Form S-3 BRIGHTHOUSE LIFE INSURAN

Table of Contents

SECURITIES AND EXCHANGE COMMISSION

UNDER THE SECURITIES ACT OF 1933

(980) 365-7100

of registrant’s principal executive offices)

c/o The Corporation Trust Company

1209 Orange Street

Corporation Trust Center

Wilmington, DE 19801

(302) 658-7581

including area code, of agent for service)

Eversheds Sutherland (US) LLP

The Grace Building, 40th Floor

1114 Avenue of the Americas

New York, NY 10036-7703

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☐ |

| |

Emerging growth company ☐ |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

BRIGHTHOUSE SMARTGUARD PLUS

Brighthouse SmartGuard Plus is a flexible premium adjustable life insurance policy (the “Policy”) issued by Brighthouse Life Insurance Company (“BLIC”, “we”, “our” or “us”) that provides life insurance protection.

BLIC is located at 11225 North Community House Road, Charlotte, NC 28277. The telephone number is 1-800-882-1292. Brighthouse Securities, LLC, 11225 North Community House Road, Charlotte, NC 28277, is the principal underwriter and distributor of the Policies.

The Risk Factors for this Policy appear on Page 14.

Please read this prospectus carefully before investing and keep it for future reference. This prospectus includes important information, including a description of all material features, rights, and obligations of the Policy. BLIC’s obligations under the Policy are subject to our financial strength and claims-paying ability. Index-linked Policies are complex insurance and investment vehicles. Before you invest, be sure to ask your financial representative about the Policy’s features, benefits, risks, and fees, and whether the Policy is appropriate for you based upon your financial situation and objectives.

The Policy provides Owners the opportunity to participate in index-linked (through Indexed Accounts) and fixed interest investment returns, as well as the option to receive Distribution Payments, in the form of loans of the Policy’s Cash Value, through the Guaranteed Distribution Rider (“GDR”) at an additional cost. If necessary, we will increase the Cash Value in order for the Distribution Payments to continue. The GDR also includes a Lifetime Lapse Prevention Benefit and guarantees a minimum amount of Policy Proceeds ($10,000) upon the Insured’s death.

There are risks associated with investing in Indexed Accounts. You may lose money, up to all or a significant amount of any Net Premium allocations, as well as earnings from prior Indexed Account allocations. Losses could be greater if you request certain transactions before the Segment Maturity Date because of the Interim Segment Value calculation. The Interim Segment Value calculation can result in a loss of Cash Value even if the Segment Index Performance has been positive.

You should not buy this Policy if you are not willing to assume these investment risks.

Partial withdrawals are not permitted under the Policy.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved these securities or the adequacy of this prospectus. Any representation to the contrary is a criminal offense. Insurance products, including this one, are not deposits of any bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation (the “FDIC”) or any other government agency. You may lose money invested in the Policy.

The Policies may be distributed through broker-dealers that have relationships with banks or other financial institutions or by employees of such banks. However, the Policies are not deposits or obligations of, or guaranteed by such institutions or any Federal regulatory agency. Investment in the Policy involves investment risks, including possible loss of principal.

The principal underwriter of the Policy is Brighthouse Securities, LLC. The offering of the Policy is intended to be continuous.

Prospectus dated [ ]

Table of Contents

| 4 | ||||

| 9 | ||||

| 10 | ||||

| 14 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| CALCULATING YOUR SEGMENT MATURITY CASH VALUE ON A SEGMENT MATURITY DATE |

28 | |||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| Segment Index-Linked Credit Rate for Determination of Interim Segment Value |

31 | |||

| 33 | ||||

| 35 | ||||

| 36 | ||||

| 40 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

| 54 | ||||

| 58 | ||||

| 59 | ||||

| 59 | ||||

| 59 | ||||

| 59 | ||||

| 60 | ||||

| 60 | ||||

| 60 | ||||

| 60 |

2

Table of Contents

| 60 | ||||

| 61 | ||||

| 61 | ||||

| 62 | ||||

| 63 | ||||

| 63 | ||||

| 63 | ||||

| 65 | ||||

| 65 | ||||

| 65 | ||||

| 65 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES |

67 | |||

| A-1 | ||||

| B-1 | ||||

| C-1 | ||||

| D-1 |

3

Table of Contents

In this prospectus, the following capitalized terms have the indicated meanings:

Accrued Buffer Rate. The portion of the Buffer Rate that has accrued from the Segment Start Date to any day within the Segment Term. This is the amount that we will absorb when calculating Interim Segment Value on any day prior to the Segment Maturity Date if Segment Index Performance is less than zero. The Accrued Buffer Rate is equal to the Buffer Rate multiplied by the number of days elapsed since the Segment Start Date, divided by the total number of days in the Segment Term.

Accrued Cap Rate. The portion of the Cap Rate that has accrued from the Segment Start Date to any day within the Segment Term. This is the maximum Segment Index Performance that may be applied in calculating the Interim Segment Value on any day prior to the Segment Maturity Date if Segment Index Performance is greater than zero. The Accrued Cap Rate is equal to the Cap Rate multiplied by the number of days elapsed since the Segment Start Date, divided by the total number of days in the Term.

Accrued Index Return. The return added to the Segment Value to determine the Interim Segment Value. The Accrued Index Return is based on the Segment Index-Linked Credit Rate, which is determined using the Segment Index Performance, adjusted for the applicable Accrued Buffer Rate, and Accrued Cap Rate. The Accrued Index Return can be positive, zero or negative.

Administrative Office. The office, or any other office that we may designate for the purpose of administering the Policy, to which notices and requests must be sent, or as otherwise changed by Notice from us.

Annual Administrative Charge. An administrative charge assessed on your Policy as part of the Annual Deduction.

Annual Cost of Insurance Charge. A cost of insurance charge assessed on your Policy as part of the Annual Deduction.

Annual Deduction. An amount deducted from the Policy’s Cash Value on the Policy Start Date and on each Policy Anniversary, consisting of the Annual Administrative Charge, the Annual Indexed Account Charge, the Annual Cost of Insurance Charge, and the GDR charge, if applicable.

Annual Deduction Refund. The amount of the Annual Deduction that may be returned to you if you Surrender the Policy or we calculate the death benefit and pay Policy Proceeds to your beneficiary. The Annual Deduction Refund equals the Annual Deduction at the beginning of the Policy Year; times the number of days to the next Policy Anniversary divided by 365.

Annual Indexed Account Charge. A charge for allocating to one or more Indexed Accounts that is assessed on your Policy as part of the Annual Deduction.

Annual Lapse Prevention Premiums. The premiums that must be paid in order to keep the Lifetime Lapse Prevention Benefit in force. Annual Lapse Prevention Premiums are calculated at issue and payable for 10 years. If not paid when due, the GDR will terminate.

Attained Age. The Attained Age is equal to the Issue Age plus the number of completed Policy Years. This includes any period during which the Policy was lapsed.

BLIC (“we,” “us,” “our”). Brighthouse Life Insurance Company.

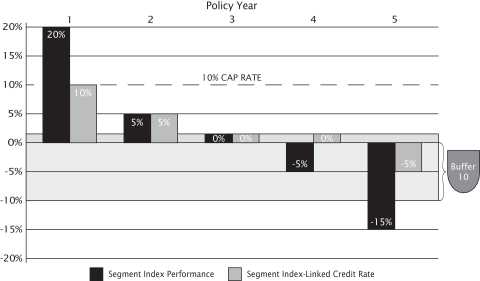

Buffer 10. The Policy provides downside protection through Buffer 10, which is a Buffer Rate where negative Segment Index Performance of up to 10% is absorbed by us at the Segment Maturity Date, which would leave you to absorb up to 90% of any remaining negative Segment Index Performance.

Buffer 15. The Policy offers downside protection through Buffer 15, which is a Buffer Rate where negative Segment Index Performance of up to 15% is absorbed by us at the Segment Maturity Date, which would leave you to absorb up to 85% of any negative Segment Index Performance.

Buffer 25. The Policy offers downside protection through Buffer 25, which is a Buffer Rate where negative Segment Index Performance of up to 25% is absorbed by us at the Segment Maturity Date, which would leave you to absorb up to 75% of any remaining negative Segment Index Performance.

Buffer 100. The Policy offers downside protection through Buffer 100, which is where 100% of negative Segment Index Performance is absorbed by us, which means you are 100% protected from any negative Segment Index Performance throughout the entire Segment Term.

4

Table of Contents

Buffer Rate. An Indexed Account Factor. The amount of negative Segment Index Performance from which we protect you at the Segment Maturity Date. Any negative Segment Index Performance beyond the Buffer Rate will reduce the Segment Value associated with the Indexed Account by any negative Segment Index performance in excess of the Buffer Rate. The Buffer Rate may vary among Indexed Accounts and is an annual rate. We currently offer the following Buffer Rates: Buffer 10, Buffer 15, Buffer 25, and Buffer 100.

Cap Rate. An Indexed Account Factor. The maximum positive Segment Index Performance that may be credited at the Segment Maturity Date. The Cap Rate may vary among Indexed Accounts and is an annual rate. It is not a guaranteed rate of return.

Cash Surrender Value. The amount you receive if you Surrender the Policy. It is equal to the Policy’s Cash Value and any Annual Deduction Refund reduced by any Surrender charge that would apply on Surrender and by any outstanding Policy Loan Balance.

Cash Value. Cash Value is equal to the total of the values in the Fixed Account, Holding Accounts, Indexed Accounts, and the Loan Account.

Closing Value of the Index. The value of the Index as of the close of the New York Stock Exchange, or any other relevant stock exchange. If the Index is on an exchange other than the New York Stock Exchange, or any other relevant stock exchange, we will use that exchange’s Closing Value. We will use consistent sources to obtain the Closing Value. If these sources are no longer available for specific indices, we will select an alternative published source for the Closing Value. If no Closing Value is published for a given day, we will use the Closing Value for the nearest prior day for which the Closing Value was published. In calculating the change in value of the Index, we use the Closing Value of the Index. We may also refer to this as the “Closing Value” in the prospectus.

Code. The Internal Revenue Code of 1986, as amended, and all related laws and regulations, which are in effect during the term of the Policy.

Distribution Payment. Represents the amount you receive for each Distribution Payment under the GDR beginning on the Distribution Start Date. You can change the amount of your Distribution Payment at any time up to the Maximum Distribution Payment.

Distribution Payment Duration. The period of time we guarantee you will receive Distribution Payments. The available durations are 10-year, 20-year, and lifetime (up to Attained Age 121).

Distribution Payment Frequency. The frequency of your Distribution Payments. The available frequencies are annual, semi-annual, quarterly, or monthly.

Distribution Start Date. The date you elect to start receiving Distribution Payments under the GDR.

Excess Loan. An Excess Loan occurs when the Cash Value of the Policy, less any Surrender charge, is less than or equal to the Policy Loan Balance.

Exchange Act. Securities Exchange Act of 1934, as amended.

Face Amount. The dollar amount we use to calculate the death benefit. The minimum Face Amount is $50,000.

Fixed Account. An account that is part of our General Account and provides guarantees of principal and a fixed rate of return. We credit interest daily at an effective annual rate, no less than the Fixed Account Guaranteed Minimum Interest Rate.

Fixed Account Cash Value. The portion of Cash Value allocated to the Fixed Account.

Fixed Account Guaranteed Minimum Interest Rate. The interest rate guaranteed to be a rate not less than the minimum interest rate allowed by state law—see Appendix C. The actual Fixed Account Guaranteed Minimum Interest Rate for your Policy is shown on your Policy specification page and applies only to amounts in the Fixed Account.

General Account. Comprised of BLIC’s assets, other than assets in any separate accounts it may maintain.

Good Order. A request or transaction generally is considered in “Good Order” if it complies with our administrative procedures and the required information is complete and accurate. A request or transaction may be rejected or delayed if not in Good Order. Good Order generally means the actual

5

Table of Contents

receipt by us of the instructions relating to the requested transaction in writing (or, when permitted, by telephone) along with all forms, information and supporting legal documentation necessary to affect the transaction. This information and documentation generally includes to the extent applicable to the transaction: your completed application; your policy number; the transaction amount (in dollars or percentage terms); the names and allocations to and/or from the Buffer Options, or the Fixed Account if applicable, affected by the requested transaction; the signatures of all Policy Owners (exactly as indicated on the policy), if necessary; Social Security Number or Tax I.D.; and any other information or supporting documentation that we may require, including any spousal or Joint Owner’s consents. With respect to premium payments, Good Order also generally includes receipt by us of sufficient funds to effect the purchase. We may, in our sole discretion, determine whether any particular transaction request is in Good Order, and we reserve the right to change or waive any Good Order requirement at any time. If you have any questions, you should contact us or your financial representative before submitting the form or request.

Guaranteed Distribution Rider (“GDR”). A rider that provides for guaranteed Distribution Payments in the form of loans of the Policy’s Cash Value for a set amount of time and is automatically included with your Policy on the Issue Date at an additional charge. We may also refer to this as the “GDR” in the prospectus and the “Rider” in the Guaranteed Rider attached to your Policy.

Guaranteed Distribution Rider Charge. A charge for the GDR that is assessed on your Policy as part of the Annual Deduction. The GDR Charge will not be deducted after Distributions Payments terminate or the GDR terminates. See “GUARANTEED DISTRIBUTION RIDER.”

Guaranteed Minimum Distribution Payment. The minimum amount that we guarantee will be available to you as an annual Distribution Payment; however, you may take less than the Guaranteed Minimum Distribution Payment when you start Distribution Payments.

Holding Accounts. A temporary account that holds Net Premium prior to being transferred to the associated Indexed Account on the next Segment Start Date, which is always on a Policy Anniversary.

Holding Account Cash Value. The Cash Value in a Holding Account.

Index (Indices). An Indexed Account Factor. The index to which Segment Index Performance for a selected Indexed Account is linked. We currently offer Indexed Accounts with indices based on the performance of securities. In the future we may offer Indexed Accounts based on other types of Indices. We may also add other indices for new Policies at our discretion.

Indexed Accounts. One or more Policy accounts, for which values will vary over time, based, in part, on the change in value of an external Index. You may allocate Net Premiums and transfer unloaned Cash Value to one or more Indexed Accounts. Each Indexed Account will have associated Indexed Account Factors and an associated Holding Account.

Indexed Account Cash Value. On the Segment Start Date and Segment Maturity Date, the Indexed Account Cash Value equals the Segment Value in that Indexed Account. On any other day, it equals the Interim Segment Value in that Indexed Account.

Indexed Account Factors. The Indexed Account Factors consist of an Index, Segment Term, Holding Account interest rate, a Buffer Rate, and a Cap Rate. For each Indexed Account, the Indexed Account Factors, except for the Holding Account interest rate, take effect on the Segment Start Date and are guaranteed to the Segment Maturity Date.

Insured. The person whose life is covered by the Policy.

Issue Age. The age of the Insured as of the Insured’s last birthday on the Policy Start Date.

Interim Segment Value. The value we assign to each Indexed Account on any Business Day prior to the Segment Maturity Date. The Interim Segment Value is the amount that is available for death benefits, loans, and Surrenders.

Lifetime Lapse Prevention Benefit. A benefit, offered through the GDR, that guarantees the Policy will not lapse if the Policy’s unloaned Cash Value is insufficient to cover any Surrender charge and any Annual Deduction due on a monthly anniversary date, provided the GDR is in force, Annual Lapse Prevention Premiums are paid when due, and there is no Excess Loan.

Loan Account. The account to which Cash Value from the Indexed Accounts, Holding Account, and/or Fixed Account is transferred when a loan is taken, or unpaid Loan Interest is added to the loan.

6

Table of Contents

Loan Interest. An amount of Interest that accrues daily based on the Policy Loan Balance and is due on each Policy Anniversary. Loan Interest is the interest we charge you for taking a loan.

Maximum Distribution Payment. Represents the maximum amount available to you, on an annual basis, if you were to start Distribution Payments that Policy Year. It is calculated at each Policy Anniversary prior to the Distribution Start Date and is equal to the Policy’s Cash Value on that date multiplied by the Distribution Payment rate.

Net Premium. An amount equal to the premium minus the Percent of Premium Charge. The Net Premium is the portion of the premium that will be applied to your Policy’s Cash Value.

Notice. Any form of communication providing information we need, within a signed writing or other manner that we approve in advance. All Notices to us must be sent to our Administrative Office and received in Good Order. To be effective for a Business Day, a Notice must be received in Good Order prior to the end of that Business Day.

NYSE. New York Stock Exchange.

One-time Payment. After the Distribution Start Date, if you have received less than your Maximum Distribution Payment, you may choose to receive a One-time Payment amount that is separate from your scheduled Distribution Payments. You may only make this election once, provided your Distribution Payments have not been terminated.

Owner (“you”, “yours”). The person(s) entitled to the ownership rights under the Policy. Subject to our administrative procedures, we may also permit ownership by a corporation (a type of non-natural person) or certain other legal entities. If Joint Owners are named, all references to Owner shall mean Joint Owners.

Percent of Premium Charge. A charge imposed on each premium payment that is comprised of the sales charge, premium tax charge, and federal tax charge.

Planned Premium Payment. The Planned Premium Payment is the premium payment schedule you choose to help meet your future goals under the Policy. The Planned Premium Payment consists of a first-year premium amount and an amount for premium payments in subsequent Policy Years. It is subject to certain limits under the Policy.

Policy Anniversary. An anniversary of the Policy Start Date.

Policy Deduction Method. Policy deductions are taken proportionally from the Fixed Account, Holding Accounts, and Indexed Accounts. The proportional amounts are calculated based on the Cash Values across these accounts. The sum of the values in an Indexed Account and its associated Holding Account is considered one proportion. The corresponding proportional amount is subtracted first from the Holding Account until it has been reduced to zero and then any remaining amount is subtracted from the associated Indexed Account.

Policy Loan Balance. An amount equal to the outstanding loan amounts plus accrued Loan Interest.

Policy Proceeds. The amount paid to the beneficiary upon the Insured’s death. The Policy Proceeds calculation is in the “DEATH BENEFIT” and “GUARANTEED DISTRIBUTION RIDER” section.

Policy Start Date. The effective date of the Policy that is used to measure Policy Years, months and anniversaries.

Policy Year. A one-year period starting on the Policy Start Date and on each Policy Anniversary thereafter.

Segment. An allocation option we establish when any part of the initial Net Premium is allocated to an Indexed Account on the Policy Start Date. Thereafter, a new Segment is started when a transfer of Cash Value is made to that Indexed Account on a Policy Anniversary. Once a Segment is created, the Indexed Account Factors will not change for the Segment during the Segment Term. We may also refer to a “Segment” as an “Indexed Account Segment” in this prospectus and in your Policy.

Segment Index-Linked Credit. The amount that is applied to the Segment Value on the Segment Maturity Date that is equal to that Segment’s Index-Linked Credit Rate multiplied by the Segment Value on the Segment Maturity Date. The Segment Index-Linked Credit may be positive, negative or zero. The Segment Index-Linked Credit is only applied to amounts that remain in a Segment until the Segment Maturity Date.

7

Table of Contents

Segment Index-Linked Credit Rate. The rate we use to determine the Segment Value on the Segment Maturity Date and the Interim Segment Value on any day prior to the Segment Maturity Date. When the Segment Index-Linked Credit Rate is positive we may also refer to this adjustment as “earnings.” When the Segment Index-Linked Credit Rate is negative we may also refer to this adjustment as “losses.”

Segment Index Performance. The percentage change in the Closing Value measured from the Segment Start Date to any day within the Segment Term. Segment Index Performance can be positive, negative, or zero.

Segment Maturity Cash Value. The amount that is allocated to the Indexed Account at the Segment Maturity Date. The Segment Maturity Cash Value is used to determine the Indexed Account Cash Value on the Segment Maturity Date and reflects adjustments for any loans and an Accelerated Death Benefit for Terminal Illness payment that have occurred during the Segment Term, and the Segment Index-Linked Credit, which can be positive or negative.

Segment Maturity Date. The Policy Anniversary on which a Segment ends.

Segment Start Date. The date a Segment is created. The initial Segment Start Date(s) begins on the Policy Start Date, and thereafter, will be the Policy Anniversary.

Segment Term. An Indexed Account Factor. The Segment Term is the number of years that the Segment is in effect. We currently offer a Segment Term of 1 year. The Initial Segment Term(s) begin on the Policy Start Date.

Segment Value. The Segment Value, for each Segment, is the amount that is allocated to the Segment and subsequently reflects all loans, charges, and deductions at the Segment Maturity Date. The Segment Value will be reduced for any loans, charges, and deductions by the same percentage that the loans, charges, and deductions reduce the Interim Segment Value attributable to that Segment.

Separate Account. Brighthouse Separate Account L.

Surrender. A full withdrawal of your Cash Surrender Value.

Terminal Illness. A medical condition, certified by a physician within the last 12 months, as being reasonably expected to result in the death of the Insured within 12 months from the date of certification.

Total Indexed Account Balance. The portion of your Policy’s Cash Value in the Indexed Accounts.

Transfer Period. The 21 calendar days following the Policy Anniversary coinciding with the Segment Maturity Date for each applicable Segment.

We, Us, Our and the Company. We, us, our and the Company refer to Brighthouse Life Insurance Company (“BLIC”).

You and Your. You and your refer to the Owner(s) of the Policy.

8

Table of Contents

The Brighthouse SmartGuard Plus life insurance policy is a flexible premium adjustable index-linked life insurance policy issued by BLIC that provides life insurance protection. It also provides Policy Owners with the opportunity for guaranteed distributions through the Guaranteed Distribution Rider (“GDR”), as well as access to index-linked investments.

The GDR, which is automatically included with the Policy for an additional charge, guarantees that you will receive distribution payments over a specific period of time, which you select when we issue the Policy. You can choose to receive Distribution Payments for a period of 10 years, 20 years, or for lifetime (up to Attained Age 121). You are eligible to start Distribution Payments after the Policy has been in force for 10 years. Distribution Payments are paid in the form of loans. The GDR also includes a Lifetime Lapse Prevention Benefit and guarantees a minimum amount of Policy Proceeds ($10,000) upon the Insured’s death.

The Policy offers various Indexed Accounts, which permit Owners to link their investments to the return of an Index. Owners receive positive interest based on the Index’s return, subject to a Cap Rate. Owners are also protected from a specified level of negative Index return—in the form of a Buffer Rate. The downside protection provided by the Buffer Rate and the potential maximum level of positive investment experience allowed by the Cap Rate are only fully available for amounts held until the Segment Maturity Date.

We currently offer Indexed Accounts with indices based on the performance of securities. Each Indexed Account has a Segment Term of one year in length, a Buffer Rate (10%, 15%, 25% or 100%) and a Cap Rate. For each Indexed Account, you select the Buffer Rate and the Index you want your investment performance to be based on. The performance of each Indexed Account will be subject to a Cap Rate. A Fixed Account that guarantees a fixed rate of interest may also be available. Unless you allocate your Net Premiums to the Fixed Account or the Buffer 100, you may lose money by investing in the Policy.

The Cap Rate is the maximum rate that may be credited at the Segment Maturity Date based on positive Segment Index Performance. For example, if the Cap Rate is 20% and the Segment Index Performance is 5%, you will only be credited with a 5% gain. The Cap Rate is not a guaranteed positive rate of return.

New Cap Rates are declared for each subsequent Segment Term. Thirty (30) days before the current Segment Term expires, we will mail you a Notice indicating which Indexed Accounts will be available at the start of the next Segment Term and their renewal Cap Rates. See “CAP RATE.” You may also obtain the new Cap Rates by accessing the Company’s website at [https://www.brighthousefinancial.com] where at least two months of renewal Cap Rates are posted – i.e., for the current month and the following month.

The Buffer Rate is the level of negative Segment Index performance from which the Company will protect you at the Segment Maturity Date. You are not protected from any negative performance in excess of the Buffer Rate. For example, if you choose an Indexed Account with a 10% Buffer Rate, we will only protect you from the first 10% of negative Segment Index Performance. If the Segment Index Performance is -50%, you will be credited with a -40% loss.

The Buffer Rates and Cap Rates accrue during the Segment Term and only reach full accrual on the last day of a Segment Term. The Buffer 100 is always fully accrued.

When we calculate the Interim Segment Value, we use the Segment Index Performance and the applicable Accrued Buffer Rate and Accrued Cap Rate as of the date of the calculation to determine the Accrued Index Return. If the Accrued Index Return is negative on the Interim Segment Value calculation date, any negative interest we add could be greater than it would be on the Segment Maturity Date because the Buffer Rate has not fully accrued. If Segment Index Performance is positive on the Interim Segment Value calculation date, any positive interest we add could be lower than it would be on the Segment Maturity Date because the Cap Rate has not fully accrued.

The Interim Segment Value is the amount we use to determine the Indexed Account Cash Value prior to the Segment Maturity Date. The Indexed Account Cash Value is part of the Policy Cash Value, which determines how much is available for Surrender, loans, a payment under Acceleration of Death Benefit for Terminal Illness (the “Accelerated Death Benefit”), and Policy Proceeds. If you choose to

9

Table of Contents

start (or restart) Distribution Payments on any day other than a Policy Anniversary, any Indexed Account Cash Value transferred to the Fixed Account will be based on Interim Segment Value. The Interim Segment Value calculation can result in a loss of Cash Value even if the Segment Index Performance has been positive. The losses could be significant.

The Policy and GDR are available only in those states where they have been approved for sale.

We have the right to substitute a comparable index prior to the Segment Maturity Date if any Index is discontinued or, at our sole discretion, we determine that our use of such Index should be discontinued, or if the calculation of an Index is substantially changed. See “Discontinuation or Substantial Change to an Index.”

See “SPECIAL TERMS” in this prospectus for more detailed explanations of the terms associated with the Indexed Accounts.

The following chart describes the key features of the Policy. Please read this prospectus for more detailed information about the Policy.

| Policy | Flexible premium adjustable index-linked life insurance policy. | |

| Premium | You choose the amount and frequency of premium payments, subject to the limits described herein. You select a Planned Premium Payment schedule, which consists of a first-year premium amount and an amount for subsequent premium payments. You can make Planned Premiums Payments on an annual, semi-annual, quarterly, or monthly schedule. No premium payment can be less than $1,000, except with our consent.

We will not accept additional premium payments after you start Distribution Payments, unless the GDR terminates.

If you have a loan and we receive a payment from you, we will treat it as a loan repayment, unless you request, in writing, for us to treat it as a premium payment. | |

| Guaranteed Distribution Rider | The GDR guarantees you will receive distribution payments over a specific period of time. On the Policy Start Date, you may choose when to receive Distribution Payments and the duration (10-year, 20-year or lifetime (up to Attained Age 121)). The GDR is automatically included with your Policy, and you pay an annual charge for this benefit. This GDR Charge will be deducted from your Policy’s Cash Value as part of the Annual Deduction.

Once the Policy has been in force for at least 10 years, you are eligible to receive Distribution Payments. Distribution Payments will be made in the form of loans. The Policy cannot be a modified endowment contract (“MEC”), and you must repay any Policy Loan Balance before starting Distribution Payments. The loans will reduce the Policy’s unloaned Cash Value and the Policy Proceeds and may have tax consequences. If the Cash Value is insufficient to cover Distribution Payments, we will increase the Cash Value in order for the Distribution Payments to continue. All Distribution Payments are subject to the minimum Distribution Payment amount ($250) and Maximum Distribution Payment.

The GDR also provides a Lifetime Lapse Prevention Benefit that guarantees the Policy will not lapse while the GDR is in force, provided Annual Lapse Prevention Premiums are paid when due and there is no Excess Loan. | |

| Issue Age | 35-65 |

10

Table of Contents

| Cash Value | The total of the Fixed Account, Holding Accounts, Indexed Accounts, and the Loan Account. See “CASH VALUE.” | |

| Indexed Account | Each Indexed Account has an associated Index and Buffer Rate. We establish a Segment in each Indexed Account that you have an allocation, and each Segment has an associated Segment Term and Cap Rate. When funds are allocated to an Indexed Account, the account will then have an associated Segment, Segment Term, and Cap Rate. See “INDEXED ACCOUNTS.” | |

| Segment Term | All Segment Terms are 1 year. See “SEGMENT TERM.” | |

| Index | The current Indices are as follows: • S&P 500® Index (Price Return Index); • Russell 2000® Index (Price Return Index); and • MSCI EAFE Index (Price Return Index). | |

| Buffer Rate | We currently offer different levels of protection:

Buffer 10 — A Buffer Rate where negative Segment Index Performance of up to 10% is absorbed by us at the Segment Maturity Date, which would leave you to absorb any remaining negative Segment Index Performance of up to 90%.

Buffer 15 — A Buffer Rate where negative Segment Index Performance of up to 15% is absorbed by us at the Segment Maturity Date, which would leave you to absorb any remaining negative Segment Index Performance of up to 85%.

Buffer 25 — A Buffer Rate where negative Segment Index Performance of up to 25% is absorbed by us at the Segment Maturity Date, which would leave you to absorb any remaining negative Segment Index Performance of up to 75%.

Buffer 100 — A Buffer Rate where 100% of negative Segment Index Performance is absorbed by us throughout the entire Segment Term. | |

| Cap Rate | The maximum rate that may be credited at the Segment Maturity Date based on positive Segment Index Performance. | |

| Interim Segment Value | We calculate an Interim Segment Value on each Business Day between the Segment Start Date and prior to the Segment Maturity Date. The Interim Segment Value is the amount we use to determine how much is available for Surrender, loans, a payment under the Accelerated Death Benefit, and Policy Proceeds (the amount payable upon the Insured’s death), if these transactions occur on any day other than the Segment Maturity Date.

The Interim Segment Value of an Indexed Account is equal to the Segment Value in the Indexed Account plus Accrued Index Return. Accrued Index Return is determined using the Accrued Buffer Rate, which is less than the full Buffer Rate (except for the Buffer 100, the Accrued Buffer Rate is always 100%), and the Accrued Cap Rate, which is less than the full Cap Rate. This means any negative interest we use to calculate the Interim Segment Value may be greater than it would be on the Segment Maturity Date, and any positive interest we credit will be less than it would be on the Segment Maturity Date. |

11

Table of Contents

| Allocations and Transfers | You may allocate Net Premiums among the Fixed Account and the Indexed Accounts. The Net Premium will be allocated according to the allocations you chose at the time you apply for the Policy. Future Net Premiums allocated to the Fixed Account will always go directly into the Fixed Account.

If the premium payment is received within the Transfer Period and you instruct us to allocate all or a portion to one or more of the Indexed Accounts, we will treat the premium payment as if it had been received on the Policy Anniversary and apply the Net Premium directly to the Indexed Accounts. Premium payments received after the Transfer Period may still be allocated to an Indexed Account but will remain in the associated Holding Account until the next Policy Anniversary. On the Policy Anniversary, we will transfer amounts in the Holding Account to its associated Indexed Account according to your latest instructions on file with us unless you provide us different allocation instructions before the end of the Transfer Period.

In addition, you may transfer any unloaned Cash Value among the Fixed Account and Indexed Accounts on a Policy Anniversary. Under our current administrative procedures, we will allow you to make transfers during the Transfer Period, and we will treat the transfer as if it occurred on the Policy Anniversary.

If you have started Distribution Payments under the GDR, all of your unloaned Cash Value will be in the Fixed Account, and you may not transfer to the Indexed Accounts while receiving Distribution Payments. | |

| Fixed Account | See Appendix C. | |

| Access to Your Money | You may borrow money from your Policy by taking a loan. A loan reduces the Policy’s Cash Value in the Indexed Accounts, Holding Accounts, and the Fixed Account and may increase your risk of Policy lapse. Policy Proceeds will also be reduced by the Policy Loan Balance. Loans may have tax consequences.

There are two ways to take a loan: (1) a loan, which is available as long as your Policy has Loan Value, which is the maximum amount you may borrow, calculated as of the date of the loan; and (2) a Distribution Payment or the One-time Payment, which is available through the GDR. Please note that while Distribution Payments and the One-time Payment are loans, the terms, conditions, and limitations are not the same as loans not covered by the GDR. For a complete understanding of the differences, see “LOANS” and “Guaranteed Distribution Rider”

Additionally, you may Surrender the Policy for its Cash Surrender Value during the lifetime of the Insured at any time. A Surrender may have tax consequences. Partial withdrawals are not permitted under the Policy. |

12

Table of Contents

| Surrender Charge | During the first ten Policy Years, if you surrender or lapse your Policy, then we will deduct a Surrender charge from the Cash Value. We deduct the Surrender charge using the Policy Deduction Method. The table below shows the maximum Surrender charge per $1,000 of Face Amount that could apply under any Policy.

| |||||||

| Beginning of Year |

The Maximum Surrender Charge of Face |

|||||||

| 1 | $45.00 | |||||||

| 2 | $42.67 | |||||||

| 3 | $40.67 | |||||||

| 4 | $38.14 | |||||||

| 5 | $35.10 | |||||||

| 6 | $26.60 | |||||||

| 7 | $25.48 | |||||||

| 8 | $23.31 | |||||||

| 9 | $19.14 | |||||||

| 10 | $12.11 | |||||||

| 11 and Later | $0.00 | |||||||

| Death Benefit | The death benefit is determined as of the date of the Insured’s death. We must receive Notice of due proof of death. The amount we pay to the beneficiary (or beneficiaries) is referred to as the Policy Proceeds.

The GDR guarantees a minimum amount of Policy Proceeds ($10,000). | |||||||

| Charges and Expenses | You will bear the following charges and expenses:

(i) Annual Indexed Account Charge; (ii) Annual Administrative Charge; (iii) Annual Cost of Insurance Charge; (iv) Annual GDR Charge; (v) Percent of Premium Charge; and (vi) Surrender charge, if applicable.

The Annual Deduction is comprised of (i) through (iv). | |||||||

13

Table of Contents

The purchase of the Policy involves certain risks. You should carefully consider the following factors, in addition to the matters set forth elsewhere in the prospectus, prior to purchasing the Policy.

Risk of loss

Segment Maturity Date

There is a risk of substantial loss of your principal and any earnings (unless you allocate your Net Premiums and any earnings to the Fixed Account or Buffer 100) because you agree to absorb all losses that exceed the Buffer Rate for the Indexed Accounts you select under the Policy. This means that if the negative Segment Index Performance for an Indexed Account you select exceeds the corresponding Buffer Rate at the Segment Maturity Date, you will bear the portion of the loss that exceeds the Buffer Rate.

Buffer Rates are not cumulative, and their protection does not extend beyond the length of any given Segment Term. If you keep amounts allocated to an Indexed Account over multiple Segment Terms in which negative interest is credited, the total combined loss of Segment Value over those multiple Segment Terms may exceed the stated Buffer Rate for a single Segment Term.

Interim Segment Value—The method we use in calculating your Interim Segment Value may result in an amount that is less than the amount you would receive had you held the investment until the Segment Maturity Date. If you Surrender your Policy (including Surrenders in connection with the Free Look Period), take a loan (not including loans in connection with Distribution Payments under the GDR), or request a payment under the Accelerated Death Benefit, or we transfer Indexed Account Cash Value to the Fixed Account because you start of Distribution Payments under the GDR, on any day other than a Policy Anniversary, we use the Interim Segment Value calculation. If Segment Index Performance is negative when we process these transactions, any remaining Segment Value may be significantly less than if you waited to when Segment Index Performance was positive.

When we calculate the Interim Segment Value, we use the Segment Index Performance and the applicable Accrued Buffer Rate and Accrued Cap Rate as of the date of the calculation. The Buffer Rates and Cap Rates accrue during the Segment Term and only reach full accrual on the last day of a Segment Term. For Buffer 100, the Buffer Rate will always be 100% throughout the Segment Term. This means that if the Segment Index Performance is negative on the Interim Segment Value calculation date, any negative interest we calculate could be greater than it would be on the Segment Maturity Date because the Buffer Rate has not fully accrued. If Segment Index Performance is positive on the Interim Segment Value calculation date, any positive interest we calculate could be lower than it would be on the Segment Maturity Date because the Cap Rate has not fully accrued. Any losses could be significant. The Interim Segment Value calculation can result in a loss of Cash Value even if the Segment Index Performance has been positive.

This means:

| • | If you allocate to Indexed Accounts and take a loan (not including loans in connection with Distribution Payments under the GDR) or request a payment under the Accelerated Death Benefit, or we transfer Indexed Account Cash Value to the Fixed Account because you start of Distribution Payments under the GDR when Segment Index Performance is negative, your Indexed Account Cash Value may be significantly less than if you waited until Segment Index Performance was positive or on the Segment Maturity Date. |

| • | If you Surrender the Policy during the Segment Term, we will pay the Surrender Cash Value, which may be less than if you held the Policy until the Segment Index Performance was positive or all of your Indexed Accounts reached their Segment Maturity Dates. |

| • | If you die, your beneficiary will receive the Policy Proceeds. If you are allocated to Indexed Accounts and we calculate the Policy Proceeds on any day other than a Segment Start Date or Segment Maturity Date, your Indexed Account Cash Value will equal the Interim Segment Value. |

No ownership of the underlying securities

When you purchase the Policy and allocate your Net Premiums to an Indexed Account(s), you will not be investing in the Index for the Indexed Accounts you select or in a mutual fund or exchange

14

Table of Contents

traded fund that tracks the Index. Your Segment Indexed-Linked Credit for an Indexed Account is limited by a Cap Rate, which means your Segment Maturity Cash Value will be lower than if you had directly invested in a mutual fund or exchange traded fund designed to track the performance of the applicable Index and the performance is greater than your Cap Rate.

Surrender—Unsuitable as a Short-Term Savings Vehicle

If you Surrender the Policy within the first ten years, you will be subject to a Surrender charge as well as income tax on any gain that is distributed or deemed to be distributed from the Policy. If you Surrender the Policy in the first Policy Year, the Surrender charge could exceed the Cash Value of your Policy and you would receive no proceeds upon Surrender. In addition, if you surrender your Policy on any day other than a Policy Anniversary date (including to exercise your Free Look Right), any available Cash Surrender Value that is invested in Indexed Accounts will be based on Interim Segment Value.

Partial withdrawals are not permitted under the Policy. As a result, you may only access your Policy’s Cash Value through loans (including Distribution Payments through the GDR) or by full Surrender of the Policy.

You should purchase the Policy only if you have the financial ability to keep it in force for a substantial period of time. You should not purchase the Policy if you intend to Surrender it in the near future. Even if you do not Surrender your Policy, Surrender charges may play a role in determining whether your Policy will lapse (terminate without value), because Surrender charges determine the Cash Surrender Value, which is a measure we use to determine whether your Policy will enter a 62-day grace period (“Grace Period”) and possibly lapse.

Risk of Lapse

If the GDR has been terminated, your Policy may lapse if you have paid an insufficient amount of premiums and your Cash Surrender Value is not enough to pay the Annual Deduction. If this happens, your Policy may enter a 62-day Grace Period. We will notify you that the Policy will lapse unless you make a sufficient payment of additional premium during the Grace Period. If your Policy does lapse, your insurance coverage will terminate. No Policy Proceeds will be payable. Lapse of a Policy on which there is an outstanding loan may have adverse tax consequences.

While the GDR is in force, the Lifetime Lapse Prevention Benefit guarantees your Policy will not lapse. However, if premiums paid to date are less than the accumulated Annual Lapse Prevention Premiums due since the Policy Start Date, you have the Grace period to pay the difference and the Excess Loan amount, if any. If this payment is not made within the 62-day Grace Period, the GDR will terminate, and your Policy may lapse.

GDR Risks

The GDR is automatically included with your Policy for a charge. Distribution Payments cannot begin until the Policy has been in force for at least 10 years, your Policy cannot be a MEC and you must repay any outstanding Policy Loan Balance. Distribution Payments are subject to minimum and maximum distribution amounts. Distribution Payments are treated as loans and reduce your unloaned Cash Value and Policy Proceeds.

There are circumstances in which we will involuntarily terminate the GDR. The GDR will terminate on the date a loan is taken for an amount that exceeds the available Distribution Payments and a One-time Payment if available. In addition, the GDR will terminate if the Policy terminates or if premiums paid are less than the accumulated Annual Lapse Prevention Premiums due since the Policy Start Date.

Distribution Payments will also terminate if your Policy becomes a MEC or you exercise the Accelerated Death Benefit or reach Attained Age 121.

When you begin receiving Distribution Payments, any Cash Value in the Indexed Accounts and Holding Accounts will be transferred into the Fixed Account. While you are receiving Distribution Payments, you cannot transfer or allocate Cash Value to the Indexed Accounts. This means you will no longer be invested in any of the Indexed Accounts, and you will no longer be exposed to any potential

15

Table of Contents

positive market investment performance. In addition, you will no longer be eligible to make premium payments. If you choose to start (or restart) Distribution Payments on any day other than a Policy Anniversary date, any Indexed Account Cash Value transferred to the Fixed Account will be based on Interim Segment Value, which could be significantly less than if you waited to the Segment Maturity Date.

When you start Distribution Payments, even though you are no longer allocated to any Indexed Account, we will not refund any portion of your Annual Indexed Account Charge.

If you suspend Distribution Payments, you may not restart Distribution Payments until the suspension is in effect at least one year from the date of your last Distribution Payment. If it has been less than one year since you received your last Distribution Payment and you request a loan, we will treat this loan as your One-time Payment, as long as you have not already received your One-time Payment. If the loan amount taken exceeds the One-time Payment amount available at the time of your request, we will process the loan, however the GDR will terminate. If the One-time Payment is not available and you request a loan during the one-year suspension period, we will process the loan, however the GDR will terminate.

You should consult with your attorney or qualified tax advisor to determine the tax consequences of the GDR and the Policy. See, “FEDERAL TAX CONSIDERATIONS” section.

Limitations on Transfers

Transfers among the Fixed Account, the Holding Accounts, and the Indexed Account(s) occur on the Policy Anniversary. This means you cannot transfer out of a current Indexed Account, Holding Account, or the Fixed Account until the Policy Anniversary. Any amounts transferred can only be transferred to new Indexed Accounts or the Fixed Account. This may limit your ability to react to market conditions. Under our current administrative procedures, we will allow you to make transfers during the Transfer Period, and we will treat the transfer as if it occurred on the Policy Anniversary. Holding Accounts are not available for direct investments; they are accounts for temporarily holding Cash Value until the next Policy Anniversary.

In addition, you should understand that for renewals into the same Indexed Account, a new Cap Rate will go into effect on the Policy Anniversary that coincides with the beginning of the new Segment. Moreover, at the Segment Maturity Date, the Segment Maturity Cash Value allocated to the Indexed Account that has reached its Segment Maturity Date will be automatically renewed into the same Indexed Account unless you instruct us to transfer such amount into a different Indexed Account(s) or the Fixed Account. Under our current administrative Procedures, you have the Transfer Period to notify us that you want to transfer some or all of your Segment Maturity Cash Value to a new Indexed Account(s) or the Fixed Account. Failure to provide such instructions during the Transfer Period will result in an automatic renewal for the duration of the new Segment Term, which is a period of one (1) year. You cannot allocate or transfer Cash Value to the Indexed Accounts while you are receiving Distribution Payments under the GDR. See the “TRANSFERS” section.

Availability of Indexed Accounts

Your selling firm may limit the Indexed Accounts available through that firm when your Policy is issued or at Segment Maturity Date. Additionally, we may discontinue our use of an Index at any time. After the Policy is issued, there will always be at least one Indexed Account available. Consequently, a particular Indexed Account may not be available for you to transfer your Segment Value, or Fixed Account Cash Value into after a Segment Maturity Date.

You cannot allocate or transfer Cash Value to the Indexed Accounts while you are receiving Distribution Payments under the GDR.

Risks Associated with the Referenced Indices

Because the S&P 500® Index (Price Return Index), the Russell 2000® Index (Price Return Index) and the MSCI EAFE Index (Price Return Index) are each comprised of a collection of equity securities, in each case the value of the component securities is subject to market risk, or the risk that market fluctuations may cause the value of the component securities to go up or down, sometimes rapidly and unpredictably. In addition, the value of equity securities may increase or decline for reasons directly related to the issuers of the securities. (See “INDICES” and “BUFFER RATES.”)

16

Table of Contents

An Indexed Account may be Substituted

We have the right to substitute a comparable Index prior to the Segment Maturity Date if any Index is discontinued or, at our sole discretion, we determine that our use of such Index should be discontinued, or if the calculation of an Index is substantially changed. We would attempt to choose a substitute Index that has a similar investment objective and risk profile to the replaced Index. Upon substitution of an Index, we will calculate your Segment Index Performance on the replaced Index up until the date of substitution and the substitute Index from the date of substitution to the Policy Anniversary. An Index substitution will not change the Buffer Rate or Cap Rate for an existing Indexed Account. The performance of the new Index may not be as good as the one that it substituted and as a result your Segment Index Performance may have been better if there had been no substitution.

Tax Risks

We anticipate that the Policy should be deemed to be a life insurance policy under Federal tax law. However, the rules are not entirely clear in certain circumstances. The insurance proceeds payable on the death of the Insured will never be less than the minimum amount required for the Policy to be treated as life insurance under section 7702 of the Internal Revenue Code, as in effect on the date the Policy was issued. If your Policy is not treated as a life insurance policy under Federal tax law, increases in the Policy’s Cash Value will be taxed on a current basis.

Even if your Policy is treated as a life insurance policy for Federal tax purposes, it may become a modified endowment contract, for example, due to the payment of excess premiums or due to a reduction in your death benefit. If your Policy becomes a modified endowment contract, Surrenders, loans, and use of the Policy as collateral for a loan will be treated as a distribution of the earnings in the Policy and will be taxable as ordinary income to the extent thereof. In addition, if the Policy Owner is under age 59 1⁄2 at the time of the Surrender or loan, the amount that is included in income will generally be subject to a 10% additional tax.

If the Policy is not a modified endowment contract, distributions generally will be treated first as a return of basis or investment in the policy and then as taxable income. However, different rules apply in the first fifteen Policy Years, when distributions accompanied by benefit reductions may be taxable prior to a complete Surrender of your investment in the Policy. Moreover, loans will generally not be treated as distributions prior to termination of your Policy, whether by lapse, Surrender or exchange. Finally, neither distributions nor loans from a Policy that is not a modified endowment contract are subject to the 10% additional tax.

See “FEDERAL TAX CONSIDERATIONS.” You should consult a qualified tax adviser for assistance in all Policy-related tax matters.

Tax Law Changes

Tax laws, regulations, and interpretations have often been changed in the past and such changes continue to be proposed. To the extent that you purchase a Policy based on its potential tax benefits, there is no certainty that such tax benefits will always continue to exist.

Loan Risks

A loan, whether or not repaid, will affect the Cash Value of your Policy over time because we subtract the amount of the loan from the Indexed Accounts, Holding Accounts, and/or Fixed Account as collateral, and hold it in the Loan Account. Loans also reduce the Policy Proceeds.

Any portion of Loan Interest that is not paid when due will be added to the loan and will bear interest at the same rate as the loan.

Any loans taken from Indexed Accounts prior to the Segment Maturity Date will be based on Interim Segment Value. Due to the application of the Accrued Buffer Rate and the Accrued Cap Rate, this means you will experience greater losses, if Segment Index performance is negative and constant throughout the Segment Term, and lesser gains, if Segment Index Performance is positive and constant throughout the Term, than you would if you waited until the end of the Segment Term.

17

Table of Contents

If your Policy has an Excess Loan, we will provide a Grace Period for payment of the excess due. If the excess due remains unpaid at the end of the Grace Period, the Policy will terminate without value. The Grace Period will end 62-days from the date the Notice is sent.

In order to keep the GDR in force on and after the Distribution Start Date, the only loans permitted to be taken are Distribution Payments and the One-time Payment. Any other loan will terminate the GDR.

The Company

No company other than BLIC has any legal responsibility to pay amounts that BLIC owes under the Policy. An Owner should look to the financial strength of BLIC for its claims-paying ability.

Cybersecurity and Certain Business Continuity Risks

Our business is largely conducted through complex digital communications and data storage networks and systems operated by us and our service providers or other business partners (e.g., the firms involved in the distribution and sale of our products). For example, many routine operations, such as processing your requests and elections and day-to-day record keeping, are all executed through computer networks and systems. We have established administrative and technical controls and business continuity and resilience plans to protect our operations against attempts by unauthorized third parties to improperly access, modify, disrupt the operation of, or prevent access to critical networks or systems or data within them (a “cyber-attack”). Despite these protocols, a cyber-attack could have a material, negative impact on BLIC, as well as individual Owners and their Policies. Our operations also could be negatively affected by a cyber-attack at a third party, such as a service provider, business partner, another participant in the financial markets or a governmental or regulatory authority. Cyber-attacks can occur through unauthorized access to computer systems, networks or devices; infection from computer viruses or other malicious software code; phishing attacks; account takeover attempts; or attacks that shut down, disable, slow or otherwise disrupt operations, business processes or website access or functionality. Disruptions or failures may also result from unintentional causes, such as market events that trigger a surge of activity that overloads current information technology and communication systems. Other disruptive events, including (but not limited to) natural disasters and public health crises, may adversely affect our ability to conduct business, in particular, if our employees or the employees of our service providers are unable or unwilling to perform their responsibilities as a result of any such event. Cyber-attacks, disruptions or failures to our business operations can interfere with our processing of Policy transactions, including the processing of transfer orders from our website; impact our ability to calculate values; cause the release and/or possible loss, misappropriation or corruption of confidential Owner or business information; or impede order processing or cause other operational issues. There can be no assurance that we or our service providers will avoid losses affecting your Policy due to cyber-attacks, disruptions, or failures in the future. Although we continually make efforts to identify and reduce our exposure to cybersecurity risk, there is no guarantee that we will be able to successfully manage and mitigate this risk at all times. Furthermore, we cannot control the cybersecurity plans and systems implemented by third parties, including service providers.

COVID-19 and Market Conditions Risks

The COVID-19 pandemic has at times resulted in or contributed to significant financial market volatility, travel restrictions and disruptions, quarantines, an uncertain interest rate environment, elevated inflation, global business, supply chain, and employment disruptions affecting companies across various industries, and government and central bank interventions, wide-ranging changes in consumer behavior, as well as general concern and uncertainty that has negatively affected the economic environment. At this time, it continues to not be possible to estimate (i) the severity or duration of the pandemic, including the severity, duration and frequency of any additional “waves” or emerging variants of COVID-19, or (ii) the efficacy or utilization of any therapeutic treatments and vaccines for COVID-19 or variants thereof. It likewise remains not possible to predict or estimate the longer-term effects of the pandemic, or any actions taken to contain or address the pandemic, on our business and financial condition, the financial markets, and the economy at large. BLIC has implemented risk management and contingency plans and continues to closely monitor this evolving

18

Table of Contents

situation, including the impact on services provided by third-party vendors. However, there can be no assurance that any future impact from the COVID-19 pandemic will not be material to BLIC and/or with respect to the services BLIC or its customers receive from third-party vendors. Significant market volatility and negative investment returns in the financial markets resulting from the COVID-19 pandemic and market conditions could have a negative impact on the performance of the Indices. Depending on market conditions and your individual circumstances (e.g., your selected Indexed Account and the timing of any premium payments or transfers), you may experience (perhaps significant) negative returns under the Policy. You should consult with your financial representative about how the COVID-19 pandemic and the recent market conditions may impact your future investment decisions related to the Policy, such as purchasing the Policy or based on your individual circumstances.

This prospectus describes Brighthouse SmartGuard Plus Life Insurance issued by us and describes all the material features of the Policy. Brighthouse SmartGuard Plus Life Insurance is a policy between you as the Owner, and us, the insurance company, where you agree to make premium payments to us and we agree to provide you life insurance coverage. The minimum Issue Age for this Policy is 35, and the maximum Issue Age is 65.

The Policy includes the application, any attached riders, and any endorsements. Together they comprise the entire Policy and are made a part of the Policy when the insurance applied for is accepted. Any change to the Policy must be in Good Order and approved by our President, Vice President or Secretary. No other persons have the authority to alter or change any terms, conditions, or agreements of the Policy, or to waive any provisions.

The primary purpose of the Policy is to provide life insurance protection. Upon receipt of satisfactory proof of the death of the Insured, we pay the Policy Proceeds to the beneficiary of the Policy.

The Policy also provides Owners with the opportunity for guaranteed distributions through the GDR. The GDR comes standard with the Policy and provides you with the opportunity for a specified amount of guaranteed distributions for a certain period of time. The minimum amount you can receive is guaranteed at issue. Distribution Payments will be based on the Cash Value at the time payments begin and subject to certain minimum and maximum limits. If necessary, we will increase your Policy’s Cash Value to cover any Distribution Payments. The Policy must be in force for at least 10 years before you are eligible to start Distribution Payments. In addition, the Policy cannot be a MEC and you must repay any Policy Loan Balance before Distributions Payments may begin. The GDR also has a Lifetime Lapse Prevention Benefit that guarantees that the Policy will not lapse, subject to certain conditions. The GDR also guarantees a minimum amount of Policy Proceeds ($10,000). See “GUARANTEED DISTRIBUTION RIDER.”

When you purchase the Policy, you can choose one or more of the available Indexed Accounts and the Fixed Account. We are obligated to pay all money we owe under the Policy, including Policy Proceeds and Guaranteed Minimum Distribution Payments. Any such amount that exceeds the assets in the Separate Account is paid from our General Account. Our ability to do so is subject to our financial strength and claims-paying ability and is not guaranteed by any other party.

The Policy is designed to be held over a long term, is not offered primarily as an investment, and should not be used as a short-term savings vehicle. Various negative consequences can occur if you fail to hold the Policy long-term. For example, if you Surrender your Policy in the first Policy Year, the Surrender charge could exceed the Cash Value of your Policy and you would receive no proceeds upon Surrender. In addition, before any applicable Segment Maturity Date, your Cash Surrender Value would be based on the Interim Segment Value.

The Policy has features and benefits that may be appropriate for you based on your financial situation and objectives, but we are not a fiduciary and do not provide investment advice or make recommendations regarding insurance or investment products, or any securities transactions or investment strategies involving securities. You should ask your financial representative for guidance as to whether this Policy may be appropriate for you. Please bear in mind that your financial representative, or any financial firm or financial professional with whom you consult for advice, acts on

19

Table of Contents

your behalf, not ours. We are not party to any agreement between you and your financial professional. See “DISTRIBUTION OF THE POLICIES” for information on firms that sell the Policy.

Generally, the Policy benefits from tax deferral. Tax deferral means that you are not taxed on any increase in your Policy’s Cash Value until a distribution or deemed distribution is made from your Policy, such as a Surrender or lapse of the Policy. (See “FEDERAL TAX CONSIDERATIONS.”)

Our General Account consists of all assets owned by us other than those in the Separate Account and our other separate accounts. We have sole discretion over the investment of assets in the General Account and the Separate Account.

As Owner, you exercise all interests and rights under the Policy. You can change the Owner at any time, subject to our underwriting requirements. The Policy may be owned generally by more than one Owner. (See “OWNERSHIP PROVISIONS.”)

Rights Reserved By Us

Upon notice to you, this Policy may be modified by us, but only such modification is necessary to make changes as required by the Internal Revenue Code or by any other applicable law, regulation or interpretation in order to continue treatment of this Policy as life insurance.

If we make any payment in good faith, relying on our records or evidence supplied to us, our duty will be fully discharged. We have the right to correct any errors in the Policy.

Statements Made in the Application for the Policy

In the absence of fraud, all statements made by the Insured or on the Insured’s behalf, or by the Owner or on the Owner’s behalf, will be deemed representations and not warranties. Material misstatements will not be used to void the Policy or any rider or to deny a claim unless made in the Application for the Policy or a rider.

Misstatement of Age or Sex

If we determine that there was a misstatement of age or sex reflected in the Policy, the death benefit will be recalculated based on the Annual Cost of Insurance Charge on the prior Policy Anniversary and the Annual Cost of Insurance Charge rate based on the correct age and sex. Future Annual Deductions will be based on the correct age and sex.

Unisex Basis

If the Policy is issued on a unisex basis, all rates, benefits and values that contain differences based on sex are modified to provide the same rates, benefits, and values regardless of sex.

Incontestability Period

We cannot contest the coverage after the Policy has been in force during the lifetime of the Insured for two years from its Policy Issue Date (the date we created your insurance policy). This provision will not apply to any rider that contains its own incontestability clause. If the Policy is reinstated, a new two-year contestability period, during the lifetime of the Insured, will begin as of the date the Policy was reinstated. The Policy will be contestable only as to statements made in the reinstatement application.

If the Policy was issued as the result of the exercise of an option given in another policy and proof of insurability was not required, the contestable period applicable to the coverage resulting from the option exercise will end at the same time as it would have under the original policy.

It may not be in your best interest to Surrender, lapse, change or borrow from existing life insurance policies or annuity contracts in connection with the purchase of the Policy. You should compare your existing insurance and the Policy carefully. You should replace your existing insurance only when you determine that the Policy is better for you. You may have to pay a Surrender charge on your existing insurance, and the Policy will impose a new Surrender charge period. You should talk to

20

Table of Contents

your financial professional or tax adviser to make sure the exchange will be tax-free. If you Surrender your existing policy for cash and then buy the Policy, you may have to pay a tax, including possibly a penalty tax, on the Surrender. Because we may not issue the Policy until we have received an initial premium from your existing insurance company, the issuance of the Policy may be delayed.

Paid-Up Life Insurance Option

The Paid-Up Life Insurance Option allows you to exchange your Policy while it is in force, on any Policy Anniversary before Attained Age 121, for a new policy that provides Paid-Up Life Insurance. Your request for the exchange must be in Good Order on or before the Policy Anniversary on which the exchange is to be effective. This Policy will be void as of the date of the exchange.

Paid-Up Life Insurance will be provided by using the Cash Surrender Value of the Policy as a net single premium at the then current age of the Insured as calculated by the issuing company for that plan of insurance. Paid-Up Life Insurance is permanent life insurance with no further premiums due. The Paid-Up Life Insurance will be issued on a plan of insurance offered by us or one of our affiliates; and with a start date as of the date the Policy ends.

Flexible Premiums

Subject to the limits described below, you choose the amount and frequency of premium payments. You select a Planned Premium Payment schedule, which consists of a first-year premium amount and an amount for subsequent premium payments. This schedule appears in your Policy. Your Planned Premium Payments will not necessarily keep your Policy in force. You may skip Planned Premium Payment or make additional payments. You should consider the risks of paying an insufficient amount of premiums (see “RISK FACTORS”). Additional payments could be subject to underwriting. No payment can be less than $1,000, except with our consent.

A Percent of Premium Charge will be deducted from each premium we receive. Premiums paid after the first premium must be paid to our Administrative Office or as otherwise approved by Us. A premium received within the Transfer Period will be applied as if it had been received on the anniversary.

You can make Planned Premiums Payments on an annual, semi-annual, quarterly, or monthly schedule. We will send premium notices for annual, semi-annual, or quarterly Planned Premiums Payments, only if premium payments are not drawn directly from your checking account pursuant to the pre-authorized checking arrangement. You can change your Planned Premium Payment schedule by sending your request to us in Good Order at our Administrative Office. You may also change your Planned Premium Payments; however, a new Policy Specification page will not be sent to you. You may not make premium payments on or after the Policy Anniversary when the Insured reaches Attained Age 121, except for premiums required during the Grace Period.

You may allocate Net Premiums among the Fixed Account and the Indexed Accounts. The Net Premium will be allocated according to the allocations you chose at the time you apply for the Policy. While your Policy is in force, you may request to change the allocation of future Net Premiums among the Fixed Account and Indexed Accounts. If an Indexed Account is not available, any amount allocated to that Indexed Account will automatically be allocated to the Fixed Account.

If any premium payments under the Policy exceed the “7-pay limit” under Federal tax law, your Policy will become a MEC, and you may have more adverse tax consequences with respect to certain distributions than would otherwise be the case if premium payments did not exceed the “7-pay limit.” Information about your “7-pay limit” is found in your Policy illustration. If we receive a premium payment 30 days or less before the anniversary of the 7-pay testing period that exceeds the “7-pay limit” and would cause the Policy to become a MEC and waiting until the anniversary to apply that payment would prevent the Policy from becoming a MEC, we may retain the premium payment in a non-interest-bearing account and apply the payment to the Policy on the anniversary. If we follow this procedure, we will notify you and give you the option of having the premium payment applied to the Policy before the anniversary. Otherwise, if you make a premium payment that exceeds the “7-pay limit,” we will

21

Table of Contents

apply the payment to the Policy according to our standard procedures described below and notify you that the Policy has become a MEC.

Under our current processing, if you have a loan and we receive a payment from you, we will treat it as a loan repayment, unless you request, in writing, for us to treat it as a premium payment. Loan repayments may be allocated in the same manner as Net Premium.

Attained Age 121. You may not make premium payments on or after the Policy Anniversary when the Insured reaches Attained Age 121, except for premiums required during the Grace Period.

Brighthouse SmartGuard Plus is an index-linked insurance policy. Its Indexed Accounts offer potential interest based upon Index performance. This potential interest—the Segment Index-Linked Credit Rate—may be a positive or negative percentage or zero.

Based upon the Segment Index Performance of the Index associated with the Indexed Account, we calculate the Segment Maturity Cash Value and Interim Segment Value, as follows:

| • | On the Segment Maturity Date, a Segment Index-Linked Credit, which reflects the full downside protection of the Buffer Rate and the full upside potential of the Cap Rate, is applied to the Segment Value to calculate the Segment Maturity Cash Value. |

| • | On any day prior to the Segment Maturity Date, we calculate Interim Segment Value. The Interim Segment Value on that day is the Segment Value plus the Accrued Index Return, which reflects an Accrued Buffer Rate (less than the full downside protection of the Buffer Rate) and an Accrued Cap Rate (less than the full upside potential of the Cap Rate). We use the Interim Segment Value calculation to determine the following: |

| (i) | the amounts available for loans; |

| (ii) | the amounts we transfer to the Fixed Account in order to start making Distribution Payments under the GDR; |

| (iii) | a payment under the Accelerated Death Benefit; |

| (iv) | the Cash Surrender Value if you Surrender the Policy; or |

| (v) | Policy Proceeds we pay your beneficiary. |

(See “INTERIM SEGMENT VALUE CALCULATION.”)

Prior to starting Distribution Payments under the GDR and when Distribution Payments are suspended or terminated, you have the opportunity to allocate your Net Premiums and unloaned Cash Value to any of the Indexed Accounts described below. We are not obligated to offer any one particular Indexed Account and your selling firm may limit the Indexed Accounts available through that firm when your Policy is issued. After the Policy is issued, there will always be at least one Indexed Account available.

22