Form PRE 14A Wayfair Inc. For: Oct 13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý | ||||||||

Filed by a Party other than the Registrant o | ||||||||

| Check the appropriate box: | ||||||||

| ý | Preliminary Proxy Statement | |||||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| o | Definitive Proxy Statement | |||||||

| o | Definitive Additional Materials | |||||||

| o | Soliciting Material under §240.14a-12 | |||||||

| WAYFAIR INC. | ||||||||||||||

| (Name of Registrant as Specified In Its Charter) | ||||||||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||||||||

| Payment of Filing Fee (Check the appropriate box): | ||||||||||||||

| ý | No fee required. | |||||||||||||

| o | Fee paid previously with preliminary materials. | |||||||||||||

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION, DATED AUGUST 19, 2022 | ||||||||||||||

| ||||||||||||||

WAYFAIR INC.

4 COPLEY PLACE, BOSTON, MA 02116

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON OCTOBER 13, 2022

To the Stockholders of Wayfair Inc.:

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders, or Special Meeting, of Wayfair Inc., a Delaware corporation, will be held on Thursday, October 13, 2022 at 9:00 a.m. eastern time. The Special Meeting will be a virtual stockholder meeting, conducted via live audio webcast, through which you can vote online. The Special Meeting can be accessed by visiting www.virtualshareholdermeeting.com/wayfair2022SM and entering your 16-digit control number (included on the Notice Regarding the Availability of Proxy Materials mailed to you).

The sole purpose of the Special Meeting is to approve an amendment to Wayfair Inc.’s 2014 Incentive Award Plan, or 2014 Plan, to increase the aggregate number of shares of Class A common stock authorized for issuance under the 2014 Plan by 5,000,000 shares to 32,187,784 shares (Proposal No. 1).

The foregoing items of business are more fully described in the Proxy Statement. Pursuant to Wayfair Inc.’s Amended and Restated Bylaws, no business may be transacted at the Special Meeting other than the business specified in this Notice of Special Meeting of Stockholders.

Only stockholders who owned our Class A common stock or Class B common stock at the close of business on August 22, 2022 can vote at the Special Meeting or any adjournments or postponements that take place. All stockholders are cordially invited to attend the virtual Special Meeting.

Our board of directors, or Board, recommends that you vote FOR the approval of an amendment to the 2014 Plan as described in Proposal No. 1.

We are pleased to continue utilizing the Securities and Exchange Commission, or SEC, rules that allow issuers to furnish proxy materials to their stockholders on the Internet. On or about [August 29, 2022], we will mail to our stockholders of record as of August 22, 2022 (other than those who previously requested electronic or paper delivery on an ongoing basis) a Notice Regarding the Availability of Proxy Materials, or Notice, with instructions for accessing the proxy materials and voting over the Internet, by telephone or mobile device or by mail. The Notice also provides information on how stockholders may request paper copies of our proxy materials. We believe electronic delivery of our proxy materials will help us reduce the environmental impact and costs of printing and distributing paper copies and improve the speed and efficiency by which our stockholders can access these materials.

Your vote is very important. Whether or not you plan to attend the virtual Special Meeting, we encourage you to read our proxy materials and submit your proxy or voting instructions as soon as possible over the Internet, by telephone or mobile device or by phone.

| By Order of the Board of Directors, | ||||||||

| ||||||||

| Boston, Massachusetts | Enrique Colbert | |||||||

[•] | General Counsel and Secretary | |||||||

TABLE OF CONTENTS

PROPOSAL NO. 1—APPROVAL OF THE AMENDMENT TO THE 2014 INCENTIVE AWARD PLAN | |||||

Compensation Committee Interlocks and Insider Participation | |||||

| ANNEX A 2014 INCENTIVE AWARD PLAN | |||||

| ANNEX B AMENDMENT NO. 1 TO 2014 INCENTIVE PLAN | |||||

i

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION, DATED AUGUST 19, 2022 | ||||||||||||||

| ||||||||||||||

WAYFAIR INC.

4 COPLEY PLACE, BOSTON, MA 02116

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD OCTOBER 13, 2022

We have provided this Proxy Statement and a Proxy Card to you on the Internet or, upon your request, have delivered those proxy materials to you, because the board of directors, or Board, of Wayfair Inc. is soliciting your proxy to vote at the Special Meeting of Stockholders, or Special Meeting, to be held on October 13, 2022 at 9:00 a.m. eastern time. Unless the context otherwise requires, references to “Wayfair,” “the company,” “we,” “us,” and “our” refer to Wayfair Inc. The Special Meeting will be held virtually, conducted via live audio webcast, at www.virtualshareholdermeeting.com/wayfair2022SM. Be sure to have your 16-digit control number (included in the Notice of Availability of Proxy Materials mailed to you) in order to access the Special Meeting.

This Proxy Statement summarizes information about the proposal to be considered at the Special Meeting and other information you may find useful in determining how to vote.

The Proxy Card is the means by which you actually authorize another person to vote your shares in accordance with your instructions.

In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, e-mail and personal interviews. All costs of solicitation of proxies will be borne by us. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting materials to the owners of stock held in their names, and we will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

We are mailing the Notice Regarding the Availability of Proxy Materials, or the Notice, to our stockholders of record as of August 22, 2022, or the Record Date, on or about [August 29, 2022]. In addition, we have provided brokers, dealers, banks, voting trustees and their nominees, at our expense, with additional copies of our proxy materials so that our record holders can supply these materials to the beneficial owners of shares of our Class A common stock and Class B common stock as of the Record Date.

Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

1 |  | |||||||||||||||||||

| INFORMATION ABOUT THE PROXY PROCESS AND VOTING | ||||||||||||||

Why am I receiving these materials?

We are providing the Proxy Statement and Proxy Card to you on the Internet or, upon your request, by mail, in connection with the Special Meeting. As a stockholder, you are invited to attend the Special Meeting, which is being held virtually on the Internet, conducted via live audio webcast, and are requested to vote on the items of business described in this Proxy Statement. However, you do not need to attend the Special Meeting to vote your shares. Instead, you may simply follow the instructions below to submit your proxy over the Internet, by telephone or mobile device or by mail.

How can I access the proxy materials over the Internet?

The Notice contains instructions on how to view the proxy materials on the Internet, vote your shares, and request electronic delivery of future proxy materials. An electronic copy of the Proxy Statement is available at www.proxyvote.com.

How can I request a paper or email copy of the proxy materials?

If you want to receive a paper or e-mail copy of these proxy materials, you must request it. There is no charge for requesting a copy. Please choose one of the following methods to make your request:

1.By Internet: www.proxyvote.com

2.By Telephone: 1-800-579-1639

3.By E-Mail: sendmaterial@proxyvote.com

Please make the request as instructed above on or before September 29, 2022 to facilitate timely delivery.

Can I attend the Special Meeting in person?

We will be hosting the Special Meeting via live audio webcast on the Internet. You will not be able to attend the meeting in person. Any stockholder can listen to the Special Meeting live via the Internet at www.virtualshareholdermeeting.com/wayfair2022SM, where you can also vote online. The webcast will start at 9:00 a.m. eastern time on October 13, 2022. Stockholders may vote while connected to the Special Meeting on the Internet. In order to do so, you will need the 16-digit control number included on the Notice mailed to you. Please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies. If you encounter difficulties accessing the Special Meeting, please call the technical support number that will be posted on the registration page for the Special Meeting website.

Who can vote at the Special Meeting?

Only holders of record of our Class A common stock and Class B common stock on the Record Date will be entitled to vote at the Special Meeting. At the close of business on August 22, 2022, we had [•] shares of Class A common stock and [•] shares of Class B common stock outstanding and entitled to vote. Holders of our Class A common stock are entitled to one (1) vote for each share held as of the above Record Date. Holders of our Class B common stock are entitled to ten (10) votes for each share held as of the above Record Date. Holders of our Class A common stock and Class B common stock will vote as a single class on all matters described in this Proxy Statement.

What am I being asked to vote on?

You are being asked to vote on one (1) proposal: Proposal No. 1—the approval of the Amendment to our 2014 Incentive Award Plan.

2 |  | |||||||||||||||||||

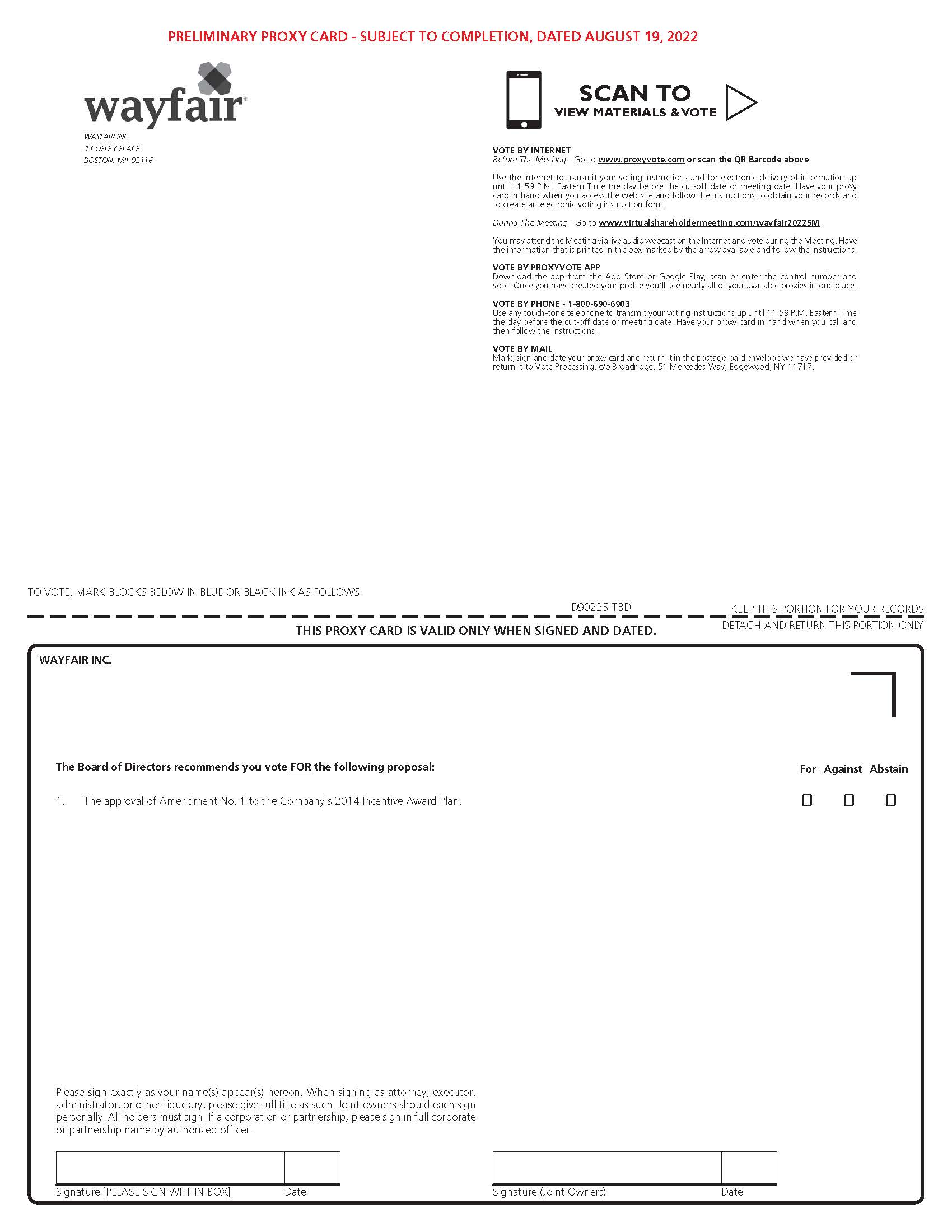

How do I vote?

Stockholder of Record (Shares Registered in Your Name)

If, on the Record Date, your shares were registered directly in your name with the transfer agent for our common stock, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote at the Special Meeting or vote by proxy. Whether or not you plan to attend the Special Meeting, we urge you to vote and submit your proxy in advance of the Special Meeting by one of the methods below to ensure your vote is counted. To vote by any of these methods, read this Proxy Statement, have your Notice, Proxy Card, or voting instruction form in hand, and follow the instructions below for your preferred method of voting. Each of these voting methods is available 24 hours per day, seven days per week.

| |||||||||||

| By internet | By phone | By mail | By scanning | ||||||||

Before the Special Meeting - go to www.proxyvote.com During the Special Meeting - go to www.virtualshareholdermeeting.com/wayfair2022SM | From the United States, U.S. territories and Canada: call 1-800-690-6903 | If you received a paper copy of the proxy materials by mail, mark, sign, date and promptly mail the enclosed proxy card in the postage-paid envelope | Scan the QR code using your mobile device to vote via the ProxyVote app | ||||||||

Beneficial Owner (Shares Registered in the Name of Broker, Bank or Other Agent)

If, on the Record Date, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice or these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Special Meeting via the Internet. However, because you are not the stockholder of record, you may not vote your shares at the Special Meeting unless you request and obtain a valid Proxy Card from your broker or other agent. Please follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a Proxy Card.

Who counts the votes?

Broadridge Investor Communication Solutions, Inc. has been engaged as our independent agent to tabulate stockholder votes, or Inspector of Elections. If you are a stockholder of record, your executed Proxy Card is returned directly to Broadridge for tabulation. As noted above, if you hold your shares through a broker, your broker returns one Proxy Card to Broadridge on behalf of all its clients.

How are votes counted?

Votes will be counted by the Inspector of Elections, who will separately count “For”, “Against”, and “Abstain” votes and broker non-votes.

3 |  | |||||||||||||||||||

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank, custodian, nominee or other record holder of common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

Is the proposal considered “routine” or “non-routine?”

The approval of the Amendment to our 2014 Incentive Award Plan (Proposal No. 1) is considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposal No. 1.

How many votes are needed to approve the proposal?

With respect to Proposal No. 1, the affirmative vote of the majority of votes cast is required for approval. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

How many votes do I have?

On each matter to be voted upon, you have one (1) vote for each share of Class A common stock you own as of the Record Date and ten (10) votes for each share of Class B common stock you own as of the Record Date.

What if I complete a Proxy Card but do not make specific choices?

If we receive a proxy instruction from you over the Internet, by telephone or mobile device or by mail that does not specify how your shares are to be voted, your shares will be voted “For” the approval of the Amendment to our 2014 Incentive Award Plan.

4 |  | |||||||||||||||||||

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must vote pursuant to the instructions on each Notice.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Special Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three (3) ways:

•You may submit another properly completed proxy with a later date over the Internet, by telephone or mobile device or by mail.

•You may send a written notice that you are revoking your proxy to us at Wayfair Inc., 4 Copley Place, Boston, MA 02116, Attention: Secretary.

•You may attend the Special Meeting via the Internet and vote online. Simply attending the Special Meeting will not, by itself, revoke your proxy.

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by them.

When are stockholder proposals due for the 2023 Annual Meeting of Stockholders?

If you are interested in submitting a proposal for potential inclusion in the proxy statement for our 2023 Annual Meeting of Stockholders, you must follow the procedures outlined in Rule 14a-8 of the Securities Exchange Act of 1934, as amended, or the Exchange Act. To be eligible for inclusion in the proxy statement, we must receive your stockholder proposal or information about your proposed director candidate at the address noted below no later than December 13, 2022. However, if the 2023 Annual Meeting of Stockholders is held before April 24, 2023 or after June 23, 2023, then we must receive your stockholder proposal or information about your proposed director candidate at the address noted below a reasonable time before we begin to print and mail our proxy materials for the 2023 Annual Meeting of Stockholders.

If you wish to present a proposal at the 2023 Annual Meeting of Stockholders, but do not wish to have the proposal considered for inclusion in our proxy statement and proxy card, you must also give written notice at the address noted below. We must receive this required notice by February 23, 2023, but no sooner than January 24, 2023. However, if our 2023 Annual Meeting of Stockholders is held before April 24, 2023 or after July 23, 2023, then we must receive the required notice of a proposal or proposed director candidate no earlier than the 120th day prior to the 2023 Annual Meeting and no later than the close of business on the later of (1) the 90th day prior to the 2023 Annual Meeting of Stockholders and (2) the 10th day following the date on which public disclosure was made of the date of the 2023 Annual Meeting of Stockholders. In addition, to comply with the universal proxy rules (once effective), stockholders who intend to solicit proxies in support of director nominees other than the company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than March 25, 2023.

Any proposals should be sent to us at Wayfair Inc., 4 Copley Place, Boston, MA 02116, Attention: Secretary.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid Special Meeting. On the Record Date, there were [•] shares of Class A common stock and [•] shares of Class B common stock outstanding and entitled to vote. A quorum will be present if stockholders holding a majority of the voting power of the shares of our Class A common stock and Class B common stock (voting together as a single class) entitled to vote are present at the Special Meeting or represented by proxy.

5 |  | |||||||||||||||||||

Your shares will be counted towards the quorum only if you submit a valid proxy or vote at the Special Meeting via the Internet. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairperson of the Special Meeting or a majority in voting power of the shares entitled to vote at the Special Meeting and present or represented by proxy, may adjourn the Special Meeting to another time or place.

How can I find out the results of the voting at the Special Meeting?

Voting results will be announced by the filing of a Current Report on Form 8-K with the Securities and Exchange Commission, or SEC, within four business days after the Special Meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days of the day the final results are available.

6 |  | |||||||||||||||||||

| PROPOSAL NO. 1 APPROVAL OF THE AMENDMENT TO THE 2014 INCENTIVE AWARD PLAN | ||||||||||||||

Overview and Rationale

On August 16, 2022, upon the recommendation of the compensation committee, our Board approved Amendment No. 1 to the 2014 Plan (as amended, the “Amended Plan”), subject to approval from our stockholders at the Special Meeting. The Amended Plan will increase the number of shares of Class A common stock authorized for issuance under the 2014 Plan by 5,000,000 shares (the “Share Increase”). A copy of the 2014 Plan is attached hereto as Annex A and Amendment No. 1 to the 2014 Plan is attached hereto as Annex B, each of which is incorporated herein by reference.

We operate in a highly competitive talent market and our future success depends to a great extent on our continuing ability to attract, develop, motivate and retain highly qualified and skilled employees, particularly mid-level managers, engineers and merchandising and technology personnel. Qualified individuals are in high demand, and the market for such positions in the Boston area and other cities in which we operate is extremely competitive. The talent, experience and aptitude that our employees have makes them attractive candidates that are often subject to significant ongoing recruiting efforts by other companies. Given this continuously competitive environment, our compensation program is designed to be competitive with those companies with whom we compete for talent and to strengthen our ability to attract and retain excellent employees.

Our compensation philosophy is weighted towards providing broad-based equity incentive awards, in addition to salary or wages, as we believe this helps to retain employees and aligns their interests with those of our stockholders by allowing them to participate in the longer-term success of Wayfair. Our outside director compensation program is also equity-driven, consisting entirely of restricted stock unit awards, and the majority of our executive officers’ compensation is in the form of equity awards, the value of which depends entirely on the price of our common stock. While salary or wages are intended to meet our employees’ near-term liquidity needs, we believe that equity awards motivate our employees to contribute to our long-term success. We believe that compensation should motivate individuals to achieve sustainable stockholder value rather than to simply remain at Wayfair or maintain the status quo. The potential for appreciation in the price of our common stock also creates an opportunity for employees to think of themselves as owners of Wayfair.

We believe the Share Increase is necessary for us to continue to offer a competitive broad-based equity incentive program that enables us to recruit, motivate and retain talented and highly qualified employees and directors who are critical to our investment plans and our ability to successfully operate our business. If we were unable to continue to grant competitive equity awards, we may be required to offer additional cash-based incentives as a means of competing for talent. This could have a significant effect on our financial and operating results, put us at a competitive disadvantage in the market for talent and will reduce the alignment between the interests of our employees and those of our stockholders.

In determining the size of the Share Increase under the Amended Plan, our Board and compensation committee worked with management and an independent compensation consultant to evaluate a number of factors, including our corporate strategy and compensation needs, our compensation philosophy of broad-based eligibility for equity incentive awards, our recent and projected share usage, share usage at peer companies and the total potential dilution of the proposed Share Increase. The Board and compensation committee believe that approving an additional 5,000,000 shares for issuance under the Amended Plan is appropriate and in the best interests of stockholders given the highly competitive environment in which we compete for talent, the recent volatility in the capital markets and its impact on our stock price, and our projected share usage. However, estimating our future share needs is challenging, particularly under current market conditions, as our estimates are based on our current internal modeling and depend on a number of factors that are difficult to predict or are beyond our control, including market conditions, competition for talent, our future financial and operating performance, our hiring needs, the amount of forfeitures of outstanding awards, and the future price of our common stock. We therefore intend to reevaluate our compensation needs and projected share usage in the first half of 2023 and determine if at our 2023 Annual Meeting of Stockholders an additional share request is necessary or whether we seek approval of a new equity incentive plan since the 2014 Plan is set to expire in 2024.

7 |  | |||||||||||||||||||

Shares Available and Outstanding Awards

As of August 10, 2022, 808,037 shares of Class A common stock were available for issuance under the 2014 Plan, which is the only equity plan under which awards may currently be granted. We expect that these shares will be insufficient to make awards to new hires, directors and existing employees for the remainder of 2022 and for 2023. As of August 10, 2022, there were approximately 7,776,334 outstanding unvested full value awards with time-based vesting. Other than the foregoing, no awards were outstanding under our equity compensation plans as of August 10, 2022.

The closing price of our Class A common stock as reported by the New York Stock Market on August 10, 2022 was $65.03.

Equity Award Practices

The Board adopted the 2014 Plan to grant cash and equity incentive awards to eligible participants in order to attract, motivate and retain talent. Our compensation philosophy is weighted towards providing broad-based equity incentive awards, linking the interests of those employees with those of our stockholders and motivating our employees to act as owners of the business. The number of equity awards to be granted under the 2014 Plan each year is estimated internally based on hiring expectations and internal modeling using a forecasted “planning price” of our common stock. Wayfair uses these planning prices to aid in establishing the expectations for the burn rate of the 2014 Plan. The compensation committee carefully monitors our annual net share usage, total dilution and equity expense in order to maximize stockholder value by granting only the number of equity incentive awards that it believes are necessary and appropriate to attract, motivate and retain our employees. As shown in the Burn Rate table below, our three-year average gross burn rate for the 2019-2021 period was 3.4%, or 2.0% on a net basis.

As a result of the recent volatility in our common stock price and the broader capital markets, we have issued awards of common stock under the 2014 Plan at a rate in excess of what was anticipated, and we need more shares to provide competitive equity awards. While we have considered alternatives to the issuance of equity awards, our compensation committee believes equity awards are the most effective mechanism for creating long-term incentives for value generation. Further, a reduced equity compensation element would put us at a competitive disadvantage in the talent market, and it would also hamper our ability to align our compensation with long-term stockholder value creation. As a result, and in order to continue to recruit and retain the employees, officers and directors needed to move Wayfair’s business forward, the Board approved the Amended Plan and the Share Increase to meet Wayfair’s compensation needs and recommends that shareholders vote in favor of this Proposal 1.

8 |  | |||||||||||||||||||

Burn Rate

The following table sets forth information regarding historical awards granted during 2019, 2020 and 2021, and the corresponding burn rate, which is defined as the number of shares subject to equity-based awards granted in a year divided by the weighted average number of shares of common stock outstanding for that year, for each of the last three fiscal years:

| Share Element | 2019 | 2020 | 2021 | Three-Year Average | ||||||||||

Stock Options Granted | 0 | 0 | 0 | |||||||||||

Full-Value Awards Granted | 4,420,948 | 2,441,898 | 3,094,056 | |||||||||||

Total Awards Granted (1) | 4,420,948 | 2,441,898 | 3,094,056 | |||||||||||

Weighted average common shares outstanding during the fiscal year | 92,200,000 | 95,824,983 | 103,855,575 | |||||||||||

Annual Gross Burn Rate (2) | 4.8% | 2.5% | 3.0% | 3.4% | ||||||||||

Annual Net Burn Rate (3) | 3.2% | 0.9% | 1.8% | 2.0% | ||||||||||

(1)Total Awards Granted represents the sum of Stock Options Granted and Full-Value Awards Granted.

(2)Gross burn rate uses Total Awards Granted.

(3)Net burn rate uses Total Awards Granted less cancellations and forfeitures.

Summary of the Amended 2014 Plan

Administration. The Amended Plan will continue to be administered by the compensation committee. The compensation committee has full power to select, from among the individuals eligible for awards, the individuals to whom awards will be granted, to make any combination of awards to participants and to determine the specific terms and conditions of each award, subject to the provisions of the Amended Plan. The administrator of the Amended Plan is authorized to exercise its discretion to reduce the exercise price of outstanding stock options and stock appreciation rights or effect the repricing of such awards through cancellation in exchange for cash or other awards without stockholder consent. Subject to certain limitations and guidelines, the Board or the compensation committee may delegate to a committee of one or more members of the Board or one or more officers of the company the authority to grant or amend awards under the Amended Plan or to take other administrative action for individuals who are not subject to Section 16 of the Exchange Act or officers or directors to whom authority to grant or amend awards has been delegated.

Eligibility; Plan Limits. The maximum number of shares of Class A common stock that may be issued under the Amended Plan is the sum of (i) 13,603,066 shares of Class A common stock, (ii) any shares of Class B common stock that are subject to awards granted under the Wayfair LLC Second Amended and Restated 2010 Incentive Plan, or the Prior Plan, that are forfeited, lapse unexercised or are settled in cash and that are not issued under the Prior Plan after the effective date of the 2014 Plan and (iii) an annual increase (“evergreen”) on the first day of each calendar year beginning on January 1, 2016 and ending on and including January 1, 2024 equal to the lesser of (A) 2,500,000 shares, (B) 2% of the aggregate number of shares of our Class A and Class B common stock outstanding on the final day of the immediately preceding calendar year and (C) such smaller number of shares as determined by the Board. All of our officers, employees, non-employee directors and consultants are eligible to participate in the Amended Plan, subject to the discretion of the administrator. As of August 10, 2022, approximately 19,375 individuals were eligible to participate in the 2014 Plan, which includes six (6) executive officers, 19,362 employees who are not executive officers, seven (7) non-employee directors and zero (0) consultants. There are certain limits on the number of awards that may be granted under the Amended Plan. For example, no more than 8,603,066 Shares of Class A common stock may be granted in the form of incentive stock options.

Non-Employee Director Compensation Limit. The Amended Plan provides that the value of all awards awarded under the Amended Plan to any non-employee director as compensation for services as a non-employee director in any calendar year shall not exceed $1,000,000.

9 |  | |||||||||||||||||||

Types of Awards. The Amended provides for the grant of the following types of awards:

•Stock Options. The Amended Plan permits the granting of (1) options to purchase Class A common stock intended to qualify as incentive stock options under Section 422 of the Internal Revenue Code of 1986, as amended, or the Code, and (2) options that do not so qualify. Options granted under the Amended Plan will be non-qualified options if they fail to qualify as incentive stock options or exceed the annual limit on incentive stock options. Incentive stock options may only be granted to employees of Wayfair and its subsidiaries. Non-qualified options may be granted to any persons eligible to receive incentive stock options and to non-employee directors and consultants. The exercise price of each option may not be less than 100% of the fair market value of the Class A common stock on the date of grant unless otherwise determined by the administrator. In the case of an incentive stock option that is granted to a 10% owner, the exercise price of such incentive stock option shall be not less than 110% of the fair market value on the grant date. Fair market value for this purpose is determined by reference to the closing price of the shares of Class A common stock on the New York Stock Exchange.

◦The term of each option is fixed by the administrator and generally may not exceed ten years from the date of grant. The administrator will determine at what time or times each option may be exercised. Options may be made exercisable in installments and the exercisability of options may be accelerated by the administrator. In general, unless otherwise permitted by the administrator, no option granted under the Amended Plan is transferable by the optionee other than by will or by the laws of descent and distribution or, subject to the consent of the administrator, pursuant to a domestic relations order, and options may be exercised during the optionee’s lifetime only by the optionee, unless the option has been disposed of pursuant to a domestic relations order.

◦Upon exercise of options, the option exercise price must be paid in full by the method or methods determined by the administrator, including: (i) cash or check, (ii) shares of Class A common stock having a fair market value equal to the payment required and held for such period of time as may be required by the administrator in order to avoid adverse accounting consequences, (iii) delivery of a written or electronic notice that the holder has placed a market sell order with a broker acceptable to Wayfair with respect to shares then issuable upon exercise or vesting of an award, and that the broker has been directed to pay a sufficient portion of the net proceeds of the sale to us in satisfaction of the aggregate payments required, or (iv) any other form of legal consideration acceptable to the administrator in its discretion.

◦To qualify as incentive stock options, options must meet additional federal tax requirements, including a $100,000 limit on the value of shares subject to incentive stock options that first become exercisable by a participant in any one calendar year.

•Restricted Stock Awards. The Amended Plan permits the grant of restricted stock awards, subject to such conditions and restrictions as the administrator may determine. These conditions and restrictions may include the achievement of certain performance goals and/or continued employment or other service relationship with us through a specified restricted period. During the vesting period, restricted stock awards may be credited with dividends but, in the discretion of the administrator, extraordinary dividends payable with respect to a restricted stock award shall be subject to the same restrictions as the underlying restricted stock award.

•Restricted Stock Units. The Amended Plan permits the grant of restricted stock units in such amounts and subject to such terms and conditions as determined by the administrator. These conditions and restrictions may include the achievement of certain performance goals and/or continued employment or other service relationship with us through a specified vesting period.

•Performance Awards. The Amended Plan permits the grant of performance awards, including awards of performance stock units and other awards determined in the administrator’s discretion from time to time. The value of performance awards may be linked to the attainment of the performance goals or other specific criteria, whether or not objective, determined by the administrator, in each case on a specified date or dates or over any period or periods and in such amounts as may be determined by the administrator.

•Dividend Equivalents. The Amended Plan permits the grant of dividend equivalent rights, which entitle the recipient to receive credits for dividends that would be paid if the recipient had held specified shares of

10 |  | |||||||||||||||||||

Class A common stock. Dividend equivalent rights may be converted to cash or additional shares of Class A common stock by such formula and at such time and subject to such restrictions and limitation as may be determined by the administrator.

•Stock Payments. The Amended Plan permits the grant of stock payments. The number or value of shares of any stock payment shall be determined by the administrator and may be based upon one or more performance goals or any other specific criteria, including service to Wayfair or any of its subsidiaries. Shares of Class A common stock underlying a stock payment that is subject to a vesting schedule or other conditions or criteria set by the administrator shall not be issued until those conditions have been satisfied. Stock payments may, but are not required to, be made in lieu of base salary, bonus, fees or other cash compensation.

•Stock Appreciation Rights. The Amended Plan permits the grant of stock appreciation rights, subject to such conditions and restrictions as the administrator may determine. Stock appreciation rights entitle the recipient to shares of Class A common stock, cash or a combination of both equal to the value of the appreciation in the stock price over the exercise price. Unless otherwise determined by the administrator, the exercise price of a stock appreciation right may not be less than the fair market value of the shares of Class A common stock on the date of grant. The term of a stock appreciation right generally may not exceed ten years.

Change in Control Provisions. In the event of a dividend or other distribution, Change in Control (as defined in the Amended Plan), reorganization, merger, amalgamation, consolidation, combination, repurchase, recapitalization, liquidation, dissolution, or sale, transfer, exchange or other disposition of all or substantially all of the assets of the Company, or sale or exchange of common stock or other securities of the Company, issuance of warrants or other rights to purchase common stock or other securities of the Company, or other similar corporate transaction, as determined by the administrator, each a Corporate Transaction, or any unusual or nonrecurring transactions or events affecting Wayfair or any of its subsidiaries, or the financial statements of Wayfair or any of its subsidiaries, or of changes in applicable law or accounting principles, the administrator, in its discretion, and on such terms and conditions as it deems appropriate, is authorized to take any one or more of the following actions whenever the administrator determines that such action is appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Amended Plan or with respect to any award under the Amended Plan, to facilitate such transactions or events or to give effect to such changes in laws, regulations or principles: (i) provide for either (A) termination of any such award in exchange for an amount of cash, if any, equal to the amount that would have been attained upon the exercise or vesting of such award or (B) the replacement of such award with other rights or property selected by the administrator, in its discretion, having an aggregate value not exceeding the amount that could have been attained upon the exercise or vesting of such award; (ii) provide that such award be assumed by the successor or survivor corporation, or a parent or subsidiary thereof, or shall be substituted for by similar options, rights or awards covering the stock of the successor or survivor corporation, or a parent or subsidiary thereof, with appropriate adjustments as to the number and kind of shares and prices; (iii) make adjustments in the number and type of shares of stock (or other securities or property) subject to outstanding awards and/or in the terms and conditions of (including the grant or exercise price) outstanding awards and awards that may be granted in the future; (iv) provide that such award shall be exercisable or payable or fully vested with respect to all shares covered thereby; and (v) provide that the award will terminate and cannot vest, be exercised or become payable after such event.

Equity Restructuring. In the event of a Corporate Transaction that affects the Class A common stock such that an adjustment is determined by the administrator to be appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Amended Plan or with respect to any award thereunder, the administrator may make equitable adjustments, if any, to reflect such change with respect to: (i) the aggregate number and kind of shares that may be issued under the Amended Plan; (ii) the number and kind of shares (or other securities or property) subject to outstanding awards; (iii) the number and kind of shares (or other securities or property) for which automatic grants are subsequently to be made to new and continuing non-employee directors; (iv) the terms and conditions of any outstanding awards (including, without limitation, any applicable performance targets or criteria with respect thereto); and (v) the grant or exercise price per share for any outstanding awards under the Amended Plan.

Tax Withholding. Participants in the Amended Plan are responsible for the payment of any federal, state, local or foreign taxes that we are required by law to withhold upon the exercise of options or stock appreciation rights or vesting of other awards. The Company or any of its subsidiaries shall have the authority and right to deduct or withhold, or require the holder to remit to us, an amount sufficient to satisfy federal, state, local and foreign taxes

11 |  | |||||||||||||||||||

required by law to be withheld with respect to any taxable event arising as a result of the Amended Plan. The administrator, in its discretion, may withhold, or allow a holder to elect to have Wayfair withhold, shares otherwise issuable under an award, which, unless otherwise determined by the administrator, shall be limited to the number of shares with a fair market value on the date of withholding or repurchase equal to the aggregate amount of such liabilities based on the minimum statutory withholding rates for federal, state, local and foreign income tax and payroll tax purposes that are applicable to such supplemental taxable income.

Amendment, Suspension or Termination of the Plan. The Board or compensation committee may at any time wholly or partially amend or otherwise modify, suspend or terminate the Amended Plan. However, no such action may impair any rights or obligation under any award without the holder’s consent unless the award otherwise expressly provides. Certain amendments to the terms of the Amended Plan, including the maximum number of shares that may be issued under the Amended Plan, will require the approval of our stockholders.

Effective Date of Plan. The Amendment No. 1 to the 2014 Plan was approved by our Board on August 16, 2022, and will become effective if and when approved by our stockholders. No awards may be granted under the Amended Plan after the tenth anniversary of the date the 2014 Plan was originally adopted by the Board, or September 9, 2024.

New Plan Benefits

The following table provides information concerning the benefits that were received by the following persons and groups under the 2014 Plan during fiscal year 2021: (i) each named executive officer; (ii) all current executive officers, as a group; (iii) all current directors who are not executive officers, as a group; and (iv) all current employees who are not executive officers, as a group.

| Stock Awards: Number of Awards | ||||||||

| Named Executive Officers | ||||||||

| Niraj Shah | — | |||||||

| Steven Conine | — | |||||||

| Michael Fleisher | — | |||||||

| Edmond Macri | 44,456 | |||||||

| James Miller | — | |||||||

| Thomas Netzer | 22,581 | |||||||

| Stephen Oblak | 44,456 | |||||||

| All current executive officers, as a group | 67,037 | |||||||

| All current directors who are not executive officers, as a group | 6,409 | |||||||

| All current employees who are not executive officers, as a group | 2,976,154 | |||||||

Tax Aspects Under the Code

The following is a summary of the principal U.S. federal income tax consequences of certain transactions under the Amended Plan. It does not describe all U.S. federal tax consequences under the Amended Plan, nor does it describe foreign, state or local tax consequences.

Incentive Stock Options. No taxable income is generally realized by the optionee upon the grant or exercise of an incentive stock option. If shares of Class A common stock issued to an optionee pursuant to the exercise of an incentive stock option are sold or transferred after two years from the date of grant and after one year from the date of exercise, then (i) upon sale of such shares, any amount realized in excess of the exercise price (the amount paid for the shares) will be taxed to the optionee as a long-term capital gain, and any loss sustained will be a long-term capital loss, and (ii) we will not be entitled to any deduction for federal income tax purposes. The exercise of an incentive stock option will give rise to an item of tax preference that may result in alternative minimum tax liability for the optionee.

If shares of Class A common stock acquired upon the exercise of an incentive stock option are disposed of prior to the expiration of the two-year and one-year holding periods described above (a “disqualifying disposition”),

12 |  | |||||||||||||||||||

generally (i) the optionee will realize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of the shares of Class A common stock at exercise (or, if less, the amount realized on a sale of such shares of Class A common stock) over the exercise price thereof, and (ii) we will be entitled to deduct such amount. Special rules will apply where all or a portion of the exercise price of the incentive stock option is paid by tendering shares of Class A common stock.

If an incentive stock option is exercised at a time when it no longer qualifies for the tax treatment described above, the option is treated as a non-qualified option. Generally, an incentive stock option will not be eligible for the tax treatment described above if it is exercised more than three months following termination of employment (or one year in the case of termination of employment by reason of disability). In the case of termination of employment by reason of death, the three-month rule does not apply.

Non-Qualified Options. No income is realized by the optionee at the time a non-qualified option is granted. Generally (i) at exercise, ordinary income is realized by the optionee in an amount equal to the difference between the exercise price and the fair market value of the shares of Class A common stock on the date of exercise, and we receive a tax deduction for the same amount, and (ii) at disposition, appreciation or depreciation after the date of exercise is treated as either short-term or long-term capital gain or loss depending on how long the shares of Class A common stock have been held. Special rules will apply where all or a portion of the exercise price of the non-qualified option is paid by tendering shares of Class A common stock. Upon exercise, the optionee will also be subject to Social Security taxes on the excess of the fair market value over the exercise price of the option.

Other Awards. We generally will be entitled to a tax deduction in connection with other awards under the Amended Plan in an amount equal to the ordinary income realized by the participant at the time the participant recognizes such income. Participants typically are subject to income tax and recognize such tax at the time that an award is exercised, vests or becomes non-forfeitable, unless the award provides for a further deferral.

Parachute Payments. The vesting of any portion of an award that is accelerated due to the occurrence of a change in control (such as a Change in Control) may cause a portion of the payments with respect to such accelerated awards to be treated as “parachute payments” as defined in the Code. Any such parachute payments may be non-deductible to us, in whole or in part, and may subject the recipient to a non-deductible 20% federal excise tax on all or a portion of such payment (in addition to other taxes ordinarily payable).

Limitation on Deductions. Under Section 162(m) of the Code, our deduction for awards under the Amended Plan may be limited to the extent that any “covered employee” (as defined in Section 162(m) of the Code) receives compensation in excess of $1 million a year.

13 |  | |||||||||||||||||||

Equity Compensation Plan Information

The following table provides information as of December 31, 2021 with respect to the shares of our common stock that may be issued under our existing equity compensation plans.

Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights (a) | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights (b) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plan (Excluding Securities Reflected in Column (a)) (c) | |||||||||||||||||

Equity compensation plans approved by security holders (1) | 5,229,708 | (2) | $ | (3) | 6,443,150 | |||||||||||||||

Equity compensation plans not approved by security holders | N/A | N/A | N/A | |||||||||||||||||

(1)Consists of our Second Amended and Restated 2010 Incentive Plan and our 2014 Plan. Our 2014 Plan contains an evergreen provision whereby the shares available for future grant are increased on the first day of each calendar year beginning January 1, 2016 and ending on and including January 1, 2024 by the least of (A) 2,500,000 shares, (B) 2% of the aggregate number of shares of Class A common stock and Class B common stock outstanding on the final day of the immediately preceding calendar year and (C) such smaller number of shares as determined by the Board. Accordingly, on each of January 1, 2016, January 1, 2017, January 1, 2018, January 1, 2019, January 1, 2020, January 1, 2021 and January 1, 2022, the number of shares available for future issuance under our 2014 Plan was increased by 1,686,216 shares, 1,716,618 shares 1,764,172 shares, 1,814,952 shares, 1,872,009 shares, 1,990,894 shares and 2,096,854 shares respectively.

(2)Consists of 5,229,708 shares issuable upon vesting of outstanding restricted stock units.

(3)The weighted average exercise price does not include restricted stock units, which do not have an exercise price.

Vote Required and Board of Directors’ Recommendation

In order for Proposal No. 1 to be approved, holders of a majority of the votes properly cast at the Special Meeting must vote “FOR” Proposal No. 1. Abstentions and broker non-votes are not votes cast and will not be counted either “FOR” or “AGAINST” the proposal. Therefore, abstentions and broker non-votes will have no effect on the proposal.

We believe strongly that the approval of the increase in the number shares of Class A common stock issuable under the 2014 Plan by 5,000,000 shares is essential to our continued success. Due to the recent volatility in our common stock price and the broader capital markets, we have issued awards of Class A common stock under the 2014 Plan at a rate in excess of what was anticipated. Our employees are among our most valuable assets and equity awards are vital to our ability to attract and retain outstanding and highly skilled individuals. Such awards also are crucial to our ability to motivate employees to achieve our goals and to act as owners of Wayfair.

Accordingly, the Board recommends that stockholders vote in favor of the Amended Plan in Proposal 1.

For the reasons stated above, the stockholders are being asked to approve Amendment No. 1 to the 2014 Plan.

| BOARD RECOMMENDATION | ||||||||||||||

| ☑ | THE BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL NO. 1 | |||||||||||||

14 |  | |||||||||||||||||||

| COMPENSATION DISCUSSION AND ANALYSIS | ||||||||||||||

Because Proposal No. 1 relates to a compensation plan in which executive officers and directors of the company will participate, the company is required under applicable disclosure rules to furnish certain executive compensation information related to our most recently completed fiscal year. As such, the following disclosure is based on the Compensation Discussion and Analysis information and related compensation tables that were included in the company’s Proxy Statement for the 2022 Annual Meeting of Stockholders filed with the SEC on April 12, 2022.

Executive Summary

This Compensation Discussion and Analysis, or CD&A, provides an overview and analysis of the elements of our compensation program for our named executive officers, or NEOs, identified below, the material compensation decisions made under that program and reflected in the executive compensation tables that follow this CD&A and the material factors considered in making those decisions. As a company dedicated to a pay-for-performance culture, we aim to provide our NEOs with compensation that is significantly performance-based. Our executive compensation program is designed to align executive pay with our performance on both short and long-term basis, link executive pay to specific, measurable results intended to create value for stockholders, and utilize compensation as a tool to assist us in attracting and retaining the high-caliber executives that we believe are critical to our long-term success. We believe that the key to our success is the long-term stockholder value that is created by our employees. Our compensation philosophy is weighted towards providing equity awards, and we believe this helps to retain our executives and aligns their interests with those of our stockholders by allowing them to participate in the longer-term success of our company as reflected in stock price appreciation. For example, we provide many of our employees, including our NEOs, with an equity award upon hire, which we believe motivates the employee to think of themselves as an owner of the company.

Compensation for our NEOs consists primarily of the elements, and their corresponding objectives, identified in the following table.

| Compensation Element | Primary Objective | |||||||

| Base Salary | To recognize performance of job responsibilities and to attract and retain individuals with superior talent. | |||||||

| Annual Cash Bonus (1) | To reward individual contributions to the achievement of the company’s performance objectives. | |||||||

| Equity Awards | To emphasize our long-term performance objectives, encourage the maximization of stockholder value and retain key executives by providing an opportunity to participate in the ownership of our common stock. | |||||||

| Retirement Savings (401(k)) | To provide an opportunity for tax-efficient savings and long-term financial security. | |||||||

(1) In 2022, we shifted our corporate approach to cash compensation to incorporate the annual cash bonus into regular base salaries, resulting in higher base salaries and the removal of annual cash bonuses for our NEOs.

The compensation committee has primary authority to determine and approve compensation decisions with respect to our NEOs; provided, however, that our Co-Founders make recommendations to the compensation committee regarding the compensation of the NEOs, excluding themselves. In alignment with the objectives set forth above, the compensation committee determines overall compensation and its allocation among the elements described above, in reliance upon the judgment and general industry knowledge of its members obtained through years of service with comparably-sized companies in our and similar industries.

15 |  | |||||||||||||||||||

Our Named Executive Officers

We have elected to provide disclosure in this section for all of our 2021 executive officers, whom we refer to as NEOs in this section for simplicity. For the year ended December 31, 2021, our NEOs were:

| Name | Title | |||||||

| Niraj Shah | Co-Founder, Chief Executive Officer and President, Director (Co-Chairman) | |||||||

| Steven Conine | Co-Founder, Director (Co-Chairman) | |||||||

| Michael Fleisher | Chief Financial Officer | |||||||

| Edmond Macri (1) | Former Chief Product & Marketing Officer | |||||||

| James Miller (2) | Former Chief Technology Officer | |||||||

| Thomas Netzer | Chief Operating Officer | |||||||

| Stephen Oblak | Chief Commercial Officer | |||||||

(1) Mr. Macri retired from his position as Chief Product & Marketing Officer on March 11, 2021 and remained part of the Wayfair leadership team through June 30, 2021 to support his transition and thereafter served as a non-executive employee until December 31, 2021.

(2) Mr. Miller retired from his position as Chief Technology Officer on March 1, 2022 and served as a non-executive employee through June 30, 2022 as he supported his transition.

Our compensation decisions for the NEOs in 2021 are discussed below in relation to each of the above-described elements of our compensation program. The discussion below is intended to be read in conjunction with the executive compensation tables and related disclosures that follow this CD&A.

Compensation Overview

Our overall compensation program is structured to attract, motivate and retain highly qualified executives by paying them competitively, consistent with our success and their contribution to that success. We believe compensation should be structured to ensure that a significant portion of an executive’s compensation opportunity will be related to factors that directly and indirectly influence stockholder value. Our pay practices are focused on providing our executives with a significant amount of their compensation in the form of upfront equity grants, which we believe attracts and retains the highest caliber employees and aligns our employees’ long-term interests with our stockholders’ interests. In addition, an NEO’s compensation may include a moderate annual cash bonus, based on personal performance rather than short-term corporate goals, and additional equity grants based on performance or promotions. Our Co-Founders do not receive cash bonuses. Also, in 2022, we shifted our corporate approach to cash compensation to incorporate the annual cash bonus into regular base salaries, resulting in higher base salaries and the removal of annual cash bonuses for our NEOs. Our NEOs, who are all employed on an at-will basis, receive limited perquisites. We offer a qualified 401(k) retirement plan with employer matching, but do not offer nonqualified deferred compensation plans, supplemental executive retirement plan benefits or formal cash severance programs.

Determination of Compensation

The compensation committee has the primary authority to determine and approve compensation paid to our NEOs. The compensation committee is charged with, among other things, reviewing compensation policies and practices to ensure adherence to our compensation philosophies and that the total compensation paid to our NEOs is fair, reasonable and competitive, taking into account our position within our industry, including our comparative performance, and our NEOs’ level of expertise and experience in their respective positions. In furtherance of the considerations described above, the compensation committee is primarily responsible for determining NEO base salaries, assessing the performance of the Chief Executive Officer and other NEOs for each applicable performance period and approving the equity awards and any cash bonuses to be paid to our Chief Executive Officer and other NEOs for each year. To aid the compensation committee in making its determinations, the Co-Founders provide recommendations at least annually to the compensation committee regarding the compensation of all NEOs, excluding themselves, and they also provide individual performance assessments that are used in determining awards under our annual cash bonus program, if any. The performance of our NEOs is reviewed at least annually by the compensation committee, and the compensation committee approves each NEO’s compensation at least annually.

16 |  | |||||||||||||||||||

In determining compensation for our NEOs, the compensation committee considers each NEO’s particular position and responsibility and relies upon the judgment and industry experience of its members, including their knowledge of competitive compensation levels across companies and industries. We believe that compensation should be competitive with compensation for executive officers in similar positions and with similar responsibilities in the market. Our compensation committee and management team reference national surveys and publicly available executive officer data from e-commerce, retail, and technology organizations as an input for compensation decisions. We did not use a compensation consultant in 2021.

In 2020, we asked our stockholders, through an advisory vote, to approve the compensation of our NEOs. The 2020 advisory vote received the approval of 99.7% of the votes cast on the proposal. Although the results of the say on pay vote are advisory and not binding on the company, the Board or the compensation committee, we value the opinions of our stockholders and take the results of the say on pay vote into account when making decisions regarding the compensation of our NEOs. In 2016, our stockholders approved, on an advisory basis, a frequency of every three (3) years for casting advisory votes to approve executive compensation. Due to the vote of stockholders on the matter, as well as the long-term focus of our compensation philosophy, we adopted a three-year interval for the advisory vote on executive compensation. Accordingly, the next stockholder advisory vote on the compensation of our NEOs will occur at the 2023 annual meeting.

Elements of Our Executive Compensation Program

Base Salary

Base salary represents annual fixed compensation and is a standard element of compensation necessary to attract and retain talent. The compensation committee reviews base salaries of our NEOs in the first quarter of each year. Base salary is set at the compensation committee’s discretion after taking into account the recommendations of our Co-Founders regarding NEOs, excluding themselves, our company-wide target for base salary increases for all employees, the competitive landscape, inflation, changes in the scope of an executive officer’s job responsibilities, and other components of compensation and other relevant factors. The maximum NEO base salary in 2021 was $200,000 and none of our NEOs received an increase in base salary during 2021. In 2022, we shifted our corporate approach to cash compensation to incorporate the annual cash bonus into regular base salaries, which resulted in an increase of the maximum NEO base salary to $250,000. The base salaries for our NEOs for 2021 were as follows:

| NEO | Base Salary ($) | |||||||

| Niraj Shah | 80,000 | |||||||

| Steven Conine | 80,000 | |||||||

| Michael Fleisher | 200,000 | |||||||

| Edmond Macri | 200,000 | |||||||

| James Miller | 200,000 | |||||||

| Thomas Netzer | 200,000 | |||||||

| Stephen Oblak | 200,000 | |||||||

17 |  | |||||||||||||||||||

Annual Cash Bonuses

During 2021, all of our NEOs were eligible to participate in a discretionary annual cash bonus program which provided the opportunity to earn a cash bonus award that ranges from 0% to 25% of base salary. Under the program, the compensation committee determined NEO bonuses based on the overall personal performance of the NEOs in 2021, and such bonuses were paid in the first quarter of 2022. Each of Messrs. Fleisher, Miller, Netzer and Oblak received a cash bonus award of 25% of his base salary, or $50,000, for 2021. Messrs. Shah, Conine and Macri did not participate in the 2021 cash bonus program. In 2022, we shifted our corporate approach to cash compensation to incorporate the annual cash bonus into base salaries, resulting in a higher maximum base salary and the removal of annual cash bonuses for our NEOs.

Equity Awards

A large portion of our NEOs’ total compensation is stock-based compensation in furtherance of our focus on long-term performance, which we believe is tied to retention and increasing stockholder value. Our NEOs receive sizable equity awards at the time of hire and are eligible to receive additional awards at the time of a promotion or at other times at the discretion of our compensation committee. NEOs do not necessarily receive equity awards on an annual basis. Therefore, an NEO’s compensation, as reported in the Summary Compensation Table, may fluctuate materially from year to year depending on whether a grant was made in a particular year. To support our retention strategy and align the interests of our NEOs with those of our stockholders, we generally grant Restricted Stock Units, or RSUs, subject to long-term vesting requirements and the NEO’s continued employment through each applicable vesting date. As our compensation philosophy has continued to evolve and our leadership team has grown, we have also started to introduce RSUs with more unique, tailored vesting schedules to facilitate promotions, role changes and the evolution of our management team. NEO equity awards (including grant amounts and vesting schedules), whether for new hires or follow-on grants, are determined at the compensation committee’s discretion after taking into account other direct compensation elements, the recommendations of our Co-Founders regarding NEOs, excluding themselves, and the landscape in which we compete for executive talent.

In 2021, the compensation committee granted the following time-based RSU awards to our NEOs:

| NEO | Shares of Class A Common Stock Subject to RSU (#) | |||||||

| Niraj Shah | — | |||||||

| Steven Conine | — | |||||||

| Michael Fleisher | — | |||||||

| Edmond Macri (1) | 44,456 | |||||||

| James Miller | — | |||||||

| Thomas Netzer (2) | 22,581 | |||||||

| Stephen Oblak (3) | 44,456 | |||||||

(1)Mr. Macri was granted RSUs which vest upon the satisfaction of a service condition and the service condition was partially satisfied on June 15, 2021 with respect to 1,885 shares and as to varying amounts of additional shares for every three (3) months of continuous service thereafter over a period of five (5) years. Upon Mr. Macri’s retirement the remaining unvested RSUs were forfeited in accordance with the terms of the grant.

(2)Mr. Netzer was granted RSUs which vest upon the satisfaction of a service condition and the service condition was partially satisfied on March 15, 2021 with respect to 298 shares and as to varying amounts of additional shares for every three (3) months of continuous service thereafter over a period of five (5) years.

(3)Mr. Oblak was granted RSUs which vest upon the satisfaction of a service condition and the service condition was partially satisfied on June 15, 2021 with respect to 1,885 shares and as to varying amounts of additional shares for every three (3) months of continuous service thereafter over a period of five (5) years.

For more information on these awards, see the “Grants of Plan-Based Awards in 2021” table below.

18 |  | |||||||||||||||||||

Defined Contribution Plans

We maintain a defined contribution plan that is tax-qualified under Section 401(a) of the Internal Revenue Code of 1986, as amended, or the Code, which we refer to as the 401(k) Plan. The 401(k) Plan permits our eligible salaried employees to defer receipt of portions of their eligible salaries, subject to certain limitations imposed by the Code, by making contributions to the 401(k) Plan, including flexible compensation contributions, Roth contributions, catch-up contributions and after-tax contributions.

We provide matching contributions to the 401(k) Plan in an amount equal to 100% of each participant’s pre-tax contribution up to a maximum of 4% of the participant’s annual eligible cash compensation, subject to certain other limits. In 2021, we made a company contribution to the 401(k) Plan in an amount equal to approximately $34.7 million. Participants are 100% vested in all contributions, including company contributions. The 401(k) Plan is offered on a nondiscriminatory basis to all of our salaried employees, including NEOs.

The compensation committee believes that matching contributions assist us in attracting and retaining talented employees and executives. The 401(k) Plan provides an opportunity for participants to save money for retirement on a tax-deferred basis and to achieve financial security, thereby promoting retention.

Employment and Change in Control Arrangements

Employment Agreements

We have entered into employment letter agreements with certain of our NEOs, the material terms of which are described below.

Messrs. Shah and Conine: We entered into amended and restated employment letter agreements with Messrs. Shah and Conine on May 6, 2014, which entitle each of Messrs. Shah and Conine to receive an annual base salary, subject to periodic increases (but not decreases) at the discretion of the Board. The letter agreements also entitle them to participate in the employee benefit plans and programs that we offer to our other full-time employees. Messrs. Shah’s and Conine’s employment letter agreements contain restrictive covenants which prohibit them from competing with us or soliciting our employees, consultants or suppliers for twenty-four (24) months following termination of employment. Pursuant to Messrs. Shah’s and Conine’s employment letter agreements, if we terminate their employment without cause (as defined in the employment letter agreements) or if they resign for good reason (as defined in the employment letter agreements) they will receive healthcare benefit continuation until the earlier of (i) the last day of the applicable COBRA period and (ii) twenty-four (24) months following termination.

Mr. Fleisher: We entered into an employment letter agreement with Mr. Fleisher on October 2, 2013, which was amended on May 5, 2014, and which entitled him to an initial annual base salary of $350,000, which he agreed to reduce to $200,000 commencing in January 2016. The employment letter agreement also provided Mr. Fleisher with an annual cash bonus opportunity between 0% and 20% of his annual salary, and the opportunity to participate in the employee benefit plans and programs that we offer to our other full-time employees. In 2015, we agreed to increase Mr. Fleisher’s annual bonus opportunity range to between 0% and 25% of his annual salary, commensurate with our other NEOs. As described elsewhere, in 2022, we shifted our corporate approach to cash compensation to incorporate the annual cash bonus into base salaries, resulting in a higher maximum base salary and the removal of annual cash bonuses for our NEOs. Mr. Fleisher is also subject to the company’s non-compete, non-solicitation, non-disclosure and invention agreement designed for all employees, which agreement generally provides that he will not disclose confidential information of the company nor solicit any employee, contractor, customer or supplier of the company.

We have not entered into employment agreements with Messrs. Macri, Miller, Netzer or Oblak, however, each of Messrs. Macri, Miller, Netzer and Oblak is subject to the company’s non-compete, non-solicitation, non-disclosure and invention agreement designed for all employees, as described above.

Restricted Stock Unit Vesting

The award agreements governing the NEOs’ outstanding RSU awards provide that, in the event an NEO’s employment is terminated for any reason other than cause (excluding a resignation by the NEO or a termination as a result of the NEO’s death or disability) within twelve (12) months following a change in control (as each such term is defined in the applicable award agreement), 50% of the NEO’s unvested RSUs will vest; provided, however, for Mr. Fleisher only, 100% of his unvested RSUs will vest in the same double-trigger scenario.

19 |  | |||||||||||||||||||

Other Elements of Compensation and Perquisites

We maintain broad-based benefits that are provided to all employees, including our NEOs. These benefits include a 401(k) retirement savings plan with matching contributions, a group health plan, group term life insurance and health and financial wellness programs. For more information about our 401(k) plan, see the discussion above under the heading “Defined Contribution Plans.” Currently, we do not view perquisites or other personal benefits as a significant component of our executive compensation program. However, we have provided certain perquisites to our NEOs in situations where we believe it is appropriate, principally to allow them to devote more time to our business and to promote their health and safety. The compensation committee reviews these perquisites to ensure they are consistent with our philosophy and appropriate in magnitude. In 2021, the compensation committee authorized a security program for Messrs. Shah and Conine to address safety concerns, including specific threats to their safety arising directly as a result of their positions with the company. We believe the costs of this overall security program are reasonable and appropriate and that the program benefits the company. Although we do not consider this program to be a perquisite for the benefit of the Co-Founders for the reasons described above, the costs related to personal security under this program are reported in the “All Other Compensation” column in the 2021 Summary Compensation Table below.

Summary Compensation Table

The following table sets forth information with respect to the compensation of our NEOs for fiscal years indicated:

| Name and Principal Position | Year | Salary ($) | Bonus ($)(1) | Stock Awards ($)(2) | All Other Compensation ($)(3) | Total ($) | ||||||||||||||||||||||||||||||||

| Niraj Shah, Co-Founder, Chief Executive Officer and President, Director (Co-Chairman) | 2021 | 80,000 | — | — | 147,271 | 227,271 | ||||||||||||||||||||||||||||||||

| 2020 | 80,000 | — | — | 3,274 | 83,274 | |||||||||||||||||||||||||||||||||

| 2019 | 80,000 | — | — | 3,237 | 83,237 | |||||||||||||||||||||||||||||||||

| Steven Conine, Co-Founder, Director (Co-Chairman) | 2021 | 80,000 | — | — | 73,363 | 153,363 | ||||||||||||||||||||||||||||||||

| 2020 | 80,000 | — | — | 3,274 | 83,274 | |||||||||||||||||||||||||||||||||

| 2019 | 80,000 | — | — | 3,237 | 83,237 | |||||||||||||||||||||||||||||||||

| Michael Fleisher, Chief Financial Officer | 2021 | 200,000 | 50,000 | — | 10,031 | 260,031 | ||||||||||||||||||||||||||||||||

| 2020 | 200,000 | 50,000 | — | 10,185 | 260,185 | |||||||||||||||||||||||||||||||||

| 2019 | 200,000 | 50,000 | — | 10,092 | 260,092 | |||||||||||||||||||||||||||||||||

| Edmond Macri, Former Chief Product & Marketing Officer (4) | 2021 | 200,000 | — | 12,963,814 | 10,031 | 13,173,845 | ||||||||||||||||||||||||||||||||

| 2020 | 200,000 | 50,000 | — | 8,954 | 258,954 | |||||||||||||||||||||||||||||||||

| 2019 | 200,000 | 50,000 | — | 8,554 | 258,554 | |||||||||||||||||||||||||||||||||

| James Miller, Former Chief Technology Officer (5) | 2021 | 200,000 | 50,000 | — | 8,054 | 258,054 | ||||||||||||||||||||||||||||||||

| 2020 | 193,077 | 50,000 | 14,212,404 | 7,174 | 14,462,655 | |||||||||||||||||||||||||||||||||

| 2019 | 70,615 | — | 2,574,390 | — | 2,645,005 | |||||||||||||||||||||||||||||||||

| Thomas Netzer, Chief Operating Officer (6) | 2021 | 200,000 | 50,000 | 6,584,845 | — | 6,834,845 | ||||||||||||||||||||||||||||||||

| 2020 | 200,000 | 50,000 | 1,879,050 | — | 2,129,050 | |||||||||||||||||||||||||||||||||

| 2019 | 224,000 | 259,885 | 2,084,030 | 73,031 | 2,640,946 | |||||||||||||||||||||||||||||||||

| Stephen Oblak, Chief Commercial Officer | 2021 | 200,000 | 50,000 | 12,963,814 | 7,877 | 13,221,691 | ||||||||||||||||||||||||||||||||

| 2020 | 200,000 | 50,000 | — | 8,031 | 258,031 | |||||||||||||||||||||||||||||||||

| 2019 | 200,000 | 50,000 | — | 7,784 | 257,784 | |||||||||||||||||||||||||||||||||