Form S-1/A Jaguar Health, Inc.

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on July 5, 2019.

Registration No. 333-231399

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

JAGUAR HEALTH, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2834 (Primary Standard Industrial Classification Code Number) |

46-2956775 (I.R.S. Employer Identification Number) |

201 Mission Street, Suite 2375

San Francisco, California 94105

(415) 371-8300

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive office)

Lisa A. Conte

Chief Executive Officer and President

Jaguar Health, Inc.

201 Mission Street, Suite 2375

San Francisco, California 94105

(415) 371-8300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Donald C. Reinke, Esq. Reed Smith LLP 101 Second Street, Suite 1800 San Francisco, California 94105 (415) 543-8700 |

Richard A. Friedman, Esq. Stephen A. Cohen, Esq. Sheppard, Mullin, Richter & Hampton LLP 30 Rockefeller Plaza New York, NY 10112 (212) 653-8700 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o |

Smaller reporting company ý Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ý

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Registered(1) |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee |

||

|---|---|---|---|---|

Class A Units consisting of: |

$12,000,000(4) | $1,454.40 | ||

(i) Shares of common stock, par value $0.0001 per share(2) |

||||

(ii) Warrants to purchase common stock(2) |

||||

Class B Units consisting of: |

$12,000,000(4) | $1,454.40 | ||

(i) Series B Convertible Preferred Stock, par value $0.0001 per share |

||||

(ii) Common stock issuable upon conversion of Series B Preferred Stock(2)(3) |

||||

(iii) Warrants to purchase common stock(2) |

||||

Common Stock issuable upon exercise of warrants(2) |

$60,000,000 | $7,272.00 | ||

Total |

$84,000,000 | $10,180.80(5) | ||

|

||||

- (1)

- Estimated

solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended. Includes

the offering price of any additional securities that the underwriter has the option to purchase.

- (2)

- Pursuant

to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issued after the date

hereof as a result of stock splits, stock dividends or similar transactions.

- (3)

- No

fee pursuant to Rule 457(i) under the Securities Act of 1933, as amended.

- (4)

- The

Registrant is issuing Class A Units and/or Class B Units up to $12 million in the aggregate.

- (5)

- The Registrant previously paid $1,212 in connection with the initial filing of this Registration Statement on May 10, 2019.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement relating to these securities filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 5, 2019

PRELIMINARY PROSPECTUS

JAGUAR HEALTH, INC.

2,521,008 Class A Units, consisting of Common Stock and Warrants or

12,000 Class B Units consisting of Series B Convertible Preferred Stock and Warrants

(and 2,521,008 shares of common stock underlying shares of Series B Convertible Preferred Stock and 5,042,016 shares of Common Stock underlying Warrants)

We are offering 2,521,008 Class A Units, with each Class A Unit consisting of (i) one share of common stock, par value $0.0001 per share, (ii) one warrant to purchase one share of common stock that expires on the earlier of (a) 12 months from the date of issuance and (b) 30 calendar days following the public announcement of Positive Interim Results (as defined on page 63) related to the diarrhea results from the HALT-D Investigator Initiated Trial (referred to as the "Series 1 warrants"), and (iii) one warrant to purchase one share of our common stock that expires on the first date on the earlier of (a) 5 years from the date of issuance and (b) 30 calendar days following the public announcement by the Company that a pivotal trial using crofelemer (Mytesi, or the same or similar product with a different name) for the treatment of cancer therapy related diarrhea has met its primary endpoint in accordance with the protocol (referred to as the "Series 2 warrants" and, together with the Series 1 warrant and the shares of common stock underlying the Series 1 warrants and Series 2 warrants, the "Class A Units") at an assumed public offering price of $4.76 per Class A Unit, which was the closing price of our common stock on June 27, 2019. The Series 1 warrants have an exercise price that is 125% of the assumed public offering price of the Class A Units. The Series 2 warrants have an exercise price that is 125% of the assumed offering price of the Class A Units.

We are also offering to those purchasers whose purchase of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock following the consummation of this offering, the opportunity to purchase, if they so choose, in lieu of the shares of common stock that would result in ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%), 12,000 Class B Units. Each Class B Unit will consist of one share of Series B Convertible Preferred Stock, with a stated value of $1,000 (the "Series B Preferred Stock") and convertible into shares of common stock at the public offering price of the Class A Units, together with the equivalent number of warrants as would have been issued to such purchaser of Class B Units if they had purchased Class A Units (together with the shares of common stock underlying such warrants, the "Class B Units" and, together with the Class A Units, the "Units") at an assumed public offering price of $1,000 per Class B Unit. For each Class B Unit we sell, the number of Class A Units we are offering will be decreased by $1,000 divided by the Class A Unit offering price. Because we will issue warrants as part of each Class A Unit or Class B Unit, the number of warrants sold in this offering will not change as a result of a change in the mix of the Class A Units and Class B Units sold.

The Class A Units and Class B Units have no stand-alone rights and will not be certificated or issued as stand-alone securities and the shares of common stock, Series B Preferred Stock and warrants comprising such Units are immediately separable and will be issued separately in this offering.

The underwriters have the option to purchase additional shares of common stock and/or warrants to purchase shares of common stock solely to cover over- allotments, if any, at the price to the public less the underwriting discounts and commissions. The over-allotment option may be used to purchase shares of common stock, or warrants, or any combination thereof, as determined by the underwriters, but such purchases cannot exceed an aggregate of 15% of the number of shares of common stock (including the number of shares of common stock issuable upon conversion of shares of Series B Preferred Stock) and warrants sold in the primary offering. The over-allotment option is exercisable for 45 days from the date of this prospectus.

Our Common Stock is listed on the Nasdaq Capital Market under the symbol "JAGX." On June 27, 2019, the last reported sale price of our common stock on the Nasdaq Capital Market was $4.76 per share. Certain investors, including certain of our officers, directors and existing investors and their affiliated entities, have agreed to purchase an aggregate of approximately $3.55 million of securities in this offering at the public offering price and on the same terms as the other purchasers in this offering. The underwriters will receive the same underwriting discounts and commissions on any securities purchased by these entities as they will on any other securities sold to the public in this offering.

Investing in our Common Stock involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks that we have described on page 12 of this prospectus under the caption "Risk Factors" and in the documents incorporated by reference into this prospectus and in any amendments or supplements to this prospectus.

|

||||||

| |

Per Class A Unit |

Per Class B Unit |

Total |

|||

|---|---|---|---|---|---|---|

Public offering price |

$ | $ | $ | |||

Underwriting discounts and commissions(1)(2) |

$ | $ | $ | |||

Proceeds, before expenses, to us |

$ | $ | $ | |||

|

||||||

- (1)

- See

"Underwriting" beginning on page 132 of this prospectus for a description of compensation payable to the underwriter.

- (2)

- We have granted a 45-day option to the underwriters to purchase additional shares of common stock and/or warrants to purchase shares of common stock (up to 15% of the number of shares of common stock and warrants sold in the primary offering) solely to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares and warrants against payment therefor on or about , 2019.

Sole Book-Running Manager

Ladenburg Thalmann

, 2019

We have not, and the underwriter has not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under the circumstances and in the jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not, and the underwriter is not, making an offer of these securities in any jurisdiction where such offer is not permitted.

For investors outside the United States: we have not, and the underwriter has not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of securities and the distribution of this prospectus outside the United States.

Jaguar Health, our logo, Napo Pharmaceuticals, Mytesi, Canalevia, Equilevia and Neonorm are our trademarks that are used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ©, ® or ™ symbols, but those references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

2

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the section in this prospectus titled "Risk Factors" appearing elsewhere in this prospectus the information incorporated by reference herein, including our financial statements and notes in our annual report on Form 10-K for 2018 and quarterly reports on Form 10-Q, before making an investment decision.

As used in this prospectus, references to "Jaguar," "we," "us" or "our" refer to Jaguar Health, Inc.

Overview

We are a commercial stage pharmaceutical company focused on developing and commercializing novel, sustainably derived gastrointestinal products on a global basis. Our wholly-owned subsidiary, Napo Pharmaceuticals, Inc. ("Napo"), focuses on developing and commercializing proprietary human gastrointestinal pharmaceuticals for the global marketplace from plants used traditionally in rainforest areas. Our Mytesi (crofelemer) product is a first-in-class anti-secretory agent, approved by the U.S. Food and Drug Administration ("FDA") for the symptomatic relief of noninfectious diarrhea in adults with HIV/AIDS on antiretroviral therapy.

Jaguar was founded in San Francisco, California as a Delaware corporation on June 6, 2013 to develop and commercialize animal health products. Effective as of December 31, 2013, Jaguar was a wholly-owned subsidiary of Napo, and, until May 13, 2015, Jaguar was a majority-owned subsidiary of Napo. On July 31, 2017, the merger of Jaguar Animal Health, Inc. and Napo became effective, at which point Jaguar Animal Health's name changed to Jaguar Health, Inc. and Napo began operating as a wholly-owned subsidiary of Jaguar focused on human health and the ongoing commercialization of, and development of follow-on indications for Mytesi. Most of the activities of the Company are now focused on the commercialization of Mytesi and development of follow-on indications for crofelemer and a second-generation anti-secretory product, lechlemer. In the field of animal health, we have limited activities which are focused on developing and commercializing first-in-class gastrointestinal products for dogs, dairy calves, foals, and high value horses.

We believe Jaguar is poised to realize a number of synergistic, value adding benefits—an expanded pipeline of potential blockbuster human follow-on indications of crofelemer, and a second-generation anti-secretory agent—upon which to build global partnerships. As previously announced, Jaguar, through Napo, now holds extensive global rights for Mytesi, and crofelemer manufacturing may occur at two FDA-inspected and approved facilities, including a newly constructed, multimillion-dollar commercial manufacturing facility. Additionally, several of the drug product candidates in Jaguar's Mytesi pipeline are backed by strong Phase 2 and proof of concept evidence from completed human clinical trials.

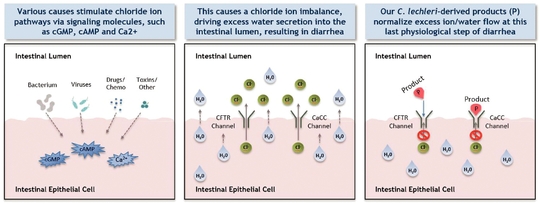

Mytesi is a novel, first-in-class anti-secretory agent which has a basic normalizing effect locally on the gut, and this mechanism of action has the potential to benefit multiple gastrointestinal disorders. Mytesi is in development for multiple possible follow-on indications, including cancer therapy-related diarrhea (CTD); orphan-drug indications for infants and children with congenital diarrheal disorders (CDDs) and short bowel syndrome (SBS); supportive care for inflammatory bowel disease (IBD); irritable bowel syndrome (IBS); and for idiopathic/functional diarrhea. In addition, a second-generation proprietary anti-secretory agent, lechlemer, is in development for cholera. Mytesi has received orphan-drug designation for pediatric SBS.

3

Recent Developments

Nasdaq Compliance

On June 21, 2019, the Company received a letter from The Nasdaq Stock Market that the Company has regained compliance with Listing Rule 5450(a)(1), which requires the Company's common stock to maintain a minimum bid price of $1.00 per share. The notification letter confirmed that the minimum bid price deficiency had been cured and that the Company was in compliance with all applicable listing standards. Nasdaq had previously notified the Company of its non-compliance with Listing Rule 5450(a)(1) on November 14, 2018, following 30 consecutive business days for which the closing bid price of the Company's common stock did not meet the $1.00 per share minimum requirement.

Kingdon Debt Refinancing

On May 28, 2019, Jaguar entered into a guaranty and suretyship agreement, pursuant to which it guaranteed payment and performance of all obligations of Napo, arising under and in connection with approximately $10.5 million outstanding aggregate amount of convertible promissory notes issued by Napo pursuant to the Amended and Restated Note Purchase Agreement, dated March 31, 2017, by and between Napo, Kingdon Associates, M. Kingdon Offshore Master Fund L.P., Kingdon Family Partnership, L.P., and Kingdon Credit Mater Fund L.P. (collectively, the "Existing Notes"). The Existing Notes bear interest at a rate of 10% per annum and mature on December 31, 2019.

On May 28, 2019, Jaguar and Napo (collectively, the "Borrower") entered into an exchange agreement with Chicago Venture Partners, L.P. ("CVP"), the holder of the Existing Notes, pursuant to which CVP exchanged the Existing Notes for a secured promissory note in the original principal amount of $10,535,900.42 ("Exchange Note 1") and a secured promissory note in the original principal amount of $2,296,926.16 ("Exchange Note 2" and together with Exchange Note 1, the "Exchange Notes"). The Exchange Notes bear interest at the rate of 10% per annum and mature on December 31, 2020. The outstanding balance of Exchange Note 2 is equal to the exchange fee that Jaguar agreed to pay CVP in consideration of certain accommodations granted to Jaguar and Napo, including but not limited to the extension of the maturity dates of the Existing Notes and the legal and other fees incurred by CVP in connection with the effectuation of the transactions contemplated under the Exchange Agreement. Through June 27, 2019, Jaguar has issued 754,838 shares of Common Stock to CVP in exchange for a reduction of approximately $4.8 million of the Exchange Notes. The shares of Common Stock that were exchanged for portions of the Exchange Notes were issued in reliance on the exemption from registration provided under Section 3(a)(9) of the Securities Act.

CVP also entered into security agreements with Jaguar (the "Jaguar Security Agreement") and Napo (the "Napo Security Agreement", and together with the Jaguar Security Agreement, the "Security Agreements"), pursuant to which CVP will receive (i) a security interest in substantially all of the Company's assets as security for the Company's obligations under Exchange Note 2 and (ii) a security interest in substantially all of Napo's assets as security for Napo's obligations under Exchange Note 1 and Exchange Note 2. Notwithstanding the foregoing, (a) the amount owing under Exchange Note 2 will not be considered part of the obligations secured by the Napo Security Agreement until such time as Jaguar receives permission from a third party and (b) the security interest granted under the Jaguar Security Agreement will be automatically terminated and released upon Jaguar's receipt of a waiver from such third party.

Reverse Stock Split

On June 3, 2019, we filed an amendment to our Third Amended and Restated Certificate of Incorporation to effect on June 7, 2019, a 1-for-70 reverse split of our voting common stock.

4

Accordingly, all of the stock figures and related market, conversion and exercise prices in this prospectus have been adjusted to reflect the reverse split.

Notes and Warrants Issuance

On March 18, 2019, Jaguar began entering into securities purchase agreements (each, a "Securities Purchase Agreement") with selected accredited investors (the "Investors" and each, an "Investor") pursuant to which Jaguar will sell promissory notes ("Bridge Notes") to such Investors. The initial offering closed on March 18, 2019, and as of June 27, 2019, $5,050,000.00 aggregate principal amount of Bridge Notes were issued in offerings and the proceeds from such offerings were paid to the Company.

The Bridge Notes bear interest at the rate of 12% per annum and mature on July 31, 2019 (the "Maturity Date"). Each Bridge Note is subject to a right to purchase by Sagard Capital Partners, L.P. and its affiliates (collectively, "Sagard"), pursuant to which Sagard may elect, within 5 business days of providing notice thereof to the holder of such Bridge Note, to purchase all or any portion of such Bridge Note and all accrued interest thereon.

At the time of entering into a Securities Purchase Agreement, an Investor may elect to purchase either a Bridge Note that is subject to a mandatory exchange provision (each a "125% Coverage Note") or a Bridge Note that is not subject to a mandatory exchange provision but is otherwise substantially the same as the 125% Coverage Note (each, a "75% Coverage Note"). The mandatory exchange provision in the 125% Coverage Notes provides that, at the Company's option upon the consummation of an underwritten public offering by the Company on or before the Maturity Date (the "Public Offering") of the Company's common stock ("Common Stock"), the principal amount of the 125% Coverage Notes plus any unaccrued interest thereon will be mandatorily exchanged into shares of Common Stock (the "Exchange Shares") at a price equal to the per share price at which the Company issues Common Stock in the Public Offering (the "Exchange Price"), subject to adjustment for reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction. Upon such exchange, the 125% Coverage Notes would be deemed repaid and terminated.

As an inducement to enter into a Securities Purchase Agreement, (i) each holder of 75% Coverage Notes will receive a 5-year warrant (the "75% Coverage Warrant") to purchase shares of Common Stock (the "Bridge Warrant Shares") in an amount equal to 75% of the principal amount of such holder's 75% Coverage Note divided by the Exercise Price (as defined below) and (ii) each holder of 125% Coverage Notes will receive a 5-year warrant (the "125% Coverage Warrant" and, together with the 75% Coverage Warrant, the "Bridge Warrants") to purchase Bridge Warrant Shares in an amount equal to 125% of the principal amount of such holder's 125% Coverage Note divided by the Exercise Price. The exercise price for the 75% Coverage Warrant and 125% Coverage Warrant is the price per share at which the Company issues Common Stock in the Public Offering, provided that if the Company has not consummated a Public Offering by the Maturity Date, then the exercise price will be equal to the closing sales price of the shares of Common Stock on the Maturity Date, in each case subject to adjustment for reclassification of the Common Stock, non-cash dividend, stock split, reverse stock split or other similar transaction (the "Exercise Price").

Amendment to the Series A Preferred Stock

On March 14, 2019, Jaguar, with the written consent of the sole holder of Jaguar's issued and outstanding Series A convertible participating preferred stock ("Series A Preferred Stock"), filed a Certificate of Amendment (the "Amendment") to the Certificate of Designation of Series A Convertible Participating Preferred Stock of Jaguar (as amended, the "Series A Certificate of Designation") with the Secretary of State of the State of Delaware to (a) adjust the conversion price of the shares of Series A Preferred Stock from $194.25 per share to $19.425 per share, provided that with

5

respect to the right to vote on an as-converted basis with holders of the Company's Common Stock, holders of Series A Preferred Stock will not be entitled to vote on any matter presented to the stockholders of the Company to the extent that such vote would be in violation of Nasdaq Listing Rule 5640, and (b) adjust the 30-day volume-weighted average price ("VWAP") threshold applicable to the Company's optional redemption right and the preferred stockholders' mandatory redemption right from $1050.00 to $105.00. The Amendment became effective upon filing with the Secretary of the State of Delaware.

CVP Note Exchanges

In January through June 2019, Jaguar entered into exchange agreements with Chicago Venture Partners L.P. ("CVP"), pursuant to which the Company issued 1,150,808 shares of Common Stock in the aggregate to CVP in exchange for a reduction of approximately $11.2 million in the principal amount of the CVP Notes and Exchange Notes. As of June 26, 2019, all of the CVP Notes have been eliminated and approximately $8.0 aggregate principal amount of the Exchange Notes remains outstanding. The shares of Common Stock that were exchanged for portions of the secured promissory notes were issued in reliance on the exemption from registration provided under Section 3(a)(9) of the Securities Act.

Risks Related to Our Business

Our business, and our ability to execute our business strategy, is subject to a number of risks as more fully described in the section titled "Risk Factors." These risks include, among others, the following:

- •

- We have a limited operating history, have not yet generated any material revenues, expect to continue to incur significant research and

development and other expenses, and may never become profitable. Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

- •

- We have generated limited revenue from operations and may need to raise additional capital to achieve our goals.

- •

- We are substantially dependent on the success of our current lead prescription drug product candidate, Mytesi, and cannot be certain that

necessary approvals will be received for planned Mytesi follow-on indications or Canalevia or that these follow on indications will be successfully commercialized, either by us or any of our partners.

- •

- The results of earlier studies may not be predictive of the results of our pivotal trials or other future studies, and we may be unable to

obtain any necessary regulatory approvals for our existing or future prescription drug product candidates under applicable regulatory requirements.

- •

- Development of prescription drug products, and, to a lesser extent, non-prescription products, for the human health and animal health market is

inherently expensive, time-consuming and uncertain, and any delay or discontinuance of our current or future pivotal trials, or dosage or formulation studies, would harm our business and prospects.

- •

- Even if we obtain any required regulatory approvals for our current or future prescription drug product candidates, they may never achieve

market acceptance or commercial success.

- •

- We are dependent upon contract manufacturers for supplies of our current prescription drug product candidates and non-prescription products and intend to rely on contract manufacturers for commercial quantities of any of our commercialized products.

6

- •

- If we are not successful in identifying, developing and commercializing additional prescription drug product candidates and non-prescription

products, our ability to expand our business and achieve our strategic objectives may be impaired.

- •

- We have a material weakness in our internal control over financial reporting related to staff turnover in our accounting department. We did not maintain a sufficient complement of internal personnel with appropriate knowledge, experience and/or training commensurate with our financial reporting requirements. If we fail to remediate the material weakness, or experience any additional material weaknesses in the future or otherwise fail to maintain an effective system of internal controls in the future, we may not be able to accurately report our financial condition or results of operations which may adversely affect investor confidence in us and, as a result, the value of our common stock.

Corporate Information

We were incorporated in the State of Delaware on June 6, 2013. Our principal executive offices are located at 201 Mission Street, Suite 2375, San Francisco, CA 94015 and our telephone number is (415) 371-8300. Our website address is www.jaguar.health. The information contained on, or that can be accessed through, our website is not part of this prospectus. Our Common Stock is listed on the NASDAQ Capital Market and trades under the symbol "JAGX." On July 31, 2017, we completed the acquisition of Napo (the "Merger") pursuant to the Agreement and Plan of Merger, dated March 31, 2017, by and among the Company, Napo, Napo Acquisition Corporation, and Napo's representative (the "Merger Agreement").

Emerging Growth Company Information

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and we may take advantage of certain exemptions and relief from various reporting requirements that are applicable to other public companies that are not "emerging growth companies." In particular, while we are an "emerging growth company" (i) we will not be required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, (ii) we will be subject to reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (iii) we will not be required to hold nonbinding advisory votes on executive compensation or stockholder approval of any golden parachute payments not previously approved. In addition, the JOBS Act provides that an emerging growth company can delay its adoption of any new or revised accounting standards, but we have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies. In addition, investors may find our common stock less attractive if we rely on the exemptions and relief granted by the JOBS Act. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may decline and/or become more volatile.

We may remain an "emerging growth company" until as late as December 31, 2020 (the fiscal year-end following the fifth anniversary of the closing of our initial public offering, which occurred on May 18, 2015), although we may cease to be an "emerging growth company" earlier under certain circumstances, including (i) if the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of any June 30, in which case we would cease to be an "emerging growth company" as of December 31 of such year, (ii) if our gross revenue exceeds $1.07 billion in any fiscal year or (iii) if we issue more than $1.0 billion of non-convertible debt over a three-year period.

7

Securities offered |

2,521,008 Class A Units, comprising of one share of our common stock, a Series 1 warrant to purchase one share of our common stock, and a Series 2 warrant to purchase one share of our common stock (together with the shares of common stock underlying such warrants). We are also offering 12,000 Class B Units, comprising of one share of Series B Preferred Stock, with a stated value of $1,000 and convertible into shares of common stock at the public offering price of the Class A Units, together with the equivalent number of warrants as would have been issued to such purchaser of Class B Units if they had purchased Class A Units (together with the shares of common stock underlying such shares of Series B Preferred Stock and such warrants) to those purchasers, if any, whose Purchase of Class A Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering. For each Class B Unit we sell, the number of Class A Units we are offering will be decreased by $1,000 divided by the Class A Unit offering price. Because we will issue warrants as part of each Class A Unit or Class B Unit, the number of warrants sold in this offering will not change as a result of a change in the mix of the Class A Units and Class B Units sold. | |

Assumed Public offering price per Class A Unit |

$4.76 per Class A Unit |

|

Assumed Public offering price per Class B Unit |

$1,000 per Class B Unit |

|

Over-allotment option |

The underwriters have the option to purchase up to (i) 378,151 additional shares of common stock and/or Series B Convertible Preferred Stock, (ii) additional Series 1 warrants to purchase up to 378,151 additional shares of common stock and/or (iii) additional Series 2 warrants to purchase up to 378,151 additional shares of common stock solely to cover over-allotments, if any, at the price to the public less the underwriting discounts and commissions. The over- allotment option may be used to purchase shares of common stock, Series B Convertible Preferred Stock or warrants, or any combination thereof, as determined by the underwriters, but such purchases cannot exceed an aggregate of 15% of the number of shares of common stock (including the number of shares of common stock issuable upon conversion of shares of Series B Preferred Stock) and warrants sold in the primary offering. The over-allotment option is exercisable for 45 days from the date of this prospectus. |

8

Series 1 Warrant |

The Series 1 warrants will be exercisable beginning on the date of issuance and expire on the earlier of (1) 12 months from the date of issuance and (2) 30 calendar days following the public announcement of Positive Interim Results (as defined on page 63) related to the diarrhea results from the HALT-D Investigator Initiated Trial, at an initial exercise price per share that is equal to 125% of the public offering price of the Class A Units, subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock. |

|

Series 2 Warrant |

The Series 2 warrants will be exercisable beginning on the date of issuance and expire on the earlier of (1) 5 years from the date of issuance and (2) 30 calendar days following the public announcement by the Company that a pivotal trial using crofelemer (Mytesi, or the same or similar product with a different name) for the treatment of cancer therapy related diarrhea has met its primary endpoint in accordance with the protocol, at an initial exercise price per share that is equal to 125% of the public offering price of the Class A Units, subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock. |

|

|

The Series 2 warrants are callable by us in certain circumstances. Subject to certain exceptions, in the event that the Series 2 warrants are outstanding, following the date that is 180 days after the closing date, (i) the volume weighted average price of our common stock for each of 30 consecutive trading days (the "Measurement Period"), which Measurement Period commences after the date that is 180 days after the closing date, exceeds 300% of the initial exercise price (subject to adjustment for forward and reverse stock splits, recapitalizations, stock dividends and similar transactions), (ii) the average daily trading volume for such Measurement Period exceeds $500,000 per trading day and (iii) the holder is not in possession of any information that constitutes or might constitute, material non-public information which was provided by the Company, and subject to the beneficial ownership limitation for the warrants described further under "Description of Securities We are Offering—Warrants—Exercise of Warrants," then we may, within one trading day of the end of such Measurement Period, upon notice (a "Call Notice"), call for cancellation of all or any portion of the Series 2 warrants for which a notice of exercise has not yet been delivered (a "Call") for consideration equal to $0.0001 per share. Any portion of a Series 2 warrant subject to such Call Notice for which a notice of exercise shall not have been received by the Call Date (as hereinafter defined) will be canceled at 6:30 p.m. (New York City time) on the tenth trading day after the date the Call Notice is received by the Holder (such date and time, the "Call Date"). Our right to call the Series 2 warrants shall be exercised ratably among the holders based on the outstanding Series 2 warrants. |

9

|

The Series 1 warrants and Series 2 warrants are collectively referred to herein as the "warrants" The forms of warrant are filed as an exhibit to the registration statement of which this prospectus forms a part. |

|

Series B Preferred Stock |

Each share of Series B Preferred Stock is convertible at any time at the holder's option into one share of common stock. Notwithstanding the foregoing, we shall not effect any conversion of Series B Preferred Stock, with certain exceptions, to the extent that, after giving effect to an attempted conversion, the holder of shares of Series B Preferred Stock (together with such holder's affiliates, and any persons acting as a group together with such holder or any of such holder's affiliates) would beneficially own a number of shares of our common stock in excess of 4.99% (or, at the election of the purchaser prior to the date of issuance, 9.99%) of the shares of our common stock then outstanding after giving effect to such conversion. For additional information, see "Description of Securities We Are Offering—Series B Preferred Stock" for a discussion of the terms of the Series B Preferred Stock. |

|

Common stock outstanding before this offering as of July 3, 2019 |

1,837,763 |

|

Common stock to be outstanding immediately after this offering |

9,400,772 |

|

No listing of Series B Preferred Stock or warrants |

There is no established public trading market for the warrants or Series B Preferred Stock, and we do not expect an active trading market to develop. We do not intend to list the warrants or the Series B Preferred Stock on any securities exchange or other trading market. Without an active trading market, the liquidity of the warrants and the Series B Preferred Stock will be limited. |

|

Registered Securities |

This prospectus also relates to the offering of the shares issuable upon conversion of the Series B Preferred Stock and upon exercise of the warrants included in the Units. |

|

Use of Proceeds |

We estimate that the net proceeds to us from this offering will be approximately $10.2 million, based on an assumed offering price of $4.76 for each Class A Unit and $1,000 for each Class B Unit, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use approximately $5.2 million of the net proceeds from this offering for debt repayment (including repayment of $1,047,718 to certain officers, directors and their respective affiliates) and the remainder for general corporate purposes, including working capital and to pay a certain investor as consideration for their consent and waiver in refinancing an outstanding loan. See "Use of Proceeds" for additional information. |

10

Risk factors |

You should read the "Risk Factors" section of this prospectus and in the documents incorporated by reference in this prospectus for a discussion of factors to consider before deciding to invest in our Common Stock. |

|

NASDAQ Capital Market symbol |

"JAGX" |

We have two classes of common stock: (i) voting common stock, par value $0.0001 per share, and (ii) non-voting common stock, par value $0.0001 per share. The shares offered by us in this offering are voting common stock.

The number of shares of our common stock to be outstanding after this offering is based on 1,799,381 shares of our voting common stock and 40,301,237 shares of our non-voting common stock (which non-voting shares are convertible into 38,382 shares of voting common stock) outstanding as of July 3, 2019, and excludes the following:

- •

- 1,168,592 shares of common stock issuable upon exercise of the Bridge Warrants issuable pursuant to the Securities Purchase Agreement entered

into beginning on March 18, 2019 by and among the Company and selected accredited investors assuming an exercise price equal to the assumed public offering price per Class A Unit of

$4.76;

- •

- 473,565 shares of common stock issuable upon conversion of outstanding preferred stock as of July 3, 2019, with a weighted-average

conversion price of $19.425 per share;

- •

- 39,307 shares of voting common stock issuable upon exercise of outstanding options as of July 3, 2019, with a weighted average exercise

price of $412.94 per share;

- •

- 2,984 shares of common stock issuable upon exercise of outstanding inducement options as of March 31, 2019 with a weighted-average

exercise price of $122.49 per share;

- •

- 11,558 shares of voting common stock reserved for future issuance under the 2014 Stock Incentive Plan, which includes shares of common stock

that will be issuable upon exercise of options that we expect to grant on the closing date of this offering;

- •

- 71,821 shares of voting common stock issuable upon exercise of warrants outstanding as of July 3, 2019, with a weighted average exercise

price of $90.00 per share;

- •

- 5,613 shares of voting common stock issuable upon vesting of outstanding restricted stock unit awards, or RSUs, as of July 3, 2019; and

11

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information contained in or incorporated by reference in this prospectus, including our financial statements and the related notes and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, as updated in our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2019, before deciding whether to invest in our Common Stock. The occurrence of any of the events or developments described below could harm our business, financial condition, results of operations and prospects. In such an event, the market price of our Common Stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may harm our business, financial condition, results of operations and prospects.

Risks Related to Our Business

We have a limited operating history, expect to incur further losses as we grow and may be unable to achieve or sustain profitability. Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

Since formation in June 2013, our operations have been primarily limited to the research and development of our animal prescription drug product candidate, Canalevia, to treat various forms of diarrhea in dogs, our non-prescription product, Neonorm Calf, to help dairies and calf farms proactively retain fluid in calves, the ongoing commercialization of Neonorm Foal, our antidiarrheal for newborn horses, and Equilevia, our non-prescription, personalized, premium product for total gut health in high-performance equine athletes. Since the consummation of the Merger on July 31, 2017, our operations have also been heavily focused on research, development and the ongoing commercialization of our lead prescription drug product candidate, Mytesi, which is approved by the U.S. FDA for the symptomatic relief of noninfectious diarrhea in adults with HIV/AIDS on antiretroviral therapy. As a result, we have limited meaningful historical operations upon which to evaluate our business and prospects and have not yet demonstrated an ability to broadly commercialize any of our animal health products, obtain any required marketing approval for any of our animal prescription drug product candidates or successfully overcome the risks and uncertainties frequently encountered by companies in emerging fields such as the animal health industry or the gastrointestinal health industry in general. We also have not generated any material revenue to date, and expect to continue to incur significant research and development and other expenses. Our net loss and comprehensive loss for the year ended December 31, 2018 was $32.1 million. As of December 31, 2018, we had total stockholders' equity of $5.4 million. We expect to continue to incur losses for the foreseeable future, which will increase significantly from historical levels as we expand our product development activities, seek necessary approvals for our human and veterinary drug product candidates, conduct species-specific formulation studies for our non-prescription products and increase commercialization activities. Even if we succeed in developing and broadly commercializing one or more of our products or product candidates, we expect to continue to incur losses for the foreseeable future, and we may never become profitable. If we fail to achieve or maintain profitability, then we may be unable to continue our operations at planned levels and be forced to reduce or cease operations.

As more fully discussed in Note 1 to our financial statements, we believe there is substantial doubt about our ability to continue as a going concern as we do not currently have sufficient cash resources to fund our operations through March 31, 2020, or one year from the filing date of our Form 10-K. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. If we are unable to continue as a viable entity, our stockholders may lose their entire investment.

12

We currently generate limited revenue from the sale of products and may never become profitable.

We are a pharmaceuticals company focused on the development and commercialization of novel, sustainably derived gastrointestinal products for human prescription use on a global basis. Napo, our wholly-owned subsidiary, began the commercial pre-launch activities of our first FDA-approved product, Mytesi, in February 2017. Accordingly, we have only generated limited revenue from product sales. In order to commercialize our other prescription drug product candidates, we must receive regulatory approval from the FDA in the United States and other regulatory agencies in various jurisdictions. Other than Mytesi, we have not yet received any regulatory approvals for our prescription drug product candidates. Accordingly, until and unless we receive any necessary regulatory approvals, we cannot market or sell our products in many regions. Moreover, even if we receive the necessary approvals, we may not be successful in generating revenue from sales of our products as we do not have any meaningful experience marketing or distributing our products. Accordingly, we may never generate any material revenue from our operations.

We expect to incur significant additional costs as we continue commercialization efforts for current prescription drug candidates or other product candidates, and undertake the clinical trials necessary to obtain any necessary regulatory approvals, which will increase our losses.

Napo commenced sales of Mytesi for adults with HIV/AIDS on antiretroviral therapy in September 2016. We will need to continue to invest in developing our internal and third-party sales and distribution network and outreach efforts to key opinion leaders in the gastrointestinal health industry, including physicians as applicable.

We are actively identifying additional products for development and commercialization, and will continue to expend substantial resources for the foreseeable future to develop Mytesi and lechlemer. These expenditures will include costs associated with:

- •

- identifying additional potential prescription drug product candidates and non-prescription products;

- •

- formulation studies;

- •

- conducting pilot, pivotal and toxicology studies;

- •

- completing other research and development activities;

- •

- payments to technology licensors;

- •

- maintaining our intellectual property;

- •

- obtaining necessary regulatory approvals;

- •

- establishing commercial supply capabilities; and

- •

- sales, marketing and distribution of our commercialized products.

We also may incur unanticipated costs in connection with developing and commercializing our products. Because the outcome of our development activities and commercialization efforts is inherently uncertain, the actual amounts necessary to successfully complete the development and commercialization of our current or future products and product candidates may be greater than we anticipate.

Because we anticipate incurring significant costs for the foreseeable future, if we are not successful in broadly commercializing any of our current or future products or product candidates or raising additional funding to pursue our research and development efforts, we may never realize the benefit of our development efforts and our business may be harmed.

13

We will need to raise substantial additional capital in the future in the event that we conduct clinical trials for new indications and we may be unable to raise such funds when needed and on acceptable terms, which would force us to delay, limit, reduce or terminate one or more of our product development programs.

We are forecasting continued losses and negative cash flows as we continue to fund our operating and marketing activities and research and development programs, and we will not have sufficient cash on hand to fund our operating plan through July 31, 2019 and to complete the development of all the current products in our pipeline, or any additional products we may identify. We will need to seek additional funds sooner than planned through public or private equity or debt financings or other sources such as strategic collaborations. Any such financings or collaborations may result in dilution to our stockholders, the imposition of debt covenants and repayment obligations or other restrictions that may harm our business or the value of our common stock. We may also seek from time to time to raise additional capital based upon favorable market conditions or strategic considerations such as potential acquisitions or potential license arrangements.

Our future capital requirements depend on many factors, including, but not limited to:

- •

- the scope, progress, results and costs of researching and developing our current and future prescription drug product candidates and

non-prescription products;

- •

- the timing of, and the costs involved in, obtaining any regulatory approvals for our current and any future products;

- •

- the number and characteristics of the products we pursue;

- •

- the cost of manufacturing our current and future products and any products we successfully commercialize;

- •

- the cost of commercialization activities for Mytesi and Canalevia, if approved, including sales, marketing and distribution costs;

- •

- the expenses needed to attract and retain skilled personnel;

- •

- the costs associated with being a public company;

- •

- our ability to establish and maintain strategic collaborations, distribution or other arrangements and the financial terms of such agreements;

and

- •

- the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing possible patent claims, including litigation costs and the outcome of any such litigation.

Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available to us on a timely basis, we may be required to delay, limit, reduce or terminate one or more of our product development programs or future commercialization efforts.

We are substantially dependent on the success of our current lead prescription drug product candidate, Mytesi, and cannot be certain that necessary approvals will be received for planned Mytesi follow-on indications or that these product candidates will be successfully commercialized, either by us or any of our partners.

Other than Mytesi, we currently do not have regulatory approval for any of our prescription drug product candidates. Our current efforts are primarily focused on the ongoing commercialization of Mytesi, and development efforts related to Mytesi. With regard to Mytesi, we are focused on the commercial launch of the product in the United States as well as on development efforts related to a follow-on indication for Mytesi in CTD, an important supportive care indication for patients undergoing primary or adjuvant chemotherapy for cancer treatment. Mytesi is in development for multiple possible follow-on indications, including diarrhea related to targeted cancer therapy;

14

orphan-drug indications for infants and children with congenital diarrheal disorders and short bowel syndrome (SBS); supportive care for inflammatory bowel disease (IBD); irritable bowel syndrome (IBS); and for idiopathic/functional diarrhea. In addition, a second-generation proprietary anti-secretory agent is in development for cholera. Mytesi has received orphan-drug designation for SBS. Accordingly, our near term prospects, including our ability to generate material product revenue, obtain any new financing if needed to fund our business and operations or enter into potential strategic transactions, will depend heavily on the success of Mytesi.

Substantial time and capital resources have been previously devoted by third parties in the development of crofelemer, the active pharmaceutical ingredient, or API, in Mytesi and Canalevia, and the development of the botanical extract used in Equilevia and Neonorm. Both crofelemer and the botanical extract used in Equilevia and Neonorm were originally developed at Shaman Pharmaceuticals, Inc. ("Shaman"), by certain members of our management team, including Lisa A. Conte, our chief executive officer and president, and Steven R. King, Ph.D., our executive vice president of sustainable supply, ethnobotanical research and intellectual property and secretary. Shaman spent significant development resources before voluntarily filing for bankruptcy in 2001 pursuant to Chapter 11 of the U.S. Bankruptcy Code. The rights to crofelemer and the botanical extract used in Equilevia and Neonorm, as well as other intellectual property rights, were subsequently acquired by Napo from Shaman in 2001 pursuant to a court approved sale of assets. Ms. Conte founded Napo in 2001 and was the current interim chief executive officer of Napo and a member of Napo's board of directors prior to the Merger. While at Napo, certain members of our management team, including Ms. Conte and Dr. King, continued the development of crofelemer. In 2005, Napo entered into license agreements with Glenmark and Luye Pharma Group Limited for rights to various human indications of crofelemer in certain territories as defined in the respective license agreements with these licensees. Subsequently, after expending significant sums developing crofelemer, including trial design and on-going patient enrollment in the final pivotal Phase 3 trial for crofelemer for non-infectious diarrhea in adults with HIV/AIDS on antiretroviral therapy, in late 2008, Napo entered into a collaboration agreement with Salix Pharmaceuticals, Inc., or Salix, for development and commercialization rights to certain indications worldwide and certain rights in North America, Europe, and Japan, to crofelemer for human use. In January 2014, Jaguar entered into the Napo License Agreement pursuant to which Jaguar acquired an exclusive worldwide license to Napo's intellectual property rights and technology, including crofelemer and the botanical extract used in Equilevia and Neonorm, for all veterinary treatment uses and indications for all species of animals. In February 2014, most of the executive officers of Napo, and substantially all Napo's employees, became Jaguar's employees. Following the merger of Jaguar and Napo in July 2017, Napo became Jaguar's wholly-owned subsidiary. If we are not successful in the development and commercialization of Mytesi, our business and our prospects will be harmed.

The successful development and commercialization of Mytesi will depend on a number of factors, including the following:

- •

- our ability to demonstrate to the satisfaction of the FDA and any other regulatory bodies, the safety and efficacy of Canalevia;

- •

- our ability and that of our contract manufacturers to manufacture supplies of Mytesi and to develop, validate and maintain viable commercial

manufacturing processes that are compliant with current good manufacturing practices, or cGMP, if required;

- •

- our ability to successfully launch Mytesi, whether alone or in collaboration with others;

- •

- the availability, perceived advantages, relative cost, relative safety and relative efficacy of our prescription drug product candidates compared to alternative and competing treatments;

15

- •

- the acceptance of our prescription drug product candidates and non-prescription products as safe and effective by physicians, veterinarians,

patients, animal owners and the human and animal health community, as applicable;

- •

- our ability to achieve and maintain compliance with all regulatory requirements applicable to our business; and

- •

- our ability to obtain and enforce our intellectual property rights and obtain marketing exclusivity for our prescription drug product candidates and non-prescription products, and avoid or prevail in any third-party patent interference, patent infringement claims or administrative patent proceedings initiated by third parties or the U.S. Patent and Trademark Office ("USPTO").

Many of these factors are beyond our control. Accordingly, we may not be successful in developing or commercializing Mytesi, Neonorm, Equilevia, Canalevia or any of our other potential products. If we are unsuccessful or are significantly delayed in commercializing Mytesi, our business and prospects will be harmed and you may lose all or a portion of the value of your investment in our common stock.

If we are not successful in identifying, licensing, developing and commercializing additional product candidates and products, our ability to expand our business and achieve our strategic objectives could be impaired.

Although a substantial amount of our efforts is focused on the commercial performance of Mytesi, a key element of our strategy is to identify, develop and commercialize a portfolio of products to serve the gastrointestinal health market. Most of our potential products are based on our knowledge of medicinal plants. Our current focus is primarily on product candidates whose active pharmaceutical ingredient or botanical extract has been successfully commercialized or demonstrated to be safe and effective in human or animal trials. In some instances, we may be unable to further develop these potential products because of perceived regulatory and commercial risks. Even if we successfully identify potential products, we may still fail to yield products for development and commercialization for many reasons, including the following:

- •

- competitors may develop alternatives that render our potential products obsolete;

- •

- an outside party may develop a cure for any disease state that is the target indication for any of our planned or approved drug products;

- •

- potential products we seek to develop may be covered by third-party patents or other exclusive rights;

- •

- a potential product may on further study be shown to have harmful side effects or other characteristics that indicate it is unlikely to be

effective or otherwise does not meet applicable regulatory criteria;

- •

- a potential product may not be capable of being produced in commercial quantities at an acceptable cost, or at all; and

- •

- a potential product may not be accepted as safe and effective by physicians, veterinarians, patients, animal owners, key opinion leaders and other decision-makers in the gastrointestinal health market, as applicable.

While we are developing specific formulations, including flavors, methods of administration, new patents and other strategies with respect to our current potential products, we may be unable to prevent competitors from developing substantially similar products and bringing those products to market earlier than we can. If such competing products achieve regulatory approval and commercialization prior to our potential products, our competitive position may be impaired. If we fail to develop and successfully commercialize other potential products, our business and future prospects may be harmed and we will be more vulnerable to any problems that we encounter in developing and commercializing our current potential products.

16

Mytesi faces significant competition from other pharmaceutical companies, both for its currently approved indication and for planned follow-on indications, and our operating results will suffer if we fail to compete effectively.

The development and commercialization of products for human gastrointestinal health is highly competitive and our success depends on our ability to compete effectively with other products in the market. During the ongoing commercialization of Mytesi for its currently approved indication, and during the future commercialization of Mytesi for any planned follow-on indications, if such follow-on indications receive regulatory approval, we expect to compete with major pharmaceutical and biotechnology companies that operate in the gastrointestinal space, such as Takeda Pharmaceuticals, Allergan, Inc., Ironwood Pharmaceuticals, Inc., Synergy Pharmaceuticals Inc., Sebela Pharmaceuticals, Inc. and Salix Pharmaceuticals.

Many of our competitors and potential competitors in the human gastrointestinal space have substantially more financial, technical and human resources and greater ability to lower costs of manufacturing and sales and marketing than we do. Many also have more experience in the development, manufacture, regulation and worldwide commercialization of human gastrointestinal health products.

For these reasons, we cannot be certain that we and Mytesi can compete effectively.

We may be unable to obtain, or obtain on a timely basis, regulatory approval for our existing or future human or animal prescription drug product candidates under applicable regulatory requirements, which would harm our operating results.

The research, testing, manufacturing, labeling, approval, sale, marketing and distribution of human and animal health products are subject to extensive regulation. We are typically not permitted to market our prescription drug product candidates in the United States until we receive approval of the product from the FDA through the filing of an NDA or NADA, as applicable. To gain approval to market a prescription drug, we must provide the FDA with safety and efficacy data from pivotal trials that adequately demonstrate that our prescription drug product candidates are safe and effective for the intended indications. Likewise, to gain approval to market an animal prescription drug for a particular species, we must provide the FDA with safety and efficacy data from pivotal trials that adequately demonstrate that our prescription drug product candidates are safe and effective in the target species (e.g. dogs, cats or horses) for the intended indications. In addition, we must provide manufacturing data evidencing that we can produce our product candidates in accordance with cGMP. For the FDA, we must also provide data from toxicology studies, also called target animal safety studies, and in some cases environmental impact data. In addition to our internal activities, we will partially rely on contract research organizations ("CROs"), and other third parties to conduct our toxicology studies and for certain other product development activities. The results of toxicology studies, other initial development activities, and/or any previous studies in humans or animals conducted by us or third parties may not be predictive of future results of pivotal trials or other future studies, and failure can occur at any time during the conduct of pivotal trials and other development activities by us or our CROs. Our pivotal trials may fail to show the desired safety or efficacy of our prescription drug product candidates despite promising initial data or the results in previous human or animal studies conducted by others. Success of a prescription drug product candidate in prior animal studies, or in the treatment of humans, does not ensure success in subsequent studies. Clinical trials in humans and pivotal trials in animals sometimes fail to show a benefit even for drugs that are effective because of statistical limitations in the design of the trials or other statistical anomalies. Therefore, even if our studies and other development activities are completed as planned, the results may not be sufficient to obtain a required regulatory approval for a product candidate.

17

Regulatory authorities can delay, limit or deny approval of any of our prescription drug product candidates for many reasons, including:

- •

- if they disagree with our interpretation of data from our pivotal studies or other development efforts;

- •

- if we are unable to demonstrate to their satisfaction that our product candidate is safe and effective for the target indication and, if

applicable, in the target species;

- •

- if they require additional studies or change their approval policies or regulations;

- •

- if they do not approve of the formulation, labeling or the specifications of our current and future product candidates; and

- •

- if they fail to approve the manufacturing processes of our third-party contract manufacturers.

Further, even if we receive a required approval, such approval may be for a more limited indication than we originally requested, and the regulatory authority may not approve the labeling that we believe is necessary or desirable for successful commercialization.

Any delay or failure in obtaining any necessary regulatory approval for the intended indications of our human or animal product candidates would delay or prevent commercialization of such product candidates and would harm our business and our operating results.

The results of our earlier studies of Mytesi may not be predictive of the results in any future clinical trials and species-specific formulation studies, respectively, and we may not be successful in our efforts to develop or commercialize line extensions of Mytesi.

Our human and animal product pipeline includes a number of potential indications of Mytesi, our lead prescription product. The results of our studies and other development activities and of any previous studies in humans or animals conducted by us or third parties may not be predictive of future results of these clinical studies and formulation studies, respectively. Failure can occur at any time during the conduct of these trials and other development activities. Even if our formulation/clinical studies and other development activities are completed as planned, the results may not be sufficient to pursue a particular line extension for Mytesi. Further, even if we obtain promising results from our clinical trials or species-specific formulation studies, as applicable, we may not successfully commercialize any line extension. Because line extensions are developed for a particular market, we may not be able to leverage our experience from the commercial launch of Mytesi in new markets. If we are not successful in developing and successfully commercializing these line extension products, we may not be able to grow our revenue and our business may be harmed.

Development of prescription drug products is inherently expensive, time-consuming and uncertain, and any delay or discontinuance of our current or future pivotal trials would harm our business and prospects.

Development of prescription drug products for human and animal gastrointestinal health remains an inherently lengthy, expensive and uncertain process, and our development activities may not be successful. We do not know whether our current or planned pivotal trials for any of our product candidates will begin or conclude on time, and they may be delayed or discontinued for a variety of reasons, including if we are unable to:

- •

- address any safety concerns that arise during the course of the studies;

- •

- complete the studies due to deviations from the study protocols or the occurrence of adverse events;

- •

- add new study sites;

18

- •

- address any conflicts with new or existing laws or regulations; or

- •

- reach agreement on acceptable terms with study sites, which can be subject to extensive negotiation and may vary significantly among different sites.

Further, we may not be successful in developing new indications for Mytesi, and Neonorm may be subject to the same regulatory regime as prescription drug products in jurisdictions outside the United States. Any delays in completing our development efforts will increase our costs, delay our development efforts and approval process and jeopardize our ability to commence product sales and generate revenue. Any of these occurrences may harm our business, financial condition and prospects. In addition, factors that may cause a delay in the commencement or completion of our development efforts may also ultimately lead to the denial of regulatory approval of our product candidates which, as described above, would harm our business and prospects.

We will partially rely on third parties to conduct our development activities. If these third parties do not successfully carry out their contractual duties, we may be unable to obtain regulatory approvals or commercialize our current or future human or animal product candidates on a timely basis, or at all.

We will partially rely upon CROs to conduct our toxicology studies and for other development activities. We intend to rely on CROs to conduct one or more of our planned pivotal trials. These CROs are not our employees, and except for contractual duties and obligations, we have limited ability to control the amount or timing of resources that they devote to our programs or manage the risks associated with their activities on our behalf. We are responsible for ensuring that each of our studies is conducted in accordance with the development plans and trial protocols presented to regulatory authorities. Any deviations by our CROs may adversely affect our ability to obtain regulatory approvals, subject us to penalties or harm our credibility with regulators. The FDA and foreign regulatory authorities also require us and our CROs to comply with regulations and standards, commonly referred to as good clinical practices (GCPs), or good laboratory practices ("GLPs"), for conducting, monitoring, recording and reporting the results of our studies to ensure that the data and results are scientifically valid and accurate.

Agreements with CROs generally allow the CROs to terminate in certain circumstances with little or no advance notice. These agreements generally will require our CROs to reasonably cooperate with us at our expense for an orderly winding down of the CROs' services under the agreements. If the CROs conducting our studies do not comply with their contractual duties or obligations, or if they experience work stoppages, do not meet expected deadlines, or if the quality or accuracy of the data they obtain is compromised, we may need to secure new arrangements with alternative CROs, which could be difficult and costly. In such event, our studies also may need to be extended, delayed or terminated as a result, or may need to be repeated. If any of the foregoing were to occur, regulatory approval, if required, and commercialization of our product candidates may be delayed and we may be required to expend substantial additional resources.

Even if we obtain regulatory approval for planned follow-on indications of Mytesi, or for Canalevia or our other product candidates, they may never achieve market acceptance. Further, even if we are successful in the ongoing commercialization of Mytesi, we may not achieve commercial success.

If we obtain necessary regulatory approvals for planned follow-on indications of Mytesi or for Canalevia or our other product candidates, such products may still not achieve market acceptance and may not be commercially successful. Market acceptance of Mytesi, Canalevia, and any of our other products depends on a number of factors, including:

- •

- the safety of our products as demonstrated in our target animal studies;

- •

- the indications for which our products are approved or marketed;

19

- •

- the potential and perceived advantages over alternative treatments or products, including generic medicines and competing products currently

prescribed by physicians or veterinarians, as applicable, and, in the case of animal products, products approved for use in humans that are used extra-label in animals;

- •

- the acceptance by physicians, veterinarians, companion animal owners, as applicable, of our products as safe and effective;

- •

- the cost in relation to alternative treatments and willingness on the part of physicians, veterinarians, patients and animal owners, as

applicable, to pay for our products;

- •

- the prevalence and severity of any adverse side effects of our products;

- •

- the relative convenience and ease of administration of our products; and

- •

- the effectiveness of our sales, marketing and distribution efforts.

Any failure by Mytesi to achieve market acceptance or commercial success would harm our financial condition and results of operations.

Human and animal gastrointestinal health products are subject to unanticipated post-approval safety or efficacy concerns, which may harm our business and reputation.