Form PREC14A BOX INC Filed by: Starboard Value LP

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under Rule 14a-12

| BOX, INC. | ||

| (Name of Registrant as Specified in Its Charter) | ||

|

STARBOARD VALUE LP STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD Starboard Value and Opportunity S LLC Starboard Value and Opportunity C LP Starboard Value and Opportunity Master Fund L LP Starboard Value L LP Starboard Value R LP Starboard Value R GP LLC Starboard x master Fund LTD STARBOARD VALUE GP LLC STARBOARD PRINCIPAL CO LP STARBOARD PRINCIPAL CO GP LLC JEFFREY C. SMITH PETER A. FELD DEBORAH S. CONRAD JOHN R. MCCORMACK XAVIER D. WILLIAMS | ||

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) | ||

| Payment of Filing Fee (Check the appropriate box): | ||

| ☒ | No fee required. | |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ |

Fee paid previously with preliminary materials.

|

|

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

| Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED JUNE 21, 2021

Starboard Value and Opportunity Master Fund Ltd

_____________, 2021

Dear Fellow BOX Stockholders:

Starboard Value and Opportunity Master Fund Ltd (together with its affiliates, “Starboard” or “we”) and the other participants in this solicitation are the beneficial owners of an aggregate of 13,016,995 shares, or approximately 8.0% of the outstanding Class A common stock, par value $0.0001 per share (the “Common Stock”) of Box, Inc., a Delaware corporation (“BOX” or the “Company”), making us one of the Company’s largest stockholders. For the reasons set forth in the attached Proxy Statement, we believe significant changes to the composition of the Board of Directors of the Company (the “Board”) are necessary in order to ensure that BOX is managed and overseen in a manner consistent with your best interests. We have nominated a slate of [four (4)] highly-qualified director candidates for election to the Board at the Company’s upcoming 2021 Annual Meeting of Stockholders (the “Annual Meeting”).

BOX is a leading player in the content management category of enterprise software, with a cloud-native offering and a best-of-breed solution. However, despite its technology leadership and strong competitive positioning, we believe the Company remains deeply undervalued with opportunities to unlock significant value within the control of management and the Board. While we believe the Company has promising future prospects, BOX has suffered from suboptimal operating and financial results, as well as poor compensation and corporate governance practices, resulting in stock price underperformance and the Company trading at one of the lowest multiples of revenue in the software industry. It has now been over two years since we first highlighted our serious concerns to the Company and, unfortunately, despite having reached a settlement agreement with BOX in March 2020, not nearly enough has been done to address these serious issues. In addition, over the past few months, while facing pressure from Starboard, BOX has taken actions that we believe are not in the best interest of stockholders and serve only to entrench the Board and preserve the status quo.

As the expiration of the standstill provisions in the 2020 settlement agreement was approaching in March 2021, and as it became clear to BOX that we were not pleased with the Company’s progress and would likely seek to effect change at the upcoming Annual Meeting, BOX chose to take unilateral actions to first extend the standstill period in our settlement agreement by extending the nomination deadline for the Annual Meeting, and shortly thereafter, execute a series of transactions that we believe serve no bona fide business purpose and were done for defensive purposes to dilute the vote of common stockholders by placing a large voting block of preferred stock with a new private equity investor. We believe these transactions were not in the best interests of stockholders and were transparently done to “buy the vote” ahead of a potential election contest with Starboard. We further believe the Board’s about-face on the preferred equity voting obligations in response to the recent class action lawsuit filed against the Board further demonstrates the Board’s defensive and entrenchment-minded motives.

We have continued to attempt to engage with the Company to find a mutually agreeable solution even following these egregious actions. Unfortunately, the Company has been unwilling to work with us to find a solution that we believe reflects the degree of change that is necessary to drive the Company forward to create value for all stockholders. It has therefore become clear to us that additional change on the Board is required to drive much needed change at BOX and to provide renewed accountability to stockholders.

We strongly believe that BOX can improve its strategy, operations, execution, and Board oversight, and we are confident that the qualified slate of professionals we nominated are well-equipped to serve as directors of the Company. The [four (4) director] candidates we have nominated – [Deborah S. Conrad, Peter A. Feld, John R. McCormack, and Xavier D. Williams] – have deeply relevant backgrounds to BOX’s business and current challenges, including backgrounds spanning operations, finance, private equity, engineering, marketing, mergers and acquisitions, restructuring, strategic transformation, and public company governance. As a group, our nominees have substantial and highly successful experience across the technology industry. Collectively, they have decades of experience as CEOs, senior executives, board chairs, and directors of well-performing technology companies.

Our goal is to create value for the benefit of all stockholders. We believe a critical step towards achieving this objective is to further improve the Board with directors who have appropriate and relevant skill sets and who we believe will provide renewed accountability, as well as a singular focus on the best interests of common stockholders. Starboard has significant experience in these areas with a long, successful track record of driving operational, financial, strategic, and governance changes in the technology industry. We believe our continued involvement is critical to ensure that BOX has the appropriate oversight to help guide the Company through a transformation. We are confident that with the right Board in place, BOX can be a best-in-class company within the enterprise software industry.

We are mindful that the Company’s CEO, Aaron Levie, is expected to be one of the directors up for election on the Company’s slate of nominees and that stockholders may be asked to vote on the election of a director candidate on our slate to replace Mr. Levie on the Board. As a general practice, we believe that public company CEOs should serve on the company’s board while serving as CEO. As such, our current intention would be to add Mr. Levie back to the Board, should he be willing to serve, in the event that one of our nominees is elected to replace him at the Annual Meeting.

Biographies of Starboard’s nominees (in alphabetical order):

|

Deborah S. Conrad

|

Ms. Conrad previously served as Corporate Vice President and Chief Marketing Officer at Intel Corporation. Ms. Conrad had an extensive career spanning 27 years at Intel, where she held senior positions of increasing responsibility across multiple areas, including marketing, communications, brand management, and business development.

Ms. Conrad currently serves as the Interim Chief Marketing Officer at NovaSignal, a medical technology company, as an Executive Advisory Board Member for BioIQ, a healthcare technology company, and as a Strategic Advisor at Grand Rounds, a healthcare technology company.

Ms. Conrad also has extensive private board experience, having previously served on the Board of Directors of the Intel Foundation, a private corporate foundation established by Intel, and Samasource (n/k/a Sama), a data production company for artificial intelligence and machine learning, among others.

|

|

Peter A. Feld

|

Relevant Experience

Mr. Feld is a Managing Member and Head of Research at Starboard Value LP. Prior to founding Starboard, he was a Managing Director at Ramius and a Portfolio Manager at Ramius Value and Opportunity Master Fund Ltd.

Mr. Feld currently serves as Chair of GCP Applied Technologies and a director of NortonLifeLock and Magellan Health.

Mr. Feld previously served as a director of AECOM, Marvell Technology, Brink’s, Insperity, Darden Restaurants, and Integrated Device Technology, among others.

|

|

John R. McCormack

|

Mr. McCormack previously served as CEO of Websense, both while it was publicly traded and following a take-private transaction by Vista Equity, and led the company through a successful sale to Raytheon.

Mr. McCormack previously served as the Chair and CEO of AppRiver and as the Chair and Interim CEO of Fidelis Cybersecurity.

Mr. McCormack currently serves as a director of Ping Identity and a director of Forcepoint, a privately held company. He is also an Operating Partner at TELEO Capital Management.

|

|

Xavier D. Williams

|

Mr. Williams currently serves as CEO and a director of American Virtual Cloud Technologies, a leading publicly traded cloud communications and information technology services provider.

Mr. Williams previously had an extensive career spanning almost 30 years at AT&T, culminating in his role as President of AT&T’s Public Sector & First Net.

At AT&T, he served in various capacities and positions of increasing responsibility, across multiple areas, including finance, product management, strategy, sales, human resources, global operations and customer service, including previous roles as President of Business Operations, President of Global Public Sector & Wholesale Markets, and President of Government Solutions & National Business, among others.

|

The Company has a classified Board, which is currently divided into three (3) classes. We believe the terms of three (3) Class I directors expire at the Annual Meeting.1 Through the attached Proxy Statement and enclosed WHITE proxy card, we are soliciting proxies to elect only our [four (4)] nominees. Accordingly, the enclosed WHITE proxy card may only be voted for our nominees and does not confer voting power with respect to any of the Company’s director nominees. You can only vote for the Company’s director nominees by signing and returning a proxy card provided by the Company. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees. There is no assurance that any of the Company’s nominees will serve as directors if all or some of the nominees are elected.

We look forward to sharing our detailed views on, and comprehensive plans for, BOX in the coming weeks and months, and we look forward to continuing to engage with you as we approach the Annual Meeting.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating, and returning the enclosed WHITE proxy card today.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating, and returning a later dated proxy or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free numbers listed below.

| Thank you for your support. | |

| /s/ Peter A. Feld | |

| Peter A. Feld | |

| Starboard Value and Opportunity Master Fund Ltd |

1 The Company has not yet announced its nominees for election at the Annual Meeting. Once the Company announces its nominees and the number of seats up for election at the Annual Meeting, Starboard will make any necessary updates to this cover letter and the attached Proxy Statement, including removing one of Starboard’s nominees for election at the Annual Meeting if there are only three seats available for election at such Annual Meeting.

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Starboard’s proxy materials, please contact Okapi Partners at the phone numbers or email address listed below.

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

Stockholders may call toll-free: (855) 208-8901

Banks and brokers call: (212) 297-0720

E-mail: [email protected]

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED JUNE 21, 2021

2021 ANNUAL MEETING OF STOCKHOLDERS

OF

BOX, Inc.

_________________________

PROXY STATEMENT

OF

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Starboard Value LP (“Starboard Value LP”), Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard Value and Opportunity Master Fund L LP (“Starboard L Master”), Starboard Value L LP (“Starboard L GP”), Starboard Value R LP (“Starboard R LP”), Starboard Value R GP LLC (“Starboard R GP”), Starboard X Master Fund Ltd (“Starboard X Master”), Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal Co”), Starboard Principal Co GP LLC (“Principal GP”), Jeffrey C. Smith and Peter A. Feld (collectively, “Starboard” or “we”) are significant stockholders of BOX, Inc., a Delaware corporation (“BOX” or the “Company”), who, together with the other participants in this solicitation, beneficially own in the aggregate approximately 8.0% of the outstanding shares of common stock, par value $0.0001 per share (the “Common Stock”), of the Company.

We are seeking to elect [four (4)] nominees to the Company’s Board of Directors (the “Board”) because we believe that the Board must be reconstituted to ensure that the interests of the common stockholders, the true owners of BOX, are appropriately represented in the boardroom. We have nominated directors who have strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. We are seeking your support at the Company’s 2021 Annual Meeting of Stockholders, scheduled to be held virtually on [__________], 2021, at [____] [_].m. (Pacific Time) (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), which will be held online via a live interactive webcast on the internet, for the following purposes2:

| 1. | To elect Starboard’s director nominees, [Deborah S. Conrad, Peter A. Feld, John R. McCormack and Xavier D. Williams] (each a “Nominee” and, collectively, the “Nominees”) as Class I directors to hold office until the 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) and until their respective successors have been duly elected and qualified; |

| 2. | To approve, on an advisory basis, the compensation of the Company’s named executive officers; |

2 As of the date of this Proxy Statement, the Company’s proxy statement has not yet been filed with the Securities and Exchange Commission (the “SEC”). The proposal numbers in this Proxy Statement may not correspond to the proposal numbers that will be used in the Company’s proxy statement. Certain information in this Proxy Statement will be updated after the Company’s proxy statement is filed.

| 3. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 31, 2022; and |

| 4. | To transact such other business as may properly come before the Annual Meeting. |

This Proxy Statement and the enclosed WHITE proxy card are first being furnished to stockholders on or about [___________], 2021.

According to the Company’s proxy statement, the Company has disclosed that the Annual Meeting will be held exclusively online via a live interactive webcast on the internet. You will not be able to attend the Annual Meeting in person at a physical location. In order to attend the Annual Meeting, you must pre-register by visiting [] by [ ] [ ].m. Pacific Daylight Time on [ ], 2021. Stockholders of record may vote at the virtual Annual Meeting or vote by proxy. Please see the “Virtual Meeting” section of this Proxy Statement for additional information.

The Company has a classified Board, which is currently divided into three (3) classes. We believe the terms of three (3) Class I directors expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our [four (4)] nominees in opposition to the Company’s [three (3)] director nominees for the class with terms expiring at the 2024 Annual Meeting. Accordingly, the enclosed WHITE proxy card may only be voted for our Nominees and does not confer voting power with respect to any of the Company’s director nominees. See the “Voting and Proxy Procedures” section of this Proxy Statement for additional information. You can only vote for the Company’s director nominees by signing and returning a proxy card provided by the Company. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications, and other information concerning the Company’s nominees. If elected, our Nominees will constitute a minority on the Board and there can be no guarantee that our Nominees will be able to implement any actions that they may believe are necessary to unlock stockholder value.

As of the date hereof, the members of Starboard and the Nominees collectively beneficially own 13,016,995 shares of Common Stock (the “Starboard Group Shares”). We intend to vote all of the Starboard Group Shares FOR the election of the Nominees, [FOR/AGAINST] an advisory (non-binding) proposal concerning the Company’s executive compensation program as described herein and [FOR] the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm. While we currently intend to vote all of the Starboard Group Shares in favor of the election of the Nominees, we reserve the right to vote some or all of the Starboard Group Shares for some or all of the Company’s director nominees, as we see fit, in order to achieve a Board composition that we believe is in the best interest of all stockholders. We would only intend to vote some or all of the Starboard Group Shares for some or all of the Company’s director nominees in the event it were to become apparent to us, based on the projected voting results at such time, that by voting the Starboard Group Shares we could help elect the Company nominee(s) that we believe are the most qualified to serve as directors and thus help achieve a Board composition that we believe is in the best interest of all stockholders. Stockholders should understand, however, that all shares of Common Stock represented by the enclosed WHITE proxy card will be voted at the Annual Meeting as marked.

The Company has set the close of business on ________, 2021 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 900 Jefferson Ave., Redwood City, California 94063.

2

According to the Company’s proxy statement, holders of record of shares of Common Stock and the Company’s Series A Convertible Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock” and together with the Common Stock, the “Voting Stock”), as of the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting. Holders of Common Stock and Series A Preferred Stock (on a fully converted basis) vote together as a single class on all matters at the Annual Meeting. Each outstanding share of Voting Stock is entitled to one vote on each matter to be voted upon at the Annual Meeting.

THIS SOLICITATION IS BEING MADE BY STARBOARD AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH STARBOARD IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

STARBOARD URGES YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING, AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING VIRTUALLY AT THE ANNUAL MEETING.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting—This Proxy Statement and our WHITE proxy card are available at

[______________________]

3

IMPORTANT

Your vote is important, no matter how few shares of Voting Stock you own. Starboard urges you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the election of the Nominees and in accordance with Starboard’s recommendations on the other proposals on the agenda for the Annual Meeting.

| · | If your shares of Voting Stock are registered in your own name, please sign and date the enclosed WHITE proxy card and return it to Starboard, c/o Okapi Partners LLC (“Okapi Partners”) in the enclosed postage-paid envelope today. |

| · | If your shares of Voting Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Voting Stock, and these proxy materials, together with a WHITE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Voting Stock on your behalf without your instructions. As a beneficial owner, you may vote the shares virtually at the Annual Meeting only if you obtain a legal proxy from the broker or bank giving you the rights to vote the shares. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

| · | You may vote your shares virtually at the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you submit your WHITE proxy card by mail by the applicable deadline so that your vote will be counted if you later decide not to attend the Annual Meeting. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our [four (4)] Nominees only on our WHITE proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Starboard’s proxy materials, please contact Okapi Partners at the phone numbers or email address listed below.

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, New York 10036

Stockholders may call toll-free: (855) 208-8901

Banks and brokers call: (212) 297-0720

E-mail: [email protected]

4

Background to the Solicitation

The following is a chronology of material events leading up to this proxy solicitation:

| · | On June 25, 2019, representatives of Starboard had a telephone discussion with Rory O’Driscoll, who was then serving as the Company’s Lead Independent Director, to discuss BOX, as well as provide background on Starboard as a new stockholder of the Company. |

| · | On July 9, 2019, representatives of Starboard had a meeting with Aaron Levie and Dylan Smith, the Company’s CEO and CFO, respectively, as well as representatives from the Company’s Investor Relations department (“IR”), to introduce Starboard and hear the management team’s perspectives on the business. |

| · | On September 3, 2019, representatives of Starboard had a call with Mr. Levie to inform him that Starboard would be filing a Schedule 13D with the SEC disclosing a 7.5% ownership stake in the Company following the market close. |

| · | Later on September 3, 2019, Starboard filed a Schedule 13D with the SEC disclosing a 7.5% ownership position in BOX. |

| · | On September 6, 2019, representatives of Starboard had a call with Mr. O’Driscoll to discuss Starboard’s Schedule 13D filing and express their desire to continue engaging constructively with the Company. |

| · | On September 18, 2019, representatives of Starboard had a meeting with Mr. Levie, Mr. Smith, and IR, in order to discuss the business and engage in a detailed discussion regarding Starboard’s questions on the issues and opportunities at BOX. |

| · | Also on September 18, 2019, representatives of Starboard met with Mr. O’Driscoll to share Starboard’s views on the Company’s issues and to hear the Board’s perspectives. |

| · | On September 28, 2019, a representative of Starboard had a call with Mr. Levie to discuss the upcoming Investor Breakout Session at the Company’s BoxWorks event, the Company’s view on the opportunity for growth and margin improvement, and a mutual desire to work together to improve the Company’s governance. |

| · | On September 30, 2019, representatives of Starboard had a follow-up call with Mr. Levie, Mr. Smith, and IR to further discuss the matters discussed on the September 28, 2019 call. |

| · | On October 1, 2019, representatives of Starboard had a call with Mr. O’Driscoll and Sue Barsamian, another member of the Board, to discuss the potential to work together to improve corporate governance and business performance. |

| · | On October 2, 2019, representatives of Starboard had a call with Mr. Levie, Mr. Smith, and IR to provide additional thoughts regarding the Company in connection with the upcoming Investor Breakout Session. |

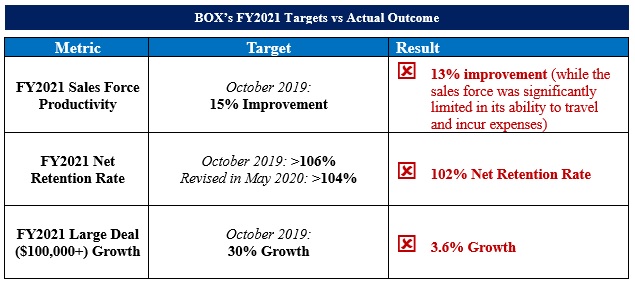

| · | On October 3, 2019, a representative of Starboard attended the Company’s BoxWorks event, during which BOX hosted an Investor Breakout presentation. During the presentation, BOX’s management team disclosed operational and financial targets, including FY2021 targets of greater than 106% net retention rate, 30% growth in $100,000+ deals, and a 15% increase in sales force productivity. BOX’s management team also provided a long-term target of reaching 12-18% revenue growth in FY2023. |

5

| · | On October 8, 2019, representatives of Starboard had a call with Mr. Levie to discuss Starboard’s perspectives on the BoxWorks event and to hear Mr. Levie’s perspectives. |

| · | On October 15, 2019, representatives of Starboard had a call with Mr. O’Driscoll and Ms. Barsamian to continue discussions regarding the potential to work together to improve corporate governance and business performance. |

| · | On October 22, 2019, representatives of Starboard had a call with Mr. Levie to discuss Starboard’s engagement with the Company to date and opportunities to work together. |

| · | On November 4, 2019, representatives of Starboard met with Mr. O’Driscoll and Ms. Barsamian to hear the Board’s perspectives on opportunities to work together to improve the Company’s corporate governance and business performance. |

| · | On November 14, 2019, representatives of Starboard had a call with Mr. O’Driscoll and Ms. Barsamian to follow up on previous discussions regarding corporate governance and business performance. |

| · | On December 5, 2019, representatives of Starboard had a call with Mr. Levie to discuss the Company’s recent earnings report. |

| · | On December 10, 2019, a representative of Starboard had a call with Mr. O’Driscoll to discuss matters related to the Company’s corporate governance. |

| · | On February 19, 2020, representatives of Starboard had a call with Mr. Levie, Mr. Smith, and IR to discuss the Company’s upcoming earnings release and business performance. |

| · | On February 21, 2020, representatives of Starboard had a call with Mr. O’Driscoll and Ms. Barsamian to discuss the February 19, 2020 call with management and to provide Starboard’s perspectives. |

| · | On March 9, 2020, representatives of Starboard had a call with Mr. O’Driscoll and Ms. Barsamian to discuss a potential framework of a settlement agreement. |

| · | On March 10, 2020, a representative of Starboard had a call with Mr. O’Driscoll and Ms. Barsamian to discuss the framework proposed on the March 9, 2020 call. |

| · | On March 11, 2020, a representative of Starboard had a call with Mr. O’Driscoll and Ms. Barsamian to continue discussions regarding a potential settlement agreement. |

| · | On March 13, 2020, a representative of Starboard had a call with Mr. O’Driscoll and Ms. Barsamian to continue discussions regarding a potential settlement agreement. |

| · | On March 16, 2020, a representative of Starboard had a call with Mr. O’Driscoll to continue discussions regarding a potential settlement agreement and during the call, they reached a tentative agreement on the material terms of such settlement agreement. |

6

| · | On March 19, 2020, representatives of Starboard had two calls, one with Mr. O’Driscoll and one with Mr. O’Driscoll and Ms. Barsamian, to continue discussions regarding a potential settlement agreement. |

| · | On March 22, 2020, a representative of Starboard had a call with Ms. Barsamian to continue discussions regarding a potential settlement agreement and the path forward for the Company. |

| · | On March 23, 2020, Starboard and the Company entered into an agreement (the “2020 Agreement”), pursuant to which the Company agreed, among other things, to immediately appoint Jack Lazar to the Board. As part of the 2020 Agreement, Starboard and the Company also agreed to appoint another director from a list of candidates provided by Starboard, and the Company agreed to appoint a third new director prior to the Company’s 2020 Annual Meeting of Stockholders (the “2020 Annual Meeting”). The Company also agreed to create an Operating Committee of the Board to drive growth and margin improvements. Pursuant to the 2020 Agreement, Starboard agreed, among other things, to vote all shares of Common Stock beneficially owned by Starboard in favor of the Company’s director nominees and, subject to certain conditions, vote in accordance with the Board’s recommendations on all other proposals at the 2020 Annual Meeting. Starboard also agreed to certain customary standstill provisions during the term of the 2020 Agreement, which has since expired. Later that day, Starboard filed Amendment No. 1 to the Schedule 13D with the SEC disclosing the 2020 Agreement with BOX. |

| · | Also on March 23, 2020, representatives of Starboard had a call with Mr. Lazar to discuss Starboard’s views on the opportunity for value creation at BOX. |

| · | On March 31, 2020, representatives of Starboard had a call with Mr. Levie, Mr. Smith, and IR as part of the Company’s virtual roadshow with Wells Fargo Securities to discuss business trends during the onset of the COVID-19 pandemic and to offer Starboard’s perspectives on managing the business through a challenging macro environment. |

| · | On April 16, 2020, representatives of Starboard had a call with Ms. Barsamian to discuss the status of the two remaining director appointments pursuant to the 2020 Agreement and the status of the Operating Committee. |

| · | On April 24, 2020, BOX announced the appointment of Bethany Mayer to the Board as the second independent director recommended by Starboard pursuant to the 2020 Agreement. |

| · | On May 27, 2020, BOX reported Q1 FY2021 earnings results. On the earnings call, Mr. Smith disclosed that the Company now expected Net Retention Rate for FY2021 to be greater than 104%, down from the greater than 106% target provided in October 2019. |

| · | Also on May 27, 2020, BOX announced the appointment of Carl Bass to the Board. Mr. Bass was selected by the Company as the third new director pursuant to the 2020 Agreement. |

| · | On May 29, 2020, representatives of Starboard had a call with Mr. Levie, Mr. Smith, and IR to discuss the Company’s Q1 FY2021 earnings results. |

| · | Also on May 29, 2020, Starboard filed Amendment No. 2 to the Schedule 13D with the SEC disclosing a 6.0% ownership position in BOX. |

7

| · | On June 18, 2020, a representative of Starboard participated in a virtual group investor event hosted by D.A. Davidson Companies with Mr. Levie and Mr. Smith. |

| · | On August 27, 2020, representatives of Starboard had a call with Mr. Levie, Mr. Smith, and IR to discuss the Company’s Q2 FY2021 earnings results. |

| · | On September 17, 2020, representatives of Starboard attended the Company's virtual BoxWorks event, during which BOX hosted a Digital Investor Breakout presentation. During the presentation, BOX's management team provided a long-term target of generating 12-16% revenue growth in FY2024, implicitly withdrawing the prior year’s target of achieving 12-18% revenue growth in FY2023. |

| · | On September 21, 2020, a representative of Starboard had a call with Mr. Levie during which Mr. Levie expressed his appreciation for Starboard’s constructive engagement with the Company and the positive changes that have resulted from Starboard’s involvement. During the call, the parties also discussed BOX’s extremely high stock-based compensation expense, and Mr. Levie acknowledged that the Company understood it was an issue and was working to improve on this topic. |

| · | On September 22, 2020, representatives of Starboard had a call with Mr. Levie, Mr. Smith, and IR to discuss latest business trends as part of the Company’s virtual non-deal roadshow with Craig-Hallum. |

| · | On December 2, 2020, representatives of Starboard had a call with Mr. Levie, Mr. Smith, and IR to discuss the Company’s Q3 FY2021 earnings results. The results indicated a further deceleration of growth, and revenue guidance for the upcoming quarter was below consensus expectations. |

| · | On December 4, 2020, representatives of Starboard had a call with Mr. Levie to follow up on the December 2, 2020, call and discuss the Company’s results and opportunities for value creation. On the call, representatives of Starboard suggested that, in addition to focusing on opportunities to improve performance as a standalone company, it may make sense for BOX to explore strategic alternatives, particularly in light of recent M&A transactions in the software industry, in order to help determine the right path forward for the Company. |

| · | On December 8, 2020, representatives of Starboard had a call with Mr. Lazar and Ms. Barsamian to discuss the Company’s history of consistently missing expectations and Starboard’s views on opportunities for value creation at BOX, including by exploring alternatives to determine whether the right path forward for BOX was a sale of the Company or continuing as an independent company. |

| · | On December 9, 2020, a representative of Starboard participated in a virtual group investor event hosted by Oppenheimer & Co with Mr. Levie, Mr. Smith, and IR. |

| · | On January 11, 2021, BOX announced a proposed private offering of $300 million of convertible senior notes. The offering also included an option for the initial purchasers to purchase up to an additional $45 million of the notes. In the announcement, BOX disclosed that it was “examining potential acquisitions.” |

| · | Also on January 11, 2021, Starboard filed Amendment No. 3 to the Schedule 13D disclosing a 7.9% ownership position in BOX. |

8

| · | On January 12, 2021, BOX announced the pricing of $315 million of convertible senior notes. The notes were issued with a 0% coupon rate and a 45% conversion premium. BOX also disclosed that the initial purchasers had an option to purchase up to an additional $30 million of the notes. The purchasers ultimately exercised that right, increasing the total principal outstanding to $345 million. |

| · | On January 13, 2021, representatives of Starboard had a call with Mr. Levie, Mr. Smith, and IR to discuss the Company’s announcement that it was raising $345 million through the issuance of convertible debt and understand the need for the capital, as well as the intended use of the proceeds. On the call, representatives of Starboard expressed their view that the capital raise was unnecessary given an already healthy net cash balance of approximately $225 million3 and that the Company had not earned the right to use stockholder capital to do meaningful M&A. |

| · | On January 15, 2021, representatives of Starboard had a call with Mr. Lazar and Ms. Barsamian to express Starboard’s views regarding the convertible debt issuance and the Company’s focus on M&A. |

| · | On January 19, 2021, Starboard sent a private letter to the Board expressing its disappointment with the Company’s continued lackluster performance due to concerns around growth, execution, and credibility, as well as the Board’s seeming unwillingness to hold management accountable for creating stockholder value. Starboard also expressed its view that the recent convertible debt issuance was unnecessary and noted its concern that the Company was exploring value dilutive acquisition opportunities in an attempt to “buy” growth following failed attempts to reaccelerate growth organically. Starboard also suggested the Board should explore strategic alternatives for the Company in order to determine the right path forward for BOX. |

| · | On February 3, 2021, BOX announced the acquisition of SignRequest, an electronic signature company, for an aggregate purchase price of $55 million. |

| · | Also on February 3, 2021, representatives of Starboard had a call with Mr. Lazar and Dana Evan, a member of the Company’s Board, to discuss the Company’s acquisition of SignRequest and hear the Board’s perspectives in response to Starboard’s January 2021 private letter. |

| · | On February 8, 2021, a representative of Starboard had a call with Mr. Levie, Mr. Smith, and IR to discuss the SignRequest acquisition and the strategic rationale of the acquisition, as well as an additional follow-up call with Mr. Levie. |

| · | On February 11, 2021, representatives of Starboard, at the Company’s request, spoke with representatives of Morgan Stanley, the Company’s financial advisor, to discuss Starboard’s views on the Company. |

| · | On March 2, 2021, BOX reported Q4 FY2021 earnings results. On the earnings call, Mr. Smith disclosed that the Company had generated a 13% improvement in sales force productivity in FY2021, below the 15% target provided in October 2019. The Company also disclosed information on the number of $100,000+ deals, which grew less than 4% in FY2021, well below the Company’s original 30% growth target. Lastly, the Company disclosed that its net retention rate for FY2021 was 102%, below both the original target of greater than 106% and the revised target of greater than 104%. |

3 As of Q3 FY2021.

9

| · | On March 4, 2021, representatives of Starboard had a call with Mr. Levie, Mr. Smith, and IR to discuss the Company’s Q4 FY2021 earnings results. |

| · | On March 15, 2021, a representative of Starboard had a call with Mr. Smith and IR to follow up on the prior call related to the Company’s Q4 FY2021 earnings results. |

| · | On March 18, 2021, representatives of Starboard, at the Company’s request, spoke with representatives of Morgan Stanley. On the call, Morgan Stanley informed Starboard that the Company had decided to unilaterally extend the deadline for director nominations from April 13, 2021 to May 11, 2021. As a result of this delay, the standstill provisions under the 2020 Agreement were extended to April 6, 2021. Morgan Stanley explained that the extension should not be viewed as a sign of entrenchment and that the Board was focused on stockholder value creation. |

| · | On April 8, 2021, BOX announced a $500 million investment led by KKR & Co. Inc. (“KKR”) in the form of convertible preferred equity. KKR directly holds $150 million of the preferred equity and syndicated the balance to other investors. The preferred equity carries a 3% dividend rate, has voting rights on an as-converted basis, and had an initial conversion price of between $24.00 and $27.00, which was to be determined based on BOX’s stock price for the 10 days following the announcement. The conversion price was ultimately set at $27.00. The investment agreement governing the preferred equity also included other terms, such as a change of control payment should BOX be sold, and initially included a provision that required the preferred equity investors to vote in accordance with the Board’s recommendations until September 30, 2024. As part of the investment, KKR received one Board seat for John Park, Head of Americas Technology Private Equity. BOX also announced that it would be using the proceeds from the $500 million financing to conduct a “Dutch auction” self-tender to repurchase $500 million of its common stock. |

| · | Also on April 8, 2021, a representative of Starboard participated in a virtual group investor event hosted by KeyBanc Capital Markets with Mr. Levie, Mr. Smith, and IR. |

| · | Also on April 8, 2021, representatives of Starboard had a call with Ms. Mayer and Mr. Lazar to discuss the preferred equity financing. Starboard expressed its disappointment that the Company chose to execute such a defensive, stockholder-unfriendly, and unnecessary transaction that it believes was done to “buy the vote” ahead of a potential election contest, despite Starboard’s constructive engagement with the Company over the prior two years. |

| · | On April 14, 2021, representatives of Starboard had a call with Ms. Mayer, Ms. Barsamian, and Mr. Lazar to follow up on the prior discussion regarding the financing. The Company’s directors expressed the Board’s and the Company’s appreciation for Starboard’s engagement over the past two years. Starboard reiterated its view that the financing was not in the best interests of common stockholders and that further changes were needed to put the Company on a path towards long-term value creation. |

| · | On April 20, 2021, representatives of Starboard had a call with Ms. Mayer and Mr. Lazar during which Starboard reiterated its views on the preferred equity financing and the fact that further changes were needed at BOX, including direct board representation for common stockholders. Ms. Mayer and Mr. Lazar provided their perspectives on the opportunities at BOX and the Board’s view on the lack of a need for further meaningful changes at the Company. Both parties agreed to continue discussions to see if there was a path towards a mutually agreeable solution ahead of the nomination deadline for the Annual Meeting. |

10

| · | On April 28, 2021, representatives of Starboard had a call with Ms. Mayer and Mr. Lazar during which BOX’s directors expressed that the Board was not interested in having direct representation for common stockholders and was not interested in any meaningful changes at the Company. |

| · | On May 3, 2021, Starboard issued a press release and delivered a public letter to BOX stockholders. In the letter, Starboard expressed its frustration with the Company’s subpar stock price, operational, and financial performance, as well as its view that the preferred equity financing was an egregious, stockholder-unfriendly decision made to insulate the management team and Board ahead of a potential election contest with Starboard. The letter also stated that while Starboard is open to working with the Board to find a mutually acceptable solution, the Board has not been willing to engage constructively. As a result, Starboard disclosed that it intended to nominate directors for election at the Annual Meeting ahead the upcoming nomination deadline. |

| · | On May 5, 2021, Starboard filed Amendment No. 4 to the Schedule 13D disclosing an 8.0% ownership position in BOX and disclosing its intent to nominate a slate of highly qualified director candidates for election to the Board at the Annual Meeting. |

| · | On May 10, 2021, Starboard delivered a letter (the “2021 Nomination Letter”) to the Company in accordance with its organizational documents, nominating Ms. Conrad and Messrs. Feld, McCormack and Williams for election to the Board at the Annual Meeting. In the 2021 Nomination Letter, Starboard stated its belief that the terms of three (3) directors currently serving on the Board expire at the Annual Meeting. |

| · | Also on May 10, 2021, Starboard issued a press release and delivered a public letter to BOX stockholders disclosing that it had nominated a slate of four highly-qualified and diverse director candidates for election at the Annual Meeting: Deborah S. Conrad, former Chief Marketing Officer of Intel; Peter A. Feld, Managing Member of Starboard; John R. McCormack, former CEO of Websense; and Xavier D. Williams, former President of AT&T’s Public Sector and First Net. In the letter, Starboard also reiterated its willingness to engage with the Company to find a mutually agreeable resolution. In addition, on May 10, 2021, Starboard filed its Amendment No. 5 to the Schedule 13D announcing its nomination of the Nominees. |

| · | On May 12, 2021, BOX announced that it closed the previously announced preferred equity financing. In connection with the closing, effective May 12, 2021, BOX appointed John Park, Head of Americas Technology Private Equity at KKR, to the Board. |

| · | Also on May 12, 2021, a class action lawsuit was filed in Delaware Chancery Court against the Board by the Building Trades Pension Fund of Western Pennsylvania (the “Complaint”). The Complaint alleged that the Board breached its fiduciary duties in approving the preferred equity financing and sought an injunction blocking enforcement of the voting provision with KKR. The Complaint set forth serious allegations regarding the Board’s motivations and rationale in approving the preferred equity financing. More specifically, the Complaint alleged that the Company had no operational need for the capital and that the Board’s true intent in approving the financing and accompanying self-tender was to “buy the vote” ahead of an anticipated election contest in order to entrench itself and management. |

11

| · | On May 17, 2021, Starboard issued a press release and delivered a public letter to BOX stockholders to share further details on its views on the preferred equity financing and to disclose that it intended to submit a books and records request pursuant to Section 220 of the Delaware General Corporation Law (the “DGCL”) to inspect certain books and records related to the Company’s strategic review that resulted in the financing and associated share repurchase. In the letter, Starboard also highlighted a class action lawsuit filed by another BOX stockholder against the Board related to concerns around the true intent of the financing, as well as the voting agreement between BOX and KKR that was part of the transaction. |

| · | Also on May 17, 2021, after Starboard issued its public letter, BOX disclosed that one day after the Complaint was filed against the Board, the Company had removed the voting restrictions from the preferred equity security. No details were provided relating to any fee agreement with the class action attorneys related to this swift change and related withdrawal of the Complaint. |

| · | Also on May 17, 2021, representatives of Starboard spoke to Ms. Mayer and Mr. Lazar to discuss Starboard’s letter released earlier that day related to the DGCL Section 220 books and records request. Starboard also reiterated its willingness to reach a mutually agreeable solution with the Company. |

| · | On May 20, 2021, Starboard delivered a letter to the Company demanding the inspection of certain books and records related to the Company’s review of strategic options that resulted in the preferred equity financing and associated share repurchase pursuant to Section 220 of the DGCL (the “Books and Records Request”). As set forth in the Books and Records Request, Starboard believes the preferred equity financing has no bona fide business purpose given BOX’s substantial cash balance and was done solely to entrench the Board and "buy the vote" ahead of a potential election contest with Starboard. |

| · | Also on May 20, 2021, Starboard filed its Amendment No. 6 to the Schedule 13D announcing its submission of the Books and Records Request to the Company. |

| · | On May 27, 2021, counsel for BOX responded to the Books and Records Request stating that the Company intends to respond by June 3, 2021. |

| · | On June 3, 2021, counsel for BOX responded to the Books and Records Request alleging purported deficiencies and agreeing to produce an extremely narrow set of Board materials subject to a non-disclosure agreement (the “June 3 Letter”). |

| · | On June 10, 2021, counsel for Starboard delivered a letter (the “June 10 Letter”) to counsel for BOX responding to the June 3 Letter regarding the Books and Records Request. In the letter, Starboard counsel stated that it vigorously disagrees with BOX counsel’s contentions that the Books and Records Request is deficient and that Starboard’s purposes for seeking the books and records are not only proper under Delaware law but that such purposes are directly aligned with the interests of BOX stockholders. Notwithstanding the foregoing, the letter also stated that Starboard is willing to accept a narrowed set of documents as part of the Books and Records Request, in furtherance of Starboard’s constructive approach over the prior two years. On June 10, 2021, Starboard also filed its Amendment No. 7 to the Schedule 13D disclosing the letter from Starboard’s counsel to BOX’s counsel responding to the June 3 Letter. |

| · | On June 18, 2021, counsel for BOX responded to the June 10 Letter by reiterating purported deficiencies in the Books and Records Request and refusing to produce the narrowed set of documents Starboard expressed its willingness to accept or even engage in discussions regarding the scope of Starboard’s request. |

| · | As of June 21, 2021, the Company has thus far refused to engage with Starboard in any meaningful way regarding Board composition. |

| · | On June 21, 2021, Starboard filed this preliminary proxy statement with the SEC. |

12

REASONS FOR THE SOLICITATION

We believe that BOX is deeply undervalued and that significant opportunities exist within the control of management and the Board to unlock substantial value for all stockholders. However, we believe that additional change is needed on the Board to enhance management oversight, provide renewed accountability, and ensure a focus on common stockholders’ interests. Since the Company’s IPO in January 2015, the Board has overseen poor operational and financial performance, as well as repeated failures to meet long-term targets. Yet, the Board has failed to take meaningful actions to challenge the status quo, which has led to BOX’s stock price performance significantly lagging both the software industry and the broader market during this time.

We invested in BOX due to the Company’s strong market position as the best-of-breed solution in cloud content management, as well as its significant valuation discount to peers due to years of missed expectations, poor results, and generally poor governance. Our investment thesis focused on a clear opportunity to drive profitable growth, improve capital allocation, and enhance governance in order to address the significant valuation gap between BOX and its closest peers. Unfortunately, despite repeated promises by management and the Board to address these issues over the past two years and to create stockholder value, performance has not sufficiently improved, and BOX is still deeply undervalued versus its peers.

It has now been more than two years since we first highlighted our concerns and perspectives regarding a litany of issues and opportunities at BOX. Despite our efforts to engage constructively, not enough progress has been made to put BOX on a better path. While we were pleased to reach an agreement on the appointment of new independent director candidates last year, it is now clear that those appointments have not created enough change. To make matters worse, the Company has made several poor capital allocation decisions, including its recent completion of a financing transaction that we believe serves no business purpose and was done in the face of a potential election contest with Starboard at the Annual Meeting in order to “buy the vote” and dilute the voice of common stockholders. It has become clear to us that further change on the Board is required to address the issues plaguing the Company and to ensure that the interests of common stockholders are appropriately represented in the boardroom.

We are therefore seeking your support to elect our slate of highly-qualified nominees, who we believe would not only bring significant and relevant experience to the Board, but also help restore credibility, demand accountability, and ensure a results-driven culture at BOX. Our nominees were carefully selected and possess experience and skillsets that directly address the current state of challenges, obstacles, and opportunities facing BOX.

13

The Board Has Overseen a Lack of Value Creation and Significant Relative Underperformance Since the Company’s IPO

Since the Company’s IPO, BOX has drastically underperformed the overall equity market, the broader software sector, and its own compensation peer group (the “Peer Group”), during what has generally been an incredibly favorable environment for public software companies. In fact, prior to Starboard’s public announcement that it would be seeking change at the upcoming Annual Meeting, BOX’s stock price was trading below the price at which it closed after its first day of trading following its IPO more than six years ago. As shown below, BOX underperformed its Peer Group by more than 400% and the broader software market by nearly 250% during this time4.

Source: Capital IQ, Bloomberg, Company filings. Prices adjusted for dividends.

Market data as of April 30, 2021. Source: Capital IQ, Bloomberg, Company filings. Prices adjusted for dividends.

Market data as of April 30, 2021. |

While BOX’s stock price performance has improved recently, we do not believe this performance is entirely indicative of fundamentals. We believe BOX’s stock price benefitted from M&A speculation earlier this year and confidence that our involvement and public pressure would catalyze further changes and improvements at BOX, as well as the Board’s more recent decision to approve a large share repurchase through a “Dutch auction” self-tender representing approximately 11.9% – 13.5% of the shares outstanding. As discussed below, we do not believe the self-tender in conjunction with the preferred equity financing is a prudent capital allocation decision, and we believe the Board is hoping that stockholders view the recent stock price appreciation, which we believe is largely driven by the factors above, as a reason to maintain the status quo at the upcoming Annual Meeting.

We believe further change is required on the Board to provide effective oversight of management, instill accountability in the boardroom, and ensure actions are taken to reverse the Company’s troubling history of underperformance and poor governance.

BOX Has a Track Record of Consistently Missing Expectations, Which We Believe Has Led To a Depressed Valuation

BOX’s history as a public company has been marked by consistently missed forecasts, repeatedly delayed promises of improving trends, and disappointing quarterly results, which has led to a lack of credibility with the investment community and the abysmal share price performance shown above.

4 Represents stock price performance through April 30, 2021, the last trading day prior to Starboard’s issuance of a public letter disclosing its intent to nominate directors and seek change at the Annual Meeting. Peer Group based on companies listed in BOX’s 10-K/A filed in May 2021. Stock price performance reflects dividends. Peer Group performance includes all Peer Group companies during the periods in which they were publicly traded since BOX’s IPO and reflects the Peer Group average.

14

BOX has an unfortunate track record of consistently missing and delaying its long-term revenue and revenue growth targets, which has significantly eroded credibility with investors. Since its IPO, BOX has fallen well short of its long-term financial targets time and time again, continually delaying and lowering targets after failing to meet its initial commitments. Below, we show just a few examples of long-term targets the Company has failed to meet (or is expected to fail to meet).

|

Source: Bloomberg, Company filings, Company presentations. Market data as of June 18, 2021.

|

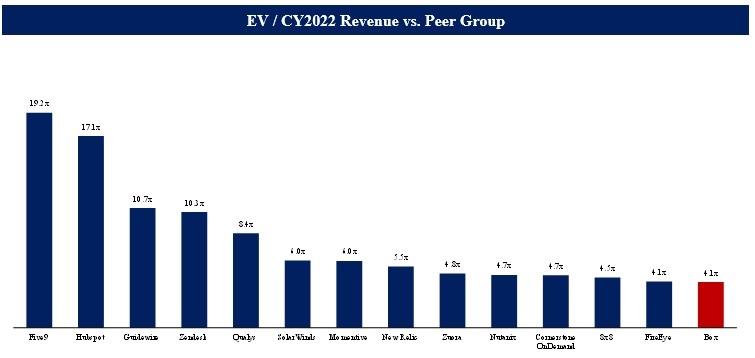

BOX now trades at one of the lowest revenue multiples in the software universe. In a golden era of software company performance and valuations, when many companies are growing rapidly, significantly expanding margins, and trading at or near all-time high stock prices and multiples, BOX unfortunately stands out as an outlier, particularly for a growing, cloud-native, highly recurring business. In fact, BOX now trades at the lowest multiple of 2022 revenue of any of the companies in its Peer Group. We believe this is indicative of a lack of credibility for future financial targets given years of repeated misses.

Note: Excludes PFPT and CLDR, each of which recently announced a sale transaction, as well as FSCT and RP, each of which completed a sale transaction. SurveyMonkey was renamed to Momentive as of June 15, 2021. |

15

We believe BOX is significantly undervalued in the market today, with an opportunity to create substantial value for stockholders moving forward.

Despite Repeated and Consistent Promises of Reaccelerating Revenue Growth, BOX’s Performance Continues to Disappoint

Over the past two years, following the public disclosure of Starboard’s involvement, BOX’s management team has consistently promised a reacceleration of revenue growth.

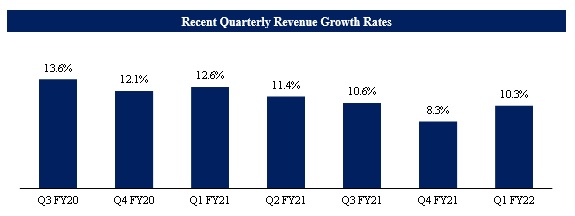

Unfortunately, BOX has repeatedly failed to keep these promises. Revenue growth has only continued to decelerate. While management continues to state that BOX is well-positioned for significant growth and that a re-acceleration is on the horizon, these sentiments fail to match reality, with revenue growth expected to modestly decelerate again in FY2022 per management’s own guidance.

16

|

Source: Company filings. |

BOX’s expected growth rate also compares poorly to that of its Peer Group. Based on consensus expectations for CY2021, BOX’s revenue growth is expected to be below that of two-thirds of the companies in its Peer Group, despite having a cloud-native product offering that should address a significant need and large market opportunity.

|

Note: Excludes PFPT and CLDR, each of which recently announced a sale transaction, as well as FSCT and RP, each of which completed a sale transaction. SurveyMonkey was renamed to Momentive as of June 15, 2021. |

We believe BOX has been significantly underperforming its potential as a public company over the past several years and that many of its issues are self-inflicted. BOX is well-positioned, with best-of-breed technology and a leading product portfolio in a growing market, and has an opportunity to take share from legacy, on-premise vendors. As a cloud-native content management platform, BOX should benefit from the digital transformations taking place at enterprises around the world in the current environment. Yet, despite these secular tailwinds and BOX’s strong competitive positioning, we believe the Company’s performance over the past year has been highly disappointing and does not reflect the strength of the Company’s technology position.

17

Unfortunately, despite what should have been a favorable environment for the Company, as noted above, BOX’s revenue growth trajectory has worsened over the course of the past several quarters. Q4 FY21 was the worst quarter of growth in the Company’s public history, and Q1 FY22 showed continued deceleration on a year-over-year basis.

|

Source: Company filings. |

We believe that this slowdown is at least partially explained by company-specific issues related to go-to-market, sales execution, and other factors. We believe these issues are largely addressable and that the Company can achieve improved revenue growth over time. Despite BOX’s massive stock price underperformance since its IPO, history of unkept promises, and continued slowdown of growth, we believe the Board has failed to take sufficient action to improve operations or hold management accountable for delivering on its commitments.

We Believe There Is a Significant Opportunity for Operational Improvement

Since our initial engagement with the Company, we have been focused on helping BOX achieve a better balance of growth and profitability. We have consistently and constructively engaged with BOX regarding the opportunities that we believe exist to significantly improve the Company’s operational performance. While BOX has taken some steps to improve operating margins, which we believe occured largely due to our repeated pressure and insistence, and aided by pandemic-related spending reductions, we believe that there are still many opportunities to improve margins and drive improved revenue growth at BOX.

18

Over the past two years, we have highlighted numerous opportunities to improve operations and create stockholder value, including, but not limited to, improving go-to-market strategy, sales execution, and sales force productivity; improving the overall cost structure of the business, including by optimizing the Company’s workforce location strategy; and addressing performance issues in the EMEA region.

We have been disappointed by the Company’s lack of progress on these, and other, opportunities over the past two years. Despite optimistic forecasts and commitments made by the management team, as shown in the table below, BOX has failed to execute on many of these operational opportunities.

|

Source: Company filings, Company presentations, Company transcripts. |

We strongly believe that BOX can both grow faster and be significantly more profitable than it is today. We believe our nominees, if elected, would be incredibly helpful to the Board and management team in identifying these opportunities and ensuring execution against these objectives. We look forward to sharing our detailed views on the opportunities for operational improvement at BOX with our fellow stockholders in the coming weeks and months.

BOX’s Excessive Stock-Based Compensation Leads to Outsized Dilution for Common Stockholders

We believe BOX’s valuation and market perception is negatively impacted by its extremely high levels of stock-based compensation. While the Company touts its Adjusted Operating Margin of 15% in FY2021 and is guiding to an Adjusted Operating Margin of 18.0-18.5% in FY2022, this metric does not account for the Company’s massive stock-based compensation expense – an issue that continues to exist despite two years of stockholder feedback and pressure. In FY2021, stock-based compensation expense was approximately 20% of revenue, which means that operating income after accounting for this expense was still negative.

19

The recognized expense and dilution from the growth in shares outstanding comes at a real cost. Due to the Company’s poor financial and operating performance, as well as its lack of credibility with investors, BOX trades at the lowest multiple of revenue in its Peer Group. Coupled with the fact that BOX’s stock-based compensation expense is approximately 20% of revenue, BOX’s stock-based compensation expense as a percentage of market capitalization is more than double the peer median.

|

Note: Based on most recent fiscal year for each company shown. Excludes FSCT, which announced a sale transaction in February 2020 and completed the transaction in August 2020. |

In our view, the current level of stock based compensation is not tenable for a company with BOX’s current growth profile and valuation. This exorbitant dilution directly and adversely impacts common stockholders, and we believe the Company’s massive stock-based compensation expense is a contributing factor to its depressed valuation multiple. Issuing 20% of revenue each year in equity compensation while only growing revenue approximately 10% in FY2022 is clearly dilutive to stockholder value and not sustainable. We have highlighted this issue to BOX for the past two years and not enough has been done to remediate this significant problem.

The Company Recently Executed Two Financings That We Believe Were Unnecessary and Not in the Best Interests of Stockholders

Over the past two years, we have continuously attempted to work with the Company privately and constructively to drive positive changes at BOX. As such, we have been deeply disappointed that despite these attempts to work collaboratively, BOX has not taken a similar approach towards meaningfully engaging with us, instead completing two financings that we believe were not in common stockholders’ best interests.

In January 2021, BOX raised $345 million through the issuance of convertible debt and stated that it was examining potential acquisitions. We communicated privately to the Board at that time that the convertible debt financing was unnecessary, as the Company already had $225 million of net cash on its balance sheet, available capacity on its revolving credit facility, access to debt markets on an as-needed basis, and was generating positive free cash flow every quarter.

20

In February 2021, BOX announced the acquisition of SignRequest for $55 million, with $45 million of the purchase price to be paid in cash, and later disclosed that it had also purchased Cloud FastPath in February 2021 for $15 million. So, since completing a transaction to raise $345 million, BOX has completed two small acquisitions for an aggregate cash purchase price of $60 million5, further illustrating that the Company did not need to raise capital.

In fact, as the Company reported a few weeks later, BOX generated $41 million of free cash flow in Q4 FY2021, meaning that the Company could have funded the majority of the cash purchase price of both acquisitions from Q4 FY2021 free cash flow alone. Instead, BOX chose to raise an unnecessary $345 million, which led to the Company incurring more than $8.5 million of issuance costs and spending almost $30 million on capped calls in an attempt to limit dilution for stockholders6. To be clear, this potential dilution risk only exists because the Company chose to do this unnecessary financing.

To make matters significantly worse, in early April 2021, BOX announced a $500 million investment in the Company led by KKR in the form of convertible preferred equity (the “KKR Financing”). The preferred equity carries voting rights and votes on an as-converted basis. We believe the KKR Financing has no bona fide business purpose and was done solely to entrench the Board and “buy the vote” ahead of a potential election contest with Starboard.

Following the $345 million convertible debt issuance and the subsequent acquisitions but prior to the KKR Financing, BOX had approximately $535 million of cash on its balance sheet and also publicly disclosed that it expected to generate approximately $170 million of free cash flow in FY20227. We believe this should have provided plenty of available liquidity for both acquisitions and buybacks; however, despite this significant and growing cash position, BOX still chose to execute the KKR Financing, which now leaves the Company with an estimated cash balance of greater than $1 billion, representing more than 25% of the Company’s current market capitalization.

We believe the Board recognized there was no valid business rationale for maintaining such a high cash balance and decided to use the proceeds from the KKR Financing to conduct a “Dutch auction” self-tender to repurchase $500 million of its common stock, which BOX announced concurrently with the KKR Financing. We believe it is transparently obvious that the Company’s goal in completing the KKR Financing was simply to substitute common stockholders who have the ability to vote as they wish with preferred investors who were legally bound to vote in accordance with the Board’s recommendations.

We fail to see how the KKR Financing and proposed “Dutch auction” share repurchase benefit common stockholders. The preferred equity carries a 3% dividend rate, significantly higher than the 0% interest rate on the convertible debt raised just a few months earlier. As a result, the Company will be paying $15 million in annual dividends for money that we believe it did not need and for which it has no use. More recently, the Company has disclosed its intention to pay the dividend in common stock, further increasing the annual dilution for existing stockholders. Based on the proposed range for the “Dutch auction” repurchase, BOX is only minimally reducing the share count on a net basis – in fact, BOX could have achieved the same reduction in share count by not executing the KKR Financing and simply repurchasing approximately $23-$79 million of stock using readily available cash from its balance sheet. This range does not even take into account the transaction costs associated with the KKR Financing and self-tender, which would further reduce the breakeven point. If we assume that the issuance costs for the preferred equity financing are in-line with the convertible debt financing as a percentage of gross proceeds, we can estimate the issuance costs to be $12.5 million. This means that the Company only needed to repurchase $11-$66 million of stock to replicate the financial impact from the KKR Financing, which would have also allowed it to avoid an annual dividend payment of $15 million and a $500 million liability that must be repaid if the stock price is not above $27.00 by May 2028. Under almost every scenario, we believe the KKR Financing and related self-tender are dilutive to common stockholders when viewed holistically.

5 Source: Company filings.

6 Source: Company filings.

7 Source: Company transcript.

21

|

| Source: Company filings, Bloomberg. Market data as of June 18, 2021. |

When combining this latest convertible preferred equity with the previously completed convertible notes, in downside scenarios, the Board has now created $845 million in liabilities in exchange for raising unnecessary capital. Company boards must evaluate a range of scenarios, including those in which the company does not achieve its desired outcomes – either because the company does not achieve its plan, the market does not react favorably to its results, or something happens outside the company’s control. We believe the adverse consequences of these financing transactions in downside scenarios far outweigh the benefits of their stated purpose, especially as BOX does not appear to have any true operational use for the capital. This leads us to seriously question the Board’s judgement and consider whether there were ulterior motives for these transactions, particularly the KKR Financing and related self-tender announced in April.

In fact, we were not alone in questioning the Board’s actions as it relates to the KKR Financing. In May 2021, there was a class action lawsuit filed in Delaware Chancery Court against the Board by the Building Trades Pension Fund of Western Pennsylvania. The Complaint alleged that the Board breached its fiduciary duties in approving the KKR Financing and sought an injunction blocking enforcement of the voting provision with KKR. The filing of the Complaint was a rather extraordinary action involving serious allegations against directors who appear to have acted out of an entrenchment motive in completing the ill-advised KKR Financing. We are concerned that these directors approved such an egregious, defensive transaction without seeming to have considered its highly problematic implications.

One day after the Complaint was filed, the Board abruptly and reactively eliminated the voting obligations for the investors in the KKR Financing, effectively acknowledging (notwithstanding the public denial of wrongdoing), in our view, that the Board made a serious misstep with the KKR Financing while revealing its true intention was simply to “buy the vote” and entrench the Board ahead of a potential election contest with Starboard.

22

We would ask our fellow stockholders to consider a simple question – was there any valid business purpose for the Company or material benefit to common stockholders in completing the KKR Financing?

We believe the answer is clearly no and should highlight the true motive of this egregious and entirely unnecessary KKR Financing, while also raising questions about the Board’s ability and willingness to focus on the best interests of common stockholders.

We believe the Board’s original intent in consummating the KKR Financing is clear and simple: to dilute the vote of common stockholders who have suffered through years of poor returns by placing more than 10% of the vote in the hands of new preferred investors who were contractually obligated to vote in accordance with the Board’s recommendations. These preferred investors were given a preferential instrument with better terms than the common shares we all own in exchange for providing their guaranteed vote of support for the Board. We believe the Board’s sudden about-face in eliminating the voting obligations only serves to raise more questions regarding the Board’s true motives and does not change the reality of the Board’s egregious and entrenchment-focused actions.

We Believe That Direct Common Stockholder Representation on the Board Is Necessary and Starboard Has a Strong Track Record of Representing Common Stockholders

We strongly believe that common stockholders need direct representation on the Board in order to ensure that our collective interests are being actively protected and represented. The Board has overseen persistent and significant underperformance for far too long and is now asking us all to trust the status quo. As we have illustrated in our prior letters to stockholders and in this proxy statement, we believe the Board’s lack of action to drive improved accountability and create long-term value, coupled with concerning governance practices and the recently completed, ill-advised KKR Financing, makes it clear that maintaining the status quo and hoping this time is finally different is not a viable solution.

We believe the common stockholders, as the true owners of the Company, need to have a strong voice at the Board level. Such a voice promotes greater accountability and creates an environment that forces other directors to consider new and innovative ways to positively impact stockholder value. We believe a culture focused on long-term value creation and stockholder accountability requires placing stockholder representatives on the Board who have a significant financial commitment to the Company along with relevant experience. This requirement ensures the proper alignment of interests between the Board and stockholders.

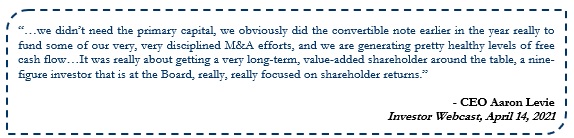

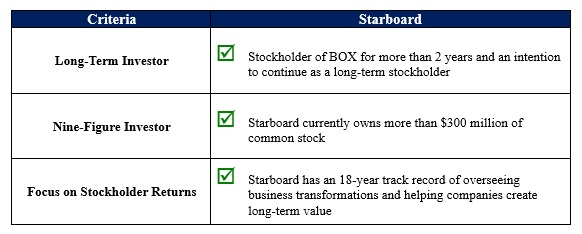

Furthermore, Mr. Levie has specifically mentioned the benefits that he and the Board believe exist as a result of having investor representation on the Board.

23

We believe Starboard meets every criteria that Mr. Levie mentions in his quote, but we are also seeking to hold management and the Board accountable for the subpar results and stockholder returns the Company has generated over the last six years.