Form 10-K REPLIGEN CORP For: Dec 31

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-14656

REPLIGEN CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 04-2729386 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 41 Seyon Street, Bldg. 1, Suite 100 Waltham, MA |

02453 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (781) 250-0111

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

Common Stock, $0.01 Par Value Per Share

Name of Exchange on Which Registered

The NASDAQ Stock Market LLC

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒.

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ No ☐.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒.

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 29, 2018, the last business day of the registrant’s most recently completed second fiscal quarter, was $1,569,493,598.

The number of shares of the registrant’s common stock outstanding as of February 22, 2019 was 43,921,488.

Documents Incorporated By Reference

The registrant intends to file a proxy statement pursuant to Regulation 14A within 120 days of the end of the fiscal year ended December 31, 2018. Portions of such proxy statement are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

| PAGE | ||||||

| Forward-looking Statements | 1 | |||||

| PART I |

||||||

| Item 1. |

Business | 2 | ||||

| Item 1A. |

Risk Factors | 11 | ||||

| Item 1B. |

Unresolved Staff Comments | 25 | ||||

| Item 2. |

Properties | 26 | ||||

| Item 3. |

Legal Proceedings | 26 | ||||

| Item 4. |

Mine Safety Disclosures | 26 | ||||

| PART II |

||||||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 27 | ||||

| Item 6. |

Selected Consolidated Financial Data | 29 | ||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 30 | ||||

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk | 44 | ||||

| Item 8. |

Financial Statements and Supplementary Data | 44 | ||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 44 | ||||

| Item 9A. |

Controls and Procedures | 44 | ||||

| Item 9B. |

Other Information | 47 | ||||

| PART III |

48 | |||||

| PART IV |

||||||

| Item 15. |

Exhibits and Financial Statement Schedules | 49 | ||||

| Item 16. |

10-K Summary | 51 | ||||

| 52 | ||||||

Table of Contents

This Annual Report on Form 10-K (“Form 10-K”) contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The forward-looking statements in this Form 10-K do not constitute guarantees of future performance. Investors are cautioned that express or implied statements in this Form 10-K that are not strictly historical statements, including, without limitation, statements regarding current or future financial performance, potential impairment of future earnings, management’s strategy, plans and objectives for future operations or acquisitions, product development and sales, research and development, selling, general and administrative expenditures, intellectual property and adequacy of capital resources and financing plans constitute forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated, including, without limitation, the risks identified under the caption “Risk Factors” and other risks detailed in this Form 10-K and our other filings with the Securities and Exchange Commission. We assume no obligation to update any forward-looking information contained in this Form 10-K, except as required by law.

1

Table of Contents

PART I

| ITEM 1. | BUSINESS |

The following discussion of our business contains forward-looking statements that involve risks and uncertainties. When used in this report, the words “intend,” “anticipate,” “believe,” “estimate,” “plan” and “expect” and similar expressions as they relate to us are included to identify forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements and are a result of certain factors, including those set forth under “Risk Factors” and elsewhere in this Annual Report on Form 10-K.

References throughout this Annual Report on Form 10-K to “Repligen”, “we”, “us”, “our”, or the “Company” refer to Repligen Corporation and its subsidiaries, taken as a whole, unless the context otherwise indicates.

Overview

Repligen is a leading provider of advanced bioprocessing technologies and solutions used in the process of manufacturing biologic drugs. Our products are made to substantially increase biopharmaceutical manufacturing efficiencies and flexibility. As the global biologics market continues to experience strong growth and expansion, our customers – primarily large biopharmaceutical companies and contract manufacturing organizations – face critical production cost, capacity, quality and time pressures that our products are made to address. Our commitment to bioprocessing is helping to set new standards for the way our customers manufacture biologic drugs, including monoclonal antibodies (“mAb”), recombinant proteins, vaccines and gene therapies. We are dedicated to inspiring advances in bioprocessing as a trusted partner in the production of biologic drugs that improve human health worldwide.

We currently operate as one bioprocessing business, with a comprehensive suite of products to serve both upstream and downstream processes in biologic drug manufacturing. Building on over 35 years of industry expertise, we have developed a broad and diversified product portfolio that reflects our commitment to build a best-in-class bioprocessing technology company with a world-class direct sales and commercial organization.

We are committed to capitalizing on growth opportunities and maximizing the value of our product platform through both organic growth initiatives (internal innovation and commercial leverage) and targeted acquisitions.

Our Products

Our bioprocessing business is comprised of three main product lines – Chromatography, Filtration and Proteins.

Direct-to-Customer Products (Chromatography and Filtration)

Since 2012, we have significantly expanded our direct-to-customer presence through our Chromatography and Filtration product lines, which include differentiated products and systems. We have diversified and grown our direct-to-customer product offering through internal innovation and through disciplined, accretive acquisitions of assets or businesses that leverage existing product lines and/or expand our customer and geographic scope.

To support our sales goals for our direct-to-consumer products, we have invested in our commercial organization. Our commercial and research and development teams work to effectively launch new products and applications, as well as build new markets for acquired technologies that increase flexibility and convenience while streamlining biomanufacturing workflow for our customers. In addition, to meet increased demand for our products, we continue to invest in increasing the volume and scale of manufacturing at our facilities in the United States, Sweden and Germany.

2

Table of Contents

Chromatography

Our Chromatography product line includes a number of products used in the downstream purification and quality control of biological drugs. The main driver of growth in this portfolio is our lab and process-scale OPUS® pre-packed chromatography (“PPC”) column line.

Our other products include chromatography resins (such as CaptivA®) used in a small number of commercial drug processes and ELISA test kits used by quality control departments to detect and measure the presence of leached Protein A and/or growth factor in the final product.

OPUS®

Our Chromatography product line features PPC columns under our OPUS brand. OPUS columns, which we deliver to our customers pre-packed with their choice of chromatography resin, are single-campaign (“single-use”) disposable columns that replace the use of traditional and more permanent glass columns used in downstream purification processes. By designing OPUS to be a technologically advanced and flexible option for the purification of biologics from process development through clinical-scale and some commercial manufacturing, Repligen has become a leader in the PPC market. The customization and ready-to-use nature of our OPUS columns makes them ideal for purification of antibodies, recombinant proteins and vaccines. Biomanufacturers value the time savings, labor and utility cost savings, product consistency and the “plug and play” convenience of OPUS.

We launched our first production-scale OPUS columns in 2012 and have since added larger diameter options such as OPUS 45 and OPUS 60. Early in 2018, we introduced OPUS 80 R, the largest available PPC on the market, for use in late-stage clinical or select commercial purification processes. We have also introduced next-generation features such as a resin recovery port on our larger columns. This allows our customers to reuse the recovered resin in other applications. The unpacking port feature was made available in the first quarter of 2017 on our largest production-scale OPUS columns.

Through our acquisition of Atoll GmbH in 2016, we established a customer-facing center in Europe and expanded our portfolio to include our smaller-scale columns, named OPUS PD, that are used in high-throughput process development screening, viral validation studies and scale down validation of chromatography processes. We maintain a broad and customizable PPC product line to meet our customers’ diverse needs.

Other Chromatography

Also included in our Chromatography portfolio are ELISA kits, which are analytical test kits to detect the presence of proteins and growth factors, and chromatography resins, including our CaptivA® brand. In addition, following our acquisition of Spectrum in 2017, we sell Spectra/Chrom® liquid chromatography products as part of our Chromatography product line.

Filtration

XCell™ ATF

Our Filtration products offer a number of advantages to manufacturers of biologic drugs at volumes that span from pilot studies to clinical and commercial-scale production. We first established our Filtration product line through our acquisition of XCell™ Alternating Tangential Flow (“ATF”) assets from Refine Technology (“Refine”) in 2014. XCell ATF systems are used primarily in upstream perfusion, or “continuous manufacturing”, processes.

3

Table of Contents

XCell ATF is a technologically advanced filtration device used in upstream processes to continuously remove cellular metabolic waste products during the course of a fermentation run, freeing healthy cells to continue producing the biologic drug of interest. XCell ATF was designed to both increase the density of cells in a bioreactor and extend the production run. By continuously removing waste products from the fermenter, the XCell ATF System routinely increases cell densities to 2- or 3-times the levels achieved by standard batch fermentation. As a result, product yield is increased, which improves facility utilization and can reduce the size of a bioreactor required to manufacture a given volume of biologic drug product. This is important to biomanufacturers who seek to maximize output from their existing facilities. XCell ATF Systems are suitable for use in laboratory and scale-up all the way to production bioreactors as large as 2,000 liters.

Through internal innovation, we developed and in 2016 launched single-use formats of the original stainless steel XCell ATF device to address increasing industry demand for “plug-and-play” technology. The XCell ATF device is now available to customers in both its original configuration (steel housing and replaceable filters) in all sizes (2, 4, 6 and 10), and/or as a single-use device (disposable housing/filter combination) in most sizes (2, 6, and 10). The availability of XCell ATF in a single-use format eliminates the pre-use workflow associated with autoclaving, leading to an 80% reduction in implementation time. The single-use format also enables our customers to accelerate evaluations of the product with a lower initial overall cost of ownership. Based on strong demand, we have continued to expand the single-use XCell ATF offering.

In September 2018, we entered into a collaboration agreement with industry leader Sartorius Stedim Biotech (“SSB”) to integrate our XCell ATF controller technology into SSB’s BIOSTAT® STR large-scale, single-use bioreactors, to create novel perfusion-enabled bioreactors.

SIUS™ Tangential Flow Filters (TangenX)

In December 2016, we acquired TangenX Technology Corporation (“TangenX”), balancing our upstream XCell ATF offering with a downstream portfolio of flat-sheet tangential flow filters (“TFF”) and cassettes used in downstream biologic drug purification and formulation processes. The TangenX portfolio includes our single-use SIUS™ TFF brand, providing customers with a high-performance, low-cost alternative to reusable TFF cassettes.

TFF is a rapid and efficient method for separation and purification of biomolecules that is widely used in laboratory, process development and process scale applications in biopharmaceutical manufacturing. SIUS is an innovative single-use TFF line of cassettes and hardware for lab-scale through large-scale biopharmaceutical manufacturing. Single-use SIUS TFF cassettes with enclosed flat sheet membranes are designed to provide a high performing membrane at significantly lower product and labor costs than reusable TFF products. Each disposable cassette is delivered pre-sanitized, integrity tested and ready to be equilibrated and used for tangential flow diafiltration and ultrafiltration processing. Use of SIUS TFF cassettes eliminates non-value added steps of cleaning and flushing required in reusable TFF products. The cassettes are interchangeable with filter hardware from multiple manufacturers, simplifying customer trial and adoption of SIUS products.

KrosFlo®, ProConnex® (Spectrum Life Sciences LLC)

We acquired Spectrum Life Sciences LLC (“Spectrum”) and its subsidiaries in August 2017 to strengthen our filtration business with the addition of a leading portfolio of hollow-fiber (HF) filters and modules, single-use flow path connectors and TFF filtration systems. Spectrum products are used in bench-top through commercial-scale processes, primarily for the filtration, isolation, purification and concentration of biologics and diagnostic products. Our Spectrum filtration products offer both standard and customized solutions to bioprocessing customers, with particular strength in consumable and single-use offerings.

With the addition of Spectrum, we now in-house manufacture hollow-fiber filters that can be used in our XCell ATF system. In addition, we increased our direct sales presence in Europe and Asia, and we diversified our end markets beyond monoclonal antibodies to include vaccines, recombinant protein and gene therapies.

4

Table of Contents

Our Spectrum filtration brands include the KrosFlo® line of hollow-fiber cartridges and TFF systems, the Spectra/Por® portfolio of laboratory and process dialysis products and Pro-Connex® single-use hollow-fiber Module-Bag-Tubing sets.

In 2018, we introduced our KONDUiT device to automate concentration and buffer exchange to be used in conjunction with our hollow fiber or flat sheet TFF filtration products.

OEM Products (Proteins)

Our OEM products are represented by our Protein A affinity ligands, which are a critical component of Protein A chromatography resins used in downstream purification, and cell culture growth factor products, which are a key component of cell culture media used upstream to increase cell density in a bioreactor and improve product yield.

Protein A/Ligands

We are a leading provider of Protein A affinity ligands to life sciences companies. Protein A ligands are an essential “binding” component of Protein A chromatography resins used in the purification of virtually all monoclonal antibody based drugs on the market or in development. We manufacture multiple forms of Protein A ligands under long-term supply agreements with major life sciences companies including GE Healthcare, MilliporeSigma and Purolite Life Sciences (“Purolite”), who in turn sell their Protein A chromatography resins to end users (“mAb manufacturers”). We have two manufacturing sites supporting overall global demand for our Protein A ligands: one in Lund, Sweden and another in Waltham, Massachusetts.

Protein A chromatography resins are considered the industry standard for purification of antibody-based therapeutics due to the ability of the Protein A ligand to very selectively bind to or “capture” antibodies from crude protein mixtures. Protein A resins are packed into the first chromatography column of typically three columns used in a mAb purification process. As a result of Protein A’s high affinity for antibodies, the mAb product is highly purified and concentrated within this first capture step before moving to polishing steps.

In June 2018, we entered into an agreement with Navigo Proteins GmbH (“Navigo”) for the exclusive co-development of multiple affinity ligands for which Repligen holds commercialization rights. We are manufacturing and have agreed to supply the first of these ligands, NGL-Impact™ A, exclusively to Purolite, who will pair our high-performance ligand with Purolite’s agarose jetting base bead technology used in their Jetted A50 Protein A resin product. We also signed a long-term supply agreement with Purolite for NGL-Impact A and potential additional affinity ligands that may advance from our Navigo collaboration. The Navigo and Purolite agreements are supportive of our strategy to secure and reinforce our Proteins product line.

Growth Factors

Most biopharmaceuticals are produced through an upstream mammalian cell fermentation process. In order to stimulate increased cell growth and maximize overall yield from a bioreactor, manufacturers often add growth factors, such as insulin, to their cell culture fermentation media. As part of the Novozymes Acquisition in 2011, we gained several cell culture growth factor additives. Among those products is LONG®R3 IGF-1, our insulin-like growth factor that has been shown to be up to 100 times more biologically potent than insulin (the industry standard), thereby increasing recombinant protein production in cell culture fermentation applications. LONG R3 IGF-1 is sold through a distribution partnership with MilliporeSigma.

Corporate Information

We are a Delaware corporation with global headquarters in Waltham, Massachusetts. We were incorporated in 1981 and became a publicly traded company in 1986. Our common stock is listed on The Nasdaq Global Market

5

Table of Contents

under the symbol “RGEN”. We have over 540 employees and operate globally with offices and manufacturing sites located at multiple locations in the United States, Europe and Asia. Our principal executive offices are located at 41 Seyon Street, Waltham, Massachusetts 02453, our website is www.repligen.com and our telephone number is (781) 250-0111.

Our Market Opportunity

The global biologics drug market was estimated to be over $200 billion in 2017. This market includes therapeutic antibodies, recombinant proteins and vaccines. Antibody-based biologics alone accounted for over $115 billion of global biopharma revenue and represented a majority of the top 10 best-selling drugs across the pharmaceutical industry in 2017. Industry sources project the biologics market to grow at a rate of 8%-10% annually over the next five years, driven by strength in the mAb class of biologics, as evidenced by the rate of new approvals, expanded labels for marketed antibodies and the emergence of biosimilar versions of originator mAbs.

In 2018, 13 mAbs (a record 11 originator mAbs and two biosimilars) were approved by the U.S. Food and Drug Administration (“FDA”) to treat a diverse range of diseases. Between 2016 and 2018, 36 mAbs were approved by the FDA, representing over 40% of all approved mAbs since the first therapeutic antibody was brought to market in 1986. There are currently more than 80 mAbs on the market and more than 400 in various stages of clinical development addressing a wide range of medical conditions including asthma, migraines and Alzheimer’s disease.

In addition to investments in the discovery and development of novel biologic drugs, there has been substantial investment in follow-on products (biosimilars) by generic and specialty pharmaceutical as well as large biopharmaceutical companies. Development of follow-on products has accelerated as the first major mAbs have come off patent in the European Union and United States. Due to the high cost of biologic drugs, many countries in the developing and emerging markets have been aggressively investing in biomanufacturing capabilities to supply lower cost biosimilars for the local markets. For both originator and follow-on biologics manufacturing, Repligen products are well-positioned to enable greater manufacturing flexibility, production yields and lower costs through improved process efficiencies.

Many of the products we manufacture are in the early stages of their adoption cycle, and together with the expansion of our commercial organization and strategic acquisitions, have contributed to product revenue growth from $47.5 million in 2013, to $193.9 million in 2018. While all product lines have grown over this period, our diversification strategy has resulted in a significant increase in direct product sales as a percent of total product revenue, from 17% in 2012. By 2018, 72% of total bioprocessing revenue was attributable to direct product sales; 47% from our Filtration product line, 23% from our Chromatography product line and a small percentage from other sources including sales of hospital products that we obtained through our acquisition of Spectrum.

Customers use our products to produce initial quantities of drug for clinical studies, and then scale-up to larger volumes as the drug progresses to commercial production following regulatory approval. Detailed specifications for a drug’s manufacturing process are included in applications that must be approved by regulators, such as the FDA, and the European Medicines Agency (“EMA”), throughout the clinical trial process and prior to final commercial approval. As a result, products that become part of the manufacturing specifications of a late-stage clinical or commercial process can be very sensitive given the costs and uncertainties associated with displacing them.

The Biologics Manufacturing Process

Manufacturing biologic drugs requires three fundamental steps. First, upstream manufacturing involves the production of the biologic by living cells that are grown in a bioreactor under controlled conditions. Methods of production vary with the industry standard being fed-batch, where nutrients (media) are added to a bioreactor to

6

Table of Contents

stimulate cell growth and productivity and then followed by a harvest step. The industry is increasingly adopting the perfusion (or continuous) method of production, which circulates nutrients into the bioreactor, while simultaneously harvesting the biologic drug product. Some manufacturers are embracing a hybrid approach combining both fed-batch and perfusion methods. The cells being grown in a bioreactor are engineered to produce the biologic drugs of interest. These tiny cell “factories” are highly sensitive to the conditions under which they grow, including the composition of the cell culture media and the growth factors used to stimulate increased cell growth and protein production, or titre. In the second downstream step, the biologic made upstream must be separated and purified, typically through various filtration and chromatography steps. Finally, the purified biologic drug is concentrated and formulated and then quality controlled and packaged into its final injectable form.

Biologics are generally high value therapies. Given the inherent complexities of the process and the final drug product, we have observed that manufacturers are seeking and investing in innovative technologies that address pressure points in the production process in order to improve yields. Manufacturers are also seeking technologies that reduce costs as the biologic drug moves through clinical stages and into commercial processes by adopting single-use technologies as well as other products that yield increased flexibility and efficiency.

Our Strategy

We are focused on the development, production and commercialization of differentiated, technology-leading solutions or products that address specific pressure points in the biologics manufacturing process and deliver substantial value to our customers. Our products are designed to increase our customers’ product yield, and we are committed to supporting our customers with strong customer service and applications expertise.

We intend to build on our recent history of developing market-leading solutions and delivering strong financial performance through the following strategies:

| • | Continued innovation. We plan to capitalize on our internal technological expertise to develop products that address unmet needs in upstream and downstream bioprocessing. We intend to invest further in our core Proteins product lines while developing platform and derivative products to support our Filtration and Chromatography product lines. |

| • | Platforming our products. A key strategy for accelerating market adoption of our products is delivery of enabling technologies that become the standard, or “platform,” technology in markets where we compete. We focus our efforts on winning early-stage technology evaluations through direct interaction with the key biomanufacturing decision makers in process development labs. This strategy is designed to establish early adoption of our enabling technologies at key accounts, with opportunity for customers to scale up as the molecule advances to later stages of development and potential commercialization. We believe this approach can accelerate the implementation of our products as platform products, thereby strengthening our competitive advantage and contributing to long-term growth. |

| • | Targeted acquisitions. We intend to continue to selectively pursue acquisitions of innovative technologies and products. We intend to leverage our balance sheet to acquire technologies and products that improve our overall financial performance by improving our competitiveness in filtration or chromatography or moving us into adjacent markets with common commercial call points. |

| • | Geographical expansion. We intend to expand our global commercial presence by continuing to selectively build out our global sales, marketing, field applications and services infrastructure. |

| • | Operational efficiency. We seek to expand operating margins through capacity utilization and process optimization strategies designed to increase our manufacturing yields. We plan to invest in systems to support our global operations, optimizing resources across our global footprint to maximize productivity. |

7

Table of Contents

Research and Development

Our research activities are focused on developing new high-value bioprocessing products. Specifically, we plan to focus these efforts on expanding our product portfolio and applications for our OPUS PPC columns, XCell ATF systems, SIUS TFF, KrosFlo®, TFF systems and other products, and developing next generation Protein A ligands.

Sales and Marketing

Our sales and marketing strategy supports our objective of strengthening our position as a leading provider of products and services, addressing upstream, downstream and quality control needs of bioprocessing customers in the biopharmaceutical industry.

Direct-to-Customer Team

To support our sales goals for our direct-to-consumer products, we have invested in our commercial organization. Since 2014, we have significantly expanded our global commercial organization, to form a 103-person commercial team as of December 31, 2018. This includes 54 people in field positions (direct sales, field applications and field service), and 49 people with internal positions (marketing, product management and customer service). This expansion also includes the team of 26 highly experienced field personnel that we added with our acquisition of Spectrum in 2017. With the acquisition, we have greatly expanded our direct sales team in Asia, where we also work effectively with key distributors to serve our expanding customer base.

As part of the Spectrum integration process, we transitioned to a new sales model in 2018, whereby all sales staff now represent all Repligen products across our Chromatography and Filtration portfolios. Our bioprocess account managers are supported in each region by bioprocess sales specialists with expertise in either Filtration or Chromatography and by technically trained field applications specialists and field service providers, who can work closely with customers on product demonstrations, implementation and support. We believe that this model helps drive further adoption at our key accounts and also open up new sales opportunities within each region.

OEM Agreements

For our Proteins product line, we are committed to being a partner of choice for our customers with distributor and supply agreements in place with large life sciences companies such as GE Healthcare, MilliporeSigma and Purolite. The GE Healthcare Protein A supply agreement relating to our Lund, Sweden facility runs, pursuant to its terms, through 2019 with an option for earlier termination on six months’ advance notice. The GE Healthcare Protein A supply agreement relating to our Waltham, Massachusetts facility runs, pursuant to its terms, through 2021. Our Protein A supply agreement with MilliporeSigma runs, pursuant to its terms, through 2023, and in 2018 we amended our Protein A supply agreement with Purolite that runs, pursuant to its terms, to August 2026 with an option for renewal through 2028. Our dual manufacturing capability provides strong business continuity and reduces overall supply risk for our OEM customers.

Significant Customers and Geographic Reporting

Customers for our bioprocessing products include major life science companies, contract manufacturing organizations, biopharmaceutical companies, diagnostics companies and laboratory researchers.

8

Table of Contents

The following table represents the Company’s total revenue by geographic area (based on the location of the customer):

| For the Years Ended December 31, | ||||||||||||

| 2018 | 2017 | 2016 | ||||||||||

| Revenue by customers’ geographic locations: |

||||||||||||

| North America |

48 | % | 43 | % | 39 | % | ||||||

| Europe |

40 | % | 46 | % | 54 | % | ||||||

| APAC |

12 | % | 11 | % | 7 | % | ||||||

| Other |

0 | % | 0 | % | 0 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Total revenue |

100 | % | 100 | % | 100 | % | ||||||

|

|

|

|

|

|

|

|||||||

GE Healthcare, our largest bioprocessing customer, accounted for 15%, 21% and 29% of total revenues in the years ended December 31, 2018, 2017 and 2016, respectively. MilliporeSigma, our second largest bioprocessing customer, accounted for 15%, 18% and 28% of total revenues in the years ended December 31, 2018, 2017 and 2016, respectively.

Employees

As of December 31, 2018, we had 548 employees. Of those employees, 54 were engaged in engineering and research and development, 325 in manufacturing, 103 in sales and marketing and 66 in administrative functions. Each of our employees has signed a confidentiality agreement. None of our U.S. employees are covered by collective bargaining agreements. We have one collective bargaining agreement with two unions that covers our 62 employees in Sweden, comprising approximately 11% of our total workforce. We renewed these collective bargaining agreements during 2017, and the new collective bargaining agreements expire on March 31, 2020. We consider our employee relations to be satisfactory.

Intellectual Property

We are committed to protecting our intellectual property through a combination of patent, copyright, trade secret and trademark laws, as well as confidentiality agreements. As further described below, we own or have exclusive rights to a number of U.S. patents and U.S. pending patent applications as well as corresponding foreign patents and patent applications.

Chromatography

For our Chromatography product line, we have a base of intellectual property that comes from our acquisitions of Atoll GmbH in 2016, and certain assets acquired from BioFlash Partners in 2010. Our issued patents cover certain unique methods and features of our OPUS pre-packed columns, including methods of making and loading these chromatography columns as well as the column structure. We continually seek to improve upon this technology and have multiple new patent filings including those covering gamma irradiation sterilization, packing methods, and methods of removing air using specialized tubing and valve systems.

Filtration

For our Filtration product line, we are leveraging our acquisitions of third-party filtration patented technology of Refine, with a focus on ATF technology, TangenX, with a focus on tangential flow flat sheet cassette technology, and Spectrum, with a focus on tangential flow hollow fiber technology. We continually seek to improve upon these technologies and have multiple new patent filings including those covering pumps and controllers, methods of harvesting, single-use products, and filters. Our patent for alternating tangential flow and associated methods to use such a device in perfusion, acquired from Refine, expires in 2020, and we are proactively developing technology in an effort to mitigate any effects resulting from the expiration of this patent.

9

Table of Contents

We currently have 44 patents granted (which expire over the next 20 years) and 85 patents pending in countries including Australia, Canada, China, France, Germany, India, Japan, Korea, Sweden, United Kingdom and the United States.

Our policy is to require each of our employees, consultants, business partners, potential collaborators and major customers to execute confidentiality agreements upon the commencement of an employment, consulting, business relationship, or product related audit with us. These agreements provide that all confidential information developed or made known to the other party during the course of the relationship with us is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of employees and consultants, the agreements generally provide that all inventions conceived by the individual in the course of rendering services to Repligen shall be our exclusive property and must be assigned to Repligen.

Protein A

We currently hold a patent for “Nucleic Acids Encoding Recombinant Protein A,” which claims an isolated nucleic acid molecule that encodes a Protein A molecule with an amino acid sequence identical to that of the natural Protein A, which has long been commercialized for bioprocessing applications. This patent will remain in effect until June 2028. We also have two pending patents covering affinity ligands through our collaboration with Navigo GmbH.

Trademarks

We vigilantly protect our products and services’ branding by maintaining trademark registrations globally for the Repligen trademark and our key product brands. We have a comprehensive branding policy that includes trademark usage guidelines to ensure Repligen trademarks are used in a manner that provides the maximum protection.

We prioritize our “housemark” trademarks, (i.e., Repligen, Spectrum and TangenX), and ensure they are sufficiently protected and registered in key countries or regions globally, such as the United States, Canada, Europe and China. We also have product trademarks, including OPUS, XCell ATF, KrosFlo, SIUS, Pro-Connex, Spectra/Por and NGL-Impact A, that provide valuable company recognition and goodwill with its customers.

Our ability to compete effectively in the marketplace is dependent in part on our ability to protect our intellectual property rights, which includes protecting the trademarks we use in connection with our products and services. We rely on several registered and unregistered trademarks to protect our brand.

Licensing Agreements

We have entered into multiple licensing and collaboration relationships with third-party business partners in an effort to fully exploit our technology and advance our bioprocessing business strategy.

Competition

Our bioprocessing products compete on the basis of quality, performance, cost effectiveness, and application suitability with numerous established technologies. Additional products using new technologies that may be competitive with our products may also be introduced. Many of the companies selling or developing competitive products, which in some cases include GE Healthcare and MilliporeSigma, our two largest customers, have greater financial and human resources, research and development, manufacturing and marketing experience than we do. They may undertake their own development of products that are substantially similar to or compete with

10

Table of Contents

our products and they may succeed in developing products that are more effective or less costly than any that we may develop. These competitors may also prove to be more successful in their production, marketing and commercialization activities. We cannot be certain that the research, development and commercialization efforts of our competitors will not render any of our existing or potential products obsolete.

Manufacturing

We manufacture seven commercial forms of Protein A, including “native” Protein A for life sciences companies, including GE Healthcare, MilliporeSigma and Purolite, under long-term supply agreements which expire between 2019 and 2023. Native Protein A is manufactured in Lund, Sweden, while the recombinant forms are manufactured in both Waltham, Massachusetts and Lund, Sweden. We currently manufacture our growth factor products in Lund, Sweden. Our OPUS chromatography columns and XCell ATF System products are manufactured in Waltham, Massachusetts. Our OPUS PD columns are manufactured in Ravensburg, Germany, and our SIUS TFF products were manufactured in Shrewsbury, Massachusetts until December 31, 2018 before manufacturing of the SIUS TFF products shifted to our new facility in Marlborough, Massachusetts. Our KrosFlo, Spectra/Pro and Pro-Connex lines of products are manufactured in Rancho Dominguez, California. Our operating room products are manufactured in Irving, Texas, and our Spectra/Chrom products are manufactured in Houston, Texas.

We utilize our own facilities in Waltham, Massachusetts and Lund, Sweden as well as third-party contract manufacturing organizations to carry out certain fermentation and recovery operations, while the purification, immobilization, packaging and quality control testing of our bioprocessing products are conducted at our facilities. Our facilities located in Waltham, Massachusetts; Lund, Sweden; Ravensburg, Germany; and Rancho Dominguez, California are ISO 9001:2015 certified and maintain formal quality systems to maintain process control, traceability, and product conformance. Additionally, our facility in Irving, Texas is ISO 13485:2012 certified. We practice continuous improvement initiatives based on routine internal audits as well as external feedback and audits performed by our partners and customers. In addition, we maintain a business continuity management system which focuses on key areas such as contingency planning, security stocks and off-site storage of raw materials and finished goods to ensure continuous supply of our products.

Available Information

We maintain a website with the address www.repligen.com. We are not including the information contained on our website as a part of, or incorporating it by reference into, this Annual Report on Form 10-K. We make available free of charge through our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such materials with, or furnish such materials to, the Securities and Exchange Commission. Our Code of Business Conduct and Ethics is also available free of charge through our website.

Our filings with the Securities and Exchange Commission may be accessed through the Securities and Exchange Commission’s Electronic Data Gathering, Analysis and Retrieval (EDGAR) system at www.sec.gov.

| ITEM 1A. | RISK FACTORS |

Investors should carefully consider the risk factors described below before making an investment decision.

If any of the events described in the following risk factors occur, our business, financial condition or results of operations could be materially harmed. In that case the trading price of our common stock could decline, and investors may lose all or part of their investment. Additional risks and uncertainties that we are unaware of or that we currently deem immaterial may also become important factors that affect Repligen.

11

Table of Contents

This Annual Report on Form 10-K contains forward looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this Annual Report on Form 10-K.

We face competition from numerous competitors, most of whom have far greater resources than we have, which may make it more difficult for us to achieve significant market penetration.

The bioprocessing market is intensely competitive, subject to rapid change and significantly affected by new product introductions and other market activities of industry participants.

Many of our competitors are large, well-capitalized companies with significantly more market share and resources than we have. As a consequence, they are able to spend more aggressively on product development, marketing, sales and other product initiatives than we can. Many of these competitors have:

| • | significantly greater name recognition; |

| • | larger and more established distribution networks; |

| • | additional lines of products and the ability to bundle products to offer higher discounts or other incentives to gain a competitive advantage; |

| • | greater experience in conducting research and development, manufacturing, clinical trials, marketing, obtaining regulatory approval and entering into collaboration or other strategic partnership arrangements; and |

| • | greater financial and human resources for product development, sales and marketing and patent litigation. |

Our current and future competitors, including certain of our customers, may at any time develop additional products that compete with our products. If any company develops products that compete with or are superior to our products, our revenue may decline. In addition, some of our competitors may compete by lowering the price of their products. If prices were to fall, we may not be able to improve our gross margins or sales growth sufficiently to maintain and grow our profitability.

Despite our increasingly diversified client base, we have historically depended on, and expect to continue to depend on, a limited number of customers for a high percentage of our revenues.

The loss of, or a significant reduction in orders from, any of our large customers, including following any termination or failure to renew a long-term supply contract, would significantly reduce our revenues and harm our results of operations. If a large customer purchases fewer of our products, defers orders or fails to place additional orders with us for any other reason, including for business continuity purposes, our revenue could decline, and our operating results may not meet market expectations. Under our long-term supply agreements with GE Healthcare (“GE”), we supply Protein A ligands to GE from our manufacturing facilities in Lund, Sweden and Waltham, Massachusetts (the “Lund Agreement” and “Waltham Agreement,” respectively). The Lund Agreement runs pursuant to its terms, through 2019 and the Waltham Agreement runs, pursuant to its terms, through 2021. GE may elect, upon six months’ prior notice to us, to reduce its minimum purchase requirements under the Lund Agreement. Even if GE so elects, GE would still be required to continue to purchase at least 50% of its global demand pursuant to the Waltham Agreement through the expiration of this agreement pursuant to its terms on December 31, 2021.

In addition, if our customers order our products, but fail to pay on time or at all, our liquidity and operating results could be materially and adversely affected. Furthermore, if any of our current or future products compete with those of any of our largest customers, these customers may place fewer orders with us or cease placing orders with us, which would negatively affect our revenues and operating results.

12

Table of Contents

If we are unable to expand our product portfolio, our ability to generate revenue could be adversely affected.

We are increasingly seeking to develop and commercialize our portfolio of products. Our future financial performance will depend, in part, on our ability to successfully develop and acquire additional bioprocessing products. There is no guarantee that we will be able to successfully acquire or develop additional bioprocessing products, and the Company’s financial performance will likely suffer if we are unable to do so.

If intangible assets and goodwill that we recorded in connection with our acquisitions become impaired, we may have to take significant charges against earnings.

In connection with the accounting for our completed acquisitions, we recorded a significant amount of intangible assets, including developed technology and customer relationships relating to the acquired product lines, and goodwill. Under U.S. GAAP, we must assess, at least annually and potentially more frequently, whether the value of intangible assets and goodwill has been impaired. Intangible assets and goodwill will be assessed for impairment in the event of an impairment indicator. Any reduction or impairment of the value of intangible assets and goodwill will result in a charge against earnings, which could materially adversely affect our results of operations and shareholders’ equity in future periods.

Our exposure to political, economic and other risks that arise from operating a multinational business has and may continue to increase.

We operate on a global basis with offices or activities in Japan, South Korea, China, India, Europe and North America. Our operations and sales outside of the United States have increased as a result of our strategic acquisitions and the continued expansion of our commercial organization. Risks related to these increased foreign operations include:

| • | fluctuations in foreign currency exchange rates, which may affect the costs incurred in international operations and could harm our results of operations and financial condition; |

| • | changes in general economic and political conditions in countries where we operate, particularly as a result of ongoing economic instability within foreign jurisdictions; |

| • | the occurrence of a trade war, or other governmental action related to tariffs or trade agreements; |

| • | being subject to complex and restrictive employment and labor laws and regulations, as well as union and works council restrictions; |

| • | changes in tax laws or rulings in the United States or other foreign jurisdictions that may have an adverse impact on our effective tax rate; |

| • | being subject to burdensome foreign laws and regulations, including regulations that may place an increased tax burden on our operations; |

| • | being subject to longer payment cycles from customers and experiencing greater difficulties in timely accounts receivable collections; and |

| • | required compliance with a variety of foreign laws and regulations, such as data privacy requirements, real estate and property laws, anti-competition regulations, import and trade restrictions, export requirements, U.S. laws such as the Foreign Corrupt Practices Act of 1977 and the U.S. Department of Commerce’s Export Administration Regulations, and other U.S. federal laws and regulations established by the office of Foreign Asset Control, local laws such as the U.K. Bribery Act of 2010 or other local laws that prohibit corrupt payments to governmental officials or certain payments or remunerations to customers. |

Our business success depends in part on our ability to anticipate and effectively manage these and other related factors. We cannot assure you that these and other related factors will not materially adversely affect our international operations or business as a whole.

13

Table of Contents

In addition, a deterioration in diplomatic relations between the United States and any country where we conduct business could adversely affect our future operations and lead to a decline in profitability.

We may be unable to efficiently manage our growth as a larger and more geographically diverse organization.

Our strategic acquisitions, the continued expansion of our commercial sales operations, and our organic growth have increased the scope and complexity of our business. As a result, we will face challenges inherent in efficiently managing a more complex business with an increased number of employees over large geographic distances, including the need to implement appropriate systems, policies, benefits and compliance programs. Our inability to manage successfully the geographically more diverse (including from a cultural perspective) and substantially larger combined organization could materially adversely affect our operating results and, as a result, the market price of our common stock.

Our business is subject to a number of environmental risks.

Our manufacturing business involves the controlled use of hazardous materials and chemicals and is therefore subject to numerous environmental and safety laws and regulations and to periodic inspections for possible violations of these laws and regulations. In addition to these hazardous materials and chemicals, our facility in Sweden also uses Staphylococcus aureus and toxins produced by Staphylococcus aureus in some of its manufacturing processes. Staphylococcus aureus and the toxins it produces, particularly enterotoxins, can cause severe illness in humans. The costs of compliance with environmental and safety laws and regulations are significant. Any violations, even if inadvertent or accidental, of current or future environmental and safety laws or regulations and the cost of compliance with any resulting order or fine could adversely affect our operations.

Our acquisitions expose us to risks that could adversely affect our business, and we may not achieve the anticipated benefits of acquisitions of businesses or technologies.

As a part of our growth strategy, we may make selected acquisitions of complementary products and/or businesses. Any acquisition involves numerous risks and operational, financial, and managerial challenges, including the following, any of which could adversely affect our business, financial condition, or results of operations:

| • | difficulties in integrating new operations, technologies, products, and personnel; |

| • | problems maintaining uniform procedures, controls and policies with respect to our financial accounting systems; |

| • | lack of synergies or the inability to realize expected synergies and cost-savings; |

| • | difficulties in managing geographically dispersed operations, including risks associated with entering foreign markets in which we have no or limited prior experience; |

| • | underperformance of any acquired technology, product, or business relative to our expectations and the price we paid; |

| • | negative near-term impacts on financial results after an acquisition, including acquisition-related earnings charges; |

| • | the potential loss of key employees, customers, and strategic partners of acquired companies; |

| • | claims by terminated employees and shareholders of acquired companies or other third parties related to the transaction; |

| • | the assumption or incurrence of additional debt obligations or expenses, or use of substantial portions of our cash; |

14

Table of Contents

| • | the issuance of equity securities to finance or as consideration for any acquisitions that dilute the ownership of our stockholders; |

| • | the issuance of equity securities to finance or as consideration for any acquisitions may not be an option if the price of our common stock is low or volatile which could preclude us from completing any such acquisitions; |

| • | any collaboration, strategic alliance and licensing arrangement may require us to relinquish valuable rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us; |

| • | diversion of management’s attention and company resources from existing operations of the business; |

| • | inconsistencies in standards, controls, procedures, and policies; |

| • | the impairment of intangible assets as a result of technological advancements, or worse-than-expected performance of acquired companies; |

| • | assumption of, or exposure to, historical liabilities of the acquired business, including unknown contingent or similar liabilities that are difficult to identify or accurately quantify; and |

| • | risks associated with acquiring intellectual property, including potential disputes regarding acquired companies’ intellectual property. |

In addition, the successful integration of acquired businesses requires significant efforts and expense across all operational areas, including sales and marketing, research and development, manufacturing, finance, legal, and information technologies. There can be no assurance that any of the acquisitions we may make will be successful or will be, or will remain, profitable. Our failure to successfully address the foregoing risks may prevent us from achieving the anticipated benefits from any acquisition in a reasonable time frame, or at all.

Servicing our debt will require a significant amount of cash, and we may not have sufficient cash flow from our business to make payments on our debt.

We incurred significant indebtedness in the amount of $115.0 million in aggregate principal with additional accrued interest under our 2.125% Convertible Senior Notes due 2021 (the “Notes”). Our ability to make scheduled payments of the principal of, to pay interest on, or to refinance our indebtedness, including the Notes, depends on our future performance, which is subject to economic, financial, competitive and other factors that may be beyond our control. Our business may not generate cash flow from operations in the future sufficient to service our debt and make necessary capital expenditures. If we are unable to generate such cash flow, we may be required to adopt one or more alternatives, such as selling assets, restructuring debt or obtaining additional equity capital on terms that may be onerous or highly dilutive. Our ability to refinance our indebtedness will depend on the capital markets and our financial condition at such time. In addition, in the event of a fundamental change or a default under the Notes, the holders and/or the trustee under the indentures governing the Notes may accelerate the payment obligations or trigger the holders’ repurchase rights under the Notes. We may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result in a default on our debt obligations, including the Notes.

If a make-whole fundamental change, such as an acquisition of our company, occurs prior to the maturity of the Notes, under certain circumstances, the conversion rate for the Notes will increase such that additional shares of our common stock will be issued upon conversion of the Notes in connection with such make-whole fundamental change. The increase in the conversion rate will be determined based on the date on which the make-whole fundamental change occurs or becomes effective and the price paid (or deemed paid) per share of our common stock in such transaction. Upon conversion of the Notes, unless we elect to deliver solely shares of our common stock to settle such conversion (other than paying cash in lieu of delivering any fractional share), we will be required to make cash payments in respect of the Notes being converted. We may not have enough available cash or be able to obtain financing at the time we are required to make repurchases of Notes surrendered therefor or

15

Table of Contents

notes being converted. Our failure to repurchase Notes at a time when the repurchase is required by the indenture or to pay any cash payable on future conversions of the Notes as required by the indenture would constitute a default under the indenture. If the repayment of the related indebtedness were to be accelerated after any applicable notice or grace periods, we may not have sufficient funds to repay the indebtedness and repurchase the notes or make cash payments upon conversions thereof.

In addition, our significant indebtedness, combined with our other financial obligations and contractual commitments, could have other important consequences. For example, it could:

| • | make us more vulnerable to adverse changes in general U.S. and worldwide economic, industry and competitive conditions and adverse changes in government regulation; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and our industry; |

| • | place us at a disadvantage compared to our competitors who have less debt; and |

| • | limit our ability to borrow additional amounts for working capital and other general corporate purposes, including to fund possible acquisitions of, or investments in, complementary businesses, products, services and technologies. |

Any of these factors could materially and adversely affect our business, financial condition and results of operations. In addition, if we incur additional indebtedness, the risks related to our business and our ability to service or repay our indebtedness would increase.

Future strategic transactions or acquisitions may require us to seek additional financing, which we may not be able to secure on favorable terms, if at all.

We plan to continue a strategy of growth and development for our bioprocessing business, and we actively evaluate various strategic transactions on an ongoing basis, including licensing or acquiring complementary products, technologies or businesses that would complement our existing portfolio of development programs. In order to complete such strategic transactions, we may need to seek additional financing to fund these investments and acquisitions. Should we need to do so, we may not be able to secure such financing, or obtain such financing on favorable terms because of the volatile nature of the biotechnology marketplace. In addition, future acquisitions may require the issuance or sale of additional equity or debt securities, which may result in additional dilution to our stockholders.

We rely on a limited number of suppliers or, for certain of our products, one supplier, and we may not be able to find replacements or immediately transition to alternative suppliers, which could have a material adverse effect on our financial condition, results of operations and reputation.

There are only a limited number of suppliers of materials for certain of our products. An interruption in operations of the business related to these products could occur if we encounter delays or difficulties in securing the required materials, or if we cannot then obtain an acceptable substitute. Any such interruption could significantly affect the business related to these products and our financial condition, results of operations and reputation.

For example, we believe that only a small number of suppliers are currently qualified to supply materials for the XCell ATF System. The use of materials furnished by these replacement suppliers would require us to alter our operations related to the XCell ATF System. Transitioning to a new supplier for our products would be time consuming and expensive, may result in interruptions in our operations, could affect the performance specifications of our product lines or could require that we revalidate the materials. There can be no assurance that we will be able to secure alternative materials and bring such materials on line and revalidate them without experiencing interruptions in our workflow. If we should encounter delays or difficulties in securing, reconfiguring or revalidating the materials required for our products, our business related to these products and our financial condition, results of operations and reputation could be adversely affected.

16

Table of Contents

As we evolve from a company dependent on others to commercialize our products to a company selling directly to end users, we may encounter difficulties in expanding our product portfolio and our commercial marketing capabilities.

Prior to 2016, we generated most of our revenues through sales of bioprocessing products to a limited number of life sciences companies, such as GE Healthcare, MilliporeSigma and other individual distributors. However, due in part to our recent strategic acquisitions, an increasing amount of our revenue is attributable to our commercialization of bioprocessing products that we sell directly to end-users, including biopharmaceutical companies and contract manufacturing organizations. This has required and will continue to require us to invest additional resources in our sales and marketing capabilities. We may not be able to attract and retain additional sales and marketing professionals, and the cost of building the sales and marketing function may not generate our anticipated revenue growth. In addition, our sales and marketing efforts may be unsuccessful. Our failure to manage these risks may have a negative impact on our financial condition, or results of operations and may cause our stock price to decline.

If we are unable to obtain or maintain our intellectual property, we may not be able to succeed commercially.

We endeavor to obtain and maintain trade secrets and, to a lesser extent with respect to the products that currently account for a majority of our revenue, patent protection when available in order to protect our products and processes from unauthorized use and to produce a financial return consistent with the significant time and expense required to bring our products to market. Our success will depend, in part, on our ability to:

| • | preserve our trade secrets and know-how; |

| • | operate without infringing the proprietary rights of third parties; |

| • | obtain and maintain patent protection for our products and manufacturing processes; and |

| • | secure any necessary licenses from others on acceptable terms. |

We consider trade secrets, know-how and other forms of market protection to be among the most important elements of our proprietary position, in particular, as it relates to the products that currently account for a majority of our revenue. We also own or have exclusive rights to a number of U.S. patents and U.S. pending patent applications as well as corresponding foreign patents and patent applications. We continue to actively and selectively pursue patent protection and seek to expand our patent estate, particularly for our products currently in development, and we cannot be sure that any patent applications that we will file in the future or that any currently pending applications will issue on a timely basis, if ever. We cannot be certain that we were the first to make the inventions covered by each of our pending patent applications or that we were the first to file patent applications for such inventions. Even if patents are issued, the degree of protection afforded by such patents will depend upon the:

| • | scope of the patent claims; |

| • | validity and enforceability of the claims obtained in such patents; and |

| • | our willingness and financial ability to enforce and/or defend them. |

The patent position of life sciences companies is often highly uncertain and usually involves complex legal and scientific questions. Patents which may be granted to us in certain foreign countries may be subject to opposition proceedings brought by third parties or result in suits by us, which may be costly and result in adverse consequences for us.

In some cases, litigation or other proceedings may be necessary to assert claims of infringement, to enforce patents issued to us or our licensors, to protect trade secrets, know-how or other intellectual property rights we own or to determine the scope and validity of the proprietary rights of third parties. Such litigation could result in

17

Table of Contents

substantial cost to us and diversion of our resources. An adverse outcome in any such litigation or proceeding could have a material adverse effect on our business, financial condition and results of operations. If our competitors prepare and file patent applications in the United States that claim technology also claimed by us, we may be required to participate in interference proceedings declared by the U.S. Patent and Trademark Office to determine priority of invention, which would result in substantial costs to us.

While one of our U.S. patents covering recombinant Protein A had its term adjusted to expire in 2028, our other U.S. patents covering recombinant Protein A have expired, and as a result, we may face increased competition, which could harm our results of operations, financial condition, cash flow and future prospects.

Other companies could begin manufacturing and selling native or some of the commercial forms of recombinant Protein A in the United States and may directly compete with us on certain Protein A products. This may induce us to sell Protein A at lower prices and may erode our market share, which could adversely affect our results of operations, financial condition, cash flow and future prospects.

Our freedom to develop our products may be challenged by others, and we may have to engage in litigation to determine the scope and validity of competitors’ patents and proprietary rights, which, if we do not prevail, could harm our business, results of operations, financial condition, cash flow and future prospects.

There has been substantial litigation and other proceedings regarding the complex patent and other intellectual property rights in the life sciences industry. We have been a party to, and in the future may become a party to, patent litigation or other proceedings regarding intellectual property rights.

Other types of situations in which we may become involved in patent litigation or other intellectual property proceedings include:

| • | We may initiate litigation or other proceedings against third parties to seek to invalidate the patents held by such third parties or to obtain a judgment that our products or services do not infringe such third parties’ patents. |

| • | We may initiate litigation or other proceedings against third parties to seek to enforce our patents against infringement. |

| • | If our competitors file patent applications that claim technology also claimed by us, we may participate in interference or opposition proceedings to determine the priority of invention. |

| • | If third-parties initiate litigation claiming that our processes or products infringe their patent or other intellectual property rights, we will need to defend against such claims. |

The cost to us of any patent litigation or other proceeding, even if resolved in our favor, could be substantial. Some of our competitors may be able to sustain the cost of such litigation or proceedings more effectively than we can because of their substantially greater financial resources. If a patent litigation or other intellectual property proceeding is resolved in a way that is unfavorable to us, we or our collaborative or strategic partners may be enjoined from manufacturing or selling our products and services without a license from the other party and be held liable for significant damages. The failure to obtain any required license on commercially acceptable terms or at all may harm our business, results of operations, financial condition, cash flow and future prospects.

Uncertainties resulting from the initiation and continuation of patent litigation or other proceedings could have a material adverse effect on our ability to compete in the marketplace. Patent litigation and other proceedings may also absorb significant management time, attention and resources.

18

Table of Contents

We may become involved in litigation or other proceedings with collaborative partners, which may be time consuming, costly and could result in delays in our development and commercialization efforts.

In connection with the Company’s decision to focus its efforts on the growth of its core bioprocessing business, we sought development and commercialization partnerships for our remaining portfolio of clinical stage assets. Any disputes with such partners that lead to litigation or similar proceedings may result in us incurring legal expenses, as well as facing potential legal liability. Such disputes, litigation or other proceedings are also time consuming and may cause delays in our development and commercialization efforts. If we fail to resolve these disputes quickly and with terms that are no less favorable to us than the current terms of the arrangements, our business, results of operations, financial condition, cash flow and future prospects may be harmed.

If we are unable to continue to hire and retain skilled personnel, then we will have trouble developing and marketing our products.

Our success depends largely upon the continued service of our management and scientific staff and our ability to attract, retain and motivate highly skilled technical, scientific, management and marketing personnel. We also face significant competition in the hiring and retention of such personnel from other companies, research and academic institutions, government and other organizations who have superior funding and resources. The loss of key personnel or our inability to hire and retain skilled personnel could materially adversely affect our product development efforts and our business.

The market may not be receptive to our new bioprocessing products upon their introduction.

We expect a portion of our future revenue growth to come from introducing new bioprocessing products, including line extensions and new features for our OPUS disposable chromatography columns, our XCell ATF System, our SIUS TFF product line, our Spectrum hollow fiber modules and TFF systems and our growth factors. The commercial success of all of our products will depend upon their acceptance by the life science and biopharmaceutical industries. Many of the bioprocessing products that we are developing are based upon new technologies or approaches. As a result, there can be no assurance that these new products, even if successfully developed and introduced, will be accepted by customers. If customers do not adopt our new products and technologies, our results of operations may suffer and, as a result, the market price of our common stock may decline.

Our products are subject to quality control requirements.

Whether a product is produced by us or purchased from outside suppliers, it is subjected to quality control procedures, including the verification of porosity and with certain products, the complete validation for good manufacturing practices, U.S. Food and Drug Administration, CE and ISO 2001 compliance, prior to final packaging. Quality control is performed by a staff of technicians utilizing calibrated equipment. In the event we, or our manufacturers, produce products that fail to comply with required quality standards, it may incur delays in fulfilling orders, write-downs, damage to our reputation and damages resulting from product liability claims.

If our products do not perform as expected or the reliability of the technology on which our products are based is questioned, we could experience lost revenue, delayed or reduced market acceptance of our products, increased costs and damage to our reputation.

Our success depends on the market’s confidence that we can provide reliable, high-quality bioprocessing products. We believe that customers in our target markets are likely to be particularly sensitive to product defects and errors. Our reputation and the public image of our products and technologies may be impaired if our products fail to perform as expected. Although our products are tested prior to shipment, defects or errors could nonetheless occur in our products. Furthermore, the Protein A that we manufacture is subsequently incorporated into products that are sold by other life sciences companies and we have no control over the manufacture and

19

Table of Contents

production of those products. In the future, if our products experience, or are perceived to experience, a material defect or error, this could result in loss or delay of revenues, delayed market acceptance, damaged reputation, diversion of development resources, legal claims, increased insurance costs or increased service and warranty costs, any of which could harm our business. Such defects or errors could also narrow the scope of the use of our products, which could hinder our success in the market. Even after any underlying concerns or problems are resolved, any lingering concerns in our target market regarding our technology or any manufacturing defects or performance errors in our products could continue to result in lost revenue, delayed market acceptance, damaged reputation, increased service and warranty costs and claims against us.

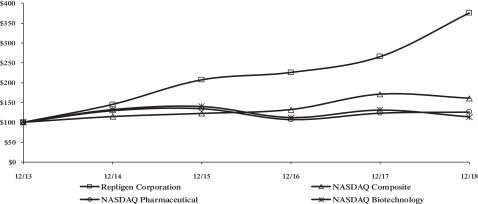

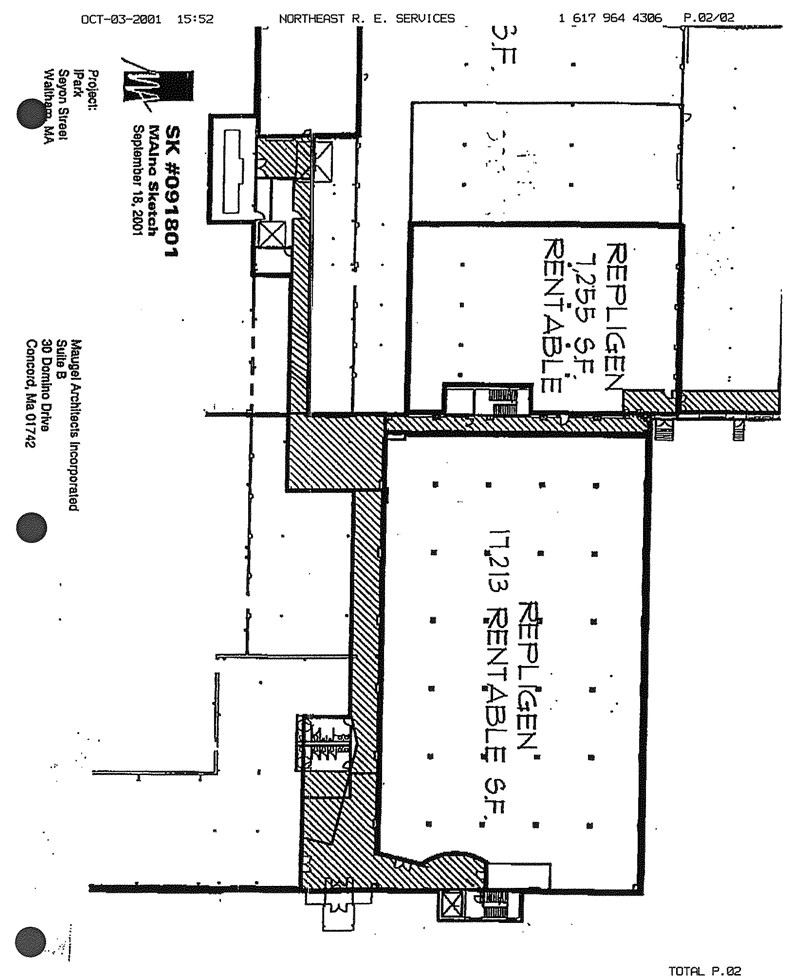

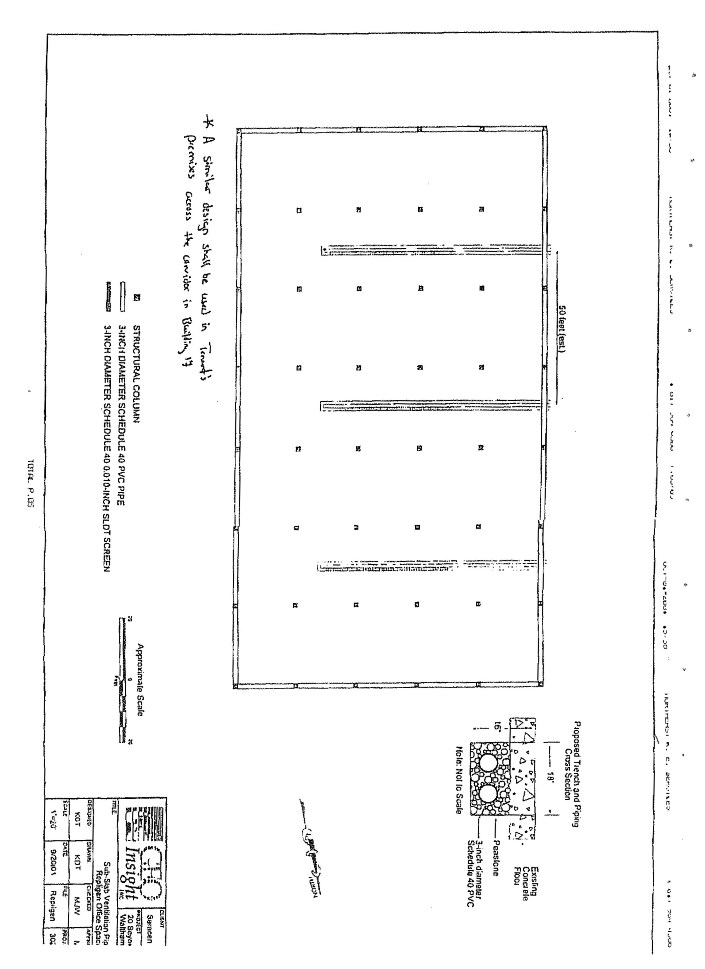

If we are unable to manufacture our products in sufficient quantities and in a timely manner, our operating results will be harmed, our ability to generate revenue could be diminished and our gross margin may be negatively impacted.