Form 10-Q Fibrocell Science, Inc. For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________________

FORM 10-Q

x Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended March 31, 2018

OR

o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

___________________________________________________________________

Commission File Number 001-31564

Fibrocell Science, Inc.

(Exact name of registrant as specified in its Charter)

Delaware | 87-0458888 | |

(State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) | |

405 Eagleview Boulevard

Exton, Pennsylvania 19341

(Address of principal executive offices, including zip code)

(484) 713-6000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for any shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o | |

Non-accelerated filer o (Do not check if a smaller reporting company) | ||

Smaller reporting company ý | ||

Emerging growth company o | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is shell company (as defined in Rule 12b-2of the Exchange Act). Yes o No ý

As of May 3, 2018, there were 28,356,351 outstanding shares of the registrant’s common stock, par value $0.001.

Fibrocell Science, Inc.

TABLE OF CONTENTS

PAGE | |||

_____________________________

Unless the context otherwise requires, all references in this Quarterly Report on Form 10-Q (this Form 10-Q) to the “Company,” “Fibrocell,” “we,” “us,” and “our” include Fibrocell Science, Inc. and its subsidiaries.

Trademark Notice

Fibrocell®, Fibrocell Science®, the Fibrocell logo and LAVIV® are trademarks of Fibrocell Science, Inc. (Exton, PA). All other trademarks, service marks or trade names appearing in this Form 10-Q are the property of their respective owners.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 10-Q contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995. These statements include, among others, statements relating to:

• | our review of strategic alternatives, including the possible sale or merger of our company; |

• | our expectation that our existing cash resources, will be sufficient to enable us to fund our operations into the first quarter of 2019; |

• | future expenses and capital expenditures; |

• | our estimates regarding expenses, future revenues, capital requirements and needs for, and ability to obtain, additional financing; |

• | our plans to address our future capital requirements and the consequences of failing to do so; |

• | our plans to resolve our noncompliance with the minimum bid price requirements of the Nasdaq Capital Market (Nasdaq) listing rules and the consequences of failing to do so; |

• | our need to raise substantial additional capital to fund our operations; |

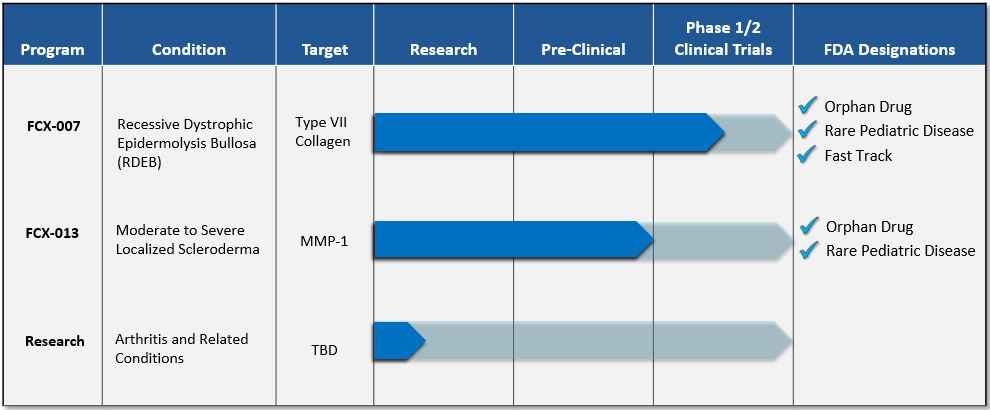

• | our plans to report interim data from adult patients from the Phase 1 portion of our Phase 1/2 clinical trial for FCX-007 and provide a trial update in the second quarter of 2018; |

• | our expectation to begin dosing patients in the Phase 2 portion of our Phase 1/2 clinical trial of FCX-007 in the second quarter of 2018; |

• | our expectation to complete enrollment of patients in the Phase 2 portion of our Phase 1/2 clinical trial of FCX-007 in the third quarter of 2018; |

• | our plans to report interim data from patients from the Phase 2 portion of our Phase 1/2 clinical trial for FCX-007 and provide a trial update in the first quarter of 2019; |

• | our plans to use the existing data from the Phase 1 portion of the Phase 1/2 clinical trial of FCX-007 to support a petition for Regenerative Medicine Advanced Therapy or Breakthrough Therapy Designation for FCX-007; |

• | our expectation to initiate enrollment in a Phase 1/2 clinical trial of FCX-013 in the third quarter of 2018; |

• | our product development goals under our collaborations with Intrexon Corporation for our product candidates; |

• | the potential benefits of Fast Track, Orphan Drug and Rare Pediatric Disease designations; |

• | the potential advantages of our product candidates and technologies; and |

• | the effect of legal and regulatory developments; |

as well as other statements relating to our future operations, financial performance and financial condition, prospects, strategies, objectives or other future events. Forward-looking statements appear primarily in the sections of this Form 10-Q entitled “Item 1—Financial Statements,” and “Item 2—Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward-looking statements by words such as “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “scheduled” and similar expressions, although not all forward-looking statements contain these identifying words.

Forward-looking statements are based upon current expectations and assumptions and are subject to a number of known and unknown risks, uncertainties and other factors that could cause actual results to differ materially and adversely from those expressed or implied by such statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Form 10-Q and our Annual Report on Form 10-K for the fiscal year ended December 31,

3

2017 (2017 Form 10-K) and in particular, the risks and uncertainties discussed under the caption “Item 1A—Risk Factors” of our 2017 Form 10-K. As a result, you should not place undue reliance on forward-looking statements.

Additionally, the forward-looking statements contained in this Form 10-Q represent our views only as of the date of this Form 10-Q (or any earlier date indicated in such statement). While we may update certain forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if new information becomes available in the future. However, you are advised to consult any further disclosures we make on related subjects in the periodic and current reports that we file with the Securities and Exchange Commission (SEC).

The foregoing cautionary statements are intended to qualify all forward-looking statements wherever they may appear in this Form 10-Q. For all forward-looking statements, we claim protection of the safe harbor for the forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

This Form 10-Q also contains estimates, projections and other information concerning our industry, our business, and the markets for certain diseases, including data regarding the estimated size of those markets, and the incidence and prevalence of certain medical conditions. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data and similar sources.

4

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

Fibrocell Science, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

($ in thousands, except share and per share data)

March 31, 2018 | December 31, 2017 | ||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 12,201 | $ | 17,417 | |||

Prepaid expenses and other current assets | 497 | 485 | |||||

Total current assets | 12,698 | 17,902 | |||||

Property and equipment, net of accumulated depreciation of $2,020 and $1,919, respectively | 1,408 | 1,470 | |||||

Other assets | 39 | 39 | |||||

Total assets | $ | 14,145 | $ | 19,411 | |||

Liabilities and Stockholders’ Equity | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 508 | $ | 862 | |||

Related party payable | 374 | 2,303 | |||||

Accrued expenses | 1,005 | 1,260 | |||||

Total current liabilities | 1,887 | 4,425 | |||||

Convertible promissory notes, net of debt discount of $18,003 and $18,003, respectively (see Note 4) | — | — | |||||

Accrued interest payable | 1,157 | 967 | |||||

Warrant liability, long term | 838 | 1,073 | |||||

Derivative liability | 3,199 | 3,136 | |||||

Deferred rent | 805 | 803 | |||||

Total liabilities | 7,886 | 10,404 | |||||

Stockholders’ equity: | |||||||

Preferred stock, $0.001 par value; 5,000,000 shares authorized: | |||||||

Series A nonredeemable convertible preferred stock; 8,000 shares designated, 8,000 shares issued and outstanding as of March 31, 2018 and December 31, 2017 respectively; aggregate liquidation preference of $8,346 at March 31, 2018 | — | — | |||||

Common stock, $0.001 par value; 150,000,000 shares authorized, 28,356,351 and 25,940,247 shares issued and outstanding at March 31, 2018 and December 31, 2017, respectively | 28 | 26 | |||||

Additional paid-in capital | 187,935 | 187,784 | |||||

Accumulated deficit | (181,704 | ) | (178,803 | ) | |||

Total stockholders’ equity | 6,259 | 9,007 | |||||

Total liabilities and stockholders’ equity | $ | 14,145 | $ | 19,411 | |||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

Fibrocell Science, Inc.

Condensed Consolidated Statements of Operations

(unaudited)

($ in thousands, except share and per share data)

Three Months Ended March 31, | ||||||||

2018 | 2017 | |||||||

Total revenues | $ | — | $ | — | ||||

Total cost of revenue | — | — | ||||||

Gross profit (loss) | — | — | ||||||

Research and development expense | 1,645 | 1,464 | ||||||

Research and development expense - related party (see Note 8) | (303 | ) | 1,509 | |||||

Selling, general and administrative expense | 1,639 | 1,481 | ||||||

Operating loss | (2,981 | ) | (4,454 | ) | ||||

Other income (expense): | ||||||||

Warrant revaluation income (expense) | 235 | (46 | ) | |||||

Derivative revaluation expense | (63 | ) | (312 | ) | ||||

Interest expense | (190 | ) | (183 | ) | ||||

Other income (expense), net | 98 | (12 | ) | |||||

Loss before income taxes | (2,901 | ) | (5,007 | ) | ||||

Income taxes | — | — | ||||||

Net loss | (2,901 | ) | (5,007 | ) | ||||

Dividend paid in-kind to preferred stockholders | (82 | ) | (20 | ) | ||||

Deemed dividend on preferred stock (see Note 10) | (121 | ) | (3,734 | ) | ||||

Net loss attributable to common stockholders | $ | (3,104 | ) | $ | (8,761 | ) | ||

Per Share Information: | ||||||||

Net loss: | ||||||||

Basic | $ | (0.11 | ) | $ | (0.60 | ) | ||

Diluted | $ | (0.11 | ) | $ | (0.60 | ) | ||

Weighted average number of common shares outstanding: | ||||||||

Basic | 28,356,351 | 14,694,613 | ||||||

Diluted | 28,356,351 | 14,697,210 | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

6

Fibrocell Science, Inc.

Condensed Consolidated Statement of Stockholders’ Equity (Deficit)

(unaudited)

($ in thousands, except share data)

Series A Convertible Preferred Stock | Common Stock | Additional paid-in capital | Accumulated deficit | Total Equity | |||||||||||||||||||||

Shares | Amount | Shares | Amount | ||||||||||||||||||||||

Balance, December 31, 2017 | 8,000 | $ | — | 25,940,247 | $ | 26 | $ | 187,784 | $ | (178,803 | ) | $ | 9,007 | ||||||||||||

Conversion of pre-funded warrants | — | — | 2,416,104 | 2 | 22 | — | 24 | ||||||||||||||||||

Stock-based compensation expense | — | — | — | — | 129 | — | 129 | ||||||||||||||||||

Net loss | — | — | — | — | — | (2,901 | ) | (2,901 | ) | ||||||||||||||||

Balance, March 31, 2018 | 8,000 | $ | — | 28,356,351 | $ | 28 | $ | 187,935 | $ | (181,704 | ) | $ | 6,259 | ||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

7

Fibrocell Science, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

($ in thousands)

Three months ended March 31, | |||||||

2018 | 2017 | ||||||

Cash flows from operating activities: | |||||||

Net loss | $ | (2,901 | ) | $ | (5,007 | ) | |

Adjustments to reconcile net loss to net cash used in operating activities: | |||||||

Stock-based compensation expense | 129 | (49 | ) | ||||

Warrant revaluation expense (income) | (235 | ) | 46 | ||||

Derivative revaluation expense | 63 | 312 | |||||

Depreciation and amortization of long lived assets | 101 | 91 | |||||

Loss on disposal or impairment of property and equipment | — | 30 | |||||

Decrease (increase) in operating assets: | |||||||

Prepaid expenses and other current assets | (12 | ) | (51 | ) | |||

Other assets | — | (34 | ) | ||||

Increase (decrease) in operating liabilities: | |||||||

Accounts payable | 23 | (55 | ) | ||||

Related party payable | (1,929 | ) | 567 | ||||

Accrued expenses and deferred rent | (190 | ) | (787 | ) | |||

Accrued interest payable | 190 | 183 | |||||

Net cash used in operating activities | (4,761 | ) | (4,754 | ) | |||

Cash flows from investing activities: | |||||||

Purchase of property and equipment | (35 | ) | (87 | ) | |||

Net cash used in investing activities | (35 | ) | (87 | ) | |||

Cash flows from financing activities: | |||||||

Proceeds from 2017 Series A Preferred Stock Offering, (net of offering costs of $377) | — | 7,886 | |||||

Payment of deferred offering costs | (444 | ) | — | ||||

Proceeds from conversion of pre-funded warrants | 24 | — | |||||

Net cash provided by (used in) financing activities | (420 | ) | 7,886 | ||||

Effect of exchange rate changes on cash balances | — | — | |||||

Net increase (decrease) in cash and cash equivalents | (5,216 | ) | 3,045 | ||||

Cash and cash equivalents, beginning of period | 17,417 | 17,515 | |||||

Cash and cash equivalents, end of period | $ | 12,201 | $ | 20,560 | |||

Supplemental disclosures of cash flow information: | |||||||

Non-cash investing and financing activities: | |||||||

Property and equipment in accounts payable | $ | 33 | $ | 13 | |||

Offering costs in accounts payable and accrued expenses | $ | — | $ | 263 | |||

Reduction of warrant liability upon cashless exercise of warrants | $ | — | $ | 41 | |||

Dividend paid in-kind to preferred stockholders | $ | 82 | $ | 20 | |||

Deemed dividend on preferred stock | $ | 121 | $ | 3,734 | |||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

8

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 1. Business and Organization

Organization

Fibrocell Science, Inc. (as used herein, “we,” “us,” “our,” “Fibrocell” or the “Company”) is the parent company of Fibrocell Technologies, Inc. (Fibrocell Tech). Fibrocell Tech is the parent company of Isolagen International, S.A., a company organized under the laws of Switzerland (Isolagen Switzerland). The Company’s international activities are currently immaterial.

Subsequent Events

On April 18, 2018, the Company announced that its Board of Directors is conducting a comprehensive review of strategic alternatives focused on maximizing stockholder value and had engaged Canaccord Genuity LLC as its strategic financial advisor to assist with the review process. The Board of Directors has established a Special Committee to explore and evaluate potential strategic alternatives which may include a sale of the Company, a business combination, a merger or reverse merger with another company, a strategic investment into the Company, a sale, license or other disposition of corporate assets of the Company or continuing with the current business plan. The Company has not set a timetable for completion of the review process. No decision has been made as to whether the Company will engage in a transaction or transactions, and there can be no assurance that this process will result in any transaction, or the terms or timing of any potential transaction.

Business Overview

Fibrocell is an autologous cell and gene therapy company translating personalized biologics into medical breakthroughs. The Company is focused on discovering and developing therapies for the localized treatment of diseases affecting the skin and connective tissue. All of the Company’s product candidates incorporate its proprietary autologous fibroblast technology. The Company’s research and development efforts focus on gaining regulatory approvals of its product candidates in the United States.

Liquidity and Financial Condition

The Company expects to continue to incur losses and will require additional capital to advance its product candidates through development to commercialization. For the three month period ended March 31, 2018 the Company incurred a net loss of approximately $2.9 million and used approximately $4.8 million in cash for operations. As of March 31, 2018, the Company had cash and cash equivalents of approximately $12.2 million, working capital of approximately $10.8 million and an accumulated deficit of approximately $181.7 million. The Company believes that its cash and cash equivalents at March 31, 2018 will be sufficient to fund operations into the first quarter of 2019. The Company will require additional capital to fund operations beyond that point. To meet its capital needs, the Company intends to raise additional capital through debt or equity financings, collaborations, partnerships or other strategic transactions. However, there can be no assurance that the Company will be able to complete any such transaction on acceptable terms or otherwise. The failure of the Company to obtain sufficient funds on acceptable terms when needed could have a material adverse effect on the Company’s business, results of operations and financial condition. These conditions raise substantial doubt about its ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. Accordingly, the consolidated financial statements have been prepared on a basis that assumes the Company will continue as a going concern and which contemplates the realization of assets and satisfaction of liabilities and commitments in the ordinary course of business.

On January 23, 2018, the Company received notice (the Notice) from the Nasdaq Stock Market LLC that the Company is not in compliance with Nasdaq Listing Rule 5550(a)(2), as the minimum bid price of the Company’s common stock has been below $1.00 per share for 30 consecutive business days. The Notice has no immediate effect on the listing of the Company’s common stock, which will continue to trade at this time on Nasdaq under the symbol “FCSC.”

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has a period of 180 calendar days, or until July 23, 2018, to regain compliance with the minimum bid price requirement. To regain compliance, the closing bid price of the Company’s common stock must meet or exceed $1.00 per share for at least ten consecutive business days during this 180 calendar day period. In the event the Company does not regain compliance by July 23, 2018, the Company may be eligible for

9

an additional 180 calendar day grace period if it meets the continued listing requirement for market value of publicly held shares ($1 million) and all other initial listing standards for Nasdaq, with the exception of the minimum bid price, and provides written notice to Nasdaq of its intention to cure the deficiency during the second compliance period by effecting a reverse stock split, if necessary. If the Company does not regain compliance within the allotted compliance period(s), Nasdaq will provide notice that the Company’s common stock will be subject to delisting from Nasdaq. In that event, the Company may appeal such delisting determination to a hearings panel.

The Company intends to monitor the closing bid price of its common stock and consider options to resolve its noncompliance with the minimum bid price requirement. To address its non-compliance with the minimum bid price requirement, the Company is seeking approval of an amendment to its Restated Certificate of Incorporation, as amended, to effect a reverse stock split of its common stock at a ratio in the range of 1:3 to 1:10, such ratio to be determined in the discretion of the Company’s Board of Directors, at its annual meeting of stockholders to be held on May 23, 2018.

Nasdaq has the authority, pursuant to Nasdaq Listing Rule 5550(b)(1), to delist the Company’s common stock if its stockholders’ equity falls below $2.5 million. As of March 31, 2018, the Company’s stockholders’ equity was approximately $6.3 million. If the Company’s stockholders equity is hereafter reduced below $2.5 million as a result of operating losses or for other reasons, the Company will fail to meet Nasdaq’s stockholders’ equity requirement. If that occurs, or if the Company is unable to demonstrate to Nasdaq’s satisfaction that it will be able to sustain compliance with this requirement, Nasdaq may delist the Company’s common stock. In addition, even if the Company regains technical compliance with the stockholders’ equity requirement, it will have to continue to meet other objective and subjective listing requirements to continue to be listed on Nasdaq, including the requirement that the Company’s common stock continues to trade above $1.00.

The Company is actively monitoring its stockholders’ equity and will consider any and all options available to it to maintain compliance. There can be no assurance, however, that the Company will be able to maintain compliance and meet Nasdaq’s minimum stockholders’ equity requirements.

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 2. Basis of Presentation

General

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared in accordance with U.S. generally accepted accounting principles (GAAP) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnote disclosures required by GAAP for complete consolidated financial statements and certain information and footnote disclosures included in the Company’s annual consolidated financial statements and accompanying notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 (2017 Form 10-K), filed with the SEC, have been condensed or omitted. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary to a fair statement of the results for the interim periods have been included. The year-end condensed balance sheet data was derived from audited financial statements, but does not include all disclosures required by GAAP.

These financial statements and accompanying notes should be read in conjunction with the consolidated financial statements and accompanying notes included in the Company’s 2017 Form 10-K. The Company’s significant accounting policies are described in the Notes to the Consolidated Financial Statements in the 2017 Form 10-K and updated, as necessary, in Note 3 in this Form 10-Q. The results of the Company’s operations for any interim period are not necessarily indicative of the results of operations for any other interim period or full year.

All intercompany accounts and transactions have been eliminated in consolidation. The Company's international operations are immaterial, it has no unrealized gains or losses from the sale of investments and its minimal assets and liabilities are highly liquid and approximate fair value.

Note 3. Summary of Significant Accounting Policies

Convertible Instruments

The Company has utilized various types of financing to fund its business needs, including convertible debt and convertible preferred stock with detachable warrants. The Company considers guidance within Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 470-20, Debt with Conversion and Other Options (ASC 470-20), ASC 480, Distinguishing Liabilities from Equity (ASC 480), and ASC 815, Derivatives and Hedging (ASC 815) when accounting for the issuance of its convertible securities. Additionally, the Company reviews the instruments to determine whether they are freestanding or contain an embedded derivative and, if so, whether they should be classified in permanent equity, mezzanine equity or as a liability at each reporting period until the amount is settled and reclassified into equity.

When multiple instruments are issued in a single transaction, the Company allocates total proceeds from the transaction among the individual freestanding instruments identified. The allocation is made after identifying (1) all the freestanding instruments and (2) the subsequent measurement basis for those instruments. The subsequent measurement basis determines how the proceeds are allocated. Generally, proceeds are allocated based on one of the following methods:

• | Fair value method - The instrument being analyzed is allocated a portion of the proceeds equal to its fair value, with the remaining proceeds allocated to the other instruments as appropriate. |

• | Relative fair value method - The instrument being analyzed is allocated a portion of the proceeds based on the proportion of its fair value to the sum of the fair values of all the instruments covered in the allocation. |

• | Residual value method - The instrument being analyzed is allocated the remaining proceeds after an allocation is made to all other instruments covered in the allocation. |

Generally, when there are multiple instruments issued in a single transaction that have different subsequent measurement bases, the proceeds from the transaction are first allocated to the instrument that is subsequently measured at fair value (i.e. - instruments accounted for as a derivative liability) at its issuance date fair value, with the residual proceeds allocated to the instrument not subsequently measured at fair value. In the event both instruments in the transaction are not

11

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 3. Summary of Significant Accounting Policies (continued)

subsequently measured at fair value (i.e. equity-classified instruments), the proceeds from the transaction are allocated to the freestanding instruments based on their respective fair values, using the relative fair value method.

After the proceeds are allocated to the freestanding instruments, resulting in an initial discount on the host contract, those instruments are further evaluated for embedded features (i.e. conversion options) that require bifurcation and separate accounting as a derivative financial instrument pursuant to ASC 815. Embedded derivatives are initially and subsequently measured at fair value. Under ASC 815, a portion of the proceeds received upon the issuance of the hybrid contract is allocated to the fair value of the derivative. See Note 4 for additional discussion on the identified embedded derivatives associated with the Company’s convertible notes.

The Company accounts for convertible instruments in which it is determined that the embedded conversion options should not be bifurcated from their host instruments, in accordance with ASC 470-20. Under ASC 470-20, the Company records, when necessary, discounts to convertible notes or convertible preferred stock for the intrinsic value of conversion options embedded in the convertible instruments based upon the differences between the fair value of the underlying common stock at the commitment date of the transaction and the effective conversion price embedded in the convertible instrument, unless limited by the proceeds allocated to such instrument. See Note 4 and Note 10 for additional discussion on the identified embedded features (conversion options) associated with the Company’s convertible notes and convertible preferred stock and resulting beneficial conversion features recorded.

The Company allocates issuance costs between the individual freestanding instruments identified on the same basis as proceeds were allocated. Issuance costs associated with the issuance of stock or equity contracts (i.e. equity-classified warrants and convertible preferred stock) are recorded as a charge against the gross proceeds of the offering. Issuance costs associated with the issuance of debt (i.e. convertible debt) is recorded as a direct reduction of the carrying amount of the debt liability, however, if debt issuance costs exceed the carrying amount of the debt, issuance costs are recorded to additional paid-in capital as a reduction of the beneficial conversion feature. Any issuance costs associated with the issuance of liability-classified warrants are expensed as incurred.

Income Taxes

In accordance with ASC 270, Interim Reporting, and ASC 740, Income Taxes, the Company is required at the end of each interim period to determine the best estimate of its annual effective tax rate and then apply that rate in providing for income taxes on a current year-to-date (interim period) basis. For the three months ended March 31, 2018 and 2017, the Company did not record a tax expense or benefit due to the expected current year loss and its historical losses. The Company does not have a net deferred tax asset as of either March 31, 2018 or December 31, 2017 because it maintained a full valuation allowance against all deferred tax assets as management has determined that it is more likely than not, that the Company will be unable to realize these future tax benefits. As of March 31, 2018 and December 31, 2017, the Company had no uncertain tax positions.

As of December 22, 2017, the United States enacted tax reform legislation “known as H.R. 1”, commonly referred to as the “Tax Cuts and Jobs Act” (TCJA or the Act), resulting in significant modifications to existing law. In response to the enactment of the TCJA, the SEC staff issued Staff Accounting Bulletin No. 118 (SAB 118), which provides guidance on accounting for the tax effects of the Act. SAB 118 provides a measurement period that should not extend beyond one year from the Act enactment date for companies to complete the accounting under ASC 740. In accordance with SAB 118, the Company has recorded a provisional estimate in these financial statements for the effect of the corporate tax rate change. There has been no change to the provisional amounts recorded by the Company since December 31, 2017.

Recently Issued Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the FASB and rules are issued by the SEC that we adopt as of the specified date. Unless otherwise noted, management does not believe that any recently issued accounting pronouncements issued by the FASB or guidance issued by the SEC had, or is expected to have, a material impact on the Company’s present or future consolidated financial statements.

12

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 3. Summary of Significant Accounting Policies (continued)

In July 2017, the FASB issued ASU No. 2017-11, “Earnings Per Share (Topic 260), Distinguishing Liabilities from Equity (Topic 480) and Derivatives and Hedging (Topic 815): Part 1 - Accounting for Certain Financial Instruments with Down Round Features and Part 2 - Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling Interests with Scope Exception”. Part 1 of ASU No. 2017-11 addresses the complexity of accounting for certain financial instruments with down round features. Down round features are features of certain equity-linked instruments (or embedded features) that result in the strike price being reduced on the basis of the pricing of future equity offerings. Current accounting guidance creates cost and complexity for entities that issue financial instruments (such as warrants and convertible instruments) with down round features that require fair value measurement of the entire instrument or conversion option. Part II of ASU No. 2017-11 addresses the difficulty of navigating Topic 480, Distinguishing Liabilities from Equity, because of the existence of extensive pending content in the FASB Accounting Standards Codification®. This pending content is the result of the indefinite deferral of accounting requirements about mandatorily redeemable financial instruments of certain nonpublic entities and certain mandatorily redeemable noncontrolling interests. For public business entities, the amendments in Part I of this update are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. The amendments in Part II of this update do not require any transition guidance because those amendments do not have an accounting effect. The Company currently does not have any outstanding financial instruments with down round provisions, and therefore the impact of the adoption of this standard on its Consolidated Financial Statements, will not be material.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which is intended to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet (including by lessees for those leases classified as operating leases under previous GAAP) and disclosing key information about leasing arrangements. The guidance is effective for public companies with annual reporting periods beginning after December 15, 2018, including interim periods within that reporting period. Earlier application is permitted. While the Company is currently assessing the full impact this ASU will have on its Consolidated Financial Statements, the Company believes the primary impact upon adoption will be the recognition, on a discounted basis, of its minimum commitments under the current noncancelable operating lease, as amended, for its Exton, PA facility, resulting in the recording of right of use assets and lease obligations. The Company does not anticipate any other material impacts to its Consolidated Financial Statements.

From time to time, new accounting pronouncements are issued by the FASB and rules are issued by the SEC that we adopt as of the specified date. Unless otherwise noted, management does not believe that any other recently issued accounting pronouncements issued by the FASB or guidance issued by the SEC had, or is expected to have, a material impact on the Company’s present or future consolidated financial statements.

Note 4. Convertible Notes

2016 Private Placement

In September 2016, the Company issued an aggregate of $18,087,500 in principal of convertible promissory notes (each, a Note and collectively, the Notes) and accompanying warrants to purchase an aggregate of 6,029,174 shares of the Company’s common stock (each a Warrant and collectively, the Warrants) in a private placement to institutional and accredited investors (each an Investor and collectively, the Investors).

The Notes bear interest at four percent (4%) per annum. Interest is earned daily and compounded quarterly and, at the election of the Company at the beginning of each quarter, shall accrue or be paid in cash. If the Company elects to have interest accrue, such interest will not be added to the principal amount of the Notes but such interest shall be subject to additional interest at the rate of four percent (4%) per annum, compounded quarterly, and shall be due and payable upon the earliest of the conversion of the Notes, exercise of the Put Right, exercise of the Prepayment Right or the Maturity Date (in each case, as defined below). Additionally, if the Company elects for interest to accrue, then (i) the Company may elect to repay any such accrued and unpaid interest in cash at any time and from time to time and (ii) each Investor may elect to have the Company repay any such accrued and unpaid interest by delivering such number of shares of the Company’s common stock equal to (x) the amount of the accrued and unpaid interest to be repaid, divided by (y) the greater of (i) the last closing bid price of a share of the Company’s common stock as reported on Nasdaq on the date of such election and (ii) the Conversion Price (as defined below). As of March 31, 2018 and for each prior quarterly period since issuance, the Company has elected to accrue interest.

13

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 4. Convertible Notes (continued)

All unpaid principal of each Investor’s Note is convertible, at any time and from time to time, at the option of such Investor into shares of the Company’s common stock at each such Investors’ applicable conversion price (as subject to adjustment, the Conversion Price) which range from $3.40875 to $3.67875 per share.

The Notes have a maturity date of the earlier of (i) September 7, 2026 and (ii) one-hundred and eighty (180) days after the date on which the Company’s product candidate, FCX-007, is approved by the FDA for the treatment of recessive dystrophic epidermolysis bullosa (the Maturity Date). Each Investor has the right to require the Company to repay all or any portion of the unpaid principal and accrued and unpaid interest from time to time on or after September 7, 2021 (such right, a Put Right). Such Put Right must be exercised by such Investor by delivering written notice to the Company no later than one-hundred and eighty (180) days prior to such exercise date of such Put Right. In addition, upon consummation of a specified change of control transaction, each Investor may elect to accelerate the repayment of all unpaid principal and accrued interest under such Investor’s Note. If an Investor does not elect to have the Company prepay its Note upon such change of control transaction, then the Company may prepay the Notes, in an amount equal to one hundred one percent (101%) of the outstanding principal due under the Notes (together with accrued and unpaid interest due thereon) (the Prepayment Right). Additionally, upon the occurrence of certain Events of Default, as defined in the Notes, each Investor may elect to accelerate the repayment of all unpaid principal and accrued interest under each Note and the Notes provide for automatic redemption upon the occurrence of certain bankruptcy related Events of Default, as defined in the Notes.

During the three months ending March 31, 2018, there were no conversions of the Notes into shares of the Company’s common stock.

Accounting for Convertible Notes and Embedded Derivatives

The Company accounts for debt as liabilities measured at amortized cost and amortizes the resulting debt discount from allocation of proceeds to interest expense using the effective interest method over the expected term of the Notes pursuant to ASC 835, Interest (ASC 835).

See Note 3 for discussion of the Company’s policies for accounting for convertible instruments (i.e. convertible debt) with detachable liability-classified warrants. In connection with the issuance of the Notes and Warrants, the Company recorded a debt discount of approximately $18.1 million based on an allocation of proceeds to the Warrants of approximately $9.6 million, an allocation to bifurcated derivatives (which consist of a contingent put option upon a change of control or acceleration upon event of default (the Contingent Put Option) and a contingent call option upon a change of control (the Contingent Call Option) included in the Notes) of approximately $1.3 million, and a beneficial conversion feature of approximately $7.2 million, before issuance costs, based on the difference between the fair value of the underlying common stock at the commitment date of each Note transaction and the effective conversion price of the Notes, as limited by the proceeds allocated to the Notes.

Convertible promissory notes outstanding were as follows:

($ in thousands) | March 31, 2018 | December 31, 2017 | |||||

Convertible promissory notes | $ | 18,003 | $ | 18,003 | |||

Debt discount - warrants | (9,598 | ) | (9,598 | ) | |||

Debt discount - compound bifurcated derivatives | (1,267 | ) | (1,267 | ) | |||

Debt discount - beneficial conversion feature | (7,138 | ) | (7,138 | ) | |||

Convertible promissory notes, net | $ | — | $ | — | |||

The debt discount and issuance costs are amortized using the effective interest method over five years, the expected term of the Notes, and is included in interest expense in the Condensed Consolidated Statements of Operations. Amortization for the three months ended March 31, 2018 and March 31, 2017, including the amortization of the issuance costs, was approximately $0 for both periods. Based on an effective yield of approximately 1,157% resulting from the Notes being

14

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 4. Convertible Notes (continued)

initially recorded at a full discount, the Company will not recognize any material amounts of amortization until years 2020 and 2021.

Assumptions Used in Determining Fair Value of Compound Bifurcated Derivative

The Company utilizes a binomial lattice model to value its bifurcated derivatives included in the Notes. ASC 815 does not permit an issuer to account separately for individual derivative terms and features embedded in hybrid financial instruments that require bifurcation and liability classification as derivative financial instruments. Rather, such terms and features must be combined together and fair valued as a single, compound embedded derivative. The Company selected a binomial lattice model to value the compound embedded derivative because it believes this technique is reflective of all significant assumptions that market participants would likely consider in negotiating the transfer of the Notes. Such assumptions include, among other inputs:

Volatility. The Company estimates stock price volatility based on the Company’s historical stock price performance over a period of time that matches the volume-weighted average expected remaining life of the Notes.

Risk-free interest rate. The risk-free interest rate is based on the U.S. Treasury zero-coupon yield curve in effect at the valuation date commensurate with the expected remaining life assumption.

Expected remaining life. The expected life of the Notes is assumed to be equivalent to their remaining contractual term.

Dividend rate. The dividend rate is based on the historical rate, which the Company anticipates will remain at zero.

Scenarios. The probability of complex features of the compound bifurcated derivative being triggered is subjective (no observable inputs or available market data) and based on internal and external information known to management at the valuation date. Such assumptions include, among other inputs, probabilities related to a change of control and when it might occur as well as probabilities related to a default under the provisions of the Notes and when it might occur.

Changes to the key assumptions or to the scenarios used in the valuation model, including the probability of key events, such as a change of control transaction, could have a material impact to the overall valuation of the compound bifurcated derivative liability. Additionally, there are other embedded features of the Notes requiring bifurcation, other than the Contingent Put Option and the Contingent Call Option, which had no value at March 31, 2018 or December 31, 2017, due to management’s estimates of the likelihood of certain events, but that may have value in the future should those estimates change.

The estimated fair value of the compound bifurcated derivative is determined to represent a Level 3 instrument. Significant inputs and assumptions used in the binomial lattice model for the derivative liability are as follows:

($ in thousands except per share data) | March 31, 2018 | December 31, 2017 | |||||

Calculated aggregate value | $ | 3,193 | $ | 3,136 | |||

Closing price per share of common stock | $ | 0.59 | $ | 0.64 | |||

Contractual remaining term | 8 years, 5 months | 8 years, 8 months | |||||

Contractual interest rate | 4.0 | % | 4.0 | % | |||

Volume-weighted average conversion rate | $ | 3.40933 | $ | 3.40933 | |||

Risk-free interest rate (term structure) | 1.63% - 2.74% | 1.28% - 2.40% | |||||

Dividend yield | — | — | |||||

Credit Rating | CC | CC | |||||

Credit Spread | 35.50 | % | 36.98 | % | |||

Volatility | 98.1 | % | 99.0 | % | |||

15

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 4. Convertible Notes (continued)

The foregoing compound bifurcated derivative was recorded at its estimated fair value at the date of issuance, with subsequent changes in estimated fair value recorded in derivative revaluation expense in the Company’s Condensed Consolidated Statements of Operations. The change in estimated fair value of the Company's derivative liability for the three months ended March 31, 2018 and March 31, 2017 resulted in non-cash expense of approximately $0.1 million and $0.3 million, respectively.

Note 5. Warrants

The Company accounts for common stock warrants as either equity instruments, derivative liabilities or liabilities depending on the specific terms of the warrant agreement. See Note 3 for further details on accounting policies related to the Company’s convertible instruments, including common stock warrants.

In connection with various financing transactions, the Company has issued warrants to purchase the Company’s common stock. In December 2017, the Company issued (i) pre-funded warrants to purchase an aggregate of 5,922,208 shares of the Company’s common stock and (ii) common stock purchase warrants to purchase up to an aggregate of 14,046,950 shares of the Company’s common stock including warrants to purchase up to 410,586 shares, issued pursuant to the partial exercise of the underwriters option to purchase additional common stock purchase warrants. Each pre-funded warrant was sold together with a common stock purchase warrant to purchase one share of the Company’s common stock at a combined effective price of $0.77 per share and accompanying warrant. Each common stock purchase warrant has an exercise price of $0.77 per share, was exercisable upon the date of issuance and expires five years from the date of issuance. As additional compensation, the Company issued warrants to the underwriter to purchase 436,364 shares of the Company’s common stock. Each such warrant has an exercise price of $0.9625 per share, and was exercisable as of the date of the underwriting agreement, and will expire five years after the date of the underwriting agreement.

In March 2017, the Company issued warrants to purchase 3,437,334 shares of its common stock in connection with the Company’s public offering of convertible preferred stock and warrants (each a Series A Warrant and collectively, the Series A Warrants), more fully described in Note 10. Each Series A Warrant has an exercise price of $2.54, will be exercisable six months after the date of issuance and will expire five years from the date of issuance.

16

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 5. Warrants (continued)

The Company’s outstanding warrants consist of both liability-classified warrants and equity-classified warrants. The following table summarizes outstanding warrants to purchase the Company’s common stock:

Number of warrants | |||||||||||

March 31, 2018 | December 31, 2017 | Exercise Price | Expiration Dates | ||||||||

Liability-classified Warrants | |||||||||||

Issued with June 2012 Convertible Notes | 375,194 | 375,194 | $ | 7.50 | Jun 2018 | ||||||

Issued in Series E Preferred Stock offering | 523,045 | 523,045 | $ | 22.50 | Dec 2018 | ||||||

Issued with September 2016 Convertible Notes | 6,029,174 | 6,029,174 | $ | 4.50 | Sep 2021 | ||||||

Total liability-classified warrants | 6,927,413 | 6,927,413 | |||||||||

Equity-classified Warrants | |||||||||||

Issued in 2017 Series A Preferred Stock Offering | 3,437,334 | 3,437,334 | $ | 2.54 | Mar 2022 | ||||||

Issued in December 2017 Common Stock Offering - common warrants | 14,046,950 | 14,046,950 | $ | 0.77 | Dec 2022 | ||||||

Issued in December 2017 Common Stock Offering - underwriter warrants | 436,364 | 436,364 | $ | 0.9625 | Dec 2022 | ||||||

Issued in December 2017 Common Stock Offering - pre-funded warrants | — | 2,416,104 | $ | 0.01 | No exp | ||||||

Total equity-classified warrants | 17,920,648 | 20,336,752 | |||||||||

Total outstanding warrants | 24,848,061 | 27,264,165 | |||||||||

The table below is a summary of the Company’s warrant activity during the three months ended March 31, 2018:

Number of warrants | Weighted- average exercise price | |||||||||

Liability-classified | Equity-classified | Total | ||||||||

Outstanding at December 31, 2017 | 6,927,413 | 20,336,752 | 27,264,165 | $ | 2.26 | |||||

Granted | — | — | — | — | ||||||

Exercised | — | (2,416,104 | ) | (2,416,104 | ) | 0.01 | ||||

Expired | — | — | — | — | ||||||

Outstanding at March 31, 2018 | 6,927,413 | 17,920,648 | 24,848,061 | $ | 2.48 | |||||

Accounting for Liability-Classified Warrants

The Company’s liability-classified warrants were recorded as liabilities at their estimated fair value at the date of issuance, with the subsequent changes in estimated fair value recorded in warrant revaluation income (expense) in the Company’s Condensed Consolidated Statements of Operations in each subsequent period. The change in the estimated fair value of the warrant liability for the three months ended March 31, 2018 and March 31, 2017, resulted in non-cash income (expense) of approximately $0.2 million and ($0.1) million respectively.

Additionally, the liability-classified warrants are classified as either current or non-current on the Company’s Condensed Consolidated Balance Sheets based on their contractual expiration date. The Company utilizes a Monte Carlo simulation valuation method to value its liability-classified warrants.

17

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 5. Warrants (continued)

Assumptions Used In Determining Fair Value of Liability-Classified Warrants

The estimated fair value of warrants is determined using Level 2 and Level 3 inputs (as described below). Inherent in the Monte Carlo simulation valuation method are the following assumptions:

Volatility. The Company estimates stock price volatility based on the Company’s historical stock price performance over a period of time that matches the volume-weighted average expected remaining life of the warrants.

Risk-free interest rate. The risk-free interest rate is based on the U.S. Treasury zero-coupon yield curve in effect at the valuation date commensurate with the expected remaining life assumption.

Expected remaining life. The expected life of the warrants is assumed to be equivalent to their remaining contractual term.

Dividend rate. The dividend rate is based on the historical rate, which the Company anticipates will remain at zero.

Scenarios. The probability of complex features of the warrants being triggered is subjective (no observable inputs or available market data) and based on internal and external information known to management at the valuation date. Such assumptions include, among other inputs, probabilities related to a change of control and when it might occur as well as probabilities related to a default under the provisions of the Notes and when it might occur.

Changes to the key assumptions or to the scenarios used in the valuation model, including the probability of key events, such as a change of control transaction, could have a material impact to the overall valuation of the warrant liability.

The following table summarizes the calculated aggregate fair values, along with the inputs and assumptions utilized in each calculation:

($ in thousands except per share data) | March 31, 2018 | December 31, 2017 | |||||

Calculated aggregate value | $ | 838 | $ | 1,073 | |||

Weighted average exercise price per share | $ | 6.02 | $ | 6.02 | |||

Closing price per share of common stock | $ | 0.59 | $ | 0.64 | |||

Volatility | 93.0 | % | 92.2 | % | |||

Weighted average remaining expected life | 3 years, 1 month | 3 years, 4 months | |||||

Risk-free interest rate | 2.34 | % | 2.00 | % | |||

Dividend yield | — | — | |||||

Note 6. Fair Value Measurements

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The Company follows the guidance in ASC 820, Fair Value Measurement, to account for financial assets and liabilities measured on a recurring basis. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability. The Company uses a fair value hierarchy, which distinguishes between assumptions based on market data (observable inputs) and an entity's own assumptions (unobservable inputs). The guidance requires fair value measurements be classified and disclosed in one of the following three categories:

18

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 6. Fair Value Measurements (continued)

• | Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. |

• | Level 2: Quoted prices in markets that are not active or inputs which are observable, either directly or indirectly, for substantially the full term of the asset or liability. |

• | Level 3: Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (i.e., supported by little or no market activity). |

Determining which category an asset or liability falls within the hierarchy requires significant judgment. The Company evaluates its hierarchy disclosures each reporting period. There were no transfers between Level 1, 2 and 3 during the three months ended March 31, 2018.

The following fair value hierarchy table presents information about each major category of the Company’s financial assets and liabilities measured at fair value on a recurring basis as of March 31, 2018 and December 31, 2017:

March 31, 2018 | |||||||||||||||

($ in thousands) | Level 1 | Level 2 | Level 3 | Total | |||||||||||

Assets: | |||||||||||||||

Cash and cash equivalents, money market funds with less than 90 days maturity | $ | 10,708 | $ | — | $ | — | $ | 10,708 | |||||||

Total Assets | $ | 10,708 | $ | — | $ | — | $ | 10,708 | |||||||

Liabilities: | |||||||||||||||

Warrant liability | $ | — | $ | — | $ | 838 | $ | 838 | |||||||

Derivative liability | — | — | 3,199 | 3,199 | |||||||||||

Total Liabilities | $ | — | $ | — | $ | 4,037 | $ | 4,037 | |||||||

December 31, 2017 | |||||||||||||||

($ in thousands) | Level 1 | Level 2 | Level 3 | Total | |||||||||||

Assets: | |||||||||||||||

Cash and cash equivalents, money market funds with less than 90 days maturity | $ | 14,670 | $ | — | $ | — | $ | 14,670 | |||||||

Total Assets | $ | 14,670 | $ | — | $ | — | $ | 14,670 | |||||||

Liabilities: | |||||||||||||||

Warrant liability | $ | — | $ | — | $ | 1,073 | $ | 1,073 | |||||||

Derivative liability | — | — | 3,136 | 3,136 | |||||||||||

Total Liabilities | $ | — | $ | — | $ | 4,209 | $ | 4,209 | |||||||

19

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 6. Fair Value Measurements (continued)

Changes in Level 3 Liabilities Measured at Fair Value on a Recurring Basis

Common Stock Warrants - Warrant Liability

The reconciliation of the Company’s warrant liability measured at fair value on a recurring basis using unobservable inputs (Level 3) was as follows:

Warrant | |||

($ in thousands) | Liability | ||

Balance at December 31, 2017 | $ | 1,073 | |

Change in fair value of warrant liability | (235 | ) | |

Balance at March 31, 2018 | $ | 838 | |

The fair value of the warrant liability is based on Level 3 inputs. For this liability, the Company developed its own assumptions that do not have observable inputs or available market data to support the fair value. See Note 5 for further discussion of the warrant liability.

Bifurcated Compound Derivative - Derivative Liability

The reconciliation of the derivative liability measured at fair value on a recurring basis using unobservable inputs (Level 3) was as follows:

Derivative | |||

($ in thousands) | Liability | ||

Balance at December 31, 2017 | $ | 3,136 | |

Change in fair value of derivative liability | 63 | ||

Balance at March 31, 2018 | $ | 3,199 | |

The fair value of the derivative liability is based on Level 3 inputs. For this liability, the Company developed its own assumptions that do not have observable inputs or available market data to support the fair value. See Note 4 for further discussion of the derivative liability.

Effect of the Company’s Stock Price and Volatility Assumptions on the Calculation of Fair Value of Financial Instruments Measured on a Recurring Basis

Common Stock Warrants - Warrant Liability

The fair value of the Company's warrant liability is based on Level 3 inputs. As discussed in Note 5, the Company uses a Monte Carlo simulation valuation method to value its liability-classified warrants. The determination of fair value as of the reporting date is affected by the Company's stock price as well as assumptions regarding a number of subjective variables that do not have observable inputs or available market data to support the fair value. These variables include, but are not limited to, expected stock price volatility over the term of the warrants and the risk-free interest rate. The primary factors affecting the fair value of the warrant liability are the Company's stock price and volatility as well as certain assumptions by the Company as to the likelihood of provisions to the underlying warrant agreements being triggered. The methods described above and in Note 5 may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Company believes its valuation method is appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value could result in a different fair value measurement at the reporting date.

20

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 6. Fair Value Measurements (continued)

Bifurcated Compound Derivative - Derivative Liability

The fair value of the derivative liability is based on Level 3 inputs. As discussed in Note 4, the Company uses a binomial lattice model to value the compound embedded derivative bifurcated from the Notes. The determination of fair value as of the reporting date is affected by the Company’s stock price as well as assumptions regarding a number of subjective variables that do not have observable inputs or available market data to support the fair value. These variables include, but are not limited to, expected stock price volatility, changes in interest rates, assumptions regarding the adjusted conversion prices in the Notes, and early redemption or conversion of the Notes. The methods described above and in Note 4 may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Company believes its valuation method is appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value could result in a different fair value measurement at the reporting date.

Fair Value of Certain Financial Assets and Liabilities

The Company believes that the fair values of its current assets and liabilities approximate their reported carrying amounts. The fair value of the long-term convertible promissory notes with embedded derivatives was approximately $11.9 million at March 31, 2018, based on Level 3 inputs, compared to a carrying value of $0, as a result of unamortized debt discounts.

21

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 7. Stock-Based Compensation

2009 Equity Incentive Plan

The Company’s Board of Directors (the Board) adopted the 2009 Equity Incentive Plan (as amended to date, the Plan) effective September 3, 2009. The Plan is intended to further align the interests of the Company and its stockholders with its employees, including its officers, non-employee directors, consultants and advisers by providing equity-based incentives. The Plan allows for the issuance of up to 2,533,333 shares of the Company’s common stock. In addition, as of March 31, 2018 there were 8,334 options outstanding that were issued outside the Plan to consultants in 2013.

The types of awards that may be granted under the Plan include options (both non-qualified stock options and incentive stock options), stock appreciation rights, stock awards, stock units and other stock-based awards. The term of each award is determined by the Compensation Committee of the Board at the time each award is granted, provided that the term of the option does not exceed ten years. Vesting schedules for stock options vary, but generally vest 25% per year, over four years for employee options and on the one year anniversary date for non-employee director options. The Plan had 1,187,558 shares available for future grants as of March 31, 2018.

Accounting for Stock-Based Compensation

The Company recognizes non-cash compensation expense for stock-based awards based on their grant date fair value, determined using the Black-Scholes option-pricing model. During the three months ended March 31, 2018 and 2017, the weighted average fair market value for options granted was and $0.52 and $1.69, respectively.

Total stock-based compensation expense recognized using the straight-line attribution method and included in operating expenses in the Condensed Consolidated Statements of Operations was approximately $0.1 million and ($0.1) million for the three months ended March 31, 2018 and 2017, respectively.

Assumptions Used In Determining Fair Value of Stock Options

Inherent in the Black-Scholes option-pricing model are the following assumptions:

Volatility. The Company estimates stock price volatility based on the Company’s historical stock price performance over a period of time that matches the expected term of the stock options.

Risk-free interest rate. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant commensurate with the expected term assumption.

Expected term. The expected term of stock options granted is based on an estimate of when options will be exercised in the future. The Company applied the simplified method of estimating the expected term of the options, described in the SEC’s Staff Accounting Bulletins 107 and 110, as the historical experience is not indicative of expected behavior in the future. The expected term, calculated under the simplified method, is applied to groups of stock options that have similar contractual terms. Using this method, the expected term is determined using the average of the vesting period and the contractual life of the stock options granted.

Dividend rate. The dividend rate is based on the historical rate, which the Company anticipates will remain at zero.

Forfeitures. The Company accounts for forfeitures when they occur. Ultimately, the actual expense recognized over the vesting period will be for only those shares that vest.

22

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 7. Stock-Based Compensation (continued)

The fair market value of these stock options at the date of grant was estimated using the Black-Scholes option-pricing model with the following weighted average assumptions for the three months ended:

March 31, 2018 | March 31, 2017 | ||||

Expected term | 6 years, 3 months | 6 years, 3 months | |||

Interest rate | 2.47 | % | 2.17 | % | |

Dividend rate | — | — | |||

Volatility | 87.7 | % | 89.3 | % | |

Stock Option Activity

The following table summarizes stock option activity for the three months ended March 31, 2018:

Number of shares | Weighted- average exercise price | Weighted- average remaining contractual term | Aggregate intrinsic value | |||||||||

Outstanding at December 31, 2017 | 1,089,513 | $ | 12.06 | 7 years, 3 months | $ | — | ||||||

Granted | 244,000 | 0.69 | 9 years, 10 months | — | ||||||||

Exercised | — | — | ||||||||||

Forfeited | — | — | ||||||||||

Expired | (822 | ) | 6.24 | |||||||||

Outstanding at March 31, 2018(1) | 1,332,691 | $ | 9.98 | 7 years, 6 months | $ | — | ||||||

Exercisable at March 31, 2018 | 707,687 | $ | 16.74 | 6 years | $ | — | ||||||

(1) | Includes both vested stock options as well as unvested stock options for which the requisite service period has not been rendered but that are expected to vest based on achievement of a service condition. |

The total fair value of options vested during the three months ended March 31, 2018 was approximately $0.2 million. Additionally, as of March 31, 2018, there was approximately $0.9 million of unrecognized compensation expense related to non-vested stock options which is expected to be recognized over a weighted-average period of 2.1 years.

Note 8. Related Party Transactions

The Company and Intrexon Corporation (Intrexon) are parties to two distinct exclusive channel collaboration agreements including the Exclusive Channel Collaboration Agreement entered into in October 2012 and amended in June 2013 and January 2014 (as amended, the 2012 ECC) and the Exclusive Channel Collaboration Agreement entered into in December 2015 (the 2015 ECC). Pursuant to these agreements, the Company engages Intrexon for support services for the research and development of product candidates covered under the respective agreements and reimburses Intrexon for its cost for time and materials for such work. Additionally, the Company’s future commitments pursuant to these agreements include potential cash royalties and various developmental milestone payments. No royalties or milestone payments have been incurred to date.

For the three months ended March 31, 2018, the Company incurred total expenses of approximately $0.2 million with Intrexon as compared to approximately $1.5 million, for the three months ended March 31, 2017, for work performed under the 2012 ECC. During the same periods, no expenses were incurred for work performed under the 2015 ECC. Of the $0.2 million incurred during the three months ended March 31, 2018, approximately $0.1 million related to direct expenses for work performed by Intrexon and approximately $0.1 million related to pass-through costs. In addition to these costs, the Company recorded an approximately $0.5 million reduction to pass through costs under the 2012 ECC, due to a reduction in the estimate of disputed amounts owed to an Intrexon vendor for pass though costs. Of the $1.5 million incurred in the three months ended

23

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 8. Related Party Transactions (continued)

March 31, 2017, approximately $0.3 million related to direct expenses for work performed by Intrexon and approximately $1.2 million related to pass-through costs. These costs are presented in the Company’s “Condensed Consolidated Statement of Operations” as research and development expenses - related party.

As of March 31, 2018 and December 31, 2017, the Company had outstanding payables to Intrexon of approximately $0.4 million and $2.3 million, respectively. These amounts are presented in the Company’s “Condensed Consolidated Balance Sheets” as related party payable.

In the second quarter of 2017, Intrexon notified the Company that it had received invoices for approximately $1.1 million in charges from a vendor who provides services to Intrexon and which are passed-through to the Company under the 2012 ECC. Additional charges have been presented since the second quarter of 2017, and the total of disputed charges at March 31, 2018, was approximately $1.4 million. Intrexon is disputing the volume and nature of these charges and has not invoiced the Company for these charges as of March 31, 2018. The Company has recorded approximately $0.2 million of such charges as its best estimate of the amount owed, which is a reduction of approximately $0.5 million from the $0.7 million recorded at December 31, 2017.

Randal J. Kirk is the chairman of the board and chief executive officer of Intrexon and, together with his affiliates, owns more than 50% of Intrexon’s common stock. Affiliates of Randal J. Kirk (including Intrexon) own approximately 29% of the Company’s common stock. Additionally, two of the Company’s directors, Julian Kirk (who is the son of Randal J. Kirk) and Marcus Smith, are employees of Third Security, LLC, which is an affiliate of Randal J. Kirk.

Affiliates of Randal J. Kirk (including Intrexon) participated in the Company’s private placement of convertible debt securities in September 2016, more fully described in Note 4, and were issued an aggregate of $6,762,500 in principal of Notes and accompanying Warrants to purchase an aggregate of 2,254,168 shares of the Company’s common stock. Affiliates of Randal J. Kirk (including Intrexon) participated in the Company's 2017 Series A Preferred Stock Offering (as defined below), more fully described in Note 10, and were issued an aggregate of 3,016 shares of Series A Preferred Stock (as defined below) and accompanying Series A Warrants to purchase 1,295,875 shares of the Company’s common stock. Additionally, affiliates of Randal J. Kirk (including Intrexon) participated in the Company’s December 2017 public offering, and were issued an aggregate of 2,727,273 shares of the Company’s common stock and accompanying warrants to purchase 2,727,273 shares of the Company’s common stock.

Note 9. Loss Per Share

Basic loss per share is computed by dividing net loss for the period by the weighted average number of shares of common stock outstanding during that period. The diluted loss per share calculation gives effect to dilutive stock options, warrants, convertible preferred stock, convertible notes and other potentially dilutive common stock equivalents outstanding during the period. Diluted loss per share is based on the if-converted method or the treasury stock method, as applicable, and includes the effect from the potential issuance of common stock, such as shares issuable pursuant to the conversion of convertible preferred stock, convertible notes and the exercise of stock options and warrants, assuming the exercise of all "in-the-money" common stock equivalents based on the average market price during the period. Common stock equivalents have been excluded where their inclusion would be anti-dilutive.

24

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 9. Loss Per Share (continued)

Details in the computation of basic and diluted loss per share is as follows:

Three months ended March 31, | ||||||||

($ in thousands except share and per share data) | 2018 | 2017 | ||||||

Loss per share - basic: | ||||||||

Net loss | $ | (2,901 | ) | $ | (5,007 | ) | ||

Less: Dividend paid in-kind to preferred stockholders | (82 | ) | (20 | ) | ||||

Less: Deemed dividend on preferred stock | (121 | ) | (3,734 | ) | ||||

Net loss attributable to common stockholders - basic | $ | (3,104 | ) | $ | (8,761 | ) | ||

Numerator for basic loss per share | $ | (3,104 | ) | $ | (8,761 | ) | ||

Denominator for basic loss per share | 28,356,351 | 14,694,613 | ||||||

Basic loss per common share | $ | (0.11 | ) | $ | (0.60 | ) | ||

Loss per share - diluted: | ||||||||

Numerator for basic loss per share | $ | (3,104 | ) | $ | (8,761 | ) | ||

Plus: Warrant revaluation income for dilutive warrants | — | 7 | ||||||

Net loss attributable to common stockholders - diluted | $ | (3,104 | ) | $ | (8,768 | ) | ||

Denominator for basic loss per share | 28,356,351 | 14,694,613 | ||||||

Adjust: Incremental shares underlying dilutive “in the money” warrants outstanding | — | 2,597 | ||||||

Denominator for diluted loss per share | 28,356,351 | 14,697,210 | ||||||

Diluted net loss per common share | $ | (0.11 | ) | $ | (0.60 | ) | ||

The following potentially dilutive securities have been excluded from the computations of diluted weighted-average shares outstanding, as their effect would be anti-dilutive:

Three months ended March 31, | ||||||

2018 | 2017 | |||||

“In the money” stock options | — | 89,801 | ||||

“Out of the money” stock options | 1,264,913 | 1,038,682 | ||||

“Out of the money” warrants | 24,848,061 | 10,364,747 | ||||

Shares underlying convertible notes | 5,280,370 | 5,304,533 | ||||

Shares underlying convertible accrued interest on convertible notes | 339,120 | 120,441 | ||||

Shares underlying convertible preferred stock | 3,584,000 | 3,440,000 | ||||

25

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 10. Equity

Preferred Stock

The Company is authorized to issue 5,000,000 shares of preferred stock, at a par value of $0.001 per share, in one or more series and to fix the rights, preferences, privileges, and restrictions thereof. These rights, preferences and privileges could include dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of such series, any or all of which may be greater than the rights of common stock. The issuance of the Company’s preferred stock could adversely affect the voting power of holders of the Company’s common stock and the likelihood that such holders will receive dividend payments and payments upon liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing a change of control of the Company or other corporate action.

Series A Convertible Preferred Stock

In March 2017, the Board authorized the issuance of 8,000 shares of preferred stock designated as Series A Convertible Preferred Stock (the Series A Preferred Stock). The rights, preferences and privileges of the Series A Preferred Stock is set forth in the Certificate of Designation of Preferences, Rights and Limitations of Series A Convertible Preferred Stock dated March 7, 2017 (Certificate of Designation).