Form 10-K WINNEBAGO INDUSTRIES For: Aug 25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K |

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended August 25, 2018; or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from ___________________ to _______________________

Commission File Number 001‑06403

WINNEBAGO INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

Iowa | 42-0802678 | |

(State or other jurisdiction of | (I.R.S. Employer Identification No.) | |

incorporation or organization) | ||

P.O. Box 152, Forest City, Iowa | 50436 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant's telephone number, including area code: (641) 585‑3535

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock ($.50 par value) | The New York Stock Exchange, Inc. | |

Chicago Stock Exchange, Inc. | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K o.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer x Accelerated Filer o Non-accelerated filer o Smaller Reporting Company o Emerging Growth Company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

Aggregate market value of the common stock held by non-affiliates of the registrant: $1,122,564,545 (26,952,330 shares at the closing price on the New York Stock Exchange of $41.65 on February 23, 2018).

Common stock outstanding on October 15, 2018: 31,629,704 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement relating to the registrant's 2018 Annual Meeting of Shareholders, scheduled to be held December 11, 2018, are incorporated by reference into Part II and Part III of this Annual Report on Form 10-K where indicated.

Winnebago Industries, Inc.

Fiscal 2018 Form 10-K

Table of Contents

2

WINNEBAGO INDUSTRIES, INC.

FORM 10‑K

Report for the Fiscal Year Ended August 25, 2018

Forward-Looking Information

Certain of the matters discussed in this Annual Report on Form 10-K are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which involve risks and uncertainties. A number of factors could cause actual results to differ materially from these statements, including, but not limited to, competition and new product introductions by competitors, our ability to attract and retain qualified personnel, business or production disruptions, sales order cancellations, risk related to compliance with debt covenants and leverage ratios, stock price volatility, availability of labor, a slowdown in the economy, low consumer confidence, the effect of global tensions, increases in interest rates, availability of credit, risk related to cyclicality and seasonality, slower than anticipated sales of new or existing products, integration of operations relating to merger and acquisition activities generally, inadequate liquidity or capital resources, inventory and distribution channel management, our ability to innovate, our reliance on large dealer organizations, significant increase in repurchase obligations, availability and price of fuel, availability of chassis and other key component parts, increased material and component costs, exposure to warranty claims, ability to protect our intellectual property, exposure to product liability claims, dependence on information systems and web applications, any unexpected expenses related to the implementation of our Enterprise Resource Planning system, risk related to data security, governmental regulation, including for climate change, risk related to anti-takeover provisions applicable to us, and other factors which may be disclosed throughout this Annual Report on Form 10-K. Although we believe that the expectations reflected in the "forward-looking statements" are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Undue reliance should not be placed on these "forward-looking statements," which speak only as of the date of this report. We undertake no obligation to publicly update or revise any "forward-looking statements," whether as a result of new information, future events, or otherwise, except as required by law or the rules of the New York Stock Exchange. We advise you, however, to consult any further disclosures made on related subjects in future quarterly reports on Form 10-Q and current reports on Form 8-K that are filed or furnished with the U.S. Securities and Exchange Commission ("SEC").

3

PART I

Item 1. Business.

General

The "Company," "Winnebago Industries," "we," "our," and "us" are used interchangeably to refer to Winnebago Industries, Inc. and its wholly-owned subsidiaries, as appropriate in the context.

Winnebago Industries, Inc., headquartered in Forest City, Iowa, is a leading U.S. manufacturer with a diversified portfolio of recreation vehicles ("RV"s) and marine products used primarily in leisure travel and outdoor recreation activities. We produce our motorhomes in manufacturing facilities in Iowa and Oregon; our travel trailer and fifth wheel trailers in Indiana; and our marine products in Florida. We distribute our RV and marine products primarily through independent dealers throughout the U.S. and Canada, who then retail the products to the end consumer. We also distribute our marine products internationally through independent dealers, who then retail the products to the end consumer.

We were incorporated under the laws of the state of Iowa on February 12, 1958, and adopted our present name on February 28, 1961. Our executive offices are located at 605 West Crystal Lake Road in Forest City, Iowa. Our telephone number is (641) 585-3535.

Available Information

Our website, located at www.wgo.net, provides additional information about us. On our website, you can obtain, free of charge, this and prior year Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all of our other filings with the SEC. Our recent press releases are also available on our website. Our website also contains important information regarding our corporate governance practices. Information contained on our website is not incorporated into this Annual Report on Form 10-K.

Principal Products

Beginning in the fourth quarter of Fiscal 2018, we have five operating segments: 1) Winnebago motorhomes, 2) Winnebago towables, 3) Grand Design towables, 4) Winnebago specialty vehicles, and 5) Chris-Craft marine. We evaluate performance based on each operating segment's Adjusted EBITDA, as defined within Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, of this Annual Report on Form 10-K, which excludes certain corporate administration expenses and non-operating income and expense.

Our two reportable segments include: 1) Motorhome (comprised of products that include a motorized chassis as well as other related manufactured products and services) and 2) Towable (comprised of products which are not motorized and are generally towed by another vehicle as well as other related manufactured products and services), which is an aggregation of the Winnebago towables and Grand Design towables operating segments.

The Corporate / All Other category includes the Winnebago specialty vehicles and Chris-Craft marine operating segments as well as expenses related to certain corporate administration expenses for the oversight of the enterprise. These expenses include items such as corporate leadership and administration costs. Previously, these expenses were allocated to each operating segment.

Prior year segment information has been reclassified to conform to the current reportable segment presentation. The reclassifications included removing the corporate administration expenses from both the Motorhome and Towable reportable segments and removing Winnebago specialty vehicles from the Motorhome reportable segment, as we begin to dedicate leadership and focus on these operations separately from our Winnebago motorhomes operations.

4

Motorhome

A motorhome is a self-propelled mobile dwelling used primarily as temporary living quarters during vacation and camping trips, or to support active and mobile lifestyles. The Recreation Vehicle Industry Association ("RVIA") classifies motorhomes into three types, all of which we manufacture and sell under the Winnebago brand name, which are defined as follows:

Type | Description | Winnebago products offerings |

Class A (gas and diesel) | Conventional motorhomes constructed directly on medium- and heavy-duty truck chassis, which include the engine and drivetrain components. The living area and driver's compartment are designed and produced by the motorhome manufacturer. | Gas: Adventurer, Intent(1), Sightseer, Suncruiser, Sunova, Sunstar, Sunstar LX, Vista, Vista LX |

Diesel: Forza, Grand Tour, Horizon(1), Journey, Tour, Via | ||

Class B (gas and diesel) | Panel-type vans to which sleeping, kitchen, and/or toilet facilities are added. These models may also have a top extension to provide more headroom. | Winnebago Touring Coach (Era, Paseo, Revel(1), Travato) |

Class C (gas and diesel) | Motorhomes built on van-type chassis onto which the motorhome manufacturer constructs a living area with access to the driver's compartment. | Aspect, Cambria, Fuse, Minnie Winnie, Navion, Outlook(1), Spirit, Trend, View |

(1) | New product offerings introduced in Fiscal 2018. |

Our Class A, B, and C motorhomes are sold by dealers in the retail market with manufacturer's suggested retail prices ranging from approximately $80,000 to $520,000, depending on size and model, plus optional equipment and delivery charges. Our motorhomes range in length from 21 to 44 feet.

Unit sales of our motorhomes for the last three fiscal years were as follows:

Year Ended (1) | ||||||||||||||

Units | August 25, 2018 | August 26, 2017 | August 27, 2016 | |||||||||||

Class A | 2,997 | 31.4 | % | 3,182 | 34.4 | % | 2,925 | 31.4 | % | |||||

Class B | 2,012 | 21.1 | % | 1,541 | 16.6 | % | 1,239 | 13.3 | % | |||||

Class C | 4,539 | 47.5 | % | 4,537 | 49.0 | % | 5,143 | 55.3 | % | |||||

Total motorhomes | 9,548 | 100.0 | % | 9,260 | 100.0 | % | 9,307 | 100.0 | % | |||||

(1) | Percentages may not add due to rounding differences. |

Motorhome parts and service activities represent revenues generated by service work we perform for retail customers at our Forest City, Iowa and Junction City, Oregon facilities as well as revenues from sales of RV parts. Our competitive strategy is to provide proprietary manufactured parts through our dealer network, which we believe increases customer satisfaction and the value of our motorhomes.

Towable

A towable is a non-motorized vehicle that is designed to be towed by automobiles, pickup trucks, SUVs, or vans and is used as temporary living quarters for recreational travel. The RVIA classifies towables in four types: conventional travel trailers, fifth wheels, folding camper trailers, and truck campers. We manufacture and sell conventional travel trailers and fifth wheels under the Winnebago and Grand Design brand names, which are defined as follows:

Type | Description | Winnebago product offerings | Grand Design product offerings |

Travel trailer | Conventional travel trailers are towed by means of a hitch attached to the frame of the vehicle. | Micro Minnie, Minnie, Minnie Drop, Minnie Plus | Imagine, Reflection, Transcend(1) |

Fifth wheel | Fifth wheel trailers are constructed with a raised forward section that is connected to the vehicle with a special fifth wheel hitch. | Minnie Plus | Momentum, Reflection, Solitude |

(1) | New product offerings introduced in Fiscal 2018. |

Our travel trailer and fifth wheel towables are sold by dealers in the retail market with manufacturer's suggested retail prices ranging from approximately $15,000 to $110,000, depending on size and model, plus optional equipment and delivery charges.

5

Unit sales of our towables for the last three fiscal years were as follows:

Year Ended (1) | ||||||||||||||

Units | August 25, 2018 | August 26, 2017 | August 27, 2016 | |||||||||||

Travel trailer | 22,360 | 61.1 | % | 13,650 | 60.7 | % | 3,613 | 86.0 | % | |||||

Fifth wheel | 14,229 | 38.9 | % | 8,824 | 39.3 | % | 586 | 14.0 | % | |||||

Total towables | 36,589 | 100.0 | % | 22,474 | 100.0 | % | 4,199 | 100.0 | % | |||||

(1) | Percentages may not add due to rounding differences. |

On November 8, 2016, we closed on our acquisition of Grand Design RV, LLC ("Grand Design"), a fast-growing towables manufacturer in Middlebury, Indiana. Grand Design manufactures travel trailers and fifth wheel products. With this acquisition, we have a broader and more balanced portfolio of motorized and towable products and intend to capitalize on the opportunities across the RV market and to drive improved profitability and long-term value for shareholders.

Winnebago Specialty Vehicles

We also manufacture other specialty commercial vehicles primarily custom designed for the buyer's specific needs and requirements, such as law enforcement command centers, mobile medical clinics, and mobile office space. These specialty commercial vehicles are manufactured in Forest City, Iowa and sold through our dealer network. In addition, we also provide commercial vehicles as bare shells to third-party upfitters for conversion at their facilities.

Chris-Craft

On June 4, 2018, we acquired 100% of the ownership interests of Chris-Craft USA, Inc. ("Chris-Craft"), a privately-owned company based in Sarasota, Florida. As a result of this acquisition, we manufacture and sell premium quality boats in the recreational powerboat industry through an established global network of independent authorized dealers.

Production

We generally produce motorhomes and towables to stock for dealers. We have some ability to increase our capacity by scheduling overtime and/or hiring additional production employees or to decrease our capacity through the use of shortened work weeks and/or reducing head count. We have long been known as an industry leader in innovation as each year we introduce new or redesigned products. These changes generally include new floor plans and sizes as well as design and decor modifications. Most of our raw materials such as steel, aluminum, fiberglass, and wood products are obtainable from numerous sources.

Our motorhomes are primarily produced in the state of Iowa at four different campuses. Beginning in Fiscal 2016, we also began assembling Class A diesel motorhomes in our Junction City, Oregon facility. Our Motorhome business utilizes vertically integrated supply streams, with the principal exceptions being chassis, engines, generators, and appliances that we purchase from reputable manufacturers. Certain parts, especially motorhome chassis, are available from a small group of suppliers. In Fiscal 2018, we had two chassis suppliers, that each individually accounted for more than 10% of our Motorhome raw material purchases.

Our towables are produced at two assembly campuses located in Middlebury, Indiana. The majority of components are comprised of frames, appliances, and furniture, and are purchased from suppliers. In Fiscal 2018, we had one supplier that accounted for more than 10% of our Towable raw material purchases.

Backlog

We strive to balance timely order fulfillment to our dealers with the lead times suppliers require to efficiently source materials and manage costs. Production facility constraints at peak periods also lead to fluctuations in backlog orders which we manage closely. The approximate revenue of our Motorhome backlog was $157.6 million and $122.1 million as of August 25, 2018 and August 26, 2017, respectively. The approximate revenue of our Towable backlog was $244.9 million and $229.7 million as of August 25, 2018 and August 26, 2017, respectively. A more detailed description of our Motorhome and Towable order backlog is included in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, of this Annual Report on Form 10-K.

Distribution and Financing

We market our products on a wholesale basis to a diversified independent dealer network located throughout the U.S. and, to a limited extent, in Canada, Africa, Asia, Europe, Australia, and South America. Foreign sales were 10.0% or less of net revenues during each of the past three fiscal years.

As of August 25, 2018, our RV dealer network in the U.S. and Canada included approximately 550 Motorhome and Towable physical dealer locations, many of which carry both products. One of our dealer organizations, La Mesa RV Center, Inc., accounted

6

for 9.8% of our consolidated net revenue for Fiscal 2018, as this dealer sold our products in 11 dealership locations across four U.S. states.

We have sales and service agreements with dealers which are subject to annual review. Many of the dealers are also engaged in other areas of business, including the sale of automobiles, trailers, or boats, and most dealers carry one or more competitive lines of RVs. We continue to place high emphasis on the capability of our dealers to provide complete service for our products. Dealers are obligated to provide full service for owners of our products or, in lieu thereof, to secure such service from other authorized providers.

We advertise and promote our products through national trade magazines, the distribution of product brochures, the Go RVing national advertising campaign sponsored by RVIA, direct-mail advertising campaigns, various national promotional opportunities, and on a local basis through trade shows, television, radio, and newspapers, primarily in connection with area dealers.

Sales to dealers are made on cash terms. Most dealers are financed on a "floorplan" basis under which a bank or finance company lends the dealer all, or substantially all, of the purchase price, collateralized by a security interest in the merchandise purchased. As is customary in our industries, we typically enter into a repurchase agreement with a lending institution financing a dealer's purchase of our product upon the lending institution's request and after completion of a credit check of the dealer involved. Our repurchase agreements provide that, for up to 18 months after an RV unit is financed and up to 24 months after a marine unit is financed, in the event of default by the dealer on the agreement to pay the lending institution and repossession of the unit(s) by the lending institution, we will repurchase the financed merchandise from the lender at the amount then due, which is often less than dealer invoice. Our maximum exposure for repurchases varies significantly from time to time, depending upon the level of dealer inventory, general economic conditions, demand for our products, dealer location, and access to and the cost of financing. See Note 11, Contingent Liabilities and Commitments, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

Competition

The RV and marine markets are highly competitive with many other manufacturers selling products which compete directly with our products. Some of our competitors are much larger than us, most notably in the towable RV market, which may provide these competitors additional purchasing power. The competition in our industry is based upon design, price, quality, and service of the products. We believe our principal competitive advantages are our brand strength, product quality, and our service after the sale. We also believe that our motorhome products have historically commanded a price premium as a result of these competitive advantages.

Seasonality

The primary use of RVs and marine products for leisure travel and outdoor recreation has historically led to a peak retail selling season concentrated in the spring and summer months and lower sales during winter months. Our sales are generally influenced by this pattern in retail sales, but sales can also be affected by the level of dealer inventory. As a result, our RV sales are historically lowest during our second fiscal quarter, which ends in February.

Governmental Regulations

We are subject to a variety of federal, state, local, and, to a limited extent, international laws and regulations, including the federal Motor Vehicle Act ("MVA"), under which the National Highway Traffic Safety Administration ("NHTSA") may require manufacturers to recall RVs that contain safety-related defects, and numerous state consumer protection laws and regulations relating to the operation of motor vehicles, including so-called "Lemon Laws." The Boat Safety Act of 1971 has similar safety-related recall requirements for marine units. In addition, marine units sold in the U.S. and Europe must meet the certification standards of the U.S. Coast Guard and the European Community, respectively.

We are also subject to regulations established by the Occupational Safety and Health Administration ("OSHA"). Our facilities are periodically inspected by federal and state agencies, such as OSHA. We are a member of RVIA, a voluntary association of RV manufacturers which promulgates RV safety standards. We place an RVIA seal on each of our RVs to certify that the RVIA standards have been met. We believe that our products and facilities comply in all material respects with the applicable vehicle safety, consumer protection, RVIA. and OSHA regulations and standards.

Our operations are subject to a variety of federal and state environmental laws and regulations relating to the use, generation, storage, treatment, emission, labeling, and disposal of hazardous materials and wastes, and noise pollution. We believe that we are currently in compliance with applicable environmental laws and regulations in all material aspects.

Trademarks

We have several domestic and foreign trademark registrations associated with our products which include: Winnebago, Adventurer, Affinity, Airlie, Aspect, Benchmark, Brave, Bryon, Cambria, Chalet, Chris-Craft (logo), Commander, Cottesloe, County Coach, Destination, Dynomax, Ellipse, Era, Forza, Fuse, Glide & Dine, Gowinnebago, Grand Design, Grand Design Recreational

7

Vehicles, Grand Design RV, Horizon, Imagine, Inlounge, Inspire, Instinct, Intable, Intent, Itasca, Intrigue, Journey, Latitude, Maxum Chassis, Meridian, Micro Minnie, Minnie, Minnie Drop, Minnie Winnie, Navion, 0ne Place, Momentum, Reflection, Powerline Energy Management System and Design, Rest Easy, Revel, Rialta, Roamer, Scorpion, Sightseer, Solei, Solitude, Spirit, Storemore and Design, Suncruiser, Sunova, Sunstar, The most recognized name in motorhomes, Thermo-Panel, Transcend, Travato, Trend, Tribute, True Air, Via, View, Vista, Viva!, Voyage, W, Flying W (logo), WIT Club, Winnie Drop, Winnebago Ind (logo), Winnebagolife, Winnebago Minnie, Winnebago Towables (logo), Winnebago Touring Coach, and Winnebago trade dress (three dimensional design of the front roof panel, front grill panel, and front body panel of motor homes). We believe that our trademarks and trade names are significant assets to our business. and we have in the past and will in the future vigorously protect them against infringement by third parties. We are not dependent upon any patents or technology licenses of others for the conduct of our business.

Human Resources

At the end of Fiscal 2018, 2017, and 2016, we employed approximately 4,700, 4,060, and 3,050 persons, respectively. None of our employees are covered under a collective bargaining agreement. We believe our relations with our employees are good.

Item 1A. Risk Factors.

Described below are certain risks that we believe apply to our business and the industry in which we operate. The following risk factors should be considered carefully in addition to the other information contained in this Annual Report on Form 10-K. The risks and uncertainties highlighted represent the most significant risk factors that we believe may adversely affect our business, financial condition, results of operations, cash flows, liquidity or access to sources of financing, and, consequently, the market value of our common stock. The risks and uncertainties discussed in this report are not exclusive and other risk factors that we may consider immaterial or do not anticipate may emerge as significant risks and uncertainties.

Competition

The markets for RVs and marine products are very competitive. Competitive factors in the industry include price, design, value, quality, service, brand awareness, and reputation. There can be no assurance that existing or new competitors will not develop products that are superior to our products or that achieve better consumer acceptance, thereby adversely affecting our market share, sales volume, and profit margins. Some of our competitors are much larger than we are and this size advantage provides these competitors with more financial resources and access to capital, additional purchasing power, and greater leverage with the dealer networks. In addition, competition could increase if new companies enter the market, existing competitors consolidate their operations, or if existing competitors expand their product lines or intensify efforts within existing product lines. Our current products, products under development, and our ability to develop new and improved products may be insufficient to enable us to compete effectively with our competitors. These competitive pressures may have a material adverse effect on our results of operations.

Hiring Constraints and Retaining Key Employees

Our ability to meet our strategic objectives and otherwise grow our business will depend to a significant extent on the continued contributions of our leadership team. Our future success will also depend in large part on our ability to identify, attract, and retain other highly qualified managerial, technical, sales and marketing, operations, and customer service personnel. Competition for these individuals in our manufacturing markets is intense and supply is limited. We may not succeed in identifying, attracting, or retaining qualified personnel on a cost-effective basis. The loss or interruption of services of any of our key personnel, inability to identify, attract, or retain qualified personnel in the future, delays in hiring qualified personnel, or any employee work slowdowns, strikes, or similar actions could make it difficult for us to conduct and manage our business and meet key objectives, which could harm our business, financial condition, and operating results.

Production Disruptions

We currently manufacture most of our products in northern Iowa and northern Indiana. These facilities may be affected by natural or man-made disasters and other external events. In the event that one of our manufacturing facilities was affected by a disaster or other event, we could be forced to shift production to one of our other manufacturing facilities or to cease operations. Although we maintain insurance for damage to our property and disruption of our business from casualties, such insurance may not be sufficient to cover all of our potential losses. Any disruption in our manufacturing capacity could have an adverse impact on our ability to produce sufficient inventory of our products or may require us to incur additional expenses in order to produce sufficient inventory, and therefore, may adversely affect our net sales and operating results. Any disruption or delay at our manufacturing facilities could impair our ability to meet the demands of our customers, and our customers may cancel orders or purchase products from our competitors, which could adversely affect our business and operating results.

8

The terms of our Credit Agreement could adversely affect our operating flexibility and pose risks of default under our Credit Agreement

We incurred substantial indebtedness to finance the acquisition of Grand Design. We entered into new asset-based revolving credit ("ABL") and term loan ("Term Loan") agreements (collectively, the "Credit Agreement") with JPMorgan Chase. Under the terms of the Credit Agreement, we have a $165.0 million ABL credit facility, which includes a $10.0 million letter of credit facility, and a $300.0 million term loan as of September 21, 2018.

The Credit Agreement is secured by certain assets, primarily cash, inventory, accounts receivable, and certain machinery and equipment. The Credit Agreement contains certain requirements, including affirmative and negative financial covenants. If we are unable to comply with these requirements and covenants, we may be restricted in our ability to pay dividends or engage in certain other business transactions, the lender may obtain control of our cash accounts, and we may experience an event of default. If a default occurs, the lenders under the Credit Agreement may elect to declare all of their respective outstanding debt, together with accrued interest and other amounts payable thereunder, to be immediately due and payable. Under such circumstances, we may not have sufficient funds or other resources to satisfy all of our obligations. In addition, the limitations imposed on our ability to incur additional debt and to take other corporate actions might significantly impair our ability to obtain other financing.

Borrowing availability under the Credit Agreement is limited to the lesser of the facility total and the calculated borrowing base, which is based on stipulated loan percentages applied to our eligible trade accounts receivable and eligible inventories plus a defined amount related to certain machinery and equipment. Should the borrowing base decline, our ability to borrow to fund future operations and business transactions could be limited. In addition, the Credit Agreement contains certain restrictions on our ability to undertake certain types of transactions. Therefore, we may need to seek permission from our lenders in order to engage in certain corporate actions. Through the Credit Agreement, we were required to enter into a hedging arrangement that fixed certain interest rates as defined in the Credit Agreement. To satisfy this requirement, an interest rate swap contract was entered into during the second quarter of Fiscal 2017. The results of the Swap Contract could create quarterly fluctuations in operating results. When we repriced our Credit Agreements during the second quarter of Fiscal 2018, the requirement to hedge a portion of the debt was removed.

In addition, the additional indebtedness could:

• | Make us more vulnerable to general adverse economic, regulatory, and industry conditions; |

• | Limit our flexibility in planning for, or reacting to, changes and opportunities in the markets in which we compete; |

• | Place us at a competitive disadvantage compared to our competitors that have less debt or could require us to dedicate a substantial portion of our cash flow to service our debt; and |

• | Restrict us from making strategic acquisitions or exploiting other business opportunities. |

Our Stock Price is Subject to Volatility

Our stock price may fluctuate based on many factors. Our acquisition of Grand Design, for example, provided important strategic positioning and earnings growth potential, but to partially finance the transaction we issued $124.1 million worth of common stock to the owners of Grand Design and registered these shares for resale after the transaction closed. Any future stock issuance by us or liquidation of stock holding by the former owners of Grand Design may cause dilution of earnings per share or put selling pressure on our share price. Changing credit agreements and leverage ratios may also impact stock price. In general, analysts' expectations and our ability to meet those expectations quarterly may cause stock price fluctuations. If we fail to meet expectations related to future growth, profitability, debt repayment, dividends, share issuance or repurchase, or other market expectations, our stock price may decline significantly.

Facility Expansion

We are expanding our production capabilities within our Towable segment. The expansion and renovation entails risks that could cause disruption in the operations of our business and unanticipated cost increases. Should we experience production variances, quality, or safety issues as we ramp up these operations, our business and operating results could be adversely affected.

Adverse Effects of Union Activities

Although none of our employees are currently represented by a labor union, unionization could result in higher employee costs and increased risk of work stoppages. We are, directly or indirectly, dependent upon companies with unionized work forces, such as parts suppliers and trucking and freight companies, and work stoppages or strikes organized by such unions could have a material adverse impact on our business, financial condition, or operating results. If a work stoppage occurs, it could delay the manufacture and sale of our products and have a material adverse effect on our business, prospects, operating results, or financial condition.

General Economic Conditions and Certain Other External Factors

Companies within the RV and marine industries are subject to volatility in operating results due primarily to general economic conditions because the purchase of an RV or marine products is often viewed as a consumer discretionary purchase. Demand for discretionary goods in general can fluctuate with recessionary conditions, slow or negative economic growth rates, negative

9

consumer confidence, reduced consumer spending levels resulting from tax increases or other factors, prolonged high unemployment rates, higher commodity and component costs, fuel prices, inflationary or deflationary pressures, reduced credit availability or unfavorable credit terms for dealers and end-user customers, higher short-term interest rates, and general economic and political conditions and expectations. Specific factors affecting the RV and marine industries include:

• | Overall consumer confidence and the level of discretionary consumer spending; |

• | Employment trends; |

• | The adverse impact of global tensions on consumer spending and travel-related activities; and |

• | The adverse impact on margins due to increases in raw material costs, which we are unable to pass on to customers without negatively affecting sales. |

Goodwill and Trade Name Impairment

Goodwill and indefinite-lived intangible assets, such as our trade names, are recorded at fair value at the time of acquisition and are not amortized but are reviewed for impairment at least annually or more frequently if impairment indicators arise. Our determination of whether goodwill impairment has occurred is based on a comparison of each of our reporting units’ fair value with its carrying value. Significant and unanticipated changes in circumstances, such as significant and long-term adverse changes in business climate, unanticipated competition, and/or changes in technology or markets, could require a provision for impairment in a future period that could negatively impact our results of operations.

Dependence on Credit Availability and Interest Rates to Dealers and Retail Purchasers

Our business is affected by the availability and terms of the financing to dealers. Generally, RV and marine dealers finance their purchases of inventory with financing provided by lending institutions. One financial flooring institution held 54.8% of our total financed dealer inventory dollars that were outstanding at August 25, 2018. In the event that this lending institution limits or discontinues dealer financing, we could experience a material adverse effect on our results of operations.

Our business is also affected by the availability and terms of financing to retail purchasers. Retail buyers purchasing one of our products may elect to finance their purchase through the dealership or a financial institution of their choice. Substantial increases in interest rates or decreases in the general availability of credit for our dealers or for the retail purchaser may have an adverse impact upon our business and results of operations.

Cyclicality and Seasonality

The RV and marine industries have been characterized by cycles of growth and contraction in consumer demand, reflecting prevailing economic and demographic conditions, which affect disposable income for leisure-time activities. Consequently, the results for any prior period may not be indicative of results for any future period.

Seasonal factors, over which we have no control, also have an effect on the demand for our products. Demand in the RV and marine industries generally declines over the winter season, while sales are generally highest during the spring and summer months. Also, unusually severe weather conditions in some markets may impact demand.

Managing Growth Opportunities

One of our growth strategies is to drive growth through targeted acquisitions and alliances, stronger customer relations, and new joint ventures and partnerships that contribute profitable growth while supplementing our existing brands and product portfolio. Our ability to grow through acquisitions will depend, in part, on the availability of suitable candidates at acceptable prices, terms, and conditions, our ability to compete effectively for acquisition candidates, and the availability of capital and personnel to complete such acquisitions and run the acquired business effectively. Any acquisition, alliance, joint venture, or partnership could impair our business, financial condition, reputation, and operating results. The benefits of an acquisition or new alliance, joint venture, or partnership may take more time than expected to develop or integrate into our operations, and we cannot guarantee that previous or future acquisitions, alliances, joint ventures, or partnerships will, in fact, produce any benefits. Such acquisitions, alliances, joint ventures, and partnerships may involve a number of risks, including:

• | Diversion of management’s attention; |

• | Disruption to our existing operations and plans; |

• | Inability to effectively manage our expanded operations; |

• | Difficulties or delays in integrating and assimilating information and financial systems, operations, and products of an acquired business or other business venture or in realizing projected efficiencies, growth prospects, cost savings, and synergies; |

• | Inability to successfully integrate or develop a distribution channel for acquired product lines; |

• | Potential loss of key employees, customers, distributors, or dealers of the acquired businesses or adverse effects on existing business relationships with suppliers, customers, distributors, and dealers; |

• | Adverse impact on overall profitability, if our expanded operations do not achieve the financial results projected in our valuation model; |

10

• | Inaccurate assessment of additional post-acquisition or business venture investments, undisclosed, contingent or other liabilities or problems, unanticipated costs associated with an acquisition or other business venture, and an inability to recover or manage such liabilities and costs; and |

• | Incorrect estimates made in the accounting for acquisitions, occurrence of non-recurring charges, and write-off of significant amounts of goodwill or other assets that could adversely affect our operating results. |

Demand Forecasting and Inventory Management

Our ability to manage our inventory levels to meet our customer's demand for our products is important for our business. For example, certain dealers are focused on the rental market which spikes over the summer vacation period while other dealers are focused on direct sales to the consumer at various price points. Our production levels and inventory management are based on demand estimates six to twelve months forward taking into account supply lead times, production capacity, timing of shipments, and dealer inventory levels. If we overestimate or underestimate demand for any of our products during a given season, we may not maintain appropriate inventory levels, which could negatively impact our net sales or working capital, hinder our ability to meet customer demand, or cause us to incur excess and obsolete inventory charges.

Distribution Channel Management

We sell many of our products through distribution channels and are subject to risks relating to their inventory management decisions and operational and sourcing practices. Our distribution channel customers carry inventories of our products as part of their ongoing operations and adjust those inventories based on their assessments of future needs. Such adjustments may impact our inventory management and working capital goals as well as operating results. If the inventory levels of our distribution channel customers are higher than they desire, they may postpone product purchases from us, which could cause our sales to be lower than the end-user demand for our products and negatively impact our inventory management and working capital goals as well as our operating results.

Responsiveness to Market Changes

One of our growth strategies is to develop innovative, customer-valued products to generate revenue growth. We may not be able to compete as effectively with our competitors, and ultimately satisfy the needs and preferences of our customers, unless we can continue to enhance existing products and develop new innovative products for the markets in which we compete. Product development requires significant financial, technological, and other resources. Product improvements and new product introductions also require significant research, planning, design, development, engineering, and testing at the technological, product, and manufacturing process levels, and we may not be able to timely develop and introduce product improvements or new products. Our competitors' new products may beat our products to market, be higher quality or more reliable, be more effective with more features and/or less expensive than our products, obtain better market acceptance, or render our products obsolete. Any new products that we develop may not receive market acceptance or otherwise generate any meaningful net sales or profits for us relative to our expectations based on, among other things, existing and anticipated investments in manufacturing capacity and commitments to fund advertising, marketing, promotional programs, and research and development.

Potential Loss of a Large Dealer Organization

One of our dealer organizations accounted for 9.8% of our net revenue for Fiscal 2018. A second dealer organization, accounted for 9.0% of our net revenue for Fiscal 2018. The loss of either or both of these dealer organizations could have a significant adverse effect on our business. In addition, deterioration in the liquidity or creditworthiness of either or both of these dealers could negatively impact our sales and could trigger repurchase obligations under our repurchase agreements.

Potential Repurchase Liabilities

In accordance with customary practice in our industries, upon request we enter into formal repurchase agreements with lending institutions financing a dealer's purchase of our products. In these repurchase agreements we agree, in the event of a default by an independent dealer in its obligation to a lender and repossession of the unit(s) by the lending institution, to repurchase units at declining prices over the term of the agreements, which can last up to 24 months. The difference between the gross repurchase price and the price at which the repurchased product can then be resold, which is typically at a discount to the gross repurchase price, represents a potential expense to us. In certain instances, we also repurchase inventory from our dealers due to state law or regulatory requirements that govern voluntary or involuntary terminations. If we are obligated to repurchase a substantially larger number of units in the future than we estimate, this would increase our costs and could have a material adverse effect on our results of operations, financial condition, and cash flows.

Dependence on Suppliers

Most of our RV and marine components are readily available from numerous sources. However, a few of our components are produced by a small group of suppliers. In the case of motorhome chassis, Ford Motor Company, Mercedes-Benz (USA and Canada), and Freightliner Custom Chassis Corporation are our major suppliers. Our relationship with our chassis suppliers is similar to our other supplier relationships in that no specific contractual commitments are engaged in by either party. This means

11

that we do not have minimum purchase requirements, and our chassis suppliers do not have minimum supply requirements. Our chassis suppliers also supply to our competitors. Historically, chassis suppliers resort to an industry-wide allocation system during periods when supply is restricted. These allocations have been based on the volume of chassis previously purchased, which could mean our larger competitors could receive more chassis in a time of scarcity. Sales of motorhomes rely on chassis supply and are affected by shortages from time to time. Decisions by our suppliers to decrease production, production delays, or work stoppages by the employees of such suppliers, or price increases could have a material adverse effect on our ability to produce motorhomes and ultimately, on our results of operations, financial condition, and cash flows. In Fiscal 2018, none of our manufacturers individually accounted for more than 10% of our raw material purchases.

Raw Material Costs

We purchase raw materials such as steel, aluminum, and other commodities, and components, such as chassis, refrigerators, and televisions, for use in our products. In addition, we are a purchaser of components and parts containing various commodities, including steel, aluminum, copper, lead, rubber, and others that are integrated into our end products. To the extent that commodity prices increase and we do not have firm pricing from our suppliers, or our suppliers are not able to honor such prices, increases in the cost of such raw materials and components and parts may adversely affect our profit margins if we are unable to pass along to our customers these cost increases in the form of price increases or otherwise reduce our cost of goods sold. In addition, increases in other costs of doing business may also adversely affect our profit margins and businesses. For example, an increase in fuel costs may result in an increase in our transportation costs, which also could adversely affect our operating results and businesses. Historically, we have mitigated cost increases, in part, by collaborating with suppliers, reviewing alternative sourcing options, substituting materials, engaging in internal cost reduction efforts, and increasing prices on some of our products, all as appropriate. However, we may not be able to fully offset such increased costs in the future. Further, if our price increases are not accepted by our customers and the market, our net sales, profit margins, earnings, and market share could be adversely affected.

Warranty Claims

We receive warranty claims from our dealers in the ordinary course of our business. Although we maintain reserves for such claims, which to date have been adequate, there can be no assurance that warranty expense levels will remain at current levels or that such reserves will continue to be adequate. A significant increase in warranty claims exceeding our current warranty expense levels could have a material adverse effect on our results of operations, financial condition, and cash flows.

In addition to the costs associated with the contractual warranty coverage provided on our products, we also occasionally incur costs as a result of additional service actions not covered by our warranties, including product recalls and customer satisfaction actions. Although we estimate and reserve for the cost of these service actions, there can be no assurance that expense levels will remain at current levels or such reserves will continue to be adequate.

Protection of our Brand

We believe that one of the strengths of our business is our brands, which are widely known around the world. We vigorously defend our brands and our other intellectual property rights against third parties on a global basis. We have, from time to time, had to bring claims against third parties to protect or prevent unauthorized use of our brand. If we are unable to protect and defend our brands or other intellectual property, it could have a material adverse effect on our results of operations or financial condition.

Product Liability

We are subject, in the ordinary course of business, to litigation including a variety of warranty, "Lemon Law" and product liability claims typical in the RV and marine industries. Although we have an insurance policy with a $50.0 million limit covering product liability, we are self-insured for the first $2.5 million of product liability claims on a per occurrence basis, with a $6.0 million aggregate per policy year. We cannot be certain that our insurance coverage will be sufficient to cover all future claims against us, which may have a material adverse effect on our results of operations and financial condition. Any increase in the frequency and size of these claims, as compared to our experience in prior years, may cause the premium that we are required to pay for insurance to rise significantly. Product liability claims may also cause us to pay punitive damages, not all of which are covered by our insurance. In addition, if product liability claims rise to a level of frequency or size that are significantly higher than similar claims made against our competitors, our reputation and business may be harmed.

Information Systems and Web Applications

We rely on our information systems and web applications to support our business operations, including but not limited to procurement, supply chain, manufacturing, distribution, warranty administration, invoicing, and collection of payments. We use information systems to report and audit our operational results. Additionally, we rely upon information systems in our sales, marketing, human resources, and communication efforts. Due to our reliance on our information systems, our business processes may be negatively impacted in the event of substantial disruption of service. Further, misuse, leakage, or falsification of information could result in a violation of privacy laws and damage our reputation which could, in turn, have a negative impact on our results.

12

In addition to our general reliance on information systems, we began implementation of a new enterprise resource planning system at the end of fiscal year 2015. Though we perform planning and testing to reduce risks associated with such a complex, enterprise-wide systems change, failure to meet requirements of the business could disrupt our business and harm our reputation, which may result in decreased sales, increased overhead costs, excess or obsolete inventory, and product shortages, causing our business, reputation, financial condition, and operating results to suffer.

Data Security

We have security systems in place with the intent of maintaining the physical security of our facilities and protecting our customers', clients', and suppliers' confidential information and information related to identifiable individuals against unauthorized access through our information systems or by other electronic transmission or through the misdirection, theft, or loss of physical media. These include, for example, the appropriate encryption of information. Despite such efforts, we are subject to breach of security systems which may result in unauthorized access to our facilities or the information we are trying to protect. Because the technologies used to obtain unauthorized access are constantly changing and becoming increasingly more sophisticated and often are not recognized until launched against a target, we may be unable to anticipate these techniques or implement sufficient preventative measures. If unauthorized parties gain physical access to one of our facilities or electronic access to our information systems or such information is misdirected, lost, or stolen during transmission or transport, any theft or misuse of such information could result in, among other things, unfavorable publicity, governmental inquiry and oversight, difficulty in marketing our services, allegations by our customers and clients that we have not performed our contractual obligations, litigation by affected parties, and possible financial obligations for damages related to the theft or misuse of such information, any of which could have a material adverse effect on our business.

Government Regulation

We are subject to numerous federal, state, and local regulations and the following summarizes some, but not all, of the laws and regulations that apply to us.

Federal Motor Vehicle Safety Standards govern the design, manufacture and sale of our RV products, which standards are promulgated by the NHTSA. NHTSA requires manufacturers to recall and repair vehicles which are non-compliant with a Federal Motor Vehicle Safety Standard or contain safety defects. In addition, the U.S. Coast Guard maintains certification standards for the manufacture of our marine products, and the safety of recreational boats in the U.S. is subject to federal regulation under the Boat Safety Act of 1971, which requires boat manufacturers to recall products for replacement of parts or components that have demonstrated defects affecting safety. Any major recalls of our products, voluntary or involuntary, could have a material adverse effect on our results of operations, financial condition, and cash flows. While we believe we are substantially in compliance with the foregoing laws and regulations as they currently exist, amendments to any of these regulations or the implementation of new regulations could significantly increase the cost of testing, manufacturing, purchasing, operating, or selling our products and could have a material adverse effect on our results of operations, financial condition, and cash flows. In addition, our failure to comply with present or future regulations could result in federal fines being imposed on us, potential civil and criminal liability, suspension of sales or production, or cessation of operations.

We are also subject to federal and numerous state consumer protection and unfair trade practice laws and regulations relating to the sale, transportation, and marketing of motor vehicles, including so-called "Lemon Laws." Federal and state laws and regulations also impose upon vehicle operators various restrictions on the weight, length, and width of motor vehicles, including motorhomes that may be operated in certain jurisdictions or on certain roadways. Certain jurisdictions also prohibit the sale of vehicles exceeding length restrictions.

Failure to comply with the New York Stock Exchange and SEC laws or regulations could also have an adverse impact on our business. Additionally, amendments to these regulations and the implementation of new regulations could increase the cost of manufacturing, purchasing, operating, or selling our products and therefore could have an adverse impact on our business.

Finally, federal and state authorities also have various environmental control standards relating to air, water, noise pollution, and hazardous waste generation and disposal that affect us and our operations. Failure by us to comply with present or future laws and regulations could result in fines being imposed on us, potential civil and criminal liability, suspension of production or operations, alterations to the manufacturing process, or costly cleanup or capital expenditures, any or all of which could have a material adverse effect on our results of operations.

Climate Change and Related Regulation

There is growing concern from members of the scientific community and the general public that an increase in global average temperatures due to emissions of greenhouse gases ("GHG") and other human activities have or will cause significant changes in weather patterns and increase the frequency and severity of natural disasters. We are currently subject to rules limiting emissions and other climate related rules and regulations in certain jurisdictions where we operate. In addition, we may become subject to additional legislation and regulation regarding climate change, and compliance with any new rules could be difficult and costly. Concerned parties, such as legislators, regulators, and non-governmental organizations, are considering ways to reduce GHG emissions. Foreign, federal, state, and local regulatory and legislative bodies have proposed various legislative and regulatory

13

measures relating to climate change, regulating GHG emissions, and energy policies. If such legislation is enacted, we could incur increased energy, environmental, and other costs and capital expenditures to comply with the limitations. Climate change regulation combined with public sentiment could result in reduced demand for our products, higher fuel prices, or carbon taxes, all of which could materially adversely affect our business. Due to uncertainty in the regulatory and legislative processes, as well as the scope of such requirements and initiatives, we cannot currently determine the effect such legislation and regulation may have on our products and operations.

Anti-takeover Effect

Provisions of our articles of incorporation, by-laws, the Iowa Business Corporation Act, and provisions in our credit agreements and certain of our compensation programs that we may enter into from time to time could make it more difficult for a third party to acquire us, even if doing so would be perceived to be beneficial by our shareholders.The combination of these provisions effectively inhibits a non-negotiated merger or other business combination, which, in turn, could adversely affect the market price of our common stock.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Our principal manufacturing, maintenance, and service operations are conducted in multi-building complexes owned or leased by us. The following sets forth our material facilities as of August 25, 2018:

Location | Facility Type/Use | Reportable Segment | # of Buildings | Owned or Leased | Square Footage | ||

Forest City, IA | Manufacturing, maintenance, service, and office | Motorhome | 33 | Owned | 1,546,772 | ||

Forest City, IA | Warehouse | Motorhome | 3 | Owned | 459,136 | ||

Charles City, IA | Manufacturing | Motorhome | 2 | Owned | 160,950 | ||

Waverly, IA | Manufacturing | Motorhome | 1 | Owned | 33,400 | ||

Junction City, OR | Manufacturing, service, and office | Motorhome | 10 | Owned | 304,962 | ||

Middlebury, IN | Manufacturing and office | Towable | 4 | Owned | 444,830 | ||

Lake Mills, IA | Manufacturing | Motorhome | 1 | Leased(1) | 98,546 | ||

Middlebury, IN | Manufacturing, service, and office | Towable | 10 | Leased(2) | 1,044,950 | ||

Eden Prairie, MN | Corporate | Motorhome | 1 | Leased(3) | 30,068 | ||

Sarasota, FL | Manufacturing and office | Corporate / All Other | 7 | Owned | 188,779 | ||

72 | 4,312,393 | ||||||

(1) | In November 2013, we entered into a five-year lease with the city of Lake Mills, IA for a manufacturing plant with two options to renew for five years each. We are currently evaluating whether to renew the lease or purchase the facility. |

(2) | In November 2016 as part of our acquisition of Grand Design, we assumed leases to two properties which hold their current principal facilities and facilities under construction for expansion. |

(3) | In January 2017, we entered into a six-year lease, expiring in 2023, for an office facility in Eden Prairie, MN. |

The facilities that we own in Forest City, Charles City, and Waverly are located on a total of approximately 320 acres of land. The facilities that we own in Junction City, Oregon are located on approximately 42 acres of land. The facilities that we own in Middlebury, Indiana are located on approximately 60 acres of land. The facilities that we own in Sarasota, Florida are located on approximately 19 acres of land. Most of our buildings are of steel or steel and concrete construction and are protected from fire with high‑pressure sprinkler systems, dust collector systems, automatic fire doors, and alarm systems. We believe that our facilities and equipment are well maintained and suitable for the purposes for which they are intended.

Under terms of our Credit Agreement, we have encumbered substantially all of our real property for the benefit of the lender under such facility. For additional information, see Note 9, Long-Term Debt, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

Item 3. Legal Proceedings.

For a description of our legal proceedings, see Note 11, Contingent Liabilities and Commitments, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

14

Item 4. Mine Safety Disclosure.

Not Applicable.

Executive Officers of the Registrant

Name | Office (Year First Elected an Officer) | Age |

Michael J. Happe | President and Chief Executive Officer (2016) | 47 |

Ashis N. Bhattacharya | Vice President, Strategic Planning and Development (2016) | 55 |

Stacy Bogart | Vice President, General Counsel and Secretary (2018) | 54 |

Donald J. Clark | President of Grand Design RV; Vice President of Winnebago Industries (2016) | 58 |

S. Scott Degnan | Vice President and General Manager, Towables Business (2012) | 53 |

Brian D. Hazelton | Vice President and General Manager, Motorhome Business (2016) | 52 |

Bryan L. Hughes | Vice President, Chief Financial Officer (2017) | 49 |

Jeff D. Kubacki | Vice President, Information Technology, Chief Information Officer (2016) | 60 |

Christopher D. West | Vice President, Operations (2016) | 46 |

Bret A. Woodson | Vice President, Administration (2015) | 48 |

Officers are elected annually by the Board of Directors and hold office until their successors are chosen and qualify or until their death or resignation. There are no family relationships between or among any of the Executive Officers or Directors of the Company.

Mr. Happe joined Winnebago Industries in January 2016 as President and Chief Executive Officer. Prior to joining Winnebago, he had been employed by The Toro Company, a provider of outdoor maintenance and beautification products, from 1997 to 2016. He served as Executive Officer and Group Vice President of Toro's Residential and Contractor businesses from March 2012 to December 2015. From August 2010 to March 2012, he served as Vice President, Residential and Landscape Contractor Businesses. Prior to that he held a series of senior leadership positions throughout his career across a variety of Toro's domestic and international divisions.

Mr. Bhattacharya joined Winnebago Industries in May 2016 as Vice President, Strategic Planning and Development. Prior to joining Winnebago, Mr. Bhattacharya served at Honeywell International, Inc., a software industrial company, as Vice President, Strategy, Alliances & Internet of Things for the Sensing and Productivity Solutions division from 2010 to 2016. Prior to that, he was employed with Moog, Motorola, and Bain & Company in a variety of roles.

Ms. Stacy Bogart joined Winnebago Industries in January 2018 as Vice President, General Counsel and Secretary. Prior to joining Winnebago Industries, Ms. Bogart was Senior Vice President, General Counsel and Compliance Officer, Corporate Secretary at Polaris Industries Inc., a manufacturer and marketer of powersports products, where she joined in November 2009. Previously, Ms. Bogart was General Counsel of Liberty Diversified International; Assistant General Counsel and Assistant Secretary at The Toro Company; and a Senior Attorney for Honeywell International, Inc.

Mr. Clark, President of Grand Design RV; Vice President of Winnebago Industries, became an officer of Winnebago Industries in November 2016 in accordance with terms of the Grand Design acquisition. He co-founded Grand Design RV, LLC in 2012 and built the team at Grand Design RV. Mr. Clark has over 30 years of successful RV industry experience.

Mr. Degnan joined Winnebago Industries in May 2012 as Vice President of Sales and Product Management. He became Vice President and General Manager, Towables Business in 2016. Prior to joining Winnebago, Mr. Degnan served as Vice President of Sales for Riverside, California's MVP RV from 2010 to 2012. He also previously served in management and sales positions with Coachmen RV from 2008 to 2010, with National RV from 2007 to 2008, and Fleetwood Enterprises from 1987 to 2007.

Mr. Hazelton joined Winnebago Industries in August 2016 as Vice President and General Manager, Motorhome Business. He previously was CEO of Schwing America, Inc., a manufacturer of concrete pumps and truck mixers, from 2009 to 2016. Prior to his employment with Schwing, he worked for Terex Corporation and Detroit Diesel Corporation in various executive roles.

Mr. Hughes joined Winnebago Industries in April 2017 and was appointed Vice President, Chief Financial Officer of the Company in May 2017. Mr. Hughes joined Winnebago Industries from Ecolab, Inc., where he served as Senior Vice President and Corporate Controller from 2014 to 2017, as Vice President of Finance from 2008 to 2014 and in various management positions from 1996 to 2008. Prior to his employment with Ecolab, Inc., a water technologies and services company, he worked for Ernst & Young, a public accounting firm.

Mr. Kubacki joined Winnebago Industries in November 2016 as Vice President, Information Technology, Chief Information Officer. He previously was Vice President and Chief Information Officer at Westinghouse Electric Company, a global provider of nuclear power plant products and services, in 2016. Prior to his employment with Westinghouse, he worked as Chief Information Officer at

15

Alliant Techsystems, a defense, aerospace, sporting goods, and retail markets company, from 2010 to 2015, and at Kroll, a global risk consulting firm, from 2007 to 2010. He also held various IT roles with Ecolab, Inc.

Mr. West joined Winnebago Industries in September 2016 as Vice President, Operations. He previously was Vice President of Global Supply Chain for Joy Global, a worldwide equipment manufacturer, from 2014 to 2016, and Operations Director from 2012 to 2014. Mr. West served as Director of Manufacturing for AGCO Corporation, an agricultural equipment manufacturer, from 2008 to 2012 and as Director of Operations and in other management positions for the Nordam Group, a manufacturer of aircraft interiors, from 1999 to 2009.

Mr. Woodson joined Winnebago Industries in January 2015 as Vice President, Administration. Prior to joining Winnebago, Mr. Woodson was Vice President of Human Resources at Corbion N.V., a food and biochemicals company, from 2007 to 2014 and Director, Human Resources at Sara Lee Corporation from 1999 to 2007. Mr. Woodson has over 24 years of business and human resources experience.

16

PART II

Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities.

Market Information

Our common stock is listed on the New York and Chicago Stock Exchanges with the ticker symbol of WGO.

Holders

Shareholders of record as of October 15, 2018: 2,593

Dividends Paid Per Share

On August 15, 2018, our Board of Directors declared a quarterly cash dividend of $0.10 per share, totaling $3.2 million, paid on September 26, 2018 to common stockholders of record at the close of business on September 12, 2018. The Board currently intends to continue to pay quarterly cash dividends payments in the future; however, declaration of future dividends, if any, will be based on several factors including our financial performance, outlook, and liquidity.

Our Credit Agreement, as further described in Note 9, Long-Term Debt, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K, contains restrictions that may limit our ability to pay dividends, if we fail to maintain certain financial covenants.

Issuer Purchases of Equity Securities

Our Credit Agreement contains restrictions that may limit our ability to make distributions or payments with respect to purchases of our common stock without consent of the lenders, except for limited purchases of our common stock from employees, in the event of a significant reduction in our EBITDA or in the event of a significant borrowing on our credit agreement ("ABL"), which was increased from $125.0 million to $165.0 million on September 21, 2018. See additional information on our ABL in Note 9, Long-Term Debt, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

On December 19, 2007, our Board of Directors authorized the repurchase of outstanding shares of our common stock, depending on market conditions, for an aggregate consideration of up to $60.0 million. On October 18, 2017, our Board of Directors authorized a share repurchase program in the amount of $70.0 million. There is no time restriction on either authorization. During Fiscal 2018, we repurchased 134,803 shares of our common stock at a cost of $5.0 million. An additional 33,560 shares of our common stock at a cost of $1.5 million were repurchased to satisfy tax obligations on employee equity awards as they vested. We continually evaluate if share repurchases reflect a prudent use of our capital and, subject to compliance with our Credit Agreement, we may purchase shares in the future. As of August 25, 2018, there was approximately $66.0 million remaining on our board repurchase authorization.

Purchases of our common stock during each fiscal month of the fourth quarter of Fiscal 2018 were:

Total Number of Shares Purchased(1) | Average Price Paid per Share | Number of Shares Purchased as Part of Publicly Announced Plans or Programs(1) | Approximate Dollar Value of Shares That May Yet Be Purchased Under the Plans or Programs(2) | ||||||||||

05/27/18 - 06/30/18 | — | $ | — | — | $ | 65,989,000 | |||||||

07/01/18 - 07/28/18 | — | $ | — | — | $ | 65,989,000 | |||||||

07/29/18 - 08/25/18 | — | $ | — | — | $ | 65,989,000 | |||||||

Total | — | $ | — | — | $ | 65,989,000 | |||||||

(1) | Shares not purchased as part of a publicly announced program were repurchased from employees who vested in Company shares and elected to pay their payroll tax via the value of shares delivered as opposed to cash. |

(2) | Pursuant to a combined $130.0 million share repurchase program authorized by our Board of Directors. On December 18, 2007, $60.0 million was approved, and on October 18, 2017, $70.0 million was approved. There is no time restriction on either authorization. |

17

Equity Compensation Plan Information

The following table provides information as of August 25, 2018 with respect to shares of our common stock that may be issued under our existing equity compensation plans:

(a) | (b) | (c) | ||||||||

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights(1) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in (a)) | |||||||

Equity compensation plans approved by shareholders - 2004 Plan | 9,000 | (2) | — | — | ||||||

Equity compensation plans approved by shareholders - 2014 Plan | 469,704 | (3) | 36.68 | 1,677,481 | (4) | |||||

Equity compensation plans not approved by shareholders(5) | 47,366 | (6) | — | — | (7) | |||||

Total | 526,070 | 36.68 | 1,677,481 | |||||||

(1) | This number represents the weighted average exercise price of outstanding stock options only. Restricted share awards do not have an exercise price so weighted average is not applicable. |

(2) | This number represents unvested share awards granted under the 2004 Plan. No new grants may be made under the 2004 Plan. |

(3) | This number represents stock options and unvested stock awards granted under the 2014 Omnibus Equity, Performance Award, and Incentive Compensation Plan, as amended ("2014 Plan"). The 2014 Plan replaced the 2004 Plan effective January 1, 2014. |

(4) | This number represents stock options available for grant under the 2014 Plan as of August 25, 2018. |

(5) | Our sole equity compensation plan not previously submitted to our shareholders for approval is the Directors' Deferred Compensation Plan, as amended ("Directors' Plan"). The Board of Directors may terminate the Directors' Plan at any time. If not terminated earlier, the Directors' Plan will automatically terminate on June 30, 2023. For a description of the key provisions of the Directors' Plan, see the information in our Proxy Statement for the Annual Meeting of Shareholders scheduled to be held December 11, 2018 under the caption "Director Compensation," which information is incorporated by reference herein. |

(6) | Represents shares of common stock issued to a trust which underlie stock units, payable on a one-for-one basis, credited to stock unit accounts as of August 25, 2018 under the Directors' Plan. |

(7) | The table does not reflect a specific number of stock units which may be distributed pursuant to the Directors' Plan. The Directors' Plan does not limit the number of stock units issuable thereunder. The number of stock units to be distributed pursuant to the Directors' Plan will be based on the amount of the director's compensation deferred and the per share price of our common stock at the time of deferral. |

18

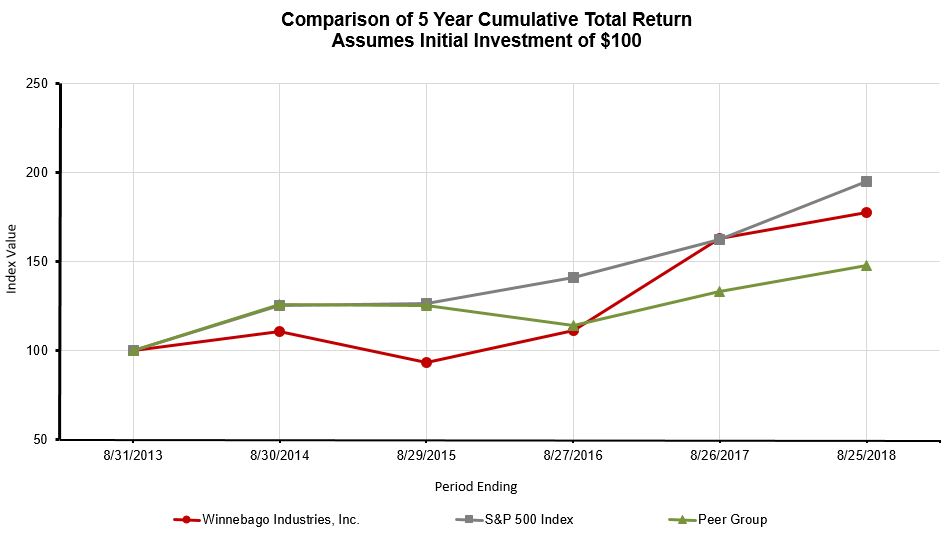

Performance Graph

The following graph compares our five-year cumulative total shareholder return (including reinvestment of dividends) with the cumulative total return on the Standard & Poor's 500 Index and a peer group. The peer group companies consisting of Thor Industries, Inc., Polaris Industries, Inc., and Brunswick Corporation were selected by us as they also manufacture recreation products. It is assumed in the graph that $100 was invested in our common stock, in the Standard & Poor's 500 Index and in the stocks of the peer group companies on August 31, 2013 and that all dividends received within a quarter were reinvested in that quarter. In accordance with the guidelines of the SEC, the shareholder return for each entity in the peer group index has been weighted on the basis of market capitalization as of each annual measurement date set forth in the graph.

Base Period | ||||||||||||

Company/Index | August 31, 2013 | August 30, 2014 | August 29, 2015 | August 27, 2016 | August 26, 2017 | August 25, 2018 | ||||||

Winnebago Industries, Inc. | 100.00 | 111.05 | 93.25 | 111.33 | 163.06 | 177.65 | ||||||

S&P 500 Index | 100.00 | 125.25 | 126.89 | 141.45 | 162.65 | 195.09 | ||||||

Peer Group | 100.00 | 125.80 | 125.54 | 114.31 | 133.51 | 147.90 | ||||||

Source: Zacks Investment Research, Inc.

19

Item 6. Selected Financial Data.

Fiscal Years Ended | |||||||||||||||||||

(In thousands, except per share data) | August 25, 2018 | August 26, 2017(1) | August 27, 2016 | August 29, 2015 | August 30, 2014 | ||||||||||||||

Income statement data: | |||||||||||||||||||

Net revenues | $ | 2,016,829 | $ | 1,547,119 | $ | 975,226 | $ | 976,505 | $ | 945,163 | |||||||||