Form 10-KT RAYONT INC. For: Jun 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-KT

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

☒ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE EXCHANGE ACT OF 1934

For the transition period from October 1, 2020 to June 30, 2021

Commission File Number: 000-56020

| RAYONT INC. |

| (Exact Name of Registrant as Specified in Its Charter) |

| Nevada | 27-5159463 | |

(State or Other Jurisdiction of Incorporation or Organization) |

(IRS Employer Identification No.) |

228 Hamilton Avenue, 3rd Floor, Palo Alto, California 94301 |

94301 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 1 (855) 801-9792

(Former name, former address and telephone number, if changed since last report)

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common stock, par value $0.001 par value | RAYT | OTC Markets Group |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $122,310,790 as of March 31, 2021.

There were 48,009,853 shares of issuer’s Common Stock outstanding as of October 15, 2021.

TABLE OF CONTENTS

| i |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This Annual Report on Form 10-KT , the other reports, statements, and information that we have previously filed or that we may subsequently file with the Securities and Exchange Commission, or SEC, and public announcements that we have previously made or may subsequently make include, may include, incorporate by reference or may incorporate by reference certain statements that may be deemed to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are intended to enjoy the benefits of that act. Unless the context is otherwise, the forward-looking statements included or incorporated by reference in this Form 10-KT and those reports, statements, information and announcements address activities, events or developments that Rayont Inc. (hereinafter referred to as “we,” “us,” “our,” “our Company” or “Rayont”) expects or anticipates, will or may occur in the future. Any statements in this document about expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “will continue,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” and similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties, which could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this document. All forward-looking statements concerning economic conditions, rates of growth, rates of income or values as may be included in this document are based on information available to us on the dates noted, and we assume no obligation to update any such forward-looking statements. It is important to note that our actual results may differ materially from those in such forward-looking statements due to fluctuations in interest rates, inflation, government regulations, economic conditions and competitive product and pricing pressures in the geographic and business areas in which we conduct operations, including our plans, objectives, expectations and intentions and other factors discussed elsewhere in this Report.

Certain risk factors could materially and adversely affect our business, financial conditions and results of operations and cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us, and you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. The risks and uncertainties we currently face are not the only ones we face. New factors emerge from time to time, and it is not possible for us to predict which will arise. There may be additional risks not presently known to us or that we currently believe are immaterial to our business. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. If any such risks occur, our business, operating results, liquidity and financial condition could be materially affected in an adverse manner. Under such circumstances, you may lose all or part of your investment.

The industry and market data contained in this report are based either on our management’s own estimates or, where indicated, independent industry publications, reports by governmental agencies or market research firms or other published independent sources and, in each case, are believed by our management to be reasonable estimates. However, industry and market data are subject to change and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. We have not independently verified market and industry data from third-party sources. In addition, consumption patterns and customer preferences can and do change. As a result, you should be aware that market share, ranking and other similar data set forth herein, and estimates and beliefs based on such data, may not be verifiable or reliable.

PRESENTATION OF INFORMATION

Except as otherwise indicated by the context, references in this Report to “Rayont”, “RAYT”, “we”, “us”, “our” and the “Company” are to the combined business of Rayont Inc. and its consolidated subsidiaries.

The Company recently changed its fiscal year-end from a fiscal year ending on September 30 to a fiscal year ending on June 30. This Report includes our audited consolidated financial statements as at and for the nine months ended June 30, 2021 and as at and for the twelve months ended September 30, 2020. These financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“US GAAP”). All financial information in this Report is presented in US dollars, unless otherwise indicated, and should be read in conjunction with our audited consolidated financial statements and the notes thereto included in this Report.

| ii |

History and Overview

Rayont Inc., formerly known as Velt International Group Inc. was incorporated in Nevada on February 7, 2011. Our current principal executive office is located at 228 Hamilton Avenue, 3rd Floor, Palo Alto, California 94301.

On March 13, 2017, Yidan (Andy) Liu and Jun (Charlie) Huang, the principal stockholders of the Company (“Sellers”), entered into a Stock Purchase Agreement (the “Agreement”) with Chin Kha Foo, the assignee of Choa-Jung Lee, and his assigns (the “Buyers”), pursuant to which, among other things, Sellers agreed to sell to the Buyers, and the Buyers agreed to purchase from Sellers, a total of 24,000,000 shares of Common Stock of the Company of record and beneficially by Sellers (the “Purchased Shares”). The Purchased Shares represented approximately 64% of the Company’s issued and outstanding shares of Common Stock, resulting in a change of the control of the Company.

The Board of the Directors and shareholders approved the reverse split of the Company’s issued and outstanding common stock whereby each twenty shares of common stock was converted into one share of common stock. The stock split became effective with the Financial Industry Regulatory Authority (“FINRA”) on May 21, 2018.

On November 19, 2018, the Company’s principal shareholder, Mr. Chin Kha Foo (“Mr. Foo”), entered into a Stock Purchase Agreement (the “SPA”) to transfer 60% of the Company’s issued and outstanding shares to Rural Asset Management Services, Inc., a Malaysian company (“RAM”). On December 14, 2018, RAM became the principal shareholder of the Company and Mr. Ali Kasa was appointed to be the Company’s President, CEO, CFO, and Secretary of the Company due to the change in control of the Company. RAM is an equity investment company with portfolio of interest in biotechnology, healthcare, cancer treatment research and technology, ICT and Crypto Currency. RAM has invested in companies located in Malaysia, Australia and the USA.

On January 22, 2019, the Company entered into an Acquisition Agreement with THF Holdings Pty Ltd., an Australian corporation (“THF”) and Rural, pursuant to which the Company acquired 100% of the issued and outstanding capital stock of THF in exchange for 4,000,000 shares of Company’s common stock, valued on January 22, 2019 at $1,000,000. THF is an Australian Cancer treatment and medical device company. Rural was the majority shareholder of THF. In March 2019, the acquisition of THF was completed and THF became a subsidiary of the Company. In addition, the acquisition was accounted for business combination under common control of Rural.

On September 7, 2019, FINRA approved name and trading symbol change. In addition to the name change the Company also commenced a significant change in corporate strategy and the future direction of the Company.

On September 30, 2020, pursuant to an Acquisition Agreement the Company acquired all of the issued and outstanding shares of Rayont International (Labuan) Inc (“RIL”), a Malaysian Offshore company as Exclusive Licensee of a Cancer Treatment technology for Sub-Sahara African Region. Under the agreement, Rayont acquired 100% of the outstanding shares of RIL in exchange for 25,714,286 shares of the Company’s common stock valued at $1.8 Million based on the closing share price on the OTC Markets on September 29, 2020.

Rayont International (Labuan) Inc is an on offshore company incorporated in Labuan, Malaysia which offers attractive 3% tax on profit. The company is a clinical-stage life sciences company that holds the exclusive license for registering and commercializing Photosoft technology for treatment of all cancers across Sub-Sahara African region. The technology has already been licensed in Australia, New Zealand, China and Malaysia. The human clinical trial efforts have started in Australia and China conducted by Hudson Medical Institute, Australian.

Photosoft technology is an improved next generation Photodynamic Therapy (PDT). PDT uses non-toxic photosensitizers and visible light in combination with oxygen to produce cytotoxic-reactive oxygen that kills malignant cells, shuts down tumors and stimulates the immune system. In contrast to surgery, or radiotherapy and chemotherapy which are mostly immunosuppressive, PDT causes acute inflammation, expression of heat-shock proteins, and invasion and infiltration of a tumor by leukocytes.

Since the acquisition of THF Holdings Pty Ltd and Rayont International (Labuan) Inc as well as the cancer treatment assets that the Company has invested in, Rayont has been focusing on commercializing these investments. The commercialization of the current assets for cancer treatment requires medical board approval for almost all of the countries subject to the license. Rayont has conducted the initial study to identify the requirements for obtaining the approvals for using PDT to treat cancer across different jurisdictions in Sub-Saharan Africa (“SSA”). The same PDT technology has been licensed in China, Australia and New Zealand. It is currently undergoing medical trials in Australia and China. The recent announcements show positive results that the technology works. The company believes that it will take time before it can start commercializing these assets and start to generate revenues and operating profits. In order to sustain and grow this business the Company has been actively looking for new opportunities post COVID-19 pandemic.

On August 26, 2020, the Company established Rayont Technologies Pty Ltd. (“Rayont Technologies”) through Rayont (Australia) Pty Ltd. Rayont Technologies is an Australian corporation and Internet of Things specialist providing services such as end-to-end employee engagement and experience platform for businesses in Australia and globally. Rayont Technologies engages in providing customized digital learning based on real-life and practical situations and e-learning program.

In order to cope with rapid growth Rayont Technologies Pty Ltd entered an agreement on October 15, 2020 with Ms. Kayla Ranee Smith to purchase the assets of Workstar Tech (Aust) Pty Ltd for USD215,017.19 (AUD302,876.22) payable over 90 days upon Ms. Smith transferring the assets to Rayont Technologies Pty Ltd. The assets that Rayont Technologies acquired under the agreement are:

1. Trademark

2. Website

3. Software

4. Office Assets

5. Customer Contracts

| 1 |

On December 23, 2020, Rayont Australia Pty Ltd, a wholly-owned subsidiary of Rayont Inc. (the “Company”), acquired all of the issued and outstanding capital stock of Prema Life Pty Ltd, an Australian company (“Prema Life”), from TheAlikasa (Australia) Pty Ltd, Prema Life’s sole shareholder. The acquisition of Prema Life was completed, and Prema Life became a subsidiary of the Company. Prema Life is a Hazard Analysis Critical Control Point (HACCP) certified manufacturer and supplier of functional foods and supplements, and of practitioner only naturopathic and homeopathic medicines. Prema Life produces an extensive range of products including proteins, green blends, sports nutrition, weight management and maintenance, and health and wellness products.

On December 23, 2020, pursuant to an Acquisition Agreement, Rayont Australia Pty Ltd, a wholly-owned subsidiary of Rayont Inc. (the “Company”), acquired all of the issued and outstanding capital stock of GGLG Properties Pty LTD, an Australian company (“GGLG”), from TheAlikasa (Australia) Pty Ltd, GGLG’s sole shareholder (the “Seller”). The Seller is an affiliate of the Company and therefore the acquisition is being treated as a related party transaction. The purchase price is $605,920, which is a 10% discount of the total amount of GGLG’s net tangible assets. The purchase price will be paid in six installments after a $265,300 down payment. In the event an installment payment is not paid timely, the Seller has agreed to accept shares of the Company valued at $0.87 per share. The price per share is based on a 20% discount of the average share price on the OTC Markets over the last 30 trading days.

On February 18, 2021 the Autralian Foreign Investment Review Board approved the capital stock transferring of GGLG Properties Pty Ltd to the Rayont Australia Pty Ltd. On March 9, 2021, the parties agreed to amend the acquisition agreements for the GGLG Properties Pty Ltd and as per Board Resolution, the Company issued 710,713 shares of its common stocks in lieu of payment by Rayont Australia Pty Ltd of approximately $605,920 to TheAlikasa Pty Ltd as full and final payment for the acquisition of 100% of the issued and outstanding common stock of GGLG.

GGLG Properties Pty Ltd is a special purpose company to hold the property asset of Rayont (Australia) Pty Ltd. Until the 28 June 2021, GGLG Properties Pty Ltd owned the property located at 11 Aldinga Street, Brendale, 4500 QLD, Australia which is the facility where Prema Life Pty Ltd operates. With the sale of property, GGLG Properties Pty Ltd has no real assets and operations hence, it has to reinvent itself and select a business activity to focus on.

On December 29, 2020, the Company incorporated Rayont Malaysia Sdn Bhd with a paid-up capital of $25 and on December 31, 2020 incorporated Rayont Technologies (M) Sdn Bhd with a paid-up capital of $25 from Rayont Malaysia Sdn Bhd to carry out its business activities in Malaysia. On February 5, 2021 Rayont Technologies (M) Pty Ltd entered into an Asset Purchase Agreement with Sage Interactive Sdn Bhd to purchase its assets in consideration of the payment of USD 105,000.00. These assets include software for remote learning, customer contracts, digital content and two key employees and one director. These assets will operate in Malaysia under Workstar trademark and operation shall be integrated with Rayont Technologies Australia to drive efficiency and scale of digital assets operations.

Rayont will focus on healthcare including the manufacturing of alternative medicine products and services across the entire value chain or across the full range of activities that companies within an industry bring a product to its end users. Longer term, we have also invested in a ground-breaking cancer treatment technology through an exclusive license arrangement for the sub-Saharan African territories. Headquartered in Australia, with expanding operations internationally, our purpose is “Making Natural Products to Improve People’s Health”. We do this by investing in early research and development, establishing high quality manufacturing assets for regional distribution, and operating across the alternative medicine value chain. Our underlying strategy is to grow organically, selectively acquire, scale profitable assets, and improve efficiency through digitalization via mobile applications, websites or modes of delivering products or services to end users.

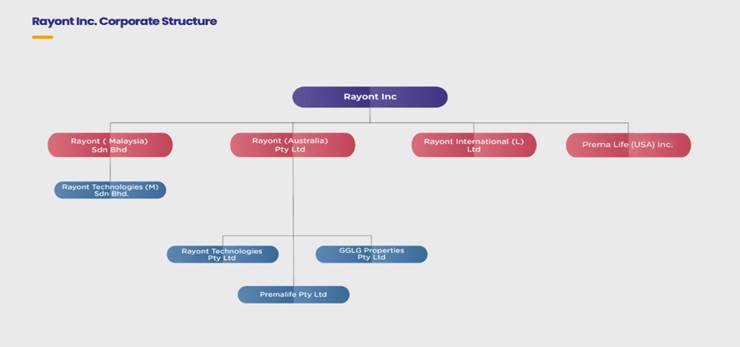

As of June 30, 2021, the company group structure consisted of the following companies:

| 2 |

The company’s focus is to grow revenues and operating profit within the next financial year and plans to acquire revenue generating companies and grow the current businesses within the sectors it focuses on. There is no assurance that these goals will be accomplished.

There were two transactions worth noting that occurred before 30 June 2021, namely GGLG Properties Pty Ltd disposed of 11 Aldinga Street Brendale QLD 4500 for USD693,403 for the land, and assets were sold for USD201,649. Premalife Pty Ltd subsequently purchased a new, more suitable building located at 32 French Avenue, Brendale QLD 4500 for USD2,304,330 excluding GST. The acquisition of this key real estate asset into the Company has further strengthened the Group.

Competitive Conditions

Since that the company has established multiple business units or divisions and the competitive conditions defer for each business unit, the company presets these conditions accordingly.

1. Healthcare Services

Cancer is emerging as a major public health problem in Sub-Saharan Africa because of population aging and growth, as well as increased prevalence of key risk factors, including those associated with social and economic transition.

According to the World Health Organization, the number of new cancer cases per year will increase by 70% in Africa between 2012 and 2030 due to demographic changes alone – faster than in any other region of the world. Furthermore, for many cancers, the risk of getting cancer and the risk of dying from cancer is nearly the same throughout the Sub-Saharan region of Africa, due mostly to the late stage of diagnosis and lack of treatment.

Rayont intends to establish numerous Next Generation Photo Dynamic Therapy (NGPDT) centers to facilitate the treatment of cancers, starting in Port Elizabeth, South Africa prior to rolling out the concept across the broader Sub-Saharan Africa license region which encompasses a total of 48 countries and 1.1 billion people.

2. Education & Technology

The Online Education industry has expanded over the past five years. Technological advancements and wider internet access have made the online education model an increasingly viable option for learning and career advancement. However, changes to government funding and intensifying competition have constrained revenue over the period. Industry revenue is expected to rise at an annualized 8.5% over the five years through 2019-20, to a total of $8.1 billion. This includes growth of 10.1% in the current year.

Online education provides greater flexibility compared with traditional education and enables full-time workers to engage in further learning. Many education providers have recognized the growing need for flexibility and have increased the breadth of courses available online. MOOCs have grown in popularity over the past five years, facilitating enrolments from mature-age students that are looking for professional education. A depreciating Australian dollar has boosted enrolments from international students, supporting the industry. In addition, the number of Vocational Education & Training (VET) providers has risen over the past five years, following government intervention to allow VET students access to financial assistance.

The COVID-19 virus outbreak has encouraged operators to move courses online, to conform with government restrictions on social distancing. However, most of these courses are expected to return to the classroom in time for the second teaching semester at most Australian institutions. For classes to be included in the industry, at least 80% of the content must be delivered online. Consequently, the effect of the COVID-19 virus outbreak on the industry is expected to be minimal in the current year.

As the industry approaches saturation, population demographics and trends in employment are projected to influence future demand for online education. The national unemployment rate is forecast to rise over the next five years, driving industry revenue growth. Additionally, the number of internet connections across Australia is projected to rise, supporting industry growth. Industry revenue is anticipated to increase at an annualized 5.6% over the five years through 2024-25, to $10.7 billion.

Rayont Technologies competitors in the learning and education space will include SAP Litmos, Kineo, Walkme and Linkedin Learning. All of these competitors are larger and more well known than the Company. With new developments in leading technology such as AI, Gamification and AR/VR, Rayont is looking to be a leader in the corporate learning market. The Workstar assets include two learning management and employment engagement software platforms and digital content creation capabilities

Customers

1. Healthcare Services

Next Generation Photo Dynamic Therapy (NGPDT) centers have not been established and commercialized yet.

2. Education & Technology

Under the agreement dated October 15, 2020 with Ms. Kayla Ranee Smith to purchase the assets of Workstar Tech (Aust) Pty Ltd Rayont Technologies Pty Ltd acquired a number of ongoing service agreement with customers who are using the Nexus or the Sphere systems. The customer contracts include large and enterprise customers from the Banking, Hospitality, Food and Beverage and Retail markets.

| 3 |

Products

1. Healthcare Services

What is Photo Dynamic Therapy?

Photo Dynamic Therapy (“PDT”) is an alternative cancer treatment that requires patients to orally or intravenously consume a synthetic photosensitizing agent (i.e., a light-activated drug) to circulate through the body. As the agent passes through the insides of the patient, it will concentrate at the sight of the cancer. Next the patients will be exposed to specific wavelength delivery devices that will use light to ‘activate’ the photosensitizing agent, and through a cascade of molecular reactions, will destroy the cells and tissues exposed to the agent (i.e., the cancer).

Despite the original form of PDT (developed in the 1970’s) which is still being used for the treatment of some cancers today, there are limitations on its effectiveness for non-superficial cancers.

For example, some patients using PDT had trouble absorbing sufficient light for cancers that had grown deep within the skin or were metastatically spread throughout the body.

Further the earlier versions of the synthetic photosensitizing agent were not selective enough and sometimes concentrated in areas that did not have cancer.

Synthetic photosensitizing agents tend to remain in the patient’s body for an extended amount of time. This made some patients sensitive to light as some surface-level remains of the agent were reacting with the sun.

Because of this, the treatment depth of PDT was limited to mainly surface level cancers. This shortcoming gave rise to a second generation of PDT treatment termed next generation or ‘NGPDT’, that addressed the limitations of its predecessor.

Next-Generation Photo Dynamic Therapy (NGPDT)

The latest NGPDT treatment varies in both the photosensitizing agent, and wavelength delivery devices, and delivers a superior and safer treatment that targets primary cancers.

This next generation treatment process is:

| ● | Non-Toxic – NGPDT uses Photosoft™ a non-toxic, chlorophyll-based PDT photosensitiser, instead of a synthetic-based photosensitizing agent used in traditional PDT. Photosoft™ is a complex of chlorin and chlorophyllin, is water soluble and completely harmless to the body. | |

| ● | Minimised Photosensitivity – The chlorophyll-based agent circulates around the patient’s system and has a significantly faster clearance time (24 Hours) than the traditional synthetic PDT agent (Up to 3 months). | |

| ● | Highly Selective for Cancer Cells – The chlorophyll-based agent is better able to selectively accumulate onto metastatically spread cancers as well as developed cancers that are hard-to-detect by the immune system. The Hudson Institute of Medical Research reports the new IVX-PO2 version is 15x more effective than its predecessors. |

NGPDT Treatment Program

The treatment plan is different for every patient. Every detail is considered via professional consultation, ensuring the most suitable treatment is facilitated. Rayont’s NGPDT treatment will follow a standardized treatment protocol that goes through three phases.

1) Preparation;

2) Treatment; and

3) Rehabilitation.

The Preparation Phase will be the initial consultation between the doctor and the patient. The doctor will closely assess the patient eligibility for NGPDT treatment, as well as provide a professional opinion on a possible treatment plan. Upon mutual consent, the patient will be able to start treatment.

The Treatment Phase is typically three consecutive rounds of NGPDT treatment; however the specifics change depending on the treatment plan produced in the Preparation Phase.

After treatment, the immune system is in a debilitated state, leaving patients vulnerable to infection or the re-growth of cancer. Rayont is looking to partner with a number of partners to facilitate the Rehabilitation Phase. For this, both will work in conjunction to recuperate the patient’s immune system, and its ability to detect and destroy abnormal cells (e.g., possible cancer re-growth).

2. Education & Technology

Under the agreement dated October 15, 2020 with Ms. Kayla Ranee Smith to purchase the assets of Workstar Tech (Aust) Pty Ltd. Rayont Technologies Pty Ltd acquired a number of established products that offer customers the following products and services:

| 1) | Custom Content Development. Rayont Technologies customers are able to develop custom content with different levels of interactivities depending on their needs. The contact is able to be uploaded or made compatible with their existing systems of can be bundled with our existing systems. | |

| 2) | End-to-end employee experience/engagement platform. The Nexus platform is a cloud-based platform that clients can manage employee experience and engagement which includes recruitment and selection, new employee onboarding, induction, competency assessment, learning management, social networking etc. | |

| 3) | Learning Management System. The Sphere Learning Management System is a cloud based digital learning solutions for businesses that want to reduce employee down time from face-to-face learning activities. The system is able to be integrated with third party content, able to upload client custom content and SCORM compliant. | |

| 4) | Content subscriptions. Workstar and Rayont Technologies Pty Ltd are in process of negotiating strategic partnership with global, regional and local content libraries to be integrated with The Nesus and The Sphere Learning Management Systems. Clients can subscribe to any content as and when they need for their employees and they pay per content they consume only. Rayont will receive revenue share based on revenues generated through our customer networks. |

Marketing and Sales

In order to become competitive in the private equity space, the Company has taken steps to establish a number of digital marketing channels namely:

| 1) | Websites. This is an effective marketing and branding tool for customers, employees and investors as well as the public educations. The Company has completed its website and updates it regularly. The following are some important websites that the Company has: |

| i. | www.rayont.com | |

| ii. | www.workstar.com.au |

| 4 |

| 2) | Social media channels The Company has set up major social media channels such as Facebook, LinkedIn and instagram for each brand. The Company has established YouTube channels for some of the brands. These social media channels are linked and integrated with the websites. |

| 3) | Digital and analog advertising. The marketing infrastructure enables the Company and its subsidiaries to conduct both digital and analog advertising activities. |

Suppliers

Rayont International (Labuan) Ltd f.k.a Natural Health Farm Inc entered into exclusive distribution and licensing agreement with RMW Cho Group Ltd on 26th November 2018 to commercialize NGPDT technology across sub-sahara African territories. Rayont’s NGPDT license provides exclusive use of the NGPDT throughout the entire Sub-Saharan Africa region. As depicted in the table opposite, this vast region is densely populated. According to “World meter” in 2019 this region is home to more than 1.1 billion individuals which represents approximately 14.35% of the entire global population.

| 5 |

Government Regulations

The opening of NGPDT treatment centers requires approval from respective medical boards of each territory or country we are licensed by the licensor to operate. The approvals require either local medical trials or approval from established jurisdiction like FDA or USA or European Community. Currently medical trials are being conducted in Australia and China. The Company plans to start the medical trials in South Africa first followed by other territories as soon as positive results are seen in Australia in order to minimize the financial risks associated with medical trials.

Employees

As of June 30, 2021, the Group of Rayont Inc has 27 employees of which Prema Life Pty Ltd has 20, Rayont Technologies Pty Ltd has 5 and Rayont Inc has 2, all of whom performed operational, technical and administrative functions. No payroll will be paid to the employees from Rayont Inc before the Company generates net profits. We believe our future success will depend to a large extent on our continued ability to attract and retain highly skilled and qualified employees. We consider our employee relations to be good. None of these employees belong to labor unions.

Not Applicable to smaller reporting companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not Applicable to smaller reporting companies.

Our executive office address is located at 228 Hamilton Avenue, 3rd Floor, Palo Alto, California 94301. The lease for this facility is $155 monthly. The subsidiary Prema Life Pty Ltd owns the property located at 32 French Avenue, Brendale QLD 4500, Australia. This property was bought on June 28, 2021. It consists of 2720m2 land and Building 1760m2.

We believe that our leased facilities are suitable and adequate for their intended use. The Company has adopted work from home policy to comply with COVID -19 restrictions in place in Australia and other jurisdictions we operate.

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

| 6 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market for Common Equity

Our common stock is quoted on the OTC Market Pink Sheet (“OTC PINK”) under the symbol “RAYT”. The following table sets forth the high and low bid prices for our common stock for the two most recently completed fiscal years. Such prices are based on inter-dealer prices, without retail mark-up, markdown or commission, and may not necessarily represent actual transactions.

| Fiscal 2019 | Low | High | ||||||

| First Quarter | $ | 0.29 | $ | 0.34 | ||||

| Second Quarter | $ | 0.23 | $ | 0.75 | ||||

| Third Quarter | $ | 0.20 | $ | 0.51 | ||||

| Fourth Quarter | $ | 0.33 | $ | 0.50 | ||||

| Fiscal 2020 | Low | High | ||||||

| First Quarter | $ | 0.09 | $ | 0.50 | ||||

| Second Quarter | $ | 0.09 | $ | 0.51 | ||||

| Third Quarter | $ | 0.05 | $ | 0.50 | ||||

| Fourth Quarter | $ | 0.07 | $ | 0.07 | ||||

| Fiscal 2021 | Low | High | ||||||

First Quarter | $ | 0.07 | $ | 1.45 | ||||

| Second Quarter | $ | 1.13 | $ | 2.65 | ||||

| Third Quarter | $ | 1.50 | $ | 3.02 | ||||

Penny Stock Considerations

The trading of our common stock is deemed to be “penny stock” as that term is generally defined in the Securities Exchange Act of 1934 to mean equity securities with a price of less than $5.00. Our shares thus are subject to rules that impose sales practice and disclosure requirements on broker-dealers who engage in certain transactions involving a penny stock.

Under the penny stock regulations, a broker-dealer selling a penny stock to anyone other than an established customer or accredited investor must make a special suitability determination regarding the purchaser and must receive the purchaser’s written consent to the transaction prior to the sale, unless the broker-dealer is otherwise exempt. Generally, an individual with a net worth in excess of $1,000,000 or annual income exceeding $100,000 individually or $300,000 together with his or her spouse is considered an accredited investor. In addition, under the penny stock regulations the broker-dealer is required to:

| ● | Deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt; |

| ● | Disclose commissions payable to the broker-dealer and our registered representatives and current bid and offer quotations for the securities; |

| ● | Send monthly statements disclosing recent price information pertaining to the penny stock held in a customer’s account, the account’s value and information regarding the limited market in penny stocks; and |

| ● | Make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction, prior to conducting any penny stock transaction in the customer’s account. |

Because of these regulations, broker-dealers may encounter difficulties in their attempt to buy or sell shares of our common stock, which may affect the ability of selling stockholders or other holders to sell their shares in the secondary market and have the effect of reducing the level of trading activity in the secondary market. These additional sales practice and disclosure requirements could impede the sale of our common stock in the market place. In addition, the liquidity for our common stock may be decreased, with a corresponding decrease in the price of our common stock. Our shares are likely to be subject to such penny stock rules for the foreseeable future.

Common Stock Currently Outstanding

As of October 15, 2021, 48,009,853 shares were issued and outstanding.

Holders

As of the date of this Report, we had approximately 505 stockholders of record of our common stock.

| 7 |

Dividends

We have not declared any cash dividends on our common stock since our inception and do not anticipate paying any dividends in the foreseeable future. We plan to retain future earnings, if any, for use in our business. Any decisions as to future payments of dividends will depend on our earnings and financial position and such other facts, as the Board of Directors deems relevant.

Reports to Stockholders

We are currently subject to the information and reporting requirements of the Securities Exchange Act of 1934 and will continue to file periodic reports, and other information with the SEC. We intend to send annual reports to our stockholders containing audited financial statements.

Transfer Agent

Pacific Stock Transfer Company located at 6725 Via Austi Pkwy., Suite 300, Las Vegas, NV 89119 is the transfer agent for our common stock.

Recent Sales of Unregistered Securities

During October 1, 2020 to June 30, 2021, the Company sold 7,911,551 shares of common stock to 168 independent investors pursuant to a private placement. 560,000 shares at $0.05; 7,195,347 shares at $0.07; 67,705 shares at $0.71; 19,231 shares at $1.04; 29,656 shares at $1.19; 5,564 shares at $1.42; 3,654 shares at $1.56; 755 shares at $1.59; 1,285 shares at $1.79; 23,354 shares at $1.64 and 5,000 shares at $2.31 for some private placements for a total amount of $701,987.56. The subscribers had paid $701,987.56 to the Company.

The Company relied upon Section 4(2) and Regulation S of the Securities Act of 1933, as amended, for the sale of these securities. No commissions were paid regarding the share issuance and the shares were issued in a book entry form with a Rule 144 restrictive legend.

Issuer Purchases of Equity Securities

None

Additional Information

Copies of our annual reports on Form 10−K, quarterly reports on Form 10−Q, current reports on Form 8−K, and any amendments to those reports, are available free of charge on the Internet at www.sec.gov. All statements made in any of our filings, including all forward-looking statements, are made as of the date of the document, in which the statement is included, and we do not assume or undertake any obligation to update any of those statements or documents unless we are required to do so by law. The reports are also available on our corporate website at https://www.rayont.com. Upon written or oral request, we will provide to each person, including any beneficial owner, a copy of any or all of such reports, at no cost.

ITEM 6. SELECTED FINANCIAL DATA.

Not Applicable to smaller reporting companies.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This Annual Report contains “forward-looking statements” that describe management’s beliefs and expectations about the future. We have identified forward-looking statements by using words such as “anticipate,” “believe,” “could,” “estimate,” “may,” “expect,” and “intend,” or words of similar import. Although we believe these expectations are reasonable, our operations involve a number of risks and uncertainties and actual results may be materially different than our expectations.

Our Management’s Discussion and Analysis contains not only statements that are historical facts, but also statements that are forward-looking. Forward-looking statements are, by their very nature, uncertain and risky. These risks and uncertainties include international, national, and local general economic and market conditions; our ability to sustain, manage, or forecast growth; our ability to successfully make and integrate acquisitions; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results; change in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; the risk of foreign currency exchange rate; and other risks that might be detailed from time to time in our filings with the Securities and Exchange Commission.

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes, and other financial information included in this Form 10-KT.

Overview

Rayont Inc. (formerly Velt International Group Inc., or “Rayont” or the “Company”) is a Nevada corporation formed on February 7, 2011. The Company’s common stock are currently traded on the Over the Counter Pink Sheet under the symbol “RAYT”.

| 8 |

On November 19, 2018, the Company’s former principal shareholder, Mr. Chin Kha Foo, entered into a stock purchase agreement to transfer 60% of the Company’s issued and outstanding shares to Rural Asset Management Services, Inc., a Malaysian company (“Rural”). On December 14, 2018, Rural became the principal shareholder of the Company and Mr. Ali Kasa was appointed to be the Company’s President, CEO, CFO, and Secretary due to the change in control of the Company. Rural is an equity investment company with portfolio of interest in biotechnology, healthcare, cancer treatment research and technology, ICT and Crypto Currency. Rural has invested to companies located in Malaysia, Australia and the USA.

On January 22, 2019, the Company entered into an acquisition agreement with THF Holdings Pty Ltd., an Australian corporation and Rural, pursuant to which the Company acquired 100% of the issued and outstanding capital stock of THF Holdings Pty Ltd. in exchange for 4,000,000 shares of the Company’s common stock, valued on January 22, 2019 at $1,000,000. THF Holdings Pty Ltd. is an Australian Cancer treatment and medical device company. Rural is the majority shareholder of THF Holdings Pty Ltd.. In March 2019, the acquisition of THF Holdings Pty Ltd. was completed and THF Holdings Pty Ltd. became a subsidiary of the Company. In addition, the acquisition was accounted for business combination under common control of Rural. On August 25, 2020, the name THF Holdings Pty Ltd. was changed to Rayont (Australia) Pty Ltd. (“Rayont Australia”).

On January 24, 2019, the Company entered into an acquisition agreement with THF International (Hong Kong) Ltd., a Hong Kong company (“THF Hong Kong”) and the shareholders of THF Hong Kong, pursuant to which the Company acquired 100% of the issued and outstanding capital stock of THF Hong Kong in exchange for 8,000,000 shares of the Company’s common stock, valued at $2,000,000 on January 24, 2019. On May 13, 2019, the Company executed an amendment to the acquisition agreement, wherein the Company agreed to acquire only 85% of THF Hong Kong and reduce the purchase price to 6,800,000 shares from 8,000,000 shares. On August 4, 2019, the Company and the THF Hong Kong agreed to terminate the acquisition.

On January 24, 2019, the Company entered into an acquisition agreement with Natural Health Farm (Labuan) Inc. (“NHF”) and the shareholders of NHF, pursuant to which the Company acquired 100% of the issued and outstanding capital stock of NHF in exchange for 40,000,000 shares of the Company’s common stock, valued at $10,000,000 on January 24, 2019. NHF is a Malaysian company concentrating on clinical life sciences and holds an exclusive license for registering and commercializing Photosoft technology for treatment of all cancers in the Sub-Sahara African region. The technology has been licensed in Australia, New Zealand, China, Malaysia and Sub-Sahara Africa. The human clinical trial efforts have started in Australia and China conducted by Hudson Medical Institute, Australia. On August 4, 2019, the Company and NHF agreed to terminate the acquisition.

On August 26, 2020, the Company established Rayont Technologies Pty Ltd. (Rayont Technologies) through Rayont Australia. Rayont Technologies is an Australian corporation and is engaged primarily in digital learning solutions to support the development of people skills that drive business growth.

On September 30, 2020, the Company acquired all of the issued and outstanding capital stock of Rayont International (L) Limited (Rayont International), a Malaysian company. The purchase price paid by the Company was 25,714,286 shares of its common stock valued at $1,800,000 or $0.07 per share, which was the closing price of the Company’s common stock on the OTC Markets on September 29, 2020. Rayont International is a clinical-stage life sciences company that holds the exclusive license for registering and commercializing PhotosoftTM technology for treatment of all cancers across Sub-Sahara African region. The technology has been licensed in Australia, New Zealand, China, Malaysia and Sub-Sahara Africa.

On October 15, 2020, Rayont Technologies Pty Ltd entered into an agreement with Ms. Kayla Ranee Smith to purchase the assets of Workstar Tech (Aust) Pty Ltd for AUD 302,876.22 payable over 90 days upon Ms Smith transfers the assets to Rayont Technologies Pty Ltd. The assets that Rayont Technologies acquired under the agreement includes trademark, website, software, office assets.

On December 23, 2020, Rayont Australia Pty Ltd, a wholly-owned subsidiary of Rayont Inc. (the “Company”), acquired all of the issued and outstanding capital stock of Prema Life Pty Ltd, an Australian company (“Prema Life”), from TheAlikasa (Australia) Pty Ltd, Prema Life’s sole shareholder. The acquisition of Prema Life was completed, and Prema Life became a subsidiary of the Company. Prema Life is a HACCP certified manufacturer and supplier of functional foods and supplements, and of practitioner only naturopathic and homeopathic medicines. Prema Life produces an extensive range of products including proteins, green blends, sports nutrition, weight management and maintenance, and health and wellness products. In addition, the acquisition was accounted for business combination under common control. The method of accounting for such transfers, as well as the acquisition of businesses, was similar to the pooling of interest’s method of accounting. Under this method, the carrying amount of net assets recognized in the balance sheets of each combining entity are carried forward to the balance sheet of the combined entity. The amount by which the proceeds paid by the Company differs from Prema Life’s historical carrying value of the acquired business is accounted for as a return of capital or contribution of capital. In addition, transfers of net assets between entities under common control were accounted for as if the transfer occurred from the date that the Company and the acquired business were both under the common control and had begun operations.

On December 23, 2020, pursuant to an Acquisition Agreement, Rayont Australia Pty Ltd, a wholly-owned subsidiary of Rayont Inc. (the “Company”), acquired all of the issued and outstanding capital stock of GGLG Properties Pty LTD, an Australian company (“GGLG”), from TheAlikasa (Australia) Pty Ltd, GGLG’s sole shareholder (the “Seller”). The Seller is an affiliate of the Company and therefore the acquisition is being treated as a related party transaction. In addition, the acquisition was accounted for business combination under common control. The method of accounting for such transfers, as well as the acquisition of businesses, was similar to the pooling of interest’s method of accounting. Under this method, the carrying amount of net assets recognized in the balance sheets of each combining entity are carried forward to the balance sheet of the combined entity. The amount by which the proceeds paid by the Company differs from GGLG ‘s historical carrying value of the acquired business is accounted for as a return of capital or contribution of capital. In addition, transfers of net assets between entities under common control were accounted for as if the transfer occurred from the date that the Company and the acquired business were both under the common control and had begun operations. The purchase price is $605,920, which is a 10% discount of the total amount of GGLG’s net tangible assets. The purchase price will be paid in six installments after a $265,300 down payment. In the event an installment payment is not paid timely, the Seller has agreed to accept shares of the Company valued at $0.87 per share. The price per share is based on a 20% discount of the average share price on the OTC Markets over the last 30 trading days.

On February 18, 2021 the Foreign Investment Review Board approved the capital stock transferring of GGLG Properties Pty Ltd to the Rayont Australia Pty Ltd. On March 9, 2021, the parties agreed to amend the acquisition agreements for the GGLG Properties Pty Ltd and as per Board Resolution, the Company issued 710,713 shares of its common stocks in leu of payment by Rayont Australia Pty Ltd of approximately $605,920 (AUD 800,000) to TheAlikasa Pty Ltd as full and final payment for the acquisition of 100% of the issued and outstanding common stock of GGLG.

On December 29, 2020, the Company incorporated Rayont Malaysia Sdn Bhd with a paid-up capital of $25 and Rayont Malaysia Sdn Bhd incorporated on December 31, 2020 Rayont Technologies (M) Sdn Bhd with a paid-up capital of $25 respectively to carry out its business activities in Malaysia. On February 5, 2021 Rayont Technologies (M) Pty Ltd entered into an Asset Purchase Agreement with Sage Interactive Sdn Bhd to purchase its assets in consideration of the payment of USD 105,000.00. These assets include software for remote learning, customer contracts, digital content and three key employees. These assets will operate in Malaysia under Workstar trademark and operation shall be integrated with Rayont Technologies Australia to drive efficiency and scale of digital assets operations.

On March 11, 2020, the World Health Organization designated COVID-19 as a global pandemic. Governments around the world have mandated, and continue to introduce, orders to slow the transmission of the virus, including but not limited to shelter-in-place orders, quarantines, significant restrictions on travel, as well as work restrictions. To date, the Company has experienced some adverse impacts; however, the impacts of COVID-19 on our operating results for the nine months ended June 30, 2021 was limited due to the nature of our business. The extent of the COVID-19 impact to the Company will depend on numerous factors and developments related to COVID-19. Consequently, any potential impacts of COVID-19 remain highly uncertain and cannot be predicted with confidence.

Current Operational Activities

Prior to the change in the control, the Company was to focus on the development and designs of a mobile application (the “Mobile App”) for a third-party company in Hong Kong. The Mobile App allows users to book airline ticket, train ticket and taxi cabs, play online games, facilitate payments for utilities and other services, and to facilitate shipping services and so forth.

With the acquisitions of Rayont Australia and Rayont International, the Company has decided to embark in life science as a sector to operate and cancer treatment as an area that it will develop its expertise and business.

Restatement

The Company has restated the consolidated financial statements for the year ended September 30, 2020 contained in our previously filed Annual Reports on Form 10-K. The restatement was due to due to fact the Company acquired Prema Life Pty Ltd and GGLG Properties Pty Ltd and since it’s a common control situation effect of acquisition was given from September 30, 2019 financial statement. The Company has not amended its previously filed Annual Reports on Form 10-K or Quarterly Reports on Form 10-Q for the periods affected by the restatement. The Company has revised the consolidated financial statements as of and for the year ended September 30, 2020 included in Item 8. Financial Statements and Supplementary Data.

| 9 |

Results of Operations

For the nine months ended June 30, 2021 and 2020

Revenue

There were $ 2,244,157 and $ 1,270,240 revenue generated for the nine months ended June 30, 2021 and 2020, respectively. The increase was attributable to revenues generated from digital learning solutions provided by Rayont Technologies in Australia, Malaysia, and the revenues generated from Prema Life. The Company continues looking for other opportunities which could potentially increase the profits of the Company.

Cost of Goods Sold

There were $979,476 and $890,696 cost of goods sold for the nine months ended June 30, 2021 and 2020, respectively. The increase was attributable to costs incurred by Rayont Technologies in Australia and Malaysia from digital learning solutions provided, and the increased revenues for nine months ended June 30, 2021 compare with 2020.

Operating Expense

Our operating expenses consist of selling, general and administrative expenses, depreciation and amortization expense.

For the nine months ended June 30, 2021 and 2020, there were a total of $ 2,110,506 and $ 1,098,374 operating expenses, respectively. The increase was primarily due to the salary expenses incurred for the operating subsidiary, Rayont Technologies, the operating expenses generated from Prema Life as for the nine months ended June 30, 2021 the revenues of Prema Life were increased compare with the respective period June 30, 2020, as well as the increase in the depreciation and amortization expense due to the existing and new intangible and tangible assets acquired. The Company recorded the amortization expense for the first time for intangible asset “Exclusive license for registering and commercializing PhotosoftTM technology” that is the biggest intangible asset of the Company. This transaction increased 215% the amortization and depreciation expense compare with the nine months ended June 30, 2020.

Other Income

Other income was $790,701 and $72,598 for the nine months ended June 30, 2021 and 2020, respectively. The increase was attributable to differences between purchase consideration of assets from Workstar Tech (Aust) Pty Ltd and it’s as-is basis value amounted to USD248,336. Whilst, USD188,995.19 arose due to tax incentive/grant obtained in relation to approved research and development activities carried out. Other incentives amount from Australian Government are USD $40,696.36 and USD9,420.45 in relation to ATO COVID19 Job Seeker and Cash Flow Boost.

The amount of USD 303,253 was attributable to differences between seller and purchase price of the property that GGLG Properties Pty Ltd sold on June 29, 2021.

| 10 |

Net Income (Loss)

We had a net income of $46,424 for the nine months ended June 30, 2021, and a net loss of $665,617 for the nine months ended June 30, 2020 based on the factors discussed above.

Liquidity and Capital Resources

As of June 30, 2021 and September 30, 2020, the Company had working capital deficit of $1,456,964 and $2,819,732, respectively.

The deficit is attributable to loans due to a related party of $ 387,238, accounts payable of $ 99,615, accrued liabilities of $ 472,021, loan payable of $ 2,051,554, other payables of $ 209,712 and finance lease of $ 8,188 at June 30, 2021.

The deficit is attributable to loans due to a related party of $3,307,990, accounts payable of $54,316, accrued liabilities of $375,260, loan payable of $481,383 and other payables of $474 at September 30, 2020. As of June 30, 2021 and September 30, 2020, the Company had $1,771,364 and $1,399,691 in current assets, respectively.

As of June 30, 2021 and September 30, 2020, we had a cash and equivalents balance of $ 243,610 and $196,174, respectively. The Company’s operations are primarily funded by the revenue, other income and proceeds received from the sale of common stock in private placements.

Cash Flows from Operating Activities

Net cash used in operating activities was $ 285,896 for the nine months ended June 30, 2021 compared with net cash used in operating activities of $ 565,262 for the nine months ended June 30, 2020. During the nine months ended June 30, 2021, the net cash used in operating activities was attributed to net income of $46,424, offset by depreciation and amortization expense of $ 422,633, gain on purchase of assets of $ 238,014 an increase in accounts receivable of $ 157,303, an increase in inventory of $22,915, an increase in accounts payable of $42,828, an increase in accrued liabilities of $78,934, an increase in prepaid expense of $24,041, an decrease in advance to officer of $6,717, an increase in other receivables of $ 398,265, an increase in other assets of $47,054 and an increase in other assets of $4,160.

During the nine months ended June 30, 2020, the net cash used in operating activities was attributed to net loss of $665,617, offset by depreciation and amortization expense of $134,191, non-cash portion of share based compensation for service of $20,000, a decrease in accounts receivable of $12,874, an increase in inventory of $130,771, an increase in accounts payable of $29,975, an increase in accrued liabilities of $53,935, a decrease in other receivables of $67,269, an increase in other payable of $20,554.

Cash Flows from Investing Activities

Net cash used in investing activities was $1,798,506 for the nine months ended June 30, 2021 compared with net cash used in investing activities of $7,402 for the nine months ended June 30, 2020.

During the nine months ended June 30, 2021, the net cash used in investing activities was attributed to the purchases of intangible assets of $ 126,479, proceeds from loan receivable of $93,000, purchases of property and equipment of $1,765,027.

During the nine months ended June 30, 2020, the net cash used in investing activities was attributed to the purchases of property and equipment of $7,402.

Cash Flow from Financing Activities

We generated cash in financing activities during the nine months ended June 30, 2021 and 2020 of $2,124,034 and $629,807, respectively, from issuance of common stock in the amount of $701,988 and $0 respectively, proceeds from loan payable in the amount of $1,577,422 and $237,045, respectively, proceeds from (repayment to) a related party in the amount of $155,376 and $379,853, respectively, adjustment in Additional Paid in Capital in the amount of $0 and $12,909, respectively.

Non-Cash Investing and Financing Activities

During the nine months ended June 30, 2021, the related party debt in the amount of $ 2,016,363 was forgiven and recorded to additional paid in capital.

During the nine months ended June 30, 2020, the related party debt in the amount of $35,071 was forgiven and recorded to additional paid in capital.

Equity and Capital Resources

We have created income for the year ended June 30, 2021 and had an accumulated deficit of $3,912,404 as of June 30, 2021. As of June 30, 2021, we had cash of $243,610 and a negative working capital of $1,456,964, compared to cash of $196,174 and a negative working capital of $2,819,732 as of September 30, 2020.

| 11 |

We had material commitments for capital expenditures as of June 30, 2021. We expect our expenses will continue to increase during the foreseeable future as a result of increased operational expenses and the development of potential business opportunities. However, we do not anticipate that the Company will generate revenue sufficient to cover its planned operating expenses in the foreseeable future, and we are dependent on the proceeds from future debt or equity investments to sustain our operations and implement our business plan. If we are unable to raise sufficient capital, we will be required to delay or forego some portion of our business plan, which would have a material adversely effect on our anticipated results from operations and financial condition. There is no assurance that we will be able to obtain necessary amounts of additional capital or that our estimates of our capital requirements will prove to be accurate. As of the date of this Form 10-K/T, we did not have any commitments from any source to provide such additional capital. Even if we are able to secure outside financing, it may not be available in the amounts or the times when we require. Furthermore, such financing would likely take the form of bank loans, private placement of debt or equity securities or some combination of these. The issuance of additional equity securities would dilute the stock ownership of current investors while incurring loans, leases or debt would increase our capital requirements and possible loss of valuable assets if such obligations were not repaid in accordance with their terms.

Off-Balance Sheet Arrangements

Under SEC regulations, we are required to disclose off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, such as changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors. An off-balance sheet arrangement means a transaction, agreement or contractual arrangement to which any entity that is not consolidated with us is a party, under which we have:

| ● | Any obligation under certain guarantee contracts, | |

| ● | Any retained or contingent interest in assets transferred to an unconsolidated entity or similar arrangement that serves as credit, liquidity or market risk support to that entity for such assets, | |

| ● | Any obligation under a contract that would be accounted for as a derivative instrument, except that it is both indexed to our stock and classified in shareholder equity in our statement of financial position, and | |

| ● | Any obligation arising out of a material variable interest held by us in an unconsolidated entity that provides financing, liquidity, market risk or credit risk support to us, or engages in leasing, hedging or research and development services with us. |

We do not have any off-balance sheet arrangements that we are required to disclose pursuant to these regulations.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not Applicable to smaller reporting companies.

| 12 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

RAYONT INC. AND SUBSIDIARIES

CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2021 AND 2020

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

| Page | ||

| Report of Independent Registered Public Accounting Firm | F-2 | |

| Consolidated Balance Sheets as of June 30, 2021 and September 30, 2020 | F-4 | |

| F-5 | ||

| F-6 | ||

| F-7 | ||

| Notes to Consolidated Financial Statements | F-8 |

| F-1 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders of Rayont, Inc.

228 Hamilton Avenue, 3rd Floor, Palo Alto, California 94301

Opinion on the Financial Statements

We have audited the accompanying balance sheets of Rayont, Inc. (the ‘Company’) as of June 30, 2021 and September 30, 2020, and the related statements of operations and comprehensive income, stockholders’ equity, and cash flows for the each of two years in the year ended of June 30, 2021 and September 30, 2020, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of June 30, 2021 and September 30, 2020, and the results of its operations and its cash flows for each of two years in the period/year ended June 30, 2021 and September 30, 2020, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the Board of Directors (Those Charged with Governance) that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgements. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

| F-2 |

Impairment assessment on intangible assets

The Group recognizes intangible assets amounting to USD2,245,231 and USD2,000,000 as at June 30, 2021 and September 30, 2021, as disclosed in Note 5 to the consolidated financial statements, representing approximately 31% and 42% of the Group’s total assets for respective financial period/year.

The Group carries out impairment test by comparing the recoverable amount of cash generating unit (“CGU”) based on the value in use method and the carrying amounts. The impairment test was significant due to the complexity of the assessment process involving significant judgements and estimation uncertainty in making key assumptions about future market and economic conditions, growth rates, profit margins, discount rate, etc. for value in use of CGU based on future discounted cash flows.

Our audit procedures in this area included the following, among others:

| a) | Examining management’s cash flows forecast that support the impairment assessment; |

| b) | Assessing the reliability of management’s forecast through the review of past trends of actual financial performance against previous forecasted results; |

| c) | Assessing the key assumptions on which the cash flows projections are based, by amongst others, comparing them against business plans, contracts with customers, historical results and market data; |

| d) | Performing sensitivity analysis to stress test the key assumptions and inputs used in the impairment assessment; and |

| e) | Assessing the adequacy and reasonableness of the disclosure in the financial statements. |

Inventory management system update and calibration

The Group recognizes inventories amounting to USD500,165 and USD454,770 as at June 30, 2021 and September 30, 2021, as disclosed in Note 3 to the consolidated financial statements, representing approximately 7% and 9% of the Group’s total assets for respective financial year.

The Group carries out inventory data input separately from an inventory management system to accounting system on every month for the purpose reporting. The inventory management system has limitation to demonstrate historical and current data on a timely manner which resulted time and effort required for reconciliation so as to ensure inventory cut off, accuracy and completeness.

Our audit procedures in this area included the following, among others:

| a) | Examining management’s record to support the incurrence and accuracy; |

| b) | Assessing the reliability of management’s procedures in place; |

| c) | Assessing management’s record with cut off to support completeness; |

| d) | Performing sensitivity analysis to test the costing and inputs; and |

| e) | Assessing the adequacy and reasonableness of the disclosure in the financial statements. |

/s/JP CENTURION & PARTNERS PLT |

|

| JP CENTURION & PARTNERS PLT | |

We have served as the Company’s auditor since 2020. | |

| Kuala Lumpur, Malaysia | |

| Date: October 15, 2021 | |

| F-3 |

CONSOLIDATED BALANCE SHEETS

| Restated | ||||||||

| June 30, | September 30, | |||||||

| 2021 | 2020 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalent | $ | 243,610 | $ | 196,174 | ||||

| Accounts receivable | 534,525 | 360,159 | ||||||

| Inventories | 500,165 | 454,770 | ||||||

| Prepaid expense | 23,933 | - | ||||||

| Due from related parties | 15,881 | 372,071 | ||||||

| Other receivables | 453,250 | 16,517 | ||||||

| Total Current Assets | 1,771,364 | 1,399,691 | ||||||

| Non-Current assets: | ||||||||

| Property and equipment, net | 3,140,757 | 1,413,976 | ||||||

| Intangible assets | 2,245,231 | 2,000,000 | ||||||

| Other assets | - | 21 | ||||||

| Total Non-Current Assets | 5,385,988 | 3,413,997 | ||||||

| TOTAL ASSETS | $ | 7,157,352 | $ | 4,813,688 | ||||

| LIABILITIES AND STOOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 99,615 | $ | 54,316 | ||||

| Accrued liabilities | 472,021 | 375,260 | ||||||

| Due to related parties | 387,238 | 3,307,990 | ||||||

| Loan payable | 2,051,554 | 481,383 | ||||||

| Finance lease payable | 8,188 | - | ||||||

| Other payables | 209,712 | 474 | ||||||

| Total Current Liabilities | 3,228,328 | 4,219,423 | ||||||

| Non-Current liabilities: | ||||||||

| Finance lease payable | 19,669 | - | ||||||

| Loan payable | 182,329 | 178,533 | ||||||

| Total Non-Current Liabilities | 201,998 | 178,533 | ||||||

| TOTAL LIABILITIES | 3,430,326 | 4,397,956 | ||||||

| COMMITMENTS AND CONTNGENCIES | ||||||||

| Stockholders’ Equity: | ||||||||

| Common stock, $0.001 par value; 500,000,000 shares authorized; 46,783,369 and 38,871,818 shares issued and outstanding as of June 30, 2021 and September 30, 2020, respectively | 46,784 | 38,872 | ||||||

| Preferred stock, $0.001 par value; 20,000,000 shares authorized; nil share issued and outstanding | - | - | ||||||

| Additional paid-in capital | 6,996,198 | 4,296,524 | ||||||

| Shares To Be Issued | 618,320 | - | ||||||

| Accumulated deficit | (3,912,404 | ) | (3,958,827 | ) | ||||

| Accumulated other comprehensive income | (21,872 | ) | 39,163 | |||||

| TOTAL STOCKHOLDERS’ EQUITY | 3,727,026 | 415,732 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 7,157,352 | $ | 4,813,688 | ||||

| F-4 |

RAYONT INC. AND S SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

| For the nine months ended June 30, 2021 | Restated For the nine months ended June 30, 2020 | Restated Year ended September 30, 2020 | Restated Year ended September 30, 2019 | |||||||||||||

| (unaudited) | ||||||||||||||||

| Revenue | $ | 2,244,157 | $ | 1,270,240 | $ | 1,984,138 | $ | 1,668,582 | ||||||||

| Cost of Revenue | (979,476 | ) | (890,696 | ) | (1,139,033 | ) | (755,936 | ) | ||||||||

| Gross profit | 1,264,681 | 379,544 | 845,105 | 912,646 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Selling, general and administrative expenses | 1,687,873 | 964,183 | 1,243,502 | 3,117,313 | ||||||||||||

| Depreciation and amortization expense | 422,633 | 134,191 | 167,352 | 204,354 | ||||||||||||

| Total Operating Expenses | 2,110,506 | 1,098,374 | 1,410,854 | 3,321,667 | ||||||||||||

| Operating Profit /(Loss) | (845,825 | ) | (718,830 | ) | (565,749 | ) | (2,409,021 | ) | ||||||||

| Other income/(expense): | ||||||||||||||||

| Interest income | 140,252 | 6,441 | 10,152 | - | ||||||||||||

| Interest expense | (38,704 | ) | (25,826 | ) | (37,117 | ) | (11,425 | ) | ||||||||

| Other income, net | 790,701 | 72,598 | 231,955 | 66,090 | ||||||||||||

| Total other income/(expense) | 892,249 | 53,213 | 204,990 | 54,665 | ||||||||||||

| Income/ (Loss) before income taxes | 46,424 | (665,617 | ) | (360,759 | ) | (2,354,356 | ) | |||||||||

| Income tax expense | - | - | - | - | ||||||||||||

| Net income (loss) | $ | 46,424 | $ | (665,617 | ) | $ | (360,759 | ) | $ | (2,354,356 | ) | |||||

| Other comprehensive items | ||||||||||||||||

| Foreign currency translation (loss)/gain | (61,035 | ) | 851 | 64,829 | (25,666 | ) | ||||||||||

| Total other comprehensive (loss)/gain | (61,035 | ) | 851 | 64,829 | (25,666 | ) | ||||||||||

| Total comprehensive loss | (14,611 | ) | (664,766 | ) | (295,930 | ) | (2,380,022 | ) | ||||||||

| Less: comprehensive income attributable to noncontrolling interest | - | - | - | - | ||||||||||||

| Total Comprehensive loss attributable to shareholders of the Company | $ | (14,611 | ) | $ | (664,766 | ) | $ | (295,930 | ) | $ | (2,380,022 | ) | ||||

| Weighted average shares, basic and diluted | 46,393,747 | 12,983,262 | 13,026,710 | 8,869,230 | ||||||||||||

| Net earnings / (loss) per common share, basic and diluted | $ | 0.00 | $ | (0.02 | ) | $ | (0.03 | ) | $ | (0.27 | ) | |||||

| F-5 |

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

| Accumulated | ||||||||||||||||||||||||||||

| Additional | Stock | Other | ||||||||||||||||||||||||||

| Common Stock | Paid-In | To Be | Accumulated | Comprehensive | ||||||||||||||||||||||||

| Shares | Amount | Capital | Issued | Deficit | Income (Loss) | Total | ||||||||||||||||||||||

| Balance as of September 30, 2018 | 1,886,622 | $ | 1,887 | $ | 1,020,563 | $ | (1,243,712 | ) | $ | - | $ | (221,262 | ) | |||||||||||||||

| Issuance of common stock | 120,910 | 121 | 27,379 | - | - | - | 27,500 | |||||||||||||||||||||

| Issuance of common stock for services | 6,900,000 | 6,900 | 1,946,100 | - | - | - | 1,953,000 | |||||||||||||||||||||

| Business acquisition of a subsidiary under common control | 4,000,000 | 4,000 | 1,332,225 | - | - | - | 1,336,225 | |||||||||||||||||||||

| Decrease in additional paid in capital from acquisitions | - | - | (344,852 | ) | - | - | - | (344,852 | ) | |||||||||||||||||||