Form 10-K Dyne Therapeutics, Inc. For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number: 001-39509

Dyne Therapeutics, Inc.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

36-4883909 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

830 Winter Street Waltham, Massachusetts |

02451 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (781) 786-8230

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, $0.0001 par value per share |

|

DYN |

|

Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

As of June 30, 2020, the last business day of the Registrant’s most recently completed second fiscal quarter, there was no public market for the Registrant’s common stock. The Registrant’s common stock began trading on the Nasdaq Global Select Market on September 17, 2020. The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on Nasdaq Global Select Market on February 26, 2021, was $552,278,064.

The number of shares of Registrant’s Common Stock outstanding as of February 26, 2021 was 51,457,555.

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant intends to file a definitive proxy statement pursuant to Regulation 14A relating to the 2021 Annual Meeting of Stockholders within 120 days of the end of the Registrant’s fiscal year ended December 31, 2020. Portions of such definitive proxy statement are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated herein.

Table of Contents

|

|

|

Page |

|

|

|

|

|

Item 1. |

2 |

|

|

Item 1A. |

60 |

|

|

Item 1B. |

124 |

|

|

Item 2. |

124 |

|

|

Item 3. |

124 |

|

|

Item 4. |

124 |

|

|

|

|

|

|

|

|

|

|

Item 5. |

125 |

|

|

Item 6. |

126 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

127 |

|

Item 7A. |

139 |

|

|

Item 8. |

139 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

139 |

|

Item 9A. |

139 |

|

|

Item 9B. |

139 |

|

|

|

|

|

|

|

|

|

|

Item 10. |

140 |

|

|

Item 11. |

140 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

140 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

140 |

|

Item 14. |

140 |

|

|

|

|

|

|

|

|

|

|

Item 15. |

141 |

|

|

Item 16 |

144 |

i

Cautionary Note Regarding Forward-Looking Statements and Industry Data

This Annual Report on Form 10-K contains forward-looking statements that involve substantial risks and uncertainties. All statements within the meaning of the U.S. Private Securities Litigation Reform Act and Section 21E of the Securities Exchange Act of 1934, as amended, other than statements of historical fact, contained in this Annual Report on Form 10-K, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “continue” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “would,” or the negative of these words or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this Annual Report on Form 10-K include, among other things, statements about:

|

|

• |

the initiation, timing, progress and results of our research and development programs and preclinical studies and clinical trials; |

|

|

• |

the anticipated timing of the submission of investigational new drug applications, or INDs, for any product candidates we develop; |

|

|

• |

the impact of the ongoing COVID-19 pandemic and our response to it; |

|

|

• |

our estimates regarding expenses, future revenue, capital requirements, need for additional financing and the period over which we believe our cash, cash equivalents and marketable securities, will be sufficient to fund our operating expenses and capital expenditure requirements; |

|

|

• |

our plans to develop and, if approved, subsequently commercialize any product candidates we may develop; |

|

|

• |

the timing of and our ability to submit applications for, obtain and maintain regulatory approvals for any product candidates we may develop; |

|

|

• |

the potential advantages of our FORCE platform; |

|

|

• |

our estimates regarding the potential addressable patient populations for our programs; |

|

|

• |

our commercialization, marketing and manufacturing capabilities and strategy; |

|

|

• |

our intellectual property position and our expectations regarding our ability to obtain and maintain intellectual property protection; |

|

|

• |

our ability to identify additional products, product candidates or technologies with significant commercial potential that are consistent with our commercial objectives; |

|

|

• |

the impact of government laws and regulations; |

|

|

• |

our competitive position and expectations regarding developments and projections relating to our competitors and any competing therapies that are or become available; |

|

|

• |

developments and expectations regarding developments and projections relating to our competitors and our industry; |

|

|

• |

our ability to establish and maintain collaborations or obtain additional funding; and |

|

|

• |

our expectations regarding the time during which we will be an emerging growth company under the JOBS Act. |

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this Annual Report on Form 10-K, particularly in Item 1A. “Risk Factors” in this Annual Report on Form 10-K, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Moreover, we operate in a competitive and rapidly changing environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to

ii

predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, collaborations, joint ventures or investments we may make or enter into.

You should read this Annual Report on Form 10-K and the documents that we have filed or incorporated by reference as exhibits to this Annual Report on Form 10-K with the understanding that our actual future results may be materially different from what we expect. The forward-looking statements contained in this Annual Report on Form 10-K are made as of the date of this Annual Report on Form 10-K, and we do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

This Annual Report on Form 10-K includes statistical and other industry and market data that we obtained from independent industry publications and research, surveys and studies conducted by independent third parties as well as our own estimates of the prevalence of certain diseases and conditions. The market data used in this Annual Report on Form 10-K involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Our estimates of the patient population with the potential to benefit from treatment with any product candidates we may develop include several key assumptions based on our industry knowledge, industry publications, third-party research and other surveys, which may be based on a small sample size and may fail to accurately reflect the addressable patient population. While we believe that our internal assumptions are reasonable, no independent source has verified such assumptions.

iii

Risk Factor Summary

Our business is subject to a number of risks that, if realized, could materially affect our business, prospects, operating results and financial condition. These risks are discussed more fully in the “Risk Factors” section of this Annual Report on Form 10-K. These risks include, but are not limited to, the following:

|

|

• |

our limited operating history may make it difficult to evaluate the success of our business to date and to assess our future viability; |

|

|

• |

we are very early in our development efforts. We have not initiated IND-enabling studies or identified any product candidates for clinical development, and as a result it will be many years before we commercialize a product candidate, if ever. If we are unable to identify and advance product candidates through preclinical studies and clinical trials, obtain marketing approval and ultimately commercialize them, or experience significant delays in doing so, our business will be materially harmed; |

|

|

• |

we may encounter substantial delays in commencement, enrollment or completion of our clinical trials or we may fail to demonstrate safety and efficacy to the satisfaction of applicable regulatory authorities, which could prevent us from commercializing any product candidates we determine to develop on a timely basis, if at all; |

|

|

• |

our approach to the discovery and development of product candidates based on our FORCE platform is unproven, and we may not be successful in our efforts to identify, discover or develop potential product candidates; |

|

|

• |

the outcome of preclinical studies and earlier-stage clinical trials may not be predictive of future results or the success of later preclinical studies and clinical trials; |

|

|

• |

if any product candidates we may develop cause undesirable side effects or have other unexpected adverse properties, such side effects or properties could delay or prevent regulatory approval, limit the commercial potential or result in significant negative consequences following any potential marketing approval; |

|

|

• |

we rely, and expect to continue to rely, on third parties to conduct some or all aspects of our product manufacturing, research, preclinical and clinical testing, and these third parties may not perform satisfactorily; |

|

|

• |

we face substantial competition, which may result in others discovering, developing or commercializing products before us or more successfully than we do; |

|

|

• |

our rights to develop and commercialize any product candidates are subject and may in the future be subject, in part, to the terms and conditions of licenses granted to us by third parties. If we fail to comply with our obligations under current or future intellectual property license agreements or otherwise experience disruptions to our business relationships with our current or any future licensors, we could lose intellectual property rights that are important to our business; |

|

|

• |

if we or our licensors are unable to obtain, maintain and defend patent and other intellectual property protection for any product candidates or technology, or if the scope of the patent or other intellectual property protection obtained is not sufficiently broad, our competitors could develop and commercialize products and technology similar or identical to ours, and our ability to successfully develop and commercialize any product candidates we may develop or our technology may be adversely affected due to such competition; and |

|

|

• |

the COVID-19 pandemic may affect our ability to initiate and complete preclinical studies, delay the initiation of our planned clinical trial or future clinical trials, disrupt regulatory activities, or have other adverse effects on our business and operations. In addition, this pandemic has caused substantial disruption in the financial markets and may adversely impact economies worldwide, which could negatively impact our operations. |

iv

Overview

We are building a leading muscle disease company focused on advancing innovative life-transforming therapeutics for patients with genetically driven diseases. We are utilizing our proprietary FORCE platform to overcome the current limitations of muscle tissue delivery and advance modern oligonucleotide therapeutics for muscle diseases. Our proprietary FORCE platform therapeutics consist of an oligonucleotide payload that we rationally design to target the genetic basis of the disease we are seeking to treat, a clinically validated linker and an antigen-binding fragment, or Fab, that we attach to the payload using the linker. With our FORCE platform, we have the flexibility to deploy different types of oligonucleotide payloads with specific mechanisms of action that modify target functions. We leverage this modularity to focus on muscle diseases with high unmet need, with etiologic targets and with clear translational potential from preclinical disease models to well-defined clinical development and regulatory pathways. Using our FORCE platform, we are assembling a broad portfolio of muscle disease therapeutics, including our lead programs in myotonic dystrophy type 1, or DM1, Duchenne muscular dystrophy, or DMD, and facioscapulohumeral dystrophy, or FSHD. In addition, we plan to expand our portfolio through development efforts focused on rare skeletal muscle diseases, as well as cardiac and metabolic muscle diseases, including some with larger patient populations. Our programs are currently all in the preclinical stage. We expect to submit investigational new drug, or IND, applications to the U.S. Food and Drug Administration, or FDA, for product candidates in each of our DM1, DMD and FSHD programs between the fourth quarter of 2021 and the fourth quarter of 2022.

Oligonucleotide therapeutics are a genetic medicine modality that, using nucleic acids, specifically aims to correct the function of disease-causing genes by either degrading the target gene or modifying expression of a target protein. While some oligonucleotide therapeutics have been approved, the development of oligonucleotide therapeutics has been limited by challenges in the delivery of the oligonucleotide to the tissue that requires therapy. To overcome these limitations, our FORCE platform utilizes the importance of Transferrin 1 receptor, or TfR1, in muscle biology as the foundation of our novel approach of linking therapeutic payloads to our TfR1-binding Fab to deliver targeted therapeutics for muscle diseases. TfR1, which is highly expressed on the surface of muscle cells, is required for iron transport into muscle cells, and evidence to date suggests that there are no other proteins that can substitute for TfR1 function. We believe our FORCE platform may provide several advantages, including targeted delivery to muscle tissue, extended durability, redosable administration and potent targeting of the genetic basis of disease to stop or reverse disease progression.

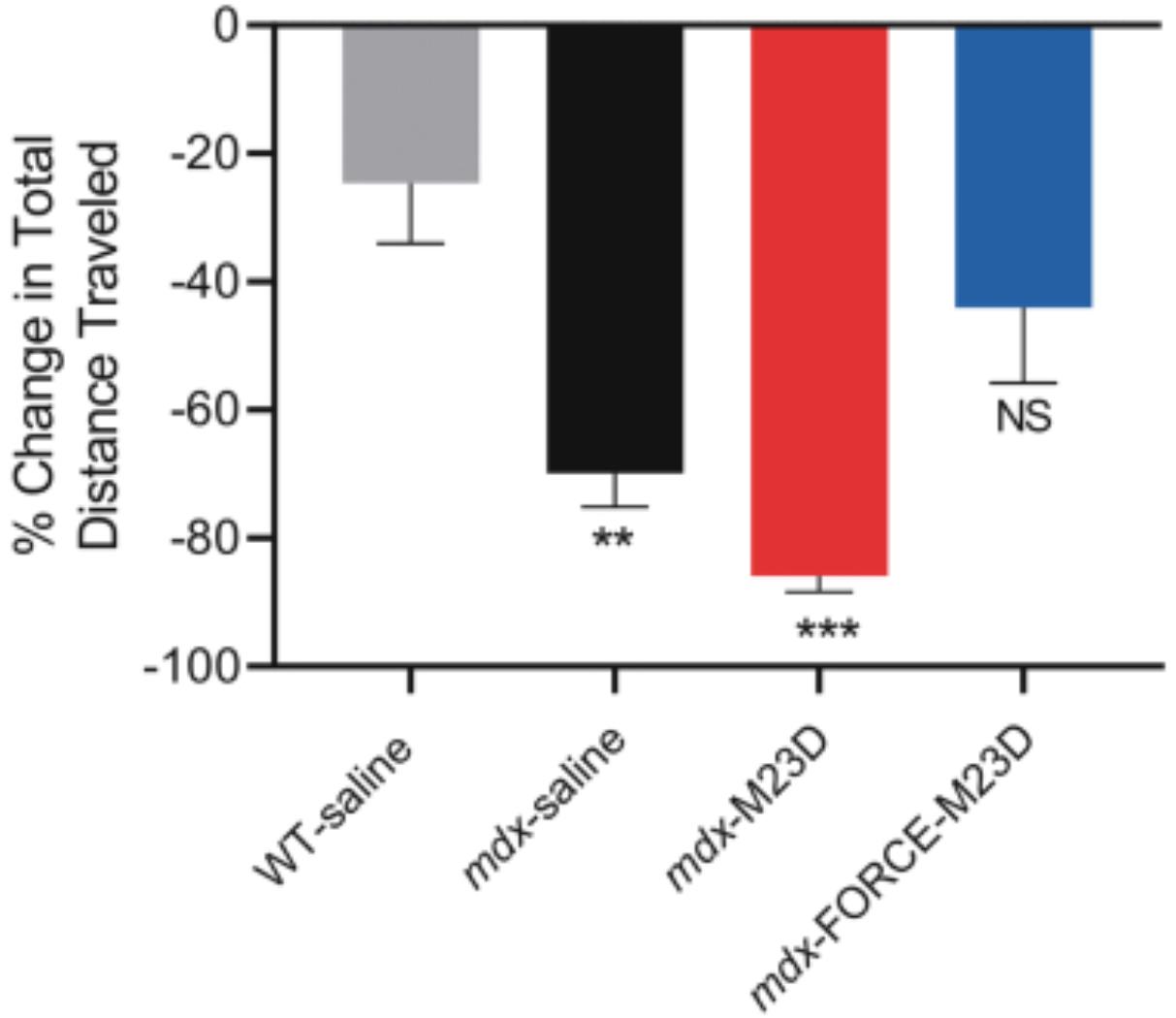

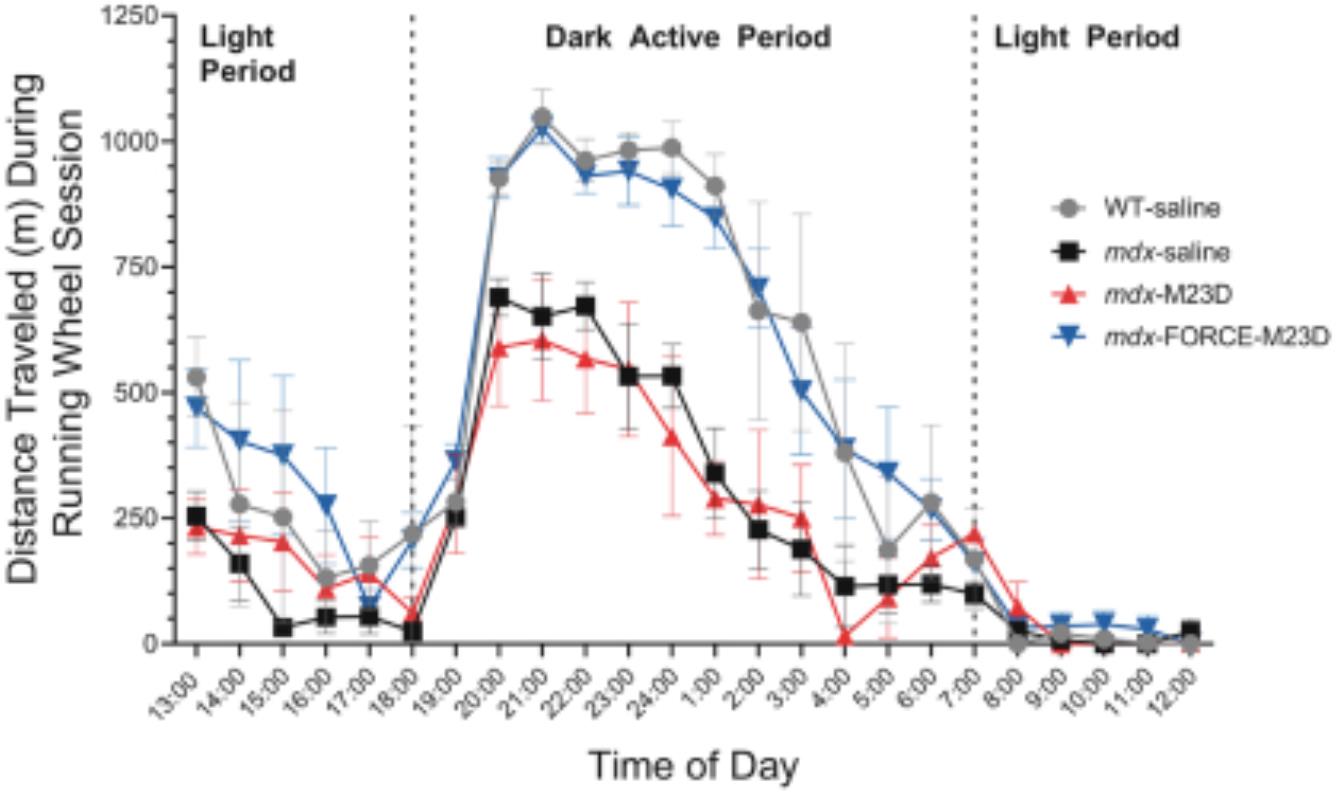

Our approach

We have designed our proprietary FORCE platform using our deep knowledge of muscle biology and oligonucleotide therapeutics. We have demonstrated proof-of-concept of our FORCE platform in multiple in vitro and in vivo studies. In murine and non-human primate studies, we have delivered antisense oligonucleotides, or ASOs, and phosphorodiamidate morpholino oligomers, or PMOs, to genetic targets within muscle tissue and observed durable, disease-modifying, functional benefit in preclinical models of disease. For instance, in our DM1 program, we observed almost complete reversal of myotonia after a single dose in the HSA-LR mouse DM1 model and reductions in levels of DMPK in wild-type, or WT, mice for up to 12 weeks after a single dose, and in our DMD program, we observed increased muscle function four weeks after a single dose in the mdx mouse DMD model that mirrored levels of muscle function in a control cohort of healthy, wild-type mice.

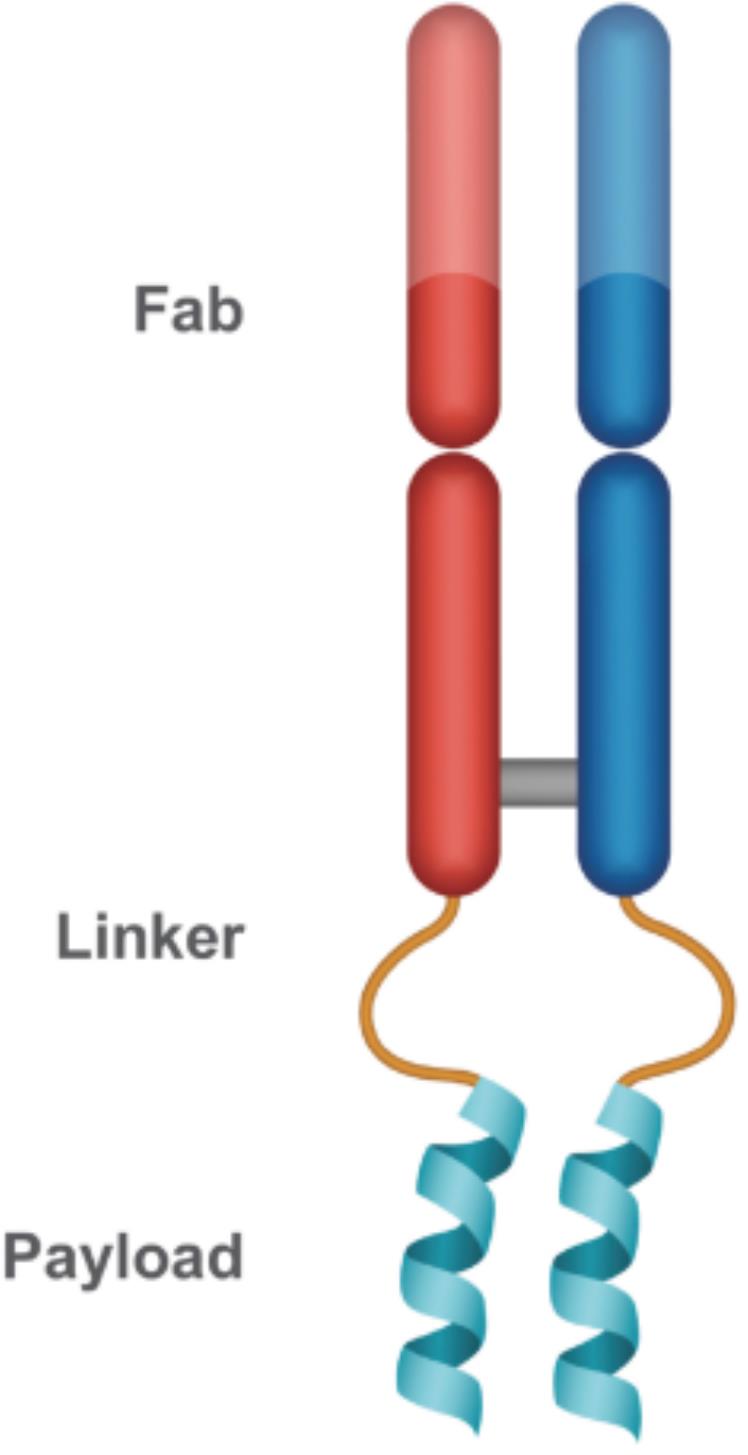

Our therapeutics consist of three essential components: a proprietary Fab, a clinically validated linker and an oligonucleotide payload that we attach to our Fab using the linker.

Proprietary antibody (Fab)

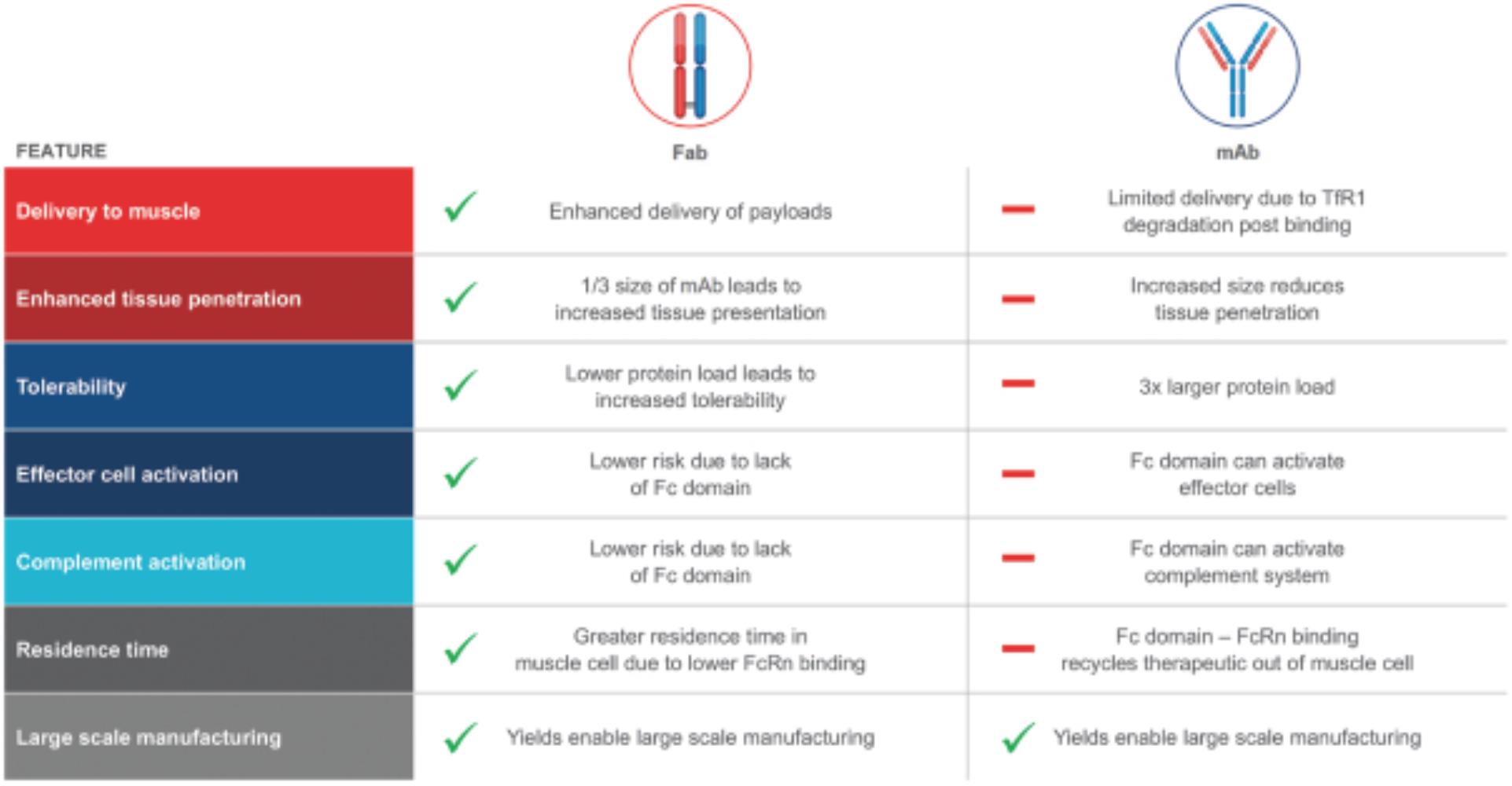

Our proprietary Fabs are engineered to bind to TfR1 to enable targeted delivery of nucleic acids and other molecules to skeletal, cardiac and smooth muscle. A Fab is the region of an antibody that binds to

2

antigens. We selected a Fab antibody over monoclonal antibodies, or mAbs, due to its potential significant advantages when targeting TfR1 to enable muscle delivery, including enhanced tissue penetration, increased tolerability due to lower protein load and reduced risk of immune system activation due to the lack of the Fc domain on the Fab. The Fc domain is the portion of an antibody that interacts with the immune system. To identify the proprietary Fab we plan to use in our product candidates, we generated and screened proprietary antibodies for selectivity to TfR1 in order to enhance muscle specificity and for binding to TfR1 without interfering with the receptor’s function of transporting iron into cells. These proprietary antibodies were also screened to minimize competition with transferrin binding and interference of iron uptake in targeted muscle cells.

Clinically validated linker

The role of the linker is to connect, or conjugate, the Fab and the oligonucleotide payload. As a result, it is critical that the linker maintain stability in serum and provide release kinetics that favor sufficient payload accumulation in the targeted muscle cell. We have selected the Val-Cit linker as the linker for our FORCE platform based on its clinically validated safety and efficacy in approved products, its serum stability and its endosomal release attributes. Additionally, our linker and conjugation chemistry allow us to optimize the ratio of payload molecules attached to the Fab for each type of payload. We believe that our linker and conjugation chemistry will enable us to rapidly design, produce and screen molecules to enable new muscle disease programs.

Optimized payload

With our FORCE platform, we have the flexibility to deploy different types of therapeutic payloads with specific mechanisms of action that modify target functions. Using this modularity, we rationally select the therapeutic payload for each program to match the biology of the target, with the aim of addressing the genetic basis of disease and stopping or reversing disease progression.

Advantages of our FORCE platform

Our FORCE platform is designed to deliver disease-modifying therapeutics for a broad portfolio of serious muscle diseases. We believe that our FORCE platform may provide the following potential advantages:

|

|

• |

Targeted delivery to muscle tissue; |

|

|

• |

Potent targeting of the genetic basis of disease to stop or reverse disease progression; |

|

|

• |

Enhanced tolerability; |

|

|

• |

Extended durability; |

|

|

• |

Redosable administration; |

|

|

• |

Well-established and scalable manufacturing; and |

|

|

• |

Accelerated and efficient development enabled by use of a single Fab and linker across all of our programs. |

3

Our portfolio

We are building a pipeline of programs to address genetically-driven muscle diseases with high unmet need with etiologic targets. Our initial focus is on DM1, DMD and FSHD with potential pipeline expansion opportunities in additional rare skeletal muscle diseases, as well as cardiac and metabolic muscle diseases. In selecting diseases to target with our FORCE platform, we seek diseases with clear translational potential from preclinical disease models to well-defined clinical development and regulatory pathways. We have global commercial rights to all of our programs.

DM1 program overview

Our DM1 program is focused on the development of a potentially disease-modifying treatment for DM1. DM1 is a monogenic, autosomal dominant, progressive disease that affects skeletal, cardiac and smooth muscle, resulting in significant physical, cognitive and behavioral impairments and disability. There are currently no disease-modifying therapies to treat DM1 that are approved or in clinical development. DM1 is caused by an abnormal CTG triplet repeat expansion in a region of the DMPK gene and it is estimated to have a genetic prevalence of 1 in 2,500 to 1 in 8,000 people in the United States and Europe, affecting over 40,000 people in the United States and over 74,000 people in Europe. Our program candidates consist of a proprietary TfR1-binding Fab conjugated using our linker to an ASO that is designed to address the genetic basis of DM1 by reducing the levels of mutant DMPK RNA in the nucleus, releasing splicing proteins, allowing normal mRNA processing and translation of normal proteins, and potentially stopping or reversing disease. In preclinical studies, we have observed reduction of nuclear foci and correction of splicing in DM1 patient cells, reduction of toxic human nuclear DMPK in a DM1 mouse model developed by us, reversal of myotonia after a single dose in a separate DM1 mouse disease model which demonstrates a DM1 phenotype, durability of response up to 12 weeks in WT mice and enhanced muscle distribution as evidenced by reduced levels of cytoplasmic WT DMPK RNA in non-human primates. We expect to submit an IND to the FDA for a product candidate in our DM1 program as one of the three INDs we expect to submit between the fourth quarter of 2021 and the fourth quarter of 2022.

DMD program overview

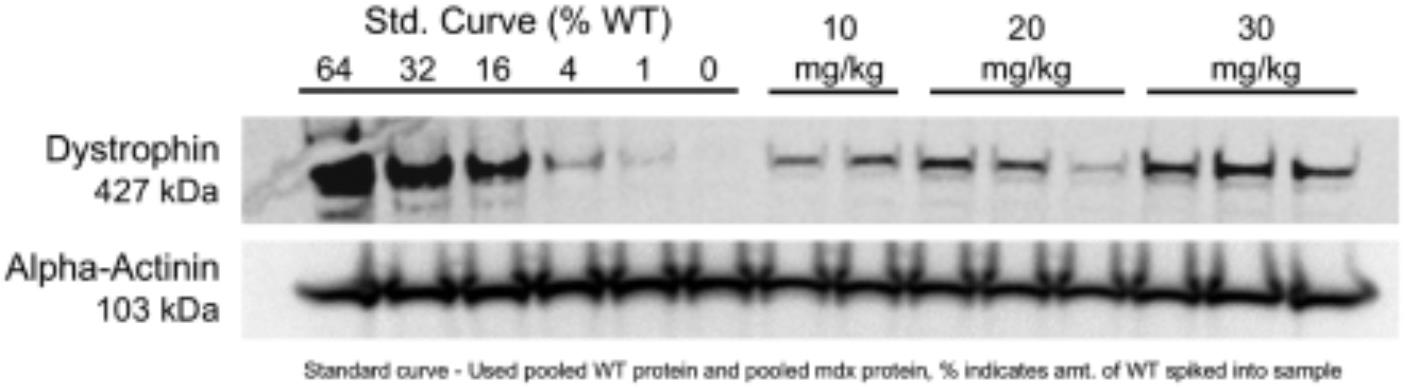

Our DMD program is focused on the development of potentially disease-modifying treatments for DMD. DMD is a monogenic, X-linked disease caused by mutations in the gene that encodes for the dystrophin protein. In patients with DMD, mutations in the dystrophin gene lead to certain exons being misread resulting in the loss of function of the dystrophin protein, muscle cell death and progressive loss of muscle function. We estimate that DMD occurs in approximately one in every 3,500 to 5,000 live male births and that the patient population is approximately 12,000 to 15,000 in the United States and approximately 25,000 in Europe. We are developing program candidates to address the genetic basis of DMD by delivering a PMO to muscle tissue to promote the skipping of specific DMD exons in the nucleus, allowing muscle cells to create a more complete, functional dystrophin protein and potentially stop or reverse disease progression. In in vitro and in vivo preclinical studies, our PMOs when conjugated to a Fab targeting TfR1 have shown increased exon skipping, increased dystrophin expression, reduced muscle

4

damage and increased muscle function. We are seeking to build a DMD franchise by initially focusing on the development of a therapeutic for patients with mutations amenable to skipping Exon 51, to be followed by the development of therapeutics for patients with mutations amenable to skipping other exons, including Exon 53, 45 and 44. We expect to submit an IND to the FDA for a product candidate in our Exon 51 skipping program as one of the three INDs we expect to submit between the fourth quarter of 2021 and the fourth quarter of 2022.

FSHD program overview

Our FSHD program is focused on the development of a potentially disease-modifying therapy for FSHD. FSHD is an autosomal dominant muscular dystrophy characterized by progressive skeletal muscle loss, resulting in significant physical impairments and disability. FSHD is caused by aberrant expression of the double homeobox 4, or DUX4, gene in muscle tissue, which leads to death of muscle and replacement by fat. There are no approved treatments for FSHD. We estimate the patient population is between 16,000 and 38,000 in the United States and approximately 35,000 in Europe. Our FSHD program candidates consist of our proprietary TfR1-binding Fab conjugated using our linker to an ASO that is designed to address the genetic basis of FSHD by reducing DUX4 expression in muscle tissue. In preclinical studies, we observed that administration of our proprietary ASO conjugated to a Fab targeting TfR1 reduced expression of key DUX4 biomarkers in FSHD patient myotubes. We expect to submit an IND to the FDA for a product candidate in our FSHD program as one of the three INDs we expect to submit between the fourth quarter of 2021 and the fourth quarter of 2022.

Discovery programs overview

We intend to utilize our FORCE platform to expand our portfolio by pursuing the development of programs in additional indications, including additional rare skeletal muscle diseases, as well as cardiac and metabolic muscle diseases. By rationally selecting therapeutic payloads to conjugate with our proprietary Fab and linker, we believe we can develop product candidates to address the genetic basis of additional muscle diseases. We have completed screening and identified potent ASO and siRNA payloads against a number of cardiac and metabolic targets. In addition to our muscle disease portfolio, we believe there is an opportunity to leverage our TfR1 antibody expertise to develop novel antibodies that cross the blood-brain barrier and deliver therapeutics to the central nervous system, or CNS, tissue through systemic intravenous administration.

Our strategy

Our goal is to become the leading muscle disease company by advancing innovative life-transforming therapeutics for genetically driven diseases. To accomplish this, we intend to continue building a team that shares our commitment to patients, to continue to enhance our platform and to advance our pipeline. The key elements of our strategy are to:

|

|

• |

Advance our lead programs in DM1, DMD and FSHD to clinical proof-of-concept and approval to offer meaningful benefit to patients. We are developing our lead programs for the treatment of DM1, DMD and FSHD. By applying our FORCE platform, we are able to optimize product candidates for each indication based on extensive preclinical data, including disease-specific models and biomarkers, thus enhancing the probability of clinical success of our programs. Our immediate focus is on our programs for DM1 and DMD followed by our program for FSHD, and we expect to submit INDs to the FDA for product candidates in each of our DM1, DMD and FSHD programs between the fourth quarter of 2021 and the fourth quarter of 2022. We intend to conduct our clinical studies in a genetically-defined patient population and to leverage learnings from other therapeutics in clinical development or approved by the FDA to inform the clinical and regulatory pathways for our programs. We believe our DM1, DMD and FSHD programs have the potential to stop or reverse the progression of the disease and offer meaningful benefit to patients in need. |

|

|

• |

Establish a DMD franchise by expanding our DMD program to reach additional DMD patient populations. We are developing our DMD program to treat the genetic basis of DMD. Approximately 80% of patients with DMD have mutations amenable to exon skipping in the |

5

|

|

nucleus. Exons 51, 53, 45 and 44 represent nearly half of the total mutations observed in DMD that are amenable to exon skipping. We are seeking to build a DMD franchise by initially focusing on the development of a therapeutic for patients with mutations amenable to skipping Exon 51, to be followed by the development of therapeutics for patients with mutations amenable to skipping other exons, including Exons 53, 45 and 44. |

|

|

• |

Expand our pipeline of therapeutics for muscle diseases to fully exploit the potential of our proprietary FORCE platform. Our FORCE platform leverages the pivotal role played by TfR1 in muscle biology as the foundation of our novel approach of linking therapeutic payloads to TfR1-targeted Fabs to deliver precision therapeutics for muscle diseases. We believe there are many muscle diseases with significant unmet need and we aim to expand our portfolio by pursuing additional programs where our FORCE platform could improve clinical efficacy relative to current therapeutic approaches. We have completed screening and identified potent ASO and siRNA payloads against a number of cardiac and metabolic targets. In addition to our muscle disease portfolio, we believe there is an opportunity to leverage our TfR1 antibody expertise to develop novel antibodies that cross the blood-brain barrier and deliver therapeutics to CNS tissue through systemic intravenous administration. |

|

|

• |

Selectively enter into strategic collaborations to maximize the value of our pipeline and our proprietary FORCE platform. Given the potential of our platform to generate novel product candidates addressing a wide variety of muscle diseases, we may opportunistically enter into strategic collaborations around certain targets, programs or muscle tissues. We may seek strategic collaborations where we believe we can utilize our FORCE platform to enhance delivery of third-party payloads to muscle tissue. We may also explore collaboration arrangements to commercialize any product candidates where we believe the resources and expertise of the third party could be beneficial. These collaborations could advance and accelerate our programs to maximize their market potential and expand our FORCE platform capabilities. |

|

|

• |

Build a sustainable leadership position in muscle diseases with a deep connection to patients, caregivers, the research community and physicians. We have global commercial rights to all of our programs and intend to build a fully integrated biotechnology company and independently pursue the development and commercialization of our lead programs. Our mission is to expand our portfolio into a wide range of muscle diseases and become a leader in this area by advancing life-transforming therapeutics for patients with serious muscle diseases. To achieve this, we plan to continue to evaluate and invest in enhancing our platform and technologies that may accelerate the development of our therapeutics, to build out our capabilities to commercialize our therapeutics on our own and to cultivate a strong network with patient advocacy groups and thought leaders. |

Our culture and team

We have established a patient-focused culture that drives our shared mission of developing life-transforming therapeutics for patients with serious muscle diseases. Our shared definition of success is simple: we do what we say we are going to do. We keep our commitments to patients, employees and Dyne stakeholders. We endeavor to act with integrity and transparency.

Our management team is led by Joshua Brumm, our President and Chief Executive Officer, who brings over 15 years of leadership experience with life sciences companies; Romesh Subramanian, Ph.D., our Chief Scientific Officer and Founder, who is an expert in nucleic acid, antibody and peptide therapeutic development as well as delivery platforms with 20 years of experience across pharmaceutical and biotechnology companies; Susanna High, our Chief Operating Officer, who has more than two decades of experience leading corporate strategy, portfolio management, business planning and operations for biotechnology companies; and Oxana Beskrovnaya, Ph.D., our Senior Vice President, Head of Research, who has extensive experience in musculoskeletal and renal research. Our organization is comprised of 47 talented individuals with significant experience across discovery, preclinical research, manufacturing, clinical development and operations. We have also established scientific and clinical advisory boards comprised of leading experts in the fields of muscle disease drug discovery and development and nucleic

6

acid therapeutics, who share our mission of delivering disease-modifying therapeutics for patients with serious muscle diseases.

Genetic medicines background

Overview

Each person’s genetic material, or genome, consists of deoxyribonucleic acid, or DNA, in sequences of genetic code called genes. A genetic disease is caused by a change, or a mutation, in an individual’s DNA sequence. Genetic diseases can be caused by a mutation in a single gene, known as a monogenic disorder, or by mutations in multiple genes, known as a multifactorial inheritance disorder. Current estimates suggest that there are more than 10,000 monogenic diseases. Many of these are rare muscle diseases, affecting thousands of patients worldwide, such as DM1, DMD and FSHD. There are also a number of more prevalent genetic muscle diseases, including many types of cardiac disease.

Genetic medicines are designed to correct disease-causing dysfunction at the genetic level and include multiple therapeutic modalities, such as oligonucleotide therapeutics, including ASOs and siRNAs, viral gene therapy and small molecules. Significant progress has been made in the field of genetic medicine over the last decade as a number of genetic medicines have been approved or are in clinical development. However, the nature and fundamental limitations of these genetic medicines, such as poor tissue specificity, reduced efficacy, unknown durability and immunogenicity, make them poorly suited to effectively address the majority of genetic muscle diseases.

Viral gene therapy, in which viral vectors are employed to deliver therapeutic genes to defective cells or tissues, has made significant progress in the past decade. The most advanced method for systemic administration is adeno-associated virus, or AAV, gene therapy, which has demonstrated durable transduction of cells in several organ systems, with long-lasting expression in non-dividing cells. Several AAV gene therapy products have been approved, including LUXTURNA (voretigene neparvovec-rzyl) for the treatment of biallelic RPE65 mutation-associated retinal dystrophy, a rare inherited blindness disorder, and ZOLGENSMA (onasemnogene abeparvovec-xioi) for spinal muscular atrophy, and a number of AAV gene therapy products are in clinical development for muscle diseases, including microdystrophin gene therapy candidates for DMD.

However, current AAV gene therapy has significant limitations, including:

|

|

• |

Limited durability: AAV gene therapies, which are administered in a single dose, have shown limited durability. This limited durability is problematic because following a single dose of AAV, antibodies are induced against the AAV capsid, the protein shell of the virus used for delivery, with the result that the therapy cannot be re-administered after the first dose. |

|

|

• |

Pre-existing immunity: Up to half of patients have antibodies against AAV due to naturally acquired infections. These antibodies prevent them from receiving AAV gene therapy due to pre-existing AAV immunity to the capsid encapsulating the transgene. |

|

|

• |

Variable safety profile: Multiple clinical trials have reported significant adverse events associated with systemic administration of AAV to treat muscle diseases, particularly at higher doses. |

|

|

• |

Limited payload capacity: AAV constructs are limited to 4.7 kb in length, restricting both the size of genes and complexity of regulatory sequences that can be delivered. For example, AAV payload capacity prevents the delivery of the full dystrophin gene. As a result, AAV gene therapies being developed for DMD use a microdystrophin, a smaller, less complete version of the dystrophin protein, as the therapeutic payload. |

|

|

• |

Off-target, multi-tissue delivery: Due to the inherent nature of AAVs, off-target delivery to unintended tissues and cell-types can lead to adverse events. |

|

|

• |

Limited manufacturing scale: The production systems for AAV gene therapies are limited in scale to 2,000 liters per batch or less. In general, the high doses required by AAV gene therapies and the low productivity of these systems combine to limit treatment to rare disease populations at a higher cost relative to other treatment modalities. |

7

Evolution of oligonucleotide therapeutics

Oligonucleotide therapeutics are a genetic medicine modality that, using nucleic acids, specifically aims to correct the function of disease-causing genes by either degrading the disease-causing gene or modifying expression of a gene or a protein. Oligonucleotides are rationally designed genetic medicines which have demonstrated clinical benefit and been approved for marketing in multiple diseases, such as spinal muscular atrophy, elevated cholesterol and hereditary transthyretin-mediated amyloidosis. Oligonucleotides are designed based on genomic data, using Watson-Crick base pairing rules, to bind to and decrease or modify the expression of specific disease-causing RNA or proteins which ultimately results in disease modification.

Oligonucleotide therapeutics include single-stranded nucleic acids, known as antisense oligonucleotides or ASOs, as well as double-stranded nucleic acids, known as small interfering RNA, or siRNAs. The ASOs are generally less than 30 nucleobases in length. ASOs can have either charged nucleobases or uncharged bases. ASOs with uncharged bases are referred to as phosphorodiamidate morpholinos oligomers, or PMOs. The charged nucleobases impart an overall negative charge to ASOs that enhances their ability to cross membranes and enter into cells without the assistance of a delivery formulation. Once inside the cell, the charged ASOs can degrade RNA if they are gapmers, which have a DNA region in the center flanked by RNA wings, by recruiting the RNAseH1 enzyme to cleave heteroduplexes of DNA and RNA. ASOs can also alter splicing or exon skipping if they are non-gapmers. ASOs are functional in the nucleus and the cytoplasm. In contrast, a PMO is neutral in charge and unable to enter into cells without a delivery enhancement. PMOs are capable of exon skipping and are functional in the nucleus. In addition to ASOs and PMOs, siRNAs are a third type of oligonucleotide therapy which are generally less than 23 nucleobases in length and are a negatively charged duplex molecule comprised of a guide strand and a passenger strand. In order to modulate RNA or protein expressions, siRNAs need to be loaded into an RNA-induced silencing complex which is generally present in the cytoplasm but not the nucleus.

While some oligonucleotide therapeutics have been approved, the development of oligonucleotide therapeutics has been limited by challenges in the delivery of the oligonucleotide to the tissue that requires therapy. These challenges have been particularly evident in the delivery of oligonucleotides to muscle tissue. Unconjugated, or naked, oligonucleotides bind non-specifically to plasma proteins which increases their plasma half-life and circulation time through filtering organs such as the liver and kidney, leading the oligonucleotides to accumulate primarily in the liver and kidney, and resulting in increased toxicity in these organs. As a result, many oligonucleotide therapeutics are limited to organs where direct delivery to the target organ can be an effective approach, such as intravitreal administration in the retina or intrathecal administration in the central nervous system. There have been efforts to enhance delivery of siRNAs to tissue by utilizing lipid nanoparticles, or LNPs, and other encapsulation vehicles. Although these approaches can increase the effectiveness of an siRNA therapeutic, they are largely limited to filtering organs such as the liver and kidney and increase the safety risk of the therapeutic. Despite these limitations, both naked ASOs and encapsulated siRNAs have been approved and commercialized.

Subsequent efforts using targeted delivery of ASOs or siRNAs have demonstrated that conjugation to a delivery moiety can effectively deliver these compounds to target tissues and provide significant health benefits to patients. For instance, third-party developers have leveraged proteins on cell surfaces to enhance the delivery of oligonucleotides using a process called receptor-mediated uptake. These developers have conjugated sugar molecules referred to as GalNAcs to oligonucleotides in order to engage asiaglycoprotein, or ASGPR, a transporter protein expressed primarily on the surface of liver cells, and facilitate intracellular delivery of oligonucleotide therapeutics, resulting in increased target engagement as compared to naked oligonucleotides. The emerging preclinical and clinical data around the GalNAc-ASGPR approach and recent FDA approval of GIVLAARI (givosiran) and OXLUMO (lumasiran), which use this approach, supports receptor-mediated uptake as a delivery strategy for oligonucleotide therapeutics.

8

In order to increase the uptake of oligonucleotides, third-party developers have also used antibody conjugates as a means of delivering oligonucleotides into cells. Antibodies are naturally occurring proteins produced by the immune system that first identify and then neutralize or clear antigens, such as bacteria, viruses and other substances, by selectively binding to these foreign substances. Antibodies can be engineered for desired characteristics, such as high selectivity and high affinity for their target cell surface proteins and antibody format, such as mAb or Fab, in order to facilitate the delivery of oligonucleotide therapeutics into those cells. The use of engineered antibodies as a conjugate to oligonucleotide therapeutics is being studied for the delivery of oligonucleotides to muscle tissue and tumors.

Developers have sought to use the TfR1 receptor, which is highly expressed on the surface of muscle cells, to deliver oligonucleotides to muscle tissue. TfR1 is required for iron transport into muscle cells, and evidence to date suggests that there are no other proteins that can substitute for TfR1 function. For instance, in third-party studies, a conditional knock-out of TfR1 in cardiac muscle was lethal in mice, and a conditional knock-out of TfR1 in skeletal muscle resulted in significant metabolic imbalance in mice. These studies provide evidence that TfR1 is critical for muscle function. However, we believe that previous efforts to develop muscle disease therapeutics based on TfR1-mediated delivery have been unsuccessful because receptor-mediated uptake requires the optimization of each component of the conjugate molecule (the antibody, the linker and the oligonucleotide), which has not yet been achieved.

Our FORCE platform utilizes the importance of TfR1 in muscle biology as the foundation of our novel approach of linking therapeutic payloads to TfR1-targeted Fabs to deliver targeted therapeutics for muscle diseases.

Our approach

We are using our proprietary FORCE platform to develop targeted, life-transforming therapeutics for serious muscle diseases. We have designed our proprietary FORCE platform using our deep knowledge of muscle biology and oligonucleotide therapeutics with the goal of overcoming the current limitations of muscle tissue delivery and advancing modern oligonucleotide therapeutics for muscle diseases. Our therapeutics consist of three essential components: a proprietary Fab, a clinically validated linker and an oligonucleotide payload that we attach to our Fab using the linker. We engineered our proprietary Fab to bind to TfR1 to enable targeted delivery to skeletal, cardiac and smooth muscle. We selected the linker for our platform based on its clinically validated safety and efficacy in approved products, its serum stability and its ability to release the therapeutic payload within the muscle cell. Finally, we attach the Fab and linker to a therapeutic payload that can be an ASO, siRNA, PMO or small molecule that we rationally select to target the genetic basis of disease to potentially stop or reverse disease progression.

We have demonstrated proof-of-concept of our FORCE platform in multiple in vitro and in vivo studies. In murine and non-human primate (NHP) studies, we have delivered ASOs and PMOs to genetic targets within muscle tissue and observed durable, disease-modifying, functional benefit in preclinical models of disease. For instance, in our DM1 program, we observed almost complete reversal of myotonia after a single dose in the HSA-LR mouse DM1 model, reduction of toxic human nuclear DMPK in a hTfR1/DMSXL DM1 mouse model developed by us and reductions in levels of DMPK in WT mice for up to 12 weeks after a single dose, and in our DMD program, we observed increased muscle function four weeks after a single dose in the mdx mouse DMD model that mirrored levels of muscle function in a control cohort of healthy, wild-type mice.

The following graphic illustrates the three components of our therapeutics:

9

FORCE platform

Proprietary antibody (Fab)

Our proprietary Fabs are engineered to bind to TfR1 to enable targeted delivery of nucleic acids and other molecules to skeletal, cardiac and smooth muscle. A Fab is the region of an antibody that binds to antigens. Although we have engineered a number of Fabs, we plan to use the same Fab to target TfR1 across all of our muscle programs. We chose to develop our programs using a Fab rather than using mAbs because we believe Fabs provide the following potential significant advantages:

10

Potential advantages of Fabs targeting TfR1

To identify the proprietary Fab we plan to use in our product candidates, we generated and screened proprietary antibodies for selectivity to TfR1 in order to enhance muscle specificity and for binding to TfR1 without interfering with the receptor’s function of transporting iron into cells.

Clinically validated linker

The role of the linker is to connect the Fab and the oligonucleotide therapy. As a result, it is critical that the linker maintain stability in serum and provide release kinetics that favor sufficient payload accumulation in the targeted muscle cell. We have selected the Val-Cit linker for our FORCE platform based on its clinically validated safety and efficacy in approved products, its serum stability and its endosomal release attributes. As shown in the figure below, serum stability of our linker was comparable across multiple species, showing at least 75% stability measured at 72 hours after intravenous dosing.

Serum stability of linker >75% at 72 hours

We believe that serum stability is necessary to enable systemic intravenous administration, stability of the conjugated oligonucleotide in the bloodstream, delivery to muscle tissue and internalization of the

11

therapeutic payload in the muscle cells. In preclinical studies, our Val-Cit linker facilitated precise conjugation of multiple types of payloads to our proprietary Fabs, including ASOs, siRNAs and PMOs. This flexibility enables us to rationally select the appropriate type of payload to address the genetic basis of each muscle disease. Additionally, our linker and conjugation chemistry allow us to optimize the ratio of payload molecules attached to each Fab for each type of payload. We believe that our linker and conjugation chemistry will enable us to rapidly design, produce and screen molecules to enable new muscle disease programs.

Optimized payload

With our FORCE platform, we have the flexibility to deploy different types of therapeutic payloads with specific mechanisms of action that modify target functions. Using this modularity, we rationally select the therapeutic payload for each program to match the biology of the target, with the aim of addressing the genetic basis of disease and stopping or reversing disease progression. For instance, in our DM1 program, where the genetic driver of DM1 is mutant DMPK pre-mRNA located in the nucleus, we have determined to use an ASO because ASOs have advantages in degrading RNA in the nucleus when compared to siRNAs. In the case of our DMD program, we are utilizing an exon skipping PMO payload with the goal of enhancing dystrophin expression. In the case of certain cardiac and metabolic programs where the genetic targets are focused in the cytoplasm, we have engineered proprietary siRNA payloads to reduce the expression of these cytoplasmic targets.

Advantages of our FORCE platform

We are using our FORCE platform to develop disease-modifying therapeutics for a broad portfolio of serious muscle diseases. We believe that these therapeutics may provide the following potential advantages:

|

|

• |

Targeted delivery to muscle tissue: Using our FORCE platform, we are designing our oligonucleotide therapeutics to leverage TfR1 expression on skeletal, cardiac and smooth muscle cells to deliver muscle-targeted therapeutics to benefit patients with serious muscle disease. |

|

|

• |

Potent targeting of the genetic basis of disease: The flexibility of our FORCE platform allows us to deploy different types of payloads with specific mechanisms of action to modify target function. This enables us to rationally select payloads that match the biology of the target, with the aim of addressing the genetic basis of disease and stopping or reversing disease progression. |

|

|

• |

Enhanced tolerability: We engineered our Fabs to enhance the tolerability of oligonucleotide therapeutics by limiting systemic drug exposure through targeted delivery of potent therapeutic payloads to muscle tissue. Additionally, we engineered our Fabs to minimize competition with transferrin binding and interference of iron uptake in targeted muscle cells. |

|

|

• |

Extended durability: Our program candidates have demonstrated in preclinical studies the ability to deliver oligonucleotides to muscle cells at concentrations that we believe could produce prolonged disease-modifying pharmacodynamic effects. We believe that the potential durability of our program candidates may enable less frequent dosing of patients. |

|

|

• |

Redosable administration: Our program candidates are engineered to be redosable, not just administered one time, which may enable individualized patient titration to reach the desired level of therapeutic expression and to potentially maintain efficacy throughout a patient’s life. |

|

|

• |

Well-established and scalable manufacturing: Our program candidates can be manufactured using well-established and scalable methods for manufacturing antibodies, linkers and oligonucleotides. In addition, we expect our manufacturing costs will be reduced by our use of the same Fab and linker in each product candidate we develop. |

|

|

• |

Accelerated and efficient development: We believe our use of a single Fab and linker across all of our programs reduces the development risk and cost of each product candidate and enables us to more quickly expand our portfolio of programs through either internally or externally developed payloads as the focus of our development will remain with the selection and optimization of each program-specific therapeutic payload. |

12

Our portfolio

Our mission is to develop life-transforming medicines for patients with serious muscle diseases. We are creating a pipeline of programs to address diseases with high unmet need with etiologic targets. Our initial focus is on DM1, DMD and FSHD with potential pipeline expansion opportunities in additional rare skeletal muscle diseases, as well as cardiac and metabolic muscle diseases. In selecting diseases to target with our FORCE platform, we seek diseases with clear translational potential from preclinical disease models to well-defined clinical development and regulatory pathways, and where we believe that we would be able to commercialize any products that we develop and are approved with an efficient, targeted sales force. We have global commercial rights to all of our programs.

Myotonic dystrophy type 1 (DM1)

Overview

We are developing program candidates under our DM1 program to address the genetic basis of DM1 by targeting the toxic nuclear DMPK RNA that causes the disease. Our DM1 program is designed to deliver an ASO to muscle tissue to reduce the accumulation of DMPK pre-mRNA in the nucleus, release splicing proteins and potentially stop or reverse disease progression. In in vitro and in vivo preclinical studies, our ASOs when conjugated to Fabs targeting TfR1 have shown reduction in nuclear foci, correction of splicing changes, reversal of myotonia, which is a neuromuscular condition in which the relaxation of a muscle is impaired, and enhanced muscle distribution as evidenced by reduced levels of cytoplasmic wild type, or WT, DMPK RNA. We anticipate submitting an IND to the FDA for a product candidate in our DM1 program as one of the three INDs we expect to submit between the fourth quarter of 2021 and the fourth quarter of 2022.

Disease overview and prevalence

DM1 is a monogenic, autosomal dominant, progressive disease that primarily affects skeletal, cardiac and smooth muscles. DM1 patients can suffer from various manifestations of the disease including myotonia, muscle weakness, cardiac arrhythmias, respiratory problems, fatigue, cardiac abnormalities, gastrointestinal, or GI, complications, early cataracts and cognitive and behavioral impairment.

DM1 is caused by an abnormal expansion in a region of the DMPK gene. Specifically, DM1 is caused by an increase in the number of CTG triplet repeats found in the 3’ non-coding region of the DMPK gene. The number of repeats ranges from up to approximately 35 in healthy individuals to many thousands in DM1 patients. The higher than normal number of triplet repeats form large hairpin loops that entrap the DMPK pre-mRNA in the nucleus and impart toxic activity, referred to as a toxic gain-of-function mutation. The mutant DMPK pre-mRNA sequesters in the nucleus, forming nuclear foci that bind splicing proteins. This inhibits the ability of splicing proteins to perform their normal function in the nucleus of guiding pre-mRNA processing of gene transcripts from many other genes. As a result, multiple pre-mRNAs that encode key proteins are mis-spliced. This mis-splicing in the nucleus results in the translation of atypical proteins which ultimately cause the clinical presentation of DM1. When nuclear DMPK levels are reduced, the nuclear foci that bind splicing proteins are diminished, releasing splicing proteins, allowing normal mRNA processing and translation of normal proteins, and potentially stopping or reversing disease progression. This disease process is illustrated below:

13

DM1: Genetic basis and clinical presentation

DM1 is estimated to have a genetic prevalence of 1 in 2,500 to 1 in 8,000 people in the United States and Europe, affecting over 40,000 people in the United States and over 74,000 people in Europe. However, we believe that the patient population is currently underdiagnosed due to lack of available therapies as is observed for other rare diseases. DM1 is highly variable with respect to disease severity, presentation and age of onset.

We are advancing our own efforts to better characterize the actual DM1 patient population through a natural history study that we are sponsoring. We believe that the introduction of new therapies for DM1 will cause the diagnosis rate to improve, resulting in an increase in the overall prevalence estimates for the disease. Based on age of onset and severity of symptoms, DM1 is typically categorized into four overlapping phenotypes: late-onset; classical (adult-onset); childhood; and congenital (cDM1):

Overview of DM1 phenotypes

|

|

|

|

|

|

Phenotype |

Clinical presentation |

Estimated % of DM1 patients |

Age of onset |

|

Late-onset |

•Myotonia •Muscle weakness •Cataracts |

10% |

40 - 70 years |

|

Classical (Adult-onset) |

•Muscle weakness and wasting •Myotonia •Cardiac conduction abnormalities •Respiratory insufficiency •Fatigue/Excessive daytime sleepiness •GI disturbance •Cataracts |

65% |

Early teens - 50 years |

|

Childhood |

•Psychological problems •Low IQ •Incontinence |

15% |

1 - 10 years |

|

Congenital (cDM1) |

•Infantile hypotonia •Severe generalized weakness •Respiratory deficits •Intellectual disability •Classic signs present in adults |

10% |

Birth |

|

|

|||

14

All DM1 phenotypes, except the late-onset form, are associated with high levels of disease burden and premature mortality. The clinical course of DM1 is progressive, and may become extremely disabling, especially when more generalized limb weakness and respiratory muscle involvement develops. Systemic manifestations such as fatigue, GI complications, cataracts and excessive daytime sleepiness greatly impact a patient’s quality of life. As a result, DM1 leads to physical impairment, activity limitations and decreased participation in social activities and work. Excluding congenital DM1 deaths, life expectancy ranges from 45 years to 60 years. Approximately 80% of early mortality is caused by cardiorespiratory complications. Respiratory failure due to muscle weakness (especially diaphragmatic weakness) causes at least 50% of early mortality, and cardiac abnormalities, including sudden death, account for approximately 30% of early mortality.

Current approaches and limitations

There are currently no disease-modifying therapies to treat DM1 that are approved or in clinical development, and treatment is focused largely on symptom management or palliative therapies. There are a number of product candidates in development, including product candidates in late stage clinical development that also are focused on symptom management or palliative therapies and do not target toxic nuclear DMPK RNA, which is the genetic basis of the disease. There remains a high unmet medical need for new disease-modifying therapies.

Our approach

Our program is designed to address the genetic basis of DM1 by targeting the toxic nuclear DMPK RNA that is the cause of the disease. We are developing program candidates linking our proprietary Fab to a proprietary ASO to address the genetic basis of DM1 by reducing the levels of mutant DMPK RNA in the nucleus, thereby releasing splicing proteins, allowing normal mRNA processing and translation of normal proteins, and potentially stopping or reversing disease progression. We expect that the proprietary ASO will be a gapmer oligonucleotide that is designed to translocate to the nucleus, bind its complementary sequence on the DMPK RNA, recruit RNAseH1 to degrade DMPK RNA and thus reduce toxic nuclear DMPK RNA. We have chosen to develop our program candidates for DM1 with an ASO because single-stranded ASOs preferentially target nuclear RNAs, which is essential for degradation of toxic nuclear DMPK RNA.

Another company previously attempted to develop a naked ASO to treat DM1 but discontinued its program due to challenges related to delivery. Specifically, the program was unable to reach the oligonucleotide muscle tissue concentration required to reduce nuclear DMPK levels, correct splicing abnormalities and address the clinical presentation. The other company believed there was a need to focus on more potent delivery to muscle. We believe that our FORCE platform has the potential to overcome the limitations faced by the other company and address the genetic basis of DM1 by achieving enhanced delivery of therapeutic ASOs to muscle.

Preclinical data

We are conducting preclinical studies of our ASOs conjugated to Fabs targeting TfR1 in DM1 patient cells and in the HSA-LR DM1 mouse model, which are disease models in which toxic RNA is observed. In in vitro and in vivo preclinical studies, our conjugated ASOs have shown reduction of nuclear foci, correction of splicing changes and reversal of myotonia in disease models, reduction of toxic human nuclear DMPK in a hTfR1/DMSXL DM1 mouse model developed by us, as well as enhanced muscle distribution as evidenced by reduced levels of cytoplasmic WT DMPK RNA. We believe these data support the potential for our oligonucleotide therapy to be a disease-modifying therapy for patients with DM1.

Reduction of nuclear foci

In preclinical studies in DM1 patient cells that contained toxic nuclear DMPK RNA, we observed that administration of an ASO conjugated to a Fab targeting TfR1 resulted in reduction of nuclear foci. In DM1, the higher than normal number of CUG repeats form large hairpin loops that remain trapped in the nucleus, forming nuclear foci that bind splicing proteins and inhibit the ability of splicing proteins to perform their normal function. When toxic nuclear DMPK levels are reduced, the nuclear foci are

15

diminished, releasing splicing proteins, allowing restoration of normal mRNA processing, and potentially stopping or reversing disease progression. As illustrated in the figure below, in this study in DM1 patient cells, a single dose of conjugated ASO (shown as Dyne in the figure below) reduced nuclear DMPK foci as determined through a fluorescence in situ hybridization (FISH) analysis. The reduced nuclear DMPK foci are indicated by the reduction in red punctate staining in the figure below for Dyne as compared to a saline control (shown as PBS). We believe the approximately 40% reduction in nuclear foci observed in this study supports the potential for our approach to advance a disease-modifying therapy for patients with DM1.

FORCE targeted nuclear DMPK and reduced nuclear foci in DM1 patient cells

Correction of splicing

In preclinical studies in DM1 patient cells that contained toxic nuclear DMPK RNA, we observed that administration of an ASO conjugated to a Fab targeting TfR1 resulted in correction of splicing of downstream RNAs such as Bridging Integrator Protein 1, or BIN1. Toxic DMPK RNA in the nucleus binds splicing proteins, inhibiting splicing protein function, and thereby reducing Exon 11 in BIN1 RNA. As illustrated in the figure below, in this study in DM1 patient cells, a single dose of the conjugated ASO (shown as Dyne in the figure) resulted in a statistically significant increase (p < 0.001) in Exon 11 inclusion compared to saline (shown as PBS), indicating that our conjugated ASO had reduced toxic DMPK RNA in the nucleus, causing the release of splicing proteins and the correction of BIN1 splicing. A p-value is a conventional statistical method for measuring the statistical significance of study results. A p-value of less than 0.05 is generally considered to represent statistical significance, meaning that there is a less than 5% likelihood that the observed results occurred by chance.

16

FORCE targeted nuclear DMPK and corrected BIN1 splicing in DM1 patient cells

*** P < 0.001

We have also observed correction of splicing in the HSA-LR DM1 mouse model. The HSA-LR DM1 mouse model is a well-validated model of DM1 that exhibits pathologies that are very similar to human DM1 patients. This model accumulates toxic RNA with triplet repeats within the nucleus and sequesters proteins responsible for splicing such as Muscleblind-like Protein, or MBNL, thus causing mis-splicing of multiple RNAs such as CLCN1 (chloride channel) and Atp2a1 (calcium channel), among others. This mis-splicing causes the mice to exhibit myotonia, which is a hallmark of the DM1 clinical presentation in humans.

In blinded preclinical studies, single doses of one of our ASOs conjugated to a Fab targeting TfR1 delivered intravenously demonstrated dose-dependent correction of splicing in multiple RNAs and multiple muscles and was well tolerated by HSA-LR mice. In these studies, we tested the ability of the conjugated ASO to correct splicing in more than 30 different RNAs that are critical for contraction and relaxation of muscle in HSA-LR mice and observed dose-dependent correction of splicing. In DM1, significant RNA mis-splicing of these RNAs reduces muscle function.

The first figure below presents the data from these studies with respect to the Atp2a1 RNA, which encodes a calcium channel and contributes to muscle contraction and relaxation. The X-axis in the figure below represents splice derangement with 1.00 on the right side of the figure representing severe mis-splicing and 0.00 on the left side of the figure representing a normal or WT splice pattern. Hence, progression from right to left on the X-axis in the figure represents a correction of splicing. The Y-axis of the figure below represents the percent of the gene spliced in, or PSI. Severe mis-splicing of Atp2a1 is caused by the lack of Exon 22 inclusion in the Atp2a1 RNA as reflected in a PS1 close to 0.00, while WT splicing reflects near complete inclusion of Exon 22 as reflected in a PSI close to 1.00. Accordingly, the blue dots in the figure indicate a near-WT splicing pattern and near-WT Exon 22 inclusion. As the figure shows, our conjugated ASO (shown as Dyne) corrected splicing of Atp2a1 in a dose-dependent manner in the gastrocnemius muscle. Two doses were administered in this study in order to evaluate dose dependence.

The second figure below presents the same data from these studies with respect to the more than 30 different RNAs that were tested, showing similar dose-dependent correction of splicing for all of the tested

17

RNAs in gastrocnemius muscle. For some of these RNAs, correction of splicing toward WT reflects an increase in PSI, like Atp2a1 RNA in the first figure below, and for others it reflects a decrease in PSI.

FORCE dose-dependently corrected Atp2a1 splicing in HSA-LR DM1 mouse model

FORCE dose-dependently corrected splicing in multiple RNAs in HSA-LR DM1 mouse model

In addition to the dose-dependent changes shown in the gastrocnemius muscle, we also observed similar dose-dependent correction of splicing across the same panel of RNAs in the quadriceps and tibialis anterior muscles.

18

The figure below presents the levels of splicing derangement observed for saline and different doses of one of our conjugated ASOs, presented on a composite basis across the more than 30 RNAs that we tested in each muscle type.

FORCE dose-dependently corrected splicing in multiple muscles in HSA-LR DM1 mouse model

Reversal of myotonia

In addition to these reductions in splicing derangement across multiple genes and muscles in the HSA-LR model, we observed in the HSA-LR model disease modification and almost complete reversal of myotonia after a single dose (20 mg/kg) of one of our ASOs conjugated to a Fab targeting TfR1. As shown in the figure below, we evaluated the severity of myotonia on a four-point scale 14 days following dosing with saline (PBS), naked ASO and the conjugated ASO, with grade 0 representing no myotonia, grade 1 representing myotonic discharge as measured by electromyography (EMG) in less than 50% of needle insertions, grade 2 representing myotonic discharge in greater than 50% of needle insertions and grade 3 representing myotonic discharge with nearly every needle insertion. We conducted this evaluation in quadriceps, gastrocnemius and tibialis anterior muscles.

19

Single dose of FORCE reversed myotonia in HSA-LR DM1 mouse model

Separately, in a third-party study of a naked ASO conducted in the same HSA-LR model by the company that discontinued its program due to delivery challenges, reductions in myotonia were observed after one month following eight 25 mg/kg doses of a naked ASO administered biweekly for a total dose of 200 mg/kg.

We believe the correction of splicing and reduction of myotonia we observed in our studies show that the intravenously administered ASO conjugated to a Fab was internalized into multiple muscles, enabling the ASO payload to enter the nucleus and degrade toxic DMPK RNA, thereby releasing splicing proteins to correct splicing of multiple RNAs and reverse myotonia.

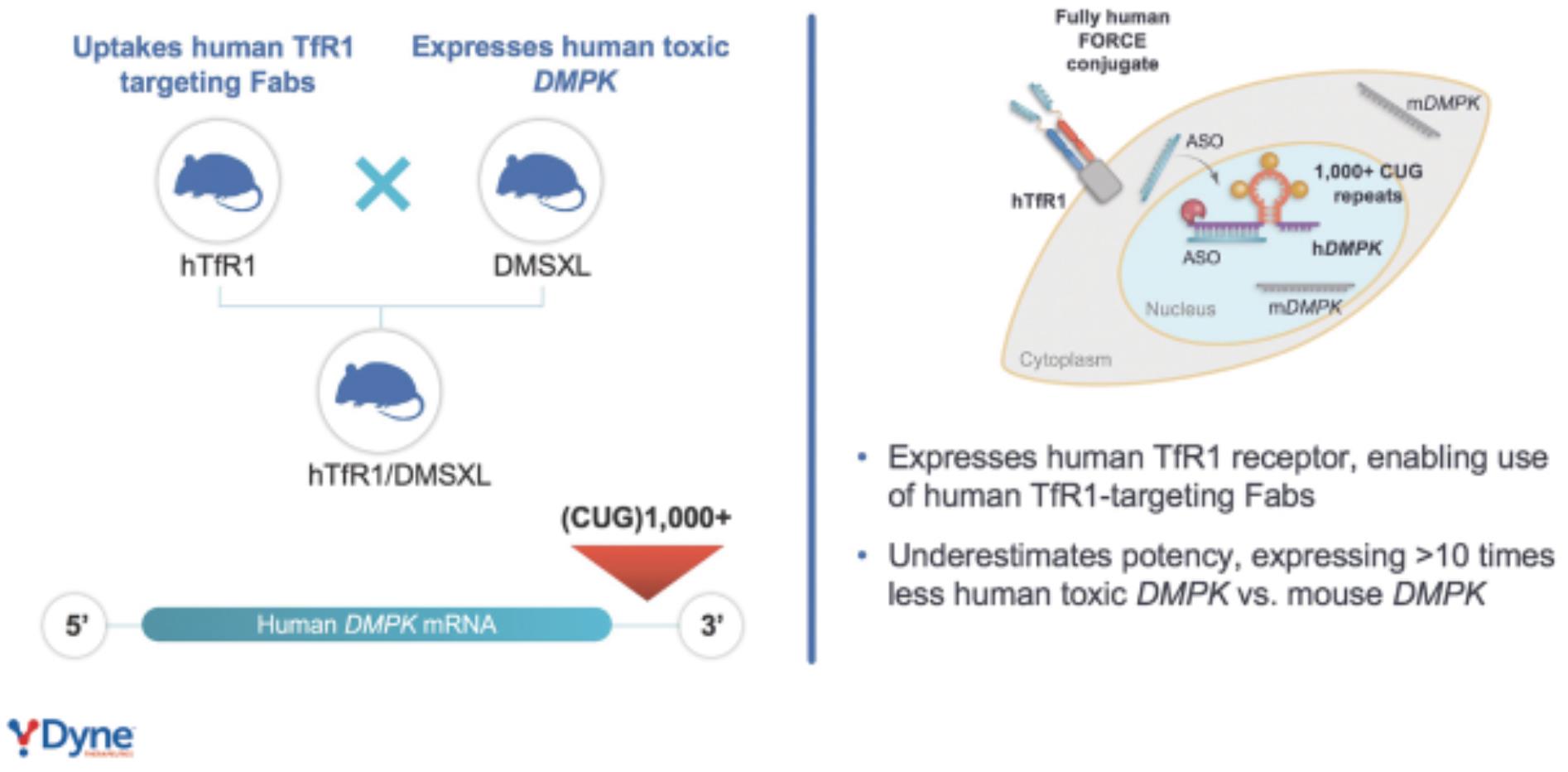

Reduction of toxic human nuclear DMPK in a DM1 mouse disease model

We have developed an innovative hTfR1/DMSXL mouse model designed to evaluate pharmacodynamics and accelerate the advancement of our DM1 program. This model was designed with two key characteristics:

|

|

• |

it expresses a human TfR1, or hTfR1, rather than the murine TfR1 expressed in WT mice, enabling uptake of human TfR1-targeting Fabs; and |

|

|

• |

it expresses murine WT DMPK and toxic human nuclear DMPK that represents a severe DM1 phenotype with more than 1,000 CTG repeats. |

These characteristics enable us to evaluate the ability of our lead DM1 candidate to reduce toxic human nuclear DMPK RNA. This hTfR1/DMSXL mouse model is illustrated below.

20

Overview of hTfR1/DMSXL DM1 mouse model

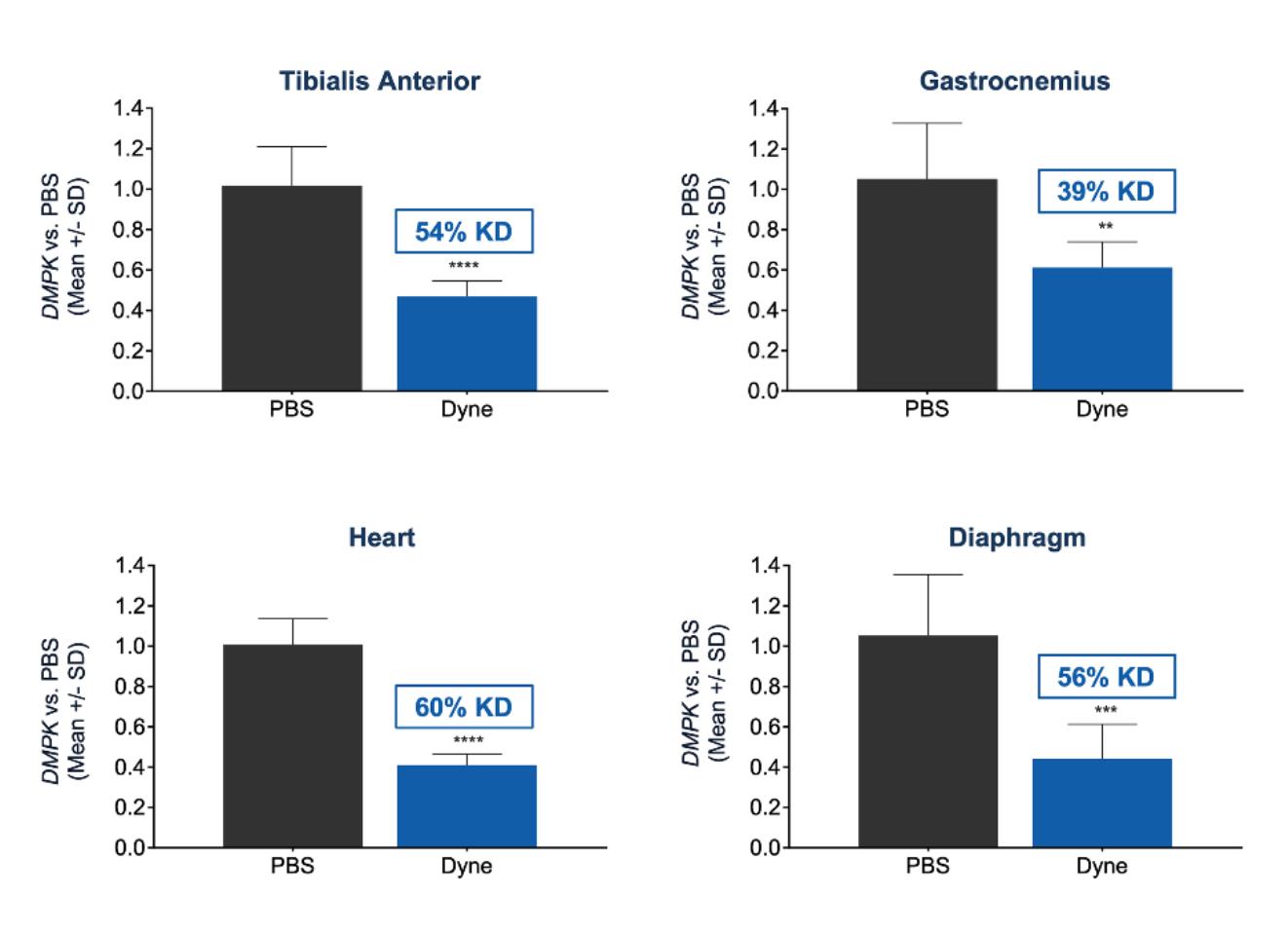

In a preclinical study using the hTfR1/DMSXL mouse model, as shown below, we observed that two doses of an ASO conjugated to a Fab targeting human TfR1 resulted in significant reductions after 14 days in toxic human nuclear DMPK RNA in the tibialis anterior, gastrocnemius, heart and diaphragm muscles. In the study, our candidate was well tolerated.

FORCE reduced toxic human nuclear DMPK RNA in multiple muscles in hTfR1/DMSXL DM1 mouse model

** P < 0.01

*** P < 0.001

**** P < 0.0001

21

Separately, in a third-party study of a naked ASO conducted in a DMSXL mouse model, after 44 days and significantly more and higher doses of the naked ASO, the naked ASO achieved toxic human nuclear DMPK knockdown at levels comparable to what we observed after 14 days in our study in the hTfR1/DMSXL mouse model.

Enhanced muscle distribution

While oligonucleotides are rationally designed genetic medicines, the current limitations with respect to delivery of oligonucleotides to muscle tissue present a significant limitation to advancing modern oligonucleotide therapeutics for muscle diseases. We have designed our FORCE platform to overcome these limitations. In preclinical studies, we observed that a single intravenous dose of one of our ASOs conjugated to a Fab targeting TfR1 was able to deliver its DMPK-targeted ASO payload to skeletal, cardiac and smooth muscle cells in mice and non-human primates and decrease WT DMPK RNA in the cytoplasm of different muscle cells.

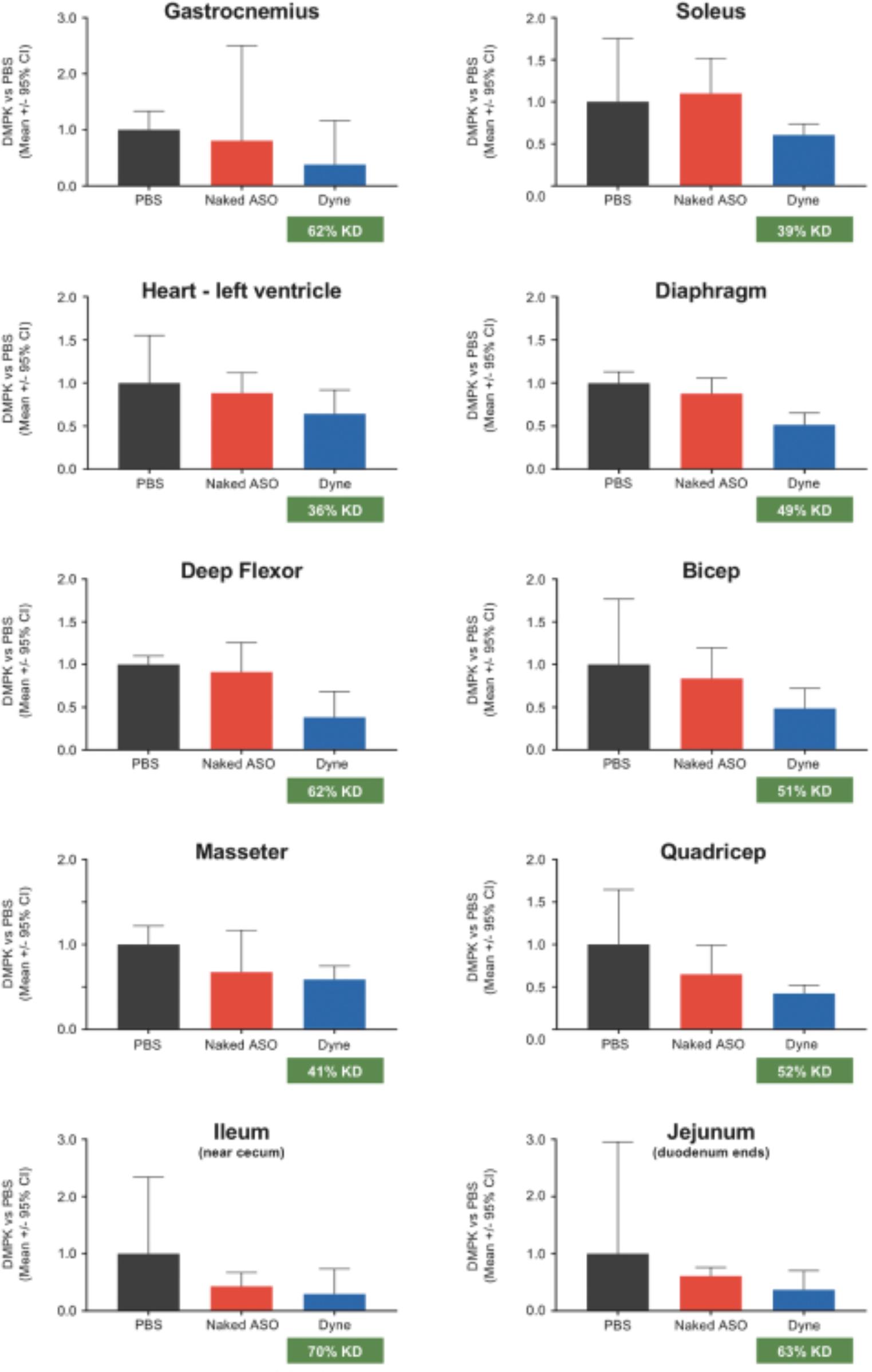

We have observed dose-dependent and long-lasting reductions in the levels of DMPK in WT mice. In preclinical studies shown in the figures below, one of our ASOs when conjugated to a Fab targeting TfR1 resulted in a dose-dependent reduction in levels of cytoplasmic WT DMPK RNA that was greater than the reductions observed with the naked ASO. In this study we also evaluated our ASO conjugated to a Fab “scramble control” which does not bind to any known murine cell receptor in the gastrocnemius, soleus, heart and diaphragm muscles, at two dose levels, to demonstrate the advantage of leveraging TfR1 to deliver oligonucleotides to muscle. The percentages in the green boxes reflect the amount by which DMPK RNA decreased with the conjugated ASO compared to saline (PBS) administration.

FORCE dose-dependently decreased DMPK RNA

Dose A: low dose

Dose B: high dose

* P < 0.05

** P < 0.01

*** P < 0.001

We have also observed results in preclinical studies important to our efforts to develop redosable, titratable and durable therapeutics under our FORCE platform. Specifically, we observed durability of

22

response up to 12 weeks in the tibialis anterior muscle and other muscles after a single dose in WT mice. In addition, repeat doses in WT mice were well tolerated and resulted in increased reductions in cytoplasmic WT DMPK RNA as compared to single doses.

We have also developed a distinct hTfR1 mouse model which expresses a human TfR1, rather than the murine TfR1 expressed in WT mice, and cytoplasmic WT DMPK. In preclinical studies using the hTfR1 mouse model, as shown below, we observed that two doses of an ASO conjugated to a Fab targeting human TfR1 resulted in significant reductions in cytoplasmic WT DMPK RNA in the tibialis anterior, gastrocnemius, heart and diaphragm muscles.

FORCE decreased WT DMPK RNA in hTfR1 mouse model

** P < 0.01

**** P < 0.0001

We also are evaluating our DM1 program in non-human primates. Currently there are no known DM1 disease models in non-human primates. As a result, any therapeutic candidate that reduces DMPK RNA expression in non-human primates is a result of targeting cytoplasmic WT DMPK RNA and not reflective of disease modification, which would require targeting toxic DMPK RNA in the nucleus. Consequently, we utilize non-human primate studies to evaluate muscle delivery, pharmacokinetics and tolerability of our FORCE platform. As shown in the figure below, in studies in non-human primates, a single intravenous dose of one of our ASOs when conjugated to a Fab targeting TfR1 reduced cytoplasmic DMPK RNA in multiple skeletal, cardiac and smooth muscles. In addition, and also as shown in the figure below, our conjugated ASO produced greater reductions, or knockdown (KD), in DMPK RNA than an equivalent dose of the naked ASO. Furthermore, our conjugated ASO produced less knockdown in DMPK RNA in non-muscle tissues, including kidney, liver and spleen tissues, as compared to a naked ASO, which we believe indicates specificity of our conjugated ASO for muscle tissue. Treatment with our conjugated ASO in these non-human primates was well tolerated with no clinically meaningful changes in hematology, serum biochemistry, platelet numbers, iron homeostasis, or kidney or liver function.

23

FORCE significantly decreased cytoplasmic DMPK RNA in non-human primate skeletal, cardiac and smooth muscle

24