Form SF-3 BA Credit Card Trust

Table of Contents

As filed with the Securities and Exchange Commission on November 29, 2021

Registration Nos. 333-[—], 333-[—] and 333-[—]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SF-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BA CREDIT CARD TRUST

(Issuing entity in respect of the Notes)

BA MASTER CREDIT CARD TRUST II

(Issuing entity in respect of the Collateral Certificate)

BA CREDIT CARD FUNDING, LLC

(Depositor)

(Exact name of registrant as specified in its charter)

| Delaware | 01-0864848 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

Commission File Number of depositor: 333-136122

Central Index Key Number of depositor: 0001370238

BA Credit Card Funding, LLC

(Exact name of depositor as specified in its charter)

Central Index Key Number of sponsor: 0001102113

Bank of America, National Association

(Exact name of sponsor as specified in its charter)

BA Credit Card Funding, LLC

1020 North French Street

DE5-002-01-05

Wilmington, Delaware 19884

(980) 683-4915

(Address, Including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David Sobul, Esq.

Assistant General Counsel

Bank of America, National Association

150 N. College Street

NC1-028-28-02

Charlotte, North Carolina 28255

(980) 387-0204

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Michael H. Mitchell, Esq. Orrick, Herrington & Sutcliffe LLP 1152 15th Street, NW Washington, D.C. 20005 (202) 339-8456 |

Mitchell Naumoff, Esq. Orrick, Herrington & Sutcliffe LLP 1152 15th Street, NW Washington, D.C. 20005 (202) 339-8412 |

Joseph Topolski, Esq. Katten Muchin Rosenman LLP 575 Madison Avenue New York, New York 10022 (212) 940-6312 |

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective as determined by market conditions.

If any of the securities being registered on this Form SF-3 are to be offered pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form SF–3 is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form SF–3 is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

CALCULATION OF REGISTRATION FEE(a)

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered(b)(c) |

Proposed maximum offering price per unit(d) |

Proposed maximum aggregate offering price(d) |

Amount of registration fee | ||||

| Notes |

— | — | — | — | ||||

| Collateral Certificate(e) |

— | — | — | — | ||||

|

| ||||||||

|

| ||||||||

| (a) | Pursuant to Rule 415(a)(6) under the Securities Act of 1933, this Registration Statement and the prospectus included herein relate to $17,498,899,022 aggregate principal amount of Notes that were previously registered, but which remain unsold, under a registration statement on Form SF-3 (File nos. 333-228572, 333-228572-01 and 333-228572-02), initially filed on November 28, 2018 with an initial effective date of December 6, 2018. A filing fee of $537,216.20 was previously paid in connection with such unsold Notes. |

| (b) | With respect to any securities issued with original issue discount, the amount to be registered is calculated based on the initial public offering price thereof. |

| (c) | With respect to any securities denominated in any foreign currency, the amount to be registered shall be the U.S. dollar equivalent thereof based on the prevailing exchange rate at the time such security is first offered. |

| (d) | Estimated solely for the purpose of calculating the registration fee. |

| (e) | This Registration Statement and the prospectus included herein also relate to a Collateral Certificate, which is pledged as security for the Notes, and which, pursuant to Commission regulations, is deemed to constitute part of any distribution of the Notes. No additional consideration will be paid by the purchasers of the Notes for the Collateral Certificate and, pursuant to Rule 457(t) under the Securities Act, no separate registration fee for the Collateral Certificate is required to be paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall subsequently become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

INTRODUCTORY NOTE

This Registration Statement includes a representative form of prospectus relating to the offering by the BA Credit Card Trust of a multiple tranche series of asset-backed notes.

2

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not seeking an offer to buy these securities in any state where the offer or sale is prohibited.

SUBJECT TO COMPLETION DATED [•] [•], 20[•]

Prospectus Dated [______ __], 202[•]

Bank of America, National Association

Sponsor, Servicer and Originator (CIK: 0001102113)

BA Credit Card Funding, LLC

Transferor and Depositor (CIK: 0001370238)

BA Credit Card Trust

Issuing Entity (CIK: 0001128250)

BAseries

| The issuing entity will issue and sell: |

Class [•](20[•]-[•]) Notes | |

| Principal amount | $[•] | |

| Interest rate | [[•]-month [LIBOR*] plus] [•]% per year [(determined as described in this prospectus)] | |

| Interest payment dates | [•]th day of each month, beginning in [•] 20[•] | |

| Expected principal payment date | [•] [•], 20[•] | |

| Legal maturity date | [•] [•], 20[•] | |

| Expected issuance date | [•] [•], 20[•] | |

| Price to public | $[•] (or [•]%) | |

| Underwriting discount | $[•] (or [•]%) | |

| Proceeds to the issuing entity | $[•] (or [•]%) |

| * | [Note: For illustrative purposes, the prospectus contemplates that floating rate tranches will accrue interest at a floating rate based on LIBOR. LIBOR is expected to be replaced with another benchmark index for floating rate tranches, in which case we will disclose the specific index that will be used to determine interest payments for floating rate tranches.] |

The Class [•](20[•]-[•]) notes are a tranche of the Class [•] notes of the BAseries [and will be offered by the underwriters to investors at varying prices to be determined at the applicable time of sale. The compensation of the underwriters will be a commission representing the difference between the purchase price for the Class [•](20[•]-[•]) notes paid to the issuing entity and the proceeds from the sales of the Class [•](20[•]-[•]) notes paid to the underwriters by investors].

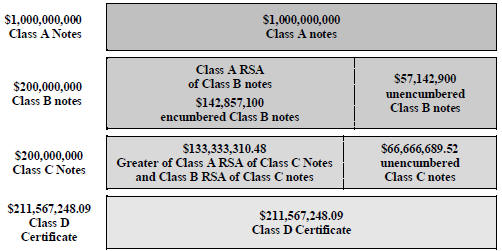

[Subordination: [Interest and principal on the Class B notes of the BAseries are subordinated to payments on the Class A notes as described in this prospectus.] [Interest and principal on the Class C notes of the BAseries are subordinated to payments on the Class A notes and the Class B notes as described in this prospectus.]]

Credit Enhancement: [Interest and principal on the Class B notes and the Class C notes of the BAseries and the Class D certificate, Series 2001-D are subordinated to payments on the Class A notes as described in this prospectus.] [Interest and principal on the Class C notes of the BAseries and the Class D certificate, Series 2001-D are subordinated to payments on the Class A notes and the Class B notes as described in this prospectus.] [Principal on the Class D certificate, Series 2001-D is subordinated to payments on the Class A notes, the Class B notes and the Class C notes of the BAseries as described in this prospectus. The Class C(20[•]-[•]) notes will have the benefit of a Class C reserve subaccount as described in this prospectus.]

[The Class [•](20[•]-[•]) notes will have the benefit of a [type of derivative agreement] provided by [NAME OF PROVIDER], as derivative counterparty.]

| You should consider the discussion under “Risk Factors” beginning on page [38] of this prospectus before you purchase any notes.

The primary asset of the issuing entity is the collateral certificate, Series 2001-D. The collateral certificate represents an undivided interest in BA Master Credit Card Trust II. Master Trust II’s assets include receivables arising in a portfolio of unsecured consumer revolving credit card accounts.

The notes are obligations of the issuing entity only and are not obligations of BA Credit Card Funding, LLC, Bank of America, National Association, their affiliates or any other person.

The notes of all series are secured by a shared security interest in the collateral certificate and the collection account, but each tranche of notes is entitled to the benefits of only that portion of the assets allocated to it under the indenture and the indenture supplement. Noteholders will have no recourse to any other assets of the issuing entity for payment of the BAseries notes.

The notes are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality. |

Neither the SEC nor any state securities commission has approved the notes or determined that this prospectus is truthful, accurate or complete. Any representation to the contrary is a criminal offense.

Underwriters

BofA Securities

Table of Contents

Information Presented in this Prospectus

BA Credit Card Trust will issue notes in series and we expect that most series will consist of multiple classes and that most classes will consist of multiple tranches. As of the date of this prospectus, the BAseries is the only issued and outstanding series of BA Credit Card Trust. The Class [•](20[•]-[•]) notes are a tranche of the Class [•] notes of the BAseries. This prospectus describes the specific terms of your series, class and tranche of notes and also provides general information about other series, classes and tranches of notes that have been and may be issued from time to time. Other series, classes and tranches of BA Credit Card Trust notes, including other tranches of notes that are included in the BAseries as a part of the Class [•] notes or other notes that are included in the Class [•](20[•]-[•]) tranche, may be issued by BA Credit Card Trust in the future without the consent of, or prior notice to, any noteholders. No series, class or tranche of notes, other than the Class [•](20[•]-[•]) notes, is being offered pursuant to this prospectus. See “Annex II: Outstanding Series, Classes and Tranches of Notes” in this prospectus for information on the other notes previously issued by BA Credit Card Trust.

The primary asset of BA Credit Card Trust is the collateral certificate, Series 2001-D, which represents an undivided interest in BA Master Credit Card Trust II. BA Master Credit Card Trust II may issue other series of certificates and any such series may consist of one or more classes. As of the date of this prospectus, Series 2001-D is the only issued and outstanding series of BA Master Credit Card Trust II. This prospectus describes the specific terms of the collateral certificate and also provides general information about other series of certificates that may be issued from time to time. Other series of BA Master Credit Card Trust II certificates may be issued by BA Master Credit Card Trust II in the future without the consent of, or prior notice to, any noteholders or certificateholders. No such series of certificates is being offered pursuant to this prospectus. See “Annex III: Outstanding Master Trust II Series of Investor Certificates” in this prospectus for information on the other certificates previously issued by BA Master Credit Card Trust II.

See “Risk Factors—Transaction Structure Risks—Issuance of additional notes or master trust II investor certificates may affect your voting rights and the timing and amount of payments on the notes” for a discussion of the potential impact that the issuance of additional notes or certificates could have on the Class [•](20[•]-[•]) notes.

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We do not claim the accuracy of the information in this prospectus as of any date other than the date stated on its cover.

We are not offering the Class [•](20[•]-[•]) notes in any state where the offer is not permitted.

Information regarding certain entities that are not affiliates of Bank of America, National Association or BA Credit Card Funding, LLC has been provided in this prospectus. See in particular “Transaction Parties; Legal Proceedings; Affiliations, Relationships and Related Transactions—The Bank of New York Mellon”, “—Wilmington Trust Company” and “—Clayton Fixed Income Services LLC.” The information contained in those sections of this prospectus was prepared solely by the party described in that section without the involvement of Bank of America, National Association, BA Credit Card Funding, LLC or any of their affiliates.

BofA Securities, Inc., one of the underwriters of the Class [•](20[•]-[•]) notes, is an affiliate of Bank of America, National Association, BA Credit Card Funding, LLC and BA Credit Card Trust. See “Underwriting (Plan of Distribution, Conflicts of Interest and Proceeds).”

Table of Contents

We include cross-references in this prospectus to captions in these materials where you can find further related discussions. The Table of Contents in this prospectus provides the pages on which these captions are located.

Parts of this prospectus use defined terms. You can find a listing of defined terms in the “Glossary of Defined Terms” beginning on page [208].

EU and UK Securitization Regulations

None of Bank of America, National Association, BA Credit Card Funding, LLC, BA Master Credit Card Trust II, BA Credit Card Trust, the master trust II trustee, the owner trustee, the indenture trustee, their respective affiliates or any other person will retain a material net economic interest in the securitization transaction constituted by the issue of the notes, or take any other action, in a manner prescribed by (a) European Union regulation 2017/2402 (as amended, the “EU Securitization Regulation”) or (b) Regulation (EU) 2017/2402, as it forms part of UK domestic law by virtue of the EUWA (as defined herein), and as amended by the Securitization (Amendment) (EU Exit) Regulations 2019 (the “UK Securitization Regulation”). In particular, no such party will take or refrain from taking any action that may be required by any prospective investor or noteholder for the purposes of its compliance with any requirement of the EU Securitization Regulation or the UK Securitization Regulation. In addition, the arrangements described under “Transaction Parties; Legal Proceedings; Affiliations, Relationships and Related Transactions—BANA and Affiliates—Credit Risk Retention” have not been structured with the objective of enabling or facilitating compliance by any person with any requirement of the EU Securitization Regulation or the UK Securitization Regulation.

Consequently, the notes may not be a suitable investment for any person that is now or may in the future be subject to any requirement of the EU Securitization Regulation or the UK Securitization Regulation.

For additional information regarding the EU Securitization Regulation and the UK Securitization Regulation, see “Risk Factors—Other Legal and Regulatory Risks—Securitization Regulations in the EU and the UK.”

Notice to Residents of the United Kingdom

The notes must not be offered or sold and this prospectus and any other document in connection with the offering and issuance of the notes must not be communicated or caused to be communicated in the United Kingdom except to persons who have professional experience in matters relating to investments and qualify as investment professionals under Article 19(5) (Investment Professionals) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, (as amended) (the “Order”) or are persons falling within Article 49(2)(a)-(d) (high net worth companies, unincorporated associations, etc.) of the Order or who otherwise fall within an exemption set forth in such Order such that Section 21(1) of the Financial Services And Markets Act 2000 (as amended) (“FSMA”) does not apply to the issuing entity or are persons to whom this prospectus or any other such document may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “Relevant Persons”). Any investment or investment activity to which this prospectus relates is available only to Relevant Persons and will be engaged in only with Relevant Persons.

Neither this prospectus nor the notes are or will be available to persons who are not Relevant Persons and this prospectus must not be acted on or relied on by persons who are not Relevant Persons. The communication of this prospectus to any person in the United Kingdom who is not a Relevant Persons is unauthorized and may contravene the FSMA.

Table of Contents

Each underwriter has represented and agreed that: (a) it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the FSMA) received by it in connection with the issue or sale of the notes in circumstances in which Section 21(1) of the FSMA does not apply to the issuing entity; and (b) it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the notes in, from or otherwise involving the United Kingdom.

The notes are not intended to be offered, sold or otherwise made available to, and should not be offered, sold or otherwise made available to, any retail investor in the United Kingdom (“UK”). For these purposes, a retail investor means a person who is one (or more) of the following: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) 2017/565, as it forms part of UK domestic law by virtue of the EUWA; or (ii) a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA (such rules and regulations as amended) to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014, as it forms part of UK domestic law by virtue of the EUWA, and as amended; or (iii) not a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129, as it forms part of UK domestic law by virtue of the EUWA (as amended, the “UK Prospectus Regulation”). Consequently no key information document required by Regulation (EU) No 1286/2014, as it forms part of UK domestic law by virtue of the EUWA, and as amended (the “UK PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

This Prospectus is not a prospectus for the purposes of the UK Prospectus Regulation.

Notice To Residents of the European Economic Area

The notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“EEA”). For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of

Directive 2014/65/EU (as amended, “MiFID II”); or (ii) a customer within the meaning of Directive (EU) 2016/97 (as amended, the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129 (as amended, the “EU Prospectus Regulation”). Consequently no key information document required by Regulation (EU) No 1286/2014 (as amended, the “EU PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in the EEA may be unlawful under the EU PRIIPs Regulation.

This Prospectus is not a prospectus for the purposes of the EU Prospectus Regulation.

Volcker Rule Considerations

BA Credit Card Trust is not now, and immediately following the issuance of the Class [•](20[•]-[•]) notes pursuant to the indenture will not be, a “covered fund” for purposes of regulations adopted under Section 13 of the Bank Holding Company Act of 1956, commonly known as the “Volcker Rule.” In reaching this conclusion, although other statutory or regulatory exclusions or exemptions under the Investment Company Act of 1940, as amended, or the Volcker Rule may be available, we have relied on the exclusion from registration set forth in Rule 3a-7 under the Investment Company Act.

Table of Contents

Forward-Looking Statements

This prospectus, including information incorporated by reference in this prospectus, may contain forward-looking statements. Such statements are subject to risks and uncertainties. Actual conditions, events or results may differ materially from those set forth in such forward-looking statements. Words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “could” or similar expressions are intended to identify forward-looking statements but are not the only means to identify these statements. Forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any such statements. Factors which could cause the actual financial and other results to differ materially from those projected by us in forward-looking statements include, but are not limited to, the following:

| • | the emergence of widespread health emergencies or pandemics, including the magnitude and duration of the coronavirus disease (“COVID-19”) pandemic and its impact on BANA’s business and on cardholder use and payment patterns; |

| • | local, regional and national business, political or economic conditions may differ from those expected; |

| • | the effects and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve Board, may adversely affect Funding’s or BANA’s business; |

| • | the timely development and acceptance of new products and services may be different than anticipated; |

| • | technological changes instituted by Funding or BANA and by persons who may affect Funding’s or BANA’s business may be more difficult to accomplish or more expensive than anticipated or may have unforeseen consequences; |

| • | the ability to increase market share and control expenses may be more difficult than anticipated; |

| • | competitive pressures among financial services companies may increase significantly; |

| • | Funding’s or BANA’s reputation risk arising from negative public opinion; |

| • | changes in laws and regulations may adversely affect Funding, BANA or their businesses; |

| • | changes in accounting policies and practices, as may be adopted by regulatory agencies and the Financial Accounting Standards Board, may affect expected financial reporting or business results; |

| • | the costs, effects and outcomes of litigation may adversely affect Funding, BANA or their businesses; and |

| • | Funding or BANA may not manage the risks involved in the foregoing as well as anticipated. |

We expect that the effects of the COVID-19 pandemic will heighten the risks and uncertainties associated with many of these factors.

Table of Contents

| Page | ||||

| THE CLASS [•](20[•]-[•]) NOTES | 1 | |||

| 1 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| Stated Principal Amount, Outstanding Dollar Principal Amount and Nominal Liquidation Amount of Notes |

17 | |||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 25 | ||||

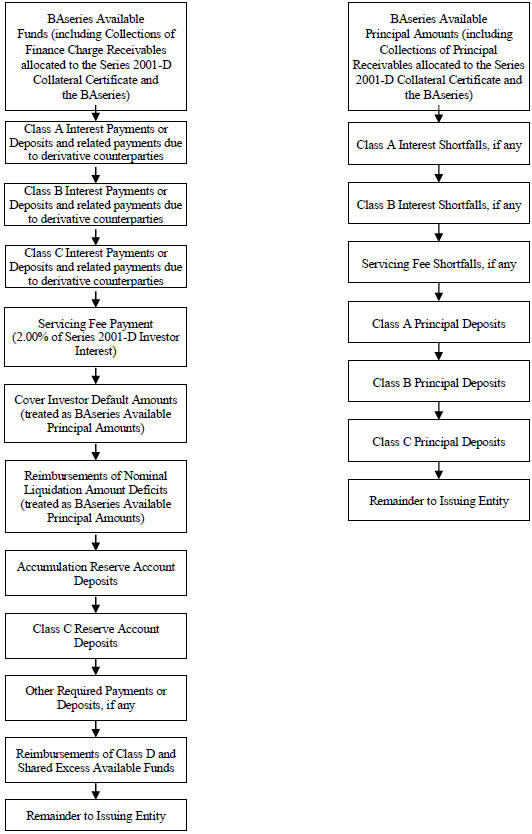

| Flow of Funds and Application of Finance Charge and Principal Collections |

25 | |||

| 26 | ||||

| 26 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| Fees and Expenses Payable from BAseries Available Funds and BAseries Available Principal Amounts |

35 | |||

| BAseries Required Subordinated Amounts and Required Class D Investor Interest |

36 | |||

- i -

Table of Contents

TABLE OF CONTENTS

(continued)

| Page | ||||

| 38 | ||||

| 38 | ||||

| 43 | ||||

| 49 | ||||

| 57 | ||||

| 66 | ||||

| TRANSACTION PARTIES; LEGAL PROCEEDINGS; AFFILIATIONS, RELATIONSHIPS AND RELATED TRANSACTIONS |

68 | |||

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 71 | ||||

| 73 | ||||

| 73 | ||||

| 74 | ||||

| 75 | ||||

| 76 | ||||

| 76 | ||||

| 76 | ||||

| 77 | ||||

| 77 | ||||

| 77 | ||||

| 78 | ||||

| 78 | ||||

| 78 | ||||

| 79 | ||||

| 80 | ||||

| Stated Principal Amount, Outstanding Dollar Principal Amount and Nominal Liquidation Amount |

81 | |||

| 82 | ||||

| 82 | ||||

| 82 | ||||

| 84 | ||||

| 85 | ||||

| 85 | ||||

| 91 | ||||

| 92 | ||||

| 94 | ||||

| 95 | ||||

| 95 | ||||

| 95 | ||||

| 95 | ||||

| 96 | ||||

- ii -

Table of Contents

TABLE OF CONTENTS

(continued)

- iii -

Table of Contents

TABLE OF CONTENTS

(continued)

| Page | ||||

| 121 | ||||

| 121 | ||||

| 122 | ||||

| 122 | ||||

| 122 | ||||

| 123 | ||||

| 124 | ||||

| 124 | ||||

| Limited Recourse to the Issuing Entity; Security for the Notes |

126 | |||

| 126 | ||||

| 126 | ||||

| 128 | ||||

| 129 | ||||

| 130 | ||||

| 131 | ||||

| 132 | ||||

| 134 | ||||

| 134 | ||||

| 134 | ||||

| 137 | ||||

| 137 | ||||

| 137 | ||||

| 137 | ||||

| 138 | ||||

| 138 | ||||

| 140 | ||||

| 140 | ||||

| Origination, Account Acquisition, Credit Lines and Use of Credit Card Accounts |

140 | |||

| 142 | ||||

| 142 | ||||

| 143 | ||||

| 143 | ||||

| 144 | ||||

| 144 | ||||

| 144 | ||||

| 145 | ||||

| 145 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

| 147 | ||||

| 148 | ||||

| 148 | ||||

| 148 | ||||

- iv -

Table of Contents

TABLE OF CONTENTS

(continued)

| Page | ||||

| 148 | ||||

| 149 | ||||

| 149 | ||||

| 151 | ||||

| 153 | ||||

| Demands for Repurchases of Receivables in Master Trust II Portfolio |

154 | |||

| 155 | ||||

| 155 | ||||

| 156 | ||||

| 157 | ||||

| 159 | ||||

| 160 | ||||

| 161 | ||||

| 162 | ||||

| 162 | ||||

| 164 | ||||

| 165 | ||||

| 165 | ||||

| 167 | ||||

| 167 | ||||

| 169 | ||||

| 170 | ||||

| 173 | ||||

| 174 | ||||

| 175 | ||||

| 176 | ||||

| 178 | ||||

| 178 | ||||

| 179 | ||||

| 179 | ||||

| 180 | ||||

| 180 | ||||

| 181 | ||||

| 182 | ||||

| 183 | ||||

| 186 | ||||

| 186 | ||||

| Resignation and Removal of the Asset Representations Reviewer |

186 | |||

| 187 | ||||

| 188 | ||||

| 188 | ||||

| 191 | ||||

- v -

Table of Contents

TABLE OF CONTENTS

(continued)

| Page | ||||

| 192 | ||||

| 193 | ||||

| 193 | ||||

| 194 | ||||

| 194 | ||||

| 196 | ||||

| 199 | ||||

| 199 | ||||

| 200 | ||||

| 200 | ||||

| Prohibited Transactions between the Benefit Plan and a Party in Interest |

200 | |||

| Prohibited Transactions between the Issuing Entity or Master Trust II and a Party in Interest |

201 | |||

| 202 | ||||

| 202 | ||||

| UNDERWRITING (PLAN OF DISTRIBUTION, CONFLICTS OF INTEREST AND PROCEEDS) |

202 | |||

| 206 | ||||

| 206 | ||||

| 208 | ||||

| A-I-1 | ||||

| A-I-1 | ||||

| A-I-1 | ||||

| A-I-4 | ||||

| A-I-6 | ||||

| A-I-7 | ||||

| A-II-1 | ||||

| A-III-1 | ||||

- vi -

Table of Contents

The Class [•](20[•]-[•]) Notes

This summary does not contain all the information you may need to make an informed investment decision. You should read this prospectus in its entirety before you purchase any notes.

Only the Class [•](20[•]-[•]) notes are being offered through this prospectus. Other series, classes and tranches of BA Credit Card Trust notes, including other tranches of notes that are included in the BAseries as a part of the Class [•] notes or other notes that are included in the Class[•](20[•]-[•]) tranche, may be issued by BA Credit Card Trust in the future without the consent of, or prior notice to, any noteholders. See “Annex II: Outstanding Series, Classes and Tranches of Notes” in this prospectus for information on the other notes previously issued by BA Credit Card Trust. See “Annex III: Outstanding Master Trust II Series of Investor Certificates” in this prospectus for information on the certificates previously issued by BA Master Credit Card Trust II.

Other series of certificates of master trust II may be issued without the consent of, or prior notice to, any noteholders or certificateholders.

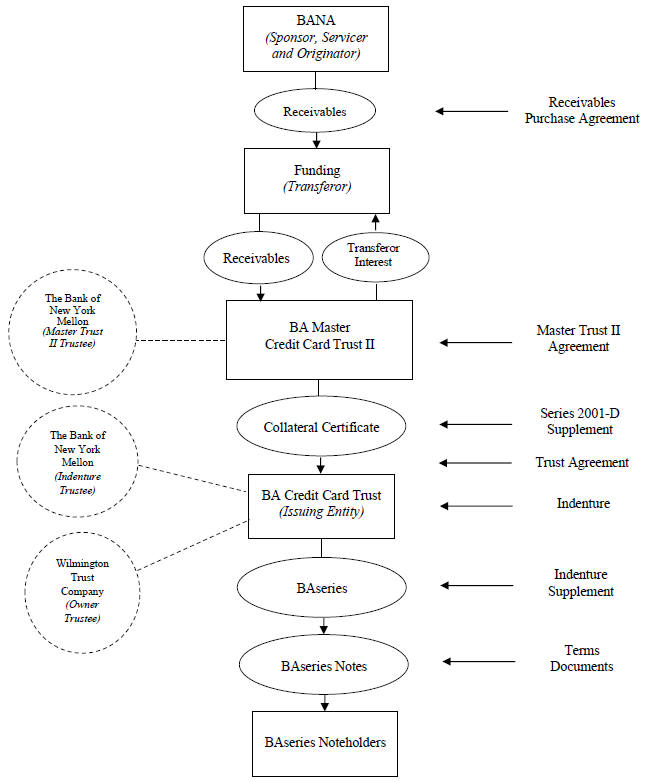

| Transaction Parties | ||||

| Issuing Entity of the Notes |

BA Credit Card Trust (“issuing entity”) | |||

| Issuing Entity of the Collateral Certificate |

BA Master Credit Card Trust II (“master trust II”) | |||

| Sponsor, Servicer and Originator |

Bank of America, National Association (“BANA”) | |||

| Transferor and Depositor |

BA Credit Card Funding, LLC (“Funding”) | |||

| Master Trust II Trustee, Indenture Trustee |

The Bank of New York Mellon | |||

| Owner Trustee |

Wilmington Trust Company | |||

| Asset Representations Reviewer |

Clayton Fixed Income Services LLC | |||

| [Derivative Counterparty] |

[NAME OF COUNTERPARTY] | |||

| Assets | ||||

| Primary Asset of the Issuing Entity |

Master trust II, Series 2001-D Collateral Certificate | |||

| Collateral Certificate |

Undivided interest in master trust II | |||

| Primary Assets of Master Trust II |

Receivables in unsecured consumer revolving credit card accounts | |||

| Receivables (as of beginning of the day |

Principal receivables: | $[•] | ||

| on [•] [•], 20[•]) |

Finance charge receivables: | $[•] | ||

| Asset Backed Securities Offered | Class [•](20[•]-[•]) | |||

| Class |

Class [•] | |||

| Series |

BAseries | |||

| Initial Principal Amount |

$[•] | |||

| Initial Nominal Liquidation Amount |

$[•] | |||

| Expected Issuance Date |

[•] [•], 20[•] | |||

| [Subordination |

[The Class B(20[•]-[•]) notes will be subordinated to the Class A notes.] [The Class C(20[•]-[•]) notes will be subordinated to the Class A and Class B notes.]] | |||

| [Credit Enhancement |

[Subordination of the Class B notes, the Class C notes and the Class D certificate] [Subordination of the Class C notes and the Class D certificate] [Subordination of the Class D certificate]] | |||

| [Credit Enhancement Amount |

Required Subordinated Amount and Required Class D Investor Interest] | |||

1

Table of Contents

| [Required Subordinated Amount of Class B Notes |

Applicable required subordination percentage of Class B notes multiplied by the adjusted outstanding dollar principal amount of the Class A(20[•]-[•]) notes.] | |

| [Required Subordination Percentage of Class B Notes |

[•]%. However, see “Prospectus Summary—BAseries Required Subordinated Amounts and Required Class D Investor Interest” and “The Notes—Required Subordinated Amount” for a discussion of the calculation of the applicable stated percentage and the method by which the applicable stated percentage may be changed in the future.] | |

| [Required Subordinated Amount of Class C Notes |

[Applicable required subordination percentage of Class C notes multiplied by the adjusted outstanding dollar principal amount of the Class A(20[•]-[•]) notes.] [An amount equal to [•]% of the adjusted outstanding dollar principal amount of the Class B(20[•]-[•]) notes that are not providing credit enhancement to the Class A notes, plus 100% of the adjusted outstanding dollar principal amount of the Class B(20[•]-[•]) notes’ pro rata share of the Class A required subordinated amount of Class C notes for all Class A notes. See “The Notes—Required Subordinated Amount” for a discussion of the calculation of the Class B(20[•]-[•]) notes’ required subordinated amount of Class C notes, and the method by which that calculation may be changed in the future.]] | |

| [Required Subordination Percentage of Class C Notes |

[•]%. However, see “Prospectus Summary—BAseries Required Subordinated Amounts and Required Class D Investor Interest” and “The Notes—Required Subordinated Amount” for a discussion of the calculation of the applicable stated percentage and the method by which the applicable stated percentage may be changed in the future.] | |

| Required Class D Investor Interest |

The required Class D investor interest is approximately equal to 10.50% of the sum of the aggregate adjusted outstanding dollar principal amount of the BAseries notes. See “Prospectus Summary—BAseries Required Subordinated Amounts and Required Class D Investor Interest” and “The Notes—Required Subordinated Amount—The Class D Certificate” for a more specific description of how the required Class D investor interest is calculated. | |

| Accumulation Reserve Account Targeted Deposit |

0.5% of the outstanding dollar principal amount of the Class [•](20[•]-[•]) notes; provided, however, that if the Class [•](20[•]-[•]) notes require only one budgeted deposit to accumulate and pay the principal of the Class [•](20[•]-[•]) notes on the expected principal payment date, the accumulation reserve account targeted deposit will be zero. See “Prospectus Summary—BAseries Accumulation Reserve Account” for a description of how the accumulation reserve account targeted deposit can be changed. | |

| [Class C Reserve Account Targeted Deposit |

Nominal liquidation amount of all BAseries notes multiplied by the applicable funding percentage.] | |

2

Table of Contents

| [Funding Percentage | Three-month average | |||||

| excess available funds | Funding % | |||||

| 4.50% or greater | 0.00% | |||||

| 4.00% to 4.49% |

1.25% | |||||

| 3.50% to 3.99% | 2.00% | |||||

| 3.00% to 3.49% | 2.75% | |||||

| 2.50% to 2.99% | 3.50% | |||||

| 2.00% to 2.49% | 4.50% | |||||

| 1.99% or less | 6.00% |

| Increases in the funding percentage will lead to a larger targeted deposit to the Class C reserve account, and therefore also to the related Class C reserve subaccount for the Class C(20[•]-[•]) notes. Funds on deposit in the Class C reserve subaccount will be available to cover shortfalls in interest and principal on the Class C(20[•]-[•]) notes. However, amounts on deposit in the Class C reserve subaccount may have been reduced due to withdrawals to cover shortfalls in interest or principal due in prior periods. In addition, the Class C reserve subaccount may not be fully funded if Available Funds after giving effect to prior required deposits are insufficient to make the full targeted deposit into the Class C reserve subaccount.] | ||

| [Excess Available Funds Percentage |

Excess of Portfolio Yield over Base Rate. See “Prospectus Summary—BAseries Class C Reserve Account.”] | |

| [[Asset-Backed Securities][Other Interests] | ||

| Not Offered | [Description of [asset-backed securities][other interests] not offered by this prospectus.]] | |

| Interest | ||

| Interest Rate |

[London interbank offered rate for U.S. dollar deposits for a [•]-month period [(or, for the first interest accrual period, the rate that corresponds to the actual number of days in the first interest accrual period)] (“LIBOR”) as of each LIBOR determination date plus1] [•]% per year. | |

| [LIBOR Determination Dates |

[•] [•], 20[•] for the period from and including the issuance date to but excluding [•] [•], 20[•], and for each interest accrual period thereafter, the date that is two London Business Days before each distribution date.] | |

| Distribution Dates |

The [•]th day of each calendar month (or the next Business Day if the [•]th is not a Business Day) | |

| [London Business Day |

London, New York, New York, Newark, Delaware, and Charlotte, North Carolina banking day.] | |

| Interest Accrual Method |

[Actual] [30]/360 | |

| Interest Accrual Periods |

From and including the issuance date to but excluding the [•]th day of the calendar month in which the first interest payment date occurs and then from and including the [•]th day of each calendar month to but excluding the [•]th day in the next | |

| 1 | [Note: For illustrative purposes, the prospectus contemplates that floating rate tranches will accrue interest at a floating rate based on LIBOR. LIBOR is expected to be replaced with another benchmark index for floating rate tranches, in which case we will disclose the specific index that will be used to determine interest payments for floating rate tranches.] |

3

Table of Contents

| calendar month. The first interest accrual period will begin on and include the issuance date for the Class [•](20[•]-[•]) notes and end on but exclude the first interest payment date for the Class [•](20[•]-[•]) notes, [•] [•], 20[•]. | ||

| Interest Payment Dates |

Each distribution date starting on [•] [•], 20[•] | |

| First Interest Payment Date |

[•] [•], 20[•] | |

| [First Interest Payment |

$[•]] | |

| Business Day |

New York, New York, Newark, Delaware, and Charlotte, North Carolina banking day | |

| Principal | ||

| Expected Principal Payment Date |

[•] [•], 20[•] | |

| Legal Maturity Date |

[•] [•], 20[•] | |

| Revolving Period End |

Between 12 and 1 months prior to expected principal payment date | |

| Servicing Fee | 2% of the Series 2001-D investor interest | |

| [Derivative Agreement | The Class [•](20[•]-[•]) notes will have the benefit of an interest rate swap agreement (referred to as the “derivative agreement”) provided by [NAME OF COUNTERPARTY], as derivative counterparty. Under the derivative agreement, for each Transfer Date: | |

| • the derivative counterparty will make a payment to the issuing entity, based on the outstanding dollar principal amount of the Class [•](20[•]-[•]) notes, at a rate equal to [•]% per year; and | ||

| • the issuing entity will make a payment to the derivative counterparty, based on the outstanding dollar principal amount of the Class [•](20[•]-[•]) notes, at a rate not to exceed [•]-month LIBOR (for the related interest period) plus [•]% per year. | ||

| For a more detailed discussion of the derivative agreement, see “Prospectus Summary—Sources of Funds to Pay the Notes—Derivative Agreement for Class [•](20[•]-[•]) Notes.”] | ||

| [Derivative Counterparties | Add name, organizational form and general character of the business of any derivative counterparty to the extent required. Disclose other information regarding the derivative counterparty as required, including, but not limited to, a description of any material affiliations or business agreements/arrangements with any other material transaction party.] | |

| Early Redemption Events | Early redemption events applicable to the Class [•](20[•]-[•]) notes include the following: (i) the occurrence of the expected principal payment date for such notes; (ii) each of the Pay Out Events described under “Master Trust II—Pay Out Events” in this prospectus; (iii) the issuing entity becoming an “investment company” within the meaning of the Investment Company Act | |

4

Table of Contents

| of 1940, as amended; (iv) for any date the amount of Excess Available Funds for the BAseries averaged over the 3 preceding calendar months is less than the Required Excess Available Funds for the BAseries for such date[; and (v) specify any other early redemption event]. See “The Indenture—Early Redemption Events” in this prospectus. | ||

| [If an early redemption event (other than clause (iii) above) applicable to the Class [•](20[•]-[•]) notes occurs and the derivative agreement has not been terminated or an interest reserve account event has not occurred, Available Principal Amounts allocable to the Class [•](20[•]-[•]) notes together with any amounts in the principal funding subaccount for the Class [•](20[•]-[•]) notes will not be paid to the holders of the Class [•](20[•]-[•]) notes, but instead will be retained in the principal funding subaccount and paid to the Class [•](20[•]-[•]) noteholders on the expected principal payment date of the Class [•](20[•]-[•]) notes. See “The Class [•](20[•]-[•]) Notes—Early Redemption of Notes.” | ||

| If following an early redemption event for the Class [•](20[•]-[•]) notes (i) the derivative agreement terminates, (ii) an interest reserve account event occurs, (iii) the issuing entity becomes an “investment company” within the meaning of the Investment Company Act of 1940, as amended or (iv) an event of default and acceleration of the Class [•](20[•]-[•]) notes occurs, Available Principal Amounts will be paid to the Class [•](20[•]-[•]) noteholders. See “The Class [•](20[•]-[•]) Notes—Early Redemption of Notes.” | ||

| See “Prospectus Summary—Sources of Funds to Pay the Notes—Derivative Agreement for Class [•](20[•]-[•]) Notes” for a description of the events leading to the occurrence of an interest reserve account event.] | ||

| Events of Default | Events of default applicable to the Class [•](20[•]-[•]) notes include the following: (i) the issuing entity’s failure, for a period of 35 days, to pay interest upon such notes when such interest becomes due and payable; (ii) the issuing entity’s failure to pay the principal amount of such notes on the applicable legal maturity date; (iii) the issuing entity’s default in the performance, or breach, of any other of its covenants or warranties, as discussed in this prospectus; and (iv) the occurrence of certain events of bankruptcy, insolvency, conservatorship or receivership of the issuing entity. See “The Indenture—Events of Default” in this prospectus. | |

| Optional Redemption | If the nominal liquidation amount is less than 5% of the highest outstanding dollar principal amount. | |

5

Table of Contents

| ERISA Eligibility | Yes, subject to important considerations described under “Benefit Plan Investors” in this prospectus (Investors are cautioned to consult with their counsel). By purchasing the Class [•](20[•]-[•]) notes, each investor purchasing on behalf of employee benefit plans or individual retirement accounts will be deemed to certify that the purchase and subsequent holding of the notes by the investor would be exempt from the prohibited transaction rules of ERISA and/or Section 4975 of the Internal Revenue Code or Similar Law. | |

| Tax Treatment | Debt for U.S. federal income tax purposes, subject to important considerations described under “Federal Income Tax Consequences” in this prospectus (Investors are cautioned to consult with their tax counsel). | |

| [Stock Exchange Listing | The issuing entity will apply to list the Class [•](20[•]-[•]) notes on a stock exchange in Europe. The issuing entity cannot guarantee that the application for the listing will be accepted or that, if accepted, the listing will be maintained. To determine whether the Class [•](20[•]-[•]) notes are listed on a stock exchange you may contact the issuing entity c/o Wilmington Trust Company, Rodney Square North, 1100 North Market Street, Wilmington, Delaware 19890-0001, telephone number: (302) 651-1000.] | |

| Clearing and Settlement | DTC/Clearstream/Euroclear | |

| EU and UK Securitization Regulations | The transaction described in this prospectus is not structured to satisfy any risk retention, due diligence or other requirements of the EU Securitization Regulation or the UK Securitization Regulation. No party to such transaction or any of their respective affiliates makes or intends to make any representation or agreement that it or any other party is undertaking or will undertake to take or refrain from taking any action to facilitate or enable compliance by any Affected Investor with the applicable Due Diligence Requirements prescribed or contemplated by the EU Securitization Regulation or the UK Securitization Regulation. | |

| Failure by an Affected Investor to comply with the applicable Due Diligence Requirements with respect to an investment in the Notes offered by this prospectus may result in the imposition of a penalty regulatory capital charge on that investment or of other regulatory sanctions by the competent authority of such Affected Investor. Consequently, the Notes may not be a suitable investment for any person that is now or may in the future be subject to any requirements of the EU Securitization Regulation or the UK Securitization Regulation. | ||

| See “Risk Factors—Other Legal and Regulatory Risks—Securitization Regulations in the EU and the UK.” | ||

6

Table of Contents

This summary does not contain all the information you may need to make an informed investment decision. You should read this prospectus in its entirety before you purchase any notes.

The issuing entity may periodically offer notes in one or more series, classes, or tranches. The notes will be issued pursuant to an indenture between the issuing entity and The Bank of New York Mellon, as indenture trustee. Each series of notes will be issued pursuant to a supplement to the indenture between the issuing entity and the indenture trustee.

The issuing entity is offering only the Class [•](20[•]-[•]) notes by means of this prospectus. The Class [•](20[•]-[•]) notes are part of a series of notes called the BAseries. As of the date of this prospectus, the BA series is the only issued and outstanding series of the issuing entity. See “Annex II: Outstanding Series, Classes and Tranches of Notes” for information about other outstanding notes issued by the issuing entity. The BAseries consists of Class [•] notes, Class B notes and Class C notes. The Class [•](20[•]-[•]) notes are a tranche of Class [•] notes of the BAseries. When issued, the Class [•](20[•]-[•]) notes will be issued by, and obligations of, BA Credit Card Trust.

On the expected issuance date, the Class [•](20[•]-[•]) notes are expected to be the [•] tranche of Class [•] notes currently outstanding in the BAseries (excluding Class A(2001-Emerald), which currently has a nominal liquidation amount of $0).

Investment in the Class [•](20[•]-[•]) notes involves risks, including business risks, legal and regulatory risks, and transaction structure risks, most of which could result in accelerated, delayed or reduced payments on your notes. We have summarized these risks below and described them more fully under the heading “Risk Factors,” beginning on page [38] in this prospectus. You should consider these risks carefully.

Business Risks Relating to BANA’s Credit Card Business

| • | The COVID-19 pandemic has adversely impacted, and may continue to adversely impact, cardholder use, payment patterns and the performance of the credit card receivables, which may impact the timing and amount of collections. |

| • | A failure in or breach of BANA’s operational or security systems or infrastructure, or those of third parties, could disrupt BANA’s ability to originate and service credit card accounts and related receivables. |

| • | A cyberattack, information or security breach, or a technology failure of BANA or of a third party could adversely affect BANA’s credit card origination and servicing activities, result in the loss of information or the disclosure or misuse of confidential or proprietary information, cause reputational harm, or reduce the rate at which new receivables are generated and repaid. |

| • | Competition in the credit card and consumer lending industry may result in a decline in BANA’s ability to generate new receivables. |

| • | Payment patterns of cardholders may not be consistent over time, which may impact the timing and amount of collections. |

| • | BANA may change the terms of the credit card accounts in a way that reduces or slows collections. |

7

Table of Contents

| • | Yield and payments on the receivables could decrease. |

Insolvency and Security Interest Risks

| • | The conservatorship, receivership, bankruptcy, or insolvency of BANA, Funding, master trust II, the issuing entity or any of their affiliates, or of other parties to the transactions, could result in accelerated, delayed, or reduced payments on the notes. |

| • | The conservatorship, receivership, bankruptcy, or insolvency of other parties to the transactions could result in accelerated, delayed, or reduced payments to you. |

| • | Some interests could have priority over the master trust II trustee’s interest in the receivables or the indenture trustee’s interest in the collateral certificate. |

| • | The master trust II trustee and the indenture trustee may not have a perfected interest in collections commingled by the servicer with its own funds or in interchange commingled by BANA with its own funds. |

Other Legal and Regulatory Risks

| • | BANA is subject to regulatory supervision and regulatory action, which could result in losses or delays in payment. |

| • | Changes to consumer protection laws, including in their application or interpretation, may impede origination or collection efforts, change cardholder use patterns, or alter timing and amount of collections. |

| • | Financial regulatory reforms could have a significant impact on the issuing entity, master trust II, Funding or BANA. |

| • | [Increased regulatory oversight and changes in the method pursuant to which LIBOR rates are determined may adversely affect the value of your notes.] |

| • | BANA, the transferor, master trust II and the issuing entity could be named as defendants in litigation, resulting in increased expenses and greater risk of loss on your notes. |

| • | Changes in federal tax legislation could adversely affect the business, financial condition and results of operations of the issuing entity, master trust II, Funding or BANA or their affiliates. |

| • | Securitization Regulations in the EU and the UK |

Transaction Structure Risks

| • | The note interest rate and the receivables interest rate may reset at different times or fluctuate differently. |

| • | Allocations of defaulted principal receivables and reallocation of Available Principal Amounts could result in a reduction in payment on your notes. |

| • | Only some of the assets of the issuing entity are available for payments on any tranche of notes. |

| • | Class B notes and Class C notes are subordinated and bear losses before Class A notes. |

| • | Payment of Class B notes and Class C notes may be delayed or reduced due to the subordination provisions. |

| • | Class A notes and Class B notes of the BAseries can lose their subordination under some circumstances. |

8

Table of Contents

| • | Addition of credit card accounts to master trust II and attrition of credit card accounts and receivables from master trust II may decrease the credit quality of the assets securing the repayment of your notes. |

| • | BANA may not be able to generate new receivables or designate new credit card accounts to master trust II when required by the master trust II agreement. |

| • | If representations and warranties relating to the receivables are breached, payments on your notes may be reduced. |

| • | The objective of the asset representations review process is to independently identify noncompliance with a representation or warranty concerning the receivables but no assurance can be given as to its effectiveness. |

| • | Issuance of additional notes or master trust II investor certificates may affect your voting rights and the timing and amount of payments on the notes. |

| • | You may have limited or no ability to control actions under the indenture and the master trust II agreement, which may result in, among other things, payment of principal on your notes earlier or later than might otherwise have been in your interest. |

| • | If an event of default occurs, your remedy options may be limited and you may not receive full payment of principal and accrued interest. |

| • | [The derivative agreement can affect the amount of credit enhancement available to the Class [•](20[•]-[•]) notes.] |

| • | [A payment default under the derivative agreement or a termination of the derivative agreement may result in early or reduced payment on the Class [•](20[•]-[•]) notes.] |

| • | [Notwithstanding the existence of the derivative agreement, the occurrence of certain events may result in early payment on the Class [•](20[•]-[•]) notes.] |

General Risk Factors

| • | There is no public market for the notes. As a result you may be unable to sell your notes or the price of the notes may suffer. |

| • | You may not be able to reinvest any early redemption proceeds in a comparable security. |

| • | If the ratings of the notes are lowered or withdrawn, their market value could decrease. |

BA Credit Card Trust, a Delaware statutory trust, is the issuing entity of the notes. The address of the issuing entity is BA Credit Card Trust, c/o Wilmington Trust Company, Rodney Square North, 1100 North Market Street, Wilmington, Delaware 19890-0001. Its telephone number is (302) 651-1000.

BA Credit Card Funding, LLC is the beneficiary of the issuing entity.

BA Credit Card Funding, LLC (referred to as “Funding”), a limited liability company formed under the laws of Delaware and a direct subsidiary of BANA, is the transferor and depositor of the issuing entity. The address for Funding is 1020 North French Street, DE5-002-01-05, Wilmington, Delaware 19884 and its telephone number is (980) 683-4915. In addition, Funding is the holder of the transferor interest in BA Master Credit Card Trust II, the beneficiary of the issuing entity, and the holder of the Class D certificate.

9

Table of Contents

On October 20, 2006, Funding was substituted for FIA Card Services, National Association (referred to as “FIA”, and to which BANA has succeeded by merger as of October 1, 2014 (referred to as the “merger date”)) as the transferor of receivables to master trust II, as holder of the transferor interest in master trust II, and as beneficiary of the issuing entity. See “Transaction Parties; Legal Proceedings; Affiliations, Relationships and Related Transactions—BA Credit Card Funding, LLC.”

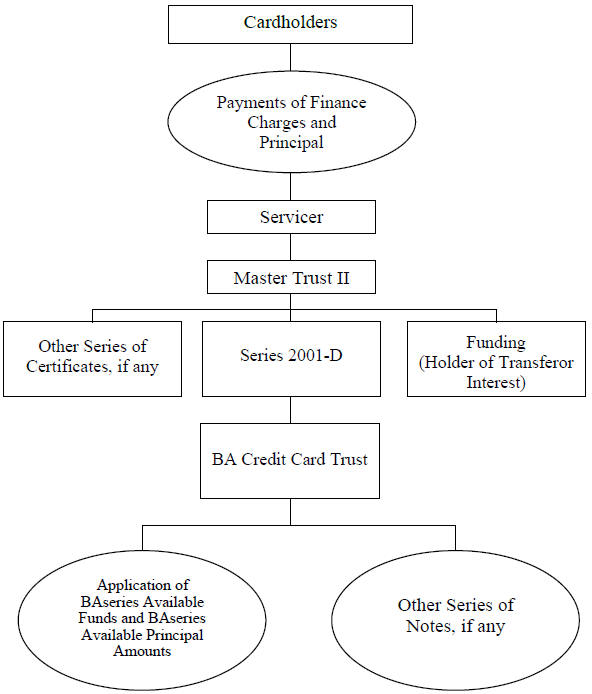

The issuing entity’s primary asset is an investor certificate issued by BA Master Credit Card Trust II (referred to as “master trust II”), a Delaware trust. This investor certificate, referred to as the collateral certificate, is a part of Series 2001-D and represents an undivided interest in master trust II. For a description of the collateral certificate, see “Sources of Funds to Pay the Notes—The Collateral Certificate.”

Also as a part of Series 2001-D, master trust II has issued the Class D certificate, which is an investor certificate that represents an undivided interest in master trust II. The Class D certificate provides credit enhancement to the collateral certificate, and therefore provides credit enhancement to the notes as well. For a description of the Class D certificate, see “Master Trust II—The Class D Certificate.”

Master trust II’s assets primarily include receivables from certain unsecured revolving credit card accounts that meet the eligibility criteria for inclusion in master trust II. These eligibility criteria are discussed in “Master Trust II—Addition of Master Trust II Assets.”

The credit card receivables in master trust II consist primarily of principal receivables and finance charge receivables. Finance charge receivables include periodic finance charges, cash advance fees, late charges and certain other fees billed to cardholders, annual membership fees, recoveries on receivables in Defaulted Accounts, and discount option receivables. Principal receivables include amounts charged by cardholders for merchandise and services and amounts advanced to cardholders as cash advances.

Funding may add additional receivables to master trust II at any time without limitation, provided the receivables are eligible receivables, Funding does not expect the addition to cause a Pay Out Event, and the rating agencies confirm the ratings on the outstanding investor certificates and notes. Under certain limited circumstances, Funding may be required to add additional receivables to master trust II to maintain the minimum transferor interest or to maintain a minimum required amount of principal receivables in master trust II.

Funding may also remove receivables from master trust II provided Funding does not expect the removal to cause a Pay Out Event and the rating agencies confirm the ratings on the outstanding investor certificates and notes. The amount of any such removal is limited and, except in limited circumstances, may generally occur only once in a calendar month. In addition, except in limited circumstances, the receivables removed from master trust II must be selected randomly. However, if Funding breaches certain representations or warranties relating to the eligibility of receivables added to master trust II, Funding may be required to immediately remove those receivables from master trust II.

If the composition of master trust II changes over time due to Funding’s ability to add and remove receivables, noteholders will not be notified of that change. However, monthly reports containing certain information relating to the notes and the collateral securing the notes will be filed with the Securities and Exchange Commission (the “SEC”). These reports will not be sent to noteholders. See “Where You Can Find More Information” for information as to how these reports may be accessed.

10

Table of Contents

Bank of America, National Association (referred to as “BANA”) is a national banking association. The address of BANA’s principal offices is 100 N. Tryon Street, Charlotte, North Carolina 28255. Its telephone number is (980) 683-4915. On the merger date, FIA merged with and into BANA, with BANA as the surviving entity, and BANA succeeded to all of FIA’s rights and obligations with respect to its credit card business, among other things. References to “BANA” in this summary and elsewhere in this prospectus include BANA’s predecessors, including FIA, unless the context requires otherwise. See “Transaction Parties; Legal Proceedings; Affiliations, Relationships and Related Transactions—BANA and Affiliates—Merger of FIA into BANA” for information on the merger.

Prior to the Substitution Date, FIA formed master trust II and transferred credit card receivables arising in accounts originated or acquired by FIA to master trust II. Currently, BANA originates and owns credit card accounts from which receivables in accounts designated for inclusion in master trust II are sold to Funding for inclusion in master trust II.

During the period from the Substitution Date to July 8, 2015 (referred to as the “BACCS Removal Date”), with certain limited exceptions, BANA transferred all of the receivables arising in its U.S. credit card accounts to Banc of America Consumer Card Services, LLC (referred to as “BACCS”), a limited liability company formed under the laws of North Carolina and a direct subsidiary of BANA. The receivables transferred to BACCS that arose in accounts designated for inclusion in master trust II were then sold by BACCS to Funding for inclusion in master trust II. On the BACCS Removal Date, BACCS was removed as the seller of receivables to Funding and replaced by BANA as the current seller of receivables to Funding as described above. BANA retains all of its obligations previously incurred in connection with the sales of receivables in designated accounts to BACCS and has assumed all obligations of BACCS as seller of receivables to Funding. See “Transaction Parties; Legal Proceedings; Affiliations, Relationships and Related Transactions—BANA and Affiliates—Removal and Dissolution of BACCS” for additional information.

Prior to the BACCS Removal Date, BACCS held all of the equity in Funding and Funding was a direct subsidiary of BACCS. On the BACCS Removal Date, BACCS assigned all of the equity in Funding to BANA and Funding became a direct subsidiary of BANA.

BACCS was dissolved through a liquidating distribution of its assets to its parent, BANA, on July 17, 2015.

The removal of BACCS as seller of receivables to Funding and the subsequent dissolution of BACCS were the result of an internal corporate restructuring and BANA does not anticipate that either the removal or the dissolution will have a material adverse effect on the Master Trust II Portfolio or the noteholders.

BANA is also the servicer for master trust II and is therefore responsible for servicing the credit card receivables in master trust II. BANA may delegate certain of its servicing functions to an affiliate of BANA or third parties. However, notwithstanding that delegation, BANA would remain obligated to service the receivables in master trust II. See “Transaction Parties; Legal Proceedings; Affiliations, Relationships and Related Transactions—BANA and Affiliates.”

11

Table of Contents

BofA Securities, Inc., one of the underwriters of the Class [•](20[•]-[•]) notes, is an affiliate of Bank of America, National Association, BA Credit Card Funding, LLC and BA Credit Card Trust. See “Underwriting (Plan of Distribution, Conflicts of Interest and Proceeds).”

The Bank of New York Mellon, a New York banking corporation, is the indenture trustee under the indenture for the notes.

Under the terms of the indenture, the role of the indenture trustee is limited. See “The Indenture—Indenture Trustee.”

See “Transaction Parties; Legal Proceedings; Affiliations, Relationships and Related Transactions—The Bank of New York Mellon.”

Wilmington Trust Company, a Delaware corporation with trust powers, is the owner trustee of the issuing entity. Under the terms of the trust agreement, the role of the owner trustee is limited. See “Transaction Parties; Legal Proceedings; Affiliations, Relationships and Related Transactions—BA Credit Card Trust.”

See “Transaction Parties; Legal Proceedings; Affiliations, Relationships and Related Transactions—Wilmington Trust Company.”

Asset Representations Reviewer

Clayton Fixed Income Services LLC, a Delaware limited liability company, is the asset representations reviewer under the asset representations review agreement. The asset representations reviewer may not delegate or subcontract its obligations under the asset representations review agreement without the consent of BANA, the transferor and the servicer. Any such delegation or subcontracting to which BANA, the transferor and the servicer have consented would not, however, relieve the asset representations reviewer of its liability and responsibility with respect to such obligations.

See “Transaction Parties; Legal Proceedings; Affiliations, Relationships and Related Transactions—Clayton Fixed Income Services LLC.”

12

Table of Contents

Table of Contents

Series, Classes and Tranches of Notes

The notes will be issued in series. Each series is secured by a shared security interest in the collateral certificate and the collection account. It is expected that most series will consist of multiple classes. A class designation determines the relative seniority for receipt of cash flows and funding of uncovered Investor Default Amounts allocated to the related series of notes. For example, subordinated classes of notes provide credit enhancement for senior classes of notes in the same series.

Some series of notes will be multiple tranche series, meaning that they may have classes consisting of multiple tranches. Tranches of notes within a class may be issued on different dates and have different stated principal amounts, rates of interest, interest payment dates, expected principal payment dates, legal maturity dates and other material terms.

In a multiple tranche series, the expected principal payment dates and the legal maturity dates of the senior and subordinated classes of such series may be different. As such, certain subordinated tranches of notes may have expected principal payment dates and legal maturity dates earlier than some or all of the senior notes of such series. However, subordinated notes will not be repaid before their legal maturity dates, unless, after payment, the remaining subordinated notes provide the required enhancement for the senior notes. In addition, senior notes will not be issued unless, after issuance, there are enough outstanding subordinated notes to provide the required subordinated amount for the senior notes. See “The Notes—Issuances of New Series, Classes and Tranches of Notes.”

Some series may not be multiple tranche series. For these series, there will be only one tranche per class and each class will generally be issued on the same date. The expected principal payment dates and legal maturity dates of the subordinated classes of such a series will either be the same as or later than those of the senior classes of that series.

The Class [•](20[•]-[•]) notes are part of the BAseries. The BAseries is a multiple tranche series. Each class of notes in the BAseries may consist of multiple tranches. Whenever a “class” of notes is referred to in this prospectus, it includes all tranches of that class of notes, unless the context otherwise requires. Notes of any tranche can be issued on any date so long as there is sufficient credit enhancement on that date, either in the form of outstanding subordinated notes or other forms of credit enhancement. See “The Notes—Issuances of New Series, Classes and Tranches of Notes.” The expected principal payment dates and legal maturity dates of tranches of senior and subordinated classes of the BAseries may be different. Therefore, subordinated notes may have expected principal payment dates and legal maturity dates earlier than some or all of the senior notes of the BAseries. Subordinated notes will generally not be paid before their legal maturity date unless, after payment, the remaining outstanding subordinated notes provide the credit enhancement required for the senior notes.

In general, the subordinated notes of the BAseries serve as credit enhancement for all of the senior notes of the BAseries, regardless of whether the subordinated notes are issued before, at the same time as, or after the senior notes of the BAseries. However, certain tranches of senior notes may not require subordination from each class of notes subordinated to it. For example, if a tranche of Class A notes requires credit enhancement solely from Class C notes, the Class B notes will not, in that case, provide credit enhancement for that tranche of Class A notes. The amount of credit exposure of any particular tranche of notes is a function of, among other things, the total amount of notes issued, the required subordinated amount, the amount of usage of the required subordinated amount and the amount on deposit in the senior tranches’ principal funding subaccounts.

14

Table of Contents

As of the date of this prospectus, the BAseries is the only issued and outstanding series of the issuing entity. See “Annex II: Outstanding Series, Classes and Tranches of Notes” for information about the other outstanding notes issued by the issuing entity. Other series, classes and tranches of notes, including other tranches of notes that are included in the BAseries, may be issued by the issuing entity in the future without the consent of, or prior notice to, any noteholders.

Each tranche of notes will bear interest from the date and at the rate set forth or as determined in the related prospectus. Interest on the notes will be paid on the interest payment dates determined in connection with the issuance of such notes.

Interest on the Class [•](20[•]-[•]) notes will accrue at [a floating rate equal to the London interbank offered rate for U.S. dollar deposits for a [•]-month period [(or, for the first interest accrual period, the rate that corresponds to the actual number of days in the first interest accrual period)] (“LIBOR”) plus a spread as] [the fixed rate] specified on the cover page of this prospectus.

Interest on the Class [•](20[•]-[•]) notes will begin to accrue on the issuance date for the Class [•](20[•]-[•]) notes and will be calculated on the basis of a 360-day year [and the actual number of days in the related interest accrual period] [consisting of twelve 30-day months]. Each interest accrual period will begin on and include an interest payment date and end on but exclude the next interest payment date. However, the first interest accrual period will begin on and include the issuance date for the Class [•](20[•]-[•]) notes and end on but exclude the first interest payment date for the Class [•](20[•]-[•]) notes, [•] [•], 20[•].

[LIBOR appears on Reuters Screen LIBOR01 Page (or comparable replacement page) and will be the rate available at 11:00 a.m., London time, on the related LIBOR determination date. If the rate does not appear on that page, the rate will be the average of the rates offered by four prime banks in London. If fewer than two London banks provide a rate at the request of the indenture trustee, the rate will be the average of the rates offered by four major banks in New York City.]

Interest on the Class [•](20[•]-[•]) notes for any interest payment date will equal [one-twelfth of] the product of:

| • | the Class [•](20[•]-[•]) note interest rate [for the applicable interest accrual period]; multiplied by |

| • | [the actual number of days in the related interest accrual period divided by 360; multiplied by] |

| • | the outstanding dollar principal amount of the Class [•](20[•]-[•]) notes as of the related record date. |

[The payment of interest on the Class A(20[•]-[•]) notes on any payment date is senior to the payment of interest on Class B and Class C notes of the BAseries on that date.] [The payment of interest on the Class B(20[•]-[•]) notes on any payment date is senior to the payment of interest on Class C notes of the BAseries on that date.] Generally, no payment of interest will be made on any Class B BAseries note until the required payment of interest has been made to all Class A BAseries notes. Likewise, generally, no payment of interest will be made on any Class C BAseries note until the required payment of interest has been made to all Class A and Class B BAseries notes. However, funds on deposit in the Class C reserve account will be available only to holders of Class C notes to cover shortfalls of interest on Class C notes on any payment date. [The Class B(20[•]-[•]) notes generally will not receive interest payments on any payment date until the Class A notes have received their full interest payment on that date.] [The Class C(20[•]-[•]) notes generally will not receive interest payments on any payment date until the Class A notes and Class B notes have received their full interest payment on that date.]

15

Table of Contents

The issuing entity will pay interest on the Class [•](20[•]-[•]) notes solely from the portion of BAseries Available Funds and from other amounts that are available to the Class [•](20[•]-[•]) notes under the indenture and the BAseries indenture supplement after giving effect to all allocations and reallocations. If those sources are not sufficient to pay the interest on the Class [•](20[•]-[•]) notes, Class [•](20[•]-[•]) noteholders will have no recourse to any other assets of the issuing entity, BANA, Funding or any other person or entity for the payment of interest on those notes.

Expected Principal Payment Date and Legal Maturity Date

It is expected that the issuing entity will pay the stated principal amount of each note in one payment on that note’s expected principal payment date. The expected principal payment date of a note is generally 29 months before its legal maturity date. The legal maturity date is the date on which a note is legally required to be fully paid in accordance with its terms. The issuing entity will generally be obligated to pay the stated principal amount of a note on its expected principal payment date, or upon the occurrence of an early redemption event or event of default and acceleration or other optional or mandatory redemption, only to the extent that funds are available for that purpose and only to the extent that payment is permitted by the subordination provisions of the senior notes of the same series. The remedies a noteholder may exercise following an event of default and acceleration or on the legal maturity date are described in “The Indenture—Events of Default Remedies” and “Sources of Funds to Pay the Notes—Sale of Credit Card Receivables.”

[Payments of principal on the Class A(20[•]-[•]) notes are not subordinated to any other notes.][Payments of principal on the Class B(20[•]-[•]) notes are subordinated to payments of principal on the BAseries Class A notes.][Payments of principal on the Class C(20[•]-[•]) notes are subordinated to payments of principal on the BAseries Class A notes and the BAseries Class B notes.] [See “Sources of Funds to Pay the Notes—Deposit and Application of Funds for the BAseries—Allocation to Principal Funding Subaccounts” for a detailed discussion of the subordination of interest and principal payments for the Class B notes and Class C notes of the BAseries.]

The issuing entity expects to pay the stated principal amount of the Class [•](20[•]-[•]) notes in one payment on the expected principal payment date specified on the cover page of this prospectus, and is obligated to do so if funds are available for that purpose [and not required for subordination]. If the stated principal amount of the Class [•](20[•]-[•]) notes is not paid in full on the expected principal payment date due to insufficient funds [or insufficient credit enhancement], noteholders will generally not have any remedies against the issuing entity until the legal maturity date of the Class [•](20[•]-[•]) notes.

In addition, if the stated principal amount of the Class [•](20[•]-[•]) notes is not paid in full on the expected principal payment date, then an early redemption event will occur for the Class [•](20[•]-[•]) notes and [, subject to the principal payment rules described under “—Subordination,” “—BAseries Credit Enhancement” and “—BAseries Required Subordinated Amount” below,] principal and interest payments on the Class [•](20[•]-[•]) notes will be made monthly until they are paid in full or until the legal maturity date occurs, whichever is earlier.

Principal of the Class [•](20[•]-[•]) notes will begin to be paid earlier than the expected principal payment date if any other early redemption event or an event of default and acceleration occurs for the Class [•](20[•]-[•]) notes. See “The Notes—Early Redemption of Notes,” “The Indenture—Early Redemption Events” and “—Events of Default” in this prospectus.

16

Table of Contents