Form 10-Q HALOZYME THERAPEUTICS, For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended September 30, 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number 001-32335

___________________________

(Exact name of registrant as specified in its charter)

___________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Zip Code) | ||||||||

| (Address of principal executive offices) | ||||||||

(858 ) 794-8889

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

☒ | Accelerated filer | ☐ | |||||||||

Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ | |||||||||||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The number of outstanding shares of the registrant’s common stock, par value $0.001 per share, was 135,213,058 as of October 31, 2022.

HALOZYME THERAPEUTICS, INC.

INDEX

| Page | ||||||||||||||

| Item 1. | ||||||||||||||

| Item 2. | ||||||||||||||

| Item 3. | ||||||||||||||

| Item 4. | ||||||||||||||

| Item 1. | ||||||||||||||

| Item 1A. | ||||||||||||||

| Item 2. | ||||||||||||||

| Item 3. | ||||||||||||||

| Item 4. | ||||||||||||||

| Item 5. | ||||||||||||||

| Item 6. | ||||||||||||||

2

Summary of Risk Factors

Our business is subject to a number of risks and uncertainties, including those described in the section labeled “Risk Factors” in “Part I, Item 2, Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Quarterly Report. These risks include the following:

Risks Related To Our Business

•Business interruptions resulting from the COVID-19 outbreak or similar public health crises could cause a disruption of the development of our and our partnered product candidates and commercialization of our approved and our partnered products, impede our ability to supply bulk rHuPH20 to our ENHANZE® partners or procure and sell our proprietary products and otherwise adversely impact our business and results of operations.

•If our partnered or proprietary product candidates do not receive and maintain regulatory approvals, or if approvals are not obtained in a timely manner, such failure or delay would substantially impair our ability to generate revenues.

•Use of our partnered or proprietary products and product candidates could be associated with adverse events or product recalls.

•If our contract manufacturers or vendors are unable or elect not to manufacture and supply to us bulk rHuPH20 or other raw materials, reagents, components or devices in the quantity and quality required by us or our partners for use in the production of Hylenex or other proprietary or partnered products and product candidates, our and our partners’ product development or commercialization efforts could be delayed or suspended and our business results of operations and our collaborations could be harmed.

•We rely on third parties to perform many necessary services for our products including services related to the distribution, invoicing, rebates and contract administration, co-pay program administration, sample distribution and administration, storage and transportation of our products. If anything should impede their ability to meet their commitments this could impact our business performance.

•If we or any party to a key collaboration agreement fail to perform material obligations under such agreement, or if a key collaboration agreement, is terminated for any reason, our business could significantly suffer.

•Hylenex and our partners’ ENHANZE products and product candidates rely on the rHuPH20 enzyme, and any adverse development regarding rHuPH20 could substantially impact multiple areas of our business, including current and potential ENHANZE collaborations, as well as any proprietary programs.

•Our business strategy is focused on growth of our ENHANZE technology, our autoinjector technology, our commercial products and potential growth through acquisition. Currently, ENHANZE is the largest revenue driver and as a result there is a risk for potential negative impact from adverse developments. Future expansion of our strategic focus to additional applications of our ENHANZE technology or by acquiring new technologies may require the use of additional resources, result in increased expense and ultimately may not be successful.

•Our partnered or proprietary product candidates may not receive regulatory approvals or their development may be delayed for a variety of reasons, including delayed or unsuccessful clinical trials, regulatory requirements or safety concerns. If we or our partners fail to obtain, or have delays in obtaining, regulatory approvals for any product candidates, our business, financial condition and results of operations may be materially adversely affected.

•Our third-party partners are responsible for providing certain proprietary materials that are essential components of our partnered products and product candidates, and any failure to supply these materials could delay the development and commercialization efforts for these partnered products and product candidates and/or damage our collaborations. Our partners are also responsible for distributing and commercializing their products, and any failure to successfully commercialize their products could materially adversely affect our revenues.

•If we or our partners fail to comply with regulatory requirements applicable to promotion, sale and manufacturing of approved products, regulatory agencies may take action against us or them, which could harm our business.

•Failure to successfully integrate the Antares business, or failure of the Antares business to perform could adversely impact our stock price and future business and operations.

•We may need to raise additional capital in the future and there can be no assurance that we will be able to obtain such funds.

•We currently have significant debt and expect to incur additional debt. Failure by us to fulfill our obligations under the applicable debt agreements may cause repayment obligations to accelerate.

3

•The conditional conversion feature of the Convertible Notes, if triggered, may adversely affect our financial condition and operating results.

•Conversion of our Convertible Notes may dilute the ownership interest of existing stockholders or may otherwise depress the price of our common stock.

•If proprietary or partnered product candidates are approved for commercialization but do not gain market acceptance resulting in commercial performance below that which was expected or projected, our business may suffer.

•Our ability to license our ENHANZE and device technologies to our partners depends on the validity of our patents and other proprietary rights.

•Developing, manufacturing and marketing pharmaceutical products for human use involves significant product liability risks for which we may have insufficient insurance coverage.

•If our partners do not achieve projected development, clinical, or regulatory goals in the timeframes publicly announced or otherwise expected, the commercialization of our partnered products may be delayed and, as a result, our stock price may decline, and we may face lawsuits relating to such declines.

•Future acquisitions could disrupt our business and harm our financial condition.

•Our effective tax rate may fluctuate, and we may incur obligations in tax jurisdictions in excess of accrued amounts.

Risks Related To Ownership of Our Common Stock

•Our stock price is subject to significant volatility.

•Future transactions where we raise capital may negatively affect our stock price.

•Anti-takeover provisions in our charter documents, the Indentures and Delaware law may make an acquisition of us more difficult.

Risks Related to Our Industry

•Our or our partnered products must receive regulatory approval before they can be sold, and compliance with the extensive government regulations is expensive and time consuming and may result in the delay or cancellation of our or our partnered product sales, introductions or modifications.

•Because some of our and our partners’ products and product candidates are considered to be drug/device combination products, the approval and post-approval requirements that we and they are required to comply with can be more complex.

•We may be subject, directly or indirectly, to various broad federal and state healthcare laws. If we are unable to comply, or have not fully complied, with such laws, we could face civil, criminal and administrative penalties, damages, monetary fines, disgorgement, possible exclusion from participation in Medicare, Medicaid and other federal healthcare programs, contractual damages, reputational harm, diminished profits and future earnings and curtailment or restructuring of our operations, any of which could adversely affect our ability to operate.

•We may be required to initiate or defend against legal proceedings related to intellectual property rights, which may result in substantial expense, delay and/or cessation of the development and commercialization of our products.

•We may incur significant liability if it is determined that we are promoting or have in the past promoted the “off-label” use of drugs or medical devices, or otherwise promoted or marketed approved products in a manner inconsistent with the FDA’s requirements.

•For certain of our products, we and our independent contractors, distributors, prescribers, and dispensers are required to comply with regulatory requirements related to controlled substances, which will require the expenditure of additional time and will incur additional expenses to maintain compliance and may subject us to additional penalties for noncompliance, which could inhibit successful commercialization.

•Patent protection for protein-based therapeutic products and other biotechnology inventions is subject to uncertainty, and if patent laws or the interpretation of patent laws change, our competitors may be able to develop and commercialize products based on our discoveries.

•If third-party reimbursement and customer contracts are not available, our proprietary and our partnered products may not be accepted in the market resulting in commercial performance below that which was expected or projected.

4

•The rising cost of healthcare and related pharmaceutical product pricing has led to cost containment pressures from third-party payers as well as changes in federal coverage and reimbursement policies and practices that could cause us and our partners to sell our products at lower prices, and impact access to our and our partners’ products, resulting in less revenue to us.

•We face competition and rapid technological change that could result in the development of products by others that are competitive with or superior to our proprietary and partnered products, including those under development.

General Risks

•If we are unable to attract, hire and retain key management and scientific personnel our business could be negatively affected.

•Our operations might be interrupted by the occurrence of a natural disaster or other catastrophic event.

•Cyberattacks, security breaches or system breakdowns may disrupt our operations and harm our operating results and reputation.

5

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements

HALOZYME THERAPEUTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except per share amounts)

| September 30, 2022 | December 31, 2021 | |||||||||||||

| ASSETS | ||||||||||||||

| Current assets: | ||||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Marketable securities, available-for-sale | ||||||||||||||

| Accounts receivable, net and contract assets | ||||||||||||||

| Inventories, net | ||||||||||||||

| Prepaid expenses and other current assets | ||||||||||||||

| Total current assets | ||||||||||||||

| Property and equipment, net | ||||||||||||||

| Prepaid expenses and other assets | ||||||||||||||

| Goodwill | ||||||||||||||

| Intangible assets, net | ||||||||||||||

| Deferred tax assets, net | ||||||||||||||

| Restricted cash | ||||||||||||||

| Total assets | $ | $ | ||||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accounts payable | $ | $ | ||||||||||||

| Accrued expenses | ||||||||||||||

| Deferred revenue, current portion | ||||||||||||||

| Current portion of long-term debt, net | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Deferred revenue, net of current portion | ||||||||||||||

| Long-term debt, net | ||||||||||||||

| Other long-term liabilities | ||||||||||||||

| Deferred tax liabilities, net | ||||||||||||||

| Contingent liability | ||||||||||||||

| Commitments and contingencies (Note 12) | ||||||||||||||

| Stockholders’ equity: | ||||||||||||||

Preferred stock - $ issued and outstanding | ||||||||||||||

Common stock - $ | ||||||||||||||

| Additional paid-in capital | ||||||||||||||

| Accumulated other comprehensive loss | ( | ( | ||||||||||||

| Retained earnings (accumulated deficit) | ( | |||||||||||||

| Total stockholders’ equity | ||||||||||||||

| Total liabilities and stockholders’ equity | $ | $ | ||||||||||||

See accompanying notes to condensed consolidated financial statements.

6

HALOZYME THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

(In thousands, except per share amounts)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||

| Royalties | $ | $ | $ | $ | ||||||||||||||||||||||

| Product sales, net | ||||||||||||||||||||||||||

| Revenues under collaborative agreements | ||||||||||||||||||||||||||

| Total revenues | ||||||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||

| Cost of sales | ||||||||||||||||||||||||||

| Amortization of intangibles | ||||||||||||||||||||||||||

| Research and development | ||||||||||||||||||||||||||

| Selling, general and administrative | ||||||||||||||||||||||||||

| Total operating expenses | ||||||||||||||||||||||||||

| Operating income | ||||||||||||||||||||||||||

| Other income (expense): | ||||||||||||||||||||||||||

| Investment and other income, net | ||||||||||||||||||||||||||

| Inducement expense related to convertible notes | ( | ( | ( | |||||||||||||||||||||||

| Interest expense | ( | ( | ( | ( | ||||||||||||||||||||||

| Net income before income taxes | ||||||||||||||||||||||||||

| Income tax expense (benefit) | ( | ( | ||||||||||||||||||||||||

| Net income | $ | $ | $ | $ | ||||||||||||||||||||||

| Net income per share: | ||||||||||||||||||||||||||

| Basic | $ | $ | $ | $ | ||||||||||||||||||||||

| Diluted | $ | $ | $ | $ | ||||||||||||||||||||||

| Shares used in computing net income per share: | ||||||||||||||||||||||||||

| Basic | ||||||||||||||||||||||||||

| Diluted | ||||||||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

7

HALOZYME THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(In thousands)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||

| Net income | $ | $ | $ | $ | ||||||||||||||||||||||

| Other comprehensive income: | ||||||||||||||||||||||||||

| Unrealized gain (loss) on marketable securities | ( | ( | ||||||||||||||||||||||||

| Foreign currency translation adjustment | ( | |||||||||||||||||||||||||

| Unrealized gain on foreign currency | ||||||||||||||||||||||||||

| Total comprehensive income | $ | $ | $ | $ | ||||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

8

HALOZYME THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

| Nine Months Ended September 30, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Operating activities: | ||||||||||||||

| Net income | $ | $ | ||||||||||||

| Adjustments to reconcile net income to net cash provided by in operating activities: | ||||||||||||||

| Share-based compensation | ||||||||||||||

| Depreciation and amortization | ||||||||||||||

| Amortization of intangible assets | ||||||||||||||

| Amortization of debt discount | ||||||||||||||

| Accretion of discounts on marketable securities, net | ||||||||||||||

| Realized loss on marketable securities | ||||||||||||||

| Loss on disposal of equipment | ||||||||||||||

| Recognition of deferred revenue | ( | ( | ||||||||||||

| Lease payments deferred | ( | ( | ||||||||||||

| Induced conversion expense related to convertible notes | ||||||||||||||

| Deferred income taxes | ( | |||||||||||||

| Other | ( | ( | ||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||||

| Accounts receivable, net and other contract assets | ( | ( | ||||||||||||

| Inventories | ( | |||||||||||||

| Prepaid expenses and other assets | ( | ( | ||||||||||||

| Accounts payable and accrued expenses | ( | |||||||||||||

| Net cash provided by operating activities | ||||||||||||||

| Investing activities: | ||||||||||||||

| Purchases of marketable securities | ( | ( | ||||||||||||

| Proceeds from sales and maturities of marketable securities | ||||||||||||||

| Acquisitions of business, net of cash acquired | ( | |||||||||||||

| Purchases of property and equipment | ( | ( | ||||||||||||

| Proceeds from the sale of assets | ||||||||||||||

| Net cash used in investing activities | ( | ( | ||||||||||||

| Financing activities: | ||||||||||||||

| Proceeds from term loan | ||||||||||||||

| Repayment of term loan | ( | |||||||||||||

| Proceeds from revolving credit facilities | ||||||||||||||

| Repayment of revolving credit facilities | ( | |||||||||||||

| Proceeds from issuance of 2027 Convertible Notes | — | |||||||||||||

| Repayment of 2024 Convertible Notes | ( | ( | ||||||||||||

| Proceeds from issuance of 2028 Convertible Notes | — | |||||||||||||

| Purchase of capped call | ( | |||||||||||||

| Payment of debt issuance cost | ( | ( | ||||||||||||

| Repurchase of common stock | ( | ( | ||||||||||||

| Proceeds from issuance of common stock under equity incentive plans, net of taxes paid related to net share settlement | ||||||||||||||

| Net cash provided by financing activities | ||||||||||||||

| Net increase in cash, cash equivalents and restricted cash | ||||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | ||||||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | $ | ||||||||||||

9

| Supplemental disclosure of non-cash investing and financing activities: | ||||||||||||||

| Amounts accrued for purchases of property and equipment | $ | $ | ||||||||||||

| Right-of-use assets obtained in exchange for lease obligation | $ | $ | ||||||||||||

| Debt issuances cost included in accounts payable | $ | $ | ||||||||||||

| Common stock issued for induced conversion related to convertible notes | $ | $ | ||||||||||||

See accompanying notes to condensed consolidated financial statements.

10

HALOZYME THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited) (in thousands)

| Three Months Ended September 30, 2022 | ||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Income/(Loss) | Retained Earnings | Total Stockholders’ Equity | ||||||||||||||||||||||||||||||||||

| Shares | Amount | |||||||||||||||||||||||||||||||||||||

| BALANCE AS OF JUNE 30, 2022 | $ | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||

| Share-based compensation expense | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Issuance of common stock for the induced conversion related to convertible notes | — | — | ||||||||||||||||||||||||||||||||||||

| Issuance of common stock pursuant to exercise of stock options and vesting of restricted stock units, net and shares issued under the ESPP plan | — | — | ||||||||||||||||||||||||||||||||||||

| Capped call transaction | ( | ( | ||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | ||||||||||||||||||||||||||||||||||

| BALANCE AS OF SEPTEMBER 30, 2022 | $ | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2022 | ||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Loss | Retained Earnings (Accumulated Deficit) | Total Stockholders’ Equity | ||||||||||||||||||||||||||||||||||

| Shares | Amount | |||||||||||||||||||||||||||||||||||||

| BALANCE AS OF DECEMBER 31, 2021 | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||

| Share-based compensation expense | — | — | — | |||||||||||||||||||||||||||||||||||

| Issuance of common stock for the induced conversion related to convertible notes | ||||||||||||||||||||||||||||||||||||||

| Issuance of common stock pursuant to exercise of stock options and vesting of restricted stock units, net and shares issued under the ESPP plan | — | |||||||||||||||||||||||||||||||||||||

| Capped call transaction | ( | ( | ||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | ||||||||||||||||||||||||||||||||||

| BALANCE AS OF SEPTEMBER 30, 2022 | $ | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||

| Three Months Ended September 30, 2021 | ||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Income/(Loss) | Retained Earnings (Accumulated Deficit) | Total Stockholders’ Equity | ||||||||||||||||||||||||||||||||||

| Shares | Amount | |||||||||||||||||||||||||||||||||||||

| BALANCE AS OF JUNE 30, 2021 | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||

| Share-based compensation expense | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Issuance of common stock pursuant to exercise of stock options and vesting of restricted stock units, net | — | — | ||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | ||||||||||||||||||||||||||||||||||

| BALANCE AS OF SEPTEMBER 30, 2021 | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2021 | ||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings (Accumulated Deficit) | Total Stockholders’ Equity | ||||||||||||||||||||||||||||||||||

| Shares | Amount | |||||||||||||||||||||||||||||||||||||

| BALANCE AS OF DECEMBER 31, 2020 | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||

| Adjustment to beginning accumulated deficit | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||

| Share-based compensation expense | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Issuance of common stock for the induced conversion related to convertible notes | ||||||||||||||||||||||||||||||||||||||

| Issuance of common stock pursuant to exercise of stock options and vesting of restricted stock units, net | — | — | ||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | ( | — | ( | ||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | ||||||||||||||||||||||||||||||||||

| BALANCE AS OF SEPTEMBER 30, 2021 | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

11

HALOZYME THERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Organization and Business

Halozyme Therapeutics, Inc. is a biopharma technology platform company that provides innovative and disruptive solutions with the goal of improving patient experience and outcomes. Our proprietary enzyme, rHuPH20, is used to facilitate the delivery of injected drugs and fluids. We license our technology to biopharmaceutical companies to collaboratively develop products that combine our ENHANZE® drug delivery technology (“ENHANZE”) with the partners’ proprietary compounds.

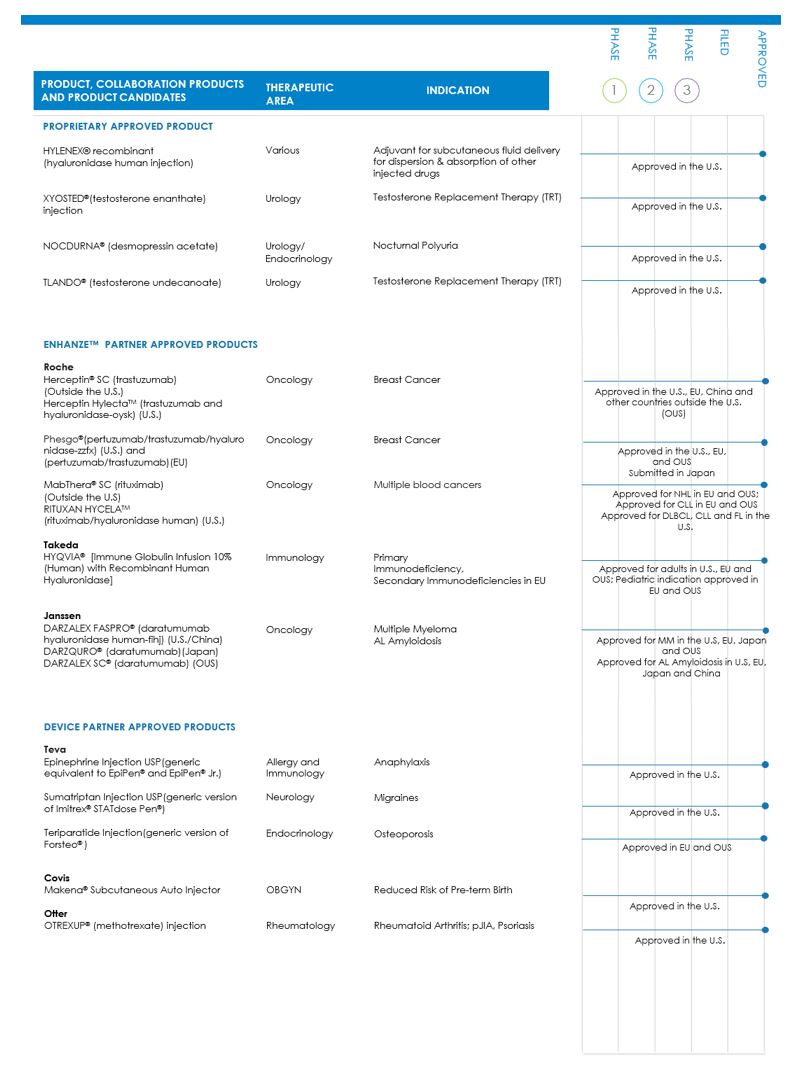

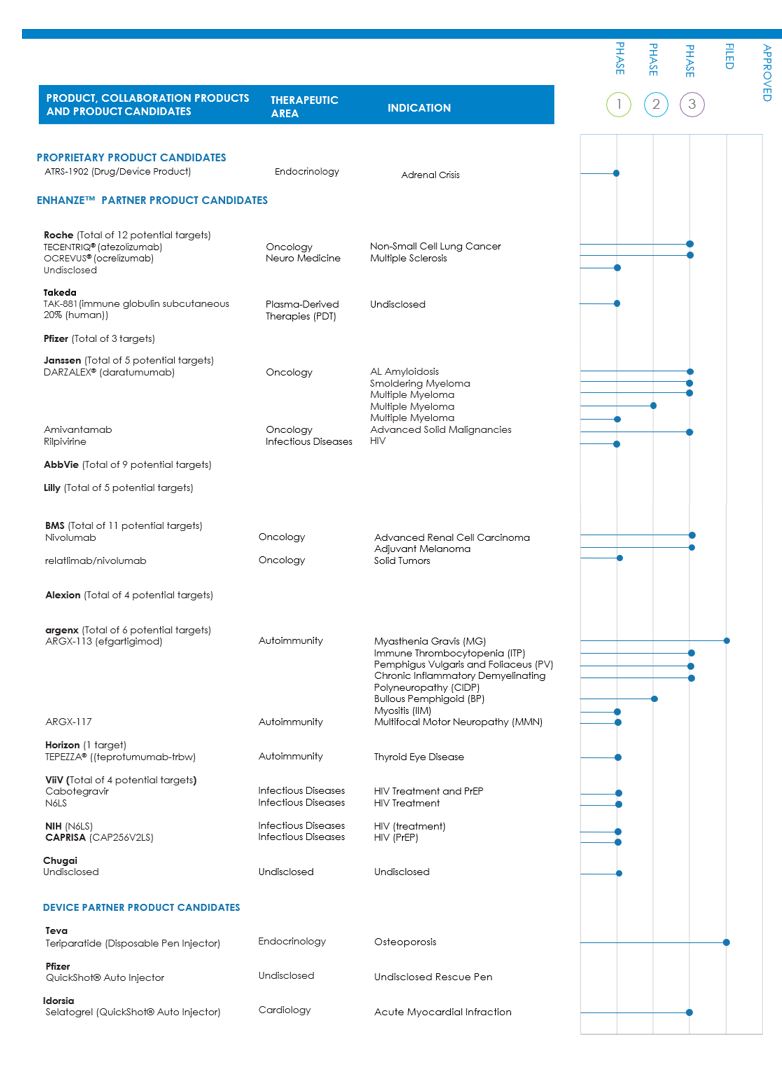

Our first commercially approved product, Hylenex® recombinant (“Hylenex”), and our ENHANZE partners’ approved products and product candidates are based on rHuPH20, our patented recombinant human hyaluronidase enzyme. rHuPH20 is the active ingredient in Hylenex and it works by breaking down hyaluronan (“HA”), a naturally occurring carbohydrate that is a major component of the extracellular matrix of the subcutaneous (“SC”) space. This temporarily reduces the barrier to bulk fluid flow allowing for improved SC delivery of high dose, high volume injectable biologics, such as monoclonal antibodies and other large therapeutic molecules, as well as small molecules and fluids. We refer to the application of rHuPH20 to facilitate the delivery of other drugs or fluids as ENHANZE®. We license the ENHANZE technology to form collaborations with biopharmaceutical companies that develop or market drugs requiring or benefiting from injection via the SC route of administration. In the development of proprietary intravenous (“IV”) drugs combined with our ENHANZE technology, data has been generated supporting the potential for ENHANZE to reduce patient treatment burden, as a result of shorter duration of SC administration with ENHANZE compared to IV administration. ENHANZE may enable fixed-dose SC dosing compared to weight-based dosing required for IV administration, and potentially allow for lower rates of infusion related reactions. ENHANZE may enable more flexible treatment options such as home administration by a healthcare professional or potentially the patient. Lastly, certain proprietary drugs co-formulated with ENHANZE have been granted additional exclusivity, extending the patent life of the product beyond the patent expiry of the proprietary IV drug.

We currently have ENHANZE collaborations with F. Hoffmann-La Roche, Ltd. and Hoffmann-La Roche, Inc. (“Roche”), Takeda Pharmaceuticals International AG and Baxalta US Inc. (“Takeda”), Pfizer Inc. (“Pfizer”), Janssen Biotech, Inc. (“Janssen”), AbbVie, Inc. (“AbbVie”), Eli Lilly and Company (“Lilly”), Bristol-Myers Squibb Company (“BMS”), Alexion Pharma International Operations Unlimited Company (an indirect wholly owned subsidiary of AstraZeneca PLC (“Alexion”), argenx BVBA (“argenx”), Horizon Therapeutics plc. (“Horizon”), ViiV Healthcare (the global specialist HIV Company majority owned by GlaxoSmithKline) (“ViiV”) and Chugai Pharmaceutical Co., Ltd (“Chugai”). In addition to receiving upfront licensing fees from our ENHANZE collaborations, we are entitled to receive event and sales-based milestone payments, revenues from the sale of bulk rHuPH20 and royalties from commercial sales of approved partner products co-formulated with ENHANZE. We currently receive royalties from three of these collaborations, including royalties from sales of one product from the Takeda collaboration, three products from the Roche collaboration and one product from the Janssen collaboration. Future potential revenues from ENHANZE collaborations and from the sales and/or royalties of our approved products will depend on the ability of Halozyme and our partners to develop, manufacture, secure and maintain regulatory approvals for approved products and product candidates and commercialize product candidates.

Through our recent acquisition of Antares Pharma, Inc. (“Antares”), we also develop, manufacture and commercialize, for ourselves or with our partners, drug-device combination products using our advanced auto-injector technologies that are designed to provide commercial or functional advantages such as convenience, improved tolerability, and enhanced patient comfort and adherence. Also, as a result of our acquisition of Antares, our commercial portfolio of proprietary products includes XYOSTED®, TLANDO™ and NOCDURNA® and ongoing product programs with industry leading pharmaceutical companies including Teva Pharmaceutical Industries, Ltd. (“Teva”), Covis Group S.a.r.l. (“Covis”), Pfizer and Idorsia Pharmaceuticals Ltd. (“Idorsia”).

Except where specifically noted or the context otherwise requires, references to “Halozyme,” “the Company,” “we,” “our,” and “us” in these notes to the condensed consolidated financial statements refer to Halozyme Therapeutics, Inc. and its wholly owned subsidiaries, Halozyme, Inc. and Antares Pharma, Inc., and Antares Pharma, Inc.’s wholly owned subsidiaries Antares Pharma IPL AG and Antares Pharma AG.

12

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying interim unaudited condensed consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”) and with the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) related to a quarterly report on Form 10-Q. Accordingly, they do not include all of the information and disclosures required by U.S. GAAP for a complete set of financial statements. These interim unaudited condensed consolidated financial statements and notes thereto should be read in conjunction with the audited consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on February 22, 2022. The unaudited financial information for the interim periods presented herein reflects all adjustments which, in the opinion of management, are necessary for a fair presentation of the financial condition and results of operations for the periods presented, with such adjustments consisting only of normal recurring adjustments. Operating results for interim periods are not necessarily indicative of the operating results for an entire fiscal year.

Cash Equivalents and Marketable Securities

Cash equivalents consist of highly liquid investments, readily convertible to cash, that mature within 90 days or less from the date of purchase. As of September 30, 2022, our cash and cash equivalents consisted of money market funds, bank certificate of deposits and demands deposits at commercial banks.

Marketable securities are investments with original maturities of more than 90 days from the date of purchase that are specifically identified to fund current operations. Marketable securities are considered available-for-sale. These investments are classified as current assets, even though the stated maturity date may be one year or more beyond the current balance sheet date which reflects management’s intention to use the proceeds from the sale of these investments to fund our operations, as necessary. Such available-for-sale investments are carried at fair value with unrealized gains and losses recorded in other comprehensive income (loss) and included as a separate component of stockholders’ equity. The cost of marketable securities is adjusted for amortization of premiums or accretion of discounts to maturity, and such amortization or accretion is included in investment and other income, net in the interim unaudited condensed consolidated statements of income. We use the specific identification method for calculating realized gains and losses on marketable securities sold. None of the realized gains and losses and declines in value that were judged to be as a result of credit loss on marketable securities, if any, are included in investment and other income, net in the interim unaudited condensed consolidated statements of operations.

Restricted Cash

Under the terms of the leases of our facilities, we are required to maintain letters of credit as security deposits during the terms of such leases. As of September 30, 2022 and December 31, 2021, restricted cash of $0.5

Fair Value of Financial Instruments

The authoritative guidance for fair value measurements establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. These tiers include: Level 1, defined as observable inputs such as quoted prices in active markets; Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and Level 3, defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions.

13

Our financial instruments include cash equivalents, available-for-sale marketable securities, accounts receivable, prepaid expenses and other assets, accounts payable, accrued expenses, long-term debt and contingent liability. Fair value estimates of these instruments are made at a specific point in time, based on relevant market information. These estimates may be subjective in nature and involve uncertainties and matters of significant judgment and therefore cannot be determined with precision. The carrying amount of cash equivalents, accounts receivable, prepaid expenses and other assets, accounts payable and accrued expenses are generally considered to be representative of their respective fair values because of the short-term nature of those instruments.

Available-for-sale marketable securities consist of asset-backed securities, corporate debt securities, U.S. Treasury securities and commercial paper, and are measured at fair value using Level 1 and Level 2 inputs. Level 2 financial instruments are valued using market prices on less active markets and proprietary pricing valuation models with observable inputs, including interest rates, yield curves, maturity dates, issue dates, settlement dates, reported trades, broker-dealer quotes, issue spreads, benchmark securities or other market related data. We obtain the fair value of Level 2 investments from our investment manager, who obtains these fair values from a third-party pricing source. We validate the fair values of Level 2 financial instruments provided by our investment manager by comparing these fair values to a third-party pricing source.

Inventories

Inventories are stated at lower of cost or net realizable value. Cost is determined on a first-in, first-out basis. Net realizable value is the estimated selling price in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. Inventories are reviewed periodically for potential excess, dated or obsolete status. We evaluate the carrying value of inventories on a regular basis, taking into account such factors as historical and anticipated future sales compared to quantities on hand, the price we expect to obtain for products in their respective markets compared with historical cost and the remaining shelf life of goods on hand.

Leases

We have entered into operating leases primarily for real estate and automobiles. These leases have contractual terms which range from 3 years to 12 years. We determine if an arrangement contains a lease at inception. Right of use (“ROU”) assets and liabilities resulting from operating leases are included in property and equipment, accrued expenses and other long-term liabilities on our condensed consolidated balance sheets. Operating lease ROU assets and liabilities are recognized based on the present value of the future minimum lease payments over the lease term at commencement date. As most of our leases do not provide an implicit rate, we use our incremental borrowing rate based on the information available at commencement date in determining the discount rate to calculate the present value of future payments. The operating lease ROU asset also includes any lease payments made and excludes lease incentives and initial direct costs incurred. Our leases often include options to extend or terminate the lease. These options are included in the lease term when it is reasonably certain that we will exercise that option. Short-term leases with an initial term of 12 months or less are not recorded on the balance sheet. Lease expense for minimum lease payments is recognized on a straight-line basis over the lease term.

We have lease agreements with lease and non-lease components, which are generally accounted for separately. For certain equipment leases, such as automobiles, we account for the lease and non-lease components as a single lease component.

In March 2022, we entered into an agreement for assignment and assumption of lease with Seismic Software, Inc. pursuant to which effective January 1, 2023, we will assume Seismic’s office lease, as amended with Kilroy Realty L.P. for approximately 72,534 square feet of space in office and research facilities which is expected to commence on January 1, 2023. The premises are intended to serve as our new headquarters.

Business Combinations

Under the acquisition method of accounting, we allocate the fair value of the total consideration transferred to the tangible and identifiable intangible assets acquired and liabilities assumed based on their estimated fair values on the date of acquisition. These valuations require us to make estimates and assumptions, especially with respect to intangible assets. We record the excess consideration over the aggregate fair value of tangible and intangible assets, net of liabilities assumed, as goodwill. Costs that we incur to complete the business combination, such as legal and other professional fees, are expensed as incurred.

If the initial accounting for a business combination is incomplete by the end of a reporting period that falls within the measurement period, we report provisional amounts in our financial statements. During the measurement period, we adjust the provisional amounts recognized at the acquisition date to reflect new information obtained about facts and circumstances that existed as of the acquisition date that, if known, would have affected the measurement of the amounts recognized as of that date. We record these adjustments to the provisional amounts with a corresponding offset to goodwill. Any adjustments identified after the measurement period are recorded in the consolidated statements of income.

14

Goodwill, Intangible Assets and Other Long-Lived Asset

Assets acquired, including intangible assets and in-process research and development (IPR&D), and liabilities assumed are measured at fair value as of the acquisition date. Goodwill, which has an indefinite useful life, represents the excess of cost over fair value of the net assets acquired. Intangible assets acquired in a business combination that are used for IPR&D activities are considered indefinite lived until the completion or abandonment of the associated research and development efforts. Upon reaching the end of the relevant research and development project (i.e., upon commercialization), the IPR&D asset is amortized over its estimated useful life. If the relevant research and development project is abandoned, the IPR&D asset is expensed in the period of abandonment.

Goodwill and IPR&D are not amortized; however, they are reviewed for impairment at least annually during the second quarter, or more frequently if an event occurs indicating the potential for impairment. Goodwill and IPR&D are considered to be impaired if the carrying value of the reporting unit or IPR&D asset exceeds its respective fair value.

We perform our goodwill impairment analysis at the reporting unit level, which aligns with our reporting structure and availability of discrete financial information. During the goodwill impairment review, we assess qualitative factors to determine whether it is more likely than not that the fair values of our reporting units are less than the carrying amounts, including goodwill. The qualitative factors include, but are not limited to, macroeconomic conditions, industry and market considerations, and our overall financial performance. If, after assessing the totality of these qualitative factors, we determine that it is not more likely than not that the fair values of our reporting units are less than the carrying amounts, then no additional assessment is deemed necessary. Otherwise, we proceed to compare the estimated fair values of the reporting units with the carrying values, including goodwill. If the carrying amounts of the reporting units exceed the fair values, we record an impairment loss based on the difference. We may elect to bypass the qualitative assessment in a period and proceed to perform the quantitative goodwill impairment test.

Our identifiable intangible assets with finite useful lives are typically comprised of acquired device technologies and product rights. The cost of identifiable intangible assets with finite lives is generally amortized on a straight-line basis over the assets’ respective estimated useful lives.

We perform regular reviews to determine if any event has occurred that may indicate that intangible assets with finite useful lives and other long-lived assets are potentially impaired. If indicators of impairment exist, an impairment test is performed to assess the recoverability of the affected assets by determining whether the carrying amount of such assets exceeds the undiscounted expected future cash flows. If the affected assets are not recoverable, we estimate the fair value of the assets and record an impairment loss if the carrying value of the assets exceeds the fair value. Factors that may indicate potential impairment include a significant decline in our stock price and market capitalization compared to the net book value, significant changes in the ability of a particular asset to generate positive cash flows for our strategic business objectives, and the pattern of utilization of a particular asset.

Revenue Recognition

We generate revenues from payments received (i) as royalties from licensing our ENHANZE technology and other royalty arrangements, (ii) under collaborative agreements and (iii) from sales of our proprietary and partnered products. We recognize revenue when we transfer promised goods or services to customers in an amount that reflects the consideration to which we expect to be entitled in exchange for those goods or services. To determine revenue recognition for contracts with customers we perform the following five steps: (i) identify the promised goods or services in the contract; (ii) identify the performance obligations in the contract, including whether they are distinct in the context of the contract; (iii) determine the transaction price, including the constraint on variable consideration; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when (or as) we satisfy the performance obligations.

15

ENHANZE and Device Royalties

Under the terms of our ENHANZE collaboration and license agreements, our partners will pay us royalties at an on average mid-single digit percent rate of their sales if products under the collaboration are commercialized. All amounts owed to us are noncancelable after the underlying triggering event occurs, and nonrefundable once paid. Unless terminated earlier in accordance with its terms, collaborations generally continue in effect until the last to expire royalty payment term, as determined on a product by product and on a country by country basis, with each royalty term starting on the first commercial sale of that product and ending the later of: (i) a specified period or term set forth in the agreement or (ii) expiration of the last to expire of the valid claims of our patents covering rHuPH20 or other specified patents developed under the collaboration which valid claim covers a product developed under the collaboration. When there are no valid claims during the applicable royalty term in a given country, the royalty rate is reduced for those sales. Partners may terminate the agreement prior to expiration for any reason in its entirety or on a target-by-target basis generally upon 90 days prior written notice to us. Upon any such termination, the license granted to partners (in total or with respect to the terminated target, as applicable) will terminate provided; however, that in the event of expiration of the agreement (as opposed to a termination), the on-going licenses granted will become perpetual, non-exclusive and fully paid. Sales-based milestones and royalties are recognized in the period the underlying sales or milestones occur. We do not receive final royalty reports from our ENHANZE partners until after we complete our financial statements for a prior quarter. Therefore, we recognize revenue based on estimates of the royalty earned, which are based on internal estimates and available preliminary reports provided by our partners. We will record adjustments in the following quarter, if necessary, when final royalty reports are received. To date, we have not recorded any material adjustments.

In addition to the royalties received from licensing our ENHANZE technology, we also earn royalties in connection with licenses granted under license and development arrangements with our device partners as a result of our acquisition of Antares. These royalties are based upon a percentage of commercial sales of partnered products with rates ranging from mid-single digits to low double digits and are tiered based on levels of net sales. These sales-based royalties, for which the license was deemed the predominant element to which the royalties relate, are estimated and recognized in the period in which the partners’ commercial sales occur. The royalties are generally reported and payable to us within 45 to 60 days of the end of the period in which the commercial sales are made. We base our estimates of royalties earned on actual sales information from our partners when available or estimated, prescription sales from external sources and estimated net selling price. We will record adjustments in the following quarter, if necessary, when final royalty reports are received. To date, we have not recorded any material adjustments.

Revenue under ENHANZE and Device Collaborative Agreements

ENHANZE Collaboration and License Agreements

Under the terms of our ENHANZE collaboration agreements, we grant the partner a worldwide license to our ENHANZE technology to develop and commercialize products that combine our patented rHuPH20 enzyme with their proprietary biologics directed at up to a specified number of targets. Targets are usually licensed on an exclusive, global basis. Targets selected subsequent to inception of the arrangement generally require payment of an additional license fee. The partner is responsible for all development, manufacturing, clinical, regulatory, sales and marketing costs for any products developed under the agreement. We are responsible for supply of bulk rHuPH20 based on the partner’s purchase orders and may also be separately engaged to perform research and development services. While these collaboration agreements are similar in that they originate from the same framework, each one is the result of an arms-length negotiation and thus may vary from one to the other.

We, in general, collect an upfront license payment from partners and are also entitled to receive event-based payments subject to partners’ achievement of specified development, regulatory and sales-based milestones. In several agreements, partners pay us annual fees to maintain their exclusive license rights if they are unable to advance product development to specified stages. We earn separate fees for bulk rHuPH20 supplies and research and development services.

Although these agreements are in form identified as collaborative agreements, we concluded for accounting purposes they represent contracts with customers and are not subject to accounting literature on collaborative arrangements. This is because we grant to partners licenses to our intellectual property and provide supply of bulk rHuPH20 and research and development services which are all outputs of our ongoing activities, in exchange for respective consideration. Under these collaborative agreements, our partners lead development of assets, and we do not share in significant financial risks of their development or commercialization activities. Accordingly, we concluded our collaborative agreements are appropriately accounted for pursuant to ASC Topic 606, Revenue from Contracts with Customers.

16

Under all of our ENHANZE collaborative agreements, we have identified licenses to use functional intellectual property as the only performance obligation. The intellectual property underlying the license is our proprietary ENHANZE technology which represents application of rHuPH20 to facilitate delivery of drugs. Each of the licenses grants the partners rights to use our intellectual property as it exists and is identified on the effective date of the license, because there is no ongoing development of the ENHANZE technology required. Therefore, we recognize revenue from licenses at the point when the license becomes effective and the partner has received access to our intellectual property, usually at the inception of the agreement.

When partners can select additional targets to add to the licenses granted, we consider these rights to be options. We evaluate whether such options contain material rights, i.e., have exercise prices that are discounted compared to what we would charge for a similar license to a new partner. The exercise price of these options includes a combination of the target selection fees, event-based milestone payments and royalties. When these amounts in aggregate are not offered at a discount that exceeds discounts available to other customers, we conclude the option does not contain a material right, and we consider grants of additional licensing rights upon option exercises to be separate contracts (target selection contracts).

Generally, we provide indemnification and protection of licensed intellectual property for our customers. These provisions are part of assurance that the licenses meet the agreements’ representations and are not obligations to provide goods or services.

We also fulfill purchase orders for supply of bulk rHuPH20 and perform research and development services pursuant to projects authorization forms for our partners, which represent separate contracts. In addition to our licenses, we price our supply of bulk rHuPH20 and research and development services at our regular selling prices, called standalone selling price or (“SSP”). Therefore, our partners do not have material rights to order these items at prices not reflective of SSP. Refer to the discussion below regarding recognition of revenue for these separate contracts.

Transaction price for a contract represents the amount to which we are entitled in exchange for providing goods and services to the customer. Transaction price does not include amounts subject to uncertainties unless it is probable that there will be no significant reversal of revenue when the uncertainty is resolved. Apart from the upfront license payment (or target selection fees in the target selection contracts), all other fees we may earn under our collaborative agreements are subject to significant uncertainties of product development. Achievement of many of the event-based development and regulatory milestones may not be probable until such milestones are actually achieved. This generally relates to milestones such as obtaining marketing authorization approvals. With respect to other development milestones, e.g., dosing of a first patient in a clinical trial, achievement could be considered probable prior to its actual occurrence based on the progress towards commencement of the trial. In order to evaluate progress towards commencement of a trial, we assess the status of activities leading up to our partner’s initiation of a trial such as feedback received from the applicable regulatory authorities, completion of IND or equivalent filings, readiness and availability of drug, readiness of study sites and our partner’s commitment of resources to the program. We do not include any amounts subject to uncertainties in the transaction price until it is probable that the amount will not result in a significant reversal of revenue in the future. At the end of each reporting period, we re-evaluate the probability of achievement of such milestones and any related constraint, and if necessary, adjust our estimate of the overall transaction price.

When target exchange rights are held by partners, and the amounts attributed to these rights are not refundable, they are included in the transaction price. However, they are recorded as deferred revenues because we have a potential performance obligation to provide a new target upon an exchange right being exercised. These amounts are recognized in revenue when the right of exchange expires or is exercised.

Because our agreements have one type of performance obligation (licenses) which are typically all transferred at the same time at agreement inception, allocation of transaction price often is not required. However, allocation is required when licenses for some of the individual targets are subject to rights of exchange because revenue associated with these targets cannot be recognized. When allocation is needed, we perform an allocation of the upfront amount based on relative SSP of licenses for individual targets. We determine license SSP using an income-based valuation approach utilizing risk-adjusted discounted cash flow projections of the estimated return a licensor would receive. When amounts subject to uncertainties, such as milestones and royalties, are included in the transaction price, we attribute them to the specific individual target licenses which generate such milestone or royalty amounts.

We also estimate SSP of bulk rHuPH20 and research and development services, to determine that our partners do not have material rights to order them at discounted prices. For supplies of bulk rHuPH20, because we effectively act as a contract manufacturer to our partners, we estimate and charge SSP based on the typical contract manufacturer margins consistently with all of our partners. We determine SSP of research and development services based on a fully-burdened labor rate. Our rates are comparable to those we observe in other collaborative agreements. We also have a history of charging similar rates to all of our partners.

Upfront amounts allocated to licenses to individual targets are recognized as revenue when the license is transferred to the partner, as discussed above, if the license is not subject to exchange rights, or when the exchange right expires or is exercised.

17

Development milestones and other fees are recognized in revenue when they are included in the transaction price, because by that time, we have already transferred the related license to the partner.

In contracts to provide research and development services, such services represent the only performance obligation. The fees are charged based on hours worked by our employees and the fixed contractual rate per hour, plus third-party pass-through costs, on a monthly basis. We recognize revenues as the related services are performed based on the amounts billed, as the partner consumes the benefit of research and development work simultaneously as we perform these services, and the amounts billed reflect the value of these services to the customer.

Device License, Development and Supply Arrangements

We have several license, development and supply arrangements with pharmaceutical partners as a result of our acquisition of Antares, under which we grant a license to our device technology and provide research and development services that often involve multiple performance obligations and highly-customized deliverables. For such arrangements, we identify each of the promised goods and services within the contract and the distinct performance obligations at inception of the contract and allocate consideration to each performance obligation based on relative SSP, which is generally determined based on the expected cost plus mark-up.

If the contract includes an enforceable right to payment for performance completed to date and performance obligations are satisfied over time, we recognize revenue over the development period using either the input or output method depending on which is most appropriate given the nature of the distinct deliverable. For other contracts that do not contain an enforceable right to payment for performance completed to date, revenue is recognized when control of the product is transferred to the customer. Factors that may indicate that the transfer of control has occurred include the transfer of legal title, transfer of physical possession, the customer has obtained the significant risks and rewards of ownership of the assets and we have a present right to payment.

Our typical payment terms for development contracts may include an upfront payment equal to a percentage of the total contract value with the remaining portion to be billed upon completion and transfer of the individual deliverables or satisfaction of the individual performance obligations. We record a contract liability for cash received in advance of performance, which is presented within deferred revenue and deferred revenue, long-term in the condensed consolidated balance sheets and recognized as revenue in the condensed consolidated statements of income when the associated performance obligations have been satisfied.

License fees and milestones received in exchange for the grant of a license to our functional intellectual property, such as patented technology and know-how in connection with a partnered development arrangement, are generally recognized at inception of the arrangement, or over the development period depending on the facts and circumstances, as the license is generally not distinct from the non-licensed goods or services to be provided under the contract. Milestone payments that are contingent upon the occurrence of future events are evaluated and recorded at the most likely amount, and to the extent that it is probable that a significant reversal will not occur when the associated uncertainty is resolved.

Refer to Note 5, Revenue, for further discussion on our collaborative arrangements.

Product Sales, Net

Proprietary Product Sales

Hylenex Recombinant

We sell Hylenex recombinant in the U.S. to wholesale pharmaceutical distributors, who sell the product to hospitals and other end-user customers. Sales to wholesalers are made pursuant to purchase orders subject to the terms of a master agreement, and delivery of individual packages of Hylenex recombinant represent performance obligations under each purchase order. We use a contract manufacturer to produce Hylenex recombinant and a third-party logistics (3PL) vendor to process and fulfill orders. We concluded we are the principal in the sales to wholesalers because we control access to services rendered by both vendors and direct their activities. We have no significant obligations to wholesalers to generate pull-through sales.

Selling prices initially billed to wholesalers are subject to discounts for prompt payment and subsequent chargebacks when wholesalers sell Hylenex recombinant at negotiated discounted prices to members of certain group purchasing organizations (“GPOs”) and government programs. We also pay quarterly distribution fees to certain wholesalers for inventory reporting and chargeback processing, and to GPOs as administrative fees for services and for access to GPO members. We concluded the benefits received in exchange for these fees are not distinct from our sales of Hylenex recombinant, and accordingly we apply these amounts to reduce revenues. Wholesalers also have rights to return unsold product nearing or past the expiration date. Because of the shelf life of Hylenex recombinant and our lengthy return period, there may be a significant period of time between when the product is shipped and when we issue credits on returned product.

18

We estimate the transaction price when we receive each purchase order taking into account the expected reductions of the selling price initially billed to the wholesaler arising from all of the above factors. We have compiled historical experience and data to estimate future returns and chargebacks of Hylenex recombinant and the impact of the other discounts and fees we pay. When estimating these adjustments to the transaction price, we reduce it sufficiently to be able to assert that it is probable that there will be no significant reversal of revenue when the ultimate adjustment amounts are known.

Each purchase order contains only one type of product and is usually shipped to the wholesaler in a single shipment. Therefore, allocation of the transaction price to individual packages is not required.

We recognize revenue from Hylenex recombinant product sales and related cost of sales upon product delivery to the wholesaler location. At that time, the wholesalers take control of the product as they take title, bear the risk of loss of ownership, and have an enforceable obligation to pay us. They also have the ability to direct sales of product to their customers on terms and at prices they negotiate. Although wholesalers have product return rights, we do not believe they have a significant incentive to return the product to us.

Upon recognition of revenue from product sales of Hylenex recombinant, the estimated amounts of credit for product returns, chargebacks, distribution fees, prompt payment discounts, and GPO fees are included in accrued liabilities and net of accounts receivable in the condensed consolidated balance sheets. We monitor actual product returns, chargebacks, discounts and fees subsequent to the sale. If these amounts differ from our estimates, we make adjustments to these allowances, which are applied to increase or reduce product sales revenue and earnings in the period of adjustment.

In connection with the orders placed by wholesalers, we incur costs such as commissions to our sales representatives. However, as revenue from product sales is recognized upon delivery to the wholesaler, which occurs shortly after we receive a purchase order, we do not capitalize these commissions and other costs, based on application of the practical expedient allowed within the applicable guidance.

Other Proprietary Product Sales

As a result of our acquisition of Antares, our commercial portfolio of proprietary products includes XYOSTED, TLANDO and NOCDURNA, which we sell primarily to wholesale and specialty distributors. Revenue is recognized when control has transferred to the customer, which is typically upon delivery, at the net selling price, which reflects the variable consideration for which reserves and sales allowances are established for estimated returns, wholesale distribution fees, prompt payment discounts, government rebates and chargebacks, plan rebate arrangements and patient discount and support programs.

The determination of certain reserves and sales allowances requires us to make a number of judgements and estimates to reflect our best estimate of the transaction price and the amount of consideration to which we believe we would be ultimately entitled to receive. The expected value is determined based on unit sales data, contractual terms with customers and third-party payers, historical and estimated future percentage of rebates incurred on sales, historical and future insurance plan billings, any new or anticipated changes in programs or regulations that would impact the amount of the actual rebates, customer purchasing patterns, product expiration dates and levels of inventory in the distribution channel. The estimated amounts of credit for product returns, chargebacks, distribution fees, prompt payment discounts, rebates and customer co-pay support programs are included in accrued liabilities and net of accounts receivable in the condensed consolidated balance sheets.

Partnered Product Sales

Bulk rHuPH20

We sell bulk rHuPH20 to partners for use in research and development and, subsequent to receiving marketing approval, we sell it for use in collaboration commercial products. Sales are made pursuant to purchase orders subject to the terms of the collaborative agreement or a supply agreement, and delivery of units of bulk rHuPH20 represent performance obligations under each purchase order. We provide a standard warranty that the product conforms to specifications. We use contract manufacturers to produce bulk rHuPH20 and have concluded we are the principal in the sales to partners. The transaction price for each purchase order of bulk rHuPH20 is fixed based on the cost of production plus a contractual markup and is not subject to adjustments. Allocation of the transaction price to individual quantities of the product is usually not required because each order contains only one type of product.

We recognize revenue from the sale of bulk rHuPH20 as product sales and related cost of sales upon transfer of title to our partners. At that time, the partners take control of the product, bear the risk of loss of ownership, and have an enforceable obligation to pay us.

19

Devices

As a result of our acquisition of Antares, we are party to several license, development, supply and distribution arrangements with pharmaceutical partners, under which we produce and are the exclusive supplier of certain products, devices and/or components. Revenue is recognized when or as control of the goods transfers to the customer as discussed below.

We are the exclusive supplier of the Makena® subcutaneous auto-injector product to Covis and the exclusive supplier of OTREXUP® to Otter Pharmaceuticals, LLC (“Otter”). Because these products are custom manufactured for each customer with no alternative use and we have a contractual right to payment for performance completed to date, control is continuously transferred to the customer as the product is produced pursuant to firm purchase orders. Revenue is recognized over time using the output method based on the contractual selling price and number of units produced. The amount of revenue recognized in excess of the amount shipped/billed to the customer, if any, is recorded as contract assets in the condensed consolidated balance sheets due to the short-term nature in which the amount is ultimately expected to be billed and collected from the customer.

All other device partnered product sales are recognized at the point in time in which control is transferred to the customer, which is typically upon shipment. Sales terms and pricing are governed by the respective supply and distribution agreements, and there is generally no right of return. Revenue is recognized at the transaction price, which includes the contractual per unit selling price and estimated variable consideration, such as volume-based pricing arrangements or profit-sharing arrangements, if any. We recognize revenue, including the estimated variable consideration we expect to receive for contract margin on future commercial sales, upon shipment of the goods to our partner. The estimated variable consideration is recognized at an amount we believe is not subject to significant reversal based on historical experience and is adjusted at each reporting period if the most likely amount of expected consideration changes or becomes fixed.

Revenue Presentation

In our condensed consolidated statements of income, we report as revenues under collaborative agreements the upfront payments, event-based development and regulatory milestones and sales milestones. We also include in this category revenues from separate research and development contracts pursuant to project authorization forms. We report royalties received from partners as a separate line in our condensed consolidated statements of income.

Revenues from sales of our proprietary and partnered products are included in product sales, net in our condensed consolidated statements of income.

In the footnotes to our condensed consolidated financial statements, we provide disaggregated revenue information by type of arrangement (product sales, net, collaborative agreements and research and device licensing and development revenues), and additionally, by type of payment stream received under collaborative agreements (upfront license and target nomination fees, event-based development and regulatory milestones and other fees, sales milestones and royalties).

Cost of Sales

Cost of sales consists primarily of raw materials, third-party manufacturing costs, fill and finish costs, freight costs, internal costs and manufacturing overhead associated with the production of proprietary and partnered products. Cost of sales also consists of the write-down of excess, dated and obsolete inventories and the write-off of inventories that do not meet certain product specifications, if any.

Research and Development Expenses

Research and development expenses include salaries and benefits, facilities and other overhead expenses, research related manufacturing services, contract services and other outside expenses. Research and development expenses are charged to operating expenses as incurred when these expenditures relate to our research and development efforts and have no alternative future uses.

We are obligated to make upfront payments upon execution of certain research and development agreements. Advance payments, including nonrefundable amounts, for goods or services that will be used or rendered for future research and development activities are deferred. Such amounts are recognized as expense as the related goods are delivered or the related services are performed or such time when we do not expect the goods to be delivered or services to be performed.

20

Share-Based Compensation

We record compensation expense associated with stock options, restricted stock awards (“RSAs”), restricted stock units (“RSUs”), performance stock units (“PSUs”) and shares issued under our employee stock purchase plan (“ESPP”) in accordance with the authoritative guidance for stock-based compensation. The cost of employee services received in exchange for an award of an equity instrument is measured at the grant date, based on the estimated fair value of the award, and is recognized as expense on a straight-line basis over the requisite service period of the award. Share-based compensation expense for an award with a performance condition is recognized when the achievement of such performance condition is determined to be probable. If the outcome of such performance condition is not determined to be probable or is not met, no compensation expense is recognized and any previously recognized compensation expense is reversed. Forfeitures are recognized as a reduction of share-based compensation expense as they occur.

Income Taxes

We provide for income taxes using the liability method. Under this method, deferred income tax assets and liabilities are determined based on the differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases at each reporting period. We measure deferred tax assets and liabilities using enacted tax rates for the year in which the differences are expected to reverse. Significant judgment is required by management to determine our provision for income taxes, our deferred tax assets and liabilities, and any associated valuation allowances recorded against our net deferred tax assets, which are based on complex and evolving tax regulations. Deferred tax assets (“DTA”) and other tax benefits are recorded when they are more likely than not to be realized. On a quarterly basis, we assess the need for valuation allowance on our DTAs, weighing all positive and negative evidence, to assess if it is more-likely-than-not that some or all of our DTAs will be realized. We recorded a provision for income taxes of $12.1 million and $33.7 million using an effective tax rate of 6.8 % and 18.7 % the three and nine months ended September 30, 2022, respectively. The difference between our effective tax rate and the U.S. federal statutory rate of 21% is primarily due to tax benefits on Foreign Derived Intangible Income Deduction (FDII), and tax detriments on 162(m), other share-based compensation and non-deductible transaction costs related to Antares acquisition.

Segment Information

As a result of the acquisition of Antares, we assessed the organization of our business and concluded that we continue to operate our business in one operating segment, which includes all activities related to the research, development and commercialization of our proprietary enzymes and devices. This segment also includes revenues and expenses related to (i) research and development and manufacturing activities conducted under our collaborative agreements with third parties (ii) product sales of proprietary and partnered products. The chief operating decision-maker reviews the operating results on an aggregate basis and manages the operations as a single operating segment.

21

Adoption and Pending Adoption of Recent Accounting Pronouncements

The following table provides a brief description of recently issued accounting standards, those adopted in the current period and those not yet adopted:

| Standard | Description | Effective Date | Effect on the Financial Statements or Other Significant Matters | |||||||||||||||||

In October 2021, the FASB issued ASU 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from contracts with customers. | The new guidance requires an acquirer to recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with Topic 606 as if it had originated the contracts. | January 1, 2023 (Early adoption is permitted, including adoption in an interim period) | We early adopted ASU 2021-08 on April 1, 2022. The adoption did not have a material impact on our condensed consolidated financial position or results of operations. | |||||||||||||||||

22

3. Business Combination

On May 24, 2022, we acquired all outstanding equity interests of Antares Pharma, Inc. according to the terms and conditions of the Agreement and Plan of Merger, dated as of April 12, 2022 (the “Merger Agreement”). Antares is a specialty pharmaceutical company focused primarily on the development and commercialization of pharmaceutical products and technologies that address patient needs in targeted therapeutic areas. We acquired Antares as a part of our strategy to expand as a drug delivery company and include specialty products.

The total purchase consideration of Antares was $1,045.7 million. Each share of Antares common stock issued and outstanding was converted into the right to receive $5.60 in cash without interest, less any applicable withholding taxes (“Merger Consideration”). Additionally, in connection with the transaction, each Antares equity award granted and outstanding as of May 24, 2022 under the Antares’ equity compensation plans was converted into the right to receive Merger Consideration. Other components of purchase consideration include cash paid at closing to settle Antares existing debt of $19.7 million and seller transaction costs paid by us on behalf of Antares of $22.9 million.