Form SC TO-C Epizyme, Inc. Filed by: Ipsen, S.A.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

EPIZYME, INC.

(Name of Subject Company (Issuer))

HIBERNIA MERGER SUB, INC.

(Offeror)

a wholly owned subsidiary of

IPSEN BIOPHARMACEUTICALS, INC.

(Offeror)

a wholly owned subsidiary of

IPSEN PHARMA SAS

(Offeror)

IPSEN S.A.

(Offeror)

(Names of Filing Persons (identifying status as offeror, issuer or other person))

Common Stock, Par Value $0.0001 Per Share

(Title of Class of Securities)

29428V104

(CUSIP Number of Class of Securities)

Francois Garnier, EVP General Counsel and Chief Business Officer

Ipsen Pharma SAS

65 Quai Georges Gorse

92100 Boulogne-Billancourt, France

Tel. +33 1 58 33 50 00

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

Copies to:

| Tony Chan, Esq. Orrick, Herrington & Sutcliffe LLP Columbia Center 1152 15th Street, N.W. Washington, DC 20005-1706 |

Marsha Mogilevich, Esq. Orrick, Herrington & Sutcliffe LLP 51 West 52nd Street New York, NY 10019-6142 |

CALCULATION OF FILING FEE

| Transaction Valuation* | Amount of Filing Fee* | |

|

Not applicable* |

Not applicable* | |

|

| ||

| * | A filing fee is not required in connection with this filing as it relates solely to preliminary communications made before the commencement of a tender offer. |

☒ Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

| ☒ | third-party tender offer subject to Rule 14d-1. |

| ☐ | issuer tender offer subject to Rule 13e-4. |

| ☐ | going-private transaction subject to Rule 13e-3. |

| ☐ | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer. ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ☐ | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ☐ | Rule 13d-1(d) (Cross-Border Third-Party Tender Offer) |

The pre-commencement communication filed under cover of this Schedule TO relates to a planned tender offer (the “Offer”) by Hibernia Merger Sub, Inc., a Delaware corporation (the “Purchaser”) and a wholly owned subsidiary of Ipsen Biopharmaceuticals, Inc., a Delaware corporation and a wholly owned subsidiary of Ipsen Pharma SAS, a French société par actions simplifiée (the “Parent”), a wholly owned subsidiary of Ipsen S.A., for all of the issued and outstanding shares of common stock, par value $0.0001 per share (the “Common Stock”), of Epizyme, Inc. (the “Company” or “Epizyme”), pursuant to an Agreement and Plan of Merger, dated as of June 27, 2022 (the “Merger Agreement”), by and among the Company, the Parent and the Purchaser.

The Offer for the outstanding shares of Common Stock has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Common Stock. The solicitation and offer to buy shares of Common Stock will only be made pursuant to the tender offer materials that the Parent intends to file with the U.S. Securities and Exchange Commission (the “SEC”) upon commencement of the Offer. At the time the Offer is commenced, the Parent will file a tender offer statement on Schedule TO with the SEC, and the Company will file a solicitation/recommendation statement on Schedule 14D-9 (“Schedule 14D-9”) with respect to the Offer. THE COMPANY’S STOCKHOLDERS ARE ADVISED TO READ THE SCHEDULE TO (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND OTHER OFFER DOCUMENTS) AND THE SCHEDULE 14D-9, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES THERETO. Both the tender offer statement and the Schedule 14D-9 will be mailed to the Company’s stockholders free of charge. Investors and stockholders may obtain free copies of the Schedule TO and Schedule 14D-9, as each may be amended or supplemented from time to time, and other documents filed by the parties (when available) at the SEC’s web site at www.sec.gov, by contacting the Company’s Investor Relations either by telephone at (617) 229-5872 or e-mail at [email protected], at the Company’s website at www.epizyme.com or by directing a request to the information agent for the tender offer who will be named in the tender offer materials.

Forward-looking Statements

This document includes statements that are not statements of historical fact, or “forward-looking statements,” including with respect to Parent’s proposed acquisition of Epizyme. Such forward-looking statements include, but are not limited to, the ability of the parties to complete the transactions contemplated by the merger agreement, including the parties’ ability to satisfy the conditions to the consummation of the offer contemplated thereby and the other conditions set forth in the merger agreement, statements about the expected timetable for completing the transaction, Parent’s and Epizyme’s beliefs and expectations and statements about the benefits sought to be achieved in Parent’s proposed acquisition of Epizyme, the potential effects of the acquisition on both Parent and Epizyme, the possibility of any termination of the merger agreement, as well as the expected benefits and success of Epizyme’s product candidates. These statements are based upon the current beliefs and expectations of Parent’s management and are subject to significant risks and uncertainties. There can be no guarantees that the conditions to the closing of the proposed transaction will be satisfied on the expected timetable or at all, with respect to pipeline products that the products will receive the necessary regulatory approvals or that they will prove to be commercially successful. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual results may differ materially from those set forth in the forward-looking statements.

Risks and uncertainties include but are not limited to, uncertainties as to the timing of the offer and the subsequent merger; uncertainties as to how many of Epizyme’s stockholders will tender their shares in the offer; the risk that competing offers or acquisition proposals will be made; the possibility that various conditions to the consummation of the merger and the offer contemplated thereby may not be satisfied or waived; the effects of disruption from the transactions contemplated by the merger agreement and the impact of the announcement and pendency of the transactions on Epizyme’s business; the risk that stockholder litigation in connection with the offer or the merger may result in significant costs of defense, indemnification and liability; the risks related to non-achievement of the CVR milestones and that holders of the CVRs will not receive payments in respect of the CVRs; general industry conditions and competition; general economic factors, including interest rate and currency exchange rate fluctuations; the impact of the global spread and impact of COVID-19; the impact of pharmaceutical industry regulation and health care legislation in the United States and internationally; global trends toward health care cost

containment; technological advances, new products and patents attained by competitors; challenges inherent in new product development, including obtaining regulatory approval; Parent’s ability to accurately predict future market conditions; manufacturing difficulties or delays; financial instability of international economies; dependence on the effectiveness of Parent’s patents and other protections for innovative products; the exposure to litigation, including patent litigation, regulatory actions and product liability claims; and effects of future judicial decisions or governmental investigations, safety, quality, data integrity or manufacturing issues.

Parent undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by law.

EXHIBIT INDEX

| Exhibit |

Description | |

| 99.1 | Investor presentation dated June 27, 2022. | |

| 99.2 | Transcript of webcast on June 27, 2022. | |

Exhibit 99.1

Investor and analyst call Acquisition of Epizyme, Inc. 27 June 2022

Disclaimer and safe harbor—This presentation includes only summary information and does not purport to be comprehensive. Forward-looking statements, targets and estimates contained herein are for illustrative purposes only and are based on management’s current views and assumptions. Such statements involve known and unknown risks and uncertainties that may cause actual results, performance or events to differ materially from those anticipated in the summary information. Actual results may depart significantly from these targets given the occurrence of certain risks and uncertainties, notably given that a new medicine can appear to be promising at a preparatory stage of development or after clinical trials but never be launched on the market or be launched on the market but fail to sell notably for regulatory or competitive reasons. Ipsen must deal with or may have to deal with competition from generic medicines that may result in market-share losses, which could affect its level of growth in sales or profitability. The Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statements, targets or estimates contained in this presentation to reflect any change in events, conditions, assumptions or circumstances on which any such statements are based, unless so required by applicable law.—All medicine names listed in this document are either licensed to Ipsen or are registered trademarks of Ipsen or its partners.—The implementation of the strategy has to be submitted to the relevant staff representation authorities in each country concerned, in compliance with the specific procedures, terms and conditions set forth by each national legislation.—In those countries in which public or private-health cover is provided, Ipsen is dependent on prices set for medicines, pricing and reimbursement-regime reforms and is vulnerable to the potential withdrawal of certain medicines from the list of reimbursable medicines by governments, and the relevant regulatory authorities in its locations. In light of the economic impact caused by the COVID-19 pandemic, there could be increased pressure on the pharmaceutical industry to lower medicine prices.—Ipsen operates in certain geographical regions whose governmental finances, local currencies or inflation rates could erode the local competitiveness of Ipsen’s medicines relative to competitors operating in local currency, and/or could be detrimental to Ipsen’s margins in those regions where Ipsen’s sales are billed in local currencies.—In a number of countries, Ipsen markets its medicines via distributors or agents; some of these partners’ financial strengths could be impacted by changing economic or market conditions, including impacts of the COVID-19 pandemic, potentially subjecting Ipsen to difficulties in recovering its receivables. Furthermore, in certain countries whose financial equilibrium is threatened by changing economic or market conditions, including impacts of the COVID-19 pandemic, and where Ipsen sells its medicines directly to hospitals, Ipsen could be forced to lengthen its payment terms or could experience difficulties in recovering its receivables in full.—Ipsen also faces various risks and uncertainties inherent to its activities identified under the caption ‘Risk Factors’ in the Company’s Universal Registration Document.—All of the above risks could affect Ipsen’s future ability to achieve its financial targets, which were set assuming reasonable macroeconomic conditions based on the information available today. 2

Speakers David Loew Howard Mayer Aymeric Le Chatelier Chief Executive Officer Head of Research and Development Chief Financial Officer 3

Agenda 1 Strategic rationale 2 The science: Tazverik® 3 Commercial opportunity 4 Financials 5 Questions 4

Strategic rationale David Loew

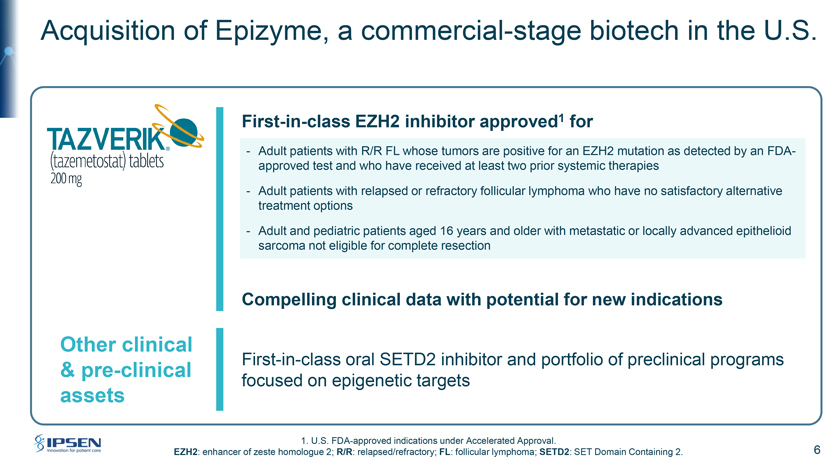

Acquisition of Epizyme, a commercial-stage biotech in the U.S. First-in-class EZH2 inhibitor approved1 for - Adult patients with R/R FL whose tumors are positive for an EZH2 mutation as detected by an FDA-approved test and who have received at least two prior systemic therapies—Adult patients with relapsed or refractory follicular lymphoma who have no satisfactory alternative treatment options—Adult and pediatric patients aged 16 years and older with metastatic or locally advanced epithelioid sarcoma not eligible for complete resection Compelling clinical data with potential for new indications Other clinical First-in-class oral SETD2 inhibitor and portfolio of preclinical programs & pre-clinical focused on epigenetic targets assets 1. U.S. FDA-approved indications under Accelerated Approval. EZH2: enhancer of zeste homologue 2; R/R: relapsed/refractory; FL: follicular lymphoma; SETD2: SET Domain Containing 2. 6

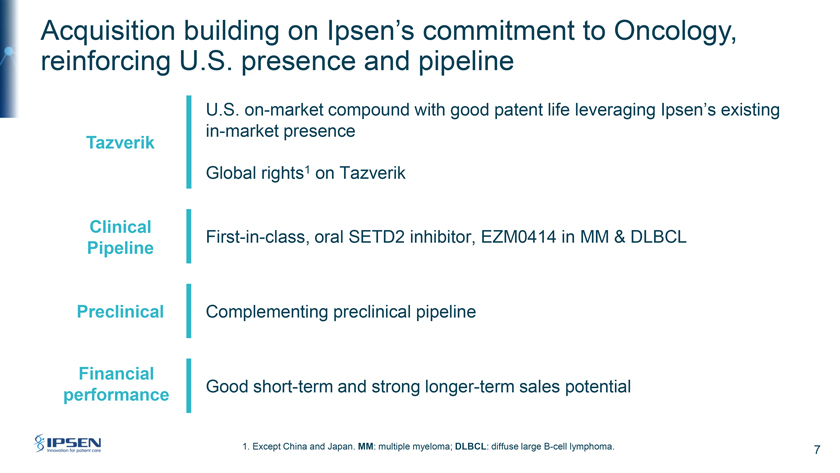

Acquisition building on Ipsen’s commitment to Oncology, reinforcing U.S. presence and pipeline U.S. on-market compound with good patent life leveraging Ipsen’s existing in-market presence Tazverik Global rights1 on Tazverik Clinical First-in-class, oral SETD2 inhibitor, EZM0414 in MM & DLBCL Pipeline Preclinical Complementing preclinical pipeline Financial Good short-term and strong longer-term sales potential performance 1. Except China and Japan. MM: multiple myeloma; DLBCL: diffuse large B-cell lymphoma. 7

The science: Tazverik Howard Mayer 8

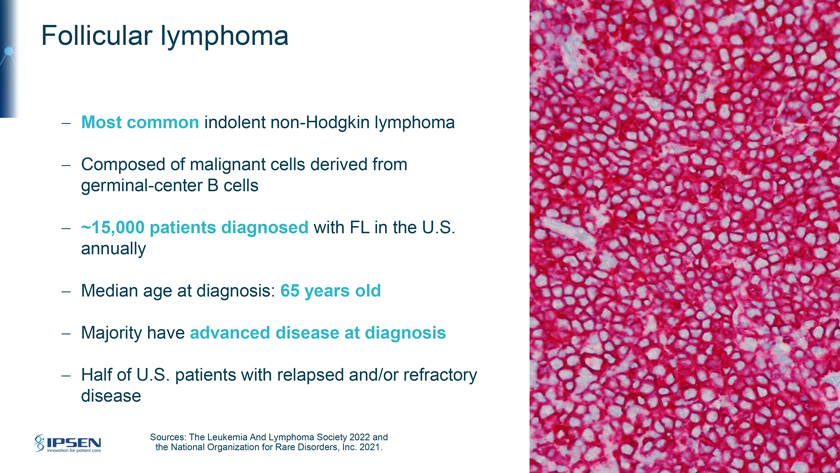

Follicular lymphoma—Most common indolent non-Hodgkin lymphoma—Composed of malignant cells derived from germinal-center B cells—~15,000 patients diagnosed with FL in the U.S. annually—Median age at diagnosis: 65 years old - Majority have advanced disease at diagnosis - Half of U.S. patients with relapsed and/or refractory disease Sources: The Leukemia And Lymphoma Society 2022 and the National Organization for Rare Disorders, Inc. 2021.

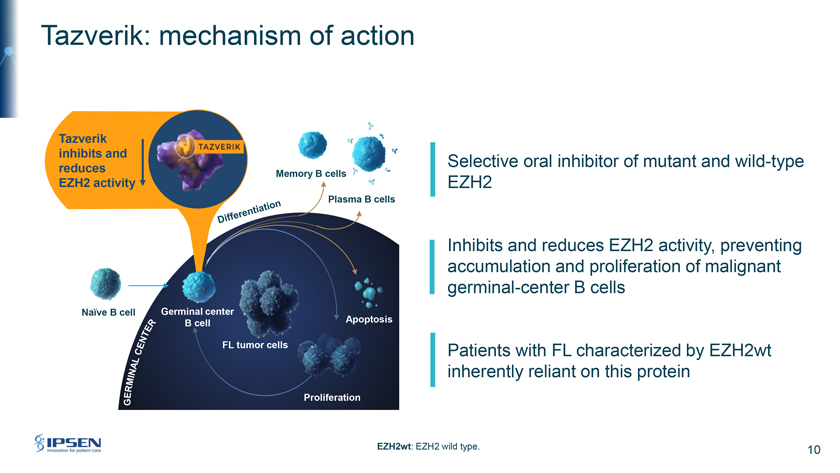

Tazverik: mechanism of action Tazverik inhibits and Selective oral inhibitor of mutant and wild-type reduces Memory B cell EZH2 activity EZH2 Plasma B cells Inhibits and reduces EZH2 activity, preventing accumulation and proliferation of malignant germinal-center B cells Naïve B cell Germinal center B cell Apoptosis FL Patients with FL characterized by EZH2wt inherently reliant on this protein Proliferation EZH2wt: EZH2 wild type. 10

Tazverik: an efficacious and tolerable treatment option for FL patients in the R/R setting Clinical-trial data: 3L FL | Phase II trial: NCT01897571 EZH2m • ORR 69% (57% PR) • Total treatment-related patients • mDOR 10.9 months grade 3+ adverse events (N=45) . <5% • mPFS 13 8 months • Discontinuation rate due to adverse events 8% (5% were treatment-related) Wild-type • ORR 34% (30% PR) patients • mDOR 13.0 months • Treatment-related SAEs (N=54) • mPFS 11.1 months? 4%; no treatment-related deaths 3L: third line; ORR: overall response rate; PR: partial response; mDOR: median duration of response; mPFS: median progression-free survival; SAEs: serious adverse events. References: Morschhauser et al. Tazemetostat for patients with relapsed or refractory follicular lymphoma: an open-label, 11 single-arm, multicentre, phase 2 trial. Lancet Oncology. November 2020, Volume 21, pages 1433-1442; Tazverik U.S. prescribing information.

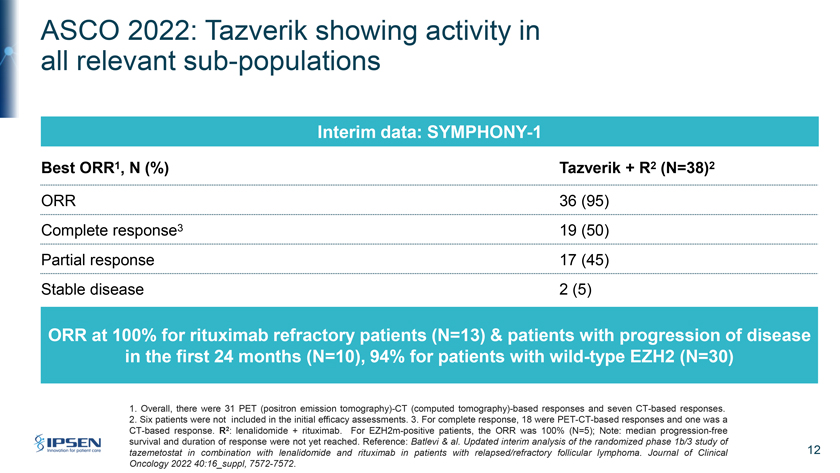

ASCO 2022: Tazverik showing activity in all relevant sub-populations Interim data: SYMPHONY-1 Best ORR1, N (%) Tazverik + R2 (N=38)2 ORR 36 (95) Complete response3 19 (50) Partial response 17 (45) Stable disease 2 (5) ORR at 100% for rituximab refractory patients (N=13) & patients with progression of disease in the first 24 months (N=10), 94% for patients with wild-type EZH2 (N=30) 1. Overall, there were 31 PET (positron emission tomography)-CT (computed tomography)-based responses and seven CT-based responses. 2. Six patients were not included in the initial efficacy assessments. 3. For complete response, 18 were PET-CT-based responses and one was a CT-based response. R2: lenalidomide + rituximab. For EZH2m-positive patients, the ORR was 100% (N=5); Note: median progression-free survival and duration of response were not yet reached. Reference: Batlevi & al. Updated interim analysis of the randomized phase 1b/3 study of tazemetostat in combination with lenalidomide and rituximab in patients with relapsed/refractory follicular lymphoma. Journal of Clinical 12 Oncology 2022 40:16_suppl, 7572-7572.

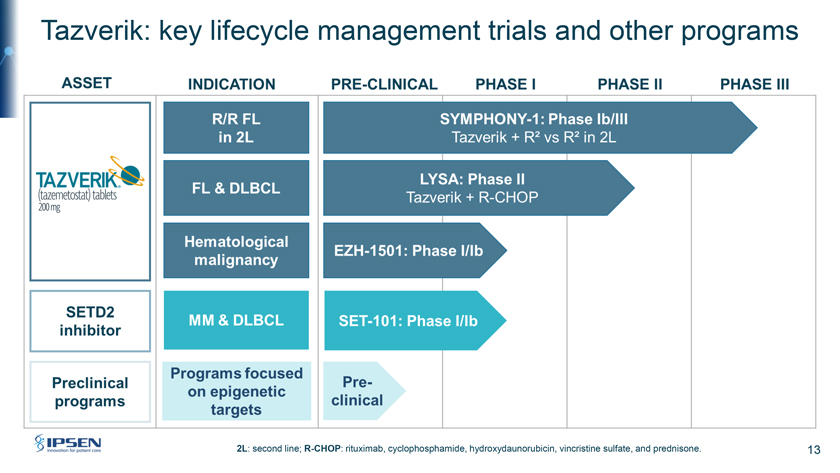

Tazverik: key lifecycle management trials and other programs 2L: second line; R-CHOP: rituximab, cyclophosphamide, hydroxydaunorubicin, vincristine sulfate, and prednisone. 13

Commercial opportunity David Loew

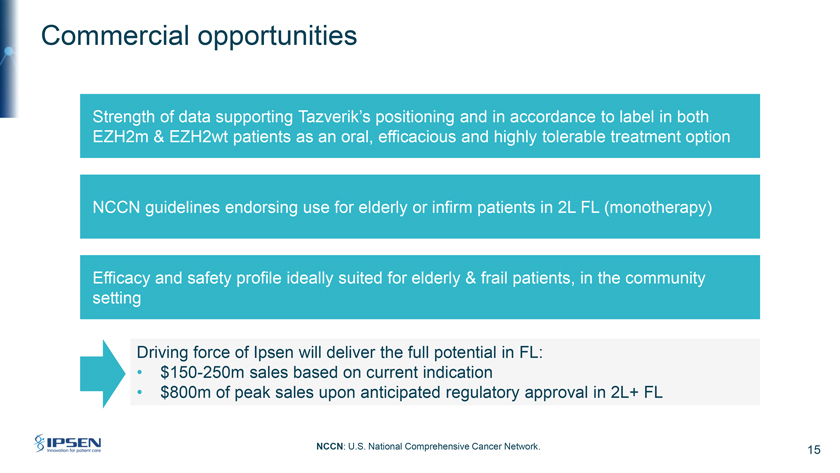

Commercial opportunities Strength of data supporting Tazverik’s positioning and in accordance to label in both EZH2m & EZH2wt patients as an oral, efficacious and highly tolerable treatment option NCCN guidelines endorsing use for elderly or infirm patients in 2L FL (monotherapy) Efficacy and safety profile ideally suited for elderly & frail patients, in the community setting Driving force of Ipsen will deliver the full potential in FL: • $150-250m sales based on current indication • $800m of peak sales upon anticipated regulatory approval in 2L+ FL NCCN: U.S. National Comprehensive Cancer Network. 15

Financials Aymeric Le Chatelier

Financial terms of transaction Ipsen to initiate a tender offer to acquire all outstanding shares of Epizyme Offer price at $1.45 per share in cash at closing Additional contingent payments (CVRs) up to $1.00 per share • $0.30 of CVR per share upon $250m in aggregate net sales of Tazverik in any period of four consecutive quarters by 31 December 2026 • $0.70 of CVR per share upon approval commercial milestones and U.S. FDA approval of Tazverik + R² in 2L FL by 1 January 2028 Transaction expected to close by the end of Q3 2022, subject to the satisfaction of all closing conditions, including antitrust requirements 17

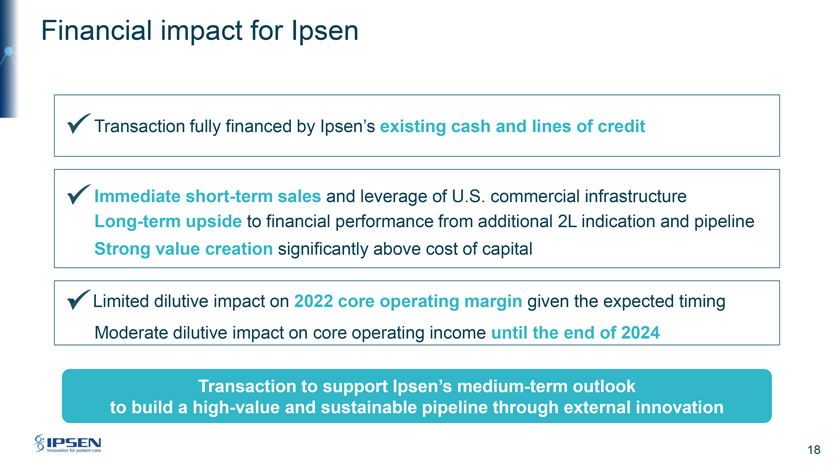

Financial impact for Ipsen Transaction fully financed by Ipsen’s existing cash and lines of credit Immediate short-term sales and leverage of U.S. commercial infrastructure Long-term upside to financial performance from additional 2L indication and pipeline Strong value creation significantly above cost of capital • Limited dilutive impact on 2022 core operating margin given the expected timing Moderate dilutive impact on core operating income until the end of 2024 Transaction to support Ipsen’s medium-term outlook to build a high-value and sustainable pipeline through external innovation 18

Summary David Loew

Summary Strengthening Ipsen’s oncology portfolio Focus and pipeline A winning strategy Providing commercial opportunities across the short and long term, focused on Tazverik Ipsen to continue its external-innovation strategy as a key platform for growth 20

Questions

Craig Marks Vice President, Investor Relations +44 7564 349 193 [email protected] Adrien Dupin de Saint-Cyr Investor Relations Manager +33 6 64 26 17 49 [email protected] 22

THANK YOU

Follow us www.ipsen.com

Exhibit 99.2

Ipsen M&A/Other Ipsen to Acquire Epizyme, Expanding Its Portfolio in Oncology

Event Date: 06/27/2022

Company Name: Ipsen

Event Description: Ipsen to Acquire Epizyme, Expanding Its Portfolio in Oncology Source: Ipsen

Version: Final

For more event information and transcripts,

visit {IPN FP Equity EVT BB-5933748-1 <GO>}

Ipsen to Acquire Epizyme, Expanding Its Portfolio in Oncology

Presentation

Operator:

Hello and welcome to Ipsen’s Conference Call and webcast to the acquisition of Epizyme. The call is being hosted by David Loew, Chief Executive of Ipsen. After a short presentation, there will be an opportunity to ask questions. (Operator Instructions)

It is now my pleasure to turn today’s call over to David Loew. Please go ahead.

David Loew, Chief Executive Officer:

Good afternoon and good morning, everyone. As you’ve just heard, I’m David Loew, Chief Executive Officer of Ipsen. I’m delighted that you have joined today as we take you through today’s exciting news on the acquisition of Epizyme.

Please turn to Slide 2. This is our usual Safe Harbor statement, which outlines the routine risks and uncertainties contained within this presentation

Please turn to Slide 3. I’m joined today by Howard Mayer, Ipsen’s Head of Research and Development as well as our CFO, Aymeric Le Chatelier. We will provide a brief presentation before using the majority of the time to answer your questions.

Please turn to Slide 4. I will begin the presentation by taking you through the strategic rationale for the acquisition of Epizyme. I will then hand over to Howard, who will explain the science behind Tazverik. I will go through the commercial opportunities, before Aymeric run through the financials and then we’ll turn to your questions.

Please turn to Slide 5. So, first, let me turn to the strategic rationale for today’s news.

Please turn to Slide 6. Ipsen has entered into an exclusive agreement to acquire Epizyme, a fully integrated, commercial-stage biopharmaceutical company developing and delivering transformative therapies for cancer patients against novel epigenetic targets. Through this agreement we will expand our assets in oncology. Ipsen’s capabilities and resources in oncology, combined with Epizyme will accelerate the growth of Tazverik to achieve its full potential in follicular lymphoma patients.

Tazverik is a first-in-class chemotherapy-free EZH2 inhibitor approved by the FDA for adult patients with relapsed or refractory follicular lymphoma whose tumors are positive for an EZH2 mutation as detected by an FDA-approved test and who have received at least two prior systemic therapies, and also importantly, adult patients with relapsed or refractory follicular lymphoma who have no satisfactory alternative treatment options. Furthermore, it is also indicated for adult and pediatric patients aged 16 years and older with metastatic or locally advanced epithelioid carcinoma not eligible for complete resection. Furthermore, we’re excited to bring onboard epigenetic expertise and the SETD2 inhibitor, as well as several preclinical compounds into our portfolio.

Please turn to Slide 7. The acquisition is a strong strategic fit for Ipsen. It builds on our commitment to oncology, expanding from solid tumors to hematology. It gives us global access to Tazverik which is already approved in the US, generating sales and which has a patent life in the US extending to 2032. Given our strong US market presence and capabilities, we can leverage our infrastructure to do sales and plan to expand also into other markets. Tazverik has additional lifecycle potential in earlier lines and I will go into more detail later what it means for peak seals.

Today’s news is also perfectly in line with our priority of replenishing our pipeline with programs of both clinical and preclinical phases of development in oncology. The acquisition comes with Epizyme’s first-in-class oral SETD2 inhibitor EZM0414 which was granted FDA Fast Track status and is currently under evaluation in multiple myeloma and diffuse large B-cell lymphoma. Furthermore, in line with our strategy to bolster our pipeline across all stages, it will also add preclinical candidates. We believe that Tazverik and the pipeline have good short-term and longer-term sales potential. Let me now hand over to Howard. Please turn to Slide 8.

Howard Mayer, Head of Research and Development:

Thanks, David, and hello, everyone. I’d like to spend a few minutes going through the science behind Tazverik, as well as the new data recently presented at ASCO.

Please turn to Slide 9. I want to start by talking to you about follicular lymphoma or FL, which is the main focus of the acquisition. It’s the most common indolent form of non-Hodgkin’s lymphoma and is composed of malignant cells derived from germinal-center B cells. Common symptoms of FL include enlargement of the lymph nodes or lymphadenopathy in the neck, under arms, abdomen or groin, as well as fatigue shortness of breath, night sweats, and weight loss, the so-called B symptoms. And often patients with FL have no obvious symptoms of the disease at diagnosis, presenting for example with asymptomatic lymphadenopathy.

As FL comprises a significant proportion of non-Hodgkin lymphoma cases, accounting for about 35% of all non-Hodgkin’s lymphoma, there are approximately 15,000 patients diagnosed with FL in the US every year. The median age of diagnosis is about 65 and the majority of patients have advanced disease at diagnosis. FL is characterized by remission followed by relapse in most patients and therefore there continues to be an unmet medical need for these patients.

Please turn to Slide 10. Turning to Tazverik, it is a selective oral inhibitor of both mutant and wild-type EZH2. EZH2 is a histone methyltransferase which inhibits genes responsible for tumor suppression. Tazverik inhibits and reduces EZH2 activity preventing the accumulation and proliferation of malignant germinal-center B cells. Importantly, given the central role of EZH2 in germinal-center formation, in addition to patients with mutant EZH2, wild-type patients are also inherently reliant on this protein.

Please turn to Slide 11. Tazverik as monotherapy was demonstrated to be an efficacious and tolerable treatment option for FL patients in the relapsed-refractory setting with at least two prior lines of therapy. I’d like to take a moment to highlight the relevant clinical data in the Phase II trial investigating Tazverik as monotherapy in third-line FL that was the basis of FDA granting accelerated approval. First, the efficacy results demonstrated an overall response rate of 69% in the EZH2 mutated population while in wild-type patients, it was 34%. But importantly, there were broadly similar median duration of response and median progression-free survivals observed in both of these two subgroups. The safety profile was also encouraging. The total number of treatment-related Grade 3 and above adverse events was below 5% while the discontinuation rate due to treatment-emergent adverse events was only 8% and only 5% were treatment-related. Treatment-related serious adverse events were only 4% and there were no treatment-related deaths.

Please turn to Slide 12. At ASCO, earlier this month, Epizyme presented updated safety and efficacy data from the Phase Ib run-in portion of SYMPHONY-1, it’s Phase Ib/III confirmatory trial. This is evaluating Tazverik in combination with rituximab and lenalidomide or R-squared versus placebo plus R-squared in patients with relapsed-refractory second line follicular lymphoma. It is scheduled to read out in 2026. The data were quite impressive, with an overall response rate of 95% with wild-type patients achieving an overall response rate of 94% and mutated patients at a 100% with a complete response rate of 50%.

The overall response rate was also 100% for rituximab refractory patients and for patients with progression of disease in the first 24 months. Median duration of response and progression-free survival have not yet been reached. The safety profile was also highly encouraging with Tazverik being generally well-tolerated and adverse events being completely consistent with those contained in the prescribing information for both Tazverik and R-squared. It’s these data that add to our confidence in the ongoing Phase III portion of the trial.

Please turn to Slide 13. There is an attractive clinical and preclinical pipeline included in the transaction. These are the three key Tazverik clinical trials. The first is SYMPHONY-1, the trial I mentioned a moment ago, which is a registrational confirmatory trial in second-line FL. It’s now in the Phase III stage of development. The LYSA trial in high-risk front line FL and in diffuse large B-cell lymphoma in combination with R-CHOP is in Phase II development, while EZH-1501 is a basket trial with Tazverik in combination with multiple targeted therapies for relapsed refractory hematologic malignancies. Outside of Tazverik, the SETD2 inhibitor EZM0414 is in Phase I clinical development in relapsed refractory multiple myeloma and diffuse large B-cell lymphoma. And finally, Epizyme also has several preclinical programs focused on epigenetic targets.

Thank you for listening. I’ll now hand you back to David. Please turn to Slide 14.

David Loew, Chief Executive Officer:

Thank you, Howard. I’m now going to outline the scale of the commercial opportunity for Tazverik. Please turn to Slide 15. I believe we have an opportunity to be more specific in the positioning of Tazverik in follicular lymphoma on to two accounts. First, we have seen the strength of the data that supports Tazverik’s positioning in fact within the current registration in all-comers meaning in mutant and wild-type patients as an efficacious and highly tolerable treatment option for patients.

Epizyme launched Tazverik in third-line follicular lymphoma during the pandemic and focused mostly on the mutated population. As we exit the pandemic, it now has the opportunity to address mutant and wild-type patients according to the label in follicular lymphoma. And it’s worth noting the recent decision of monotherapy Tazverik to NCCN guidelines endorsement for the second-line treatment of follicular lymphoma in elderly or infirm patients.

Second, while we have all seen the strong results of CAR-T therapies and the recent approvals of bispecific antibodies, we believe that they will have a stronger role in the fit and younger patient populations. We believe that the cytokine release syndrome which bispecific has shown will not make it very easy to be used in a community setting even with the subcutaneous version. Therefore, Tazverik can have (inaudible) in the more elderly unfit population, given the strong efficacy and safety profile. As a reminder, the average age of diagnosis is 65 years. The unfit and elderly patients are mostly treated in the community setting. Here, we can leverage our commercial and medical affairs in field strength and capabilities to reach more patients.

Over the short term, our focus will be on the current indication in the United States. We are looking also at the expansion to other markets and the additional indication in second line, which is a larger patient pool. Therefore, in the short and mid-term period, we estimate between $150 million to $250 million of peak sales should Tazverik be approved in second-line follicular. Peak sales could reach around $800 million. In this estimate, we recognize another recent regulatory approval in follicular lymphoma as well as other potential competition.

And I’ll now hand over to Aymeric, who will summarize the financials. Please turn to Slide 16.

Aymeric Le Chatelier, Chief Financial Officer:

Thank you, David. I will now go through the financial terms and impact to Ipsen of the transaction. Please turn to Slide 17. The terms of the agreement include an offer to acquire all outstanding shares of Epizyme for $1.45 per share in cash at the closing for estimated consideration of $247 million. We continue to build significant firepower for other external innovation transactions. We are going to (inaudible) to reduce the risk position with contingent value right or CVR based on the success of Tazverik. The contingent value right per share will entitle its holder to deferred cash payments of $0.30 per CVR payable upon the first achievement of $250 million by December of 2026 and an additional $0.70 per CVR payable upon an FDA approval in second-line FL by the start of 2028. Subject to the satisfaction of all closing conditions, including the clearance of US antitrust authorities and the completion of the tender offer, we anticipate the closing of the transaction by the end of September.

Please turn to Slide 18. (inaudible) we will fully finance the transaction through existing cash and line of credits. The transaction will provide immediate sales and based on the Q1 performance of Tazverik, which generated already full-year sales of more than $30 million we will very sharply leverage our US commercial infrastructure. The acquisition will also enhance our long-term performance through the potential approval of the Tazverik combination in second-line FL as well as through the potential of rest of Ipsen’s pipeline. (inaudible) will be a moderate dilutive impact on core operating income until the end of 2024 and vis-a-vis 2022 given that typically the transaction will have a limited impact on the core operating margin. As you can see, this agreement supports Ipsen’s medium term outlook to build high value and sustainable pipeline through external innovation strategy.

I will now hand you back to David. Please turn to Slide 19.

David Loew, Chief Executive Officer:

Thank you, Aymeric. I’d now like to conclude our presentation. Before we go to your questions, please turn to Slide 20. This deal is a great strategic fit for Ipsen, strengthening our portfolio in oncology and our early and clinical-stage pipeline. Focusing on Tazverik, our commercial opportunities are significant across both the short and long term. We were impressed by the efficacy and safety profile and the recent Phase Ib response data. Finally, I look forward to updating you on our continuing journey with external innovation as a key platform for growth.

Please turn to Slide 21. Thank you for listening to our presentation. We now have time for questions. Operator, over to you.

Questions And Answers

Operator:

(Operator Instructions) We will take our first question from Michael Leuchten with UBS. Your line is open.

Michael Leuchten, Analyst:

Thank you. Michael Leuchten from UBS. Two questions, if I could, please. Just thinking about the infrastructure that you may need to put in place in the US, you’ve made it very clear, David, that one thing you were looking for is sort of access to oncology assets in the US, but is there an ability to leverage what you have already that you can then try to integrate the new resources and infrastructure into or is this basically an infrastructure play as well that you will then look to leverage further down the line with potential additional assets.

And then the second question, just going back to your commentary around whether bispecifics may or may not fit, could you give us an idea what you think the percentage of the patient population is that is elderly and frail where things like CRS are just not acceptable? And hence, giving you a commercial opportunity with Tazverik in follicular lymphoma second-line. Thank you.

David Loew, Chief Executive Officer:

Yeah. Thank you, Michael. Regarding your first question on the infrastructure in the US, yes, we will be able to leverage our current infrastructure and certainly, we will add also Epizyme’s infrastructure because they are already present now. And so we are going to combine to a certain degree our two field forces because in fact Epizyme, given its size, did not have enough resources yet and also were launching under COVID. So it was hard for them to access to the office-based hematologists. And they also focused more in the launch on the mutant patients. As I’ve said, we believe that this is an all-comer drug, yet, more positions for elderly and frail patients.

And that leads me to your second question, which is we estimate that the elderly and frail are roughly 50% of the population. So, of course, you need to then look at some of them are going to be treated in academic hospitals, some other ones are going to be treated in the office-based setting where we think bispecifics are going to have less pickup because of the cytokine release syndrome. And even if you look at the subcutaneous version which has recently been published, there clearly still is Grade 2 cytokine release syndrome (Technical Difficulty) So that’s a problem for the elderly and frail patients.

Michael Leuchten, Analyst:

Thank you.

Operator:

And we’ll take our next question from Simon Baker with Redburn. Your line is open.

Simon Baker, Analyst:

Thank you for taking my questions. Two if I may, please. Firstly, a financial question. You talk about moderate dilutive impact on core operating income till the end of 2024. I wonder if you could give us a little more quantification of what moderate means there. And then secondly, both EZH2 and SETD2 are expressed in solid tumors. So I just wonder if you could give us the scope beyond the hematologic setting for both these drugs. I notice that Tazverik is already in CELLO-1 study for prostate cancer, but if you could just give us an idea of the scope in solid tumors for both these assets that would be very helpful. Thanks so much.

David Loew, Chief Executive Officer:

Thank you, Simon. We’ll have Aymeric answer your first question and then Howard answer the second question.

Howard Mayer, Head of Research and Development:

So regarding the dilution, as you’ve noted, we expect dilution especially in 2022, so this year and 2023 given the level of R&D spend, but also that there will be a positive offer on sales, there will be also a positive impact of the expected synergies. I think that we expect less dilution going into 2024 and then the deal to be accretive starting from 2025.

I think regarding the — I won’t give you the exact number, but provide you maybe some elements of the quantification. As David said, we are expecting to be able to leverage our current US infrastructure. We know also that Epizyme has started to prioritize its R&D program and we will also have a look at it in order to positively optimize the R&D spend in order to be able to deliver on the acquisition from 2025.

Howard? Yeah. And maybe I’ll take the second question. I mean, I think that it’s fair to say that our focus for tazemetostat is on hematologic malignancies. However, CELLO-1 is an important study. It’s looking at tazemetostat in combination with novel hormonal therapies and chemo-naive patients with mCRPC and I think we’re very interested in that. We’re looking carefully at that study. I should also note that there are preclinical programs that where there is a focus on solid tumors rather than hematologic malignancies. So, I think the epigenetic platform in general can be both for hematologic malignancies and also for solid tumors.

Simon Baker, Analyst:

Right. Thank you very much.

Operator:

And our next question comes from Matt Weston with Credit Suisse. Your line is open.

Matthew Weston, Analyst:

Thank you very much. I hope you can hear me. David, you laid out the peak sales potential and you mentioned that you would consider opportunities in other geographies. There is just as many elderly and frail patients with follicular lymphoma in Europe where you have also very strong oncology business. So could you tell us how much of your potential peak sales in the two settings in second-line and third-line you would consider coming from the European market, or is that incremental upside on those numbers?

And then secondly, you mentioned the challenges of the CD3/CD20s with CRS. But I also note that Epizyme recently added mosun plus tazemetostat to one of their multi-cohort studies in heme malignancies in Phase II. And I wondered what potential you saw of that combination moving forward, and how much that played a part in your decision on the company?

David Loew, Chief Executive Officer:

Thanks a lot, Matt. Two great questions. On the peak sales, other geographies that’s incremental, we believe that Epizyme did not really have contact with EMA on the accelerated approval program very recently. We are looking at payer research, because with the ASCO data that has recently been published, we need to see if actually that would be reimbursed or not. For the moment we want to be a bit careful because we know that the payer environment in US is pretty tough and they might want to wait for the second-line full approval. So for the moment we have not had really sales in there in a significant fashion.

Then on your question on CD3/CD20, the combination of mosun and Tazverik has not been the primary driver of this. We really model the sales with the Elderly and frail. We will have to see what the combination of the two gives. I mean, that might open up new opportunities because the tolerability of the Tazverik is excellent. And if you would use the bispecific in a setting where you have the infrastructure to actually handle the CRS syndrome, then it could absolutely be combined with the Tazverik and then the positioning would actually be enlarged perhaps also into the market — population — at the younger population. But it’s very early days. The protocol amendment is being made as we talk. So it’s going to be potentially a very interesting combination.

Matthew Weston, Analyst:

Can I just jump in with another one, following on from Simon’s question about dilution. So I totally understand that you don’t want to put numbers on it, and I totally understand that you see synergies. But what I’m struggling to square the circle on is Aymeric’s comment that the dilution in 2022 isn’t very dramatic because it’s only towards the end of the year, but also that you intend to keep the commercial infrastructure and it will take some time to review R&D. So mathematically, if you take consensus expectations on a full year if you just bang the two companies together would be about a 20% dilution, half a year of that this year, so that’s whatever 5% for a quarter in 2022 and then obviously there is a synergy element. The market seems to have decided that the right number is 10% dilution moving forward because we just assume you are half the cost out. Is that a reasonable assumption, Aymeric, or do you think it will take some time to get to that level of high single digits, low double digits dilution?

Aymeric Le Chatelier, Chief Financial Officer:

So Matthew, thank you. You’re very good at doing some of the math. So I’m not going to — as I said, I’m not going to give you a precise, but I think you get the story. Clearly 2022 because of the timing of the transaction, within the quarter the impact will be limited to our financials. I think that we will be able to generate synergy pretty quickly, but there will be an offer to fully execute on that. So that’s why the peak of the dilution is going to be in 2023, but clearly not on the consensus number Epizyme today, because clearly our objective is to integrate as quickly as possible and we are going to start from today to be opened up to give them the Epizyme pill and that’s why to give them also other prioritization on the R&D pipeline which has already been announced by Epizyme and we look at it on a more detail and also generic synergies. So clearly — and then the sub-element, as you know, will be expected turnaround on the sales and that’s really apart from the cost synergies, a very important driver of the transaction, which will take a little bit time to fully realize.

Matthew Weston, Analyst:

Thank you very much.

Operator:

And our next question comes from Richard Vosser with JPMorgan. Your line is now open.

Richard Vosser, Analyst:

Thanks very much. Just a few questions, please. First question just is the — I know you mentioned that you want to expand into sort of wild-type tumors as well, but just if you could give us the proportion of tumors that are sequenced for EZH2 today in follicular lymphoma and how that’s been going would be great.

Second question is, we’ve seen other compounds in this — in blood cancer have their accelerated approvals remove particularly the PI3s. So just how — is there any risk here in terms of the accelerated approval that — and how you’ve looked at that?

And then finally, just a couple of questions, thinking about future M&A. I think you mentioned earlier sort of maybe building on the infrastructure or at least you were asked about that. So maybe we could get your updated thoughts post this deal on whether you’re focused on similar size deals or continuing to or any larger and what the focus areas might be for those? Yeah. And I’ll stop there. Thanks very much.

David Loew, Chief Executive Officer:

Okay. Thanks, Richard. On the number of patients being — if I got this right, number of patients being tested currently for the EZH2 mutation, that’s your question?

Richard Vosser, Analyst:

Yeah, that was the question.

David Loew, Chief Executive Officer:

So roughly, from what we have seen, it’s about 20% are being diagnosed today as mutant out of a pool which is probably 25% roughly. But it’s a small number. That’s why we need to be careful on those. If you run the numbers, though, the mutant pool of course is a relatively small pool in the big scheme of things and that’s why we believe actually making sure that also wild-type patients, which when you look at the PFS had 11 months of PFS. And if there is no alternative treatments, then you can give the drug also to other patients. It’s a much larger pool. And so for the elderly and frail, as we said before, they don’t really have today big alternative treatments because, as we said, the bispecific we believe are not an ideal treatment for the elderly and frail in the office-based setting and I’m talking office space. So, therefore, we believe actually you can pretty much expand from there.

To your second questions on the other indications, after these — others have seen their indication being pulled, of course, you always have that theoretical risk with your confirmatory study you’re actually not hitting it. Now this is why we said we were very comforted with the lead-in portion of the Phase III trial because seeing roughly 95% overall response rate is a very good result. It’s clearly above what, for example, the AUGMENT study has shown. So we believe that this is really reassuring for us that this trial should be the right trial as the confirmatory study.

Regarding your third questions on similar or larger acquisition and which focus areas, you have — of course, we have a strategy, right, that we have communicated to you and it can be similar size or it can also be larger. I mean, the firepower that we have has not been absorbed in a significant fashion by this deal. You have seen that it was roughly $250 million upfront, but then you have the earnouts. So our overall firepower is not really affected by that and we could also forge, for example, a larger deal. And we are absolutely looking at both categories here. And the focus areas remain the ones we have communicated on the Capital Markets Day, which can be either the oncology ones, solid tumors, hematological tumors. It can be rare disease or it can be in neuroscience.

Richard Vosser, Analyst:

Excellent. Can I just clarify on the first question on the timing? So the screening — everybody screened for this and so then — and you’re finding most of the patients? Is that the right interpretation? So screening 100% and you’re finding most of the patients?

David Loew, Chief Executive Officer:

How many exactly are being tested, I would have to come back to you, but it’s — I know it’s a good portion. I couldn’t give you right now a number, but it’s a significant portion.

Richard Vosser, Analyst:

Okay, perfect. Thanks very much.

Operator:

(Operator Instructions) And we have a follow-up question from Matt Weston with Credit Suisse. Your line is open.

Matthew Weston, Analyst:

Thank you. Can I just understand — I think this molecule has a history of partners which I think leaves it with royalties, with deals done in different geographies and other pay-aways. Could you just remind us of the royalty pay-away on the molecule? Whether any milestones remain due to partners? And just remind us who has rights in other geographies and what the relationship is in terms of income that Epizyme will book from those partnerships?

Aymeric Le Chatelier, Chief Financial Officer:

Yeah. So there are some — so you’re right to say that. So Eisai was initially the owner of that compound. So today Eisai is responsible only for the Japan sales and there is no more milestone that they are expecting on that side. Other than that, there is a partner for China. And the partner for China is HUTCHMED and for which there is a license agreement for which most of the — some of the milestone have been already received and there is expectation to receive some further milestones. So all in all, there is not a very significant part of royalties to be paid. So this is clearly a product that will have an attractive profile in terms of profitabilities and gross margin.

Matthew Weston, Analyst:

Okay. So just to check, I thought that was a mid-teens royalty payable to Eisai on US sales, is that incorrect, Aymeric?

Aymeric Le Chatelier, Chief Financial Officer:

Yes, I think there is some royalties to be paid to Eisai which are in a way limited.

Matthew Weston, Analyst:

Okay, thank you very much.

David Loew, Chief Executive Officer:

(Multiple Speakers) Richard Vosser’s question. Richard, we looked at the current testing rate which is 55% estimated testing rates on the mutant patients and it’s going to continue to increase going up probably to 70% testing rate.

Operator:

And, Richard, your line is open.

Richard Vosser, Analyst:

Sorry. Apologies. And my follow-up question was just thinking about moving into the earlier lines of follicular lymphoma. My impression is, survival is quite a long time in earlier lines. So is there any sort of thoughts about the warning on the label for secondary malignancies? Do you see that having a bearing at all on use in earlier lines? Just your thoughts there would be great? Thanks very much.

David Loew, Chief Executive Officer:

Yeah. Howard do you want to take this, because we discussed this obviously?

Howard Mayer, Head of Research and Development:

Yeah. So we’ve looked very, very carefully at this issue, including all the trials that have been conducted post-marketing surveillance and we’re basically seeing a rate of less than 1% in things like myelodysplastic syndrome in patients that’s consistent with the original Phase II trial for tazemetostat in FL and epithelial sarcoma. So we don’t think that this is an impediment to moving to second-line therapy and potentially earlier.

David Loew, Chief Executive Officer:

Maybe, Matthew, just to come back to your question regarding Eisai, you are right to say that there are royalties in the mid-term to be paid to Eisai for ex-US sales on top of the agreement for Japan for which we receive — we will receive — Epizyme will receive royalties.

Operator:

And we’ll take our next question from Keyur Parekh from Goldman Sachs. Your line is open.

Keyur Parekh, Analyst:

Hi, thank you. And apologies if this question has been asked already. But I was just wondering if you can give us a sense for how you perceive kind of this third and second-line market for both kind of follicular lymphoma and DLBCL kind of developing over the next few years. There are lots of competitive studies ongoing and kind of the standard of care there is changing quite quickly. So I would be keen to understand better kind of what due diligence you’ve done around that and what you think the standard of care looks like over the next three to five years in those settings. Thank you.

David Loew, Chief Executive Officer:

Yeah. Thank you, Keyur. Well, you’re absolutely right that this market is becoming quite crowded and very segmented. What we anticipate is that there is a good segment which are more of the fit and healthy patients where either you can give CAR-Ts or the bispecific antibodies. And one might actually be in competition with the other. And so we see a lot of competition going in there, because you see a lot of bispecific antibodies — several bispecific antibodies coming in. You also see MONJUVI obviously playing also big in that segment because the tolerability profile of MONJUVI is also not the most straightforward.

So, I think there will be a segmentation in the market for the fit and younger patients, a lot being treated in the more academic institutions or the larger hospitals, which have the infrastructure to actually handle the side effects. And then there will be especially in follicular since those are mostly elderly patients, but even the more progressed DLBCL patients start also to age because they have also been surviving longer. There will be a good chunk of patients, which are more elderly and frail. They often have comorbidities and there you need to really think what you can give. And you need to go for efficacy, but also for tolerability.

And especially in the office based setting, this is going to be even more important because you don’t have the full infrastructure in the office-based setting to take care of some of the side effects in the adequate fashion. And so we believe the more aggressive therapies are going to be more often used in the larger extremely well-staffed infrastructure hospitals. So that was a simplified version of it, because you can look at this with all the details and there are going to be many, many patient segments and there are many, many crossovers going from one treatment to the others, which are possible, et cetera. So, yes, it is a crowded market.

On the other side, the market is also increasing because patients actually survive longer and therefore — I remember, I was responsible for Rituxan MabThera at the time at Roche and then for the whole oncology and then for all franchises at Roche. And actually over that time, these markets started to expand because patients were just living longer. And so you can cycle them through different lines of therapies. And some pools did not even exist at that time like a third, fourth-line or fifth-line pool did not exist. And today it will exist. So you also have to look at that point.

Keyur Parekh, Analyst:

Thank you. I will have to just follow up on your kind of — you’re saying $150 million to $250 million in sales based on current indication. How much of that is current indication in existing geographies versus does it require any geographic expansion for you to get to those numbers?

David Loew, Chief Executive Officer:

Yeah. We treated that question before. So I’m going to be very short on this one. It is going to be incremental to geographic expansion because Epizyme did not really have very recent interactions with EMA and we will have to conduct further payer research, especially with the ASCO data. So far we were relatively careful on modeling more sales, because the payer environment ex-US is relatively conservative and tough and several compounds with accelerated approval did not achieve good reimbursement rates. So, that’s certainly something that we will have to be mindful of.

Keyur Parekh, Analyst:

Thank you very much.

Operator:

It appears we have no further questions at this time. I will now turn the program back over to David Loew.

David Loew, Chief Executive Officer:

Thank you very much, everybody. Thank you for joining and have a good morning or afternoon. Thank you. Bye-bye.

Operator:

This does conclude today’s program. Thank you for your participation. You may disconnect at any time.

This transcript may not be 100 percent accurate and may contain misspellings and other inaccuracies. This transcript is provided “as is”, without express or implied warranties of any kind. Bloomberg retains all rights to this transcript and provides it solely for your personal, non-commercial use. Bloomberg, its suppliers and third-party agents shall have no liability for errors in this transcript or for lost profits, losses, or direct, indirect, incidental, consequential, special or punitive damages in connection with the furnishing, performance or use of such transcript. Neither the information nor any opinion expressed in this transcript constitutes a solicitation of the purchase or sale of securities or commodities. Any opinion expressed in the transcript does not necessarily reflect the views of Bloomberg LP

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Ben Lang on Notion, Building a Community, and the Art of Angel Investing

- Affimed Announces Acceptance of AFM24 Clinical Abstract at the 2024 Annual Meeting of the American Society of Clinical Oncology

- Nokia Corporation - Managers' transactions (Martikainen)

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share