Form S-1 Bitech Technologies Corp

As filed with the Securities and Exchange Commission on August 15, 2022

Registration No. [__]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified in Its Charter)

| (State

or Other Jurisdiction of Incorporation or Organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification Number) |

Telephone:

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Telephone:

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Laura Anthony, Esq.

Craig D. Linder, Esq.

Anthony L.G., PLLC

625 N. Flagler Drive, Suite 600

West Palm Beach, Florida 33401

Telephone: (561) 514-0936

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller

reporting company | |

| Emerging

growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to section 8(a) may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED AUGUST 15, 2022 |

BITECH TECHNOLOGIES CORPORATION

141,954,924 Shares of Common Stock for Resale by Selling Stockholders

This prospectus relates to the resale from time to time of 141,954,924 shares of our common stock, par value $0.001 per share (“common stock”) held by the selling securityholders named in this prospectus or their permitted transferees (“Selling Stockholders”).

The Selling Stockholders will sell their shares registered for resale in this prospectus at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale or at negotiated prices.

We will not receive any of the proceeds from the sale of the securities owned by the Selling Stockholders. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The Selling Stockholders will bear all commissions and discounts, if any, attributable to their sale of securities. See “Plan of Distribution” beginning on page 75 of this prospectus.

Our common stock is currently quoted on the OTC Market Group, Inc.’s OTCQB tier under the symbol “BTTC.” On August 4, 2022, the last reported sale price of our common stock was $0.159.

Our principal executive offices are located at 600 Anton Boulevard, Suite 1100, Costa Mesa, CA 92626.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 19 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is ____________, 2022.

TABLE OF CONTENTS

No dealer, salesperson or other individual has been authorized to give any information or to make any representation other than those contained in this prospectus in connection with the offer made by this prospectus and, if given or made, such information or representations must not be relied upon as having been authorized by us or the selling stockholder. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such offer or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in our affairs or that information contained herein is correct as of any time subsequent to the date hereof.

For investors outside the United States: We have not, and the selling stockholders have not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the United States.

| i |

Cautionary Note Regarding Forward-Looking Statements

This prospectus contains forward-looking statements. Specifically, forward-looking statements may include statements relating to:

| ● | our ability to develop and manufacture each of the components of the Evirontek Integrated Platform, and to do so economically, at scale, of sufficient quality, on schedule and to customers’ specifications. | |

| ● | our ability to engage target customers successfully and to convert such contacts into meaningful orders in the future. | |

| ● | our future financial performance; | |

| ● | changes in the market for our products and services; | |

| ● | the rapidly changing regulatory and legal environment in which we operate, may lead to unknown future challenges to operating our business or which may subject our business to added costs and/or uncertainty regarding the ability to operate; and | |

| ● | other statements preceded by, followed by or that include the words “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “target” or similar expressions. |

These forward-looking statements are based on information available as of the date of this prospectus and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

| ● | Our ability to develop and manufacture each of the components of the Evirontek Integrated Platform, and to do so economically, at scale, of sufficient quality, on schedule and to customers’ specifications. | |

| ● | Our ability to engage target customers successfully and to convert such contacts into meaningful orders in the future. | |

| ● | Our ability to establish supply relationships for necessary components and materials which could prevent or delay the introduction of our planned products and negatively impact our business. | |

| ● | Our ability to retain key employees and qualified personnel, and hire technical, engineering, sales, marketing, manufacturing plant operations and support personnel, our ability to compete and successfully grow the business could be harmed. | |

| ● | Our limited operating history makes evaluating our business and future prospects difficult and may increase the risk of your investment. | |

| ● | Our business model of manufacturing the components of the Evirontek Integrated Platform is capital-intensive, and we may not be able to raise additional capital on attractive terms, if at all, which could be dilutive to shareholders. If we cannot raise additional capital when needed, our operations and prospects could be materially and adversely affected. | |

| ● | We are subject to substantial regulation and unfavorable changes to, or failure by us to comply with, these regulations could substantially harm our business and operating results. | |

| ● | Other risks and uncertainties indicated in this prospectus, including those under “Risk Factors.” |

INDUSTRY AND MARKET DATA

We are responsible for the disclosure in this prospectus. However, this prospectus includes industry data that we obtained from internal surveys, market research, publicly available information and industry publications. The market research, publicly available information and industry publications that we use generally state that the information contained therein has been obtained from sources believed to be reliable. The information therein represents the most recently available data from the relevant sources and publications and we believe remains reliable. We did not fund and are not otherwise affiliated with any of the sources cited in this prospectus. Forward-looking information obtained from these sources is subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus.

TRADEMARKS AND COPYRIGHTS

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate name, logo and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect the Tesdison System Solution we are developing. This prospectus may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this prospectus are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

| 1 |

PROSPECTUS SUMMARY

This summary highlights certain information about us, this offering, and selected information contained in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common stock. For a more complete understanding of the Company and this offering, we encourage you to read and consider the more detailed information in this prospectus, including “Risk Factors” and the financial statements and related notes. Unless the context otherwise requires, “we,” “us,” “our,” or “the Company” refers to “Bitech Technologies Corporation,” a Delaware corporation, and its consolidated subsidiaries.

Our Company

We are a development-stage technology company dedicated to providing a suite of green energy solutions which we call the Evirontek Integrated Platform with a focus on cryptocurrency mining, data centers, commercial and residential utility, electric vehicle, and other renewable energy initiatives. We seek to offer our Evirontek Integrated Platform to resolve the exorbitantly high cost of electricity in crypto mining and related industries. Our initial core technology is Tesdison; a revolutionary U.S. patented self-charging dual-battery system technology providing increased efficiency in power generation. We plan to seek business partnerships with renewable energy providers for various applications and engage with value-added resellers to facilitate and implement our scalable and modular system solution.

There is an urgency in the global needs of today’s ever-changing energy landscape in the world of cryptocurrency mining where power saving is the most challenging issue for this business. Our goal is to change the future of the cryptocurrency mining businesses by providing our patented revolutionary green technology power-saving solution that has been designed to be safe, reliable, cost effective, and easily scalable.

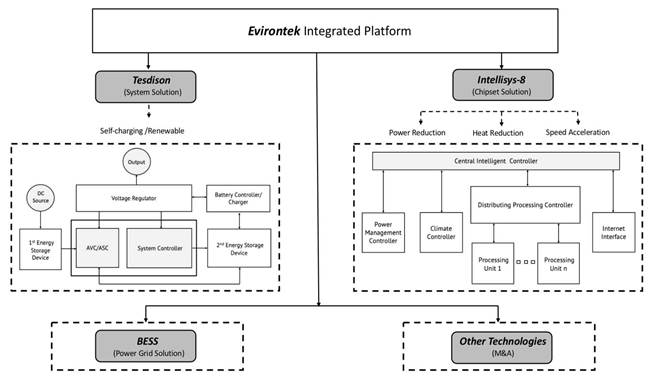

We plan to initially market the Evirontek Integrated Platform to the cryptocurrency mining industry to reduce the exorbitant high cost of electricity. The Evirontek Integrated Platform, once fully developed, will be comprised of (1) a patented high efficiency electric power generation and charging system which we license and call the “Tesdison Technology”, (2) a chipset and related software component we plan to develop which we call the “Bitech Intellisys-8 Chipset Solution” or “Intellisys-8”, (3) BESS technology solution for power grid efficiency, and (4) other complementary clean energy technologies that we plan to acquire. Combined, we refer to these technologies as the Evirontek Integrated Platform.

To respond to the current increasing demand in energy efficiency solutions while expanding our potential revenue options, we also plan to (1) become a Resource Entity (RE) operating our own state-of-the-art Battery Energy Storage Systems (BESS) solution in order to re-optimize the power capacity and balance the grid with intelligent time peak shifting control, and (2) penetrate into the solar power plant market and partner with or acquire outdated, mid-field solar power plants in the U.S., especially in California and Texas, and implement a BESS solution to increase energy efficiency and monetize time peak shifting implementation with targeted power plants ranging from 20MW to 500MW. Our planned containerized BESS solution is expected to provide a high level of user-friendly and seamless integration, intelligent monitoring ability with multimode authorization for dynamic connection, ultimate safety features, and flexible application via modular design, while enhancing robustness for interference from external factors in the field.

| 2 |

Prior to March 31, 2022, we were engaged in the business of owning, developing and leasing the Quad Video Halo video recording system (“QVH”) used to record medical procedures including the collection of accounts receivables related to previously provided spine injury diagnostic services (collectively, the “QVH Business”). On June 30, 2022, we sold the assets related to the QVH Business.

Corporate History and General Development of our business

Bitech Technologies Corporation (formerly, Spine Injury Solutions Inc.) was incorporated under the laws of Delaware on March 4, 1998. We changed our name from Spine Pain Management Inc. to Spine Injury Solutions, Inc. on October 1, 2015. On April 29, 2022 we changed our name to Bitech Technologies Corporation as part of the expansion of our business to focus on the introduction of Tesdison technology, a patented self-charging technology to provide a green energy solution to the cryptocurrency mining sector as discussed in this prospectus. Effective as of July 8, 2022, the Financial Industry Regulatory Authority, Inc. (“FINRA”) confirmed that it received the necessary documentation to process our request to change our corporate name to Bitech Technologies Corporation and trading symbol on the OTCQB tier of the OTC Markets Group. Inc. to “BTTC”.

From 2009 to 2018, we operated as a technology, marketing, billing, and collection company facilitating diagnostic services for patients who have sustained spine injuries resulting from traumatic accidents.

During the fourth quarter of 2018, we discontinued our involvement in future medical procedures pursued the collection of previously funded procedures and continued in the business of owning, developing and leasing the Quad Video Halo video recording system (“QVH”).

Our wholly owned subsidiary, Bitech Mining Corporation (“Bitech Mining”) was founded on January 21, 2021 in the state of Wyoming by Benjamin Tran and Michael Cao. Mr. Tran has been serving as Bitech’s Chairman and Chief Executive Officer since its inception. Mr. Cao has been serving as a member of the board of directors of Bitech Mining.

On January 15, 2021, Bitech Mining acquired the global exclusive license of Tesdison technology (U.S. patent No. 10,547,179 B2 - High electric Power Generation and Charging System) for the crypto mining vertical market worldwide from licensor Supergreen Energy Corp.

On May 3, 2021, Bitech Mining started its initial launch of Evirontek, an integrated technology platform of Bitech Mining to provide integrated solutions to the crypto mining industry to include (1) U.S. patented Tesdison technology, and (2) Bitech Intellisys-8, an in-house proprietary system architectural design for crypto miners.

On October 25, 2021, Bitech Mining executed the amendment from its licensor to upgrade from 4-year exclusivity license to the perpetual exclusive license for the crypto mining vertical market worldwide.

In 2021, Bitech Mining started the architecture design of Bitech Intellysis-8 and engaged with its Chief Scientific Advisor Calvin Cao who is the inventor of Tesdison technology to lead the technical implementation and commercialization of the Tesdison technology and hired Robert Brilon to serve Bitech Mining in the capacity of its Chief Financial Officer.

| 3 |

On March 31, 2022, the shareholders of Bitech Mining acquired the control of Bitech Technologies Corporation (formerly, Spine Injury Solutions, Inc.). See “Prospectus Summary - Acquisition of Bitech Mining”.

In April 2022, we hired Roy Bao as our Chief Technology Officer to continue the development of the Evirontek Integrated Platform and identify and/or manage new energy projects that we believe are positioned to generate revenue as well as leading the efforts of our plans to acquire new energy technology in order to enhance our technology portfolio.

Acquisition of Bitech Mining

We acquired Bitech Mining on March 31, 2022 (the “Closing Date”) through a share exchange pursuant to a Share Exchange Agreement (the “Share Exchange Agreement”) by and among the Company, Bitech Mining, each of Bitech Mining’s shareholders (each, a “Seller” and collectively, the “Sellers”), and Benjamin Tran, solely in his capacity as Sellers’ Representative (“Sellers’ Representative”). The transaction contemplated by the Share Exchange Agreement is hereinafter referred to as the “Share Exchange”). Pursuant to Share Exchange Agreement, we acquired from the Sellers, an aggregate of 94,312,250 shares of Bitech Mining’s Common Stock, par value $0.001 per share, representing 100% of the issued and outstanding shares of Bitech Mining (collectively, the “Bitech Mining Shares”). In consideration of the Bitech Mining Shares, we issued to the Sellers an aggregate of 9,000,000 shares of our newly authorized Series A Convertible Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”). Each Bitech Mining Share received 0.09543 shares of Series A Preferred Stock. Each share of Series A Preferred Stock automatically converted into 53.975685 shares (an aggregate of 485,781,168) of our common stock (the “Company Common Stock”) on June 27, 2022 when we filed an amendment to our Certificate of Incorporation increasing the number of shares of our authorized common stock so that there were a sufficient number of shares of our common stock authorized but unissued to permit a full conversion of all the Series A Preferred Stock. Upon conversion of the Series A Preferred Stock, the Sellers held, in the aggregate, approximately 96% of the issued and outstanding shares of our capital stock on a fully diluted basis.

The following agreements were entered into in connection with our acquisition of Bitech Mining:

Management Services Agreement. On the Closing Date, the Company, its wholly owned subsidiary Quad Video Halo, Inc. (“Quad”) and Peter L. Dalrymple (“Dalrymple”), a director of the Company, entered into a Management Services Agreement (the “MSA”) whereby Dalrymple agreed to act as the general manager of the video recording operations of Quad and collect certain accounts receivable of the Company (the “Services”). In exchange for providing the Services, we agreed to pay Dalrymple a fee equal to the net revenues derived from these operations after payment of all operating expenses related to such operations. The term of the MSA commences on the Closing Date and continues until the earlier to occur of the following: (i) 90 days after the Closing Date; (ii) the Company and Dalrymple’s mutual written consent; or (iii) any material breach of the MSA by either party, provided that the breaching party has been provided written notice of such breach and has failed to cure such breach within ten (10) days of receipt of such written notice.

| 4 |

Promissory Note Amendment. On the Closing Date, the Company, Quad and Dalrymple, entered into an Amendment to the Secured Promissory Note (the “Note Amendment”) whereby Dalrymple agreed that (i) the principal and accrued interest outstanding under the Secured Promissory Note dated August 31, 2020 as amended on October 29, 2021 issued by the Company in favor of Dalrymple (collectively, the “Note”) is $95,000 as of the Closing Date, (ii) the date on which the outstanding principal and accrued interest is due is 90 days after the Closing Date, (iii) any obligations of (x) the Company that become due and owing to Bitech Mining or the Sellers under Section 4.07(c) of the Share Exchange Agreement or (y) that become due and owing under Section 6.12 of the MSA may be offset against any amounts owed by the Company or Quad under the Note and (iv) all claims or causes of action (whether in contract or in tort, in law or in equity) that may be based upon, arise out of or relate to the Note, or the negotiation, execution or performance of the Note (including any representation or warranty made in or in connection with the Note or as an inducement to enter into the Note or this Amendment), may be made only against Quad, and BTTC who is not a party to the Note as of the Closing Date, including without limitation any past, present or future director, officer, employee, incorporator, member, manager, partner, equity holder, affiliate, agent, attorney or representative of SPIN (“SPIN Parties”), shall have no liability (whether in contract or in tort, in law or in equity, or based upon any theory that seeks to impose liability of the SPIN Parties) for any obligations or liabilities arising under, in connection with or related to the Note or for any claim based on, in respect of, or by reason of the Note or its negotiation or execution, and Dalrymple waives and releases all such liabilities, claims and obligations against any such SPIN Parties.

Security Agreement Amendment. On the Closing Date, the Company, Quad and Dalrymple, entered into an Amendment to Security Agreement (the “Security Agreement Amendment”) whereby the parties to that agreement agreed that (i) Quad shall be included with the Company as an additional debtor for all purposes in the Security Agreement entered into between the Company and Dalrymple dated August 31, 2020 (the “Security Agreement”), (ii) Quad’s collateral obligations under the Security Agreement shall only relate to its accounts receivable, and the collateral described relating to “Pledged Securities” as defined in the Security Agreement shall not apply to Quad’s obligations under the Security Agreement, (iii) our pledge of its accounts receivables as provided for in the Security Agreement will be limited solely to our accounts receivables in existence as of March 27, 2022 at 11:59 P.M. ET, and shall not apply to any after acquired accounts receivables and (iv) the Company is authorized to file an amended financing statement to reflect the terms of Security Agreement Amendment and Quad shall promptly file a financing statement reflecting the terms set for in such amendment.

Disposition of Quad Video Assets

On June 30, 2022 (the “Effective Date”), we completed the sale of all of the assets of our wholly owned subsidiary Quad Video Halo, Inc. (“Quad Video”) pursuant to the terms of an Asset Purchase Agreement entered into among Quad Video, Quad Video Holdings Corporation (“Quad Holdings”) and Peter Dalrymple, a former officer, director and substantial shareholder of the Company (“Dalrymple,” together with Quad Holdings, collectively, the “Buyers”) dated as of the Effective Date (the “Quad Video APA”). Pursuant to the terms of the Quad Video APA, Quad Video sold all of its assets to Quad Holdings which included its accounts receivables, fixed assets, intangible assets and all customer lists associated with Quad Video’s business (the “Quad Video Assets”).

Under the terms of the Quad Video APA, the Buyers cancelled a promissory note with an approximate principal balance of $8,789 plus accrued interest as of the Effective Date and a security agreement securing payment of that note pursuant to a Secured Promissory Note and Security Agreement Cancellation Agreement and assumed all liabilities related the Quad Video’s operations and the Quad Video Assets and terminated the Management Services Agreement entered into among the Company, Quad Video and Dalrymple dated March 31, 2022 pursuant to a Management Services Termination Agreement.

| 5 |

In addition, on the Effective Date, we completed the sale of certain accounts receivables related to our spine pain management business pursuant to the terms of an Asset Purchase Agreement entered into among the Company, SPIN Collections LLC, a company owned or controlled by Dalrymple and Dalrymple (the “SPIN Accounts Receivable APA”). The consideration received by the Company in connection with the SPIN Accounts Receivable APA was nominal and immaterial.

Series A Preferred Stock Conversion

Effective as of June 27, 2022, we issued an aggregate of 485,781,168 shares (the “Conversion Shares”) of our common stock upon the conversion of 9,000,000 shares of our Series A Convertible Preferred Stock, $0.001 par value per share (the “Series A Preferred”). The shares of the Series A Preferred were issued to the former shareholders of Bitech Mining on March 31, 2022 in exchange for their shares in Bitech Mining representing 100% of the issued and outstanding shares of Bitech Mining. The Series A Preferred automatically converted into our common stock upon our filing of a Certificate of Amendment to our Certificate of Incorporation, as amended on June 27, 2022.

Our Business

We are a development-stage technology company dedicated to providing a suite of revolutionary electrical power generation technologies we call the “Evirontek Integrated Platform” as discussed below.

Overview of Bitech’s Business

There is an urgency in the global needs of today’s ever-changing energy landscape in the world of cryptocurrency mining where power saving is the most challenging issue for this business. Bitech’s primary goal is to change the future of the cryptocurrency mining businesses by providing a U.S. patented revolutionary green technology power-saving solution that has been designed to be safe, reliable, cost effective, and easily scalable. In addition, to respond to the current increasing demand for energy efficiency solutions while expanding our potential revenue options, we also seek to participate in providing high-efficiency energy solutions to data centers, commercial and residential utility, electric vehicle, and other renewable energy initiatives

We plan to initially market the “Evirontek Integrated Platform” to the cryptocurrency mining industry to reduce the exorbitant high cost of electricity. The Evirontek Integrated Platform, once fully developed, will be comprised of:

(1) a patented high efficiency electric power generation and charging system which we license and call the “Tesdison Technology”,

(2) a chipset and related software component we plan to develop which we call the “Bitech Intellisys-8 Chipset Solution” or “Intellisys-8”,

(3) BESS technology solution for power grid efficiency, and

(4) other complementary clean energy technologies that we plan to acquire .

Combined, we refer to these technologies as the Evirontek Integrated Platform.

| 6 |

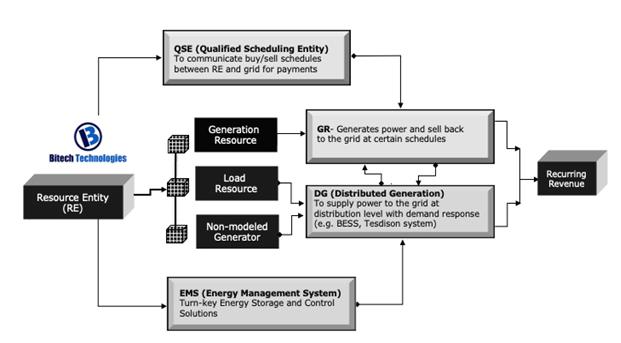

We also plan to enter the BESS solution business in a two-pronged approach:

(1) Become a Resource Entity (RE) operating our own state-of-the-art Battery Energy Storage Systems (BESS) solutions in order to re-optimize the power capacity and balance the grid with intelligent time peak shifting control; and

(2) Penetrate into the solar power plant market and partner with or acquire operators of outdated, mid-field solar power plants in the U.S., especially in California and Texas, and implement a BESS solution to increase energy efficiency and monetize time peak shifting implementation with targeted power plants ranging from 20MW to 500MW. Our planned containerized BESS solution is expected to provide a high level of user-friendly and seamless integration, intelligent monitoring ability with multimode authorization for dynamic connection, ultimate safety features, and flexible application via modular design, while enhancing robustness for interference from external factors in the field.

To generate recurring revenue from the BESS solution, we plan to qualify as a Resource Entity (RE) with the Electric Reliability Council of Texas or ERCOT, and partner with a local Qualified Scheduling Entity (QSE) to allow communication on buy and sell schedules between the RE and the grid for daily payment and engage with a selected Energy Management System solution provider or EMS to manage intelligent control in interfacing with the grid via our Generation Resource with a specific Load Resource to buy power from the grid at off-peak schedules and supply power back to the grid at peak schedules at a distribution level with controllable demand response. Once our Tesdison system solution is approved with the QSE, we plan to apply as an RE using our state-of-the-art BESS solution initially and add on the Tesdison system as a generator capable of providing net output of energy to the ERCOT system known as a “Non-modeled Generator”.

| 7 |

The Tesdison System

The Tesdison System is a virtually renewable electric power-generating system configured to provide an efficient means for generating electricity for charging an electrical energy storage source such as batteries as well as provide energy for other uses. Bitech intends to develop a large scale Tesdison System based on the current prototype. The prototype Tesdison System utilizes patented technology that:

| ● | Enables the generation of electricity to enhance battery storage efficiency | |

| ● | Is a modular and scalable electrical storage and power generation device, | |

| ● | Is capable of distributing a steady stream of 120/220/480 volts of electricity, and | |

| ● | Can be run in concert with other units to generate a constant, uninterrupted supply of electricity 24 hours per day at any desired voltage. |

The Tesdison System technology was validated by National Technical Systems, Inc. (“NTS”) on September 17, 2019. Established in 1961, NTS is a global provider of testing, inspection and certification services.

The Tesdison technology commercialization plan has three phases:

| (1) | Alpha Production: We plan to produce five (5) 100KW Alpha Tesdison units to be deployed at the test sites of our customers and incorporate learnings to update the Tesdison system to create a beta version of the system. | |

| (2) | Beta Production: We plan to produce additionally five (5) 100KW Beta Tesdison units to be deployed at a customer test site and incorporate additional learnings to update the system to a final version before mass production. | |

| (3) | Mass production: We plan to mass produce stand-alone Tesdison systems starting with 1MW systems for smaller crypto miners and take purchase orders for specific power requirements from committed customers for much higher power requirements. |

We have identified potential manufacturing options for building Tesdison systems. We are performing due diligence and exploring pricing options with technologically advanced manufacturers in the United States in order to select the most suitable manufactures who can demonstrate long-term commitment, and the highest level of technology, quality, reliable shipment schedule, and customer support excellency.

The Bitech Intellisys-8 Chipset Solution (“Intellisys-8”)

The planned Intellisys-8 Chipset Solution is a combination of computer chips and other hardware components that will be driven by software that is intended to reduce power consumption and heat in computer systems and accelerate their computational speed. The solution will include a central intelligent controller that controls a power management controller, a climate controller, distributing processing controller and internet interface.

| 8 |

Below is a diagram of the Evirontek Integrated Platform:

Revenue Model

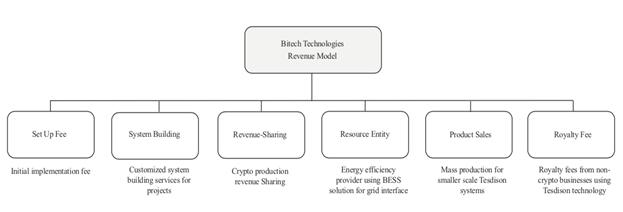

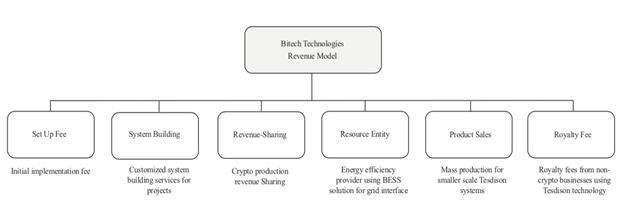

Bitech’s planned revenue model is a six -pronged revenue ecosystem including (1) initial set up fees, (2) system building services, (3) cryptocurrency production revenue sharing, (4) recurring revenue from operating as a Resource Entity to produce energy using grid-interfacing BESS solution, (5) mass production sales of smaller scale systems using the Tesdison Technology, and (6) royalty fees from non-cryptocurrency businesses that use the Tesdison Technology.

The recurring revenue nature of our planned crypto-production sharing is intended to be our main revenue source, enhanced with other potential revenue streams to strengthen our business longevity. At times, we plan to offer customized power-saving system buildings for data centers and power plants using our licensed Tesdison Technology while providing working capital to support the continued expansion of all six prongs of our planned revenue model. Bitech, while introducing the Tesdison Technology to business partners throughout the world, also expects to benefit from collecting a portion of any revenue derived from various large-scale commercialization projects with partners, using this technology to replace other outdated, ineffective power solutions in data centers.

| 9 |

The following diagram illustrates our planned revenue model:

Marketing Plans

We plan to, in conjunction with international business developers, seek cryptocurrency mining partners with large-scale productions to facilitate and initially market the Tesdison Technology solution and implement its planned revenue share business model with cryptocurrency miners of the most popular cryptocurrencies such as Bitcoin and Ethereum. Once development of the Intellisys-8 has been completed, we intend to integrate this solution with the Tesdison Technology and market this solution as the Evirontek Integrated Platform. Bitech has an exclusive license to use the Tesdison Technology in the cryptocurrency industry. We can also offer the Tesdison Technology pursuant to our license agreement on a non-exclusive basis to any other industry application outside of the cryptocurrency industry to include data centers, solar power plants, natural resource mining, data centers, and many other renewable initiatives.

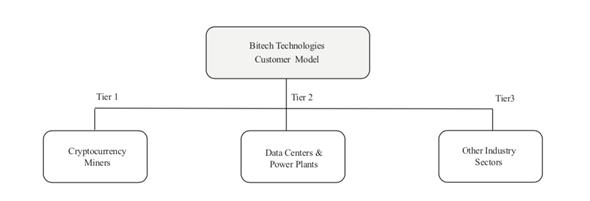

We plan to capture market share in three tiers as depicted in the diagram below. We plan to take a strategic approach by partnering with major players of in the cryptocurrency mining industry to accelerate revenue generation in order to quickly obtain sizable market share executing its revenue sharing model via technology licensing and solution-driven implementations. Bitech has created a market penetration model that accommodates its “green tech” brand recognition with plans for global expansion and balanced revenue lines between three major customer tiers, primarily including (1) cryptocurrency mining market leaders, (2) data centers and power plants, and (3) other industries that are heavy users of electricity that seek to reduce operating costs by reducing their costs of electricity.

| 10 |

Core Technology

The Evirontek technology integrated platform includes both a renewable energy system solution using Tesdison Technology for power saving and a chipset solution using the Bitech Intellisys-8 architecture we are developing based on its design to reduce power consumption and heat in computer systems and accelerate their computational speed.

We plan to offer the patented Tesdison Technology with its expected cost savings, reliability and scalability solution to clients and client partners via a licensing model with revenue-sharing partnerships. The proprietary Tesdison Technology has been shown to generate up to twice the original energy output and is a modular, scalable storage and power generation solution. Tesdison Technology distributes a steady stream of 120/220/480 VAC output and multiple Tesdison units can be run in concert to generate a constant, uninterrupted supply of electricity 24 hours a day at any desired voltage.

Our core technology Tesdison system is a virtually renewable electric power-generating system configured to provide an efficient means for generating electricity for charging an electrical energy storage source such as batteries using the same energy storage source to power an electro-mechanical system for generating electricity. Part of the output of the electro-mechanical system for generating electricity is fed back to the energy storage source to recharge the storage source, as well as provide energy to charge a second energy storage system.

Cryptocurrency Mining Industry

The global cryptocurrency market is expected to grow at a compound annual growth rate (CAGR) of 30% from 2019 to 20261.

The global cryptocurrency mining market size is projected to reach US$ 2,584.6 million by 2026, from US$ 1,015.9 million in 2020, at a CAGR of 16.8% during 2021-20262.

According to The Block Research, bitcoin miners made more than $15 billion in revenue over the course of 2021. The estimate represents a year-over-year increase of 206%. The bitcoin mining revenue peaked in March last year, when miners brought in some $1.75 billion, including $167 million in transaction fees. Throughout the year, bitcoin mining revenue was buoyed by soaring prices for the digital asset, which hit an all-time high in early November 2021. The scenario was no different for Ethereum miners. “Ethereum miners have generated a total of $16.5 billion in revenue, representing a year-on-year increase of 678%, a record revenue year,” says the report3.

The United States is now the bitcoin mining capital of the world. It is because China has recently banned all domestic cryptocurrency mining in June 2021 and then outlawed cryptocurrencies completely in September 20214.

1 See Current and Upcoming Trends in CryptoCurrency Market - https://www.globenewswire.com/news-release/2021/02/23/2180372/0/en/Current-and-Upcoming-Trends-in-CryptoCurrency-Market-Cap-to-Hit-5-190-62-Million-by-2026-Soars-at-30-CAGR-Facts-Factors.html

2 See InvestorPlace – Stock Market News –

https://www.yahoo.com/video/4-crypto-mining-stocks-worth-165938416.html.

3 See Bitcoin Miners' Revenue Rose 206% In 2021 –

https://www.prnewswire.com/news-releases/bitcoin-miners-revenue-rose-206-in-2021-301482452.html

4 See U.S. is now the ‘Bitcoin mining capital of the world’ –

https://news.yahoo.com/us-is-now-the-bitcoin-mining-capital-of-the-world-gem-mining-ceo-155729770.html

| 11 |

The green new era has begun entering the cryptocurrency mining world with a technological shift toward green energy solutions. Organizations such as the Bitcoin Mining Council are working to increase transparency in the industry through higher reporting standards. Many crypto-native organizations are also joining the Crypto Climate Accord, committing to achieve net-zero emissions from electricity consumption associated with crypto-related operations by 20305.

The rising tide of bitcoin prices has lifted stock prices for Bitcoin mining company. Although Bitcoin proponents claim that anyone can mine it, the cryptocurrency’s mining ecosystem is dominated by industrial outfits. This is primarily due to the considerable equipment and electric cost associated with the activity6.

Renewable/Electricity Industry

In its Annual Energy Outlook 2021 (AEO2021), the U.S. Energy Information Administration (EIA) projects that the share of renewables in the United States electricity generation mix will increase from 21% in 2020 to 42% in 20507.

According to International Energy Agency Report in October 2020, electricity production is witnessing a profound transformation, with a greater role for smarter grids going hand in hand with increased solar and wind deployment. Electricity grids – transmission and distribution - provide the bedrock of today’s and tomorrow’s power systems, enabling electricity to flow and all sources of flexibility to contribute to electricity security. Grid expansion must accelerate over the next decade to connect all new sources of electricity, including renewables, extending grids by 16 million kilometers, 80% more than over the past decade8.

Ernst & Young in its 2021 report stated that a reinvigorated focus on talent and skills is necessary to fully realize the value of technology and propel transformation across the utility value chain9. Electricity demand and emissions are now 5% higher than where they were before the Covid-19 outbreak in 2020, which prompted worldwide lockdowns that led to a temporary drop in global greenhouse gas emissions. Electricity demand also surpassed the growth of renewable energy, the analysis found.10

5 See Green New Era Dawn For Crypto with Global Mining Shift – https://techcrunch.com/2021/12/13/green-new-era-dawns-for-crypto-with-global-mining-shift/

6 See Bitcoin Mining Firms Benefit From Soaring Bitcoin Price – https://www.investopedia.com/bitcoin-mining-firms-benefit-from-soaring-bitcoin-price-5094729

7 See EIA projects renewables share of U.S. electricity generation mix will double by 2050 – https://www.eia.gov/todayinenergy/detail.php?id=46676

8 See Electricity Security in Tomorrow’s Power Systems – https://www.iea.org/articles/electricity-security-in-tomorrow-s-power-systems

9 See If Tech Powers the Future, Who Power the Tech? – https://www.ey.com/en_us/power-utilities/if-tech-powers-the-future-who-powers-the-tech

10

See Global electric power demand surges above pre-pandemic level –

https://www.cnbc.com/2021/08/25/global-electric-power-demand-surges-above-pre-pandemic-levels-.html

| 12 |

Patent License Agreement

On January 15, 2021, Bitech entered into a Patent & Technology Exclusive and Non-Exclusive License Agreement with Supergreen Energy Corp. (“SGE”) which was amended on October 25, 2021 and on March 26, 2022 (collectively, the “License Agreement” or “License”). Pursuant to the terms of the License Agreement, Bitech has a perpetual and globally exclusive license to United States patent no. 10,547,179 B2 granted by the U.S. Patent and Trademark Office on January 28, 2020 for a high efficiency electric power generation and charging system (the “Power Generation Patent”) within the cryptocurrency mining industry and a non-exclusive license for all other industries.

Bitech issued to SGE 10,000,000 shares of Bitech’s Common Stock and paid it $25,000 in cash as a license fee under the License Agreement. In addition, Bitech agreed to pay SGE the following milestone fees pursuant to the terms of the License Agreement: (1) 10% of the total cash received from Bitech’s clients, (2) 30% of the total equity received from Bitech’s clients, (3) 30% of the total value of any coin, token or cryptocurrency received from Bitech’s clients and (4) 10% of the total gross sales revenue or 15% of net profit from its sales revenue. In addition, Bitech agreed to pay SGE the following sublicense fees pursuant to the terms of the License Agreement: (1) 10% of cash, non-royalty sublicensing consideration, (2) 30% of royalty sublicensing consideration and (3) 30% of royalty sublicensing consideration paid in equity, tokens or bitcoins. Further, Bitech is obligated to pay SGE an assignment fee of 15% of the consideration received by the shareholders of Bitech in the event of a transaction involving a change of control of Bitech or sale of all or substantially all of its assets but excluding issuance of equity in financing transactions or acquisitions of synergistic businesses and the Share Exchange.

The term of the license continues for the term of the Power Generation Patent. Bitech may terminate the License Agreement at any time upon 90 days prior notice to SGE. SGE may terminate the License Agreement if (a) Bitech fails to make any payments due under the License Agreement within 30 days after written notice from SGE, (b) Bitech breaches any non-payment provision of the License Agreement and does not cure such breach within 60 days after written notice from SGE, (c) SGE delivers notice to Bitech of three or more actual breaches of the License Agreement in any 12-month period even in the event Bitech cures such breaches in the allowed period, or (d) Bitech or any sublicensee of Bitech initiates any proceeding or action to challenge the validity, enforceability or scope of the Power Generation Patent or assists a third party in pursuing such a proceeding.

Calvin Cuong Cao who is the principal owner of SGE is the brother of Michael Cao, a director and substantial shareholder of the Company.

Intellectual Property—Patents, Trademarks

We regularly seek to protect our intellectual property rights in connection with our Tesdison Technology platform. We rely on non-disclosure/confidentiality agreements to protect our intellectual property rights. To the extent we describe or disclose our proprietary technology, we redact or request redaction of such information prior to public disclosure. Despite these measures, we may be unable to detect the unauthorized use of, or take appropriate steps to enforce our intellectual property rights. Effective trade secret protection may not be available in every country in which we plan to license our technology to the same extent as in the United States. Failure to adequately protect our intellectual property could impair our ability to compete effectively. Further, enforcing our intellectual property rights could result in the expenditure of significant financial and managerial resources and may not prove successful. Although we intend to protect our rights vigorously, there can be no assurance that these measures will be successful.

| 13 |

We own the website www.bitech.tech.

We license from SGE United States patent no. 10,547,179 B2 granted by the U.S. Patent and Trademark Office on January 28, 2020 for a high efficiency electric power generation and charging system (the “Power Generation Patent”) pursuant to the License Agreement. The Power Generation Patent and the License Agreement expires on April 4, 2038 so long as all required filing fees are paid with respect to such patent.

Competition

The renewable energy market is evolving and highly competitive. With the introduction of new technologies and the potential entry of new competitors into the market, we expect competition to increase in the future, which could harm our business, results of operations, or financial condition once we complete development and commence marketing the Tesdison Technology and the Intellisys-8 Chipset Solution. Electrical power consumption associated with cryptocurrency mining is a significant challenge facing all cryptocurrency miners. We believe that the more energy efficient proprietary Tesdison Technology will enable us to be competitive with other renewable energy providers by achieving a reduction in electrical power consumption that results in costs savings greater than the costs to implement either the Tesdison Technology or the Intellisys-8 Chipset Solution. We expect to face significant competition from other providers of renewable energy sources, which may have an adverse effect on expected revenues.

We believe our ability to compete successfully with other renewable energy providers will also depend on a number of factors including implementation costs, safety and cycle life, and on non-technical factors such as brand, established customer relationships and financial and manufacturing resources. Many of the incumbents have, and future entrants may have, greater resources than we have and may also be able to devote greater resources to the development of their current and future technologies. They may also have greater access to larger potential customer bases and have and may continue to establish cooperative or strategic relationships amongst themselves or with third parties (including OEMs) that may further enhance their resources and offerings.

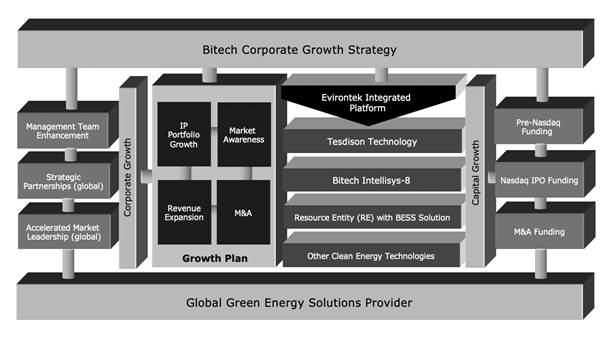

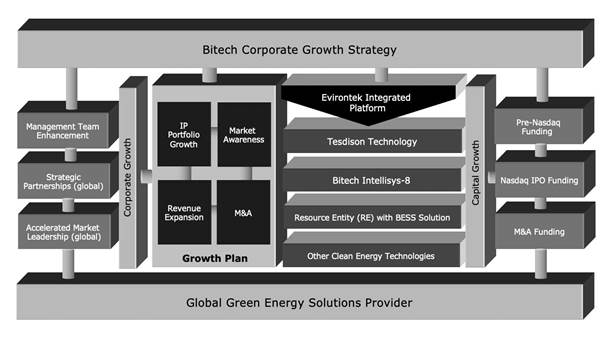

Corporate Growth Plan

We started our business with our core power-saving technology solution starting with Tesdison technology for crypto mining business as a part of the Evirontek Integrated Platform with a plan to (1) enhance our technology portfolio by acquiring additional clean energy technology and using our internal resources to further develop our existing technology, (2) accelerate our revenue plan via the commercialization of the Tesdison Technology and also becoming a qualified Resource Entity using state-of-the-art and low-cost BESS solutions, (3) execute technology-enabling plan for renewable infrastructure, allowing us to acquire other providers while exploring partnership opportunities to acquire income-producing infrastructure projects that require new technology implementation to enhance revenue and profit sharing, (4) execute our capital market growth plan via market awareness of our technological solutions, and (5) optimize our human capital strategy via a management enhancement plan to expand our business in several related industry sectors that demand more energy efficiency.

| 14 |

Sources and Availability of Materials

As discussed above, we plan to develop a full scale Tesdison Technology based system and since we are not currently producing these systems, we have no current need to obtain the input materials needed to produce them. Once we commence production, we plan to source our input materials from industry leading suppliers of the needed components on a purchase order basis and using contract manufacturers.

Once we commence commercial production of the Evirontek Integrated Platform or any of its component systems, any significant interruption or negative change in the availability or economics of the supply chain for key inputs, such as the raw material cost of batteries or computer chips, could, however, materially impact our business, financial condition, results of operations or prospects. We intend to purchase input materials on a purchase order basis from worldwide suppliers at market prices based on our production requirements. Consequently, our management believes that we will have access to a sufficient supply of the key inputs for the foreseeable future. Furthermore, we do not anticipate any unique supply constraints that would impede the commercialization of our planned products or systems for the foreseeable future.

Employees

As of June 30, 2022, we had two full-time employees. To date, we have not experienced any work stoppages and we consider our relationship with our employees to be good. None of our employees are either represented by a labor union or are subject to a collective bargaining agreement.

Government Regulation and Compliance with Respect to Bitech’s Business

There are government regulations pertaining to battery safety, transportation of batteries, use of batteries in industry, factory safety, and disposal of hazardous materials. We will ultimately have to comply with these regulations to license or sell our Tesdison Technology based systems into the market. The license and sale of these systems abroad is likely to be subject to export controls in the future.

| 15 |

Properties

Our principal executive offices are located at 600 Anton Boulevard, Suite 1100, Costa Mesa, CA 92626. We occupy this location pursuant to a lease that may be terminated by us on 90 days prior notice.

Selling Stockholders

On March 31, 2022 (the “Closing Date”) pursuant to a Share Exchange Agreement (the “Share Exchange Agreement”) by and among the Company, Bitech Mining, each of Bitech Mining’s shareholders (each, a “Seller” and collectively, the “Sellers”), and Benjamin Tran, solely in his capacity as Sellers’ Representative (“Sellers’ Representative”), the Company acquired 94,312,250 shares of Bitech Mining’s common stock representing 100% of the issued and outstanding shares of Bitech Mining (collectively, the “Bitech Shares”). In consideration of the Bitech Shares, the Company issued to the Sellers an aggregate of 9,000,000 shares of the Company’s Series A Convertible Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”). Pursuant to the Certificate of Designations of Preferences and Rights of Series A Convertible Preferred Stock dated March 31, 2022, each share of Series A Preferred Stock automatically converted into 53.975685 shares (an aggregate of 485,781,168) of the Company’s common stock on June 27, 2022 upon the Company’s filing of an amendment to its Certificate of Incorporation increasing the number of the Company’s authorized common stock so that there were a sufficient number of shares of Company common stock authorized but unissued to permit a full conversion of all the Series A Preferred Stock.

The Company agreed to use commercially reasonable efforts to file with the SEC a registration statement covering the resale of shares of our common stock held by the Sellers.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties, including those in the section entitled “Risk Factors” and elsewhere in this prospectus. These risks include, but are not limited to, the following:

| ● | Our success will depend on our ability to develop and manufacture each of the components of the Evirontek Integrated Platform, and to do so economically, at scale, of sufficient quality, on schedule and to customers’ specifications. | |

| ● | Our licensing strategy is subject to various risks which could adversely affect our business and future prospects. There are no assurances that SGE or other future counterparties will not provide similar licenses to other manufacturers which will increase the competition faced by us. | |

| ● | We may license technology that has not been commercialized or commercialized only to a limited extent, and the success of our business depends on technology licensed performing as expected. | |

| ● | We may not be able to engage target customers successfully and to convert such contacts into meaningful orders in the future. |

| 16 |

| ● | We may not be able to establish supply relationships for necessary components and materials which could prevent or delay the introduction of our planned products and negatively impact our business. | |

| ● | Substantial increases in the prices for our raw materials and components, some of which are obtained in volatile markets where demand may exceed supply, could materially and adversely affect our business and negatively impact our prospects. | |

| ● | We are sensitive to increases in the cost of supply of electricity, which is obtained in a highly regulated marketplace, susceptible to changes in the regulatory regime. | |

| ● | If the components of the Evirontek Integrated Platform fail to perform as expected, our ability to develop, market, and sell our products could be harmed. | |

| ● | If we are unable to retain key employees and qualified personnel, and hire technical, engineering, sales, marketing, manufacturing plant operations and support personnel, our ability to compete and successfully grow the business could be harmed. | |

| ● | Our limited operating history makes evaluating our business and future prospects difficult and may increase the risk of your investment. | |

| ● | We are unable to assert, enforce and otherwise protect the intellectual property rights licensed by SGE and rights to indemnification under the license and services agreement with SGE may be insufficient or unavailable, which could lead to increased costs and negatively affect the business. | |

| ● | The renewable electricity market and our technology are rapidly evolving and may be subject to unforeseen changes, such as technological developments in existing technologies or new developments in competitive technologies that could adversely affect the demand for our products. | |

| ● | Our business model of manufacturing the components of the Evirontek Integrated Platform is capital-intensive, and we may not be able to raise additional capital on attractive terms, if at all, which could be dilutive to shareholders. If we cannot raise additional capital when needed, our operations and prospects could be materially and adversely affected. | |

| ● | We may become subject to product liability and warranty claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims. | |

| ● | We are subject to substantial regulation and unfavorable changes to, or failure by us to comply with, these regulations could substantially harm our business and operating results. | |

| ● | Concentration of ownership among our existing executive officers, directors and their affiliates may prevent new investors from influencing significant corporate decisions. | |

| ● | Future sales of common stock by management and other stockholders may have an adverse effect on the then prevailing market price of our common stock. | |

| ● | An investor may face liquidity risks with an investment in our common stock. | |

| ● | Risks related to a lack of dividend payments by us on our common stock and, consequently, the ability of investors to achieve a return on their investment. |

Corporate Information

Our principal executive offices are located at 600 Anton Boulevard, Suite 1100, Costa Mesa, CA 92626, and our telephone number at that location is (855) 777-0888. The address of our website is www.bitech.tech. The inclusion of our website address in this prospectus does not include or incorporate by reference the information on our website into this prospectus.

The name of the Company, our logos and other trade names, trademarks or service marks appearing in this prospectus are the property of our company. Trade names, trademarks and service marks of other organizations appearing in this prospectus are the property of their respective holders.

| 17 |

THE OFFERING

141,954,924 Shares of Common Stock for Resale by Selling Stockholders

We are registering 141,954,924 shares of our Common Stock which we issued to the Selling Stockholders upon conversion of the Series A Preferred Stock.

| Common Stock offered by the Selling Stockholders | 141,954,924 | |

| Selling Stockholders | 141,954,924 shares of common stock are being offered by the Selling Stockholders. See “Selling Stockholders” on page 73 of this prospectus for more information on the Selling Stockholders. | |

| Common stock to be outstanding after the offering | 514,005,770 shares of common stock, based on our issued and outstanding shares of common stock as of August 4, 2022. | |

| Use of Proceeds | We will not receive any proceeds from the sale of common stock by the Selling Stockholders participating in this offering. The Selling Stockholders will receive all of the net proceeds from the sale of their respective shares of common stock in this offering.

See “Use of Proceeds” on page 35 of this prospectus for more information. | |

| Risk Factors | See “Risk Factors” on page 19 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. | |

| Plan of Distribution | The Selling Stockholders, or their pledgees, donees, transferees, distributees, beneficiaries or other successors-in-interest, may offer or sell the shares of common stock from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The Selling Stockholders may also resell the shares of common stock to or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions.

See “Plan of Distribution” beginning on page 75 of this prospectus for additional information on the methods of sale that may be used by the Selling Stockholders. | |

| Trading Market | The Company’s Common Stock is currently quoted on the OTCQB under the symbol “BTTC.” |

| 18 |

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

The Share Exchange was treated as a recapitalization and reverse acquisition for financial reporting purposes, and Bitech Mining is considered the acquirer for accounting purposes. As a result of the Share Exchange and the change in our business and operations, a discussion of the past financial results of our predecessor, Spine Injury Solutions Inc., is not pertinent, and under applicable accounting principles, the historical financial results of Bitech Mining, the accounting acquirer, prior to the Share Exchange are considered our historical financial results.

The following table presents our selected historical consolidated financial data for the periods indicated. The selected historical consolidated financial data for the years ended December 31, 2021 and 2020 and the balance sheet data as of December 31, 2021 and 2020 are derived from the audited financial statements. The summary historical consolidated financial data for the six months ended June 30, 2022 and 2021 and the balance sheet data as of June 30, 2022 and 2021 are derived from our unaudited financial statements.

Historical results are included for illustrative and informational purposes only and are not necessarily indicative of results we expect in future periods, and results of interim periods are not necessarily indicative of results for the entire year. The data presented below should be read in conjunction with, and are qualified in their entirety by reference to, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the notes thereto included elsewhere in this prospectus.

| Six months Ended | Years Ended | |||||||||||||||

| June 30, | December 31, | |||||||||||||||

| 2022 | 2021 | 2021 | 2020 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Total Revenue | 76,672 | - | - | - | ||||||||||||

| Operating, general and administrative expenses | (566,749 | ) | (32,970 | ) | (284,959 | ) | - | |||||||||

| Total other income (Expense) | (200 | ) | - | - | - | |||||||||||

| Net Loss | (490,278 | ) | (32,970 | ) | (284,959 | ) | - | |||||||||

| Net loss per common share | (0.02 | ) | (0.00 | ) | (0.01 | ) | (0.0 | ) | ||||||||

| Total Assets | 478,920 | 206,830 | 1,011,947 | - | ||||||||||||

| Current Liabilities | (28,237 | ) | - | (11,106 | ) | - | ||||||||||

RISK FACTORS

The following are certain factors relating to our business. These risks and uncertainties are not the only ones we face. Additional risks and uncertainties not presently known to us or currently deemed immaterial by us, may also impair our operations. If any such risks actually occur, our shareholders could lose all or part of their investment and its business, financial condition, liquidity, results of operations and prospects could be materially adversely affected and its ability to implement its growth plans could be adversely affected. Our shareholders should evaluate carefully the following risk factors associated with the shares of common stock.

| 19 |

Risks Related to our Business and Operations

Item 1A. Risk Factors

Risks Relating to Development and Commercialization of our Evirontek Integrated Platform

Our success will depend on our ability to develop and manufacture each of the components of the Evirontek Integrated Platform, and to do so economically, at scale, of sufficient quality, on schedule and to customers’ specifications.

Our business depends in large part on our ability to execute the plans to develop, manufacture, market and sell the Evirontek Integrated Platform and to deploy it at sufficient capacity and to pre-agreed specifications to meet the demands of customers. We have no prior experience to date in manufacturing either of the two initial components of the Evirontek Integrated Platform. We cannot be certain that the technologies we intend to use will result in efficient, automated, low-cost manufacturing capabilities and processes, that will enable us to meet the quality, price, engineering, design and production standards, as well as the production volumes, required to successfully market the Evirontek Integrated Platform. Even if we are successful in developing our manufacturing capability and processes and reliably sourcing our component supply, we cannot be certain whether we will be able to do so in a manner that avoids significant delays and cost overruns, including as a result of factors beyond our control such as problems with suppliers and vendors, or in time to meet our commercialization schedules or to satisfy the requirements of customers. We have not entered into any contracts for the supply of components or a manufacturer needed to produce the Evirontek Integrated Platform. The lack of these agreements may result in increases in costs or delays in production which could have a material adverse effect on our business, prospects, operating results and financial condition.

Our licensing strategy is subject to various risks which could adversely affect our business and future prospects. There are no assurances that SGE or other future counterparties will not provide similar licenses to other manufacturers which will increase the competition faced by us.

As part of our strategy to license the technology on which the Evirontek Integrated Platform is based, we have entered into a Patent & Technology Exclusive and Non-Exclusive License Agreement with SGE (the “SGE License”) to use SGE’s technology and accelerate our time to market. Our business, competitive advantage and financial results rely heavily on the technology licensed from SGE and the relationship with SGE. However, SGE may have economic, business or legal interests or goals that are inconsistent with ours. Any disagreements with SGE or other future counterparties may impede our ability to maximize the benefits of our licensing strategy and slow or otherwise adversely impact the development or deployment of our Evirontek Integrated Platform. Among other things, SGE has the right to terminate the SGE License in various circumstances, including based on our failure to make any payments due under the SGE License within 30 days after written notice from SGE, our breach of any non-payment provision of the SGE License and our failure to cure such breach within 60 days after written notice from SGE, SGE delivers notice to us of three or more actual breaches of the SGE License in any 12-month period even in the event we cure such breaches in the allowed period, or we or any sublicensee of ours initiates any proceeding or action to challenge the validity, enforceability or scope of the patent on which the SGE License is based or assists a third party in pursuing such a proceeding. We are not currently engaged in discussions with other licensors for alternative technology and, as a result, any disagreement with SGE or termination of the license agreement could result in a material adverse effect on our business, prospects and financial results.

| 20 |

Furthermore, the SGE License only provides for limited exclusivity. With the exception of licenses within the cryptocurrency mining industry, SGE may provide licenses to its Power Generation Patent to our competitors in market segments not covered by the exclusivity provision. The use by our competitors or potential competitors of SGE technology as a result of the limitations of the SGE license could result in a material adverse effect on our business, prospects and financial results.

We may license technology that has not been commercialized, and the success of our business depends on technology licensed performing as expected.

The technology licensed from SGE has not been commercialized and may not perform as expected. Our business plans are dependent on the technology from SGE performing as expected. If the cost, performance characteristics, manufacturing process or other specifications of the technology licensed from SGE fall short of our expectations, our projected sales, costs, time to market, competitive advantage, product pricing and margins would likely be adversely affected. In addition, we may license technology from other third parties, which may not have been commercialized broadly or at all. If the technology that we license does not perform as expected, our competitive advantage, prospects, business and financial results may be adversely affected.

We may not be able to engage target customers successfully and to convert such contacts into meaningful orders in the future.

Our success depends on our ability to generate revenue and operate profitably, which depends in part on our ability to identify target customers and convert such contacts into meaningful orders. We do not currently have any revenue or orders from customers. If we are unable to negotiate, finalize and satisfy the conditions of customer orders, or only able to do so on terms that are unfavorable to us, we will not be able to generate any revenue, which would have a material adverse effect on our business, prospects, operating results and financial condition.

We anticipate that in some cases the Evirontek Integrated Platform may be delivered to certain customers on an early trial deployment basis, where such customers have the ability to evaluate whether our products meet their performance requirements before they commit to meaningful orders. If our targeted customers do not commit to make meaningful orders, or at all, it could adversely affect our business, prospects and results of operations. Our customers may require protections in the form of price reductions and similar arrangements that allow them to require us to deliver additional products or reimburse them for losses they suffer as a result of our late delivery or failure to meet agreed upon performance specification. Delays in delivery of the Evirontek Integrated Platform, unexpected performance problems or other events could cause us to fail to meet these contractual commitments, resulting in defects in material or workmanship or unexpected problems in our manufacturing process, which could lead to unanticipated revenue and earnings losses and financial penalties. The occurrence of any of these events could harm our business, prospects, results of operations and financial results.

| 21 |

We may not be able to establish sufficient supply relationships for necessary components and materials which could prevent or delay the introduction of our product and negatively impact our business.

We will rely on third-party suppliers for components necessary to develop and manufacture the Evirontek Integrated Platform, including key supplies, such as batteries, fly wheels, motor generators and other components and materials. We have begun discussions with key suppliers who have experience in engineering, procurement and construction, power generation, power transmission, control systems, outage and maintenance projects, but have not yet entered into definitive agreements for the manufacture of any of the components of the Evirontek Integrated Platform or the supply of the components, materials and services needed to produce the a final product. To the extent that we are unable to enter into commercial agreements with these suppliers or contract manufacturers on beneficial terms, or at all, or these suppliers or contract manufacturers experience difficulties ramping up their supply of components and materials to meet our requirements, the introduction of the Evirontek Integrated Platform will be delayed. To the extent our suppliers and contract manufacturers experience any delays in providing or developing the necessary components and materials, we could experience delays in delivering on our timelines. In addition, we cannot guarantee that our suppliers or contract manufacturers will not deviate from agreed-upon quality standards.

Changes in business conditions, unforeseen circumstances, governmental changes, the spread of COVID-19 and other factors beyond our control or which we do not presently anticipate, could also affect our suppliers’ ability to deliver components and materials to us on a timely basis. Any of the foregoing could materially and adversely affect our results of operations, financial condition and prospects.

We are dependent on key inputs, suppliers, contract manufacturers and skilled labor for the production of the Evirontek Integrated Platform.

We expect to incur significant costs related to procuring components and materials and the manufacturing required to manufacture and assemble each of the components of the Evirontek Integrated Platform. Any significant interruption or negative change in the availability or economics of the supply chain for key inputs as noted above, could materially impact our business, financial condition, results of operations or prospects. Some of these inputs and manufacturers may only be available from a single source or a limited group of suppliers or manufacturers. If a sole source supplier was to go out of business, we might be unable to find a replacement for such source in a timely manner, or at all. If a sole source supplier were to be acquired by a competitor, that competitor may elect not to sell to us in the future. Any inability to secure required components, materials and a contract manufacturer for the production of the Evirontek Integrated Platform, or to do so on appropriate terms, could have a materially adverse impact on our business, prospects, revenue, results of operation and financial condition. We plan to purchase key inputs on a purchase order basis from suppliers at market prices and enter into contract manufacturing agreements based on our production requirements and anticipated demand. We believe that we will have access to a sufficient supply of the key inputs and contract manufacturers for the foreseeable future.

The ability to compete and grow will be dependent on us having access, at a reasonable cost and in a timely manner, to skilled labor, equipment, parts, components and contract manufacturers. No assurances can be given that we will be successful in maintaining our required supply of skilled labor, equipment, parts and components. This could have a material effect on our financial results.

| 22 |

If our Evirontek Integrated Platform fails to perform as expected, our ability to develop, market, and sell the Evirontek Integrated Platform could be harmed and we could be subject to increased warranty claims.