Form 10-Q ETSY INC For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 10-Q

__________________________________

| Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | ||||||||

| For the quarterly period ended | ||||||||

| OR | ||||||||

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from to | ||||||||

Commission File Number 001-36911

__________________________________

(Exact name of registrant as specified in its charter)

__________________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

| (Address of principal executive offices) | (Zip code) | ||||||||||

(718 ) 880-3660

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |||||||||

| $0.001 par value per share | |||||||||||

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated Filer | ☐ | |||||||||

| Non-accelerated Filer | ☐ | Smaller Reporting Company | |||||||||

Emerging Growth Company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of common stock outstanding as of October 28, 2022 was 125,688,316 .

Table of Contents

| Part I - Financial Information | ||||||||

| Item 1. | Condensed Consolidated Financial Statements (Unaudited) | |||||||

| Notes to Condensed Consolidated Financial Statements | ||||||||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||||

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | |||||||

| Item 4. | Controls and Procedures | |||||||

| Part II - Other Information | ||||||||

| Item 1. | Legal Proceedings | |||||||

| Item 1A. | Risk Factors | |||||||

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |||||||

| Item 3. | Defaults Upon Senior Securities | |||||||

| Item 4. | Mine Safety Disclosures | |||||||

| Item 5. | Other Information | |||||||

| Item 6. | Exhibits | |||||||

| Signatures | ||||||||

Unless the context otherwise requires, we use the terms “Etsy,” the “Company,” “we,” “us,” and “our” in this Quarterly Report on Form 10-Q (“Quarterly Report”) to refer to Etsy, Inc. and, where appropriate, our consolidated subsidiaries.

See Part I, Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operating and Financial Metrics” for the definitions of the following terms used in this Quarterly Report: “active buyer,” “active seller,” “Adjusted EBITDA,” “GMS,” “non-U.S. GMS,” “mobile GMS,” and “currency-neutral GMS growth.”

Etsy has used, and intends to continue using, its investor relations website and the Etsy News Blog (blog.etsy.com/news) to disclose material non-public information and to comply with its disclosure obligations under Regulation FD. Accordingly, you should monitor our investor relations website and the Etsy News Blog in addition to following our press releases, SEC filings, and public conference calls and webcasts.

Note Regarding Forward-Looking Statements

This Quarterly Report contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include statements relating to our opportunity; the impact of our “Right to Win” and other growth strategies, including our strategies for integrating our “House of Brands” marketplaces, marketing and product initiatives, and investments and other levers of growth on our business and operating results, including future gross merchandise sales (“GMS”) and revenue growth; our ability to attract, engage, and retain buyers and sellers; strategic investments and the potential benefits thereof; our intended environmental and social impacts; the global macroeconomic uncertainty and volatility, including additional or unforeseen impacts that the COVID-19 pandemic and general market, political, economic, and business conditions may have on our business, strategy, operating results, key metrics, financial condition, profitability, and cash flows; and uncertainty regarding and changes in overall levels of consumer spending and e-commerce generally. Forward-looking statements include all statements that are not historical facts. In some cases, forward-looking statements can be identified by terms such as “aim,” “anticipate,” “believe,” “could,” “enable,” “estimate,” “expect,” “goal,” “intend,” “may,” “plan,” “potential,” “project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and derivative forms and/or negatives of those terms.

Forward-looking statements are not guarantees of performance and involve known and unknown risks and uncertainties. Other factors may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Those risks include those described in Part II, Item 1A, “Risk Factors” and elsewhere in this Quarterly Report. Given these uncertainties, you should read this Quarterly Report in its entirety and not place undue reliance on any forward-looking statements in this Quarterly Report.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Quarterly Report and, although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

Moreover, we operate in a competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements made in this Quarterly Report. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Quarterly Report may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. In addition, global macroeconomic uncertainty, including additional or unforeseen effects from the COVID-19 pandemic and general market, political, economic, and business conditions, may amplify many of these risks.

Forward-looking statements represent our beliefs and assumptions only as of the date of this Quarterly Report. We disclaim any obligation to update forward-looking statements.

Summary Risk Factors

Our business is subject to numerous risks. The following summary highlights some of the risks we are exposed to in the normal course of our business activities. This summary is not complete and the risks summarized below are not the only risks we face. You should review and consider carefully the risks and uncertainties described in more detail in Part II, Item 1A, “Risk Factors,” which includes a more complete discussion of the risks summarized below as well as a discussion of other risks related to our business and an investment in our common stock.

Financial Performance and Operational Risks Related to Our Business

•We experienced rapid growth during the early part of the pandemic, and there may not be sustained demand for our services or the products sold in our marketplaces. We also may not have the infrastructure, human resources, or operational resources or otherwise be able to support our recent growth.

•The ongoing, unprecedented COVID-19 pandemic has impacted, and may continue to impact, our GMS and results of operations in numerous volatile and unpredictable ways.

•Our quarterly operating results may fluctuate, which could cause our stock price to decline. The price of our common stock has been and will likely continue to be volatile, and declines in the price of our common stock could subject us to litigation.

•We may fail to meet our publicly announced guidance or other expectations about our business and future operating results, which could cause our stock price to decline.

•Our business could suffer if we experience a technology disruption that results in a loss of information, if personal data or sensitive information about members of our communities or employees is misused or disclosed, or if we or our third-

3

party providers are unable to protect against technology vulnerabilities, service interruptions, security breaches, or other cyber incidents.

•The trustworthiness of our marketplaces and the connections within our communities are important to our success. Our business, financial performance, and growth depend on our ability to attract and retain active and engaged communities of buyers and sellers. If we are unable to retain our existing buyers and sellers and activate new ones, our financial performance could decline.

•Our business depends on third-party services, platforms, and infrastructure that we rely upon to maintain and scale our platforms.

•Our business could be adversely affected by economic downturns, inflation, natural disasters, public health crises, political crises, geopolitical changes, such as the crisis in Ukraine, or other macroeconomic conditions, which have in the past and may in the future negatively impact our business and financial performance.

•Our ability to attract and hire a diverse group of employees and retain key employees is important to our success. If we experience significant attrition or turnover it could impact our ability to grow our business.

Strategic Risks Related to Our Business and Industry

•We face intense competition and may not be able to compete effectively.

•If we are not able to keep pace with technological changes, and enhance current and develop new offerings to respond to the changing needs of sellers and buyers, our business, financial performance, and growth may be harmed.

•If the widely adopted mobile, social, search, and/or advertising solutions that we, our sellers, and our buyers rely on as part of our key offering are no longer available or effective, or if access to these major platforms is limited, the use of our marketplaces could decline.

•If we do not demonstrate progress against our environmental, social, and governance impact strategy (our “Impact strategy”) or if this strategy is not perceived to be adequate, our reputation could be harmed. Our reputation and the value of our brands may also be damaged if we fail to demonstrate that our commitment to our Impact strategy enhances our overall financial performance.

•Expanding our operations outside of the United States is part of our strategy, and the growth of our business could be harmed if our international expansion efforts do not succeed.

•Our recent acquisitions of Depop Limited (“Depop”) and Elo7 Serviços de Informática S.A. (“Elo7”) have created and may continue to create strains on our management, technology, and operational resources and may prove to be costlier and take longer to integrate than we anticipate, which may ultimately reduce or eliminate the benefits to Etsy of the acquisitions.

•We have incurred impairment charges for our goodwill and may incur further impairment charges for our goodwill and other intangible assets, which would negatively impact our operating results.

•We may expand our business through additional acquisitions of other businesses or assets or strategic partnerships and investments, which may divert management’s attention and/or prove to be unsuccessful.

•We have a significant amount of debt and may incur additional debt in the future.

Regulatory, Compliance, and Legal Risks

•Compliance and protection under evolving global legal and regulatory requirements including privacy and data protection laws, tax laws, product liability laws, antitrust laws, intellectual property and counterfeiting regulations, may materially impact our time, resources, and ability to grow our business.

•Expanding our operations in Latin America and India may expose us to additional risks.

•We have been involved in, and in the future may be involved in, litigation and regulatory matters that are expensive and time consuming and that may require changes to our strategy, the features of our marketplaces and/or how our business operates.

•We may be subject to intellectual property or other claims, which, even if untrue, could be costly to defend, damage our brands, require us to pay significant damages, and limit our ability to use certain technologies or business strategies in the future.

4

Other Risks

•Future sales and issuances of our common stock, or rights to purchase common stock, including upon conversion of our convertible notes, could result in additional dilution to our stockholders and could cause the price of our common stock to decline.

5

Part I - Financial Information

Item 1. Condensed Consolidated Financial Statements (Unaudited).

Etsy, Inc.

Consolidated Balance Sheets (Unaudited)

(In thousands, except share and per share amounts)

| As of September 30, 2022 | As of December 31, 2021 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Short-term investments | |||||||||||

Accounts receivable, net of expected credit losses of $ | |||||||||||

| Prepaid and other current assets | |||||||||||

| Funds receivable and seller accounts | |||||||||||

| Total current assets | |||||||||||

| Restricted cash | |||||||||||

Property and equipment, net of accumulated depreciation and amortization of $ | |||||||||||

| Goodwill | |||||||||||

Intangible assets, net of accumulated amortization of $ | |||||||||||

| Deferred tax assets | |||||||||||

| Long-term investments | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Accrued expenses | |||||||||||

| Finance lease obligations—current | |||||||||||

| Funds payable and amounts due to sellers | |||||||||||

| Deferred revenue | |||||||||||

| Other current liabilities | |||||||||||

| Total current liabilities | |||||||||||

| Finance lease obligations—net of current portion | |||||||||||

| Deferred tax liabilities | |||||||||||

| Long-term debt, net | |||||||||||

| Other liabilities | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies (Note 10) | |||||||||||

| Stockholders’ (deficit) equity: | |||||||||||

Common stock ($ | |||||||||||

Preferred stock ($ | |||||||||||

| Additional paid-in capital | |||||||||||

| (Accumulated deficit) retained earnings | ( | ||||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

| Total stockholders' (deficit) equity | ( | ||||||||||

| Total liabilities and stockholders' (deficit) equity | $ | $ | |||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

Etsy, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

(In thousands, except share and per share amounts)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Revenue | $ | $ | $ | $ | |||||||||||||||||||

| Cost of revenue | |||||||||||||||||||||||

| Gross profit | |||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Marketing | |||||||||||||||||||||||

| Product development | |||||||||||||||||||||||

| General and administrative | |||||||||||||||||||||||

| Goodwill impairment | |||||||||||||||||||||||

| Total operating expenses | |||||||||||||||||||||||

| (Loss) income from operations | ( | ( | |||||||||||||||||||||

| Other income, net | |||||||||||||||||||||||

| (Loss) income before income taxes | ( | ( | |||||||||||||||||||||

| (Provision) benefit for income taxes | ( | ( | |||||||||||||||||||||

| Net (loss) income | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Net (loss) income per share attributable to common stockholders: | |||||||||||||||||||||||

| Basic | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Diluted | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Weighted-average common shares outstanding: | |||||||||||||||||||||||

| Basic | |||||||||||||||||||||||

| Diluted | |||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

7

Etsy, Inc.

Consolidated Statements of Comprehensive (Loss) Income (Unaudited)

(In thousands)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Net (loss) income | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Other comprehensive loss: | |||||||||||||||||||||||

| Cumulative translation adjustment | ( | ( | ( | ( | |||||||||||||||||||

Unrealized losses on marketable securities, net of tax benefit of $ | ( | ( | ( | ( | |||||||||||||||||||

| Total other comprehensive loss | ( | ( | ( | ( | |||||||||||||||||||

| Comprehensive (loss) income | $ | ( | $ | $ | ( | $ | |||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

8

Etsy, Inc.

Consolidated Statements of Changes in Stockholders’ (Deficit) Equity (Unaudited)

(In thousands, except share amounts)

| Three Months Ended September 30, 2022 | |||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Retained Earnings (Accumulated Deficit) | Accumulated Other Comprehensive Loss | Total | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance as of June 30, 2022 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| Stock-based compensation (1) | — | — | — | ||||||||||||||||||||||||||||||||

| Exercise of vested options | — | — | |||||||||||||||||||||||||||||||||

| Settlement of convertible senior notes, net of taxes | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Vesting of restricted stock units, net of shares withheld | — | ( | — | — | ( | ||||||||||||||||||||||||||||||

| Stock repurchase | ( | ( | — | ( | — | ( | |||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||

| Balance as of September 30, 2022 | $ | $ | $ | ( | $ | ( | $ | ( | |||||||||||||||||||||||||||

| Nine Months Ended September 30, 2022 | |||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Retained Earnings (Accumulated Deficit) | Accumulated Other Comprehensive Loss | Total | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2021 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| Stock-based compensation (1) | — | — | — | ||||||||||||||||||||||||||||||||

| Exercise of vested options | — | — | |||||||||||||||||||||||||||||||||

| Settlement of convertible senior notes, net of taxes | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Vesting of restricted stock units, net of shares withheld | ( | — | — | ( | |||||||||||||||||||||||||||||||

| Stock repurchase | ( | ( | — | ( | — | ( | |||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||

| Balance as of September 30, 2022 | $ | $ | $ | ( | $ | ( | $ | ( | |||||||||||||||||||||||||||

9

Etsy, Inc.

Consolidated Statements of Changes in Stockholders’ (Deficit) Equity (Unaudited)

(In thousands, except share amounts)

| Three Months Ended September 30, 2021 | |||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive Loss | Total | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance as of June 30, 2021 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

| Exercise of vested options | — | — | — | ||||||||||||||||||||||||||||||||

| Vesting of restricted stock units, net of shares withheld | — | ( | — | — | ( | ||||||||||||||||||||||||||||||

| Stock repurchase | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Net income | — | — | — | — | |||||||||||||||||||||||||||||||

| Balance as of September 30, 2021 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2021 | |||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive Income (Loss) | Total | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2020 | $ | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||

| — | — | ( | — | ( | |||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

| Exercise of vested options | — | — | — | ||||||||||||||||||||||||||||||||

| Purchase of capped calls, net of taxes | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||

| Settlement of convertible senior notes, net of taxes | ( | — | — | ( | |||||||||||||||||||||||||||||||

| Vesting of restricted stock units, net of shares withheld | ( | — | — | ( | |||||||||||||||||||||||||||||||

| Stock repurchase | ( | ( | — | ( | — | ( | |||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Net income | — | — | — | — | |||||||||||||||||||||||||||||||

| Balance as of September 30, 2021 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

10

Etsy, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In thousands)

| Nine Months Ended September 30, | |||||||||||

| 2022 | 2021 | ||||||||||

| Cash flows from operating activities | |||||||||||

| Net (loss) income | $ | ( | $ | ||||||||

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | |||||||||||

| Stock-based compensation expense | |||||||||||

| Depreciation and amortization expense | |||||||||||

| Provision for expected credit losses | |||||||||||

| Foreign exchange gain | ( | ( | |||||||||

| Deferred benefit for income taxes | ( | ( | |||||||||

| Goodwill impairment | |||||||||||

| Other non-cash expense, net | |||||||||||

| Changes in operating assets and liabilities (net of impact of business combinations): | |||||||||||

| Current assets | ( | ||||||||||

| Non-current assets | ( | ||||||||||

| Current liabilities | ( | ( | |||||||||

| Non-current liabilities | |||||||||||

| Net cash provided by operating activities | |||||||||||

| Cash flows from investing activities | |||||||||||

| Acquisition of businesses, net of cash acquired | ( | ||||||||||

| Cash paid for intangible assets | ( | ( | |||||||||

| Purchases of property and equipment | ( | ( | |||||||||

| Development of internal-use software | ( | ( | |||||||||

| Purchases of marketable securities | ( | ( | |||||||||

| Sales and maturities of marketable securities | |||||||||||

| Net cash used in investing activities | ( | ( | |||||||||

| Cash flows from financing activities | |||||||||||

| Payment of tax obligations on vested equity awards | ( | ( | |||||||||

| Repurchase of stock | ( | ( | |||||||||

| Proceeds from exercise of stock options | |||||||||||

| Proceeds from issuance of convertible senior notes | |||||||||||

| Payment of debt issuance costs | ( | ( | |||||||||

| Purchase of capped calls | ( | ||||||||||

| Settlement of convertible senior notes | ( | ( | |||||||||

| Payments on finance lease obligations | ( | ( | |||||||||

| Other financing, net | ( | ( | |||||||||

| Net cash (used in) provided by financing activities | ( | ||||||||||

| Effect of exchange rate changes on cash | ( | ( | |||||||||

| Net increase (decrease) in cash, cash equivalents, and restricted cash | ( | ||||||||||

| Cash, cash equivalents, and restricted cash at beginning of period | |||||||||||

| Cash, cash equivalents, and restricted cash at end of period | $ | $ | |||||||||

11

Etsy, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In thousands)

| Nine Months Ended September 30, | |||||||||||

| 2022 | 2021 | ||||||||||

| Supplemental cash flow disclosures: | |||||||||||

| Cash paid for income taxes, net of refunds | $ | $ | |||||||||

| Supplemental non-cash disclosures: | |||||||||||

| Deferred consideration (1) | $ | $ | |||||||||

| Replacement share-based awards issued in conjunction with acquisitions | $ | $ | |||||||||

| Stock-based compensation capitalized in development of capitalized software and asset additions in exchange for liabilities | $ | $ | |||||||||

| Right-of-use assets obtained in exchange for new lease liabilities | $ | $ | |||||||||

| Debt issuance costs included in accounts payable and accrued expenses | $ | $ | |||||||||

(1) See “Note 12—Stock-Based Compensation” for more information on the settlement of deferred consideration.

The following table provides a reconciliation of cash and cash equivalents and restricted cash reported within the Consolidated Balance Sheets that sum to the total of the same such amounts shown above:

| Nine Months Ended September 30, | |||||||||||

| 2022 | 2021 | ||||||||||

| Beginning balance: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Total cash, cash equivalents, and restricted cash | $ | $ | |||||||||

| Ending balance: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Total cash, cash equivalents, and restricted cash | $ | $ | |||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

12

Note 1—Basis of Presentation and Summary of Significant Accounting Policies

Description of Business

Etsy operates two-sided online marketplaces that connect millions of passionate and creative buyers and sellers around the world. These marketplaces - which collectively create a “House of Brands” - share the Company’s mission, common levers for growth, similar business models, and a strong commitment to use the power of business and technology to strengthen communities and empower people. The Company’s primary marketplace, Etsy.com, is the global destination for unique and creative goods. The Company generates revenue primarily from marketplace activities, including transaction, listing, and payments processing fees, and fees for optional seller services, which include on-site advertising and shipping label services.

Reclassification

Certain items in the prior years’ condensed consolidated financial statements have been reclassified to conform to the current year presentation reflected in the condensed consolidated financial statements.

Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and pursuant to the applicable rules and regulations of the Securities and Exchange Commission (“SEC”). The Company has condensed or omitted certain information and notes normally included in complete annual financial statements prepared in accordance with GAAP. These unaudited interim condensed consolidated financial statements should therefore be read in conjunction with the audited condensed consolidated financial statements and accompanying notes included in the Company’s Annual Report on Form 10-K filed with the SEC on February 25, 2022 (the “Annual Report”). In the opinion of management, all material adjustments, which are of a normal and recurring nature, necessary for a fair statement of the results for the periods presented have been reflected in the condensed consolidated financial statements. The results of operations of any interim period are not necessarily indicative of the results of operations for the full annual period or any future period due to seasonal and other factors.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires the Company to make estimates and judgments that affect the amounts reported and disclosed in the condensed consolidated financial statements and accompanying notes. Actual results could differ from these estimates and judgments. The accounting estimates that require management’s most subjective judgments include: stock-based compensation; income taxes, including the estimate of the annual effective tax rate at interim periods and evaluation of uncertain tax positions; the valuation of acquired intangible assets, developed technology, and goodwill as part of purchase price allocations for business combinations; valuation of goodwill; and leases. As of September 30, 2022, the effects of global macroeconomic and geopolitical uncertainty, including COVID-19 pandemic related factors and general market, political, and economic conditions, on the Company’s business, results of operations, and financial condition continue to evolve. As a result, many of the Company’s estimates and judgments require increased judgment and carry a higher degree of variability and volatility. As additional information becomes available, the Company’s estimates may change materially in future periods.

13

Interim Impairment Evaluation

During the quarter ended September 30, 2022, the Company evaluated whether events or circumstances had changed such that it would indicate it is more likely than not that its goodwill, finite-lived intangible assets, and other long-lived assets of the Depop and Elo7 reporting units fair values were less than their carrying amounts. Given that the trend of adverse macroeconomic conditions continued, including reopening, pressures on consumer discretionary spending, foreign exchange rate volatility, and ongoing geopolitical events, and the resultant headwinds to the Company’s business and the global economy; the changes to the Company’s executive management at Depop and Elo7; and the Company’s downward revisions to its business forecasts; the Company concluded a triggering event had occurred for the Depop and Elo7 reporting units and conducted an impairment test of each of their goodwill, finite-lived intangible assets, and other long-lived assets as of September 30, 2022. The Company prepared a quantitative assessment for the Depop and Elo7 reporting units, including estimates of future revenue, net available cash flows, and the discount rate. The Company concluded that finite-lived intangible assets and other long-lived assets for the Depop and Elo7 reporting units were not

Note 2—Revenue

The following table summarizes revenue disaggregated by Marketplace revenue and optional Services revenue for the periods presented (in thousands):

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Marketplace revenue | $ | $ | $ | $ | |||||||||||||||||||

| Services revenue | |||||||||||||||||||||||

| Revenue | $ | $ | $ | $ | |||||||||||||||||||

Effective April 11, 2022, the Etsy marketplace increased the seller transaction fee, included in Marketplace revenue, from 5 % to 6.5 %.

Contract balances

Deferred revenues

The amount of revenue recognized in the nine months ended September 30, 2022 that was included in the deferred balance at January 1, 2022 was $12.3 million.

14

Note 3—Income Taxes

The Company’s provision or benefit from income taxes in interim periods is determined using an estimate of the annual effective tax rate, adjusted for discrete items, if any, that are taken into account in the relevant period. Each quarter the Company updates its estimate of the annual effective tax rate, and if its estimated tax rate changes, the Company makes a cumulative adjustment. The estimate of the annual effective income tax rate for the full year is applied to the respective interim period, taking into account year-to-date amounts and projected results for the full year.

The Company’s quarterly tax provision, and its quarterly estimate of the annual effective tax rate, is subject to significant variation due to several factors, including variability in accurately predicting its income or loss before tax and the mix of jurisdictions to which they relate, taxable income or loss in each jurisdiction, changes in its stock price, audit-related developments, acquisitions, changes in its deferred tax assets and liabilities and their valuation, foreign currency gains (losses), changes in statutes, regulations, case law, and administrative practices, principles, and interpretations related to tax, including changes to the global tax framework, competition, and other laws and accounting rules in various jurisdictions, and relative changes of expenses or losses for which tax benefits are not recognized. Additionally, the effective tax rate can be more or less volatile based on the amount of income or loss before tax. For example, the impact of discrete items and non-deductible expenses on the effective tax rate is greater when income before income taxes is lower.

For the nine months ended September 30, 2022, the Company’s effective income tax rate was (1.8 )% representing an income tax provision recorded on net loss before tax. The effective tax rate for the nine months ended September 30, 2022 was impacted by the non-cash impairment of Depop and Elo7 non-deductible goodwill, partially offset by excess tax benefits from employee stock-based compensation, the impact from foreign operations, and a benefit related to a research and development tax credit.

Although management believes its tax positions and related provisions reflected in the condensed consolidated financial statements are fully supportable, it recognizes that these tax positions and related provisions may be challenged by various tax authorities. These tax positions and related provisions are reviewed on an ongoing basis and are adjusted as additional facts and information become available, including progress on tax audits, changes in interpretation of tax laws, developments in case law and closing of statute of limitations. To the extent that the ultimate results differ from the original or adjusted estimates of the Company, the effect will be recorded in the provision for income taxes.

The provision for income taxes involves a significant amount of management judgment regarding interpretation of relevant facts and laws in the jurisdictions in which the Company operates. Future changes in applicable laws, projected levels of taxable income and tax planning could change the effective tax rate and tax balances recorded by the Company. In addition, tax authorities periodically review income tax returns filed by the Company and can raise issues regarding its filing positions, timing and amount of income and deductions, and the allocation of income among the jurisdictions in which the Company operates. A significant period of time may elapse between the filing of an income tax return and the ultimate resolution of an issue raised by a revenue authority with respect to that return. Any adjustments as a result of any examination may result in additional taxes or penalties against the Company. If the ultimate result of these audits differ from original or adjusted estimates, they could have a material impact on the Company’s tax provision.

The amount of unrecognized tax benefits included in the Consolidated Balance Sheets increased $1.4 million in the nine months ended September 30, 2022, from $28.8 million as of December 31, 2021 to $30.2 million as of September 30, 2022. The total amount of unrecognized tax benefits that, if recognized, would favorably affect the effective tax rate is $29.3 million as of September 30, 2022. Although the timing of the resolution and/or closure of audits is highly uncertain, it is reasonably possible that the balance of gross unrecognized tax benefits could significantly change in the next 12 months. The Company’s reasonable estimate of its gross unrecognized tax benefits, excluding interest and penalties, that could potentially be reduced during the next 12 months is $3.7 million.

15

Note 4—Net (Loss) Income Per Share

The following table presents the calculation of basic and diluted net (loss) income per share for the periods presented (in thousands, except share and per share amounts):

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Numerator: | |||||||||||||||||||||||

| Net (loss) income | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Add back interest expense, net of tax attributable to assumed conversion of convertible senior notes | |||||||||||||||||||||||

| Net (loss) income attributable to common stockholders—diluted | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Denominator: | |||||||||||||||||||||||

| Weighted-average common shares outstanding—basic | |||||||||||||||||||||||

| Dilutive effect of assumed conversion of options to purchase common stock | |||||||||||||||||||||||

| Dilutive effect of assumed conversion of restricted stock units | |||||||||||||||||||||||

| Dilutive effect of assumed conversion of convertible senior notes (1) | |||||||||||||||||||||||

| Weighted-average common shares outstanding—diluted | |||||||||||||||||||||||

| Net (loss) income per share attributable to common stockholders—basic | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Net (loss) income per share attributable to common stockholders—diluted | $ | ( | $ | $ | ( | $ | |||||||||||||||||

(1)The $1.0 billion aggregate principal amount of 0.25 % Convertible Senior Notes due 2028 (the “2021 Notes”), $650.0 million aggregate principal amount of 0.125 % Convertible Senior Notes due 2027 (the “2020 Notes”), $649.9 million aggregate principal amount of 0.125 % Convertible Senior Notes due 2026 (the “2019 Notes”), and 0 % Convertible Senior Notes due 2023 (the “2018 Notes” and together with the 2021 Notes, 2020 Notes, and 2019 Notes, the “Notes”) were anti-dilutive for the three and nine months ended September 30, 2022 and dilutive for the three and nine months ended September 30, 2021.

The following potential common shares were excluded from the calculation of diluted net (loss) income per share attributable to common stockholders because their effect would have been anti-dilutive for the periods presented:

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Stock options | |||||||||||||||||||||||

| Restricted stock units | |||||||||||||||||||||||

| Convertible senior notes | |||||||||||||||||||||||

| Total anti-dilutive securities | |||||||||||||||||||||||

Since the Company has reported net losses in the three and nine months ended September 30, 2022, diluted net loss per share attributable to common stockholders is the same as basic net loss per share attributable to common stockholders, because dilutive common shares are not assumed to have been issued if their effect is anti-dilutive.

16

Note 5—Business Combinations

The Company accounts for business combinations using the acquisition method of accounting. The purchase price is allocated to the assets acquired and liabilities assumed using the fair values determined by management as of the acquisition date. The excess of the purchase price over the estimated fair value of the net assets acquired is recorded as goodwill. The results of businesses acquired in a business combination are included in the Company’s condensed consolidated financial statements from the date of acquisition.

Depop Acquisition

On July 12, 2021, the Company acquired all of the issued share capital of Depop, an online global peer-to-peer fashion resale marketplace. The Company believes Depop extends its market opportunity in the high frequency apparel sector, specifically in the fast-growing resale space, and deepens the Company’s reach into the Gen Z consumer. The fair value of consideration transferred of $1.493 billion consisted of: (1) cash consideration paid of $1.489 billion, net of cash acquired and (2) non-cash consideration of $4.8 million representing the portion of the replacement equity awards issued in connection with the acquisition that was associated with services rendered through the date of the acquisition. The portion of the replacement equity awards associated with services rendered post-acquisition is recorded as post-combination expense on a straight-line basis over the remaining vesting period of the awards. Additionally, deferred consideration awards issued to certain Depop executives are also recorded as post-combination expense on a straight-line basis over the mandatory service period associated with the deferred consideration. Neither of these awards was included in the fair value of the consideration transferred. See “Note 12—Stock-Based Compensation” for more information on these awards.

Goodwill consists largely of assembled workforce, expanded market opportunities, and value creation across the Company’s businesses. The resulting goodwill is not expected to be deductible for tax purposes.

The Company finalized the valuation of assets acquired and liabilities assumed for the acquisition of Depop as of December 31, 2021.

Depop Purchase Price Allocation

The following table summarizes the allocation of the purchase price (at fair value) to the assets acquired and liabilities of Depop assumed as of July 12, 2021 (the date of acquisition) (in thousands):

| Final Purchase Price Allocation as Adjusted | Estimated Useful Life (in years) | ||||||||||

| Current assets | $ | ||||||||||

| Property and equipment other | |||||||||||

| Developed technology | |||||||||||

| Trademark | |||||||||||

| Customer relationships | |||||||||||

| Goodwill | Indefinite | ||||||||||

Current liabilities | ( | ||||||||||

| Non-current liabilities (1) | ( | ||||||||||

| Deferred tax liability, net | ( | ||||||||||

| Total purchase price | $ | ||||||||||

(1)Non-current liabilities are primarily related to non-income tax related contingency reserves.

17

Elo7 Acquisition

On July 2, 2021, the Company acquired all the outstanding shares of Elo7 (including Elo7, Ltd. and related subsidiaries entities), by means of a merger, an e-commerce marketplace in Brazil focused on unique, handmade items. The Company sees significant potential in Brazil's e-commerce sector, which is still in early stages of development and fueled by one of the largest economies in the world. The Company believes having a well-known local brand will help Etsy to better capitalize on this opportunity. The fair value of consideration transferred of $212.1 million consisted of: (1) cash consideration paid of $211.3 million, net of cash acquired, and (2) non-cash consideration of $0.8 million representing the portion of the replacement equity awards issued in connection with the acquisition that was associated with services rendered through the date of the acquisition. The portion of the replacement equity awards associated with services rendered post-acquisition are recorded as post-combination expense on a straight-line basis over the remaining vesting period of the awards, and were therefore not included in the fair value of the consideration transferred. See “Note 12—Stock-Based Compensation” for more information on these awards.

Goodwill consists largely of assembled workforce, expanded market opportunities, and value creation across the Company’s businesses. The resulting goodwill is not expected to be deductible for tax purposes.

The Company finalized the valuation of assets acquired and liabilities assumed for the acquisition of Elo7 as of December 31, 2021.

Elo7 Purchase Price Allocation

The following table summarizes the allocation of the purchase price (at fair value) to the assets acquired and liabilities assumed of Elo7 as of July 2, 2021 (the date of acquisition) (in thousands):

| Final Purchase Price Allocation as Adjusted | Estimated Useful Life (in years) | ||||||||||

| Current assets | $ | ||||||||||

| Developed technology | |||||||||||

| Trademark | |||||||||||

| Customer relationships | |||||||||||

| Goodwill | Indefinite | ||||||||||

Non-current assets | |||||||||||

Current liabilities | ( | ||||||||||

Non-current liabilities | ( | ||||||||||

| Deferred tax liability, net | ( | ||||||||||

| Total purchase price | $ | ||||||||||

Acquisition-Related Expenses

Acquisition-related expenses are expensed as incurred. They were recorded in general and administrative expenses and were $0.5 million and $2.1 million for the three and nine months ended September 30, 2022, respectively, and $25.0 million and $35.0 million for the three and nine months ended September 30, 2021, respectively.

18

Unaudited Supplemental Pro Forma Information

The following unaudited pro forma summary presents consolidated information of the Company, including Depop and Elo7, as if the business combinations had occurred on January 1, 2020 (in thousands):

| Three Months Ended September 30, 2021 | Nine Months Ended September 30, 2021 | ||||||||||

| Revenue | $ | $ | |||||||||

| Net income | |||||||||||

The pro forma financial information includes adjustments that are directly attributable to the business combinations and are factually supportable. The pro forma adjustments include incremental amortization of intangible and developed technology assets, and remove non-recurring transaction costs directly associated with the acquisitions, such as legal and other professional service fees, and the pro forma tax impact for such adjustments. Cost savings or operating synergies expected to result from the acquisitions are not included in the pro forma results. For the three and nine months ended September 30, 2021, the pro forma financial information excludes $44.2 million and $58.4 million, respectively, of non-recurring acquisition-related expenses. These pro forma results are illustrative only and not indicative of the actual results of operations that would have been achieved nor are they indicative of future results of operations.

Depop and Elo7 Goodwill Impairment

During the three months ended September 30, 2022, the Company impaired goodwill related to the Depop and Elo7 reporting units. See “Note 6—Goodwill” for further information.

19

Note 6—Goodwill

| As of September 30, 2022 | As of December 31, 2021 | ||||||||||

| Balance as of the beginning of the period | $ | $ | |||||||||

| Business combinations | |||||||||||

| Impairment | ( | ||||||||||

| Foreign currency translation adjustments | ( | ( | |||||||||

| Balance as of the end of the period | $ | $ | |||||||||

Management has determined that the Company has four operating segments, Etsy, Reverb, Depop, and Elo7, which qualify for aggregation as one reportable segment for purposes of allocating resources and evaluating financial performance, and each operating segment is determined to be a reporting unit.

Due to then current adverse macroeconomic conditions, including reopening, inflationary pressures on consumer discretionary spending, foreign exchange rate volatility, and ongoing geopolitical events, and related headwinds on business performances, the Company concluded it was more likely than not that the fair values of the Depop and Elo7 reporting units were less than their carrying amounts at June 30, 2022. As a result, the Company performed impairment assessments of each of their goodwill, finite-lived intangible assets, and other long-lived assets. The quantitative impairment tests as of June 30, 2022 did not indicate an impairment.

During the three months ended September 30, 2022, the trend of adverse macroeconomic conditions continued; there were executive management changes at Depop and Elo7; and the Company made downward revisions to its business forecasts. Therefore, the Company concluded a triggering event had occurred for the Depop and Elo7 reporting units and conducted an impairment test of each of their goodwill, finite-lived intangible assets, and other long-lived assets as of September 30, 2022. The Company updated the forecasted future cash flows used in the impairment assessment, including revenues, to reflect current conditions. Other changes in valuation assumptions compared to June 30, 2022 included the discount rates, which increased based on higher interest rates, market volatility, and other current market participant assumptions. The September 30, 2022 quantitative goodwill impairment test indicated a decline in the fair values of the Depop and Elo7 reporting units. As a result of this test, the Company recorded non-cash impairment charges of $897.9 million and $147.1 million to write off goodwill in full for the Depop and Elo7 reporting units, respectively. The Company did not

20

Note 7—Fair Value Measurements

The Company has characterized its investments in marketable securities, based on the priority of the inputs used to value the investments, into a three-level fair value hierarchy. The fair value hierarchy gives the highest priority to quoted prices in active markets for identical assets or liabilities (Level 1), and lowest priority to unobservable inputs (Level 3). If the inputs used to measure the investments fall within different levels of the hierarchy, the categorization is based on the lowest level input that is significant to the fair value measurement of the investment. Investments recorded in the accompanying Consolidated Balance Sheets are categorized based on the inputs to valuation techniques as follows:

Level 1 These are investments where values are based on unadjusted quoted prices for identical assets in an active market that the Company has the ability to access.

Level 2 These are investments where values are based on quoted market prices in markets that are not active or model derived valuations in which all significant inputs are observable in active markets.

Level 3 These are financial instruments where values are derived from techniques in which one or more significant inputs are unobservable. The Company did not have any Level 3 instruments as of September 30, 2022 and December 31, 2021.

Short- and long-term investments and certain cash equivalents consist of investments in debt securities that are available-for-sale. The following table sets forth the cost, gross unrealized losses, gross unrealized gains, and fair value of the Company’s investments as of the dates indicated (in thousands):

| Cost | Gross Unrealized Holding Loss | Gross Unrealized Holding Gain | Fair Value | Cash and Cash Equivalents | Short-term Investments | Long-term Investments | |||||||||||||||||||||||||||||||||||

| September 30, 2022 | |||||||||||||||||||||||||||||||||||||||||

| Cash | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

| Level 1 | |||||||||||||||||||||||||||||||||||||||||

| Money market funds (1) | |||||||||||||||||||||||||||||||||||||||||

| U.S. Government and agency securities | ( | ||||||||||||||||||||||||||||||||||||||||

| ( | |||||||||||||||||||||||||||||||||||||||||

| Level 2 | |||||||||||||||||||||||||||||||||||||||||

| Certificate of deposit | ( | ||||||||||||||||||||||||||||||||||||||||

| Commercial paper | ( | ||||||||||||||||||||||||||||||||||||||||

| Corporate bonds | ( | ||||||||||||||||||||||||||||||||||||||||

| ( | |||||||||||||||||||||||||||||||||||||||||

| $ | $ | ( | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

| December 31, 2021 | |||||||||||||||||||||||||||||||||||||||||

| Cash | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

| Level 1 | |||||||||||||||||||||||||||||||||||||||||

| Money market funds | |||||||||||||||||||||||||||||||||||||||||

| U.S. Government and agency securities | ( | ||||||||||||||||||||||||||||||||||||||||

| ( | |||||||||||||||||||||||||||||||||||||||||

| Level 2 | |||||||||||||||||||||||||||||||||||||||||

| Certificate of deposit | ( | ||||||||||||||||||||||||||||||||||||||||

| Commercial paper | ( | ||||||||||||||||||||||||||||||||||||||||

| Corporate bonds | ( | ||||||||||||||||||||||||||||||||||||||||

| ( | |||||||||||||||||||||||||||||||||||||||||

| $ | $ | ( | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||

(1)$76.4 million of money market funds were classified as funds receivable and seller accounts as of September 30, 2022.

21

At December 31, 2021, there were no The table below shows the gross unrealized loss and fair value of the following investments in debt securities that are available-for-sale classified by the length of time that the securities have been in a continuous unrealized loss position at September 30, 2022 (in thousands):

| Gross Unrealized Holding Loss | Fair Value | ||||||||||

Less than 12 months in a continuous unrealized loss position | |||||||||||

| Corporate bonds | $ | ( | $ | ||||||||

| U.S. Government and agency securities | ( | ||||||||||

| $ | ( | $ | |||||||||

12 months or longer in a continuous unrealized loss position | |||||||||||

| Corporate bonds | $ | ( | $ | ||||||||

| U.S. Government and agency securities | ( | ||||||||||

| $ | ( | $ | |||||||||

The Company evaluates fair value for each individual security in the investment portfolio.

The Company typically invests in short- and long-term instruments, including fixed-income funds and U.S. Government and agency securities aligned with the Company’s investment strategy. The maturities of the Company’s non-current marketable debt securities generally range from greater than 12 and up to 37 months.

Disclosure of Fair Values

The Company’s financial instruments that are not remeasured at fair value in the Consolidated Balance Sheets include the Notes. See “Note 9—Debt” for additional information. The Company estimates the fair value of the Notes through inputs that are observable in the market, classified as Level 2 as described above. The following table presents the carrying value and estimated fair value of the Notes as of the dates indicated (in thousands):

| As of September 30, 2022 | As of December 31, 2021 | ||||||||||||||||||||||

| Carrying Value | Fair Value | Carrying Value | Fair Value | ||||||||||||||||||||

| 2021 Notes | $ | $ | $ | $ | |||||||||||||||||||

| 2020 Notes | |||||||||||||||||||||||

| 2019 Notes | |||||||||||||||||||||||

| 2018 Notes (1) | |||||||||||||||||||||||

| $ | $ | $ | $ | ||||||||||||||||||||

(1)Contemporaneously with the partial repurchase of the 2018 Notes in the third quarter of 2020, the Company agreed with the counterparties to the associated capped call instrument (the “2018 Capped Call Transactions”) that the 2018 Capped Call Transactions would remain outstanding with a maturity of March 2023 and there was no exchange of any consideration for such agreement. See “Note 9—Debt” for more information on the Company’s capped call transactions.

The carrying value of other financial instruments, including accounts receivable, funds receivable and seller accounts, accounts payable, and funds payable and amounts due to sellers approximate fair value due to the immediate or short-term maturity associated with these instruments.

22

Note 8—Accrued Expenses

Accrued expenses consisted of the following as of the dates indicated (in thousands):

| As of September 30, 2022 | As of December 31, 2021 | ||||||||||

| Pass-through marketplace tax collection obligation | $ | $ | |||||||||

| Vendor accruals | |||||||||||

| Employee compensation-related liabilities | |||||||||||

| Taxes payable | |||||||||||

| Total accrued expenses | $ | $ | |||||||||

Note 9—Debt

The following table presents the outstanding principal amount and carrying value of the Notes as of the dates indicated (in thousands):

| As of September 30, 2022 | |||||||||||||||||||||||||||||

| 2021 Notes | 2020 Notes | 2019 Notes | 2018 Notes | Total | |||||||||||||||||||||||||

| Principal | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Unamortized debt issuance costs | |||||||||||||||||||||||||||||

| Net carrying value | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| As of December 31, 2021 | |||||||||||||||||||||||||||||

| 2021 Notes | 2020 Notes | 2019 Notes | 2018 Notes | Total | |||||||||||||||||||||||||

| Principal | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Unamortized debt issuance costs | |||||||||||||||||||||||||||||

| Net carrying value | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Terms of the Notes

The Notes will mature at their maturity date unless earlier converted or repurchased. The terms of the Notes are summarized below:

| Convertible Notes | Maturity Date | Contractual Convertibility Date (1) | Initial Conversion Rate per $1,000 Principal | Initial Conversion Price | Annual Effective Interest Rate | |||||||||||||||||||||||||||

2021 Notes | June 15, 2028 | February 15, 2028 | 4.0518 | $ | % | |||||||||||||||||||||||||||

2020 Notes | September 1, 2027 | May 1, 2027 | 5.0007 | % | ||||||||||||||||||||||||||||

2019 Notes | October 1, 2026 | June 1, 2026 | 11.4040 | % | ||||||||||||||||||||||||||||

2018 Notes | March 1, 2023 | November 1, 2022 | 27.5691 | % | ||||||||||||||||||||||||||||

(1)During any calendar quarter preceding the respective convertibility date of each series of Notes, in which the closing price of the Company’s common stock exceeds 130 % of the applicable conversion price of the Notes on at least 20 of the last 30 consecutive trading days of the quarter, holders may, in the immediate quarter following, convert all or a portion of their Notes. Based on the daily closing prices of the Company’s stock during the quarter ended September 30, 2022, holders of the remaining 2018 Notes are eligible to convert their 2018 Notes, and holders of the 2021 Notes, 2020 Notes, and 2019 Notes are not eligible to convert their 2021 Notes, 2020 Notes, and remaining 2019 Notes, respectively, during the fourth quarter of 2022.

Based on the terms of each series of Notes, when a conversion notice is received, the Company has the option to pay or deliver cash, shares of the Company’s common stock, or a combination thereof. Accordingly, the Company cannot be required to settle the Notes in cash and, therefore, the Notes are classified as long-term debt as of September 30, 2022.

23

The Company may redeem all or any portion of the 2021 Notes, at the Company’s option, subject to partial redemption limitations, on or after June 20, 2025, if the last reported sale price of the Company’s common stock has been at least 130 % of the conversion price then in effect for at least 20 trading days (whether or not consecutive), including the trading day immediately preceding the date on which the Company provides notice of redemption, during any 30 consecutive trading day period ending on, and including, the trading day immediately preceding the date on which the Company provides notice of redemption at a redemption price equal to 100 % of the principal amount of the 2021 Notes to be redeemed, plus accrued and unpaid interest to, but excluding, the redemption date.

The Notes are general unsecured obligations of the Company. The Notes rank senior in right of payment to all of the Company’s future indebtedness that is expressly subordinated in right of payment to the Notes; rank equal in right of payment with all of the Company’s liabilities that are not so subordinated; are effectively junior to any of the Company’s secured indebtedness; and are structurally junior to all indebtedness and liabilities (including trade payables) of the Company’s subsidiaries.

Interest Expense

Interest expense, which consists of coupon interest and amortization of debt issuance costs, related to each of the Notes for the periods presented below was as follows (in thousands):

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| 2021 Notes | $ | $ | $ | $ | |||||||||||||||||||

| 2020 Notes | |||||||||||||||||||||||

| 2019 Notes | |||||||||||||||||||||||

| 2018 Notes | |||||||||||||||||||||||

| Total interest expense | $ | $ | $ | $ | |||||||||||||||||||

Fair Value of Notes

The estimated fair value of each of the Notes was determined through inputs that are observable in the market, and are classified as Level 2. See “Note 7—Fair Value Measurements” for more information regarding the fair value of the Notes.

Capped Call Transactions

The Company used a portion of the net proceeds from each of the Notes offerings to enter into separate privately negotiated capped call instruments (the 2018, 2019, 2020, and 2021 capped call instruments collectively referred to as the “Capped Call Transactions”) with certain financial institutions, initial purchasers, and/or their respective affiliates. The Capped Call Transactions are expected generally to reduce the potential dilution and/or offset the cash payments the Company is required to make in excess of the principal amount of the Notes upon conversion of the Notes in the event that the market price per share of the Company’s common stock is greater than the strike price of the Capped Call Transactions with such reduction and/or offset subject to a cap. Collectively, the Capped Call Transactions cover, initially, the number of shares of the Company’s common stock underlying the respective Notes, subject to anti-dilution adjustments substantially similar to those applicable to the Notes.

The initial terms of the Company’s Capped Call Transactions are presented below:

| Capped Call Transactions | Maturity Date | Initial Cap Price per Share | Cap Price Premium | |||||||||||||||||

| 2021 Capped Call Transactions | June 13, 2028 | $ | % | |||||||||||||||||

| 2020 Capped Call Transactions | September 1, 2027 | % | ||||||||||||||||||

| 2019 Capped Call Transactions | October 1, 2026 | % | ||||||||||||||||||

| 2018 Capped Call Transactions | March 1, 2023 | % | ||||||||||||||||||

24

2019 Credit Agreement

On February 25, 2019, the Company entered into a $200.0 million senior secured revolving credit facility pursuant to a Credit Agreement (the “2019 Credit Agreement”) with lenders party thereto from time to time, and Citibank N.A., as administrative Agent. The 2019 Credit Agreement will mature in February 2024. The 2019 Credit Agreement includes a letter of credit sublimit of $30.0 million and a swingline loan sublimit of $10.0 million.

Borrowings under the 2019 Credit Agreement (other than swingline loans) bear interest, at the Company’s option, at (i) a base rate equal to the highest of (a) the prime rate, (b) the federal funds rate plus 0.50 %, and (c) an adjusted LIBOR rate for a one-month interest period plus 1.00 %, in each case plus a margin ranging from 0.25 % to 0.875 % or (ii) an adjusted LIBOR rate plus a margin ranging from 1.25 % to 1.875 %. Swingline loans under the 2019 Credit Agreement bear interest at the same base rate (plus the margin applicable to borrowings bearing interest at the base rate). These margins are determined based on the senior secured net leverage ratio (defined as secured funded debt, net of unrestricted cash up to $100 million, to EBITDA) for the preceding four fiscal quarter periods. The 2019 Credit Agreement contains customary provisions for the replacement of the adjusted LIBOR rate with an alternate benchmark rate when the adjusted LIBOR rate is phased out in the lending market. The Company does not anticipate that replacement of the benchmark rate, as provided in the 2019 Credit Agreement, will materially impact its liquidity or financial position. The Company is also obligated to pay other customary fees for a credit facility of this size and type, including an unused commitment fee, ranging from 0.20 % to 0.35 % depending on the Company’s senior secured net leverage ratio, and fees associated with letters of credit.

At September 30, 2022, the Company did no t have any borrowings under the 2019 Credit Agreement and was in compliance with all financial covenants.

Note 10—Commitments and Contingencies

Legal Proceedings

From time to time in the normal course of business, various other claims and litigation have been asserted or commenced against the Company. Due to uncertainties inherent in litigation and other claims, the Company can give no assurance that it will prevail in any such matters, which could subject the Company to significant liability for damages. Any claims or litigation could have an adverse effect on the Company’s results of operations, cash flows, or business and financial condition in the period the claims or litigation are resolved. Although the results of litigation and claims cannot be predicted with certainty, the Company currently believes that the final outcome of these ordinary course matters will not have a material adverse effect on its business.

25

Note 11—Stockholders’ Equity

In December 2020, the Board of Directors approved a stock repurchase program that enabled the Company to repurchase up to $250 million of its common stock. The program was completed in the third quarter of 2022.

Effective May 3, 2022, the Board of Directors approved a new stock repurchase program that authorizes the Company to repurchase up to an additional $600 million of its common stock. The program does not have a time limit and may be modified, suspended, or terminated at any time by the Board of Directors. The number of shares repurchased and the timing of repurchases will depend on a number of factors, including, but not limited to, stock price, trading volume, and general market conditions, along with the Company’s working capital requirements, general business conditions, and other factors.

Under the stock repurchase programs, the Company may purchase shares of its common stock through various means, including open market transactions, privately negotiated transactions, tender offers, or any combination thereof. In addition, open market repurchases of common stock could be made pursuant to trading plans established pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, which would permit common stock to be repurchased at a time that the Company might otherwise be precluded from doing so under insider trading laws or self-imposed trading restrictions.

The following table summarizes the Company’s cumulative share repurchase activity under the programs noted above, excluding shares withheld to satisfy tax withholding obligations in connection with the vesting of employee restricted stock units (“RSUs”) (in thousands, except share and per share amounts):

| Shares Repurchased | Average Price Paid per Share (1) | Value of Shares Repurchased (1) | Remaining Amount Authorized | ||||||||||||||||||||

| Balance as of January 1, 2022 | $ | ||||||||||||||||||||||

| Repurchases of common stock for the three months ended: | |||||||||||||||||||||||

| March 31, 2022 | $ | $ | ( | ||||||||||||||||||||

| June 30, 2022 | ( | ||||||||||||||||||||||

New Authorization as of May 3, 2022 | — | — | — | ||||||||||||||||||||

| Repurchases of common stock for the three months ended: | |||||||||||||||||||||||

| September 30, 2022 | ( | ||||||||||||||||||||||

| Balance as of September 30, 2022 | $ | $ | $ | ||||||||||||||||||||

(1) Average price paid per share excludes broker commissions. Value of shares repurchased includes broker commissions.

All repurchases were made using cash resources, and all repurchased shares of common stock have been retired.

Note 12—Stock-Based Compensation

During the three and nine months ended September 30, 2022, the Company granted RSUs, including financial performance-based restricted stock units (“Financial PBRSUs”) and total shareholder return performance-based restricted stock units (“TSR PBRSUs”), under its 2015 Equity Incentive Plan (“2015 Plan”) and, pursuant to the evergreen increase provision of the 2015 Plan, 6,351,106 additional shares were added to the total number of shares available for issuance under the 2015 Plan effective as of January 3, 2022. At September 30, 2022, 50,391,850 shares were authorized under the 2015 Plan and 32,035,675 shares were available for future grant.

The following table summarizes the activity for the Company’s unvested RSUs, which includes Financial PBRSUs and TSR PBRSUs, during the nine months ended September 30, 2022:

| Shares | Weighted-Average Grant Date Fair Value | ||||||||||

| Unvested at December 31, 2021 | $ | ||||||||||

| Granted | |||||||||||

| Vested | ( | ||||||||||

| Forfeited/Canceled | ( | ||||||||||

| Unvested at September 30, 2022 | |||||||||||

26

The total unrecognized compensation expense at September 30, 2022 related to the Company’s unvested RSUs, including the Financial PBRSUs and TSR PBRSUs, was $730.3 million, which will be recognized over an estimated weighted-average amortization period of 3.11 years.

In connection with the acquisition of Depop, certain Depop executives are eligible to receive deferred consideration of $44.0 million in shares of Etsy common stock over the three years following the acquisition date, subject to certain service-based vesting conditions during the vesting period. These awards will be settled by issuing shares of Etsy common stock on or shortly following the applicable vesting date, with the number of shares to be determined based on the Company’s stock price on, or leading up to, the applicable vesting date. These awards will be recognized as post-combination service stock-based compensation expense over a vesting period equal to the mandatory service period associated with the award, with a corresponding liability included within Other liabilities on the Company’s Consolidated Balance Sheets until the service-based vesting criteria are met and the awards are settled in shares of Etsy common stock. The unrecognized compensation expense at September 30, 2022 related to these awards was $5.4 million, which will be recognized over an estimated weighted-average amortization period of 1.78 years. The decrease from the initial unrecognized compensation expense of $44.0 million primarily relates to the departure of Depop’s Chief Executive Officer, effective September 2022, and the partial payments of Depop deferred consideration in the nine months ended September 30, 2022. These amounts are excluded from the unrecognized compensation expense associated with the Company’s unvested RSUs noted above.

The total unrecognized compensation expense at September 30, 2022 related to the Company’s options was $17.1 million, which will be recognized over an estimated weighted-average amortization period of 2.07 years.

Stock-based compensation expense included in the Condensed Consolidated Statements of Operations for the periods presented below is as follows (in thousands):

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Cost of revenue | $ | $ | $ | $ | |||||||||||||||||||

| Marketing | |||||||||||||||||||||||

| Product development | |||||||||||||||||||||||

| General and administrative | |||||||||||||||||||||||

| Stock-based compensation expense | $ | $ | $ | $ | |||||||||||||||||||

27

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

You should read the following discussion and analysis of our financial condition and results of operations together with our condensed consolidated financial statements and related notes and other financial information included elsewhere in this Quarterly Report on Form 10-Q (“Quarterly Report”) and with the audited consolidated financial statements included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on February 25, 2022 (the “Annual Report”). This discussion, particularly information with respect to our outlook, key trends and uncertainties, our plans and strategy for our business, and our performance and future success, includes forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those discussed below. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this Quarterly Report, particularly in Part II, Item 1A, “Risk Factors.” We also believe that our performance and future success depend on a number of factors that present significant opportunities for us, as discussed in Part I, Item 1, “Business,” in our Annual Report, which we incorporate by reference.

Overview

Business

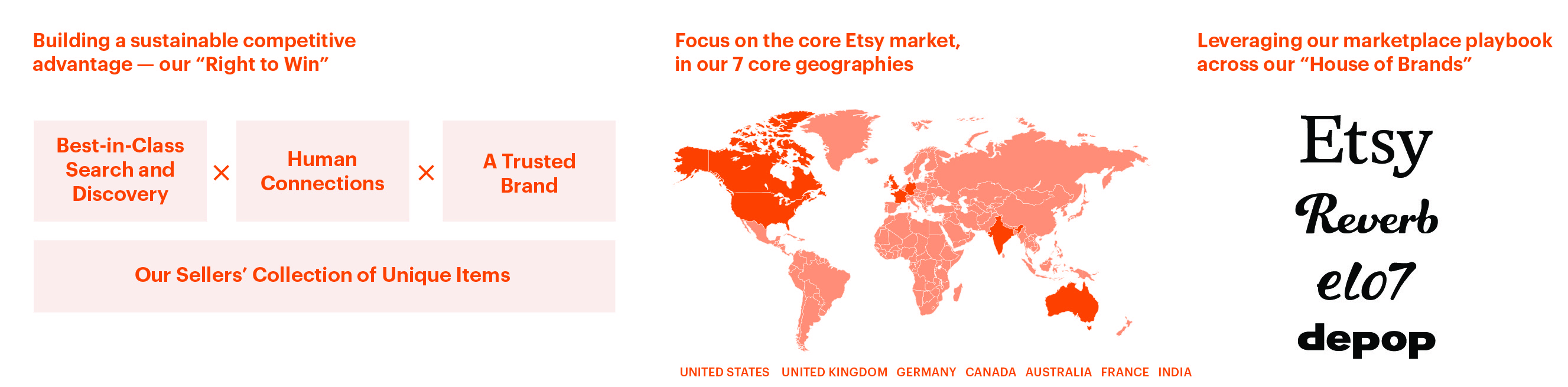

Etsy operates two-sided online marketplaces that connect millions of passionate and creative buyers and sellers around the world. These marketplaces - which collectively create a “House of Brands” - share our mission, common levers for growth, similar business models, and a strong commitment to use business and technology to strengthen communities and empower people.

Our primary marketplace, Etsy.com, is the global destination for unique and creative goods made by independent sellers. The Etsy marketplace connects creative artisans and entrepreneurs with thoughtful consumers looking for items that are a joyful expression of their taste and values. Our sellers are the heart and soul of Etsy, and our technology platform allows our sellers to turn their creative passions into economic opportunity. We have a seller-aligned business model: we make money when our sellers make money. We offer Etsy.com sellers a marketplace with tens of millions of buyers along with a range of seller tools and services that are specifically designed to help our creative entrepreneurs generate more sales and scale their businesses.

Buyers come to the Etsy marketplace for meaningful, one-of-a-kind items handcrafted and curated with passion and expertise by our creative entrepreneurs. We are focused on attracting potential buyers to Etsy for everyday items that have meaning and those “special” purchase occasions that happen throughout the year. These include items that reflect an individual’s unique style; gifting that demonstrates thought and care; and celebrations that express creativity and fun.

In addition to our core Etsy marketplace, our “House of Brands” consists of Reverb Holdings, Inc. (“Reverb”), our musical instrument marketplace, Depop Limited (“Depop”), our fashion resale marketplace, and Elo7 Serviços de Informática S.A. (“Elo7”), our Brazil-based marketplace for handmade and unique items. Each of our marketplaces operates independently, while benefiting from shared expertise in product, marketing, technology, and customer support. The results of Elo7 and Depop, acquired on July 2, 2021 and July 12, 2021, respectively, are included in all financial and other metrics discussed in this report, unless otherwise noted, from their respective dates of acquisition.

We generate revenue primarily from marketplace activities, including transaction, listing, and payments processing fees, and optional services, which include on-site advertising and shipping labels.

28