Form POS AM BRIGHTHOUSE LIFE INSURAN

REGISTRATION

STATEMENT FILE NO. 333-265199

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 2

ON FORM S-3 TO FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

UNDER THE SECURITIES ACT OF 1933

BRIGHTHOUSE LIFE INSURANCE COMPANY OF NY

(Exact name of registrant as specified in its charter)

New York

(State or other jurisdiction of incorporation or organization)

6311

(Primary Standard Industrial Classification Code Number)

13-3690700

(I.R.S. Employer Identification Number)

285 Madison Avenue, New York, NY 10017

(980) 365-7100

(980) 365-7100

(Address, including zip code, and telephone number, including area code, of registrant’s principal

executive offices)

Brighthouse Life Insurance Company of NY

c/o C T Corporation System

28 Liberty Street

New York, NY 10005

(800) 448-5350

c/o C T Corporation System

28 Liberty Street

New York, NY 10005

(800) 448-5350

(Name, address, including zip code, and telephone number, including area code, of agent for

service)

Copies to:

Dodie Kent

Eversheds Sutherland (US) LLP

1114 Avenue of the Americas, 40th Floor

New York, NY 10036

Eversheds Sutherland (US) LLP

1114 Avenue of the Americas, 40th Floor

New York, NY 10036

As soon as practicable following the effectiveness of the registration statement

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to

Rule 415 under the Securities Act of 1933,

check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If this Form is a post-effective amendment filed pursuant to rule 462(d) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

Indicate by

check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer filer ☐ |

Accelerated filer filer ☐ |

| Non-accelerated filer ☒ (Do not check if a smaller reporting company) |

Smaller reporting company filer ☐ |

| |

Emerging growth company filer ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of

the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective

date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section

8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may

determine.

Explanatory Note

Brighthouse Life Insurance Company of NY (“BLNY”) is changing the registration form for the Contracts from Form S-3 to Form S-1 to facilitate BLNY’s intended reliance on Rule 12h-7 under the Securities Exchange Act of 1934 (the “1934 Act”). Rule 12h-7 exempts insurance companies from the 1934 Act’s periodic and current reporting requirements with respect to non-variable insurance products that are registered under the Securities Act of 1933, provided that certain

conditions are satisfied. While registration on Form S-1 is not an express condition of Rule 12h-7, the eligibility requirements of Form S-3 require a registrant to file 1934 reports, making reliance on Rule 12h-7 and registration on Form

S-3 generally incompatible.

BLNY decided to register the Contracts on Form S-3 in order to realize the

benefits associated with that registration form (e.g., shorter-form prospectus and forward incorporated by reference). In light of certain business decisions, BLNY has decided

that suspending 1934 Act reporting (by relying on Rule 12h-7) outweighs the benefits associated with Form S-3. Accordingly, BLNY is taking the necessary step of registering the

Contracts on Form S-1.

The information in this prospectus is not complete and may be changed. We may not sell

these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

BRIGHTHOUSE SHIELD® LEVEL SELECT 6-YEAR ANNUITY

Brighthouse Shield® Level Select 6-Year Annuity is an individual single premium deferred index-linked separate account annuity contract

(the “Contract”) issued by Brighthouse Life Insurance Company of NY (“BLNY,” “we”, “our” or “us”).

This Contract is available for use in connection with Non-Qualified Plans, Traditional IRAs and Roth IRAs. This version of the Contract is only available in New York state.

BLNY is located at 285 Madison Avenue, New York, NY 10017. The telephone number is

1-888-243-1932. Brighthouse

Securities, LLC, 11225 North Community House Road, Charlotte, NC 28277, is the principal underwriter and distributor of the Contracts.

The Risk Factors for this Contract appear on Page 14.

Please read the prospectus carefully before investing and keep it for future

reference. This prospectus includes important information including a description of all material features, rights and obligations of the Contract. BLNY’s

obligations under the Contract are subject to our financial strength and claims-paying ability. The Contract offers various Shield Options which provide certain protections in that

the Company will absorb specified levels of negative indexed returns. Index-linked annuity contracts are complex insurance and investment vehicles. Before you invest, be sure to ask your financial representative about the Contract’s features, benefits, risks and

fees, and whether the Contract is appropriate for you based upon your financial situation and objectives.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved these securities or the adequacy of this prospectus. Any representation to the contrary is a criminal offense. Mutual funds, annuities and insurance products are not deposits of any bank, and are not insured or guaranteed by the Federal Deposit Insurance Corporation (the “FDIC”) or any other government agency. You may lose money invested in the Contract.

The Contracts may be distributed through broker-dealers that have relationships with banks or other financial institutions or by employees of such banks. However, the Contracts are not deposits or obligations of, or guaranteed by such institutions or any Federal regulatory agency. Investment in the Contracts involves investment risks, including possible loss of principal.

The principal underwriter of the Contract is Brighthouse Securities, LLC. The offering of the Contract is intended to be continuous.

Prospectus dated [ ]

TABLE OF

CONTENTS

| 5 | |

| 5 | |

| 6 | |

| 10 | |

| 10 | |

| 14 | |

| 17 | |

| 18 | |

| 18 | |

| 18 | |

| 18 | |

| 18 | |

| 19 | |

| 19 | |

| 20 | |

| 20 | |

| 21 | |

| 21 | |

| 21 | |

| 22 | |

| 22 | |

| 22 | |

| 22 | |

| 22 | |

| 23 | |

| 23 | |

| 23 | |

| 24 | |

| 27 | |

| 27 | |

| 27 | |

| 27 | |

| 29 | |

| 29 | |

| 30 | |

| 31 | |

| 31 | |

| 31 | |

| 35 | |

| 37 | |

| 37 | |

| 37 | |

| 38 | |

| 38 | |

| 38 | |

| 38 |

2

| 40 | |

| 40 | |

| 40 | |

| 40 | |

| 40 | |

| 41 | |

| 41 | |

| 42 | |

| 42 | |

| 49 | |

| 50 | |

| 50 | |

| 50 | |

| 50 | |

| 50 | |

| 50 | |

| 50 | |

| 51 | |

| 51 | |

| 51 | |

| 51 | |

| 51 | |

| 52 | |

| 52 | |

| 52 | |

| 53 | |

| 53 | |

| 53 | |

| 54 | |

| 55 | |

| 55 | |

| 55 | |

| 55 | |

| 55 | |

| 55 | |

| 55 |

3

AVAILABLE INFORMATION AND INCORPORATION BY REFERENCE

Incorporation by Reference

Under the Securities Act of 1933, BLNY has filed with the SEC a registration statement (the “Registration Statement”) relating to the Contracts offered by this prospectus. This prospectus has been filed as a part of the Registration Statement and does not contain all of the information set forth in the Registration Statement and the exhibits and reference is hereby made to such Registration Statement and exhibits for further information relating to BLNY and the Contracts.

This prospectus incorporates by reference the following documents:

The Annual Report contains additional information about BLNY, including audited financial statements for BLNY’s latest fiscal year. If requested, BLNY will furnish to each person to whom a copy of this prospectus has been delivered, without

charge, a copy of any document referred to above which has been incorporated by reference into this prospectus but has not been delivered with this prospectus, including any exhibits that are specifically incorporated by reference in them. You may direct your requests for copies to BLNY at, 285 Madison Avenue, New York, NY 10017. The telephone number is

1-888-243-1932. You may also access the incorporated reports and other documents at

www.brighthousefinancial.com.

The SEC maintains an internet site that contains

reports, proxy statements, and other information regarding issuers that file electronically with the SEC (http://www.sec.gov).

STATUS PURSUANT TO SECURITIES EXCHANGE ACT OF

1934

As of the date of this prospectus, BLNY relies on the exemptions provided by

Rule 12h-7 under the Securities Act of 1934 from the requirement to file reports pursuant to Section 15(d) of that Act.

5

Special Terms

In this prospectus, the following capitalized terms have the indicated meanings:

Account Value. The total of the Fixed Account Value and the value of the Shield

Option(s) under the Contract during the Accumulation Period.

Accrued Cap Rate. The portion of the Cap Rate that has accrued from the Term Start

Date to any day within the Term. This is the maximum Index Performance that may be applied in calculating the Interim Value on any day prior to the Term End Date if Index Performance is greater than zero. The Accrued Cap Rate is equal to the Cap Rate multiplied by the number of days

elapsed since the Term Start Date, divided by the total number of days in the Term.

Accrued Shield Rate. The portion of the Shield Rate that has accrued from the Term

Start Date to any day within the Term. This is the amount that will be applied in calculating the Interim Value on any day prior to the Term End Date if Index Performance is less than zero. The Accrued Shield Rate is equal to the Shield Rate multiplied by the number of days elapsed since the Term Start Date, divided by the total number of days in the Term.

Accrued Step Rate. The portion of the Step Rate that has accrued from the Term

Start Date to any day within the Term. This is the rate that will be applied in calculating the Interim Value on any day prior to the Term End Date if Index Performance is

equal to or greater than zero. The Accrued Step Rate is equal to the Step Rate multiplied by the number of days elapsed since the Term Start Date, divided by the total number of days in the Term.

Accumulation Period. The period prior to the Annuity Date.

Annuitant. The

natural person(s) listed on the Contract Schedule on whose life Income Payments are based. Any reference to Annuitant will also include any Joint Annuitant under an Annuity

Option.

Annuity Date. A date on which you choose to begin receiving Income Payments. If we agree, you may change the Annuity Date,

subject to certain requirements. If you do not choose an Annuity Date, the Annuity Date will be the Annuity Date indicated on the Contract Schedule.

Annuity Service Office. The office indicated on the Contract Schedule to which notices and requests must be sent, or as otherwise changed

by Notice from us.

BLNY (“we,” “us,”

“our”). Brighthouse Life Insurance Company of NY.

Beneficiary. The person(s) or entity(ies) you name to receive a death benefit

payable under the Contract upon the death of the Owner or a Joint Owner, or in certain circumstances, an Annuitant.

Brighthouse

Securities. Brighthouse Securities, LLC.

Business Day. Our “business day” is generally any day the NYSE is open

for regular trading. For purposes of administrative requests and transactions, a Business Day ends at 4:00 PM Eastern Standard Time. If the SEC determines the existence of

emergency conditions on any day, and consequently, the NYSE does not open, then that day is not a Business Day.

Cap Rate. The maximum rate that may be credited at the Term End Date based on Index Performance. The Cap Rate may

vary between Shield Options and it is not an annual rate.

Code. The Internal Revenue Code of 1986, as amended, and all related laws and

regulations, which are in effect during the term of the Contract.

Contract. The legal agreement between you and BLNY. It contains relevant provisions of your

deferred annuity.

Contract Anniversary. An anniversary of the Issue Date of the Contract.

Contract Schedule. The schedule attached to your Contract.

Contract Year. A

one-year period starting on the Issue Date and on each Contract Anniversary thereafter.

Death Benefit Amount. For Owners age 76 or older at the Issue Date of

the Contract, the standard death benefit is the Account Value. For Owners age 75 or younger at the Issue Date of the Contract, the standard death benefit (known as the Return of Premium death benefit) is the greater of the Account Value or your Purchase Payment (reduced proportionally by the percentage reduction in Account Value of the Shield Option(s) and the Fixed Account for each partial withdrawal (including any applicable Withdrawal Charge)). The Death Benefit Amount is determined as of the end of the Business Day on which we have

received Notice of due proof of death and an acceptable election for the payment method.

ERISA. Employee Retirement Income Security Act of 1974, as amended.

Exchange Act. Securities

Exchange Act of 1934, as amended.

6

FDIC. Federal Deposit Insurance Corporation.

FINRA. Financial Industry Regulatory Authority.

Fixed

Account. An account, if available, that consists of all of the assets under the Contract other than those in the Separate Account. You may allocate your Purchase Payment or transfer your Investment Amount to the Fixed Account. The

Fixed Account is part of the General Account assets of BLNY.

Fixed Account Value. The initial Fixed Account Value is the amount of

your Purchase Payment initially allocated to the Fixed Account. Thereafter, the Fixed Account Value equals: (a) the initial Fixed Account Value or the Fixed Account Value on

the most recent Contract Anniversary, including any transfers, whichever is applicable; plus (b) any interest credited by us; less (c) the amount of any withdrawals including any Withdrawal Charges; and less (d) any Premium or Other Taxes, if applicable.

Free Look. If you change your mind about owning the Contract, you can cancel it within 10 days after receiving it. This is known as

a “Free Look.” We ask that you submit your request to cancel in writing, signed by you, to us (e.g., the Annuity Service Office) or to the financial

representative who sold it. When you cancel the Contract within this Free Look period, we will not assess a Withdrawal Charge. You will receive (i) whatever your Contract is

worth on the day that we receive your cancellation request, plus (ii) the sum of all fees, taxes and charges deducted from the Purchase Payment during the Free Look period. The amount you receive may be more or less than your Purchase Payment depending upon the Shield Options you

allocated your Purchase Payment to during the Free Look period. This means that you bear the risk of any decline in the Account Value of your Contract during the Free Look

period.

Free Withdrawal Amount. The Free Withdrawal Amount in the first Contract Year is zero. Thereafter, the Free Withdrawal Amount each Contract Year

is equal to 10% of your Account Value as of the prior Contract Anniversary, less the total amount withdrawn from the Account Value in the current Contract Year. The Free

Withdrawal Amount is non-cumulative and is not carried over to other Contract Years.

General Account. Comprised of BLNY’s assets, other than assets in any separate accounts it

may maintain.

Good Order. A request or transaction generally is considered in “Good Order” if it complies with our administrative

procedures and the required information is complete and accurate. A request or transaction may be rejected or delayed if not in Good Order. Good Order generally means the actual receipt by us of the instructions relating to the requested transaction in writing (or, when permitted, by telephone) along with all forms, information and supporting legal documentation necessary to effect the transaction. This information and documentation generally includes to the extent applicable to the transaction: your completed application; your contract number; the transaction amount (in dollars or percentage terms); the names and

allocations to and/or from the Shield Options, or the Fixed Account if applicable, affected by the requested transaction; the signatures of all Contract Owners (exactly as indicated on the contract), if necessary; Social Security Number or Tax I.D.; and any other information or supporting documentation that we may require, including any spousal or Joint Owner’s consents. With respect to purchase payments, Good Order also generally includes receipt by us of sufficient funds to effect the

purchase. We may, in our sole discretion, determine whether any particular transaction request is in Good Order, and we reserve the right to change or waive any Good Order requirement at any time. If you have any questions, you should contact

us or your financial representative before submitting the form or request.

Income Payments. A series of payments made by us during the Income Period, which we guarantee as

to dollar amount.

Income Period. A period starting on the Annuity Date during which Income Payments are payable.

Index (Indices). We currently offer Shield Options with indices based

on the performance of securities. In the future we may offer Shield Options based on other types of Indices. We may also add other indices for new Contracts at our

discretion.

Index Performance. The percentage change in the Index Value measured from the Term Start Date to any day, including the Term End

Date, within the Term. Index Performance can be positive, zero or negative.

Index Value. The Index Value of an Index, on a Business Day, is the published

closing value of the Index on that Business Day. The Index Value on any day that is not a Business Day is the value as of the prior Business Day.

Interest Rate Term. The length of time over which the current Fixed Account interest rate is guaranteed. No Interest Rate Term will

extend beyond the Annuity Date. The minimum Interest Rate Term depends on the date your Contract is issued but will not be less than one (1) year.

Interest Rate Term End

Date. The Contract Anniversary on which an Interest Rate Term ends.

Interest Rate Term Start Date. The Contract Anniversary on which an Interest Rate

Term is established. If chosen at issue, the initial Interest Rate Term Start Date begins on the Issue Date or otherwise it will begin on the first Contract Anniversary in

which you allocate to the Fixed Account.

7

Interim Value. For each Shield Option, the value we assign on any Business Day

prior to the Term End Date. During the Transfer Period, the Interim Value of each Shield Option will equal the Investment Amount in that Shield Option. After the Transfer Period, the Interim Value of that Shield Option is equal to the Investment Amount in the Shield Option, adjusted for the Index Performance of the associated Index and subject to the applicable Accrued Shield Rate, Accrued Cap Rate or Accrued

Step Rate. The Interim Value is the amount that is available for annuitization, death benefits, withdrawals and Surrenders.

Investment Amount. The Investment Amount, for each Shield Option, is the amount that is allocated to the Shield Option and

subsequently reflects all withdrawals and adjustments at the Term End Date. The Investment Amount will be reduced for any withdrawal by the same percentage that the withdrawal

reduces the Interim Value attributable to that Shield Option.

Issue Date. The date the Contract is issued.

Joint Annuitant. If there is more than one Annuitant, each Annuitant will be a Joint Annuitant of

the Contract.

Joint Owner. If there is more than one Owner, each Owner will be a Joint Owner of the Contract. Joint Owners are limited to

natural persons.

Maturity Date. The Maturity Date is specified in your Contract and is the first

day of the calendar month following the Annuitant’s 90th birthday or 10 years from the date we issue your Contract, whichever is later. The Contract will be annuitized

at the Maturity Date.

Minimum Account Value. $2,000. If your Account Value falls below

the Minimum Account Value as a result of a withdrawal we will treat the withdrawal request as a request for a full withdrawal.

Minimum Guaranteed Cap Rate. The actual Minimum Guaranteed Cap Rate for your Contract is the amount shown on your Contract Schedule but will not be

less than 2% for Shield Options with a 1-Year Term, 6% for Shield Options with a 3-Year Term and 8% for Shield Options with a 6-Year Term.

Minimum Guaranteed Interest Rate. The current Minimum Guaranteed Interest Rate will not be less than 1%. This interest rate is guaranteed to be a

rate not less than the minimum interest rate allowed by state law—see Appendix D. The actual Minimum Guaranteed Interest Rate for your Contract is the amount shown on your

Contract Schedule and applies only to amounts in the Fixed Account.

Minimum Guaranteed Step Rate. The actual Minimum Guaranteed Step Rate for your

Contract is the amount shown on your Contract Schedule but will not be less than 1.5%.

Notice. Any form of communication providing information we need, either in a

signed writing or another manner that we approve in advance. All Notices to us must be sent to our Annuity Service Office and received in Good Order. To be effective for a Business Day, a Notice must be received in Good Order prior to the end of that Business Day.

NYSE. New York Stock Exchange.

Owner (“you”, “yours”). The person(s) entitled to the ownership rights under the Contract. Subject to our administrative procedures, we

may also permit ownership by a corporation (a type of non-natural person) or certain other legal entities. If Joint Owners are named, all references to Owner shall mean Joint

Owners.

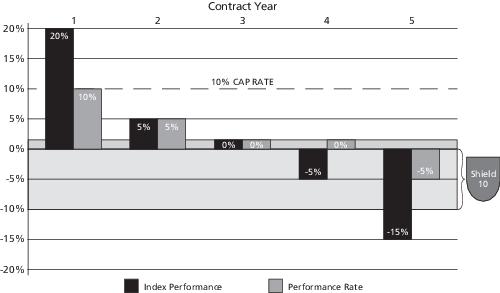

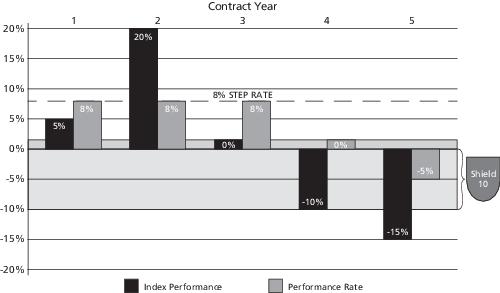

Performance Rate. The rate credited at the Term End Date. The Performance Rate is based on the Index Performance, adjusted for the

applicable Shield Rate, Cap Rate or Step Rate. The Performance Rate can be positive, zero or negative. At the end of the Term, any increase or reduction in the Investment Amount

in a particular Shield Option is determined by multiplying the Performance Rate by the Investment Amount of the Shield Option on the last day of the Term.

Performance Rate Adjustment. The adjustment made to the Investment Amount for each Shield Option on any day during the Term, up to, and

including, the Term End Date. Prior to the Term End Date, this adjustment is based on the Index Performance of the associated Index for a particular Term, subject to any

applicable Accrued Shield Rate, Accrued Cap Rate or Accrued Step Rate. On the Term End Date, this adjustment is based on the Performance Rate. This adjustment can be positive,

zero or negative. When the Performance Rate Adjustment is positive we may also refer to this adjustment as “earnings.” When the Performance Rate Adjustment is negative we may also refer to this adjustment as “losses.”

Premium Tax. The amount of tax, if any, charged by the state or

municipality. New York state does not currently assess Premium Taxes on Purchase Payments.

Purchase Payment. The amount paid to us under the Contract as consideration for the benefits it

provides.

Rate Crediting Type. Either the Cap Rate or the Step Rate.

RMD. Required Minimum Distribution.

8

SEC. Securities and Exchange Commission.

Separate Account. The separate account is Brighthouse Separate Account SA II.

Shield 10. The Contract provides downside protection through the Shield 10, which is a

Shield Rate where negative Index Performance of up to 10% of your Investment Amount is absorbed by us at the Term End Date, which would leave you to absorb any remaining negative Index Performance of up to 90% of your Investment Amount.

Shield 15. The Contract provides downside protection through the

Shield 15, which is a Shield Rate where negative Index Performance of up to 15% of your Investment Amount is absorbed by us at the Term End Date, which would leave you to absorb any remaining negative Index Performance of up to 85% of your Investment Amount.

Shield 25. The Contract provides downside protection through the

Shield 25, which is a Shield Rate where negative Index Performance of up to 25% of your Investment Amount is absorbed by us at the Term End Date, which would leave you to absorb any remaining negative Index Performance of up to 75% of your Investment Amount.

Shield Rate. The amount of any negative Index Performance that is

absorbed by us at the Term End Date. Any negative Index Performance beyond the Shield Rate will reduce the Investment Amount associated with the Shield Option. The Shield Rate may vary between Shield Options and it is not an annual rate. We currently offer the following Shield Rates: Shield 10, Shield 15 and Shield 25.

Shield Option. You may allocate your Purchase Payment or transfer your Investment Amount to one or more of the available Shield

Options. Each Shield Option offered through this Contract has an associated Term, Index, Shield Rate and either a Cap Rate or Step Rate.

Step Rate. The rate credited at the Term End Date if the Index Performance is equal to or greater than zero. The

Step Rate may vary between Shield Options and it is not an annual rate.

Surrender. A full withdrawal of your Account Value.

Term. The Term is the number of years that the Shield Option is in effect. We currently offer Terms of 1 year, 3 years or 6

years. The Initial Term(s) begin on the Issue Date.

Term End Date. The Contract Anniversary on which a Shield Option ends.

Term Start Date. The Contract Anniversary on which a Shield Option is established. The initial Term Start Date(s) begins on the Issue

Date, and thereafter, will be the Contract Anniversary coinciding with the duration of the current Term you have selected.

Transfer Period. The five (5) calendar days following the Contract Anniversary coinciding with the Term End Date for each

applicable Shield Option and/or the Interest Rate Term End Date for the Fixed Account, during the Accumulation Period.

Withdrawal Charge. A charge applied to the percentage of the amount withdrawn from your Account Value in a Contract Year in excess of the

Free Withdrawal Amount.

9

Summary

The Brighthouse Shield® Level Select 6-Year Annuity is an individual single premium deferred index-linked separate account annuity contract

(the “Contract”) issued by BLNY, that provides for the potential accumulation of retirement savings. The Contract is intended for retirement or other long term

investment purposes.

This version of the Contract is only available in

New York state.

The Contract offers various Shield Options, which permit Owners to

potentially receive interest equal to the percentage returns of certain indices, up to a Cap Rate or Step Rate, with guarantees against a specified level of negative

returns—guarantees we call “Shield Rates.” We currently offer Shield Options based on indices. Additionally, each Shield Option has a Term of 1, 3 or 6 years in length, a Shield Rate (Shield 10, Shield 15 or Shield 25) and Rate Crediting Type (Cap Rate or Step Rate). For each Shield Option, you select the Term, the Shield Rate and which Index you want the performance of your

Contract to be based on. If you select a Shield 10 with a 1-Year Term, you may also select whether you want your Contract performance based on the Cap Rate or Step Rate. A Fixed Account that guarantees a fixed rate of interest may also be

available. Unless you allocate your Purchase Payment to the Fixed Account, you may lose

money by investing in the Contract.

The Cap Rate and Step Rate (each, a “Rate Crediting Type”) are the two ways we offer that you can potentially receive interest based on the upside performance of an Index. The Cap Rate is the maximum rate that may be credited at the Term

End Date based on Index Performance and the Step Rate is the rate credited at the Term End Date if the Index Performance is equal to or greater than zero. The protections specified by the Shield Rate and the level of positive

investment experience that can be credited to Account Value allowed by the Cap Rate or specified by the Step Rate are only fully available for amounts held until the end of the Term.

New Cap Rates and Step Rates are declared for each subsequent Term. There are two ways you may find out what the renewal Cap Rates and Step Rates will be for a subsequent Term. Thirty (30) days before the current Term expires we will mail you a Notice indicating your maturing Shield Options and how you can obtain the new Cap Rates and Step Rates. You may

also access the Company’s website at

https://www.brighthousefinancial.com/products/annuities/shield-annuities/shield-rates/ where at least two

months of renewal Cap Rates and Step Rates are posted – i.e., for the current month and the following month. See “RATE CREDITING TYPES.”

You may withdraw a portion or all of your Account Value at any time until you commence receiving

Income Payments, subject to an adjustment to the Investment Amounts. Depending on the performance of the Indices you choose, this adjustment may be substantial. Withdrawal Charges may also apply. The protections offered by the Shield Rate as to amounts

withdrawn when there has been adverse investment experience to date is reduced based on the length of time remaining in the Term when the withdrawal is made. In addition, the Step Rate and the upper limit specified by the Cap Rate are reduced as to amounts withdrawn before the end of the Term based on the length of time remaining in the Term when the withdrawal is

made.

When

you purchase the Contract, if you are age 76 or older at the Issue Date of the Contract, the standard death benefit is the Account Value. For Owners age 75 or younger at the

Issue Date of the Contract, the standard death benefit (known as the Return of Premium death benefit) will be the greater of your (i) Account Value or (ii) Purchase Payment,

reduced proportionally by the percentage reduction in Account Value of the Shield Option(s) and the Fixed Account for each partial withdrawal (including any applicable Withdrawal Charge).

Like all annuity contracts the Contract offers a range of annuity options, which provide Income Payments for your lifetime.

We have the

right to substitute a comparable index prior to the Term End Date if any Index is discontinued or, at our sole discretion, we determine that our use of such Index should be

discontinued, or if the calculation of an Index is substantially changed. See “An Index may be Substituted.”

See “SPECIAL TERMS” in this prospectus for more detailed explanations

of the terms associated with the Shield Options.

The following chart describes the

key features of the Contract. Please read this prospectus for more detailed information about the Contract.

Key Features of the Contract

| Contract |

Individual single premium deferred index-linked separate account annuity

contract. |

10

| Purchase Payment |

The minimum Purchase Payment: $25,000. Prior approval required for a

Purchase Payment of less than $25,000 or $1,000,000 or more. |

| Owner and Annuitant Issue Ages |

0-85 |

| Contract Periods |

The Contract has two periods: •The Accumulation Period, the period prior to the Annuity Date; and •The Income Period, which begins on the Annuity Date and during which Income Payments are provided. |

| Account Value |

The total of the Fixed Account Value and the value of the Shield Option(s) under

the Contract during the Accumulation Period. |

| Shield Option |

Each Shield Option has an associated Term, Index, Shield Rate and Rate

Crediting Type. |

| Term |

The Term may be 1, 3, or 6 years in length. |

| Index |

The current Indices are as follows: •S&P 500® Index (Price Return Index); •Russell 2000® Index (Price Return Index); and •MSCI EAFE Index (Price Return Index). |

| Shield Rate |

We currently offer different levels of protection:

Shield 10 — A Shield Rate where negative Index Performance of up to 10% of your Investment Amount is absorbed by us at the Term End Date, which would

leave you to absorb any remaining negative Index Performance of up to 90% of

your Investment Amount.

Shield 15 — A Shield Rate where negative Index Performance of up to 15% of your Investment Amount is absorbed by us at the Term End Date, which would

leave you to absorb any remaining negative Index Performance of up to 85% of

your Investment Amount.

Shield 25 — A Shield Rate where negative Index Performance of up to 25% of your Investment Amount is absorbed by us at the Term End Date, which would

leave you to absorb any remaining negative Index Performance of up to 75% of

your Investment Amount. |

| Rate Crediting Type |

A Shield Option can only have one associated Rate Crediting Type: either a Cap

Rate or a Step Rate. |

| Interim Value |

For each Shield Option, the value we assign on any Business Day prior to the

Term End Date. The Interim Value of a Shield Option is equal to the

Investment Amount in the Shield Option, adjusted for the Index

Performance of the associated Index and subject to the applicable

Accrued Shield Rate, Accrued Cap Rate or Accrued Step

Rate. |

| Transfers |

During the Accumulation Period you may make transfers to the Fixed Account

and/or to new Shield Option(s) during the Transfer Period. The

effective date of such transfer is the first day of the Interest

Rate Term and/or a Term(s) in which the transfer is

made. |

| Fixed Account |

See Appendix D. |

| Access to Your Money |

You may withdraw some or all of your money at any time prior to the Annuity

Date. For any withdrawal, a Performance Rate Adjustment, as of the

date of the withdrawal, will apply and may be substantial. In

addition, a withdrawal taken in excess of the Free Withdrawal Amount

may be subject to a Withdrawal Charge. |

11

| Withdrawal Charge |

A percentage charge applied to withdrawals in excess of the Free Withdrawal

Amount.The Free Withdrawal Amount is 0% in the first Contract Year,

and 10% of Account Value in each subsequent Contract Year to the

extent that amount has not already been withdrawn that Contract

Year.The Withdrawal Charge is calculated at the time of each

withdrawal in accordance with the following: |

| |

|

|

|

|

| |

|

Number of

Complete

Contract

Years since Issue

Date |

Withdrawal

Charge

percentage |

|

| |

|

0 |

7% |

|

| |

|

1 |

7% |

|

| |

|

2 |

6% |

|

| |

|

3 |

5% |

|

| |

|

4 |

4% |

|

| |

|

5 |

3% |

|

| |

|

6 or more |

0% |

|

| |

See “WITHDRAWAL PROVISIONS — When No Withdrawal Charge Applies”

for a list of Withdrawal Charge waivers. |

|||

| Systematic Withdrawal Program |

You may elect the Systematic Withdrawal Program to

provide automated processing of amounts withdrawn from your

Contract, subject to program terms. We do not assess a charge

for the program and you may terminate your

participation in the program at any time. Withdrawals

under the Systematic Withdrawal Program are subject

to the same Withdrawal Charge provisions and risks as any other

withdrawals under the Contract. Moreover, since Withdrawal Amounts

from a Shield Option will reduce the Investment Amount for that

Shield Option by the percentage reduction in the Interim Value of that Shield

Option, a withdrawal when Index Performance is negative will cause a

greater percentage reduction in the Investment Amount relative to

the percentage reduction for the same Withdrawal Amount when Index

Performance is positive. Since withdrawals

under the Systematic Withdrawal Program are automatic,

you will have no control over the timing of those withdrawals. See

“WITHDRAWAL PROVISIONS – Systematic Withdrawal Program” for

availability and other restrictions. |

| Death Benefit |

For Owners age 76 or older at the Issue Date of the Contract, the standard

death benefit is the Account Value. For Owners age 75 or younger at

the Issue Date of the Contract, the standard death benefit (known as

the Return of Premium death benefit) is the greater of the Account

Value or your Purchase Payment (reduced proportionally by the

percentage reduction in Account Value of the Shield Option(s) and

the Fixed Account for each partial withdrawal (including any

applicable Withdrawal Charge)). The Death Benefit Amount is

determined as of the end of the Business Day on which we receive Notice of

due proof of death and an acceptable election for the payment

method. |

| Annuity Options |

You can choose an Annuity Option. After Income Payments begin, you cannot

change the Annuity Option. You can choose one of the following

Annuity Options on a fixed payment basis or any other Annuity Option

acceptable to us: (i)Life Annuity; (ii)Life Annuity with 10 Years of Income Payments Guaranteed; (iii)Joint and Last Survivor Annuity; and (iv)Joint and Last Survivor Annuity with 10 Years of Income Payments Guaranteed. The Annuity Options may be limited due to the requirements of the Code. |

| Charges and Expenses |

You will bear the following charges and expenses: (i)Withdrawal Charges; and (ii)Premium and Other Taxes. |

12

| Your Right to Cancel |

You may cancel the Contract within 10 days after receiving it by mailing or

delivering the Contract to either us or the financial representative

who sold it. This is known as a “Free Look.” You will

receive (i) whatever your Contract is worth, plus (ii) the sum of

all fees, taxes and charges deducted from the Purchase Payment

during the Free Look period, as of the effective date of the Free

Look, on the Business Day we receive your Contract and we will not

deduct a Withdrawal Charge. The amount you receive may be more or less than

your Purchase Payment depending on the Shield Options you allocated

your Purchase Payment to during the Free Look period.

|

13

Risk Factors

The purchase of the Contract involves certain risks. You should carefully consider the following factors, in addition to the matters set forth elsewhere in the prospectus, prior to purchasing the Contract.

Risk of loss

There is a risk of substantial loss of your principal (unless you allocated your Purchase Payment

to the Fixed Account) because you agree to absorb all losses that exceed the Shield Rate for the Shield Options you select under the Contract. This means that if a negative Index Performance for a Shield Option you select exceeds the corresponding Shield Rate at the Term End Date, you will bear the portion of the loss that exceeds the Shield Rate.

No ownership of the underlying securities

When you purchase the Contract and allocate your Purchase Payment to a Shield Option(s), you will not be investing in the Index for the Shield Options you select or in a mutual fund or exchange traded fund that also tracks the Index. Your

Performance Rate Adjustment for a Shield Option is limited by a Cap Rate or Step Rate, which means your Investment Amount will be lower than if you had invested in a mutual fund or exchange traded fund designed to track the performance of the

applicable Index and the performance is greater than your Cap Rate or Step Rate.

Withdrawal Charges

You may withdraw some or all of your money at any time prior to the Annuity Date; however, any applicable Withdrawal Charge is calculated as a percentage of the amount withdrawn. After the first Contract Year, the Contract provides for a limited free access to your money, called the Free Withdrawal Amount. If you withdraw an amount that is greater than the Free

Withdrawal Amount for your Contract, you may be subject to a Withdrawal Charge which will reduce the amount that is payable to you. For example, assume you make a $100,000 Purchase Payment at Contract issue. If your Account Value is

$80,000 in the beginning of the sixth (6th) Contract Year and you take a full withdrawal from your Contract, the Free Withdrawal Amount is $8,000 (10% of $80,000) and a Withdrawal Charge percentage of 3% is applied to the remaining

amount. This is a 3% reduction of your Account Value, less the Free Withdrawal Amount ($72,000 = $80,000 – $8,000). The Withdrawal Charge would be $2,160 (3% of $72,000). This results in a cash value of $77,840 paid to you ($77,840 = $80,000

– $2,160). If you make a withdrawal before a Term End Date, a Performance Rate Adjustment, as of the date of the withdrawal, will apply. A Performance Rate Adjustment may result in a loss that is greater than the Accrued Shield Rate when Index Performance is negative on the date of the withdrawal. Performance Rate Adjustments, at the time of the withdrawal,

may decrease the amount that is payable to you.

Effect of Withdrawals, Surrender, Annuitization or Death

The method we use in calculating your Interim Value may result in an amount that is less than the amount you would receive had you held the investment until the Term End Date. If you take a withdrawal when Index Performance is negative,

your remaining Investment Amount may be significantly less than if you waited to take the withdrawal when Index Performance was positive.

•

If you take a withdrawal, including RMDs, your Account Value will be reduced by the amount

withdrawn proportionally from your Shield Options and Fixed Account unless you tell us from which options, in which you currently have any Account Value, where the withdrawal should be taken.

•

If you die (unless your Contract was issued with the Return of Premium death benefit), make a

withdrawal or Surrender your Contract prior to the Term End Date, we will pay the Interim Value, which may be less than if you held the Contract until all of your Shield Options reached their Term End Dates.

•

If your Contract is annuitized prior to a Term End Date, we will use the Interim Value to

calculate the Income Payments you will receive based on the applicable Annuity Option. In deciding on an Annuity Date, you should take into consideration the Term End Dates of your Shield Options relative to the Annuity Date you have chosen.

•

The calculation of the Interim Value will be based on Index Performance and the applicable

Accrued Shield Rate, Accrued Cap Rate or Accrued Step Rate as of the date of the calculation. The Shield Rates, Cap Rates and Step Rates accrue during the Term and only reach full accrual on the last day of a Term. If negative Index Performance is constant

during the Term, the Interim Value will be lower the earlier a withdrawal is made during the Term because the Shield Rate is accruing during this period. Also, withdrawals prior

to the Term End Date, when Index Performance is positive, are subject to an Accrued Cap Rate or Accrued Step Rate based on the period those amounts were

14

invested

in the Shield Option. This means the earlier you take a withdrawal the lesser extent to which any positive Index Performance is reflected in your Account Value due to the

accruing of the Cap Rate or Step Rate.

•

If your Account

Value falls below the Minimum Account Value as a result of a withdrawal, we may terminate your Contract.

Limitations on Transfers

You may make transfers between the Fixed Account and the Shield Option(s) only during the

Transfer Period. You cannot make transfers outside the Transfer Period, you

cannot transfer out of a current Shield Option to another Shield Option or the Fixed Account until the Term End Date of the current Shield Option and you cannot transfer out of

the Fixed Account to a Shield Option until the Interest Rate Term End Date (which will not be less than one (1) year). In both cases, the amount transferred can only be transferred to new Shield Options or the Fixed Account. This may limit your ability to react to market conditions.

In addition, you should understand that for renewals into the same Shield Option, a new Cap Rate

or Step Rate, as applicable, will be declared and will go into effect on the Contract Anniversary that coincides with the beginning of the new Shield Option.

Moreover,

at the Term End Date, the Investment Amount allocated to the Shield Option that has reached its Term End Date will be automatically renewed into the same Shield Option unless you

instruct us to transfer such amount into a different Shield Option(s) or the Fixed Account. You have the Transfer Period to notify us that you want to transfer some or all of

your Investment Amount to a new Shield Option(s) or the Fixed Account. Thus, failure to provide such instructions during the Transfer Period will result in an automatic renewal for a period of at least one (1) year.

Availability of Shield Options

Your selling firm may limit the Shield Options available through that firm when your Contract is issued or at Term End Date. Additionally, we may stop selling certain Shield Options. After the Contract is issued, there will always be at least one Shield Option available. Consequently, a particular Shield Option may not be available for you to transfer your Investment

Amount or Fixed Account Value into after a Term End Date or the Interest Rate Term End Date. If the same Shield Option is no longer available at the Term End Date, the Investment Amount in the applicable Shield Option(s) will automatically transfer into the Fixed Account at the Term End Date, unless you instruct us otherwise. The amounts transferred to the Fixed Account must remain in the Fixed Account until the Interest Rate Term End Date (which, currently, will not be less than one (1) year). The Investment Amount held in the Fixed Account may earn a return that is less than the return you might have earned if those

amounts were held in a Shield Option. If we exercise this right, your ability to increase your Account Value and, consequently, increase your death benefit will be limited. If the Fixed Account is not available, the Investment Amount will automatically transfer into the Shield Option with, in order of priority, the shortest Term, the highest Shield Rate and the lowest Cap Rate from the Shield Options available at the Term End Date, unless you instruct us otherwise. A 3-Year Term will be available for at least the first six (6) Contract Years, subject to the transfer requirements.

Risks Associated with the Referenced Indices

Because the S&P 500® Index (Price Return Index), the Russell 2000® Index (Price Return Index) and the MSCI EAFE Index (Price Return Index) are each comprised of a collection of equity

securities, in each case the value of the component securities is subject to market risk, or the risk that market fluctuations may cause the value of the component securities to

go up or down, sometimes rapidly and unpredictably. In addition, the value of equity securities may increase or decline for reasons directly related to the issuers of the securities. (See “INDICES” and “SHIELD RATES.”)

An Index may be Substituted

We have the right to substitute a comparable index prior to the Term End Date if any Index is

discontinued or, at our sole discretion, we determine that our use of such Index should be discontinued, or if the calculation of an Index is substantially changed. We would attempt to choose a substitute index that has a similar investment objective and risk profile to the

replaced index. Upon substitution of an Index, we will calculate your Index Performance on the replaced Index up until the date of substitution and the substitute Index from the date of substitution to the Term End Date. An Index substitution will not change the Shield Rate, Cap Rate or Step Rate for an existing Shield Option. The performance of the new Index may not be as good as the one that it substituted and as a result your Index Performance may have been better if there had been no

substitution.

15

Issuing Company

No company other than BLNY has any legal responsibility to pay amounts that BLNY owes under the Contract. An Owner should look to the financial strength of BLNY for its claims-paying ability.

Cybersecurity and Certain Business Continuity Risks

Our business is largely conducted through complex digital communications and data storage networks and systems operated by us and our service providers or other business partners (e.g., the firms involved in the distribution and sale of our products). For example, many routine operations, such as processing your requests and elections and day-to-day record

keeping, are all executed through computer networks and systems. We have established administrative and technical controls and business continuity and resilience plans to protect our operations against attempts by unauthorized third parties to improperly access, modify, disrupt the operation of, or prevent access to critical networks or systems or data within them (a “cyber-attack”). Despite these protocols, a cyber-attack could have a material, negative impact on BLNY, as well as individual Owners and their Contracts. Our operations also could be negatively affected by a cyber-attack at a third party, such as a

service provider, business partner, another participant in the financial markets or a governmental or regulatory authority. Cyber-attacks can occur through unauthorized access to computer systems, networks or devices; infection from computer

viruses or other malicious software code; phishing attacks; account takeover attempts; or attacks that shut down, disable, slow or otherwise disrupt operations, business processes or website access or functionality. There may be an increased risk of cyber-attacks during periods of geo-political or military conflict. Disruptions or failures may also result from unintentional causes, such as market events that trigger a surge of activity that overloads current information technology and

communication systems. Other disruptive events, including (but not limited to) natural disasters, military actions, and public health crises, may adversely affect our ability to conduct business, in particular if our employees or the employees of our service providers are unable or unwilling to perform their responsibilities as a result of any such event. Cyber-attacks,

disruptions or failures to our business operations can interfere with our processing of Contract transactions, including the processing of transfer orders from our website; impact our ability to calculate values; cause the release and/or possible loss, misappropriation or corruption of confidential Owner or business information; or impede order processing or cause other

operational issues. There can be no assurance that we or our service providers will avoid losses affecting your Contract due to cyber-attacks, disruptions or failures in the future. Although we continually make efforts to identify and reduce our exposure to cybersecurity risk, there is no guarantee that we will be able to successfully manage and mitigate this risk at all times. Furthermore, we cannot control the cybersecurity plans and systems implemented by third parties, including service

providers.

COVID-19 and Market Conditions Risks

The COVID-19 pandemic has at times resulted in or contributed to significant financial market

volatility, travel restrictions and disruptions, quarantines, an uncertain interest rate environment, elevated inflation, global business, supply chain, and employment disruptions affecting companies across various industries, and government and central bank

interventions, wide-ranging changes in consumer behavior, as well as general concern and uncertainty that has negatively affected the economic environment. At this time, it continues to not be possible to estimate (i) the severity or duration of the pandemic, including the severity, duration and frequency of any additional “waves” or emerging variants of COVID-19, or (ii) the efficacy or utilization of any therapeutic treatments and vaccines for COVID-19 or variants thereof. It likewise remains not possible to predict or estimate the longer-term effects of the pandemic, or any actions taken to contain or address the pandemic, on our business and financial condition, the financial markets, and the economy at large. BLNY has implemented

risk management and contingency plans and continues to closely monitor this evolving situation, including the impact on services provided by third-party vendors. However, there can be no assurance that any future impact from the COVID-19

pandemic will not be material to BLNY and/or with respect to the services BLNY or its customers receive from third-party vendors. Significant market volatility and negative investment returns in the financial markets resulting from the COVID-19 pandemic and market conditions could have a negative impact on the performance of the Indices. Depending on market

conditions and your individual circumstances (e.g., your selected Shield Option and the timing of any Purchase Payments, transfers, or withdrawals), you may experience (perhaps significant) negative returns under the Contract. You should consult with your financial representative about how the COVID-19 pandemic and the recent market conditions may impact your

future investment decisions related to the contract, such as purchasing the contract, transfers, or withdrawals, based on your individual circumstances.

16

THE ANNUITY CONTRACT

This prospectus describes the Brighthouse Shield® Level Select 6-Year Annuity issued by us and describes all the material features of the Contract. The Brighthouse

Shield® Level Select 6-Year Annuity is a contract between you as

the Owner, and us, the insurance company, where you agree to make a Purchase Payment to us and we agree to make a series of payments at a later date you select (the “Annuity Date”).

The Contract, like all deferred annuity contracts, has two periods: the Accumulation Period and the Income Period. During the Accumulation Period, Account Value accumulates on a tax-deferred basis and is taxed as income when you make a

withdrawal. If you make a withdrawal during the Accumulation Period, we may assess a Withdrawal Charge of up to 7%. Withdrawals, depending on the amount and timing, may negatively impact the benefits and guarantees provided by your

Contract. You should carefully consider whether a withdrawal under a particular circumstance will have any negative impact to your benefits or guarantees. The Income Period occurs when you or a designated payee begin receiving regular Income

Payments from your Contract.

The maximum issue age for this Contract is 85.

When you purchase the Contract, you can choose one or more of the available Shield Options and the Fixed Account. A Purchase Payment applied to the Shield Options is allocated to the Separate Account. You do not share in the investment

performance of assets allocated to the Separate Account. We are obligated to pay all money we owe under the Contract, including death benefits and Income Payments. Any such amount that exceeds the assets in the Separate Account is paid

from our General Account, subject to our financial strength and claims-paying ability and our long-term ability to make such payments, and is not guaranteed by any other party. (See “THE SEPARATE ACCOUNT.”)

The Contract is intended for retirement savings or other long-term investment purposes. The Contract has features and benefits that may be appropriate for you based on your financial situation and objectives, but we are not a fiduciary and do not provide investment advice or make recommendations regarding insurance or investment products, or any securities

transactions or investment strategies involving securities. You should ask your financial representative for guidance as to whether this contract may be appropriate for you. Please bear in mind that your financial representative, or any financial firm or financial professional with whom you consult for advice, acts on your behalf, not ours. We are not party to any agreement between you and your financial professional. See “DISTRIBUTION OF THE CONTRACTS” for information on firms that sell the Contract.

The Contract

benefits from tax deferral. Tax deferral means that you are not taxed on Account Value or appreciation on the assets in your Contract until you take money out of your Contract.

Non-qualified annuity Contracts (which are not retirement plans) owned by a non-natural person such as a corporation or certain other legal entities (other than a trust that

holds the Contract as an agent for a natural person), do not receive tax deferral on earnings. In addition, for any tax qualified account (e.g., an IRA), the tax deferred accrual feature is provided by the tax qualified retirement plan. Therefore, there should be reasons other than tax deferral for acquiring the Contract by a corporation, certain legal entities or within a qualified plan. (See “FEDERAL TAX CONSIDERATIONS.”)

Currently, a Fixed Account is available. However, the Fixed Account may not always be available. You should consult your financial representative for information regarding the Fixed Account, if available. See Appendix D for certain information regarding the Fixed Account. The Fixed Account offers an interest rate that is guaranteed by us. The minimum interest rate depends on the date your Contract is issued and will not be less than 1% annually. Your financial representative can tell you the current and minimum interest rates that apply. If you select the Fixed Account, your money will be placed with our other General Account assets, and the amount of money you are able to accumulate in your Contract during the Accumulation

Period depends upon the total interest credited to your Contract. The Fixed Account is part of our General Account. Our General Account consists of all assets owned by us other than those in the Separate Account and our other separate accounts. We

have sole discretion over the investment of assets in the General Account and the Separate Account. If you select an Annuity Option during the Income Period, payments are made from our General Account assets.

The amount of the Income Payments you receive during the Income Period from an Income Payment option will remain level for the entire Income Period, subject to the payout chosen. (See “INCOME PAYMENTS (THE INCOME PERIOD)” for more information.)

As Owner,

you exercise all interests and rights under the Contract. You can change the Owner at any time, subject to our underwriting requirements. The Contract may be owned generally by

Joint Owners (limited to natural persons). (See “OWNERSHIP PROVISIONS.”)

Any Internal Revenue Code reference to “spouse” includes those persons who are married spouses under state law, regardless of sex.

17

Replacement of Contracts

Exchanges. Generally

you can exchange one non-qualified annuity contract for another in a tax-free exchange under Section 1035 of the Code. Before making an exchange, you should compare both

annuities carefully. If you exchange another annuity for the one described in this prospectus, you might have to pay a withdrawal charge on your old annuity, and there will

be a new Withdrawal Charge period for the Contract. Other charges may be higher (or lower) and the benefits may be different. Also, because we will not issue the Contract until we have received the initial premium from your existing insurance company, the issuance of the Contract may be delayed. Generally, it is not advisable to purchase a Contract as a replacement for an existing annuity contract. Before you exchange another annuity for our Contract, ask your financial representative

whether the exchange would be advantageous, given the Contract features, benefits and charges.

Exchange Programs. From time to time we may make available programs under which

certain annuity contracts previously issued by us or one of our affiliates may be exchanged for the Contracts offered by this prospectus. Currently, with respect to exchanges from certain of our annuity contracts to the Contract, an existing contract is eligible for exchange if a surrender of the existing contract would not trigger a withdrawal charge. You should carefully consider whether an exchange is appropriate for you by comparing the benefits and other guarantees provided by the contract you currently own to the

benefits and guarantees that would be provided by the new Contract offered by this prospectus. Then, you should compare the fees and charges of your current contract to the fees and charges of the new Contract, which may be higher than your

current contract. The programs we offer will be made available on terms and conditions determined by us, and any such programs will comply with applicable law. We believe the exchanges will be tax free for Federal income tax purposes;

however, you should consult your tax advisor before making any such exchange.

PURCHASE

The Contract may not be available for purchase through your broker dealer (“selling firm”) during certain periods. There are a number of reasons why the Contract periodically may not be available, including that the insurance company wants to

limit the volume of sales of the Contract. You may wish to speak to your financial representative about how this may affect your purchase. For example, you may be required to submit your purchase application in Good Order prior to or on a stipulated date in order to purchase a Contract, and a delay in such process could result in your not being able to purchase a Contract. Your selling firm may offer the Contract with a lower maximum issue age for the Contract compared to what other selling

firms may offer. Your selling firm may limit the Shield Options available through that firm when your Contract is issued or at the Term End Date. However, at the end of your initial Shield Option(s), you may transfer into any Shield Option(s) available under the Contract, subject to any transfer restrictions (see “TRANSFERS”). Please be aware that your financial representative may not be able to provide you information or answer questions you may have with regard to those Shield Options that your

selling firm does not make available. Therefore, you may contact us directly at (888) 243-1932 or in writing at Brighthouse Life Insurance Company of NY, Annuity Service Office, P.O. Box 305075, Nashville, TN, 37230-5075.

We offer other

individual single premium deferred indexed-linked separate account contracts. However, not every contract we issue is available through every selling firm. In

addition, these other contracts may have different Shield Options, Shield Rates, Cap Rates and Step Rates.

Purchase Payment

A Purchase Payment is the total amount of money you give us to invest in the Contract. The Purchase Payment is due on the date the Contract is issued.

•

The minimum Purchase Payment we will accept is $25,000.

•

If you want to

make a Purchase Payment of less than $25,000 or $1,000,000 or more, you will need our prior approval.

•

We reserve the right to refuse a Purchase Payment made via a personal check in excess of

$100,000. A Purchase Payment over $100,000 may be accepted in other forms, including, but not limited to, EFT/wire transfers, certified checks, corporate checks, and checks written on financial institutions.

•

We will not accept a Purchase Payment made with cash, money orders, or travelers

checks.

•

Corporations and other legal entities we approve, may purchase the Contract; however, we will

not accept a Purchase Payment made by a corporation or other legal entity (other than a trust that holds the Contract as agent for a natural person) to fund any type of qualified or non-qualified retirement plan.

We reserve the right to reject any application.

18

Allocation of

the Purchase Payment

You may allocate your Purchase Payment to one or more of the

available Shield Options or into the Fixed Account. On your Issue Date, your Purchase Payment is allocated to the Shield Option(s) and/or the Fixed Account, as you specified on

the application, unless we receive Notice of any changes from you before we have issued your Contract. All allocations must be in whole percentages that total 100% or in whole dollars. Once your Purchase Payment is allocated to the Shield Options and/or the Fixed Account, they become part of your Account Value.

SHIELD OPTIONS

The Brighthouse Shield® Level Select 6-Year Annuity is not a variable annuity where your account value varies based on the investment

performance of the underlying portfolios you choose, rather the Shield Options offer potential interest based upon index performance. This potential interest—the

Performance Rate Adjustment—may be a positive or negative percentage or zero. You may allocate your Purchase Payment to one or more of the available Shield Options and the

Fixed Account. Based upon the Index Performance of the Index associated with the Shield Option, a Performance Rate Adjustment will be applied to the Investment Amount in that Shield Option on any day during the Term that you make a withdrawal from

the Shield Option, Surrender your Contract, annuitize your Contract, a Death Benefit is paid or the Term ends. Given that Index Performance may be positive, zero or negative, your Performance Rate Adjustment may be positive, zero or negative. It is

possible for you to lose a portion of the Purchase Payment and any earnings invested in the Contract. The Performance Rate Adjustment is based on a certain amount of protection against decreases in an Index Value and a limitation on potential

interest based on an Index Value. The extent of the downside protection varies by the Shield Rate you select. If you access amounts in the Shield Options before the Term End Date, we will instead calculate an Interim Value on each Business Day

between the Term Start Date and the Term End Date. (See “Interim Value Calculation.”)

You have the opportunity to allocate your Investment Amount to any of the Shield Options

described below, subject to the requirements, limitations and procedures disclosed in the prospectus. We are not obligated to offer any one particular Shield Option and your selling firm may limit the Shield Options available through that firm when your Contract is issued. After the Contract is issued, there will always be at least one Shield Option available. Each Shield Option has an associated (i) Term, (ii) Index, (iii) Shield Rate and (iv) Rate Crediting Type you select.

19

The following chart lists the Shield Options (each of which is issued with a Cap Rate unless otherwise noted) currently available:

| SHIELD OPTIONS | |

| TERM |

INDEX |

| SHIELD 25 (up to 25% downside protection) | |

| 6 Year |

S&P

500® Index

Russell 2000® Index

MSCI EAFE Index |

| SHIELD 15 (up to 15% downside protection) | |

| 3 Year |

S&P

500® Index

Russell 2000® Index

MSCI EAFE Index |

| 6 Year |

S&P

500® Index

Russell 2000® Index

MSCI EAFE Index |

| SHIELD 10 (up to 10% downside protection) | |

| 1 Year |

S&P

500® Index

S&P

500® Index Step Rate

Russell 2000® Index

Russell 2000® Index Step Rate

MSCI EAFE Index MSCI EAFE Index Step Rate |

| 3 Year |

S&P

500® Index

Russell 2000® Index

MSCI EAFE Index |

| 6 Year |

S&P 500® Index Russell 2000® Index

MSCI EAFE Index |

The Indices are described in more detail below, under the heading “Indices.” For each

new Shield Option we declare a new Cap Rate or a new Step Rate, as applicable, for each Term. The initial Cap Rate or Step Rate, as applicable, for each Shield Option is declared on the Issue Date. Thereafter the Cap Rate or Step Rate, as applicable, for each subsequent Shield Option is declared for each subsequent Term. See “Cap Rate” and “Step Rate”.

Please note, Shield Options with higher Shield Rates tend to have lower Cap Rates and Step Rates, as applicable, than other Shield Options that use the same Index and Term but provide lower Shield Rates. For example,

a S&P 500® Index with a 3-Year Term and a Shield 15 will tend to have a Cap Rate that is lower than a S&P 500® Index with a 3-Year Term and a Shield 10.

A Shield

Option will always be available; however, we reserve the right to change the duration of any new Shield Options, stop offering any of the Shield Options or suspend offering any

of the Shield Options. We may also add Shield Options in the future.

TERM

The Term is the number of years that a Shield Option is in effect. For specific Shield Options we currently offer Terms of 1 year, 3 years or 6 years. An initial Term(s) begins on the Issue Date. A Term ends and a subsequent Term begins on the

Contract Anniversary coinciding with the duration of the then current Term for the Shield Option you have selected.

Term Start Date

Each Shield Option will have a Term Start Date, which is the Contract Anniversary on which a Shield Option is established. The initial Term Start Date(s) begins on the Issue Date, and thereafter, will be the Contract Anniversary coinciding with the duration of the Term for the Shield Option completed.

20

Term End Date

Each Shield Option will have a Term End Date, which is the Contract Anniversary on which a Shield Option ends. We will send you written Notice thirty (30) days in advance of the maturing Shield Options in which you are currently invested. At the Term End Date, the Investment Amount allocated to the Shield Option that has reached its Term End Date will automatically be renewed into the same Shield Option unless you instruct us to transfer such amount into a different Shield Option(s) or the Fixed Account. If the same Shield Option is no longer available at the Term End Date, the Investment Amount will automatically transfer into the Fixed Account at the Term End Date, unless you instruct us otherwise. The amounts transferred to the Fixed Account must remain in the Fixed Account until the Interest Rate Term End Date (which, currently, will not be less than one (1) year). If the Fixed Account is not available, the Investment Amount will automatically transfer into the Shield Option with, in order of priority, the shortest Term, the highest Shield Rate and the lowest Cap Rate from the Shield Options available at the Term End Date, unless you instruct us otherwise. You have the Transfer Period to notify us that you want to transfer some or all of your Investment Amount to a new Shield Option(s) or the Fixed Account. For renewals into the same Shield Option, a new

Cap Rate or Step Rate, as applicable, will be declared and will go into effect on the Contract Anniversary that coincides with the beginning of the new Term in the Shield Option that just ended. The amount transferred to the new Shield Option is the

Investment Amount as of the Contract Anniversary.

INDICES

The Performance Rate of a Shield Option is based on the performance of the associated Index. We currently offer Shield Options with indices based on the performance of securities. In the future we may offer Shield Options based on other types of indices. We may also add or remove indices for new Contracts at our discretion.

The following Indices are currently available:

S&P 500® Index (Price Return Index). The S&P 500® Index includes 500 large cap stocks from leading companies in leading industries of the U.S. economy, capturing approximately 80% coverage of U.S. equities by market capitalization. The S&P 500® Index does not include dividends declared by any of the companies in this Index.

Russell 2000® Index (Price Return Index). The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell

3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a

combination of their market cap and current index membership. The Russell 2000® Index does not include dividends declared by any of the companies in this Index.

MSCI EAFE Index (Price Return Index). The MSCI EAFE Index (Europe,

Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. As of the date of this prospectus the MSCI EAFE Index consists of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the

Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The MSCI EAFE Index does not include dividends declared by any of the companies in this Index. Index Value and Index Performance will be calculated without any exchange rate adjustment.

See Appendix A for important information regarding the publishers of the Indices.

Discontinuation or Substantial Change to an Index. If any Index is discontinued or, we determine that our use of such Index should be discontinued, or if the

calculation of an Index is substantially changed, we may substitute a comparable index with a similar investment objective and risk profile. We will send you (i) written Notice