Form 10-Q FREEPORT-MCMORAN INC For: Mar 31

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended March 31, 2022

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number: 001-11307-01

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) | |||||||

| incorporation or organization) | ||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☑ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☑ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☑ | Accelerated filer | ☐ | |||||||||

Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☑ No

On April 29, 2022, there were issued and outstanding 1,449,262,382 shares of the registrant’s common stock, par value $0.10 per share.

Freeport-McMoRan Inc.

TABLE OF CONTENTS

| Page | |||||

S-1 | |||||

2

Part I.FINANCIAL INFORMATION

Item 1.Financial Statements.

Freeport-McMoRan Inc.

CONSOLIDATED BALANCE SHEETS (Unaudited)

| March 31, 2022 | December 31, 2021 | ||||||||||

| (In millions) | |||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Trade accounts receivable | |||||||||||

| Income and other tax receivables | |||||||||||

| Inventories: | |||||||||||

| Materials and supplies, net | |||||||||||

| Mill and leach stockpiles | |||||||||||

| Product | |||||||||||

| Other current assets | |||||||||||

| Total current assets | |||||||||||

| Property, plant, equipment and mine development costs, net | |||||||||||

| Long-term mill and leach stockpiles | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES AND EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable and accrued liabilities | $ | $ | |||||||||

| Accrued income taxes | |||||||||||

| Current portion of debt | |||||||||||

| Current portion of environmental and asset retirement obligations | |||||||||||

| Dividends payable | |||||||||||

| Total current liabilities | |||||||||||

| Long-term debt, less current portion | |||||||||||

| Deferred income taxes | |||||||||||

| Environmental and asset retirement obligations, less current portion | |||||||||||

| Other liabilities | |||||||||||

| Total liabilities | |||||||||||

| Equity: | |||||||||||

| Stockholders’ equity: | |||||||||||

| Common stock | |||||||||||

| Capital in excess of par value | |||||||||||

| Accumulated deficit | ( | ( | |||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

| Common stock held in treasury | ( | ( | |||||||||

| Total stockholders’ equity | |||||||||||

| Noncontrolling interests | |||||||||||

| Total equity | |||||||||||

| Total liabilities and equity | $ | $ | |||||||||

The accompanying notes are an integral part of these consolidated financial statements.

3

Freeport-McMoRan Inc.

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

| Three Months Ended | ||||||||||||||

| March 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| (In millions, except per share amounts) | ||||||||||||||

| Revenues | $ | $ | ||||||||||||

| Cost of sales: | ||||||||||||||

| Production and delivery | ||||||||||||||

| Depreciation, depletion and amortization | ||||||||||||||

| Total cost of sales | ||||||||||||||

| Selling, general and administrative expenses | ||||||||||||||

| Mining exploration and research expenses | ||||||||||||||

Environmental obligations and shutdown costs | ||||||||||||||

| Total costs and expenses | ||||||||||||||

| Operating income | ||||||||||||||

| Interest expense, net | ( | ( | ||||||||||||

| Other income, net | ||||||||||||||

| Income before income taxes and equity in affiliated companies’ net earnings (losses) | ||||||||||||||

| Provision for income taxes | ( | ( | ||||||||||||

| Equity in affiliated companies’ net earnings (losses) | ( | |||||||||||||

| Net income | ||||||||||||||

| Net income attributable to noncontrolling interests | ( | ( | ||||||||||||

| Net income attributable to common stockholders | $ | $ | ||||||||||||

| Net income per share attributable to common stockholders: | ||||||||||||||

Basic | $ | $ | ||||||||||||

Diluted | $ | $ | ||||||||||||

| Weighted-average common shares outstanding: | ||||||||||||||

Basic | ||||||||||||||

Diluted | ||||||||||||||

| Dividends declared per share of common stock | $ | $ | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

Freeport-McMoRan Inc.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Unaudited)

| Three Months Ended | ||||||||||||||

| March 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| (In millions) | ||||||||||||||

| Net income | $ | $ | ||||||||||||

| Other comprehensive income, net of taxes: | ||||||||||||||

| Defined benefit plans: | ||||||||||||||

| Actuarial losses arising during the period | ( | |||||||||||||

| Prior service costs arising during the period | ( | |||||||||||||

| Amortization of unrecognized amounts included in net periodic benefit costs | ||||||||||||||

| Foreign exchange losses | ( | |||||||||||||

| Other comprehensive income | ||||||||||||||

| Total comprehensive income | ||||||||||||||

| Total comprehensive income attributable to noncontrolling interests | ( | ( | ||||||||||||

| Total comprehensive income attributable to common stockholders | $ | $ | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

5

Freeport-McMoRan Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

| Three Months Ended | ||||||||||||||

| March 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| (In millions) | ||||||||||||||

| Cash flow from operating activities: | ||||||||||||||

| Net income | $ | $ | ||||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||||||||

| Depreciation, depletion and amortization | ||||||||||||||

| Stock-based compensation | ||||||||||||||

| Net charges for environmental and asset retirement obligations, including accretion | ||||||||||||||

| Payments for environmental and asset retirement obligations | ( | ( | ||||||||||||

| Net charges for defined pension and postretirement plans | ||||||||||||||

| Pension plan contributions | ( | ( | ||||||||||||

| Deferred income taxes | ||||||||||||||

Charges for Cerro Verde royalty dispute | ||||||||||||||

| Payments for Cerro Verde royalty dispute | ( | |||||||||||||

| Other, net | ||||||||||||||

Changes in working capital and other: | ||||||||||||||

| Accounts receivable | ( | ( | ||||||||||||

| Inventories | ( | |||||||||||||

| Other current assets | ||||||||||||||

| Accounts payable and accrued liabilities | ( | ( | ||||||||||||

| Accrued income taxes and timing of other tax payments | ( | |||||||||||||

| Net cash provided by operating activities | ||||||||||||||

| Cash flow from investing activities: | ||||||||||||||

| Capital expenditures: | ||||||||||||||

| North America copper mines | ( | ( | ||||||||||||

| South America | ( | ( | ||||||||||||

| Indonesia mining | ( | ( | ||||||||||||

| Indonesia smelter projects | ( | ( | ||||||||||||

| Molybdenum mines | ( | ( | ||||||||||||

| Other | ( | ( | ||||||||||||

| Proceeds from sales of assets | ||||||||||||||

| Loans to PT Smelting for expansion | ( | |||||||||||||

| Other, net | ( | ( | ||||||||||||

| Net cash used in investing activities | ( | ( | ||||||||||||

| Cash flow from financing activities: | ||||||||||||||

| Proceeds from debt | ||||||||||||||

| Repayments of debt | ( | ( | ||||||||||||

| Cash dividends and distributions paid: | ||||||||||||||

| Common stock | ( | |||||||||||||

| Noncontrolling interests | ( | |||||||||||||

| Treasury stock purchases | ( | |||||||||||||

| Contributions from noncontrolling interests | ||||||||||||||

| Proceeds from exercised stock options | ||||||||||||||

| Payments for withholding of employee taxes related to stock-based awards | ( | ( | ||||||||||||

| Debt financing costs and other, net | ( | ( | ||||||||||||

| Net cash (used in) provided by financing activities | ( | |||||||||||||

| Net increase in cash, cash equivalents, restricted cash and restricted cash equivalents | ||||||||||||||

| Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of year | ||||||||||||||

| Cash, cash equivalents, restricted cash and restricted cash equivalents at end of period | $ | $ | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

6

Freeport-McMoRan Inc.

CONSOLIDATED STATEMENTS OF EQUITY (Unaudited)

THREE MONTHS ENDED MARCH 31

| Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Accum-ulated Deficit | Accumu- lated Other Compre- hensive Loss | Common Stock Held in Treasury | Total Stock-holders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Shares | At Par Value | Capital in Excess of Par Value | Number of Shares | At Cost | Non- controlling Interests | Total Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2021 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||

| Exercised and issued stock-based awards | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation, including the tender of shares | — | — | — | — | ( | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury stock purchases | — | — | — | — | — | ( | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends | — | — | ( | — | — | — | — | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Contributions from noncontrolling interests | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to common stockholders | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Net income attributable to noncontrolling interests | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2022 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Accum-ulated Deficit | Accumu- lated Other Compre- hensive Loss | Common Stock Held in Treasury | Total Stock-holders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Shares | At Par Value | Capital in Excess of Par Value | Number of Shares | At Cost | Non- controlling Interests | Total Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||

| Exercised and issued stock-based awards | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation, including the tender of shares | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividends | — | — | ( | — | — | — | — | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Contributions from noncontrolling interests | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to common stockholders | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interests | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2021 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

7

Freeport-McMoRan Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

NOTE 1. GENERAL INFORMATION

The accompanying unaudited consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and do not include all information and disclosures required by generally accepted accounting principles in the United States (U.S.). Therefore, this information should be read in conjunction with Freeport-McMoRan Inc.’s (FCX) consolidated financial statements and notes contained in its annual report on Form 10-K for the year ended December 31, 2021 (2021 Form 10-K). The information furnished herein reflects all adjustments that are, in the opinion of management, necessary for a fair statement of the results for the interim periods reported. All such adjustments are, in the opinion of management, of a normal recurring nature. Operating results for the three-month period ended March 31, 2022, are not necessarily indicative of the results that may be expected for the year ending December 31, 2022.

Subsequent Events. FCX evaluated events after March 31, 2022, and through the date the consolidated financial statements were issued, and determined any events and transactions occurring during this period that would require recognition or disclosure are appropriately addressed in these consolidated financial statements.

NOTE 2. EARNINGS PER SHARE

FCX calculates its basic net income per share of common stock under the two-class method and calculates its diluted net income per share of common stock using the more dilutive of the two-class method or the treasury-stock method. Basic net income per share of common stock was computed by dividing net income attributable to common stockholders (after deducting accumulated dividends and undistributed earnings to participating securities) by the weighted-average shares of common stock outstanding during the period. Diluted net income per share of common stock was calculated by including the basic weighted-average shares of common stock outstanding adjusted for the effects of all potential dilutive shares of common stock, unless their effect would be antidilutive.

Reconciliations of net income and weighted-average shares of common stock outstanding for purposes of calculating basic and diluted net income per share follow (in millions, except per share amounts):

| Three Months Ended | ||||||||||||||

| March 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Net income | $ | $ | ||||||||||||

| Net income attributable to noncontrolling interests | ( | ( | ||||||||||||

| Undistributed earnings allocated to participating securities | ( | ( | ||||||||||||

| Net income attributable to common stockholders | $ | $ | ||||||||||||

Basic weighted-average shares of common stock outstanding | ||||||||||||||

| Add shares issuable upon exercise or vesting of dilutive stock options and restricted stock units (RSUs) | ||||||||||||||

Diluted weighted-average shares of common stock outstanding | ||||||||||||||

| Basic net income per share attributable to common stockholders | $ | $ | ||||||||||||

| Diluted net income per share attributable to common stockholders | $ | $ | ||||||||||||

Outstanding stock options with exercise prices greater than the average market price of FCX’s common stock during the period are excluded from the computation of diluted net income per share of common stock. Stock options for 2 million shares of common stock in first-quarter 2022 and 10 million shares of common stock in first-quarter 2021, were excluded.

8

NOTE 3. INVENTORIES, INCLUDING LONG-TERM MILL AND LEACH STOCKPILES

The components of inventories follow (in millions):

| March 31, 2022 | December 31, 2021 | |||||||||||||

| Current inventories: | ||||||||||||||

Total materials and supplies, neta | $ | $ | ||||||||||||

| Mill stockpiles | $ | $ | ||||||||||||

| Leach stockpiles | ||||||||||||||

| Total current mill and leach stockpiles | $ | $ | ||||||||||||

| Raw materials (primarily concentrate) | $ | $ | ||||||||||||

| Work-in-process | ||||||||||||||

| Finished goods | ||||||||||||||

| Total product | $ | $ | ||||||||||||

| Long-term inventories: | ||||||||||||||

| Mill stockpiles | $ | $ | ||||||||||||

| Leach stockpiles | ||||||||||||||

Total long-term mill and leach stockpilesb | $ | $ | ||||||||||||

a.Materials and supplies inventory was net of obsolescence reserves totaling $39 million at March 31, 2022, and $36 million at December 31, 2021.

b.Estimated metals in stockpiles not expected to be recovered within the next 12 months.

NOTE 4. INCOME TAXES

Geographic sources of FCX’s provision for income taxes follow (in millions):

| Three Months Ended | ||||||||||||||

| March 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| U.S. operations | $ | ( | $ | |||||||||||

| International operations | ( | ( | ||||||||||||

| Total | $ | ( | $ | ( | ||||||||||

FCX’s consolidated effective income tax rate was 30 percent for first-quarter 2022 and 32 percent for first-quarter 2021. Variations in the relative proportions of jurisdictional income result in fluctuations to FCX’s consolidated effective income tax rate.

NOTE 5. DEBT AND EQUITY

The components of debt follow (in millions):

| March 31, 2022 | December 31, 2021 | |||||||||||||

| Senior notes and debentures: | ||||||||||||||

| Issued by FCX | $ | $ | ||||||||||||

| Issued by Freeport Minerals Corporation | ||||||||||||||

| PT-FI Term Loan | ||||||||||||||

| Cerro Verde Term Loan | ||||||||||||||

| Other | ||||||||||||||

| Total debt | ||||||||||||||

| Less current portion of debt | ( | a | ( | |||||||||||

| Long-term debt | $ | $ | ||||||||||||

a.Includes $325 million for the Cerro Verde Term Loan due June 2022 and $995 million for the FCX 3.875% Senior Notes due March 2023.

9

Revolving Credit Facility. At March 31, 2022, FCX had no borrowings outstanding and $8 million in letters of credit issued under its revolving credit facility, resulting in availability of approximately $3.5 billion, of which approximately $1.5 billion could be used for additional letters of credit. Availability under FCX’s revolving credit facility consists of $3.28 billion maturing April 2024 and $220 million maturing April 2023. At March 31, 2022, FCX was in compliance with its revolving credit facility covenants.

PT-FI Credit Facility. In July 2021, PT-FI entered into a $1.0 billion, five-year , unsecured credit facility (consisting of a $667 million term loan and a $333 million revolving credit facility) to fund project costs in connection with the PT Smelting expansion and construction of a precious metals refinery (PMR), and for PT-FI’s general corporate purposes. At March 31, 2022, $614 million ($603 million net of debt issuance costs) was drawn under the term loan, no amounts were drawn under the revolving credit facility and PT-FI was in compliance with its credit facility covenants.

Senior Notes issued by PT-FI. In April 2022, PT-FI completed the sale of $3.0 billion of unsecured senior notes, consisting of $750 million of 4.763% Senior Notes due 2027, $1.5 billion of 5.315% Senior Notes due 2032 and $750 million of 6.200% Senior Notes due 2052. PT-FI intends to use the proceeds, net of underwriting fees, of $2.99 billion to finance its smelter projects, to refinance the PT-FI Term Loan and for general corporate purposes.

Interest Expense, Net. Consolidated interest costs (before capitalization) totaled $153 million in first-quarter 2022 and $160 million in first-quarter 2021. Capitalized interest added to property, plant, equipment and mine development costs, net, totaled $26 million in first-quarter 2022 and $15 million in first-quarter 2021. The increase in capitalized interest costs for the 2022 period resulted from increased construction and development projects in process.

Share Repurchase Program. In first-quarter 2022, FCX acquired 12.3 million shares of its common stock under the share repurchase program for a total cost of $541 million ($44.02 average cost per share). Through May 5, 2022, FCX acquired 28.7 million shares of its common stock for a total cost of $1.2 billion ($41.64 average cost per share) and $1.8 billion remains available for repurchases under the program.

Dividends. On March 23, 2022, FCX declared quarterly cash dividends totaling $0.15 per share ($0.075 per share base dividend and $0.075 per share variable dividend) on its common stock, which were paid on May 2, 2022, to common stockholders of record as of April 14, 2022.

The declaration and payment of dividends (base or variable) and timing and amount of any share repurchases is at

the discretion of FCX’s Board of Directors (Board) and management, respectively, and is subject to a number of factors, including maintaining FCX’s net debt target, capital availability, FCX’s financial results, cash requirements, business prospects, global economic conditions, changes in laws, contractual restrictions and other factors deemed relevant by FCX’s Board or management, as applicable. FCX’s share repurchase program may be modified, increased, suspended or terminated at any time at the Board’s discretion.

NOTE 6. FINANCIAL INSTRUMENTS

FCX does not purchase, hold or sell derivative financial instruments unless there is an existing asset or obligation, or it anticipates a future activity that is likely to occur and will result in exposure to market risks, which FCX intends to offset or mitigate. FCX does not enter into any derivative financial instruments for speculative purposes but has entered into derivative financial instruments in limited instances to achieve specific objectives. These objectives principally relate to managing risks associated with commodity price changes, foreign currency exchange rates and interest rates.

Commodity Contracts. From time to time, FCX has entered into derivative contracts to hedge the market risk associated with fluctuations in the prices of commodities it purchases and sells. Derivative financial instruments used by FCX to manage its risks do not contain credit risk-related contingent provisions.

10

A discussion of FCX’s derivative contracts and programs follows:

Derivatives Designated as Hedging Instruments – Fair Value Hedges

Copper Futures and Swap Contracts. Some of FCX’s U.S. copper rod and cathode customers request a fixed market price instead of the Commodity Exchange Inc. (COMEX) average copper price in the month of shipment. FCX hedges this price exposure in a manner that allows it to receive the COMEX average price in the month of shipment while the customers pay the fixed price they requested. FCX accomplishes this by entering into copper futures or swap contracts. Hedging gains or losses from these copper futures and swap contracts are recorded in revenues. FCX did not have any significant gains or losses resulting from hedge ineffectiveness during the three-month periods ended March 31, 2022 and 2021. At March 31, 2022, FCX held copper futures and swap contracts that qualified for hedge accounting for 84 million pounds at an average contract price of $4.47 per pound, with maturities through February 2024.

A summary of gains (losses) recognized in revenues for derivative financial instruments related to commodity contracts that are designated and qualify as fair value hedge transactions, including on the related hedged item follows (in millions):

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Copper futures and swap contracts: | |||||||||||

| Unrealized gains (losses): | |||||||||||

| Derivative financial instruments | $ | $ | |||||||||

| Hedged item – firm sales commitments | ( | ( | |||||||||

| Realized gains: | |||||||||||

| Matured derivative financial instruments | |||||||||||

Derivatives Not Designated as Hedging Instruments

Embedded Derivatives. Certain FCX concentrate, copper cathode and gold sales contracts provide for provisional pricing primarily based on the London Metal Exchange (LME) copper price or the COMEX copper price and the London Bullion Market Association (London) gold price at the time of shipment as specified in the contract. FCX receives market prices based on prices in the specified future month, which results in price fluctuations recorded in revenues until the date of settlement. FCX records revenues and invoices customers at the time of shipment based on then-current LME or COMEX copper prices and the London gold prices as specified in the contracts, which results in an embedded derivative (i.e., a pricing mechanism that is finalized after the time of delivery) that is required to be bifurcated from the host contract. The host contract is the sale of the metals contained in the concentrate or cathode at the then-current LME or COMEX copper price, and the London gold price. FCX applies the normal purchases and normal sales scope exception in accordance with derivatives and hedge accounting guidance to the host contract in its concentrate or cathode sales agreements since these contracts do not allow for net settlement and always result in physical delivery. The embedded derivative does not qualify for hedge accounting and is adjusted to fair value through earnings each period, using the period-end LME or COMEX copper forward prices and the adjusted London gold prices, until the date of final pricing. Similarly, FCX purchases copper under contracts that provide for provisional pricing. Mark-to-market price fluctuations from these embedded derivatives are recorded through the settlement date and are reflected in revenues for sales contracts and in inventory for purchase contracts.

A summary of FCX’s embedded derivatives at March 31, 2022, follows:

| Open Positions | Average Price Per Unit | Maturities Through | |||||||||||||||||||||

| Contract | Market | ||||||||||||||||||||||

| Embedded derivatives in provisional sales contracts: | |||||||||||||||||||||||

| Copper (millions of pounds) | $ | $ | August 2022 | ||||||||||||||||||||

| Gold (thousands of ounces) | June 2022 | ||||||||||||||||||||||

| Embedded derivatives in provisional purchase contracts: | |||||||||||||||||||||||

| Copper (millions of pounds) | July 2022 | ||||||||||||||||||||||

11

Copper Forward Contracts. Atlantic Copper, FCX’s wholly owned smelting and refining unit in Spain, enters into copper forward contracts designed to hedge its copper price risk whenever its physical purchases and sales pricing periods do not match. These economic hedge transactions are intended to hedge against changes in copper prices, with the mark-to-market hedging gains or losses recorded in production and delivery costs. At March 31, 2022, Atlantic Copper held net copper forward purchase contracts for 4 million pounds at an average contract price of $4.60 per pound, with maturities through May 2022.

Summary of Gains (Losses). A summary of the realized and unrealized gains (losses) recognized in operating income for commodity contracts that do not qualify as hedge transactions, including embedded derivatives, follows (in millions):

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

Embedded derivatives in provisional sales contracts:a | |||||||||||

| Copper | $ | $ | |||||||||

| Gold and other metals | ( | ||||||||||

Copper forward contractsb | ( | ||||||||||

a.Amounts recorded in revenues.

b.Amounts recorded in cost of sales as production and delivery costs.

Unsettled Derivative Financial Instruments

A summary of the fair values of unsettled commodity derivative financial instruments follows (in millions):

| March 31, 2022 | December 31, 2021 | |||||||||||||

| Commodity Derivative Assets: | ||||||||||||||

Derivatives designated as hedging instruments: | ||||||||||||||

| Copper futures and swap contracts | $ | $ | ||||||||||||

Derivatives not designated as hedging instruments: | ||||||||||||||

| Embedded derivatives in provisional sales/purchase contracts | ||||||||||||||

| Copper forward contracts | ||||||||||||||

| Total derivative assets | $ | $ | ||||||||||||

| Commodity Derivative Liabilities: | ||||||||||||||

Derivatives not designated as hedging instruments: | ||||||||||||||

| Embedded derivatives in provisional sales/purchase contracts | $ | $ | ||||||||||||

| Copper forward contracts | ||||||||||||||

| Total derivative liabilities | $ | $ | ||||||||||||

FCX’s commodity contracts have netting arrangements with counterparties with which the right of offset exists, and it is FCX’s policy to generally offset balances by contract on its balance sheet. FCX’s embedded derivatives on provisional sales/purchase contracts are netted with the corresponding outstanding receivable/payable balances.

12

A summary of these unsettled commodity contracts that are offset in the balance sheets follows (in millions):

| Assets | Liabilities | |||||||||||||||||||||||||

| March 31, 2022 | December 31, 2021 | March 31, 2022 | December 31, 2021 | |||||||||||||||||||||||

| Gross amounts recognized: | ||||||||||||||||||||||||||

| Embedded derivatives in provisional | ||||||||||||||||||||||||||

| sales/purchase contracts | $ | $ | $ | $ | ||||||||||||||||||||||

| Copper derivatives | ||||||||||||||||||||||||||

| Less gross amounts of offset: | ||||||||||||||||||||||||||

| Embedded derivatives in provisional | ||||||||||||||||||||||||||

| sales/purchase contracts | ||||||||||||||||||||||||||

| Copper derivatives | ||||||||||||||||||||||||||

| Net amounts presented in balance sheet: | ||||||||||||||||||||||||||

| Embedded derivatives in provisional | ||||||||||||||||||||||||||

| sales/purchase contracts | ||||||||||||||||||||||||||

| Copper derivatives | ||||||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||

| Balance sheet classification: | ||||||||||||||||||||||||||

| Trade accounts receivable | $ | $ | $ | $ | ||||||||||||||||||||||

| Other current assets | ||||||||||||||||||||||||||

| Other assets | ||||||||||||||||||||||||||

| Accounts payable and accrued liabilities | ||||||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||

Credit Risk. FCX is exposed to credit loss when financial institutions with which it has entered into derivative transactions (commodity, foreign exchange and interest rate swaps) are unable to pay. To minimize the risk of such losses, FCX uses counterparties that meet certain credit requirements and periodically reviews the creditworthiness of these counterparties. As of March 31, 2022, the maximum amount of credit exposure associated with derivative transactions was $195 million.

Other Financial Instruments. Other financial instruments include cash and cash equivalents, restricted cash, restricted cash equivalents, accounts receivable, investment securities, legally restricted funds, accounts payable and accrued liabilities, accrued income taxes, dividends payable and debt. The carrying value for these financial instruments classified as current assets or liabilities approximates fair value because of their short-term nature and generally negligible credit losses. Refer to Note 7 for the fair values of investment securities, legally restricted funds and debt.

In addition, as of March 31, 2022, FCX has contingent consideration assets related to the sales of certain oil and gas properties (refer to Note 7 for the related fair values).

Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents. The following table provides a reconciliation of total cash, cash equivalents, restricted cash and restricted cash equivalents presented in the consolidated statements of cash flows (in millions):

| March 31, 2022 | December 31, 2021 | |||||||||||||

| Balance sheet components: | ||||||||||||||

Cash and cash equivalentsa | $ | $ | ||||||||||||

| Restricted cash and restricted cash equivalents included in: | ||||||||||||||

| Other current assets | ||||||||||||||

| Other assets | ||||||||||||||

| Total cash, cash equivalents, restricted cash and restricted cash equivalents presented in the consolidated statements of cash flows | $ | $ | ||||||||||||

a.Includes time deposits of $0.2 billion at each of March 31, 2022, and December 31, 2021.

13

NOTE 7. FAIR VALUE MEASUREMENT

Fair value accounting guidance includes a hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). FCX did not have any significant transfers in or out of Level 3 during first-quarter 2022.

FCX’s financial instruments are recorded on the consolidated balance sheets at fair value except for contingent consideration associated with the sale of the Deepwater Gulf of Mexico (GOM) oil and gas properties (which was recorded under the loss recovery approach) and debt. A summary of the carrying amount and fair value of FCX’s financial instruments (including those measured at net asset value (NAV) as a practical expedient), other than cash and cash equivalents, restricted cash, restricted cash equivalents, accounts receivable, accounts payable and accrued liabilities, accrued income taxes and dividends payable (refer to Note 6) follows (in millions):

| At March 31, 2022 | |||||||||||||||||||||||||||||||||||

| Carrying | Fair Value | ||||||||||||||||||||||||||||||||||

| Amount | Total | NAV | Level 1 | Level 2 | Level 3 | ||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

Investment securities:a,b | |||||||||||||||||||||||||||||||||||

| Equity securities | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| U.S. core fixed income fund | |||||||||||||||||||||||||||||||||||

| Total | |||||||||||||||||||||||||||||||||||

Legally restricted funds:a | |||||||||||||||||||||||||||||||||||

| U.S. core fixed income fund | |||||||||||||||||||||||||||||||||||

| Government bonds and notes | |||||||||||||||||||||||||||||||||||

| Corporate bonds | |||||||||||||||||||||||||||||||||||

| Government mortgage-backed securities | |||||||||||||||||||||||||||||||||||

| Asset-backed securities | |||||||||||||||||||||||||||||||||||

| Money market funds | |||||||||||||||||||||||||||||||||||

| Collateralized mortgage-backed securities | |||||||||||||||||||||||||||||||||||

| Total | |||||||||||||||||||||||||||||||||||

| Derivatives: | |||||||||||||||||||||||||||||||||||

Embedded derivatives in provisional sales/purchase contracts in a gross asset positionc | |||||||||||||||||||||||||||||||||||

Copper futures and swap contractsc | |||||||||||||||||||||||||||||||||||

Copper forward contractsc | |||||||||||||||||||||||||||||||||||

| Total | |||||||||||||||||||||||||||||||||||

| Contingent consideration for the sale of the | |||||||||||||||||||||||||||||||||||

Deepwater GOM oil and gas propertiesa | |||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||

Derivatives:c | |||||||||||||||||||||||||||||||||||

| Embedded derivatives in provisional sales/purchase contracts in a gross liability position | |||||||||||||||||||||||||||||||||||

| Copper forward contracts | |||||||||||||||||||||||||||||||||||

| Total | |||||||||||||||||||||||||||||||||||

Long-term debt, including current portiond | |||||||||||||||||||||||||||||||||||

14

| At December 31, 2021 | |||||||||||||||||||||||||||||||||||

| Carrying | Fair Value | ||||||||||||||||||||||||||||||||||

| Amount | Total | NAV | Level 1 | Level 2 | Level 3 | ||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

Investment securities:a,b | |||||||||||||||||||||||||||||||||||

| Equity securities | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| U.S. core fixed income fund | |||||||||||||||||||||||||||||||||||

| Total | |||||||||||||||||||||||||||||||||||

Legally restricted funds:a | |||||||||||||||||||||||||||||||||||

| U.S. core fixed income fund | |||||||||||||||||||||||||||||||||||

| Government bonds and notes | |||||||||||||||||||||||||||||||||||

| Corporate bonds | |||||||||||||||||||||||||||||||||||

| Government mortgage-backed securities | |||||||||||||||||||||||||||||||||||

| Asset-backed securities | |||||||||||||||||||||||||||||||||||

| Money market funds | |||||||||||||||||||||||||||||||||||

| Municipal bonds | |||||||||||||||||||||||||||||||||||

| Total | |||||||||||||||||||||||||||||||||||

| Derivatives: | |||||||||||||||||||||||||||||||||||

Embedded derivatives in provisional sales/purchase contracts in a gross asset positionc | |||||||||||||||||||||||||||||||||||

Copper futures and swap contractsc | |||||||||||||||||||||||||||||||||||

Copper forward contractsc | |||||||||||||||||||||||||||||||||||

| Total | |||||||||||||||||||||||||||||||||||

| Contingent consideration for the sale of the | |||||||||||||||||||||||||||||||||||

Deepwater GOM oil and gas propertiesa | |||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||

Derivatives:c | |||||||||||||||||||||||||||||||||||

| Embedded derivatives in provisional sales/purchase contracts in a gross liability position | |||||||||||||||||||||||||||||||||||

| Copper forward contracts | |||||||||||||||||||||||||||||||||||

| Total | |||||||||||||||||||||||||||||||||||

Long-term debt, including current portiond | |||||||||||||||||||||||||||||||||||

a.Current portion included in other current assets and long-term portion included in other assets.

b.Excludes time deposits (which approximated fair value) included in (i) other current assets of $117 million at March 31, 2022, and $114 million at December 31, 2021, and (ii) other assets of $133 million at March 31, 2022, and $132 million at December 31, 2021, primarily associated with an assurance bond to support PT-FI’s commitment for additional domestic smelter development in Indonesia and PT-FI’s closure and reclamation guarantees.

c.Refer to Note 6 for further discussion and balance sheet classifications.

d.Recorded at cost except for debt assumed in acquisitions, which are recorded at fair value at the respective acquisition dates.

Valuation Techniques. Equity securities are valued at the closing price reported on the active market on which the individual securities are traded and, as such, are classified within Level 1 of the fair value hierarchy.

The U.S. core fixed income fund is valued at NAV. The fund strategy seeks total return consisting of income and capital appreciation primarily by investing in a broad range of investment-grade debt securities, including U.S. government obligations, corporate bonds, mortgage-backed securities, asset-backed securities and money market instruments. There are no restrictions on redemptions (which are usually within one business day of notice).

Fixed income securities (government securities, corporate bonds, asset-backed securities, collateralized mortgage-backed securities and municipal bonds) are valued using a bid-evaluation price or a mid-evaluation price. These evaluations are based on quoted prices, if available, or models that use observable inputs and, as such, are classified within Level 2 of the fair value hierarchy.

Money market funds are classified within Level 1 of the fair value hierarchy because they are valued using quoted market prices in active markets.

15

FCX’s embedded derivatives on provisional copper concentrate, copper cathode and gold purchases and sales are valued using quoted monthly LME or COMEX copper forward prices and the adjusted London gold prices at each reporting date based on the month of maturity (refer to Note 6 for further discussion); however, FCX’s contracts themselves are not traded on an exchange. As a result, these derivatives are classified within Level 2 of the fair value hierarchy.

FCX’s derivative financial instruments for copper futures and swap contracts and copper forward contracts that are traded on the respective exchanges are classified within Level 1 of the fair value hierarchy because they are valued using quoted monthly COMEX or LME prices at each reporting date based on the month of maturity (refer to Note 6 for further discussion). Certain of these contracts are traded on the over-the-counter market and are classified within Level 2 of the fair value hierarchy based on COMEX and LME forward prices.

In December 2016, FCX’s sale of its Deepwater GOM oil and gas properties included up to $150 million in contingent consideration that was recorded at the total amount under the loss recovery approach. The contingent consideration is being received over time as cash flows are realized from a third-party production handling agreement for an offshore platform, with the related payments commencing in third-quarter 2018. The contingent consideration included in (i) other current assets totaled $20 64 million at March 31, 2022, and $70 million at December 31, 2021. The fair value of this contingent consideration was calculated based on a discounted cash flow model using inputs that include third-party estimates for reserves, production rates and production timing, and discount rates. Because significant inputs are not observable in the market, the contingent consideration is classified within Level 3 of the fair value hierarchy.

Long-term debt, including current portion, is primarily valued using available market quotes and, as such, is classified within Level 2 of the fair value hierarchy.

The techniques described above may produce a fair value that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while FCX believes its valuation techniques are appropriate and consistent with other market participants, the use of different techniques or assumptions to determine fair value of certain financial instruments could result in a different fair value measurement at the reporting date. There have been no changes in the techniques used at March 31, 2022, as compared with those techniques used at December 31, 2021.

A summary of the changes in the fair value of FCX’s Level 3 instrument, contingent consideration for the sale of the Deepwater GOM oil and gas properties, during the first three months of 2022 follows (in millions):

| Fair value at January 1, 2022 | $ | |||||||

| Net unrealized loss related to assets still held at the end of the period | ( | |||||||

Settlements | ( | |||||||

| Fair value at March 31, 2022 | $ | |||||||

NOTE 8. CONTINGENCIES AND COMMITMENTS

Asset Retirement Obligations (ARO)

Arizona Environmental and Reclamation Programs. FCX’s Arizona operations are subject to regulatory oversight by the Arizona Department of Environmental Quality (ADEQ). ADEQ has adopted regulations for its aquifer protection permit (APP) program that require permits for, among other things, certain facilities, activities and structures used for mining, leaching, concentrating and smelting, and require compliance with aquifer water quality standards during operations and closure. An application for an APP requires a proposed closure strategy that will meet applicable groundwater protection requirements following cessation of operations and an estimate of the implementation cost, with a more detailed closure plan required at the time operations cease. A permit applicant must demonstrate its financial ability to meet the closure costs approved by ADEQ. Closure costs for facilities covered by APPs are required to be updated every six years and financial assurance mechanisms are required to be updated every two years . During first-quarter 2022, Bagdad increased its ARO liability and asset retirement cost asset by $45 million associated with an updated closure strategy that Bagdad submitted to ADEQ for approval. Morenci is also preparing an update to its closure strategy for submission to ADEQ, which is expected to result in increased costs that could be significant. FCX will continue updating its closure strategy and closure cost estimates at other Arizona sites, and any such updates may also result in increased costs that could be significant.

16

Litigation

There were no significant updates to previously reported legal proceedings included in Note 12 of FCX’s 2021 Form 10-K.

Other Matters

Smelter Development Progress. On January 7, 2021, the Indonesia government levied an administrative fine of $149 million for the period from March 30, 2020, through September 30, 2020, on PT-FI for failing to achieve physical development progress on its greenfield smelter as of July 31, 2020. On January 13, 2021, PT-FI responded to the Indonesia government objecting to the fine because of events outside of its control causing a delay of the greenfield smelter’s development progress. PT-FI believes that its communications during 2020 with the Indonesia government were not properly considered before the administrative fine was levied.

In June 2021, the Indonesia government issued a ministerial decree for the calculation of an administrative fine for lack of smelter development in light of the COVID-19 pandemic. During 2021, PT-FI recorded charges totaling $16 million for a potential settlement of the administrative fine. On January 25, 2022, the Indonesia government submitted a new estimate of the administrative fine totaling $57 million. In March 2022, PT-FI paid the administrative fine and recorded a charge of $41 million in first-quarter 2022. Based on PT-FI’s revised smelter construction schedule, PT-FI does not believe any additional fines should be applied and will dispute any attempts by the Indonesia government to levy additional fines, which could be significant.

NOTE 9. BUSINESS SEGMENTS

FCX has organized its mining operations into four primary divisions – North America copper mines, South America mining, Indonesia mining and Molybdenum mines – and operating segments that meet certain thresholds are reportable segments. Separately disclosed in the following tables are FCX’s reportable segments, which include the Morenci and Cerro Verde copper mines, the Grasberg minerals district (Indonesia Mining), the Rod & Refining operations and Atlantic Copper Smelting & Refining.

Intersegment sales between FCX’s business segments are based on terms similar to arms-length transactions with third parties at the time of the sale. Intersegment sales may not be reflective of the actual prices ultimately realized because of a variety of factors, including additional processing, timing of sales to unaffiliated customers and transportation premiums.

FCX defers recognizing profits on sales from its mines to other segments, including Atlantic Copper Smelting & Refining, and on 39.5 percent of PT-FI’s sales to PT Smelting, until final sales to third parties occur. Quarterly variations in ore grades, the timing of intercompany shipments and changes in product prices result in variability in FCX’s net deferred profits and quarterly earnings.

FCX allocates certain operating costs, expenses and capital expenditures to its operating divisions and individual segments. However, not all costs and expenses applicable to an operation are allocated. U.S. federal and state income taxes are recorded and managed at the corporate level (included in Corporate, Other & Eliminations), whereas foreign income taxes are recorded and managed at the applicable country level. In addition, most mining exploration and research activities are managed on a consolidated basis, and those costs, along with some selling, general and administrative costs, are not allocated to the operating divisions or individual segments. Accordingly, the following Financial Information by Business Segment reflects management determinations that may not be indicative of what the actual financial performance of each operating division or segment would be if it was an independent entity.

17

Product Revenues. FCX’s revenues attributable to the products it sold for the first quarters of 2022 and 2021 follow (in millions):

| Three Months Ended | ||||||||||||||

| March 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Copper: | ||||||||||||||

| Concentrate | $ | $ | ||||||||||||

| Cathode | ||||||||||||||

| Rod and other refined copper products | ||||||||||||||

Purchased coppera | ||||||||||||||

| Gold | ||||||||||||||

| Molybdenum | ||||||||||||||

| Other | ||||||||||||||

| Adjustments to revenues: | ||||||||||||||

| Treatment charges | ( | ( | ||||||||||||

Royalty expenseb | ( | ( | ||||||||||||

Export dutiesc | ( | ( | ||||||||||||

| Revenues from contracts with customers | ||||||||||||||

Embedded derivativesd | ||||||||||||||

| Total consolidated revenues | $ | $ | ||||||||||||

a.FCX purchases copper cathode primarily for processing by its Rod & Refining operations.

b.Reflects royalties on sales from PT-FI and Cerro Verde that will vary with the volume of metal sold and prices.

c.Reflects PT-FI export duties, including a first-quarter 2022 charge of $18 million associated with an adjustment to prior-period export duties.

d.Refer to Note 6 for discussion of embedded derivatives related to FCX’s provisionally priced concentrate and cathode sales contracts.

18

Financial Information by Business Segment

| (In millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Atlantic | Corporate, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North America Copper Mines | South America Mining | Copper | Other | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cerro | Indonesia | Molybdenum | Rod & | Smelting | & Elimi- | FCX | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Morenci | Other | Total | Verde | Other | Total | Mining | Mines | Refining | & Refining | nations | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaffiliated customers | $ | $ | $ | $ | $ | $ | $ | a | $ | $ | $ | $ | b | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Intersegment | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Production and delivery | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Depreciation, depletion and amortization | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Selling, general and administrative expenses | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mining exploration and research expenses | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Environmental obligations and shutdown costs | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating income (loss) | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense, net | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for (benefit from) income taxes | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets at March 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital expenditures | c | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unaffiliated customers | $ | $ | $ | $ | $ | $ | $ | a | $ | $ | $ | $ | b | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Intersegment | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Production and delivery | ( | d | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Depreciation, depletion and amortization | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Selling, general and administrative expenses | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mining exploration and research expenses | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Environmental obligations and shutdown costs | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating income (loss) | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense, net | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for (benefit from) income taxes | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets at March 31, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital expenditures | c | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

a.Includes PT-FI's sales to PT Smelting totaling $917 million in first-quarter 2022 and $792 million in first-quarter 2021.

b.Includes revenues from FCX's molybdenum sales company, which includes sales of molybdenum produced by the Molybdenum mines and by certain of the North America and South America copper mines.

c.Includes capital expenditures for the greenfield smelter and PMR.

d.Includes charges associated with the major maintenance turnaround at the Miami Smelter totaling $68 million.

19

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Freeport-McMoRan Inc.

Results of Review of Interim Financial Statements

We have reviewed the accompanying consolidated balance sheet of Freeport-McMoRan Inc. (the Company) as of March 31, 2022, the related consolidated statements of income, comprehensive income, equity and cash flows for the three-month periods ended March 31, 2022 and 2021, and the related notes (collectively referred to as the “consolidated interim financial statements”). Based on our reviews, we are not aware of any material modifications that should be made to the consolidated interim financial statements for them to be in conformity with U.S. generally accepted accounting principles.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated balance sheet of the Company as of December 31, 2021, the related consolidated statements of operations, comprehensive income (loss), equity and cash flows for the year then ended, and the related notes (not presented herein); and in our report dated February 15, 2022, we expressed an unqualified audit opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying consolidated balance sheet as of December 31, 2021, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

Basis for Review Results

These financial statements are the responsibility of the Company's management. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our review in accordance with the standards of the PCAOB. A review of interim financial statements consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the PCAOB, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

/s/ Ernst & Young LLP

Phoenix, Arizona

May 5, 2022

20

Item 2.Management’s Discussion and Analysis of Financial Condition and Results of Operations.

In Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A), “we,” “us” and “our” refer to Freeport-McMoRan Inc. (FCX) and its consolidated subsidiaries. You should read this discussion in conjunction with our consolidated financial statements, the related MD&A and the discussion of our Business and Properties in our annual report on Form 10-K for the year ended December 31, 2021 (2021 Form 10-K), filed with the United States (U.S.) Securities and Exchange Commission (SEC). The results of operations reported and summarized below are not necessarily indicative of future operating results (refer to “Cautionary Statement” for further discussion). References to “Notes” are Notes included in our Notes to Consolidated Financial Statements (Unaudited). Throughout MD&A, all references to income or losses per share are on a diluted basis.

OVERVIEW

We are a leading international mining company with headquarters in Phoenix, Arizona. We operate large, long-lived, geographically diverse assets with significant proven and probable mineral reserves of copper, gold and molybdenum. We are one of the world’s largest publicly traded copper producers. Our portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world’s largest copper and gold deposits; and significant mining operations in North America and South America, including the large-scale Morenci minerals district in Arizona and the Cerro Verde operation in Peru.

Our results for first-quarter 2022 reflect strong operating and financial performance, cash flow generation and cash returns to shareholders. We remain focused on cost and capital management and are advancing our sustainability objectives. We achieved a 24 percent increase in copper sales and a 59 percent increase in gold sales, compared to first-quarter 2021. We plan to continue to execute our operating plans, which we expect will provide strong cash flows to support advancement of organic growth initiatives and continued cash returns to shareholders under our established financial policy, based on a favorable operational and market outlook.

As further discussed in “Operations,” first-quarter 2022 highlights include:

•Continued growth in operating rates at Lone Star toward achieving production of 300 million pounds of copper per year from oxide ores (compared with the initial design capacity of 200 million pounds per year).

•Strong performance from Cerro Verde's concentrator facilities, with milling rates averaging 394,400 metric tons of ore per day. Subject to ongoing monitoring of COVID-19 protocols, milling rates are currently expected to average approximately 400,000 metric tons of ore per day for the remainder of 2022.

•Increased milling rates from the underground mines at the Grasberg minerals district, which averaged 186,500 metric tons of ore per day, a 50 percent increase from milling rates in first-quarter 2021. Milling rates at the Grasberg minerals district are expected to average approximately 180,000 to 190,000 metric tons of ore per day for the remainder of 2022.

Net income attributable to common stock totaled $1.5 billion in first-quarter 2022, compared with $0.7 billion in first-quarter 2021, primarily reflecting higher copper and gold sales volumes and prices, partly offset by a higher provision for income taxes and increased energy and other input costs. Refer to “Consolidated Results” for further discussion.

At March 31, 2022, we had consolidated debt of $9.6 billion and consolidated cash and cash equivalents of $8.3 billion, resulting in net debt of $1.3 billion (including $0.6 billion of net debt for the Indonesia smelter projects). Refer to “Net Debt” for reconciliations of consolidated debt and consolidated cash and cash equivalents to net debt.

At March 31, 2022, we had no borrowings and $3.5 billion available under our revolving credit facility. At March 31, 2022, we had $1.4 billion of current debt, including $995 million of senior notes maturing in March 2023 (with redemption rights at par in December 2022) and $325 million under Cerro Verde’s Term Loan maturing in June 2022.

In April 2022, PT Freeport Indonesia (PT-FI) completed the sale of $3.0 billion of senior notes primarily in connection with its financing plans for construction of additional domestic smelting capacity.

In first-quarter 2022, we acquired 12.3 million shares of our common stock under the share repurchase program for a total cost of $541 million ($44.02 average cost per share). Through May 5, 2022, we acquired 28.7 million shares

21

of our common stock for a total cost of $1.2 billion ($41.64 average cost per share) and $1.8 billion remains available under the share repurchase program.

Refer to Note 5 and “Capital Resources and Liquidity” for further discussion.

OUTLOOK

We continue to view the long-term outlook for our business positively, supported by limitations on supplies of copper and the requirements for copper in the world’s economy. Our financial results vary as a result of fluctuations in market prices primarily for copper, gold and, to a lesser extent, molybdenum, as well as other factors. World market prices for these commodities have fluctuated historically and are affected by numerous factors beyond our control. Refer to “Markets” below and “Risk Factors” in Part I, Item 1A. of our 2021 Form 10-K for further discussion. Because we cannot control the prices of our products, the key measures that management focuses on in operating our business are sales volumes, unit net cash costs, operating cash flows and capital expenditures.

Consolidated Sales Volumes

Following are our projected consolidated sales volumes for the year 2022:

Copper (millions of recoverable pounds): | ||||||||

| North America copper mines | 1,536 | |||||||

| South America mining | 1,154 | |||||||

| Indonesia mining | 1,564 | |||||||

| Total | 4,254 | |||||||

Gold (millions of recoverable ounces) | 1.6 | |||||||

Molybdenum (millions of recoverable pounds) | 80 | a | ||||||

a.Projected molybdenum sales include 30 million pounds produced by our Molybdenum mines and 50 million pounds produced by our North America and South America copper mines.

Consolidated sales volumes in second-quarter 2022 are expected to approximate 1.0 billion pounds of copper, 405 thousand ounces of gold and 21 million pounds of molybdenum. Projected sales volumes are dependent on operational performance, weather-related conditions, timing of shipments, and other factors detailed in the “Cautionary Statement” below.

For other important factors that could cause results to differ materially from projections, refer to “Risk Factors” contained in Part I, Item 1A. of our 2021 Form 10-K.

Consolidated Unit Net Cash Costs

Assuming average prices of $1,950 per ounce of gold and $19.00 per pound of molybdenum for the remainder of 2022 and achievement of current sales volume and cost estimates, consolidated unit net cash costs (net of by-product credits) for our copper mines are expected to average $1.44 per pound of copper for the year 2022 (including $1.41 per pound of copper in second-quarter 2022). The increase from the January 2022 estimate of $1.35 per pound of copper primarily reflects higher costs of energy and other consumables and currency exchange rates in South America, partly offset by higher gold volumes and commodity price assumptions. We are experiencing significant cost inflation, principally associated with energy (which represents about 20 percent of our site operating costs) and other consumables such as sulfuric acid, explosives and steel. Russia’s invasion of Ukraine has placed additional pressure on an already challenging global supply chain environment. The impact of price changes during the remainder of 2022 on consolidated unit net cash costs for the year 2022 would approximate $0.03 per pound of copper for each $100 per ounce change in the average price of gold and $0.02 per pound of copper for each $2.00 per pound change in the average price of molybdenum. Quarterly unit net cash costs vary with fluctuations in sales volumes and realized prices, primarily for gold and molybdenum.

22

Consolidated Operating Cash Flows

Our consolidated operating cash flows vary with sales volumes; prices realized from copper, gold and molybdenum sales; production costs; income taxes; other working capital changes; and other factors. Based on current sales volume and cost estimates, and assuming average prices of $4.75 per pound for copper, $1,950 per ounce for gold, and $19.00 per pound for molybdenum for the remainder of 2022, our consolidated operating cash flows are estimated to approximate $8.6 billion (net of $0.9 billion of working capital and other uses) for the year 2022. Estimated consolidated operating cash flows for the year 2022 also reflect an estimated income tax provision of $3.4 billion (refer to “Consolidated Results – Income Taxes” for further discussion of our projected income tax rate for the year 2022). The impact of price changes for the remainder of 2022 on operating cash flows would approximate $300 million for each $0.10 per pound change in the average price of copper, $80 million for each $100 per ounce change in the average price of gold and $75 million for each $2.00 per pound change in the average price of molybdenum.

Consolidated Capital Expenditures

Consolidated capital expenditures for the year 2022 are expected to approximate $4.6 billion ($3.2 billion excluding capital expenditures for the greenfield smelter and precious metals refinery (PMR) - collectively, the Indonesia smelter projects), and include $1.9 billion for major mining projects ($1.3 billion for planned projects primarily associated with underground mine development in the Grasberg minerals district and supporting mill and power capital costs and $0.6 billion for discretionary growth projects).

Capital expenditures for the Indonesia smelter projects are expected to approximate $1.4 billion for the year 2022.

Development of additional smelting capacity in Indonesia will result in the elimination of export duties, providing an

offset to the economic cost associated with the Indonesia smelter projects. Capital expenditures for the Indonesia smelter projects are being funded with the net proceeds from PT-FI's unsecured senior notes issued in April 2022 and its available bank credit facilities.

23

MARKETS

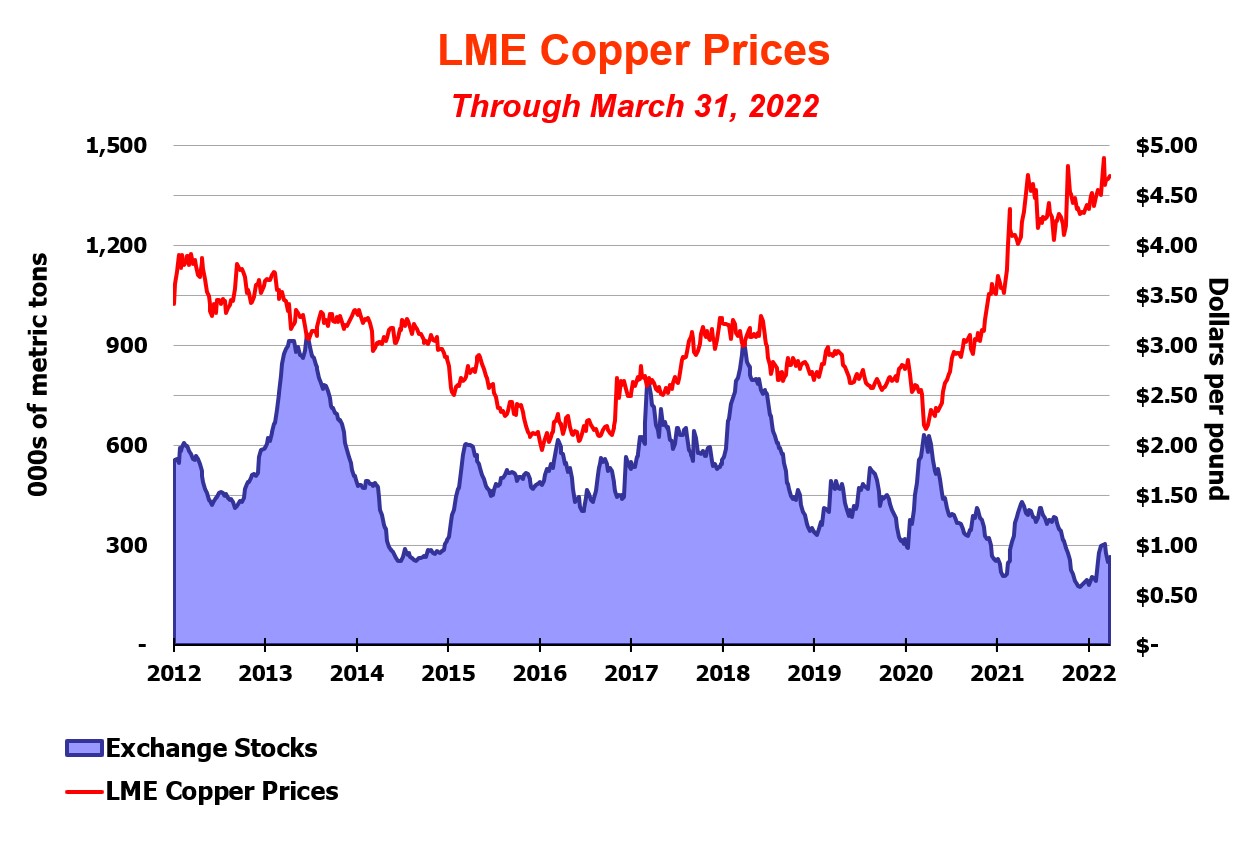

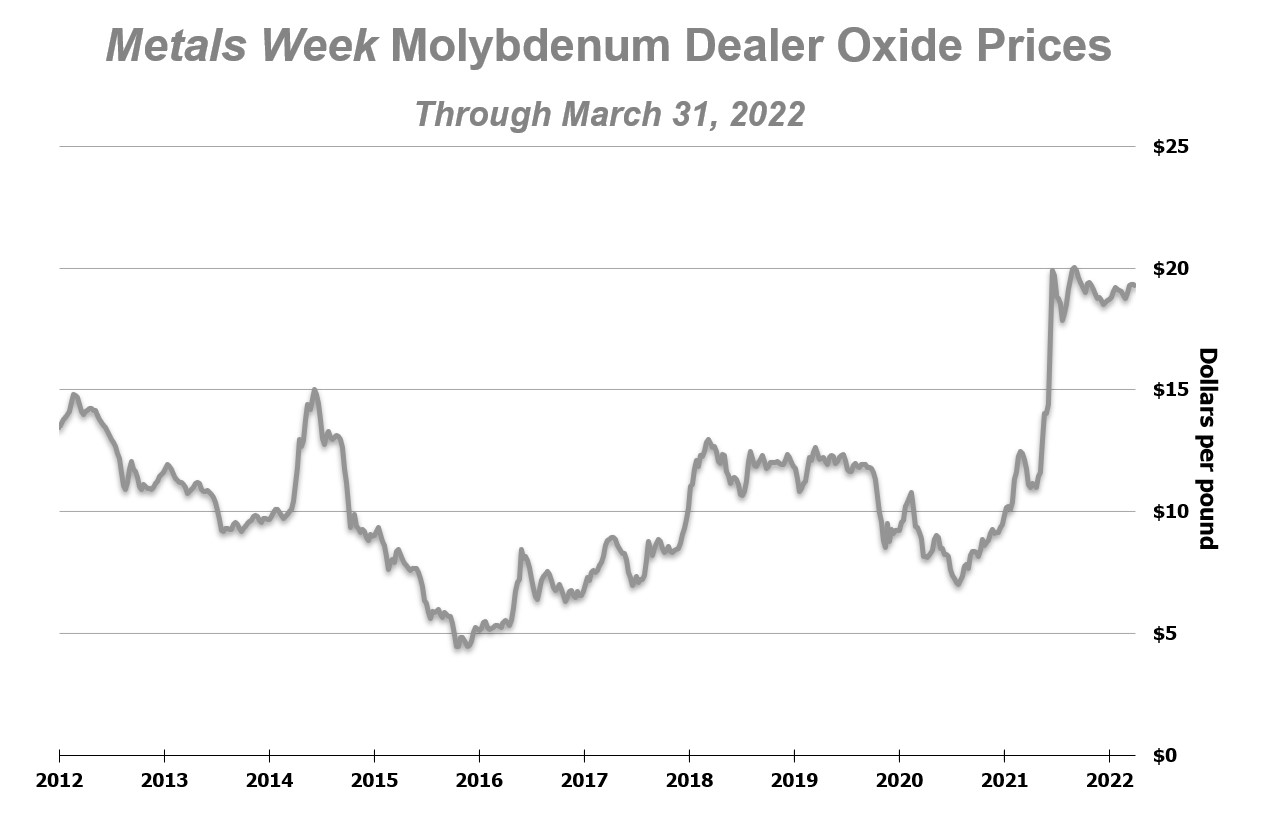

World prices for copper, gold and molybdenum can fluctuate significantly. During the period from January 2012 through March 2022, the London Metal Exchange (LME) copper settlement price varied from a low of $1.96 per pound in 2016 to a record high of $4.87 per pound in 2022; the London Bullion Market Association (London) PM gold price fluctuated from a low of $1,049 per ounce in 2015 to a record high of $2,067 per ounce in 2020; and the Metals Week Molybdenum Dealer Oxide weekly average price ranged from a low of $4.46 per pound in 2015 to a high of $20.01 per pound in 2021. Copper, gold and molybdenum prices are affected by numerous factors beyond our control as described further in “Risk Factors” contained in Part I, Item 1A. of our 2021 Form 10-K.

This graph presents LME copper settlement prices and the combined reported stocks of copper at the LME, Commodity Exchange Inc., and the Shanghai Futures Exchange from January 2012 through March 2022. During first-quarter 2022, LME copper settlement prices ranged from a low of $4.34 per pound to a record high of $4.87 per pound, averaged $4.53 per pound and settled at $4.69 per pound on March 31, 2022. Copper prices have been supported by strong demand during the pandemic recovery, rising investor sentiment associated with copper’s prominent role in the global transition to cleaner energy, ongoing supply disruptions and falling inventories. The LME copper settlement price was $4.45 per pound on April 29, 2022.

Long-term fundamentals for copper remain positive. We believe future demand will be supported by copper’s role in the global transition to renewable power, electric vehicles and other carbon-reduction initiatives, and continued urbanization in developing countries. The small number of approved, large-scale projects beyond those expected to commence operations in 2022 and 2023, the long lead times required to permit and build new mines and declining ore grades at existing operations continue to highlight the fundamental supply challenges for copper.

24

This graph presents London PM gold prices from January 2012 through March 2022. During first-quarter 2022, London PM gold prices ranged from a low of $1,788 per ounce to a high of $2,039 per ounce, averaged $1,877 per ounce, and closed at $1,942 per ounce on March 31, 2022. Many analysts expect future gold prices to be supported by the effects of elevated debt levels associated with large pandemic-related stimulus efforts, historically low U.S. interest rates and a weaker U.S. dollar. The London PM gold price was $1,911 per ounce on April 29, 2022.

25

This graph presents the Metals Week Molybdenum Dealer Oxide weekly average price from January 2012 through March 2022. During first-quarter 2022, the weekly average price of molybdenum ranged from a low of $18.74 per pound to a high of $19.33 per pound, averaged $19.08 per pound, and was $19.30 per pound on March 31, 2022. Molybdenum prices continue to be supported by supply constraints and increased demand, as mines in Chile continued to report low production, logistic challenges and geopolitical risk due to Russia’s invasion of Ukraine causing traders to increase inventories. The Metals Week Molybdenum Dealer Oxide weekly average price was $19.22 per pound on April 29, 2022.

26

CONSOLIDATED RESULTS

| Three Months Ended March 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

SUMMARY FINANCIAL DATA | (in millions, except per share amounts) | |||||||||||||

Revenuesa,b | $ | 6,603 | $ | 4,850 | ||||||||||

Operating incomea | $ | 2,809 | $ | 1,532 | ||||||||||

Net income attributable to common stockc | $ | 1,527 | d | $ | 718 | e | ||||||||

| Diluted net income per share of common stock | $ | 1.04 | $ | 0.48 | ||||||||||

Diluted weighted-average common shares outstanding | 1,469 | 1,477 | ||||||||||||

Operating cash flowsf | $ | 1,691 | $ | 1,075 | ||||||||||

Capital expenditures | $ | 723 | $ | 370 | ||||||||||

| At March 31: | ||||||||||||||

Cash and cash equivalents | $ | 8,338 | $ | 4,580 | ||||||||||

Total debt, including current portion | $ | 9,621 | $ | 9,809 | ||||||||||

a.Refer to Note 9 for a summary of revenues and operating income by operating division.

b.Includes favorable adjustments to prior period provisionally priced concentrate and cathode copper sales totaling $102 million ($42 million to net income attributable to common stock or $0.03 per share) in first-quarter 2022 and $146 million ($57 million to net income attributable to common stock or $0.04 per share) in first-quarter 2021 (refer to Note 6 for further discussion).

c.We defer recognizing profits on intercompany sales until final sales to third parties occur. Refer to “Operations – Smelting and Refining” for a summary of net impacts from changes in these deferrals.

d.Includes net charges totaling $38 million ($0.03 per share), primarily associated with the settlement of an administrative fine and an adjustment to prior-period export duties at PT-FI. These net charges, before income taxes and noncontrolling interests, were recorded to production and delivery ($43 million) and to revenues ($18 million).

e.Includes net charges totaling $38 million ($0.03 per share), primarily associated with contested matters at PT-FI (including an administrative fine levied by the Indonesia government and historical tax audits), employee separation charges in North America and asset retirement obligation adjustments. These charges, before income taxes and noncontrolling interests, were recorded to production and delivery ($37 million), interest expense, net ($4 million) and other income, net ($5 million), partly offset by credits recorded to environmental obligations and shutdown costs ($3 million).

f.Working capital and other uses totaled $811 million in first-quarter 2022 and $336 million in first-quarter 2021.

| Three Months Ended March 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| SUMMARY OPERATING DATA | ||||||||||||||

Copper (millions of recoverable pounds) | ||||||||||||||

| Production | 1,009 | 910 | ||||||||||||

| Sales, excluding purchases | 1,024 | 825 | ||||||||||||

| Average realized price per pound | $ | 4.66 | $ | 3.94 | ||||||||||

Site production and delivery costs per pounda | $ | 2.03 | $ | 1.86 | ||||||||||

Unit net cash costs per pounda | $ | 1.33 | $ | 1.39 | ||||||||||

Gold (thousands of recoverable ounces) | ||||||||||||||

| Production | 415 | 297 | ||||||||||||

Sales, excluding purchases | 409 | 258 | ||||||||||||

| Average realized price per ounce | $ | 1,920 | $ | 1,713 | ||||||||||

Molybdenum (millions of recoverable pounds) | ||||||||||||||

| Production | 21 | 20 | ||||||||||||

Sales, excluding purchases | 19 | 21 | ||||||||||||

| Average realized price per pound | $ | 19.30 | $ | 11.62 | ||||||||||

a.Reflects per pound weighted-average production and delivery costs and unit net cash costs (net of by-product credits) for all copper mines, before net noncash and other costs. For reconciliations of per pound unit costs (credits) by operating division to production and delivery costs applicable to sales reported in our consolidated financial statements, refer to “Product Revenues and Production Costs.”

27

Revenues

Consolidated revenues totaled $6.6 billion in first-quarter 2022 and $4.9 billion in first-quarter 2021. Revenues from our mining operations primarily include the sale of copper concentrate, copper cathode, copper rod, gold in concentrate and molybdenum. Refer to Note 9 for a summary of product revenues.

Following is a summary of changes in our consolidated revenues between periods (in millions):

| Three Months Ended March 31 | |||||||||||

| Consolidated revenues - 2021 period | $ | 4,850 | |||||||||

| Higher (lower) sales volumes: | |||||||||||

| Copper | 786 | ||||||||||

| Gold | 259 | ||||||||||

| Molybdenum | (16) | ||||||||||

| Higher average realized prices: | |||||||||||

| Copper | 737 | ||||||||||

| Gold | 85 | ||||||||||

| Molybdenum | 149 | ||||||||||

| Adjustments for prior period provisionally priced copper sales | (44) | ||||||||||