Form 10-Q Restaurant Brands Intern For: Mar 31

EXHIBIT 10.77

OFFER LETTER

January 15, 2021

Personal & Confidential

Axel Schwan

Dear Axel:

I am pleased to confirm changes to the terms and conditions of your employment with The TDL Group Corp. (the “Company”) as set out in this offer letter (the “Offer Letter”). Your entitlement to the payments and benefits set out herein is subject to our receipt of a signed copy of this Offer Letter. By signing this Offer Letter, you acknowledge and accept all the provisions below, and you acknowledge that, other than as set forth in this Offer Letter, no representations or warranties regarding your employment have been made to you.

1. Position. Your job title remains President, Tim Hortons, Americas, reporting to Jose Cil, Chief Executive Officer, or such other person as the Company may designate from time to time, and you will continue to have such duties and responsibilities as are customarily assigned to persons serving in such position and such other duties consistent with your position as the Company specifies from time to time.

2. Location. Your position remains based in Toronto. However, you may be required to travel in and outside of Toronto as the needs of the Company’s business dictate.

3. Compensation.

(a) Base Salary. Effective on the later of March 1, 2021 and the date upon which we receive a signed copy of this Offer Letter, your base salary will be CAD $729,498.12 gross per annum (“Base Salary”), payable in instalments on the Company’s regular payroll dates. Notwithstanding the foregoing, the Company will adjust a portion of your Base Salary on a quarterly basis in an effort to minimize the impact of currency fluctuations between the United States Dollar (USD) and the Canadian Dollar (CAD), such adjustment to be made in accordance with the Company’s Mobility Compensation Policy, as such policy may be amended by the Company from time to time. For purposes of clarity, the USD equivalent used to determine your Base Salary is $525,000.

(b) Annual Bonus Program.

i. Bonus. You will remain eligible to participate in the Company’s Annual Bonus Program or such other annual bonus program to be adopted and maintained for employees of the Company at your pay band that the Company designates, in its sole discretion (any such plan, the “Bonus Plan”), in accordance with the terms of the Bonus Plan (including any performance targets or objectives established under such plan and the timing of any payment under such plan) as in effect from time to time. The Bonus Plan (including your target bonus rate under such Bonus Plan) is a discretionary, non-contractual benefit, which the Company reserves the right to amend or withdraw at any time. Under the Bonus Plan, your target bonus rate for the 2021 performance year will be One Hundred Twenty percent (120%) of your Base Salary (subject to tax equalization and currency conversion described below).

ii. Tax Equalization. Your bonus entitlement will be calculated in accordance with the Bonus Plan and will be based on your Base Salary in USD, in accordance with the Company’s Mobility Compensation Policy. It will then be subject to tax equalization in accordance with the

Company’s Compensation Policy in an effort to provide you with the same net bonus payment that you would have received if your employment was subject to tax and other withholdings in the United States, and will be paid to you in CAD based upon the applicable currency exchange rate determined under the Company’s Mobility Compensation Policy.

(c) Host Premium. For the duration of time during which you hold the position set forth in Section 1 of this Offer Letter, the Company will pay you a host premium which, effective March 1, 2021 (or the date upon which we receive a signed copy of this Offer Letter, if later), will be at a gross annualized rate of CAD $289,110.46, payable in instalments on the Company’s regular payroll dates (the “Host Premium”). This Host Premium will be reviewed periodically, and may be amended or withdrawn in the Company’s sole discretion. Notwithstanding the foregoing, a portion of this Host Premium will be adjusted on a quarterly basis, to the extent a portion of your Base Salary is adjusted (as described above) in an effort to minimize the impact of currency fluctuations between the USD and the CAD, both such adjustments to be made in accordance with the Company’s Mobility Compensation Policy, as such policy may be amended by the Company from time to time.

(d) Payments and Deductions. All compensation will be payable in accordance with the applicable plan, policy or agreement and the Company’s normal payroll practices as they relate to time and frequency of payments and payroll deductions. Payments of Base Salary, bonus (if any) or other compensation or benefits will be subject to all applicable taxes and other withholdings, and the Company may withhold all such taxes and other withholdings from any payments made to you as shall be required by law. In addition, if at any time money is owed and payable by you to the Company, it is agreed that the Company may deduct such sums from time to time owed from any payment due to you from the Company in accordance with applicable law.

4. Employee Benefits.

(a) Medical and Other Health Care Benefits. During your employment with the Company, you will remain eligible to participate in the employee medical and other health care benefit plans and programs maintained by the Company from time to time for employees at your level, in each case, such benefits will be provided in accordance with the terms and conditions of the plans in effect from time to time. The Company reserves the right to perform periodic reviews of the Company’s benefits and to revise your eligibility for medical and other health care benefits based upon the results of any such review. Your participation in the Company’s group benefit plans is mandatory and cannot be waived.

(b) Pension. You will remain eligible to participate in the Company pension plan, in accordance with the terms and conditions of the plan in effect from time to time.

5. Vacation and Other Leaves.

(a) Vacation. In addition to public holidays and any paid leave required by applicable law, you will remain entitled to receive paid vacation on an accrued basis in the amount provided by, and in accordance with the terms and conditions of, applicable Company policy (currently five weeks per calendar year).

(b) Personal Days. You will remain entitled to receive paid personal days on an annualized basis in the amount provided by, and in accordance with the terms and conditions of, applicable Company policy.

6. Termination.

(a) Termination Without Cause. The Company may terminate your employment at any time, without just cause, by providing you with only the minimum entitlements as required by the Employment Standards Act, 2000. The minimum requirements under the Employment Standards Act, 2000 to which you are entitled shall represent your complete entitlement on termination in full satisfaction of all statutory, common law and/or other entitlements. The decision to provide notice of termination or pay in lieu of notice, or any combination thereof, except where otherwise prescribed by the Employment Standards Act, 2000, shall be at the sole discretion of the Company.

(b) Termination “for Cause”. You will not be entitled to advanced notice of termination in the event that the Company terminates your employment “for cause” or your employment terminates on the basis of frustration of contract, each as defined below. In either such event, you shall have no right to receive any further remuneration or benefits (including, without limitation, notice or payment in lieu of notice or, if applicable, any bonus or redundancy payments) other than accrued salary, accrued but unused vacation pay, approved but unreimbursed business expenses that are owed to you as at the date of your termination, and any other minimum entitlements to which you may be entitled under the Employment Standards Act, 2000. For purposes of this Offer Letter, your employment will be deemed to have been terminated “for cause” in the event of (i) a material breach by you of any provision of this Offer Letter; (ii) a material violation by you of any Policy (as defined in sub-paragraph 7(c), Compliance with Company Policies, below), (iii) the failure by you to reasonably and substantially perform your duties hereunder (other than as a result of physical or mental illness or injury); (iv) your wilful misconduct or gross negligence that has caused or is reasonably expected to result in demonstrable injury to the business, reputation or prospects of the Company or any of its affiliates; (v) your fraud or misappropriation of funds or other property; (vi) the commission by you of an offence or other crime involving fraud or dishonesty, whether in connection with your employment or otherwise; or (vii) conduct by you that, in any other respect, amounts to “just cause” under applicable law. If, subsequent to your termination of employment hereunder without cause, it is determined in good faith by the Company that your employment could have been terminated for cause under clauses (iv), (v), (vi) or (vii) above, your employment shall, at the election of the Company, be deemed to have been terminated for cause, effective as of the date the events giving rise to cause occurred. For purposes of this Offer Letter, your employment will be deemed to have been terminated on the basis of frustration of contract in the event that, if applicable, your eligibility to work in Canada under the provisions of applicable immigration laws and regulations is refused, revoked, cancelled or otherwise withdrawn for any reason whatsoever by the relevant governmental authorities or you cease to qualify for the relevant work permit exemption, as the case may be, or in the event of any other circumstance that constitutes frustration under applicable law.

(c) Bonus upon Termination. Except as explicitly set forth in the Bonus Plan, you will not be

eligible to receive a bonus payment under the Company’s Annual Bonus Program unless you are actively employed on the date upon which the bonus payment is paid (the “Bonus Payment Date”). For purposes of this Offer Letter, active employment ceases on the date that you give or receive notice of termination of your employment. For the avoidance of doubt, even if you are terminated without cause or otherwise found by a court of competent jurisdiction to have been wrongfully terminated prior to the Bonus Payment Date, you will receive no incentive bonus payout or pro-rated bonus payout under the Annual Bonus Program (except as explicitly set forth in the Bonus Plan) unless you were actively employed on the Bonus Payment Date, and you will not be eligible for a bonus payout under the Annual Bonus Program or any other bonus payout for any period, including any common law or reasonable notice period, except as required by applicable employment standards legislation, in which case such minimum prescribed period under the Employment Standards Act, 2000 shall apply.

7. Employee Covenants.

(a) Restrictive Covenants. You acknowledge and agree that you will have a prominent role in the

management of the business, and the development of the goodwill, of the Company and its affiliates, and will establish and develop relations and contacts with the franchisees and suppliers of the Company and its affiliates throughout the world, all of which constitute valuable goodwill of, and could be used by you to compete unfairly with, the Company and its affiliates. In addition, you recognize that you will have access to and become familiar with or be exposed to Confidential Information (as such term is defined below), in particular, trade secrets, proprietary information, customer lists, and other valuable business information of the Company and its affiliates pertaining or related to the quick service restaurant business. You agree that you could cause grave harm to the Company and its affiliates if you, among other things, worked for the Company’s competitors, solicited the Company’s employees or those of its affiliates away from the Company or its affiliates, solicited the Company’s franchisees or those of its affiliates upon the termination of your employment with the Company or misappropriated or divulged Confidential Information, and that as such, the Company has legitimate business interests in protecting its good will and Confidential Information, and these legitimate business interests therefore justify the following restrictive covenants:

i. Confidentiality. You agree that during your employment with the Company and

thereafter, you will not, directly or indirectly (A) disclose any Confidential Information to any Person (other than, only with respect to the period that you are employed by the Company, to an employee or outside advisor of the Company who requires such information to perform his or her duties for the Company), or (B) use any Confidential Information for your own benefit or the benefit of any third party. “Confidential Information” means confidential, proprietary or commercially sensitive information relating to (y) the Company or its affiliates, or members of their respective management or boards or (z) any third parties who do business with the Company or its affiliates, including franchisees and suppliers. Confidential Information includes, without limitation, the terms of this Offer Letter, marketing plans, business plans, recipes and formulations, financial information and records, operation methods, personnel information, drawings, designs, information regarding product development, other commercial or business information and any other information not available to the public generally. The foregoing obligation shall not apply to any Confidential Information that has been previously disclosed to the public or is in the public domain (other than by reason of your breach of your obligations to hold such Confidential Information confidential).

If you are required or requested by a court or governmental agency to disclose Confidential Information, you must notify the General Counsel of the Company , in writing, of such disclosure obligation or request no later than three (3) business days after you learn of such obligation or request, and permit the Company to take all lawful steps it deems appropriate to prevent or limit the required disclosure.

ii. Conflicts of Duty. You agree that during your employment with the Company, you shall devote all of your skill, knowledge, commercial efforts and business time to the conscientious and good faith performance of your duties and responsibilities to the Company to the best of your ability and you shall not, directly or indirectly, be employed by, render services for, engage in business with or serve as an agent or consultant to any Person other than the Company.

iii. Non-Competition. You acknowledge that in your position as a member of the Company’s management, you will have insight into sensitive information which is relevant for the development of Company’s business as well as for the development of the goodwill of the Company and its affiliates and you will, in the course of your employment under this Offer Letter, acquire knowledge of the Company's or its affiliates’ trade secrets and proprietary information, have insight into the Company's or its affiliate’s customer base, and further establish and develop relations and contacts such as with management of other affiliated companies, with the franchisees, customers and suppliers of the Company and its affiliates

throughout Canada and the United States, all of which constitute valuable goodwill of the Company and its affiliates. You acknowledge and agree that the use of such knowledge could significantly damage the Company or its affiliates. Accordingly, you agree that, for a period of one (1) year following the termination of your employment (irrespective of the cause or manner of termination), you shall not, directly or indirectly:

a. engage in any activities that are competitive with the quick service restaurant business conducted by the Company in Canada and/or the United States, or

b. become employed by, render services for, engage in business with, serve as an agent or consultant to, or become a partner, member, principal, stockholder or other owner of, any Person which competes with the Company in the quick serve restaurant business in Canada and/or the United States, including any franchisee of the Company or any of its affiliates,

provided that you shall be permitted to hold one percent or less interest in the equity or debt securities of any publicly traded company.

iv. Non-Solicitation. You agree that during your employment with the Company and for a period of one (1) year following the termination of such employment (irrespective of the cause or manner of termination), you will not, directly or indirectly, by yourself or through any third party, whether on your own behalf or on behalf of any other Person, (a) solicit or induce or endeavour to solicit or induce, divert, employ or retain, (b) interfere with the relationship or potential relationship of the Company or any of its affiliates with, or (c) attempt to establish a business relationship of a nature that is competitive with the business of the Company or any of its affiliates with, any Person that is or was (during the last twelve (12) months of your employment with the Company) (A) an employee of the Company or any of its affiliates, (B) engaged to provide services to the Company or any of its affiliates, including vendors who provide or have provided advertising, marketing or other services to the Company or any of its affiliates, or (C) a franchisee of the Company or any of its affiliates.

v. Franchisee Activities. In addition to, and not by way of limitation of, any of the covenants set forth elsewhere herein, you agree that, during your employment with the Company and for an indefinite period following the termination of your employment (irrespective of the cause or manner of termination), you will not, whether on your own behalf or in conjunction with or on behalf of any other Person, directly or indirectly, solicit, or assist in soliciting, offer, or entice, consult, provide advice to, or otherwise be involved with, a franchisee of (or an operator under an operating/license agreement with) the Company or any of its affiliates to engage in any act or activity, whether individually or collectively with other franchisees, operators, or Persons, that is adverse or contrary to the direct or indirect interests of the Company or its affiliate’s business, financial, or general relationship with such franchisees and operators. Such prohibited activities include but are not limited to the organization or facilitation of, or provision of management services to, an association or organization of franchisees/operators with respect to the business or any other relationship that such franchisees/operators have with the Company or any of its affiliates, including but not limited to any such organization or association that would act as an additional layer of negotiations between the Company or its affiliates and its franchisees/operators.

(b) Work Product. To the extent permitted by law, you agree that all inventions, discoveries, processes, reports, plans, projections, budgets, software, data, technology, designs, documentation, innovations, and improvements and other work product created, discovered, developed, compiled, or prepared by you (whether created solely or jointly with others) in connection with your employment with the Company (collectively, “Work Product”) shall be and is the sole and exclusive property of, the Company. In the event that any such Work Product does

not vest by operation of law as the sole and exclusive property of the Company, you hereby irrevocably assign, transfer and convey to the Company, exclusively and perpetually, all right, title and interest which you may have or acquire in and to such Work Product throughout the world. The Company and its affiliates or their designees shall have the exclusive right to make full and complete use of, and make changes to all Work Product without restrictions or liabilities of any kind, and you shall not have the right to use any such materials, other than within the legitimate scope and purpose of your employment with the Company. You shall promptly disclose to the Company the creation or existence of any Work Product and shall take whatever additional lawful action may be necessary, and sign whatever documents the Company may require, in order to secure and vest in the Company or its designee all right, title and interest in and to any Work Product and any industrial or intellectual property rights therein (including full cooperation in support of any Company applications for patents and copyright or trademark registrations). Additionally, you agree that you will not share with or disclose to any third party any underlying technology and/or code used to develop the Work Product. Further, you agree that you will not use in any of the Work Product any pre-existing development tools, routines, subroutines or other programs, data or materials that you may have created or learned prior to the commencement of your provision of services to the Company.

(c) Compliance with Company Policies. During your employment with the Company, you shall be governed by and be subject to, and you hereby agree to comply with, all Company policies, procedures, rules and regulations applicable to you or to the Company’s employees generally, including without limitation, the Restaurant Brands International Inc. Code of Business Ethics and Conduct, in each case, as they may be amended from time to time in the Company’s sole discretion (collectively, the “Policies”).

(d) Return of Company Property. In the event of termination of your employment for any reason, you shall return to the Company all of the property of the Company and its affiliates, including without limitation all materials or documents containing or pertaining to Confidential Information. You agree not to retain any copies, duplicates, reproductions or excerpts of material or documents.

(e) Resignation upon Termination. Effective as of the date of termination of your employment with the Company for any reason, you shall resign, in writing, from all board and board committee memberships and other positions then held by you, or to which you have been appointed, designated or nominated, with the Company and its affiliates.

(f) Full Effect of Restrictive Covenants. Your obligations under this Offer Letter, including but not limited to your obligations under this Section 7, are independent of any of the Company’s obligations to you under this Offer Letter or generally by virtue of your employment. The existence of any claim or cause of action by you against the Company shall not constitute a defense to the enforcement by the Company of this Section 7.

8. Equitable Relief. You acknowledge and agree that a breach by you of any of your obligations under Section 7 is a material breach of this Offer Letter and that remedies at law may be inadequate to protect the Company and its affiliates in the event of such breach, and, without prejudice to any other rights and remedies otherwise available to the Company, you agree to the granting of injunctive relief in the Company’s favour in connection with any such breach or violation without proof of irreparable harm, plus legal fees and costs to enforce these provisions. You further agree that the foregoing is appropriate for any such breach inasmuch as actual damages cannot be readily calculated, such relief is fair and reasonable under the circumstances, and the Company would suffer irreparable harm if any of these paragraphs were breached.

9. Data Protection & Privacy.

(a) You acknowledge that the Company, directly or through its affiliates, collects, uses, processes and discloses data (including personal sensitive data and information retained in email) relating to you. You hereby consent to such collection, use, processing and disclosure for the purposes described in and further agree to execute the Company’s Employee Consent to Collection, Use, Processing, Disclosure and Transfer of Personal Information, a copy of which is attached to this Offer Letter as Attachment 1.

(b) To ensure regulatory compliance and for the protection of its employees, customers, suppliers and business, the Company reserves the right to digitaly record you, monitor, intercept, review and access telephone logs, internet usage, voicemail, email and other communication facilities provided by the Company which you may use during your employment with us. The Company will use this right of access reasonably, but it is important that you are aware that all communications and activities on our equipment or premises cannot be presumed to be private and accordingly, you shall have no reasonable expectation of privacy with respect to any such communications or activities.

10. Entire Agreement. This Offer Letter, including any schedules, attachments or addenda, constitutes the entire agreement between you and the Company or any affiliates of the Company with respect to your employment, and supersedes all prior correspondence, offers, proposals, promises, offer letters, agreements or arrangements relating to the subject matter contained herein.

11. Modification. The terms of this Offer Letter may not be changed unless the changes are approved by an authorized representative of the Company.

12. Survival. The following Sections shall survive the termination of your employment with the Company and of this Offer Letter: 3, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17 or 18.

13. Severability. If any provision of this Offer Letter or the application thereof to any circumstance shall be invalid or unenforceable to any extent, the remainder of this Offer Letter and the application of such provisions to other circumstances shall not be affected thereby and shall be enforced to the fullest extent permitted by law. In the event that one or more terms or provisions of this Offer Letter are deemed invalid or unenforceable under applicable law, by reason of being vague or unreasonable as to duration or geographic scope of activities restricted, or for any other reason, the provision in question shall be immediately amended or reformed to the extent necessary to make it valid and enforceable by the court of such jurisdiction charged with interpreting and/or enforcing such provision. You agree and acknowledge that the provision in question, as so amended or reformed, shall be valid and enforceable as though the invalid or unenforceable portion had never been included herein.

14. Governing Law. The terms of this Offer Letter shall be governed by and construed in accordance with the laws of the Province of Ontario and the federal laws of Canada applicable therein.

15. Dispute Resolution. If any dispute or controversy arises under or in connection with your employment with the Company (e.g., including but not limited to, claims for discrimination, wages, or any statutory or common law claims), you must attempt in good faith to resolve such claim or dispute informally through discussions with your immediate supervisor or, if the problem is with him/her, go up the chain of command. If after thirty (30) calendar days you believe your efforts are unsuccessful, you will then submit any grievance in writing to the Chief People and Services Officer. If after completing the above procedures, and thirty (30) calendar days have passed and you disagree with the Chief People and Services Officer’s determinations, the Company and you agree that if the dispute or controversy is a legally cognizable claim, it shall be resolved by final and binding arbitration before an arbitrator who is a member in good standing of the applicable Law Society in the Province of Ontario and who is mutually agreed to by you and the Company. If you and the Company fail to agree on such an arbitrator, either party may make an application to the provincial court in the Province of Ontario for the appointment of an arbitrator. Any arbitrator so appointed will proceed to determine the

rights of the parties pursuant to the provisions of the applicable arbitration legislation then in force in the Province of Ontario and his/her decision will be final and binding on the parties hereto, and not subject to appeal (provided, that, the failure of the parties to follow the above dispute resolution procedure shall be grounds for the arbitrator to issue a stay until such time as the above conditions precedent are exhausted). Notwithstanding the provisions of the applicable arbitration legislation then in force, the parties agree that e-discovery shall be limited to five individuals, and examinations for discovery, if permitted by the arbitrator, shall be limited to two (2) per side, each not to exceed five (5) hours. The costs of arbitration will be borne equally by each party to the dispute and each party will be responsible for their own legal and professional fees and expenses incurred during such dispute. The arbitration shall not impair the Company’s right to request injunctive or other equitable relief in accordance with Section 8 of this Agreement. Notwithstanding the above, nothing prevents proceeding to any applicable process where such right is expressly required and cannot be waived.

16. Voluntary Agreement; No Conflicts. You represent that you are entering into this Offer Letter voluntarily and that your employment with the Company and compliance with the terms and conditions of this Offer Letter will not conflict with or result in the breach by you of any agreement to which you are a party or by which you or your properties or assets may be bound.

17. Counterparts; Electronic Copy. This Offer Letter may be executed you and the Company in counterparts (including by electronic copy), each of which shall be deemed an original and all of which together shall constitute one and the same instrument.

18. Certain Definitions. For purposes of this Offer Letter, the term “affiliates” means any natural person, firm, partnership, limited liability company, association, corporation, company, trust, business trust, governmental authority or other entity (each a “Person”) that, directly or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with the Company, including but not limited to a subsidiary of the Company, and the term “control” (including, with correlative meanings, the terms “controlling”, “controlled by” and “under common control with”) means, with respect to any Person, the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities, by contract or otherwise.

If the terms of this Offer Letter are acceptable to you, please sign below and return countersigned copy of this Offer Letter to Trish Bhupsingh at tbhupsingh@rbi.com within seven (7) days of the date of this Offer Letter.

Axel, I would like to thank you for your continued dedication to the Company. Should you have any questions on any of the above, please do not hesitate to contact me.

Yours sincerely,

The TDL Group Corp.

Jose Cil

Chief Executive Officer

Agreed to and accepted by:

/s/ Axel Schwan

Axel Schwan

February 26, 2021

Date

ATTACHMENT 1

The TDL Group Corp.

EMPLOYEE CONSENT TO COLLECTION

AND PROCESSING OF PERSONAL INFORMATION

The TDL Group Corp. (the “Company”) has informed me that the Company, on behalf of itself and its related and affiliated entities, including those operating restaurants under the BURGER KING®, TIM HORTONS® and POPEYES® brands (collectively, the “Affiliates”), collects, retains, processes, uses, and transfers my personal information (and also discloses my personal information to the Company’s employees, consultants and services providers) only for human resource and business purposes such as payroll administration, background checks, fulfilment of employment positions, fulfilment of my direct requests, maintaining accurate records, compliance with applicable law and meeting governmental reporting requirements, compiling internal reports, including diversity and distribution metrics, security, health, benefits, and safety management, performance assessment and management, provision of services, company network access and authentication. I understand the Company will treat my personal data as confidential and will not permit unauthorized access to this personal data. I HEREBY CONSENT to the Company collection, retention, processing, use, transfer and disclosure of my personal information for such purposes described in this statement.

I understand and consent to the transfer and storage of my personal data for the purposes described in this statement to the corporate offices of the Company and its Affiliates (currently located in Toronto, Ontario, Canada; Miami, Florida, United States of America; Mexico City, Mexico; Singapore, and Baar, Switzerland), and to other third parties, agents, processors and representatives who may be located in countries outside my home country or the country in which I work, including countries where data protection laws may differ from those of my home country.

I further understand the Company and its Affiliates may from time-to-time disclose, transfer and store my personal information to or with a third-party consultant, processor or service provider acting on the behalf of Company or its Affiliates or at the Company’s direction. These third parties will be required to use appropriate measures to protect the confidentiality and security of personal information.

To the extent that I provide the Company details of my racial or ethnic origin, job evaluations or educations records, commission (or alleged commission) of an offense or related proceedings, military or veteran status, or gender identity, I expressly authorize the Company and its Affiliates to handle such details for the purposes set forth in this statement.

I understand that the Company also may disclose personal information about me in order to: (1) protect the legal rights, privacy, safety or property of the Company, its Affiliates, or its employees, agents, contractors, customers or the public; (2) protect the safety and security of guests to the Company’s digital and physical properties; (3) protect against fraud or other illegal activity or for risk management purposes; (4) respond to inquiries or requests from public or legal authorities, including to meet national security or law enforcement requirements; (5) permit the Company to pursue available remedies or limit the damages that it may sustain; (6) respond to an emergency; (7) comply with the law or legal process; (8) effect a license, sale or transfer of all or a portion of the business or assets (including in connection with any bankruptcy or similar proceedings); or (9) manage or arrange for acquisitions, mergers and reorganizations.

I understand that the provision of my personal information is voluntary.

I have been advised that the Company is committed to resolving complaints about my privacy and its collection, use or disclosure of my personal information. If I have concerns or complaints about the use of

my personal information, or if I choose to exercise my right to withdraw my consent set forth in this consent statement, I understand that I can contact the Company at the following email address: privacy@rbi.com or at the mailing address below:

The TDL Group Corp.

Address: 130 King St. West, Suite 300, PO BOX 339, Toronto, ON M5X 1E1

Attn: Legal Department – Privacy Office

/s/ Axel Schwan

(Employee’s Signature)

Axel Schwan

(Employee’s Name – Please Print)

Date: February 26, 2021

EXHIBIT 10.78

CONFIRMATION OF TAX EQUALIZATION

As of December 21, 2020

Personal & Confidential

Sami Siddiqui

BK Asiapac Pte. Ltd.

Popeyes Louisiana Kitchen, Inc.

Dear Sami:

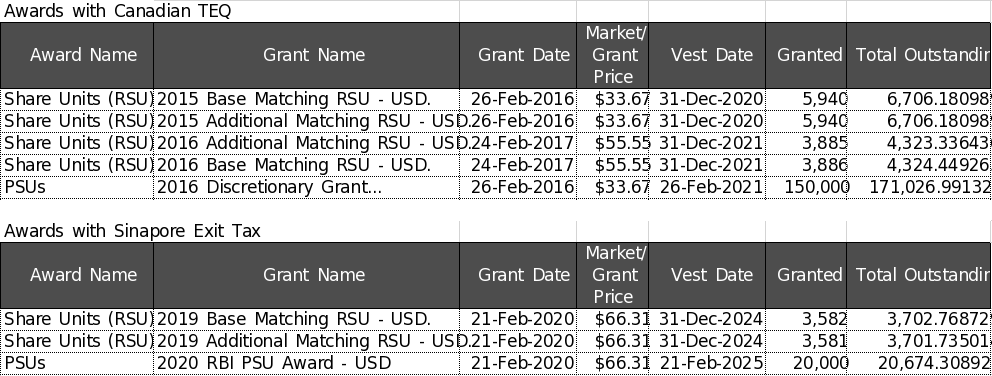

This letter confirms that contingent upon your execution and delivery to us of the Non-Compete, Non-Solicitation and Confidentiality Agreement dated as of December 21, 2021, in the form attached and made a part hereof as Exhibit A, you will be provided tax equalization in accordance with Exhibit B, on all equity awards to acquire common stock in Restaurant Brands International Inc. represented by the award agreements described in Exhibit C (the “Awards”), all of which Awards were (i) granted to you during the course of your employment with BK Asiapac Pte. Ltd. (“BKAP”) and/or (ii) have a portion allocable to Canada from a tax perspective, including your previous position at The TDL Group Corp. (“TDL”).

We are providing tax equalization as a result of your joining Popeyes Louisiana Kitchen, Inc. (“Popeyes”) as the Popeyes Americas Brand President. Popeyes is an Affiliate of BKAP and TDL, as such term is defined in the applicable award agreements.

For purposes of the equalization described in this letter, the “home” country is the United States of America (the “US”).

Pursuant to Singapore law, upon the termination of your employment with BKAP, you will be deemed to have exercised or vested in all of the Awards granted during the course of your employment as BKAP, and you must pay local taxes on the deemed gain (the “Deemed Vesting”). For the avoidance of doubt, for all purposes other than Singapore law relating to exit taxes, the Awards will vest pursuant to their respective award agreements. As part of the equalization described in this letter, BKAP shall pay any taxes due as a result of the Deemed Vesting upon your exit from Singapore.

Additionally, a portion of Awards granted prior to or during the time you worked in Canada, will be subject to tax in Canada.

Your burden with respect to the foregoing will remain at a similar level as if you had been employed and resided in the US, in the State of Florida. This will be achieved by (a)

upon the exercise or vesting of any of the Awards, Popeyes (or an affiliate thereof, as applicable) withholding from your compensation or the exercise proceeds a hypothetical tax equivalent to the amount of tax which would have been due from you had you been located in the US (Florida) from the date of issuance through the date of exercise if relating to options or vesting if relating to restricted shares and restricted share units (whether or not performance based), and (b) Popeyes (or an affiliate thereof, as applicable) paying the actual taxes due on the exercise or vesting of the Awards and receiving the benefit of applicable tax credits as determined in accordance with Exhibit B.

You agree that upon your actual exercise or vesting of the Awards subject to Deemed Vesting, should the gain be less than the gain reported to the Inland Revenue Authority of Singapore at the time of the Deemed Vesting, then any and all associated tax credits or refunds (collectively, the “Refunds”) shall belong to BKAP. You agree to cooperate with BKAP in applying for any such Refunds, including but not limited to completing all necessary paperwork, assigning to BKAP your rights in and to such Refunds and designating BKAP or any of its designated affiliates as your attorney in fact to apply for such Refunds.

This letter, including Exhibit B, and all of your obligations hereunder shall survive the termination of your employment with BKAP and Popeyes.

Please sign a copy of this letter where indicated below to evidence your agreement to the terms and conditions set forth in this letter. If you should have any questions regarding this matter, please do not hesitate to contact me.

Sincerely,

/s/ Jeffrey Housman

Jeffrey Housman

Chief People and Services Officer

Agreed and Accepted, as of the ___ day of December, 2020

_/s/ Sami Siddiqui________________

Sami Siddiqui

Acknowledgment

Each of BK Asiapac Pte. Ltd. and Popeye Louisiana Kitchen, Inc. hereby acknowledges and agrees to the terms and conditions set forth in the foregoing letter, effective as of the date set forth above.

BK Asiapac Pte. Ltd.

By: /s/ Rohan Kaul

Name: Rohan Kaul

Title: Director

Popeyes Louisiana Kitchen, Inc.

By: /s/ Jill Granat

Name: Jill Granat

Title: Secretary

Exhibit A

Exhibit B

Introduction

This Attachment regarding tax reimbursement for taxation of equity awards related to employment through Popeyes and previous employment by TDL and BKAP, or any of their Affiliates in more than one (1) tax jurisdiction is called “tax equalization”.

Objective

The objective of tax equalization is to ensure that employment in more than one (1) tax jurisdiction over time neither adds significantly to the executive’s tax liability nor results in significant tax savings due to differences in income and social tax costs between the State of Florida, USA, and the other jurisdiction(s) where the executive may incur individual income taxes due to his or her prior employment in other jurisdictions by TDL, BKAP and their Affiliates. It ensures that the executive’s out-of-pocket obligations remain approximately the same as they would have been had he or she remained employed and resident only in the State of Florida, USA.

Reason for Tax Equalization

The actual tax the executive is expected to incur due to multi-jurisdictional employment may differ from the amount of tax he or she would have paid during an employment in the State of Florida, USA. The change results from two independent factors:

•The amount of taxable income, in some cases, significantly increases due to receipt of allowances such as tax equalization; and

•The executive is usually subject to taxation and the tax regulations (types of income taxed, tax rates, etc.) of international jurisdictions, which differ, often

significantly, from those applicable in the US for a resident in the State of Florida, USA.

The result is often that the executive’s worldwide tax liability may increase significantly.

Scope

This tax equalization is limited to income and social taxes with respect to the Awards. The policy specifically excludes all other taxes such as inheritance/estate tax, gift tax, sales tax, and property tax.

Tax Equalization

Methodology

Popeyes’ (the “Company”) designated tax consultant (the “Consultant”) will determine the appropriate method to ensure that the executive and the Company pay their fair share of the taxes incurred in connection with the Awards. The executive’s share of the tax burden is called “hypothetical tax”.

Hypothetical Tax: Calculation and Process

Hypothetical tax is, as stated earlier, the portion of the overall tax liability for which the executive is responsible.

Calculation

All executives will have their hypothetical tax calculated based on the executive’s “normal” residency within the home country for both income and social taxes considering the relevant filing status and position (for example, marital status and number of dependents, etc.). This includes any applicable local government jurisdictions (such as state, province, canton, city, municipality, etc.).

The deductions and credits used to calculate hypothetical tax may vary depending on whether or not the executive continues to have an ongoing tax filing obligation in the United States (e.g., U.S. citizens or permanent residents).

| Ongoing Home Country Tax Filing Obligation | Deductions and Credits Used to Calculate Hypothetical Tax | ||||

| Yes | Actual amounts on the home country tax return (excluding any credits that were funded by Company) but with the inclusion of any deduction for local government hypothetical tax (replacing actual local government tax) such as state income tax. * | ||||

| No | “Standard” or general deductions and credits available to people with the same status (marital, family, filing, etc.). | ||||

*For U.S. executives, hypothetical state and city tax replaces actual state and city taxes as a hypothetical itemized deduction.

Withholding

Hypothetical tax will be retained from the settlement of executive’s Awards. The Company and the Consultant will determine the appropriate withholding rate on such items.

Final Settlement

Tax Equalization Calculation

As previously stated, the tax equalization settlements are prepared using relevant data, in order to:

•Calculate and reconcile the executive’s final hypothetical tax responsibility; and

•Allocate all actual host-country taxes (and any home-country taxes, if applicable) between the executive and the Company.

Tax equalization calculations are prepared by the Consultant to ensure consistency and proper application of Company policy. The Consultant will send the Company a copy of the summary tax data from the equalization for processing at the time the equalization is mailed or delivered to the executive.

The tax equalization settlement usually results in an amount due to/from the executive.

Any payments due to the Company from the executive must be settled within 30 days of the later of:

•Receipt of the tax equalization calculation; or

•Receipt of any refund due to the executive by the home and/or host country taxing authorities.

The Company also reserves the right to deduct outstanding balances from bonus or termination payments in order to collect unpaid equalization balances.

Upon receipt of the completed tax returns, the executive is expected to pay any balance due on the US tax return, and the Company, BKAP or an affiliate will pay any balance due on a Canadian or Singaporean tax return. Conversely, if the actual returns generate a refund, the executive will collect the refund or, at Company’s or BKAP’s option, designate Company or BKAP (or an entity designated by Company or BKAP) as executive’s attorney in fact to collect the refund. Both balances due and refunds owed will be included as part of the tax equalization settlement (see above).

The Company may, at its discretion, make direct payments to the taxing authorities on behalf of the executive for taxes owed when the tax is the Company’s responsibility, as determined by the tax equalization settlement.

Tax Credits

Any tax credits for taxes paid by the Company, which reduced the executive’s income tax liability before, during, or subsequent to an assignment, are owned/utilized by the Company. The Company determines whether to keep the executive in the tax equalization program if the expatriate has carryover tax credits that may be used in the future.

Exhibit C

Applicable Awards

Future dividend equivalents with respect to these awards will also be considered in accordance with Exhibit B.

Exhibit 31.1

CERTIFICATION

I, José E. Cil, certify that:

1.I have reviewed this quarterly report on Form 10-Q of Restaurant Brands International Inc.;

2.Based on my knowledge, this quarterly report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this quarterly report;

3.Based on my knowledge, the financial statements, and other financial information included in this quarterly report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a.Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this quarterly report is being prepared;

b.Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c.Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d.Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a. All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b.Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| /s/ José E. Cil | ||

| José E. Cil | ||

| Chief Executive Officer | ||

Dated: April 30, 2021

Exhibit 31.2

CERTIFICATION

I, Matthew Dunnigan, certify that:

1.I have reviewed this quarterly report on Form 10-Q of Restaurant Brands International Inc.;

2.Based on my knowledge, this quarterly report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this quarterly report;

3.Based on my knowledge, the financial statements, and other financial information included in this quarterly report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a.Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this quarterly report is being prepared;

b.Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c.Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d.Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a.All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b.Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| /s/ Matthew Dunnigan | ||

| Matthew Dunnigan | ||

| Chief Financial Officer | ||

Dated: April 30, 2021

Exhibit 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report on Form 10-Q of Restaurant Brands International Inc. (the “Company”) for the quarter ended March 31, 2021 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, José E. Cil, Chief Executive Officer of the Company, certify, pursuant to 18 U.S.C. §1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, that to the best of my knowledge:

1.The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and

2.The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| /s/ José E. Cil | ||

| José E. Cil | ||

| Chief Executive Officer | ||

Dated: April 30, 2021

Exhibit 32.2

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report on Form 10-Q of Restaurant Brands International Inc. (the “Company”) for the quarter ended March 31, 2021 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Matthew Dunnigan, Chief Financial Officer of the Company, certify, pursuant to 18 U.S.C. §1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, that to the best of my knowledge:

1.The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and

2.The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| /s/ Matthew Dunnigan | ||

| Matthew Dunnigan | ||

| Chief Financial Officer | ||

Date: April 30, 2021

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Tims China Announces Fourth Quarter and Full Year 2023 Financial Results

- All Y'alls Foods Debuts Charming Mascot Plus New Customer Program to Reward Good Deeds

- SCS Cloud Joins the Smartsheet Aligned Partner Program

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share