Form S-11/A SOTHERLY HOTELS LP

Table of Contents

As filed with the Securities and Exchange Commission on September 20, 2021

Registration No. 333-258195

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 2

TO

FORM S-11

FOR REGISTRATION

UNDER

THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

SOTHERLY HOTELS LP

SOTHERLY HOTELS INC.

(Exact name of Registrant as specified in its governing instruments)

306 South Henry Street

Suite 100

Williamsburg, Virginia 23185

(757) 229-5648

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

David Folsom

Chief Executive Officer

Sotherly Hotels Inc.

306 South Henry Street

Suite 100

Williamsburg, Virginia 23185

(757) 229-5648

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Thomas J. Egan, Jr., Esq. Nathaniel A. Douglas, Esq. Baker & McKenzie LLP 815 Connecticut Avenue, NW Washington, DC 20006 (202) 452-7000 |

Justin R. Salon, Esq. Emily K. Beers, Esq. Morrison & Foerster LLP 2100 L Street, NW Washington, DC 20037 (202) 827-2957 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934).

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |||

| Non-accelerated Filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed or supplemented without notice. We may not sell the securities described in this preliminary prospectus until the registration statement that we have filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities, in any state where the offer or sale of these securities is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 20, 2021

PRELIMINARY PROSPECTUS

$

SOTHERLY HOTELS LP

% Senior Unsecured Notes Due 2026

Fully and Unconditionally Guaranteed by Sotherly Hotels Inc.

Sotherly Hotels LP, which we refer to in this prospectus as the Issuer or the Operating Partnership, is offering and selling % Senior Unsecured Notes due 2026 or the notes. The notes will be issued in minimum denominations of $25 and integral multiples of $25 in excess thereof, will mature on , 2026 and will bear interest at a fixed rate of % per year. Interest on the notes will be payable quarterly in arrears, beginning , 2021. Promptly after the closing of this offering, the Issuer will deposit $ of the net proceeds from this offering, which is equal to one year of interest payments on the notes, into a reserve account administered by Wilmington Trust, National Association, in its capacity as Trustee, which funds will be used to make the first four quarterly payments on the notes.

The notes will be senior unsecured obligations of the Issuer and will rank equally in right of payment with all of the Issuer’s existing and future senior obligations, senior in right of payment to any of the Issuer’s future obligations that are by their terms expressly subordinated or junior in right of payment to the notes and effectively subordinated to any of the Issuer’s existing and future secured obligations to the extent of the value of the assets securing such obligations.

The Issuer may, at its option, on or after , redeem some or all of the notes as described in “Description of the Notes and the Guarantee–Optional Redemption.” The Issuer expects to apply to list the notes on the NASDAQ® Global Market under the symbol “SOHOL.” The Issuer expects trading in the notes to begin within 30 days of 2021, the original issue date. The Issuer may from time to time purchase the notes in the open market or otherwise.

The notes will be fully and unconditionally guaranteed on a senior unsecured basis by Sotherly Hotels Inc., the sole general partner of the Operating Partnership, which we refer to in this prospectus as Sotherly. Sotherly does not have any significant assets other than its interest in the Operating Partnership.

Investing in the notes involves certain risks. Please carefully read the “Risk Factors” section beginning on page 13 of this prospectus and the documents that are incorporated by reference into this prospectus including our Annual Report on Form 10-K for the year ended December 31, 2020 for a discussion of certain risk factors you should consider before making an investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Public Offering Price(1) |

Underwriting Discounts and Commissions(2) |

Proceeds to Issuer(3) |

||||||||||

| Per note |

$ | $ | ||||||||||

| Total |

$ | $ | ||||||||||

| (1) | Plus accrued interest, if any, from , 2021. |

| (2) | See “Underwriting” for additional disclosure regarding the underwriting discounts and expenses payable to the underwriters by us. |

| (3) | Before deducting expenses of the offering. |

The underwriters may also purchase up to an additional $ aggregate principal amount of the notes from us at the public offering price per note, less the underwriting discounts and commissions, within 30 days from the date of this prospectus, solely to cover over-allotments, if any.

It is expected that delivery of the notes in book-entry form only will be made through the facilities of The Depository Trust Company on or about , 2021 against payment therefor in immediately available funds.

Joint Bookrunners

| Piper Sandler | Janney Montgomery Scott |

The date of this prospectus is , 2021.

Table of Contents

| Page | ||||

| ii | ||||

| iv | ||||

| vi | ||||

| vii | ||||

| vii | ||||

| 1 | ||||

| 13 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| INVESTMENT POLICIES AND POLICIES WITH RESPECT TO CERTAIN ACTIVITIES |

50 | |||

| 53 | ||||

| CERTAIN PROVISIONS OF MARYLAND LAW AND OF SOTHERLY’S CHARTER AND BYLAWS |

68 | |||

| 73 | ||||

| 78 | ||||

| 94 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

i

Table of Contents

You should rely only on the information contained or incorporated by reference in this prospectus and any related free writing prospectus issued by us. Neither the underwriters nor we have authorized any other person to provide you with different or additional information. If anyone provides you with different, additional or inconsistent information, you should not rely on it. You should assume that the information appearing in this prospectus and any free writing prospectus, as well as information that we have previously filed with the U.S. Securities and Exchange Commission, or the SEC, that is incorporated by reference, is accurate only as of the date of the applicable document. Our business, financial condition, liquidity, results of operations and prospects may have changed since those respective dates. We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs. This prospectus do not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such offer or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in our affairs or that information contained herein is correct as of any time subsequent to the date hereof.

We may use market data and industry forecasts and projections throughout this prospectus and any related free writing prospectus, including data from publicly available information and industry publications. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on industry surveys and the preparers’ experience in the industry and there can be no assurance that any of the forecasts or projections will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently investigated or verified this information. If you purchase notes, your sole recourse for any alleged or actual inaccuracies in the market data and industry forecasts and projections used in this prospectus will be against us.

TRADE NAMES, LOGOS AND TRADEMARKS

All brand and trade names, logos or trademarks contained or referred to in this prospectus, as well as any document incorporated by reference in this prospectus, are the properties of their respective owners. These references shall not in any way be construed as participation by, or endorsement of, the offering of any of our securities by any of our franchisors.

“DoubleTree”, “Hilton” and “Tapestry Collection” are registered trademarks of Hilton Worldwide, Inc. or one of its affiliates. All references below to “DoubleTree”, “Hilton” or “Tapestry Collection” mean Hilton Worldwide, Inc. and all of its affiliates and subsidiaries.

“Hyatt” is the registered trademarks of Hyatt Hotels Corporation or one of its affiliates. All references below to “Hyatt” include Hyatt Hotels Corporation and all of its affiliates and subsidiaries.

“Hyde Resort & Residences” is the registered trademark of SBE Entertainment Group or one of its affiliates. All references below to “Hyde” include SBE Entertainment Group and all of its affiliates and subsidiaries.

“Sheraton” is the registered trademark of Marriott International, Inc. or one of its affiliates. All references below to “Sheraton” include Marriott International, Inc. and all of its affiliates and subsidiaries.

ii

Table of Contents

None of DoubleTree, Hilton, Tapestry Collection, Hyatt, Sheraton or Hyde, which we refer to collectively as the trademark owners, is responsible for the content of this prospectus, or for the information incorporated by reference in this prospectus, whether relating to hotel information, operating information, financial information, its relationship with us or otherwise. None of the trademark owners are involved in any way, whether as an “issuer” or “underwriter” or otherwise, in any offering by us of the securities covered by this prospectus. None of the trademark owners have expressed any approval or disapproval regarding the offering of securities pursuant to this prospectus, and the grant by any of them of any franchise or other rights to us shall not be construed as any expression of approval or disapproval. None of the trademark owners nor any of their respective officers, directors, members, managers, agents, stockholders, employees, accountants or attorneys have assumed, and none shall have, any liability in connection with the offering of securities contemplated by this prospectus. If you purchase securities in an offering pursuant to this prospectus, your sole recourse for any alleged or actual impropriety relating to any offer and sale of securities and the operation of our business will be against us (and/or, as may be applicable, the seller of such securities) and in no event may you seek to impose liability arising from or related to such activity, directly or indirectly, upon any of the trademark owners or any of their respective officers, directors, members, managers, agents, stockholders, employees, accountants or attorneys.

iii

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

We make statements in this prospectus and documents incorporated by reference herein that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, the Exchange Act. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements, which are based on certain assumptions and describe our current strategies, expectations and future plans, are generally identified by our use of words, such as “intend,” “plan,” “may,” “should,” “will,” “project,” “estimate,” “anticipate,” “believe,” “expect,” “continue,” “potential,” “opportunity,” and similar expressions, whether in the negative or affirmative, but the absence of these words does not necessarily mean that a statement is not forward-looking. The forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. The factors listed under “Risk Factors” in this prospectus and those listed in the documents incorporated by reference, as well as any cautionary language in this prospectus, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements.

Currently, one of the most significant factors that could cause actual outcomes to differ materially from the Company’s forward-looking statements is the adverse effect of the novel coronavirus (COVID-19) on the Company’s business, financial performance and condition, operating results and cash flows, the real estate market and the hospitality industry specifically, and the global economy and financial markets. The significance, extent and duration of the impacts caused by the COVID-19 outbreak on the Company will depend on future developments, which are highly uncertain and cannot be predicted with confidence at this time, including the scope, severity and duration of the pandemic, the extent and effectiveness of the actions mandated and taken to contain the pandemic or mitigate its impact, the Company’s ability to negotiate forbearance and/or modifications agreements with its lenders on acceptable terms, or at all, and the direct and indirect economic effects of the pandemic and containment measures, among others. Moreover, investors are cautioned to interpret many of the risks identified under the section titled “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 as being heightened as a result of the ongoing and numerous adverse impacts of COVID-19. Such additional factors include, but are not limited to, the ability of the Company to effectively acquire and dispose of properties; the ability of the Company to implement its operating strategy; changes in general political, economic and competitive conditions and specific market conditions; reduced business and leisure travel due to travel-related health concerns, including the widespread outbreak of COVID-19 or any other infectious or contagious diseases in the U.S. or abroad; adverse changes in the real estate and real estate capital markets; financing risks; litigation risks; regulatory proceedings or inquiries; and changes in laws or regulations or interpretations of current laws and regulations that impact the Company’s business, assets or classification as a REIT. Although the Company believes that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore there can be no assurance that such statements included in this prospectus will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the results or conditions described in such statements or the objectives and plans of the Company will be achieved. Additional factors which could have a material adverse effect on our operations and future prospects include, but are not limited to:

| • | national and local economic and business conditions that affect occupancy rates and revenues at our hotels and the demand for hotel products and services; |

| • | risks associated with the hotel industry, including competition and new supply of hotel rooms, increases in wages, energy costs and other operating costs; |

iv

Table of Contents

| • | risks associated with the level of our indebtedness and our ability to meet covenants in our debt agreements, including our recently negotiated forbearance agreements and loan modifications and, as necessary, to refinance or seek an extension of the maturity of such indebtedness or further modification of such debt agreements; |

| • | risks associated with adverse weather conditions, including hurricanes; |

| • | impacts on the travel industry from pandemic diseases, including COVID-19; |

| • | the availability and terms of financing and capital and the general volatility of the securities markets; |

| • | management and performance of our hotels; |

| • | risks associated with maintaining our system of internal controls; |

| • | risks associated with the conflicts of interest of the Company’s officers and directors; |

| • | risks associated with redevelopment and repositioning projects, including delays and cost overruns; |

| • | supply and demand for hotel rooms in our current and proposed market areas; |

| • | risks associated with our ability to maintain our franchise agreements with our third party franchisors; |

| • | our ability to acquire additional properties and the risk that potential acquisitions may not perform in accordance with expectations; |

| • | our ability to successfully expand into new markets; |

| • | legislative/regulatory changes, including changes to laws governing taxation of real estate investment trusts, or REITs; |

| • | the Company’s ability to maintain its qualification as a REIT; and |

| • | our ability to maintain adequate insurance coverage. |

These risks and uncertainties should be considered in evaluating any forward-looking statement contained in this prospectus. All forward-looking statements speak only as of the date of the respective document including such statement. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are qualified by the cautionary statements in this section. We undertake no obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date of this prospectus, except as required by law. In addition, our past results are not necessarily indicative of our future results.

v

Table of Contents

The SEC allows us to “incorporate by reference” information into this document. This means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be part of this prospectus. We incorporate by reference into this prospectus the documents listed below. The following documents filed with the SEC are incorporated by reference in this prospectus:

| • | our Annual Report on Form 10-K for the year ended December 31, 2020, or our 2020 Annual Report; |

| • | our Quarterly Report on Form 10-Q for the quarter ended March 31, 2021; |

| • |

| • | our Current Reports on Form 8-K filed with the SEC on April 28, 2021, June 9, 2021, June 17, 2021, June 21, 2021 and July 16, 2021; and |

| • |

Any statement in a document incorporated or by reference in this prospectus is deemed to be modified or superseded to the extent that a statement contained in this prospectus modifies or supersedes that statement. If any statement is modified or superseded, it does not constitute a part of this prospectus, except as modified or superseded.

You may request a copy of any or all of the information incorporated by reference into this prospectus (other than an exhibit to the filings unless we have specifically incorporated that exhibit by reference into the filing), at no cost, by writing or telephoning us at the following address:

Sotherly Hotels Inc.

306 S. Henry Street, Suite 100

Williamsburg, Virginia 23185-4046

Attention: Investor Relations/Mack Sims,

Telephone: 757-229-5648

vi

Table of Contents

Unless the context otherwise requires or where otherwise indicated, in this prospectus, all references to “Operating Partnership” or the “Issuer” means only Sotherly Hotels LP, a Delaware limited partnership. All references in this prospectus to “Sotherly” means only Sotherly Hotels Inc., a Maryland corporation and the sole general partner of the Operating Partnership. All references in this prospectus to the “Company,” “we,” “us” and “our” refer to Sotherly Hotels Inc. and its subsidiaries and predecessors, including the Operating Partnership, unless the context otherwise requires or where otherwise indicated.

There are a few differences between Sotherly and the Operating Partnership, which are reflected in the disclosure in this prospectus. We believe it is important to understand the differences between Sotherly and the Operating Partnership in the context of how Sotherly Hotels Inc. and Sotherly Hotels LP operate as an interrelated consolidated company. Sotherly Hotels Inc. is a self-managed and self-administered real estate investment trust, or REIT, whose only material asset is its ownership of partnership interests of Sotherly Hotels LP. As a result, Sotherly Hotels Inc. does not conduct business itself, other than acting as the sole general partner of Sotherly Hotels LP, and issuing public securities from time to time. As general partner with control of Sotherly Hotels LP, Sotherly consolidates Sotherly Hotels LP for financial reporting purposes. Substantially all of the Company’s operations are conducted through Sotherly Hotels LP, and Sotherly Hotels LP holds, directly or indirectly, substantially all the assets of the Company. Sotherly Hotels LP conducts the operations of the Company’s business and is structured as a limited partnership with no publicly traded equity. Except for net proceeds from public securities issuances by Sotherly Hotels Inc., which are generally contributed by Sotherly to Sotherly Hotels LP in exchange for partnership units, Sotherly Hotels LP generates the capital required by the Company’s business through Sotherly Hotels LP’s operations or by Sotherly Hotels LP’s direct or indirect incurrence of indebtedness.

This prospectus contains supplemental financial measures that are not calculated pursuant to GAAP, including FFO Available to Common Stockholders and Unitholders, Adjusted FFO Available to Common Stockholders and Unitholders, EBITDA and Hotel EBITDA.

We consider FFO Available to Common Stockholders and Unitholders, Adjusted FFO Available to Common Stockholders and Unitholders, EBITDA and Hotel EBITDA, all of which are non-GAAP financial measures, to be key supplemental measures of our performance and could be considered along with, not alternatives to, net income (loss) as a measure of our performance. These measures do not represent cash generated from operating activities determined by U.S. GAAP or amounts available for our discretionary use and should not be considered alternative measures of net income, cash flows from operations or any other operating performance measure prescribed by U.S. GAAP.

FFO and Adjusted FFO. Industry analysts and investors use Funds from Operations, or FFO, as a supplemental operating performance measure of an equity REIT. FFO is calculated in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts, or NAREIT. FFO, as defined by NAREIT, represents net income or loss determined in accordance with U.S. GAAP, excluding extraordinary items as defined under U.S. GAAP and gains or losses from sales of previously depreciated operating real estate assets, plus certain non-cash items such as real estate asset depreciation and amortization, and after adjustment for any noncontrolling interest from unconsolidated partnerships and joint ventures. Historical cost accounting for real estate assets in accordance with U.S. GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, many investors and analysts have considered the presentation of operating results for real estate companies that use historical cost accounting to be insufficient by itself.

vii

Table of Contents

We consider FFO to be a useful measure of adjusted net income (loss) for reviewing comparative operating and financial performance because we believe FFO is most directly comparable to net income (loss), which remains the primary measure of performance, because by excluding gains or losses related to sales of previously depreciated operating real estate assets and excluding real estate asset depreciation and amortization, FFO assists in comparing the operating performance of a company’s real estate between periods or as compared to different companies.

Although FFO is intended to be a REIT industry standard, other companies may not calculate FFO Available to Common Stockholders and Unitholders in the same manner as we do, and investors should not assume that FFO Available to Common Stockholders and Unitholders as reported by us is comparable to FFO as reported by other REITs.

We further adjust FFO Available to Common Stockholders and Unitholders for certain additional items that are not in NAREIT’s definition of FFO, including changes in deferred income taxes, any unrealized gain (loss) on hedging instruments or warrant derivative, loan impairment losses, losses on early extinguishment of debt, aborted offering costs, loan modification fees, franchise termination costs, costs associated with the departure of executive officers, litigation settlement, over-assessed real estate taxes on appeal, management contract termination costs, and change in control gains or losses. We exclude these items as we believe it allows for meaningful comparisons between periods and among other REITs and is more indicative than FFO of the on-going performance of our business and assets. Our calculation of Adjusted FFO Available to Common Stockholders and Unitholders may be different from similar measures calculated by other REITs.

EBITDA. We believe that excluding the effect of non-operating expenses and non-cash charges, and the portion of those items related to unconsolidated entities, all of which are also based on historical cost accounting and may be of limited significance in evaluating current performance, can help eliminate the accounting effects of depreciation and financing decisions and facilitate comparisons of core operating profitability between periods and between REITs, even though EBITDA also does not represent an amount that accrued directly to shareholders.

Hotel EBITDA. We define Hotel EBITDA as net income or loss excluding: (1) interest expense, (2) interest income, (3) income tax provision or benefit, (4) equity in the income or loss of equity investees, (5) unrealized gains and losses on derivative instruments not included in other comprehensive income, (6) gains and losses on disposal of assets, (7) realized gains and losses on investments, (8) impairment of long-lived assets or investments, (9) loss on early debt extinguishment, (10) gains or losses on change in control, (11) gain on exercise of development right, (12) corporate general and administrative expense, (13) depreciation and amortization, (14) gains and losses on involuntary conversions of assets, (15) distributions to preferred stockholders and (16) other operating revenue not related to our wholly-owned portfolio. We believe this provides a more complete understanding of the operating results over which our wholly-owned hotels and its operators have direct control. We believe Hotel EBITDA provides investors with supplemental information on the on-going operational performance of our hotels and the effectiveness of third-party management companies operating our business on a property-level basis. Our calculation of Hotel EBITDA may be different from similar measures calculated by other REITs.

viii

Table of Contents

The following summary highlights the information contained elsewhere or incorporated by reference in this prospectus. This summary does not contain all of the information that you should consider before deciding whether to invest in the notes. Before making an investment decision you should carefully read this entire prospectus and the documents incorporated by reference herein, including the information under the heading “Risk Factors” in this prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2020. You should also read the financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2020 and in our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2021 and the quarter ended June 30, 2021, each of which are incorporated by reference into this prospectus. Unless otherwise indicated, the information contained in this prospectus assumes that the underwriters’ option to purchase additional notes is not exercised.

Company Overview

The Company was formed in August 2004 to own, acquire, renovate and reposition full-service, primarily upscale and upper-upscale hotel properties located in the Mid-Atlantic and Southern United States. On December 21, 2004, Sotherly successfully completed its initial public offering and elected to be treated as a self-advised REIT for federal income tax purposes. As of June 30, 2021, Sotherly owns approximately 93.5% of the general and limited partnership units in the Operating Partnership. Limited partners (including certain of Sotherly’s officers and directors) own the remaining Operating Partnership units.

Our portfolio currently consists of twelve full-service, primarily upscale and upper-upscale hotels located in eight states with an aggregate of 3,156 rooms as well as interests in two condominium hotels and their associated rental programs. All of our hotels are wholly-owned by subsidiaries of the Operating Partnership and are managed on a day-to-day basis by Our Town Hospitality LLC, or Our Town. Our portfolio is concentrated in markets that we believe possess multiple demand generators and have significant barriers to entry for new product delivery, which are important factors for us in identifying hotel properties that we expect will be capable of providing strong risk-adjusted returns.

In order for Sotherly to qualify as a REIT, it cannot directly manage or operate our hotels. Therefore, our wholly-owned hotel properties are leased to MHI Hospitality TRS, LLC, or our TRS Lessee, and managed by Our Town, an eligible independent management company. Our TRS Lessee is wholly-owned by MHI Hospitality TRS Holding, Inc., or MHI Holding, a taxable REIT subsidiary that is wholly-owned by the Operating Partnership. Our TRS Lessee is disregarded as an entity separate from MHI Holding for U.S. federal income tax purposes.

Competitive Strengths

We believe the following factors differentiate us from other owners, acquirers and investors in hotel properties:

Stable Portfolio of High Quality Properties. Our properties consist of well-located, geographically diverse, full-service hotels predominantly in the central business districts of cities in the Mid-Atlantic and Southeastern United States. Our hotels typically offer attractive amenities such as swimming pools, fitness centers, food and beverage facilities, parking and meeting space. Since Sotherly’s initial public offering, each of our hotels has undergone a substantial renovation program to enhance the quality and performance of the property.

Longtime Relationships with Leading Full-Service Hotel Brands. Our senior management team has developed strong relationships with many of the top full-service hotels brands in the upscale to upper-upscale categories, which is characterized by such brands as Hilton, Hyatt and Sheraton, and has received numerous awards from nationally recognized hotel franchisors.

1

Table of Contents

Existing Portfolio Repositioned, Relicensed and Renovated. From 2014 through 2020, we expended approximately $102 million in capital improvements resulting in the substantial renovation and rebranding or relicensing of ten of our twelve wholly-owned properties. We believe this substantial level of capital investment and our upbranding efforts have positioned our properties to capture revenue opportunities in their respective markets and outperform our competitors as these locations mature.

Strategic Focus on Select Southern Markets. We are focusing our growth strategy on the major markets in the Southern United States, which we believe have and will continue to benefit from attractive demographic and economic growth characteristics. We believe this region also reflects an attractive business climate with respect to governmental and regulatory policies and taxation. In addition, our hotels are located near stable demand generators, such as large state universities, convention centers, corporate headquarters, sports venues and office parks and in markets that we believe have significant barriers to entry for new product delivery.

Experienced Management Team. We believe the Company’s and its predecessor’s longevity in the industry and its success through many market cycles, together with management’s experience in the lodging industry, is indicative of the Company’s conservative and disciplined approach toward hotel acquisition, ownership and operation. The members of our senior management team, led by Messrs. Sims, Folsom and Domalski, have significant experience in the lodging, capital markets, finance, and accounting industries, and have worked together at Sotherly since 2006. Mr. Sims, Sotherly’s chairman, has spent his entire career with Sotherly and its predecessor, and has over 40 years of experience in the lodging industry as an operator, owner, developer, and financier. Mr. Folsom has nearly 15 years of experience with Sotherly and 20 years of experience working in public real estate companies and in the real estate capital markets. Mr. Domalski has nearly 35 years of experience as an accountant and auditor and has worked at Sotherly since 2005.

Our Strategy and Investment Criteria

Our strategy is to grow through acquisitions of full-service, upscale and upper-upscale hotel properties located in the primary markets of the southern United States. We intend to grow our portfolio through disciplined acquisitions of hotel properties and believe that we will be able to source significant external growth opportunities through our management team’s extensive network of industry, corporate and institutional relationships. Current market conditions and the terms of our loan agreements limit our ability to pursue our growth strategy, but as economic conditions improve and demand and consumer confidence increase, we intend to position the Company to execute on our growth strategy.

Our investment criteria are further detailed below:

| • | Geographic Growth Markets: Our growth strategy focuses on the major markets in the Southern region of the United States. Our management team remains confident in the long-term growth potential associated with this part of the United States. We believe these markets have, during the Company’s and our predecessors’ existence, been characterized by population growth, economic expansion, growth in new businesses and growth in the resort, recreation and leisure segments. We will continue to focus on these markets, including coastal locations, and will investigate other markets for acquisitions only if we believe these new markets will provide similar long-term growth prospects. |

| • | Full-Service Hotels: Our acquisition strategy focuses on the full-service hotel segment. Our full-service hotels fall primarily under the upscale to upper-upscale categories and include such brands as Hilton, Doubletree by Hilton, Tapestry Collection, Sheraton, Hyatt and Hyde, as well as independent hotels affiliated with Preferred Hotels & Resorts. We may also acquire commercial unit(s) within upscale to upper-upscale condominium hotel projects, allowing us to establish and operate unit rental programs. We do not own economy hotels. We believe that full-service hotels, in the upscale to upper-upscale categories, will outperform the broader U.S. hotel industry, and thus offer higher returns on invested capital. |

2

Table of Contents

| • | Significant Barriers to Entry: We intend to execute a strategy that entails the acquisition of hotels in prime locations with significant barriers to entry. |

| • | Proximity to Demand Generators: We seek to acquire hotel properties located in central business districts for both leisure and business travelers within the respective markets, including large state universities, airports, convention centers, corporate headquarters, sports venues and office buildings. We seek to be in walking locations that are proximate to the markets’ major demand generators. |

We generally have a bias toward acquiring underperforming hotels, which we typically define as those that are poorly managed, suffer from significant deferred maintenance and capital investment and that are not properly positioned in their respective markets. In pursuing these opportunities, we hope to improve revenue and cash flow and increase the long-term value of the underperforming hotels we acquire. Our ultimate goal is to achieve a total investment that is substantially less than replacement cost of a hotel or the acquisition cost of a market performing hotel. In analyzing a potential investment in an underperforming hotel property, we typically characterize the investment opportunity as one of the following:

| • | Branding Opportunity: The acquisition of properties that includes a repositioning of the property through a change in brand affiliation, which may include positioning the property as an independent hotel. Branding opportunities typically include physical upgrades and enhanced efficiencies brought about by changes in operations. |

| • | Shallow-Turn Opportunity: The acquisition of an underperforming but structurally sound hotel that requires moderate renovation to re-establish the hotel in its market. |

| • | Deep-Turn Opportunity: The acquisition of a hotel that is closed or functionally obsolete and requires a restructuring of both the business components of the operations as well as the physical plant of the hotel, including extensive renovation of the building, furniture, fixtures and equipment. |

Typically, in our experience, a deep turn opportunity takes a total of approximately four years from the initial acquisition of a property to achieving full post-renovation stabilization. Therefore, when evaluating future opportunities in underperforming hotels, we intend to focus on up-branding and shallow-turn opportunities, and to pursue deep-turn opportunities on a more limited basis and in joint venture partnerships, if possible.

Investment Vehicles. In pursuit of our investment strategy, we may employ various traditional and non-traditional investment vehicles:

| • | Direct Purchase Opportunity: Our traditional investment strategy is to acquire direct ownership interests via our Operating Partnership in properties that meet our investment criteria, including opportunities that involve full-service, upscale and upper-upscale properties in identified geographic growth markets that have significant barriers to entry for new product delivery. Such properties, or portfolio of properties, may or may not be acquired subject to a mortgage, or other financing or lending instruments, by the seller or third-party. |

| • | Joint Venture/Mezzanine Lending Opportunities: We may, from time to time, undertake a significant renovation and rehabilitation project that we characterize as a deep-turn opportunity. In such cases, we may acquire a functionally obsolete hotel whose renovation may be very lengthy and require significant capital. In these projects, we may choose to structure such acquisitions as a joint venture, or mezzanine lending program, in order to avoid severe short-term dilution and loss of current income commonly referred to as the “negative carry” associated with such extensive renovation programs. We will not pursue joint venture or mezzanine programs in which we would become a “de facto” lender to the real estate community. |

3

Table of Contents

Portfolio and Asset Management Strategy

We intend to ensure that the management of our hotel properties maximizes market share, as evidenced by revenue per available room, or RevPAR, penetration indices, and that our market share yields the optimum level of revenues for our hotels in their respective markets. Our strategy is designed to actively monitor our hotels’ operating expenses in an effort to maximize hotel earnings before interest, taxes, depreciation and amortization, or Hotel EBITDA.

Over our long history in the lodging industry, we have refined many portfolio and asset management techniques that we believe provide for exceptional cash returns at our hotels. We undertake extensive budgeting due diligence wherein we examine market trends, one-time or exceptional revenue opportunities, and/or changes in the regulatory climate that may impact costs. We review daily revenue results and revenue management strategies at the hotels, and we focus on our managers’ ability to produce high quality revenues that translate to higher profit margins. We look for ancillary forms of revenues, such as leasing roof-top space for cellular towers and other communication devices and also look to lease space to third parties in our hotels, which may include, but are not limited to, gift shops or restaurants. We have and will continue to engage parking management companies to maximize parking revenue. Our efforts further include periodic review of property insurance costs and coverage, and the cost of real and personal property taxes. We generally appeal tax increases in an effort to secure lower tax payments and routinely pursue strategies that allow for lower overall insurance costs, such as purchasing re-insurance.

We also require detailed and refined reporting data from our hotel manager, which includes detailed accounts of revenues, revenue segments, expenses and forecasts based on current and historic booking patterns. We also believe we optimize and successfully manage capital costs at our hotels while ensuring that adequate product standards are maintained to provide a positive guest experience.

None of our hotels are managed by a major national or global hotel franchise company. Through our long history in the lodging industry, we have found that management of our hotels by management companies other than franchisors is preferable to and more profitable than management services provided by the major franchise companies, specifically with respect to optimization of operating expenses and the delivery of guest service.

Our portfolio management strategy includes efforts to optimize labor costs. Our third-party hotel manager is responsible for hiring and maintaining the labor force at each of our hotels. Although we do not directly employ or manage employees at our hotels, we monitor our hotel manager and make recommendations regarding the operation of our hotels. The labor force in our hotels is predominately non-unionized, with only one property, the DoubleTree by Hilton Jacksonville Riverfront, having approximately 31 employees electing to participate under a collective bargaining arrangement. Further, the employees at our hotels are eligible to receive health and other insurance coverage through our manager, which self-insures. Self-insuring has, in our opinion and experience, provided significant savings over traditional insurance company sponsored plans.

Asset Disposition Strategy. When a property no longer fits with our investment objectives, we will pursue a direct sale of the property for cash so that our investment capital can be redeployed according to the investment strategies outlined above. Where possible, we will seek to subsequently purchase a hotel in connection with the requirements of a tax-free exchange. Such a strategy may be deployed in order to mitigate the tax consequence that a direct sale may cause.

4

Table of Contents

Our Properties

As of the date of this prospectus, our portfolio consisted of the following properties:

| Property |

Number of Rooms |

Location | Date of Acquisition | Chain/ Class Designation |

||||||||||||

| Wholly-owned Hotels |

||||||||||||||||

| The DeSoto |

246 | Savannah, GA | December 21, 2004 | Upper Upscale(1) | ||||||||||||

| DoubleTree by Hilton Jacksonville Riverfront |

293 | Jacksonville, FL | July 22, 2005 | Upscale | ||||||||||||

| DoubleTree by Hilton Laurel |

208 | Laurel, MD | December 21, 2004 | Upscale | ||||||||||||

| DoubleTree by Hilton Philadelphia Airport |

331 | Philadelphia, PA | December 21, 2004 | Upscale | ||||||||||||

| DoubleTree by Hilton Raleigh Brownstone-University |

190 | Raleigh, NC | December 21, 2004 | Upscale | ||||||||||||

| DoubleTree Resort by Hilton Hollywood Beach |

311 | Hollywood, FL | August 9, 2007 | Upscale | ||||||||||||

| Georgian Terrace |

326 | Atlanta, GA | March 27, 2014 | Upper Upscale(1) | ||||||||||||

| Hotel Alba Tampa, Tapestry Collection by Hilton |

222 | Tampa, FL | October 29, 2007 | Upscale | ||||||||||||

| Hotel Ballast Wilmington, Tapestry Collection by Hilton |

272 | Wilmington, NC | December 21, 2004 | Upscale | ||||||||||||

| Hyatt Centric Arlington |

318 | Arlington, VA | March 1, 2018 | Upper Upscale | ||||||||||||

| Sheraton Louisville Riverside(3) |

180 | Jeffersonville, IN | September 20, 2006 | Upper Upscale | ||||||||||||

| The Whitehall |

259 | Houston, TX | November 13, 2013 | Upper Upscale(1) | ||||||||||||

|

|

|

|||||||||||||||

| Hotel Rooms Subtotal |

3,156 | |||||||||||||||

|

|

|

|||||||||||||||

| Condominium Hotels |

||||||||||||||||

| Hyde Resort & Residences |

129 | (2) | Hollywood, FL | January 30, 2017 | Luxury(1) | |||||||||||

| Hyde Beach House Resort & Residences |

135 | (2) | Hollywood, FL | September 27, 2019 | Luxury(1) | |||||||||||

|

|

|

|||||||||||||||

| Total Hotel & Participating Condominium Hotel Rooms |

3,420 | |||||||||||||||

|

|

|

|||||||||||||||

5

Table of Contents

| (1) | Operated as an independent hotel. |

| (2) | We own the hotel commercial unit and operate a rental program. Reflects only those condominium units that were participating in the rental program as of June 30, 2021. At any given time, some portion of the units participating in our rental program may be occupied by the unit owner(s) and unavailable for rental to hotel guests. We sometimes refer to each participating condominium unit as a “room”. |

| (3) | The Company entered into a purchase and sale agreement for the disposition of the Sheraton Louisville Riverside, dated June 15, 2021 as amended by the amended and restated purchase and sale agreement dated July 9, 2021, for a net purchase price of $11.5 million, including the assumption or payoff by the purchaser of the outstanding balance of approximately $11.0 million on the existing mortgage and approximately $500,000 in cash. The closing of the sale, which was subject to various closing conditions, including the assumption by the purchaser of the existing mortgage on the property or securing of alternative financing to replace the existing mortgage on the property, was scheduled to take place on September 13, 2021. We are currently in negotiations with the purchaser to amend the purchase and sale agreement in order to extend the term during which closing may take place. |

The selected operating data presented above should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” found in our Annual Report on Form 10-K for the year ended December 31, 2020 and in our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2021 and the quarter ended June 30, 2021, each of which are incorporated herein by reference.

COVID-19 Impact

In March 2020, the World Health Organization declared COVID-19 to be a global pandemic and the virus has continued to spread throughout the United States and the world. As a result of this pandemic and subsequent government mandates and health official recommendations, hotel demand has been significantly reduced. Following the government mandates and health official recommendations, we significantly reduced operations at all our hotels, temporarily suspended operations of our hotel condominium rental programs and dramatically reduced staffing and expenses. All of our hotels have remained open on a limited basis in order to serve the needs of the community, with the exception of the rental programs at our condominium hotels, which were temporarily closed during April and May of 2020. We believe that maintaining limited operations has allowed us to increase capacity at individual hotels as demand has begun to return and the Centers for Disease Control, or the CDC, and state guidelines have started to permit an easing of travel and other business restrictions. Our hotels have been gradually re-introducing guest amenities relative to the return of business while focusing on profit generators and margin control and we intend to continue those re-introductions, provided we can be confident that occupancy levels and reduced social distancing will not unduly jeopardize the health and safety of our guests, employees and communities.

COVID-19 has had a significant negative impact on our operations and financial results, including a substantial decline in our revenues, profitability and cash flows from operations compared to similar pre-pandemic periods.

In response to those negative impacts, in March 2020 we took a number of actions to reduce costs and preserve liquidity. The Company’s board of directors suspended quarterly cash dividends on shares of the Company’s common stock and deferred payment of dividends on the Company’s 8.0% Series B Cumulative Redeemable Perpetual Preferred Stock, or the Series B Preferred Stock, 7.875% Series C Cumulative Redeemable Perpetual Preferred Stock, or the Series C Preferred Stock, and 8.25% Series D Cumulative Redeemable Perpetual Preferred Stock, or the Series D Preferred Stock. We also suspended most planned capital expenditure projects and reduced the cash compensation of our executive officers. Three of our subsidiaries obtained funding under the Federal Paycheck Protection Program, or the PPP Loans, provided pursuant to the Coronavirus Aid, Relief and Economic Security Act, as amended, or the CARES Act, and, in December 2020 the Operating Partnership closed on a $20.0 million secured note financing in which the Operating Partnership issued

6

Table of Contents

$20.0 million aggregate principal amount of secured notes, which we refer to as the Secured Notes, to certain investors, with an option for the Operating Partnership to require such investors to purchase an additional $10.0 million of Secured Notes prior to the end of 2021. As of the date of this prospectus, we have not exercised such option and there are an aggregate of $20.0 million Secured Notes outstanding. Working closely with our hotel manager, we significantly curtailed our hotels’ operating expenses. We also sought and obtained forbearance and loan modification agreements with the lenders under the mortgages for all our hotel properties. Based on our completed mortgage loan amendments and forbearance agreements, our current unrestricted and restricted cash, our current cash utilization, our forecast of future operating results and our anticipated ability to refinance or extend mortgage obligations maturing within the 12 months following the date of this prospectus, we have concluded that the previously-reported substantial doubt of the Company’s ability to continue as a going concern has been alleviated. As of June 30, 2021, the Company had approximately $21.8 million in unrestricted cash and approximately $11.7 million in restricted cash.

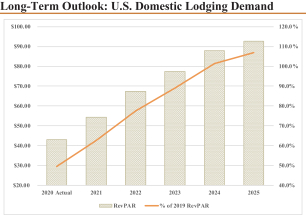

We believe that long-term recovery of the sector is underway based on better-than-expected first half 2021 results. As such, CBRE has updated and improved its current forecast for 2021 based on the pace of vaccine distribution, increased consumer confidence, and improved corporate and group travel segments. Per the graph below, CBRE predicts U.S. Domestic Lodging Demand to recover to 2019 RevPAR levels by mid 2024.

Source: CBRE Hotels Research, Kalibri Labs, July 2021

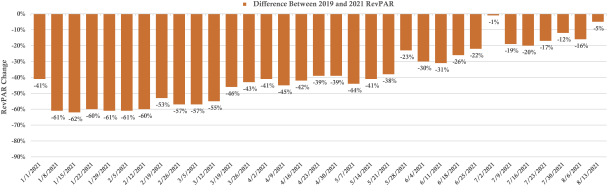

Further, CBRE reported that industry-wide weekly year-over-year percentage change in RevPAR continued to improve during the summer months and neared 2019 levels (see below).

Source: CBRE Hotels Research, Kalibri Labs, September 2021

7

Table of Contents

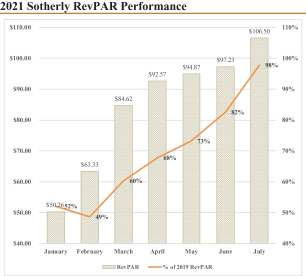

Further, conditions in the second quarter of 2021 improved significantly over the same period in the prior year, as the Company witnessed increased demand fueled predominantly by leisure travel. Revenues, profitability, and cash flows from operations during the second quarter of 2021 exceeded our expectations but were still far below the same period in 2019, before the pandemic. While the extent and duration of the negative effects resulting from COVID-19 on the Company’s business remain uncertain, the second quarter’s operations and financial results were a marked improvement over the same period in 2020. In fact, our key operating metric, RevPAR, paced ahead of the U.S. lodging industry during the second quarter of 2021 as our year-to-date RevPAR performance has improved each month this year through July (see chart below).

Source: Disclosures incorporated by reference and included in this prospectus.

As reflected in the above chart, RevPAR performance for the Company’s composite portfolio, which includes the rooms participating in our rental programs at the Hyde Resort & Residences and the Hyde Beach House Resort & Residences, was $106.50 for the month ended July 31, 2021, which represented an increase of $73.42, or 221.9%, over the same month in 2020. While that represents a substantial recovery from the same period in 2020, it is $2.44, or 22%, below the RevPAR performance for the same month in 2019, before the pandemic.

Facts and circumstances could change in the future that are outside the Company’s control – such as additional government mandates, health official orders, travel restrictions and extended business shutdowns due to COVID-19.

Recent Developments

On June 21, 2021, Sotherly and the Operating Partnership entered into a share exchange agreement with Palogic Value Fund, L.P., a Delaware limited partnership, Palogic, pursuant to which, Palogic agreed to exchange 100,000 shares of Sotherly’s 8.0% Series B Cumulative Redeemable Perpetual Preferred Stock, 85,000 shares of the Company’s 7.875% Series C Cumulative Redeemable Perpetual Preferred Stock, and 35,000 shares of the Company’s 8.25% Series D Cumulative Redeemable Perpetual Preferred Stock, the Palogic Shares, together with all of Palogic’s rights to receive accrued and unpaid dividends on those Palogic Shares, for 1,542,727 shares of Sotherly’s common stock, par value $0.01 per share. The transactions contemplated by share exchange agreement, which we refer to as the Preferred Exchange, closed on June 22, 2021.

8

Table of Contents

Sotherly did not receive any cash proceeds as a result of the Preferred Exchange, and the Palogic Shares exchanged have been retired and cancelled. The issuance of the shares of Sotherly’s common stock was made by Sotherly pursuant to the exemption from the registration requirements of the Securities Act contained in Section 3(a)(9) of such act on the basis that these offers constituted an exchange with existing holders of Sotherly’s securities, and no commission or other remuneration was paid to any party for soliciting such exchange.

Summary Risk Factors

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may materially and adversely affect our business, financial condition, results of operation, cash flows and prospects. You should carefully consider the matters discussed in the “Risk Factors” section of this prospectus and of our 2020 Annual Report which is incorporated by reference in this prospectus before making an investment decision.

Risks Related to the Notes and the Offering

| • | Risks related to the structural subordination of the notes. |

| • | Risks related to Sotherly’s operations. |

| • | Risks related to voidance of the guarantee. |

| • | Risks related to financial covenants in the notes. |

| • | Risks related to Operating Partnership’s ability to repurchase the notes in the event of a change of control. |

| • | Risks related to market conditions. |

| • | Risks related to the trading market of the notes. |

| • | Risks related to interest rates. |

Risks Related to Our Debt and Financing

| • | Risks related to our financial leverage. |

| • | Risks related to our forbearance agreements. |

| • | Risks related to our financial covenants. |

| • | Risks related to our debt maturities. |

| • | Risks related to our borrowing costs. |

| • | Risks related to interest rates. |

Our Partnership Information

The Issuer is a Delaware limited partnership formed in August 2004. The Issuer changed its name from MHI Hospitality, L.P. to Sotherly Hotels LP effective August 2, 2013. Our principal executive offices are located at 306 South Henry Street, Suite 100, Williamsburg, VA 23185. Our telephone number is (757) 229-5648. Our website is http://www.sotherlyhotels.com. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated into, this prospectus.

Employees

We currently employ ten full-time persons. All persons employed in the day-to-day operations of the hotels are employees of Our Town, the management company engaged by our TRS Lessee to operate such hotels.

9

Table of Contents

The Offering

The following summary contains basic information about the notes, the guarantee and the offering and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the notes and the guarantee, you should read the section of this prospectus entitled “Description of the Notes and the Guarantee.”

| Issuer | Sotherly Hotels LP, a Delaware limited partnership | |

| Securities Offered | $ million aggregate principal amount of the notes (or $ million if the underwriters’ option to purchase additional notes is exercised in full). | |

| Maturity Date | , 2026. | |

| Interest Rate | % per annum, computed on the basis of a 360-day year of twelve 30-day months, from . | |

| Interest Payment Dates | , , , and of each year, commencing , 2021. | |

| Price to Public | % of the principal amount, plus accrued interest, if any, from , 2021. | |

| Ranking | The notes will be senior unsecured obligations of Sotherly Hotels LP, will rank equally in right of payment with the Issuer’s other senior obligations, senior in right of payment to any of the Issuer’s future obligations that are by their terms expressly subordinated or junior in right of payment to the notes and effectively subordinated to any of the Issuer’s existing and future secured obligations to the extent of the value of the assets securing such obligations, and will be structurally subordinated to all obligations of our subsidiaries. As of June 30, 2021, we had outstanding principal debt balances of approximately $387.5 million, which is comprised of approximately $20.0 million under the Secured Notes, approximately $356.8 million of mortgage debt secured by our properties, and approximately $10.7 million of unsecured indebtedness. Of the approximately $387.5 million indebtedness outstanding at June 30, 2021, approximately $367.2 million was held by our subsidiaries and approximately $20.0 million relates to the Secured Notes of the Operating Partnership. | |

| Guarantee | The notes will be fully and unconditionally guaranteed by Sotherly on a senior unsecured basis as described under “Description of the Notes and the Guarantee—Guarantee.” Sotherly does not have any significant assets other than its interest in the Operating Partnership. | |

| Use of Proceeds | We estimate that the net proceeds from the offering of the notes pursuant to this prospectus, after deducting the underwriting discount and estimated offering costs and expenses payable by us, will be approximately $ (or $ if the underwriters’ option to purchase additional notes is exercised in full). We intend to use the net proceeds from this offering to further strengthen our balance sheet, including repaying $20.0 million of outstanding secured indebtedness under our Secured Notes plus any accrued but unpaid interest and any make-whole amounts or premium then due and payable on such indebtedness, which we estimate to be approximately $9.7 million. We also intend to use $ of the net proceeds from this offering to fund the deposit of one year of interest payments into a reserve account administered by Wilmington Trust, National Association, in its capacity as Trustee, from which the first four quarterly payments on the notes will be paid and | |

10

Table of Contents

| the remaining net proceeds from the offering of the notes for general corporate purposes. See “Use of Proceeds” in this prospectus. | ||

| Optional Redemption | The Issuer may, at its option, redeem the notes in whole or in part at any time, or from time to time, on or after , at a redemption price equal to % of the principal amount of the notes to be redeemed plus accrued and unpaid interest thereon to the date of redemption as described in “Description of the Notes and the Guarantees—Optional Redemption” in this prospectus. The notes will not be entitled to the benefit of any sinking fund. The notes will not be subject to repayment at the option of the holder at any time prior to maturity, except in connection with a Change of Control Repurchase Event as defined under “Description of the Notes and the Guarantees—Certain Covenants—Offer to Repurchase Upon a Change of Control Repurchase Event” in this prospectus. | |

| Change of Control Offer to Purchase | If a Change of Control Repurchase Event as defined under “Description of the Notes and the Guarantee—Certain Covenants—Offer to Repurchase Upon a Change of Control Repurchase Event” occurs, we must offer to repurchase the notes at a repurchase price equal to % of the aggregate principal amount plus any accrued and unpaid interest to, but not including, the repurchase date. | |

| Default | The notes will contain events of default, the occurrence of which may result in the acceleration of our obligations under the notes in certain circumstances. See “Description of the Notes and the Guarantee—Events of Default; Modification and Waiver” in this prospectus. | |

| Certain Covenants | We will issue the notes under an indenture, which is referred to as the Indenture, to be dated as of the issue date, between the Issuer, Sotherly, as guarantor, and Wilmington Trust, National Association, as the trustee. The Indenture contains covenants that limit our ability to incur, or permit our subsidiaries to incur, third-party indebtedness if certain debt to asset value and/or interest coverage ratios would be exceeded. These covenants are subject to a number of important exceptions, qualifications, limitations and specialized definitions. See “Description of the Notes and the Guarantee—Certain Covenants” in this prospectus. | |

| Form | The notes will be evidenced by global notes deposited with the trustee for the notes, as custodian for The Depository Trust Company, or DTC. Beneficial interests in the global notes will be shown on, and transfers of those beneficial interests can only be made through, records maintained by DTC and its participants. See “Description of the Notes and the Guarantee—Book-entry, Delivery and Form” in this prospectus. | |

| Denominations | We will issue the notes only in minimum denominations of $25 and integral multiples of $25 in excess thereof. | |

| Payment of Principal and Interest | Principal and interest on the notes will be payable in U.S. dollars or other legal tender, coin or currency of the United States of America. | |

| Interest Reserve Account | Promptly after the closing of this offering, the Issuer will deposit $ of the net proceeds from this offering, which is equal to one year of interest payments on the notes, into a reserve account administered by Wilmington Trust, National Association, in its capacity as Trustee, which funds will be used to make the first four quarterly payments on the notes. | |

| Future Issuances | We may, from time to time, without notice to or consent of the holders, increase the aggregate principal amount of the notes outstanding by issuing additional notes in the | |

11

Table of Contents

| future with the same terms as the notes, except for the issue date and offering price, and such additional notes shall be consolidated with the notes issued in this offering and form a single series. | ||

| Listing | We have applied to list the notes on the NASDAQ® Global Market under the symbol “SOHOL.” If the listing is approved, trading of the notes on the NASDAQ® Global Market is expected to commence within a 30-day period after the initial delivery of the notes. Currently, there is no public market for the notes. | |

| Trustee, Registrar and Paying Agent | Wilmington Trust, National Association. | |

| Governing Law | The Indenture, the notes and the guarantee will be governed by the laws of the State of New York. The Indenture will be subject to the provisions of the Trust Indenture Act of 1939, as amended. | |

| Material Tax Considerations | You should consult your tax advisors concerning the U.S. federal income tax consequences of owning the notes in light of your own specific situation, as well as consequences arising under the laws of any other taxing jurisdiction. See “Material U.S. Federal Income Tax Considerations.” | |

| Risk Factors | An investment in the notes involves certain risks. You should carefully consider the risks described under “Risk Factors” beginning on page 13 of this prospectus before making an investment decision. | |

12

Table of Contents

An investment in the notes involves various risks. The following are the material risks that apply to an investment in the notes. You should carefully consider the risks described below, together with the information under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020 and in subsequent Quarterly Reports on Form 10-Q and the other information included or incorporated by reference in this prospectus before making a decision to invest in the notes. Any of the following risks could materially adversely affect our business, operations, industry or financial position or our future financial performance.

Risks Related to the Notes and the Offering

The notes are senior unsecured obligations of the Operating Partnership and not obligations of our subsidiaries and will be effectively subordinated to the Operating Partnership’s existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness and structurally subordinated to any future obligations of the Operating Partnership’s subsidiaries. Structural subordination increases the risk that we will be unable to meet our obligations on the notes when they mature.

The notes will be senior unsecured obligations of the Operating Partnership and will rank equally in right of payment with all of the Operating Partnership’s other senior indebtedness and senior in right of payment to any of the Operating Partnership’s future obligations that are by their terms expressly subordinated or junior in right of payment to the notes. The notes will be effectively subordinated to the Operating Partnership’s existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness. At June 30, 2021, we had outstanding principal debt balances of approximately $387.5 million, which is comprised of approximately $20.0 million under the Secured Notes, $356.8 million of mortgage debt secured by properties owned by our subsidiaries, and approximately $10.7 million of unsecured debt.

The notes will be obligations of the Operating Partnership that are guaranteed by Sotherly and not of any of its subsidiaries. None of the Operating Partnership’s subsidiaries will be a guarantor of the notes and the notes are not required to be guaranteed by any subsidiaries we or the Operating Partnership may acquire or create in the future. The notes will also be effectively subordinated to all of the liabilities of the Operating Partnership’s subsidiaries, to the extent of their assets, since they are separate and distinct legal entities with no obligation to pay any amounts due under the Issuer’s indebtedness, including the notes, or to make any funds available to make payments on the notes, whether by paying dividends or otherwise. Several of our forbearance and loan modification agreements include restrictions on distributions by subsidiaries of the Operating Partnership and the Operating Partnership guaranteed obligations of certain subsidiaries under some of the loan modification agreements. The Operating Partnership’s right to receive any assets of any subsidiary in the event of a bankruptcy or liquidation of the subsidiary, and therefore the right of the Operating Partnership’s creditors to participate in those assets, will be effectively subordinated to the claims of that subsidiary’s creditors, including trade creditors, in each case to the extent that the Operating Partnership is not recognized as a creditor of such subsidiary. In addition, even where the Operating Partnership is recognized as a creditor of a subsidiary, the Operating Partnership’s rights as a creditor with respect to certain amounts are subordinated to other indebtedness of that subsidiary, including secured indebtedness to the extent of the assets securing such indebtedness. As of June 30, 2021, $355 million of our consolidated debt was in the form of mortgages secured by properties owned by subsidiaries of the Operating Partnership, and none of our properties were unencumbered as of June 30, 2021.

Sotherly has no significant operations, other than as the sole general partner of the Operating Partnership, and no significant assets, other than its interest in the Operating Partnership.

The notes will be fully and unconditionally guaranteed by Sotherly. However, Sotherly has no significant operations, other than as the sole general partner of the Operating Partnership, and no significant assets, other than its interest in the Operating Partnership. Furthermore, Sotherly’s guarantee of the notes will be effectively

13

Table of Contents

subordinated in right of payment to all liabilities, whether secured or unsecured, and any preferred equity of its subsidiaries (including the Operating Partnership and any entity Sotherly accounts for under the equity method of accounting). As of June 30, 2021, the Company’s subsidiaries had approximately $367.2 million of total liabilities (excluding unamortized debt premiums and discounts, intercompany debt, guarantees of debt of the Operating Partnership, accrued expenses and trade payables) and no preferred equity of such subsidiaries was outstanding.

Federal and state statutes allow courts, under specific circumstances, to void guarantees and require holders of indebtedness and lenders to return payments received from guarantors.

Under the federal bankruptcy law and comparable provisions of state fraudulent transfer laws, a guarantee, such as the guarantee provided by Sotherly, could be voided, and payment thereon could be required to be returned to the guarantor or to a fund for the benefit of the creditors of the guarantor, if, among other things, the guarantor, at the time it incurred the indebtedness evidenced by its guarantee (i) received less than reasonably equivalent value or fair consideration for the incurrence of the guarantee and (ii) one of the following was true:

| • | the guarantor was insolvent or rendered insolvent by reason of the incurrence of the guarantee; |

| • | the guarantor was engaged in a business or transaction for which the guarantor’s remaining assets constituted unreasonably small capital; or |

| • | the guarantor intended to incur, or believed that it would incur, debts beyond its ability to pay those debts as they mature. |

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a guarantor would be considered insolvent if:

| • | the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all of its assets; |

| • | the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they became absolute and mature; or |

| • | it could not pay its debts as they become due. |

A court might also void such guarantee, without regard to the above factors, if it found that a guarantor entered into its guarantee with actual intent to hinder, delay, or defraud its creditors.

A court would likely find that a guarantor did not receive reasonably equivalent value or fair consideration for its guarantee unless it benefited directly or indirectly from the issuance or incurrence of such indebtedness. If a court voided such guarantee, holders of the indebtedness and lenders would no longer have a claim against such guarantor or the benefit of the assets of such guarantor constituting collateral that purportedly secured such guarantee. In addition, the court might direct holders of the indebtedness and lenders to repay any amounts already received from a guarantor.