Form 10-K/A Rush Street Interactive, For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 2)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020, OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM ______________ TO

Commission File Number 001-39232

RUSH STREET INTERACTIVE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 84-3626708 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

|

900 N. Michigan Avenue, Suite 950 Chicago, Illinois 60611 |

(312) 915-2815 | |

| (Address of principal executive offices, including zip code) | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Exchange on Which Registered | ||

| Class A common stock, $0.0001 par value per share | “RSI” | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company x Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or reviews financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2020, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the Class A common stock held by non-affiliates was $230,690,000 based upon the closing sales price for the registrant’s Class A common stock of $10.03 as reported by the New York Stock Exchange. For the purpose of calculating the aggregate market value of shares held by non-affiliates, we have assumed that all outstanding shares are held by non-affiliates, except for shares beneficially owned by each of our executive officers, directors and 5% or greater stockholders. In the case of 5% or greater stockholders, we have not deemed such stockholders to be affiliates unless there are facts and circumstances indicating that such stockholders exercise any control over our company. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

As of May 5, 2021, there were 58,911,668 shares of the registrant’s Class A common stock, $0.0001 par value per share, issued and outstanding, and 160,000,000 shares of the registrant’s Class V common stock, $0.0001 per value per share, issued and outstanding.

EXPLANATORY NOTE

Unless the context requires otherwise, references throughout this Amendment No. 2 to the Annual Report on Form 10-K/A to the “Company,” “Rush Street Interactive,” “RSI,” “we,” “our,” “us” and similar terms used herein refer collectively to Rush Street Interactive, Inc., a Delaware corporation, and its consolidated subsidiaries, following the Business Combination (as defined below), other than certain historical information which refers to the business of Rush Street Interactive, LP prior to the consummation of the Business Combination.

This Amendment No. 2 (“Amendment No. 2”) to the Annual Report on Form 10-K/A amends the Annual Report on Form 10-K of Rush Street Interactive, Inc. for the fiscal year ended December 31, 2020, as filed with the Securities and Exchange Commission (‘SEC”) on March 25, 2021 (the “Original Filing”) and as amended by the Amendment No. 1 to the Original Filing, as filed with the SEC on April 30, 2021 (“Amendment No. 1” and together with the Original Filing and Amendment No. 2, the “Amended Annual Report”). This Amended Annual Report restates the Company’s consolidated financial statements and related disclosures as of and for the year ended December 31, 2020. See Note 3, “Restatement of Consolidated Financial Statements,” to our audited consolidated financial statements included elsewhere in this Amended Annual Report for additional information. The impact of such restatement is included herein.

On April 12, 2021, the staff of the Securities and Exchange Commission (the “SEC Staff”) issued a public statement entitled “Staff Statement on Accounting and Reporting Considerations for Warrants issued by Special Purpose Acquisition Companies (“SPACs”)” (the “SEC Staff Statement”). In the SEC Staff Statement, the SEC Staff expressed its view that certain terms and conditions common to SPAC warrants may require the warrants to be classified as liabilities on the SPAC’s balance sheet as opposed to equity.

Since their issuance, our publicly issued and privately placed warrants to purchase Class A common stock of the Company (collectively, the “Warrants”), which were initially issued by dMY Technology Group, Inc. (“dMY”) and assumed by the Company with the consummation of the transactions contemplated by the Business Combination Agreement dated as of July 27, 2020 (as amended and restated on October 9, 2020, as further amended on December 4, 2020), were accounted for as equity within our balance sheet. The Company initially evaluated the accounting for its Warrants and believed its positions to be appropriate at that time, and while the terms of the Warrants as described in the warrant agreement governing the Warrants have not changed, as a result of the SEC Staff Statement, the Company has determined to classify its warrants as liabilities and will subsequently measure them at fair value through earnings pursuant to Accounting Standards Codification 815-40, Derivative and Hedging, Contracts in Entity’s Own Equity (“ASC 815-40”).

Therefore, the Company, in consultation with its Audit Committee (the “Audit Committee”) of the Board of Directors (the “Board”), concluded that its previously issued audited consolidated financial statements for the year ended December 31, 2020 (the “Affected Period”) should be restated because of a misapplication of the guidance pertaining to the accounting for our then-outstanding Warrants and should no longer be relied upon.

We are filing this Amendment No. 2 to amend and restate certain of the Company’s Risk Factors under Item 1A, Management’s Discussion and Analysis of Financial Condition and Results of Operation described in Item 7, and the Financial Statements and Supplementary Data described in Item 8, which such financial data give effect to the change in accounting for the Warrants as disclosed in the Original Filing.

To give effect to the change in accounting for the Warrants disclosed in the Original Filing, we are filing this Amendment No. 2 to amend and restate certain information and financial detail included in the Company’s Risk Factors under Item 1A, Management’s Discussion and Analysis of Financial Condition and Results of Operation described in Item 7, Financial Statements and Supplementary Data described in Item 8, and information relating to Controls and Procedures described in Item 9A.

The change in accounting for the Warrants did not have any impact on our liquidity, cash flows, revenues or costs of operating our business and the other non-cash adjustments to our audited consolidated financial statements in the Affected Period or in any of the periods included in Item 8, Financial Statements and Supplementary Data in this filing. The change in accounting for the Warrants does not impact the amounts previously reported for the Company’s cash and cash equivalents, investments held in the trust account (as applicable), operating expenses or total cash flows from operations for the Affected Period. Additionally, the historical quarterly dMY financial statements were not restated to reflect this change in accounting, as we believe that information is no longer relevant to investors.

Items Amended in this Form 10-K/A

This Form 10-K/A presents the Original Report (as amended by Amendment No. 1), amended and restated with modifications as necessary to reflect the restatements. The following items have been amended to reflect the restatement:

Part I, Item 1A. Risk Factors

Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Part II, Item 8. Financial Statements

Part II, Item 9A. Controls and Procedures

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, new certifications by our principal executive officer and principal financial officer are filed as exhibits to this Amendment No. 2 under Item 15 of Part IV hereof.

Except as described above, this Form 10-K/A does not amend, update or change any other items or disclosures in the Original Report and does not purport to reflect any information or events subsequent to the filing thereof. As such, this Form 10-K/A speaks only as of the date the Original Report was filed, and we have not undertaken herein to amend, supplement or update any information contained in the Original Report to give effect to any subsequent events. Accordingly, this Form 10-K/A should be read in conjunction with our filings made with the SEC subsequent to the filing of the Original Report, including any amendment to those filings.

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

This Amended Annual Report on Form 10-K/A contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 that reflect future plans, estimates, beliefs and expected performance. The forward-looking statements depend upon events, risks and uncertainties that may be outside of our control. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. You are cautioned that our business and operations are subject to a variety of risks and uncertainties, many of which are beyond our control, and, consequently, our actual results may differ materially from those projected.

Factors that could cause or contribute to such differences include, but are not limited to, those identified below and those discussed in the section entitled “Risk Factors” included elsewhere in this Annual Report. Any statements contained herein that are not statements of historical fact may be forward-looking statements.

| • | competition in the online casino, online sports betting and retail sports betting (i.e., such as within a bricks-and-mortar casino) industries is intense and, as a result, we may fail to attract and retain customers, which may negatively impact our operations and growth prospects; |

| • | economic downturns and political and market conditions beyond our control, including a reduction in consumer discretionary spending and sports leagues shortening, delaying or cancelling their seasons due to COVID-19, could adversely affect our business, financial condition, results of operations and prospects; |

| • | our growth prospects may suffer if we are unable to develop successful offerings, if we fail to pursue additional offerings or if we lose any of our key executives or other key employees; |

| • | our business is subject to a variety of U.S. and foreign laws (including Colombia, where we have business operations), many of which are unsettled and still developing, and our growth prospects depend on the legal status of real-money gaming in various jurisdictions; |

| • | failure to comply with regulatory requirements or to successfully obtain a license or permit applied for could adversely impact our ability to comply with licensing and regulatory requirements or to obtain or maintain licenses in other jurisdictions, or could cause financial institutions, online platforms and distributors to stop providing services to us; |

| • | we rely on information technology and other systems and platforms (including reliance on third-party providers to validate the identity and location of our customers and to process deposits and withdrawals made by our customers), and any breach or disruption of such information technology could compromise our networks and the information stored there could be accessed, publicly disclosed, lost, corrupted or stolen; |

| • | our officers and directors allocating their time to other businesses and potentially having conflicts of interest with our business; |

| • | our projections, including for revenues, market share, expenses and profitability, are subject to significant risks, assumptions, estimates and uncertainties; |

| • | the requirements of being a public company, including compliance with the SEC’s requirements regarding internal controls over financial reporting, may strain our resources and divert our attention, and the increases in legal, accounting and compliance expenses that will result from our recent Business Combination (as defined below) may be greater than we anticipate; |

| • | we license certain trademarks and domain names to RSG and its affiliates, and RSG’s and its affiliates’ use of such trademarks and domain names, or failure to protect or enforce our intellectual property rights, could harm our business, financial condition, results of operations and prospects; and |

| • | we currently and will likely continue to rely on licenses and service agreements to use the intellectual property rights of third parties that are incorporated into or used in our products and services. |

Due to the uncertain nature of these factors, management cannot assess the impact of each factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any of these statements to reflect events or circumstances occurring after the date of this Annual Report. New factors may emerge, and it is not possible to predict all factors that may affect our business and prospects.

1

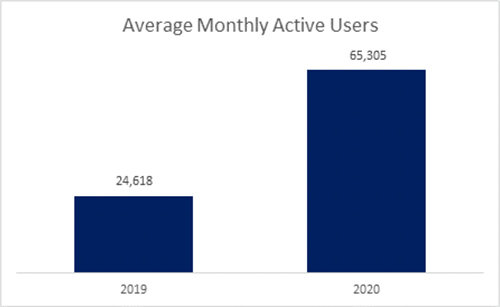

Limitations of Key Metrics and Other Data

The numbers for our key metrics, which include our monthly active users (“MAUs”) and average revenue per MAU (“ARPMAU”), are calculated using internal company data based on the activity of user accounts. While these numbers are based on what we believe to be reasonable estimates of our user base and activity levels for the applicable period of measurement, there are inherent challenges in measuring usage of our offerings across large online and mobile populations across numerous jurisdictions. In addition, we are continually seeking to improve our estimates of our user base and user activity, and such estimates may change due to improvements or changes in our methodology.

We regularly evaluate these metrics to estimate the number of “duplicate” accounts among our MAUs and remove the effects of such duplicate accounts on our key metrics. A duplicate account is one that a user maintains in addition to his or her principal account. Generally duplicate accounts arise as a result of users signing up to use more than one of our brands (i.e., BetRivers and PlaySugarHouse) or to use our offerings in more than one jurisdiction, for instance when a user lives in New Jersey but works in Pennsylvania. The estimates of duplicate accounts are based on an internal review of a limited sample of accounts, and we apply significant judgment in making this determination. For example, to identify duplicate accounts we use data signals such as similar IP addresses or user names. Our estimates may change as our methodologies evolve, including through the application of new data signals or technologies, which may allow us to identify previously undetected duplicate accounts and may improve our ability to evaluate a broader population of our users. Duplicate accounts are very difficult to measure, and it is possible that the actual number of duplicate accounts may vary significantly from our estimates.

Our data limitations may affect our understanding of certain details of our business. We regularly review our processes for calculating these metrics, and from time to time we may discover inaccuracies in our metrics or make adjustments to improve their accuracy, including adjustments that may result in the recalculation of our historical metrics. We believe that any such inaccuracies or adjustments are immaterial unless otherwise stated. In addition, our key metrics and related information and estimates, including the definitions and calculations of the same, may differ from those published by third parties or from similarly titled metrics of its competitors due to differences in operations, offerings, methodology and access to information.

The data and numbers used to calculate MAUs and ARPMAU discussed in this Annual Report only include U.S.-based users unless stated otherwise.

Unless the context requires otherwise, each of the terms the “Company,” “Rush Street Interactive,” “RSI,” “we,” “our,” “us” and similar terms used herein refer collectively to Rush Street Interactive, Inc., a Delaware corporation, and its consolidated subsidiaries, following the Business Combination, other than certain historical information which refers to the business of Rush Street Interactive, LP prior to the consummation of the Business Combination.

Overview

RSI is a leading online gaming and entertainment company that focuses primarily on online casino and online sports betting in the U.S. and Latin American markets. Our mission is to provide our customers with the most player-friendly online casino and online sports betting experience in the industry. In furtherance of this mission, we strive to create an online community for our players where we are transparent and honest, treat our players fairly, show them that we value their time and loyalty, and listen to feedback. We also endeavor to implement industry leading responsible gaming practices and provide them with a cutting-edge online gaming platform and exciting, personalized offerings that will enhance their user experience.

We provide our customers an array of leading gaming offerings such as real-money online casino, online sports betting, and retail sports betting (i.e., sports betting services provided to bricks-and-mortar casinos), as well as social gaming, which involves free-to-play games that use virtual credits that can be earned or purchased. We launched our first social gaming website in 2015 and began accepting real-money bets in the United States in 2016. Currently, we offer a combination of real-money online casino, online sports betting and retail sports betting in nine U.S. states as outlined in the table below.

| U.S. State | Online Casino | Online Sports Betting |

Retail Sports Betting | |||

| Colorado | ü | |||||

| Illinois | ü | ü | ||||

| Indiana | ü | ü | ||||

| Iowa | ü | |||||

| Michigan | ü | ü | ü | |||

| Pennsylvania | ü | ü | ü | |||

| New Jersey | ü | ü | ||||

| New York | ü | |||||

| Virginia | ü |

2

In 2018, we also became the first U.S.-based online gaming operator to launch in Colombia, which was an early adopting Latin American country to legalize and regulate online casino and sports betting nationally.

Our real-money online casino and online sports betting offerings are provided under our BetRivers.com and PlaySugarHouse.com brands in the United States and under our RushBet.co brand in Colombia. We operate and/or support retail sports betting for our bricks-and-mortar casino partners primarily under their respective brands. Many of our social gaming offerings are marketed under our partners’ brands, although we also offer social gaming under our own brands in certain markets as well. Our decision about what brand or brands to use is market-specific and partner-specific, and is based on brand awareness, market research and marketing efficiency.

Our proprietary online gaming platform is the foundation of our digital business and reflects a suite of technologies that together provide a leading management, administrative, reporting and regulatory compliance end-to-end solution that powers our operations with respect to our online offerings. It incorporates multiple sophisticated technologies and provides a central back-office function to manage player accounts, payments, risk, a wide range of proprietary bonusing and loyalty programs and features, while ensuring that we can deliver a seamless experience for both players and gaming operators. Our technology platform is flexible and supports both real-money online offerings and social gaming on a single code base.

In 2014, we acquired the source code that served as the starting point for our online gaming platform, and since then we have continued to develop, improve and support it with a talented in-house product development team. We began offering online casino in the United States using this platform in September 2016. Following the lifting of the federal restrictions on sports betting in May 2018 as a result of the U.S. Supreme Court’s repeal of the Profession and Amateur Sports Protection Act of 1992 (“PASPA”), we began offering online sports betting using the same proprietary online gaming platform with the same emphasis on player-friendly features.

Experienced gaming operators Neil Bluhm, Greg Carlin and Richard Schwartz founded Rush Street Interactive, LP (“RSILP”), which is now an indirect subsidiary of RSI, with the goal of offering real-money online gaming products in legal and regulated markets with a particular focus on the emerging U.S. markets. Prior to the Business Combination (as defined below), our founders had invested approximately $50 million into RSILP. This capital was primarily used to fund the development of our proprietary online gaming platform and offerings, recruit and grow an experienced team, and expand into new geographic and product markets.

Corporate History, Background and Business Combination

We were initially a blank check company called dMY Technology Group, Inc. (“dMY”), incorporated as a corporation in Delaware on September 27, 2019, formed for the purpose of effecting a merger, share exchange, asset acquisition, stock purchase, reorganization, recapitalization or other similar business combination with one or more businesses. On December 29, 2020, dMY consummated the transactions contemplated by the business combination agreement dated as of July 27, 2020, as amended and amended and restated (the “Business Combination Agreement” and the transactions contemplated thereby, the “Business Combination”), and in connection therewith:

| (i) | dMY acquired RSILP in an umbrella partnership–C corporation (“Up-C”) structure, in which substantially all the assets of the Company are held by RSILP, and the Company’s only assets are its equity interests in RSILP; |

| (ii) | the holders of equity interests of RSILP (the “Sellers”) retained certain of their Class A common units of RSILP (the “RSILP Units”) and received an equal number of Class V common stock, par value $0.0001 per share, of the Company (the “Class V Voting Stock”); |

| (iii) | the Company issued and sold to subscribers in a private placement an aggregate of 16,043,002 shares of Class A common stock, $0.0001 par value per share (“Class A Common Stock”), at $10.00 per share (the “PIPE”); and |

| (iv) | dMY changed its name to “Rush Street Interactive, Inc.” |

Beginning on the six month anniversary of the Closing, the Sellers will have the right to exchange the RSILP Units retained by the Sellers (the “Retained RSILP Units”) for either one share of Class A Common Stock or, upon certain conditions, the cash equivalent of the market value of one share of Class A Common Stock. For each Retained RSILP Unit so exchanged, the Company will cancel one share of the Class V Voting Stock.

A description of the material terms of the Business Combination and ancillary agreements entered into in connection therewith is set forth in the Registration Statement on Form S-1, Registration No. 333-252810, filed with the SEC on February 5, 2021, which is incorporated herein by reference.

3

Our Business and Operating Models

We enter new markets by leveraging our proprietary online gaming platform and our ability to provide either a full-suite service model or a customized solution to fit a specific situation. Our business model is designed to be nimble, innovative and customer-centric. By leveraging our dynamic proprietary online gaming platform, we aspire to be “first to market” where real-money online gaming has been newly legalized and where our management determines that it is desirable to enter such market.

Our principal offerings are our real-money online casino and online sports betting products. These products can be launched under one of our existing brands or customized to be incorporated into a local or third-party brand. We also provide a variety of retail sports betting solutions to service land-based casino partners and leverage our social gaming offerings to increase customer engagement and build online databases in key markets both before and after legalization and regulation.

We currently generate revenue through two operating models: (i) business-to-consumer (“B2C”) and (ii) business-to-business (“B2B”). Through our B2C operations, we offer online casino, online sports betting and social gaming directly to the end customer through our websites or apps. B2C is our primary operating model, contributing more than 99% of our total revenue for the years ended December 31, 2020 and 2019, and we expect that it will continue to be our primary operating model into the future. We believe this is a flexible operating model that permits us to customize our operating structure based on applicable gaming regulations, market demands and, as applicable, our land-based partner’s operations. Through our B2B operations, we offer retail sports betting services to land-based businesses, such as bricks-and-mortar casinos, in exchange for a monthly commission.

Often in advance of markets legalizing online gaming, we build relationships with local bricks-and-mortar casino operators and other potential land-based partners who are looking for online gaming and sports betting partners. In most U.S. jurisdictions, the applicable gaming regulations require online gaming operators that offer real-money offerings to operate under the gaming license of, or partner with, a land-based operator such as a bricks-and-mortar casino. Consequently, we leverage our relationships with bricks-and-mortar casinos and vendors in the gaming industry to find high-quality and reliable partners for online gaming collaboration. Upon securing a partner for access to a specific market (if required or desirable) and before we launch operations in that market, we customize our online gaming platform to the laws and regulations of the jurisdiction. Then, upon entering a new market, we employ a number of marketing strategies to obtain new customers as well as leverage our partner’s database when applicable. We continuously refine our offerings and marketing strategies based on data collected from each market.

To attract, engage, retain and/or reactivate customers, we offer a loyalty program that rewards players in exciting, fair and transparent ways. We recognize and reward player loyalty by, among other things, ensuring that there are exciting benefits at each of the player loyalty levels we currently offer. Each of our online gaming customers is a member of our customer loyalty program. We grant bonus store points to our customers based upon completed bets. Once earned, such points can be redeemed to unlock bonus incentives and to play our proprietary bonus games, providing further opportunities to win prizes and bonus dollars. Customers also have the option to “bank” awarded bonuses in our proprietary “bonus bank”, which they can draw from whenever they wish under our industry-leading 1x wager playthrough requirement, meaning that they may only place one bet with the bonus dollars before cashing out any winnings. Based on research and player feedback, we attempt to address player concerns about the general lack of transparency in the industry around awarding, redeeming and tracking bonuses by enabling players to easily track their loyalty and bonus progressions and giving players control over when and how to redeem their rewards.

Although we strive to be a first-mover in most new markets, and we have been a first-mover in many markets, we have also achieved success when we were not the first to enter a market. For example, we entered the New Jersey online casino market approximately three years after that market opened and there were already numerous competitors in the market at that time. Less than three years after beginning operations in New Jersey, we were the #4 online casino brand in New Jersey based on revenue, out of 19 total operators in the market at that time, according to the Eilers & Krejcik Gaming (“EKG”) United States Online Casino Tracker for April 2019.

We believe our success in New Jersey is also noteworthy because we compete with many other companies that have affiliated land-based casinos in the state. Neither us nor RSG, an affiliated land-based casino operator, operate a bricks-and-mortar casino in New Jersey. Thus, we believe our performance in New Jersey demonstrates that we can be successful in entering competitive markets even without the benefit of an affiliated bricks-and-mortar casino presence.

Competitive Strengths

As we continue to expand in existing and new jurisdictions, we believe we are well-positioned to maintain and build upon our accomplishments by virtue of our competitive strengths:

Proprietary Online Gaming Platform. Owning a proprietary online gaming platform has allowed us to innovate quickly and introduce numerous unique, player-friendly features. We believe these features have helped increase conversion rates from registrations to first-time depositors, improve customer engagement and retention and increase customer spending. Further, we can update our online gaming platform at a rate that we believe is among the fastest in the industry. As the U.S. online gaming industry develops, our online gaming platform should help us better cater to the evolving needs of our current and potential customers and partners. In the long run, we believe our online gaming platform will lead to reduced costs and improved revenue per customer relative to our peers, many of which license their online platforms from third parties.

4

Unique and Diversified Product Offering. We have prioritized the customization of our offerings, bonusing of our customers and optimization of our platform. For example, we have developed some of our own online casino games, which are higher margin for us than those licensed from third parties. We have also developed and incorporated numerous proprietary bonusing features that appeal to casino and sports betting customers alike. Our omni-channel platform provides a vast amount of functionality such as location-based decisioning, unified conditional bonusing, gamified award scenarios, player dashboards (online and at retail), promotional games, real-time awards and promotion management, sophisticated reporting and responsible gaming features, among others.

Market Access and Speed to Market. We currently operate online casino and/or online sports betting in eight states (Colorado, Illinois, Indiana, Iowa, Michigan, New Jersey, Pennsylvania and Virginia) with an aggregate population of approximately 68.7 million people. In addition, we have currently secured potential market access to New York, Ohio, Maryland, Missouri and if certain conditions are met, Texas, in each case subject to certain legislative and/or regulatory developments or approvals, which have an aggregate population of approximately 73.0 million people. We have a proven ability to quickly enter markets as they are regulated. For instance, in the last 24 months, we have been “first to market” or among the “first to market” where multiple operators were granted approval to launch at the same time, in Colorado, Illinois, Indiana, Michigan and Pennsylvania for online sports betting and in New York and Illinois for retail sports betting.

Flexible Business Model. We believe we are well positioned to serve newly regulated jurisdictions regardless of the form of their regulations. Our flexible business model enables us to function as a B2C operator or a B2B supplier or joint venturer, depending on market conditions, applicable laws and regulations, and the needs of our partners. This flexibility should allow us to have a core advantage in securing market access and help us address the largest potential total addressable market (“TAM”).

Large TAM with International Opportunity. We believe our TAM is larger than most U.S.-only operators because of our international real-money online gaming and betting operations in Colombia as well as our flexible business model as described directly above. We believe this experience will help us enter other regulated Latin American markets and beyond.

Broad Demographic Appeal of our Brands & Products. We also believe that our brands, offerings and marketing strategies have demonstrated an appeal to both female and male customers, as evidenced by an approximately 52-48 female/male split in our active U.S. online casino-only players during calendar year 2020. We believe that while many sports-centric brands appeal more to male customers, our brands and offerings (especially our slot machine game play experience) appeal strongly to female customers – an important demographic for high-value offerings such as online slot machine games.

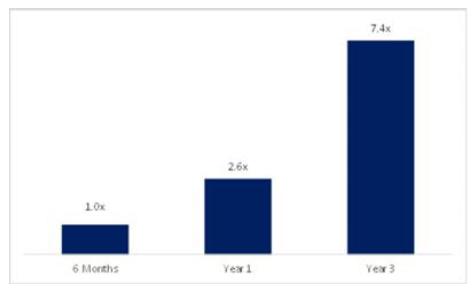

Compelling Unit Economics. Based on our performance to date, including in New Jersey, currently the most highly competitive U.S. market in terms of the number of online gaming operators, we believe that we can achieve industry-leading lifetime value to customer acquisition cost ratios. Despite entering the New Jersey online casino market nearly three years after it launched, we generated revenue in excess of six times the advertising costs to acquire those same customers in those customers’ first three years after becoming active on our platform. As shown in the table below, we were able to recoup our acquisition costs on a gross revenue basis within five months of launching in New Jersey. We believe this rapid return on advertising spending is a result of our expertise in strategically targeting, acquiring, engaging and retaining the right customers.

Lifetime Value / Customer Acquisition Cost in New Jersey

Source: RSI management estimates. Data represents cumulative gross gaming revenue before a deduction of promotional credits divided by customer acquisition costs. Data represents all player cohorts that signed up since January 2017.

5

Seasoned Executive Team. Our executive team has significant global gaming experience, including with online market leaders such as WMS Industries (now Scientific Games), Playtech and the Kindred Group. Our President Richard Schwartz, CIO Einar Roosileht and COO Mattias Stetz all had online gaming experience prior to joining RSI, which we believe has been instrumental in helping capture U.S. market share. Our Chairman Neil Bluhm and our CEO Greg Carlin each have a proven track record of developing world-class land-based casinos, and Mr. Bluhm has developed numerous successful real estate projects.

Social Gaming Platform. We offer social gaming on the same proprietary online gaming platform as our real-money offerings, which allows us to build customer databases in jurisdictions where real-money gaming is not yet regulated or legal. Having both of these products on the same platform allows us to invest in markets before real-money gaming has launched. We believe our social gaming offering strengthens brand awareness and engagement from existing players, helps to acquire new players and drives increased visitation to our partners’ bricks-and-mortar properties.

Growth Strategies

As we continue to invest in our core competitive advantages and improve the user experience for our customers, we believe we will remain well positioned to expand upon our existing leadership position in the online casino and online sports betting industries. We have established several key areas of strategic focus that will guide the way we consider our future growth:

Access new geographies. With our experience in regulated gaming jurisdictions in the United States and Latin America, we are prepared to enter new jurisdictions as online casino and sports betting are authorized. Whether we enter a new jurisdiction as an online operator marketing directly to end users or on behalf of our land-based partner (B2C), as a platform provider to a third-party (B2B), or any permutation of the foregoing, our goal is to be ready to enter jurisdictions that provide for legal online casino and sports betting where we believe conditions enable us to earn a strong return on our invested capital.

Leverage existing customer-level economics to increase marketing spending. Since January 2017, we have generated approximately 7.4 times the lifetime revenue per the acquisition cost to acquire those same players in New Jersey. We may see opportunities to leverage those attractive economics to increase marketing spending in New Jersey and other jurisdictions on a strategic basis and where we project acquiring incremental players will generate revenue that exceed our internal targets.

Continue to invest in our offerings and our platform. We have established a set of competencies that we believe position us at the forefront of the evolving online casino and online sports industry. We will continue iterating on our core user experiences while reinforcing the data-driven, marketing and technological infrastructure that allows us to continue to scale our offerings. We plan to continue to invest in our customers and our offerings as we remain driven to keep customers engaged while expanding the capabilities of our platform that will enable us to rapidly reach new jurisdictions and attract new customers.

Continue to invest in personnel. In furtherance of accessing new jurisdictions, we have been and plan to continue to grow our operational, technology and corporate services teams to broaden product development capabilities, innovation and efficiency, reduce reliance on third parties and scale digital user capabilities.

Acquisitions. On a targeted basis, we will seek out acquisition targets that enable us to accelerate our technology plans, obtain exclusive content, expand our customer reach or add efficiencies that potentially bring third-party costs in-house.

Human Capital Resources

We strongly believe that our people are a key reason for our success. As such, we focus heavily on our people, starting with the recruiting process to ensure we are hiring the right people who have a desirable skillset while enhancing our corporate culture. Once hired, we strive to empower our people and encourage creativity, collaboration and entrepreneurship. We provide, among other things, on-the-job training to support the development and advancement of our employees. Our corporate culture focuses heavily on valuing employees and enabling them to grow, succeed and take on roles and projects that utilize their strengths. Recognizing our people’s accomplishments, both professionally and personally, is also crucial to our corporate culture. Furthermore, we believe that developing a diverse, inclusive and safe workplace for our people will enable our people to be more productive and ultimately will result in our long-term success.

We have built a team of talented industry professionals, primarily focused on technology and operations, who are supported by a highly experienced senior management team with significant experience in the online and land-based gaming industries. We believe our corporate culture combined with our growth and success has created very high rates of employee retention.

6

As of March 22, 2021, we had a global workforce of approximately 264 employees and contractors, with approximately 37% of our people working in technical roles. Approximately 50% of our people are based in the United States with the remaining 50% being based elsewhere in the world, including Canada, Colombia, Estonia and Mexico.

Our Products and Economic Model

Our Revenue-Generating Product Offerings

We offer real-money online casino, online sports betting and/or retail sports betting in nine U.S. states and Colombia. We also provide social gaming, where players are given virtual credits to enjoy free-to-play games.

Our revenue is predominantly generated from our U.S. operations with the remaining revenue being generated from our Colombian operations. See Note 2 to our audited consolidated financial statements, included elsewhere in this Annual Report. We generate revenue primarily through the following offerings.

Online Casino

Online casino offerings typically include the full suite of games available in bricks-and-mortar casinos, such as table games (i.e., blackjack and roulette) and slot machines. For these offerings, we function similarly to bricks-and-mortar casinos, generating revenue through hold, or gross winnings, as players play against the house. Like bricks-and-mortar casinos, there is volatility with online casino, but as the volume of bets placed increases, the revenue retained from bets placed becomes easier to predict. Our experience has been that online casino revenue is less volatile than online sports betting revenue.

Our online casino offering consists of licensed content from leading suppliers, customized third-party games and a small number of proprietary games that we developed in-house. Third-party content is subject to standard revenue-sharing agreements specific to each supplier, where the supplier generally receives a percentage of the net gaming revenue generated from the casino games played on our platform. In exchange, we receive a limited license to offer the games on our platform to players in jurisdictions where use is approved by the regulatory authorities. We pay much lower fees on revenue generated through our self-developed casino games such as our multi-bet blackjack (with side bets: 21+3, Lucky Ladies, Lucky Lucky) and our single-deck blackjack, which primarily relate to hosting/remote gaming server fees and certain intellectual property license fees.

Online casino revenue is generated based on total player bets less amounts paid to players for winning bets, less incentives awarded to players, plus or minus the change in the progressive jackpot reserve.

Online Sports Betting

Online sports betting involves a user placing a bet on the outcome of a sporting event, or a series of sporting events, with the chance to win a pre-determined amount, often referred to as fixed odds. Online sports betting revenue is generated by setting odds such that there is a built-in theoretical margin in each sports bet offered to its customers. While sporting event outcomes may result in revenue volatility, we believe that we can achieve a long-term betting win margin. In addition to traditional fixed-odds betting, we also offer other sports betting products including in-game betting and multi-sport parlay betting. We have also incorporated live streaming of certain sporting events into our online sports betting offering.

Integrated into our online sports betting platform is a third-party risk and trading platform currently provided by certain subsidiaries of Kambi Group plc.

Online sports revenue is generated based on total player bets less amounts paid to players for winning bets, less incentives awarded to players, plus or minus the change in unsettled sports bets.

Retail Sports Betting

We provide retail sports services to land-based casinos in exchange for a monthly commission that is calculated based on the land-based casino’s retail sportsbook revenue. Services include ongoing management and oversight of the retail sportsbook (i.e., within a bricks-and-mortar casino), technical support for the casino’s customers, customer support, risk management, advertising and promotion, and support for third-party sports betting equipment.

In addition, certain relationships with business partners provide us the ability to operate the retail sportsbook at the land-based partner’s facility. In this scenario, revenue is generated based on total player bets less amounts paid to players for winning bets, less other incentives awarded to players.

7

Social Gaming

We provide social gaming where players are given virtual credits to enjoy free-to-play games. Players who exhaust their credits can either purchase additional virtual credits from the virtual cashier or wait until their virtual credits are replenished for free. Virtual credits have no independent monetary value and can only be used within our social gaming platform.

Our social gaming business has three main goals: building online databases in key markets ahead of and post-legalization and regulation; generating revenues; and increasing engagement and visitation to our bricks-and-mortar casino partner properties. Our social gaming products are a marketing tool that keeps the applicable brands at the top of our players’ minds and engages with players through another channel while providing the entertainment value that players seek. We also leverage our social gaming products to cross-sell to our real-money offerings in jurisdictions where real-money gaming is authorized.

We recognize deferred revenue when players purchase virtual credits and revenue when those credits are redeemed. We pay a percentage of the social gaming revenue derived from the sale and redemption of the virtual credits to content suppliers as well as to our land-based partners.

Costs and Expenses

Costs of Revenue. Costs of revenue consist primarily of (i) revenue share and market access fees, (ii) platform and content fees, (iii) gaming taxes, (iv) payment processing fees and chargebacks and (v) salaries and benefits of dedicated personnel. These costs are variable in nature and should correlate with the change in revenue. Revenue share and market access fees consist primarily of amounts paid to local land-based operators that hold the applicable gaming license, providing us the ability to offer our real-money online offerings in the respective jurisdictions. Our platform and content fees are primarily driven by costs associated with third-party casino content, sports betting trading services and certain elements of our platform technology, such as geolocation and know-your-customer). Gaming taxes primarily relate to state taxes and are determined on a jurisdiction-by-jurisdiction basis. We incur payment processing costs on player deposits and occasionally chargebacks (i.e., when a payment processor contractually disallows customer deposits in the normal course of business).

Advertising and Promotions Costs. Advertising and promotion costs consist primarily of costs associated with marketing the product via different channels, promotional activities and the related costs incurred to acquire new customers. These costs include salaries and benefits for dedicated personnel and are expensed as incurred.

Our ability to effectively market is critical to our success. Using dynamic learnings and analytics, we leverage marketing to acquire, convert, retain and re-engage customers. We use earned media and paid marketing channels, in combination with compelling offers and unique game and site features, to attract and engage customers. Further, we continuously optimize our marketing spend using data collected from our operations. Our marketing spend is based on a return-on-investment model that considers a variety of factors, including the products offered in the jurisdiction, the performance of different marketing channels, predicted lifetime value, marginal costs and expenses and behavior of customers across various product offerings.

With respect to paid marketing, we use a broad array of advertising channels, including television, radio, social media platforms, sponsorships, affiliates and paid search, and other digital channels. We also use other forms of marketing and outreach, such as our social media channels, first-party websites, media interviews and other media spots and organic searches. These efforts are primarily concentrated within the specific jurisdictions where we operate or intend to operate. We believe there is significant benefit to having a flexible approach to advertising spending as we can quickly redirect our advertising spending based on dynamic testing of which advertising methods and channels are working and which ones are not.

General Administration and Other. General administration and other expenses consist primarily of administrative personnel costs, including salaries, bonuses and benefits, share-based compensation expense, professional fees related to legal, compliance, audit and consulting services, rent and insurance costs. As part of the certain agreements with key executives, share-based awards in the form of profit interests were granted. Share-based compensation expense consists of the expenses related to the vesting of these awards in addition to the remeasurement of liability-classified awards. See Note 10 to our audited consolidated financial statements, included elsewhere in this Annual Report.

Depreciation and Amortization. Depreciation and amortization expense consists of depreciation on our property and equipment over the useful lives as well as amortization of market access licenses and gaming jurisdictional licenses over the useful lives. See Notes 2, 5 and 6 to our audited consolidated financial statements, included elsewhere in this Annual Report.

Distribution

We distribute our offerings through various channels, including websites (traditional and mobile), direct application downloads and global direct-to-consumer digital platforms such as the Apple App Store, and we expect to offer some or all of our apps in the Google Play store in the near future.

8

B2C Market Access. We have developed proprietary technology, product offerings and partnerships to create a sustainable advantage in the online casino and sports betting industry. Strategic multi-year arrangements with land-based partners such as bricks-and-mortar casinos or Native American tribes enable us to make our offerings available to players in certain jurisdictions using a B2C operating model. Currently, we have the following arrangements in place where legislation or regulations require us to enter the market through a relationship with a land-based partner or we have otherwise determined that entering into such an arrangement is desirable:

| • | An agreement with Golden Nugget Atlantic City Casino, which enables us to operate online casino in New Jersey; |

| • | An agreement with Monmouth Racetrack, which enables us to operate online sports betting in New Jersey; |

| • | An agreement with SugarHouse Casino (since renamed Rivers Casino Philadelphia), which enables us to operate online casino and online sports betting throughout Pennsylvania; |

| • | An agreement with Rivers Casino Pittsburgh, which enables us to operate online casino under the Rivers Casino Philadelphia license, and online sports betting throughout Pennsylvania; |

| • | We expect to memorialize in writing our existing agreement with Rivers Casino Des Plaines, which will enable us to continue operating online sports betting in Illinois and online casino if authorized in Illinois (we have been operating online sports betting under the Rivers Casino Des Plaines gaming license under that agreement); |

| • | An agreement with French Lick Resort, which enables us to operate online and retail sports betting in Indiana and online casino if authorized in Indiana; |

| • | An agreement with Wild Rose Casino & Resort, which enables us to operate online sports betting in Iowa and online casino if authorized in Iowa; |

| • | An agreement with J.P. McGill’s Hotel & Casino, which enables us to operate online sports betting in Colorado; |

| • | An agreement with the Little River Casino Resort, a wholly owned and operated enterprise of the Little River Band of Ottawa Indians, which enables us to operate online and sports betting and online casino in Michigan; |

| • | An agreement with Rivers Casino & Resort Schenectady, which enables us to offer online sports betting and online casino if either or both of those activities are authorized in New York; |

| • | An agreement with Rivers Casino Portsmouth, which enables us to operate online sports betting in Virginia and online casino if authorized in Virginia; |

| • | An agreement with Mountaineer Casino, Racetrack & Resort, which enables us to offer online casino in West Virginia; |

| • | An agreement with Penn National Gaming, Inc. (NASDAQ: PENN), which enables us to offer online sports betting and online casino, in each case if two or more skins are authorized in Ohio, Maryland and Missouri, and depending on certain conditions being met, Texas; and |

| • | An agreement with Coushatta Casino Resort, a gaming enterprise owned and operated by the Coushatta Tribe of Louisiana, to offer Coushatta Casino Resort-branded free-to-play social casino services. |

B2B Distribution. We also have relationships with the following partners through a B2B operating model:

| • | An agreement with SugarHouse Casino (since renamed Rivers Casino Philadelphia) for us to provide retail sports betting services at Rivers Casino in Philadelphia; |

| • | An agreement with Rivers Casino Pittsburgh for us to provide retail sports betting services at Rivers Casino in Pittsburgh; |

| • | An agreement with Rivers Casino & Resort Schenectady for us to provide retail sports betting services at Rivers Casino & Resort Schenectady in New York; |

| • | An agreement with Rivers Casino Des Plaines for us to provide retail sports betting services at Rivers Casino Des Plaines in Illinois; |

| • | An agreement with the Little River Casino Resort, a wholly owned and operated enterprise of the Little River Band of Ottawa Indians to provide retail sports betting services at their Little River casino in Michigan; and |

| • | An agreement with Rivers Casino Portsmouth to provide retail sports betting services at the yet-to-be-developed Rivers Portsmouth Casino in Virginia. |

9

Our Development Team

Our development team is led by our Chief Information Officer, Einar Roosileht, and consists of a set of cross functional product development teams comprised of talented individuals with expertise in system architecture, client and server-side product engineering, database architecture, product, engineering and project management, website and native app design and development, security and technical support. Consistent with our overall corporate strategy, the team constantly aims to innovate and differentiate our online offerings.

Proprietary Online Gaming Platform

Our proprietary online gaming platform has been developed and is operated by a seasoned team with global online gaming experience operating across product categories, with particular expertise in the two largest online/mobile product categories: casino and sports betting. We believe our online gaming platform and technology stack give us the ability and flexibility to provide a personalized, data-driven player journey. The ability to customize the playing experience for each player is a key feature of our online gaming platform. We achieve player personalization by analyzing player history and transactions, and offering customized promotions and real-time, betting-driven bonusing.

As demonstrated in the picture below, in addition to developing a robust online gaming platform, we have developed and are continuing to improve proprietary modules for our online casino and sports betting product verticals in order to offer unique and differentiated experience to our customers. Such modules include both frontend and backend components and flexible management tools, which our operations teams use to customize experiences for different player segments. Content for both online casino games and sports betting offers primarily comes from integrated third parties. In addition to developing proprietary technology, as a vertically integrated technology company we operate our own products and platform, with our customer service and marketing operations teams leveraging powerful existing analytics solutions, which are a part of our online gaming platform.

We can develop and implement new features in real-time, which we believe enhances the customer experience and increases customer retention. By owning our own online gaming platform, we can more easily improve and customize the player experience and incorporate key aspects of our operational services into our offerings:

| • | Payments & Risk Management |

| • | Regulatory Online Reporting & Accounting / Online Gaming Compliance |

| • | Website Management / Games Management / Live Tech Ops / Security |

| • | Online Affiliate Management & Tracking |

| • | Retention / CRM / Business Intelligence & Analytics |

| • | Customer Service |

In addition, owning our online gaming platform enables us to prioritize speed to market for new offerings while providing an engaging and unique user experience. Since 2016, we have leveraged our platform to expand our real-money operations and launch in new markets. Additionally, we were the first company to launch (or among the first to launch if multiple operators launched on the same day) online or retail sports betting in several of the markets in which we operate, which we believe has allowed us to acquire customers at a lower cost than we could have if launching in a more mature market.

10

Our Industry and Opportunity

We currently operate within the online gaming and entertainment industry. The global gaming industry includes a wide array of products such as lotteries, bingo, slot machines, casino games and sports betting, across land-based and online platforms. The industry has various operators and stakeholders across the private and public sectors, including traditional bricks-and-mortar casinos, state-run lottery operators, Native American tribes, legacy online gaming operators, racetracks/racinos/video lottery terminals, gaming content providers, gaming regulators, gaming technology companies and payment processors.

Recently, online gaming has seen outsized growth and increased penetration. Per EKG, regulated online gaming grew in Europe, the most mature online gaming market in the world, at an annual rate of 11% from 2018 to 2019, and according to the European Gaming & Betting Association (the “EGBA”), Europe’s online gambling revenue is expected to increase by 7% from 2019 to 2020, despite cancellations and postponements of major European sports in 2020. The EGBA also projects a 7% growth rate through 2025 in European online gaming revenue.

We believe the following trends are potential drivers of growth in this industry:

| • | New jurisdictions in the United States and internationally authorizing and/or privatizing their online casino and online sports betting industries; and |

| • | Increased consumer adoption of digital and online activities, including casino and sports betting. While many other large U.S. industries (i.e., banks, retail stores, movies, etc.) digitalized over a decade ago, the U.S. gaming industry has just started to do so more recently. |

In the past decade, there has been significant regulatory momentum with respect to online gaming across the globe. This momentum has been particularly relevant in developed nations whose citizens generally have disposable income to spend on entertainment and gaming. For example, the U.K., Denmark, France, Spain, Italy, Ireland, Denmark, Poland, Sweden and Switzerland have legalized and regulated online casino and online sports betting. In addition, several U.S. states, Mexico, certain jurisdictions in Argentina and Colombia have introduced regulated sports betting in recent years. Canada has also introduced legislation to allow single-game sports betting where to date, sports betting has been limited to parlay cards. All these countries are in the “high income” income group according to the World Bank. We expect this trend to continue into the future, most notably in the United States.

U.S. Gaming Industry

We see tremendous opportunity in the U.S. online gaming market. As U.S. jurisdictions become regulated and mature, online gaming penetration may approach that of other developed nations. For example, the UK Gambling Commission (“UKGC”) reported that approximately 40% of the U.K.’s gross gaming revenue during the period April 2019 to March 2020 (a period that was largely unaffected by the impacts of the COVID-19 pandemic) came from online gaming. To put that U.K. figure into context, Pennsylvania, which launched online casino and sports betting in H1 2019, generated a combined $1.71 billion in taxable revenue from land-based casino, online casino and online sports betting revenue in H2 2019 (a period largely unaffected by the impacts of the COVID-19 pandemic) according to data from the Pennsylvania Gaming Control Board. Of this amount, only approximately 4.5% came from online casino and online sports betting. During H2 2020, when the United States was experiencing many of the effects of the COVID-19 pandemic, including stay-at-home orders, shutdowns of bricks-and-mortar businesses and cancellations of sporting events, Pennsylvania generated a combined $1.62 billion in taxable revenue from land-based casino, online casino and online sports betting according to Pennsylvania Gaming Control Board. Of this amount, 29.3% came from online casino and online sports betting. Although the United States has a much more significant land-based casino industry than the U.K., we believe these statistics show the future opportunity for online gaming in the United States.

U.S. Online Casino

Currently, online casino is authorized in fewer states than sports betting. As of the date hereof, online casino is authorized only in six states: Delaware, Michigan, New Jersey, Pennsylvania, West Virginia and Nevada (although regulators have not authorized online casino outside of physical casinos in Nevada). We believe there is great potential for revenue growth as new markets open in the United States. For example, the mature land-based U.S. casino industry is sizable, with estimated combined revenues in 2019 for U.S. land-based commercial and tribal casinos of approximately $78.2 billion based on data from the National Indian Gaming Commission in Washington D.C. and the American Gaming Association.

In the latter half of 2013, New Jersey became the first U.S. state to legally permit online casino. That market got off to a slow start; however, online casino revenue in New Jersey has risen steadily over the last several years. Notably, online casino revenue was not negatively impacted when New Jersey began permitting online sports betting in 2018. Online casino revenue from slot machines and table games in New Jersey grew from $277.3 million in 2018 to $461.8 million in 2019 according to the New Jersey Division of Gaming Enforcement. Furthermore, land-based casino revenue in New Jersey grew during that same period from $2.51 billion in 2018 to $2.69 billion in 2019 according to the New Jersey Division of Gaming Enforcement, showing that land-based casino revenue can grow at the same time that online casino revenue grows. This fact may serve as a catalyst for lawmakers in other states with land-based casinos to consider authorizing online casino.

11

In New Jersey in 2020, online casino revenue continued to increase to $931.6 million while revenues from land-based casinos decreased to $1.51 billion. We believe this trend in online and land-based casino revenues for New Jersey from 2019 to 2020 is not indicative of the expected longer-term trend of continued online and land-based casino revenue growth because of the impacts of COVID-19 in 2020, which likely resulted in decreased revenue for land-based casinos and increased revenue for online casinos because of, among other things, stay-at-home orders and shutdowns of brick-and-mortar casinos.

We believe that more states have and will consider authorizing online casino for the following reasons, among others:

| • | We believe that COVID-19 has resulted in increased expenses and/or reduced tax revenue in many states, increasing the need for new sources of tax revenue. |

| • | In states that have land-based casinos, COVID-19 caused temporary casino closures, which reduced tax revenue. |

| • | We believe that COVID-19 has caused increased general consumer adoption of digital activity, including online gaming. |

| • | Online casino generated more tax revenue compared to online sports betting in New Jersey and Pennsylvania in 2020, meaning authorizing online sports betting alone may not optimize tax revenue. |

| • | Land-based casino revenue grew as online casino revenue grew in New Jersey from 2018 to 2019, demonstrating that land-based casino revenue can grow with online casino revenue. |

| • | We believe that the land-based casino industry, an important stakeholder in many states, generally has shown a wider acceptance of online casino. |

Both Pennsylvania and New Jersey were experiencing online casino taxable revenue growth prior to COVID-19; however, that growth accelerated in March 2020 into Q4 2020. The charts below highlight the growth of online slot and table games taxable revenue in New Jersey and Pennsylvania since Q4 2019:

Pennsylvania Online Slot and Table Taxable Revenue ($ in millions)

Source: Pennsylvania Gaming Control Board

12

New Jersey Online Slot and Table Gross Revenue ($ in millions)

Source: New Jersey Division of Gaming Enforcement

U.S. Sports Betting

On May 14, 2018, the U.S. Supreme Court ruled that PASPA – a nationwide ban of sports betting – was unconstitutional, thus allowing states (beyond the few states that were grandfathered into PASPA by virtue of authorizing sports betting prior to PASPA) to enact their own sports betting laws. Since the U.S. Supreme Court’s decision, as of the date hereof, 22 states and the District of Columbia have legalized sports betting. Of those 23 jurisdictions, 15 states have authorized statewide online sports betting while eight remain retail-only at casinos or retail locations.

According to EKG, the United States generated approximately $1.15 billion in online sports betting revenue in 2020, despite the impacts of COVID-19 and the cancellations, postponement, shortening or rescheduling of sporting events and seasons. While the overall industry is still nascent, growth to date has been strong. For example, December 2020 online sports betting revenue in New Jersey, the first state to regulate sports betting after PASPA was struck down, and Pennsylvania grew 130% and 292% year-over-year, respectively, according to data from the New Jersey Division of Gaming Enforcement and the Pennsylvania Gaming Control Board.

13

U.S. Sports Betting Policy Landscape

Source: EKG United States Sports Betting Policy Monitor – Released March 2021

We believe the U.S. sports betting market still has significant opportunity for growth. Only 35% of the United States currently has access to online sports betting, per EKG. This fact is significant when one considers that according to the New Jersey Division of Gaming Enforcement, more than 80% of New Jersey sports betting revenue in February 2020, the last month not significantly impacted by the effects of COVID-19 (such as mandatory stay-in-place and closure orders), came via online betting. Populous states such as California, Florida, New York and Texas have not yet legalized online sports betting. We believe the sports betting industry will grow significantly over the next several years as more states authorize sports betting and as current operating markets mature.

Share of Total Monthly Sports Betting Handle (December 2020)

Source: EKG United States Sports Betting Market Monitor – Released February 2021

New Jersey and Pennsylvania, two states that offer online sports betting, accounted for approximately 41% of all U.S. sports betting handle in December 2020 according to EKG. In states that permit online and retail sports betting, online sports betting handle is generally higher than retail handle; however, some states have legalized retail sports betting only (e.g., New York and Arkansas) while other states have legalized restricted forms of online sports betting (e.g., in-person registration required in Nevada and for a period of time in Iowa, Illinois and Rhode Island). As more states legalize and reduce restrictions around online sports betting, we expect that New Jersey and Pennsylvania will hold less dominant positions across the United States.

14

United States Online Gaming: Estimating the Total Addressable Industry Size

If every U.S. state was to legalize online casino, based on state level projections from EKG, it is projected that the U.S. market would generate approximately $20 billion in revenue. Similarly, if every U.S. state was to legalize online sports betting, based on state level projections from EKG, it is projected that the U.S. market would generate approximately $15 billion in revenue.

Latin America Gaming Industry

Latin America is another area of focus for us. Since 2018, we have been operating online gaming in Colombia, a country with a population of approximately 50 million. We believe this experience will enable us to expand further in Latin America and other countries as more markets become regulated. Online gaming is also authorized in Mexico and Brazil, which have populations of approximately 128.9 million and 212.6 million, respectively. Both Mexico and Brazil still have relatively low internet penetration, with 70% and 67%, respectively, of the population having internet access compared to 87% in the United States and 93% in the U.K., so the expansion of internet penetration in these countries would allow us to grow our revenues from online gaming there to the extent we make our offerings available in those countries.

The highest populated country in Latin America, Brazil, legalized sports betting in December 2018. While the government has been creating a regulatory framework since then, Brazil recently moved to “privatize” its impending sports betting market in response to the COVID-19 pandemic. By including sports betting in its Council of Investment Partnerships Program (IPP), Brazil will allow potential operators to bid on a limited number of sports betting licenses instead of the previous plan that called for an “unlimited” number of operators and tax revenue dispensed to the government. We believe given our experience and success in neighboring Colombia, we will be well-qualified to obtain a sports betting license in Brazil.

Competition

We operate in the global gaming and entertainment industry. Therefore, we generally view any type of discretionary leisure and entertainment provider to be a competitor with respect to our customers’ time and share of wallet. Specifically, in the online casino and sports betting space in the United States (our primary market), our competitors come from two main groups – (i) established online-first companies and (ii) bricks-and-mortar casino and similar gaming establishments. Established online-first companies in the U.S. market include companies such as Flutter Entertainment / The Stars Group (through their FanDuel and FoxBet brands), DraftKings, 888, Roar Digital (through its BetMGM brand and partnership with GVC), Bet365, Betfred and PointsBet, among others. Additionally, we expect competition from U.S. casinos such as Penn National Gaming through its Barstool brand, Golden Nugget Online Gaming, Hard Rock through its Hard Rock Digital brand, Caesars Entertainment through its partnership with William Hill, and Churchill Downs Incorporated. In addition, theScore, Circa Sports and Smarkets have recently entered the U.S. market.

We compete on a number of factors across our B2C offerings. These include, without limitation, our front-end online gaming platform, our back-end infrastructure, our ability to retain and monetize existing customers, re-engage prior customers and attract new customers, and our regulatory access and compliance experience.

In the B2B space, primarily in the retail sportsbook market, our competitors for include, without limitation, SBTech, US Bookmaking, International Gaming Technology (IGT), Kambi, Playtech and Scientific Games. We compete primarily on the quality and breadth of our technology solutions and support services.

Intellectual Property

Our business relies significantly on the creation, authorship, development, use and protection of intellectual property. This intellectual property consists of, for example, software code, proprietary technology, trademarks, domain names, copyrights, patents and trade secrets that we use to develop and provide our offerings and related services, as well as online betting and gaming content (both proprietary and licensed) and proprietary data acquired from our customers’ use of our offerings and related services.

We own the copyrights in the software code we author. From time to time, we may seek patent protection covering inventions we conceive and pursue the registration of our domain names, trademarks and service marks in the United States and in certain foreign jurisdictions.

We rely on common law rights or contractual restrictions to protect certain of our intellectual property rights, and we control access to our software source code and other trade secrets by entering into confidentiality and intellectual property assignment agreements with our employees and contractors and confidentiality agreements with third parties that have access to our software source code or trade secrets. From time to time, we may assert our rights in our intellectual property as appropriate or desirable against third parties who may be infringing such rights.

Some of the intellectual property we use is owned by third parties, and we have entered into licenses and other agreements with applicable third parties to obtain rights to use such intellectual property. Although we believe we have sufficient rights under such agreements for the intended operation of our business, such agreements often restrict our use of the third parties’ intellectual property and limit such use to specific time periods.

15

Pursuant to the Business Combination Agreement, RSG and its affiliates assigned to us several of the trademarks and domain names that we use in connection with our business, and we granted to RSG and its affiliates a perpetual, royalty-free license to use certain of these trademarks and domain names in certain fields of use. This license may be either exclusive or non-exclusive based on the field of use and the particular trademark or domain name. This license precludes our use of certain trademarks and domain names in the exclusive fields of use.

Third parties in the sports betting, online gaming and casino, technology and other industries may own patents, copyrights and trademarks and may frequently threaten litigation or file suit against us or request us to enter into license agreements, in each case based on allegations of infringement or other violations of intellectual property rights. Occasionally we have received, and we expect to receive in the future, third-party allegations or cease-and-desist letters, including from our competitors and non-practicing entities, that we have infringed such parties’ intellectual property rights, such as their trademarks, copyrights, and patents. Such allegations may increase as our business grows.

Government Regulation

We are subject to various U.S. and foreign laws and regulations that affect our ability to operate in the gaming and entertainment industry, in particular in the online gaming industry. These industries are generally subject to extensive and evolving regulations that could change based on political and social norms and that could be interpreted or enforced in ways that could negatively impact our business.