Form N-CSRS UNIFIED SERIES TRUST For: Mar 31

united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21237

Unified Series Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices)

(Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 9/30

Date of reporting period: 3/31/2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) |

Ballast Small/Mid Cap ETF (MGMT)

NYSE Arca, Inc.

Semi-Annual Report

March 31, 2023

Fund Adviser:

Ballast Asset Management, LP

2911 Turtle Creek Blvd, Suite 840

Dallas, TX 75219

1-866-383-6468

Investment Results (Unaudited)

Average Annual Total Return* as of March 31, 2023

| Since | ||||||

| Inception | ||||||

| December 2, | ||||||

| Six Months | One Year | 2020 | ||||

| Ballast Small/Mid Cap ETF - NAV | 15.72% | (4.31)% | 13.62% | |||

| Ballast Small/Mid Cap ETF - Market Price | 15.87% | (4.45)% | 13.77% | |||

| Russell 2500 Value Index(a) | 10.73% | (10.53)% | 7.55% |

Total annual operating expenses, as disclosed in the Ballast Small/Mid Cap ETF’s (the “Fund”) prospectus dated January 28, 2023, were 1.10% of average daily net assets (1.37% before fee waivers/expense reimbursements by Ballast Asset Management, LP (the “Adviser”)). The Adviser contractually has agreed to waive its management fee and/or reimburse expenses so that total annual Fund operating expenses, excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any administrative and/or shareholder servicing fees payable pursuant to a plan adopted by the Board of Trustees; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business, do not exceed 1.10% through January 31, 2024. This expense cap may not be terminated prior to this date except by the Board of Trustees. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of the recoupment. Additional information pertaining to the Fund’s expense ratios as of March 31, 2023 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses should be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (866) 383-6468. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. Since exchange-traded funds are bought and sold at prices set by the market, which can result in a premium or discount to NAV, the returns calculated using Market Price can differ from those calculated using NAV.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. Total returns for less than one year are not annualized. |

1

Investment Results (Unaudited) (continued)

| (a) | The Russell 2500 Value Index (the “Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses should be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling (866) 383-6468. Please read it carefully before investing.

The Fund is distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC.

2

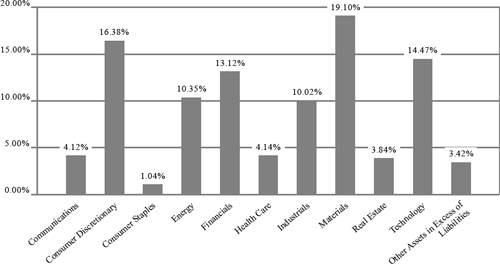

Fund Holdings (Unaudited)

Ballast Small/Mid Cap ETF Holdings as of March 31, 2023.*

| * | As a percentage of net assets. |

The Fund seeks to generate positive risk adjusted returns as its investment objective.

Portfolio holdings are subject to change.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at www. sec.gov or on the Fund’s website at www.etf.mgmtetf.com.

3

| Ballast Small/Mid Cap ETF |

| Schedule of Investments |

| March 31, 2023 (Unaudited) |

| COMMON STOCKS — 96.58% | Shares | Fair Value | ||||||

| Communications — 4.12% | ||||||||

| Criteo S.A. - ADR(a) | 58,930 | $ | 1,856,590 | |||||

| IAC/InterActiveCorp.(a) | 5,229 | 269,816 | ||||||

| TripAdvisor, Inc.(a) | 36,271 | 720,342 | ||||||

| 2,846,748 | ||||||||

| Consumer Discretionary — 16.38% | ||||||||

| Advance Auto Parts, Inc. | 6,035 | 733,916 | ||||||

| American Eagle Outfitters, Inc. | 70,965 | 953,770 | ||||||

| America’s Car-Mart, Inc.(a) | 19,090 | 1,512,119 | ||||||

| BorgWarner, Inc. | 37,350 | 1,834,259 | ||||||

| Cavco Industries, Inc.(a) | 4,316 | 1,371,366 | ||||||

| Global Business Travel Group Inc.(a) | 186,707 | 1,237,867 | ||||||

| Polished.com, Inc.(a) | 1,093,232 | 568,590 | ||||||

| Wayside Technology Group, Inc. | 58,100 | 3,096,149 | ||||||

| 11,308,036 | ||||||||

| Consumer Staples — 1.04% | ||||||||

| Olaplex Holdings, Inc.(a) | 168,214 | 718,274 | ||||||

| Energy — 10.35% | ||||||||

| CNX Resources Corp.(a) | 60,507 | 969,322 | ||||||

| Epsilon Energy Ltd. | 117,681 | 628,417 | ||||||

| Green Plains, Inc.(a) | 72,957 | 2,260,937 | ||||||

| Kosmos Energy Ltd.(a) | 110,375 | 821,190 | ||||||

| Sitio Royalties Corp. | 35,080 | 792,808 | ||||||

| Solaris Oilfield Infrastructure, Inc., Class A | 195,963 | 1,673,524 | ||||||

| 7,146,198 | ||||||||

| Financials — 13.12% | ||||||||

| Capital Bancorp, Inc. | 81,257 | 1,352,116 | ||||||

| Everest Re Group Ltd. | 4,150 | 1,485,783 | ||||||

| Federal Agricultural Mortgage Corp., Class C | 15,023 | 2,000,914 | ||||||

| International General Insurance Holdings Ltd. | 169,408 | 1,404,392 | ||||||

| International Money Express, Inc.(a) | 53,758 | 1,385,881 | ||||||

| MGIC Investment Corp. | 106,489 | 1,429,083 | ||||||

| 9,058,169 | ||||||||

| Health Care — 4.14% | ||||||||

| Bausch + Lomb Corp.(a) | 84,976 | 1,479,432 | ||||||

| iRadimed Corp. | 16,268 | 640,146 | ||||||

| QuidelOrtho Corp.(a) | 8,300 | 739,447 | ||||||

| 2,859,025 | ||||||||

| Industrials — 10.02% | ||||||||

| AZZ, Inc. | 43,160 | 1,779,918 | ||||||

| Eagle Bulk Shipping, Inc. | 20,300 | 923,650 | ||||||

| Landstar System, Inc. | 9,794 | 1,755,673 | ||||||

| Lennox International, Inc. | 4,316 | 1,084,524 | ||||||

| Timken Co. (The) | 9,090 | 742,835 | ||||||

| XPO, Inc.(a) | 19,682 | 627,856 | ||||||

| 6,914,456 | ||||||||

See accompanying notes which are an integral part of these financial statements.

4

| Ballast Small/Mid Cap ETF |

| Schedule of Investments (continued) |

| March 31, 2023 (Unaudited) |

| COMMON STOCKS — 96.58% (continued) | Shares | Fair Value | ||||||

| Materials — 19.10% | ||||||||

| Bioceres Crop Solutions Corp.(a) | 125,704 | $ | 1,459,423 | |||||

| CONSOL Energy, Inc. | 24,094 | 1,403,957 | ||||||

| Eagle Materials, Inc. | 12,035 | 1,766,136 | ||||||

| Ecovyst, Inc.(a) | 66,790 | 738,030 | ||||||

| Huntsman Corp. | 54,199 | 1,482,885 | ||||||

| Natural Resource Partners, L.P. | 35,134 | 1,833,995 | ||||||

| Northern Technologies International Corp. | 141,183 | 1,670,194 | ||||||

| Perimeter Solutions S.A.(a) | 121,838 | 984,451 | ||||||

| UFP Technologies, Inc.(a) | 14,157 | 1,838,145 | ||||||

| 13,177,216 | ||||||||

| Real Estate — 3.84% | ||||||||

| EPR Properties | 29,050 | 1,106,805 | ||||||

| Lamar Advertising Co., Class A | 15,438 | 1,542,102 | ||||||

| 2,648,907 | ||||||||

| Technology — 14.47% | ||||||||

| Amdocs Ltd. | 16,204 | 1,556,070 | ||||||

| Cass Information Systems, Inc. | 44,820 | 1,941,154 | ||||||

| Extreme Networks, Inc.(a) | 50,400 | 963,648 | ||||||

| F5, Inc.(a) | 7,387 | 1,076,212 | ||||||

| Richardson Electronics Ltd. | 41,482 | 925,878 | ||||||

| Rimini Street, Inc.(a) | 295,231 | 1,216,352 | ||||||

| Teradata Corp.(a) | 57,270 | 2,306,836 | ||||||

| 9,986,150 | ||||||||

| Total Investments — 96.58% (Cost $68,195,954) | 66,663,179 | |||||||

| Other Assets in Excess of Liabilities — 3.42% | 2,359,825 | |||||||

| NET ASSETS — 100.00% | $ | 69,023,004 | ||||||

| (a) | Non-income producing security. |

ADR - American Depositary Receipt.

See accompanying notes which are an integral part of these financial statements.

5

| Ballast Small/Mid Cap ETF |

| Statement of Assets and Liabilities |

| March 31, 2023 (Unaudited) |

| Assets | ||||

| Investments in securities, at fair value (cost $68,195,954) | $ | 66,663,179 | ||

| Cash | 2,403,508 | |||

| Dividends receivable | 22,694 | |||

| Prepaid expenses | 768 | |||

| Total Assets | 69,090,149 | |||

| Liabilities | ||||

| Payable to Adviser, net of waiver | 45,880 | |||

| Payable to affiliates | 6,950 | |||

| Payable to audit and tax | 10,471 | |||

| Other accrued expenses | 3,844 | |||

| Total Liabilities | 67,145 | |||

| Net Assets | $ | 69,023,004 | ||

| Net Assets consist of: | ||||

| Paid-in capital | $ | 75,242,052 | ||

| Accumulated deficit | (6,219,048 | ) | ||

| Net Assets | $ | 69,023,004 | ||

| Shares outstanding (unlimited number of shares authorized, no par value) | 2,075,000 | |||

| Net asset value per share | $ | 33.26 |

See accompanying notes which are an integral part of these financial statements.

6

| Ballast Small/Mid Cap ETF |

| Statement of Operations |

| For the six months ended March 31, 2023 (Unaudited) |

| Investment Income | ||||

| Dividend income | $ | 750,945 | ||

| Total investment income | 750,945 | |||

| Expenses | ||||

| Adviser | 322,454 | |||

| Administration | 32,311 | |||

| Custodian | 14,556 | |||

| Legal | 11,084 | |||

| Compliance services | 9,972 | |||

| Audit and tax | 9,663 | |||

| Trustee | 9,564 | |||

| Transfer agent | 5,383 | |||

| Report printing | 5,018 | |||

| Insurance | 1,552 | |||

| Pricing | 533 | |||

| Miscellaneous | 16,049 | |||

| Total expenses | 438,139 | |||

| Fees waived by Adviser | (64,517 | ) | ||

| Net operating expenses | 373,622 | |||

| Net investment income | 377,323 | |||

| Net Realized and Change in Unrealized Gain (Loss) on Investments | ||||

| Net realized gain (loss) on: | ||||

| Investment securities | (409,368 | ) | ||

| Change in unrealized appreciation on: | ||||

| Investment securities | 9,361,084 | |||

| Net realized and unrealized gain (loss) on investment securities | 8,951,716 | |||

| Net increase in net assets resulting from operations | $ | 9,329,039 |

See accompanying notes which are an integral part of these financial statements.

7

| Ballast Small/Mid Cap ETF |

| Statements of Changes in Net Assets |

| For the Six | For the | |||||||

| Months Ended | Year Ended | |||||||

| March 31, | September 30, | |||||||

| 2023 | 2022 | |||||||

| (Unaudited) | ||||||||

| Increase (Decrease) in Net Assets due to: | ||||||||

| Operations | ||||||||

| Net investment income | $ | 377,323 | $ | 545,617 | ||||

| Net realized loss on investment securities | (409,368 | ) | (1,565,196 | ) | ||||

| Change in unrealized appreciation (depreciation) on investment securities | 9,361,084 | (12,145,398 | ) | |||||

| Net increase (decrease) in net assets resulting from operations | 9,329,039 | (13,164,977 | ) | |||||

| Distributions to Shareholders from: | ||||||||

| Earnings | (593,243 | ) | (120,500 | ) | ||||

| Total distributions | (593,243 | ) | (120,500 | ) | ||||

| Capital Transactions | ||||||||

| Proceeds from shares sold | 7,205,150 | 48,030,316 | ||||||

| Amount paid for shares redeemed | (6,359,153 | ) | (12,811,113 | ) | ||||

| Net increase in net assets resulting from capital transactions | 845,997 | 35,219,203 | ||||||

| Total Increase in Net Assets | 9,581,793 | 21,933,726 | ||||||

| Net Assets | ||||||||

| Beginning of period | $ | 59,441,211 | $ | 37,507,485 | ||||

| End of period | $ | 69,023,004 | $ | 59,441,211 | ||||

| Share Transactions | ||||||||

| Shares sold | 225,000 | 1,375,000 | ||||||

| Shares redeemed | (200,000 | ) | (375,000 | ) | ||||

| Net increase in shares outstanding | 25,000 | 1,000,000 | ||||||

See accompanying notes which are an integral part of these financial statements.

8

| Ballast Small/Mid Cap ETF |

| Financial Highlights |

| (For a share outstanding during each period) |

| For the Six | ||||||||||||

| Months | For the | |||||||||||

| Ended | For the | Period | ||||||||||

| March | Year Ended | Ended | ||||||||||

| 31, 2023 | September | September | ||||||||||

| (Unaudited) | 30, 2022 | 30, 2021(a) | ||||||||||

| Selected Per Share Data: | ||||||||||||

| Net asset value, beginning of period | $ | 29.00 | $ | 35.72 | $ | 25.00 | ||||||

| Investment operations: | ||||||||||||

| Net investment income | 0.18 | 0.30 | 0.02 | |||||||||

| Net realized and unrealized gain (loss) on investments | 4.37 | (6.92 | ) | 10.70 | ||||||||

| Total from investment operations | 4.55 | (6.62 | ) | 10.72 | ||||||||

| Less distributions to shareholders from: | ||||||||||||

| Net investment income | (0.29 | ) | (0.10 | ) | — | |||||||

| Total distributions | (0.29 | ) | (0.10 | ) | — | |||||||

| Net asset value, end of period | $ | 33.26 | $ | 29.00 | $ | 35.72 | ||||||

| Market price, end of period | $ | 33.26 | $ | 29.05 | $ | 35.80 | ||||||

| Total Return(b) | 15.72 | % (c) | (18.60 | )% | 42.88 | % (c) | ||||||

| Ratios and Supplemental Data: | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 69,023 | $ | 59,441 | $ | 37,507 | ||||||

| Ratio of net expenses to average net assets | 1.10 | % (d) | 1.10 | % | 1.10 | % (d) | ||||||

| Ratio of expenses to average net assets before waiver and reimbursement | 1.29 | % (d) | 1.37 | % | 2.08 | % (d) | ||||||

| Ratio of net investment income to average net assets | 1.11 | % (d) | 1.00 | % | 0.10 | % (d) | ||||||

| Portfolio turnover rate(e) | 15 | % (c) | 29 | % | 8 | % (c) | ||||||

| (a) | For the period December 2, 2020 (commencement of operations) to September 30, 2021. |

| (b) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of the period. Distributions are assumed, for the purpose of this calculation, to be reinvested at the ex-dividend date net asset value per share on their respective payment dates. |

| (c) | Not annualized. |

| (d) | Annualized. |

| (e) | Portfolio turnover rate excludes securities received or delivered from in-kind processing of creations or redemptions. |

See accompanying notes which are an integral part of these financial statements.

9

| Ballast Small/Mid Cap ETF |

| Notes to the Financial Statements |

| March 31, 2023 (Unaudited) |

NOTE 1. ORGANIZATION

Ballast Small/Mid Cap ETF (the “Fund”) was organized as a diversified series of Unified Series Trust (the “Trust”) on November 18, 2020, and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated October 14, 2002, as amended (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is Ballast Asset Management, LP (the “Adviser”). The Fund seeks to generate positive risk adjusted returns as its investment objective.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the six months ended March 31, 2023, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations when incurred. During the period, the Fund did not incur any interest or

10

| Ballast Small/Mid Cap ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2023 (Unaudited) |

penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months.

Expenses – Expenses incurred by the Trust that do not relate to the Fund are allocated to the individual funds of the Trust based on each fund’s relative net assets or another appropriate basis (as determined by the Board). The Adviser has agreed to pay all regular and recurring expenses of the Fund under terms of the investment advisory agreement.

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Distributions received from investments in real estate investment trusts (“REITs”) that represent a return of capital or capital gain are recorded as a reduction of the cost of investment or as a realized gain, respectively. The calendar year-end amounts of ordinary income, capital gains, and return of capital included in distributions received from the Fund’s investments in REITs are reported to the Fund after the end of the calendar year; accordingly, the Fund estimates these amounts for accounting purposes until the characterization of REIT distributions is reported. Estimates are based on the most recent REIT distributions information available. Withholding taxes on foreign dividends and related reclaims have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

11

| Ballast Small/Mid Cap ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2023 (Unaudited) |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m. Eastern Time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

12

| Ballast Small/Mid Cap ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2023 (Unaudited) |

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the Nasdaq over-the-counter market are generally valued at the Nasdaq Official Closing Price. When using market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, securities are valued in good faith by the Adviser, as Valuation Designee, under oversight of the Board. The Adviser has adopted written policies and procedures for valuing securities and other assets in circumstances where market quotes are not readily available. In the event that market quotes are not readily available, and the security or asset cannot be valued pursuant to one of the valuation methods, the value of the security or asset will be determined in good faith by the Adviser pursuant to its policies and procedures. The Trust’s administrator maintains a pricing review committee that will review any fair value provided by the Valuation Designee, subject to the ultimate review of the pricing methodology by the Pricing & Liquidity Committee of the Board on a quarterly basis. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV provided by the service agent of the mutual funds. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies and fair value determinations pursuant to Rule 2a-5, the Adviser as Valuation Designee is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Valuation Designee would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Valuation Designee’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Valuation Designee is aware of any other data that calls into question the reliability of market quotations.

13

| Ballast Small/Mid Cap ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2023 (Unaudited) |

The following is a summary of the inputs used to value the Fund’s investments as of March 31, 2023:

| Valuation Inputs | ||||||||||||||||

| Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks (a) | $ | 66,663,179 | $ | — | $ | — | $ | 66,663,179 | ||||||||

| Total | $ | 66,663,179 | $ | — | $ | — | $ | 66,663,179 | ||||||||

| (a) | Refer to Schedule of Investments for sector classifications. |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

The Adviser, under the terms of the management agreement with the Trust with respect to the Fund (the “Agreement”), manages the Fund’s investments. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.95% of the Fund’s average daily net assets. For the six months ended March 31, 2023, before the waiver described below, the Adviser earned a management fee of $322,454 from the Fund.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses through January 31, 2024 so that total annual operating expenses (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any administrative and/or shareholder servicing fees payable pursuant to a plan adopted by the Board of Trustees; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business) do not exceed 1.10% of the Fund’s average daily net assets. For the six months ended March 31, 2023, the Adviser waived fees and reimbursed Fund expenses of $64,517. At March 31, 2023, the Fund owed the Adviser $45,880.

Each fee waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date in which that particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the

14

| Ballast Small/Mid Cap ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2023 (Unaudited) |

annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of the recoupment. As of March 31, 2023 the Adviser may seek repayment of management fees waived and expense reimbursements pursuant to the aforementioned conditions, from the Fund no later than the dates stated below:

| Recoverable Through | ||||

| September 30, 2024 | $ | 165,632 | ||

| September 30, 2025 | 147,001 | |||

| March 31, 2026 | 64,517 |

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration and fund accounting services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services.

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Fund, which are approved annually by the Board.

Under the terms of a Distribution Agreement with the Trust, Northern Lights Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is an affiliate of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also employees of Ultimus and such persons are not paid by the Fund for serving in such capacities.

The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chairman of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” as defined in the 1940 Act. The Independent Trustees review and establish compensation at least annually. Each Independent Trustee of the Trust receives annual compensation, which is an established amount paid quarterly per fund in the Trust at the time of the regular quarterly Board meetings. The Chairman of the Board receives the highest compensation, commensurate with his additional duties and each Chair of a committee receives additional compensation as well. Independent Trustees also receive $1,000 for attending any special meeting that requires an in-person approval of a contract and $250 for the first hour and $200 for each additional hour for attending other special meetings. In addition, the Trust reimburses Independent Trustees for out-of-pocket expenses incurred in conjunction with attendance at meetings.

15

| Ballast Small/Mid Cap ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2023 (Unaudited) |

NOTE 5. INVESTMENT TRANSACTIONS

For the period ended March 31, 2023, purchases and sales of investment securities, other than short-term investments, were $9,930,593 and $11,960,951, respectively.

For the period ended March 31, 2023, purchases and sales for in-kind transactions were $7,110,046 and $6,559,515, respectively.

For the period ended March 31, 2023, the Fund had in-kind net realized gains of $1,338,971.

There were no purchases or sales of long-term U.S. government obligations during the period ended March 31, 2023.

NOTE 6. CAPITAL SHARE TRANSACTIONS

Shares are not individually redeemable and may be redeemed by the Fund at NAV only in large blocks known as “Creation Units” of 25,000 shares. Only Authorized Participants or transactions done through an Authorized Participant are permitted to purchase or redeem Creation Units from the Fund. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company participant and, in each case, must have executed a Participant Agreement with the Distributor. Such transactions are generally permitted on an in-kind basis, with a balancing cash component to equate the transaction to the NAV per share of the Fund on the transaction date. Cash may be substituted equivalent to the value of certain securities generally when they are not available in sufficient quantity for delivery, not eligible for trading by the Authorized Participant, or as a result of other market circumstances. In addition, the Fund may impose transaction fees on purchases and redemptions of Fund shares to cover the custodial and other costs incurred by the Fund in effecting trades. A fixed fee payable to the Custodian may be imposed on each creation and redemption transaction regardless of the number of Creation Units involved in the transaction (“Fixed Fee”). Purchases and redemptions of Creation Units for cash or involving cash-in-lieu are required to pay an additional variable charge to compensate the Fund and its ongoing shareholders for brokerage and market impact expenses relating to Creation Unit transactions (“Variable Charge,” and together with the Fixed Fee, the “Transaction Fees”). Transactions in capital shares for the Fund are disclosed in the Statements of Changes in Net Assets. For the six months ended March 31, 2023, the Fund received $8,400 and $0 in fixed fees and variable fees, respectively. The Transaction Fees for the Fund are listed in the table below:

| Fixed Fee | Variable Charge | |

| $350 | 2.00%* |

| * | The maximum Transaction Fee may be up to 2.00% of the amount invested. |

16

| Ballast Small/Mid Cap ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2023 (Unaudited) |

NOTE 7. FEDERAL TAX INFORMATION

At March 31, 2023, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

| Gross unrealized appreciation | $ | 5,449,741 | ||

| Gross unrealized depreciation | (6,982,516 | ) | ||

| Net unrealized depreciation on investments | $ | (1,532,775 | ) | |

| Tax cost of investments | $ | 68,195,954 |

| (a) | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

At September 30, 2022, the Fund’s most recent fiscal year end, the components of accumulated earnings (deficit) on a tax basis were as follows:

As of September 30, 2022, the Fund had short-term and long-term capital loss carryforwards available to offset future gains and not subject to expiration in the amount of $3,674,008 and $803,539, respectively.

NOTE 8. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 9. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

17

| Summary of Fund Expenses (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. You may pay brokerage commissions on purchases and sales of exchange-traded fund shares, which are not reflected in the example. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2022 through March 31, 2023.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| Beginning | Ending | |||||||||||||

| Account | Account | Expenses | ||||||||||||

| Value | Value | Paid | Annualized | |||||||||||

| October 1, | March 31, | During | Expense | |||||||||||

| 2022 | 2023 | Period(a) | Ratio | |||||||||||

| Actual | $ | 1,000.00 | $ | 1,157.20 | $ | 5.92 | 1.10% | |||||||

| Hypothetical(b) | $ | 1,000.00 | $ | 1,019.45 | $ | 5.54 | 1.10% | |||||||

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

18

| Adviser Agreement Renewal (Unaudited) |

The Ballast Small/Mid Cap ETF (the “Fund”) is a series of Unified Series Trust (the “Trust”). The Trust’s Board of Trustees (the “Board” or the “Trustees”) oversees the management of the Fund and, as required by law, considered the approval of the continuance of the Fund’s management agreement with its investment adviser, Ballast Asset Management, LP (“Ballast”). The Board approved the continuance of the management agreement.

The Board requested and evaluated all information that the Trustees deemed reasonably necessary under the circumstances in connection with the approval of the continuance of the management agreement.

The Trustees held a teleconference on November 9, 2022 to review and discuss materials compiled by Ultimus Fund Solutions, LLC, the Trust’s administrator, with regard to the management agreement between the Trust and Ballast. At the Trustees’ quarterly meeting held in November 2022, the Board interviewed certain executives of Ballast including Ballast’s Chief Executive Officer and its Chief Compliance Officer. After discussion, the Trustees, including the Trustees who are not “interested persons” (as that term is defined in the Investment Company Act of 1940) of the Trust or Ballast (the “Independent Trustees”), approved the continuance of the management agreement between the Trust and Ballast for an additional year. The Trustees’ approval of the continuance of the Fund’s management agreement was based on a consideration of all the information provided to the Trustees, and was not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations are described below, although individual Trustees may have evaluated this information differently, ascribing different weights to various factors.

(i) The Nature, Extent, and Quality of Services. The Trustees reviewed and considered information regarding the nature, extent, and quality of services that Ballast provides to the Fund, which include, but are not limited to, providing a continuous investment program for the Fund, adhering to the Fund’s investment restrictions, complying with the Trust’s policies and procedures, and voting proxies on behalf of the Fund. The Trustees considered the qualifications and experience of Ballast’s portfolio manager who is responsible for the day-to-day management of the Fund’s portfolio, as well as the qualifications and experience of the other individuals at Ballast who provide services to the Fund. After a thorough discussion and consideration of the nature, extent and quality of services provided by Ballast, the Trustees concluded that Ballast is providing excellent investment

19

| Adviser Agreement Renewal (Unaudited) (continued) |

management services to the Fund.

(ii) Fund Performance. The Trustees next reviewed and discussed the Fund’s performance for periods ended September 30, 2022. The Trustees observed that that Fund had underperformed the Fund’s benchmark index, the Russell 2500 Value Index, for the one-year period but had outperformed since inception. The Trustees noted that the Fund underperformed its Morningstar Small Blend category for the one-year period but outperformed the category average and median since inception. The Trustees observed that the Fund performed in-line with its peer group over the one-year period and outperformed its peer group since inception. The Trustees considered Ballast’s explanation that the underperformance over the one-year period was due to an overweight position in the consumer discretionary sector and that it had reduced the Fund’s exposure to this sector.

The Trustees next reviewed and discussed the performance of Ballast’s separately managed account that has an investment strategy similar to that of the Fund, noting that the performance of both was substantially similar. It was the consensus of the Trustees that they are very satisfied with the performance of the Fund.

(iii) Fee Rate and Profitability. The Trustees reviewed a fee and expense comparison for the Morningstar Small Blend category, which indicated that the Fund’s management fee and net expense ratio are higher than the average and median for the category. The Trustees noted that the Fund’s management fee and net expense ratio are also higher than the average and median of its peer group. The Trustees considered that the Fund’s management fee is slightly lower than the management fee charged on Ballast’s separately managed accounts. The Trustees also noted Ballast’s explanation that the peer group consists almost exclusively of quantitative and factor-based ETFs which have much lower operating costs than an actively managed ETF such as the Fund. The Trustees further acknowledged that the size of the Fund contributes to its higher net expense ratio.

The Trustees considered a profitability analysis prepared by Ballast for its management of the Fund, which indicated that Ballast is earning a profit as a result of managing the Fund.

The Trustees considered other potential benefits that Ballast may receive in connection with its management of the Fund, including third-party research

20

| Adviser Agreement Renewal (Unaudited) (continued) |

obtained by soft dollars, and noted that Ballast has soft dollar arrangements on behalf of the Fund in accordance with its compliance policies and procedures. After further discussion, the Trustees determined that the current profit was reasonable in light of Ballast’s services provided to the Fund.

After considering the above information, the Trustees concluded that the current management fee represents reasonable compensation in light of the nature and quality of the services that Ballast provides to the Fund, the fees paid by larger funds in the Morningstar category and peer group, and the profitability of Ballast’s services to the Fund.

(iv) Economies of Scale. In determining the reasonableness of the management fee, the Trustees also considered the extent to which Ballast will realize economies of scale as the Fund grows larger. The Trustees determined that, in light of the size of the Fund, it does not appear that Ballast is benefitting from economies of scale in managing the Fund to such an extent that breakpoints in the management fee should be considered at this time.

21

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (866) 383-6468 and (2) in Fund documents filed with the SEC on the SEC’s website at www.sec.gov.

| TRUSTEES Daniel J. Condon, Chairman David R. Carson Kenneth G.Y. Grant Freddie Jacobs, Jr. Catharine B. McGauley Ronald C. Tritschler |

INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM Cohen & Company, Ltd. 151 North Franklin Street, Suite 575 Chicago, IL 60606 |

| OFFICERS Martin R. Dean, President Gweneth K. Gosselink, Chief Compliance Officer Zachary P. Richmond, Treasurer and Chief Financial Officer Lynn E. Wood, Assistant Chief Compliance Officer |

LEGAL

COUNSEL Thompson Hine LLP 312 Walnut Street, 20th Floor Cincinnati, OH 45202 |

| INVESTMENT

ADVISER Ballast Asset Management, LP 2301 Cedar Springs Road, Suite 450 Dallas, TX 75201 |

CUSTODIAN Brown Brothers Harriman & Co. 50 Post Office Square Boston, MA 02110 |

| DISTRIBUTOR Northern Lights Distributors, LLC 4221 North 203rd Street, Suite 100 Elkhorn, NE 68022 |

ADMINISTRATOR Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246 |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Northern Lights Distributors, LLC Member FINRA/SIPC

Ballast Small-SAR-23

Semi-Annual Report

March 31, 2023

Fund Adviser:

Pekin

Hardy Strauss, Inc.

227 West Monroe Street, Suite 3625

Chicago, IL 60606

Toll Free (800) 470-1029

www.appleseedfund.com

April 25, 2023

Dear Appleseed Shareholder:

“Winter is coming.”

—Ned Stark, “Game of Thrones”

In the investment world, “winter” can be viewed as a synonym to recession, and, technically, winter is always coming at an uncertain point in the future. However, a number of recent economic signals highlight concerns that winter may be coming sooner rather than later, even though we most certainly do not have a crystal ball to forecast exactly when winter will come nor how severe it may well become.

We have been closely watching the economic indicators and trends provided below:

| ● | Inflation is hitting consumers hard. |

Since 2021, prices in the United States and elsewhere in the developed world have risen at a mid-to-high single-digit clip. The world is paying more for the same amount of goods and services and yet getting less for their money. In short, the quality of living has diminished with lower consumer purchasing power. Across the board, savings rates have fallen in the face of inflation, making the average person less prepared for financial emergencies, forcing many to rely on expensive loans or credit card debt to address unexpected expenses. Demand for discretionary items is falling, which should dampen economic growth.

With inflation squeezing the economy, consumers are more reliant on credit cards to afford increasingly expensive necessities like rent and food (and pricey discretionary items as well). As a result, total U.S. credit card debt spiked to a record $931 billion at the end of 2022, an 18.5% increase relative to 2021.1 Juxtaposed against this increased credit card debt is an unemployment rate that stands at a 53-year low, yet credit card delinquency rates are rising.

| 1 | Source: TransUnion. |

| www.appleseedfund.com | (800) 470-1029 |

1

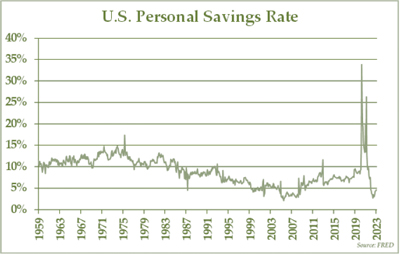

The personal savings rate, which is an important component of the financial security of U.S. households, measures how much of Americans’ disposable income remains after spending on food, rent, debt, and bills. As demonstrated in the chart below, the personal savings rate stands near all-time lows, reflecting the financial struggles of the average household. While some Americans are temporarily draining their savings by spending more to enjoy life post-lockdown, others are reducing savings to cover essentials because their wages simply are not maintaining pace with inflation.

| ● | Noteworthy bank closures are inciting fears. |

In March of 2023, the rapid collapse of Silicon Valley Bank, Silvergate Capital, and Signature Bank, along with the takeover of 166-year-old Credit Suisse by UBS, stoked concerns about the health of the banking system. In response, regulators took surprisingly aggressive steps to stem the contagion. Additional banking regulation and increased expenses for the banks are in the queue, thus placing incremental obstacles for credit formation and economic growth. Moreover, instability in the financial services sector negatively impacts the allocation of resources as well as the assessment and management of financial risks.

| www.appleseedfund.com | (800) 470-1029 |

2

| ● | Corporations are tightening their belts. |

Despite the well-publicized difficulty of hiring over the last few years, even highly profitable companies like Apple, Goldman Sachs, McKinsey, and Disney have announced material cuts in their highly paid work forces. In February 2023, the U.S. Bureau of Labor Statistics announced that there were just 9.9 million job openings; this report represented the first sub-10 million print since May 2021 and was 1.3 million lower than the December 2022 print. Moreover, companies are tapping the breaks on capital spending with particular weakness in more economically sensitive sectors; essentially, corporations are signaling that they are preparing for muted demand and pressured profit margins.

| ● | The return of student loan payments looms ominously. |

During the coronavirus pandemic, the Federal government issued regulations that allowed student loan payments to be temporarily paused. Ceased student loan payments are set to resume in September 2023, which will impact aggregate discretionary spending with more capital directed towards debt paydown. Notably, certain cohorts of Generation Z have never made a single debt repayment in their lives, and those people should feel this loss of discretionary capital more acutely than most.

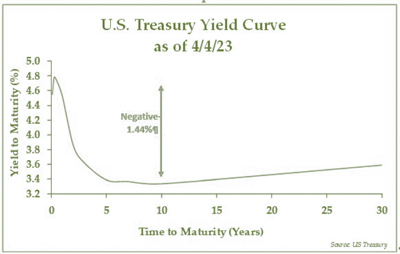

| ● | The inverted yield curve portends an ominous future. |

The yield curve is a chart that plots the interest rates of a specific type of debt at differing maturities. The slope of the yield curve is normally upward sloping, which indicates that investors require more return to invest capital for a longer period. Typically, an upward-sloping yield curve shape indicates stable economic conditions.

An inverted yield curve occurs when short-term interest rates exceed long-term rates, which is unusual because investors normally would not require a higher return to tie up their capital for shorter periods of time. As of March 31, 2023, the 90-day to 10-year U.S. Treasury yield spread

| www.appleseedfund.com | (800) 470-1029 |

3

stood at negative 1.37%, which is quite wide as compared to historical norms. Notably, an inverted Treasury yield curve has been one of the most reliable leading indicators of an impending recession.2

The current shape of the yield curve has serious implications for credit formation. With the Fed Funds target rate of 5% as of March 31, 2023 and banks’ estimated earnings yield on assets below that rate, depositors are moving capital to money market funds, and banks are responding by tightening their lending standards.

| ● | The Federal Reserve’s posture remains hawkish. |

Despite the recent banking turmoil, the Federal Reserve raised the Fed Funds interest rate by another 0.25% in late March, pushing forward with its aggressive campaign to rein in inflation. Federal Reserve officials are now forecasting just one more interest rate increase this year but doing so with an increasingly uncertain tone. These interest rate increases slow economic activity, as they drive up the cost of credit for credit cards, adjustable-rate mortgages, and other variable loans.

| 2 | https://www.chicagofed.org/publications/chicago-fed-letter/2018/404. |

| www.appleseedfund.com | (800) 470-1029 |

4

Moreover, in June 2022, the Federal Reserve began to passively shrink its assets as the underlying securities on its balance sheet matured -- a process called Quantitative Tightening, which drains liquidity out of the financial system. The objectives of Quantitative Tightening are deflationary in nature and are similar to that of raising borrowing costs because it cools down an overheated economy by reducing the amount of money in circulation.

| ● | The U.S. stock market performance is increasingly narrow. |

During the first quarter of 2023, investors rotated back into the beaten-up stocks of technology giants like Apple and Nvidia, leading to massive price gains in the worst-performing sector of 2022. Despite significant volatility, defensive stocks suffered, as most stocks in consumer defensive, healthcare, and utility sectors all ended the quarter with losses. Plus, the energy sector, which led the stock market in 2022 by a large margin, was the worst-performing sector of the stock market. The narrow nature of the recent stock market moves is rather perplexing and is likely indicative of unhealthy, anemic growth as well as a possible recession looming. If the economy was exhibiting healthy growth, then the move in the stock market would be far more broad-based in nature.

| ● | The Federal debt ceiling simply cannot be breached. |

Created by Congress in 1917, the debt ceiling is the approved debt limit for the U.S. government, which now stands at $31.4 trillion. The U.S. Treasury reached the current limit earlier this year, so it has no room to borrow incremental capital, other than to replace maturing debt. Further, Treasury Secretary Janet Yellen is pursuing “extraordinary measures” to keep the government funded. Bumping against the debt ceiling is not necessarily a new issue, as the debt limit has been increased many dozens of times over the years. Both political parties all too often engage in contentious battles with regard to this issue, usually about spending and taxing priorities.

We expect that a debt ceiling agreement will be reached after significant negotiation. However, in today’s highly polarized political environment, it could be a publicly contentious process that could exacerbate market

| www.appleseedfund.com | (800) 470-1029 |

5

volatility and weaken confidence in the economy. Given that the Federal Reserve is trying to tame inflation, a protracted debt ceiling battle that undermines confidence would be counterproductive.

On the other side of this dizzying myriad of headwinds, certain countervailing forces play roles in positively impacting the economy. Next year is an election year, and Congress and the Executive branch will likely use fiscal policy to stimulate the broader economy in order to attract votes. Also, Federal Reserve Chairman Jerome Powell might have to reverse course in its monetary tightening campaign if financial instability increases sufficiently. While it is a backward-looking economic indicator, unemployment rates do stand near all-time lows. In our view, despite these possible countervailing forces, we believe that a recession beginning later this year is more likely than not.

Performance and Portfolio Changes

Over the six months ended 3/31/2023, Appleseed Fund Investor Class has generated an absolute return of 5.42%, outperforming the Morningstar Global Markets Small-Mid Cap Index, which generated a total return of 3.57%. Strong performance was driven by the equity portion of the portfolio and by physical gold but partially offset by weakness in financial services stocks and by our hedging activities with index puts.

During the most recent quarter, Appleseed Fund added three new equity holdings: Medtronic (MDT), Stanley Black & Decker (SWK), and Synovus Financial (SNV). Medtronic is the world’s largest medical device manufacturer, and it holds the number one or number two market share in most of its product segments. Medtronic’s business is heavily weighted towards complicated in-patient procedures, which are typically quite profitable. Industry dynamics are quite attractive with an aging global population and the growth of improved healthcare in emerging markets; furthermore, most of its segments are highly concentrated with just 2-3 players that split each segment’s market share, affording the key participants with significant economies of scale and pricing power. The Company has been recently addressing several temporary headwinds including a strong dollar, inflation, a delayed recovery in surgical volumes from the coronavirus pandemic, and supply chain issues. Once these issues reach the rearview mirror, the Company’s growth and margin expansion plans should transform into reality.

| www.appleseedfund.com | (800) 470-1029 |

6

Stanley Black & Decker is the world’s largest tool manufacturer. It produces power tools, hand tools, storage, digital tool solutions, lifestyle products, outdoor products, engineered fasteners, and other industrial equipment. 2022 was quite a forgettable year for the Company with its stock price falling by roughly 60%. Due to supply chain issues, bloated inventories, inflationary pressures, and weaker demand, the Company badly missed its original 2022 guidance. With recessionary fears, waning earnings momentum, a more elevated leverage profile, and reliance on the U.S. construction market, it is of no surprise how poorly the stock price behaved last year. In our view, the sell-off has been excessive with the stock price trading near March 2020 pandemic lows and at levels otherwise not seen since early 2014. We view the stock at washed-out levels with a favorable profile going forward.

In February 2023, Appleseed Fund took a position in Synovus, a Georgia-based regional bank; retrospective vision being 20/20, our timing with this initial purchase was poor. Synovus’ business performed admirably in 2022 with an expanding net interest margin, achievement of its annual cost and revenue benefits from its 2020 restructuring program, improved non-performing loans, and accelerating loan growth. The business clearly was performing well, and the stock market had not given the Company much credit when we took a partial position earlier this year at attractive valuations.

Indeed, the banking crisis that began the next month wiped out several well-respected regional banks (e.g., Silicon Valley Bank, Signature Bank) and a global bank (e.g., Credit Suisse). The instability in the financial services sector caused investors to throw the baby (Synovus) out with the bath water, despite the attractive economics and compelling valuation associated with Synovus. Today, we believe Synovus to be well capitalized and with strong risk controls. At current levels, we think the risk/return characteristics of this business are that much more attractive, but the entry point on this investment has thus far proved to be early and a little painful.

During the quarter, Appleseed Fund sold two equity investments: Adidas AG (ADS-DE) and Allstate Corporation (ALL). Adidas aggressively made the decision to wind-down the highly profitable Yeezy business due to Kanye West’s anti-Semitic commentary, which was a painful blow to Adidas’ revenues and earnings. That issue, combined with continued weakness in its China business, lowered our long-term expectations in Adidas. However, the stock

| www.appleseedfund.com | (800) 470-1029 |

7

price reacted very positively to the Yeezy exit, and we subsequently sold our Adidas shares at an attractive price. Allstate’s stock price reached our estimate for intrinsic value, so Appleseed Fund exited its position.

Within the equity portion of the portfolio, the three biggest contributors to Appleseed Fund’s performance over the six months were Ardelyx (ARDX), Samsung Electronics (005930-KR), and Adidas. The most significant detractors to Appleseed Fund’s performance over the past six months have been Synovus (SNV), CNB Financial (CCNE), and Rockley Photonics (RKLY).

Currently, Appleseed Fund is generally positioned defensively in light of this bearish outlook on the economy. With regards to equities, we are favoring companies in the consumer staples, healthcare, and agriculture sectors as well as inexpensive, out-of-favor value stocks.

Beyond equities, Appleseed Fund is overweight U.S.Treasury Inflation Protected Securities (TIPS) and physical gold trusts. We own TIPS because, in the current environment, real yields have become attractive for the first time in years. We own gold because gold should help to reduce portfolio volatility and is likely to perform well in an environment where inflation remains persistently elevated even while real growth is slowing.

Appleseed Fund thanks you for your continued support in asking us to manage your investable assets.

Sincerely,

Adam Strauss, CFA

William Pekin, CFA

Joseph Plevelich, CFA

Shaun Roach, CFA

Joshua Strauss, CFA

| www.appleseedfund.com | (800) 470-1029 |

8

The Fund’s Top Ten Holdings can be found at: www.appleseedfund.com.

Diversification does not ensure a profit or guarantee against loss.

Investments in commodities such as gold may be affected by overall market movements, changes in interest rates, and other factors such as embargoes and international economic and political developments. Commodities are assets that have tangible properties, such as oil, metals, and agricultural products. These instruments may subject the Fund to greater volatility than investments in traditional securities.

The views and opinions expressed in this material are those of the authors. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate. These opinions are current as of the date of this letter but are subject to change. There is no guarantee that any forecasts or opinions in this material will be realized. Information should not be construed as investment advice nor be considered a recommendation to buy, sell, or hold any particular security.

You should consider the Fund’s investment objectives, risks, charges, and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month by calling 1-800-470-1029.

Distributed by Ultimus Fund Distributors, LLC (Member FINRA).

| www.appleseedfund.com | (800) 470-1029 |

9

| INVESTMENT RESULTS – (Unaudited) |

| Average Annual Total Returns(a) | ||||||||

| (for the periods ended March 31, 2023) | ||||||||

| Since | Since | |||||||

| Six | One | Five | Ten | Inception | Inception | |||

| Months | Year | Year | Year | (12/08/06) | (1/31/11) | |||

| Appleseed Fund | ||||||||

| Investor Class | 5.42% | -10.73% | 3.88% | 3.93% | 5.61% | N/A | ||

| Institutional Class | 5.46% | -10.54% | 4.07% | 4.13% | N/A | 5.32% | ||

| Morningstar Global Markets Small-Mid Cap Index(b) | 3.57% | -8.82% | 4.67% | 7.18% | 5.91% | 7.04% | ||

| Expense Ratios(c) | ||||||||

| Investor | Institutional | |||||||

| Class | Class | |||||||

| Gross | 1.57% | 1.32% | ||||||

| With Applicable Waivers | 1.23% | 1.04% | ||||||

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Appleseed Fund (the “Fund”) distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted.The Fund’s investment objectives, risks, charges and expenses should be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (800) 470-1029.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performances would have been lower. Total returns for less than one year are not annualized. |

| (b) | The Morningstar Global Markets Small-Mid Cap Index (the “Morningstar Index”) measures the performance of global equity markets targeting the top 71% to 97% of stocks by market capitalization in both developed and emerging markets. The Morningstar Index does not incorporate Environmental, Social, or Governance (ESG) criteria. The Morningstar Index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. The Morningstar Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. An individual cannot invest directly in the Morningstar Index. However, an individual may be able to invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. The Fund is not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”).The Morningstar Entities make no representation or warranty, express or implied, to individuals who invest in the Fund or any member of the public regarding the advisability of investing in equity securities generally or in the Fund in particular or the ability of the Fund to track the Morningstar Indices or general equity market performance.THE MORNINGSTAR ENTITIES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE FUNDS OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. You cannot invest directly in an index. |

| (c) | The expense ratios, which include acquired fund fees and expenses of 0.09%, are from the Fund’s prospectus dated January 28, 2023. Pekin Hardy Strauss, Inc. (the “Adviser”) has contractually agreed to waive its management fee and/or reimburse expenses through January 31, 2024 so that total annual operating expenses (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on |

| www.appleseedfund.com | (800) 470-1029 |

10

| INVESTMENT RESULTS – continued (Unaudited) |

securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; any administrative and/ or shareholder servicing fees payable pursuant to a plan adopted by the Board of Trustees; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business) do not exceed 0.95% of the Fund’s average daily net assets. Each waiver/ expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/ expense payment and any expense limitation in effect at the time of the recoupment. This expense cap may not be terminated prior to this date except by the Board of Trustees upon 60 days’ written notice to the Adviser. Additional information pertaining to the Fund’s expense ratios as of March 31, 2023 can be found in the financial highlights, which do not include acquired fund fees and expenses.

You should consider the Fund’s investment objectives, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month-end by calling (800) 470-1029.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

| www.appleseedfund.com | (800) 470-1029 |

11

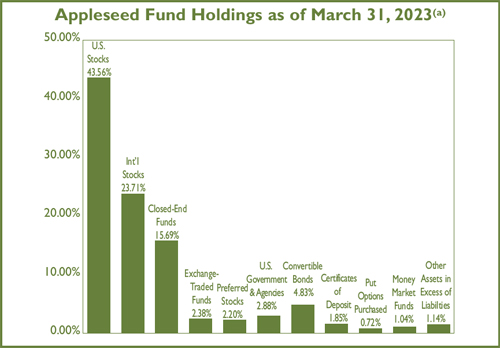

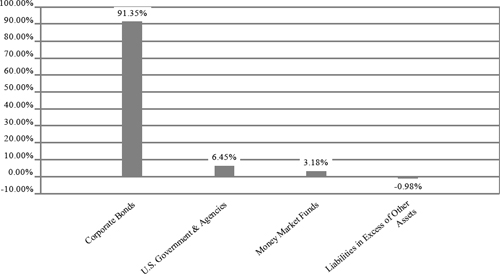

| FUND HOLDINGS – (Unaudited) |

| (a) | As a percentage of net assets. |

The Fund invests primarily in a portfolio of equity securities of companies that are undervalued in the opinion of the Adviser. The investment objective of the Fund is long-term capital appreciation.

Availability of Portfolio Schedule – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov and on the Fund’s website at www.appleseedfund.com.

12

| APPLESEED FUND |

| SCHEDULE OF INVESTMENTS – (Unaudited) |

| March 31, 2023 |

| Fair | ||||||||

| Common Stocks — 67.27% | Shares | Value | ||||||

| Canada — 4.31% | ||||||||

| Real Estate — 4.31% | ||||||||

| Boardwalk Real Estate Investment Trust | 85,000 | $ | 3,467,873 | |||||

| Total Canada | 3,467,873 | |||||||

| France — 3.15% | ||||||||

| Communications — 3.15% | ||||||||

| Bollore SA | 410,000 | 2,530,535 | ||||||

| Total France | 2,530,535 | |||||||

| Ireland — 5.51% | ||||||||

| Financials — 3.50% | ||||||||

| AerCap Holdings NV(a) | 50,000 | 2,811,500 | ||||||

| Health Care — 2.01% | ||||||||

| Medtronic PLC | 20,000 | 1,612,400 | ||||||

| Total Ireland | 4,423,900 | |||||||

| Israel — 3.39% | ||||||||

| Industrials — 3.39% | ||||||||

| Ituran Location and Control Ltd. | 125,000 | 2,722,500 | ||||||

| Total Israel | 2,722,500 | |||||||

| Japan — 3.39% | ||||||||

| Technology — 3.39% | ||||||||

| Sony Group Corp. - ADR | 30,000 | 2,719,500 | ||||||

| Total Japan | 2,719,500 | |||||||

| Russia — 0.00% | ||||||||

| Financials — 0.00% | ||||||||

| Moscow Exchange MICEX-RTS PJSC - ADR(a)(b)(c) | 1,300,000 | 167 | ||||||

| Sberbank of Russia PJSC - ADR(a)(b)(c) | 324,000 | 4 | ||||||

| Total Russia | 171 | |||||||

| South Korea — 3.96% | ||||||||

| Technology — 3.96% | ||||||||