Form 10-Q CHIPOTLE MEXICAN GRILL For: Mar 31

Exhibit 10.2

CHIPOTLE MEXICAN GRILL, INC.

PERFORMANCE SHARE AGREEMENT

Name of Participant:

Target Number of

Performance Shares:

Grant Date:

Performance Period: January 1, 2021 – December 31, 2023

Vesting Date: Date of the Performance Certification (as defined below)

This Performance Share Agreement (this “Agreement”), dated as of the Grant Date stated above, is delivered by Chipotle Mexican Grill, Inc., a Delaware corporation (the “Company”), to the Participant named above (the “Participant” or “you”).

WHEREAS, the Company is awarding you performance shares (“Performance Shares”) representing the right to receive shares of Common Stock of the Company (the “Shares”) on the terms and conditions provided below and pursuant to the Amended and Restated Chipotle Mexican Grill, Inc. 2011 Stock Incentive Plan (the “Plan”). This Agreement and the Performance Shares granted hereunder are expressly subject to all of the terms, definitions and provisions of the Plan. Except as expressly indicated herein, defined terms used in this Agreement have the meanings set forth in the Plan.

WHEREAS, the Compensation Committee (the “Committee”) of the Company’s Board of Directors (the “Board”) has approved this award of Performance Shares (the “Award”).

NOW, THEREFORE, the parties hereby agree as follows:

1. Grant of Performance Shares. The Company hereby grants to you the Award with respect to the target number of Performance Shares set forth above, pursuant to which you shall be eligible to receive a number of equivalent Shares for each Performance Share that vests, subject to your fulfillment of the vesting and other conditions set forth in this Agreement, including Appendix A hereto, including both:

(a) Certification by the Committee of the extent to which the Performance Goals set forth on Appendix A have been achieved (the “Performance Certification”), if at all, and the satisfaction or occurrence of any additional conditions to vesting set forth on Appendix A, with such Performance Certification occurring on February 15, 2024, which follows the conclusion of the Performance Period; and

8

(b) Your continuous employment with the Company (subject to the provisions of Section 2) from the Grant Date through the date of Performance Certification (the “Vesting Date”).

2. Effect of Termination of Employment and Change in Control.

(a) Termination of Employment Due to Death, Disability or Retirement. Unless otherwise determined by the Committee, or except as provided in an agreement between you and your Employer, if your employment terminates by reason your death, termination by the Company due to Disability, or Retirement (each as defined below) prior to the Vesting Date, you shall vest in the Performance Shares as follows:

(i) In the event of your Retirement prior to the one-year anniversary of the Grant Date, you shall become vested on the Vesting Date in a pro rata portion of the Performance Shares, determined by multiplying the total number of Performance Shares determined based on actual achievement during the Performance Period of the Performance Goals set forth on Appendix A by a fraction, the numerator of which is the number of days from the Grant Date through your Retirement and the denominator of which is 365.

(ii) In the event of your Retirement on or after the one-year anniversary of the Grant Date, the total number of Performance Shares determined based on actual achievement during the Performance Period of the Performance Goals set forth on Appendix A, without proration, shall become vested on the Vesting Date.

(iii) In the event of your death or termination by the Company due to Disability at any time after the Grant Date, the total number of Performance Shares determined based on actual achievement during the Performance Period of the Performance Goals set forth on Appendix A, without proration, shall become vested on the Vesting Date.

For purposes of this Agreement: “Disability” means your medically-diagnosed, permanent physical or mental inability to perform your duties as an employee of the Company; “Retirement” means that you have a combined Age and Years of Service (each as defined below) of at least 70 and you have done all of the following (w) given the Company at least six (6) months prior written notice of your Retirement; (x) signed and delivered to the Company an agreement providing for such restrictive covenants, as may be determined from time to time by the Committee, based on individual facts and circumstances, to be reasonably necessary to protect the Company’s interests, with such restrictive covenants continuing for a period of two (2) years after such Retirement (or, indefinitely, in the case of confidentiality and similar restrictive covenants), (y) signed and delivered to the Company, within 21 days of the date of your employment termination (or such later time as required under applicable law) a general release agreement of claims against the Company and its affiliates in a form reasonably acceptable to the Company, which is not later revoked, and (z) voluntarily terminated your employment with the Company. The term “Age” means (as of a particular date of determination), your age on that date in whole years and any fractions thereof; and “Years of Service” means the number of years and fractions thereof during the period beginning on your most recent commencement of employment with the Company and

2

ending on the date your employment with the Company terminated. Your refusal to fulfill any of the conditions set forth in (w), (x), (y) or (z) above, your breach of any agreement entered into pursuant to (x) or (y) above, or if, after your Retirement, facts and circumstances are discovered that would have justified your termination for Cause (as defined below) if you were still employed by the Company, shall constitute a waiver by you of the benefits attributable to Retirement under this Agreement.

(b) Forfeiture of Performance Shares. Unless otherwise determined by the Committee, or except as provided in an agreement between you and the Company, if your employment terminates before the Vesting Date for any reason other than Death, termination by the Company due to Disability, Retirement or a Qualifying Termination (as described in Section 2(c) below), all Performance Shares subject to this Award shall be forfeited and canceled as of the date of such employment termination.

(c) Effect of a Change in Control.

(i) Satisfaction of Performance Goals. In the event of a Change in Control prior to the end of a Performance Period, the Performance Period shall end as of the date of the Change in Control and the Performance Goals shall be deemed to have been satisfied at the greater of (A) 100% of the target level, with the potential payout pro-rated based on the time elapsed in the Performance Period through the date of the Change in Control and (B) the actual level of achievement of the Performance Goals set forth in Appendix A as of the date of the Change in Control, as determined by the Committee, as constituted immediately prior to the Change in Control, without proration.

(ii) Settlement of Award Not Assumed. In the event of a Change in Control prior to the end of a Performance Period pursuant to which the Award is not assumed or continued by the surviving or acquiring corporation in such Change in Control (as determined by the Board or Committee, with appropriate adjustments to the number and kind of shares, in each case, that preserve the value of the Award and other material terms and conditions of this Award as in effect immediately prior to the Change in Control), the Performance Shares shall vest as of the date of the Change in Control, based on the performance level determined in accordance with clause (i) above and shall be settled within 60 days following the Change in Control; provided, however, if the Performance Shares are “nonqualified deferred compensation” within the meaning of Section 409A of the Code and the Change in Control is not a “change in control event” within the meaning of Section 409A of the Code or the settlement upon such Change in Control would otherwise be prohibited under Section 409A of the Code, then the Performance Shares shall be settled at the time specified in Section 3.

(iii) Settlement of Award Assumed. In the event of a Change in Control prior to the end of a Performance Period pursuant to which this Award is assumed or continued by the surviving or acquiring corporation in such Change in Control (as determined by the Board or Committee, with appropriate adjustments to the number and kind of shares, in each case, that preserve the value of the Award and other material terms and conditions of this Award as in effect immediately prior to the Change in Control) and either (A) you remain continuously and actively employed by the Company through the end of such Performance Period, (B) you experience a Qualifying Termination or your employment

3

terminates due to death, termination by the Company due to Disability or Retirement following such Change in Control, then in any such case, the Performance Shares shall vest based on the performance level determined in accordance with clause (i) above and shall be settled within 60 days following the earlier to occur of (x) the end of the Performance Period and (y) the date of your death or such termination of employment.

For purposes of this Agreement and notwithstanding anything in the Plan to the contrary for purposes of determining whether a Qualifying Termination has occurred during the two-year period following a Change in Control: (A) “Cause” means, unless otherwise provided in an effective employment agreement or other written agreement with respect to the termination of your employment with the Company, the termination of your employment with the Company on account of: (u) your failure to substantially perform your duties (other than as a result of physical or mental illness or injury); (w) your willful misconduct or gross negligence which is materially injurious to the Company or results in reputational harm to the Company; (x) a breach by you of your fiduciary duty or duty of loyalty to the Company; (y) your commission of any felony or other serious crime involving moral turpitude; or (z) your material violation of Company policies or agreements between you and the Company and (B) “Good Reason” means, unless otherwise provided in an effective employment agreement or other written agreement with respect to the termination of your employment with the Company, the termination of your employment with the Company on account of: (x) a material diminution of your duties and responsibilities other than a change in your duties and responsibilities that results from becoming part of a larger organization following a Change in Control, (y) a material decrease in your base salary or bonus opportunity other than a decrease in bonus opportunity that applies to all employees of the Company otherwise eligible to participate in the applicable bonus plan, or (z) a relocation of your primary work location more than 30 miles from your work location on the Grant Date, without your prior written consent; provided that, within thirty days following the occurrence of any of the Good Reason events set forth herein, you shall have delivered written notice to the Company of your intention to terminate your employment for Good Reason, which notice specifies in reasonable detail the circumstances claimed to give rise to your right to terminate employment for Good Reason, and the Company shall not have cured such circumstances within thirty days following the Company’s receipt of such notice.

3. Distribution Upon Vesting. Subject to Sections 2 and 18, as soon as practicable following the expiration of the Performance Period (but no later than March 15th following the expiration of the Performance Period), the Company shall issue or deliver, subject to the conditions of this Agreement, the Shares for the vested Performance Shares to you. The Award may only be settled in Shares. Such issuance or delivery of Shares shall be evidenced by the appropriate entry on the books of the Company or of a duly authorized transfer agent of the Company. The Company shall pay all original issue or transfer taxes and all fees and expenses incident to such issuance or delivery, except as otherwise provided in Section 6. Prior to the issuance to you of the Shares subject to the Award, you shall have no direct or secured claim in any specific assets of the Company or in such Shares, and will have the status of a general unsecured creditor of the Company.

4

4. No Shareholder Rights. Neither you nor any person claiming under or through you shall have rights as a holder of Shares (e.g., you have no right to vote or receive dividends) with respect to the Performance Shares granted hereunder unless and until such Performance Shares have been settled in Shares that have been registered in your name as owner.

5. Dividend Equivalents. Prior to the settlement of the Performance Shares, you shall accumulate dividend equivalents with respect to the Performance Shares, which dividend equivalents shall be paid in cash (without interest) to you only if and when the applicable Performance Shares vest and become payable. Dividend equivalents shall equal the dividends, if any, actually paid with respect to Shares prior to the settlement of the Award while (and to the extent) the Performance Shares remain outstanding and unpaid. In the event you forfeit Performance Shares, you also shall immediately forfeit any dividend equivalents held by the Company that are attributable to the Shares underlying such forfeited Performance Shares.

6. Tax Withholding. As a condition precedent to the issuance of Shares following the vesting of the Performance Shares, you shall, upon request by the Company, pay to the Company such amount as the Company determines is required, under all applicable federal, state, local or other laws or regulations, to be withheld and paid over as income or other withholding taxes (the “Required Tax Payments”) with respect to such vesting of the Performance Shares. If you shall fail to advance the Required Tax Payments after request by the Company, the Company may, in its discretion, deduct any Required Tax Payments from any amount then or thereafter payable by the Company to you. Notwithstanding the foregoing, your obligation to advance the Required Tax Payments shall be satisfied by the Company withholding whole Shares that would otherwise be delivered to you upon vesting of the Performance Shares having an aggregate fair market value, determined as of the date on which such withholding obligation arises (the “Tax Date”), equal to the Required Tax Payments; however, if you submit a written request to the Company at least ten (10) days in advance of the Vesting Date, the Company may agree, in its discretion, to permit you to satisfy your obligation to advance the Required Tax Payments by a check or cash payment to the Company. Shares shall be withheld based on the applicable statutory minimum tax rate; however, if you submit a written request to the Company at least ten (10) days in advance of the Vesting Date, the Company (or, in the case of an individual subject to Section 16 of the Securities Exchange Act of 1934, as amended, the Committee) may agree, in its discretion, to withhold shares based on a higher tax rate permitted by applicable withholding rules and accounting rules without resulting in variable accounting treatment. No Share or certificate representing a Share shall be issued or delivered until the Required Tax Payments have been satisfied in full.

7. Repayment; Right of Set-Off. You agree and acknowledge that this Agreement is subject the Company’s Executive Compensation Recoupment Policy and any other repayment policies that are in effect on the Grant Date or that the Committee may adopt from time to time with respect to the repayment to the Company of any benefit received hereunder, including “clawback,” recoupment or set-off policies. In addition, you agree that in the event the Company, in its reasonable judgment, determines that you owe the Company any amount due to any loan, note, obligation or indebtedness, including but not limited to amounts owed to the Company pursuant to the Company’s policies with respect to travel and business expenses, and if you have not satisfied such obligation, then the Company may instruct the plan administrator to withhold

5

and/or sell Shares acquired by you upon settlement of the Award, or the Company may deduct funds equal to the amount of such obligation from other funds due to you from the Company.

8. Adjustment of Performance Shares. The number of Performance Shares subject to this Award and the related Performance Goals shall automatically be adjusted in accordance with Section 9 of the Plan to prevent accretion, or to protect against dilution, in the event of a change to the Common Stock resulting from a recapitalization, stock split, consolidation, spin-off, reorganization, or liquidation or other similar transactions.

9. Non-Transferability of Award. Unless the Committee specifically determines otherwise, the Performance Shares may not be transferred by you other than by will or the laws of descent and distribution. Except to the extent permitted by the foregoing sentence, the Award may not be sold, transferred, assigned, pledged, hypothecated, encumbered or otherwise disposed of (whether by operation of law or otherwise) or be subject to execution, attachment or similar process. Upon any attempt to so sell, transfer, assign, pledge, hypothecate, encumber or otherwise dispose of the Award, the Award and all rights hereunder shall immediately become null and void.

10. No Right to Continued Employment or Service. The granting of the Award shall not be construed as granting to you any right to continue your employment or Service with the Company.

11. Amendment of this Award. This Award or the terms of this Agreement may be amended by the Board or the Committee at any time (a) if the Board or the Committee determines, in its reasonable discretion, that amendment is necessary or appropriate to conform the Award to, or otherwise satisfy, any legal requirement (including without limitation the provisions of Section 409A of the Code), which amendments may be made retroactively or prospectively and without your approval or consent to the extent permitted by applicable law; provided that, such amendment shall not materially and adversely affect your rights hereunder; or (b) with your consent.

12. Electronic Delivery and Acceptance. You hereby consent and agree to electronic delivery of any Plan documents, proxy materials, annual reports and other related documents. You also hereby consent to any and all procedures that the Company has established or may establish for an electronic signature system for delivery and acceptance of Plan documents (including documents relating to any programs adopted under the Plan), and agree you’re your electronic signature is the same as, and shall have the same force and effect as, your manual signature. You consent and agree that any such procedures and delivery may be effected by a third party engaged by the Company to provide administrative services related to the Plan, including any program adopted under the Plan.

13. Governing Plan Document. The Award is subject to all the provisions of the Plan, the provisions of which are hereby made a part of this Agreement, and is further subject to all interpretations, amendments, rules and regulations which may from time to time be promulgated and adopted pursuant to the Plan. In the event of any conflict between the provisions of the Award or this Agreement and those of the Plan, the provisions of the Plan shall control.

6

14. Governing Law. The validity, construction, interpretation and effect of this Agreement shall exclusively be governed by and determined in accordance with the laws of the State of Delaware, without giving effect to conflict of law rules or principles.

15. Entire Agreement. This Agreement and the Plan constitute the entire understanding and agreement between the Company and the Participant with respect to the subject matter contained herein and supersedes any prior agreements, understandings, restrictions, representations, or warranties between the Company and the Participant with respect to such subject matter other than those as set forth or provided for herein.

16. No Waiver. No failure by any party to insist upon the strict performance of any covenant, duty, agreement or condition of this Agreement or to exercise any right or remedy consequent upon a breach thereof shall constitute waiver of any such breach or any other covenant, duty, agreement or condition.

17. Saving Clause. If any provision of this Agreement shall be determined to be illegal or unenforceable, such determination shall in no manner affect the legality or enforceability of any other provision hereof.

18. Compliance with Section 409A of the Code. This Award is intended to be exempt from or comply with Section 409A of the Code, and shall be interpreted and construed accordingly, and each payment hereunder shall be considered a separate payment. To the extent this Agreement provides for the Award to become vested and be settled upon the Holder’s termination of employment, the applicable shares of Stock shall be transferred to you or your beneficiary upon your “separation from service,” within the meaning of Section 409A of the Code; provided that if you are a “specified employee,” within the meaning of Section 409A of the Code, then to the extent the Award constitutes nonqualified deferred compensation, within the meaning of Section 409A of the Code, such Shares shall be transferred to you or your beneficiary upon the earlier to occur of (i) the six-month anniversary of such separation from service and (ii) the date of your death.

CHIPOTLE MEXICAN GRILL, INC.

Chief People Officer

7

Appendix A to 2021 Performance Share Agreement

Performance Criteria

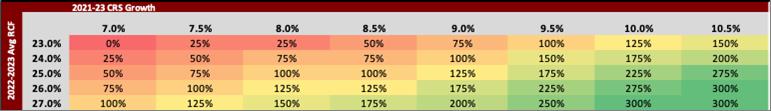

The performance criteria under this Performance Share Award shall be 3 Year CRS Growth and 2 Year Average RCF Margin, as such terms are defined below. In addition, there is a cap on above target payout based on relative Total Shareholder Return (TSR) compared to the S&P 500.

Performance Period

Performance will be measured from January 1, 2021 through December 31, 2023 for CRS and TSR, and from January 1, 2022 through December 31, 2023 for RCF.

Performance Goal Table

The number of Shares that can be earned under this Performance Share Award is equal to the Target Number of Performance Shares multiplied by the percentage determined under the Performance Goal Table set forth below (the “Payout Percentage”).

2022-2023 Avg RCF 2021-23 CRS Growth 7.0% 0% 25% 50% 75% 100% 7.5% 25% 50% 75% 100% 125% 8.0% 25% 75% 100% 125% 150% 8.5% 50% 75% 100% 125% 175% 9.0% 75% 100% 125% 175% 200% 9.5% 100% 150% 175% 225% 250% 10.0% 125% 175% 225% 275% 300% 10.5% 150% 200% 275% 300% 300% 23.0% 24.0% 25.0% 26.0% 27.0%

In no event will any Performance Shares be earned under this Appendix A if either (a) the 3 Year Average RCF Margin is less than 23.0% or (b) the 3 Year CRS Growth is less than 7.0%. In no event may more than 300% of the Target Number of Performance Shares be earned under this Appendix A. If the level of performance for either 3 Year CRS Growth, 2 Year Average RCF Margin or both falls between two stated performance levels in the Performance Goal Table, the Payout Percentage shall be determined under the heading “Interpolation” below.

Cap on Above Target Payout

In no event may more than 100% of the Target Number of Performance Shares be earned under this Appendix A if Chipotle’s 3 Year TSR is below the 25th percentile of the constituent companies comprising the S&P 500 on the date of grant.

“TSR” means total shareholder return as determined by dividing (i) the sum of (A) the Ending Period Average Price minus the Beginning Period Average Price plus (B) all dividends and other distributions paid on the issuer’s shares during the Performance Period by (ii) the Beginning Period Average Price. In calculating TSR, all dividends are assumed to have been reinvested in shares when paid. TSR for a constituent company will be negative one hundred percent (-100%) if during the Performance Period it: (i) files for bankruptcy, reorganization, or liquidation under

8

any chapter of the U.S. Bankruptcy Code; (ii) is the subject of an involuntary bankruptcy proceeding that is not dismissed within 30 days; (iii) is the subject of a stockholder approved plan of liquidation or dissolution; or (iv) ceases to conduct substantial business operations. If a constituent company is acquired, taken private or delisted (independent of situations covered in (i) through (IV) above) during the performance period, it will be excluded from the TSR calculation.

“Beginning Period Average Price” means the average closing price per share of the issuer over the 20-consecutive-trading days starting with and including the first day of the Performance Period (if the applicable day is not a trading day, the immediately preceding trading day), adjusted for stock splits or similar changes in capital structure.

“Ending Period Average Price” means the average closing price per share of the issuer over the 20-consecutive-trading days ending with and including the last day of the Performance Period (if the applicable day is not a trading day, the immediately preceding trading day), adjusted for stock splits or similar changes in capital structure.

3 Year CRS Growth

For purposes of the Performance Goal Table under this Appendix A, “3-Year CRS Growth” shall be determined with respect to the three-year period beginning on January 1, 2021 using the following formula:

[(1+X)*(1+Y)*(1+Z)]^(1/3)-1

Where:

“X” = the annual percentage change in the Comparable Restaurant Sales for the fiscal year ending December 31, 2021

“Y” = the annual percentage change in Comparable Restaurant Sales for the fiscal year ending December 31, 2022

“Z” = the annual percentage change in Comparable Restaurant Sales for the fiscal year ending December 31, 2023

The following terms shall have the respective meanings set forth below when determining 3-Year CRS Growth:

“Comparable Restaurant” means a restaurant operated under the Chipotle Mexican Grill and/or Pizzeria Locale brands by the Company or its direct or indirect Subsidiaries, beginning in such restaurant’s 13th full calendar month of operations.

“CRS” or “Comparable Restaurant Sales” with respect to a fiscal year, means the net sales attributable to Comparable Restaurants that are realized during such year, as determined in accordance with generally accepted accounting principles. For avoidance of doubt, net sales from a restaurant shall only be counted after it has become a Comparable Restaurant.

9

2 Year Average RCF Margin

For purposes of the Performance Goal Table under this Appendix A, “2 Year Average RCF Margin” shall be determined under the following formula:

Y + Z

2

Where:

“Y” = the Company’s RCF Margin from restaurant operations for the fiscal year ending December 31, 2022.

“Z” = the Company’s RCF Margin from restaurant operations for the fiscal year ending December 31, 2023.

“RCF Margin” represents the Company’s total revenue less restaurant operating costs (exclusive of depreciation and amortization), expressed as a percentage of the Company’s total revenue, for the applicable Company fiscal year. RCF Margin shall be determined in accordance with generally accepted accounting principles as in effect on the first day of the applicable Performance Period.

Potential Force-Majeure Related Adjustments

Notwithstanding the foregoing, if the Committee certifies that a Force Majeure Event has occurred and RCF Margin and/or CRS Growth, calculated on a consolidated company-wide basis, is “Significantly Impacted,” the calculation of RCF Margin and/or CRS Growth shall be adjusted in the manner outlined below. For purposes of this section, a “Force Majeure Event” is an extraordinary event or circumstance such as an act of God, war or war condition, government mandate, widespread civil disorder, embargo, fire, flood, earthquake or other nature disaster, epidemic, pandemic or other similar occurrence beyond the reasonable control of the company.

RCF Margin Adjustment – Expense Impact

The expenses that arise directly from or due to a Force Majeure Event will be excluded from the calculation of RCF Margin in the fiscal year during which the Company’s RCF Margin is significantly impacted by a Force Majeure Event.

“Significantly Impacted” means that (i) the direct costs associated with the Force Majeure event negatively impact RCF Margin by 100 BPS for three months in the fiscal year; or (ii) the direct costs associated with the Force Majeure event negatively impact RCF Margin by 100 BPS for the entire fiscal year.

RCF Adjustment – Sales Reduction Impact in 2022 and/or 2023

The calculation of RCF Margin will exclude any month in 2022 and/or 2023 during which the Company’s CRS is significantly impacted by a Force Majeure Event.

10

“Significantly Impacted” means that, for fiscal years 2022 and 2023, the CRS for the impacted month is 5% lower than the average CRS figure for the three months immediately preceding the month in which the Force Majeure event occurred.

CRS Adjustment in 2023

The calculation of CRS Growth in 2023 will exclude any month during with the Company’s CRS is significantly impacted by a Force Majeure Event.

“Significantly Impacted” means the CRS for the impacted month is 5% lower than the average CRS figure for the three months immediately preceding the month in which the Force Majeure event occurred.

Interpolation

The following rules shall be used to determine the Payout Percentage when the level of performance for either 3 Year CRS Growth, 2 Year Average RCF Margin or both falls between two stated performance levels in the Performance Goal Table:

(1) Determine what the Payout Percentage would have been without interpolation based on the highest actual results achieved and reflected in the Performance Goal Table for 3 Year CRS Growth and 2 Year Average RCF Margin. For example, assume that 2 Year Average RCF Margin is 23.50% and 3 Year CRS Growth is 7.25%. The Payout Percentage with no interpolation would be zero, as the highest achieved level of performance under the Performance Goal Table is 23% for 2 Year Average RCF Margin and 7.0% for 3 Year CRS Growth (with respect to each Performance Criteria, the “Base Achieved Level”).

(2) Calculate the CRS Adjustment Factor as follows:

(a) Determine what the Payout Percentage would have been had positive results in excess of the Base Achieved Level for 3 Year CRS Growth been rounded up to the next highest level of stated performance in the Performance Goal Table (the “CRS Rounded Up Level”). In the example noted in paragraph (1) above, the CRS Rounded Up Level would be 7.5% for 3 Year CRS Growth (7.25% rounded up to 7.5%), and the Payout Percentage based on the CRS Rounded Up Level would be 25% under the Performance Goal Table.

(b) Determine, as a percentage, the extent to which the Company achieved results for 3 Year CRS Growth greater than its Base Achieved Level as compared to its CRS Rounded Up Level, assuming that 2 Year Average RCF Margin equals its Base Achieved Level. In the example noted in Paragraph (1) above, the extent to which 3 Year CRS Growth was attained between its Base Achieved Level and CRS Rounded Up Level was 25%, assuming a Base Achieved Level of 23% for 2 Year Average RCF Margin (7.25% is halfway in between the Base Achieved Level and the CRS Rounded Up Level).

(c) Calculate the CRS Adjustment Factor by (A) multiplying the difference between the percentages in paragraphs (2)(a) and (1) above by the percentage determined in paragraph

11

(2)(b) above, rounded to the nearest tenth of a percent. In the example noted in paragraph (1) above, the CRS Adjustment Factor is 12.5% (i.e., (25% - 0%) multiplied by 50%).

(3) Calculate the RCF Adjustment Factor as follows:

(a) Determine what the Payout Percentage would have been had positive results in excess of the Base Achieved Level for 2 Year Average RCF Margin been rounded up to the next highest level of stated performance in the Performance Goal Table (the “RCF Rounded Up Level”). In the example noted in paragraph (1) above, the RCF Rounded Up Level would be 24% for 2 Year Average RCF Margin (23.50% rounded up to 24%), and the Payout Percentage based on the RCF Rounded Up Level would be 25% under the Performance Goal Table.

(b) Determine, as a percentage, the extent to which the Company achieved results for 2 Year Average RCF Margin greater than its Base Achieved Level as compared to its RCF Rounded Up Level, assuming that 3 Year CRS Growth equals its Base Achieved Level. In the example noted in Paragraph (1) above, the extent to which 2 Year Average RCF Margin was attained between its Base Achieved Level and Rounded Up Level was 25%, assuming a Base Achieved Level of 7% for 3 Year CRS Growth.

(c) Calculate the RCF Adjustment Factor by (A) multiplying the difference between the percentages in paragraphs (3)(a) and (1) above by the percentage determined in paragraph (3)(b) above, rounded to the nearest tenth of a percent. In the example noted in paragraph (1) above, the RCF Adjustment Factor is 12.5% (i.e., (25% - 0%) multiplied by 50%).

(4) Calculate the Payout Percentage by adding the CRS Adjustment Factor and the RCF Adjustment Factor to the Base Achieved Level from Paragraph (1). In the example noted in paragraph (1) above, the interpolated Payout Percentage would be 25% (i.e. 12.5% + 12.5%).

Other Provisions

If the Committee determines, after granting the Performance Share Award, that there has been a change in law or accounting rules that impacts CRS and/or RCF Margin as set forth in this Appendix A, the Committee shall modify these measures, in whole or in part, as it deems appropriate and equitable in its discretion for such events that were not determinable or considered at the Grant Date. For the avoidance of doubt, no adjustments otherwise authorized under Section 8 of the Plan shall be made with respect to the Performance Shares except as specifically provided in this Appendix A.

Performance Shares that are earned under this Appendix A shall only be issued to the Participant to the extent that the continued employment conditions set forth in the Performance Share Agreement have been satisfied.

12

Exhibit 10.3

Amended and Restated Performance Share Agreement

This Performance Share Agreement, including the Appendices attached hereto, are amended and restated as of December 31, 2020.

Name of Participant:

Target Number of

Performance Shares:

Grant Date:

Performance Period: January 1, 2018 – December 31, 2020

This Performance Share Agreement (“Agreement”) evidences the grant to the Participant by Chipotle Mexican Grill, Inc. (the “Company”) of the right to receive shares of Common Stock of the Company, $.01 par value per share (“Common Stock”), on the terms and conditions provided for herein pursuant to the Amended and Restated Chipotle Mexican Grill, Inc. 2011 Stock Incentive Plan (the “Plan”). Except as specifically set forth herein, this Agreement and the rights granted hereunder are expressly subject to all of the terms, definitions and provisions of the Plan as it may be amended and restated from time to time. Capitalized terms used in this Agreement and not defined herein shall have the meanings attributed to them in the Plan.

1. Grant of Performance Shares. Subject to the terms and provisions of this Agreement and the Plan, the Company hereby grants to Participant the right to be issued shares of Common Stock as provided in this Agreement, including Appendix A and Appendix C hereto (the “Performance Shares”), subject to the following conditions:

(a) Certification by the Committee of the extent to which the Performance Goals set forth on Appendix A and Appendix C have been achieved;

(b) Participant being continuously employed (subject to the provisions of Section 2) with the Company (as defined in the Plan) from the Grant Date through the final day of the Performance Period; and

(c) The satisfaction or occurrence of any additional conditions to vesting set forth on Appendix A and Appendix C.

The date on which all of the conditions set forth above are satisfied is the “Vesting Date,” and the Company will issue one share of Common Stock for each Performance Share earned and vested to the Participant on the March 15th immediately following the Performance Period, subject to (i) earlier payment in connection with a Change in Control under Section 3(c) or to the extent administratively practicable following the Vesting Date, or (ii) later payment as permitted without resulting in tax under Section 409A of the Code (the date of such issuance of shares following the Vesting Date, the “Payout Date”).

This Agreement represents the Company’s unfunded and unsecured promise to issue Common Stock at a future date, subject to the terms of this Agreement and the Plan. Participant has no rights under this Agreement other than the rights of a general unsecured creditor of the Company.

Subject to the satisfaction of any tax withholding obligations described in Section 6 below, Participant may elect to defer the receipt of any of the shares of Common Stock underlying the Performance Shares by submitting to the Company a deferral election in the form provided by the Company. In the event Participant intends to defer the receipt of Performance Shares, Participant must submit to the Company a completed deferral election form no later than the Final Election Date (as defined below). By submitting such deferral election, Participant represents that he/she understands the effect of any such deferral under relevant federal, state and local tax and social security laws, including, but not limited to, the fact that social security contributions may be due upon the Vesting Date notwithstanding the deferral election. Any deferral election may be amended or terminated prior to the Final Election Date. A deferral election shall become irrevocable on the Final Election Date and any deferral election or revision of a deferral election submitted after the Final Election Date shall be void and of no force or effect. The “Final Election Date” shall be the last business day occurring on or before the date that is six months prior to the final day of the Performance Period, provided that in no circumstances will the Final Election Date be later than the date Participant ceases to provide services to the Company or the date that the making of such election causes the Performance Shares to become subject to the excise tax pursuant to Code Section 409A.

2. Termination of Employment. Subject to the provisions that follow in this Section 2 and Section 3, if at any time prior to the expiration of the Performance Period Participant’s service with the Company terminates, then notwithstanding any contrary provision of this Agreement, the Performance Shares subject to this Agreement will be forfeited and cancelled automatically as of the date of such termination, and no shares of Common Stock will be issued hereunder.

Notwithstanding the foregoing or any contrary provision in the Plan, if Participant’s employment terminates prior to the Vesting Date as a result of Participant’s death, or the Committee determines that such termination is in connection with Participant’s Retirement (as defined below), or is as a result of Participant’s medically diagnosed permanent physical or mental inability to perform his or her job duties, then the award evidenced by this Agreement will continue in force following the date of such termination, and, subject to any then effective deferral election, a pro-rata portion of the shares of Common Stock underlying the Performance Shares will be issued to Participant (or if applicable his or her estate, heirs or beneficiaries) on the Payout Date, in an amount reflecting the period of Participant’s continued service to the Company from and after the Grant Date through the date of termination of Participant’s service. The Committee will determine the pro-rata portion of the Performance Shares to be paid out under the following formula: Total number of shares of Common Stock issuable on account of attaining the Performance Goals based upon the actual performance results during the Performance Period multiplied by a fraction, the numerator of which is the number of days of service following the Grant Date and occurring during the Performance Period and the denominator of which is the total number of days following the Grant Date through the final day of the Performance Period.

2

For purposes of this Section 2, “Retirement” means that a Participant having a combined Age and Years of Service (as those terms are defined below) of at least 70 (a) has given the Chief Executive Officer of the Company or his or her designee at least six months prior written notice of such Participant’s retirement; (b) has signed and delivered to the Company an agreement providing for such restrictive covenants, for a period of two years after such retirement, as may be determined from time to time by the Committee, based on individual facts and circumstances, to be reasonably necessary to protect the Company’s interests; (c) has signed and delivered to the Company, within 21 days of the Executive’s date of employment termination (or such later time as required under applicable law) a general release agreement of claims against the Company and its affiliates in a form reasonably acceptable to the Committee, which is not later revoked; and (d) voluntarily terminates from service with the Company. The term “Age” of a Participant means (as of a particular date of determination), the Participant’s age on that date in whole years and any fractions thereof, and the term “Years of Service” means the number of years and fractions thereof during the period beginning on a Participant’s most recent commencement of employment with the Company or a subsidiary or parent of the Company (or such other Company-associated entity as the Committee may determine from time to time) and ending on the date of such Participant’s termination of service with the Company or a subsidiary or parent of the Company. The Participant’s refusal to meet any of the conditions set forth in (a), (b), (c) or (d) above, or breach of any agreement entered into pursuant to (b) or (c) above, shall constitute a waiver by the Participant of the benefits attributable to Retirement under this Agreement.

Notwithstanding the foregoing, if at any time prior to the Payout Date Participant’s service with the Company terminates for Cause, then notwithstanding any contrary provision of this Agreement, the Performance Shares subject to this Agreement will be forfeited and cancelled automatically as of the date of such termination, and no shares of Common Stock will be issued hereunder.

(a) In the event of a Change in Control that does not also constitute a “change in the ownership or effective control of a corporation, or a change in the ownership of a substantial portion of the assets of a corporation” under Treas. Reg. § 1.409A-3(i)(5), then (i) the Performance Shares subject to this Agreement shall remain outstanding, (ii) the Performance Shares shall continue to be subject to the terms of this Agreement, and (iii) the provisions of the first paragraph of Section 7(b) of the Plan (regarding rights upon a Qualifying Termination) shall not apply to such Performance Shares.

(b) In the event of a Change in Control that is also a “change in the effective control of a corporation” under Treas. Reg. § 1.409A-3(i)(5)(vi), then (i) the Performance Shares subject to this Agreement shall remain outstanding, (ii) the Performance Shares shall continue to be subject to the terms of this Agreement, (iii) the provisions of the first paragraph of Section 7(b) of the Plan shall apply to such Performance Shares, and (iv) such Performance Shares shall be paid out upon the Payout Date based upon the actual level of performance.

3

(c) In the event of a Change in Control that is also a “change in the ownership of a corporation” under Treas. Reg. § 1.409A-3(i)(5)(v) or a “change in the ownership of a substantial portion of a corporation’s assets” under Treas. Reg. § 1.409A-3(i)(5)(vii) (a “Special CIC”), the Performance Shares subject to this Agreement shall immediately vest and the Participant shall receive, within 10 days of such Special CIC, the consideration (including all stock, other securities or assets, including cash) payable in respect of the Target Number of Performance Shares (or, if greater, the number of Performance Shares based on actual performance from the beginning of the Performance Period until the Special CIC, as reasonably determined by the Committee based on available information) as if they were vested, issued and outstanding at the time of such Special CIC; provided, however, that with respect to Performance Shares that are otherwise subject to a “substantial risk of forfeiture” under Treas. Reg. § 1.409A-1(d) and to the extent permitted by Treas. Reg. § 1.409-3, the Committee may arrange for the substitution for the Performance Shares with the grant of a replacement award (the “Replacement Award”) to Participant of shares of restricted stock of the surviving or successor entity (or the ultimate parent thereof) in such Change in Control, but only if all of the following criteria are met:

(i) Such Replacement Award shall consist of securities listed for trading following such Change in Control on a national securities exchange;

(ii) Such Replacement Award shall have a value as of the date of such Change in Control equal to the value of the Target Number of Performance Shares (or, if greater, the number of Performance Shares based on actual performance from the beginning of the Performance Period until the Special CIC, as reasonably determined by the Committee based on available information), calculated as if the Performance Shares were exchanged for the consideration (including all stock, other securities or assets, including cash) payable for shares of Common Stock in such Change in Control transaction;

(iii) Such Replacement Award shall become vested and the securities underlying the Replacement Award shall be issued to the Participant on the second anniversary of the commencement of the Performance Period or if such Change in Control occurs following that date shall become vested and shall be issued on third anniversary of the commencement of the Performance Period, in either case subject to Participant’s continued employment with the surviving or successor entity (or a direct or indirect subsidiary thereof) through such date, provided, however, that such Replacement Award will vest immediately upon and the securities underlying the Replacement Award shall be issued within 60 days after the date that (i) Participant’s employment is terminated by the surviving or successor entity Without Cause, (ii) Participant’s employment is terminated for Good Reason, (iii) Participant’s death or (iv) Participant’s medically diagnosed permanent physical or mental inability to perform his or her job duties;

(iv) Notwithstanding Section 3(c), such Replacement Award shall vest immediately prior to and the securities underlying the Replacement Award shall be issued to Participant upon (A) any transaction with respect to the surviving or

4

successor entity (or parent or subsidiary company thereof) of substantially similar character to a Change in Control, or (B) the securities constituting such Replacement Award ceasing to be listed on a national securities exchange, in each case so long as Participant remains continuously employed until such time; and

(v) The Replacement Award or the right to such Replacement Award does not cause the Performance Shares to become subject to tax under Code Section 409A.

Upon such substitution the Performance Shares shall terminate and be of no further force and effect.

4. Rights as Shareholder. Participant shall not have any of the rights of a shareholder with respect to the Performance Shares except to the extent that shares of Common Stock on account of such Performance Shares are issued to Participant in accordance with the terms and conditions of this Agreement and the Plan.

5. No Right to Continued Employment. Nothing contained in this Agreement shall be deemed to grant Participant any right to continue in the employ of the Company for any period of time or to any right to continue his or her present or any other rate of compensation, nor shall this Agreement be construed as giving Participant, Participant’s beneficiaries or any other person any equity or interests of any kind in the assets of the Company or creating a trust of any kind or a fiduciary relationship of any kind between the Company and any such person.

6. Withholding Taxes. No later than the date as of which an amount first becomes includible in the gross income of Participant for federal income or employment tax purposes with respect to the Performance Shares, Participant shall pay to the Company or make arrangements satisfactory to the Committee regarding the payment of, any federal, state, local or foreign taxes of any kind required by law to be withheld with respect to such amount. To the extent approved in writing by the Committee, a Participant shall have the right to direct the Company to satisfy the minimum amount (or an amount up to a Participant’s highest marginal tax rate as may be permitted under the Plan from time to time provided such withholding does not trigger liability accounting under FASB ASC Topic 718 or its successor) required for federal, state and local tax withholding with Shares, including without limitation Shares otherwise delivered upon exercise of the SARs. The obligations of the Company under the Plan and this Agreement shall be conditional on such payment, and the Company shall, to the extent permitted by law, have the right to deduct any such taxes from any payment otherwise due to the Participant.

7. No Fractional Shares. If any terms of this Agreement call for payment of a fractional Performance Share, the number of Performance Shares issuable hereunder will be rounded down to the nearest whole number.

8. Non-Transferability of Award. The Common Stock underlying the Performance Shares shall not be assignable or transferable by Participant prior to their vesting and issuance in accordance with this Agreement, except by will or by the laws of descent and

5

distribution. In addition, no Performance Shares shall be subject to attachment, execution or other similar process prior to vesting.

9. Applicability of the Plan. Except as specifically set forth herein, the Performance Shares are subject to all provisions of the Plan and all determinations of the Committee made in accordance with the terms of the Plan. By executing this Agreement, the Participant expressly acknowledges (i) receipt of the Plan and any current Plan prospectus and (ii) the applicability of the provisions of the Plan to the Performance Shares.

10. Additional Conditions to Issuance of Performance Shares. Notwithstanding the occurrence of the Vesting Date or Payout Date, the Company shall not be required to issue any Common Stock underlying the Performance Shares hereunder so long as the Company reasonably anticipates that such issuance will violate federal or state securities law or other applicable law; provided however, that in such event the Company shall issue such Performance Shares at the earliest possible date at which the Company reasonably anticipates that the issuance of the shares will not cause such violation.

11. Modification; Waiver. Except as provided in the Plan or this Agreement, no provision of this Agreement may be amended, modified, or waived unless such amendment or modification is agreed to in writing and signed by Participant and by a duly authorized officer of the Company, and such waiver is set forth in writing and signed by the party to be charged, provided that any change that is advantageous to Participant may be made by the Committee without Participant’s consent or written signature or acknowledgement. No waiver by either party hereto at any time of any breach by the other party hereto of any condition or provision of this Agreement to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent time. Participant acknowledges and agrees that the Committee has the right to amend this Agreement in whole or in part from time-to-time if the Committee believes, in its sole and absolute discretion, such amendment is required or appropriate in order to conform the award evidenced hereby to, or otherwise satisfy any legal requirement (including without limitation the provisions of Section 409A of the Code). Such amendments may be made retroactively or prospectively and without the approval or consent of Participant to the extent permitted by applicable law, provided that the Committee shall not have any such authority to the extent that the grant or exercise of such authority would cause any tax to become due under Section 409A of the Code.

12. Notices. Except as the Committee may otherwise prescribe or allow in connection with communications procedures developed in coordination with any third party administrator engaged by the Company, all notices, including notices of exercise, requests, demands or other communications required or permitted with respect to the Plan, shall be in writing addressed or delivered to the parties. Such communications shall be deemed to have been duly given to any party when delivered by hand, by messenger, by a nationally recognized overnight delivery company, by facsimile, or by first-class mail, postage prepaid and return receipt requested, in each case to the applicable addresses set forth below:

6

If to Participant:

to Participant’s most recent address on the records of the Company

If to the Company:

Chipotle Mexican Grill, Inc.

610 Newport Center Drive

Newport Beach, CA 92660

Attn: Director – Compensation & Benefits

(or to such other address as the party in question shall from time to time designate by written notice to the other parties).

13. Compensation Recovery. The Company may cancel, forfeit or recoup any rights or benefits of, or payments to, the Participant hereunder, including but not limited to any Shares issued by the Company following vesting of the Performance Shares under this Agreement or the proceeds from the sale of any such Shares, under any future compensation recovery policy that it may establish and maintain from time to time, to meet listing requirements that may be imposed in connection with the Dodd-Frank Wall Street Reform and Consumer Protection Act or otherwise. The Company shall delay the exercise of its rights under this Section for the period as may be required to preserve equity accounting treatment.

14. Governing Law. Except to the extent that provisions of the Plan are governed by applicable provisions of the Code or other substantive provisions of federal law, this Agreement shall be governed by and construed and enforced in accordance with the laws of the State of Delaware without regard to the principles of conflicts of law thereof.

|

|

|

|

|

|

CHIPOTLE MEXICAN GRILL, INC. |

|

|

|

|

|

|

|

By: |

/s/ Neil Flanzraich |

|

|

By: |

Neil Flanzraich |

|

|

|

Chairman, Compensation Committee |

|

|

|

|

|

|

|

Participant |

|

|

|

|

|

|

|

Name: |

Signature Page to Performance Share Agreement

7

Amended and Restated

Appendix A to 2018 Performance Share Agreement

This Appendix A to 2018 Performance Share Agreement is amended and restated as of December 31, 2020.

Name of Participant:

Performance Criteria

The performance criteria under this Incentive Award shall be 3 Year Comparable Restaurant Sales (“CRS”) Growth (for the period from January 1, 2018 to December 31, 2020) and 2 Year Average Restaurant Cash Flow (“RCF”) Margin (for the period from January 1, 2019 to December 31, 2020), as such terms are defined below.

Performance Goal Table

The number of shares that can be earned under this Incentive Award is equal to the Target Number of Performance Shares multiplied by the percentage determined under the Performance Goal Table set forth below (the “Payout Percentage”).

|

2 Year Average RCF Margin |

3 Year CRS Growth |

|||||||

|

3.50% |

4.00% |

4.50% |

5.00% |

5.50% |

6.00% |

6.50% |

7.00% |

|

|

18.50% |

0% |

0% |

25% |

50% |

75% |

100% |

125% |

150% |

|

19.00% |

0% |

25% |

50% |

75% |

100% |

150% |

150% |

200% |

|

20.00% |

50% |

75% |

100% |

150% |

150% |

200% |

200% |

250% |

|

21.00% |

75% |

100% |

150% |

200% |

200% |

250% |

250% |

300% |

|

22.00% |

75% |

125% |

175% |

225% |

250% |

275% |

300% |

300% |

In no event will any Performance Shares be earned under this Appendix A if either (a) the 2 Year Average RCF Margin is less than 18.5%, or (b) 3 Year CRS Growth is less than 3.5%. Notwithstanding a higher number in the table above, in no event may more than 275% of the Target Number of Performance Shares be earned under this Appendix A. If the level of performance for either 3 Year CRS Growth, 2 Year Average RCF Margin or both falls between two stated performance levels in the Performance Goal Table, the Payout Percentage shall be determined under the heading “Interpolation” below.

3 Year CRS Growth

For purposes of the Performance Goal Table under this Appendix A, “3-Year CRS Growth” shall be determined with respect to the three-year period beginning on January 1, 2018 using the following formula:

[(1+X)*(1+Y)*(1+Z)]^(1/3)-1

8

Where:

“X” = the annual percentage change in the CRS for the fiscal year ending December 31, 2018

“Y” = the annual percentage change in CRS for the fiscal year ending December 31, 2019

“Z” = the annual percentage change in CRS for the fiscal year ending December 31, 2020; provided that (i) COVID Impacted Months will be excluded from the calculation, and (ii) “Z” will be calculated as a straight average of change in 2020 CRS over 2019 for each non-COVID Impacted Month.

The following terms shall have the respective meanings set forth below when determining 3-Year CRS Growth:

“Comparable Restaurant” means a restaurant operated under the Chipotle Mexican Grill and/or Pizzeria Locale brands by the Company or its direct or indirect Subsidiaries, beginning in such restaurant’s 13th full calendar month of operations.

“COVID Impacted Months” means March, April and May 2020, the only months during the fiscal year ending December 31, 2020 in which CRS was below -7.5%. For purposes of this calculation, only food and beverage revenue, excluding delivery service revenue (i.e., delivery and related service fees charged to customers on sales made through Chipotle’s app and website) were used. Conversely, the “non-COVID Impacted Months” means the nine months of January, February and June – December 2020.

“CRS” or “Comparable Restaurant Sales,” with respect to a fiscal year (or single month), means the net sales attributable to Comparable Restaurants that are realized during such year (or single month), as determined in accordance with generally accepted accounting principles. For avoidance of doubt, net sales from a restaurant shall only be counted after it has become a Comparable Restaurant.

For purposes of the Performance Goal Table under this Appendix A, “2 Year Average RCF Margin” shall be determined under the following formula:

X + Y

2

Where:

“X” = the Company’s RCF Margin from restaurant operations for the fiscal year ending December 31, 2019

“Y” = the Company’s RCF Margin from restaurant operations for the fiscal year ending December 31, 2020; provided that (i) COVID Impacted Months will be excluded from the calculation, and (ii) for non-COVID Impacted Months beginning after February 2020, COVID Increase in Delivery Cost will be excluded from cash flow in the RCF Margin calculation. “Y” will be calculated as a straight average of the RCF Margin for the non-COVID Impacted Months.

9

The following terms shall have the respective meanings set forth below when determining the 2-Year Average RCF Margin:

“Baseline Delivery Cost Margin” equals: (a) delivery fees the Company paid to third parties during January and February 2020, divided by (b) total sales for January and February 2020.

“Non-Baseline Delivery Cost Margin” for each non-COVID Impacted Month beginning after February 2020, equals: the sum of (a) delivery fees the Company paid to third parties less (b) increased menu prices for delivery in effect during that month, divided by (c) total sales.

“COVID Increase in Delivery Cost” for each non-COVID Impacted Month occurring after February 2020, equals: the sum of (a) Non-Baseline Delivery Cost Margin less (b) Baseline Delivery Cost Margin, multiplied by (c) total sales.

“RCF Margin” means, for any fiscal year, (i) the Company’s total revenue less restaurant operating costs (excluding depreciation and amortization), divided by (ii) the Company’s total revenue. RCF Margin shall be determined in accordance with generally accepted accounting principles as in effect on the first day of the applicable Performance Period.

The calculation of Baseline Delivery Cost and Non-Baseline Delivery Cost shall be performed by the Company’s finance team and reviewed and approved by the Committee, and the Committee’s determination shall be final.

Example: Calculation of “COVID Increase in Delivery Cost”

For each non-COVID Impacted Month after February 2020, the COVID Increase in Delivery Cost will need to be calculated. Below is an example of the calculation using figures from the month ended August 31, 2020.

Step 1. Calculate Unadjusted “RCF Margin”

(a) Restaurant Level Operating Costs: $432,609,651

(b) Sales: $544,260,32

Unadjusted RCF Margin[((b) - (a))/(b)]: 20.5%

Step 2. Calculate “Baseline Delivery Cost Margin”

(a) Jan/Feb 2020 Delivery fees paid to third parties: $18,459,606

(b) Jan/Feb 2020 Sales: $944,553,173

Baseline Delivery Cost Margin[(a)/(b)]: 1.86%

10

Step 3. Calculate “Non-Baseline Delivery Cost Margin”

(a) Delivery fees paid to third parties: $26,399,115

(b) Increased delivery menu prices1 $6,922,203

(c) Adjusted Delivery fees paid to third parties[(a) – (b)]: $19,476,912

(d) Sales: $544,360,322

Non-Baseline Delivery Cost Margin [(c)/(d)] 3.58%

Step 4. Calculate “COVID increase in Delivery Cost”

(a) Non-Baseline Delivery Cost Margin: 3.58%

(b) Sales: $544,360,322

(c) Non-Baseline Delivery Cost [(a) x (b)]: $19,476,912

(d) Baseline Delivery Cost Margin: 1.86%

(e) Sales: $544,360,322

(f) Baseline Delivery Cost: $10,103,710

COVID Increase in Delivery Cost[(c) – (f)]: $9,373,202

Step 5. Calculate Adjusted RCF

(a) Sales: $544,360,322

(b) Restaurant Level Costs: $432,609,651

(c) COVID Increase in Delivery Cost: $9,373,202

(d) Adjusted Restaurant Level Costs [(b)-(c)]: $423,236,499

August Adjusted RCF [((a) – (d)) / (a)]: 22.25%

_______________________

1 Increased delivery menu prices equal the incremental revenue earned by placing differential menu pricing on delivery transactions.

11

Interpolation

The following rules shall be used to determine the Payout Percentage when the level of performance for either 3 Year CRS Growth, 2 Year Average RCF Margin or both falls between two stated performance levels in the Performance Goal Table:

(1) Determine what the Payout Percentage would have been without interpolation based on the highest actual results achieved and reflected in the Performance Goal Table for 3 Year CRS Growth and 2 Year Average RCF Margin. For example, assume that 2 Year Average RCF Margin is 18.75% and 3-Year CRS Growth is 4.25%. The Payout Percentage with no interpolation would be zero, as the highest achieved level of performance under the Performance Goal Table is 18.5% for 2 Year Average RCF Margin and 4.0% for 3 Year CRS Growth (with respect to each Performance Criteria, the “Base Achieved Level”).

(2) Calculate the CRS Adjustment Factor as follows:

(a) Determine what the Payout Percentage would have been had positive results in excess of the Base Achieved Level for 3 Year CRS Growth been rounded up to the next highest level of stated performance in the Performance Goal Table (the “CRS Rounded Up Level”). In the example noted in paragraph (1) above, the CRS Rounded Up Level would be 4.5% for 3 Year CRS Growth (4.25% rounded up to 4.5%), and the Payout Percentage based on the CRS Rounded Up Level would be 25% under the Performance Goal Table.

(b) Determine, as a percentage, the extent to which the Company achieved results for 3 Year CRS Growth greater than its Base Achieved Level as compared to its CRS Rounded Up Level, assuming that 2 Year Average RCF Margin equals its Base Achieved Level. In the example noted in Paragraph (1) above, the extent to which 3 Year CRS Growth was attained between its Base Achieved Level and CRS Rounded Up Level was 50%, assuming a Base Achieved Level of 18.5% for 2 Year Average RCF Margin (4.25% is halfway in between the Base Achieved Level and the CRS Rounded Up Level).

(c) Calculate the CRS Adjustment Factor by (A) multiplying the difference between the percentages in paragraphs (2)(a) and (1) above by the percentage determined in paragraph (2)(b) above, rounded to the nearest tenth of a percent. In the example noted in paragraph (1) above, the CRS Adjustment Factor is 12.5% (i.e., (25% - 0%) multiplied by 50%).

(3) Calculate the RCF Adjustment Factor as follows:

(a) Determine what the Payout Percentage would have been had positive results in excess of the Base Achieved Level for 2 Year Average RCF Margin been rounded up to the next highest level of stated performance in the Performance Goal Table (the “RCF Rounded Up Level”). In the example noted in paragraph (1) above, the RCF Rounded Up Level would be 19% for 2 Year Average RCF Margin (18.75% rounded up to 19%), and the Payout Percentage based on the RCF Rounded Up Level would be 25% under the Performance Goal Table.

12

(b) Determine, as a percentage, the extent to which the Company achieved results for 2 Year Average RCF Margin greater than its Base Achieved Level as compared to its RCF Rounded Up Level, assuming that 3 Year CRS Growth equals its Base Achieved Level. In the example noted in Paragraph (1) above, the extent to which 2 Year Average RCF Margin was attained between its Base Achieved Level and Rounded Up Level was 50%, assuming a Base Achieved Level of 4.0% for 3 Year CRS Growth (18.75% is halfway in between the Base Achieved Level and the RCF Rounded Up Level).

(c) Calculate the RCF Adjustment Factor by (A) multiplying the difference between the percentages in paragraphs (3)(a) and (1) above by the percentage determined in paragraph (3)(b) above, rounded to the nearest tenth of a percent. In the example noted in paragraph (1) above, the RCF Adjustment Factor is 12.5% (i.e., (25% - 0%) multiplied by 50%).

(4) Calculate the Payout Percentage by adding the CRS Adjustment Factor and the RCF Adjustment Factor to the Base Achieved Level from Paragraph (1). In the example noted in paragraph (1) above, the interpolated Payout Percentage would be 25% (i.e. 12.5% + 12.5% + 0%).

See Appendix B for additional examples of the interpolation method used to determine Payout Percentages when the level of performance for either 3 Year CRS Growth, 2 Year Average RCF Margin or both falls between two stated performance levels in the Performance Goal Table.

Other Provisions

If the Committee determines after granting an Incentive Award that there has been a change in law or accounting rules, that impacts CRS and/or RCF Margin as set forth in this Appendix A, the Committee shall modify these measures, in whole or in part, as it deems appropriate and equitable in its discretion for such events that were not determinable or considered at the Grant Date. For the avoidance of doubt, no adjustments otherwise authorized under Section 8 of the Plan shall be made with respect to the Performance Shares except as specifically provided in this Appendix A.

The Target Number of Performance Shares shall be adjusted to prevent the enlargement or dilution of rights under this Award Agreement due to any increase or decrease in issued shares of the Company’s Common Stock without consideration consistent with the terms of the Plan.

Performance Shares that are earned under this Appendix A shall only be issued to the Participant to the extent that the continued employment conditions set forth in the Performance Share Agreement have been satisfied.

13

Appendix B to 2018 Performance Share Agreement

Set forth below are additional examples illustrating the interpolation method used to determine Payout Percentages when the level of performance for either 3 Year CRS Growth, 2 Year Average RCF Margin or both falls between two stated performance levels in the Performance Goal Table in Appendix A. The numbered steps below refer to the steps described in detail in Appendix A, above.

Example 1

Assume that 2 Year Average RCF Margin is 19.5% and 3-Year CRS Growth is 4.75%.

(1) The Base Achieved Level is 50%.

(2) The CRS Adjustment Factor is calculated as follows:

(a) The CRS Rounded Up Level would be 5% (4.75% rounded up to 5%), and the Payout Percentage based on the CRS Rounded Up Level would be 75% under the Performance Goal Table.

(b) The percentage reflecting the extent to which 3 Year CRS Growth was attained between its Base Achieved Level and CRS Rounded Up Level is 50% (4.75% is halfway in between 4.5% and 5%).

(c) The CRS Adjustment Factor is 12.5% (i.e., (75% - 50%) multiplied by 50%).

(3) The RCF Adjustment Factor is calculated as follows:

(a) The RCF Rounded Up Level would be 20% (19.5% rounded up to 20%), and the Payout Percentage based on the RCF Rounded Up Level would be 100% under the Performance Goal Table.

(b) The percentage reflecting the extent to which 2 Year Average RCF Margin was attained between its Base Achieved Level and Rounded Up Level was 50% (19.5% is halfway in between 19% and 20%).

(c) The RCF Adjustment Factor is 25% (i.e., (100% - 50%) multiplied by 50%).

(4) The interpolated Payout Percentage would be 87.5% (i.e. 12.5% + 25% + 50%).

14

Example 2

Assume that 2 Year Average RCF Margin is 20.5% and 3-Year CRS Growth is 6.75%.

(1) The Base Achieved Level is 200%.

(2) The CRS Adjustment Factor is calculated as follows:

(a) The CRS Rounded Up Level would be 7% (6.75% rounded up to 7%), and the Payout Percentage based on the CRS Rounded Up Level would be 250% under the Performance Goal Table.

(b) The percentage reflecting the extent to which 3 Year CRS Growth was attained between its Base Achieved Level and CRS Rounded Up Level is 50% (6.75% is halfway in between 6.5% and 7%).

(c) The CRS Adjustment Factor is 25% (i.e., (250% - 200%) multiplied by 50%).

(3) The RCF Adjustment Factor is calculated as follows:

(a) The RCF Rounded Up Level would be 21% (20.5% rounded up to 21%), and the Payout Percentage based on the RCF Rounded Up Level would be 250% under the Performance Goal Table.

(b) The percentage reflecting the extent to which 2 Year Average RCF Margin was attained between its Base Achieved Level and Rounded Up Level was 50% (20.5% is halfway in between 20% and 21%).

(c) The RCF Adjustment Factor is 25% (i.e., (250% - 200%) multiplied by 50%).

(4) The interpolated Payout Percentage would be 250% (i.e. 25% + 25% + 200%).

15

Example 3

Assume that 2 Year Average RCF Margin is 20.9% and 3-Year CRS Growth is 4.9%.

(1) The Base Achieved Level is 100%.

(2) The CRS Adjustment Factor is calculated as follows:

(a) The CRS Rounded Up Level would be 5% (4.9% rounded up to 5%), and the Payout Percentage based on the CRS Rounded Up Level would be 150% under the Performance Goal Table.

(b) The percentage reflecting the extent to which 3 Year CRS Growth was attained between its Base Achieved Level and CRS Rounded Up Level is 80% (4.9% is four-fifths in between 4.5% and 5%).

(c) The CRS Adjustment Factor is 40% (i.e., (150% - 100%) multiplied by 80%).

(3) The RCF Adjustment Factor is calculated as follows:

(a) The RCF Rounded Up Level would be 21% (20.9% rounded up to 21%), and the Payout Percentage based on the RCF Rounded Up Level would be 150% under the Performance Goal Table.

(b) The percentage reflecting the extent to which 2 Year Average RCF Margin was attained between its Base Achieved Level and Rounded Up Level was 90% (20.9% is nine-tenths in between 20% and 21%).

(c) The RCF Adjustment Factor is 45% (i.e., (150% - 100%) multiplied by 90%).

(4) The interpolated Payout Percentage would be 185% (i.e. 40% + 45% + 100%).

16

Appendix C to 2018 Performance Share Agreement

The terms and conditions of this Appendix C shall apply only to shares of Common Stock subject to the “Post-Modified PSUs,” defined as (i) the total number of shares of Common Stock issuable pursuant to this Amended and Restated Performance Share Agreement, minus (ii) the total number of shares of Common Stock that would have been issuable pursuant to the original terms and conditions of the Performance Share Agreement, without regard to this Amendment and Restatement (such shares in (ii), the “Original PSUs”). The calculation of issuable PSUs shall be performed by the Company’s finance team and reviewed and approved by the Committee, and the Committee’s determination shall be final. You acknowledge that, absent the Amended and Restated Performance Share Agreement, you would have no rights to such Post-Modified PSUs and such Post-Modified PSUs shall be considered separate payments from the Original PSUs and shall not be subject to the deferral election contemplated in Section 1 of the Amended and Restated Performance Share Agreement. Except as expressly set forth in this Appendix C, the Post-Modified PSUs are subject to the terms and conditions of the Amended and Restated Performance Share Agreement.

1. Vesting Schedule for Post-Modified PSUs. Subject to Section 2 below, any Post-Modified PSUs shall vest over a two-year period as follows (the “Vesting Schedule”), subject to your continued employment through the applicable vesting date:

One-third of the Post-Modified PSUs shall vest on June 30, 2021

One-third of the Post-Modified PSUs shall vest on December 31, 2021

One-sixth of the Post-Modified PSUs shall vest on June 30, 2022

One-sixth of the Post-Modified PSUs shall vest on December 31, 2022

2. Effect of Termination of Employment on Post-Modified PSUs.

(a) Termination of Employment Due to Death, Disability or Retirement. If your employment terminates by reason your death, termination by the Company due to Disability, or Retirement (each as defined below) prior to December 31, 2022, you shall vest in the Post-Modified PSUs as follows:

(i) In the event of your Retirement or termination by the Company due to Disability, you shall continue to vest in the Post-Modified PSUs in accordance with the Vesting Schedule, even after your termination of employment;

(iii) In the event of your death, all Post-Modified PSUs shall vest in full on the date of your death.

For purposes of this Agreement: “Disability” means your medically-diagnosed, permanent physical or mental inability to perform your duties as an employee of the Company; “Retirement” means that you have a combined Age and Years of Service (each as defined below) of at least 70 and you have done all of the following (w) given the Company at least six (6) months prior written notice of your Retirement; (x) signed and delivered to the Company an agreement providing for such restrictive covenants, as may be determined from time to time by the Committee, based on individual facts and

17

circumstances, to be reasonably necessary to protect the Company’s interests, with such restrictive covenants continuing for a period of two (2) years after such Retirement (or, indefinitely, in the case of confidentiality and similar restrictive covenants), (y) signed and delivered to the Company, within 21 days of the date of your employment termination (or such later time as required under applicable law) a general release agreement of claims against the Company and its affiliates in a form reasonably acceptable to the Company, which is not later revoked, and (z) voluntarily terminated your employment with the Company. The term “Age” means (as of a particular date of determination), your age on that date in whole years and any fractions thereof; and “Years of Service” means the number of years and fractions thereof during the period beginning on your most recent commencement of employment with the Company and ending on the date your employment with the Company terminated. Your refusal to fulfill any of the conditions set forth in (w), (x), (y) or (z) above, your breach of any agreement entered into pursuant to (x) or (y) above, or if, after your Retirement, facts and circumstances are discovered that would have justified your termination for Cause (as defined below) if you were still employed by the Company, shall constitute a waiver by you of the benefits attributable to Retirement under this Agreement.