Form 10-Q FENNEC PHARMACEUTICALS For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2021

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from____ to ____

Commission File Number: 001-32295

FENNEC PHARMACEUTICALS INC.

(Exact Name of Registrant as Specified in Its Charter)

|

British Columbia, Canada (State or Other Jurisdiction of Incorporation or Organization |

20-0442384 (I.R.S. Employer Identification No.) |

|

PO Box 13628, 68 TW Alexander Drive Research Triangle Park, North Carolina (Address of Principal Executive Offices) |

27709 (Zip Code) |

Registrant's Telephone Number, Including Area Code: (919) 636-4530

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, no par value | FENC | Nasdaq Capital Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ¨ | Accelerated Filer | ¨ |

| Non-Accelerated Filer x | Smaller reporting company | x |

| Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

As of May 11, 2021, there were 26,002,853 common shares outstanding.

TABLE OF CONTENTS

Fennec Pharmaceuticals Inc.

Condensed Consolidated Balance Sheets

(U.S. Dollars and shares in thousands)

| March 31, 2021 | December 31, | |||||||

| (unaudited) | 2020 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 26,751 | $ | 30,344 | ||||

| Prepaid expenses | 619 | 797 | ||||||

| Other current assets | 455 | 276 | ||||||

| Total current assets | 27,825 | 31,417 | ||||||

| Total assets | $ | 27,825 | $ | 31,417 | ||||

| Liabilities and stockholders' equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 2,508 | $ | 1,571 | ||||

| Accrued liabilities | 384 | 776 | ||||||

| Total current liabilities | 2,892 | 2,347 | ||||||

| Commitments and Contingencies (Note 6) | ||||||||

| Stockholders' equity: | ||||||||

| Common stock, no par value; unlimited shares authorized; | ||||||||

| 26,003 shares issued and outstanding (2020-26,003) | 140,733 | 140,733 | ||||||

| Additional paid-in capital | 49,830 | 49,234 | ||||||

| Accumulated deficit | (166,873 | ) | (162,140 | ) | ||||

| Accumulated other comprehensive income | 1,243 | 1,243 | ||||||

| Total stockholders’ equity | 24,933 | 29,070 | ||||||

| Total liabilities and stockholders’ equity | $ | 27,825 | $ | 31,417 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 3 |

Fennec Pharmaceuticals Inc.

Condensed Consolidated Statements of Operations

(U.S. Dollars and shares in thousands, except per share amounts)

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | March 31, | |||||||

| 2021 | 2020 | |||||||

| Revenue | $ | - | $ | - | ||||

| Operating expenses: | ||||||||

| Research and development | 2,416 | 1,393 | ||||||

| General and administrative | 2,507 | 2,442 | ||||||

| Total operating expenses | 4,923 | 3,835 | ||||||

| Loss from operations | (4,923 | ) | (3,835 | ) | ||||

| Other (expense) income: | ||||||||

| Unrealized gain on securities | 182 | - | ||||||

| Other (loss) | (8 | ) | (9 | ) | ||||

| Amortization expense | - | (17 | ) | |||||

| Interest income | 16 | 35 | ||||||

| Total other income, net | 190 | 9 | ||||||

| Net loss | $ | (4,733 | ) | $ | (3,826 | ) | ||

| Basic net loss per common share | $ | (0.18 | ) | $ | (0.19 | ) | ||

| Diluted net loss per common share | $ | (0.18 | ) | $ | (0.19 | ) | ||

| Weighted-average number of common shares outstanding, basic | 26,003 | 19,896 | ||||||

| Weighted-average number of common shares outstanding, diluted | 26,003 | 19,896 | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 4 |

Fennec Pharmaceuticals Inc.

Condensed Consolidated Statements of Cash Flows

(U.S. Dollars in thousands)

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | March 31, | |||||||

| 2021 | 2020 | |||||||

| Cash flows used in: | ||||||||

| Operating activities: | ||||||||

| Net loss | $ | (4,733 | ) | $ | (3,826 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Amortization of deferred issuance cost | - | 17 | ||||||

| Unrealized gain on securities | (182 | ) | - | |||||

| Stock-based compensation - employees | 587 | 391 | ||||||

| Stock-based compensation - contractors | 9 | 21 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid assets | 178 | 6 | ||||||

| Other current assets | 3 | 6 | ||||||

| Accounts payable | 937 | 63 | ||||||

| Accrued liabilities | (392 | ) | (427 | ) | ||||

| Net cash used in operating activities | (3,593 | ) | (3,749 | ) | ||||

| Decrease in cash and cash equivalents | (3,593 | ) | (3,749 | ) | ||||

| Cash and cash equivalents - Beginning of period | 30,344 | 13,650 | ||||||

| Cash and cash equivalents - End of period | $ | 26,751 | $ | 9,901 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 5 |

Fennec Pharmaceuticals Inc.

Condensed Consolidated Statements of Stockholders' Equity

Three Months Ended March 31, 2021 and 2020

(U.S. dollars and shares in thousands)

(Unaudited)

| Accumulated | ||||||||||||||||||||||||

| Additional | Other | Total | ||||||||||||||||||||||

| Common Stock | Paid-in | Accumulated | Comprehensive | Stockholders' | ||||||||||||||||||||

| Number (Note 4) | Amount | Capital | Deficit | Income | Equity | |||||||||||||||||||

| Balance at December 31, 2020 | 26,003 | $ | 140,733 | $ | 49,234 | $ | (162,140 | ) | $ | 1,243 | $ | 29,070 | ||||||||||||

| Stock options issued to employees | - | - | 587 | - | - | 587 | ||||||||||||||||||

| Stock options issued to contractors | - | - | 9 | - | - | 9 | ||||||||||||||||||

| Net loss | - | - | - | (4,733 | ) | - | (4,733 | ) | ||||||||||||||||

| Balance at March 31, 2021 | 26,003 | $ | 140,733 | $ | 49,830 | $ | (166,873 | ) | $ | 1,243 | $ | 24,933 | ||||||||||||

| Balance at December 31, 2019 | 19,896 | $ | 106,392 | $ | 48,271 | $ | (144,031 | ) | $ | 1,243 | $ | 11,875 | ||||||||||||

| Stock options issued to employees | - | - | 391 | - | - | 391 | ||||||||||||||||||

| Stock options issued to contractors | - | - | 21 | - | - | 21 | ||||||||||||||||||

| Net loss | - | - | - | (3,826 | ) | - | (3,826 | ) | ||||||||||||||||

| Balance at March 31, 2020 | 19,896 | $ | 106,392 | $ | 48,683 | $ | (147,857 | ) | $ | 1,243 | $ | 8,461 | ||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 6 |

Fennec Pharmaceuticals Inc.

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

(U.S. dollars and shares in thousands, except per share information)

| 1. | Nature of Business and Going Concern |

Fennec Pharmaceuticals Inc., a British Columbia corporation (“Fennec,” the “Company,” “we,” “us,” or “our”), is a biopharmaceutical company focused on the development of PEDMARKTM (a unique formulation of sodium thiosulfate) for the prevention of platinum-induced ototoxicity in pediatric cancer patients. We have four wholly-owned subsidiaries: Oxiquant, Inc. and Fennec Pharmaceuticals, Inc., both Delaware corporations, Cadherin Biomedical Inc., a Canadian company, and Fennec Pharmaceuticals (EU) Limited (“Fennec Limited”), an Ireland company. With the exception of Fennec Pharmaceuticals, Inc., all subsidiaries are inactive.

These unaudited interim condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”) that are applicable to a going concern which contemplates that the Company will continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities in the normal course of business.

During the three months ended March 31, 2021, the Company incurred a loss from operations of $4,923. At March 31, 2021, the Company had an accumulated deficit of $166,900 million and had experienced negative cash flows from operating activities during the three months ended March 31, 2021 in the amount of $3,593.

On May 5, 2020, the Company announced the completion of an underwritten public offering of 4,800,000 common shares at a public offering price of $6.25 per share. In addition, Fennec issued an additional 660,204 common shares in connection with the partial exercise of the underwriters’ over-allotment option. The approximate total gross proceeds from the offering were $34,100 ($32,189 net of commissions, fees and issue costs).

On February 1, 2019, the Company’s wholly owned subsidiary Fennec Pharmaceuticals, Inc. entered into a Loan and Security Agreement (the “Loan and Security Agreement”) with Bridge Bank, a division of Western Alliance Bank, an Arizona corporation (“Bridge Bank”), pursuant to which Bridge Bank agreed to loan $12,500 to Fennec Pharmaceuticals, Inc., to be made available upon New Drug Application (“NDA”) approval of PEDMARKTM by the U.S. Food and Drug Administration (“FDA”) no later than September 30, 2020. The Loan and Security Agreement was amended on June 26, 2020 to increase the total potential amount of the loan to $18,000 and to extend the outside date to receive NDA approval of PEDMARKTM to December 31, 2020. In connection with this facility, the Company issued Bridge Bank a warrant to purchase up to 39,000 of the Company’s common shares at an exercise price of $6.80 per share, with an exercise period of ten years from the date of issuance subject to certain early termination conditions. Under Accounting Standards Codification ("ASC") 470-50, Modifications and Extinguishments, the amendment to the facility was considered a modification. As such, the Company had been amortizing the loan fee and the value of the warrant over the remainder of the loan term. Following receipt of the FDA’s Complete Response Letter (“CRL”) in August 2020, which identified deficiencies in the third-party manufacturing facility that manufactures PEDMARKTM on the Company’s behalf, the Company decided to fully amortize the remaining portions of the loan fee and the value of the warrants. The Loan and Security Agreement expired on December 31, 2020 as a result of the Company not obtaining NDA approval of PEDMARKTM by that date, with no amounts advanced under the facility prior to its termination. The warrant issued to Bridge Bank remains outstanding notwithstanding termination of the facility.

The Company believes the funds raised in its May 2020 public offering provide sufficient funding for the Company to carry out its planned activities, including NDA resubmission and, if approved, the commencement of commercialization efforts, for at least the next twelve months as it continues its strategic development of PEDMARKTM.

These financial statements do not reflect the potentially material adjustments in the carrying values of assets and liabilities, the reported expenses, and the balance sheet classifications used, that would be necessary if the going concern assumption were not appropriate.

| 7 |

Fennec Pharmaceuticals Inc.

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

(U.S. dollars and shares in thousands, except per share information)

| 2. | Significant Accounting Policies |

Basis of presentation

The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with US GAAP and are the responsibility of the Company’s management. These unaudited interim condensed consolidated financial statements do not include all of the information and notes required by US GAAP for annual financial statements. Accordingly, these unaudited interim condensed consolidated financial statements should be read in conjunction with the Company's audited consolidated financial statements and notes filed with the Securities and Exchange Commission (“SEC”) in the Company's Annual Report on Form 10-K for the year ended December 31, 2020. The Company's accounting policies are consistent with those presented in the audited consolidated financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2020. These unaudited interim condensed consolidated financial statements have been prepared in U.S. dollars. All amounts presented are in thousands except for per share amounts.

Use of estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that impact the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the interim condensed consolidated financial statements and the reported amounts of expense during the reporting period. Actual results could differ from those estimates.

In the opinion of management, these unaudited interim condensed consolidated financial statements include all adjustments, which are normal and recurring in nature, necessary for the fair presentation of the Company’s financial position at March 31, 2021 and to state fairly the results for the periods presented. The most significant estimates utilized during the quarter ended March 31, 2021 included estimates necessary to value grants of stock options to employees and various contractors, disclosed in Note 4.

New accounting pronouncements

In January 2021, the FASB issued ASU No. 2021-01, Reference Rate Reform (Topic 848). In this ASU, the FASB refines the scope of Topic 848 to clarify that certain optional expedients and exceptions therein for contract modifications and hedge accounting apply to contracts that are affected by the discounting transition. Specifically, modifications related to reference rate reform would not be considered an event that requires reassessment of previous accounting conclusions. The ASU also amends the expedients and exceptions in Topic 848 to capture the incremental consequences of the scope clarification and to tailor the existing guidance to derivative instruments affected by the discounting transition. The amendments in the ASU are effective immediately for all entities. Entities may choose to apply the amendments retrospectively as of any date from the beginning of an interim period that includes or is subsequent to March 12, 2020, or prospectively to new modifications from any date within an interim period that includes or is subsequent to January 7, 2021, up to the date that financial statements are available to be issued. The Company chose to apply amendments prospectively and concluded after evaluation that ASU 2021-01 has no significant effect on our condensed consolidated financial statements.

Cash and cash equivalents

Cash equivalents consist of highly liquid investments with original maturities at the date of purchase of three months or less. The Company places its cash and cash equivalents in investments held by highly rated financial institutions in accordance with its investment policy designed to protect the principal investment. At March 31, 2021, the Company had $26,751 in cash, savings and money market accounts ($30,344 at December 31, 2020). At March 31, 2021, the Company held $668 in cash of which $34 (as presented in U.S. dollars) was in Canadian dollars ($45 at December 31, 2020 as presented in U.S. dollars). At March 31, 2021, the Company held $26,083 in money market investments. Money market investments typically have minimal risks. While the Company has not experienced any loss or write-down of its money market investments, the amounts it holds in money market accounts are substantially above the $250,000 amount insured by the FDIC and may lose value.

Financial instruments

Financial instruments recognized on the balance sheets at March 31, 2021 and December 31, 2020 consist of cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities, the carrying values of which approximate fair value due to their relatively short time to maturity. The Company does not hold or issue financial instruments for trading.

| 8 |

Fennec Pharmaceuticals Inc.

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

(U.S. dollars and shares in thousands, except per share information)

The Company’s investment policy is to manage investments to achieve, in the order of importance, the financial objectives of preservation of principal, liquidity and return on investment. Investments, when made, are made in U.S. or Canadian bank securities, commercial paper of U.S. or Canadian industrial companies, utilities, financial institutions and consumer loan companies, and securities of foreign banks provided the obligations are guaranteed or carry ratings appropriate to the policy. Securities must have a minimum Dun & Bradstreet rating of A for bonds or R1 low for commercial paper.

The policy risks are primarily the opportunity cost of the conservative nature of the allowable investments. As the main purpose of the Company is research and development, the Company has chosen to avoid investments of a trading or speculative nature.

Revenue

The Company's revenue is generated through sales of intellectual property (“IP”). The Company generates its revenue through one segment and the revenue recognized under each of the Company's arrangements during the current period is described below. The terms of these agreements may contain multiple promised goods or services or optional goods and services, including licenses to product candidates, referred to as exclusive licenses, as well as research and development activities to be performed by the Company on behalf of the collaboration partner related to the licensed product candidates.

Revenue recognition

Revenue is recognized when control of the promised goods or services are transferred to customers in an amount that reflects the consideration the Company expects to be entitled to in exchange for transferring those goods or providing services. The Company accounts for a contract when it has approval and commitment from both parties, the rights of the parties are identified, payment terms are identified, the contract has commercial substance and collectability of consideration is probable.

When determining whether the customer has obtained control of the goods or services, the Company considers the point at which the customer may benefit from the goods or services. For sale of IP to, revenue is recognized upon grant or transfer of the IP, as the Company's IP is considered functional in nature.

Performance obligations

A performance obligation is a promise in a contract to transfer a distinct good or service to the customer and is the unit of account in ASC 606. A contract’s transaction price is allocated to each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied. The Company's contracts may contain multiple performance obligations if a promise to transfer goods or services is separately identifiable from other promises in a contract and, therefore, is considered distinct. For contracts with multiple performance obligations, the Company determines the standalone selling price of each performance obligation and allocates the total transaction price using the relative selling price basis. The Company recognizes performance obligations based on their nature.

Significant payment terms

The Company’s revenue arrangements include payments to the Company of one or more of the following: a non-refundable, upfront payment; milestone payments and royalties on commercial sales of IP product candidates, if any. To date, the Company has received upfront payments and several milestone payments but has not received any license or option fees or earned royalty revenue as a result of product sales.

Under ASC 606, the Company estimates the amount of consideration to which it will be entitled in exchange for satisfying performance obligations. Based on the Company’s current contracts, variable consideration primarily exists in the following forms: development and regulatory milestones, royalties and sales-based milestones. The Company utilizes the "most likely amount" variable consideration method for estimating development and regulatory milestone consideration to include in the transaction price. The Company only includes an amount of variable consideration in the transaction price to the extent it is probable that a significant reversal in the cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. The Company refers to this as the variable consideration constraint.

| 9 |

Fennec Pharmaceuticals Inc.

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

(U.S. dollars and shares in thousands, except per share information)

Due to the uncertainty associated with the occurrence of the underlying events which would trigger development and regulatory milestone consideration under its revenue arrangements, with the exception of certain initial conditions precedent milestones, the Company has concluded the variable consideration associated with all development and regulatory milestones to be fully constrained as of the ASC 606 transition date and as of March 31, 2021, and therefore has not included such consideration in the transaction price for any of its revenue arrangements. The Company will reassess this conclusion at each subsequent reporting period and will only include amounts associated with regulatory or development milestones in the transaction price when, or if, the variable consideration is determined to be released from the constraint.

In accordance with ASC 606, the Company is required to adjust the transaction price for the effects of the time value of money if the timing of payments agreed to by the parties to the contract, explicitly or implicitly, provides the Company or its customer with a significant benefit of financing the transfer of goods or services. The Company concluded that its licensing and collaboration arrangements do not contain a significant financing component because the payment structure of its agreements arise from reasons other than providing a significant benefit of financing.

Contract assets

The Company did not have a contract asset as of March 31, 2021 or December 31, 2020.

Contract liabilities

The Company did not have a contract liability as of March 31, 2021 or December 31, 2020.

Revenue arrangements

Elion

In May 2016, the Company sold Eniluracil to Elion Oncology, LLC (“Elion”). The agreement called for $40,000 in cash and 5% royalties to be paid to Fennec for any income derived from the sale of Eniluracil. The agreement was for the sale, not license of IP. In addition, the agreement did not call for any additional good or service beyond the transfer of IP and related assets (e.g. “all information and know-how”, documentation, etc.).

In August 2020, Elion entered into a license agreement with Processa Pharmaceuticals, Inc. (“Processa”). The license agreement called for equity and cash upon satisfying the Condition Precedent, along with development and regulatory milestone payments, Sales Milestone Payments, and Product Royalties. The grant of the license was conditioned upon the “Condition Precedent” which was defined as (i) Processa’s closing of a public offering by October 30, 2020 in which Processa raised at least $15M and (ii) Processa’s shares being listed on NASDAQ. Upon satisfying the Condition Precedent, which occurred in October 2020, Elion was entitled to receive $100,000 in cash and 825,000 in shares of Processa of which the Company is entitled to 5%. As a result, in January 2021, the Company received $5,000 in cash and 41,250 restricted shares of Processa common shares.

The agreement between Elion and Processa entitles Elion to the payments outlined in the table below. Fennec would be eligible to receive 5% of the following based on future milestone events:

| Milestone Event | Milestone Payment ($) |

| 1st Year Anniversary of Effective Date | 100,000 Restricted Shares |

| 2nd Year Anniversary of Effective Date | 100,000 Restricted Shares |

| 1st Patient in Dose Confirmation Study | 100,000 Restricted Shares |

| NDA Submission | 300,000 Restricted Shares |

| 1st FDA Approval in US | $5,000,000 |

| 2nd FDA Approval in US | $3,000,000 |

| 1st Regulatory Approval Outside US | $2,000,000 |

| 2nd Regulatory Approval Outside US | $2,000,000 |

Since the Condition Precedent was achieved, and only the passage of time must occur in order for the 1st and 2nd Year Anniversary payments to become due, the Company concluded the 1st and 2nd Year Anniversary milestone payments are also probable of coming to fruition and thus were included in the transaction price during the 4th quarter of 2020 along with the aforementioned Condition Precedent payments.

| 10 |

Fennec Pharmaceuticals Inc.

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

(U.S. dollars and shares in thousands, except per share information)

The arrangement with Elion contains consideration that is variable based on the Processa’s achievement of the above referenced development and regulatory milestones. The next milestone payment the Company may be entitled to receive is 5,000 restricted shares for 1st patient in Dose Confirmation Study and then another 15,000 restricted shares for the NDA submission. These are considered variable consideration that is fully constrained due to the uncertainty associated with the achievement of the development milestone. The considerations related to royalties (first and second FDA approval in US and first and second regulatory approval outside of US) are also variable consideration that are fully constrained in accordance with the royalty recognition constraint. The variable consideration related to royalties will be recognized in the period the products are sold by Processa and the Company has a present right to payment.

The Company recognized $0.2 million in revenue associated with the aforementioned cash and shares it became entitled to for the year ended December 31, 2020. Due to the one year lockup provision on the Processa shares, the Company deemed it reasonable to apply a liquidity discount of 20% to the valuation of the shares associated with the achievement of the Condition Precedent. Shares associated with the one- and two-year anniversary milestones had a 30% and 40% liquidity discount applied to their fair market valuations. Recognizing the passage of time, the Company adjusted its liquidity discount to the original shares of 15% and then 25 and 30% for the one- and two-year anniversary tranches.

Subsequent changes to the fair value of the underlying securities are recognized as unrealized gains or losses on marketable equity securities within the consolidated statement of operations and comprehensive loss. During the quarter ended March 31, 2021, the Company reported $182 in unrealized gain on the fair value of the underlying Processa shares.

3. Loss per Share

Earnings per common share is presented under two formats: basic earnings per common share and diluted earnings per common share. Basic earnings per common share is computed by dividing net income attributable to common shareholders by the weighted average number of common shares outstanding during the period. Diluted earnings per common share is computed by dividing net income by the weighted average number of common shares outstanding during the period, plus the potentially dilutive impact of common stock equivalents (i.e. stock options and warrants). Dilutive common share equivalents consist of the incremental common shares issuable upon exercise of stock options and warrants. The following table sets forth the computation of basic and diluted net loss per share:

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Numerator: Net (loss) | $ | (4,733 | ) | $ | (3,826 | ) | ||

| Denominator: | ||||||||

| Weighted-average common shares, basic | 26,003 | 19,896 | ||||||

| Dilutive effect of stock options | - | - | ||||||

| Dilutive effect of warrants | - | - | ||||||

| Incremental dilutive shares | - | - | ||||||

| Weighted-average common shares, dilutive | 26,003 | 19,896 | ||||||

| Net (loss) per share, basic and diluted | $ | (0.18 | ) | $ | (0.19 | ) | ||

The following outstanding options and warrants were excluded from the computation of basic and diluted net loss per share for the periods presented because including them would have had an anti-dilutive effect:

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Options to purchase common stock | 2,952 | 3,088 | ||||||

| Warrants to purchase common stock | 39 | 39 | ||||||

| 11 |

Fennec Pharmaceuticals Inc.

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

(U.S. dollars and shares in thousands, except per share information)

4. Stockholders' Equity

Authorized capital stock

The Company’s authorized capital stock consists of an unlimited number of common shares, no par value per share.

Warrants to Purchase Common Stock

During the three months ended March 31, 2021 and 2020, there were no warrants issued or exercised. Outstanding warrants have a weighted average life of 7.85 years on March 31, 2021. The following tables detail the Company’s warrant activity for the three months ended March 31, 2021 and 2020, respectively:

Investor Warrants | Common Shares Issuable Upon Exercise of Outstanding Warrants | Weighted-Average Exercise Price $USD | ||||||

| Outstanding December 31, 2020 | 39 | 6.80 | ||||||

| Issued | - | - | ||||||

| Outstanding March 31, 2021 | 39 | 6.80 | ||||||

| Total | 39 | 6.80 | ||||||

Investor Warrants | Common Shares Issuable Upon Exercise of Outstanding Warrants | Weighted-Average Exercise Price $USD | ||||||

| Outstanding December 31, 2019 | 39 | 6.80 | ||||||

| Issued | - | - | ||||||

| Outstanding March 31, 2020 | 39 | 6.80 | ||||||

| Total | 39 | 6.80 | ||||||

Stock option plan

Equity Incentive Plan

The Compensation Committee of the Board of Directors administers the Company’s equity incentive plan (the “Plan”). The Compensation Committee designates eligible participants to be included under the Plan and approves the number of options to be granted from time to time under the Plan. Currently, the maximum number of option shares issuable under the Plan, together with the Company’s prior stock option plan, is twenty-five percent (25%) of the total number of issued and outstanding common shares. Based upon the current shares outstanding, a maximum of 6,501 shares of common stock are authorized for issuance pursuant to stock options or other equity awards granted under the Plan. For all options issued under the Plan, the exercise price is the fair value of the underlying shares on the date of grant. All options vest within three years or less and are exercisable for a period of ten years from the date of grant. The Plan allows the issuance of Canadian and U.S. dollar grants. The table below outlines recognized contractor and employee expense from option awards for the three month periods ended March 31, 2021 and 2020.

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Contractor options expense recognized | $ | 9 | $ | 21 | ||||

| Employee options expense recognized | 587 | 391 | ||||||

| Total option expense recognized | $ | 596 | $ | 412 | ||||

Stock option activity

The following is a summary of option activity for the three months ended March 31, 2021 and 2020 for stock options denominated in U.S. and Canadian dollars. As of August 2020, there were no Canadian denominated options outstanding.

| Number of | Weighted-Average | |||||||

| US Denominated Options | Options (thousands) | Exercise Price $USD | ||||||

| Outstanding December 31, 2020 | 2,952 | $ | 4.82 | |||||

| Granted | - | - | ||||||

| Exercised | - | - | ||||||

| Outstanding at March 31, 2021 | 2,952 | $ | 4.82 | |||||

| 12 |

Fennec Pharmaceuticals Inc.

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

(U.S. dollars and shares in thousands, except per share information)

| Number of | Weighted-Average Exercise | |||||||

| US Denominated Options | Options (thousands) | Price $USD and $CAD | ||||||

| Outstanding December 31, 2019 | 3,088 | $ | 3.59 | (1) | ||||

| Granted | - | - | ||||||

| Exercised | - | - | ||||||

| Outstanding at March 31, 2020 | 3,088 | $ | 3.56 | (2) | ||||

| 1. | Figure represents 2,440 US denominated with a weighted average price of $4.05, and 648 $CAD denominated options with a weighted average price of $1.87 translated at $CAD/$USD 0.768174. |

2. Figure represents 2,440 US denominated with a weighted average price of $4.05, and 648 $CAD denominated options with a weighted average price of $1.72 translated at $CAD/$USD 0.70978.

During the three month periods ended March 31, 2021 and 2020, there was no US denominated option activity. Of the 2,952 options granted and outstanding at March 31, 2021, 2,154 are fully vested and exercisable.

| 5. | Fair Value Measurements |

The Company has adopted ASC 820 the Fair Value Measurements and Disclosure Topic of the FASB. This Topic applies to certain assets and liabilities that are being measured and reported on a fair value basis. The Fair value Measurements Topic defines fair value, establishes a framework for measuring fair value in accordance with US GAAP, and expands disclosure about fair value measurements. This Topic enables the reader of the financial statements to assess the inputs used to develop those measurements by establishing a hierarchy for ranking the quality and reliability of the information used to determine fair values. The Topic requires that financial assets and liabilities carried at fair value be classified and disclosed in one of the following three categories:

Level 1: Quoted market prices in active markets for identical assets or liabilities.

Level 2: Observable market-based inputs or unobservable inputs that are corroborated by market data.

Level 3: Unobservable inputs that are not corroborated by market data.

| Quoted Price in Active Market for Identical Instruments |

Significant Other Observable Inputs |

Significant |

||||||||||||||||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 668(1) | $ | 678(1) | $ | 26,083 | $ | 29,666 | $ | - | $ | - | $ | 26,751 | $ | 30,344 | ||||||||||||||||

| Processa common shares | - | - | 182(2) | - | - | 182 | - | |||||||||||||||||||||||||

| (1) | The Company held approximately, $668 in cash as of March 31, 2021, of which approximately, $34 was in Canadian funds (translated into U.S. dollars). As of December 31, 2020, the Company held approximately $347 of which approximately $45 was in Canadian funds (translated into U.S. dollars). |

| (2) | The Company received 41,250 restricted common shares of Processa (PSCA). The share restriction will expire in three tranches: 50%, 25% and 25% at the 6, 9 and 12 month intervals, respectively from October 30, 2020. At October 30, 2020 Processa shares were trading at $4.11 per share. The Company originally applied a 20%, 30% and 40% liquidity discount to the shares and will mark to market at each balance sheet date. |

| 13 |

Fennec Pharmaceuticals Inc.

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

(U.S. dollars and shares in thousands, except per share information)

6. Commitments and Contingencies

Oregon Health & Science University Agreement

On February 20, 2013, Fennec entered into a new exclusive license agreement with Oregon Health & Science University (“OHSU”) for exclusive worldwide license rights to intellectual property directed to thiol-based compounds, including PEDMARKTM, and their use in oncology (the "OHSU Agreement"). OHSU will receive certain milestone payments, royalty on net sales for licensed products and a royalty on any consideration received from sublicensing of the licensed technology.

On May 18, 2015, Fennec negotiated an amendment ("Amendment 1") to the OHSU Agreement, which expands Fennec’s exclusive license to include the use of N-acetylcysteine as a standalone therapy and/or in combination with sodium thiosulfate for the prevention of ototoxicity induced by chemotherapeutic agents to treat cancers. Further, Amendment 1 adjusts select milestone payments entered in the OHSU Agreement including but not limited to the royalty rate on net sales for licensed products, royalty rate from sublicensing of the licensed technology and the fee payable upon the regulatory approval of a licensed product.

The term of the OHSU Agreement as amended by Amendment 1 expires on the date of the last to expire claim(s) covered in the patents licensed to Fennec or 8 years, whichever is later. In the event a licensed product obtains regulatory approval and is covered by the Orphan Drug Designation, the parties will in good faith amend the term of the agreement. Sodium thiosulfate is currently protected by methods of use patents that the Company exclusively licensed from OHSU that expire in Europe in 2021 and that expire in the United States in 2038. The OHSU Agreement is terminable by either Fennec or OHSU in the event of a material breach of the agreement by either party after 45 days prior written notice. Fennec also has the right to terminate the OHSU Agreement at any time upon 60 days prior written notice and payment of all fees due to OHSU under the OHSU Agreement.

Securities Class Action Suit

Following the FDA’s CRL regarding our NDA for PEDMARKTM as described in Note 1, a putative lawsuit was filed against us purportedly on behalf of purchasers of the Company’s securities between December 20, 2018 and August 10, 2020. The lawsuit seeks to recover damages for Fennec investors under federal securities laws. While we believe that the lawsuit is without merit and intend to vigorously defend against it, the lawsuit is in its early stages and no assessment can be made as to its likely outcome or whether the outcome will be material to us. This litigation, and any other securities class actions that may be brought against us, could result in substantial costs and a diversion of our management’s attention and resources.

Executive Severance

In the event of his termination with us other than for cause, we will be obligated to pay Mr. Raykov a one-time severance payment equal to twelve months of salary ($442,900 as of March 31, 2021). In the event of his termination with us other than for cause, we will be obligated to pay Mr. Andrade a one-time severance payment equal to six months of salary ($160,423 as of March 31, 2021). In the event of her termination with us other than for cause, we will be obligated to pay Ms. Goel a one-time severance payment equal to three months of salary ($92,700 as of March 31, 2021).

Leases

We have an operating lease in Research Triangle Park, North Carolina utilizing small space within a commercial building. The operating lease has payments of $400 per month with no scheduled increases. This operating lease is terminable with 30 days’ notice and has no penalties or contingent payments due.

On January 23, 2020, the Company entered into an Office Service Agreement (the “Office Service Agreement”) with Regus to lease office space at in Hoboken, New Jersey. Per the terms of the Office Service Agreement, the monthly rent payments are $1,441. The Company was required to pay a security deposit of $2,300, which is the equivalent to two months of rent. The Office Service Agreement commenced on January 27, 2020 and terminates on July 31, 2020, thereafter the lease may continue on a month-to-month basis with either party being able to terminate the agreement by providing one months' advance written notice of termination.

| 14 |

Fennec Pharmaceuticals Inc.

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

(U.S. dollars and shares in thousands, except per share information)

COVID-19

Our operations may be affected by the ongoing COVID-19 pandemic. The ultimate disruption which may be caused by the outbreak is uncertain; however, it may result in a material adverse impact on our financial position, operations and cash flows. Possible effects may include, but are not limited to, disruption to our product launch which includes the ability of sales reps to communicate with oncologists, absenteeism in our labor workforce, unavailability of products and supplies used in operations, and a decline in value of our assets, including inventories, property and equipment, and marketable securities. COVID-19 has not had a material effect on our operations to date as we have historically had a workforce which works remotely, preparations for product launch have been under the assumption of a virtual launch, and product supplies have not been impacted.

| 7. | Subsequent Events |

Management has evaluated subsequent events through the date of this filing and concluded there are no events of significance which require disclosure.

| 15 |

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

CAUTIONARY STATEMENT

This section and other parts of this Quarterly Report on Form 10-Q contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Forward-looking statements can be identified by words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “can,” “may,” and similar terms. Forward-looking statements are not guarantees of future performance and our actual results may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such differences include, but are not limited to, those discussed in Part I, Item 1A of the our Annual Report on Form 10-K for the year ended December 31, 2020 under the heading “Risk Factors.” We assume no obligation to revise or update any forward-looking statements for any reason, except as required by law.

The following discussion should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2020 and the condensed consolidated financial statements and accompanying notes included elsewhere in this report.

Overview

Product Candidate PEDMARKTM

Our only product candidate in the clinical stage of development is:

| · | PEDMARKTM (sodium thiosulfate (STS) anhydrous injection). We have announced results of two Phase 3 clinical trials for the prevention of cisplatin induced hearing loss, or ototoxicity in children, including the pivotal Phase 3 study SIOPEL 6, “A Multicentre Open Label Randomised Phase 3 Trial of the Efficacy of Sodium Thiosulfate in Reducing Ototoxicity in Patients Receiving Cisplatin Chemotherapy for Standard Risk Hepatoblastoma,” and the proof of concept Phase 3 study in collaboration with the Children’s Oncology Group (“COG ACCL0431”) “A Randomized Phase 3 Study of Sodium Thiosulfate for the Prevention of Cisplatin-Induced Ototoxicity in Children”. COG ACCL0431 final results were published in the Lancet Oncology in 2016. SIOPEL 6 final results were published in the New England Journal of Medicine in June 2018. |

We continue to focus our resources on the development of PEDMARKTM.

We have licensed from OHSU intellectual property rights for the use of PEDMARKTM as a chemoprotectant and are developing PEDMARKTM as a protectant against the hearing loss often caused by platinum-based anti-cancer agents in children. Preclinical and clinical studies conducted by OHSU and others have indicated that PEDMARKTM can effectively reduce the incidence of hearing loss caused by platinum-based anti-cancer agents.

Hearing loss among children receiving platinum-based chemotherapy is frequent, permanent and often severely disabling. The incidence of hearing loss in these children depends upon the dose and duration of chemotherapy, and many of these children require lifelong hearing aids. In addition, adults undergoing chemotherapy for several common malignancies, including ovarian cancer, testicular cancer, and particularly head and neck cancer and brain cancer, often receive intensive platinum-based therapy and may experience severe, irreversible hearing loss, particularly in the high frequencies.

We estimate in the U.S. and Europe that annually over 10,000 children with solid tumors are treated with platinum agents. The vast majority of these newly diagnosed tumors are localized and classified as low to intermediate risk in nature. These localized cancers may have overall survival rates of greater than 80%, further emphasizing the importance of quality of life after treatment. The incidence of hearing loss in these children depends upon the dose and duration of chemotherapy, and many of these children require lifelong hearing aids. There is currently no established preventive agent for this hearing loss and only expensive, technically difficult and sub-optimal cochlear (inner ear) implants have been shown to provide some benefit. Infants and young children at critical stages of development lack speech language development and literacy, and older children and adolescents lack speech language development and literacy, and older children and adolescents lack social-emotional development and educational achievement.

| 16 |

In March 2018, PEDMARKTM received Breakthrough Therapy and Fast Track designations from the U.S. FDA. Further, PEDMARKTM has received Orphan Drug Designation in the U.S. in this setting.

We initiated our rolling NDA for PEDMARKTM for the prevention of ototoxicity induced by cisplatin chemotherapy patients 1 month to < 18 years of age with localized, non-metastatic, solid tumors with the FDA in December 2018. We announced that we had submitted full completion of the NDA in February 2020. On April 13, 2020, we announced that the FDA had accepted for filing and granted Priority Review for our NDA. The FDA set a Prescription Drug Fee Act (“PDUFA”) target action date of August 10, 2020 for the completion of the FDA’s review. On August 10, 2020, we announced that we received a CRL from the FDA regarding our NDA for PEDMARKTM, which identified deficiencies in the third-party manufacturing facility that manufactures PEDMARKTM on our behalf. Importantly, no clinical safety or efficacy issues were identified during the review and there is no requirement for further clinical data. In the fourth quarter of 2020, we engaged in a Type A meeting with the FDA concerning the CRL that we believe was constructive and collaborative. We are working closely with our third-party drug manufacturer and the FDA to fully address the CRL, and we plan to resubmit our NDA for PEDMARKTM in the second quarter of 2021.

In August 2018, the Pediatric Committee (“PDCO”) of the European Medicines Agency (“EMA”) accepted our pediatric investigation plan (PIP) for sodium thiosulfate with the trade name Pedmarqsi for the condition of the prevention of platinum-induced hearing loss. An accepted PIP is a prerequisite for filing a Marketing Authorization Application (“MAA”) for any new medicinal product in Europe. The indication targeted by our PIP is for the prevention of platinum-induced ototoxic hearing loss for standard risk hepatoblastoma (SR-HB). Additional tumor types of the proposed indication will be subject to the Committee for Medicinal Products for Human Use (“CHMP”) assessment at the time of the MAA. No deferred clinical studies were required in the positive opinion given by PDCO. We were also advised that sodium thiosulfate (tradename to be determined) is eligible for submission of an application for a Pediatric Use Marketing Authorization (“PUMA”). A PUMA is a dedicated marketing authorization covering the indication and appropriate formulation for medicines developed exclusively for use in the pediatric population and provides data and market protection up to 10 years. Therefore, this decision allows us to proceed with the submission of a PUMA in the European Union (EU) with incentives of automatic access to the centralized procedure and up to 10 years of data and market protection. In February 2020, we announced that we had submitted a MAA for the prevention of ototoxicity induced by cisplatin chemotherapy patients 1 month to < 18 years of age with localized, non-metastatic, solid tumors.

In August 2018, the Pediatric Committee (PDCO) of the European Medicines Agency (EMA) accepted our pediatric investigation plan (PIP) for sodium thiosulfate with the trade name Pedmarqsi for the condition of the prevention of platinum-induced hearing loss. An accepted PIP is a prerequisite for filing a Marketing Authorization Application (MAA) for any new medicinal product in Europe. The indication targeted by the Company’s PIP is for the prevention of platinum-induced ototoxic hearing loss for standard risk hepatoblastoma (SR-HB). Additional tumor types of the proposed indication will be subject to the Committee for Medicinal Products for Human Use (CHMP) assessment at the time of the MAA. No deferred clinical studies were required in the positive opinion given by PDCO. The Company was also advised that sodium thiosulfate (tradename to be determined) is eligible for submission of an application for a Pediatric Use Marketing Authorization (PUMA). Therefore, this decision allows Fennec to proceed with the submission of a PUMA in the European Union (EU) with incentives of automatic access to the centralized procedure and up to 10 years of data and market protection The PUMA is a dedicated marketing authorization covering the indication and appropriate formulation for medicines developed exclusively for use in the pediatric population and provides data and market protection up to 10 years. In February 2020, Fennec announced that it has submitted a MAA for the prevention of otoxicity induced by cisplatin chemotherapy patients 1 month to < 18 years of age with localized, non-metastatic, solid tumors.

Clinical Studies

PEDMARKTM has been studied by cooperative groups in two Phase 3 clinical studies of survival and reduction of ototoxicity, COG ACCL0431 and SIOPEL 6. Both studies have been completed. The COG ACCL0431 protocol enrolled one of five childhood cancers typically treated with intensive cisplatin therapy for localized and disseminated disease, including newly diagnosed hepatoblastoma, germ cell tumor, osteosarcoma, neuroblastoma, and medulloblastoma. SIOPEL 6 enrolled only hepatoblastoma patients with localized tumors.

| 17 |

SIOPEL 6

In October 2007, we announced that our collaborative partner, the International Childhood Liver Tumour Strategy Group, known as SIOPEL, a multi-disciplinary group of specialists under the umbrella of the International Society of Pediatric Oncology, had launched a randomized Phase 3 clinical trial SIOPEL 6 to investigate whether STS reduces hearing loss in standard risk hepatoblastoma (liver) cancer patients receiving cisplatin as a monotherapy.

The study was initiated in October 2007 initially in the United Kingdom and completed enrollment at the end of 2014. 52 sites from 11 countries enrolled 109 evaluable patients. Under the terms of our agreement, SIOPEL conducted and funded all clinical activities and we provided drug, drug distribution and pharmacovigilance, or safety monitoring, for the study. SIOPEL 6 was completed in December 2014 and the final results of SIOPEL 6 were published in The New England Journal of Medicine in June 2018.

The primary objectives of SIOPEL 6 were:

| · | To assess the efficacy of sodium thiosulfate to reduce the hearing impairment caused by cisplatin. |

| · | To carefully monitor any potential impact of sodium thiosulfate on response to cisplatin and survival. |

SIOPEL 6 - Results

Background / Objectives:

Bilateral high-frequency hearing loss is a serious permanent side-effect of cisplatin therapy, particularly debilitating when occurring in young children. STS has been shown to reduce cisplatin induced hearing loss. SIOPEL 6 was a Phase 3 randomized trial to assess the efficacy of STS in reducing ototoxicity in young children treated with cisplatin (Cis) for Standard Risk Hepatoblastoma (SR-HB).

Design / Methods:

Newly diagnosed patients with SR-HB, defined as tumor limited to PRETEXT I, II or III, no portal or hepatic vein involvement, no intra-abdominal extrahepatic disease, AFP >100ng/ml and no metastases, were randomized to Cis or Cis+STS for 4 preoperative and 2 postoperative courses. Cisplatin 80mg/m2 was administered over 6 hours, STS 20g/m2 was administered intravenously over 15 minutes exactly 6 hours after stopping cisplatin. Tumor response was assessed after 2 and 4 preoperative cycles with serum AFP and liver imaging. In case of progressive disease (PD), STS was to be stopped and doxorubicin 60mg/m2 combined with cisplatin. The primary endpoint was centrally reviewed absolute hearing threshold, at the age of ≥3.5 years by pure tone audiometry.

Results:

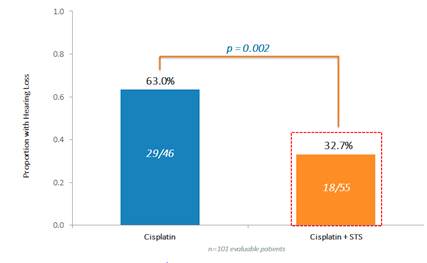

109 randomized patients (52 Cisplatin only ("Cis") and 57 Cis+STS) were evaluable. The combination of Cis+STS was generally well tolerated. With a patient follow-up time of 52 months, the three-year Event Free Survival ("EFS") for Cis was 78.8% Cisplatin and 82.1% for the Cis + STS. The three-year Overall Survival ("OS") is 92.3% for Cis and 98.2% for Cis + STS. Treatment failure defined as Progressive Disease ("PD") at 4 cycles was equivalent in both arms. Among the first 101 evaluable patients, hearing loss occurred in 29/46=63.0% under Cis and in 18/55=32.7% under Cis +STS, corresponding to a relative risk of 0.52(P=0.002).

| 18 |

Conclusions:

This randomized Phase 3 trial in SR-HB of cisplatin versus cisplatin plus STS shows that the addition of STS significantly reduces the incidence of cisplatin-induced hearing loss without any evidence of tumor protection.

COG ACCL0431

In March 2008, we announced the activation of a Phase 3 trial with STS to prevent hearing loss in children receiving cisplatin-based chemotherapy in collaboration with the Children’s Oncology Group. The goal of this Phase 3 study was to evaluate in a multi-centered, randomized trial whether STS is an effective and safe means of preventing hearing loss in children receiving cisplatin-based chemotherapy for newly diagnosed germ cell, liver (hepatoblastoma), brain (medulloblastoma), nerve tissue (neuroblastoma) or bone (osteosarcoma) cancers. Eligible children, one to eighteen years of age, were to receive cisplatin according to their disease-specific regimen and, upon enrollment in this study, were randomized to receive STS or not. Efficacy of STS was determined through comparison of hearing sensitivity at follow-up relative to baseline measurements using standard audiometric techniques. The Children’s Oncology Group was responsible for funding the clinical activities for the study and we were responsible for providing the drug, drug distribution and pharmacovigilance, or safety monitoring, for the study. The trial completed enrollment of 131 pediatric patients in the first quarter of 2012. The final results of COG ACCL0431 were published in Lancet Oncology in December 2016.

COG ACCL0431 - Results

COG Study ACCL0431, “A Randomized Phase 3 Study of Sodium Thiosulfate for the Prevention of Cisplatin-Induced Ototoxicity in Children,” finished enrollment of 131 patients of which 125 were eligible patients. The patients had been previously diagnosed with childhood cancers.

The primary endpoint was to evaluate the efficacy of STS for prevention of hearing loss in children receiving cisplatin chemotherapy (hypothesis: 50% relative reduction in hearing loss).

Secondary endpoints included:

| · | Compare change in mean hearing thresholds. |

| · | Compare incidence of other Grade 3/4 toxicities (renal and hematological). |

| · | Monitor Event Free Survival (EFS) and Overall Survival (OS) in two groups. |

125 eligible subjects were enrolled with germ cell tumor (32), osteosarcoma (29), neuroblastoma (26), medulloblastoma/pnet (26), hepatoblastoma (7), or other (5). Of these, 104 subjects (64 male and 29 <5 years old) were evaluable for the primary endpoint.

Subjects were randomized either to no treatment (control) or treatment with STS 16 grams/m2 IV over 15 minutes, 6 hours after each cisplatin dose. Hearing was measured using standard audiometry for age and data was reviewed centrally using American Speech-Language-Hearing Association criteria.

| 19 |

The proportion of subjects with hearing loss assessed at 4 weeks post the final cisplatin dose (primary endpoint):

| · | The proportion of hearing loss for STS vs. Control was 28.6% (14/49) vs. 56.4% (31/55), respectively (p=0.004). |

| · | In a predefined subgroup of patients less than 5 years old with 29 eligible subjects: STS vs. Control was 21.4% (3/14) vs. 73.3% (11/15), respectively (p=0.005). |

Conclusions:

| · | STS protects against cisplatin-induced hearing loss in children across a heterogeneous range of tumor types, with even stronger efficacy in the protocol predefined subgroup of patients under five years old, and is not associated with serious adverse events attributed to its use. |

| · | Further potential clinical use will be informed by the final results of SIOPEL 6 study. |

Capital Funding

We have not received and do not expect to have significant revenues from our product candidate until we are either able to sell our product candidate after obtaining applicable regulatory approvals or we establish collaborations that provide us with up-front payments, licensing fees, milestone payments, royalties or other revenue.

We generated a net loss of approximately $4.7 million for the three months ended March 31, 2021 and a net loss of $3.8 million for the three months ended March 31, 2020. As of March 31, 2021, our accumulated deficit was approximately $166.9 million ($162.1 million at December 31, 2020).

We believe that our cash and cash equivalents as of March 31, 2021, which totaled $26.8 million, will be sufficient to meet our cash requirements through the at least the next twelve months, including anticipated NDA approval and, if approved, the first commercial launch of PEDMARKTM in the United States. Our projections of our capital requirements are subject to substantial uncertainty, and more capital than we currently anticipate may be required thereafter. To finance our continuing operations, we may need to raise substantial additional funds through either the sale of additional equity, the issuance of debt, the establishment of collaborations that provide us with funding, the out-license or sale of certain aspects of our intellectual property portfolio or from other sources. We may not be able to raise the necessary capital, or such funding may not be available on financially acceptable terms if at all. If we cannot obtain adequate funding in the future, we might be required to further delay, scale back or eliminate certain research and development studies, consider business combinations, or even shut down some, or all, of our operations.

Our operating expenses will depend on many factors, including the progress of our drug development efforts and efficiency of our operations and current resources. Our research and development expenses, which include expenses associated with our clinical trials, drug manufacturing to support clinical programs, stock-based compensation, consulting fees, sponsored research costs, toxicology studies, license fees, milestone payments, and other fees and costs related to the development of our product candidate, will depend on the availability of financial resources, the results of our clinical trials, and any directives from regulatory agencies, which are difficult to predict. Our general and administration expenses include expenses associated with the compensation of employees, stock-based compensation, professional fees, consulting fees, insurance and other administrative matters associated in support of our drug development programs.

| 20 |

Results of Operations

Three months ended March 31, 2021 versus three months ended March 31, 2020:

| Three Months | Three Months | |||||||||||||||||||

| Ended | Ended | |||||||||||||||||||

| In thousands of U.S. Dollars | March 31, 2021 | % | March 31, 2020 | % | Change | |||||||||||||||

| Revenue | $ | - | $ | - | $ | - | ||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Research and development | 2,416 | 49 | % | 1,393 | 36 | % | 1,023 | |||||||||||||

| General and administration | 2,507 | 51 | % | 2,442 | 64 | % | 65 | |||||||||||||

| Total operating expenses | 4,923 | 100 | % | 3,835 | 100 | % | 1,088 | |||||||||||||

| Loss from operations | (4,923 | ) | (3,835 | ) | (1,088 | ) | ||||||||||||||

| Unrealized gain on securities | 182 | - | 182 | |||||||||||||||||

| Other loss | (8 | ) | (9 | ) | 1 | |||||||||||||||

| Amortization expense | - | (17 | ) | 17 | ||||||||||||||||

| Interest income and other | 16 | 35 | (19 | ) | ||||||||||||||||

| Total other income | 190 | 9 | 181 | |||||||||||||||||

| Net loss | $ | (4,733 | ) | $ | (3,826 | ) | $ | (907 | ) | |||||||||||

Research and development expenses increased by $1,023 for the three months ended March 31, 2021 over the same period in 2020 as the Company’s development activities shifted back to research and development expenses from product launch readiness and pre-commercial development of PEDMARKTM. General and administrative expenses increased by $65 over same period in 2020 with the slight increase mainly driven by additional employees.

The Company holds shares of Processa (PCSA) which are marked to market each balance sheet date and unrealized gains or losses are recognized at that time. The unrealized gain on those shares on March 31, 2021 was $182. Other loss was driven mainly by fluctuations in the Company’s foreign currency transactions and is a non-cash expense. The Company has vendors that transact in Euros, Great British Pounds and Canadian Dollars. There was an decrease of $1 in other gain/(loss) for the three months ended March 31, 2021 over the same period in 2020. Amortization expense is also a non-cash expense and relates to amortization of the deferred issuance cost of the loan facilities with Bridge Bank. Amortization expense decreased by $17 for the three months ended March 31, 2021 over the same period in 2020 due to the deferred issuance cost of the loan facility being fully expensed in the fourth quarter of 2020. Interest income was $19 lower for the three months ended March 31, 2020 over the same period in 2020. This was driven mainly by a sharp decrease in interest rates for the three months ended March 31, 2021 over the same period in 2020 despite the higher average cash balance in 2021.

Quarterly Information

The following table presents selected condensed financial data for each of the last eight quarters through March 31, 2021, as prepared under US GAAP (U.S. dollars in thousands, except per share information):

Period | Net (Loss)/Income for the Period | Basic Net (Loss)/Income per Common Share | Diluted Net (Loss)/Income per Common Share | |||||||||

| June 30, 2019 | $ | (4,730 | ) | $ | (0.24 | ) | $ | (0.24 | ) | |||

| September 30, 2019 | (1,809 | ) | (0.09 | ) | (0.09 | ) | ||||||

| December 31, 2019 | (3,610 | ) | (0.18 | ) | (0.18 | ) | ||||||

| March 31, 2020 | (3,826 | ) | (0.19 | ) | (0.19 | ) | ||||||

| June 30, 2020 | (4,845 | ) | (0.21 | ) | (0.21 | ) | ||||||

| September 30, 2020 | (6,200 | ) | (0.24 | ) | (0.24 | ) | ||||||

| December 31, 2020 | (3,238 | ) | (0.13 | ) | (0.13 | ) | ||||||

| March 31, 2021 | (4,733 | ) | (0.18 | ) | (0.18 | ) | ||||||

| 21 |

Liquidity and Capital Resources

| U.S. Dollars in thousands | ||||||||

| Selected Asset and Liability Data: | March 31, 2021 | December 31, 2020 | ||||||

| Cash and cash equivalents | $ | 26,751 | $ | 30,344 | ||||

| Other current assets | 1,074 | 1,073 | ||||||

| Current liabilities | 2,892 | 2,347 | ||||||

| Working capital(1) | 24,933 | 29,070 | ||||||

| (1) [Current assets – current liabilities] | ||||||||

| Selected equity: | ||||||||

| Common stock | 190,563 | 189,967 | ||||||

| Accumulated deficit | (166,873 | ) | (162,140 | ) | ||||

| Stockholders’ equity | 24,933 | 29,070 | ||||||

Cash and cash equivalents were $26,751 at March 31, 2021 and $30,344 at December 31, 2020. The decrease in cash and cash equivalents between March 31, 2021 and December 31, 2020 is the result of expenses related to the development and preparation of NDA resubmission of PEDMARKTM and general and administrative expenses. The minimal increase in other current assets between March 31, 2021 and December 31, 2020 relates to the increase in the valuation of the Company’s holdings of Processa shares, the pre-payment of annual Nasdaq listing fee, offset by the decrease in value of the deferred asset related to the financing of the Company’s Director’s and Officer’s Insurance.

Current liabilities increased primarily due to manufacturing and pre-commercialization activities associated with PEDMARKTM and related regulatory expenses. The Company also had payables balances for legal and other professional services related to our ongoing shareholder class action lawsuit.

Working capital decreased between December 31, 2020 and March 31, 2021 by $4.1 million. The decrease was almost entirely due to the increase in current liabilities and cash expenditures during the quarter ended March 31, 2021. The Company expects modest increases in cash outflows as it prepares for resubmission of its NDA and increased commercial readiness activities upon resubmission.

The following table illustrates a summary of cash flow data for the three month periods of March 31, 2021 and 2020:

|

U.S. Dollar in thousands Selected cash flow data: |

Three Months Ended March 31, | |

| 2021 | 2020 | |

| Net cash used in operating activities | $ (3,593) | $ (3,749) |

| Net cash provided by investing activities | - | - |

| Net cash used in financing activities | - | - |

| Decrease in cash and cash equivalents | $ (3,593) | $ (3,749) |

Net cash used in operating activities for the three months ended March 31, 2021 primarily reflected a net loss of $4,733. This loss was adjusted for the add back of non-cash items consisting of $596 in stock-based compensation expense less $182 in unrealized gain on securities, and a net change in prepaid and other assets of minus $181,coupled with a net increase in current liabilities of $545. Cash flows from operating activities were $3,593. Net cash used in operating activities for the three months ended March 31, 2020 primarily reflected a net loss of $3,826. This loss was adjusted for the add back of non-cash items consisting of $412 in stock-based compensation expense and $17 in amortization expense, and a net change in prepaid and other assets of $12, coupled with a net decrease in current liabilities of $364. Cash flows from operating activities were $3,749.

| 22 |

We continue to pursue various strategic alternatives including collaborations with other pharmaceutical and biotechnology companies. Our projections of further capital requirements are subject to substantial uncertainty. Our working capital requirements may fluctuate in future periods depending upon numerous factors, including: our ability to obtain additional financial resources; our ability to enter into collaborations that provide us with up-front payments, milestones or other payments; results of our research and development activities; progress or lack of progress in our preclinical studies or clinical trials; unfavorable toxicology in our clinical programs, our drug substance requirements to support clinical programs; change in the focus, direction, or costs of our research and development programs; headcount expense; the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing our patent claims; competitive and technological advances; the potential need to develop, acquire or license new technologies and products; our business development activities; new regulatory requirements implemented by regulatory authorities; the timing and outcome of any regulatory review process; and commercialization activities, if any.

Outstanding Share Information

Our outstanding share data for our Company as of March 31, 2021 and December 31, 2020 was as follows (in thousands):

| March 31, 2021 | December 31, 2020 | Change | ||||||||||

| Common shares | 26,003 | 26,003 | - | |||||||||

| Warrants | 39 | 39 | - | |||||||||

| Stock options | 2,952 | 2,952 | - | |||||||||

| Total | 28,994 | 28,994 | - | |||||||||

Financial Instruments

We invest excess cash and cash equivalents in high credit quality investments held by financial institutions in accordance with our investment policy designed to protect the principal investment. At December 31, 2020, we had approximately $0.7 million in our cash accounts and $29.6 million in savings and money market accounts. While we have never experienced any loss or write down of our money market investments since our inception, the amounts we hold in money market accounts are substantially above the $250,000 amount insured by the FDIC and may lose value.

Our investment policy is to manage investments to achieve, in the order of importance, the financial objectives of preservation of principal, liquidity and return on investment. Investments may be made in U.S. or Canadian obligations and bank securities, commercial paper of U.S. or Canadian industrial companies, utilities, financial institutions and consumer loan companies, and securities of foreign banks provided the obligations are guaranteed or carry ratings appropriate to the policy. Securities must have a minimum Dun & Bradstreet rating of A for bonds or R1 low for commercial paper. The policy also provides for investment limits on concentrations of securities by issuer and maximum-weighted average time to maturity of twelve months. This policy applies to all of our financial resources.

The policy risks are primarily the opportunity cost of the conservative nature of the allowable investments. As our main purpose is research and development, we have chosen to avoid investments of a trading or speculative nature.

Off-Balance Sheet Arrangements

Since our inception, we have not had any material off-balance sheet arrangements. In addition, we do not engage in trading activities involving non-exchange traded contracts. As such, we are not materially exposed to any financing, liquidity, market or credit risk that could arise if we had engaged in such activities.

Research and Development

Our research and development efforts have been focused on the development of PEDMARKTM since 2013.

We have established relationships with contract research organizations, universities and other institutions, which we utilize to perform many of the day-to-day activities associated with our drug development. Where possible, we have sought to include leading scientific investigators and advisors to enhance our internal capabilities. Research and development issues are reviewed internally by our executive management and supporting scientific team.

Research and development expenses for the three months ended March 31, 2021 and 2020 were $2,416 and $1,393, respectively. We have increased our research and development expenses related to PEDMARKTM as our efforts have shifted to pre-commercialization with continued regulatory expenses associated with the resubmission of our NDA for PEDMARKTM.

| 23 |

Our product candidate still requires significant, time-consuming and costly research and development, testing and regulatory clearances. In developing our product candidate, we are subject to risks of failure that are inherent in the development of products based on innovative technologies. For example, it is possible that our product candidate will be ineffective or toxic, or will otherwise fail to receive the necessary regulatory clearances. There is a risk that our product candidate will be uneconomical to manufacture or market or will not achieve market acceptance. There is also a risk that third parties may hold proprietary rights that preclude us from marketing our product candidate or that others will market a superior or equivalent product. As a result of these factors, we are unable to accurately estimate the nature, timing and future costs necessary to complete the development of this product candidate. In addition, we are unable to reasonably estimate the period when material net cash inflows could commence from the sale, licensing or commercialization of such product candidate, if ever.

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. These estimates are based on assumptions and judgments that may be affected by commercial, economic and other factors. Actual results could differ from these estimates.

Our accounting policies are materially consistent with those presented in our annual consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2020.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Money Market Investments

We maintain an investment portfolio consisting of U.S. or Canadian obligations and bank securities and money market investments in compliance with our investment policy. We do not hold any mortgaged-backed investments in our investment portfolio. Securities must have a minimum Dun & Bradstreet rating of A for bonds or R1 low for commercial paper. The policy also provides for investment limits on concentrations of securities by issuer and maximum-weighted average time to maturity of twelve months. This policy applies to all of our financial resources.

At March 31, 2021, we had $26,083 in money market investments and savings accounts as compared to $29,666 at December 31, 2020; these investments typically have minimal risk. The financial markets had been volatile resulting in concerns regarding the recoverability of money market investments, but those conditions have stabilized. While we have never experienced any loss or write down of our money market investments since our inception, the amounts we hold in money market accounts are substantially above the $250,000 amount insured by the FDIC and may lose value.