Form PRE 14A EGAIN Corp For: Dec 08

United States

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ⌧

Filed by a Party other than the Registrant ◻

Check the appropriate box:

⌧ |

| Preliminary Proxy Statement |

◻ |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

◻ |

| Definitive Proxy Statement |

◻ |

| Definitive Additional Materials |

◻ |

| Soliciting Material Pursuant to §240.14a-12 |

eGain Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

⌧ |

| No fee required. | ||

◻ |

| Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. | ||

|

| 1) |

| Title of each class of securities to which transaction applies: |

|

| 2) |

| Aggregate number of securities to which transaction applies: |

|

| 3) |

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| 4) |

| Proposed maximum aggregate value of transaction: |

|

| 5) |

| Total fee paid: |

◻ |

| Fee paid previously with preliminary materials. | ||

◻ |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

|

| 1) |

| Amount Previously Paid: |

|

| 2) |

| Form, Schedule or Registration Statement No.: |

|

| 3) |

| Filing Party: |

|

| 4) |

| Date Filed: |

eGain

Corporation

1252 Borregas Avenue

Sunnyvale, CA 94089

(408) 636-4500

October [27], 2021

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders, or the Annual Meeting, of eGain Corporation that will be held on December 8, 2021, at 1:00 p.m., Pacific Time at eGain Corporation — 1252 Borregas Avenue, Sunnyvale, CA 94089.

The formal notice of the Annual Meeting and the Proxy Statement has been made a part of this invitation.

After reading the Proxy Statement, please mark, date, sign and return, at an early date, the enclosed proxy in the enclosed prepaid envelope, to ensure that your shares will be represented. YOUR SHARES MAY NOT BE VOTED WITH RESPECT TO EACH OF THE PROPOSALS UNLESS YOU SIGN, DATE AND RETURN THE ENCLOSED PROXY OR VOTE YOUR SHARES ELECTRONICALLY AT THE ANNUAL MEETING.

A copy of eGain’s 2021 Annual Report to Stockholders on Form 10-K is also enclosed.

The Board of Directors and management look forward to seeing you at the Annual Meeting.

| Sincerely yours, |

|

|

| Ashutosh Roy |

| Chief Executive Officer |

eGain Corporation

Notice of Annual Meeting of Stockholders

to be held December 8, 2021

To the Stockholders of eGain Corporation:

The Annual Meeting of Stockholders, or the Annual Meeting, of eGain Corporation, or eGain or the Company, a Delaware corporation, will be held on December 8, 2021, at 1:00 p.m., Pacific Time at eGain Corporation — 1252 Borregas Avenue, Sunnyvale, CA 94089.

We are holding this Annual Meeting for the following purposes:

| 2. | to elect directors to serve until the 2022 annual meeting of stockholders and thereafter until their successors are elected and qualified; |

| 3. | to approve an amendment to eGain’s Amended and Restated 2005 Stock Incentive Plan to increase the number of shares of common stock reserved for issuance thereunder from 6,460,000 shares to 7,460,000 shares; |

| 4. | to approve, on a non-binding advisory basis, the compensation paid by us to our named executive officers; |

| 5. | to ratify the appointment of BPM LLP, as eGain’s Independent Registered Public Accounting Firm; and |

| 6. | to transact such other business as may properly come before the Annual Meeting and any adjournment of the Annual Meeting. |

Stockholders of record as of the close of business on October 13, 2021 are entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. A complete list of stockholders entitled to vote at the Annual Meeting will be available at eGain’s offices, 1252 Borregas Avenue, Sunnyvale, California 94089, ten days prior to the Annual Meeting. This list will also be available for examination during the Annual Meeting.

It is important that your shares are represented at the Annual Meeting. Even if you plan to attend the Annual Meeting, we hope that you will promptly mark, sign, date and return the enclosed proxy. This will not limit your right to attend or vote at the Annual Meeting, subject to your prior registration to attend and vote at the Annual Meeting.

| By Order of the Board of Directors, |

|

|

| Stanley F. Pierson |

| Secretary |

Sunnyvale, California

October [27], 2021

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be held on December 8, 2021.

The Proxy Statement for our Annual Meeting and eGain’s Annual Report to Stockholders on Form 10-K for the fiscal year ended June 30, 2021, or the 2021 Annual Report, are available at http://www.edocumentview.com/EGAN.

| Page |

1 | |

3 | |

4 | |

| |

5 | |

5 | |

6 | |

6 | |

6 | |

7 | |

8 | |

8 | |

8 | |

9 | |

9 | |

10 | |

11 | |

| |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 12 |

13 | |

| |

14 | |

14 | |

15 | |

| |

20 | |

21 | |

22 | |

22 | |

| |

PROPOSAL 3 AMENDMENT TO THE AMENDED AND RESTATED 2005 STOCK INCENTIVE PLAN | 23 |

23 | |

23 | |

26 | |

27 | |

27 | |

28 | |

28 | |

| |

PROPOSAL 4 NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION | 29 |

PROPOSAL 5 RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 30 |

31 | |

32 | |

32 | |

| |

33 | |

33 | |

34 |

Appendix A — Form of Second Amended and Restated Certificate of Incorporation

Appendix B — Amended and Restated 2005 Stock Inventive Plan

eGain Corporation

1252 Borregas Avenue,

Sunnyvale, California 94089

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of eGain Corporation, a Delaware corporation, referred to as eGain or the Company, of proxies in the accompanying form to be used at the Annual Meeting of Stockholders of eGain (the “Annual Meeting”), to be held at eGain Corporation—1252 Borregas Avenue, Sunnyvale, CA 94089, on December 8, 2021 at 1:00 p.m., Pacific Time, and any postponement or adjournment thereof. The shares represented by the proxies received in response to this solicitation and not properly revoked will be voted at the Annual Meeting in accordance with the instructions therein. A stockholder who has given a proxy may revoke it at any time before it is exercised by filing with the Secretary of eGain a written revocation or a duly executed proxy bearing a later date or by voting electronically at the Annual Meeting, subject to your prior registration to attend and vote at the Annual Meeting. On the matters coming before the Annual Meeting for which a choice has been specified by a stockholder by means of the ballot on the proxy, the shares will be voted accordingly. If no choice is specified, the shares will be voted in accordance with the recommendations of the Board of Directors set forth below.

The Board of Directors recommends that you vote:

| ● | “FOR” the election of each of the nominated directors to serve until the 2022 annual meeting of stockholders and thereafter until their successors are elected and qualified; |

| ● | “FOR” the proposal to approve an amendment to the Company’s Amended and Restated 2005 Stock Incentive Plan to increase the number of shares of common stock reserved for issuance thereunder from 6,460,000 shares to 7,460,000 shares; |

| ● | “FOR” the proposal to approve, on a non-binding advisory basis, the compensation paid by us to our named executive officers; and |

| ● | “FOR” the ratification of the appointment of BPM LLP, as the Company’s Independent Registered Public Accounting Firm. |

Stockholders of record at the close of business on October 13, 2021 (the “Record Date”), are entitled to vote at the Annual Meeting. As of the close of business on the Record Date, eGain had 31,387,974 shares of common stock, par value $0.001 per share (“Common Stock”), outstanding. The presence in person or by proxy of the holders of a majority of eGain’s outstanding shares of Common Stock entitled to vote constitutes a quorum for the transaction of business at the Annual Meeting. Each holder of Common Stock is entitled to one vote for each share held as of the Record Date.

Directors are elected by a plurality vote. The five nominees for director who receive the most votes cast in their favor will be elected to serve as a director. Other proposals submitted for stockholder approval at the Annual Meeting will be decided by the affirmative vote of the majority of the shares present in person or represented by proxy at the Annual Meeting. Abstentions with respect to any proposal are treated as shares present or represented and entitled to vote on that proposal and thus have the same effect as negative votes. If a broker which is the record holder of shares indicates on a proxy that it does not have discretionary authority to vote on a particular proposal as to such shares, or if shares are not voted in other circumstances in which proxy authority is defective or has been withheld with respect to a particular proposal, these non-voted shares will be

1

counted for quorum purposes and will have the same effect as negative votes, because approval requires an absolute percentage of affirmative votes.

The expense of printing, mailing proxy materials and soliciting proxies will be borne by eGain. Our directors, and certain of our officers and employees in the ordinary course of their employment, may solicit proxies by mail, internet, facsimile, in person, email or other online methods. eGain will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation materials to beneficial owners of eGain’s Common Stock. No additional compensation will be paid to such persons for such solicitation.

This Proxy Statement, the accompanying form of proxy and the 2021 Annual Report, including our consolidated financial statements, are being mailed to stockholders on or about October [29], 2021.

You will be able to attend the Annual Meeting at eGain Corporation—1252 Borregas Avenue, Sunnyvale, CA 94089 on December 8, 2021 at 1:00 p.m., Pacific Time. A complete list of stockholders entitled to vote at the Annual Meeting will be available for examination during the Annual Meeting upon request.

IMPORTANT

Please mark, sign and date the enclosed proxy and return it at your earliest convenience in the enclosed postage-paid return envelope so that, whether you intend to be present at the Annual Meeting or not, your shares can be voted. This will not limit your rights to attend or vote at the Annual Meeting, subject to your prior registration to attend and vote at the Annual Meeting.

2

PROPOSAL 1

THE CHARTER AMENDMENT PROPOSAL

The following table sets forth a summary of the principal changes proposed to be made between the Existing Charter and the Amended Charter. Stockholders are being asked to vote on each of the proposed principal changes to the Existing Charter individually, as provided on the proxy card. This summary is qualified by reference to the complete text of the proposed Amended Charter, a copy of which is attached to this Proxy Statement as Appendix A. All stockholders are encouraged to read the proposed Amended Charter in its entirety for a more complete description of its terms.

| Existing Charter |

| Proposed Amended Charter | |||

|---|---|---|---|---|---|---|

Authorized Shares of Common Stock |

| The Existing Charter authorizes the issuance of up to 50,000,000 shares of Common Stock. See Article IV of the Existing Charter. |

| The proposed Amended Charter will authorize the issuance of up to 60,000,000 shares of Common Stock. See Article IV of the Amended Charter. | ||

Required Vote to Amend the Bylaws | | None. Under the DGCL, the stockholders entitled to vote have the power to adopt, amend, or repeal bylaws, unless that power is conferred upon the directors in its certificate of incorporation. | | The proposed Amended Charter provides that the Bylaws may be adopted, amended, or repealed by approval of a majority of the Board of Directors. The stockholders may also have the power to adopt, amend, or repeal the Bylaws by an affirmative vote of the holders of at least a majority of the voting power of all of the then outstanding shares of the capital stock of the Company, voting together as a single class. See Article VII of the Amended Charter. | ||

Choice of Forum | | None. | | The proposed Amended Charter provides that, unless the Company consents in writing to the selection of an alternative forum, to the fullest extent permitted by law, the Court of Chancery of the State of Delaware (or, if that court lacks subject matter jurisdiction, another federal or state court in the State of Delaware) will be the sole and exclusive forum for (a) any derivative action or proceeding brought on behalf of the Company, (b) any action asserting a claim of breach of a fiduciary duty owed to the Company or its stockholders by any director, officer or other employee of the Company, (c) any action asserting a claim arising pursuant to any provision of the DGCL, or (d) any action asserting a claim governed by the internal affairs doctrine. The proposed Amended Charter also requires that, unless the Company consents in writing to the selection of an alternative forum, the federal district courts of the United States will be the sole and exclusive forum for the resolution of any complaint asserting a cause of action under the Securities Act of 1933. See Article IX of the Amended Charter. | ||

3

Reasons for the Charter Amendments

Authorized Common Stock

The Board of Directors considers it advisable and preferable to have a sufficient number of unissued and unreserved authorized shares of Common Stock to provide the Company with flexibility with respect to its authorized capital sufficient to execute its business strategy and to enhance stockholder value without delay or the necessity for a special stockholders’ meeting. At the same time, the proposed authorized share increase was designed, based on a survey of shares of Common Stock authorized and shares of Common Stock outstanding at our peer group companies, to strike the appropriate balance so that the Company does not have what some stockholders might view as an unreasonably high number of authorized shares of Common Stock that are unissued or reserved for issuance.

The additional shares of Common Stock will be available for issuance by the Board of Directors for various corporate purposes, including but not limited to, raising capital, strategic transactions, including mergers, acquisitions, strategic partnerships, joint ventures, divestitures, business combinations, stock splits and stock dividends, as well as other general corporate transactions, and providing equity incentive grants under employee stock plans. The Company does not currently have any definitive agreements or arrangements to issue any of the proposed additional authorized shares of Common Stock that will become available for issuance if this proposal is approved.

The amendment to the Existing Charter will ensure that the Company will continue to have an adequate number of authorized and unissued shares of Common Stock available for future use. As is the case with the shares of Common Stock which are currently authorized but unissued, if this amendment is adopted by the Company’s stockholders, the Board of Directors will only have authority to issue the additional shares of Common Stock from time to time without further action on the part of stockholders to the extent not prohibited by applicable law or by the rules of any stock exchange or market on which our securities may then be listed or authorized for quotation.

Required Vote to Amend the Bylaws

We believe that most publicly traded corporations incorporated in the State of Delaware grant the right to amend bylaws to its board of directors. Our Board of Directors believes that having such authority to amend the bylaws without stockholder approval provides it with important flexibility to make amendments to the Bylaws that the Board of Directors believes is in the best interests of the Company and its stockholders. Requiring stockholder approval of all Bylaw amendments would impose an unnecessary administrative burden, expense and delay on the Company as it would require waiting until an annual meeting of stockholders or the convening of a special meeting of stockholders. As a result, important or necessary amendments to the Bylaws may not be able to be made within the timeframe to serve the best interests of the Company and its stockholders. In addition, the stockholders will still have power to adopt, amend, or repeal the Bylaws even if the proposed Amended Charter is approved.

Choice of Forum

Designating the choice of forum provision is desirable to delineate specific matters for which the Court of Chancery of the State of Delaware, or, if that court lacks subject matter jurisdiction, another federal or state court situated in the State of Delaware, is the sole and exclusive forum, unless the Company consents in writing to the selection of an alternative forum; and provide notice to stockholders of the Company that the federal district courts of the United States are the exclusive forum for the resolution of any complaint asserting a cause of action under the Securities Act of 1933. Although we believe these provisions will benefit the Company by providing increased consistency in the application of Delaware law in the types of lawsuits to which it applies, a court may determine that these provisions are unenforceable, and to the extent they are enforceable, the provisions may have the effect of discouraging lawsuits against the Company’s directors and officers, although the Company’s stockholders will not be deemed to have waived the Company’s compliance with federal securities laws and the rules and regulations thereunder.

The Board of Directors recommends a vote “FOR” the proposal to amend and restate the Existing Charter as set forth in the Amended Charter, including to increase the number of authorized shares of Common Stock to 60,000,000 shares, to allow a majority of the Board of Directors to adopt, amend, or repeal the Bylaws, and to approve choice of forum provisions.

4

ELECTION OF DIRECTORS

Our Board of Directors proposes the election of five directors of eGain to serve until the 2022 annual meeting of stockholders and thereafter until their successors are elected and qualified. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, an event not now anticipated, proxies will be voted for any nominee designated by our Board of Directors to fill the vacancy.

The names of the nominees and certain biographical information about them are set forth below:

Ashutosh Roy, age 55, co-founded eGain and has served as Chief Executive Officer and a Director of eGain since September 1997 and as President since October 2003. From May 1995 through April 1997, Mr. Roy served as Chairman of WhoWhere? Inc., an Internet-services company co-founded by Mr. Roy. From June 1994 to April 1995, Mr. Roy worked at Parsec Technologies, a call center company based in New Delhi, India, which he co-founded. From August 1988 to August 1992, Mr. Roy worked as a software engineer at Digital Equipment Corporation, a major company in the computer industry at the time. Mr. Roy holds a B.S. in Computer Science from the Indian Institute of Technology, New Delhi, a Master’s degree in Computer Science from Johns Hopkins University and a M.B.A. from Stanford University. Mr. Roy’s qualifications to serve on our Board of Directors include his industry experience and deep knowledge of eGain from his position as a founder of our Company and as our Chief Executive Officer for over 20 years.

Gunjan Sinha, age 54, co-founded eGain and has served as a Director of eGain since its inception in September 1997 and as President of eGain from January 1998 until September 2003. Since January 2004, Mr. Sinha has served as Executive Chairman of MetricStream Inc., a supplier of software applications for enterprise quality and compliance management. From May 1995 through April 1997, Mr. Sinha served as President of WhoWhere? Inc., an internet service company co-founded by Mr. Sinha. Prior to co-founding WhoWhere? Inc., Mr. Sinha was a hardware developer of multiprocessor servers at Olivetti Advanced Technology Center. In June 1994, Mr. Sinha co-founded Parsec Technologies, Inc. Mr. Sinha has also served as Chairman of Regalix Inc., a digital marketing company, since 1998 and as Chairman of Open Growth, LLC, a technology holding company, since January 2014. Mr. Sinha holds a degree in Computer Science from the Indian Institute of Technology, New Delhi, a master’s degree in Computer Science from the University of California, Santa Cruz, and a master’s degree in Engineering Management from Stanford University. We believe that Mr. Sinha’s qualifications to serve on our Board of Directors include his extensive experience founding, managing and investing in technology companies and deep knowledge of the Company gained from his position as a founder and former officer of the Company.

Phiroz P. Darukhanavala, Ph.D., age 73, also known as Daru, has served as a member of eGain’s Board of Directors since September 2000. Dr. Darukhanavala, has an extensive global background in the oil and gas industry including exploration, production, refining, retail and marketing; holding several technology, operational and strategy leadership positions at BP p.l.c., and multinational oil and gas company (“BP”). From June 2010 to February 2015, he was the Vice President and Chief Technology Officer at BP. Previously, Dr. Darukhanavala was Vice President, Merger and Integration at BP where he led the IT integration programs resulting from the merger of BP, Amoco and Arco. Earlier in his BP career, Dr. Darukhanavala was the IT Functional Chief at BP Exploration in London, chief information officer for BP Retail, chief information officer of BP Alaska, chief information officer for BP Exploration US and Head of Scientific Systems and Operations Research at SOHIO. In addition to his contributions running large scale, complex businesses, he has gained a high-level strategic perspective as a director for several companies, as well as board roles for high profile industry associations and universities. Dr. Darukhanavala holds a Ph.D. and a M.S. degree in Operations Research from Case Western Reserve University in Cleveland, Ohio and a BS in Mechanical Engineering from IIT (Bombay). We believe that Dr. Darukhanavala’s qualifications to serve on our Board of Directors include his business financial expertise and his extensive management experience.

Brett Shockley, age 62, joined eGain’s Board of Directors in January 2016 and has served as eGain’s Lead Independent Director since September 2017. Mr. Shockley currently provides strategy and corporate development consulting for software and cloud-based services companies. From August 2008 to December 2014, Mr. Shockley held numerous positions at Avaya Inc., a global provider of business collaboration and communications solutions, including Senior Vice President and General Manager of Software and Emerging Technologies, and Senior Vice President of Corporate Development, Strategy and Chief Technology Officer. Before joining Avaya, Mr. Shockley was the Chief Executive Officer and co-founder of Spanlink

5

Communications Inc., a contact center software and services business, which he brought through an initial public offering on Nasdaq. In 2007, Mr. Shockley co-founded Calabrio, a workforce optimization software company which was acquired by KKR & Co. Inc. (NYSE: KKR) in 2016. Prior to Calabrio, Mr. Shockley was the Vice President and General Manager of the Customer Contact Business Unit of Cisco Systems Inc., a multinational technology company. Mr. Shockley currently serves as a member of the board of directors of Spok Holdings, Inc. (Nasdaq: SPOK), a healthcare communications company. In addition to holding patents in social networking and telecommunications, Mr. Shockley has an M.B.A. in Marketing from the University of Minnesota’s Carlson School of Management and a bachelor’s degree in Mechanical Engineering from the University of Minnesota’s Institute of Technology. Mr. Shockley attended Stanford University’s Directors Consortium in 2017. Mr. Shockley was a 2007 Ernst & Young Entrepreneur of the Year award winner, University of Minnesota Alumni Lifetime Achievement award winner in 2006 and 2008 Minnesota High Tech Association Emerging Technology Company award winner. We believe that Mr. Shockley’s qualifications to serve on our Board of Directors include his extensive experience founding, managing, investing and serving as a Director in public and private technology companies, and deep knowledge of the Company’s industry.

Christine Russell, age 72, joined eGain’s Board of Directors in February 2017. From July 2018 to August 2020, Ms. Russell served as the Chief Financial Officer and Executive VP of PDF Solutions, Inc. (Nasdaq: PDFS), a company that offers process software for the semiconductor industry. Prior to that, she was the Chief Financial Officer of Uni-Pixel, Inc. (Nasdaq: UNXL), a company that develops and markets high performance metal mesh capacitive touch sensors, from May 2015 to March 2018, the Chief Financial Officer of Vendavo, Inc., a SaaS model pricing optimization enterprise software company, from May 2014 to March 2015, and the Chief Financial Officer of Evans Analytical Group, a leading international provider of materials characterization and microelectronic failure analysis and “release to production” services, from May 2009 to September 2013. Ms. Russell has served as a director and chair of the audit committee of the board of directors of QuickLogic Corporation (Nasdaq: QUIK), a fabless semiconductor company, since June 2005, and as a director and audit committee member of the board of directors of AXT Inc. (Nasdaq: AXTI), a material science company, since December 2019. Ms. Russell previously served as a director of Silicon Valley Directors’ Exchange (SVDX) and also served as president of Financial Executives International (Silicon Valley Chapter), and as an emeritus member of the business school advisory board at Santa Clara University, Leavey School of Business. Ms. Russell holds a B.A. degree and an M.B.A. in finance from Santa Clara University. We believe that Ms. Russell’s extensive experience, including serving as Chief Financial Officer and in other finance positions at five publicly traded companies, two private equity-backed firms and a number of venture capital backed companies for over the past 30 years qualifies her to serve on our Board of Directors.

Our Board of Directors has determined that, except for Mr. Roy, each individual who currently serves as a member of our Board of Directors is an “independent director” within the meaning of the rules of The Nasdaq Stock Market and the Securities and Exchange Commission (the “SEC”).

The Board of Directors does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board, as the Board of Directors believes it is in the best interests of eGain and its stockholders to evaluate such roles from time to time based on the composition of the Board of Directors and on the input from our independent directors. The Board of Directors has determined that having eGain’s Chief Executive Officer serve as Chairman of the Board is in the best interests of the Company’s stockholders at this time. Our Board of Directors believes that this structure makes the best use of the Chief Executive Officer’s extensive knowledge of the Company and its industry, as well as fosters greater communication between the Company’s management and the Board of Directors.

The Board of Directors also recognized the importance of strong independent board leadership. For that reason, the Board of Directors established the position and responsibilities of Lead Independent Director. Mr. Sinha currently serves as Lead Independent Director. Responsibilities of the Lead Independent Director include presiding over board meetings in the absence of the Chairman of the Board, serving as a liaison between the Chairman of the Board and the independent directors, acting as a liaison to stockholders under appropriate circumstances, and performing such other functions and responsibilities as requested by the Board of Directors from time to time.

Board of Directors - Risk Oversight

Companies, including eGain, face a variety of risks, including credit risk, liquidity risk, currency exchange risk and operational risk. For a detailed discussion of these risks, we encourage you to review the 2021 Annual Report. Our Board of

6

Directors believes an effective risk management system will timely identify the material risks that eGain faces and communicate necessary information with respect to material risks to senior executives. As appropriate, our Board of Directors or its relevant committees have in the past and will in the future implement risk management strategies consistent with the Company’s risk profile and integrate risk management into the Company’s decision-making.

Our Board of Directors retains ultimate oversight over the Company’s risk management. Our Audit Committee takes an active role in overseeing company-wide risk management and discusses risk management processes with our Board of Directors. The Compensation Committee also oversees the Company’s compensation policies and practices to ensure that the Company’s compensation policies and practices do not motivate imprudent risk taking. In addition, our Board of Directors encourages management to promote a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations. Our Board of Directors, with the input of the Company’s executive officers, assesses likely areas of future risk for the Company on an on-going basis.

Our Board of Directors held four regular meetings during fiscal year 2021. Each director attended or participated in 75% or more of the meetings of our Board of Directors and of the committees on which such director served during fiscal year 2021. Three directors attended the 2020 annual meeting of stockholders virtually. While we do not have a formal policy on attendance at our annual meeting of stockholders, we encourage each of the members of our Board of Directors to attend our annual meeting of stockholders.

Our Board of Directors has appointed a Compensation Committee, a Stock Option Committee, a Nominating and Corporate Governance Committee and an Audit Committee. Copies of the charters of the Compensation Committee, Nominating and Corporate Governance Committee and Audit Committee are available on our website at http://www.egain.com/company/investors/governance-documents/.

The members of the Compensation Committee for fiscal year 2021 were independent directors Gunjan Sinha and Brett Shockley. The Compensation Committee held two meetings during fiscal year 2021. The Compensation Committee’s functions are to assist in the implementation of, and provide recommendations with respect to, general and specific compensation policies and practices of eGain. The Compensation Committee operates under the Compensation Committee Charter adopted by our Board of Directors.

The members of the Stock Option Committee for the fiscal year 2021 were Ashutosh Roy and Gunjan Sinha. The Stock Option Committee met or took action by written consent on twelve occasions during fiscal year 2021. The Stock Option Committee’s functions are to grant options to non-officer employees and other service providers of the Company, consistent with eGain’s compensation policies and practices.

The members of the Nominating and Corporate Governance Committee for fiscal year 2021 were independent directors Dr. Phiroz P. Darukhanavala and Christine Russell. The Nominating and Corporate Governance Committee held two meetings during fiscal year 2021. The Nominating and Corporate Governance Committee’s primary functions are to seek and recommend to our Board of Directors qualified candidates for election to our Board of Directors and to oversee matters of corporate governance, including the evaluation of our Board of Directors’ performance and processes as well as the assignment and rotation of members on the committees established by the Board of Directors. The Nominating and Corporate Governance Committee operates under the Nominating and Corporate Governance Committee Charter adopted by our Board of Directors.

The members of the Audit Committee for fiscal year 2021 were independent directors Christine Russell, Brett Shockley and Dr. Phiroz P. Darukhanavala. Christine Russell is currently the “audit committee financial expert” as defined by the rules of the SEC and an “independent director” under the rules of The Nasdaq Stock Market. The Audit Committee held four meetings during fiscal year 2021. The Audit Committee’s functions are to review the scope of the annual audit, monitor the Independent Registered Public Accounting Firm’s relationship with eGain, advise and assist the Board of Directors in evaluating the Independent Registered Public Accounting Firm’s examination, supervise eGain’s financial and accounting organization and financial reporting, and nominate, for approval of the Board of Directors, the Independent Registered Public Accounting Firm whose duty it is to audit the financial statements of eGain for the fiscal year for which it is appointed. The Audit Committee operates under the Audit Committee Charter adopted by our Board of Directors.

7

Stockholder Communications with the Board of Directors

If you wish to communicate with the Board of Directors, you may send your communications in writing to: Secretary, eGain Corporation, 1252 Borregas Avenue, Sunnyvale, California 94089. You must include your name and address in the written communication and indicate whether or not you are a stockholder of the Company. The Secretary will review any communications received from a stockholder, and all material communications from stockholders will be forwarded to the appropriate director or directors or committee of the Board of Directors based on the subject matter.

Our Board of Directors approved a code of ethics applicable to the Board of Directors, senior management, including financial officers, and all other employees. The Code of Ethics and Business Conduct (the “Code of Ethics”), includes standards intended to deter wrongdoing and promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; full, fair, accurate, timely and understandable disclosure in reports filed with the SEC; compliance with laws; prompt internal reporting of violations of the Code of Ethics; and accountability for the adherence to the Code of Ethics. The Code of Ethics is available on our website at http://www.egain.com/company/investors/governance-documents/. Copies of the Code of Ethics are also available in print upon written request to: Secretary, eGain Corporation, 1252 Borregas Avenue, Sunnyvale, California 94089.

The Nominating and Corporate Governance Committee periodically reviews with our Board of Directors the appropriate skills and characteristics required for members of the Board of Directors given the current composition of the Board of Directors. Although we have no formal diversity policy for members of our Board of Directors, the Board of Directors and the Nominating and Corporate Governance Committee believe that our Board of Directors should be comprised of individuals who have a diversity of backgrounds, leadership qualities, a record of success in their arena of activity and who can make substantial contributions to the operations of the Board of Directors. The assessment of Board of Directors candidates includes, but is not limited to, consideration of relevant industry experience, financial experience, general business experience and compliance with independence and other qualifications necessary to comply with any applicable corporate and securities laws and the rules and regulations thereunder. Specific consideration is also given to: contributions valuable to the business community; personal qualities of leadership, character, and judgment: whether the candidate possesses and maintains throughout his or her service on the Board of Directors, a reputation in the community at large, of integrity, competence and adherence to the highest ethical standards; relevant knowledge and diversity of background and experience in such things as business, software development, manufacturing, technology, finance and accounting, marketing, international business, government and the like; and whether the candidate is free of conflicts and has the time required for preparation, participation and attendance at all meetings. There are no formal minimum criteria for director nominees. The Nominating and Corporate Governance Committee does, however, believe it is appropriate for at least one, and preferably multiple, members of the Board of Directors to meet the criteria for an “audit committee financial expert,” as defined by SEC rules, and that a majority of the members of the Board of Directors meet the definition of “independent director” under the rules of The Nasdaq Stock Market. The Nominating and Corporate Governance Committee also believes it is appropriate for certain members of management to serve on the Board of Directors. When evaluating a candidate for the Board of Directors, the Nominating and Corporate Governance Committee does not assign specific weight to any of these factors nor does it believe that all of the criteria necessarily apply to every candidate. A director’s qualifications in light of the above-mentioned criteria are considered at least each time the director is nominated or re-nominated for Board of Directors membership.

8

Identifying and Evaluating Director Nominees

The Nominating and Corporate Governance Committee considers candidates for Board of Directors membership suggested by members of the Board of Directors and management of eGain. The Nominating and Corporate Governance Committee will consider persons recommended by eGain’s stockholders in the same manner as a nominee recommended by members of the Board of Directors or management. A stockholder who wishes to suggest a prospective nominee for the Board of Directors should notify eGain’s Secretary or any member of the Nominating and Corporate Governance Committee in writing with any supporting material the stockholder considers appropriate. After completing the evaluation and review, the Nominating and Corporate Governance Committee makes a recommendation to our full Board of Directors as to the person who should be nominated to the Board of Directors, and our Board of Directors considers the nominee after evaluating the recommendation and report of the Nominating and Corporate Governance Committee. Each director candidate recommended for election at this year’s Annual Meeting is an existing director, seeking re-election to the Board of Directors.

In addition, our Bylaws contain provisions that address the process by which a stockholder may nominate an individual to stand for election to our Board of Directors at our annual meeting of stockholders. In order to nominate a candidate for director, a stockholder must give timely notice in writing to eGain’s Secretary and otherwise comply with the provisions of our Bylaws. To be timely, our Bylaws provide that we must have received the stockholder’s notice not less than 120 days prior to any meeting called for the election of directors; however, if we have not given 100 days’ notice of such meeting, we must have received the stockholder’s notice not later than the close of business on the 7th day following the day on which notice was given. Information required by the Bylaws to be in the notice includes (a) the name, age, business address and, if known, residence address of each nominee proposed in such notice, (b) the principal occupation or employment of each such nominee, (c) the number of shares of our Common Stock which are beneficially owned by each such nominee and by the nominating stockholder, and (d) any other information concerning the nominee that must be disclosed of nominees in proxy solicitations regulated by Regulation 14A of the Securities Exchange Act of 1934, as amended.

Stockholder nominations must be made in accordance with the procedures outlined in, and include the information required by, our Bylaws and must be addressed to: Secretary, eGain Corporation, 1252 Borregas Avenue, Sunnyvale, California 94089.

The non-employee members of the Board of Directors receive compensation in the form of annual cash compensation and equity compensation from time to time. Non-employee directors receive an annual fee of $50,000 in cash payable quarterly, and Mr. Sinha receives an additional annual fee of $10,000, payable quarterly, for his service as Lead Independent Director. eGain last granted options to purchase Common Stock to directors in September 2017, which options vest over four years. Directors are also reimbursed for their expenses for each meeting attended.

The following table details the compensation paid to non-employee directors during fiscal year 2021:

Name |

| Fees earned or paid in cash ($) |

| Option awards ($) (1) |

| Total |

Gunjan Sinha |

| 57,500 |

| 4,733 |

| 62,233 |

Phiroz P. Darukhanavala |

| 50,000 |

| 4,733 |

| 54,733 |

Brett Shockley | | 52,500 | | 4,212 | | 56,712 |

Christine Russell | | 50,000 | | 2,713 | | 52,713 |

| (1) | Amounts reported represent the compensation recognized for financial reporting purposes for fiscal year 2021, in accordance with Financial Accounting Standards Board (“FASB”), Accounting Standards Codification (“ASC”) 718, Compensation—Stock Compensation, excluding forfeitures, utilizing the assumptions discussed in Note 5 to our consolidated financial statements in the 2021 Annual Report. |

9

The following table provides information on the outstanding option awards for each of the non-employee directors as of June 30, 2021:

| | Number of Securities Underlying Unexercised Options (#) | | Option Exercised | | Option Expiration | ||

Name | | Exercisable |

| Unexercisable |

| Price ($) |

| Date |

Gunjan Sinha | | 500 | | — |

| 13.40 |

| 11/8/2023 |

| | 500 | | — |

| 5.31 |

| 11/7/2024 |

| | 500 | | — |

| 4.34 |

| 11/6/2025 |

| | 65,625 | | 4,375 | | 2.50 | | 9/19/2027 |

Total | | 67,125 | | 4,375 |

| |

| |

| | | | | | | | |

Phiroz P. Darukhanavala | | 500 | | — |

| 13.40 |

| 11/8/2023 |

| | 500 | | — |

| 5.31 |

| 11/7/2024 |

| | 500 | | — |

| 4.34 |

| 11/6/2025 |

| | 65,625 | | 4,375 |

| 2.50 |

| 9/19/2027 |

Total | | 67,125 | | 4,375 |

| |

| |

| | | | | | | | |

Brett Shockley | | 38,373 | | 3,894 | | 2.50 | | 09/19/2027 |

Total | | 38,373 | | 3,894 |

| |

| |

| | | | | | | | |

Christine Russell | | 50,000 | | — |

| 1.80 |

| 02/24/2027 |

| | 24,609 | | 1,641 | | 2.50 | | 09/19/2027 |

Total | | 74,609 | | 1,641 |

| |

| |

Compensation Committee Interlocks and Insider Participation

Dr. Darukhanavala and Mr. Shockley, each of whom are non-employee directors, served as members of the Compensation Committee in fiscal year 2021. None of eGain’s executive officers serves as a member of the Board of Directors or Compensation Committee of any entity that has one or more of its executive officers serving as a member of eGain’s Board of Directors or Compensation Committee.

10

The following information is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 or to the liabilities of Section 18 of the Securities Exchange Act of 1934, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate it by reference into such a filing.

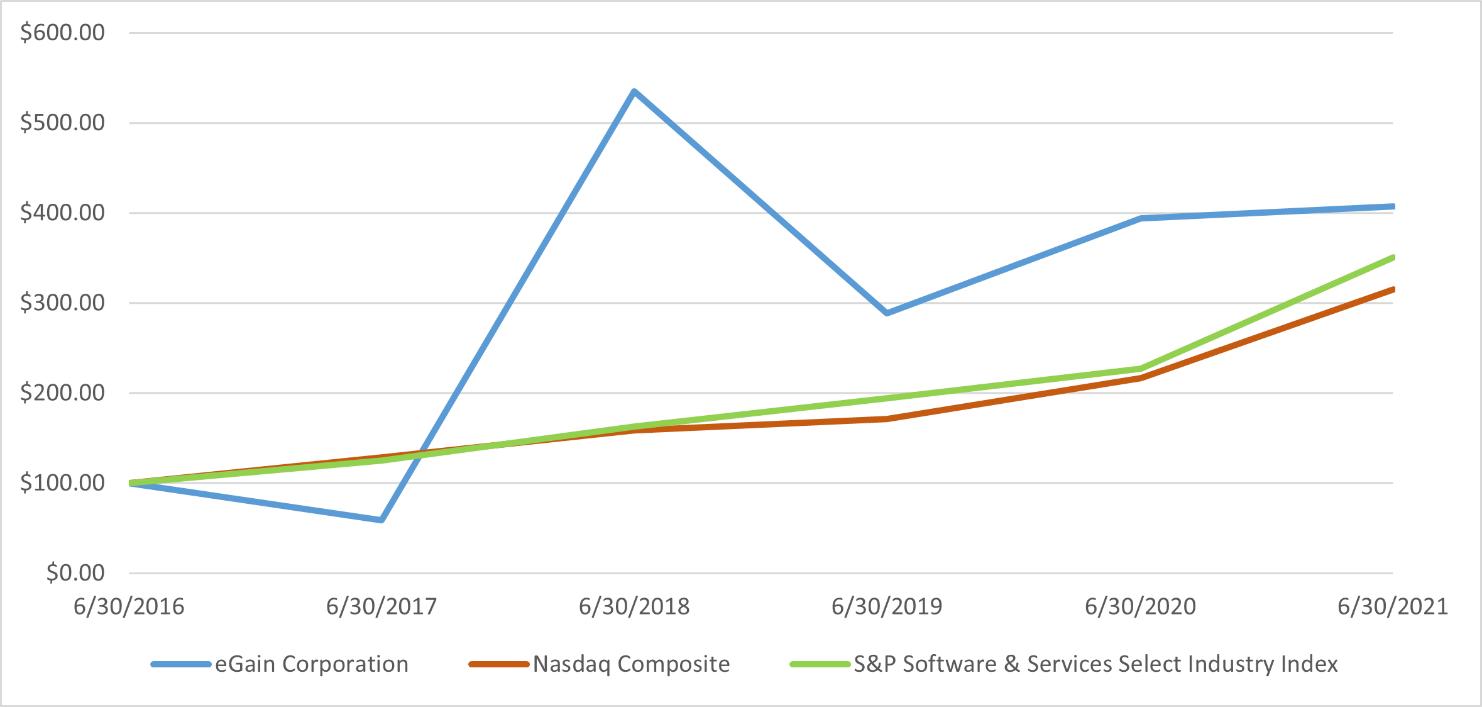

Set forth below is a line graph showing the cumulative total stockholder return (change in stock price plus reinvested dividends) assuming the investment of $100 on June 30, 2016 in each of our Common Stock, the Nasdaq Market Index and the S&P Software & Services Select Industry Index for the period commencing on June 30, 2016 and ending on June 30, 2021. The comparisons in the table are required by the SEC and are not intended to forecast or be indicative of future performance of our Common Stock.

Comparison of Cumulative Total Return Among eGain Corporation,

Nasdaq Market Index and S&P Software & Services Select Industry Index

|

| 06/30/16 |

| 06/30/17 |

| 06/30/18 |

| 06/30/19 |

| 06/30/20 | | 06/30/21 | ||||||

eGain Corporation | | $ | 100.00 | | $ | 58.51 | | $ | 535.46 | | $ | 288.65 | | $ | 393.97 | | $ | 407.09 |

Nasdaq Composite | | $ | 100.00 | | $ | 128.30 | | $ | 158.57 | | $ | 170.91 | | $ | 216.47 | | $ | 315.10 |

S&P Software & Services Select Industry Index | | $ | 100.00 | | $ | 124.89 | | $ | 162.67 | | $ | 194.46 | | $ | 227.05 | | $ | 350.71 |

The Board of Directors recommends a vote “FOR” the election as director of each of the nominees set forth above.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information concerning the beneficial ownership of Common Stock of eGain as of October 13, 2021 for the following:

●each person or entity who is known by eGain to own beneficially more than 5% of the outstanding shares of Common Stock;

●each of our named executive officers included in the 2021 summary compensation table; and

●each of eGain’s current directors and executive officers as a group.

Unless otherwise noted, the address of each named beneficial owner is that of eGain.

The percentage ownership is based on 31,387,974 shares of eGain Common Stock outstanding as of October 13, 2021. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of Common Stock subject to options and warrants held by that person (and only that person) that are currently exercisable or exercisable within sixty (60) days after October 13, 2021. Unless otherwise indicated below, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. In addition to our Chief Executive Officer and Chief Financial Officer, we had only one additional named executive officers during fiscal year 2021.

Name and address of beneficial owner |

| Common Stock beneficially owned (Shares) |

| Common Stock beneficially owned (%) |

Other 5% Stockholders: |

| |

| |

Oaktop Capital Management II, L.P. (1) |

| 2,536,843 |

| 8.1 |

The Vanguard Group (2) | | 1,752,806 | | 5.6 |

| | | | |

Named executive officers and directors: | | | | |

Ashutosh Roy (3) | | 8,973,300 | | 28.2 |

Gunjan Sinha (4) | | 889,128 | | 2.8 |

Promod Narang (5) | | 511,863 | | 1.6 |

Eric N. Smit (6) | | 212,520 | | * |

Phiroz P. Darukhanavala (7) | | 72,333 | | * |

Christine Russell (8) | | 57,083 | | * |

Brett Shockley (9) | | 43,100 | | * |

All current executive officers and directors as a group: (7 persons) | | 10,759,327 | | 33.3 |

* Indicates less than one percent.

| (1) | Based solely on a Schedule 13G filed on February 4, 2020. The mailing address of Oaktop Capital Management II, L.P. is One Main Street, Suite 202, Chatham, NJ 07928. |

| (2) | Based solely on a Schedule 13G filed on February 10, 2021. The Vanguard Group has shared voting power with respect to 27,573 shares and shared dispositive power with respect to 44,588 shares. The Vanguard Group has sole dispositive power with respect to 1,708,218 shares. The mailing address of The Vanguard Group is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

| (3) | All shares are held by Mr. Roy’s living trust, The Roy and Sharma Living Trust, and includes 406,250 shares subject to options exercisable within 60 days of October 13, 2021. Mr. Roy has sole voting and dispositive power over such shares. |

| (4) | Includes 72,333 shares subject to options exercisable within 60 days of October 13, 2021. |

| (5) | Includes 214,395 shares subject to options exercisable within 60 days of October 13, 2021. |

| (6) | Includes 83,333 shares subject to options exercisable within 60 days of October 13, 2021. |

| (7) | Consists of 72,333 shares subject to options exercisable within 60 days of October 13, 2021. |

| (8) | Consists of 57,083 shares subject to options exercisable within 60 days of October 13, 2021. |

| (9) | Includes 43,100 shares subject to options exercisable within 60 days of October 13, 2021. |

12

Delinquent Section 16(a) Reports

To the Company’s knowledge, based solely on a review of such reports furnished to the Company and written representations from the reporting persons, no director, executive officer, or beneficial owner of more than 10% of our Common Stock failed to file a report in a timely manner during fiscal year 2021, except Mr. Sinha filed a Form 4 on July 15, 2020 that was required to be filed by July 6, 2020 regarding shares of Common Stock disposed of on July 2, 2020.

13

The following table sets forth information regarding eGain’s executive officers as of October 13, 2021:

Name |

| Age |

| Position |

Ashutosh Roy |

| 55 |

| Chief Executive Officer and Chairman of the Board |

Eric N. Smit |

| 59 |

| Chief Financial Officer |

Promod Narang |

| 63 |

| Senior Vice President of Products and Engineering |

Ashutosh Roy co-founded eGain and has served as Chief Executive Officer and a Director of eGain since September 1997 and as President since October 1, 2003. From May 1995 through April 1997, Mr. Roy served as Chairman of WhoWhere? Inc., an Internet-services company co-founded by Mr. Roy. From June 1994 to April 1995, Mr. Roy worked at Parsec Technologies, a call center company based in New Delhi, India, which he co-founded. From August 1988 to August 1992, Mr. Roy worked as a software engineer at Digital Equipment Corporation. Mr. Roy holds a B.S. in Computer Science from the Indian Institute of Technology, New Delhi, a Master’s degree in Computer Science from Johns Hopkins University and a M.B.A. from Stanford University. Mr. Roy’s qualifications to serve on our Board of Directors include his industry experience and deep knowledge of eGain from his position as a founder of our Company and as our Chief Executive Officer for over 20 years.

Eric N. Smit has served as Chief Financial Officer since August 2002. Prior to that, Mr. Smit served in a variety of roles at eGain, including Vice President, Operations from April 2001 to July 2002, Vice President, Finance and Administration from June 1999 to April 2001, and Director of Finance from June 1998 to June 1999. From December 1996 to May 1998, Mr. Smit served as Director of Finance for WhoWhere? Inc., an Internet services company. From April 1993 to November 1996, Mr. Smit served as Vice President of Operations and Chief Financial Officer of Velocity Incorporated, a software game developer and publishing company. Mr. Smit holds a Bachelor of Commerce in Accounting from Rhodes University, South Africa.

Promod Narang has served as Senior Vice President of Products and Engineering since March 2000. Mr. Narang joined eGain in October 1998, and served as Director of Engineering prior to assuming his current position. Prior to joining eGain, Mr. Narang served as President of VMpro, a system software consulting company, from September 1987 to October 1998. Mr. Narang holds a Bachelor of Science in Computer Science from Wayne State University.

14

Compensation Discussion and Analysis

Company Philosophy on Compensation

The Compensation Committee of our Board of Directors is responsible for providing oversight and determining our executive compensation programs. To that end, our Compensation Committee reviews corporate performance relevant to the compensation of our executive officers and works with management to establish our executive compensation programs. The general philosophy of our executive compensation program is to:

| ● | encourage creation of stockholder value and achievement of strategic corporate objectives by providing management with long-term incentives through equity ownership by management; |

| ● | provide a competitive total compensation package that enables us to attract and retain, on a long-term basis, high caliber personnel; |

| ● | provide a total compensation opportunity that is competitive with companies in our industry, taking into account relative company size, performance and geographic location, as well as individual responsibilities and performance; |

| ● | provide fair and internally consistent compensation; and |

| ● | other relevant considerations such as rewarding extraordinary performance. |

Our executive compensation program is designed to reward team accomplishments while promoting individual accountability. The combination of incentives is designed to balance annual operating objectives and eGain’s earnings’ performance with longer-term stockholder value creation.

Establishing Compensation

Recommendations for executive compensation are made by our Compensation Committee and approved by the independent members of our Board of Directors. The Compensation Committee may not delegate its authority in these matters to other persons. Our Compensation Committee typically reviews our executive officers’ compensation, including our named executive officers’ compensation, on an annual basis. Our Compensation Committee determines the appropriate levels of compensation to recommend based primarily on:

| ● | competitive benchmarking consistent with our recruiting and retention goals; |

| ● | internal consistency and fairness; and |

| ● | other relevant considerations such as rewarding extraordinary performance. |

In addition, our Compensation Committee evaluated the results of the most recent stockholder advisory vote on executive compensation, where stockholder voting on the proposal strongly supported such executive compensation.

Role of External Compensation Committee Consultant

The Compensation Committee has the independent authority to hire external consultants as well as the sole authority to retain and terminate the services of its consultant. In fiscal year 2021, the Compensation Committee engaged Gallagher Human Resources & Compensation Consulting (“Gallagher”) as its independent consultant. During the course of fiscal year 2021, Gallagher worked directly under the guidance of our Compensation Committee, in cooperation with management, to assist the Compensation Committee with executing its executive compensation-related responsibilities. In such role, the Compensation Committee’s consultant served as an objective third-party advisor in assessing the reasonableness of compensation levels for nine executives to support the Company’s current and future business strategy and human resource objectives.

Based on the data and analysis provided by Gallagher as well as information from management, the Compensation Committee applied business judgment in recommending compensation awards, taking into account the dynamic nature of the SaaS businesses and the adaptability and response required by leadership to manage significant changes that arose during the course of the year. Other than serving as the consultant to the Compensation Committee, Gallagher provides no other services to the Company. The Compensation Committee determined that, based on the factors specified in the exchange listing rules, Gallagher’s services produced no conflicts of interest.

15

Role of CEO and Management

The Chief Executive Officer does not participate in the Compensation Committee’s determination of his own compensation. However, he makes recommendations to the Compensation Committee for each of our named executive officers other than the Chief Executive Officer. The Chief Executive Officer bases these recommendations on his holistic assessment of each executive’s individual performance, as well as overall Company financial goals for the fiscal year as described above. The Compensation Committee reviews and considers the Chief Executive Officer’s recommendations, makes adjustments as it determines appropriate, and approves compensation in its sole discretion.

Use of Peer Company Data

In making its determinations for fiscal year 2022, the Compensation Committee considered publicly available information of a select group of peer companies as well as survey data from the Company’s compensation surveys to inform the pay levels and structures for the senior executive team. All compensation data used was reviewed by Gallagher as the Compensation Committee’s independent compensation consultant. The peer group was selected by the Compensation Committee based on the recommendations of Gallagher of information technology publicly traded companies. For conducting a competitive assessment of the compensation levels for the Company’s executives for fiscal year 2022, Gallagher provided an analysis of, and the Compensation Committee considered, the following peer group of 19 companies: 8x8, Inc., Absolute Software Corporation, American Software, Inc., Asure Software, Inc., Brightcove Inc., Castlight Health, Inc., ChannelAdvisor Corporation, Docebo Inc., Five9, Inc., GTY Technology Holdings Inc., LivePerson, Inc., Mitek Systems, Inc., Model N, Inc., Smith Micro Software, Inc., Sprout Social, Inc., Support.com, Inc., Tecsys Inc., Veritone, Inc. and Xactly Corp.

Compensation Components

Our executive compensation program generally consists of three primary components: base salary, annual non-equity incentives and stock option awards. These primary compensation components are described in more detail below.

Executive officers are also eligible to participate in all of our respective local employee benefits plans, such as medical insurance, life and disability insurance and our 401(k) retirement plan, in each case on the same basis as other employees.

We view the three primary components of executive compensation as related, but we do not believe that compensation should be derived entirely from one component, or that significant compensation from one component should necessarily reduce compensation from other components. Our Compensation Committee has not adopted a formal or informal policy for allocating compensation between long-term and current compensation or between cash and non-cash compensation.

Base Salary

We provide our named executive officers with a base salary to compensate them for services rendered during the fiscal year. We establish base salaries for our executives based on the scope of their responsibilities and experience and take into account competitive market compensation paid by companies in our peer group commensurate for similar responsibilities and positions. We believe that executive base salaries should be targeted to be within the range of salaries for similar positions at comparable companies, which is in line with our compensation philosophy, in order to best attract, retain and motivate our executives. In reviewing compensation of our peer companies, our Compensation Committee takes into account the annual revenues and market size of these companies and other relevant factors it deems appropriate. Our Compensation Committee attempts to establish compensation, particularly base salary, in the same comparable range that our revenues and market size fall when compared to these peer companies. In some cases, our executive compensation may rise above this range due to certain circumstances, such as a strong retention need or an extraordinary performance.

In September 2021, the Board of Directors reviewed the base salaries of our named executive officers, taking into consideration market compensation and the recommendations of our CEO (except with respect to his own base salary), as well as the other factors described above. Following this review, the Compensation Committee determined to prospectively increase the base compensation of Messrs. Smit and Narang, effective as of September 1, 2021, in order to reflect merit raises and increases to make the base salaries more competitive relative to the market.

We attempt to review base salaries annually and adjust base salaries from time to time to ensure that our compensation programs remain competitive with market levels.

16

The base salary for each of our named executive officers as of September 1, 2021 was as follows:

Name |

| Base Salary | | Percentage Adjustment | |

Ashutosh Roy |

| 250,000 | | — | |

Eric N. Smit |

| 320,000 | | 3.2 | % |

Promod Narang |

| 300,000 | | — | |

Annual Non-Equity Incentive Plan Compensation

Currently, most eGain employees participate in either a non-equity incentive plan tied primarily to revenue or bookings metrics or, in the case of sales representatives and managers, a commission plan tied primarily to revenue and bookings metrics. The plans are designed to provide awards to employees as an incentive to contribute to eGain’s continued growth.

Amounts paid to our named executive officers pursuant to our non-equity incentive plan are contingent upon the attainment of certain performance targets established by our Compensation Committee and Board of Directors and are made in accordance with our executive compensation strategy. For fiscal year 2021, 100% of the target for each executive officer was tied to company performance. The performance targets may include:

| ● | financial metrics, such as new cloud and license bookings, annualized contract value, revenues, operating income, cash flow, cash balances, days sales outstanding; and |

| ● | business operational metrics, such as customer satisfaction, customer retention, operational efficiencies, product delivery and product quality. |

Amounts paid to our named executive officers pursuant to our commission plan are contingent upon the attainment of certain sales targets established by our Compensation Committee and Board of Directors and are made in accordance with our executive compensation strategy. The sales targets include financial metrics such as SaaS revenue, new hosting bookings and professional services invoiced.

Stock Option Awards

We believe the use of stock-based awards for our named executive officers is a strong compensation tool that encourages officers to act in a manner that leads to long-term company success. We believe this type of compensation aligns our executive officers’ performance with the interests of our long-term investors by rewarding our officers through equity appreciation. The stock-based incentive program for the entire Company, including executive officers, currently consists of only stock option grants, but we may introduce in the future different types of equity awards or instruments to remain competitive in the compensation we pay our employees.

Our Stock Option Committee approves grants of proposed stock options awards and administers our stock option plans consistent with the compensation policies and practices as set by our Compensation Committee. Proposed stock option awards to our executive officers are presented to our entire Board of Directors for consideration. The Stock Option Committee normally grants options to executive officers upon the hiring of an executive officer, as part of an annual review, and as special circumstances arise. The exercise price of our stock option awards is based on the closing price of our Common Stock on The Nasdaq Stock Market on the date such stock option award is approved. Except with respect to new hire grants, proposals for significant stock option awards to our executive officers are not considered during our established “blackout period,” which commences 20 days prior to the end of each fiscal quarter and ends the trading day following the announcement of earnings for such fiscal quarter. Except for such proposed stock option awards to our executive officers, we intend to grant options in accordance with the foregoing procedures without regard to the timing of the release of material non-public information, such as an earnings announcement.

Other Benefits

In addition to the compensation opportunities we describe above, we also provide our named executive officers and other employees with benefits, such as medical insurance, life and disability insurance and our 401(k) retirement plan, in each case on the same basis as other employees.

17

Effective July 1, 2014, the Company began contributing 50% of employee contributions up to a maximum of 6% of the total employee salary.

Defined Pension Plan

None of our named executive officers participate in or have account balances in qualified or non-qualified defined benefit plans sponsored by us. We do not offer such qualified or non-qualified defined benefit plans to our executives because we believe that such defined benefit plans are not typical for similar companies in both our industry and geographic region. We may elect to adopt qualified or non-qualified defined benefit plans if our Compensation Committee and Board of Directors determine that doing so is in our best interests.

Change of Control Benefits

On November 2, 2015, the Board of Directors approved a form of change of control and severance agreement and authorized the Company to enter into that standard form agreement with several of the Company’s employees and executive officers, including named executive officers Eric N. Smit and Promod Narang, but not including, at this time, Ashutosh Roy.

The form of change of control and severance agreement has an initial term of one year, which term automatically renews for additional one-year periods unless either party provides written notice of non-renewal at least 60 days prior to the date of automatic renewal and which term extends for one year from a “change of control,” as defined in the agreement. Pursuant to the agreement, if the individual is terminated by us without “cause” (as defined in the agreement), or terminates his or her employment for “good reason” (as defined in the agreement), each during a period not within two months prior to and ending 12 months following a change of control, or the “change of control period” (as defined in the agreement), he or she is entitled to six months of salary continuation from the termination date plus 50% of the individual’s target bonus in the year of termination and six months of accelerated vesting of any outstanding equity awards.

The receipt of the above-described benefits is subject to the individual executing a release of certain claims against us. Further, in either of the above situations the individual will also be reimbursed (or receive payments in lieu of such reimbursements) if he or she elects and pays to continue health insurance under the Consolidated Omnibus Budget Reconciliation Act of 1985 for any premiums paid for continued health benefits for the individual and his or her eligible dependents until the earlier of (i) six months following the termination date or (ii) the date upon which the executive and his or her eligible dependents become covered under similar plans.

18

The following table provides hypothetical amounts of cash severance payments related to salary, non-equity incentive plan compensation, equity incentive plan compensation and all other compensation had a change in control of our Company occurred on June 30, 2021, with a price per share equal to $11.66, the closing market price as of June 29, 2021, and the employment of the following officers was terminated without cause or the officers resign for good reason within the first twelve months following a change in control (based on salary and other compensation arrangements as of June 30, 2021):

Name and principal position |

| Salary | | Non-equity incentive plan compensation | | Equity incentive plan compensation | | All other compensation |

| Total |

Eric N. Smit | | 155,000 | | 45,000 | | 326 | | 3,216 |

| 203,542 |

Promod Narang |

| 150,000 | | 45,000 | | 326 | | 3,809 |

| 199,135 |

| (1) | Represents 50% of each of the officer’s salary as of June 30, 2021. |

| (2) | Represents 50% of the hypothetical non-equity incentive plan compensation amount that would be subject to approval by our Compensation Committee and Board of Directors relating to fiscal year 2021. |

| (3) | Represents estimated stock-based compensation expense of options outstanding as of June 30, 2021 that hypothetically would have vested over a term of six months after June 30, 2021 had the employment of each of the named executive officers continued. |

| (4) | Represents payroll benefits that hypothetically would have been provided for a term of six months after June 30, 2021 had the employment of each of the named executive officers continued. |

Change in control provisions were not in effect for Mr. Roy as of June 30, 2021.

Non-qualified Deferred Compensation

None of our named executive officers participate in or have account balances in non-qualified defined contribution plans or other deferred compensation plans maintained by us. To date, we have not had a significant reason to offer such non-qualified defined contribution plans or other deferred compensation plans. We may elect to provide our officers and other employees with non-qualified defined contribution or deferred compensation benefits if our Compensation Committee and Board of Directors determine that doing so is in our best interests.

Section 162(m) Treatment Regarding Performance-Based Equity Awards

Under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), we may not receive a federal income tax deduction for compensation paid to our Chief Executive Officer, Chief Financial Officer or up to three additional executive officers whose total compensation is required to be reported in our Proxy Statement to the extent that any of these persons receives more than $1,000,000 in compensation in the taxable year. We intend to preserve the deductibility of compensation payable to our executives, although deductibility will be only one of the many factors considered in determining appropriate levels or modes of compensation.

Hedging Transactions

The Board of Directors has not adopted, and we do not have, any specific practices or policies regarding the ability of our officers and directors to purchase financial instruments, or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of shares of our Common Stock.

19

The following report of the Compensation Committee does not constitute soliciting material and shall not be deemed filed or incorporated by reference into any other filing by eGain under the Securities Act of 1933 or the Securities Exchange Act of 1934.

The Compensation Committee of our Board of Directors has reviewed and discussed the Compensation Discussion and Analysis with management. Based on this review and discussion, the Compensation Committee recommended to our Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement on Schedule 14A for the Annual Meeting, which is incorporated by reference in the 2021 Annual Report, each as filed with the SEC.

| |

| Compensation Committee |

| |

| Gunjan Sinha |

| Brett Shockley |

| |

20

2021 Summary Compensation Table

The following table summarizes information concerning compensation earned by our Chief Executive Officer (principal executive officer) and our two other most highly compensated executive officers during the fiscal year ended June 30, 2021. These individuals are referred to as our “named executive officers.”

Name and principal position |

| Fiscal year |

| Salary |

| Option |

| Non-equity |

| All other |

| Total |

Ashutosh Roy |

| 2021 |

| 250,008 |

| 13,522 |

| — |

| — |

| 263,530 |

Chief Executive Officer | | 2020 |

| 250,008 |

| 36,869 |

| — |

| — |

| 286,877 |

| | 2019 |

| 250,008 |

| 70,956 |

| — |

| — |

| 320,964 |

| | | | | | | | | | | | |

Eric N. Smit |

| 2021 | | 310,000 | | 7,572 | | 90,000 | | 5,038 | | 412,610 |

Chief Financial Officer | | 2020 |

| 318,750 |

| 20,647 |

| 90,000 |

| 5,338 |

| 434,735 |

| | 2019 |

| 269,792 |

| 40,336 |

| 75,000 |

| 3,552 |

| 388,680 |

| | | | | | | | | | | | |

Promod Narang |

| 2021 | | 300,000 | | 7,572 | | 90,000 | | 10,806 | | 408,378 |

Senior Vice President of Products and Engineering | | 2020 |

| 306,250 |

| 20,646 |

| 90,000 |

| 5,700 |

| 422,596 |

| | 2019 |

| 269,792 |

| 41,297 |

| 75,000 |

| 3,438 |

| 389,526 |

| (1) | Amounts reported represent the compensation recognized for financial reporting purposes for fiscal year 2021, in accordance with ASC 718, Compensation—Stock Compensation, excluding forfeitures, utilizing the assumptions discussed in Note 5 to our consolidated financial statements in the 2021 Annual Report. |

| (2) | Reflects the amount approved by our Compensation Committee and Board of Directors as cash incentive to executive officers based upon satisfaction of the criteria established under our non-equity incentive plan and commission plan. See “Compensation Components—Annual Non-Equity Incentive Plan Compensation” for discussion. |

| (3) | Amounts reported for Mr. Smit and Mr. Narang represent 401(k) employer matching contribution and certain medical reimbursement. |

21

Outstanding Equity Awards at Fiscal Year End

The following table provides information on the outstanding option awards held by each of our named executive officers as of June 30, 2021:

| | Number of Securities Underlying Unexercised Options (#) | | Option Exercise | | Option Expiration | | | |||

Name |

| Exercisable |

| Unexercisable |

| Price ($) | | Date | | | |

Ashutosh Roy | | 200,000 | | — | | $ | 5.28 | | 02/28/2022 | | (1) |

| | 187,500 | | 12,500 | | $ | 2.50 | | 09/19/2027 | | (1) |

Total | | 387,500 | | 12,500 | | | | | | | |

| | | | | | | | | | | |

Eric N. Smit | | 31,000 | | — | | $ | 6.29 | | 09/11/2024 | | (1) |

| | 57,000 | | 7,000 | | $ | 2.50 | | 09/19/2027 | | (1) |

Total | | 88,000 | | 7,000 | | | | | | | |

| | | | | | | | | | | |

Promod Narang | | 100,000 | | — | | $ | 6.29 | | 09/11/2024 | | (1) |

| | 105,000 | | 7,000 | | $ | 2.50 | | 09/19/2027 | | (1) |

Total | | 205,000 | | 7,000 | | | | | | | |

| (1) | Shares vest in equal monthly installments over 4 years. |

Options Exercised During Fiscal Year 2021

Name (1) |

| Options exercised |

| Value realized on exercise |

Eric N. Smit |

| 60,000 |

| 708,984 |

22

PROPOSAL 3

AMENDMENT TO THE AMENDED AND RESTATED 2005 STOCK INCENTIVE PLAN

On October 11, 2021, our Board unanimously approved an amendment to the eGain Corporation Amended and Restated 2005 Stock Incentive Plan (as proposed to be amended, the “2005 Stock Incentive Plan”), subject to stockholder approval. If the amendment is approved by stockholders, the number of shares of Common Stock reserved for issuance under the 2005 Stock Incentive Plan will be increased by 1,000,000 shares from 6,460,000 shares to 7,460,000 shares (the “Stock Incentive Plan Amendment Proposal”).

We are requesting that our stockholders approve the Stock Incentive Plan Amendment Proposal.