Form PRE 14A NATIONAL RESEARCH CORP For: Jun 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☑ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☐ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

National Research Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☑ |

No fee required. |

||

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

||

|

(1) |

Title of each class of securities to which transaction applies: |

||

|

(2) |

Aggregate number of securities to which transaction applies: |

||

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

||

|

(4) |

Proposed maximum aggregate value of transaction: |

||

|

(5) |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials. |

||

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

||

|

(1) |

Amount Previously Paid: |

||

|

(2) |

Form, Schedule or Registration Statement No.: |

||

|

(3) |

Filing Party: |

||

|

(4) |

Date Filed: |

[PRELIMINARY COPY – SUBJECT TO COMPLETION]

National Research Corporation

D/B/A NRC Health

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held June 29, 2021

To the Shareholders of

National Research Corporation:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of National Research Corporation will be held on Tuesday, June 29, 2021, at 12:30 P.M., Central Time, via the Internet at www.virtualshareholdermeeting.com/nrc2021, for the following purposes:

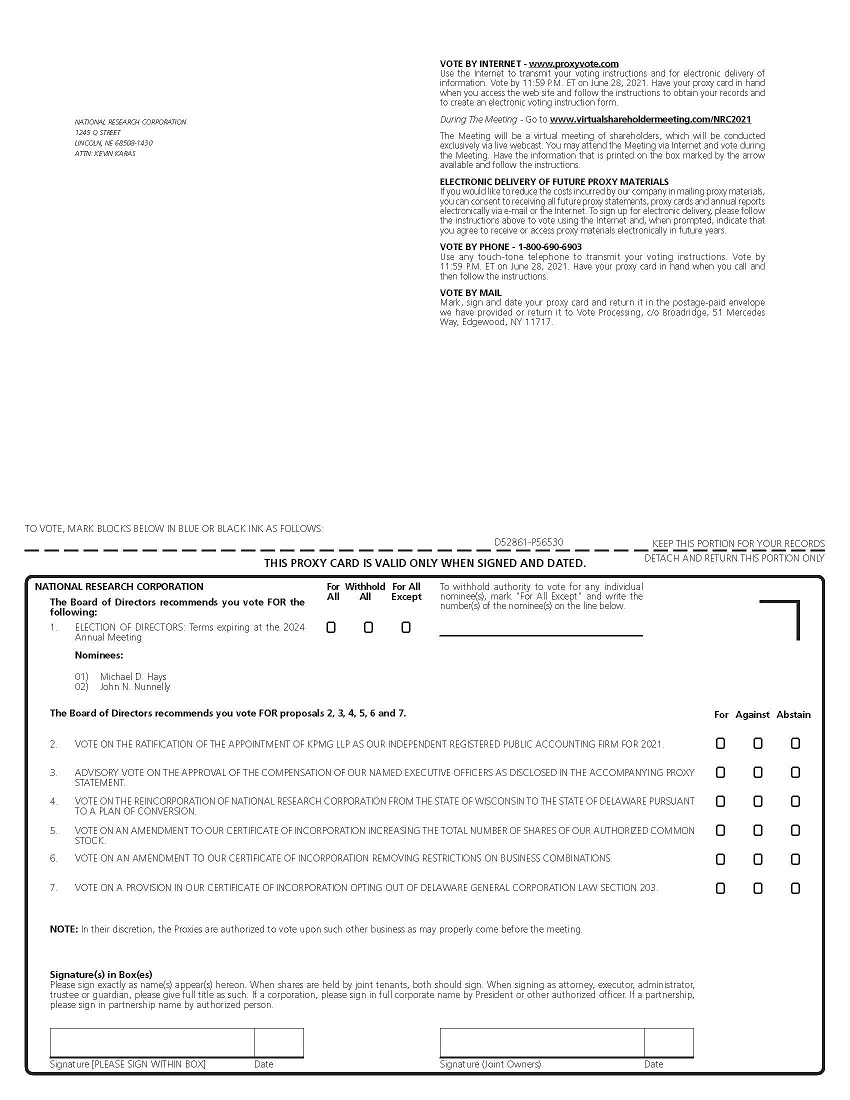

1. To elect two directors to hold office until the 2024 annual meeting of shareholders and until their successors are duly elected and qualified.

2. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2021.

3. To conduct an advisory vote to approve the compensation of our named executive officers as disclosed in the accompanying proxy statement.

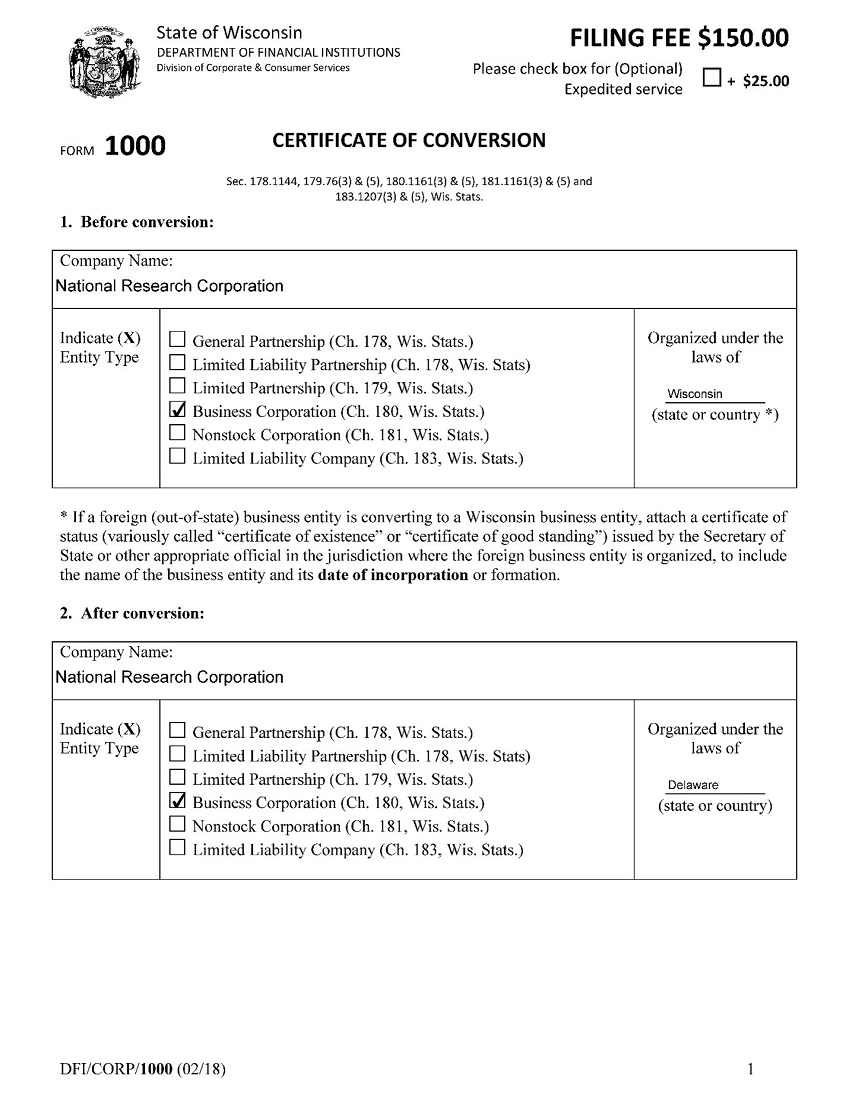

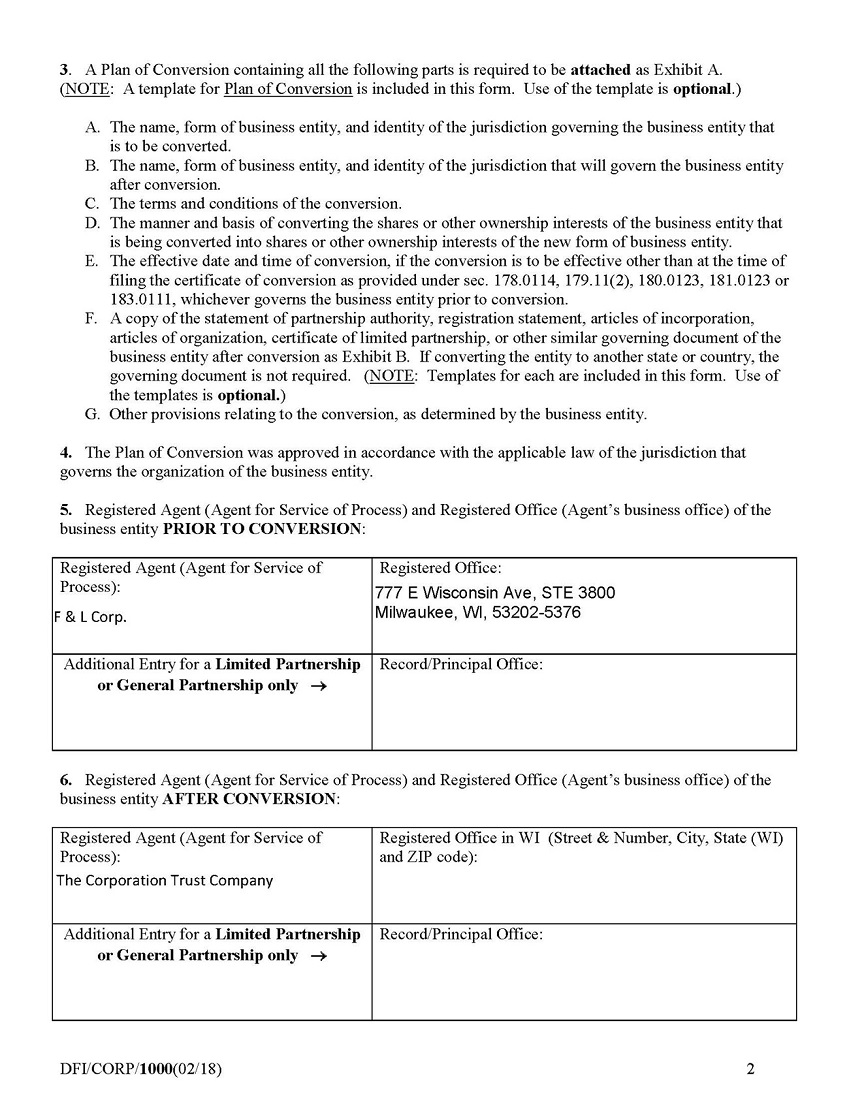

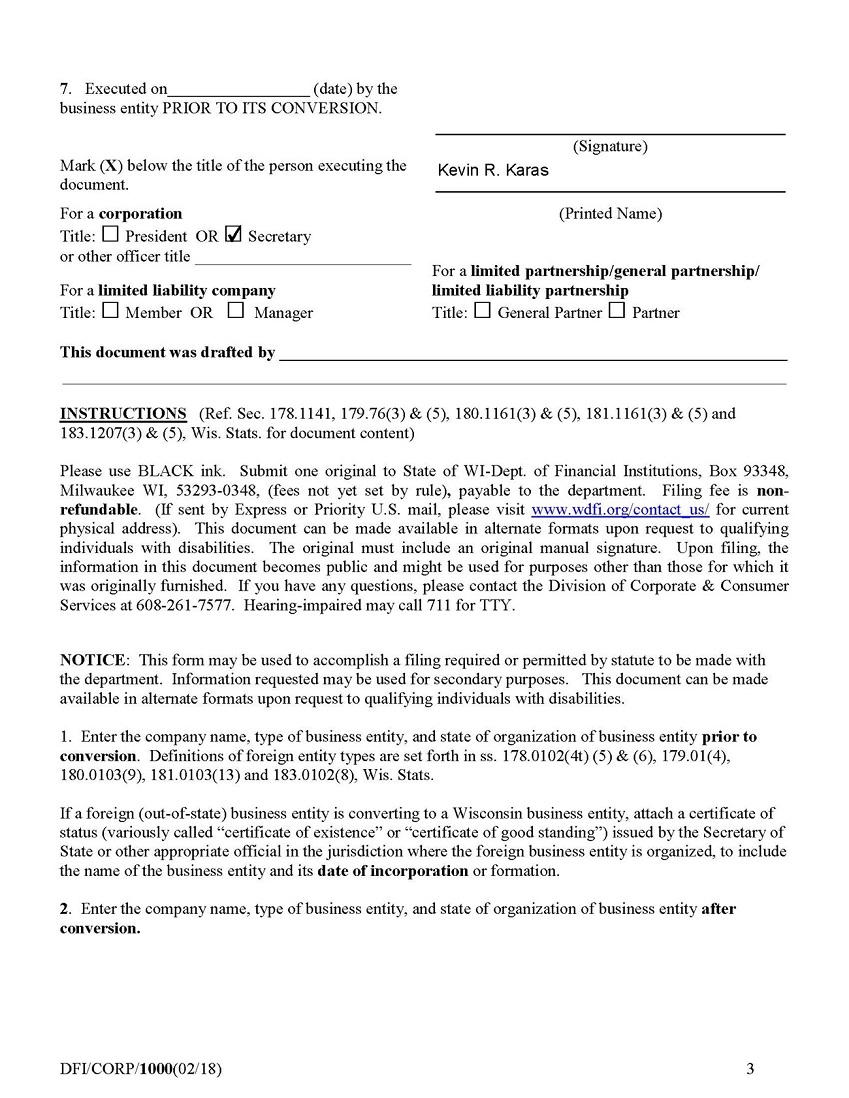

4. To approve the reincorporation of National Research Corporation from the State of Wisconsin to the State of Delaware pursuant to a plan of conversion.

5. To approve our Delaware Certificate of Incorporation increasing the total number of shares of the Company’s authorized common stock.

6. To approve our Delaware Certificate of Incorporation removing restrictions on business combinations.

7. To approve a provision in our Delaware Certificate of Incorporation opting out of Delaware General Corporation Law Section 203 in connection with the reincorporation to Delaware; and

8. To consider and act upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

The close of business on May 5, 2021, has been fixed as the record date for the determination of shareholders entitled to notice of, and to vote at, the meeting and any adjournment or postponement thereof.

A proxy for the meeting and a proxy statement are enclosed herewith.

|

By Order of the Board of Directors NATIONAL RESEARCH CORPORATION

Kevin R. Karas Secretary |

Lincoln, Nebraska

June 3, 2021

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on June 29, 2021. The National Research Corporation proxy statement for the 2021 Annual Meeting of Shareholders and the 2020 Annual Report to Shareholders are available at www.proxyvote.com.

YOUR VOTE IS IMPORTANT NO MATTER HOW LARGE OR SMALL YOUR HOLDINGS MAY BE. TO ASSURE YOUR REPRESENTATION AT THE MEETING, PLEASE DATE THE ENCLOSED PROXY, WHICH IS SOLICITED BY THE BOARD OF DIRECTORS, SIGN EXACTLY AS YOUR NAME APPEARS THEREON AND RETURN IMMEDIATELY.

|

Page |

|

|

1 |

|

|

3 |

|

|

Security Ownership of Certain Beneficial Owners and Management |

13 |

|

Proposal No. 2 – Ratification of the Appointment of Independent Registered Public Accounting Firm |

15 |

|

16 |

|

|

27 |

|

|

Commentary from the Board of Directors on Proposals 4 through 7 |

29 |

|

30 |

|

|

45 |

|

|

48 |

|

|

50 |

|

|

52 |

|

|

A-1 |

|

|

B-1 |

|

|

C-1 |

|

|

D-1 |

|

|

E-1 |

|

|

F-1 |

D/B/A NRC Health

1245 Q Street

Lincoln, Nebraska 68508

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

To Be Held June 29, 2021

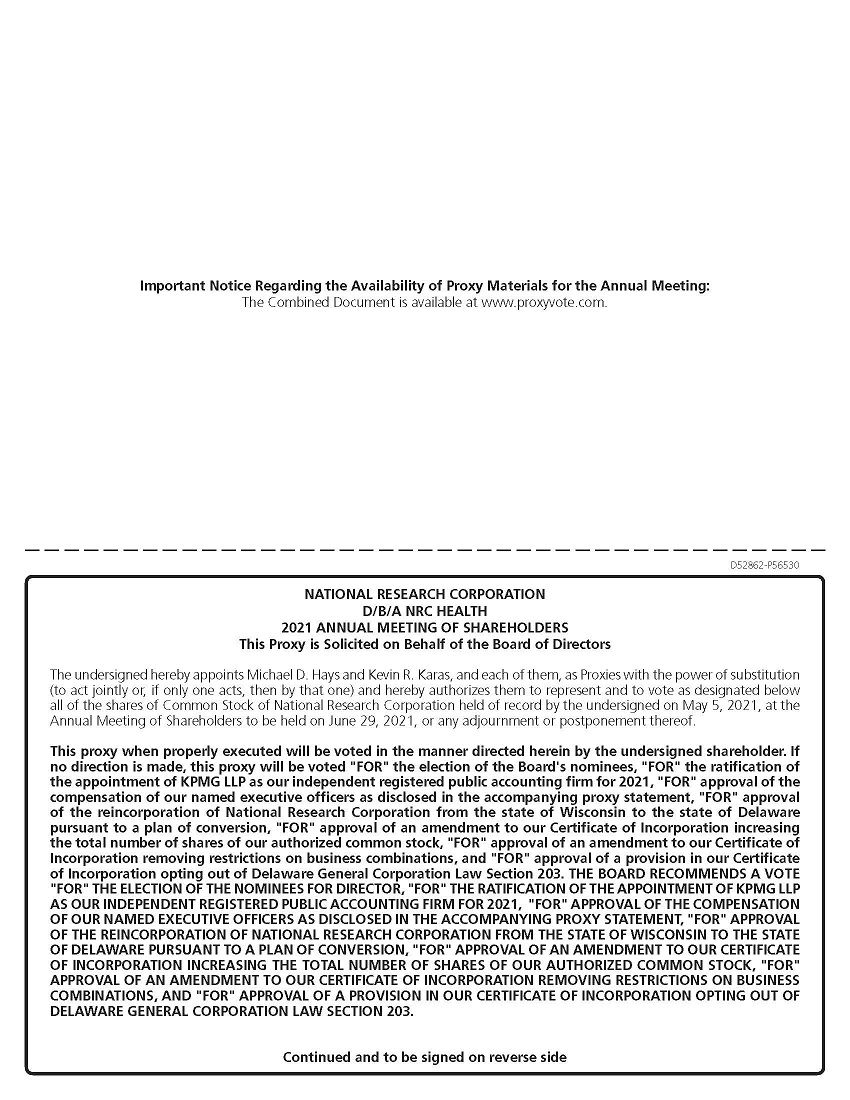

This proxy statement is being furnished to shareholders by the Board of Directors (the “Board”) of National Research Corporation, doing business as NRC Health (“NRC Health,” the “Company,” “we,” “our,” “us” or similar terms), beginning on or about June 3, 2021, in connection with a solicitation of proxies by the Board for use at the Annual Meeting of Shareholders to be held on Tuesday, June 29, 2021, at 12:30 P.M., Central Time, virtually via the Internet at www.virtualshareholdermeeting.com/nrc2021, and all adjournments or postponements thereof (the “Annual Meeting”) for the purposes set forth in the attached Notice of Annual Meeting of Shareholders.

Execution of a proxy given in response to this solicitation will not affect a shareholder’s right to vote their shares during the Annual Meeting. Participation at the Annual Meeting of a shareholder who has signed a proxy does not in itself revoke a proxy. Any shareholder giving a proxy may revoke it at any time before it is exercised by giving notice thereof to us in writing or in open meeting. Instructions on how to vote while participating in the Annual Meeting live via the Internet are posted at www.virtualshareholdermeeting.com/nrc2021.

A proxy, in the enclosed form, which is properly executed, duly returned to us and not revoked, will be voted in accordance with the instructions contained therein. The shares represented by executed but unmarked proxies will be voted as follows:

| ● | FOR the two persons nominated for election as directors referred to herein; | |

|

● |

FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2021; |

|

● |

FOR the advisory vote to approve the compensation of the individuals named in the Summary Compensation Table set forth below in this proxy statement (such group of individuals are sometimes referred to as our named executive officers); |

|

● |

FOR the reincorporation of National Research Corporation from the State of Wisconsin to the State of Delaware pursuant to a plan of conversion; |

|

● |

FOR our Delaware Certificate of Incorporation increasing the total number of shares of the Company’s authorized common stock; |

|

● |

FOR our Delaware Certificate of Incorporation removing restrictions on business combinations; |

|

● |

FOR the approval of a provision in our Delaware Certificate of Incorporation opting out of Delaware General Corporation Law Section 203 in connection with the reincorporation to Delaware; and |

|

| ● | On such other business or matters which may properly come before the Annual Meeting in accordance with the best judgment of the persons named as proxies in the enclosed form of proxy. |

Other than the election of two directors, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2021, the advisory vote to approve the compensation of our named executive officers, the reincorporation from the State of Wisconsin to the State of Delaware, increasing the total number of shares of the Company’s authorized common stock in our Delaware Certificate of Incorporation, removing restrictions on business combinations in our Delaware Certificate of Incorporation, and in connection with the reincorporation, the approval of a provision in our Delaware Certificate of Incorporation opting out of Delaware General Corporation Law Section 203, the Board has no knowledge of any matters to be presented for action by the shareholders at the Annual Meeting.

Only holders of record of our common stock, $.001 par value per share (the “Common Stock”), at the close of business on May 5, 2021 (the “Record Date”), are entitled to vote at the Annual Meeting. On that date, we had outstanding and entitled to vote 25,439,013 shares of Common Stock, each of which is entitled to one vote per share. The presence at the Annual Meeting, via live webcast or by proxy, of a majority of the votes entitled to be cast shall constitute a quorum for the purpose of transacting business at the Annual Meeting. Abstentions and broker non-votes will be counted as present in determining whether there is a quorum.

Information Regarding Participation in the Annual Meeting via the Internet

Due to the public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our associates and shareholders, we will be hosting the Annual Meeting live via the Internet. You will not be able to attend the Annual Meeting in person. Any stockholder can listen to and participate in the Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/ nrc2021. The Annual Meeting webcast will begin promptly at 12:30 P.M., Central Time. We encourage you to access the Annual Meeting webcast prior to the start time. Online check-in will begin, and stockholders may begin submitting written questions, at 12:15 P.M., Central Time, and you should allow ample time for the check-in procedures.

You will need the 16-digit control number included on your proxy card or voting instruction form, or included in the e-mail to you if you received the proxy materials by e-mail, in order to be able to vote your shares or submit questions during the Annual Meeting. Instructions on how to connect to the Annual Meeting and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/nrc2021. If you do not have your 16-digit control number, you will be able to access and listen to the Annual Meeting but you will not be able to vote your shares or submit questions during the Annual Meeting. Our virtual meeting platform vendor will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting or submitting questions. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting login page.

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Our By-Laws provide that the directors shall be divided into three classes, with staggered terms of three years each. At the Annual Meeting, the shareholders will elect two directors to hold office until the 2024 annual meeting of shareholders and until their successors are duly elected and qualified. Unless shareholders otherwise specify, the shares represented by the proxies received will be voted in favor of the election as directors of the two persons named as nominees herein. The Board has no reason to believe that the listed nominees will be unable or unwilling to serve as directors if elected. However, in the event that any nominee should be unable to serve or for good cause will not serve, the shares represented by proxies received will be voted for another nominee selected by the Board. Each director will be elected by a plurality of the votes cast at the Annual Meeting (assuming a quorum is present). Consequently, any shares not voted at the Annual Meeting, whether due to abstentions, broker non-votes or otherwise, will have no impact on the election of the directors. Votes will be tabulated by an inspector of elections appointed by the Board.

The following sets forth certain information, as of May 5, 2020, about the Board’s nominees for election at the Annual Meeting and each director of the Company whose term will continue after the Annual Meeting.

Nominees for Election at the Annual Meeting

Terms expiring at the 2024 Annual Meeting

Michael D. Hays, 66, has served as Chief Executive Officer and a director since he founded the Company in 1981. He also served as President of the Company from 1981 to 2004, from July 2008 to July 2011, and from October 2020 to present. Prior to founding the Company, Mr. Hays served for seven years as a Vice President and a director of SRI Research Center, Inc. (n/k/a the Gallup Organization). Mr. Hays’ background as founder of the Company, and his long and successful tenure as Chief Executive Officer and a director, led to the conclusion that he should serve as a director of the Company.

John N. Nunnelly, 68, has served as a director of the Company since December 1997. Mr. Nunnelly is a retired Group President from McKesson Corporation, a leader in pharmaceutical distribution and healthcare information technology. During his 28-year career at McKesson, Mr. Nunnelly served in a variety of other positions, including Vice President of Strategic Planning and Business Development, Vice President and General Manager of the Amherst Product Group and Vice President of Sales-Decision Support. These responsibilities included leading several business units, including one with over $360 million in annual revenue. In addition, he was involved in managing a number of mergers and acquisitions. Mr. Nunnelly has also served as an adjunct professor at the University of Massachusetts, School of Nursing, advising students and faculty on matters pertaining to healthcare information technology. These experiences and Mr. Nunnelly’s expertise as a professional and educator in the field of healthcare information technology led to the conclusion that he should serve as a director of the Company.

THE BOARD RECOMMENDS THE FOREGOING NOMINEES FOR ELECTION AS DIRECTORS AND URGES EACH SHAREHOLDER TO VOTE “FOR” SUCH NOMINEES. SHARES OF THE COMPANY’S COMMON STOCK REPRESENTED BY EXECUTED BUT UNMARKED PROXIES WILL BE VOTED “FOR” SUCH NOMINEES.

Directors Continuing in Office

Terms expiring at the 2022 Annual Meeting

Donald M. Berwick, 74, has served as a director of the Company since October 2015. Dr. Berwick is the former President and Chief Executive Officer of the Institute for Healthcare Improvement, which he co-founded and led for almost 20 years, and where he now serves as President Emeritus and Senior Fellow. He is also currently a Lecturer in the Department of Health Care Policy at Harvard Medical School. From July 2010 to December 2011, Dr. Berwick served as the Administrator of the Centers for Medicare and Medicaid Services as an appointee of President Barack Obama. Dr. Berwick previously served on the faculty of the Harvard Medical School and the Harvard School of Public Health (from 1974 to 2010). He was also vice chair of the U.S. Preventive Services Task Force (from 1990 to 1995), the first “Independent Member” of the Board of Trustees of the American Hospital Association (from 1996 to 1999) and the chair of the National Advisory Council of the Agency for Healthcare Research and Quality (from 1995 to 1999). Dr. Berwick’s expertise as a professional, administrator, lecturer and educator in the field of healthcare led to the conclusion that he should serve as a director of the Company.

Stephen H. Lockhart, 62, has served as a director of the Company since May 2021. Dr. Lockhart served as senior vice president and chief medical officer for Sutter Health Network, a not-for-profit system of hospitals, physician organizations, and research institutions in Northern California, from 2015 to 2021. Prior to that role, Dr. Lockhart served as Sutter Health Network’s regional chief medical officer for the East Bay Region from 2010 to 2015. From 2008 to 2010, Dr. Lockhart served as the chief administrative officer at the St. Luke’s campus of Sutter’s California Pacific Medical Center. In 2017, Dr. Lockhart was named to California Governor Brown’s Advisory Committee on Precision Medicine as part of California’s effort to use advanced computing and technology to better understand, treat, and prevent disease. Dr. Lockhart serves on the board of Molina Healthcare, Inc. (NYSE: MOH), a health plan provider under Medicaid and Medicare programs and in state insurance marketplaces. Dr. Lockhart also serves on the boards of the ECRI Institute, Recreational Equipment, Inc., the David and Lucile Packard Foundation, and is chairman of Parks California – a nonprofit dedicated to supporting California's parks and public lands. Dr. Lockhart’s 35 years of experience in the healthcare industry and his background as medical provider and administrator in a large healthcare system led to the conclusion that he should serve as a director of the Company.

Terms expiring at the 2023 Annual Meeting

JoAnn M. Martin, 66, has served as a director of the Company since June 2001. Ms. Martin served as the Vice Chair of the Board of Ameritas Mutual Holding Company, Ameritas Holding Company, and Ameritas Life Insurance Corp. (“Ameritas”) until May 2021. Ms. Martin was elected President and Chief Executive Officer of Ameritas, an insurance and financial services company, in July 2005 and served as Chair and Chief Executive Officer until January 2020. From April 2003 to July 2005, she served Ameritas as President and Chief Operating Officer. Prior to that role, Ms. Martin served as Senior Vice President and Chief Financial Officer of Ameritas for more than the preceding five years. In April 2009, Ms. Martin was elected Chief Executive Officer of Ameritas Holding Company and Ameritas Mutual Holding Company (previously named UNIFI Mutual Holding Company), where she had served as Executive Vice President and Chief Financial Officer for more than the preceding five years, and served as Chief Executive Officer of Ameritas Mutual Holding Company until January 2020. Prior to her retirement from the position of Chief Executive Officer in January 2020, Ms. Martin had served as an officer of Ameritas and/or its affiliates since 1988. Ms. Martin has also served as a director of Nelnet, Inc. (NYSE: NNI), a diversified educational services, technology solutions, telecommunications, and asset management company, since March 2020 and currently serves on Nelnet’s Audit Committee. Ms. Martin’s financial background as a certified public accountant and as the former Chief Financial Officer and Chief Executive Officer of a mutual insurance holding company, as well as her past leadership experiences as a director of the Omaha Branch of the Federal Reserve Bank of Kansas City and other organizations, led to the conclusion that she should serve as a director of the Company.

Penny A. Wheeler, 63, has served as a director of the Company since May 2021. Since 2015, Dr. Wheeler has served as the chief executive officer of Allina Health, a not-for-profit healthcare system serving over 1.5 million individuals in Minnesota and western Wisconsin. Prior to that role she served as chief clinical officer since 2006. For 20 years, Dr. Wheeler has also served as a board certified obstetrician/gynecologist where she spent considerable time interacting with, and caring for, patients and the community. In 2015, Minnesota Governor Mark Dayton appointed Dr. Wheeler to the Taskforce for Health Care Financing, and Dr. Wheeler has been named as one of the top 25 women in health care by Modern Healthcare magazine. Dr. Wheeler also serves on the board of Portico Healthnet, a not-for-profit organization dedicated to helping uninsured Minnesotans receive affordable health coverage and care, St. Thomas University, and the University of Minnesota Foundation. She was also named to the Board of Cedar Cares, an organization that eases the patient billing experience through customized engagement. Dr. Wheeler’s past leadership experiences in the healthcare industry led to the conclusion that she should serve as a director of the Company.

CORPORATE GOVERNANCE

Independent Directors and Annual Meeting Attendance

Of the six directors currently serving on the Board, the Board has determined that Donald M. Berwick, JoAnn M. Martin, John N. Nunnelly, Stephen H. Lockhart, and Penny A. Wheeler are “independent directors” as that term is defined in the listing standards of The NASDAQ Stock Market.

Directors are typically expected to attend our annual meeting of shareholders each year. For the 2021 Annual Meeting, such attendance will be through the Internet via live webcast. Each of the directors attended our 2020 annual meeting of shareholders.

Currently, we do not have a chairman, and the Board does not have a policy on whether the roles of chief executive officer and chairman should be separate. The Board has, however, designated a lead director since 2007, with Ms. Martin serving as the lead director from 2007 until May 2012 and Mr. Nunnelly serving as the lead director since May 2012. The Board believes its current leadership structure is appropriate at this time since it establishes our chief executive officer as the primary executive leader with one vision and eliminates ambiguity as to who has primary responsibility for our performance.

The lead director is an independent director who is appointed by the independent directors and who works closely with the chief executive officer. In addition to serving as the principal liaison between the independent directors and the chief executive officer in matters relating to the Board as a whole, the primary responsibilities of the lead director are as follows:

| ● |

Preside at all meetings of the Board at which the chief executive officer is not present, including any executive sessions of the independent directors, and establish agendas for such executive sessions in consultation with the other directors and the chief executive officer; |

| ● |

Advise the chief executive officer as to the quality, quantity, and timeliness of the flow of information from management that is necessary for the independent directors to effectively perform their duties; |

| ● |

Have the authority to call meetings of the independent directors as appropriate; and |

| ● |

Be available to act as the spokesperson for the Company if the chief executive officer is unable to act as the spokesperson. |

Committees

The Board held eleven meetings in 2020. All persons serving as directors in 2020 attended at least 75% of the meetings of the Board and the committees on which they served during 2020.

The Board has a standing Audit Committee, Compensation and Talent Committee, Nominating Committee and Strategic Planning Committee. Each of these committees has the responsibilities set forth in formal written charters adopted by the Board. We make available copies of each of these charters free of charge on our website located at www.nrchealth.com/our-purpose/investor-relations/corporate-governance/. Other than the text of the charters, we are not including the information contained on or available through our website as a part of, or incorporating such information by reference into, this proxy statement.

The Audit Committee’s primary function is to assist the Board in fulfilling its oversight responsibilities by overseeing our systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established; our accounting and financial reporting processes; and the audits of our financial statements. The Audit Committee presently consists of JoAnn M. Martin (Chairperson), John N. Nunnelly, and Donald M. Berwick, each of whom meets the independence standards of The NASDAQ Stock Market and the Securities and Exchange Commission for audit committee members. The Board has determined that JoAnn M. Martin qualifies as an “audit committee financial expert,” as that term is defined by the Securities and Exchange Commission, because she has the requisite attributes through, among other things, education and experience as a president, chief financial officer and certified public accountant. The Audit Committee held five meetings in 2020.

The Compensation and Talent Committee determines compensation programs for our executive officers, reviews management’s recommendations as to the compensation to be paid to other key personnel and administers our equity-based compensation plans. The Compensation and Talent Committee presently consists of Donald M. Berwick (Chairperson), JoAnn M. Martin, and John N. Nunnelly, each of whom meets the independence standards of The NASDAQ Stock Market and the Securities and Exchange Commission for compensation committee members. The Compensation and Talent Committee held two meetings in 2020. From time to time, with the last time being in 2015, the Compensation and Talent Committee or our management has engaged a nationally recognized compensation consultant to assist us in our review of our compensation and benefits programs, including the competitiveness of pay levels, executive compensation design issues, market trends and technical considerations. The Compensation and Talent Committee, however, did not use this information in setting the compensation of our executive officers in 2020.

The Nominating Committee presently consists of Donald M. Berwick (Chairperson) and John N. Nunnelly, each of whom meets the independence standards of The NASDAQ Stock Market for nominating committee members. The Nominating Committee’s primary functions are to: (1) recommend persons to be selected by the Board as nominees for election as directors and (2) recommend persons to be elected to fill any vacancies on the Board. The Nominating Committee held three meetings in 2020.

The Strategic Planning Committee assists the Board in reviewing and, as necessary, altering, our strategic plan, reviewing industry trends and their effects, if any, on us and assessing our products, services and offerings and the viability of such portfolio in meeting the needs of the markets that we serve. John N. Nunnelly (Chairperson), Donald M. Berwick and JoAnn M. Martin are the current members of the Strategic Planning Committee. The Strategic Planning Committee did not hold any meetings in 2020.

Board Oversight of Risk

The full Board is responsible for the oversight of our operational and strategic risk management process. The Board relies on its Audit Committee to address significant financial risk exposures facing us and the steps management has taken to monitor, control and report such exposures, with appropriate reporting of these risks to be made to the full Board. The Board relies on its Compensation and Talent Committee to address significant risk exposures facing us with respect to compensation, with appropriate reporting of these risks to be made to the full Board. The Board’s role in our risk oversight has not affected the Board’s leadership structure.

Nominations of Directors

The Nominating Committee will consider persons recommended by shareholders to become nominees for election as directors. Recommendations for consideration by the Nominating Committee should be sent to the Secretary of the Company in writing together with appropriate biographical information concerning each proposed nominee. Our By-Laws also set forth certain requirements for shareholders wishing to nominate director candidates directly for consideration by the shareholders. With respect to an election of directors to be held at an annual meeting, a shareholder must, among other things, give notice of intent to make such a nomination to the Secretary of the Company not less than 60 days or more than 90 days prior to the second Wednesday in the month of April. In the event, however, that the date of the annual meeting is advanced by more than 30 days or delayed by more than 60 days from the second Wednesday in the month of April, in order to be timely notice by the shareholder must be received not earlier than the 90th day prior to the date of such annual meeting and not later than the close of business on the later of (i) the 60th day prior to such annual meeting and (ii) the 10th day following the day on which public announcement of the date of such meeting is first made.

In identifying and evaluating nominees for director, the Nominating Committee seeks to ensure that the Board possesses, in the aggregate, the strategic, managerial and financial skills and experience necessary to fulfill its duties and to achieve its objectives, and seeks to ensure that the Board is comprised of directors who have broad and diverse backgrounds, possessing knowledge in areas that are of importance to us. The Nominating Committee looks at each nominee on a case‑by‑case basis regardless of who recommended the nominee. In looking at the qualifications of each candidate to determine if their election would further the goals described above, the Nominating Committee takes into account all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills or financial acumen, diversity of viewpoint and industry knowledge. In addition, the Board and the Nominating Committee believe that the following specific qualities and skills are necessary for all directors to possess:

| ● |

A director must display high personal and professional ethics, integrity and values. |

| ● |

A director must have the ability to exercise sound business judgment. |

| ● |

A director must be accomplished in his or her respective field, with broad experience at the administrative and/or policy-making level in business, government, education, technology or public interest. |

| ● |

A director must have relevant expertise and experience, and be able to offer advice and guidance based on that expertise and experience. |

| ● |

A director must be independent of any particular constituency, be able to represent all shareholders of the Company and be committed to enhancing long-term shareholder value. |

| ● |

A director must have sufficient time available to devote to activities of the Board and to enhance his or her knowledge of the Company’s business. |

The Board also believes the following qualities or skills are necessary for one or more directors to possess:

| ● |

At least one independent director must have the requisite experience and expertise to be designated as an “audit committee financial expert,” as defined by applicable rules of the Securities and Exchange Commission, and have past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the member’s financial sophistication, as required by the rules of NASDAQ. |

| ● |

One or more of the directors generally must be active or former executive officers of public or private companies or leaders of major complex organizations, including commercial, scientific, government, educational and other similar institutions. |

As noted above, in identifying and evaluating nominees for director, the Nominating Committee seeks to ensure that, among other things, the Board is comprised of directors who have broad and diverse backgrounds, because the Board believes that directors should be selected so that the Board is a diverse body. The Nominating Committee implements this policy by considering how potential directors’ backgrounds would contribute to the diversity of the Board. As part of its annual self-evaluation, the Nominating Committee assesses the effectiveness of its efforts to attain diversity by considering whether it has an appropriate process for identifying and selecting director candidates.

Compensation Committee Interlocks and Insider Participation

Barbara Mowry, Ms. Martin, Mr. Nunnelly, and Mr. Berwick served on the Compensation and Talent Committee during 2020. None of such individuals were our officers or employees at any time during 2020 or as of the date of this Proxy Statement, nor was any such individual a former officer of the Company. In 2020 we purchased dental and vision insurance for certain of our associates from Ameritas, a company for whom Ms. Martin served as Chair and Chief Executive Officer during 2020, in arms’ length transactions for approximately $248,000. See Transactions with Related Persons for additional information on this transaction. Otherwise, in 2020, no member of our Compensation and Talent Committee had any relationship or transaction with us that would require disclosure as a "related person transaction" under Item 404 of Securities and Exchange Commission Regulation S-K in this Proxy Statement under the section entitled Transactions with Related Persons.

During 2020, none of our executive officers served as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served on our Compensation and Talent Committee. Additionally, during 2020, none of our executive officers served as a member of the compensation committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served as a member of our Board or Compensation and Talent Committee.

Transactions with Related Persons

Except as otherwise disclosed in this section, we had no related person transactions during 2020, and none are currently proposed, in which we were a participant and in which any related person had a direct or indirect material interest. Our Board has adopted written policies and procedures regarding related person transactions. For purposes of these policies and procedures:

| ● |

A “related person” means any of our directors, executive officers, nominees for director, any holder of 5% or more of the common stock or any of their immediate family members; and |

| ● |

A “related person transaction” generally is a transaction (including any indebtedness or a guarantee of indebtedness) in which we were or are to be a participant and the amount involved exceeds $120,000, and in which a related person had or will have a direct or indirect material interest. |

Each of our executive officers, directors or nominees for director is required to disclose to the Audit Committee certain information relating to related person transactions for review, approval or ratification by the Audit Committee. Disclosure to the Audit Committee should occur before, if possible, or as soon as practicable after the related person transaction is effected, but in any event as soon as practicable after the executive officer, director or nominee for director becomes aware of the related person transaction. The Audit Committee’s decision whether or not to approve or ratify a related person transaction is to be made in light of the Audit Committee’s determination that consummation of the transaction is not or was not contrary to our best interests. Any related person transaction must be disclosed to the full Board.

Until January 2020, Ms. Martin served as Chair and Chief Executive Officer of Ameritas. Until May 2021, Ms. Martin served on the board of directors of Ameritas and certain of its affiliated companies. In connection with our regular assessment of our insurance-based associate benefits and the costs associated therewith, which is conducted by an independent insurance broker, in 2007 we began purchasing dental insurance for certain of our associates from Ameritas and, in 2009, we also began purchasing vision insurance for certain of our associates from Ameritas. The total value of these purchases, which were conducted in arms’ length transactions and approved by the Audit Committee pursuant to our related person transaction policies and procedures, was approximately $248,000 in 2020.

During 2017, we acquired a cost method investment in convertible preferred stock of PracticingExcellence.com, Inc., a privately-held Delaware corporation (“PX”). As part of the investment, we have the right to appoint one member to PX’s board of directors. Prior to the investment, we entered into an agreement with PX, under which we act as a reseller of PX services (the “PX reseller agreement”). The total revenue we earned from the PX reseller agreement was approximately $294,000 in 2020. These transactions were conducted at arms’ length and approved by the Audit Committee pursuant to our related person transaction policies and procedures.

Barbara Mowry, who served as one of our directors through May 2020, also served on the board of directors of IMA Financial Group Inc. (“IMA”). In connection with our regular assessment of our insurance coverages and the costs associated therewith, in 2020, we purchased directors and officers and employment practices liability insurance from IMA. The total payments for these services, which were conducted in arms’ length transactions and approved by the Audit Committee pursuant to our related person transaction policies and procedures, was approximately $1,100,000 in 2020.

Communications with the Board of Directors

Shareholders may communicate with the Board by writing to NRC Health, Board of Directors (or, at the shareholder’s option, to a specific director), c/o Kevin R. Karas, Secretary, 1245 Q Street, Lincoln, Nebraska 68508. The Secretary will ensure that the communication is delivered to the Board or the specified director, as the case may be.

Information About Our Executive Officers

Set forth below is certain information regarding our current executive officers (other than our CEO and President, Mr. Hays, for whom information is set forth above under Nominees for Election at the Annual Meeting).

Kevin R. Karas, 63, has served as our Chief Financial Officer, Treasurer and Secretary since September 2011, and as Senior Vice President Finance since he joined us in December 2010. From 2005 to 2010, he served as Vice President of Finance for Lifetouch Portrait Studios, Inc., a national retail photography company. Mr. Karas also previously served as Chief Financial Officer at CARSTAR, Inc., an automobile collision repair franchise business, from 2000 to 2005, Chief Financial Officer at Rehab Designs of America, Inc., a provider of orthotic and prosthetic services, from 1993 to 2000, and as a regional Vice President of Finance and Vice President of Operations at Novacare, Inc., a provider of physical rehabilitation services, from 1988 to 1993. He began his career as a Certified Public Accountant at Ernst & Young.

Jona S. Raasch, 62, has served as our Chief Operating Officer from 1988 to 2011 and from 2014 to present. She has also served as Chief Executive Officer of the Governance Institute, one of our divisions, since May 2006.

Helen L. Hrdy, 56, has served as our Chief Growth Officer since January 2020. Prior to that position Ms. Hrdy served as our Senior Vice President, Customer Success, from January 2012 to January 2020. Prior to this Ms. Hrdy held various positions of increasing responsibility with the Company since 2000.

Our executive officers are elected by and serve at the discretion of the Board. There are no family relationships between any of our directors or executive officers. There are no arrangements or understandings between any of our executive officers and any other person pursuant to which any of our executive officers was or is to be selected as an officer.

Employee, Officer and Director Hedging

We do not have practices or policies regarding the ability of employees (including officers) or directors of the Company, or any of their designees, to purchase financial instruments, or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our equity securities. Our officers and Named Executive Officers have not historically engaged in any such hedging transactions and as of the Record Date none of our officers or Named Executive Officers were party to any such hedging transactions.

2020 DIRECTOR COMPENSATION

Directors who are executive officers of the Company receive no compensation for service as members of either the Board or committees thereof. Directors who are not executive officers of the Company receive an annual fixed fee of $75,000 for the lead director and $50,000 for each other director. Directors are also reimbursed for out-of-pocket expenses associated with attending meetings of the Board and committees thereof. Ms. Martin served as our lead director from 2007 to May 2012, and Mr. Nunnelly has served as our lead director since May 2012.

Pursuant to the National Research Corporation 2004 Non-Employee Director Stock Plan, as amended (the “Director Plan”), each director who is not an associate (i.e., employee) of the Company also receives an annual grant of an option to purchase shares of our Common Stock on the date of each Annual Meeting of Shareholders. For the period from January 1, 2020 to December 31, 2020, each director continuing in office who was not an associate of the Company received a grant of options to purchase shares of our Common Stock with a target grant date fair value of approximately $100,000, rounded to the nearest whole share and computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation-Stock Compensation (“FASB ASC Topic 718”), or successor rule, on the date of our 2020 annual meeting of shareholders. The options were granted with an exercise price equal to the fair market value of our common stock on the date of grant, and are scheduled to vest the day immediately preceding the Annual Meeting.

The following table sets forth information regarding the compensation received by each of our directors during 2020:

|

Name |

Fees Earned or Paid in Cash |

Option Awards(1) |

Total |

|||||||||

|

Donald M. Berwick |

$ | 50,000 | $ | 100,003 | $ | 150,003 | ||||||

|

JoAnn M. Martin |

$ | 50,000 | $ | 100,003 | $ | 150,003 | ||||||

|

Barbara J. Mowry(2) |

$ | 19,231 | - | $ | 19,231 | |||||||

|

John N. Nunnelly |

$ | 75,000 | $ | 100,003 | $ | 175,003 | ||||||

1 Represents the aggregate grant date fair value of option awards granted during the year, computed in accordance with FASB ASC Topic 718. See Note 9 to our Consolidated Financial Statements included in our Annual Report on Form 10-K for the years ended December 31, 2020, December 31, 2019, and December 31, 2018, for a discussion of assumptions made in the valuation of share-based compensation. As of December 31, 2020, the outstanding option awards for each director were as follows: Dr. Berwick – 14,000 options; Ms. Martin – 60,440 options; Ms. Mowry – 50,000 options; and Mr. Nunnelly – 49,675 options.

2 Ms. Mowry’s term as director expired on May 18, 2020 and she did not stand for reelection.

REPORT OF THE AUDIT COMMITTEE

In accordance with its written charter, the Audit Committee’s primary function is to assist the Board in fulfilling its oversight responsibilities by overseeing the Company’s systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established; the Company’s accounting and financial reporting processes; and the audits of the financial statements of the Company.

In fulfilling its responsibilities, the Audit Committee has reviewed and discussed the audited financial statements contained in the 2020 Annual Report on Form 10-K with the Company’s management and independent registered public accounting firm. Management is responsible for the financial statements and the reporting process, including the system of internal controls. The independent registered public accounting firm is responsible for expressing an opinion on the audited financial statements in conformity with U.S. generally accepted accounting principles and on the Company’s internal control over financial reporting.

The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed under the applicable requirements of the Public Company Accounting Oversight Board regarding communications with audit committees. In addition, the Company’s independent registered public accounting firm provided to the Audit Committee the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and the Audit Committee discussed with the independent registered public accounting firm the firm’s independence. The Audit Committee pre-approves all audit and permissible non-audit services provided by the independent registered public accounting firm. The Audit Committee has considered whether the provision of the services relating to the Audit-Related Fees, Tax Fees and All Other Fees set forth in “Miscellaneous – Independent Registered Public Accounting Firm” was compatible with maintaining the independence of the independent registered public accounting firm and determined that such services did not adversely affect the independence of the firm.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board (and the Board has approved) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, for filing with the Securities and Exchange Commission.

This report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, and shall not otherwise be deemed filed under such Acts.

AUDIT COMMITTEE

JoAnn M. Martin, Chairperson

John N. Nunnelly

Donald M. Berwick

The following table sets forth certain information regarding the beneficial ownership of Common Stock as of the Record Date (i.e., May 5, 2021) by: (1) each director and director nominee; (2) each of the executive officers named in the Summary Compensation Table; (3) all of the directors, director nominees and executive officers as a group; and (4) each person or entity known to the Company to be the beneficial owner of more than 5% of the Common Stock. Except as otherwise indicated in the footnotes, each of the holders listed below has sole voting and investment power over the shares beneficially owned. As of the Record Date, there were 25,439,013 shares of Common Stock outstanding.

| Shares Beneficially Owned | |||||||||

|

Name of Beneficial Owner |

Shares |

% (1) |

|||||||

|

Directors and Executive Officers (2) |

|||||||||

|

Michael D. Hays |

223,794 | (3)(4) | * | ||||||

|

Kevin R. Karas |

42,754 | (4)(5) | * | ||||||

|

Jona S. Raasch |

95,735 | (4)(6) | * | ||||||

|

Helen L. Hrdy |

58,691 | (4) | * | ||||||

|

Steven D. Jackson |

55,567 | * | |||||||

|

Donald M. Berwick |

14,540 | (4) | * | ||||||

|

JoAnn M. Martin |

199,395 | (4) | * | ||||||

|

John N. Nunnelly |

76,569 | (4) | * | ||||||

|

Stephen H. Lockhart |

0 | (4) | * | ||||||

|

Penny A. Wheeler |

0 | (4) | * | ||||||

|

All directors, nominees and executive officers as a group (ten persons) |

767,045 | (4) | 3.0 | % | |||||

|

Other Holders |

|||||||||

|

Amandla MK Trust and Patrick E. Beans, as the Special Holdings Direction Advisor under this Trust (7) |

6,265,055 | 24.6 | % | ||||||

|

Common Property Trust, Common Property Trust LLC and Thomas Richardson, as Trustee of Common Property Trust and Manager of Common Property Trust LLC(8) |

4,772,522 | 18.8 | % | ||||||

|

Kayne Anderson Rudnick Investment Management LLC (9) |

3,334,366 | 13.1 | % | ||||||

_______________________

* Denotes less than 1%.

| (1) | In accordance with applicable rules under the Securities Exchange Act of 1934, as amended, the number of shares indicated as beneficially owned by a person includes shares of common stock and shares underlying options that are currently exercisable or will be exercisable within 60 days of May 5, 2021. Shares of common stock underlying stock options that are currently exercisable or will be exercisable within 60 days of May 5, 2021 are deemed to be outstanding for purposes of computing the percentage ownership of the person holding such options, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. |

| (2) | The address of all directors and officers is 1245 Q Street, Lincoln, Nebraska 68508. |

| (3) | Includes 139,095 shares of Common Stock held by Mr. Hays’ wife. Mr. Hays disclaims beneficial ownership of the shares held by his wife. |

| (4) | Includes shares of Common Stock that may be purchased under stock options which are currently exercisable or exercisable within 60 days of May 5, 2021, as follows: Mr. Hays, 47,950 shares; Mr. Karas, 20,458 shares; Ms. Raasch, 45,116 shares; Ms. Hrdy, 25,866 shares; Mr. Berwick, 14,000 shares; Ms. Martin, 60,440 shares; Mr. Nunnelly, 49,675 shares; Dr. Lockhart, 0 shares; Dr. Wheeler, 0 shares; and all directors, nominees and executive officers as a group, 263,505 shares. |

| (5) | Includes 22,296 shares of Common Stock pledged as security. |

| (6) | Includes 50,619 shares of Common Stock held indirectly through a trust. |

| (7) | The trustee of this Trust is The Bryn Mawr Trust Company of Delaware and its address is 20 Montchanin Road, Suite 100, Greenville, Delaware 19807. The address of the Special Holdings Direction Advisor for this Trust is 709 Pier 2, Lincoln, Nebraska 68528. |

| (8) | The address for the Common Property Trust and Common Property Trust LLC is 4535 Normal Boulevard, Suite 195, Lincoln, Nebraska 68506. The trustee of Common Property Trust and the manager of Common Property Trust LLC is Thomas Richardson. Mr. Richardson’s address is 601 Massachusetts Avenue, NW, Washington, D.C. 2000. |

| (9) | The number of shares owned set forth above in the table is as of or about December 31, 2020 as reported by Kayne Anderson Rudnick Investment Management LLC (“Kayne Anderson”) in its amended Schedule 13G filed with the Securities and Exchange Commission. The address for Kayne Anderson is 1800 Avenue of the Stars, 2nd Floor, Los Angeles, California 90067. Kayne Anderson reports sole voting and dispositive power with respect 717,151 of these shares and shared voting and dispositive power with respect to 2,617,215 of these shares. The amended Schedule 13G further provides that the shares noted as beneficially owned by Kayne Anderson include: (i) 2,617,215 shares beneficially owned by Virtus Investment Advisers, Inc., One Financial Plaza, Hartford, Connecticut 06103, for which such person has shared voting and dispositive power, and (ii) 2,409,518 shares beneficially owned by Virtus Equity Trust, on behalf of Virtus KAR Small Cap Growth Fund, 101 Munson Street, Greenfield, Massachusetts 01301, for which such person has shared voting and dispositive power. |

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and any owner of greater than 10% of our Common Stock to file reports with the Securities and Exchange Commission concerning their ownership of our Common Stock. Based solely upon information provided to us by individual directors and executive officers, we believe that, during the fiscal year ended December 31, 2020, all of our directors and executive officers and owners of greater than 10% of our Common Stock complied with the Section 16(a) filing requirements, except that (i) a Form 4 for Mr. Jackson reporting the forfeiture of shares upon the vesting of restricted stock and (ii) a Form 4 for Mr. Hays reporting his acquisition of shares from a family trust were not timely filed.

PROPOSAL NO. 2 – RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed KPMG LLP to serve as our independent registered public accounting firm for the year ending December 31, 2021.

We are asking our shareholders to ratify the appointment of KPMG LLP as our independent registered public accounting firm. Although ratification is not required, our Board is submitting the appointment of KPMG LLP to our shareholders for ratification because we value our shareholders’ views on our independent auditors and as a matter of good corporate practice. In the event that our shareholders fail to ratify the appointment, the Audit Committee will consider it as a direction to consider the appointment of a different firm. Even if the appointment is ratified, the Audit Committee in its discretion may select a different independent auditor at any time if it determines that such a change would be in the best interests of the Company and our shareholders.

Representatives of KPMG LLP are expected to participate in the Annual Meeting via the live webcast with the opportunity to make a statement if they so desire. Such representatives are also expected to be available to respond to appropriate questions.

Assuming a quorum is present at the Annual Meeting, the number of votes cast for the ratification of the Audit Committee’s appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2021 must exceed the number of votes cast against it. Abstentions and broker non-votes will be counted as present in determining whether there is a quorum; however, they will not constitute a vote “for” or “against” ratification and will be disregarded in the calculation of votes cast. A broker non-vote occurs when a broker submits a proxy card with respect to shares that the broker holds on behalf of another person but declines to vote on a particular matter, either because the broker elects not to exercise its discretionary authority to vote on the matter or does not have authority to vote on the matter.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. SHARES OF THE COMPANY’S COMMON STOCK REPRESENTED BY EXECUTED BUT UNMARKED PROXIES WILL BE VOTED “FOR” RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion and analysis relates to the compensation of the individuals named in the Summary Compensation Table, a group we refer to as our “named executive officers.” In this discussion, the terms “we,” “our,” “us” or similar terms refer to the Company.

Overview of Executive Compensation Philosophy

Key features of our compensation program include the following:

|

✓ |

Conservative pay policy with total named executive officer and director compensation positioned below the median |

|

|

✓ |

Direct link between pay and performance that aligns business strategies with stockholder value creation |

|

|

✓ |

Annual say-on-pay votes |

|

|

✓ |

No tax gross-ups |

|

|

✓ |

No excessive perquisites for executives |

|

|

✓ |

No change of control or severance obligations to named executive officers, including no accelerated vesting of equity awards upon a change of control |

|

|

✓ |

No re-pricing or back-dating of stock options or similar awards |

|

|

✓ |

Appropriate balance between short- and long-term compensation that discourages short-term risk taking at the expense of long-term results |

|

|

✓ |

Five year vesting period for executive option grants |

We recognize the importance of maintaining sound principles for the development and administration of our executive compensation and benefit programs. Specifically, we design our executive compensation and benefit programs to advance the following core principles:

| ● |

Competitive Pay for Our Market. We strive to compensate our executive officers at levels to ensure that we continue to attract and retain a highly competent, committed management team. Our Midwest headquarters provides a low cost of living that allows us to provide compensation that accomplishes this goal while keeping total compensation below that of many similar companies. |

| ● |

Align with Shareholders. We seek to align the interests, perspectives and decision-making of our executive officers with the interests of our shareholders. |

| ● |

Incentivize Performance. We link our executive officers’ compensation, particularly annual cash bonuses, to our established financial performance goals. |

We believe that a focus on these principles will benefit us and, ultimately, our shareholders in the long term by ensuring that we can attract and retain highly-qualified executive officers who are committed to our long-term success.

Role of the Compensation and Talent Committee

The Board appoints the Compensation and Talent Committee (the “Committee”), which consists entirely of directors who are “non-employee directors” for purposes of the Securities Exchange Act of 1934. The following individuals are members of the Committee:

| ● |

Donald M. Berwick (Chairperson) |

| ● |

JoAnn M. Martin |

| ● |

John N. Nunnelly |

The Committee is responsible for discharging the Board’s responsibilities with respect to all significant aspects of our compensation policies, programs and plans, and accordingly the Committee determines compensation programs for our executive officers or recommends such programs to the full Board for approval. The Committee also reviews management’s recommendations as to the compensation to be paid to other key personnel and administers our equity-based compensation plans. Periodically, the Committee reviews and determines our compensation and benefit programs, with the objective of ensuring the executive compensation and benefits programs are consistent with our compensation philosophy. The Committee has authority to carry out the foregoing responsibilities under its charter and may delegate such authority to subcommittees of the Committee. From time to time, the Committee or management has engaged a nationally recognized compensation consultant to conduct a benchmarking study of executive compensation levels and practices. This market information has, in the past, been used to help inform and shape decisions, but was (and is) neither the only nor the determinative factor in making compensation decisions.

At the time our Committee recommended, and our Board approved, our named executive officers’ 2020 compensation, our most recent review of our compensation and benefit programs was in late 2015, when our Committee engaged Aon Hewitt to review our programs before determining compensation for 2016. In determining compensation levels for our named executive officers in 2020, our Committee did not engage Aon Hewitt or any other compensation consultant to provide advice concerning executive officer compensation.

One objective of the Committee in setting compensation for our executive officers, other than our Chief Executive Officer, is to establish base salary at a level that will attract and retain highly-qualified individuals. The Committee’s considerations in setting our Chief Executive Officer’s base salary are described below. For our executive officers other than our Chief Executive Officer, we also consider individual performance, level of responsibility, skills and experience, and internal comparisons among executive officers in determining base salary levels.

The Committee administers our annual cash incentive program and long-term equity incentive plans and approves all awards made under the program and plans. For annual and long-term incentives, the Committee considers internal comparisons and other existing compensation awards or arrangements in making compensation decisions and recommendations. In its decision-making process, the Committee receives and considers the recommendations of our Chief Executive Officer as to executive compensation programs for all of the other officers. In its decision-making process for the long-term incentives for our executive officers, the Committee considers relevant factors, including our performance and relative shareholder return and the awards given to the executive officer in past years. The Committee makes its decisions regarding general program adjustments to future base salaries, annual incentives and long-term incentives concurrently with its assessment of the executive officers’ performance. Adjustments generally become effective in January of each year.

In fulfilling its objectives as described above, the Committee took the following steps in determining 2020 compensation levels for our named executive officers:

| ● |

Considered the performance of our Chief Executive Officer and determined his total compensation; |

| ● |

Considered the performance of our other executive officers and other key associates (i.e., employees) with assistance from our Chief Executive Officer; and |

| ● |

Determined total compensation for our named executive officers based on recommendations by our Chief Executive Officer (as to the other officers) and the Committee’s consideration of the Company’s and the individual officer’s performance. |

2020 Say on Pay Vote

In May 2020 (after the 2020 executive compensation actions described in this Compensation Discussion and Analysis had taken place), we held our annual advisory shareholder vote on the compensation of our named executive officers at our annual shareholders’ meeting, and, consistent with the recommendation of the Board, our shareholders approved our executive compensation, with more than 99% of votes cast in favor. Consistent with this strong vote of shareholder approval, we have not undertaken any material changes to our executive compensation programs.

Total Compensation

We intend to continue our strategy of compensating our executive officers through programs that emphasize performance-based incentive compensation in the form of cash and equity-based awards. To that end, we have structured total executive compensation to ensure that there is an appropriate balance between a focus on our long-term versus short-term performance. We believe that the total compensation paid or awarded to the executive officers during 2020 was consistent with our financial performance and the individual performance of each of our executive officers. We also believe that this total compensation was reasonable in its totality and is consistent with our compensation philosophies described above.

CEO Compensation

The Committee reviews annually the salary and total compensation levels of Michael D. Hays, our Chief Executive Officer. While Mr. Hays’ salary and overall compensation are significantly below the median level paid to chief executive officers of comparable companies, he requested that his base salary and targeted overall compensation remain unchanged. The Committee has not proposed an increase in his salary or overall compensation since 2005.

Elements of Compensation

Base Salary

The objective of the Committee is to establish base salary, when aligned with performance incentives, to continue to attract and retain the best talent (with the exception of Mr. Hays’ salary as noted above). We have historically attempted to minimize base salary increases in order to limit our executive compensation expense if we do not meet our objectives for financial growth under our incentive compensation program.

Consistent with this practice, the Committee left base salaries unchanged in 2020 for Mr. Hays, Mr. Karas, Ms. Raasch and Mr. Jackson, maintaining the salary levels in place since 2016. In the case of Mr. Hays, the decision was based on his request, described above, that his salary not be increased. In the case of the other named executive officers, the decision was based on our performance and the belief that such named executive officer’s salaries were at an appropriate level to retain their talent. Ms. Hrdy received a pay increase in 2020 due to her promotion to Chief Growth Officer.

Base salaries paid to our named executive officers represented the following percentages of their total compensation (as calculated for purposes of the Summary Compensation Table).

|

Base Salary as a Percentage |

|

|

Michael D. Hays |

50% |

|

Kevin R. Karas |

50% |

|

Jona S. Raasch |

50% |

|

Helen L. Hrdy |

52% |

|

Steven D. Jackson |

58% |

Annual Cash Incentive

Our executive officers are eligible for annual cash incentive awards under our incentive compensation program. Please note that, while we may refer to annual cash incentive awards as bonuses in this discussion, the award amounts are reported in the Summary Compensation Table under the column titled “Non-Equity Incentive Plan Compensation” pursuant to the Securities and Exchange Commission’s regulations.

We intend for our incentive compensation program to provide an incentive to meet and exceed our financial goals, and to promote a superior level of performance. Within the overall context of our pay philosophy and culture, the program:

| ● |

Provides total cash compensation to attract and retain key executive talent; |

| ● |

Aligns pay with organizational performance; |

| ● |

Focuses executive attention on key business metrics; and |

| ● |

Provides a significant incentive for achieving and exceeding performance goals. |

Under our incentive compensation program, the Committee establishes performance measures for our named executive officers at the beginning of each year. For 2020, the Committee used our overall revenue and net income as performance measures because the Committee believes these are key measures of our ability to deliver value to our shareholders for which our named executive officers have primary responsibility. The Committee weighted the two performance measures equally in determining bonus payouts. The Committee structured the incentive compensation program so that our named executive officers would receive a bonus based on the percentage of growth in overall revenue and net income in 2020 over 2019, starting from “dollar one” of such growth. Consistent with past years, the Committee structured the incentive compensation program for our named executive officers to require performance representing growth in revenue or net income for any payout to be received.

The Committee structured the incentive compensation program to permit payouts to be earned for any growth in revenue and net income because it believed that providing an incentive to achieve growth in these measures would provide an effective incentive to the executive officers in 2020. The Committee determined that the bonuses under the incentive compensation program would be equal to the following (subject to a maximum of 200% of base salary): the product of the executive officer’s base salary (i) multiplied by the sum of the percentage year over year increase, if any, in overall revenue plus the percentage year over year increase, if any, in overall net income (ii) multiplied by 2.5.

In determining the potential bonus amounts for our named executive officers described above, the Committee concluded that their payouts determined by these formulas were likely to produce results consistent with our past practice of setting annual target payouts at 50% of base salary, and would continue to provide competitive compensation consistent with our goals for annual incentive awards.

The following table shows amounts actually earned by our named executive officers for 2020, along with the percentages of their total compensation (as calculated for purposes of the Summary Compensation Table) that these amounts represent.

|

Name |

2020 Actual Bonus Percentage of |

2020 Actual Bonus Amount |

||||||

|

Michael D. Hays |

25% | $ | 62,426 | |||||

|

Kevin R. Karas |

25% | $ | 139,650 | |||||

|

Jona S. Raasch |

25% | $ | 147,000 | |||||

|

Helen L. Hrdy |

25% | $ | 139,650 | |||||

|

Steven D. Jackson(1) |

0% | $ | 0 | |||||

|

(1) Mr. Jackson resigned effective October 2, 2020 and, accordingly, did not receive a bonus for 2020. |

||||||||

Long-Term Equity Incentive

The general purpose of our current equity-based plans is to promote the achievement of our long-range strategic goals and enhance shareholder value. The Committee may from time to time approve discretionary awards, however, we generally grant equity-based awards in the following circumstances:

|

● |

Annual Awards. To provide an additional performance incentive for our executive officers and other key management personnel, our executive compensation package generally includes annual grants of stock options with respect to our common stock. |

|

● |

New Hire or Promotion Awards. We also award restricted stock grants to newly hired or promoted executive officers during their first year of participation in our equity incentive program to provide greater alignment between the officers’ interests and those of our shareholders, and to assist in retention. |

Options to purchase shares of common stock are typically granted with a per-share exercise price of 100% of the fair market value of each share of common stock subject to the option on the date of grant. The value of the option will be dependent on the future market value of the common stock, which we believe helps to align the economic interests of our key management personnel with the interests of our shareholders. To encourage our key management personnel to continue in employment with us, when we grant restricted stock under the 2006 Equity Incentive Plan to executive officers, we generally impose a 5-year restriction period on the grant, pursuant to which the options do not become fully vested and exercisable until the fifth anniversary of the grant date.

In determining equity incentive awards for 2020, the Committee concluded that setting annual equity awards for our named executive officers at a grant date target fair value of approximately 50% of their respective then-current base salaries would provide competitive compensation consistent with our goals for equity awards. The Committee generally grants stock options effective on a date in the first week of January. Accordingly, effective January 3, 2020, the Committee granted options to each of our named executive officers. To determine the number of option shares with a grant date target fair value approximately equal to 50% of an executive officer’s base salary, the Committee divided 50% of the current base salary by the most recent Common Stock closing price to determine the number of shares that equal 50% of the current base salary. The number of shares were then multiplied by a factor of three to determine the number of option shares to be granted. The number of options granted to our named executive officers is shown in the Grants of Plan-Based Awards Table.

For 2020, no performance-based equity awards were granted to our named executive officers. Our Committee may, however, consider in the future conditioning awards on the achievement of various performance goals, including return on equity, shareholder value added, earnings from operations, net earnings, net earnings per share, market price of our common stock and/or total shareholder return.

Other Benefits

To assist our associates in preparing financially for retirement, we maintain a 401(k) plan for all associates over 21 years of age, including our executive officers. Pursuant to the 401(k) plan, we match 25% of the first 6% of compensation contributed by our associates up to allowable Internal Revenue Service limitations. We also maintain group life, health, dental and vision insurance programs for all of our salaried associates, and our named executive officers are eligible to participate in these programs on the same basis as all other eligible associates. During 2020 we also provided our associates a work-from-home allowance to further enable remote work due to COVID-19.

Agreements with Officers

We do not have employment, retention, severance, change of control or similar agreements with any of our executive officers. While we enter into award agreements with our executive officers and other participants under our long-term equity award plans, these agreements and plans do not provide for acceleration of vesting or other benefits upon a change of control or termination.

2020 SUMMARY COMPENSATION TABLE

Set forth below is information regarding compensation earned by or paid or awarded to the following executive officers: Michael D. Hays, our Chief Executive Officer and President; Kevin R. Karas, our Senior Vice President Finance, Chief Financial Officer, Treasurer and Secretary; Jona S. Raasch, our Chief Operating Officer; Helen L. Hrdy, our Chief Growth Officer and Steven D. Jackson, our former President. We had no other executive officers, as defined in Rule 3b-7 of the Securities Exchange Act of 1934, whose total compensation exceeded $100,000 during 2020. The identification of such named executive officers is determined based on the individual’s total compensation for 2020, as reported below in the Summary Compensation Table, other than amounts reported as above-market earnings on deferred compensation and the actuarial increase in pension benefit accruals.

The following table sets forth for our named executive officers with respect to 2020, 2019, and 2018: (1) the dollar value of base salary earned during the year; (2) the aggregate grant date fair value of stock and option awards granted during the year, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation-Stock Compensation (“FASB ASC Topic 718”); (3) the dollar value of earnings for services pursuant to awards granted during the year under non-equity incentive plans; (4) all other compensation for the year; and (5) the dollar value of total compensation for the year.

|

Name and Principal Position |

Year |

Salary ($) |

Option Awards ($)(1) |

Non-Equity Incentive Plan Compensation ($) |

All Other Compensation ($)(2) |

Total ($) |

||||||||||||||||

|

Michael D. Hays(3) |

2020 |

$ | 127,400 | $ | 60,258 | $ | 62,426 | $ | 4,420 | $ | 254.504 | |||||||||||

|

Chief Executive Officer |

2019 |

$ | 127,400 | $ | 54,890 | $ | 47,265 | $ | 4,323 | $ | 233,878 | |||||||||||

|

President |

2018 |

$ | 127,400 | $ | 53,332 | $ | 104,468 | $ | 4,267 | $ | 289,467 | |||||||||||

|

Kevin R. Karas |

2020 |

$ | 285,000 | $ | 134,813 | $ | 139,650 | $ | 6,868 | $ | 566,331 | |||||||||||

|

Senior Vice President |

2019 |

$ | 285,000 | $ | 122,782 | $ | 105,735 | $ | 6,529 | $ | 520,046 | |||||||||||

|

Finance, Chief |

2018 |

$ | 285,000 | $ | 119,307 | $ | 233,700 | $ | 6,604 | $ | 644,611 | |||||||||||

|

Financial Officer, |

||||||||||||||||||||||

|

Jona S. Raasch |

2020 |

$ | 300,000 | $ | 141,909 | $ | 147,000 | $ | 6,914 | $ | 595,823 | |||||||||||

|

Chief Operating Officer |

||||||||||||||||||||||

|

Helen L. Hrdy |

2020 |

$ | 285,000 | $ | 118,254 | $ | 139,650 | $ | 5,410 | $ | 548,314 | |||||||||||

|

Chief Growth Officer |

||||||||||||||||||||||

|

Steven D. Jackson(3) |

2020 |

$ | 225,000 | $ | 141,909 | $ | 0 | $ | 20,363 | $ | 387,272 | |||||||||||

|

Former President |

2019 |

$ | 300,000 | $ | 129,239 | $ | 111,300 | $ | 5,100 | $ | 545,639 | |||||||||||

|

2018 |

$ | 300,000 | $ | 125,582 | $ | 246,000 | $ | 5,025 | $ | 676,607 | ||||||||||||

| (1) | Represents the aggregate grant date fair value of the option awards granted during the year, computed in accordance with FASB ASC Topic 718. See Note 9 to our Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2020 for a discussion of assumptions made in the valuation of share-based compensation. |

| (2) | Includes, for each of our named executive officers, the amount of our 401(k) matching contributions; for Messrs. Hays and Karas and Mses. Raasch and Hrdy, the amount of our health saving account matching contributions; for Messrs. Karas and Jackson and Mses. Raasch and Hrdy, the amount of our technology allowance; and for Mr. Jackson, a housing allowance of $15,200. |

| (3) | Mr. Jackson resigned from his position as President and Mr. Hays was appointed President effective October 2, 2020. |

GRANTS OF PLAN-BASED AWARDS IN 2020