Form 10-Q Spirit AeroSystems Holdi For: Jul 01

Exhibit 10.1

Annual Nonemployee Director Compensation Overview

| Board Service | |||||

| Cash Retainer | $110,000 (Cash) | ||||

| Equity Award | $135,000 (Restricted Stock or RSUs*) | ||||

| Additional Cash Retainers for Board Leadership | |||||

| Nonexecutive Chairman of the Board | $115,000 | ||||

| Audit Committee Chair | $26,000 | ||||

| Compensation Committee Chair | $21,000 | ||||

| Corporate Governance and Nominating Committee Chair | $15,000 | ||||

| Risk Committee Chair | $15,000 | ||||

| Stock Ownership Guidelines | |||||

| Nonemployee Directors | 5X Annual Cash Retainer** | ||||

* RSUs are deferred until separation from the Board

** A nonemployee Director is expected to reach the stock ownership guideline four years from the date the individual is first elected to the Board.

Exhibit 10.2

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT IS BOTH (i) NOT MATERIAL AND (ii) WOULD BE LIKELY TO CAUSE COMPETITITVE HARM TO THE COMPANY IF PUBLICLY DISCLOSED. SUCH EXCLUDED INFORMATION IS DENOTED BY ASTERISKS IN BRACKETS [*****].

AMENDMENT NUMBER 34

TO

Special Business Provisions (SBP) BCA-MS-65530-0019

BETWEEN

THE BOEING COMPANY

AND

SPIRIT AEROSYSTEMS, INC.

THIS AMENDMENT NUMBER 34 (“Amendment No. 34”) to Special Business Provisions BCA-MS-65530-0019 is made as of the last date executed below (the “Effective Date”) by and between Spirit AeroSystems, Inc., a Delaware corporation having its principal office in Wichita, Kansas (“Spirit”) and The Boeing Company, a Delaware corporation, acting by and through its division, Boeing Commercial Airplanes (“Boeing”). Hereinafter, Spirit and Boeing may be referred to jointly as the “Parties”.

BACKGROUND

A.The Parties have entered into the General Terms Agreement, GTA BCA-65520-0032, dated June 16, 2005 as amended from time to time (the “GTA”) and the Special Business Provisions, BCA-MS-65530-0019, dated June 16, 2005 as amended from time to time (the "SBP") and now desire to again amend the SBP.

B.This Amendment No. 34 incorporates the CY2019 Annual Shipset Price Adjustments for changes committed on and before December 31, 2019 and which are effective on or before Shipset Line Number [*****] and the annual update of the traveled work cost estimating relationship values.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing and the mutual agreements contained herein, and for other good and valuable consideration, the value, receipt, and sufficiency of which are hereby acknowledged, the Parties hereby agree as follows:

1.The SBP is hereby amended by adding the SBP Table of Amendments Page 5, attached hereto as Exhibit 1.

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 1 of 15

2.The SBP is hereby amended by deleting SBP Attachment 1 “Work Statement and Pricing” and replacing it in its entirety with a new SBP Attachment 1, attached hereto as Exhibit 2

3.The SBP is hereby amended by deleting SBP Attachment 2 “Production Article Definition and Contract Change Notices” and replacing it in its entirety with a new SBP Attachment 2, attached hereto as Exhibit 3

4.The SBP is hereby amended by deleting SBP Attachment 16 “Pricing Methodologies” Section A “Boeing Performed Repair and Rework” and replacing it in its entirety with a new SBP Attachment 16 Section A, attached hereto as Exhibit 4

5.Entire Agreement. Except as otherwise indicated in this Amendment No. 34, all terms defined in the GTA or SBP shall have the same meanings when used in this Amendment No. 34. This Amendment No. 34 constitutes the complete and exclusive agreement between the Parties with respect to the subject matter of this Amendment No. 34, and this Amendment No. 34 supersedes all previous agreements between the Parties relating to the subject matter of Amendment No. 34, whether written or oral. The GTA and SBP shall remain in full force and effect and are not modified, revoked, or superseded except as specifically stated in this Amendment No. 34.

IN WITNESS WHEREOF, the duly authorized representatives of the Parties have executed this Amendment No. 34 as of the last date of execution set forth below.

The Boeing Company Spirit AeroSystems Inc.

Acting by and through its division

Boeing Commercial Airplanes

By: /s/Helena Langowski By: /s/Ryan Grant

Name: Helena Langowski Name: Ryan Grant

Title: Procurement Agent Title: Contract Administrator

Date: June 30, 2021 Date: June 30, 2021

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 2 of 15

SBP BCA-MS-65530-0019, Amendment No. 34 Exhibit 1

AMENDMENTS

Page 5

| Number | Description | Date | Approval | ||||||||

| 30 | Annual Shipset Price Adjustment thru Line Number [*****] 1. Updated SBP Section 7.2.1 and SBP Attachments 1 and 2 | 8/12/19 | H. Langowski R. Grant | ||||||||

| 31 | 9/25/19 | H. Langowski R. Grant | |||||||||

| Configuration Control 1. Updated SBP Section 21 2. Added new Section 21.1 [*****] | |||||||||||

| 32 | 4/15/20 | H. Langowski R. Grant | |||||||||

| Supply Chain Integration 1. Updated SBP Section 12.8 2. Added new Section 12.8.8 [*****] | |||||||||||

| 33 | 1/19/21 | H. Langowski R. Grant | |||||||||

| Payment Terms 1. Updated SBP Section 5.2.1 | |||||||||||

| 34 | 6/30/21 | H. Langowski R. Grant | |||||||||

| Annual Shipset Price Adjustment thru Line Number [*****] | |||||||||||

| 1. Updated SBP Attachments 1 and 2 | |||||||||||

| Boeing Performed Rework and Repair | |||||||||||

| 1. Updated SBP Attachment 16 Section A | |||||||||||

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 3 of 15

SBP BCA-MS-65530-0019, Amendment No. 34 Exhibit 2

SBP ATTACHMENT 1 TO

SPECIAL BUSINESS PROVISIONS

WORK STATEMENT AND PRICING

Recurring Shipset Price -8 | |||||||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

Recurring Shipset Price -9 | |||||||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

Recurring Shipset Price -10 | |||||||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 4 of 15

SBP BCA-MS-65530-0019, Amendment No. 34 Exhibit 2

SBP ATTACHMENT 1 TO

SPECIAL BUSINESS PROVISIONS

WORK STATEMENT AND PRICING (cont.)

| Advanced Payment Recovery (Per Shipset) | |||||||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||

| Boeing Amendment 17 Cost Recovery (per Shipset) | |||||||||||||||||||||||||||||||||||||||||

| Totals | |||||||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | ||||||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | ||||||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | ||||||||||||||||||||||||||||||||||||||||

Annual Price Adjustment Line Number [*****] Nonrecurring Allocation through [*****] | |||||||||||||||||||||||||||||||||||||||||

| (Reference SBP 7.2.2, SBP Attachment 16 Section C.3.1.2) | |||||||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | |||||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||||||||||||||||||

SBP BCA-MS-65530-0019, Amendment No. 34 Exhibit 2

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 5 of 15

SBP ATTACHMENT 1 TO

SPECIAL BUSINESS PROVISIONS

WORK STATEMENT AND PRICING (cont.)

| Advance Payments for Recurring | (See Recurring page for Advance Payment Recovery (per Shipset)) | |||||||||||||||||||||||||

| Years | Section 41 & NLG | Pylons | Wing Leading Edges | Totals | ||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | |||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | |||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | |||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | |||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | |||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | |||||||||||||||||||||

Non-Recurring Value Agreements | ||||||||||||||||||||||||||

| Estimated MS Timing | Section 41 & NLG R&D | Other D/MI NR | Pylons R&D | Other D/MI NR | Wing Leading Edges R&D | Other D/MI NR | Totals R&D | Other D/MI NR | ||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| [*****] | ||||||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| Advance Payments for Remaining Other D/MI NR Balance | ||||||||||||||||||||||||||

| Years | Section 41 & NLG | Pylon | Wing Leading Edges | Totals | ||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||

| Advance Payments Recovery of Remaining Other D/MI NR Balance | ||||||||||||||||||||||||||

| Shipset | Section 41 & NLG | Pylon | Wing Leading Edges | Totals | ||||||||||||||||||||||

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 6 of 15

| [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||||||

| Incentive Plan Payments (Reference SBP Section 4.9) | ||||||||||||||||||||||||||

| Periods | Section 41 & NLG | Pylon | Wing Leading Edge | Totals | ||||||||||||||||||||||

| R&D | Other D/MI | R&D | Other D/MI | R&D | Other D/MI | R&D | Other D/MI | |||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||||||||

| Incentive Plan for Quality Payments (Reference SBP Section 4.11) | ||||||||||||||||||||||||||

| Payment | ||||||||||||||||||||||||||

| Year | Totals | |||||||||||||||||||||||||

| [*****] | [*****] | |||||||||||||||||||||||||

| [*****] | [*****] | |||||||||||||||||||||||||

| [*****] | [*****] | |||||||||||||||||||||||||

SBP BCA-MS-65530-0019, Amendment No. 34 Exhibit 3

SBP ATTACHMENT 2 TO

SPECIAL BUSINESS PROVISIONS

PRODUCTION ARTICLE DEFINITION AND CONTRACT CHANGE NOTICES

(Reference SBP Sections 3.3.2.1, 3.3.2.2, 3.3.4.6, 3.4.1; GTA Section 1.0N,

1.0.P)

A. Configuration

The configuration of each Production Article shall be as described in the Integrated Control Station Plan revision identified below, and in the Contract Change Notices listed in Paragraph B below as such Contract Change Notices relate to the configuration of any Production Article

| Type | Product Number | Name | Manufacturing Change Level | Current Mfg Frozen LN | Extended Eff (Usage) | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 7 of 15

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

| [*****] | [*****] | [*****] | [*****] | [*****] | [*****] | ||||||||||||

SBP BCA-MS-65530-0019, Amendment No. 34 Exhibit 3

SBP ATTACHMENT 2

TO SPECIAL BUSINESS PROVISIONS

PRODUCTION ARTICLE DEFINITION AND CONTRACT CHANGE NOTICES

(cont.)

B. Contract Change Notices

The following Contract Change Notices (CCN’s) are hereby incorporated into

this SBP.

B.1 Non-D/MI Contract Change Notices:

A. All CCN’s listed in this Section B.1 are inclusive of all revisions and

cancellations issued on or before December 21, 2010:

CCN 1 through 318, 320 through 542, 544 through 762, 764 through 766, 768 through 779, 781 through 871, 873 through 889, 891 through 984, 986 through 990, 992 through 1024, 1028 through 1100, 1102 through 1142, 1144 through 1148, 1150 through 1162, 1164 through 1170, 1172 through 1240, 1242 through 1295, 1298 through 1420, 1422 through 1440, 1442 through 1452, 1454 through 1461, 1463 through 1472, 1474 through 1503, 1505 through 1564,

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 8 of 15

1566 through 1593, 1595 through 1611, 1613 through 1616, 1618 through 1623, 1625 through 1633, 1635 through 1658, 1661 through 1671, 1673 through 1686, 1688 through 1696, 1698, 1700 through 1709, 1710, 1712 through 1716, 1718 through 1748, 1750, 1751, 1753 through 1763, 1765 through 1810, 1814 through 1833, 1837 through 1844, 1846 through 1856, 1858 through 1866, 1868 through 1895, 1897, 1898, 1901, 1904 through 1906, 1908, 1909, 1911 through 1914, 1919, 1921 through 1925, 1928, 1933 through 1937, 1940 through 1943, 1946 through 1950, 1952 through 1963, 1968, 1973 through 1976, 1980, 1982, 1984, 1985, 1988 through 1993, 1995, 1999, 2000, 2004, 2005, 2007, 2014 through 2019, 2021.

SBP BCA-MS-65530-0019, Amendment No. 34 Exhibit 3

SBP ATTACHMENT 2 TO

SPECIAL BUSINESS PROVISIONS

PRODUCTION ARTICLE DEFINITION AND CONTRACT CHANGE NOTICES

(cont.)

B. All CCN’s listed in this Section B1.B. are inclusive of all revisions committed on and before December 31, 2011 and which are effective on or before Shipset Line Number [*****]:

CCN 319, 543, 763, 767, 780, 991,1025 through 1027, 1101, 1143, 1149, 1171,1296,1297,1421,1441,1473,1504,1565,1594,1617,1624,1634,1659,1660,1687, 1697, 1699, 1717, 1749, 1752, 1764, 1770, 1834, 1836, 1926, 1927, 1929 through 1932, 1938, 1939, 1945, 1951, 1966, 1967, 1969, 1971, 1972, 1977 through 1979, 1981, 1983, 1986, 1987, 1994, 1996 through 1998, 2002, 2003, 2006, 2008 through, 2013, 2020, 2022 through 2037, 2039 through 2058, 2060 through 2073, 2075 through 2111, 2113, 2115, 2116, 2118, 2120 through

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 9 of 15

2108, 2130 through 2135, 2137 through 2139, 2141, 2143, 2145 through 2157, 2160, 2161, 2162.

C. All CCN’s listed in this Section B1.C. are inclusive of all revisions committed

on and before December 31, 2012 and which are effective on or before Shipset

Line Number [*****]:

CCN 1835, 1899, 1902, 1903, 1944, 1965, 1970, 2038, 2074, 2112, 2114, 2117,

2142, 2144, 2178.

D. All CCN’s listed in this Section B.1.D are inclusive of all revisions committed

on and before December 31, 2013 and which are effective on or before Shipset

Line Number [*****]:

CCN 2001, 2059, 2129, 2140, 2172, 2197

E. All CCN’s listed in this Section B.1.E are inclusive of all revisions committed

on and before December 31, 2014 and which are effective on or before Shipset

Line Number [*****]:

CCN 2171, 2173, 2200

F. CCN 2207 is inclusive of all revisions committed on and before December 31,

2015 and which are effective on or before Shipset Line Number [*****].

SBP BCA-MS-65530-0019, Amendment No. 34 Exhibit 3

SBP ATTACHMENT 2 TO

SPECIAL BUSINESS PROVISIONS

PRODUCTION ARTICLE DEFINITION AND CONTRACT CHANGE NOTICES

(cont.)

G. CCN 2233 is inclusive of all revisions committed on and before December

31, 2016 and which are effective on or before Shipset Line Number [*****].

H. CCN 2248 is inclusive of all revisions committed on and before December

31, 2017 and which are effective on or before Shipset Line Number [*****].

I. CCN 2267 is inclusive of all revisions committed on and before December 31,

2018 and which are effective on or before Shipset Line Number [*****].

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 10 of 15

J. CCN 2322 is inclusive of all revisions committed on and before December 31, 2019 and which are effective on or before Shipset Line Number [*****].

B.2 D/MI PtP Contract Change Notices:

Section 41 D/MI CCN’s: 1163, 1241, 1915, 1916, 2158, 2159, 2168, 2170R2,

2179, 2198, 2201

Pylon D/MI CCN’s: 1811, 1812, 2166, 2179, 2198, 2201, 2208

Wing LE D/MI CCN’s: 2167, 2170R2, 2198, 2201

CCN’s listed above are inclusive of any numerical formatting convention, i.e.

CCN 1 is the same as CCN-00001 or CCN 0001.

B. 3 Price Agreement Contract Change Notices (beginning 05/01/2018):

2246, 2249, 2250, 2251, 2254, 2256, 2264, 2273, 2282, 2283, 2293, 2298,

2306, 2310, 2313, 2318, 2319

B. 4 Other Contract Change Notices (beginning 05/01/2018):

2247, 2248, 2252, 2253, 2255, 2257, 2258, 2259, 2260, 2261, 2262 2263, 2265, 2266, 2267, 2268, 2269, 2270, 2271, 2274, 2275, 2276, 2277, 2278, 2279, 2280, 2281, 2284, 2285, 2286, 2287, 2288, 2289, 2290, 2291, 2292, 2294, 2295, 2296, 2297, 2299, 2300, 2301, 2302, 2303, 2304, 2305, 2307, 2308, 2309, 2311, 2312, 2314, 2315, 2316, 2317, 2320, 2321, 2322

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 11 of 15

SBP BCA-MS-65530-0019, Amendment No. 34 Exhibit 4

SBP ATTACHMENT 16 TO

SPECIAL BUSINESS PROVISIONS

PRICING METHODOLOGIES

(Reference SBP Sections 7.8.1, 11.1, 12.10.1)

A. Boeing Performed Repair and Rework

Prices for Boeing performed repair and rework (including traveled or incomplete work) shall utilize the following methodology

A.1 Price for non-conformance and traveled work identified in Spirit Generated

Line Unit OSSN EPD (Open Ship Short Notification Emergent Process

Document)

Definitions for Traveled Work Nomenclature:

SOI-A = All Traveled Work other than SOI-B

SOI-B = Traveled work resulting from PMI delivery delays that are the responsibility of Boeing or written instructions by Boeing to not complete certain Spirit responsible work.

Upon delivery of any Product by Spirit, all exceptions to defined configuration are documented by Spirit in a product known as a OSSN EPD or through other approved processes. Upon analysis by Boeing of such OSSN EPDs or other Spirit documented product, Boeing will establish incomplete work, repair and rework to be accomplished at Boeing’s facility. Incomplete Spirit work shall be comprised of incomplete work that is 1) due to Spirit (SOI-A) and 2) due to Boeing (SOI-B). The definition of this incomplete work will be documented in a product known as a “Closure Report”, or through other approved processes. Upon release of a line number Closure Report, or other documentation through approved processes, Boeing shall notify Spirit of the total quantity of SOI’s planned by Boeing for such Shipset multiplied by the prices per unit in table A.1.

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 12 of 15

SBP BCA-MS-65530-0019, Amendment No. 34 Exhibit 4

SBP ATTACHMENT 16

TO SPECIAL BUSINESS PROVISIONS

PRICING METHODOLOGIES (cont.)

Boeing shall notify Spirit of the total number of Line Unit OSSN EPDs due to traveled non-conformances. These shall be multiplied by the prices per unit in table A.1. The resulting values shall be the costs and expenses incurred by Boeing for such repair or rework as provided in SBP Section 11.1.

Table A.1

| Traveled Work Nomenclature | Price Per Unit | ||||

| SOI-A | $[*****] | ||||

| SOI-B | $[*****] | ||||

| Non-conformance EPD | $[*****] | ||||

A.2 Price for non-conformance, repair or rework identified at Boeing

Boeing shall consolidate and notify Spirit in a timely manner of all non-conformance EPDs identified at Boeing deemed to be Spirit responsibility. Spirit shall notify Boeing in a timely manner of any exceptions to the assignment of responsibility of any non-conformance EPD. The Parties shall work in good faith to resolve such exceptions.

Upon delivery of an Aircraft to Boeing’s customer, Boeing shall notify Spirit of all non-conformance EPDs identified at Boeing for such Shipset multiplied by the prices per unit in table A.1. The resulting value shall be the costs and expenses incurred by Boeing for such repair or rework as provided in SBP Section 11.1.

A.3 Other incomplete work, repair or rework

For any other incomplete work, repair or rework, including such work performed at a consuming partner/supplier, Boeing shall notify Spirit of the costs and expenses incurred by Boeing for such repair and rework.

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 13 of 15

SBP BCA-MS-65530-0019, Amendment No. 34 Exhibit 4

SBP ATTACHMENT 16 TO

SPECIAL BUSINESS PROVISIONS

PRICING METHODOLOGIES (cont.)

A.4 Process for updating prices for Boeing performed traveled work, repair and rework

In the third calendar quarter of each year, the fixed prices for traveled work, repair and rework shall be updated.

The value for SOI-A shall be updated based on the following:

The total quantity of Boeing direct factory labor hours expended from January 1 through June 30 (occurring in the same year the third quarter update is being calculated) for those SOI’s completed by Boeing in those calendar months, shall be divided by the total quantity of the same SOI’s used to establish the total quantity of Boeing direct factory labor hours. The quantity of SOI’s shall be determined on a per unit basis. The result shall be the average direct factory labor hours per SOI-A. [*****] additional [*****] shall be added to this average to account for additional support labor (M.E. Planning) not included in the above calculation or the Boeing wrap rate. The sum of the average hours per SOI-A plus [*****] shall be multiplied by the Boeing developed wrap rates. Boeing developed wrap rates shall reflect any annual changes in Boeing rates utilized for traveled work, repair and rework. The result shall be the fixed dollars per SOI-A per unit for such work.

The value for SOI-B’s shall be updated based on the following:

The average direct labor hours per SOI-A described above shall be divided by [*****] and multiplied by the Spirit developed wrap rate as calculated in SBP Attachment 16, Paragraph B. This calculation shall exclude the additional [*****] incorporated in to the SOI-A calculation.

The value for Non-conformance EPD’s shall be updated based on the following:

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 14 of 15

SBP BCA-MS-65530-0019, Amendment No. 34 Exhibit 4

SBP ATTACHMENT 16 TO

SPECIAL BUSINESS PROVISIONS

PRICING METHODOLOGIES (cont.)

The total quantity of Boeing direct factory labor hours expended from January 1 through June 30 (occurring in the same year the third quarter update is being calculated) for those EPD’s completed by Boeing in those calendar months, shall be divided by the total quantity of the same EPD’s used to establish the total quantity of Boeing direct factory labor hours. The quantity of EPD’s shall be determined on a per unit basis. The result shall be the average direct factory labor hours per EPD. [*****] additional [*****] shall be added to this average to account for additional overhead not included in the above calculation or the Boeing wrap rate. The sum of the average hours per EPD plus [*****] additional [*****] shall be multiplied by the Boeingdeveloped wrap rates for EPD work. Boeing developed wrap rates shall reflect any annual changes in Boeing rates utilized for traveled work, repair and rework. The result shall be the fixed dollars per EPD per unit for such work.

During any update, the Parties may review the relationship of the Boeing direct factory

labor hours and the hours of Boeing support to total rework hours and adjust the CER

accordingly.

These updated values shall be effective beginning October 1st of each year and shall

be in effect until the subsequent annual update.

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment No. 34 Boeing Initials: Spirit Initials:

Page 15 of 15

Exhibit 10.3

February 5, 2021

6-5AC1-TMW-21-111

Krista Clark

Spirit AeroSystems, Inc.

3801 S. Oliver St.

Wichita, KS, 67210

Subject: 737 Recalculated Pre-Payment

Reference:

a) Administrative Agreement ("AA") AA-65530-0010, General Terms

Areement ("GTA") BCA-65530-0016, and Special Business

Provisions ("SBP") MS-65530-0016 together with all Amendments

thereto respectively; collectively the “Supply Agreement”

b) Memorandum of Agreement dated February 6, 2020 (“737 Production

Rate Adjustment and Other Settlements MOA”), and the first

Amendment to 737 Production Rate Adjustment and Other

Settlements MOA, dated May 5, 2020 (collectively, the “MOAs”)

c) Contract Change Notice (“CCN”) 13108 dated December 16, 2020

d) Boeing Letter 6-5GC2-AAK-20-1681 dated December 17, 2020

e) CCN 13114 dated December 18, 2020

f) CCN 13120 dated December 21, 2020

g) Email from Spirit (K. Clark) to Boeing (T. Willis) dated January 5,

2021

h) CCN 13150 dated January 14, 2021

All terms used but not defined in this letter agreement (“Letter Agreement”) shall have the same meaning as in the Supply Agreement and the MOAs. Boeing and Spirit sometimes may be referred to herein individually as a “Party” and collectively as the “Parties”.

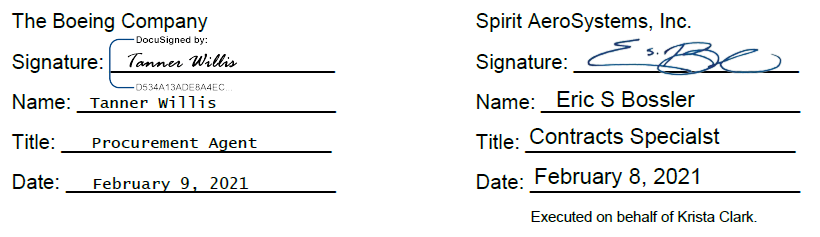

This Letter Agreement is effective as of the date of the last signature below (the “Effective Date”).

1. Background.

Pursuant to MOA Sub-Section 4.4, within sixty calendar (60) days following the U.S. Federal Aviation Administration 737 MAX ungrounding, the Parties will recalculate the Pre-Payment (“Recalculated Pre-Payment”) by using the i) planned Build Rate, ii) the planned quantity of each minor model defined in the latest F.O.B. master schedule, and iii) minor model pricing assumptions stated in MOA Attachment A.

Additionally, as set forth in MOA Sub-Section 4.4 (b), the Parties will compare the Pre-Payment to the Recalculated Pre-Payment (“Comparison”). If the Comparison identifies a gap, either over or under the Pre-Payment amount, then the respective Party will make any such payment to address the gap, no later than one hundred and twenty (120) calendar days following the 737 MAX ungrounding.

Exhibit 10.3

Krista Clark

6-5AC1-TMW-21-111

Page 2

The U.S. Federal Aviation Administration 737 MAX ungrounding took place on November

18, 2020.

The planned Build Rate provided in Boeing’s December 17, 2020 letter (reference d) and

the fuselage R192 Ship-in-Place schedule (provided via reference g), and CCNs 13114,

13120, and 13150 were used as the baseline to determine the Recalculated Pre-Payment.

For clarity, the Recalculated Pre-Payment is based on the fuselage schedule and does not

reflect the schedules for non-fuselage end items.

2. Agreement.

The Recalculated Pre-Payment is two hundred twenty-three million, five hundred sixty-

three thousand, and two hundred thirty-four U.S. dollars ($223,563,234). The Comparison

between the Pre-Payment and the Recalculated Pre-Payment is a difference of sixty-eight

million, four hundred seventy-one thousand, and seven hundred thirty-four U.S. dollars

($68,471,734). Boeing will pay Spirit the difference between the Pre-Payment and the

Recalculated Pre-Payment less the thirty million U.S. dollars ($30,000,000) Credit. Boeing

will pay thirty-eight million, four hundred seventy-one thousand, and seven hundred

thirtyfour U.S. dollars ($38,471,734) no later than March 18, 2021.

EXECUTED by the duly authorized representatives of the Parties.

EXHIBIT 31.1

CERTIFICATION PURSUANT TO

RULE 13a/15d OF THE SECURITIES EXCHANGE ACT OF 1934,

AS ADOPTED PURSUANT TO

SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Thomas C. Gentile III, certify that:

1. I have reviewed this Quarterly Report on Form 10-Q of Spirit AeroSystems Holdings, Inc. (“registrant”);

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s Board of Directors (or persons performing the equivalent functions):

(a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize, and report financial information; and

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| /s/ Thomas C. Gentile III | |||||

| Thomas C. Gentile III | |||||

| President and Chief Executive Officer | |||||

Date: August 4, 2021

EXHIBIT 31.2

CERTIFICATION PURSUANT TO

RULE 13a/15d OF THE SECURITIES EXCHANGE ACT OF 1934,

AS ADOPTED PURSUANT TO

SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Mark J. Suchinski, certify that:

1. I have reviewed this Quarterly Report on Form 10-Q of Spirit AeroSystems Holdings, Inc. (“registrant”);

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s Board of Directors (or persons performing the equivalent functions):

(a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize, and report financial information; and

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| /s/ Mark J. Suchinski | |||||

| Mark J. Suchinski | |||||

| Senior Vice President and Chief Financial Officer | |||||

Date: August 4, 2021

EXHIBIT 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of Spirit AeroSystems Holdings, Inc. (the “Company”) on Form 10-Q for the period ended July 1, 2021, as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Thomas C. Gentile III, as President and Chief Executive Officer of the Company, certify, pursuant to 18 U.S.C. § 1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, that, to the best of my knowledge:

(1) The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and

(2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| /s/ Thomas C. Gentile III | |||||

| Thomas C. Gentile III | |||||

| President and Chief Executive Officer | |||||

Date: August 4, 2021

EXHIBIT 32.2

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of Spirit AeroSystems Holdings, Inc. (the “Company”) on Form 10-Q for the period ended July 1, 2021, as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Mark J. Suchinski, as Senior Vice President and Chief Financial Officer of the Company, certify, pursuant to 18 U.S.C. § 1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, that, to the best of my knowledge:

(1) The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and

(2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| /s/ Mark J. Suchinski | |||||

| Mark J. Suchinski | |||||

| Senior Vice President and Chief Financial Officer | |||||

Date: August 4, 2021

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Spirit AeroSystems (SPR) PT Raised to $31 at Goldman Sachs

- Grand Peak Closes Non-Brokered Private Placement

- Adams Diversified Equity Fund Declares Distribution and Announces First Quarter Performance

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share