Form SC 13D/A LEAF GROUP LTD. Filed by: Spectrum Equity Investors V L P

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Leaf Group Ltd.

(Name of Issuer)

Common Stock, par value $0.0001 par value

(Title of Class of Securities)

52177G 102

(CUSIP Number)

Carolina Picazo

Spectrum Equity

One International Place

35th Floor

Boston, Massachusetts 02110

(617) 464-4600

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

June 29, 2020

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Section 240.13d-7 for other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 52177G 102

| 1. |

Names of Reporting Persons.

Spectrum Equity Investors V, L.P. | |||||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) (a) ☐ (b) ☒

| |||||

| 3. | SEC Use Only

| |||||

| 4. | Source of Funds (See Instructions)

WC | |||||

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ | |||||

| 6. | Citizenship or Place of Organization

Delaware | |||||

| Number of Shares Beneficially Owned by Each Reporting Person With |

7. | Sole Voting Power

0 | ||||

| 8. | Shared Voting Power

2,756,688 | |||||

| 9. | Sole Dispositive Power

0 | |||||

| 10. | Shared Dispositive Power

2,756,688 | |||||

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,756,688 | |||||

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ | |||||

| 13. | Percent of Class Represented by Amount in Row (11)

10.3% | |||||

| 14. | Type of Reporting Person (See Instructions)

PN | |||||

CUSIP No. 52177G 102

| 1. |

Names of Reporting Persons.

Spectrum Equity Associates V, L.P. | |||||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) (a) ☐ (b) ☒

| |||||

| 3. | SEC Use Only

| |||||

| 4. | Source of Funds (See Instructions)

AF | |||||

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ | |||||

| 6. | Citizenship or Place of Organization

Delaware | |||||

| Number of Shares Beneficially Owned by Each Reporting Person With |

7. | Sole Voting Power

0 | ||||

| 8. | Shared Voting Power

2,756,688 | |||||

| 9. | Sole Dispositive Power

0 | |||||

| 10. | Shared Dispositive Power

2,756,688 | |||||

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,756,688 | |||||

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ | |||||

| 13. | Percent of Class Represented by Amount in Row (11)

10.3% | |||||

| 14. | Type of Reporting Person (See Instructions)

PN | |||||

CUSIP No. 52177G 102

| 1. |

Names of Reporting Persons.

SEA V Management, LLC | |||||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) (a) ☐ (b) ☒

| |||||

| 3. | SEC Use Only

| |||||

| 4. | Source of Funds (See Instructions)

AF | |||||

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ | |||||

| 6. | Citizenship or Place of Organization

Delaware | |||||

| Number of Shares Beneficially Owned by Each Reporting Person With |

7. | Sole Voting Power

0 | ||||

| 8. | Shared Voting Power

2,770,540 | |||||

| 9. | Sole Dispositive Power

0 | |||||

| 10. | Shared Dispositive Power

2,770,540 | |||||

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,770,540 | |||||

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ | |||||

| 13. | Percent of Class Represented by Amount in Row (11)

10.4% | |||||

| 14. | Type of Reporting Person (See Instructions)

OO | |||||

CUSIP No. 52177G 102

| 1. |

Names of Reporting Persons.

Spectrum V Investment Managers’ Fund, L.P. | |||||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) (a) ☐ (b) ☒

| |||||

| 3. | SEC Use Only

| |||||

| 4. | Source of Funds (See Instructions)

WC | |||||

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ | |||||

| 6. | Citizenship or Place of Organization

Delaware | |||||

| Number of Shares Beneficially Owned by Each Reporting Person With |

7. | Sole Voting Power

0 | ||||

| 8. | Shared Voting Power

13,852 | |||||

| 9. | Sole Dispositive Power

0 | |||||

| 10. | Shared Dispositive Power

13,852 | |||||

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

13,852 | |||||

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ | |||||

| 13. | Percent of Class Represented by Amount in Row (11)

0.1% | |||||

| 14. | Type of Reporting Person (See Instructions)

PN | |||||

CUSIP No. 52177G 102

| 1. |

Names of Reporting Persons.

Brion B. Applegate | |||||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) (a) ☐ (b) ☒

| |||||

| 3. | SEC Use Only

| |||||

| 4. | Source of Funds (See Instructions)

AF | |||||

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ | |||||

| 6. | Citizenship or Place of Organization

United States of America | |||||

| Number of Shares Beneficially Owned by Each Reporting Person With |

7. | Sole Voting Power

0 | ||||

| 8. | Shared Voting Power

2,770,540 | |||||

| 9. | Sole Dispositive Power

0 | |||||

| 10. | Shared Dispositive Power

2,770,540 | |||||

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,770,540 | |||||

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ | |||||

| 13. | Percent of Class Represented by Amount in Row (11)

10.4% | |||||

| 14. | Type of Reporting Person (See Instructions)

IN | |||||

CUSIP No. 52177G 102

| 1. |

Names of Reporting Persons.

Christopher T. Mitchell | |||||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) (a) ☐ (b) ☒

| |||||

| 3. | SEC Use Only

| |||||

| 4. | Source of Funds (See Instructions)

AF | |||||

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ | |||||

| 6. | Citizenship or Place of Organization

United States of America | |||||

| Number of Shares Beneficially Owned by Each Reporting Person With |

7. | Sole Voting Power

0 | ||||

| 8. | Shared Voting Power

2,770,540 | |||||

| 9. | Sole Dispositive Power

0 | |||||

| 10. | Shared Dispositive Power

2,770,540 | |||||

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,770,540 | |||||

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ | |||||

| 13. | Percent of Class Represented by Amount in Row (11)

10.4% | |||||

| 14. | Type of Reporting Person (See Instructions)

IN | |||||

CUSIP No. 52177G 102

| 1. |

Names of Reporting Persons.

Victor E. Parker, Jr. | |||||

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) (a) ☐ (b) ☒

| |||||

| 3. | SEC Use Only

| |||||

| 4. | Source of Funds (See Instructions)

AF | |||||

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ | |||||

| 6. | Citizenship or Place of Organization

United States of America | |||||

| Number of Shares Beneficially Owned by Each Reporting Person With |

7. | Sole Voting Power

0 | ||||

| 8. | Shared Voting Power

2,770,540 | |||||

| 9. | Sole Dispositive Power

0 | |||||

| 10. | Shared Dispositive Power

2,770,540 | |||||

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,770,540 | |||||

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ | |||||

| 13. | Percent of Class Represented by Amount in Row (11)

10.4% | |||||

| 14. | Type of Reporting Person (See Instructions)

IN | |||||

Explanatory Note

This Amendment No. 1 (this “Amendment”) amends and supplements the Schedule 13D filed with the Securities and Exchange Commission on June 22, 2020 by the Reporting Persons (as amended from time to time, the “Schedule 13D”) relating to their beneficial ownership in Leaf Group Ltd. (the “Issuer”). Except to the extent set forth in this Amendment, all material information disclosed in the Schedule 13D remains unchanged. Capitalized terms used but not defined in this Amendment have the respective meanings set forth in the Schedule 13D.

Item 4. Purpose of Transaction

Item 4 of the Schedule 13D is hereby amended and supplemented to add the following:

On June 29, 2020, the Investors issued a press release and submitted a letter to the board of directors of the Issuer (the “Board”) regarding the Investors’ concerns with the operational and financial underperformance of the Issuer. In the letter, the Investors called for the Board to (i) remove the Issuer’s Chief Executive Officer, (ii) enhance corporate governance by refreshing and de-staggering the Board, and (iii) sell both the media and marketplace assets. A copy of the press release and the letter is attached hereto as Exhibit 2.

Item 7. Material to be Filed as Exhibits

Item 7 of the Schedule 13D is hereby amended and supplemented to add the following:

Exhibit 3 Press Release and Letter to Board of Directors, dated June 29, 2020

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: June 29, 2020

| Spectrum Equity Investors V, L.P. | ||||

| By: | Spectrum Equity Associates V, L.P. | |||

| its general partner | ||||

| By: | SEA V Management, LLC | |||

| its general partner | ||||

| By: | /s/ Carolina Picazo | |||

| Carolina Picazo | ||||

| Authorized Signatory | ||||

| Spectrum Equity Associates V, L.P. | ||||

| By: | SEA V Management, LLC | |||

| its general partner | ||||

| By: | /s/ Carolina Picazo | |||

| Carolina Picazo | ||||

| Authorized Signatory | ||||

| SEA V Management, LLC | ||||

| By: | /s/ Carolina Picazo | |||

| Carolina Picazo | ||||

| Authorized Signatory | ||||

| Spectrum V Investment Managers’ Fund, L.P. | ||||

| By: | SEA V Management, LLC | |||

| its general partner | ||||

| By: | /s/ Carolina Picazo | |||

| Carolina Picazo | ||||

| Authorized Signatory | ||||

| * | ||||

| Brion B. Applegate | ||||

| * | ||||

| Christopher T. Mitchell | ||||

| * | ||||

| Victor E. Parker, Jr. | ||||

| *By: | /s/ Carolina Picazo | |

| Carolina Picazo | ||

| As attorney-in-fact |

This Schedule 13D was executed by Carolina Picazo on behalf of the individuals listed above pursuant to a Power of Attorney, a copy of which is attached as Exhibit 2.

EXHIBIT INDEX

| Exhibit 1 | Joint Filing Agreement | |

| Exhibit 2 | Power of Attorney | |

| Exhibit 3 | Press Release and Letter to Board of Directors, dated June 29, 2020 | |

Exhibit 3

Major Investors Representing Over 40% of Shares Deliver Letter to Leaf Group

Believe Leaf Group Is Deeply Undervalued and Significant Opportunities Exist to Unlock Trapped Value

Stunned by Extent to Which the Company Has Disregarded Shareholders’ Rights and Believe Significant Corporate Governance Changes and Removal of the CEO Are Required to Align Company with Shareholders’ Interests

Propose That Leaf Group Must Immediately Restart Process to Sell Media and Marketplace Assets in One or More Transactions

Los Angeles, June 29, 2020—Investors owning over 40% of the issued and outstanding shares of Leaf Group, Ltd. (“Leaf Group” or the “Company”) (NYSE: LEAF), today released a detailed letter to the Company’s board of directors expressing their concern with the current corporate strategy, management team and lack of corporate governance. The list of signatories to the letter includes Osmium Partners LLC, PEAK6 Investments LLC, Boyle Capital Opportunity Fund, LP, Oak Management Corp., Generation Capital Partners II LP, Generation Partners II LLC, Spectrum Equity Investors V, L.P. and Spectrum Equity Associates V, L.P. (together, the “Investors”) and is comprised of several of the Company’s largest and longest-standing shareholders.

In the letter, the Investors contend that the Company is not realizing its full potential, and there are clear opportunities to unlock shareholder value. In order to address many of the issues plaguing the Company, the Investors call on the board to immediately:

1. Remove the Company’s CEO,

2. Enhance corporate governance by refreshing and de-staggering the board, and

3. Sell both the Media and Marketplace assets of the Company.

The full text of the letter to Leaf Group’s board of directors can be found in the included PDF.

About Osmium Partners

We seek to generate strong, risk-adjusted returns by investing in undervalued, small capitalization companies across equity markets. Our Osmium 8 research process is based on eight simple factors involving factors such as balance sheet strength, aligned interests, attractive reinvestment opportunities, a low valuation, and reasonable growth prospects. As engaged owners, we actively discuss corporate strategy and capital structure with management teams and boards of directors. We prefer to conduct these discussions in private, but we will publicly debate important items with all shareholders when appropriate.

About PEAK6

PEAK6 uses technology to find a better way of doing things. The company’s first tech-based solution was developed in 1997 to optimize options trading and, over the past two decades, the same formula has been used across a range of industries, asset classes and business stages to consistently deliver superior results. Today, PEAK6 seeks transformational opportunities to provide capital and strategic support to entrepreneurs and forward-thinking businesses, helping to unlock potential and activate what is into what ought to be. PEAK6’s core brands include: PEAK6 Capital Management, Apex Clearing, National Flood Services and Evil Geniuses. Learn more at www.PEAK6.com or follow us on LinkedIn.

About Boyle Capital Opportunity Fund

Boyle Capital Opportunity Fund, LP is a value-oriented investment partnership. We manage a focused portfolio of deeply undervalued securities and actively engage with the company’s management and board of directors to unlock shareholder value over the long-term.

About Oak Investment Partners

Oak Investment Partners was founded in 1978. Since that time, the firm has invested $9 billion in over 525 companies around the world, earning the trust of entrepreneurs with a senior team that delivers steady guidance, deep domain expertise and a consistent investment philosophy. We are involved in the formation of companies, fund spinouts of operating divisions and technology assets, and provide growth equity to mid- and late-stage private businesses and to public companies through PIPE investments. These companies are concentrated in the five major sectors that fuel the most disruptive growth in our world today: Information Technology, FinTech, Internet and Consumer, Healthcare Services, and Clean Energy.

About Generation Partners

Founded in 1995, Generation Partners provides equity capital to growth companies through buyout and growth equity investments.

About Spectrum Equity

Spectrum Equity is a leading growth equity firm providing capital and strategic support to innovative companies in the information economy. For over 25 years, the firm has partnered with proven entrepreneurs and management teams to build long-term value in market-leading internet, software and information services companies. Representative investments include Ancestry, Bats Global Markets, Definitive Healthcare, GoodRx, Grubhub, Lynda.com, Origami Risk, SurveyMonkey and Verafin. For more information, including a complete list of portfolio investments, visit www.spectrumequity.com.

Contact:

Dana Taormina

JConnelly

973.850.7305

June 29, 2020

Leaf Group Ltd.

1655 26th Street

Santa Monica, CA 90404

Attention: James R. Quandt, Sean P. Moriarty, Charles C. Baker, Deborah A. Benton, Beverly K. Carmichael, John Pleasants, Jennifer Schulz, Mitchell Stern

Dear Board Members of Leaf Group Ltd. (“Leaf,” “Leaf Group” or the “Company”):

This letter is submitted on behalf of Osmium Partners LLC, PEAK6 Investments LLC, Boyle Capital Opportunity Fund, LP, Oak Management Corp., Generation Capital Partners II LP, Generation Partners II LLC, Spectrum Equity Investors V, L.P. and Spectrum Equity Associates V, L.P. (together, the “Investors” or “we”). The Investors beneficially own over 40% of Leaf Group’s outstanding common stock and are several of the Company’s largest and longest-standing shareholders. We strongly believe Leaf Group is not realizing its true potential.

The purpose of this letter is to communicate our concerns with the operational and financial underperformance of Leaf Group’s management, which we believe have gone largely unchecked due to serious governance issues at the Company. The board of Leaf Group, which collectively owns less than 3.5% of the Company’s shares, has shown a wanton disregard for shareholders’ interests and has supported a business strategy that has destroyed shareholders’ capital, while very generously rewarding a poorly performing CEO. The market has responded by placing a valuation discount of approximately 85% on Leaf Group relative to its publicly traded peers,1 as well as an 85% discount to our current CEO’s very own sum of the parts valuation analysis from 2017.2 We believe the only way to interpret the market’s valuation discount of Leaf is that investors have lost all confidence in Leaf’s CEO’s business strategy and your oversight of the CEO.

Over the past few years, various signatories to this letter have attempted to conduct an active and constructive dialogue with the Company, and when it became clear that ongoing concerns were not being addressed by the Company, it eventually resulted in an activist campaign surrounding the 2019 Shareholder Meeting. A settlement was reached with this CEO and board, with the primary stipulation and understanding being that a robust, transparent, and honest strategic sales process of the Company or Company assets would be undertaken. To the best of our knowledge as investors, that did not happen. To any independent party who observes the ongoing value dislocation of the Company, it could not have been a serious sales process if the end result was simply no action whatsoever. Not only did the process take 13 months to conclude, with absolutely nothing to show for it, but also we lost another credible CFO and the enterprise value of the Company is down another 79.12%3 during one of the biggest bull markets in history. The Company has given patient shareholders no viable options, other than making the demands set forth herein, in order to finally deliver shareholder value.

| 1 | Peer group includes Redbubble Limited, Wayfair Inc., Etsy, Inc., IAC/InterActiveCorp and J2 Global, Inc. |

| 2 | Leaf Group company presentation 11/2017 |

| 3 | Leaf Group stock price performance from 4/14/2019 – 5/20/2020 during course of strategic review |

When the Company announced the disappointing results of a failed strategic sales process, it simultaneously proclaimed that a “successful turnaround of the company has been underway,…streamlining the business,…optimizing operations…and strengthen[ing] the team.” These assertions cannot be validated by any rational observer. Further, the Company stated that “…the organic growth potential…can provide more value to shareholders than a strategic sale of the company’s disparate assets.” There is no evidence to support these statements when shareholders have been given the same rationale over the past five years, all while the Company’s value, profits and cash flow have languished. The five-year experiment of this strategy needs to end. It would represent an abdication of our collective responsibilities if shareholders allowed it to continue unabated any further.

In our opinion, each of you as board members must decide now whether to (a) perform your responsibility as a director and uphold your fiduciary duties to all shareholders, or (b) deliberately choose to work against your shareholders and support a value-incinerating CEO.

Our Calls to Action

In order to address many of the issues plaguing the Company, the board must immediately act to:

| 1. | Remove the Company’s CEO, |

| 2. | Enhance corporate governance by refreshing and de-staggering the board, and |

| 3. | Sell both the Media and Marketplace assets. |

Remove the Company’s CEO

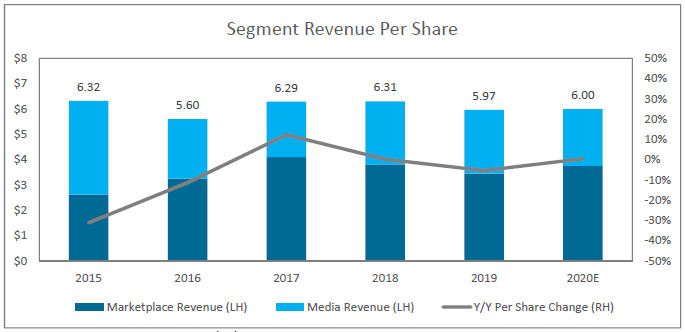

We believe a CEO should be an asset to a company; however, Leaf’s CEO, Sean Moriarty, is apparently a liability. Leaf stock has dropped from $9.76 per share on the day Mr. Moriarty took over as CEO4 to an all-time low of $1.03 and a market capitalization of $27.5 million on April 24, 2020, representing a decline of 89.45% during his tenure. This depressed valuation is largely the product of the fact that, during his tenure, the Company has seen revenue per share shrink by 5.54%5 (despite an aggressive acquisition strategy) and FY 2019 total consolidated expenses that reach 117.45%6 of total revenue, while shareholders have been diluted by 40.43%7 in new share issuances. Under the current CEO, the Company’s operational performance is deteriorating at an accelerating pace.

Mr. Moriarty has offered a multitude of excuses for the Company’s poor performance and inability to consistently hit financial targets. He has alienated and opposed any constructive feedback and input from countless stakeholders of the Company throughout his tenure. The failure to deliver, along with migrating explanations from Mr. Moriarty to rationalize the Company’s prolonged underperformance, has clearly eroded the market’s confidence in Leaf’s leadership.

| 4 | Opening LEAF share price on 8/11/2014 |

| 5 | FY 2015 revenue per share of $6.32 vs. FY 2019 revenue per share of $5.97 |

| 6 | Leaf Group 10-K 3/04/2019: $182.0 million of total operating expenses |

| 7 | Diluted shares in FY 2014 of 18.8 million to Q1 2020 of 26.4 million |

Source: FactSet

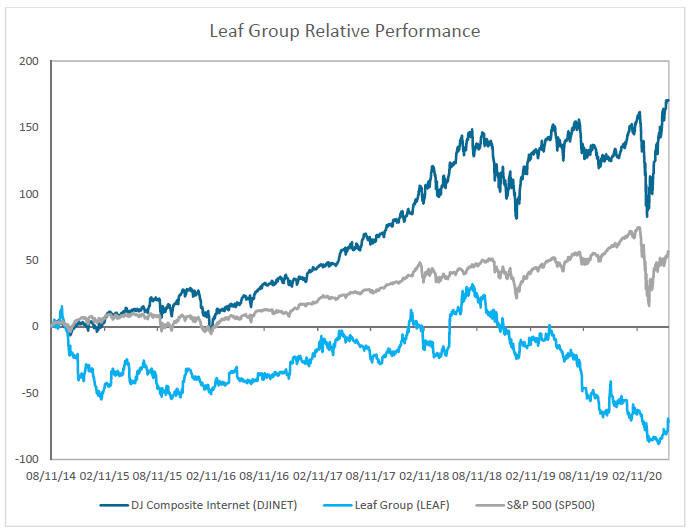

Leaf shares have also underperformed on every time period listed: YTD, 1 YR, 3 YR, 5 YR, and since Mr. Moriarty was hired (Inception).

| Period Returns | ||||||||||||||||||||

| YTD | 1 YR | 3 YR | 5 YR | Inception | ||||||||||||||||

| LEAF |

-27.50 | % | -57.73 | % | -63.75 | % | -52.46 | % | -65.11 | % | ||||||||||

| S&P 500 |

-3.27 | % | 8.19 | % | 28.98 | % | 48.85 | % | 160.82 | % | ||||||||||

| DJ Internet |

20.74 | % | 17.09 | % | 79.87 | % | 151.38 | % | 184.28 | % | ||||||||||

Source: FactSet, 8/11/14 – 6/16/20

In addition, since becoming CEO, Mr. Moriarty has touted an $11 to $25 sum-of-the-parts stock price, followed by 20% revenue growth guidance. Eventually, that guidance morphed into a “long term opportunity to deliver against 20% annual revenue growth target.” Just two weeks later, while Mr. Moriarty reiterated the Company’s bright future on the annual meeting call and proceeded to end the strategic review, he suddenly reduced the growth guidance yet again to 15% annual revenue growth.

That being said, the guidance numbers are a bit irrelevant, since none of them has come remotely close to being achieved. How much credibility is the CEO entitled to maintain, when approximately 30 months ago, he presented that Leaf Media and Marketplace assets were worth $11 to $25 in a sale, but could find no interest in a sale with a $1.70 share price? Furthermore, how can board members observe a business strategy led by a CEO that has not only consistently missed financial targets but also burned over $90 million in cash since 2015, and still believe his leadership will deliver any meaningful value? At this point, the board must rectify a situation where the CEO’s guidance has little credibility given his track record of consistently over-promising and under-delivering.

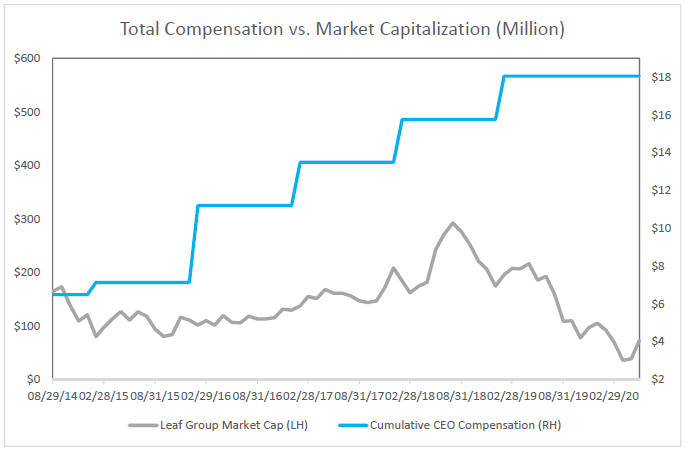

To make matters worse, investors have borne the cost of best-in-class pay for worst-in-class performance by richly rewarding the CEO while the stock dropped a staggering 65%.8 The chart below illustrates that, during that time period, the board has approved Mr. Moriarty’s cumulative total compensation of $18,052,1219 (which does not even include the $200,000 bonus awarded to Mr. Moriarty on June 18, 202010). In April of this year, his total cumulative compensation represented 65% of the total market capitalization of the Company.

It is unfathomable that the board continues to increase Mr. Moriarty’s compensation while shareholder value has been destroyed. Any fiduciary of shareholders would, at a minimum, hold compensation steady or tie it to performance. Nevertheless, Leaf’s own SEC filings boast “certain provisions in our charter documents and Delaware law could discourage takeover attempts and lead to management entrenchment.” The board is certainly following true to its word in one respect, at least.

| 8 | LEAF stock price 8/11/2014 – 6/16/2020 |

| 9 | Leaf Group Proxy Statements 2015-2020 – Cumulative Total Compensation from Summary Compensation Table |

| 10 | Leaf Group 8-K, 6/19/2020 |

Source: FactSet, Leaf Group Proxy Statements

This substantial transfer of value was clearly unjustified given the prolonged underperformance of the Company and should be rectified by the board on a go-forward basis for the current and any future CEO.

The Company has suffered extremely under the helm of Mr. Moriarty, and it is time for the board to save the Company from its misguided leader and his chronic underperformance. We have assessed the consequent risks and have determined that they are outweighed by the benefits of putting an end to his track record of poor execution, operational issues and undue influence exerted over the board (further detailed herein). Mr. Moriarty must be removed as CEO and board member immediately and replaced with a qualified and capable leader who can oversee the Company during the sales process described herein.

Enhance Corporate Governance by Refreshing and De-Staggering the Board

In addition to the foregoing issues, on May 19, 2020, a clear line was drawn in the sand for this board when Leaf Group’s shareholders voted to withhold a staggering 39.22% of their votes11 in an uncontested election of board nominees at this year’s annual meeting. This vote was a loud cry indicating that the Company’s owners do not support the board and the Company’s value destruction, which they are condoning.

| 11 | Leaf Group 8-K, 5/21/2020: 8,666,155 votes withheld vs. 13,428,251 votes for |

Furthermore, we believe there are too many prior business and social relationships between the existing board members. Because the staggered board deprives Leaf shareholders of the ability to hold accountable problematic directors, we ask that the board move immediately to institute annual director elections. Annual director elections will permit shareholders to hold the board accountable for the issues detailed in this letter.

Finally, the board of Leaf Group collectively owns less than 3.5% of the Company’s shares, as compared to the Investors writing this letter, which owns more than 40% of the Company’s shares. The board must be reconstituted to better represent its owners. We demand that five additional director nominees are appointed to the board, such that the Investors’ board representation is proportionate to their cumulative ownership share of the Company.

Failing to remedy these serious concerns would be indicative of a board that not only ignores its shareholders, but goes to great lengths to completely suppress shareholder rights.

Sell Both the Media and Marketplace Assets

In addition to the corporate governance reforms detailed above, we call on the board to accept that the Company’s current course of action is not a viable strategy and that it must change course in order to unlock trapped value. For these reasons, we demand that the board restart its strategic review process and separately sell the Marketplace and Media businesses.

Stop Waiting on a Failed Strategy

With most physical retailers closed over the last 12 weeks, the entire online marketplace industry is experiencing impressive growth rates. As a result, we expect the CEO to urge investors to be patient and believe that NOW is the time for his “turnaround” to become reality. Yet, in our opinion, given the horrific long-term business results, we are very skeptical that the public market will close the massive gap in value. Therefore, we believe despite the potential of participating in widespread industry public market value creation and multiple expansion, the track record of value destruction will outweigh any progress. We can already see this dynamic playing out. Many of the publicly traded marketplace comps are making, or are close to reclaiming, all-time high stock prices, yet Leaf stock still lingers around $3 per share – less than half of what it was even a year ago and well off its recent highs of $12 per share.

The Craig-Hallum analyst put it best when he asked the question on the latest quarterly call: “in the last year or two, we’ve seen kind of a changeover, where Media has been a bigger driver for the business, while Marketplace has been somewhat lighter, and now over the course of the last four to six weeks, that’s turned.” He is spot on, and that was only describing the last year or two. This is not a “diverse portfolio” that generates value through a market cycle; it is a constant flip-flop to whatever is working best at the time to mask the reality. The fact of the matter is these businesses have been unable to demonstrate consistent profitable growth under current leadership and are, therefore, reliant on capital markets to sustain operations. When we look at revenue on a per share basis, the diversification benefits and the growth are not there, as seen in the chart below. Revenue per share is actually down since 2015. On top of that, the Company will still likely generate a net loss of around $25 million in 2020, roughly the same as 2018 and 2019. What more evidence does the board need that more of the same is an unviable option?

Source: Leaf Group SEC Filings

Pursue Opportunities to Unlock Trapped Value

There is little doubt that Leaf Group is worth significantly more than what it trades for today. The issue is that, in the hands of the same management, running the same misguided playbook, the outcome is going to be the same. Albert Einstein famously said, “The definition of insanity is doing the same thing over and over again and expecting different results.”

So what should we do? A 2016 investor presentation by the CEO, in which he was unveiling the new Leaf Group, included an investment thesis slide that stated, “Sum of the parts analysis points to significant value dislocation.” Below is the supplemental chart provided in that presentation implying a valuation of $11.22 – $25.94 per share, while the stock was then trading at $6.50.

Source: 2016 Leaf Group Company Presentation

For those curious, this slide is no longer included in the investor presentations for obvious reasons.

Conducting the same sum-of-the-parts analysis today shows that there is still meaningful value embedded in both Media and Marketplace assets:

| • | Public company valuation data provided by GCA Advisors12 shows an average Internet Content valuation of 3.4x Enterprise Value / 2020E Revenue. Applying this multiple to estimates of 2020E Media revenue gets us to a value of $205 million for that segment alone. |

| • | According to the same GCA report, Marketplace assets trade for 4.8x Enterprise Value / 2020E Revenue, which would get us a value of $460 million for the Marketplace assets. Even if we take very conservative estimates based on select comparable public marketplace companies, we still get to a value of at least $90 million for that segment.13 |

Lastly, the average sell-side analyst price target for Leaf stock is $5.00, a 72.41% premium to current levels.14 Craig-Hallum writes in its March 2020 report, “Note that our price target valuation includes no value for Saatchi Art, Society 6, or Deny Designs, but we believe these could be monetized.” We agree they could and should be monetized. This plainly illustrates that while the Leaf assets have tremendous value, they are undoubtedly better suited in the separate hands of two or more buyers who can each operate with focus and scale.

| 12 | GCA Global Internet and Digital Media Sector Report, Q1 2020 |

| 13 | Company filings and presentations, internal estimates |

| 14 | Based on 6/16/2020 stock price |

But rather than focusing on value creation, it seems the current CEO is focused only on value destruction. When Mr. Moriarty became CEO in 2014, the Company’s market capitalization was approximately $170 million, and since that time, the Company has spent ~$35 million on its acquisition strategy (The Other Art Fair for $2M, Deny Designs for $12M, Well+Good for $19M and Only In Your State for $2M).15 Today, the market capitalization of Leaf Group is approximately $75 million. The more acquisitions the Company makes, and the more equity capital provided, the more per-share value is ultimately destroyed. Leaf Group has now accumulated $350.4 million in net operating losses to prove it.

How can a public board with directors who are accountable to shareholders ignore these enormously destructive issues? The board must wake up and stop supporting a business strategy and a CEO that has failed to hit stated targets, incinerated shareholder capital and created massive shareholder dilution.

Restart the Strategic Review Process

In response to these concerns, the board may point to the recently completed strategic review process and state that it was unsuccessful. We contest that characterization because we believe the strategic review process was a sham. Just as the market does not believe in the story of Leaf as a “house of brands,” we find it unlikely a suitor would choose to acquire this entire holding company, comprised of such disparate assets.

We do not believe the board diligently tried to separately sell the Media and Marketplace assets to a set of logical buyers. Furthermore, we believe the integrity of the sales process was tainted by an entrenched management and unquestioning board. If the board disputes this characterization, we would ask to be provided with records to determine whether the Company did, in fact, engage in a full and proper process.

In addition, as the board embarks on a new strategic review, it must address and cure the conflict of interest that existed during the previous sale process: while Mr. Baker chaired the strategic review, he also served as the CFO of Eventbrite; at the same time, the CEO of the Leaf Group sat, and continues to sit, on Eventbrite’s board of directors. In Mr. Moriarty’s role as a board member of Eventbrite, he is charged with evaluating Mr. Baker’s performance and influencing his compensation, among other responsibilities.

We believe the board of Leaf must replace Mr. Baker with an unconflicted director to lead this critical process. The CEO could well oppose a sale out of self-interest (or could be requesting a set of economic awards to remain CEO through a sale transaction), and we doubt whether Mr. Baker can properly discharge his fiduciary duties to shareholders of the Leaf Group. In our opinion, this creates a material conflict that we believe undermined the sale process. Our confidence is not restored by the fact that the Company’s trusted CFO, Jantoon Reigersman, resigned immediately upon completion of the strategic review process.

We demand that the board restart its strategic review and, this time, conduct a fair, robust, and transparent sales process – that is not overseen by Mr. Moriarty – to separately sell both the Media and Marketplace businesses.

| 15 | Craig-Hallum 1/24/2020 research note |

Conclusion

Why does the stock perennially trade at a large discount to the asset value that even your investor presentations have touted for five years now? Why does the stock still languish near all-time lows even though the Company will receive nearly $9.5 million of cash with the Hearst transaction, took in $7.14 million in a PPP loan, and the CEO says the Company is at an inflection point? THAT IS WHAT HAPPENS WHEN YOU HAVE AN INCOMPETENT LEADER THAT THE MARKET HAS NO TRUST IN. If the signal the market is sending you isn’t clear enough, perhaps this message directly from the owners of Leaf Group is.

Shareholders are done being taken advantage of by this board and management. NEARLY 40% OF SHAREHOLDERS WHO PARTICIPATED IN THE COMPANY’S 2020 ANNUAL MEETING EXPLICITLY VOTED AGAINST YOUR DIRECTORS IN AN UNCONTESTED VOTE.16 Imagine what would happen in any sort of formal and fair process. Can the board still say they know and are acting in the interests of what is best for all shareholders when the only platform they have given us to express our views demonstrates the exact opposite?

Given the historical and recent track record of our CEO, a separate shareholder activist campaign in 2019, the dubious last-minute board of director changes for the 2020 annual meeting, the negligence with the strategic review process, two CFO resignations, the stock hitting all-time lows, a delisting notice from the NYSE, massive shareholder opposition to the directors and egregious executive compensation practices, how have the members of the board of directors fulfilled their fiduciary duties? If I were a director that had any part in this, I would be running as fast and as far from Leaf Group as possible.

We are writing this letter to share our perspectives, not just as individual large shareholders, but as aligned investors representing nearly half of the Company’s ownership. If this board chooses to work against the interests of a near-majority of Leaf shareholders, we will hold each of you accountable. We are prepared to highlight management and the board’s entrenchment and shareholder value destruction in a bright public spotlight if immediate action is not taken. Inaction is not an option; no change means you support Mr. Moriarty.

Immediate change must occur now. If the board is unwilling to terminate the CEO, enhance its corporate governance mechanisms, and sell both the Media and Marketplace businesses, we intend to hold the Company accountable for years of disastrous results. Leaf’s employees, shareholders and customers deserve better. Your duties compel you to act.

| 16 | Leaf Group 8-K, 5/21/2020 |

We look forward to communicating directly with the board and hope that the board approaches these discussions in good faith and with urgency.

| Sincerely, |

| John H. Lewis on behalf Osmium Partners LLC |

| Rachel Saunders on behalf of PEAK6 Investments LLC |

| Erik Ritland on behalf of Boyle Capital Opportunity Fund, LP |

| Fredric W. Harman on behalf of Oak Management Corp. |

| John Hawkins on behalf of Generation Capital Partners II LP and Generation Partners II LLC |

| Victor E. Parker, Jr. and Brian Regan on behalf of Spectrum Equity Investors V, L.P. and Spectrum Equity Associates V, L.P. |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Marriott Vacations Worldwide (VAC) ticks higher on new activist investor

- SmallRig, 2024 NAB Show에서 혁신적인 제품 라인 공개

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Spectrum Equity, 13DSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share