Form S-3ASR TEVA PHARMACEUTICAL INDU

Table of Contents

As filed with the Securities and Exchange Commission on October 27, 2021

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TEVA PHARMACEUTICAL INDUSTRIES LIMITED

(Exact name of registrant as specified in its charter and translation of registrant’s name into English)

| Israel | Not Applicable | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

124 Dvora Hanevi’a Street

Tel Aviv, 6944020, Israel

+972-3-914-8213

(Address and telephone number of registrant’s principal executive offices)

| TEVA PHARMACEUTICAL FINANCE IV, LLC | TEVA PHARMACEUTICAL FINANCE V, LLC | |

| (Exact name of registrant as specified in its charter) | (Exact name of registrant as specified in its charter) |

| Delaware | 22-1734359 | Delaware | 22-1734359 | |||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

TEVA PHARMACEUTICAL FINANCE VI, LLC

(Exact name of registrant as specified in its charter)

| Delaware | 22-1734359 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

400 Interpace Parkway, Building A

Parsippany, NJ 07054

Attention: Asaph Namaan

(800) 545-8800

(Address and telephone number of registrant’s principal executive offices)

TEVA PHARMACEUTICAL FINANCE NETHERLANDS II B.V.

(Exact name of registrant as specified in its charter)

| Netherlands | N/A | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

TEVA PHARMACEUTICAL FINANCE NETHERLANDS III B.V.

(Exact name of registrant as specified in its charter)

| Netherlands | N/A | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

TEVA PHARMACEUTICAL FINANCE NETHERLANDS IV B.V.

(Exact name of registrant as specified in its charter)

| Netherlands | N/A | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Piet Heinkade 107

1019 GM Amsterdam, Netherlands

Attention: Bibianne Bon

+31 (0)20-2193000

(Address and telephone number of registrant’s principal executive offices)

Teva Pharmaceuticals USA, Inc.

400 Interpace Parkway, Building A, Parsippany, NJ 07054

Attention: Asaph Namaan

(800) 545-8800

(Name, address and telephone number of agent for service)

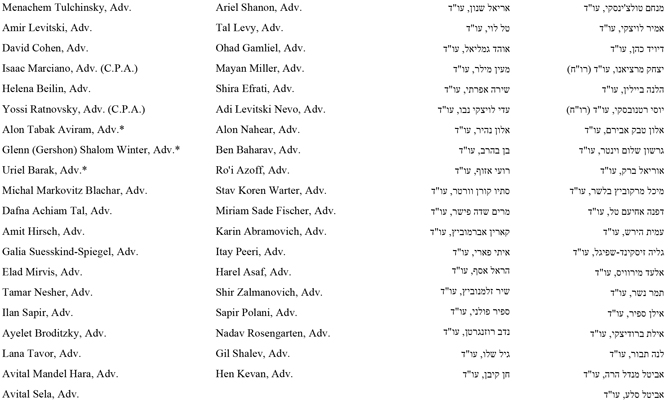

with copies to:

Joshua N. Korff, P.C.

Ross M. Leff P.C.

Kirkland & Ellis LLP

601 Lexington Avenue

New York, New York 10022

(212) 446-4800

Table of Contents

Approximate date of commencement of proposed sale to the public: From time to time on or after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered (1) |

Proposed maximum offering price per unit (1) |

Proposed maximum aggregate offering price (1) |

Amount of registration fee (1) | ||||

| Teva Pharmaceutical Industries Limited Ordinary Shares (2) |

||||||||

| Teva Pharmaceutical Industries Limited Purchase Contracts (3)(4) |

||||||||

| Teva Pharmaceutical Industries Limited Units (3)(5) |

||||||||

| Teva Pharmaceutical Industries Limited Senior Debt Securities (3) |

||||||||

| Teva Pharmaceutical Industries Limited Subordinated Debt Securities (3) |

||||||||

| Teva Pharmaceutical Finance IV, LLC Senior Debt Securities (3) |

||||||||

| Teva Pharmaceutical Finance IV, LLC Subordinated Debt Securities (3) |

||||||||

| Teva Pharmaceutical Finance V, LLC Senior Debt Securities (3) |

||||||||

| Teva Pharmaceutical Finance V, LLC Subordinated Debt Securities (3) |

||||||||

| Teva Pharmaceutical Finance VI, LLC Senior Debt Securities (3) |

||||||||

| Teva Pharmaceutical Finance VI, LLC Subordinated Debt Securities (3) |

||||||||

| Teva Pharmaceutical Finance Netherlands II B.V. Senior Debt Securities (3) |

||||||||

| Teva Pharmaceutical Finance Netherlands II B.V. Subordinated Debt Securities (3) |

||||||||

| Teva Pharmaceutical Finance Netherlands III B.V. Senior Debt Securities (3) |

||||||||

| Teva Pharmaceutical Finance Netherlands III B.V. Subordinated Debt Securities (3) |

||||||||

| Teva Pharmaceutical Finance Netherlands IV B.V. Senior Debt Securities (3) |

||||||||

| Teva Pharmaceutical Finance Netherlands IV B.V. Subordinated Debt Securities (3) |

||||||||

| Guarantees by Teva Pharmaceutical Industries Limited of Debt Securities of each finance subsidiary listed above (6) |

||||||||

|

| ||||||||

|

| ||||||||

| (1) | Pursuant to General Instruction II.E of Form S-3, not specified as to each class of securities to be registered. These offered securities may be sold separately, together or as units with other offered securities. An indeterminate aggregate initial offering price, principal amount or number of securities of each identified class is being registered as may from time to time be issued at indeterminate prices. Separate consideration may or may not be received for securities that are issuable on exercise, conversion or exchange of other securities or that are issued in units or represented by depositary shares. Securities registered hereunder may be offered in U.S. dollars or the equivalent thereof in foreign currencies. In reliance on Rules 456(b) and 457(r) under the Securities Act of 1933, as amended, the registrant is deferring payment of the registration fees until such fees become payable in connection with specific offerings of such securities. |

| (2) | Such ordinary shares may be represented by American Depositary Shares. Such American Depositary Shares are or will be registered on a separately filed registration statement on Form F-6. Each American Depositary Share represents one ordinary share. |

| (3) | Also includes such currently indeterminate number of ordinary shares of Teva Pharmaceutical Industries Limited as may be issued upon conversion of or exchange for any securities that provide for conversion or exchange into such ordinary shares. |

| (4) | There are being registered hereby such indeterminate number of Purchase Contracts as may be issued at indeterminate prices. Such Purchase Contracts may be issued together with any of the other securities being registered hereby. Purchase Contracts may require the holder thereof to purchase or sell any of the other securities registered hereby or to purchase or sell a basket of such securities, an index or indices of such securities or any combination of the above. |

| (5) | There are being registered hereby such indeterminate number of Units as may be issued at indeterminate prices. Units may consist of any combination of the securities being registered hereby or an indeterminate number of ordinary shares of Teva Pharmaceutical Industries Limited. |

| (6) | The guarantees will be issued by Teva Pharmaceutical Industries Limited. No separate consideration will be received for any of these guarantees. |

Table of Contents

PROSPECTUS

TEVA PHARMACEUTICAL INDUSTRIES LIMITED

American Depositary Shares,

each representing one Ordinary Share,

Debt Securities,

Purchase Contracts and Units

TEVA PHARMACEUTICAL FINANCE IV, LLC

TEVA PHARMACEUTICAL FINANCE V, LLC

TEVA PHARMACEUTICAL FINANCE VI, LLC

TEVA PHARMACEUTICAL FINANCE NETHERLANDS II B.V.

TEVA PHARMACEUTICAL FINANCE NETHERLANDS III B.V.

TEVA PHARMACEUTICAL FINANCE NETHERLANDS IV B.V.

Debt Securities, fully and unconditionally guaranteed by

TEVA PHARMACEUTICAL INDUSTRIES LIMITED

Teva Pharmaceutical Industries Limited and its finance subsidiaries (“Teva,” the “Company,” “we,” “us” or “our”) may offer and sell from time to time:

| • | American Depositary Shares (“ADSs”), each representing one ordinary share; |

| • | senior or subordinated debt securities; |

| • | purchase contracts; and |

| • | units. |

This prospectus describes some of the general terms that may apply to the securities. Teva will provide the specific terms and public offering prices of these securities in supplements to this prospectus. Before investing, you should carefully read this prospectus and any related prospectus supplement, including any document incorporated or deemed incorporated by reference into this prospectus or any prospectus supplement. The prospectus supplements may also add, update or change information contained in this prospectus. Our registration of securities covered by this prospectus does not mean that we will offer or sell any securities.

We may sell these securities to or through one or more underwriters, dealers or agents, or directly to purchasers, on a continuous or delayed basis. The names of any underwriters, dealers or agents will be stated in a supplement to this prospectus.

Our ADSs are quoted on the New York Stock Exchange (the “NYSE”) under the symbol “TEVA.” On October 26, 2021, the last reported sale price for the ADSs on the NYSE was $9.39. If we decide to list any of these securities on a national securities exchange upon issuance, the applicable prospectus supplement to this prospectus will identify the exchange and the date when we expect trading to begin.

Our principal executive offices are located at 124 Dvora Hanevi’a Street, Tel Aviv, 6944020, Israel, and our telephone number is +972-3-914-8213

.

.

You should carefully read this prospectus and any accompanying prospectus supplement, together with the documents incorporated by reference herein and therein, and any free writing prospectus, before you make an investment decision.

Investing in our securities involves risks. You should consider the risk factors described in any accompanying prospectus supplement and the documents we incorporate by reference. See “Risk Factors” on page 4 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 27, 2021.

Table of Contents

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 7 | ||||

| 8 | ||||

| 14 | ||||

| 24 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 43 |

Table of Contents

This prospectus is part of a Registration Statement that Teva and the other registrants filed with the United States Securities and Exchange Commission (the “SEC”) as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), utilizing a “shelf” registration process. Under this shelf process, any of the registrants may, from time to time, sell the securities described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the securities which we may offer and the related guarantees, if any, of those securities. Each time we sell securities we will provide a prospectus supplement that will contain specific information about the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with additional information described below under the heading “Where You Can Find More Information” before purchasing any of our securities.

We have not authorized anyone to provide any information or to make any representation other than those contained or incorporated by reference in this prospectus. “Incorporated by reference” means that we can disclose important information to you by referring you to another document filed separately with the SEC. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making, and we will not make, an offer to sell securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any supplement to this prospectus is current only as of the dates on their respective covers. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless the context otherwise requires, references in this prospectus and any supplement to this prospectus to “Teva,” “we,” “us” and “our” refer to Teva Pharmaceutical Industries Limited and its subsidiaries, collectively. References to “Teva Finance IV LLC” refer to Teva Pharmaceutical Finance IV, LLC. References to “Teva Finance V LLC” refer to Teva Pharmaceutical Finance V, LLC. References to “Teva Finance VI LLC” refer to Teva Pharmaceutical Finance VI, LLC. References to the “LLCs” refer to Teva Finance IV LLC, Teva Finance V LLC and Teva Finance VI LLC. References to “Teva Finance Netherlands II” refer to Teva Pharmaceutical Finance Netherlands II B.V. References to “Teva Finance Netherlands III” refer to Teva Pharmaceutical Finance Netherlands III B.V. References to “Teva Finance Netherlands IV” refer to Teva Pharmaceutical Finance Netherlands IV B.V. References to the “Netherlands BVs” refer to Teva Finance Netherlands II, Teva Finance Netherlands III and Teva Finance Netherlands IV. References to the “finance subsidiaries” refer to the LLCs, and the Netherlands BVs, collectively.

Table of Contents

TEVA PHARMACEUTICAL INDUSTRIES LIMITED

Business Overview

We are a global pharmaceutical company, committed to helping patients around the world to access affordable medicines and benefit from innovations to improve their health. Our mission is to be a global leader in generics, specialty medicines and biopharmaceuticals, improving the lives of patients.

We operate worldwide, with headquarters in Israel and a significant presence in the United States, Europe and many other markets around the world. Our key strengths include our world-leading generic medicines expertise and portfolio, focused specialty medicines portfolio and global infrastructure and scale.

Teva was incorporated in Israel on February 13, 1944 and is the successor to a number of Israeli corporations, the oldest of which was established in 1901.

Our Business Segments

We operate our business through three segments: North America, Europe and International Markets. Each business segment manages our entire product portfolio in its region, including generics, specialty and over-the-counter (“OTC”) products. This structure enables strong alignment and integration between operations, commercial regions, R&D and our global marketing and portfolio function, optimizing our product lifecycle across therapeutic areas.

In addition to these three segments, we have other activities, primarily the sale of active pharmaceutical ingredients (“API”) to third parties, certain contract manufacturing services and an out-licensing platform offering a portfolio of products to other pharmaceutical companies through our affiliate Medis.

2

Table of Contents

Teva has organized various finance subsidiaries for the purpose of issuing debt securities. There are no separate financial statements of the finance subsidiaries in this prospectus because these entities are, or will be treated as, subsidiaries of Teva for financial reporting purposes. We do not believe the financial statements would be helpful to the holders of the securities of these entities because:

| • | Teva is a reporting company under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and owns, directly or indirectly, all of the voting interests of these entities; |

| • | these entities do not have any independent operations and do not propose to engage in any activities other than issuing securities and investing the proceeds in Teva or its affiliates; and |

| • | these entities’ obligations under the securities will be fully and unconditionally guaranteed by Teva. These entities are exempt from the information reporting requirements of the Exchange Act. |

Teva Finance IV LLC

Teva Finance IV LLC is a limited liability company that was formed on December 1, 2008 under the Delaware Limited Liability Company Act, as amended. Its address is 400 Interpace Parkway, Building A, Parsippany, NJ 07054, telephone number (800) 545-8800.

Teva Finance V LLC

Teva Finance V LLC is a limited liability company that was formed on December 1, 2011 under the Delaware Limited Liability Company Act, as amended. Its address is 400 Interpace Parkway, Building A, Parsippany, NJ 07054, telephone number (800) 545-8800.

Teva Finance VI LLC

Teva Finance VI LLC is a limited liability company that was formed on December 1, 2011 under the Delaware Limited Liability Company Act, as amended. Its address is 400 Interpace Parkway, Building A, Parsippany, NJ 07054, telephone number (800) 545-8800.

Teva Finance Netherlands II

Teva Finance Netherlands II is a Dutch private limited liability company that was formed on October 16, 2013. Its address is Piet Heinkade 107, 1019 GM Amsterdam, Netherlands, telephone number +31 (0)20-2193000.

Teva Finance Netherlands III

Teva Finance Netherlands III is a Dutch private limited liability company that was formed on September 21, 2015. Its address is Piet Heinkade 107, 1019 GM Amsterdam, Netherlands, telephone number +31 (0)20-2193000.

Teva Finance Netherlands IV

Teva Finance Netherlands IV is a Dutch private limited liability company that was formed on April 22, 2016. Its address is Piet Heinkade 107, 1019 GM Amsterdam, Netherlands, telephone number +31 (0)20-2193000.

3

Table of Contents

Investing in our securities involves risk. Please see the risks incorporated by reference from our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, the risk factors described under the caption “Risk Factors” in any applicable prospectus supplement and any risk factors set forth in our other filings with the SEC. See “Where You Can Find More Information—Incorporation by Reference.” Our business, financial condition, liquidity or results of operations could be materially adversely affected by any of these risks. Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus and any accompanying prospectus supplement.

4

Table of Contents

The disclosure and analysis in this prospectus, including statements that are predictive in nature, or that depend upon or refer to future events or conditions, contain or incorporate by reference some forward-looking statements within the meaning of Section 21E of the Exchange Act and Section 27A of the Securities Act, which are based on management’s current beliefs and expectations and are subject to substantial risks and uncertainties, both known and unknown, that could cause our future results, performance or achievements to differ significantly from that expressed or implied by such forward-looking statements. You can identify these forward-looking statements by the use of words such as “should,” “expect,” “anticipate,” “estimate,” “target,” “may,” “project,” “guidance,” “intend,” “plan,” “believe” and other words and terms of similar meaning and expression in connection with any discussion of future operating or financial performance. Important factors that could cause or contribute to such differences include risks relating to:

| • | our ability to successfully compete in the marketplace, including: that we are substantially dependent on our generic products; consolidation of our customer base and commercial alliances among our customers; delays in launches of new generic products; the increase in the number of competitors targeting generic opportunities and seeking U.S. market exclusivity for generic versions of significant products; our ability to develop and commercialize biopharmaceutical products; competition for our specialty products, including AUSTEDO®, AJOVY® and COPAXONE®; our ability to achieve expected results from investments in our product pipeline; our ability to develop and commercialize additional pharmaceutical products; and the effectiveness of our patents and other measures to protect our intellectual property rights; |

| • | our substantial indebtedness, which may limit our ability to incur additional indebtedness, engage in additional transactions or make new investments, may result in a further downgrade of our credit ratings; and our inability to raise debt or borrow funds in amounts or on terms that are favorable to us; |

| • | our business and operations in general, including: uncertainty regarding the COVID-19 pandemic and its impact on our business, financial condition, operations, cash flows, and liquidity and on the economy in general; our ability to successfully execute and maintain the activities and efforts related to the measures we have taken or may take in response to the COVID-19 pandemic and associated costs therewith; effectiveness of our optimization efforts; our ability to attract, hire and retain highly skilled personnel; manufacturing or quality control problems; interruptions in our supply chain; disruptions of information technology systems; breaches of our data security; variations in intellectual property laws; challenges associated with conducting business globally, including political or economic instability, major hostilities or terrorism; costs and delays resulting from the extensive pharmaceutical regulation to which we are subject or delays in governmental processing time due to travel and work restrictions caused by the COVID-19 pandemic; the effects of reforms in healthcare regulation and reductions in pharmaceutical pricing, reimbursement and coverage; significant sales to a limited number of customers; our ability to successfully bid for suitable acquisition targets or licensing opportunities, or to consummate and integrate acquisitions; and our prospects and opportunities for growth if we sell assets; |

| • | compliance, regulatory and litigation matters, including: failure to comply with complex legal and regulatory environments; increased legal and regulatory action in connection with public concern over the abuse of opioid medications and our ability to reach a final resolution of the remaining opioid-related litigation; scrutiny from competition and pricing authorities around the world, including our ability to successfully defend against the U.S. Department of Justice criminal charges of Sherman Act violations; potential liability for patent infringement; product liability claims; failure to comply with complex Medicare and Medicaid reporting and payment obligations; compliance with anti-corruption sanctions and trade control laws; and environmental risks; and |

| • | other financial and economic risks, including: our exposure to currency fluctuations and restrictions as well as credit risks; potential impairments of our intangible assets; potential significant increases in tax |

5

Table of Contents

| liabilities (including as a result of potential tax reform in the United States); and the effect on our overall effective tax rate of the termination or expiration of governmental programs or tax benefits, or of a change in our business. |

The forward-looking statements contained or incorporated by reference herein involve a number of known and unknown risks and uncertainties that could cause our future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this prospectus, could cause our results to differ materially from those expressed in the forward-looking statements. Potential factors that could affect our results, include, in addition to others not described in this prospectus, those referenced under “Risk Factors.” These are factors that we think could cause our actual results to differ materially from our expected results.

Forward-looking statements speak only as of the date on which they are made, and we assume no obligation to update or revise any forward-looking statements or other information contained in this prospectus, whether as a result of new information, future events or otherwise, except as may be required by law. You are advised, however, to consult any additional disclosures we make in our Annual Reports on Form 10-K, our subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are filed with the SEC. See “Risk Factors.” Other factors besides those listed here could also adversely affect us.

6

Table of Contents

Unless the applicable prospectus supplement states otherwise, the net proceeds from the sale of securities offered by Teva or the finance subsidiaries will be used for general corporate purposes, which may include additions to working capital, investments in or extensions of credit to our subsidiaries and the repayment of indebtedness.

7

Table of Contents

DESCRIPTION OF ORDINARY SHARES

The following is a summary of the terms of Teva ordinary shares, including certain provisions contained in Teva’s memorandum of association (the “Memorandum”), Teva’s articles of association (the “Articles”) and applicable Israeli laws in effect on the date of this Registration Statement. This summary is qualified by reference to the full text of the Memorandum and the Articles, which are incorporated by reference as exhibits hereto.

Description of Ordinary Shares

The par value of Teva’s ordinary shares is NIS 0.10 per share, and all issued and outstanding ordinary shares are fully paid and non-assessable. Holders of ordinary shares are entitled to participate equally in the receipt of dividends and other distributions and, in the event of liquidation, in all distributions after the discharge of liabilities to creditors. All ordinary shares represented by the ADSs will be issued in registered form only. The Israeli Companies Law, 5759-1999 (the “Companies Law”) and the Articles do not provide for preemptive rights to the holders of Teva’s shares. Each Teva ordinary share entitles the holder thereof to one vote.

Neither the Memorandum nor the Articles or the laws of the State of Israel restrict the ownership or voting of Teva’s ordinary shares or ADSs by non-residents or persons who are not citizens of Israel, except with respect to citizens or residents of countries that are in a state of war with Israel.

General Shareholder Meetings

Under the Companies Law and the Articles, Teva is required to hold an annual general meeting every calendar year, no later than 15 months after the previous annual general meeting. In addition, Teva is required to convene a special meeting of shareholders:

| • | upon the demand of two directors or one-quarter of the serving directors; |

| • | upon the demand of one or more shareholders holding at least 5% of our issued share capital and 1% or more of our voting rights; and |

| • | upon the demand of one or more shareholders holding at least 5% of our voting rights; |

provided that a demand by a shareholder to convene a special shareholders meeting must set forth the matters to be considered at the meeting and otherwise comply with all other requirements of applicable law and the Articles.

If the board of directors receives a demand to convene a special meeting satisfying the above conditions, it must announce the scheduling of the meeting within 21 days after the demand was delivered, subject to the relevant requirements of the Companies Law and the regulations thereunder. If the board of directors fails to do so, the party who demanded to convene the special meeting may convene the meeting itself, subject to the provisions of the Companies Law.

The agenda of a general meeting is determined by the board of directors. The agenda must also include matters for which the convening of a special meeting was demanded, as well as any matter requested by one or more shareholders who hold at least 1% of Teva’s voting rights, subject to complying with certain requirements. Pursuant to Israeli law, a Teva shareholder who wishes to include a matter on the agenda of a general meeting must submit the request within seven days of publication of the notice with respect to the general meeting or within 14 days of a preliminary notice of the intention to convene the general meeting, if such was filed, in order for it to be eligible to be considered at the general meeting. Under the Articles, a request by a shareholder who holds at least 1% of Teva’s voting rights to include a matter on the agenda of a general meeting must be submitted in writing to Teva no later than 14 days after the first publication of Teva’s annual consolidated financial statements preceding the annual general meeting at which the consolidated financial statements for such year are to be presented. Any such demands or requests must comply with the requirements of applicable law, applicable stock exchange rules and the Articles.

8

Table of Contents

Notices

Pursuant to the Companies Law, the regulations thereunder and the Articles, Teva is generally required to announce the convening of general meetings at least 35 days in advance, but is not required to deliver personal notices of a general meeting or of any adjournment thereof to shareholders. Teva may reasonably determine the method of publicizing the convening of general meetings, including by publishing a notice in one or more daily newspapers in Israel or in one or more international wire services, and any such publication will be deemed to have been duly given and delivered on the date of such publication. Shareholders as of the record date determined in respect of the general meeting are entitled to participate in and vote at the meeting. The Articles require that shareholder meetings take place in Israel, unless Teva’s center of management has been transferred to another country in accordance with the Articles.

Voting and Quorum Requirements

The quorum required for a general meeting of shareholders is at least two shareholders present in person or by proxy or represented by an authorized representative, who jointly hold at least 25% of our paid-up share capital. If a meeting is adjourned for lack of a quorum, it will generally be adjourned to the same time and place on the same day of the following week unless the board of directors sets another date, time and place in a notice to all persons who are entitled to receive notice of general meetings. Should no legal quorum be present at such reconvened meeting a half hour following the time set for such meeting, the necessary quorum consists of any two shareholders present, in person or by proxy, who jointly hold at least 20% of Teva’s paid-up share capital.

A shareholder who intends to vote at a meeting must demonstrate ownership of shares in accordance with the Companies Law and the regulations promulgated thereunder.

Shareholder Resolutions

The Companies Law provides that resolutions on certain matters, such as amending a company’s articles of association, exercising the authority of the board of directors in certain circumstances, appointing auditors, approving certain transactions, increasing or decreasing the registered share capital and approving certain mergers, must be approved by the shareholders at a general meeting. A company may determine in its articles of association certain additional matters with respect to which decisions will be made by the shareholders at a general meeting.

Generally, under the Articles, shareholder resolutions are deemed adopted if approved by the holders of a simple majority of the voting rights represented at a general meeting in person or by proxy and voting, unless a different majority is required by law or the Articles. Pursuant to the Companies Law and the Articles, certain shareholder resolutions (for example, resolutions amending many of the provisions of the Articles) require the affirmative vote of at least 75% of the voting rights represented at a general meeting and voting in person or by proxy, and certain other amendments to the Articles require the affirmative vote of at least 85% of the voting rights represented in a general meeting voting in person or by proxy, unless the board of directors sets a lower percentage, by a supermajority of three-quarters of the voting directors.

Change of Control

Subject to certain exceptions, the Companies Law requires that a merger (which, for these purposes, is defined as involving two Israeli companies) be approved by both the board of directors and by the shareholders of each of the merging companies and, with respect to the target company, if its share capital is divided into more than one class, the approval of each class of shares is required (in accordance with the majority and legal quorum requirements set forth in the Companies Law and the Articles). However, a merger may not be approved if it is objected to by shareholders holding a majority of the voting rights participating and voting at the meeting (disregarding any abstentions), after excluding the shares held by the other party to the merger, by any person

9

Table of Contents

who holds 25% or more of the other party to the merger or by anyone on their behalf, including the relatives of or corporations controlled by these persons, unless an Israeli court determines otherwise at the request of shareholders holding at least 25% of the voting rights of the company.

In approving a merger, the board of directors of both merging companies must determine that there is no reasonable concern that, as a result of the merger, the surviving company will not be able to satisfy its obligations to its creditors. Similarly, upon the request of a creditor of either party to the proposed merger, an Israeli court may prevent or delay the merger if it concludes that there exists a reasonable concern that, as a result of the merger, the surviving company will not be able to satisfy the obligations of the merging parties. A court may also issue other instructions for the protection of creditors’ rights in connection with a merger. Further, a merger may not be completed unless at least (i) 50 days have passed from the time that the requisite proposals for the approval of the merger were filed with the Israeli Registrar of Companies; and (ii) 30 days have passed since the merger was approved by the shareholders of each party to the merger.

Under the Companies Law, subject to certain exceptions, an acquisition of shares in a public company must be made by means of a tender offer if, as a result of the acquisition, the purchaser would hold (i) 25% or more of the voting rights of the company if there is no other holder of 25% or more of the company’s voting rights; or (ii) more than 45% of the voting rights of the company if there is no other holder of more than 45% of the company’s voting rights. This requirement does not apply to certain events set forth in the Companies Law, including a purchase of shares by an offeree in a “private placement” that receives specific shareholder approval. The board of directors must either give the shareholders its opinion as to the advisability of the tender offer or explain why it is unable to do so. The board of directors must also disclose any personal interest of any of its members in the proposed acquisition. The tender offer may be consummated only if (i) at least 5% of the company’s voting rights will be acquired; and (ii) the majority of the offerees who responded to the offer accepted the offer, excluding offerees who are controlling shareholders of the offeror, offerees who hold 25% or more of the voting rights in the company or who have a personal interest in accepting the tender offer, or anyone on their behalf or on behalf of the offeror including the relatives of or corporations controlled by these persons.

Under the Companies Law, a person may not acquire shares in a public company if, after the acquisition, he will hold more than 90% of the shares or more than 90% of any class of shares of that company, unless a tender offer is made to purchase all of the shares or all of the shares of the particular class, which we refer to as a full tender offer. The Companies Law also generally provides that as long as a shareholder in a public company holds more than 90% of the company’s shares or of a class of shares, that shareholder shall be precluded from purchasing any additional shares. In order that all of the shares that the purchaser offered to purchase be transferred to the purchaser by operation of law, one of the following must have occurred: (i) the shareholders who declined or who did not respond to the full tender offer hold less than 5% of the company’s outstanding share capital or of the relevant class of shares and the majority of offerees who do not have a personal interest in accepting the full tender offer accepted the offer, or (ii) the shareholders who declined or who did not respond to the full tender offer hold less than 2% of the company’s outstanding share capital or of the relevant class of shares.

If the conditions set forth above are not met, the purchaser may not acquire shares of the company from shareholders who accepted the full tender offer to the extent that following such acquisition, the purchaser would own more than 90% of the company’s issued and outstanding share capital or more than 90% of the particular class of shares with respect to which the full tender offer was made.

A shareholder that had his or her shares so transferred, whether he or she accepted the full tender offer or not, has the right, within six months from the date of acceptance of the full tender offer, to petition the court to determine that the full tender offer was for less than fair value and that the fair value should be paid as determined by the court. However, subject to certain conditions, the purchaser may provide in its offer that shareholders who accept the full tender offer will not be entitled to such rights.

10

Table of Contents

Board of Directors

Our board of directors consists of three classes of directors plus the chief executive officer, who is not part of any class. One of the classes is elected each year by the shareholders at our annual meeting for a term of approximately three years. Elected directors cannot be removed from office by the shareholders until the expiration of their term of office, unless they violate their duties of care or loyalty.

In accordance with the Companies Law, we have elected to comply with SEC and NYSE requirements for independent directors on the Board and audit and compensation committees, in lieu of the Israeli requirements for statutory independent directors and audit committee and compensation committee composition. Following such election, we no longer designate any of our directors as statutory independent directors or designated independent directors under Israeli law.

The holders of our ordinary shares representing a majority of the voting power represented at a shareholders’ meeting and voting at the meeting have the power to elect all of the directors up for election.

In general, the board of directors formulates company policy and supervises the performance of the chief executive officer. Subject to the provisions of the Companies Law and the Articles, any Teva power that has not been conferred upon another body may be exercised by the board of directors.

Neither our Memorandum or Articles, nor Israeli law, mandate retirement of directors at a certain age, or share ownership for a director’s qualification.

Conflicts of Interest

Approval of Related Party Transactions

The Companies Law requires that an “office holder” (as defined in the Companies Law) of a company promptly disclose any personal interest that he or she may have and all related material information known to him or her, in connection with any existing or proposed transaction of the company.

Pursuant to the Companies Law, any transaction with an office holder or in which the office holder has a personal interest (other than with respect to such office holder’s Terms of Office and Employment) must be brought before the audit committee, in order to determine whether such transaction is an “extraordinary transaction” (defined as a transaction not in the ordinary course of business, not on market terms or likely to have a material impact on the company’s profitability, assets or liabilities). The term “Terms of Office and Employment,” as defined in the Companies Law, includes compensation, equity-based awards, releases from liability, indemnification and insurance, severance and other benefits.

Pursuant to the Companies Law, the Articles and Teva policy, in the event the audit committee determines that the transaction is not an extraordinary transaction, the transaction will require only audit committee approval; if, however, it is determined to be an extraordinary transaction, board of directors approval is also required, and in some circumstances shareholder approval may also be required. Such a transaction may only be approved if it is determined to be in the best interests of Teva.

A person with a personal interest in the matter generally may not be present at meetings of the board of directors or certain committees where the matter is being considered and, if a member of the board of directors or a committee, may generally not vote on the matter.

Transactions with Controlling Shareholders

Under Israeli law, extraordinary transactions with a controlling shareholder or in which the controlling shareholder has a personal interest and any engagement with a controlling shareholder or a controlling

11

Table of Contents

shareholder’s relative with respect to the provision of services to the company or with their Terms of Office and Employment as an office holder or their employment, if they are not office holders, generally require the approval of the audit committee (or with respect to Terms of Office and Employment, the compensation committee), the board of directors and the shareholders. If required, shareholder approval must include at least a majority of the shareholders who do not have a personal interest in the transaction and are present and voting at the meeting (abstentions are disregarded), or, alternatively, that the total shareholdings of the disinterested shareholders who vote against the transaction cannot represent more than two percent of the voting rights in the company. Transactions for a period of more than three years generally need to be brought for approval in accordance with the above procedures every three years.

A shareholder who holds 25% or more of the voting rights in a company is considered a controlling shareholder for these purposes if no other shareholder holds more than 50% of the voting rights. If two or more shareholders are interested parties in the same transaction, their shareholdings are combined for the purposes of calculating percentages.

Approval of Director and Executive Officer Compensation

As required by the Companies Law, we have adopted a compensation policy regarding the Terms of Office and Employment of our office holders (the “Compensation Policy”).

Pursuant to the Companies Law, arrangements between Teva and its office holders must generally be consistent with the Compensation Policy. However, under certain circumstances, we may approve an arrangement that is not consistent with the Compensation Policy, if such arrangement is approved by a special disinterested majority of our shareholders.

In addition, pursuant to the Companies Law, the Terms of Office and Employment of office holders generally require the approval of the compensation committee and the Board of Directors. The Terms of Office and Employment of directors (including those of a chief executive officer who is a director) further require the approval of the shareholders by a simple majority; with respect to a chief executive officer who is not a director, the approval of the shareholders by the special disinterested majority is also generally required. Pursuant to regulations promulgated under the Companies Law, shareholder approval is not required with respect to the remuneration granted to a director or a chief executive officer for the period following his or her appointment until the next general meeting of shareholders, provided such remuneration is approved by the compensation committee and the Board of Directors, is consistent with the Compensation Policy and is on similar or less favorable terms than those of such person’s predecessor.

Under certain circumstances, if the Terms of Office and Employment of office holders who are not directors are not approved by the shareholders (where such approval is required), the compensation committee and the Board of Directors may nonetheless approve such terms. In addition, non-material amendments of the Terms of Office and Employment of office holders who are not directors may be approved by the compensation committee only and non-material amendments of the Terms of Office and Employment of executive officers other than the chief executive officer may be approved by the chief executive officer only, provided such approval is permitted under the Compensation Policy.

Insurance, Exemption and Indemnification of Directors and Executive Officers

The Companies Law provides that a company may not exempt or indemnify a director or an executive officer, or enter into an insurance contract, which would provide coverage for any liability incurred as a result of any of the following: (i) a breach by the director and/or executive officer of his or her duty of loyalty unless, with respect to insurance coverage or indemnification, due to a breach of his or her duty of loyalty to the company committed in good faith and with reasonable grounds to believe that such act would not prejudice the interests of the company; (ii) a breach by the director and/or the executive officer of his or her duty of care to the company

12

Table of Contents

committed intentionally or recklessly (other than if solely done in negligence); (iii) any act or omission done with the intent of unlawfully realizing personal gain; or (iv) a fine, monetary sanction, forfeit or penalty imposed upon a director and/or executive officer. In addition, the Companies Law provides that directors and executive officers can be exempted in advance with respect to liability for damages caused as a result of a breach of their duty of care to the company (but not for such breaches committed intentionally or recklessly, as noted above, or in connection with a distribution (as defined in the Companies Law)).

Pursuant to indemnification and release agreements, we release our directors and executive officers from liability and indemnify them to the fullest extent permitted by law and the Articles. Under these agreements, our undertaking to indemnify each director and executive officer for certain payments and expenses as well as monetary liabilities imposed by a court judgment (including a settlement or an arbitrator’s award that was approved by a court), which indemnification of monetary liabilities (i) shall be limited to matters that are connected or otherwise related to certain events or circumstances set forth therein, and (ii) shall not exceed $200 million in the aggregate per director or executive officer. Under Israeli law, indemnification is subject to other limitations, including those described above. Subject to applicable law, we may also indemnify our directors and officers following specific events.

Our directors and executive officers are also covered by directors’ and officers’ liability insurance.

Dividends

Under the Companies Law, dividends may generally be distributed only out of profits, provided that there is no reasonable concern that the distribution will prevent us from satisfying our existing and anticipated obligations when they become due. In accordance with the Companies Law and the Articles, the decision to distribute dividends and the amount to be distributed is made by the board of directors.

CEO and Center of Management

Under the Articles, our chief executive officer is required to be a resident of Israel and our board of directors is required to consist of a meaningful representation of Israeli resident directors, unless, in each case, our center of management has been transferred to another country in accordance with the Articles. The Articles require that our center of management remain in Israel, unless the board of directors otherwise resolves, by a supermajority of three-quarters of the participating votes.

Exchange Controls

Non-residents of Israel who purchase ADSs with U.S. dollars or other non-Israeli currency will be able to receive dividends, if any, and any amounts payable upon the dissolution, liquidation or winding up of the affairs of Teva, in U.S. dollars at the rate of exchange prevailing at the time of conversion. Dividends to non-Israeli residents are subject to withholding.

13

Table of Contents

DESCRIPTION OF AMERICAN DEPOSITARY SHARES

This section summarizes certain information regarding the American Depositary Shares (“ADSs”) of Teva Pharmaceutical Industries Limited (the “Company”), each of which represents one ordinary share of the Company. The following description is only a summary and does not purport to be complete and is qualified by reference to the Memorandum, the Articles, and our Second Amended and Restated Deposit Agreement, by and among the Company, Citibank, N.A., as depositary, and the holders and beneficial owners of ADSs issued thereunder, dated as of December 4, 2018 (the “Deposit Agreement”), each of which is incorporated by reference as exhibits hereto.

American Depositary Shares and Receipts

General

ADSs represent ownership interests in securities that are on deposit with the depositary bank. ADSs may be represented by certificates that are commonly known as “American Depositary Receipts” or “ADRs.” The depositary bank typically appoints a custodian to safekeep the securities on deposit. Citibank N.A., having its principal office at 388 Greenwich Street, New York, New York 10013, U.S.A., is acting as depositary bank for our ADSs and the custodians are Citibank Tel Aviv and Citibank, N.A.

The Company has appointed Citibank as depositary bank pursuant to the Deposit Agreement.

Each ADS represents the right to receive one ordinary share on deposit with the custodian. An ADS also represents the right to receive any other property received by the depositary bank or the custodian on behalf of the owner of the ADS but that has not been distributed to the owners of ADSs because of legal restrictions or practical considerations. The custodian, the depositary bank and their respective nominees will hold all deposited property for the benefit of the holders and beneficial owners of ADSs. The deposited property does not constitute the proprietary assets of the depositary bank, the custodian or their nominees. Beneficial ownership in the deposited property will under the terms of the Deposit Agreement be vested in the beneficial owners of the ADSs. The depositary bank, the custodian and their respective nominees will be the record holders of the deposited property represented by the ADSs for the benefit of the holders and beneficial owners of the corresponding ADSs. Owners of ADSs will be able to exercise beneficial ownership interests in the deposited property only through the registered holders of the ADSs, by the registered holders of the ADSs (on behalf of the applicable ADS owners) only through the depositary bank, and by the depositary bank (on behalf of the owners of the corresponding ADSs) directly, or indirectly through the custodian or their respective nominees, in each case upon the terms of the Deposit Agreement.

Owners of ADSs become a party to the Deposit Agreement and will be bound to its terms and to the terms of any ADR that represents ADSs. The Deposit Agreement and the ADR specify the rights and obligations of the Company, the depositary bank and the ADS owners. The Deposit Agreement and the ADRs are governed by New York law. However, the Company’s obligations to the holders of ordinary shares will continue to be governed by the laws of the State of Israel, which may be different from the laws of the United States.

Owners of ADSs may hold ADSs either by means of an ADR registered in their name, through a brokerage or safekeeping account, or through an account established by the depositary bank in their name reflecting the registration of uncertificated ADSs directly on the books of the depositary bank (commonly referred to as the “direct registration system” or “DRS”). The direct registration system reflects the uncertificated (book-entry) registration of ownership of ADSs by the depositary bank. Under the direct registration system, ownership of ADSs is evidenced by periodic statements issued by the depositary bank to the holders of the ADSs. The direct registration system includes automated transfers between the depositary bank and The Depository Trust Company, or DTC, the central book-entry clearing and settlement system for equity securities in the United States.

14

Table of Contents

Dividends and Distributions

Holders of ADSs generally have the right to receive distributions made by the Company on the securities deposited with the custodian. Receipt of these distributions may be limited, however, by practical considerations and legal limitations. Holders of ADSs will receive such distributions under the terms of the Deposit Agreement in proportion to the number of ADSs held as of a specified record date, after deduction of the applicable fees, taxes and expenses.

Distributions of Cash

Whenever the Company makes a cash distribution for the securities on deposit with the custodian, the Company will deposit the funds with the depositary bank or the custodian on behalf of the depositary bank. Upon receipt of confirmation of the deposit of the requisite funds, the depositary bank will arrange for the funds to be converted into U.S. dollars and for the distribution of the U.S. dollars to the holders, subject to the laws and regulations of the State of Israel.

The conversion into U.S. dollars will take place only if practicable and if the U.S. dollars are transferable to the United States. The depositary bank will apply the same method for distributing the proceeds of the sale of any property (such as undistributed rights) held by the custodian in respect of securities on deposit.

The distribution of cash will be made net of the fees, expenses, taxes and governmental charges payable by holders under the terms of the Deposit Agreement. The depositary bank will hold any cash amounts it is unable to distribute in a non-interest bearing account for the benefit of the applicable holders and beneficial owners of ADSs until the distribution can be effected or the funds that the depositary bank holds must be escheated as unclaimed property in accordance with the laws of the relevant states of the United States.

Distributions of Shares

Whenever the Company makes a free distribution of shares for the securities on deposit with the custodian, the Company will deposit the applicable number of shares with the custodian. Upon receipt of confirmation of such deposit, the depositary bank will either distribute to holders new ADSs representing the ordinary shares deposited or modify the ADS-to-shares ratio, in which case each ADS held by holders will represent rights and interests in the additional ordinary shares or preference shares so deposited. Only whole new ADSs will be distributed. Fractional entitlements will be sold and the proceeds of such sale will be distributed as in the case of a cash distribution.

The distribution of new ADSs or the modification of the ADS-to-ordinary shares ratio upon a distribution of ordinary shares or preference shares will be made net of the fees, expenses, taxes and governmental charges payable by holders under the terms of the Deposit Agreement. In order to pay such taxes or governmental charges, the depositary bank may sell all or a portion of the new ordinary shares so distributed. No such distribution of new ADSs will be made if it would violate a law (i.e., the U.S. securities laws) or if it is not operationally practicable. If the depositary bank does not distribute new ADSs as described above, it may sell the shares received upon the terms described in the Deposit Agreement and will distribute the proceeds of the sale as in the case of a distribution of cash.

Elective Distributions of Cash or Shares

Whenever the Company intends to distribute a dividend payable at the election of shareholders either in cash or in additional shares, it will give prior notice thereof to the depositary bank and will indicate whether it wishes the elective distribution to be made available to holders. In such case, the Company will assist the depositary bank in determining whether such distribution is lawful and reasonably practicable.

15

Table of Contents

The depositary bank will make the election available to holders only if it is reasonably practicable and if the Company has provided all of the documentation contemplated in the Deposit Agreement. In such case, the depositary bank will establish procedures, in consultation with the Company, to enable holders to elect to receive either cash or additional ADSs, in each case as described in the Deposit Agreement.

If the election is not made available to holders, holders will receive either cash or additional ADSs, depending on what a shareholder under Israeli law would receive upon failing to make an election, as more fully described in the Deposit Agreement.

Distribution of Rights

Whenever the Company intends to distribute rights to purchase additional ordinary shares, it will give prior notice to the depositary bank and will assist the depositary bank in determining whether it is lawful and reasonably practicable to distribute rights to purchase additional ADSs to holders.

The depositary bank will establish procedures, in consultation with the Company, to distribute rights to purchase additional ADSs to holders and to enable such holders to exercise such rights if it is lawful and reasonably practicable to make the rights available to holders of ADSs, and if the Company provides all of the documentation contemplated in the Deposit Agreement (such as opinions to address the lawfulness of the transaction). Holders may have to pay fees, expenses, taxes and other governmental charges to subscribe for the new ADSs upon the exercise of their rights. The depositary bank is not obligated to establish procedures to facilitate the distribution and exercise by holders of rights to purchase new ordinary shares other than in the form of ADSs.

The depositary bank will not distribute the rights to holders if:

| • | the Company does not timely request that the rights be distributed to holders or the Company requests that the rights not be distributed to holders; or |

| • | the Company fails to deliver satisfactory documents to the depositary bank; or |

| • | it is not reasonably practicable to distribute the rights. |

The depositary bank will sell the rights that are not exercised or not distributed if such sale is lawful and reasonably practicable. The proceeds of such sale will be distributed to holders as in the case of a cash distribution. If the depositary bank is unable to sell the rights, it will allow the rights to lapse.

Other Distributions

Whenever the Company intends to distribute property other than cash, ordinary shares or rights to purchase additional ordinary shares, it will notify the depositary bank in advance and will indicate whether it wishes that such distribution be made to holders of ADSs. If so, the Company will assist the depositary bank in determining whether such distribution to holders is lawful and reasonably practicable. If it is reasonably practicable to distribute such property to holders and if the Company provides all of the documentation contemplated in the Deposit Agreement, the depositary bank will distribute the property to the holders in a manner it, in consultation with the Company, deems practicable.

The distribution will be made net of fees, expenses, taxes and governmental charges payable by holders under the terms of the Deposit Agreement. In order to pay such taxes and governmental charges, the depositary bank may, in consultation with the Company, sell all or a portion of the property received.

The depositary bank will not distribute the property to holders and will sell the property if:

| • | the Company does not request that the property be distributed to holders or if the Company asks that the property not be distributed to holders; or |

16

Table of Contents

| • | the Company does not deliver satisfactory documents to the depositary bank; or |

| • | the depositary bank determines, in consultation with the Company, that all or a portion of the distribution to holders is not reasonably practicable. |

The proceeds of such a sale will be distributed to holders as in the case of a cash distribution.

Redemption

Whenever the Company intends to redeem any of the securities on deposit with the custodian, it will notify the depositary bank in advance. If it is practicable and if the Company provides all of the documentation contemplated in the Deposit Agreement, the depositary bank will provide notice of the redemption to the holders.

The custodian will be instructed to surrender the shares being redeemed against payment of the applicable redemption price. The depositary bank will convert the redemption funds received into U.S. dollars upon the terms of the Deposit Agreement and will establish procedures to enable holders to receive the net proceeds from the redemption upon surrender of their ADSs to the depositary bank. Holders may have to pay fees, expenses, taxes and other governmental charges upon the redemption of their ADSs. If less than all ADSs are being redeemed, the ADSs to be retired will be selected by lot or on a pro rata basis, as the depositary bank may determine in consultation with the Company.

Changes Affecting Ordinary Shares and Preference Shares

The ordinary shares held on deposit for ADSs may change from time to time. For example, there may be a change in nominal or par value, a split-up, cancellation, consolidation or reclassification of such ordinary shares or a recapitalization, reorganization, merger, consolidation or sale of assets.

If any such change were to occur, the ADSs would, to the extent permitted by law, represent the right to receive the property received or exchanged in respect of the new ordinary shares held on deposit. The depositary bank may in such circumstances deliver new ADSs to holders, amend the Deposit Agreement, the applicable ADRs and the applicable Registration Statement(s) on Form F-6, call for the exchange of existing ADSs for new ADSs and take any other actions that are appropriate to reflect as to the ADSs the change affecting the ordinary shares. If the depositary bank may not lawfully distribute such property to holders, the depositary bank may sell such property and distribute the net proceeds to holders as in the case of a cash distribution.

Issuance of ADSs upon Deposit of Ordinary Shares

Upon receipt of notice from the custodian confirming (i) that a deposit of ordinary shares has been made pursuant to the requirements of the Deposit Agreement, (ii) that all required documentation has been received, and (iii) the person(s) to whom ADSs are deliverable and the number of ADSs to be delivered, the depositary bank will issue, subject to the terms of the Deposit Agreement, applicable law and payment of all applicable charges, taxes and other governmental fees, ADSs to the persons named in the custodian’s notice. The depositary bank will only issue ADSs in whole numbers.

When a holder makes a deposit of ordinary shares, such holder will be responsible for transferring good and valid title to the depositary bank. As such, holders will be deemed to represent and warrant that:

| • | the ordinary shares are duly authorized, validly issued, fully paid, non-assessable and legally obtained; |

| • | all preemptive (and similar) rights, if any, with respect to such ordinary shares have been validly waived or exercised; |

| • | the person making the deposit is duly authorized to deposit the ordinary shares; |

17

Table of Contents

| • | the ordinary shares presented for deposit are free and clear of any lien, encumbrance, security interest, charge, mortgage or adverse claim, and the ADSs issuable upon such deposit will not be “restricted securities” (as defined in the Deposit Agreement); and |

| • | the ordinary shares presented for deposit have not been stripped of any rights or entitlements. |

If any of the representations or warranties are incorrect in any way, the Company and the depositary bank may, at holders’ cost and expense, take any and all actions necessary to correct the consequences of the misrepresentations.

Transfer, Combination and Split of ADRs

Holders are entitled to transfer, combine or split up their ADRs and the ADSs evidenced thereby. For transfers of ADRs, holders will have to surrender the ADRs to be transferred to the depositary bank and also:

| • | ensure that the surrendered ADR is properly endorsed or otherwise in proper form for transfer; |

| • | provide such proof of identity and genuineness of signatures as the depositary bank deems appropriate; |

| • | provide any transfer stamps required by the State of New York or the United States; and |

| • | pay all applicable fees, charges, expenses, taxes and other government charges payable by ADR holders pursuant to the terms of the Deposit Agreement, upon the transfer of ADRs. |

To have ADRs either combined or split up, holders must surrender the ADRs in question to the depositary bank with a request to have them combined or split up, and holders must pay all applicable fees, charges and expenses payable by ADR holders, pursuant to the terms of the Deposit Agreement, upon a combination or split up of ADRs.

Withdrawal of Ordinary Shares upon Cancellation of ADSs

Holders of ADSs are entitled to present their ADSs to the depositary bank for cancellation and then receive the corresponding number of underlying ordinary shares at the custodian’s offices. Holders’ ability to withdraw the ordinary shares may be limited by U.S. and Israeli legal considerations applicable at the time of withdrawal. In order to withdraw the ordinary shares represented by ADSs, holders will be required to pay to the depositary bank the fees for cancellation of ADSs and any charges and taxes payable upon the transfer of the ordinary shares being withdrawn. Holders assume the risk for delivery of all funds and securities upon withdrawal. Once canceled, the ADSs will not have any rights under the Deposit Agreement.

If holders hold ADSs registered in their name, the depositary bank may ask such holders to provide proof of identity and genuineness of any signature and such other documents as the depositary bank may deem appropriate before it will cancel the ADSs. The withdrawal of the ordinary shares represented by the ADSs may be delayed until the depositary bank receives satisfactory evidence of compliance with all applicable laws and regulations. The depositary bank will only accept ADSs for cancellation that represent a whole number of securities on deposit.

Holders have the right to withdraw the securities represented by ADSs at any time except for:

| • | temporary delays that may arise because (i) the transfer books for the ordinary shares or ADSs are closed, or (ii) ordinary shares are immobilized on account of a shareholders’ meeting or a payment of dividends; |

| • | outstanding obligations to pay fees, taxes and similar charges; or |

| • | restrictions imposed because of laws or regulations applicable to ADSs or the withdrawal of securities on deposit. |

18

Table of Contents

The Deposit Agreement may not be modified to impair holders’ right to withdraw the securities represented by their ADSs, except to comply with mandatory provisions of law.

Reports and Communications

The Company will furnish to the depositary bank all notices of shareholders’ meetings, proxy soliciting material and other reports and communications that are made generally available to the holders of ordinary shares and English translations of the same (including a summary, in English, of any applicable provisions or proposed provisions of the Articles that may be relevant to such notices, reports and communications). The depositary bank will make such notices, reports and communications available for inspection by holders of ADSs at its principal office when furnished by the Company pursuant to the Deposit Agreement and, upon request by the Company, will mail such notices, reports and communications to holders at the Company’s expense.

Voting Rights

Holders of ADSs generally have the right under the Deposit Agreement to instruct the depositary bank to exercise the voting rights for the ordinary shares represented by their ADSs.

At the Company’s request, the depositary bank will distribute to holders any notice of shareholders’ meeting received from the Company together with information explaining how to instruct the depositary bank to exercise the voting rights of the securities represented by ADSs.

If the depositary bank timely receives voting instructions from a holder of ADSs, it will endeavor to vote the securities (in person or by proxy) represented by the holder’s ADSs in accordance with such voting instructions.

The ability of the depositary bank to carry out voting instructions may be limited by practical and legal limitations and the terms of the securities on deposit. The Company cannot assure that holders will receive voting materials in time to enable them to return voting instructions to the depositary bank in a timely manner. Securities for which no voting instructions have been received will not be voted.

Fees and Charges

Holders of ADSs will be required to pay the following service fees to the depositary bank:

| Service |

Fees | |

| (1) Issuance of ADSs (e.g., an issuance upon a deposit of shares, upon a change in the ADS(s)-to-share(s) ratio, or for any other reason), excluding issuances as a result of distributions described in paragraph (4) below. | Up to U.S. $5.00 per 100 ADSs (or fraction thereof) issued. | |

| (2) Cancellation of ADSs (e.g., a cancellation of ADSs for delivery of deposited shares, upon a change in the ADS(s)-to-share(s) ratio, or for any other reason). | Up to U.S. $5.00 per 100 ADSs (or fraction thereof) cancelled. | |

| (3) Distribution of cash dividends or other cash distributions (e.g., upon a sale of rights and other entitlements). | Up to U.S. $5.00 per 100 ADSs (or fraction thereof) held. | |

| (4) Distribution of ADSs pursuant to (i) stock dividends or other free stock distributions, or (ii) exercise of rights to purchase additional ADSs. | Up to U.S. $5.00 per 100 ADSs (or fraction thereof) held. | |

| (5) Distribution of securities other than ADSs or rights to purchase additional ADSs (e.g., spin-off shares). | Up to U.S. $5.00 per 100 ADSs (or fraction thereof) held. | |

| (6) ADS Services. | Up to U.S. $5.00 per 100 ADSs (or fraction thereof) held on the applicable record date(s) established by the depositary bank. | |

19

Table of Contents

Holders of ADSs will also be responsible to pay certain fees and expenses incurred by the depositary bank and certain taxes and governmental charges such as:

| (1) | taxes and other governmental charges; |

| (2) | fees related to the transfer and registration of ordinary shares charged by the registrar and transfer agent (i.e., upon deposit and withdrawal of ordinary shares); |

| (3) | expenses for cable, telex and fax transmissions and for delivery of securities; |

| (4) | expenses incurred for converting foreign currency into U.S. dollars; |

| (5) | expenses incurred in connection with compliance with exchange control regulations and other regulatory requirements; and |

| (6) | fees and expenses incurred in connection with the delivery or servicing of ordinary shares on deposit. |

Depositary fees payable upon the issuance and cancellation of ADSs are typically paid to the depositary bank by the brokers (on behalf of their clients) receiving the newly issued ADSs from the depositary bank and by the brokers (on behalf of their clients) delivering the ADSs to the depositary bank for cancellation. The brokers in turn charge these fees to their clients. Depositary fees payable in connection with distributions of cash or securities to holders and the depositary services fee are charged by the depositary bank to the holders of record of ADSs as of the applicable ADS record date.

The Depositary fees payable for cash distributions are generally deducted from the cash being distributed. In the case of distributions other than cash (i.e., stock dividend, rights), the depositary bank charges the applicable fee to the ADS record date holders concurrent with the distribution. In the case of ADSs registered in the name of the investor (whether certificated or uncertificated in direct registration), the depositary bank sends invoices to the applicable record date ADS holders. In the case of ADSs held in brokerage and custodian accounts (via DTC), the depositary bank generally collects its fees through the systems provided by DTC (whose nominee is the registered holder of the ADSs held in DTC) from the brokers and custodians holding ADSs in their DTC accounts. The brokers and custodians who hold their clients’ ADSs in DTC accounts in turn charge their clients’ accounts the amount of the fees paid to the depositary banks.

In the event of refusal to pay the depositary fees, the depositary bank may, under the terms of the Deposit Agreement, refuse the requested service until payment is received or may set off the amount of the depositary fees from any distribution to be made to the holder.

The fees and charges holders may be required to pay may vary over time and may be changed by the Company and by the depositary bank. Holders will receive prior notice of such changes.

The depositary bank may reimburse the Company for certain expenses incurred by the Company in respect of the ADR program established pursuant to the Deposit Agreement, by making available a portion of the depositary fees charged in respect of the ADR program or otherwise, upon such terms and conditions as the Company and the depositary bank may agree from time to time.

Amendment and Termination