Form 1-A MANUFACTURED HOUSING

1-A LIVE 0001277998 XXXXXXXX Manufactured Housing Properties Inc. NV 2003 0001277998 6500 51-0482104 19 0 136 Main Street Pineville NC 28134 980-273-1702 Louis A. Bevilacqua, Esq. Other 2099390.00 0.00 45293.00 40434643.00 40558982.00 798211.00 32764665.00 33934702.00 -4932522.00 40558982.00 4435269.00 1380968.00 1357629.00 -657651.00 -0.16 -0.16 Liggett & Webb, P.A. Common Stock 12397480 56469P209 OTC Pink Market Series A Cumulative 1890000 000000000 n/a Series B Cumulative 641254 56469P308 n/a n/a 0 000000000 n/a true true Tier2 Audited Equity (common or preferred stock) Y Y N Y N N 50000 0 1000.0000 50000000.00 0.00 0.00 0.00 50000000.00 Arete Wealth Management, LLC 5000000.00 Liggett & Webb, P.A. 10000.00 Bevilacqua PLLC 60000.00 Bevilacqua PLLC 12000.00 44856 44903000.00 true AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC PR A0 A1 A2 A3 A4 A5 A6 A7 A8 A9 B0 Z4 AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC PR A0 A1 A2 A3 A4 A5 A6 A7 A8 A9 B0 Z4 Manufactured Housing Properties Inc. Series B Cumulative Redeemable Preferred Stock 641254 0 $6412540.00 ($10.0/share) Manufactured Housing Properties Inc. Common Stock 27900 0 Bonus shares issued to investors in Regulation A offering Manufactured Housing Properties Inc. Common Stock 0 50000 Issued to board members in consideration for services Issued to board members in consideration for services Regulation A for Series B Cumulative Redeemable Preferred Stock and Common Stock issued as bonus shares. Rule 506 of Regulation D of the Securities Act of 1933, as amended, for Common Stock issued to board members.

Preliminary Offering Circular, Dated January 21, 2021

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

Manufactured Housing Properties Inc.

136 Main Street

Pineville, NC 28134

(980) 273-1702; www.mhproperties.com

UP TO 50,000 SHARES OF

SERIES C CUMULATIVE REDEEMABLE PREFERRED STOCK

Manufactured Housing Properties Inc. (which we refer to as “we,” “us,” “our” or “our company”) is offering up to 50,000 shares of Series C Cumulative Redeemable Preferred Stock, which we refer to as the Series C Preferred Stock, at an offering price of $1,000 per share, for a maximum offering amount of $50,000,000.

The Series C Preferred Stock being offered will rank, as to dividend rights and rights upon our liquidation, dissolution, or winding up, senior to our Common Stock and pari passu with our Series A Cumulative Convertible Preferred Stock, which we refer to as our Series A Preferred Stock, and our Series B Cumulative Redeemable Preferred Stock, which we refer to as our Series B Preferred Stock. Each share of Series C Preferred Stock will have an initial stated value equal to $1,000, subject to appropriate adjustment for certain events, which will automatically increase by ten percent (10%) on the fifth (5th) anniversary of the date on which the first share of Series C Preferred Stock is issued. Holders of our Series C Preferred Stock will be entitled to receive cumulative monthly cash dividends at a per annum rate of 7% of the stated value (or $5.83 per share each month based on the initial stated value). Upon a liquidation, dissolution or winding up of our company, holders of shares of our Series C Preferred Stock will be entitled to receive, before any payment or distribution is made to the holders of our Common Stock and on a pari passu basis with holders of our Series A Preferred Stock and Series B Preferred Stock, a liquidation preference equal to the stated value per share, plus accrued but unpaid dividends thereon. Shares of Series C Preferred Stock will be redeemable by us or by the holders under certain circumstances described elsewhere in this offering circular. The Series C Preferred Stock will have no voting rights (except for certain matters) and are not convertible into shares of our Common Stock. See “Description of Securities” beginning on page 43 for additional details.

There is no existing public trading market for the Series C Preferred Stock, and we do not anticipate that a secondary market for the stock will develop. We do not intend to apply for listing of the Series C Preferred Stock on any securities exchange or for quotation in any automated dealer quotation system or other over-the-counter market. Our Common Stock trades on the OTC Pink Market under the symbol “MHPC.”

Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 11 before deciding to invest in our securities.

| Per Share | Maximum Offering | |||||||

| Public offering price | $ | 1,000 | $ | 50,000,000 | ||||

| Sales commissions(1)(3) | $ | 60.0 | $ | 3,000,000 | ||||

| Dealer manager fee(1)(3) | $ | 27.5 | $ | 1,375,000 | ||||

| Proceeds to us, before expenses(2)(3) | $ | 912.5 | $ | 45,625,000 | ||||

| (1) | Selling commissions and the dealer manager fee will equal up to and including 6.00% and 2.75% of aggregate gross proceeds, respectively. Each is payable to the dealer manager. However, we expect the dealer manager to authorize other broker-dealers that are members of the Financial Industry Regulatory Authority, or FINRA, which we refer to as participating broker-dealers, to sell our Series C Preferred Stock. The dealer manager may reallow all or a portion of its selling commissions attributable to a participating broker-dealer. In addition, the dealer manager also may reallow a portion of its dealer manager fee earned on the proceeds raised by a participating broker-dealer to such participating broker-dealer as a non-accountable marketing and due diligence allowance or as a wholesale fee. The amount of the reallowance to any participating broker-dealer will be determined by the dealer manager in its sole discretion. |

| (2) | In addition to the selling commissions and dealer management fee, we have agreed to pay the dealer manager a monthly service fee of $2,500 and to reimburse the deal manager for such expenses incurred in connection with the offering as mutually agreed to by us and the dealer manager. Please see the section captioned “Plan of Distribution” for details regarding the expenses payable in connection with this offering. |

| (3) | The combined selling commissions, dealer manager fee and additional compensation paid to the dealer manager for this offering will not exceed 10% of the aggregate gross proceeds of this offering. |

The dealer manager of this offering is Arete Wealth Management, LLC. The dealer manager is not required to sell any specific number or dollar amount of shares but will use its “reasonable best efforts” to sell the shares offered. The minimum permitted purchase is generally $10,000 but purchases of less than $10,000 may be made in the discretion of the dealer manager.

This offering is being conducted pursuant to Regulation A of Section 3(6) of the Securities Act of 1933, as amended, or the Securities Act, for Tier 2 offerings. This offering will terminate at the earlier of: (1) the date at which the maximum amount of offered Series C Preferred Stock has been sold, (2) the date which is one year after the offering statement of which this offering circular forms a part is qualified by the U.S. Securities and Exchange Commission, or the SEC, subject to an extension of up to an additional one year at the discretion of our company and the dealer manager, or (3) the date on which this offering is earlier terminated by us in our sole discretion.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

This offering circular follows the disclosure format of Part I of Form S-1 pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

Arete Wealth Management, LLC,

as Dealer Manager

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This offering circular and the documents incorporated by reference herein contain, in addition to historical information, certain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that include information relating to future events, future financial performance, strategies, expectations, competitive environment, regulation and availability of resources. These forward-looking statements include, without limitation: statements concerning projections, predictions, expectations, estimates or forecasts for our business, financial and operating results and future economic performance; statements of management’s goals and objectives; trends affecting our financial condition, results of operations or future prospects; statements regarding our financing plans or growth strategies; statements concerning litigation or other matters; and other similar expressions concerning matters that are not historical facts. Words such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes” and “estimates,” and similar expressions, as well as statements in future tense, identify forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times, or by which, that performance or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management’s good faith beliefs as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause these differences include, but are not limited to:

| ● | the impact of the coronavirus pandemic on our business; |

| ● | changes in the real estate market and general economic conditions; |

| ● | the inherent risks associated with owning real estate, including local real estate market conditions, governing laws and regulations affecting manufactured housing communities and illiquidity of real estate investments; |

| ● | increased competition in the geographic areas in which we own and operate manufactured housing communities; |

| ● | our ability to continue to identify, negotiate and acquire manufactured housing communities and/or vacant land which may be developed into manufactured housing communities on terms favorable to us; |

| ● | our ability to maintain rental rates and occupancy levels; |

| ● | changes in market rates of interest; |

| ● | our ability to repay debt financing obligations; |

| ● | our ability to refinance amounts outstanding under our credit facilities at maturity on terms favorable to us; |

| ● | our ability to comply with certain debt covenants; |

| ● | our ability to integrate acquired properties and operations into existing operations; |

| ● | the availability of other debt and equity financing alternatives; |

| ● | continued ability to access the debt or equity markets; |

| ● | the loss of any member of our management team; |

| ● | our ability to maintain internal controls and processes to ensure all transactions are accounted for properly, all relevant disclosures and filings are timely made in accordance with all rules and regulations, and any potential fraud or embezzlement is thwarted or detected; |

| ● | the ability of manufactured home buyers to obtain financing; |

| ● | the level of repossessions by manufactured home lenders; |

| ● | market conditions affecting our investment securities; |

| ● | changes in federal or state tax rules or regulations that could have adverse tax consequences; and |

| ● | those risks and uncertainties referenced under the caption “Risk Factors” contained in this offering circular. |

Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason. Potential investors should not make an investment decision based solely on our company’s projections, estimates or expectations.

The specific discussions herein about our company include financial projections and future estimates and expectations about our company’s business. The projections, estimates and expectations are presented in this offering circular only as a guide about future possibilities and do not represent actual amounts or assured events. All the projections and estimates are based exclusively on our company management’s own assessment of its business, the industry in which it works and the economy at large and other operational factors, including capital resources and liquidity, financial condition, fulfillment of contracts and opportunities. The actual results may differ significantly from the projections.

TABLE OF CONTENTS

Please read this offering circular carefully. It describes our business, our financial condition and results of operations. We have prepared this offering circular so that you will have the information necessary to make an informed investment decision.

You should rely only on the information contained in this offering circular. We have not, and the dealer manager has not, authorized anyone to provide you with any information other than that contained in this offering circular. We are offering to sell, and seeking offers to buy, the securities covered hereby only in jurisdictions where offers and sales are permitted. The information in this offering circular is accurate only as of the date of this offering circular, regardless of the time of delivery of this offering circular or any sale of the securities covered hereby. Our business, financial condition, results of operations and prospects may have changed since that date. We are not, and the dealer manager is not, making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not, and the dealer manager has not, taken any action that would permit this offering or possession or distribution of this offering circular in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this offering circular must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby or the distribution of this offering circular outside the United States.

This offering circular includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe that the data obtained from these industry publications and third-party research, surveys and studies are reliable.

WE HAVE NOT AUTHORIZED ANY DEALER, SALESPERSON OR OTHER PERSON TO GIVE ANY INFORMATION OR REPRESENT ANYTHING NOT CONTAINED IN THIS OFFERING CIRCULAR. YOU SHOULD NOT RELY ON ANY UNAUTHORIZED INFORMATION. THIS OFFEIRNG CIRCULAR IS NOT AN OFFER TO SELL OR BUY ANY SECURITIES IN ANY STATE OR OTHER JURISDICTION IN WHICH IT IS UNLAWFUL. THE INFORMATION IN THIS OFFERING CIRCULAR IS CURRENT AS OF THE DATE ON THE COVER. YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR.

i

This summary highlights selected information contained elsewhere in this offering circular. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our securities. You should carefully read the entire offering circular, including the risks associated with an investment in our company discussed in the “Risk Factors” section of this offering circular, before making an investment decision.

Our Company

Overview

We are a self-administered, self-managed, vertically integrated owner and operator of manufactured housing communities. We earn income from leasing manufactured home sites to tenants who own their own manufactured home and the rental of company-owned manufactured homes to residents of the communities.

We own and operate nineteen manufactured housing communities containing approximately 1,249 developed sites and a total of 407 company-owned manufactured homes, including:

| ● | Pecan Grove – a 81 lot, all-age community situated on 10.71 acres and located in Charlotte, North Carolina. |

| ● | Azalea Hills – a 41 lot, all-age community situated on 7.46 acres and located in Gastonia, North Carolina, a suburb of Charlotte, North Carolina. |

| ● | Holly Faye – a 37 lot all-age community situated on 8.01 acres and located in Gastonia, North Carolina, a suburb of Charlotte North Carolina. |

| ● | Lakeview – a 97 lot all-age community situated on 17.26 acres in Spartanburg, South Carolina. |

| ● | Chatham Pines – a 49 lot all-age community situated on 23.57 acres and located in Chapel Hill, North Carolina. |

| ● | Maple Hills – a 73 lot all-age community situated on 21.20 acres and located in Mills River, North Carolina, which is part of the Asheville, North Carolina, Metropolitan Statistical Area. |

| ● | Hunt Club Forest – a 79 lot all-age community situated on 13.02 acres and located in the Columbia, South Carolina metro area. |

| ● | B&D – a 97 lot all-age community situated on 17.75 acres and located in Chester, South Carolina. |

| ● | Crestview – a 113 lot all-age community situated on 17.1 acres and located in the Ashville, NC MSA, North Carolina, Metropolitan Statistical Area. |

| ● | Spring Lake – three all-age communities with 225 lots situated on 72.7 acres and located in Warner Robins, Georgia. |

| ● | ARC – five all-age communities with 182 lots situated on 39.34 acres and located in Lexington, South Carolina. |

| ● | Countryside – a 110 lot all-age community situated on 35 acres and located in Lancaster, North Carolina. |

| ● | Evergreen – a 65 lot all-age community situated on 28.4 acres and located in Dandridge, Tennessee. |

The Manufactured Housing Community Industry

Manufactured housing communities are residential developments designed and improved for the placement of detached, single-family manufactured homes that are produced off-site and installed and set on residential sites within the community. The owner of a manufactured home leases the site on which it is located and the lessee of a manufactured home leases both the home and site on which the home is located.

We believe that manufactured housing is accepted by the public as a viable and economically attractive alternative to common stick-built single-family housing. We believe that the affordability of the modern manufactured home makes it a very attractive housing alternative. Manufactured housing is one of the only non-subsidized affordable housing options in the U.S. Demand for housing affordability continues to increase, but supply remains static, as there are virtually no new manufactured housing communities being developed. We are committed to becoming an industry leader in providing this affordable housing option and an improved level of service to our residents, while producing an attractive and stable risk adjusted return to our investors.

1

A manufactured housing community is a land-lease community designed and improved with home sites for the placement of manufactured homes and includes related improvements and amenities. Each homeowner in a manufactured housing community leases from the community a site on which a home is located. The manufactured housing community owner owns the underlying land, utility connections, streets, lighting, driveways, common area amenities, and other capital improvements and is responsible for enforcement of community guidelines and maintenance of the community. Generally, each homeowner is responsible for the maintenance of his or her home and upkeep of his or her leased site. In some cases, customers may rent homes with the community owner’s maintaining ownership and responsibility for the maintenance and upkeep of the home. This option provides flexibility for customers seeking a more affordable, shorter-term housing option and enables the community owner to meet a broader demand for housing and improve occupancy and cash flow.

Our Competition

There are numerous private companies, but only three publicly-traded real estate investment trusts, or REITs, that compete in the manufactured housing industry. Many of the private companies and one of the REITs, UMH Properties, Inc., may compete with us for acquisitions of manufactured housing communities. Many of these companies have larger operations and greater financial resources than we do. The number of competitors, however, is increasing as new entrants discover the benefits of the manufactured housing asset class. We believe that due to the fragmented nature of ownership within the manufactured housing sector, the level of competition is less than that in other commercial real estate sectors.

Our Competitive Strengths

We believe that the following competitive strengths enable us to compete effectively:

| ● | Deal Sourcing. Our deal sourcing consists of marketed deals, pocket listings, and off market deals. Marketed deals are properties that are listed with a broker who exposes the property to the largest pool of buyers possible. Pocket listings are properties that are presented by brokers to a limited pool of buyers. Off market deals are ones that are not actively marketed. As a result of our network of relationships in our industry, only two properties in our portfolio were marketed deals, the rest were off-market or pocket listings. |

| ● | Centralized Operations. We have centralized many operational tasks, including accounting, marketing, lease administration, and accounts payable. The use of professional staff and technology allows us to scale efficiently and operate properties profitably by reducing tasks otherwise completed at the property level. |

| ● | Deal Size. We believe that our small capitalization size with non-institutional deals of less than 150 sites are accretive to our balance sheet. These sized properties typically have less bidders at lower prices than larger properties. We can profitably operate these smaller properties through our centralized operations. |

| ● | Creating Value. Our underwriting expertise enables us to identify acquisition prospects to provide attractive risk adjusted returns. Our operational team has the experience, skill and resources to create this value through physical and/or operational property improvements. |

Our Growth Strategy

Our growth strategy is to acquire both stable and undervalued and underperforming manufactured housing properties that have current income. We believe that we can enhance value through our professional asset and property management. Our property management services are mainly comprised of tenant contracts and leasing, marketing vacancies, community maintenance, enforcement of community policies, establishment and collection rent, and payment of vendors. Our lot and manufactured home leases are generally for one month and auto renew monthly for an additional month.

Our investment mission on behalf of our stockholders is to deliver an attractive risk-adjusted return with a focus on value creation, capital preservation, and growth. In our ongoing search for acquisition opportunities we target and evaluate manufactured housing communities nationwide.

We may invest in improved and unimproved real property and may develop unimproved real property. These property investments may be located throughout the United States, but to date we have concentrated in the Southeast portion of the United States. We are focused on acquiring communities with significant upside potential and leveraging our expertise to build long-term capital appreciation.

2

We are one of four public companies in the manufactured housing sector, but we are the only one not organized as a REIT, thereby giving us flexibility to focus on growth through reinvestment of income and employing higher leverage upon acquisition than the REITs traditionally utilize due to market held norms around 50-60%. This can give us a competitive advantage when bidding for assets. Additionally, due to our small size, non-institutional sized deals of less than 150 sites, which have less bidders and lower prices, are accretive to our balance sheet.

Our Risks and Challenges

Our prospects should be considered in light of the risks, uncertainties, expenses and difficulties frequently encountered by similar companies. Our ability to realize our business objectives and execute our strategies is subject to risks and uncertainties, including, among others, the following:

| ● | The coronavirus pandemic may cause a material adverse effect on our business. |

| ● | We may not be able to obtain adequate cash to fund our business. |

| ● | General economic conditions and the concentration of our properties in Georgia, North Carolina, South Carolina, and Tennessee may affect our ability to generate sufficient revenue. |

| ● | We face risks generally associated with our debt. |

| ● | Covenants in our credit agreements could limit our flexibility and adversely affect our financial condition. |

| ● | A change in the United States government policy regarding to the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) could impact our financial condition. |

| ● | We may not be able to integrate or finance our acquisitions and our acquisitions may not perform as expected. |

| ● | New acquisitions may fail to perform as expected and the intended benefits may not be realized, which could have a negative impact on our operations. |

| ● | We may be unable to sell properties when appropriate because real estate investments are illiquid. |

| ● | We may be unable to compete with our larger competitors, which may in turn adversely affect our profitability. |

| ● | Losses in excess of our insurance coverage or uninsured losses could adversely affect our cash flow. |

| ● | Costs associated with taxes and regulatory compliance may reduce our revenue. |

| ● | Rent control legislation may harm our ability to increase rents. |

| ● | We have one stockholder that can single-handedly control our company. |

| ● | There is no present market for the Series C Preferred Stock and we have arbitrarily set the price. |

| ● | We cannot assure you that we will be able to pay dividends. |

| ● | You will not have a vote or influence on the management of our company. |

Impact of Coronavirus Pandemic

In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China. The virus has since spread to over 150 countries and every state in the United States. On March 11, 2020, the World Health Organization declared the outbreak a pandemic, and on March 13, 2020, the United States declared a national emergency.

3

Most states and cities, including where our properties are located, have reacted by instituting quarantines, restrictions on travel, “stay at home” rules and restrictions on the types of businesses that may continue to operate, as well as guidance in response to the pandemic and the need to contain it.

We are carefully reviewing all rules, regulations, and orders and responding accordingly. We have taken steps to take care of our employees, including providing the ability for employees to work remotely and implementing strategies to support appropriate social distancing techniques for those employees who are not able to work remotely. We have also taken precautions with regard to employee, facility and office hygiene as well as implementing significant travel restrictions. We are also assessing our business continuity plans for all business units in the context of the pandemic. This is a rapidly evolving situation, and we will continue to monitor and mitigate developments affecting our workforce, our tenants, and the public at large to the extent we are able to do so.

The rules and restrictions put in place have had a negative impact on the economy and business activity and may adversely impact the ability of our tenants, many of whom may be restricted in their ability to work, to pay their rent as and when due. In addition, our property managers may be limited in their ability to properly maintain our properties. Enforcing our rights as landlord against tenants who fail to pay rent or otherwise do not comply with the terms of their leases may not be possible as many jurisdictions, including those where are properties are located, have established rules and/or regulations preventing us from evicting tenants for certain periods in response to the pandemic. If we are unable to enforce our rights as landlords, our business would be materially affected.

If the current pace of the pandemic cannot be slowed and the spread of the virus is not contained, our business operations could be further delayed or interrupted. We expect that government and health authorities may announce new or extend existing restrictions, which could require us to make further adjustments to our operations in order to comply with any such restrictions. The duration of any business disruption cannot be reasonably estimated at this time but may materially affect our ability to operate our business and result in additional costs.

The extent to which the pandemic may impact our results will depend on future developments, which are highly uncertain and cannot be predicted as of the date of this offering circular, including new information that may emerge concerning the severity of the pandemic and steps taken to contain the pandemic or treat its impact, among others. Nevertheless, the pandemic and the current financial, economic and capital markets environment present material uncertainty and risk with respect to our performance, financial condition, results of operations and cash flows. See also “Risk Factors” below.

Corporate Information

Our principal executive offices are located at 136 Main Street, Pineville, NC 28134 and our telephone number is (980) 273-1702. We maintain a website at www.mhproperties.com. Information available on our website is not incorporated by reference in and is not deemed a part of this offering circular.

4

The Offering

| Securities being offered: | Up to 50,000 shares of Series C Preferred Stock at an offering price of $1,000 per share for a maximum offering amount of $50,000,000. |

| Terms of Series C Preferred Stock: | ● | Ranking. The Series C Preferred Stock will rank, as to dividend rights and rights upon our liquidation, dissolution, or winding up, senior to our Common Stock and pari passu with our Series A Preferred Stock and Series B Preferred Stock. |

| ● | Stated Value; Increase in Stated Value after Five Year Anniversary. Each share of Series C Preferred Stock will have an initial stated value of $1,000, which is equal to the offering price per share, subject to appropriate adjustment in relation to certain events, such as recapitalizations, stock dividends, stock splits, stock combinations, reclassifications or similar events affecting our Series C Preferred Stock. The stated value shall automatically increase one time by ten percent (10%) on the fifth (5th) anniversary of the date of issuance of the first share of Series C Preferred Stock. | |

| ● | Dividend Rate and Payment Date. Holders of our Series C Preferred Stock will be entitled to receive cumulative monthly cash dividends at a per annum rate of 7% of the stated value (or $5.83 per share each month based on the initial stated value). Dividends on each share will begin accruing on, and will be cumulative from, the date of issuance and regardless of whether our board of directors declares and pays such dividends. If our articles of incorporation, provisions of Nevada law or our borrowing agreements prohibit us from paying dividends, unpaid dividends will cumulate. | |

| ● | Liquidation Preference. Upon a liquidation, dissolution or winding up of our company, holders of shares of our Series C Preferred Stock will be entitled to receive, before any payment or distribution is made to the holders of our Common Stock and on a pari passu basis with holders of our Series A Preferred Stock and Series B Preferred Stock, a liquidation preference equal to the stated value per share, plus accrued but unpaid dividends thereon. | |

| ● | Redemption Request at the Option of a Holder. Once per calendar quarter, a holder will have the opportunity to request that we redeem that holder’s Series C Preferred Stock. Our board of directors may, however, suspend cash redemptions at any time in its discretion if it determines that it would not be in the best interests of our company to effectuate cash redemptions at a given time because we do not have sufficient cash, including because our board believes that our cash on hand should be utilized for other business purposes. Redemptions will be limited to four percent (4%) of the total outstanding Series C Preferred Stock per quarter and any redemptions in excess of such limit or to the extent suspended, shall be redeemed in subsequent quarters on a first come, first served, basis. We will redeem shares at a redemption price equal to the stated value of such redeemed shares, plus any accrued but unpaid dividends thereon, less the applicable redemption fee (if any). As a percentage of the aggregate redemption price of a holder’s shares to be redeemed, the redemption fee shall be: |

| ● | 11% if the redemption is requested on or before the first anniversary of the original issuance of such shares; | |

| ● | 8% if the redemption is requested after the first anniversary and on or before the second anniversary of the original issuance of such shares; | |

| ● | 5% if the redemption is requested after the second anniversary and on or before the third anniversary of the original issuance of such shares; and |

5

| ● | after the third anniversary of the date of original issuance of shares to be redeemed, no redemption fee shall be subtracted from the redemption price. |

| ● | Optional Redemption by our company. We will have the right (but not the obligation) to redeem shares of Series C Preferred Stock at a redemption price equal to the stated value of such redeemed shares, plus any accrued but unpaid dividends thereon; provided, however, that if we redeem any shares of Series C Preferred Stock prior to the fifth (5th) anniversary of their issuance, then the redemption price shall include a premium equal to ten percent (10%) of the stated value. | |

| ● | Mandatory Redemption by our company. We are required to redeem all outstanding shares of Series C Preferred Stock on the tenth (10th) anniversary of the date of issuance of the first share of Series C Preferred Stock at a redemption price equal to the stated value of such redeemed shares, plus any accrued but unpaid dividends thereon. | |

| ● | Optional Repurchase Upon Death, Disability or Bankruptcy of a Holder. Subject to certain restrictions and conditions, we will also repurchase shares of Series C Preferred Stock of a holder who is a natural person (including an individual beneficial holder who holds shares through a custodian or nominee, such as a broker-dealer) upon his or her death, total disability or bankruptcy, within sixty (60) days of our receipt of a written request from the holder or the holder’s estate at a repurchase price equal to the stated value, plus accrued and unpaid dividends thereon. A “total disability” means a determination by a physician approved by us that a holder, who was gainfully employed and working at least forty (40) hours per week as of the date on which his or her shares were purchased, has been unable to work forty (40) or more hours per week for at least twenty-four (24) consecutive months. | |

| ● | Restrictions on Redemption and Repurchase. We will not be obligated to redeem or repurchase shares of Series C Preferred Stock if we are restricted by applicable law or our articles of incorporation from making such redemption or repurchase or to the extent any such redemption or repurchase would cause or constitute a default under any borrowing agreements to which we or any of our subsidiaries are a party or otherwise bound. In addition, we will have no obligation to redeem shares in connection with a redemption request made by a holder if we determine, as of the redemption date, that we do not have sufficient funds available to fund that redemption. In this regard, we will have complete discretion under the certificate of designation for the Series C Preferred Stock to determine whether we are in possession of “sufficient funds” to fund a redemption request. To the extent we are unable to complete redemptions we may have earlier agreed to make, we will complete those redemptions promptly after we become able to do so, with all such deferred redemptions being satisfied on a first come, first served, basis. | |

| ● | Voting Rights. The Series C Preferred Stock will have no voting rights relative to matters submitted to a vote of our stockholders (other than as required by law). However, we may not, without the affirmative vote or written consent of the holders of a majority of the then issued and outstanding Series C Preferred Stock: (i) amend or waive any provision of the certificate of designation or otherwise take any action that modifies any powers, rights, preferences, privileges or restrictions of the Series C Preferred Stock (other than an amendment solely for the purpose of changing the number of shares of Series C Preferred Stock designated for issuance as provided in the certificate of designation); (ii) authorize, create or issue shares of any class of stock having rights, preferences or privileges as to dividends or distributions upon a liquidation that are superior to the Series C Preferred Stock; or (iii) amend our articles of incorporation in a manner that adversely and materially affects the rights of the Series C Preferred Stock. | |

| ● | No Conversion Right. The Series C Preferred Stock will not be convertible into shares of our Common Stock. |

6

| Best efforts offering: | The dealer manager is selling the shares of Series C Preferred Stock offered in this offering circular on a “best efforts” basis and is not required to sell any specific number or dollar amount of shares of Series C Preferred Stock offered by this offering circular but will use its best efforts to sell such shares. | |

| Securities issued and outstanding before this offering: | 12,397,480 shares of Common Stock, 1,890,000 shares of Series A Preferred Stock, 641,254 shares of Series B Preferred Stock and no shares of Series C Preferred Stock. | |

| Securities issued and outstanding after this offering: | 12,397,480 shares of Common Stock, 1,890,000 shares of Series A Preferred Stock, 641,254 shares of Series B Preferred Stock and 50,000 shares of Series C Preferred Stock if the maximum number of shares being offered are sold. | |

| Minimum subscription price: | The minimum initial investment is at least $10,000 and any additional purchases must be investments of at least $5,000; provided that purchases of less than $10,000 may be made in the discretion of the dealer manager. | |

| Use of proceeds: |

We estimate our net proceeds from this offering will be approximately $44,903,000 if the maximum number of shares being offered are sold based upon the public offering price of $1,000 per share and after deducting the sales commissions, dealer manager fees and estimating offering expenses payable by us.

We intend to use the net proceeds from this offering for the acquisition and development of manufactured housing communities and/or recreational vehicle communities and for other general and working capital purposes, which may include the funding of capital improvements at properties. For a discussion, see “Use of Proceeds.” | |

| Termination of the offering: | This offering will terminate at the earlier of: (1) the date at which the maximum amount of offered Series C Preferred Stock has been sold, (2) the date which is one year after the offering statement of which this offering circular forms a part is qualified by the SEC, subject to an extension of up to an additional one year at the discretion of our company and the dealer manager, or (3) the date on which this offering is earlier terminated by us in our sole discretion. | |

| Closings of the offering: |

We may undertake one or more closings on a rolling basis. Until we complete a closing, the proceeds for this offering will be kept in an escrow account maintained at Wilmington Trust, National Association. At a closing, the proceeds will be distributed to us and the associated shares will be issued to the investors. If there are no closings or if funds remain in the escrow account upon termination of this offering without any corresponding closing, the investments for this offering will be promptly returned to investors, without deduction and generally without interest.

You may not subscribe to this offering prior to the date offering statement of which this offering circular forms a part is qualified by the SEC. Before such date, you may only make non-binding indications of your interest to purchase securities in the offering. For any subscription agreements received after such date, we have the right to review and accept or reject the subscription in whole or in part, for any reason or for no reason. If rejected, we will return all funds to the rejected investor within ten business days. If accepted, the funds will remain in the escrow account until all conditions to closing have been satisfied or waived, at which point we will have an initial closing of the offering and the funds in escrow will then be transferred into our general account. |

7

| Following the initial closing of this offering, we expect to have several subsequent closings of this offering until the maximum offering amount is raised or the offering is terminated. We expect to have closings on a monthly basis and expect that we will accept all funds subscribed for each month subject to our working capital and other needs consistent with the use of proceeds described in this offering circular. Investors should expect to wait approximately one month and no longer than forty-five days before we accept their subscriptions and they receive the securities subscribed for. An investor’s subscription is binding and irrevocable and investors will not have the right to withdraw their subscription or receive a return of funds prior to the next closing unless we reject the investor’s subscription. You will receive a confirmation of your purchase promptly following the closing in which you participate. | ||

| Restrictions on investment amount: | Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov. | |

| No market for Series C Preferred Stock; transferability: | There is no existing public trading market for the Series C Preferred Stock and we do not anticipate that a secondary market for the stock will develop. We do not intend to apply for listing of the Series C Preferred Stock on any securities exchange or for quotation in any automated dealer quotation system or other over-the-counter market. Nevertheless, you will be able to freely transfer or pledge your shares subject to the availability of applicable exemptions from the registration requirements of the Securities Act of 1933, as amended. | |

| Current symbol: | Our Common Stock trades on the OTC Pink Market under the symbol “MHPC.” | |

| Risk factors: | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 11 before deciding to invest in our securities. |

8

Summary Financial Data

The following tables summarize selected financial data regarding our business and should be read in conjunction with our financial statements and related notes contained elsewhere in this offering circular and the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The summary consolidated financial data as of December 31, 2019 and 2018 and for the years then ended for our company are derived from our audited consolidated financial statements included elsewhere in this offering circular. We derived the summary consolidated financial data as of September 30, 2020 and for the nine months ended September 30, 2020 and 2019 from our unaudited consolidated financial statements included elsewhere in this offering circular, which include all adjustments, consisting of normal recurring adjustments, that our management considers necessary for a fair presentation of our financial position and results of operations as of the dates and for the periods presented.

Our consolidated financial statements are prepared and presented in accordance with generally accepted accounting principles in the United States, or GAAP. The summary financial data information is only a summary and should be read in conjunction with the historical financial statements and related notes contained elsewhere herein. The financial statements contained elsewhere fully represent our financial condition and operations; however, they are not indicative of our future performance.

| Nine Months Ended September 30, | Years Ended December 31, | |||||||||||||||

| 2020 | 2019 | 2019 | 2018 | |||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| Statements of Operations Data | ||||||||||||||||

| Total revenues | $ | 4,435,269 | $ | 1,983,283 | $ | 3,021,691 | $ | 2,000,312 | ||||||||

| Total community operating expenses | 1,380,968 | 676,228 | 1,149,788 | 676,381 | ||||||||||||

| Corporate payroll and overhead | 1,065,624 | 587,463 | 1,253,383 | 1,030,527 | ||||||||||||

| Depreciation and amortization expense | 1,357,629 | 496,966 | 786,179 | 534,290 | ||||||||||||

| Interest expense | 1,288,699 | 1,076,254 | 1,312,469 | 1,001,455 | ||||||||||||

| Refinancing costs | - | 552,272 | 552,272 | - | ||||||||||||

| Total expenses | 5,092,920 | 3,389,183 | 5,054,091 | 3,242,653 | ||||||||||||

| Net loss before provision for income taxes | (657,651 | ) | (1,405,900 | ) | (2,032,400 | ) | (1,242,341 | ) | ||||||||

| Provision for income taxes | - | - | 6,347 | 8,286 | ||||||||||||

| Net loss | $ | (657,651 | ) | $ | (1,405,900 | ) | $ | (2,038,747 | ) | $ | (1,250,627 | ) | ||||

| Net income attributable to the non-controlling interest | - | - | - | 45,766 | ||||||||||||

| Net loss attributable to the company | $ | (657,651 | ) | $ | (1,405,900 | ) | $ | (2,038,747 | ) | $ | (1,296,393 | ) | ||||

| Total preferred stock dividends | 1,355,217 | 90,834 | 360,937 | - | ||||||||||||

| Net loss attributable to common stockholders | $ | (2,012,868 | ) | $ | (1,496,734 | ) | $ | (2,399,684 | ) | $ | (1,296,393 | ) | ||||

| Weighted average shares - basic and fully diluted | 12,369,344 | 12,738,962 | 12,624,171 | 10,100,747 | ||||||||||||

| Net loss per share - basic and fully diluted | $ | (0.16 | ) | $ | (0.12 | ) | $ | (0.19 | ) | $ | (0.13 | ) | ||||

| As of September 30, 2020 | As of December 31, | As of December 31, | ||||||||||

| (unaudited) | (as revised) | |||||||||||

| Balance Sheet Data | ||||||||||||

| Cash and cash equivalents | $ | 2,099,390 | $ | 4,146,411 | $ | 458,271 | ||||||

| Net investment property | 11,378,818 | 33,172,506 | 11,881,833 | |||||||||

| Total assets | 40,558,982 | 37,907,810 | 12,452,563 | |||||||||

| Total liabilities | 33,934,702 | 31,982,075 | 13,405,593 | |||||||||

| Stockholders’ equity (deficit) | (4,932,522 | ) | (2,956,875 | ) | (953,030 | ) | ||||||

| Total liabilities and stockholders’ equity (deficit) | $ | 40,558,982 | $ | 37,907,810 | $ | 12,452,563 | ||||||

9

Unaudited Pro Forma Consolidated Financial Information

The following unaudited pro forma combined financial statements have been prepared in accordance with GAAP and S-X Article 11 to provide pro forma information with regards to the real estate acquisition described below.

On January 7, 2020, MHP Pursuits LLC, our wholly-owned subsidiary, entered into a purchase and sale agreement with J & A Real Estate, LLC for the purchase of a manufactured housing community known as Countryside Estates Mobile Home Park, which is located in Lancaster, South Carolina and totals 110 sites, for a total purchase price of $3.7 million, of which approximately $2.6 million was attributed to the value of land and land improvements and $1.1 million was attributed to the mobile homes. Closing of the acquisition was completed on March 12, 2020 and our newly formed wholly owned subsidiary, Countryside MHP LLC, purchased the assets. The transaction was accounted for as an asset acquisition.

This unaudited pro forma combined financial information is presented for informational purposes only and does not purport to be indicative of our financial results as if the acquisition had occurred on the date or been in effect during the periods indicated. This pro forma combined financial information should not be viewed as indicative of our financial results in the future and should be read in conjunction with our financial statements and the financial statements of J & A Real Estate, LLC included elsewhere in this offering circular.

Unaudited Pro Forma Combined Statements of Operations

For the Year Ended December 31, 2019

| Historical | Acquisition | Adjustment | Pro Forma | |||||||||||||

| Revenue | ||||||||||||||||

| Rental and related income | $ | 2,968,472 | $ | 485,445 | $ | 3,453,917 | ||||||||||

| Management fees, related party | 48,319 | - | 48,319 | |||||||||||||

| Home sales | 4,900 | - | 4,900 | |||||||||||||

| Total revenues | 3,021,691 | 485,445 | 3,507,136 | |||||||||||||

| Community operating expenses | ||||||||||||||||

| Repair and maintenance | 234,770 | 40,199 | 274,969 | |||||||||||||

| Real estate taxes | 142,187 | 29,018 | 171,205 | |||||||||||||

| Utilities | 212,719 | 4,116 | 216,835 | |||||||||||||

| Insurance | 83,975 | - | 83,975 | |||||||||||||

| General and administrative expense | 476,137 | 77,912 | 554,049 | |||||||||||||

| Total community operating expenses | 1,149,788 | 111,046 | 1,260,834 | |||||||||||||

| Corporate payroll and overhead | 1,253,383 | - | 1,253,383 | |||||||||||||

| Depreciation and amortization expense | 786,179 | - | 174,621 | (a) | 960,800 | |||||||||||

| Interest expense | 1,312,469 | - | 165,000 | (b) | 1,477,469 | |||||||||||

| Refinancing costs | 552,272 | - | 552,272 | |||||||||||||

| Total expenses | 5,054,091 | 151,245 | 5,544,957 | |||||||||||||

| Net income (loss) before provision for income taxes | (2,032,400 | ) | 334,200 | (2,037,821 | ) | |||||||||||

| Provision for income taxes | 6,347 | - | 6,347 | |||||||||||||

| Net income (loss) attributable to the Company | (2,038,747 | ) | 334,200 | (2,044,168 | ) | |||||||||||

| Total preferred stock dividends | 360,937 | - | 360,937 | |||||||||||||

| Net income (loss) attributable to common shareholders | $ | (2,399,684 | ) | $ | 334,200 | $ | (2,405,105 | ) | ||||||||

| Weighted average loss per share - basic and fully diluted | $ | (0.19 | ) | |||||||||||||

| Weighted averages shares - basic and fully diluted | 12,624,171 | |||||||||||||||

| (a) | Adjustment to recognize depreciation expense on the investment property and amortization expense on the acquisition costs. |

| (b) | Adjustment to recognize the interest expense on the outstanding debt issued for the purchase of investment property. |

10

An investment in our securities involves a high degree of risk. You should carefully read and consider all of the risks described below, together with all of the other information contained or referred to in this offering circular, before making an investment decision with respect to our securities. If any of the following events occur, our financial condition, business and results of operations (including cash flows) may be materially adversely affected. In that event, the value of your Series C Preferred Stock could decline, and you could lose all or part of your investment.

Risks Related to our Business and Industry

The coronavirus pandemic may cause a material adverse effect on our business.

In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China. The virus has since spread to over 150 countries and every state in the United States. On March 11, 2020, the World Health Organization declared the outbreak a pandemic, and on March 13, 2020, the United States declared a national emergency.

The spread of the virus in many countries continues to adversely impact global economic activity and has contributed to significant volatility and negative pressure in financial markets. The pandemic has had, and could have a significantly greater, material adverse effect on the U.S. economy as a whole, as well as the local economies where our properties are located. The pandemic has resulted, and may continue to result for an extended period, in significant disruption of global financial markets, which may reduce our ability to access capital in the future, which could negatively affect our liquidity.

Most states and cities, including where are our properties are located, have reacted by instituting quarantines, restrictions on travel, “stay at home” rules and restrictions on the types of businesses that may continue to operate, as well as guidance in response to the pandemic and the need to contain it. These rules and restrictions have had a negative impact on the economy and business activity and may adversely impact the ability of our tenants, many of whom may be restricted in their ability to work, to pay their rent as and when due. In addition, our property managers may be limited in their ability to properly maintain our properties. Enforcing our rights as landlord against tenants who fail to pay rent or otherwise do not comply with the terms of their leases may not be possible as many jurisdictions, include those where are properties are located, have established rules and/or regulations preventing us from evicting tenants for certain periods in response to the pandemic. If we are unable to enforce our rights as landlords, our business would be materially affected.

If the current pace of the pandemic cannot be slowed and the spread of the virus is not contained, our business operations could be further delayed or interrupted. We expect that government and health authorities may announce new or extend existing restrictions, which could require us to make further adjustments to our operations in order to comply with any such restrictions. The duration of any business disruption cannot be reasonably estimated at this time but may materially affect our ability to operate our business and result in additional costs.

The extent to which the pandemic may impact our results will depend on future developments, which are highly uncertain and cannot be predicted as of the date of this offering circular, including new information that may emerge concerning the severity of the pandemic and steps taken to contain the pandemic or treat its impact, among others. Nevertheless, the pandemic and the current financial, economic and capital markets environment present material uncertainty and risk with respect to our performance, financial condition, results of operations and cash flows.

We may not be able to obtain adequate cash to fund our business.

Our business requires access to adequate cash to finance our operations, distributions, capital expenditures, debt service obligations, development and redevelopment costs and property acquisition costs, if any. We expect to generate the cash to be used for these purposes primarily with operating cash flow, borrowings under secured and unsecured loans, proceeds from sales of strategically identified assets and, when market conditions permit, through the issuance of debt and equity securities from time to time. We may not be able to generate sufficient cash to fund our business, particularly if we are unable to renew leases, lease vacant space or re-lease space as leases expire according to our expectations.

General economic conditions and the concentration of our properties in Georgia, North Carolina, South Carolina, and Tennessee may affect our ability to generate sufficient revenue.

The market and economic conditions in our current markets may significantly affect manufactured housing occupancy or rental rates. Occupancy and rental rates, in turn, may significantly affect our revenues, and if our communities do not generate revenues sufficient to meet our operating expenses, including debt service and capital expenditures, current cash flow and ability to pay or refinance our debt obligations could be adversely affected. As a result of the current geographic concentration of our properties in Georgia, North Carolina, South Carolina and Tennessee, we are exposed to the risks of downturns in the local economy or other local real estate market conditions that could adversely affect occupancy rates, rental rates, and property values in these markets.

11

Other factors that may affect general economic conditions or local real estate conditions include:

| ● | the national and local economic climate which may be adversely affected by, among other factors, plant closings, and industry slowdowns; |

| ● | local real estate market conditions such as the oversupply of manufactured home sites or a reduction in demand for manufactured home sites in an area; |

| ● | the number of repossessed homes in a particular market; |

| ● | the lack of an established dealer network; |

| ● | the rental market which may limit the extent to which rents may be increased to meet increased expenses without decreasing occupancy rates; |

| ● | the safety, convenience and attractiveness of our properties and the neighborhoods where they are located; |

| ● | zoning or other regulatory restrictions; |

| ● | competition from other available manufactured housing communities and alternative forms of housing (such as apartment buildings and single-family homes); |

| ● | our ability to provide adequate management, maintenance and insurance; |

| ● | increased operating costs, including insurance premiums, real estate taxes and utilities; and |

| ● | the enactment of rent control laws or laws taxing the owners of manufactured homes. |

Our income would also be adversely affected if tenants were unable to pay rent or if sites were unable to be rented on favorable terms. If we were unable to promptly renew the leases for a significant number of sites, or if the rental rates upon such renewal or reletting were significantly lower than expected rates, then our business and results of operations could be adversely affected. In addition, certain expenditures associated with each property (such as real estate taxes and maintenance costs) generally are not reduced when circumstances cause a reduction in income from the property.

We face risks generally associated with our debt.

We finance a portion of our investments in properties through debt. As of September 30, 2020, our total indebtedness for borrowed money was $32,764,665. We are subject to the risks normally associated with debt financing, including the risk that our cash flow will be insufficient to meet required payments of principal and interest. In addition, debt creates other risks, including:

| ● | failure to repay or refinance existing debt as it matures, which may result in forced disposition of assets on disadvantageous terms; |

| ● | refinancing terms less favorable than the terms of existing debt; and |

| ● | failure to meet required payments of principal and/or interest. |

We face risks related to “balloon payments” and re-financings.

Certain of our mortgages will have significant outstanding principal balances on their maturity dates, commonly known as “balloon payments.” As of September 30, 2020, our total future minimum principal payments were $32,905,645. There can be no assurance that we will be able to refinance the debt on favorable terms or at all. To the extent we cannot refinance debt on favorable terms or at all, we may be forced to dispose of properties on disadvantageous terms or pay higher interest rates, either of which would have an adverse impact on our financial performance and ability to service debt and make distributions.

12

We may become more highly leveraged, resulting in increased risk of default on our obligations and an increase in debt service requirements that could adversely affect our financial condition and results of operations and our ability to pay distributions.

We have incurred, and may continue to incur, indebtedness in furtherance of our activities. We could become more highly leveraged, resulting in an increased risk of default on our obligations and in an increase in debt service requirements, which could adversely affect our financial condition and results of operations and our ability to pay distributions to stockholders.

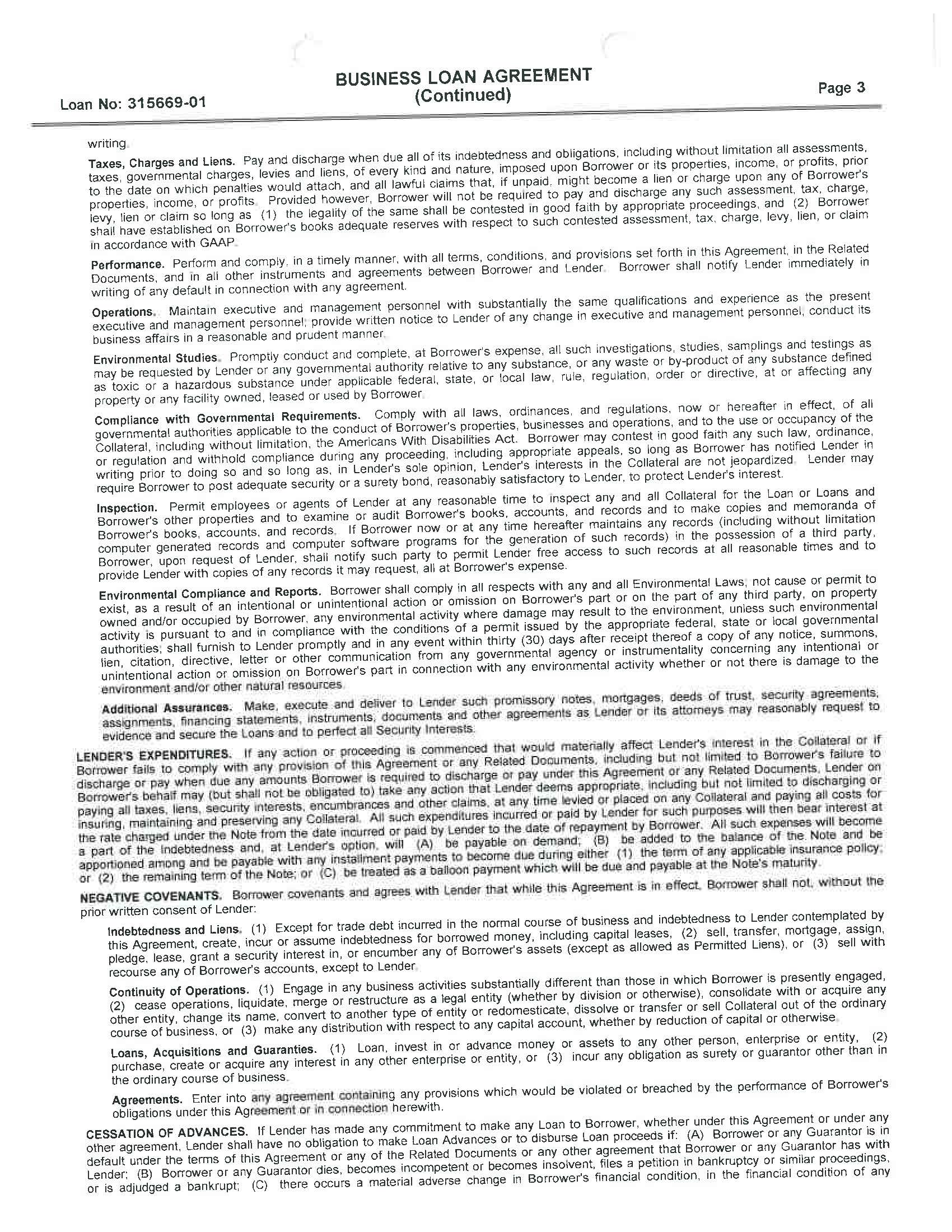

Covenants in our credit agreements could limit our flexibility and adversely affect our financial condition.

The terms of our various credit agreements and other indebtedness require us to comply with a number of customary financial and other covenants, such as maintaining debt service coverage and leverage ratios and maintaining insurance coverage. These covenants may limit our flexibility in our operations, and breaches of these covenants could result in defaults under the instruments governing the applicable indebtedness even if we had satisfied our payment obligations. If we were to default under our credit agreements, our financial condition would be adversely affected.

A change in the United States government policy regarding to the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) could impact our financial condition.

Fannie Mae and Freddie Mac are a major source of financing for the manufactured housing real estate sector. We could depend on Fannie Mae and Freddie Mac to finance growth by purchasing or guarantying manufactured housing community loans. In February 2011, the Obama Administration released a report to Congress that included options, among others, to gradually shrink and eventually shut down Fannie Mae and Freddie Mac. We do not know when or if Fannie Mae or Freddie Mac will restrict their support of lending to our real estate sector or to us in particular. A final decision by the government to eliminate Fannie Mae or Freddie Mac or reduce their acquisitions or guarantees of our mortgage loans, may adversely affect interest rates, capital availability and our ability to refinance our existing mortgage obligations as they come due and obtain additional long-term financing for the acquisition of additional communities on favorable terms or at all.

We face risks relating to the property management services that we provide.

There are inherent risks in our providing property management services to the manufactured housing communities on the properties that we own. The more significant of these risks include:

| ● | our possible liability for personal injury or property damage suffered by our employees and third parties, including our tenants, that are not fully covered by our insurance; |

| ● | our possible inability to keep our manufactured housing communities at or near full occupancy; |

| ● | our possible inability to attract and keep responsible tenants; |

| ● | our possible inability to expediently remove “bad” tenants from our communities; |

| ● | our possible inability to timely and satisfactorily deal with complaints of our tenants; |

| ● | our possible inability to locate, hire and retain qualified property management personnel; and |

| ● | our possible inability to adequately control expenses with respect to our properties. |

We may not be able to integrate or finance our acquisitions and our acquisitions may not perform as expected.

We acquire and intend to continue to acquire manufactured housing communities on a select basis. Our acquisition activities and their success are subject to the following risks:

| ● | we may be unable to acquire a desired property because of competition from other well capitalized real estate investors, including both publicly traded REITs and institutional investment funds; |

| ● | even if we enter into an acquisition agreement for a property, it is usually subject to customary conditions for closing, including completion of due diligence investigations to our satisfaction, which may not be satisfied; |

13

| ● | even if we are able to acquire a desired property, competition from other real estate investors may significantly increase the purchase price; |

| ● | we may be unable to finance acquisitions on favorable terms; |

| ● | acquired properties may fail to perform as expected; |

| ● | acquired properties may be located in new markets where we face risks associated with a lack of market knowledge or understanding of the local economy, lack of business relationships in the area and unfamiliarity with local governmental and permitting procedures; and |

| ● | we may be unable to quickly and efficiently integrate new acquisitions, particularly acquisitions of portfolios of properties, into our existing operations. |

If any of the above were to occur, our business and results of operations could be adversely affected.

In addition, we may acquire properties subject to liabilities and without any recourse, or with only limited recourse, with respect to unknown liabilities. As a result, if a liability were to be asserted against us based on ownership of those properties, we might have to pay substantial sums to settle it, which could adversely affect our cash flow.

New acquisitions may fail to perform as expected and the intended benefits may not be realized, which could have a negative impact on our operations.

We intend to continue to acquire manufactured housing communities. However, newly acquired properties may fail to perform as expected and could pose risks for our ongoing operations including the following:

| ● | integration may prove costly or time-consuming and may divert management’s attention from the management of daily operations; |

| ● | difficulties or an inability to access capital or increases in financing costs; |

| ● | we may incur costs and expenses associated with any undisclosed or potential liabilities; |

| ● | unforeseen difficulties may arise in integrating an acquisition into our portfolio; |

| ● | expected synergies may not materialize; and |

| ● | we may acquire properties in new markets where we face risks associated with lack of market knowledge such as understanding of the local economy, the local governmental and/or local permit procedures. |

As a result of the foregoing, we may not accurately estimate or identify all costs necessary to bring an acquired manufactured housing communities up to standards established for our intended market position. As such, we cannot provide assurance that any acquisition that we make will be accretive to us in the near term or at all. Furthermore, if we fail to realize the intended benefits of an acquisition, it may have a negative impact on our operations.

Development and expansion properties may fail to perform as expected and the intended benefits may not be realized, which could have a negative impact on our operations.

We may periodically consider development and expansion activities, which are subject to risks such as construction costs exceeding original estimates and construction and lease-up delays resulting in increased construction costs and lower than expected revenues. Additionally, there can be no assurance that these properties will operate better as a result of development or expansion activities due to various factors, including lower than anticipated occupancy and rental rates causing a property to be unprofitable or less profitable than originally estimated.

We regularly expend capital to maintain, repair and renovate our properties, which could negatively impact our financial condition and results of operations.

We may, or we may be required to, from time to time make significant capital expenditures to maintain or enhance the competitiveness of our manufactured housing communities. There can be no assurances that any such expenditures would result in higher occupancy or higher rental rates.

14

We may be unable to sell properties when appropriate because real estate investments are illiquid.

Real estate investments generally cannot be sold quickly and, therefore, will tend to limit our ability to vary our property portfolio promptly in response to changes in economic or other conditions. The inability to respond promptly to changes in the performance of our property portfolio could adversely affect our financial condition and ability to service our debt and make distributions to our stockholders.

We may be unable to compete with our larger competitors, which may in turn adversely affect our profitability.

The real estate business is highly competitive. We compete for manufactured housing community investments with numerous other real estate entities, such as individuals, corporations, REITs, and other enterprises engaged in real estate activities. In many cases, the competing concerns may be larger and better financed than we are, making it difficult for us to secure new manufactured housing community investments. Competition among private and institutional purchasers of manufactured housing community investments has led to increases in the purchase prices paid for manufactured housing communities and consequent higher fixed costs. To the extent we are unable to effectively compete in the marketplace, our business may be adversely affected.

Actions by our competitors may decrease or prevent increases in the occupancy and rental rates of our properties which could adversely affect our business.

We compete with other owners and operators of manufactured housing community properties, some of whom own properties similar to ours in the same submarkets in which our properties are located. The number of competitive manufactured housing community properties in a particular area could have a material adverse effect on our ability to lease sites and increase rents charged at our properties or at any newly acquired properties. In addition, other forms of multi-family residential properties, such as private and federally funded or assisted multi-family housing projects and single-family housing, provide housing alternatives to potential tenants of manufactured housing communities. If our competitors offer housing at rental rates below current market rates or below the rental rates we currently charge our tenants, we may lose potential tenants, and we may be pressured to reduce our rental rates below those we currently charge in order to retain tenants when our tenants’ leases expire. As a result, our financial condition, cash flow, cash available for distribution, and ability to satisfy our debt service obligations could be materially adversely affected.

Losses in excess of our insurance coverage or uninsured losses could adversely affect our cash flow.

We generally maintain insurance policies related to our business, including casualty, general liability and other policies covering business operations, employees and assets. However, we may be required to bear all losses that are not adequately covered by insurance. In addition, there are certain losses that are not generally insured because it is not economically feasible to insure against them, including losses due to riots or acts of war. If an uninsured loss or a loss in excess of insured limits occurs with respect to one or more of our properties, then we could lose the capital we invested in the properties, as well as the anticipated profits and cash flow from the properties and, in the case of debt that carries recourse to us, we would remain obligated for any mortgage debt or other financial obligations related to the properties. Although we believe that our insurance programs are adequate, no assurance can be given that we will not incur losses in excess of its insurance coverage, or that we will be able to obtain insurance in the future at acceptable levels and reasonable cost.

Costs associated with taxes and regulatory compliance may reduce our revenue.

We are subject to significant regulation that inhibits our activities and may increase our costs. Local zoning and use laws, environmental statutes and other governmental requirements may restrict expansion, rehabilitation and reconstruction activities. These regulations may prevent us from taking advantage of economic opportunities. Legislation such as the Americans with Disabilities Act may require us to modify our properties at a substantial cost and noncompliance could result in the imposition of fines or an award of damages to private litigants. Future legislation may impose additional requirements. We cannot predict what requirements may be enacted or amended or what costs we will incur to comply with such requirements. Costs resulting from changes in real estate laws, income taxes, service or other taxes may adversely affect our funds from operations and our ability to pay or refinance our debt. Similarly, changes in laws increasing the potential liability for environmental conditions existing on properties or increasing the restrictions on discharges or other conditions may result in significant unanticipated expenditures, which would adversely affect our business and results of operations.

15

Rent control legislation may harm our ability to increase rents.

State and local rent control laws in certain jurisdictions may limit our ability to increase rents and to recover increases in operating expenses and the costs of capital improvements. We may purchase additional properties in markets that are either subject to rent control or in which rent-limiting legislation exists or may be enacted.

Environmental liabilities could affect our profitability.