Form 10-Q Apollo Endosurgery, Inc. For: Jun 30

Exhibit 10.2

SECOND AMENDMENT TO OFFICE LEASE AGREEMENT

This Second Amendment to Office Lease Agreement (this “Amendment”) is executed as of June 18, 2021, 2021, between BC EXCHANGE CITYVIEW MASTER TENANT, LLC, a Delaware limited liability company (“Landlord”), and APOLLO ENDOSURGERY, INC., a Delaware corporation (“Tenant”), for the purpose of amending the Office Lease Agreement between Landlord’s predecessor-in-interest and Tenant dated July 16, 2012 (the “Original Lease”). The Original Lease, as amended by a First Amendment to Office Lease Agreement dated June 11, 2018, is referred to herein as the “Lease”. Capitalized terms used herein but not defined shall be given the meanings assigned to them in the Lease.

RECITALS:

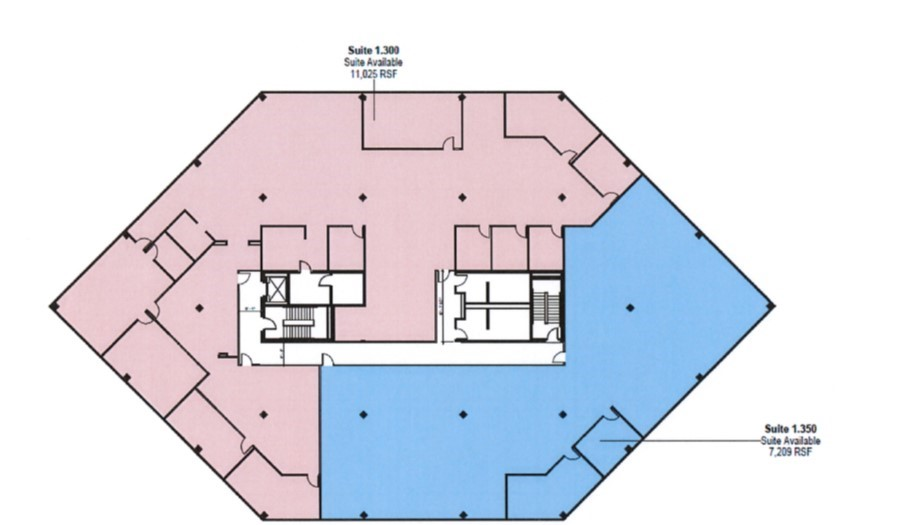

Pursuant to the terms of the Lease, Tenant is currently leasing Suite 1.300, consisting of approximately 18,234 square feet (the “Existing Premises”), in Building 1 (the “Building”), having an address of 1120 South Capital of Texas Highway, Austin, Texas 78746. Tenant desires to (a) extend the Lease Term for a period of twelve (12) months, and (b) surrender the space depicted on Exhibit A hereto, containing approximately 7,209 square feet (the “Surrendered Premises”), and Landlord has agreed to such extension and such surrender on the terms and conditions contained herein.

AGREEMENTS:

For valuable consideration, whose receipt and sufficiency are acknowledged, Landlord and Tenant agree as follows:

1.Extension of Lease Term. The Lease Term is hereby extended such that it expires at 5:00 p.m., Austin, Texas time, on September 30, 2022, on the terms and conditions of the Lease, as modified hereby. Tenant shall have no further rights to extend or renew the Lease Term.

2.Surrender.

a.Effective as of 11:59 p.m., local time on September 30, 2021 (the “Surrendered Premises Termination Date”), the Lease shall terminate as to the Surrendered Premises only. Accordingly, (i) from and after the day immediately following the Surrendered Premises Termination Date, the term “Premises” shall exclude the Surrendered Premises (and by reason of such exclusion, the Premises will then contain 11,025 square feet sometimes referred to herein as the “Remaining Premises”), and (ii) from and after the Surrendered Premises Termination Date, the percentage represented by Tenant’s Pro Rata Share shall be revised and reduced (and the calculation of Additional Rent for periods after the Surrendered Premises Termination Date shall be adjusted) to reflect the elimination of the Surrendered Premises from the Premises; however, an appropriate pro rata adjustment shall be made in the calculation of Additional Rent for the calendar year in which the revised percentage becomes effective to reflect the varying size of the Premises during the period for which such calculations are made. Notwithstanding the generality of the foregoing, neither Landlord nor Tenant shall be released from any obligation to refund or pay, respectively, any overpayment or underpayment, respectively, of Additional Rent paid by Tenant with respect to the Surrendered Premises. From and after the Surrendered Premises Termination Date, Tenant’s Pro Rata Share shall be decreased to 7.66%, which is the percentage obtained by dividing the number of square feet in the Remaining Premises (11,025) by the number of square feet in the Property (144,002). Landlord and Tenant stipulate that the number of square feet in the Remaining Premises and the Property are correct.

b.On or before the Surrendered Premises Termination Date, Tenant shall vacate and surrender the Surrendered Premises in the condition required under Section 26 of the Lease (as if the Surrendered Premises Termination Date were the expiration date of the Lease Term as to the Surrendered Premises) and shall remove all of Tenant’s personal property from the Surrendered Premises; provided, (i) Tenant may leave its furniture, fixtures, and equipment (the “FF&E”) in the Surrendered Premises until Landlord provides written notice to Tenant, and Tenant shall remove such FF&E within thirty (30) days following Landlord’s delivery of such written notice, and (ii) Landlord will permit Tenant to maintain its server room in its current location until Landlord delivers

Exhibit 10.2

written notice to Tenant of Landlord’s intent to construct a multi-tenant corridor on the third (3rd) floor of the Building, in which event Tenant must relocate its server room to a location reasonably acceptable to Landlord, at Tenant’s sole cost and expense and (iii) until the Surrendered Premises are modified to construct a multi-tenant corridor and reception area as shown in Exhibit A, Tenant may access the Surrendered Premises to gain access to the eastern stairwell and to restroom facilities serving the floor on which the Remaining Premises is located. If Tenant fails to so vacate the Surrendered Premises, then Tenant shall be a holdover tenant with respect thereto pursuant to Section 23 of the Lease and shall pay to Landlord the holdover rent with respect to the Surrendered Premises as set forth in such Section 23.

c.Notwithstanding anything to the contrary in the Lease, from and after the date of this Amendment through the Surrendered Premises Termination Date, Landlord and its employees, agents, contractors, and representatives shall have the right to enter the Surrendered Premises for any purpose, including without limitation, to show the Surrendered Premises to prospective tenants and to permit inspection of the Surrendered Premises by space planners, contractors and other parties in connection with preparing the Surrendered Premises for occupancy by a prospective tenant. Landlord shall inform Tenant of upcoming visits, and such visitors shall sign in at the reception area per Tenant’s company policy.

d.Landlord will not construct a demising wall (the “Demising Wall”) to demise the Remaining Premises from the Surrendered Premises until such time that Landlord enters into a lease or other agreement with a third party for the Surrendered Premises. Prior to Landlord’s construction of the Demising Wall, Landlord will identify the Surrendered Premises via “chalk line” or other means. Following the Surrendered Premises Termination Date, Tenant shall have no right to access or occupy the Surrendered Premises, except as set forth in Section 2(b) above. If Tenant occupies any portion of the Surrendered Premises following the Surrendered Premises Termination Date (other than as provided in Section 2(b) of this Amendment), Landlord shall provide written notice thereof to Tenant, and Tenant shall take reasonable steps to remove any occupation of the Surrendered Premises within one business day following Landlord’s delivery of such notice. Such written notice shall be provided per Section 25 of the Lease and shall also include an email notification to maggie.keller@apolloendosurgery.com or such other recipient designated by Tenant in writing. If such occupation is not remedied within the one business day period, the Remaining Premises shall automatically be expanded to include the Surrendered Premises, and Tenant shall pay Rent for the Surrendered Premises, with the Base Rent being calculated using the per square foot rates then payable for the Remaining Premises.

e.Tenant may request to expand the square footage of the Remaining Premises any time up until December 31, 2021 at the existing Annual Base Rent Rate per square foot for the Remaining Premises for the remainder of the Term of the Lease. Such expansion shall be subject to Landlord’s prior written consent, which shall be in Landlord’s discretion. Any additional square footage added to the Remaining Premises shall be calculated per Section 2(a) and Section 3 of this Amendment.

3.Base Rent. Beginning October 1, 2021 (the “Renewal Date”), the monthly Base Rent shall be the following amounts for the following periods of time:

| Period | Annual Base Rent Rate/SF | Monthly Base Rent | ||||||

| 10/1/21 – 9/30/22 | $26.00 | $23,887.50 | ||||||

4.Condition of Premises; Tenant Improvements. Tenant hereby accepts the Remaining Premises in their “AS-IS” condition and Landlord shall have no obligation for any construction or finish-out allowance or providing to Tenant any other tenant inducement.

5.Signage. Section 8(C) of the Original Lease is amended by deleting the last sentence thereof.

6.Parking. On the Renewal Date, Section I of Exhibit E to the Lease is amended to provide that Landlord shall make available to Tenant the use of forty-four (44) of the Building’s unreserved parking spaces (the “Spaces”) in the Building parking lot. Tenant may convert up to a total of ten (10) of such unreserved Spaces

Exhibit 10.2

to covered Spaces in the CityView parking garage, by giving written notice to Landlord; provided, Landlord may take back five (5) of the covered Spaces upon sixty (60) days prior written notice to Tenant.

7.Hazardous Materials. To Landlord’s current actual knowledge, as of the date of this Amendment, Landlord has not received written notice from any applicable governmental authority that the Premises is in violation of any Environmental Laws that remains uncured.

8.Options. All option rights granted to Tenant, if any, contained in the Lease, including, without limitation, options to extend or renew the term of the Lease or to expand the Premises or to terminate the Lease, are hereby deleted and are of no force and effect.

9.Confidentiality. Each Party acknowledges the terms and conditions of the Lease (as amended hereby) are to remain confidential for the other Party’s benefit and may not be disclosed by the Party to anyone, by any manner or means, directly or indirectly, without the other Party’s prior written consent. The consent by the other Party to any disclosures shall not be deemed to be a waiver on the part of such other Party of any prohibition against any future disclosure.

10.Brokerage. Landlord and Tenant each warrant to the other that is has not dealt with any broker or agent in connection with the negotiation or execution of this Amendment other than Transwestern, representing Landlord, and Jones Lang LaSalle Brokerage, Inc., representing Tenant, whose commissions shall be paid by Landlord pursuant to separate written agreements. Tenant and Landlord shall each indemnify the other against all costs, expenses, attorneys’ fees, and other liability for commissions or other compensation claimed by any other brokers or agents claiming the same by, through, or under the indemnifying party.

11.Prohibited Persons and Transactions. Tenant represents and warrants to Landlord that Tenant is currently in compliance with and shall at all times during the Lease Term (including any extension thereof) remain in compliance with the regulations of the Office of Foreign Asset Control (“OFAC”) of the Department of the Treasury (including those named on OFAC’s Specially Designated Nationals and Blocked Persons List) and any statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action relating thereto.

12.No Representations. Landlord and Landlord's agents have made no representations or promises, express or implied, in connection with this Amendment except as expressly set forth herein and Tenant has not relied on any representations except as expressly set forth herein.

13.Ratification. Tenant hereby ratifies and confirms its obligations under the Lease, and represents and warrants to Landlord that it has no defenses thereto. Additionally, Tenant further confirms and ratifies that, as of the date hereof, (a) the Lease is and remains in good standing and in full force and effect, (b) Tenant has no claims, counterclaims, set-offs or defenses against Landlord arising out of the Lease or in any way relating thereto or arising out of any other transaction between Landlord and Tenant, and (c) except as expressly provided for in this Amendment, all tenant finish-work allowances provided to Tenant under the Lease or otherwise, if any, have been paid in full by Landlord to Tenant, and Landlord has no further obligations with respect thereto.

14.Binding Effect; Governing Law. Except as modified hereby, the Lease shall remain in full effect and this Amendment shall be binding upon Landlord and Tenant and their respective successors and assigns. If any inconsistency exists or arises between the terms of this Amendment and the terms of the Lease, the terms of this Amendment shall prevail. This Amendment shall be governed by the laws of the State in which the Premises are located.

15.Counterparts. This Amendment may be executed in multiple counterparts, each of which shall constitute an original, but all of which shall constitute one document.

Exhibit 10.2

16.Electronic Signatures. This Amendment may be executed by electronic signature, which shall be considered as an original signature for all purposes and shall have the same force and effect as an original signature. For these purposes, “electronic signature” shall mean electronically scanned and transmitted versions (e.g., via pdf file) of an original signature, signatures electronically inserted and verified by software such as Adobe Sign, or faxed versions of an original signature.

[THE REMAINDER OF THIS PAGE IS INTENTIONALLY LEFT BLANK]

Exhibit 10.2

This Amendment is executed on the respective dates set forth below, but for reference purposes this Amendment shall be dated as of the date first above written. If the execution date is left blank, this Amendment shall be deemed executed as of the date first written above.

LANDLORD: BC EXCHANGE CITY VIEW MASTER TENANT LLC, a Delaware limited liability company By: BC Exchange Master Tenant LLC, a Delaware limited liability company, its sole member By: DCTRT Real Estate Holdco LLC, a Delaware limited liability company, its sole member By: Black Creek Diversified Property Operating Partnership LP, a Delaware limited partnership, its sole member By: Black Creek Diversified Property Fund Inc., a Maryland corporation, its general partner By: /s/ Brian Lindenberg Name: Brian Lindenberg Title: Vice President | ||

TENANT: APOLLO ENDOSURGERY, INC., a Delaware corporation By: /s/ Stefanie Cavanaugh Name: Stefanie Cavanaugh Title: CFO | ||

Exhibit 10.2

EXHIBIT A

SURRENDERED PREMISES

Surrendered Premises

Exhibit 31.1

CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER

PURSUANT TO RULE 13a-14(a) AND 15d-14(a) OF THE SECURITIES EXCHANGE ACT, AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Charles McKhann, certify that:

1.I have reviewed this quarterly report on Form 10-Q of Apollo Endosurgery, Inc.;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a.Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b.Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision; to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c.Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d.Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.The registrant's other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a.All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b.Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| August 3, 2021 | By: | /s/ Charles McKhann | ||||||

| Charles McKhann | ||||||||

Chief Executive Officer | ||||||||

(Principal Executive Officer) | ||||||||

Exhibit 31.2

CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER

PURSUANT TO RULE 13a-14(a) AND 15d-14(a) OF THE SECURITIES EXCHANGE ACT, AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Stefanie Cavanaugh, certify that:

1.I have reviewed this quarterly report on Form 10-Q of Apollo Endosurgery, Inc.;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a.Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b.Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision; to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c.Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d.Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.The registrant's other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a.All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b.Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| August 3, 2021 | By: | /s/ Stefanie Cavanaugh | ||||||

Stefanie Cavanaugh | ||||||||

Chief Financial Officer | ||||||||

(Principal Financial Officer) | ||||||||

Exhibit 32.1

CERTIFICATION OF CHIEF EXECUTIVE OFFICER

PURSUANT TO 18 U.S.C. SECTION 1350

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

Pursuant to the requirement set forth in Rule 13a-14(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. §1350), Charles McKhann, Chief Executive Officer of Apollo Endosurgery, Inc. (the “Company”), hereby certifies to the best of his knowledge that:

1.The Company’s Report on Form 10-Q for the period ended June 30, 2021, to which this Certification is attached as Exhibit 32.1 (the “Report”), fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934, as amended; and

2.The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| August 3, 2021 | By: | /s/ Charles McKhann | ||||||

| Charles McKhann | ||||||||

Chief Executive Officer | ||||||||

(Principal Executive Officer) | ||||||||

A signed original of this written statement required by Section 906 has been provided to Apollo Endosurgery, Inc. and will be retained by Apollo Endosurgery, Inc. and furnished to the Securities and Exchange Commission or its staff upon request.

This certification accompanies the Form 10-Q to which it relates, is not deemed filed with the Securities and Exchange Commission, and is not to be incorporated by reference into any filing of Apollo Endosurgery, Inc. under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (whether made before or after the date of the Form 10-Q), irrespective of any general incorporation language contained in such filing.

Exhibit 32.2

CERTIFICATION OF CHIEF FINANCIAL OFFICER

PURSUANT TO 18 U.S.C. SECTION 1350

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

Pursuant to the requirement set forth in Rule 13a-14(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. §1350), Stefanie Cavanaugh, Chief Financial Officer of Apollo Endosurgery, Inc. (the “Company”), hereby certifies to the best of her knowledge that:

1.The Company’s Report on Form 10-Q for the period ended June 30, 2021, to which this Certification is attached as Exhibit 32.2 (the “Report”), fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934, as amended; and

2.The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| August 3, 2021 | By: | /s/Stefanie Cavanaugh | ||||||

Stefanie Cavanaugh | ||||||||

Chief Financial Officer | ||||||||

(Principal Financial Officer) | ||||||||

A signed original of this written statement required by Section 906 has been provided to Apollo Endosurgery, Inc. and will be retained by Apollo Endosurgery, Inc. and furnished to the Securities and Exchange Commission or its staff upon request.

This certification accompanies the Form 10-Q to which it relates, is not deemed filed with the Securities and Exchange Commission, and is not to be incorporated by reference into any filing of Apollo Endosurgery, Inc. under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (whether made before or after the date of the Form 10-Q), irrespective of any general incorporation language contained in such filing.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Realfinity and OnCourse Learning to Make Dual-Licensing a Reality for Real Estate Professionals

- Flexible morals: A key reason American voters support divisive misinformation

- Signal Gold Initiates Further Drilling at the Western Extension of Goldboro, Targeting Increased Mineral Resources

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share