Form 10-Q PERRIGO Co plc For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________

FORM 10-Q

_______________________________________________

[X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-36353

_______________________________________________

Perrigo Company plc

(Exact name of registrant as specified in its charter)

_______________________________________________

Ireland | Not Applicable | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

Treasury Building, Lower Grand Canal Street, Dublin 2, Ireland | - | |

(Address of principal executive offices) | (Zip Code) | |

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | [X] | Accelerated filer | [ ] | Non-accelerated filer | [ ] | (Do not check if smaller reporting company) | ||||

Smaller reporting company | [ ] | Emerging growth company | [ ] | |||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | [ ] | |||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] YES [X] NO

As of May 4, 2018, there were 138,462,112 ordinary shares outstanding.

PERRIGO COMPANY PLC

FORM 10-Q

INDEX

PAGE NUMBER | ||

PART I. FINANCIAL INFORMATION | ||

1 | ||

2 | ||

3 | ||

4 | ||

5 | ||

6 | ||

7 | ||

8 | ||

9 | ||

10 | ||

11 | ||

12 | ||

13 | ||

14 | ||

15 | ||

16 | ||

PART II. OTHER INFORMATION | ||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this report are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created thereby. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. In particular, statements about our expectations, beliefs, plans, objectives, assumptions, future events or future performance contained in this report, including certain statements contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” "forecast," “predict,” “potential” or the negative of those terms or other comparable terminology.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control, including: the timing, amount and cost of any share repurchases; future impairment charges; the success of management transition; customer acceptance of new products; competition from other industry participants, some of whom have greater marketing resources or larger market shares in certain product categories than we do; pricing pressures from customers and consumers; potential third-party claims and litigation, including litigation relating to our restatement of previously-filed financial information; potential impacts of ongoing or future government investigations and regulatory initiatives; resolution of uncertain tax positions; the impact of U.S. tax reform legislation and healthcare policy; general economic conditions; fluctuations in currency exchange rates and interest rates; the consummation of announced acquisitions or dispositions and the success of such transactions, and our ability to realize the desired benefits thereof; and our ability to execute and achieve the desired benefits of announced cost-reduction efforts and other initiatives. In addition, we may identify new, or be unable to remediate previously identified, material weaknesses in our internal control over financial reporting. Furthermore, we may incur additional tax liabilities in respect of 2016 and prior years or be found to have breached certain provisions of Irish company law in connection with our restatement of our previously filed financial statements, which may result in additional expenses and penalties. These and other important factors, including those discussed in our Form 10-K for the year ended December 31, 2017 and in this report under “Risk Factors” and in any subsequent filings with the United States Securities and Exchange Commission, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements in this report are made only as of the date hereof, and unless otherwise required by applicable securities laws, we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This report contains trademarks, trade names and service marks that are the property of Perrigo Company plc, as well as, for informational purposes, trademarks, trade names, and service marks that are the property of other organizations. Solely for convenience, certain trademarks, trade names, and service marks referred to in this report appear without the ®, ™ and SM symbols, but those references are not intended to indicate that we or the applicable owner, as the case may be, will not assert, to the fullest extent under applicable law, our or their rights to such trademarks, trade names, and service marks.

1

Perrigo Company plc - Item 1

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share amounts)

(unaudited)

Three Months Ended | |||||||

March 31, 2018 | April 1, 2017 | ||||||

Net sales | $ | 1,217.0 | $ | 1,194.0 | |||

Cost of sales | 724.3 | 729.6 | |||||

Gross profit | 492.7 | 464.4 | |||||

Operating expenses | |||||||

Distribution | 24.7 | 21.1 | |||||

Research and development | 38.4 | 39.8 | |||||

Selling | 161.3 | 155.0 | |||||

Administration | 107.6 | 105.4 | |||||

Impairment charges | — | 12.2 | |||||

Restructuring | 1.5 | 38.7 | |||||

Other operating loss (income) | 2.9 | (36.3 | ) | ||||

Total operating expenses | 336.4 | 335.9 | |||||

Operating income | 156.3 | 128.5 | |||||

Change in financial assets | 9.6 | (17.1 | ) | ||||

Interest expense, net | 31.4 | 53.3 | |||||

Other expense (income), net | 4.3 | (3.5 | ) | ||||

Loss on extinguishment of debt | 0.5 | — | |||||

Income before income taxes | 110.5 | 95.8 | |||||

Income tax expense | 29.7 | 24.2 | |||||

Net income | $ | 80.8 | $ | 71.6 | |||

Earnings per share | |||||||

Basic | $ | 0.57 | $ | 0.50 | |||

Diluted | $ | 0.57 | $ | 0.50 | |||

Weighted-average shares outstanding | |||||||

Basic | 140.8 | 143.4 | |||||

Diluted | 141.4 | 143.6 | |||||

Dividends declared per share | $ | 0.19 | $ | 0.16 | |||

See accompanying Notes to the Condensed Consolidated Financial Statements

2

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in millions)

(unaudited)

Three Months Ended | |||||||

March 31, 2018 | April 1, 2017 | ||||||

Net income | $ | 80.8 | $ | 71.6 | |||

Other comprehensive income: | |||||||

Foreign currency translation adjustments | 73.0 | 65.4 | |||||

Change in fair value of derivative financial instruments, net of tax | (0.6 | ) | 1.6 | ||||

Change in fair value of investment securities, net of tax | — | (11.4 | ) | ||||

Change in post-retirement and pension liability, net of tax | (0.2 | ) | (0.1 | ) | |||

Other comprehensive income, net of tax | 72.2 | 55.5 | |||||

Comprehensive income | $ | 153.0 | $ | 127.1 | |||

See accompanying Notes to the Condensed Consolidated Financial Statements

3

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions, except per share amounts)

(unaudited)

March 31, 2018 | December 31, 2017 | ||||||

Assets | |||||||

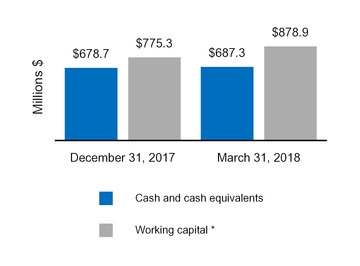

Cash and cash equivalents | $ | 687.3 | $ | 678.7 | |||

Accounts receivable, net of allowance for doubtful accounts of $6.5 million and $6.2 million, respectively | 1,123.4 | 1,130.8 | |||||

Inventories | 843.8 | 806.9 | |||||

Prepaid expenses and other current assets | 246.2 | 203.2 | |||||

Total current assets | 2,900.7 | 2,819.6 | |||||

Property, plant and equipment, net | 829.3 | 833.1 | |||||

Goodwill and other indefinite-lived intangible assets | 4,300.8 | 4,265.7 | |||||

Other intangible assets, net | 3,259.1 | 3,290.5 | |||||

Non-current deferred income taxes | 19.6 | 10.4 | |||||

Other non-current assets | 330.1 | 409.5 | |||||

Total non-current assets | 8,738.9 | 8,809.2 | |||||

Total assets | $ | 11,639.6 | $ | 11,628.8 | |||

Liabilities and Shareholders’ Equity | |||||||

Accounts payable | $ | 512.2 | $ | 450.2 | |||

Payroll and related taxes | 113.0 | 148.8 | |||||

Accrued customer programs | 438.3 | 419.7 | |||||

Accrued liabilities | 205.3 | 230.8 | |||||

Accrued income taxes | 65.7 | 116.1 | |||||

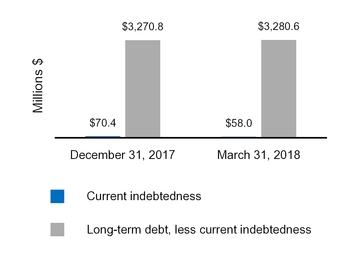

Current indebtedness | 58.0 | 70.4 | |||||

Total current liabilities | 1,392.5 | 1,436.0 | |||||

Long-term debt, less current portion | 3,280.6 | 3,270.8 | |||||

Non-current deferred income taxes | 332.0 | 321.9 | |||||

Other non-current liabilities | 428.9 | 429.5 | |||||

Total non-current liabilities | 4,041.5 | 4,022.2 | |||||

Total liabilities | 5,434.0 | 5,458.2 | |||||

Commitments and contingencies - Note 14 | |||||||

Shareholders’ equity | |||||||

Controlling interest: | |||||||

Preferred shares, $0.0001 par value per share, 10 shares authorized | — | — | |||||

Ordinary shares, €0.001 par value per share, 10,000 shares authorized | 7,769.5 | 7,892.9 | |||||

Accumulated other comprehensive income | 324.3 | 253.1 | |||||

Retained earnings (accumulated deficit) | (1,888.4 | ) | (1,975.5 | ) | |||

Total controlling interest | 6,205.4 | 6,170.5 | |||||

Noncontrolling interest | 0.2 | 0.1 | |||||

Total shareholders’ equity | 6,205.6 | 6,170.6 | |||||

Total liabilities and shareholders' equity | $ | 11,639.6 | $ | 11,628.8 | |||

Supplemental Disclosures of Balance Sheet Information | |||||||

Ordinary shares, issued and outstanding | 139.7 | 140.8 | |||||

See accompanying Notes to the Condensed Consolidated Financial Statements

4

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

Three Months Ended | |||||||

March 31, 2018 | April 1, 2017 | ||||||

Cash Flows From (For) Operating Activities | |||||||

Net income | $ | 80.8 | $ | 71.6 | |||

Adjustments to derive cash flows | |||||||

Depreciation and amortization | 109.5 | 109.4 | |||||

Share-based compensation | 12.7 | 6.1 | |||||

Impairment charges | — | 12.2 | |||||

Change in financial assets | 9.6 | (17.1 | ) | ||||

Loss on extinguishment of debt | 0.5 | — | |||||

Restructuring charges | 1.5 | 38.7 | |||||

Deferred income taxes | (7.2 | ) | (46.0 | ) | |||

Amortization of debt premium | (2.1 | ) | (6.4 | ) | |||

Other non-cash adjustments, net | 12.1 | (1.1 | ) | ||||

Subtotal | 217.4 | 167.4 | |||||

Increase (decrease) in cash due to: | |||||||

Accounts receivable | 2.6 | 50.1 | |||||

Inventories | (43.7 | ) | 0.5 | ||||

Accounts payable | 57.5 | 2.5 | |||||

Payroll and related taxes | (38.9 | ) | (10.1 | ) | |||

Accrued customer programs | 17.3 | (32.7 | ) | ||||

Accrued liabilities | (24.0 | ) | 2.3 | ||||

Accrued income taxes | 6.4 | 41.4 | |||||

Other, net | (22.2 | ) | (26.9 | ) | |||

Subtotal | (45.0 | ) | 27.1 | ||||

Net cash from operating activities | 172.4 | 194.5 | |||||

Cash Flows From (For) Investing Activities | |||||||

Proceeds from royalty rights | 10.0 | 85.3 | |||||

Additions to property, plant and equipment | (13.4 | ) | (22.0 | ) | |||

Net proceeds from sale of business and other assets | 1.3 | 25.3 | |||||

Proceeds from sale of the Tysabri® financial asset | — | 2,200.0 | |||||

Other investing, net | — | (0.8 | ) | ||||

Net cash from (for) investing activities | (2.1 | ) | 2,287.8 | ||||

Cash Flows From (For) Financing Activities | |||||||

Issuances of long-term debt | 431.0 | — | |||||

Payments on long-term debt | (444.5 | ) | (13.6 | ) | |||

Borrowings (repayments) of revolving credit agreements and other financing, net | (6.2 | ) | 0.3 | ||||

Deferred financing fees | (2.4 | ) | (0.4 | ) | |||

Repurchase of ordinary shares | (108.1 | ) | — | ||||

Cash dividends | (26.7 | ) | (23.0 | ) | |||

Other financing, net | (5.7 | ) | (0.5 | ) | |||

Net cash (for) financing activities | (162.6 | ) | (37.2 | ) | |||

Effect of exchange rate changes on cash and cash equivalents | 0.9 | 10.4 | |||||

Net increase (decrease) in cash and cash equivalents | 8.6 | 2,455.5 | |||||

Cash and cash equivalents, beginning of period | 678.7 | 622.3 | |||||

Cash and cash equivalents, end of period | $ | 687.3 | $ | 3,077.8 | |||

See accompanying Notes to the Condensed Consolidated Financial Statements

5

Perrigo Company plc - Item 1

Note 1

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

General Information

The Company

Perrigo Company plc was incorporated under the laws of Ireland on June 28, 2013 and became the successor registrant of Perrigo Company, a Michigan corporation, on December 18, 2013 in connection with the acquisition of Elan Corporation, plc ("Elan"). Unless the context requires otherwise, the terms "Perrigo," the "Company," "we," "our," "us," and similar pronouns used herein refer to Perrigo Company plc, its subsidiaries, and all predecessors of Perrigo Company plc and its subsidiaries.

We are a leading global healthcare company, delivering value to our customers and consumers by providing Quality Affordable Healthcare Products®. Founded in 1887 as a packager of home remedies, we have built a unique business model that is best described as the convergence of a fast-moving consumer goods company, a high-quality pharmaceutical manufacturing organization and a world-class supply chain network. We believe we are one of the world's largest manufacturers of over-the-counter (“OTC”) healthcare products and suppliers of infant formulas for the store brand market. We are a leading provider of branded OTC products throughout Europe, and also a leading producer of generic pharmaceutical topical products such as creams, lotions, gels, and nasal sprays ("extended topical") prescription drugs. We are headquartered in Ireland, and sell our products primarily in North America and Europe, as well as in other markets, including Australia, Israel and China.

Basis of Presentation

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared in accordance with U.S. generally accepted accounting principles ("GAAP") for interim financial information and with the instructions to Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. The unaudited Condensed Consolidated Financial Statements should be read in conjunction with the Consolidated Financial Statements and footnotes included in our Annual Report on Form 10-K for the year ended December 31, 2017. In the opinion of management, all adjustments (consisting of normal recurring accruals and other adjustments) considered necessary for a fair presentation of the unaudited Condensed Consolidated Financial Statements have been included and include our accounts and the accounts of all majority-owned subsidiaries. All intercompany transactions and balances have been eliminated in consolidation.

Recent Accounting Standard Pronouncements

Below are recent Accounting Standard Updates ("ASU") that we are still assessing to determine the effect on our Condensed Consolidated Financial Statements. We do not believe that any other recently issued accounting standards could have a material effect on our Condensed Consolidated Financial Statements. As new accounting pronouncements are issued, we will adopt those that are applicable under the circumstances.

6

Perrigo Company plc - Item 1

Note 1

Recently Issued Accounting Standards Not Yet Adopted | ||||||

Standard | Description | Effective Date | Effect on the Financial Statements or Other Significant Matters | |||

Leases | This guidance was issued to increase transparency and comparability among organizations by requiring recognition of lease assets and lease liabilities on the balance sheet and disclosure of key information about leasing arrangements. For leases with a term of 12 months or less, lessees are permitted to make an election to not recognize right-of-use assets and lease liabilities. The guidance is required to be adopted using the modified retrospective approach. Early adoption is permitted. | January 1, 2019 | We have begun to prepare a full inventory of our portfolio of leases and once complete, we will begin to assess and quantify the likely impact on our Consolidated Financial Statements. In addition, we are in the design phase of our lease integration tool. | |||

Derivatives and Hedging | This update was issued to enable entities to better portray the economics of their risk management activities in the financial statements and enhance the transparency and understandability of hedge results. In addition, the amendments simplify the application of hedge accounting in certain situations. Under the new rule, the entity’s ability to hedge non-financial and financial risk components is expanded. The guidance eliminates the requirement to separately measure and report hedge ineffectiveness and also eases certain documentation and assessment requirements. Early adoption is permitted. | January 1, 2019 | We are currently evaluating the implications of adoption on our Consolidated Financial Statements. | |||

Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income | This guidance permits tax effects stranded in accumulated other comprehensive income as a result of tax reform to be reclassified to retained earnings. This reclassification is optional and will require additional disclosure regarding whether reclassification is elected or not. | January 1, 2019 | We are currently evaluating the implications of adoption on our Consolidated Financial Statements. | |||

Measurement of Credit Losses on Financial Instruments | This guidance changes the impairment model for most financial assets and certain other instruments, replacing the current "incurred loss" approach with an "expected loss" credit impairment model, which will apply to most financial assets measured at amortized cost and certain other instruments, including trade and other receivables, loans, held-to-maturity debt securities, and off-balance sheet credit exposures such as letters of credit. Early adoption is permitted. | January 1, 2020 | We are currently evaluating the new standard for potential impacts on our receivables, and other financial instruments. | |||

Intangibles - Goodwill and Other Simplifying the Test for Goodwill | The objective of this update is to reduce the cost and complexity of subsequent goodwill accounting by simplifying the impairment test by removing the Step 2 requirement to perform a hypothetical purchase price allocation when the carrying value of a reporting unit exceeds its fair value. If a reporting unit’s carrying value exceeds its fair value, an entity would record an impairment charge based on that difference, limited to the amount of goodwill attributed to that reporting unit. The proposal would not change the guidance on completing Step 1 of the goodwill impairment test. The proposed guidance would be applied prospectively. Early adoption is permitted. | January 1, 2020 | Upon adoption, this guidance eliminates the requirement to calculate the implied fair value of goodwill to measure a goodwill impairment. After adoption, a Step 1 failure will result in an immediate impairment charge based on the carrying value of the reporting unit. There is no immediate adoption impact on the Consolidated Financial Statements as the standard will be adopted prospectively. | |||

7

Perrigo Company plc - Item 1

Note 2

NOTE 2 – REVENUE RECOGNITION

We adopted ASU 2014-09 Revenue from Contracts with Customers and its related amendments (collectively, "ASC 606"), as required, on January 1, 2018 using the modified retrospective method for all contracts not completed as of the adoption date. The reported results for the periods in 2018 reflect the application of ASC 606 while the results for the comparable reporting periods in 2017 were prepared under the guidance of Revenue Recognition ("ASC 605"). The adoption of ASC 606 represents a change in accounting principle that will more closely align revenue recognition with the transfer of control of our products and will provide enhanced disclosures to understand the nature, amount, timing, and uncertainty of revenues and cash flows arising from contracts with customers. In accordance with ASC 606, revenue is recognized when a customer obtains control of promised products. The amount of revenue recognized reflects the consideration to which we expect to be entitled to receive in exchange for these products.

Product Revenue

Revenues from product sales are recognized when or as the customer obtains control of our products.

We generally recognize product revenues for our contract performance obligations at a point in time, typically upon shipment or delivery of the product to the customer. For point in time customers for which control transfers on delivery to the customer due to free on board destination terms (“FOB”), an adjustment is recorded to defer revenue recognition over an estimate of days until control transfers at the point of delivery. Where we recognize revenues at a point in time, the transfer of title is the primary indicator that control has transferred. In other limited instances, primarily relating to those contracts that relate to contract manufacturing performed for our customers and certain store branded products, control transfers as the product is manufactured. Control is deemed to transfer over time for these contracts as the product does not have an alternative use and we have a contractual right to payment for performance completed to date. Revenue for contract manufacturing contracts is recognized over the transfer period using an input method that measures progress towards completion of the performance obligation as costs are incurred. For store branded product revenues recognized over time, an output method is used to recognize revenue when production of a unit is completed, because product customization occurs when the product is packaged as a finished good under the store brand label of the customer.

Net product sales include estimates of variable consideration for which accruals and allowances are established. Variable consideration for product sales consists primarily of chargebacks, rebates, sales returns, shelf stock allowances, administrative fees and other incentive programs. Certain of these accruals and allowances are recorded in the balance sheet as current liabilities and others are recorded as a reduction in accounts receivable. Where appropriate, these estimates take into consideration a range of possible outcomes in which relevant factors such as historical experience, current contractual and statutory requirements, specific known market events and trends, industry data and forecasted customer buying and payment patterns are either probability weighted to derive an estimate of expected value or the estimate reflects the single most likely outcome. Overall, these reserves reflect the best estimates of the amount of consideration to which we are entitled based on the terms of the contract. Actual amounts of consideration ultimately received may differ from our estimates. If actual results in the future vary from the estimates, these estimates are adjusted, which would affect revenue and earnings in the period such variances become known.

Other Revenue Policies

We receive payments from our customers based on billing schedules established in each contract. Amounts are recorded as accounts receivable when our right to consideration is unconditional. In most cases, the timing of the unconditional right to payment aligns with shipment or delivery of the product and the recognition of revenue; however, for those customers where revenue is recognized at a time prior to shipment or delivery due to over-time revenue recognition, a contract asset is recorded and is reclassified to an accounts receivable when it becomes unconditional under the contract upon shipment or delivery to the customer.

We do not assess whether a contract has a significant financing component if the expectation at contract inception is such that the period between payment by the customer and the transfer of the promised products to the customer will be one year or less, which is the case with substantially all customers.

8

Perrigo Company plc - Item 1

Note 2

Taxes collected from customers relating to product sales and remitted to governmental authorities are excluded from revenues.

Shipping and handling costs billed to customers are included in net sales. Conversely, shipping and handling expenses we incur are included in cost of sales.

Disaggregation of Revenue

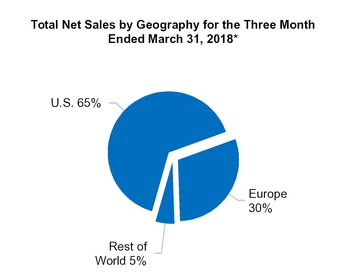

We generated net sales in the following geographic locations(1) (in millions):

Three Months Ended | |||

March 31, 2018 | |||

U.S. | $ | 786.4 | |

Europe(2) | 361.9 | ||

All other countries(3) | 68.7 | ||

$ | 1,217.0 | ||

(1) The net sales by geography is derived from the location of the entity that sells to a third party.

(2) Includes Ireland net sales of $5.4 million.

(3) Includes net sales generated primarily in Israel, Mexico, Australia, and Canada.

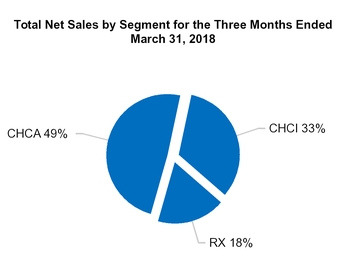

The following is a summary of our net sales by category (in millions):

Three Months Ended | |||

March 31, 2018 | |||

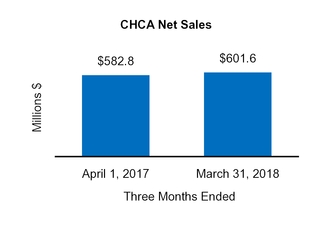

CHCA | |||

Cough/Cold/Allergy/Sinus(1) | $ | 141.5 | |

Infant Nutritionals | 103.4 | ||

Analgesics(1) | 93.7 | ||

Gastrointestinal(1) | 92.2 | ||

Smoking Cessation | 65.9 | ||

Animal Health | 26.3 | ||

Vitamins, Minerals and Dietary Supplements(1) | 3.0 | ||

Other CHCA(1),(2) | 75.6 | ||

Total CHCA | 601.6 | ||

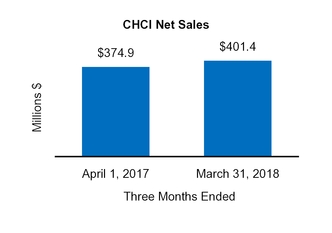

CHCI | |||

Cough, Cold, and Allergy | 98.7 | ||

Lifestyle | 89.7 | ||

Personal Care and Derma-Therapeutics | 75.6 | ||

Natural Health and Vitamins, Minerals and Dietary Supplements | 33.2 | ||

Anti-Parasite | 28.1 | ||

Other CHCI(3) | 76.1 | ||

Total CHCI | 401.4 | ||

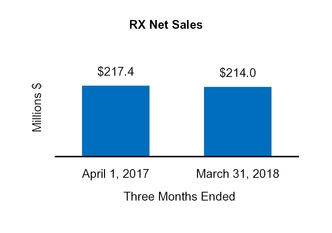

Total RX | 214.0 | ||

Total net sales | $ | 1,217.0 | |

(1) Includes net sales from our OTC contract manufacturing business.

(2) | Consists primarily of branded OTC, diagnostic products and other miscellaneous or otherwise uncategorized product lines and markets, none of which is greater than 10% of the segment net sales. |

(3) | Consists primarily of liquid licensed products, diagnostic products and other miscellaneous or otherwise uncategorized product lines and markets, none of which is greater than 10% of the segment net sales. |

9

Perrigo Company plc - Item 1

Note 2

While the majority of revenue is recognized at a point in time, certain of our product revenues are recognized on an over time basis. Predominately, over time customer contracts exist in contract manufacturing arrangements which occur in both the Consumer Healthcare Americas ("CHCA") and Consumer Healthcare International ("CHCI") segments. Contract manufacturing revenues were $69.4 million for the three months ended March 31, 2018.

We also recognized a portion of the store brand OTC product revenues in the CHCA segment on an over time basis; however, the timing between over time and point in time revenue recognition for store brand contracts is not significant due to the short time period between the customization of the product and shipment or delivery.

Contract Balances

The following table provides information about contract assets from contracts with customers (in millions):

Balance Sheet Location | January 1, 2018 | March 31, 2018 | |||||||

Short-term contract assets | Prepaid expenses and other current assets | $ | 20.5 | $ | 26.1 | ||||

We had no asset impairment charges related to contract assets in the three months ended March 31, 2018.

Impact on financial statements

Condensed Consolidated Statement of Operations

Net sales and Cost of sales were higher in the three months ended March 31, 2018 as a result of adopting ASC 606 due to net sales from contract manufacturing and certain OTC product sales being recognized on an over time basis as the performance obligation was satisfied, compared to the previous revenue recognition under ASC 605, which would have occurred when the product was shipped or delivered. This has resulted in the recognition of a contract asset.

Three Months Ended | |||||||||||

March 31, 2018 | |||||||||||

(in millions, except per share amounts, unaudited) | As reported | Adjustments | Before adoption of ASC 606 | ||||||||

Net sales | $ | 1,217.0 | $ | (5.6 | ) | $ | 1,211.4 | ||||

Cost of sales | 724.3 | (3.1 | ) | 721.2 | |||||||

Gross profit | 492.7 | (2.5 | ) | 490.2 | |||||||

Operating income | 156.3 | (2.5 | ) | 153.8 | |||||||

Net income | $ | 80.8 | $ | (2.5 | ) | $ | 78.3 | ||||

Earnings per share | |||||||||||

Basic | $ | 0.57 | $ | (0.02 | ) | $ | 0.55 | ||||

Diluted | $ | 0.57 | $ | (0.02 | ) | $ | 0.55 | ||||

Condensed Consolidated Statement of Comprehensive Income

Three Months Ended | |||||||||||

March 31, 2018 | |||||||||||

(in millions, unaudited) | As reported | Adjustments | Before adoption of ASC 606 | ||||||||

Net income | $ | 80.8 | $ | (2.5 | ) | $ | 78.3 | ||||

Comprehensive income | $ | 153.0 | $ | (2.5 | ) | $ | 150.5 | ||||

10

Perrigo Company plc - Item 1

Note 2

Condensed Consolidated Balance Sheet

Three Months Ended | |||||||||||

March 31, 2018 | |||||||||||

(in millions, unaudited) | As reported | Adjustments | Before adoption of ASC 606 | ||||||||

Assets | |||||||||||

Inventories | $ | 843.8 | $ | 17.9 | $ | 861.7 | |||||

Prepaid expenses and other current assets | 246.2 | (26.1 | ) | 220.1 | |||||||

Total current assets | 2,900.7 | (8.2 | ) | 2,892.5 | |||||||

Total assets | $ | 11,639.6 | $ | (8.2 | ) | $ | 11,631.4 | ||||

Liabilities and Shareholders’ Equity | |||||||||||

Other non-current liabilities | $ | 428.9 | $ | (0.3 | ) | $ | 428.6 | ||||

Total non-current liabilities | 4,041.5 | (0.3 | ) | 4,041.2 | |||||||

Total liabilities | 5,434.0 | (0.3 | ) | 5,433.7 | |||||||

Shareholders’ equity | |||||||||||

Controlling interest: | |||||||||||

Retained earnings (accumulated deficit) | (1,888.4 | ) | (7.9 | ) | (1,896.3 | ) | |||||

Total controlling interest | 6,205.4 | (7.9 | ) | 6,197.5 | |||||||

Total shareholders’ equity | 6,205.6 | (7.9 | ) | 6,197.7 | |||||||

Total liabilities and shareholders' equity | $ | 11,639.6 | $ | (8.2 | ) | $ | 11,631.4 | ||||

Condensed Consolidated Statement of Cash Flows

Three Months Ended | |||||||||||

March 31, 2018 | |||||||||||

(in millions, unaudited) | As reported | Adjustments | Before adoption of ASC 606 | ||||||||

Cash Flows From (For) Operating Activities | |||||||||||

Net income | $ | 80.8 | $ | (2.5 | ) | $ | 78.3 | ||||

Increase (decrease) in cash due to: | |||||||||||

Inventories | (43.7 | ) | (3.1 | ) | (46.8 | ) | |||||

Other, net | (22.2 | ) | 5.6 | (16.6 | ) | ||||||

Subtotal | (45.0 | ) | 2.5 | (42.5 | ) | ||||||

Net cash from operating activities | $ | 172.4 | $ | — | $ | 172.4 | |||||

NOTE 3 – DIVESTITURES

Prior Year Divestitures

On January 3, 2017, we sold certain Abbreviated New Drug Applications ("ANDAs") for $15.0 million to a third party, which was recorded as a gain in Other operating loss (income) on the Condensed Consolidated Statements of Operations in our Prescription Pharmaceuticals ("RX") segment.

On February 1, 2017, we completed the sale of the animal health pet treats plant fixed assets within our CHCA segment, which were previously classified as held-for sale. We received $7.7 million in proceeds, which resulted in an immaterial loss.

11

Perrigo Company plc - Item 1

Note 4

NOTE 4 – GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill

Changes in the carrying amount of goodwill, by reportable segment, were as follows (in millions):

Reporting Segments: | December 31, 2017 | Currency translation adjustments | March 31, 2018 | |||||||||

CHCA | $ | 1,847.4 | $ | 1.7 | $ | 1,849.1 | ||||||

CHCI | 1,205.7 | 32.7 | 1,238.4 | |||||||||

RX | 1,122.3 | (0.3 | ) | 1,122.0 | ||||||||

Total goodwill | $ | 4,175.4 | $ | 34.1 | $ | 4,209.5 | ||||||

Intangible Assets

Other intangible assets and related accumulated amortization consisted of the following (in millions):

March 31, 2018 | December 31, 2017 | ||||||||||||||

Gross | Accumulated Amortization | Gross | Accumulated Amortization | ||||||||||||

Definite-lived intangibles: | |||||||||||||||

Distribution and license agreements and supply agreements | $ | 312.3 | $ | 180.2 | $ | 311.2 | $ | 169.8 | |||||||

Developed product technology, formulations, and product rights | 1,362.8 | 629.5 | 1,358.4 | 598.7 | |||||||||||

Customer relationships and distribution networks | 1,675.0 | 500.8 | 1,642.0 | 460.6 | |||||||||||

Trademarks, trade names, and brands | 1,367.5 | 149.9 | 1,335.4 | 129.5 | |||||||||||

Non-compete agreements | 14.8 | 12.9 | 14.7 | 12.6 | |||||||||||

Total definite-lived intangibles | $ | 4,732.4 | $ | 1,473.3 | $ | 4,661.7 | $ | 1,371.2 | |||||||

Indefinite-lived intangibles: | |||||||||||||||

Trademarks, trade names, and brands | $ | 52.8 | $ | — | $ | 52.1 | $ | — | |||||||

In-process research and development | 38.5 | — | 38.2 | — | |||||||||||

Total indefinite-lived intangibles | 91.3 | — | 90.3 | — | |||||||||||

Total other intangible assets | $ | 4,823.7 | $ | 1,473.3 | $ | 4,752.0 | $ | 1,371.2 | |||||||

Certain intangible assets are denominated in currencies other than the U.S. dollar; therefore, their gross and accumulated amortization balances are subject to foreign currency movements.

We recorded amortization expense of $87.2 million and $85.5 million for the three months ended March 31, 2018 and April 1, 2017, respectively.

We recorded an impairment charge of $12.2 million on certain In Process Research and Development ("IPR&D") assets during the three months ended April 1, 2017 due to changes in the projected development and regulatory timelines for various projects. We also recorded a decrease in the contingent consideration liability associated with certain IPR&D assets in Other operating loss (income) on the Condensed Consolidated Statements of Operations (refer to Note 7).

NOTE 5 - ACCOUNTS RECEIVABLE FACTORING

We have accounts receivable factoring arrangements with non-related third-party financial institutions (the “Factors”). Pursuant to the terms of the arrangements, we sell to the Factors certain of our accounts receivable balances on a non-recourse basis for credit approved accounts. An administrative fee per invoice is charged on the gross amount of accounts receivables assigned to the Factors, and interest is calculated at the applicable EUR

12

Perrigo Company plc - Item 1

Note 4

LIBOR rate plus a spread. The total amount factored on a non-recourse basis and excluded from accounts receivable was $22.5 million and $27.5 million at March 31, 2018 and December 31, 2017, respectively.

NOTE 6 – INVENTORIES

Major components of inventory were as follows (in millions):

March 31, 2018 | December 31, 2017 | ||||||

Finished goods | $ | 467.4 | $ | 454.3 | |||

Work in process | 161.1 | 152.8 | |||||

Raw materials | 215.3 | 199.8 | |||||

Total inventories | $ | 843.8 | $ | 806.9 | |||

NOTE 7 – FAIR VALUE MEASUREMENTS

Fair value is the price that would be received upon sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The following fair value hierarchy is used in selecting inputs, with the highest priority given to Level 1, as these are the most transparent or reliable.

Level 1: | Quoted prices for identical instruments in active markets. |

Level 2: | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs are observable in active markets. |

Level 3: | Valuations derived from valuation techniques in which one or more significant inputs are not observable. |

The following table summarizes the valuation of our financial instruments carried at fair value and measured at fair value on a recurring and non-recurring basis by the above pricing categories (in millions):

Fair Value | ||||||||||

Fair Value Hierarchy | March 31, 2018 | December 31, 2017 | ||||||||

Measured at fair value on a recurring basis: | ||||||||||

Assets: | ||||||||||

Investment securities | Level 1 | $ | 13.8 | $ | 17.0 | |||||

Foreign currency forward contracts | Level 2 | $ | 5.0 | $ | 6.3 | |||||

Funds associated with Israeli severance liability | Level 2 | 15.0 | 16.3 | |||||||

Total level 2 assets | $ | 20.0 | $ | 22.6 | ||||||

Royalty Pharma contingent milestone payments | Level 3 | $ | 124.9 | $ | 134.5 | |||||

Liabilities: | ||||||||||

Foreign currency forward contracts | Level 2 | $ | 3.8 | $ | 3.8 | |||||

Contingent consideration | Level 3 | $ | 18.1 | $ | 22.0 | |||||

Measured at fair value on a non-recurring basis: | ||||||||||

Assets: | ||||||||||

Definite-lived intangible assets(1) | Level 3 | $ | — | $ | 11.5 | |||||

(1) | As of December 31, 2017, definite-lived intangible assets with a carrying amount of $31.2 million were written down to a fair value of $11.5 million. |

13

Perrigo Company plc - Item 1

Note 7

There were no transfers among Level 1, 2, and 3 during the three months ended March 31, 2018 or the year ended December 31, 2017. Our policy regarding the recording of transfers between levels is to record any such transfers at the end of the reporting period (refer to Note 8 for information on our investment securities and Note 9 for a discussion of derivatives).

Foreign Currency Forward Contracts

The fair value of foreign currency forward contracts is determined using a market approach, which utilizes values for comparable derivative instruments.

Funds Associated with Israel Severance Liability

Israeli labor laws and agreements require us to pay benefits to employees dismissed or retiring under certain circumstances. Severance pay is calculated on the basis of the most recent employee salary levels and the length of employee service. Our Israeli subsidiaries also provide retirement bonuses to certain managerial employees. We make regular deposits to retirement funds and purchase insurance policies to partially fund these liabilities. The funds are determined using prices for recently traded financial instruments with similar underlying terms, as well as directly or indirectly observable inputs, such as interest rates and yield curves, that are observable at commonly quoted intervals.

Financial Assets

On March 27, 2017, we announced the completed divestment of our Tysabri® financial asset to Royalty Pharma for up to $2.85 billion, consisting of $2.2 billion in cash and $250.0 million and $400.0 million in milestone payments if the royalties on global net sales of Tysabri® that are received by Royalty Pharma meet specific thresholds in 2018 and 2020, respectively. As a result of this transaction, we transferred the entire financial asset to Royalty Pharma and recorded a $17.1 million gain during the three months ended April 1, 2017. We elected to account for the contingent milestone payments using the fair value option method, and these were recorded at an estimated fair value of $184.5 million as of April 1, 2017. We chose the fair value option as we believe it will help investors understand the potential future cash flows we may receive associated with the two contingent milestones.

Royalty Pharma Contingent Milestone Payments

We valued our contingent milestone payments from Royalty Pharma using a modified Black-Scholes Option Pricing Model ("BSOPM"). Key inputs in the BSOPM are the estimated volatility and rate of return of royalties on global net sales of Tysabri® that are received by Royalty Pharma until the contingent milestones are resolved. Volatility and the estimated fair value of the milestones have a positive relationship such that higher volatility translates to a higher estimated fair value of the contingent milestone payments. In the valuation of contingent milestone payments performed, we assumed volatility of 30.0% and a rate of return of 8.08% as of March 31, 2018. We assess volatility and rate of return inputs quarterly by analyzing certain market volatility benchmarks and the risk associated with Royalty Pharma achieving the underlying projected royalties. During the three months ended March 31, 2018, the fair value of the Royalty Pharma contingent milestone payments decreased $9.6 million. The decrease was primarily attributed to projected global net sales of Tysabri® continuing to fall below the threshold required for payment of the $250.0 million milestone payment for 2018. Global net sales of Tysabri® are being impacted by competition, namely the launch of Ocrevus® in the U.S. and European markets in 2017 and 2018, respectively.

Payment of the contingent milestone payments is dependent on actual global net sales of Tysabri® in 2018 and 2020. Of the $124.9 million of estimated fair value contingent milestone payments as of March 31, 2018, $68.2 million and $56.7 million relates to the 2018 and 2020 contingent milestone payments, respectively. If Tysabri® global net sales do not meet the prescribed threshold in 2018, we will write off the $68.2 million asset as an expense to Change in financial assets on the Condensed Consolidated Statement of Operations. If the prescribed threshold is exceeded, we will write up the asset to $250.0 million and recognize income of $181.8 million in Change in financial assets on the Condensed Consolidated Statement of Operations. If Tysabri® global net sales do not meet the prescribed threshold in 2020, we will write off the $56.7 million asset as an expense to Change in financial assets on the Condensed Consolidated Statement of Operations. If the prescribed threshold is exceeded,

14

Perrigo Company plc - Item 1

Note 7

we will write up the asset to $400.0 million and recognize income of $343.8 million in Change in financial assets on the Condensed Consolidated Statement of Operations.

Global Tysabri® net sales need to exceed $1.85 billion and $1.95 billion in 2018 and 2020, respectively, in order for Royalty Pharma to receive the level of royalties needed to trigger the milestone payments owed to us.

The table below presents a reconciliation for the Royalty Pharma contingent milestone payments measured at fair value on a recurring basis using significant unobservable inputs (Level 3) (in millions). Change in fair value in the table was recorded in Change in financial assets on the Condensed Consolidated Statements of Operations.

Three Months Ended | |||

March 31, 2018 | |||

Royalty Pharma Contingent Milestone Payments | |||

Beginning balance | $ | 134.5 | |

Change in fair value | (9.6 | ) | |

Ending balance | $ | 124.9 | |

Contingent Consideration

Contingent consideration represents milestone payment obligations obtained through product acquisitions, which are valued using estimates based on probability-weighted outcomes, sensitivity analysis, and discount rates reflective of the risk involved. The estimates are updated quarterly and the liabilities are adjusted to fair value depending on a number of assumptions, including the competitive landscape and regulatory approvals that may impact the future sales of a product. We reduced a contingent consideration liability associated with certain IPR&D assets (refer to Note 4) and recorded a corresponding gain of $16.5 million during the three months ended April 1, 2017, this gain was partially offset by net realized losses of $2.1 million. The liability decrease relates to a reduction of the probability of achievement assumptions and anticipated cash flows.

The table below presents a reconciliation for liabilities measured at fair value on a recurring basis using significant unobservable inputs (Level 3) (in millions). Net realized losses in the table were recorded in Other expense (income), net on the Condensed Consolidated Statements of Operations.

Three Months Ended | |||||||

March 31, 2018 | April 1, 2017 | ||||||

Contingent Consideration | |||||||

Beginning balance | $ | 22.0 | $ | 69.9 | |||

Net realized (gains) losses | 0.4 | (14.4 | ) | ||||

Currency translation adjustments | 0.1 | (0.1 | ) | ||||

Settlements | (4.4 | ) | (3.4 | ) | |||

Ending balance | $ | 18.1 | $ | 52.0 | |||

Non-recurring Fair Value Measurements

The non-recurring fair values represent only those assets whose carrying values were adjusted to fair value during the reporting period.

15

Perrigo Company plc - Item 1

Note 7

Definite-Lived Intangible Assets

When assessing our definite-lived assets for impairment, we utilize either a multi-period excess earnings method ("MPEEM") or a relief from royalty method to determine the fair value of the asset and use the forecasts that are consistent with those used in the reporting unit analysis. Below is a summary of the various metrics used in our valuations:

Year Ended | |

December 31, 2017 | |

Lumara Branded Intangible | |

5-year average growth rate | (4.1)% |

Discount rate | 13.5% |

Valuation method | MPEEM |

Fixed Rate Long-term Debt

Our fixed rate long-term debt consisted of public bonds, a private placement note, and a retail bond as follows:

Fair Value Hierarchy | March 31, 2018 | December 31, 2017 | |||||||

(in billions) | |||||||||

Public Bonds | Level 1 | ||||||||

Carrying Value (excluding discount) | $ | 2.6 | $ | 2.6 | |||||

Fair value | $ | 2.6 | $ | 2.7 | |||||

(in millions) | |||||||||

Retail bond and private placement note | Level 2 | ||||||||

Carrying value (excluding premium) | $ | 314.3 | $ | 306.0 | |||||

Fair value | $ | 348.0 | $ | 342.1 | |||||

The fair values of our public bonds for all periods were based on quoted market prices. The fair values of our retail bond and private placement note for all periods were based on interest rates offered for borrowings of a similar nature and remaining maturities.

The carrying amounts of our other financial instruments, consisting of cash and cash equivalents, accounts receivable, accounts payable, short-term debt and variable rate long-term debt, approximate their fair value.

16

Perrigo Company plc - Item 1

Note 8

NOTE 8 – INVESTMENTS

The following table summarizes our equity security measurement category, balance sheet location, and balances (in millions):

Measurement Category | Balance Sheet Location | March 31, 2018 | December 31, 2017(2) | |||||||

Fair value method | Prepaid expenses and other current assets | $ | 13.8 | $ | 17.0 | |||||

Fair value method(1) | Other non-current assets | $ | 5.1 | $ | 6.3 | |||||

Equity method | Other non-current assets | $ | 4.7 | $ | 4.9 | |||||

(1) The March 31, 2018 equity securities are measured at fair value using the Net Asset Value practical expedient.

(2) The December 31, 2017 balances presented reflect historical recognition and measurement investment categories existing prior to the adoption of ASU 2016-01, which include available for sale and cost method securities.

The following table summarizes our equity security expense (income) recognized in earnings (in millions):

Three Months Ended | ||||||||||

Measurement Category | Income Statement Location | March 31, 2018 | April 1, 2017 | |||||||

Fair value method | Other expense (income), net | $ | 4.4 | $ | — | |||||

Equity method | Other expense (income), net | $ | 0.2 | $ | (0.1 | ) | ||||

On January 1, 2018, as a result of the adoption of ASU 2016-01, we made a $1.4 million cumulative-effect adjustment to Retained earnings (accumulated deficit) that consisted of net unrealized losses on previously classified available for sale securities from Other comprehensive income ("OCI").

NOTE 9 – DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

We enter into certain derivative financial instruments, when available on a cost-effective basis, to mitigate our risk associated with changes in interest rates and foreign currency exchange rates as follows:

Interest rate risk management - We are exposed to the impact of interest rate changes through our cash investments and borrowings. We utilize a variety of strategies to manage the impact of changes in interest rates, including using a mix of debt maturities along with both fixed-rate and variable-rate debt. In addition, we may enter into treasury-lock agreements and interest rate swap agreements on certain investing and borrowing transactions to manage our exposure to interest rate changes and our overall cost of borrowing.

Foreign currency exchange risk management - We conduct business in several major currencies other than the U.S. dollar and are subject to risks associated with changing foreign exchange rates. Our objective is to reduce cash flow volatility associated with foreign exchange rate changes on a consolidated basis to allow management to focus its attention on business operations. Accordingly, we enter into various contracts that change in value as foreign exchange rates change to protect the value of existing foreign currency assets and liabilities, commitments, and anticipated foreign currency sales and expenses.

All derivative instruments are managed on a consolidated basis to efficiently net exposures and thus take advantage of any natural offsets. Gains and losses related to the derivative instruments are expected to be offset largely by gains and losses on the original underlying asset or liability. We do not use derivative financial instruments for speculative purposes.

All of our designated derivatives were classified as cash flow hedges as of March 31, 2018 and December 31, 2017. Designated derivatives meet hedge accounting criteria, which means the fair value of the hedge is recorded in Shareholders’ equity as a component of OCI, net of tax. The deferred gains and losses are recognized in income in the period in which the hedged item affects earnings. Any ineffective portion of the change in fair value of the derivative is immediately recognized in earnings. All of our designated derivatives are assessed for hedge effectiveness quarterly.

17

Perrigo Company plc - Item 1

Note 9

We also have economic non-designated derivatives that do not meet hedge accounting criteria. These derivative instruments are adjusted to current market value at the end of each period through earnings. Gains or losses on these instruments are offset substantially by the remeasurement adjustment on the hedged item.

Interest Rate Swaps

Interest rate swap agreements are contracts to exchange floating rate for fixed rate payments (or vice versa) over the life of the agreement without the exchange of the underlying notional amounts. The notional amounts of the interest rate swap agreements are used to measure interest to be paid or received and do not represent the amount of exposure to credit loss. The differential paid or received on the interest rate swap agreements is recognized as an adjustment to Interest expense, net.

Foreign Currency Derivatives

We enter into foreign currency forward contracts, both designated and non-designated, in order to manage the impact of foreign exchange fluctuations on expected future purchases and related payables denominated in a foreign currency, as well as to hedge the impact of foreign exchange fluctuations on expected future sales and related receivables denominated in a foreign currency. Both types of forward contracts have a maximum maturity date of 18 months. The total notional amount for these contracts was $583.3 million and $592.3 million as of March 31, 2018 and December 31, 2017, respectively.

Effects of Derivatives on the Financial Statements

The below tables indicate the effects of all derivative instruments on the Condensed Consolidated Financial Statements. All amounts exclude income tax effects and are presented in millions.

The balance sheet location and gross fair value of our outstanding derivative instruments were as follows:

Asset Derivatives | |||||||||

Balance Sheet Location | Fair Value | ||||||||

March 31, 2018 | December 31, 2017 | ||||||||

Designated derivatives: | |||||||||

Foreign currency forward contracts | Other current assets | $ | 3.4 | $ | 4.1 | ||||

Non-designated derivatives: | |||||||||

Foreign currency forward contracts | Other current assets | $ | 1.6 | $ | 2.2 | ||||

Liability Derivatives | |||||||||

Balance Sheet Location | Fair Value | ||||||||

March 31, 2018 | December 31, 2017 | ||||||||

Designated derivatives: | |||||||||

Foreign currency forward contracts | Accrued liabilities | $ | 2.2 | $ | 1.4 | ||||

Non-designated derivatives: | |||||||||

Foreign currency forward contracts | Accrued liabilities | $ | 1.6 | $ | 2.4 | ||||

The gains (losses) recorded in OCI for the effective portion of our designated cash flow hedges were as follows:

Amount of Gain/(Loss) Recorded in OCI (Effective Portion) | ||||||||

Three Months Ended | ||||||||

Designated Cash Flow Hedges | March 31, 2018 | April 1, 2017 | ||||||

Foreign currency forward contracts | $ | (0.2 | ) | $ | 2.5 | |||

18

Perrigo Company plc - Item 1

Note 9

The gains (losses) reclassified from Accumulated other comprehensive income ("AOCI") into earnings for the effective portion of our designated cash flow hedges were as follows:

Amount of Gain/(Loss) Reclassified from AOCI into Earnings (Effective Portion) | ||||||||||

Three Months Ended | ||||||||||

Designated Cash Flow Hedges | Income Statement Location | March 31, 2018 | April 1, 2017 | |||||||

Interest rate swap agreements | Interest expense, net | $ | (0.4 | ) | $ | (0.6 | ) | |||

Foreign currency forward contracts | Net sales | (0.1 | ) | 0.2 | ||||||

Cost of sales | 2.3 | 0.7 | ||||||||

Interest expense, net | (1.0 | ) | (0.6 | ) | ||||||

Other expense (income), net | (0.4 | ) | (0.5 | ) | ||||||

Total | $ | 0.4 | $ | (0.8 | ) | |||||

The net of tax amount expected to be reclassified out of AOCI into earnings during the next 12 months is a $1.8 million loss.

The gains (losses) recognized in earnings for the ineffective portion of our designated cash flow hedges were as follows:

Amount of Gain/(Loss) Recognized in Earnings (Ineffective Portion) | ||||||||||

Three Months Ended | ||||||||||

Designated Cash Flow Hedges | Income Statement Location | March 31, 2018 | April 1, 2017 | |||||||

Foreign currency forward contracts | Other expense (income), net | $ | — | $ | 0.9 | |||||

The effects of our non-designated derivatives on the Condensed Consolidated Statements of Operations were as follows:

Amount of Gain/(Loss) Recognized against Earnings | ||||||||||

Three Months Ended | ||||||||||

Non-Designated Derivatives | Income Statement Location | March 31, 2018 | April 1, 2017 | |||||||

Foreign currency forward contracts | Other expense (income), net | $ | 3.5 | $ | (8.9 | ) | ||||

Interest expense, net | (0.9 | ) | (0.4 | ) | ||||||

Total | $ | 2.6 | $ | (9.3 | ) | |||||

19

Perrigo Company plc - Item 1

Note 10

NOTE 10 – INDEBTEDNESS

Total borrowings outstanding are summarized as follows (in millions):

March 31, 2018 | December 31, 2017 | ||||||||||

Term loans | |||||||||||

2018 Term loan due March 8, 2020(1) | $ | 417.9 | $ | — | |||||||

2014 Term loan due December 5, 2019(1) | — | 420.0 | |||||||||

Total term loans | 417.9 | 420.0 | |||||||||

Notes and Bonds | |||||||||||

Coupon | Due | ||||||||||

5.000% | March 23, 2019(1) | 147.9 | 144.0 | ||||||||

3.500% | March 15, 2021 | 280.4 | 280.4 | ||||||||

3.500% | December 15, 2021 | 309.6 | 309.6 | ||||||||

5.105% | July 19, 2023(1) | 166.4 | 162.0 | ||||||||

4.000% | November 15, 2023 | 215.6 | 215.6 | ||||||||

3.900% | December 15, 2024 | 700.0 | 700.0 | ||||||||

4.375% | March 15, 2026 | 700.0 | 700.0 | ||||||||

5.300% | November 15, 2043 | 90.5 | 90.5 | ||||||||

4.900% | December 15, 2044 | 303.9 | 303.9 | ||||||||

Total notes and bonds | 2,914.3 | 2,906.0 | |||||||||

Other financing | 5.3 | 11.7 | |||||||||

Unamortized premium (discount), net | 20.1 | 21.4 | |||||||||

Deferred financing fees | (19.0 | ) | (17.9 | ) | |||||||

Total borrowings outstanding | 3,338.6 | 3,341.2 | |||||||||

Current indebtedness | (58.0 | ) | (70.4 | ) | |||||||

Total long-term debt less current portion | $ | 3,280.6 | $ | 3,270.8 | |||||||

(1) | Debt denominated in euros subject to fluctuations in the euro-to-U.S. dollar exchange rate. |

We are in compliance with all covenants under our debt agreements as of March 31, 2018.

Revolving Credit Agreements

On December 5, 2014, Perrigo Finance entered into a $600.0 million revolving credit agreement, which increased to $1.0 billion on March 30, 2015 (the "2014 Revolver"). On March 8, 2018, we terminated the 2014 Revolver and entered into a $1.0 billion revolving credit agreement maturing on March 8, 2023 (the "2018 Revolver"). There were no borrowings outstanding under the 2018 Revolver or 2014 Revolver as of March 31, 2018 or December 31, 2017, respectively.

Term Loans

On December 5, 2014, Perrigo Finance entered into a term loan agreement consisting of a €500.0 million ($614.3 million) tranche, maturing December 5, 2019. On March 8, 2018, we refinanced the €350.0 million outstanding under the term loan with the proceeds of a new €350.0 million ($431.0 million) term loan, maturing March 8, 2020. In addition, as a result of the refinancing during the three months ended March 31, 2018, we recorded a loss of $0.5 million, consisting of the write-off of deferred financing fees in Loss on extinguishment of debt.

20

Perrigo Company plc - Item 1

Note 10

Other Financing

Overdraft Facilities

We have overdraft facilities available that we use to support our cash management operations. We report any balances outstanding in the above table under "Other financing". The balance outstanding under the overdraft facilities was $1.2 million and $6.9 million at March 31, 2018 and December 31, 2017, respectively.

NOTE 11 – EARNINGS PER SHARE AND SHAREHOLDERS' EQUITY

Earnings per Share

A reconciliation of the numerators and denominators used in the basic and diluted earnings per share ("EPS") calculation is as follows (in millions):

Three Months Ended | |||||||

March 31, 2018 | April 1, 2017 | ||||||

Numerator: | |||||||

Net income | $ | 80.8 | $ | 71.6 | |||

Denominator: | |||||||

Weighted average shares outstanding for basic EPS | 140.8 | 143.4 | |||||

Dilutive effect of share-based awards | 0.6 | 0.2 | |||||

Weighted average shares outstanding for diluted EPS | 141.4 | 143.6 | |||||

Anti-dilutive share-based awards excluded from computation of diluted EPS | 0.7 | 1.0 | |||||

Shareholders' Equity

Shares

We issued shares related to the exercise and vesting of share-based compensation as follows:

Three Months Ended | ||||

March 31, 2018 | April 1, 2017 | |||

53,000 | 14,400 | |||

Share Repurchases

In October 2015, the Board of Directors approved a three-year share repurchase plan of up to $2.0 billion. During the three months ended March 31, 2018, we repurchased 1.3 million ordinary shares at an average repurchase price of $81.92 per share, for a total of $108.1 million. We did not repurchase any shares under the share repurchase plan during the three months ended April 1, 2017.

21

Perrigo Company plc - Item 1

Note 13

NOTE 12 – ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

Changes in our AOCI balances, net of tax were as follows (in millions):

Foreign currency translation adjustments | Fair value of derivative financial instruments, net of tax | Fair value of investment securities, net of tax | Post-retirement and pension liability adjustments, net of tax | Total AOCI | |||||||||||||||

Balance at December 31, 2017 | $ | 260.6 | $ | (9.8 | ) | $ | 1.0 | $ | 1.3 | $ | 253.1 | ||||||||

ASU 2016-01 adoption impact | — | — | (1.0 | ) | — | (1.0 | ) | ||||||||||||

Balance at December 31, 2017 after adoption impact | $ | 260.6 | $ | (9.8 | ) | $ | — | $ | 1.3 | $ | 252.1 | ||||||||

OCI before reclassifications | 73.0 | (0.1 | ) | — | (0.2 | ) | 72.7 | ||||||||||||

Amounts reclassified from AOCI | — | (0.5 | ) | — | — | (0.5 | ) | ||||||||||||

Other comprehensive income | $ | 73.0 | $ | (0.6 | ) | $ | — | $ | (0.2 | ) | $ | 72.2 | |||||||

Balance at March 31, 2018 | $ | 333.6 | $ | (10.4 | ) | $ | — | $ | 1.1 | $ | 324.3 | ||||||||

NOTE 13 – INCOME TAXES

The effective tax rates were as follows:

Three Months Ended | ||||

March 31, 2018 | April 1, 2017 | |||

26.9 | % | 25.3 | % | |

The effective tax rate for the three months ended March 31, 2018 increased in comparison to the prior year period due primarily to additional valuation allowances recorded against deferred tax assets partially offset by discrete tax benefits.

Our tax rate is subject to adjustment over the balance of the fiscal year due to, among other things: the jurisdictions in which our profits are determined to be earned and taxed; changes in the valuation of our deferred tax assets and liabilities; adjustments to estimated taxes upon finalization of various tax returns; adjustments based on differing interpretations of the applicable transfer pricing standards; changes in available tax credits, grants and other incentives; changes in stock-based compensation expense; changes in tax laws or the interpretation of such tax laws (for example, proposals for fundamental U.S. international tax reform); changes in U.S. GAAP; and expiration of or the inability to renew tax rulings or tax holiday incentives.

We file income tax returns in numerous jurisdictions and are therefore subject to audits by tax authorities. Our primary income tax jurisdictions are Ireland, the United States, Israel, Belgium, France, and the United Kingdom.

On August 15, 2017, we filed a complaint in the U.S. District Court for the Western District of Michigan to recover $163.6 million of Federal income tax, penalties, and interest assessed and collected by the Internal Revenue Service (“IRS”), plus statutory interest thereon from the dates of payment, for the fiscal years ended June 27, 2009, June 26, 2010, June 25, 2011, and June 30, 2012 (the “2009 tax year,” “2010 tax year,” “2011 tax year,” and “2012 tax year,” respectively). The IRS audits of those years culminated in the issuances of two statutory notices of deficiency: (1) on August 27, 2014 for the 2009 and 2010 tax years and (2) on April 20, 2017 for the 2011 and 2012 tax years. The statutory notices of deficiency both included un-agreed income adjustments related principally to transfer pricing adjustments regarding the purchase, distribution, and sale of store-brand OTC pharmaceutical products in the United States. In addition, the statutory notice of deficiency for the 2011 and 2012 tax years included the capitalization of certain expenses that were deducted when paid or incurred in defending against certain patent infringement lawsuits. We fully paid the assessed amounts of tax, interest, and penalties set forth in the statutory notices and filed timely claims for refund on June 11, 2015 and June 7, 2017 for the 2009-2010 tax years and 2011-2012 tax years, respectively. Our claims for refund were disallowed by certified letters dated August 18, 2015 and July 11, 2017, for the 2009-2010 tax years and 2011-2012 tax years, respectively. The

22

Perrigo Company plc - Item 1

Note 13

complaint was timely, based upon the refund claim denials, and seeks refunds of tax, interest, and penalties of $37.2 million for the 2009 tax year, $61.5 million for the 2010 tax year, $40.2 million for the 2011 tax year, and $24.7 million for the 2012 tax year. The amounts sought in the complaint for the 2009 and 2010 tax years were recorded as deferred charges in Other non-current assets on our balance sheet during the three months ended March 28, 2015, and the amounts sought in the complaint for the 2011 and 2012 tax years were recorded as deferred charges in Other non-current assets on our balance sheet during the three months ended July 1, 2017.

On December 22, 2016, we received a notice of proposed adjustment for the IRS audit of Athena Neurosciences, Inc. (“Athena”), a subsidiary of Elan acquired in 1996, for the years ended December 31, 2011, December 31, 2012, and December 31, 2013. Perrigo acquired Elan in December 2013. This proposed adjustment relates to the deductibility of litigation costs. We disagree with the IRS’s position asserted in the notice of proposed adjustment and intend to contest it.

On July 11, 2017, we received a draft notice of proposed adjustment associated with transfer pricing positions for the IRS audit of Athena for the years ended December 31, 2011, December 31, 2012, and December 31, 2013. Athena was the originator of the patents associated with Tysabri® prior to the acquisition of Athena by Elan in 1996. In response to the draft notice of proposed adjustment, we provided the IRS with substantial additional documentation supporting our position. The amount of adjustments that may be asserted by the IRS in the final notice of proposed adjustment cannot be quantified at this time; however, based on the draft notice received, the amount to be assessed may be material. We disagree with the IRS’s position as asserted in the draft notice of proposed adjustment and intend to contest it.

We have ongoing audits in multiple other jurisdictions the resolution of which remains uncertain. These jurisdictions include, but are not limited to, the U.S., Israel, Ireland and other jurisdictions in Europe. In addition to the matters discussed above, the IRS is currently auditing our fiscal years ended June 29, 2013, June 28, 2014, and June 27, 2015 (which covers the period of the Elan transaction). The Israel Tax Authority is currently auditing our fiscal years ended June 29, 2013 and June 28, 2014. The Ireland Tax Authority is currently auditing our years ended December 31, 2012 and December 31, 2013.

Tax Law Changes

On December 22, 2017, the U.S. enacted the Tax Cuts and Jobs Act (“U.S. Tax Act”). The U.S. Tax Act includes a number of significant changes to existing U.S. tax laws that impact us. These changes include a corporate income tax rate reduction from 35% to 21% and the elimination or reduction of certain U.S. deductions and credits including limitations on the U.S. deductibility of interest expense and executive compensation. The U.S. Tax Act also transitions the U.S. taxation of international earnings from a worldwide system to a modified territorial system. These changes are effective beginning in 2018. The U.S. Tax Act also includes a one-time mandatory deemed repatriation tax on accumulated U.S. owned foreign corporations’ previously untaxed foreign earnings (“Transition Toll Tax”). The Transition Toll Tax may be paid over an eight-year period, starting in 2018, and will not accrue interest.

On December 22, 2017, Staff Accounting Bulletin No. 118 ("SAB 118") was issued to address the application of the U.S. GAAP ASC 740 income tax accounting for tax law changes enacted during 2017, in situations when a registrant does not have the necessary information available, prepared, or analyzed (including computations) in reasonable detail to complete the accounting for certain income tax effects of the U.S. Tax Act. In accordance with SAB 118, for the year ended December 31, 2017, we recorded an income tax benefit of $2.4 million in connection with the remeasurement of certain deferred tax assets and liabilities and also recorded a $17.5 million increase of current tax expense in connection with the Transition Toll Tax on cumulative U.S. owned foreign earnings of $1.2 billion. The tax impacts represent provisional amounts and are a reasonable estimate. The IRS issued additional guidance related to the U.S. Tax Act during the quarter ended March 31, 2018, which resulted in no changes to the provisional estimates recorded at December 31, 2017. Further work is necessary to perform additional analysis of historical foreign earnings and U.S. cumulative temporary differences, as well as potential correlative adjustments. Any subsequent adjustment to these amounts will be recorded to current tax expense when the analysis is complete in 2018.

The U.S. Tax Act subjects a U.S. shareholder to tax on global intangible low-taxed income ("GILTI") earned by certain foreign subsidiaries. The FASB Staff Q&A, Topic 740, No. 5, Accounting for Global Intangible Low-Taxed

23

Perrigo Company plc - Item 1

Note 13

Income states that an entity can make an accounting policy election to either recognize deferred taxes for temporary basis differences expected to reverse as GILTI in future years or provide for the tax expense related to GILTI in the year the tax is incurred. Given the complexity of the GILTI provisions, we are still evaluating the effects of the GILTI provisions and have not yet determined our accounting policy. At March 31, 2018, we made a reasonable estimate of the tax effect of a GILTI inclusion for 2018, which is not material for the quarter. We also estimate that we will not be subject to the base erosion anti-avoidance tax in 2018 and will not record tax benefits for deductions related to foreign-derived intangible income.

On December 22, 2017, the Belgian Parliament approved Belgian tax reform legislation (“Belgium Tax Act”), which was signed by the Belgian King and enacted on December 25, 2017. The Belgium Tax Act provides for a reduction to the corporate income tax rate from 34% to 30%, for 2018 and 2019, as well as a reduced corporate income tax rate of 25% for 2020 and beyond. The Belgium Tax Act also increased the participation exemption on dividend distributions to Belgium entities from 95% to 100%. The Belgium Tax Act also introduces Belgium tax consolidation and other anti-tax avoidance directives. For the year ended December 31, 2017, we recorded additional income tax expense of $24.1 million for the remeasurement of certain deferred tax assets and additional income tax benefit of $33.2 million for the remeasurement of certain deferred tax liabilities as a result of the Belgium Tax Act.

NOTE 14 – COMMITMENTS AND CONTINGENCIES

In view of the inherent difficulties of predicting the outcome of various types of legal proceedings, we cannot determine the ultimate resolution of the matters described below. We establish reserves for litigation and regulatory matters when losses associated with the claims become probable and the amounts can be reasonably estimated. The actual costs of resolving legal matters may be substantially higher or lower than the amounts reserved for those matters. For matters where the likelihood or extent of a loss is not probable or cannot be reasonably estimated as of March 31, 2018, we have not recorded a loss reserve. If certain of these matters are determined against us, there could be a material adverse effect on our financial condition, results of operations, or cash flows. We currently believe we have valid defenses to the claims in these lawsuits and intend to defend these lawsuits vigorously regardless of whether or not we have a loss reserve. Other than what is disclosed below, we do not expect the outcome of the litigation matters to which we are currently subject to, individually or in the aggregate, have a material adverse effect on our financial condition, results of operations, or cash flows.

Antitrust Violations

We were named as a counterclaim co-defendant in the lawsuit Fera Pharmaceuticals, LLC v. Akorn, Inc., et al. in the Southern District of New York, in which Akorn, Inc. (“Akorn”) alleged tortious interference and antitrust violations against us and Fera Pharmaceuticals, LLC (“Fera”). Trial was set for February 2018 in the Southern District of New York. This litigation arose out of our acquisition of bacitracin ophthalmic ointment from Fera in 2013. Akorn asserted claims under Sections 1 and 2 of the Sherman Antitrust Act alleging that we and Fera conspired to monopolize, attempted to monopolize, and did unlawfully monopolize the market for sterile bacitracin ophthalmic ointment in the United States through the use of an exclusive agreement with a supplier of sterile bacitracin active pharmaceutical ingredient. The parties have executed a written settlement of all claims and the case has been dismissed.

Price-Fixing Lawsuits

We have been named as a co-defendant with other manufacturers in a number of class actions alleging that we and other manufacturers of the same product engaged in anti-competitive behavior to fix or raise the prices of certain drugs starting, in some instances, as early as June 2013. The products in question are Clobetasol, Desonide, and Econazole. These complaints, along with complaints filed against other companies alleging price fixing with respect to more than two dozen other drugs, have been consolidated for pretrial proceedings as part of a case captioned In re Generic Pharmaceuticals Pricing Antitrust Litigation, MDL No. 2724 in the U.S. District Court for the Eastern District of Pennsylvania. Pursuant to the court’s schedule staging various cases in phases, we have moved to dismiss the complaints relating to Clobetasol and Econazole. We have also recently been named a defendant along with 31 other manufacturers in a complaint filed by three supermarket chains alleging that defendants conspired to fix prices of all generic pharmaceutical products starting in 2013. A schedule for responses

24

Perrigo Company plc - Item 1

Note 14

to this complaint will be determined after decisions are rendered on the pending motions to dismiss the class cases. At this stage, we cannot reasonably predict the outcome of the liability, if any, associated with these claims.

Securities Litigation

In the United States