Form S-1 Columbia Care Inc.

Table of Contents

As filed with the Securities and Exchange Commission on May 19, 2022

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Columbia Care Inc.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | 0100 | 98-1488978 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

680 Fifth Ave., 24th Floor

New York, New York 10019

(212) 634-7100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Derek Watson

Chief Financial Officer

Columbia Care LLC

680 Fifth Ave., 24th Floor

New York, New York 10019

(212) 634-7100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

James Guttman

Dorsey & Whitney LLP

TD Canada Trust Tower

Brookfield Place, 161 Bay Street, Suite 4310

Toronto, Ontario

Canada, M5J 2S1

(416) 367-7376

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act ☐

Table of Contents

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED MAY 19, 2022

PROSPECTUS

18,755,082 Common Shares

Columbia Care Inc.

This prospectus relates to 18,755,082 Common Shares of Columbia Care Inc., a British Columbia, Canada corporation, that may be sold from time to time by the selling securityholders set forth in this prospectus under the heading “Selling Securityholders ” beginning on page 20 which we refer to as the “Selling Securityholders.”

We will not receive any proceeds from the sale of the securities under this prospectus.

Information regarding the Selling Securityholders, the amounts of Common Shares that may be sold by them and the times and manner in which they may offer and sell the Common Shares under this prospectus is provided under the sections titled “Selling Securityholders” and “Plan of Distribution,” respectively, in this prospectus. We have not been informed by any of the Selling Securityholders that they intend to sell their securities covered by this prospectus and do not know when or in what amounts the Selling Securityholders may offer the securities for sale. The Selling Securityholders may sell any, all, or none of the securities offered by this prospectus.

The Selling Securityholders and intermediaries through whom such securities are sold may be deemed “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation. We have agreed to indemnify the Selling Securityholders against certain liabilities, including liabilities under the Securities Act.

Columbia Care Inc.’s common shares are listed on the NEO Exchange Inc. (the “NEO”) under the symbol “CCHW”, on the Canadian Securities Exchange (the “CSE”) under the symbol “CCHW”, and are quoted on the OTCQX Best Market (the “OTCQX”) under the symbol “CCHWF” and on the Frankfurt Stock Exchange under the symbol “3LP”. On May 18, 2022, the last reported sale price of our Common Shares on the CSE was C$2.49 per share.

Investing in our securities involves a high degree of risk. See the section titled “Risk Factors,” which begins on page 13.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

You should rely only on the information contained in this prospectus. We have not authorized any dealer, salesperson or other person to provide you with information concerning us, except for the information contained in this prospectus. The information contained in this prospectus is complete and accurate only as of the date on the front cover page of this prospectus, regardless of the time of delivery of this prospectus or the sale of any securities. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is , 2022

Table of Contents

Table of Contents

FORWARD-LOOKING STATEMENTS

This registration statement includes “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities laws and United States securities laws (collectively, “forward-looking information”). All information, other than statements of historical facts, included in this registration statement that addresses activities, events or developments that the Company expects or anticipates will or may occur in the future is forward-looking information. Forward-looking information is often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or similar expressions or phrases. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and assumptions that are difficult to predict. Particular risks and uncertainties that could cause our actual results to be materially different from those expressed in our forward-looking statements include those listed below:

| • | the satisfaction of the conditions precedent to the closing of the Arrangement (as defined herein); |

| • | the receipt of the Key Regulatory Approvals (as defined herein); |

| • | the impact of the Arrangement (as defined herein), or failure to complete the Arrangement (as defined herein), on the market price of the Common Shares; |

| • | the closing of the Arrangement (as defined herein); |

| • | the impact of the Arrangement (as defined herein) on the Company’s current and future operations, financial condition and prospects; |

| • | the impact of restrictions on the Company during the pending Arrangement (as defined herein); |

| • | the value of the Cresco Labs Subordinate Voting Shares (as defined herein); |

| • | the impact of epidemic diseases, such as the recent COVID-19 pandemic; |

| • | the impact of potential payments to the Company’s shareholders who exercise dissent rights in onnection with the Arrangement (as defined herein); |

| • | the availability of another attractive take-over, merger or business combination; |

| • | the costs of the Arrangement and potential payment of the Columbia Care Termination Fee (as defined herein); |

| • | the ability of former Columbia Care shareholders to significantly influence certain corporate actions of Cresco Labs (as defined herein) following the completion of the Arrangement (as defined herein); |

| • | the ability to successfully integrate with the operations of Cresco Labs (as defined herein) and realize the expected benefits of the Arrangement (as defined herein); |

| • | integration costs in connection with the Arrangement (as defined herein); |

| • | the fact that marijuana remains illegal under federal law; |

| • | the enforcement of cannabis laws, including by U.S. border officials; |

| • | the renewal of the Rohrabacher-Farr Amendment (as defined herein); |

| • | the possibility of civil asset forfeiture of the Company’s assets; |

| • | the application of anti-money laundering laws and regulations to the Company; |

| • | access to U.S. bankruptcy protections; |

| • | heightened scrutiny by regulatory authorities; |

| • | the ability of U.S. residents to settle trades of the Company’s securities; |

| • | legal, regulatory or political change to the cannabis industry; |

1

Table of Contents

| • | access to the services of banks; |

| • | access to public and private capital; |

| • | unfavorable publicity or consumer perception of the cannabis industry; |

| • | results of future clinical research; |

| • | expansion to the adult-use market; |

| • | the impact of laws, regulations and guidelines; |

| • | regulation by the Food and Drug Administration (the “FDA”) and the Federal Trade Commission (the “FTC”); |

| • | the impact of Section 280E of the U.S. Internal Revenue Code of 1986, as amended (the “IRC”); |

| • | the continuing availability of third-party service providers; |

| • | the ability of the Company to enforce its contracts; |

| • | the impact of state laws pertaining to the cannabis industry; |

| • | the lack of reliable data on the cannabis industry; |

| • | the effect of conversion and potential future sales of Common Shares on the market prices of the Common Shares; |

| • | the impact of additional issuances of equity by the Company; |

| • | the availability of an investor to bring a derivative claim in a judicial forum of its choosing; |

| • | the quality of cannabis grown by the Company and related agricultural business risks; |

| • | the impact of climate change; |

| • | the Company’s reliance on third-party product manufacturers; |

| • | potential product liability claims; |

| • | the impact of products recalls; |

| • | the impact of the Company’s quality control systems; |

| • | the impact of environmental regulation; |

| • | the Company’s limited operating history; |

| • | the Company’s history of negative cash flow from operations; |

| • | competition, including from new well-capitalized entrants into the medical cannabis industry; |

| • | rising energy costs; |

| • | the Company’s reliance on key inputs, suppliers and skilled labor; |

| • | the difficulty of forecasting the Company’s sales; |

| • | the ability to protect the Company’s intellectual property, including its patents and trademarks; |

| • | the potential infringement on intellectual property rights of third parties; |

| • | competition from synthetic production and technological advances; |

| • | constraints on marketing products; |

| • | fraudulent or illegal activity by employees, contractors and consultants; |

| • | the prohibition of public company ownership of cannabis businesses; |

2

Table of Contents

| • | potential cyber-attacks and security breaches; |

| • | the potential application of high bonding requirements; |

| • | the availability of insurance coverage; |

| • | the ability to pay dividends; |

| • | the application of international regulations; |

| • | the use of customer information and other personal and confidential information; |

| • | liability for both U.S. and Canadian tax; |

| • | net operating loss and other tax attribute limitations; |

| • | the application of withholding tax on dividends; |

| • | the application of gift, estate and transfer taxes on transfer of the Common Shares; |

| • | the impact of changes in tax laws; |

| • | the volatility of the market price of the Common Shares; |

| • | the impact of further equity financing; |

| • | potential conflicts of interest between the Company and its directors or officers; |

| • | the limitation of certain remedies under the laws of British Columbia; |

| • | the anticipated benefits of the Green Leaf Medical, LLC (“Green Leaf Medical”) acquisition; |

| • | reliance on management; |

| • | litigation; |

| • | the ability to manage growth; |

| • | the costs of being a public company; |

| • | the impact of securities industry analyst research reports; |

| • | future results and financial projections; |

| • | the impact of global financial conditions and disease outbreaks; and |

| • | other events or conditions that may occur in the future. |

Readers are cautioned that forward-looking information and statements are not based on historical facts but instead are based on assumptions, estimates, analysis and opinions of management of the Company at the time they were provided or made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, as applicable, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information and statements. Forward-looking information and statements are not a guarantee of future performance and are based upon estimates and assumptions of management at the date the statements are made including among other things estimates and assumptions about:

| • | the impact of epidemic diseases, such as the recent COVID-19 pandemic; |

| • | contemplated acquisitions being completed on the current terms and current contemplated timeline; |

| • | the ability to raise sufficient capital to advance the business of the Company and to fund planned operating and capital expenditures and acquisitions; |

3

Table of Contents

| • | the ability to manage anticipated and unanticipated costs; |

| • | achieving the anticipated results of the Company’s strategic plans; |

| • | increasing gross profits, including relative to increases in revenue; |

| • | the amount of savings, if any, expected from cost-cutting measures and divestitures of non-core assets; |

| • | favorable equity and debt capital markets; |

| • | the availability of future funding under the Company’s equity and debt finance facilities; |

| • | access to and stability in financial and capital markets; |

| • | the ability to sustain negative operating cash flows until profitability is achieved; |

| • | the ability to satisfy operational and financial covenants under the Company’s existing debt obligations; |

| • | favorable operating and economic conditions; |

| • | political and regulatory stability; |

| • | obtaining and maintaining all required licenses and permits; |

| • | receipt of governmental approvals and permits; |

| • | sustained labor stability; |

| • | favorable production levels and sustainable costs from the Company’s operations; |

| • | consistent or increasing pricing of various cannabis products; |

| • | the ability of the Company to negotiate favorable pricing for the cannabis products supplied to it; |

| • | the level of demand for cannabis products, including the Company’s and third-party products sold by the Company; |

| • | the continuing availability of third-party service providers, products and other inputs for the Company’s operations; and |

| • | the Company’s ability to conduct operations in a safe, efficient and effective manner. |

While the Company considers these estimates and assumptions to be reasonable, the estimates and assumptions are inherently subject to significant business, social, economic, political, regulatory, public health, competitive and other risks and uncertainties, contingencies and other factors that could cause actual performance, achievements, actions, events, results or conditions to be materially different from those projected in the forward-looking information and statements. Many estimates and assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct. Risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, as applicable, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information and statements include, among others:

| • | uncertain and changing U.S. regulatory landscape and enforcement related to cannabis, including political risks; |

| • | risks and uncertainties related to the recent COVID-19 pandemic and the impact it may have on the global economy and retail sector, particularly the cannabis retail sector in the states in which the Company operates, and on regulation of the Company’s activities in the states in which it operates, particularly if there is any resurgence of the pandemic in the future; |

| • | the inability to raise necessary or desired funds; |

4

Table of Contents

| • | the inability to satisfy operational and financial covenants under the Company’s existing debt obligations and other ongoing obligations as they become payable; |

| • | funds being raised on terms that are not favorable to the Company or to existing shareholders; |

| • | the inability to consummate any proposed acquisitions and the inability to obtain required regulatory approvals and third-party consents and the satisfaction of other conditions to the consummation of any proposed acquisitions on the proposed terms and schedule; |

| • | the potential adverse impacts of the announcement or consummation of any proposed acquisitions on relationships, including with regulatory bodies, employees, suppliers, customers and competitors; |

| • | the diversion of management time on any proposed acquisitions; |

| • | risks related to future acquisitions or dispositions, resulting in unanticipated liabilities; |

| • | reliance on the expertise and judgment of senior management of the Company; |

| • | adverse changes in public opinion and perception of the cannabis industry; |

| • | risks relating to anti-money laundering laws and regulation; |

| • | risks of new and changing governmental and environmental regulation; |

| • | risk of costly litigation (both financially and to the brand and reputation of the Company and relationships with third parties); |

| • | risks related to contracts with and the inability to satisfy obligations to third-party service providers; |

| • | risks related to the unenforceability of contracts; |

| • | risks inherent in an agricultural business, including the impact of climate and pests; |

| • | risks related to proprietary intellectual property and potential infringement by third parties; |

| • | risks relating to financing activities including leverage; |

| • | the inability to effectively manage growth; |

| • | errors in financial statements and other reports; |

| • | costs associated with the Company being a publicly-traded company; |

| • | the dilutive impact of raising additional financing through equity or convertible debt; |

| • | increasing competition in the industry; |

| • | increases in energy and other raw material costs; |

| • | risks associated with cannabis products manufactured for human consumption, including potential product recalls; |

| • | inputs, suppliers and skilled labor being unavailable or available only at uneconomic costs; |

| • | breaches of and unauthorized access to the Company’s systems and related cybersecurity risks; |

| • | constraints on marketing cannabis products; |

| • | fraudulent activity by employees, contractors and consultants; |

| • | tax and insurance related risks, including any changes in cannabis or cultivation tax rates; |

| • | risks related to the economy generally; |

| • | conflicts of interest of management and directors; |

| • | failure of management and directors to meet their duties to the Company, including through fraud or breaches of their fiduciary duties; |

5

Table of Contents

| • | risks relating to certain remedies being limited and the difficulty of enforcement of judgments and effect service outside of Canada; |

| • | sales by existing shareholders negatively impacting market prices; |

| • | the limited market for securities of the Company; |

| • | risks related to the Company’s inability to list its securities on a national securities exchange; and |

| • | limited research and data relating to cannabis. |

Readers are cautioned that the foregoing lists are not exhaustive of all factors, estimates and assumptions that may apply to or impact the Company’s results. Although the Company has attempted to identify important factors that could cause actual results to differ materially from the forward-looking information and statements contained in this this registration statement, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information and statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such information and statements. Accordingly, readers should not place undue reliance on forward- looking information and statements. The forward-looking information and statements contained herein are presented to assist readers in understanding the Company’s expected financial and operating performance and the Company’s plans and objectives and may not be appropriate for other purposes. The forward-looking information and statements contained in this registration statement represents the Company’s views and expectations as of the date of this registration statement unless otherwise indicated. The Company anticipates that subsequent events and developments may cause its views and expectations to change. However, while the Company may elect to update such forward-looking information and statements at a future time, it has no current intention of and assumes no obligation for doing so, except to the extent required by applicable law.

Readers should read this registration statement and the documents that the Company references herein and has filed with the Securities and Exchange Commission at www.sec.gov completely and with the understanding that the Company’s actual future results may be materially different from what it expects.

6

Table of Contents

ABOUT THIS PROSPECTUS

Unless the context indicates or suggests otherwise, references to “we,” “our,” “us,” the “Company,” or “Columbia Care” refer to Columbia Care Inc., a corporation organized under the laws of British Columbia, Canada, individually, or as the context requires, collectively with its subsidiaries.

In this prospectus, currency amounts are stated in U.S. dollars (“$”), unless specified otherwise. All references to C$, CAD$ and CDN$ are to Canadian dollars.

This summary highlights selected information contained elsewhere in this prospectus and the documents that we incorporate by reference. It is not complete and does not contain all of the information that you should consider before making an investment decision. For a more complete understanding of our business and this offering and before making any investment decision, you should read the entire prospectus and the documents incorporated by reference, including the section entitled “Risk Factors” commencing on page 13 of this prospectus and the “Risk Factors” sections contained in our Annual Report on Form 10-K for the year ended December 31, 2021 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022.

General

Columbia Care Inc.’s common shares are listed on the NEO Exchange Inc. (the “NEO”) under the symbol “CCHW”, on the Canadian Securities Exchange (the “CSE”) under the symbol “CCHW”, and are quoted on the OTCQX Best Market (the “OTCQX”) under the symbol “CCHWF” and on the Frankfurt Stock Exchange under the symbol “3LP”.

The Company’s principal business activity is the production and sale of cannabis as regulated by the regulatory bodies and authorities of the jurisdictions in which it operates.

The Company, through its subsidiaries, currently owns or manages interests in several state-licensed medical and/or adult use marijuana businesses in Arizona, California, Colorado, Delaware, European Union, Florida, Illinois, Maryland, Massachusetts, Missouri, New Jersey, New York, Ohio, Pennsylvania, Puerto Rico, Utah, Virginia, Washington, D.C. and West Virginia.

7

Table of Contents

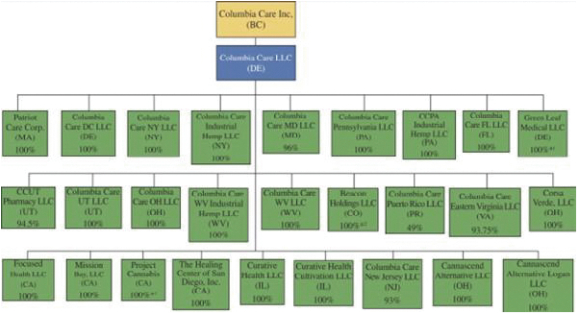

The following organizational chart describes the organizational structure of the Company as of December 31, 2021. See Exhibit 21.1 to this registration statement for a list of subsidiaries of the Company. All lines represent 100% ownership of outstanding securities of the applicable subsidiary unless otherwise noted in Exhibit 21.1 or in the chart below.

Notes:

| 1. | As a result of Columbia Care’s acquisition of a 100% ownership interest in Resource Referral Services Inc., PHC Facilities Inc. and Wellness Earth Energy Dispensary, Inc., and a 49.9% ownership interest in Access Bryant SPC (collectively, “Project Cannabis”), Columbia Care owns 100% of PHC Facilities, Inc., Resource Referral Services, Inc., and Wellness Earth Energy Dispensary, Inc. Columbia Care also acquired 49.9% of Access Bryant SPC with an option to purchase 100% of the entity when regulatory conditions permit such. |

| 2. | Beacon Holdings, LLC includes the following licensed subsidiary entities: The Green Solution, LLC, Rocky Mountain Tillage, LLC, and Infuzionz, LLC. |

| 3. | Green Leaf Medical, LLC includes the following licensed subsidiary entities: Green Leaf Medical, LLC (MD), Green Leaf Extracts, LLC (MD), Time for Healing, LLC (MD), Wellness Institute of Maryland, LLC (MD), Green Leaf Medical of Ohio II, LLC (OH), Green Leaf Medicals, LLC (PA), and Green Leaf Medical of Virginia, LLC (VA). |

The registered office of the Company is 666 Burrard St., #1700, Vancouver, BC V6C 2X8. The head office is located at 680 Fifth Ave., 24th Floor, New York, New York 10019.

History of the Company

The Company was incorporated under the Business Corporations Act (Ontario) (the “OBCA”) on August 13, 2018 under the name “Canaccord Genuity Growth Corp.” as a special purpose acquisition corporation for the purpose of effecting an acquisition of one or more businesses or assets, by way of a merger, amalgamation, arrangement, share exchange, asset acquisition, share purchase, reorganization or any other similar business combination.

8

Table of Contents

On October 17, 2018, the Company announced that it had entered into a letter of intent with Columbia Care LLC (“Old Columbia Care”) to exclusively negotiate a business combination between the two companies. On November 21, 2018, the Company announced that it had entered into a definitive agreement (the “Transaction Agreement”) with Old Columbia Care pursuant to which, among other things, the Company would acquire all of the membership interests of Old Columbia Care by way of a merger between Old Columbia Care and a newly-formed Delaware subsidiary of the Company (the “Business Combination”). The Business Combination constituted the Company’s qualifying transaction.

The Business Combination was completed on April 26, 2019, at which point Old Columbia Care became a 100% wholly-owned subsidiary of the Company. In connection with the closing of the Business Combination, the Company was continued out of the jurisdiction of Ontario under the OBCA and into the jurisdiction of British Columbia under the Business Corporations Act (British Columbia) (“BCBCA”).

Arrangement Agreement

On March 23, 2022, the Company entered into an arrangement agreement (the “Arrangement Agreement”) with Cresco Labs Inc. (“Cresco”), pursuant to which, Cresco has agreed, subject to the terms and conditions thereof, to acquire all of the issued and outstanding Common Shares and proportionate voting shares (“Proportionate Shares” and together with the Common Shares, the “Columbia Care Shares”) of the Columbia Care, pursuant to a statutory plan of arrangement (the “Plan of Arrangement”) under the Business Corporations Act (British Columbia) (the “Arrangement”).

Consideration

Subject to the terms and conditions set forth in the Arrangement Agreement and Plan of Arrangement, holders of Columbia Care Shares will receive 0.5579 of a subordinate voting share of Cresco (each a “Cresco Labs Subordinate Voting Share”), subject to adjustment as described below (the “Exchange Ratio”), for each Columbia Care Share (on an as converted to Common Share basis) outstanding immediately prior to the effective time of the Arrangement (the “Effective Time”), with the Proportionate Shares treated on an as if converted basis to Common Shares pursuant to their respective terms; provided, the Exchange Ratio is subject to adjustment in the event that Columbia Care is required to issue shares in satisfaction of an earn-out payment for a prior acquisition, with the potential adjustment in proportion to the additional dilution from such potential issuance relative to Columbia Care’s current fully diluted in-the-money outstanding shares. The Arrangement is intended to qualify as a reorganization for U.S. federal income tax purposes.

At the Effective Time, (i) all Columbia Care equity awards granted under Columbia Care’s equity incentive plan or otherwise that are outstanding immediately prior to the Effective Time will be exchanged for replacement equity awards such that, upon exercise (with respect to options) or vesting (with respect to performance share units or restricted share units), as applicable, the holder will be entitled to receive Cresco Shares, with the number of shares underlying such award and, in the case of options, the exercise price of such award adjusted based on the Exchange Ratio; (ii) each of the warrants to acquire Common Shares issued by Columbia Care that are outstanding immediately prior to the Effective Time will be exercisable, in accordance with the terms of such warrants, for the number of Cresco Shares that the holder of such warrants would have been entitled to receive as a result of the transactions contemplated by the Arrangement if, immediately prior to the Effective Date, such holder had been the registered holder of the number of Common Shares to which such holder would have been entitled if such holder had exercised such holder’s warrants immediately prior to the Effective Time; and (iii) each of the convertible notes issued by Columbia Care that are outstanding immediately prior to the Effective Time will be convertible, in accordance with the terms of such convertible notes, into the number of Cresco Shares that the holder of such convertible notes would have been entitled to receive as a result of the transactions contemplated by the Arrangement if, immediately prior to the Effective Date, such holder had been

9

Table of Contents

the registered holder of the number of Common Shares to which such holder would have been entitled if such holder had converted such holder’s convertible notes immediately prior to the Effective Time.

Conditions to the Arrangement

The Arrangement is subject to a number of conditions, including the approval by Columbia Care shareholders holding at least 66 2/3% of the votes cast on the Arrangement resolution by Columbia Care shareholders voting as a single class present in person or represented by proxy and entitled to vote at the Meeting, and if required by applicable law, approval by Columbia Care shareholders holding a simple majority of the votes attached to Columbia Care Shares voting as a single class present in person or represented by proxy and entitled to vote at the Meeting, excluding the votes of those persons whose votes are required to be excluded under Multilateral Instrument 61-101—Protection of Minority Security Holders in Special Transactions. It is a condition to closing in favor of Cresco that holders of less than 5% of the outstanding Columbia Care Shares shall have validly exercised dissent rights with respect to the Arrangement that have not been withdrawn as of the effective date of the Arrangement.

In addition, the Arrangement is subject to approval of the Supreme Court of British Columbia (or any other court with appropriate jurisdiction) at a hearing upon the procedural and substantive fairness of the terms and conditions of the Arrangement and certain regulatory approvals, including but not limited to the approval under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. The Arrangement is also conditioned upon neither a delisting from the Canadian Securities Exchange having occurred nor a cease trade order having been issued by any governmental entity in respect of the Cresco Shares since the date of this Agreement and that remains in effect. The Arrangement Agreement may be terminated by mutual written consent of the Columbia Care and Cresco and by either party in certain circumstances as more particularly set forth in the Arrangement Agreement.

Certain Other Terms of the Arrangement Agreement

The Arrangement Agreement includes customary representations, warranties and covenants of Cresco and Columbia Care and each party has agreed to customary covenants, including, among others, covenants relating to the conduct of its business during the interim period between execution of the Arrangement Agreement and the Effective Time.

The Arrangement Agreement provides for customary non-solicitation covenants, subject to the right of the board of directors of Columbia Care (the “Board”) to consider and accept a superior proposal (as defined in the Arrangement Agreement), and the right of Cresco to match any such proposal within five business days. The Arrangement Agreement also provides for the payment by Columbia Care to Cresco of a $65.0 million termination fee if the Arrangement Agreement is terminated in certain specified circumstances, including, among other things, in the event of (i) a Change in Recommendation, whereby the Board’s recommendations or determinations with respect to the Arrangement are modified in a manner adverse to Cresco; (ii) Columbia Care, in accordance with certain procedures set forth in the Arrangement Agreement, accepts, recommends, approves or enters into an agreement to implement a Superior Proposal; or (iii) the Arrangement Agreement is terminated in certain circumstances, including in the event the resolution approving the Arrangement is not approved by Company Shareholders, the Arrangement is not consummated on or prior to March 22, 2023 (subject to modification by the parties and extension in certain circumstances), or in the event Columbia Care breaches any representation or warranty or fails to perform any covenant or agreement that causes the closing conditions related to Columbia Care’s representations and warranties and covenants not to be satisfied, and such breach or failure is incapable of being cured on or prior to the March 22, 2023 or is not cured and Cresco is not then in breach of the Arrangement Agreement so as to directly or indirectly cause any closing condition related to Cresco’s representations and warranties and covenants not to be satisfied, and if (x) prior to the date of termination an acquisition proposal meeting certain requirements has been publicly announced or otherwise

10

Table of Contents

communicated to Columbia Care, and (y) within 12 months of the date of such termination the acquisition proposal transaction is completed or Columbia Care has entered into a definitive agreement with respect to such transaction and such transaction is later consummated or effected (whether or not within such 12 month period).

Voting Support Agreements and Lock-up Agreements

Pursuant to certain voting support agreements (the “Voting Support Agreements”), certain Columbia Care shareholders holding an aggregate of more than 20% of the voting power of the issued and outstanding Columbia Care Shares as of March 23, 2022 have entered into Voting Support Agreements with Cresco, pursuant to which they have agreed to vote in favor of the Arrangement at the Meeting. The Voting Support Agreements terminate in certain circumstances, including upon the termination of the Arrangement Agreement in accordance with its terms. Under the Arrangement Agreement, Columbia Care has agreed to hold the Meeting as soon as reasonably practicable and, in any event, on or before June 15, 2022 (or such later date as may be agreed to by Columbia Care and Cresco in writing). In addition, pursuant to certain lock-up agreements (the “Lock-up Agreements”), certain Columbia Care shareholders holding an aggregate of more than 20% of issued and outstanding Columbia Care Shares (on an as converted to Common Share basis) as of March 23, 2022 agreed to restrict the sale or other transfer of 90% of the Cresco Shares to be received by such Company Care shareholders pursuant to the Arrangement. The Lock-up Agreements provide for the release of the restrictions on the sale or other transfer of such Cresco Shares in four equal installments on the date that is (i) 60 days following the Effective Date; (ii) 120 days following the Effective Date; (iii) 180 days following the Effective Date; and (iv) 240 days following the Effective Date.

General Development of the Business

Columbia Care has grown primarily by submitting responses to state-issued requests for proposals and obtaining cannabis licenses pursuant to such processes throughout the United States, where such activity is legal at the state-level. In 2020 and 2021, Columbia Care also grew significantly from acquiring other leading cannabis operations. The Company also provides management services to licensed entities. As of May 12, 2022, Columbia Care holds, directly or indirectly, 116 licenses with 131 discrete facilities that are operational or in development.

2013-2021 Growth

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022(1) | |||||||||||||||||||||||||||||||

| Employees |

10 | 19 | 59 | 219 | 279 | 418 | 697 | 1775 | 2,586 | 2,497 | ||||||||||||||||||||||||||||||

| Facilities |

6 | 10 | 18 | 21 | 25 | 54 | 70 | 107 | 132 | 131 | ||||||||||||||||||||||||||||||

| Jurisdictions |

3 | 4 | 7 | 10 | 11 | 15 | 16 | 16 | 18 | 17 | ||||||||||||||||||||||||||||||

Notes:

| (1) | As of May 12, 2022 |

Excluding industrial hemp products, Columbia Care’s cannabis license portfolio allows for an aggregate of approximately 2.039 million square feet of cultivation and manufacturing space within its currently leased or owned facilities and the potential to produce over 150,000 kilograms of dry flower annually, based on an assumed 65 grams per square foot of cultivation space and 5.2 harvests per year.

As a vertically-integrated company in the cannabis sector, where there may be material relationships or transactions that involve conflicts of interest, whether actual or perceived, Columbia Care will disclose any commissions, incentives, or other fees earned by Columbia Care, its pharmacists or other consultants. Columbia Care will also disclose risks associated with conflicts of interest, including but not limited to situations where Columbia Care, its clinics, pharmacists, or other consultants are paid a commission or education grant from a licensed producer or dispensary that is, or is related to, Columbia Care. Columbia Care does not currently have any material relationships or transactions that involve conflicts of interest, whether actual or perceived.

11

Table of Contents

| Common Shares Offered: | 18,755,082 | |

| Outstanding Common Shares: | 384,943,683 | |

| Use of Proceeds: | We are not selling any securities under this prospectus and we will not receive any proceeds from any sale of securities by the Selling Securityholders. | |

| NEO Symbol for Common Shares: | CCHW | |

| CSE Symbol for Common Shares: | CCHW | |

| OTCQX Symbol for Common Shares: | CCHWF | |

12

Table of Contents

Investing in shares of our Common Shares involves a number of risks. You should carefully consider the risk factors and all of the other information included in, or incorporated by reference into this prospectus, including those in our most recent Annual Report on Form 10-K for the year ended December 31, 2021, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 and this prospectus before deciding to invest in our Common Shares. These risk factors, and others that are not presently known to us or that we currently believe are immaterial, may cause our operating results to vary from anticipated results or may materially and adversely affect our business and financial condition. If any of the unfavorable events or circumstances described in the risk factors actually occurs, our business and results of operations could be significantly affected, the trading price of our Common Shares could decline and you could lose all or part of your investment.

Risks Related to the Arrangement

There can be no assurance that all of the conditions precedent to closing of the Arrangement will be satisfied.

The completion of the Arrangement is subject to a number of conditions precedent, some of which are outside of Columbia Care’s control, including receipt of the final order of the Supreme Court of British Columbia approving the Arrangement, receipt of Columbia Care shareholder approval and receipt of any necessary regulatory approvals (the “Key Regulatory Approvals”).

In addition, the completion of the Arrangement by Columbia Care and Cresco Labs is conditional on, among other things, no material adverse effect having occurred or having been disclosed to the public (if previously undisclosed to the public) in respect of the other Party.

There can be no certainty, nor can Columbia Care and Cresco Labs provide any assurance, that all conditions precedent to the Arrangement will be satisfied or waived, or, if satisfied or waived, when they will be satisfied or waived and, accordingly, the Arrangement may not be completed. If the Arrangement is not completed, the market price of the Common Shares may be adversely affected.

The Key Regulatory Approvals may not be obtained or, if obtained, may not be obtained on a favorable basis.

To complete the Arrangement, each of Columbia Care and Cresco Labs must make certain filings with and obtain certain consents and approvals from various governmental and regulatory authorities, including certain state cannabis regulators.. The Key Regulatory Approvals have not yet been obtained and in some cases will be dependent on the successful divestiture of certain of Columbia Care’s and Cresco’s assets (the “Divestitures”). The regulatory approval processes and the Divestitures may take a lengthy period of time to complete, which could delay completion of the Arrangement. If obtained, the Key Regulatory Approvals may be conditioned, with the conditions imposed by the applicable governmental entity not being acceptable to either Columbia Care or Cresco Labs, or, if acceptable, not being on terms that are favorable to the resulting combined company (the “Combined Company”). There can be no assurance as to the outcome of the regulatory approval processes, including the undertakings and conditions that may be required for approval or whether the Key Regulatory Approvals will be obtained. If not obtained, or if obtained on terms that are not satisfactory to either Columbia Care or Cresco Labs, the Arrangement may not be completed.

Columbia Care and Cresco may not be able to complete the Divestitures, or if completed, may not be completed on a favorable basis.

Obtaining the Key Regulatory Approvals will, in some cases, be dependent on the completion of the Divestitures. There can be no assurance that Columbia Care and Cresco will be able to complete the Divestitures on terms acceptable to Columbia Care and/or Cresco or at all. If all of the Divestitures are not completed and the conditions to the completion of the Arrangement are not waived or satisfied, the Arrangement may not be consummated and any Divestiture that may have been completed in connection with the Arrangement could have an adverse affect on the businesses of Columbia Care and Cresco.

13

Table of Contents

If the Arrangement is not approved by the Columbia Care shareholders, or the Arrangement is otherwise not completed, then the market price for the Columbia Care common shares may decline.

If the Arrangement is not approved by the Columbia Care shareholders, or if, for any reason, the Arrangement is not completed or its completion is materially delayed and/or the Arrangement Agreement is terminated, then the market price of the Columbia Care common shares may decline to the extent that the current market price of the Columbia Care common shares reflects an assumption by the market that the Arrangement will be completed. Depending on the reasons for terminating the Arrangement Agreement, Columbia Care’s business, financial condition or results of operations could also be subject to various material adverse consequences, including as a result of paying the termination fee of $65 million (the “Columbia Care Termination Fee”). If the Arrangement is not approved and the Columbia Care Board decides to seek another merger or arrangement, there can be no assurance that it will be able to find a party willing to pay an equivalent or more attractive price than the value of the Cresco Shares to be transferred pursuant to the Arrangement.

There can be no assurance that the Arrangement Agreement will not be terminated by Columbia Care or Cresco Labs in certain circumstances.

Each of Columbia Care and Cresco Labs has the right, in certain circumstances, in addition to termination rights relating to the failure to satisfy the conditions of closing, to terminate the Arrangement Agreement. Accordingly, there can be no certainty, nor can Columbia Care provide any assurance that the Arrangement Agreement will not be terminated by either of Columbia Care or Cresco Labs prior to the completion of the Arrangement. The Arrangement Agreement also contemplates the payment of the Columbia Care Termination Fee if the Arrangement Agreement is terminated in certain circumstances. Additionally, any termination will result in the failure to realize the expected benefits of the Arrangement in respect of the operations and business of Columbia Care and Cresco Labs.

The Columbia Care Termination Fee may discourage other parties from attempting to acquire Columbia Care or Cresco Labs.

Under the Arrangement Agreement, in the event the Arrangement Agreement is terminated in connection with entry into a superior proposal, Columbia Care may be required to pay the Termination Fee. The Columbia Care Termination Fee may discourage other parties from attempting to acquire Common Shares or otherwise make any acquisition proposal to Columbia Care, even if those parties would otherwise be willing to offer greater value to Columbia Care shareholders than that offered by Cresco Labs under the Arrangement.

The uncertainty surrounding the Arrangement could negatively impact Columbia Care’s current and future operations, financial condition and prospects.

As the Arrangement is dependent upon receipt of, among other things, the Key Regulatory Approvals and satisfaction of certain other conditions, its completion is uncertain. If the Arrangement is not completed for any reason, there are risks that the announcement of the Arrangement and the dedication of Columbia Care’s resources to the completion thereof could have a negative impact on its relationships with its stakeholders and could negatively impact current and future operations, financial condition and prospects of Columbia Care.

In addition, Columbia Care has, and will continue to, incur significant transaction expenses in connection with the Arrangement, regardless of whether the Arrangement is completed.

Restrictions during the pending Arrangement that prevent Columbia Care from pursuing business opportunities could have an adverse effect on Columbia Care.

Each of Columbia Care and Cresco Labs is subject to customary non-solicitation provisions under the Arrangement Agreement, pursuant to which, the Parties are restricted from soliciting, initiating or knowingly

14

Table of Contents

encouraging any acquisition proposal, among other things. The Arrangement Agreement also restricts them from taking specified actions until the Arrangement is completed without the consent of the other Party. These restrictions may prevent Columbia Care or Cresco Labs from pursuing attractive business opportunities that may arise prior to the completion of the Arrangement and could have an adverse effect on the business, operating results or prospects of Columbia Care.

There can be no assurance that the value of the Cresco Labs Subordinate Voting Shares received by Columbia Care shareholders will equal or exceed the value of the Common Shares prior to the Effective Date.

The Exchange Ratio will not increase or decrease due to fluctuations in the market price of the Common Shares or Cresco Labs Subordinate Voting Shares; provided, the Exchange Ratio may potentially be adjusted in the event that Columbia Care is required to issue shares in satisfaction of an earn- out payment for the Green Leaf Medical acquisition, with the potential adjustment in proportion to the additional dilution from such potential issuance relative to Columbia Care’s current fully diluted in-the money outstanding shares. The market price of the Common Shares or Cresco Labs Subordinate Voting Shares could each fluctuate significantly prior to the effective date of the Arrangement (the “Effective Date”) in response to various factors and events, including, without limitation, as a result of the differences between Columbia Care’s and Cresco Labs’ actual financial or operating results and those expected by investors and analysts, changes in analysts’ projections or recommendations, changes in general economic or market conditions, and broad market fluctuations. As a result of such fluctuations, historical market prices are not indicative of future market prices or the market value of the Cresco Labs Subordinate Voting Shares that holders of Common Shares will receive on the Effective Date. There can be no assurance that the market value of the Cresco Labs Subordinate Voting Shares that the holders of Common Shares will receive on the Effective Date will equal or exceed the market value of the Common Shares held by such Columbia Care shareholders prior to the Effective Date. Similarly, there can be no assurance that the trading price of Cresco Labs Subordinate Voting Shares will not decline following the completion of the Arrangement.

Potential payments to Columbia Care shareholders who exercise dissent rights could have an adverse effect on the Combined Company’s financial condition or prevent the completion of the Arrangement.

Registered Columbia Care shareholders as at May 10, 2022 have the right to exercise dissent rights and demand payment equal to the fair value of their Common Shares. If dissent rights are exercised in respect of a significant number of Common Shares, a substantial payment may be required to be made to such Columbia Care shareholders, which could have an adverse effect on the Combined Company’s financial condition and cash resources. Further, Cresco Labs’ obligation to complete the Arrangement is conditional upon Columbia Care shareholders holding no more than 5% of the outstanding Common Shares having exercised dissent rights. Accordingly, the Arrangement may not be completed if Columbia Care shareholders exercise dissent rights in respect of more than 5% of the outstanding Columbia Care Shares.

Another attractive take-over, merger or business combination may not be available if the Arrangement is not completed.

If the Arrangement is not completed and is terminated, there can be no assurance that Columbia Care will be able to find a party willing to pay equivalent or more attractive consideration than the consideration to be provided by Cresco Labs under the Arrangement or be willing to proceed at all with a similar transaction or any alternative transaction.

Columbia Care will incur costs even if the Arrangement is not completed and may have to pay the Columbia Care Termination Fee.

Certain costs related to the Arrangement, such as legal, accounting and certain financial advisor fees, must be paid by Columbia Care even if the Arrangement is not completed. Given Columbia Care’s current financial

15

Table of Contents

condition, there is no assurance that Columbia Care will have the funds to pay these costs which would adversely affect the share price of the Common Shares. If the Arrangement Agreement is terminated, Columbia Care may be required in certain circumstances to pay Cresco Labs the Columbia Care Termination Fee.

Following completion of the Arrangement, former Columbia Care shareholders will not have the ability to significantly influence certain corporate actions of Cresco Labs.

Immediately following the completion of the Arrangement, former Columbia Care shareholders are expected to own approximately 35% of the pro forma Cresco Labs Shares (on a fully diluted in-the-money, treasury method basis), based on the number of Columbia Care Shares outstanding upon completion of the Arrangement and assuming that (i) there are no dissenting Columbia Care shareholders, (ii) there are no Columbia Care Options exercised prior to the Effective Time, (iii) there are no Columbia Care Convertible Notes converted prior to the Effective Time, and (iv) there are no Columbia Care Warrants exercised prior to the Effective Time. Former Columbia Care shareholders (other than any dissenting Columbia Care shareholders) will not be in a position to exercise significant influence over all matters requiring shareholder approval, including the election of directors, determination of significant corporate actions, amendments to Cresco Labs’ articles of incorporation and the approval of any business combinations, mergers or takeover attempts.

We may experience difficulties integrating Columbia Care and Cresco’s operations and realizing the expected benefits of the Arrangement.

The success of the Arrangement will depend in part on our ability to realize the expected operational efficiencies and associated cost synergies and anticipated business opportunities and growth prospects from combining Columbia Care and Cresco in an efficient and effective manner. We may not be able to fully realize the operational efficiencies and associated cost synergies or leverage the potential business opportunities and growth prospects to the extent anticipated or at all.

Challenges associated with the integration may include those related to retaining and motivating executives and other key employees, blending corporate cultures, eliminating duplicative operations, and making necessary modifications to internal control over financial reporting and other policies and procedures in accordance with applicable laws. Some of these factors are outside our control, and any of them could delay or increase the cost of our integration efforts.

The integration process could take longer than anticipated and could result in the loss of key employees, the disruption of ongoing business, increased tax costs, inefficiencies, and inconsistencies in standards, controls, information technology systems, policies and procedures, any of which could adversely affect our ability to maintain relationships with employees, customers or other third parties, or our ability to achieve the anticipated benefits of the transaction, and could harm our financial performance. If we are unable to successfully integrate certain aspects of the operations of Columbia Care and Cresco or experience delays, we may incur unanticipated liabilities and expenses, and be unable to fully realize the potential benefit of the revenue growth, synergies and other anticipated benefits resulting from the Arrangement, and our business, results of operations and financial condition could be adversely affected.

We incurred, and may continue to incur, significant Arrangement-related costs and integration costs in connection with the Arrangement with Cresco.

We incurred, and may continue to incur, significant Arrangement-related costs and integration costs in connection with the Arrangement with Cresco. We may incur additional costs to maintain employee morale and to retain key employees. Unanticipated costs may be incurred in the course of integration, and management cannot ensure that the elimination of duplicative costs or the realization of other efficiencies will offset the transaction and integration costs in the near term or at all.

16

Table of Contents

The pending Arrangement may divert the attention of Columbia Care’s management.

The pending Arrangement could cause the attention of Columbia Care’s management to be diverted from the day-to-day operations. These disruptions could be exacerbated by a delay in the completion of the Arrangement and could have an adverse effect on the business, operating results or prospects of Columbia Care regardless of whether the Arrangement is ultimately completed.

Cresco may issue additional equity securities.

Following, or prior to, the completion of the Arrangement, Cresco may issue equity securities to finance its activities, including in order to finance acquisitions. If Cresco were to issue additional equity securities, the ownership interest of existing Cresco shareholders may be diluted and some or all of Cresco financial measures on a per share basis could be reduced. Moreover, as Cresco’s intention to issue additional equity securities becomes publicly known, its share price may be materially adversely affected.

The Columbia Care directors and executive officers may have interests in the Arrangement that are different from those of the Columbia Care Shareholders.

In considering the recommendation of the Columbia Care Board to vote in favor of the Arrangement Resolution, Columbia Care Shareholders should be aware that certain members of the Columbia Care Board and management team have agreements or arrangements that provide them with interests in the Arrangement that differ from, or are in addition to, those of Columbia Care Shareholders generally.

Tax consequences of the Arrangement may differ from anticipated treatment, including if the Arrangement does not qualify as a “reorganization” under Section 368(a) of the Internal Revenue Code (“Section 368(a)”), U.S. Holders may be required to pay substantial U.S. federal income taxes.

There can be no assurance that the Canada Revenue Agency, the United States Internal Revenue Service (the “IRS”) or other applicable taxing authorities will agree with the Canadian and U.S. federal income tax consequences of the Arrangement, as applicable. Furthermore, there can be no assurance that applicable Canadian and U.S. income tax laws, regulations or tax treaties or conventions will not change (legislatively, judicially or otherwise and potentially with retroactive effect) or be interpreted in a manner, or that applicable taxing authorities will not take an administrative position, that is adverse to Columbia Care, Cresco and their respective shareholders (in each case, including any successor thereto) following completion of the Arrangement. Taxation authorities may also disagree with how Columbia Care and Cresco following the Arrangement calculate or have in the past calculated their income or other amounts for tax purposes. Any such events could adversely affect Cresco following the Arrangement, its share price or the dividends that may be paid to Cresco’s shareholders following completion of the Arrangement

The Arrangement is intended to qualify as a “reorganization” within the meaning of Section 368(a), and Columbia Care and Cresco intend to report the Arrangement consistent with such qualification. If the IRS or a court determines that the Arrangement should not be treated as a “reorganization” within the meaning of Section 368(a), a U.S. holder of Columbia Care Shares would generally recognize taxable gain or loss upon the exchange of Columbia Care Shares for Cresco Shares pursuant to the Arrangement.

Columbia Care’s convertible notes, first-lien notes and warrants may cease to be qualified investments for Registered Plans.

As a result of the Arrangement, Columbia Care’s convertible notes, first-lien notes and warrants may cease to be qualified investments under the Income Tax Act (Canada) and the regulations promulgated thereunder (the “Tax Act”) for trusts governed by a RRSP, RRIF, RESP, RDSP, TFSA or deferred profit sharing plan (each, a “Registered Plan”) and adverse tax consequences may arise as a result. The tax considerations applicable to

17

Table of Contents

holders of Columbia Care Notes or Columbia Care Warrants are not described herein. Any holder of Columbia Care Notes or Columbia Care Warrants to which this may apply should consult with and rely upon their own tax advisors to discuss the tax consequences to them of the Arrangement.

Risks Related to Our Securities

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional Common Shares or other securities convertible into or exchangeable for common shares at prices that may not be the same as the price per share paid by any investor in an offering in a subsequent prospectus supplement. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by any investor in an offering in a subsequent prospectus supplement, and investors purchasing shares or other securities in the future could have rights superior to you. The price per share at which we sell additional Common Shares or securities convertible or exchangeable into Common Shares, in future transactions may be higher or lower than the price per share paid by any investor in an offering under a subsequent prospectus supplement.

Future offerings of debt or preferred equity securities, which would rank senior to our Common Shares, may adversely affect the market price of our Common Shares.

If, in the future, we decide to issue debt or preferred equity securities that may rank senior to our Common Shares, it is likely that such securities will be governed by an indenture or other instrument containing covenants restricting our operating flexibility. Any convertible or exchangeable securities that we issue in the future may have rights, preferences and privileges more favorable than those of our common shares and may result in dilution to owners of our common shares. We and, indirectly, our shareholders, will bear the cost of issuing and servicing such securities. Because our decision to issue debt or equity securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. Thus, holders of our Common Shares will bear the risk of our future offerings reducing the market price of our Common Shares and diluting the value of their stock holdings in us.

Future sales by our Shareholders may adversely affect our share price and our ability to raise funds in new share offerings.

Sales of our Common Shares in the public market following any prospective offering could lower the market price of our common shares. Sales may also make it more difficult for us to sell equity securities or equity-related securities in the future at a time and price that our management deems acceptable.

The price of our Common Shares is subject to volatility and you could lose all or part of your investment as a result.

There is no guarantee that our Common Shares will appreciate in value or maintain the price at which our shareholders have purchased their shares. Securities of mining companies have experienced substantial volatility and downward pressure in the recent past, often based on factors unrelated to the financial performance or prospects of the companies involved. These factors include macroeconomic conditions in North America and globally, and market perceptions of the attractiveness of particular industries. Other factors unrelated to our performance that may have an effect on the price of our securities include the following: the extent of research coverage available to investors concerning our business may be limited if investment banks with research capabilities do not follow our securities; lessening in trading volume and general market interest in our securities may affect an investor’s ability to trade significant numbers of our securities; the size of our public float and the exclusion from market indices may limit the ability of some institutions to invest in our securities; and a substantial decline in the price of our securities that persists for a significant period of time could cause our securities to be delisted from an exchange, further reducing market liquidity. Our exclusion from certain market indices may reduce market liquidity or the price of our securities. If an active market for our securities does not

18

Table of Contents

continue, the liquidity of an investor’s investment may be limited and the price of our securities may decline. If an active market does not exist, investors may lose their entire investment. As a result of any of these factors, the market price of our securities at any given point in time may not accurately reflect our long-term value. Securities class-action litigation often has been brought against companies in periods of volatility in the market price of their securities, and following major corporate transactions or mergers and acquisitions. We may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management’s attention and resources.

The Company is subject to taxation in both Canada and the United States.

Columbia Care is treated as a U.S. domestic corporation for U.S. federal income tax purposes under Section 7874(b) of the Internal Revenue Code. Consequently, Columbia Care is subject to U.S. federal income tax on its worldwide taxable income. Since Columbia Care is a resident of Canada for purposes of the Tax Act, Columbia Care is also subject to Canadian income tax. Consequently, Columbia Care is liable for both U.S. and Canadian income tax, which could have a material adverse effect on its financial condition and results of operations, and could inhibit efficient use of its capital.

Proposed legislation in the U.S. Congress, including changes in U.S. tax law, may adversely impact Columbia Care and the value of the Common Shares.

Changes to U.S. tax laws (which changes may have retroactive application) could adversely affect Columbia Care or holders of Common Shares. In recent years, many changes to U.S. federal income tax laws have been proposed and made, and additional changes to U.S. federal income tax laws are likely to continue to occur in the future.

The U.S. Congress is currently considering numerous items of legislation which may be enacted prospectively or with retroactive effect, which legislation could adversely impact Columbia Care’s financial performance and the value of our Common Shares. In particular, new proposed legislation known as the “Build Back Better Act” is under consideration within both houses of U.S. Congress. The proposed legislation includes, without limitation, new corporate minimum income taxes. If enacted, most of the proposals would be effective for 2022 or later years. The proposed legislation remains subject to change, and its impact on the Company and purchasers of our Common Shares is uncertain.

19

Table of Contents

We are not selling any securities under this prospectus and we will not receive any proceeds from the sale of securities by the Selling Securityholders.

The Selling Securityholders may from time to time offer and sell any or all of our securities set forth below pursuant to this prospectus. When we refer to “Selling Securityholders” in this prospectus, we mean the persons listed in the table below, and the pledgees, donees, permitted transferees, assignees, successors and others who later come to hold any of the Selling Securityholders’ interests in our securities other than through a public sale.

The following table sets forth, as of May 12, 2022:

| • | the name of the Selling Securityholders for whom we are registering shares for resale to the public, |

| • | the number of shares that the Selling Securityholders beneficially owned prior to the offering for resale of the securities under this prospectus, |

| • | the number of shares that may be offered for resale for the account of the Selling Securityholders pursuant to this prospectus, and |

| • | the number and percentage of shares to be beneficially owned by the Selling Securityholders after the offering of the resale securities (assuming all of the offered shares are sold by the Selling Securityholders). |

This table is prepared solely based on information supplied to us by the listed Selling Securityholders.

| Common Shares Prior to the Offering |

Common Shares Owned Following the Offering |

|||||||||||||||||||

| Selling Securityholder | Shares Beneficially Owned |

Percentage of Shares Beneficially Owned |

Outstanding Shares Being Offered |

Shares Beneficially Owned |

Percentage of Shares Beneficially Owned |

|||||||||||||||

| Brian O’Neil, Trustee of the Zero-1-derful Living Trust |

9,217,483 | 2.3 | % | 2,623,899 | 6,593,584 | 1.7 | % | |||||||||||||

| Harmerle Investments LLC |

2,623,899 | 0.7 | % | 2,623,899 | — | — | ||||||||||||||

| David Anthony Guard |

969,682 | 0.2 | % | 969,682 | — | — | ||||||||||||||

| Razmig Der-Tavitian |

558,898 | 0.1 | % | 518,898 | 40,000 | 0.0 | % | |||||||||||||

| Ozymandias Business Trust dated Sept. 12, 2021 |

907,741 | 0.2 | % | 787,266 | 120,475 | 0.0 | % | |||||||||||||

| Jennifer A. Greenhall, Trustee of the Arbor Vitae Living Trust, dated 10/15/2013, as amended |

1,079,767 | 0.3 | % | 820,714 | 259,053 | 0.1 | % | |||||||||||||

| Jerry Greenfield |

1,008,588 | 0.3 | % | 813,091 | 195,497 | 0.0 | % | |||||||||||||

| B Squared Ventures, LLC |

1,054,012 | 0.3 | % | 1,054,012 | — | — | ||||||||||||||

| Stafford Broumand |

3,074,094 | 0.8 | % | 2,806,213 | 267,881 | 0.1 | % | |||||||||||||

| Todd Simon |

2,661,104 | 0.7 | % | 2,185,183 | 475,921 | 0.1 | % | |||||||||||||

| Sean Gabriel |

4,649,519 | 1.2 | % | 2,101,519 | 2,548,000 | 0.6 | % | |||||||||||||

| Dr. Patricia D. Hawkins |

349,645 | 0.1 | % | 349,645 | — | — | ||||||||||||||

| Bennett Cohen |

1,479,233 | 0.4 | % | 1,101,061 | 378,172 | 0.1 | % | |||||||||||||

| * | Represents beneficial ownership of less than 1% |

Acquisition of Resale Securities

18,755,082 Common Shares will be offered for resale by the Selling Securityholders. The Selling Securityholders acquired the 18,755,082 Common Shares in connection with the acquisition and settlement of

20

Table of Contents

pre-existing relationships, inclusive of prospective acquisition costs relating to third-party entities and other litigation costs relating to VentureForth LLC (“VentureForth”). On April 18, 2022, in connection with the accrual, the Company issued 18,755,082 Common Shares and, on April 18, 2022 and April 24, 2022 paid approximately $26,000,000 to acquire, by merger, VentureForth Holdings, LLC, which is the owner of VentureForth. VentureForth holds two licenses from the Washington D.C. Alcoholic Beverage Regulation Administration (“ABRA”), specifically, one license to cultivate and manufacture medical cannabis and one license to dispense medical cannabis. The merger was approved by ABRA. The Company previously had a management services agreement with VentureForth. In further connection with the accrual, the shares issued, and amounts paid also amicably resolved, with no admissions of liability and in exchange for releases, certain direct, indirect, derivative and indemnification claims relating to a confidential arbitration to which VentureForth, a separate subsidiary of the Company and certain members of the Company’s management team were respondent parties (the “VentureForth Matter”).

21

Table of Contents

The description of our business is incorporated by reference from Part I, Item 1 of the Company’s Annual Report on Form 10-K as filed with the SEC on March 31, 2022 (see “Incorporation of Certain Information by Reference”).

The description of our properties is incorporated by reference from Part I, Item 2 of the Company’s Annual Report on Form 10-K as filed with the SEC on March 31, 2022 (see “Incorporation of Certain Information by Reference”).

A former owner of the Company’s Florida-licensed business was sued by a former purported joint venture partner, alleging various statutory and common law claims related to the terminated joint venture. The Company was not a party to this lawsuit, but, as part of its acquisition of the business, had agreed to indemnify the owner for litigation costs and any judgment rendered in the matter, in excess of $750,000. On January 20, 2021, following an arbitration hearing, the arbitration panel issued a partial final award in the former joint venture partner’s favor on three of the 11 claims asserted and awarded the former joint venture partner $10,553,214.30 plus prejudgment interest from July 26, 2017 through the present, as well as reasonable attorneys’ fees. On March 2, 2021, the Panel issued a Final Award, awarding the former joint venture partner a total of $15,195,230.85, inclusive of prejudgment interest and attorneys’ fees. The Company was financially responsible for payment of the Final Award, pursuant to its indemnification commitment to the former owner. Two subsidiaries of the Company, and certain members of the Company’s management team were named in a separate lawsuit commenced by the same former joint venture partner alleging various claims related to the same terminated joint venture. The trial court dismissed a majority of the claims in the lawsuit. All parties to the arbitration and the additional lawsuit agreed to amicably resolve the arbitration and the additional lawsuit. There were no admissions of liability. In furtherance of the resolution, the Company made two payments of $11,425,000 each in December 2021 and January 2022 against the total accrual of $22,800,000 and accrued interest. The Company did not have an accrued balance as of March 31, 2021.

For the quarter ended September 30, 2021, the Company had anticipatorily accrued $68,000,000 for potential share issuances and cash payments for purposes of acquisition and settlement of pre-existing relationships, inclusive of prospective acquisition costs relating to third-party entities and other litigation costs. For the three months ended March 31, 2022, there have been no changes to the accrued balance. On April 18, 2022, in connection with the accrual, the Company issued 18,755,082 common shares and on April 18, 2022 and April 24, 2022 paid approximately $26,000,000 to acquire, by merger, VentureForth Holdings, LLC, which is the owner of VentureForth. VentureForth holds two licenses from ABRA, specifically, one license to cultivate and manufacture medical cannabis and one license to dispense medical cannabis. The merger was approved by ABRA. The Company previously had a management services agreement with VentureForth. In further connection with the accrual, the shares issued, and amounts paid also amicably resolved, with no admissions of liability and in exchange for releases, certain direct, indirect, derivative and indemnification claims relating to a confidential arbitration to which VentureForth, a separate subsidiary of the Company and certain members of the Company’s management team were respondent parties.

22

Table of Contents

MARKET PRICE AND DIVIDENDS ON COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Trading Price and Volume