finance Documents to a Finance Party or under the Hedging Agreements to a Hedging Bank from an Obligor shall be a separate and independent debt. |

(c) | A Finance Party and a Hedging Bank may, except as otherwise stated in the Finance Documents and the Hedging Agreements, separately enforce its rights under the Finance Documents and the Hedging Agreements. |

22

(d) | No Finance Party or Hedging Bank will be liable (including, without limitation, for negligence or any other category of liability whatsoever) for any action taken by it under or in connection with any Finance Document or Hedging Agreement, unless directly caused by its gross negligence or wilful misconduct. |

3. | PURPOSE |

3.1 | Purpose of the Pre-Delivery Facility |

The Borrowers shall apply all amounts borrowed by them under the Pre-Delivery Facility towards financing of instalments under the Shipbuilding Contracts.

3.2 | Purpose of the Post-Delivery Facility |

The Borrowers shall apply all amounts borrowed by them under the Post-Delivery Facility towards (a) refinancing the amounts borrowed under the Pre-Delivery Facility, (b) financing the delivery instalments of the Vessels and (c) financing and/or refinancing any other Aggregate Project Costs.

3.3 | Monitoring |

No Finance Party is bound to monitor or verify the application of any amount borrowed pursuant to this Agreement.

4. | CONDITIONS OF UTILISATION |

4.1 | Initial conditions precedent |