Form N-CSRS FIDELITY SALEM STREET For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | September 30 |

Date of reporting period: | March 31, 2022 |

Item 1.

Reports to Stockholders

Fidelity® Strategic Real Return Fund

Semi-Annual Report

March 31, 2022

Includes Fidelity and Fidelity Advisor share classes

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of COVID-19 emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and corporate earnings. On March 11, 2020, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread. The pandemic prompted a number of measures to limit the spread of COVID-19, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. To help stem the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

In general, the overall impact of the pandemic lessened in 2021, amid a resilient economy and widespread distribution of three COVID-19 vaccines granted emergency use authorization from the U.S. Food and Drug Administration (FDA) early in the year. Still, the situation remains dynamic, and the extent and duration of its influence on financial markets and the economy is highly uncertain, due in part to a recent spike in cases based on highly contagious variants of the coronavirus.

Extreme events such as the COVID-19 crisis are exogenous shocks that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets. Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we continue to take extra steps to be responsive to customer needs. We encourage you to visit us online, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary (Unaudited)

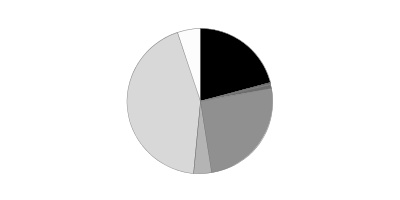

The information in the Quality Diversification and Asset Allocation tables is based on the combined investments of the Fund and its pro-rata share of investments of each Fidelity Central Fund other than the Commodity Strategy and Money Market Central Funds.Holdings Distribution (% of fund's net assets)

| As of March 31, 2022 | ||

| Commodity-Linked Notes and Related Investments* | 29.2% | |

| Inflation-Protected Investments | 20.9% | |

| Floating Rate High Yield** | 25.8% | |

| Real Estate Investments*** | 19.6% | |

| Cash and Cash Equivalents | 4.8% | |

* Includes investment in Fidelity® Commodity Strategy Central Fund

** Includes investment in Fidelity® Floating Rate Central Fund

*** Includes investment in Fidelity® Real Estate Equity Central Fund

Quality Diversification (% of fund's net assets)

| As of March 31, 2022 | ||

| U.S. Government and U.S. Government Agency Obligations | 20.9% | |

| AAA | 0.3% | |

| AA | 0.1% | |

| BBB | 1.0% | |

| BB and Below | 25.2% | |

| Not Rated | 4.0% | |

| Equities* | 43.4% | |

| Short-Term Investments and Net Other Assets | 5.1% | |

* Includes investment in Fidelity® Commodity Strategy Central Fund of 14.8%

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

Asset Allocation (% of fund's net assets)

| As of March 31, 2022*,** | ||

| Stocks | 27.2% | |

| U.S. Government and U.S. Government Agency Obligations | 20.9% | |

| Corporate Bonds | 2.8% | |

| Asset-Backed Securities | 0.3% | |

| Bank Loan Obligations | 24.4% | |

| CMOs and Other Mortgage Related Securities | 3.2% | |

| Other Investments*** | 16.1% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.1% | |

* Foreign investments - 9.1%

** U.S. Treasury Inflation-Indexed Securities - 20.9%

*** Includes investment in Fidelity® Commodity Strategy Central Fund of 14.8%

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or institutional.fidelity.com, as applicable.

Schedule of Investments March 31, 2022 (Unaudited)

Showing Percentage of Net Assets

| Corporate Bonds - 2.0% | |||

| Principal Amount | Value | ||

| Convertible Bonds - 0.1% | |||

| FINANCIALS - 0.1% | |||

| Mortgage Real Estate Investment Trusts - 0.1% | |||

| Arbor Realty Trust, Inc. 4.75% 11/1/22 | $109,000 | $112,815 | |

| Granite Point Mortgage Trust, Inc. 5.625% 12/1/22 (a) | 110,000 | 108,969 | |

| KKR Real Estate Finance Trust, Inc. 6.125% 5/15/23 | 77,000 | 79,695 | |

| MFA Financial, Inc. 6.25% 6/15/24 | 285,000 | 286,247 | |

| Redwood Trust, Inc.: | |||

| 4.75% 8/15/23 | 224,000 | 220,863 | |

| 5.625% 7/15/24 | 130,000 | 129,025 | |

| RWT Holdings, Inc. 5.75% 10/1/25 | 130,000 | 126,506 | |

| 1,064,120 | |||

| Nonconvertible Bonds - 1.9% | |||

| COMMUNICATION SERVICES - 0.1% | |||

| Diversified Telecommunication Services - 0.0% | |||

| Switch Ltd. 4.125% 6/15/29 (a) | 100,000 | 98,375 | |

| Media - 0.1% | |||

| Clear Channel Outdoor Holdings, Inc. 7.5% 6/1/29 (a) | 350,000 | 349,249 | |

| TOTAL COMMUNICATION SERVICES | 447,624 | ||

| CONSUMER DISCRETIONARY - 0.3% | |||

| Hotels, Restaurants & Leisure - 0.2% | |||

| Hilton Domestic Operating Co., Inc. 3.625% 2/15/32 (a) | 285,000 | 258,638 | |

| Hilton Grand Vacations Borrower Escrow LLC 4.875% 7/1/31 (a) | 435,000 | 404,137 | |

| Marriott Ownership Resorts, Inc. 4.5% 6/15/29 (a) | 400,000 | 377,000 | |

| Sugarhouse HSP Gaming Prop Mezz LP/Sugarhouse HSP Gaming Finance Corp. 5.875% 5/15/25 (a) | 250,000 | 246,250 | |

| Times Square Hotel Trust 8.528% 8/1/26 (a) | 271,312 | 276,365 | |

| 1,562,390 | |||

| Household Durables - 0.1% | |||

| Adams Homes, Inc. 7.5% 2/15/25 (a) | 70,000 | 69,825 | |

| Ashton Woods U.S.A. LLC/Ashton Woods Finance Co.: | |||

| 4.625% 8/1/29 (a) | 20,000 | 17,637 | |

| 4.625% 4/1/30 (a) | 70,000 | 60,982 | |

| 6.625% 1/15/28 (a) | 175,000 | 179,296 | |

| Brookfield Residential Properties, Inc./Brookfield Residential U.S. Corp. 4.875% 2/15/30 (a) | 15,000 | 13,415 | |

| Century Communities, Inc. 3.875% 8/15/29 (a) | 65,000 | 58,289 | |

| LGI Homes, Inc. 4% 7/15/29 (a) | 170,000 | 149,258 | |

| M/I Homes, Inc. 3.95% 2/15/30 | 100,000 | 88,003 | |

| TRI Pointe Homes, Inc. 5.25% 6/1/27 | 100,000 | 99,292 | |

| 735,997 | |||

| TOTAL CONSUMER DISCRETIONARY | 2,298,387 | ||

| ENERGY - 0.0% | |||

| Oil, Gas & Consumable Fuels - 0.0% | |||

| Global Partners LP/GLP Finance Corp. 7% 8/1/27 | 100,000 | 100,000 | |

| FINANCIALS - 0.0% | |||

| Banks - 0.0% | |||

| HAT Holdings I LLC/HAT Holdings II LLC 3.75% 9/15/30 (a) | 100,000 | 90,000 | |

| HEALTH CARE - 0.0% | |||

| Health Care Providers & Services - 0.0% | |||

| Sabra Health Care LP 3.2% 12/1/31 | 250,000 | 223,098 | |

| INDUSTRIALS - 0.1% | |||

| Trading Companies & Distributors - 0.1% | |||

| Williams Scotsman International, Inc. 4.625% 8/15/28 (a) | 350,000 | 341,250 | |

| REAL ESTATE - 1.4% | |||

| Equity Real Estate Investment Trusts (REITs) - 1.1% | |||

| American Finance Trust, Inc./American Finance Operating Partnership LP 4.5% 9/30/28 (a) | 345,000 | 310,541 | |

| American Tower Corp.: | |||

| 2.7% 4/15/31 | 250,000 | 226,101 | |

| 3.8% 8/15/29 | 250,000 | 248,783 | |

| Boston Properties, Inc. 3.25% 1/30/31 | 250,000 | 241,782 | |

| CBL & Associates HoldCo II LLC 10% 11/15/29 | 30,435 | 30,435 | |

| CBL & Associates LP 5.95% 12/15/26 (b)(c) | 132,000 | 0 | |

| Crown Castle International Corp. 2.25% 1/15/31 | 500,000 | 440,692 | |

| CTR Partnership LP/CareTrust Capital Corp. 3.875% 6/30/28 (a) | 225,000 | 212,112 | |

| Equinix, Inc. 3.2% 11/18/29 | 500,000 | 478,498 | |

| GLP Capital LP/GLP Financing II, Inc. 3.25% 1/15/32 | 250,000 | 226,825 | |

| Invitation Homes Operating Partnership LP 2% 8/15/31 | 500,000 | 426,985 | |

| iStar Financial, Inc.: | |||

| 4.25% 8/1/25 | 305,000 | 300,044 | |

| 4.75% 10/1/24 | 150,000 | 151,226 | |

| MPT Operating Partnership LP/MPT Finance Corp.: | |||

| 4.625% 8/1/29 | 565,000 | 559,350 | |

| 5% 10/15/27 | 105,000 | 106,772 | |

| Office Properties Income Trust 4.25% 5/15/24 | 80,000 | 80,510 | |

| Omega Healthcare Investors, Inc.: | |||

| 3.375% 2/1/31 | 500,000 | 458,044 | |

| 4.5% 4/1/27 | 83,000 | 84,649 | |

| Park Intermediate Holdings LLC 4.875% 5/15/29 (a) | 250,000 | 234,363 | |

| RLJ Lodging Trust LP: | |||

| 3.75% 7/1/26 (a) | 100,000 | 95,000 | |

| 4% 9/15/29 (a) | 455,000 | 420,811 | |

| Senior Housing Properties Trust: | |||

| 4.75% 5/1/24 | 271,000 | 259,829 | |

| 4.75% 2/15/28 | 100,000 | 91,054 | |

| 9.75% 6/15/25 | 400,000 | 421,000 | |

| Sun Communities Operating LP 2.7% 7/15/31 | 500,000 | 451,068 | |

| Uniti Group LP / Uniti Group Finance, Inc. 6.5% 2/15/29 (a) | 430,000 | 400,911 | |

| Uniti Group, Inc. 6% 1/15/30 (a) | 105,000 | 94,500 | |

| Welltower, Inc. 3.85% 6/15/32 | 250,000 | 251,745 | |

| XHR LP 4.875% 6/1/29 (a) | 250,000 | 242,858 | |

| 7,546,488 | |||

| Real Estate Management & Development - 0.3% | |||

| DTZ U.S. Borrower LLC 6.75% 5/15/28 (a) | 435,000 | 454,575 | |

| Greystar Real Estate Partners 5.75% 12/1/25 (a) | 290,000 | 292,175 | |

| Howard Hughes Corp.: | |||

| 4.125% 2/1/29 (a) | 40,000 | 37,530 | |

| 4.375% 2/1/31 (a) | 285,000 | 267,900 | |

| 5.375% 8/1/28 (a) | 130,000 | 130,517 | |

| Kennedy-Wilson, Inc.: | |||

| 4.75% 3/1/29 | 225,000 | 216,929 | |

| 4.75% 2/1/30 | 225,000 | 213,955 | |

| 5% 3/1/31 | 40,000 | 38,400 | |

| Mattamy Group Corp. 5.25% 12/15/27 (a) | 100,000 | 98,709 | |

| Realogy Group LLC/Realogy Co-Issuer Corp. 5.75% 1/15/29 (a) | 35,000 | 32,988 | |

| Realogy Group LLC/Realogy Co.-Issuer Corp. 5.25% 4/15/30 (a) | 250,000 | 230,000 | |

| 2,013,678 | |||

| TOTAL REAL ESTATE | 9,560,166 | ||

| TOTAL NONCONVERTIBLE BONDS | 13,060,525 | ||

| TOTAL CORPORATE BONDS | |||

| (Cost $14,215,136) | 14,124,645 | ||

| U.S. Treasury Inflation-Protected Obligations - 20.9% | |||

| U.S. Treasury Inflation-Indexed Bonds: | |||

| 0.125% 2/15/51 | $1,645,737 | $1,687,294 | |

| 0.125% 2/15/52 | 1,050,358 | 1,090,811 | |

| 0.25% 2/15/50 | 1,705,954 | 1,793,631 | |

| 0.625% 2/15/43 | 1,647,192 | 1,839,552 | |

| 0.75% 2/15/42 | 2,212,241 | 2,530,012 | |

| 0.75% 2/15/45 | 2,590,828 | 2,976,771 | |

| 0.875% 2/15/47 | 1,587,472 | 1,908,456 | |

| 1% 2/15/46 | 1,332,507 | 1,623,235 | |

| 1% 2/15/48 | 1,241,580 | 1,542,764 | |

| 1% 2/15/49 | 1,100,521 | 1,382,158 | |

| 1.375% 2/15/44 | 2,364,426 | 3,033,362 | |

| 1.75% 1/15/28 | 1,572,847 | 1,794,137 | |

| 2% 1/15/26 | 1,763,567 | 1,973,376 | |

| 2.125% 2/15/40 | 863,711 | 1,222,136 | |

| 2.125% 2/15/41 | 1,315,926 | 1,861,049 | |

| 2.375% 1/15/25 | 2,845,839 | 3,155,282 | |

| 2.375% 1/15/27 | 1,702,245 | 1,970,292 | |

| 2.5% 1/15/29 | 1,478,414 | 1,794,413 | |

| 3.375% 4/15/32 | 744,447 | 1,048,777 | |

| 3.625% 4/15/28 | 1,633,974 | 2,064,437 | |

| 3.875% 4/15/29 | 2,064,236 | 2,722,837 | |

| U.S. Treasury Inflation-Indexed Notes: | |||

| 0.125% 7/15/24 | 4,423,611 | 4,636,546 | |

| 0.125% 10/15/24 | 3,931,802 | 4,104,058 | |

| 0.125% 4/15/25 | 3,255,554 | 3,392,817 | |

| 0.125% 10/15/25 | 3,915,950 | 4,094,096 | |

| 0.125% 4/15/26 | 3,052,155 | 3,178,627 | |

| 0.125% 7/15/26 | 3,702,877 | 3,883,875 | |

| 0.125% 10/15/26 | 4,213,223 | 4,411,104 | |

| 0.125% 1/15/30 | 3,893,468 | 4,097,095 | |

| 0.125% 7/15/30 | 4,379,661 | 4,646,897 | |

| 0.125% 1/15/31 | 4,622,528 | 4,894,779 | |

| 0.125% 7/15/31 | 4,632,296 | 4,929,682 | |

| 0.125% 1/15/32 (d) | 3,367,244 | 3,583,463 | |

| 0.25% 1/15/25 | 4,037,021 | 4,229,118 | |

| 0.25% 7/15/29 | 3,587,528 | 3,818,848 | |

| 0.375% 7/15/23 | 5,142,924 | 5,391,133 | |

| 0.375% 7/15/25 | 4,461,262 | 4,718,154 | |

| 0.375% 1/15/27 | 3,506,801 | 3,701,290 | |

| 0.375% 7/15/27 | 3,837,613 | 4,068,421 | |

| 0.5% 4/15/24 | 2,757,867 | 2,892,651 | |

| 0.5% 1/15/28 | 3,951,652 | 4,215,138 | |

| 0.625% 4/15/23 | 4,556,909 | 4,744,434 | |

| 0.625% 1/15/24 | 4,888,401 | 5,140,880 | |

| 0.625% 1/15/26 | 3,729,541 | 3,969,540 | |

| 0.75% 7/15/28 | 3,445,243 | 3,760,592 | |

| 0.875% 1/15/29 | 3,020,790 | 3,320,948 | |

| TOTAL U.S. TREASURY INFLATION-PROTECTED OBLIGATIONS | |||

| (Cost $143,595,821) | 144,838,968 | ||

| Asset-Backed Securities - 0.3% | |||

| American Homes 4 Rent Series 2015-SFR2 Class XS, 0% 10/17/52 (a)(c)(e)(f) | $137,157 | $1 | |

| Conseco Finance Securitizations Corp.: | |||

| Series 2002-1 Class M2, 9.546% 12/1/33 | 284,000 | 286,464 | |

| Series 2002-2 Class M2, 9.163% 3/1/33 | 355,296 | 327,788 | |

| DigitalBridge Issuer, LLC / DigitalBridge Co.-Issuer, LLC Series 2021-1A Class A2, 3.933% 9/25/51 (a) | 85,000 | 81,522 | |

| FirstKey Homes Trust Series 2021-SFR2 Class F1, 2.908% 9/17/38 (a) | 100,000 | 88,808 | |

| Home Partners of America Trust: | |||

| Series 2021-1 Class F, 3.325% 9/17/41 (a) | 93,415 | 83,863 | |

| Series 2021-2 Class G, 4.505% 12/17/26 (a) | 187,720 | 173,900 | |

| Lehman ABS Manufactured Housing Contract Trust Series 2001-B Class M2, 7.17% 4/15/40 | 373,601 | 267,524 | |

| Progress Residential Series 2022-SFR2 Class E2, 4.8% 4/17/27 | 100,000 | 95,500 | |

| Progress Residential Trust: | |||

| Series 2021-SFR6 Class F, 3.422% 7/17/38 (a) | 100,000 | 90,707 | |

| Series 2021-SFR8: | |||

| Class F, 3.181% 10/17/38 (a) | 100,000 | 88,811 | |

| Class G, 4.005% 10/17/38 (a) | 100,000 | 90,577 | |

| Tricon Residential Series 2022-SFR1: | |||

| Class E1, 5.344% 4/17/39 (a) | 238,000 | 237,827 | |

| Class E2, 5.739% 4/17/39 (a) | 295,000 | 294,806 | |

| TOTAL ASSET-BACKED SECURITIES | |||

| (Cost $2,405,466) | 2,208,098 | ||

| Commercial Mortgage Securities - 3.2% | |||

| BAMLL Commercial Mortgage Securities Trust floater Series 2021-JACX Class E, 1 month U.S. LIBOR + 3.750% 4.147% 9/15/38 (a)(e)(g) | 106,000 | 104,055 | |

| BANK Series 2020-BN30 Class MCDG, 2.9182% 12/15/53 (e) | 189,000 | 142,390 | |

| Benchmark Mortgage Trust Series 2020-B18 Class AGNG, 4.3885% 7/15/53 (a)(e) | 63,000 | 55,106 | |

| BMO Mortgage Trust Series 2022-C1: | |||

| Class 360D, 3.9392% 2/15/42 (a)(e) | 84,000 | 73,369 | |

| Class 360E, 3.9392% 2/15/42 (a)(e) | 105,000 | 86,240 | |

| BPR Trust floater Series 2021-TY Class E, 1 month U.S. LIBOR + 3.600% 3.997% 9/15/38 (a)(e)(g) | 100,000 | 98,242 | |

| BX Commercial Mortgage Trust: | |||

| floater: | |||

| Series 2018-BIOA Class E, 1 month U.S. LIBOR + 1.950% 2.3481% 3/15/37 (a)(e)(g) | 233,021 | 229,223 | |

| Series 2021-CIP: | |||

| Class F, 1 month U.S. LIBOR + 3.210% 3.616% 12/15/38 (a)(e)(g) | 210,000 | 202,619 | |

| Class G, 1 month U.S. LIBOR + 3.960% 4.366% 12/15/38 (a)(e)(g) | 499,000 | 480,603 | |

| Series 2021-FOX Class F, 1 month U.S. LIBOR + 4.250% 4.647% 11/15/32 (a)(e)(g) | 370,642 | 367,628 | |

| Series 2021-PAC Class G, 1 month U.S. LIBOR + 2.940% 3.3431% 10/15/36 (a)(e)(g) | 198,000 | 190,205 | |

| Series 2021-VINO: | |||

| Class F, 1 month U.S. LIBOR + 2.800% 3.1993% 5/15/38 (a)(e)(g) | 333,000 | 321,329 | |

| Class G, 1 month U.S. LIBOR + 3.950% 4.3493% 5/15/38 (a)(e)(g) | 401,000 | 387,950 | |

| Series 2020-VIVA Class E, 3.5488% 3/11/44 (a)(e) | 600,000 | 525,698 | |

| BX Trust: | |||

| floater: | |||

| Series 2018-IND Class G, 1 month U.S. LIBOR + 2.050% 2.447% 11/15/35 (a)(e)(g) | 259,000 | 257,046 | |

| Series 2019-XL Class G, 1 month U.S. LIBOR + 2.300% 2.697% 10/15/36 (a)(e)(g) | 386,750 | 378,509 | |

| Series 2021-21M Class H, 1 month U.S. LIBOR + 4.010% 4.407% 10/15/36 (a)(e)(g) | 84,000 | 81,156 | |

| Series 2021-ACNT Class G, 1 month U.S. LIBOR + 3.290% 3.692% 11/15/38 (a)(e)(g) | 126,000 | 123,181 | |

| Series 2021-ARIA: | |||

| Class F, 1 month U.S. LIBOR + 2.590% 2.9905% 10/15/36 (a)(e)(g) | 27,000 | 26,238 | |

| Class G, 1 month U.S. LIBOR + 3.140% 3.5391% 10/15/36 (a)(e)(g) | 93,000 | 89,507 | |

| Series 2021-BXMF Class G, 1 month U.S. LIBOR + 3.340% 3.7465% 10/15/26 (a)(e)(g) | 126,000 | 120,952 | |

| Series 2021-MFM1: | |||

| Class F, 1 month U.S. LIBOR + 3.000% 3.3966% 1/15/34 (a)(e)(g) | 336,000 | 330,023 | |

| Class G, 1 month U.S. LIBOR + 3.900% 4.2966% 1/15/34 (a)(e)(g) | 170,000 | 166,355 | |

| Series 2021-SDMF Class F, 1 month U.S. LIBOR + 1.930% 2.334% 9/15/34 (a)(e)(g) | 100,000 | 95,985 | |

| Series 2021-SOAR Class J, 4.147% 6/15/38 (a)(e) | 600,000 | 577,796 | |

| Series 2021-VOLT: | |||

| Class F, 1 month U.S. LIBOR + 2.400% 2.7966% 9/15/36 (a)(e)(g) | 100,000 | 96,454 | |

| Class G, 1 month U.S. LIBOR + 2.850% 3.2466% 9/15/36 (a)(e)(g) | 105,000 | 100,880 | |

| Series 2021-XL2 Class J, 1 month U.S. LIBOR + 3.890% 4.287% 10/15/38 (a)(e)(g) | 658,776 | 632,543 | |

| Series 2022-LBA6: | |||

| Class F, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 3.350% 3.6512% 1/15/39 (a)(e)(g) | 100,000 | 98,017 | |

| Class G, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 4.200% 4.5012% 1/15/39 (a)(e)(g) | 100,000 | 98,057 | |

| Series 2022-LP2 Class G, CME TERM SOFR 1 MONTH INDEX + 4.100% 4.4108% 2/15/39 (a)(e)(g) | 500,000 | 486,985 | |

| floater sequential payer Series 2021-LGCY Class J, 1 month U.S. LIBOR + 3.190% 3.59% 10/15/23 (a)(e)(g) | 200,000 | 191,563 | |

| sequential payer Series 2019-OC11 Class A, 3.202% 12/9/41 (a) | 500,000 | 483,183 | |

| Series 2019-OC11 Class E, 4.0755% 12/9/41 (a)(e) | 96,000 | 83,336 | |

| BXSC floater Series 2022-WSS Class F, 5.579% 3/15/35 (a) | 133,000 | 132,050 | |

| Camb Commercial Mortgage Trust sequential payer Series 2021-CX2 Class A, 2.7% 11/10/46 (a) | 500,000 | 460,659 | |

| CGMS Commercial Mortgage Trust Series 2017-MDRB Class E, 1 month U.S. LIBOR + 3.870% 4.2685% 7/15/30 (a)(e)(g) | 105,000 | 102,420 | |

| COMM Mortgage Trust: | |||

| sequential payer Series 2013-LC6 Class E, 3.5% 1/10/46 (a) | 150,000 | 129,447 | |

| Series 2012-CR1 Class G, 2.462% 5/15/45 (a) | 100,000 | 20,415 | |

| Series 2017-CD4 Class D, 3.3% 5/10/50 (a) | 313,000 | 267,814 | |

| Series 2020-CX Class E, 2.6835% 11/10/46 (a)(e) | 195,000 | 155,374 | |

| CPT Mortgage Trust sequential payer Series 2019-CPT Class A, 2.865% 11/13/39 (a) | 500,000 | 472,317 | |

| Credit Suisse Commercial Mortgage Trust floater Series 2021-SOP2 Class F, 1 month U.S. LIBOR + 4.210% 4.6134% 6/15/34 (a)(g) | 85,622 | 82,835 | |

| Credit Suisse Mortgage Trust: | |||

| floater: | |||

| Series 2019-ICE4 Class E, 1 month U.S. LIBOR + 2.150% 2.547% 5/15/36 (a)(e)(g) | 100,000 | 98,122 | |

| Series 2021-4SZN Class A, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 3.960% 4.2677% 11/15/23 (a)(e)(g) | 141,000 | 137,026 | |

| Series 2020-NET Class E, 3.7056% 8/15/37 (a)(e) | 100,000 | 94,907 | |

| CSAIL Commercial Mortgage Trust: | |||

| Series 2017-C8 Class D, 4.584% 6/15/50 (a)(e) | 156,000 | 129,580 | |

| Series 2017-CX10 Class UESD, 4.2366% 10/15/32 (a)(e) | 84,000 | 82,223 | |

| DBCCRE Mortgage Trust Series 2014-ARCP Class E, 4.9345% 1/10/34 (a)(e) | 100,000 | 97,594 | |

| DBGS Mortgage Trust floater Series 2018-BIOD Class F, 1 month U.S. LIBOR + 2.000% 2.306% 5/15/35 (a)(e)(g) | 201,028 | 195,946 | |

| ELP Commercial Mortgage Trust floater Series 2021-ELP Class J, 1 month U.S. LIBOR + 3.610% 4.0119% 11/15/38 (a)(e)(g) | 210,000 | 205,277 | |

| Extended Stay America Trust floater Series 2021-ESH Class F, 1 month U.S. LIBOR + 3.700% 4.097% 7/15/38 (a)(e)(g) | 434,327 | 424,486 | |

| GS Mortgage Securities Corp. Trust floater Series 2019-70P: | |||

| Class E, 1 month U.S. LIBOR + 2.200% 2.597% 10/15/36 (a)(e)(g) | 139,000 | 130,609 | |

| Class F, 1 month U.S. LIBOR + 2.650% 3.047% 10/15/36(a)(e)(g) | 218,000 | 203,555 | |

| GS Mortgage Securities Trust: | |||

| Series 2011-GC5: | |||

| Class E, 5.1634% 8/10/44 (a)(e) | 63,000 | 5,701 | |

| Class F, 4.5% 8/10/44 (a)(c) | 42,000 | 147 | |

| Series 2012-GC6 Class E, 5% 1/10/45 (a)(e) | 11,984 | 11,951 | |

| Series 2012-GCJ9 Class D, 4.7383% 11/10/45 (a)(e) | 178,000 | 176,366 | |

| Series 2013-GC16 Class F, 3.5% 11/10/46 (a) | 269,000 | 200,616 | |

| Series 2019-GC40 Class DBD, 3.5497% 7/10/52 (a)(e) | 570,000 | 543,992 | |

| Hilton U.S.A. Trust Series 2016-HHV Class F, 4.1935% 11/5/38 (a)(e) | 163,000 | 146,684 | |

| Independence Plaza Trust Series 2018-INDP Class E, 4.996% 7/10/35 (a) | 100,000 | 91,562 | |

| JPMBB Commercial Mortgage Securities Trust Series 2014-C23 Class UH5, 4.7094% 9/15/47 (a) | 54,000 | 44,797 | |

| JPMorgan Chase Commercial Mortgage Securities Trust: | |||

| floater Series 2021-MHC Class F, 1 month U.S. LIBOR + 2.950% 3.347% 4/15/38 (a)(e)(g) | 210,000 | 202,087 | |

| sequential payer Series 2021-1MEM Class E, 2.6535% 10/9/42 (a)(e) | 100,000 | 78,032 | |

| Series 2011-C3 Class E, 5.5249% 2/15/46 (a)(e) | 200,000 | 69,914 | |

| Series 2012-CBX Class G 4% 6/15/45 (a) | 151,000 | 10,935 | |

| Series 2019-OSB Class C, 3.749% 6/5/39 (a)(e) | 500,000 | 483,696 | |

| KNDL Mortgage Trust floater Series 2019-KNSQ: | |||

| Class E, 1 month U.S. LIBOR + 1.800% 2.197% 5/15/36 (a)(e)(g) | 500,000 | 492,768 | |

| Class F, 1 month U.S. LIBOR + 2.000% 2.397% 5/15/36 (a)(e)(g) | 250,000 | 243,382 | |

| KNDR Trust floater Series 2021-KIND Class F, 1 month U.S. LIBOR + 3.950% 4.347% 8/15/38 (a)(e)(g) | 100,000 | 98,203 | |

| La Quita Mortgage Trust floater Series 2022-LAQ Class F, CME TERM SOFR 1 MONTH INDEX + 5.970% 6.231% 3/15/39 (a)(e)(g) | 131,000 | 130,961 | |

| LIFE Mortgage Trust floater Series 2021-BMR Class G, 1 month U.S. LIBOR + 2.950% 3.347% 3/15/38 (a)(e)(g) | 393,188 | 375,471 | |

| Manhattan West Series 2020-1MW Class C, 2.335% 9/10/39 (a)(e) | 214,000 | 193,499 | |

| MED Trust floater Series 2021-MDLN Class G, 1 month U.S. LIBOR + 5.250% 5.647% 11/15/38 (a)(e)(g) | 559,000 | 545,809 | |

| Merit floater Series 2021-STOR Class G, 1 month U.S. LIBOR + 2.750% 3.147% 7/15/38 (a)(e)(g) | 105,000 | 101,309 | |

| MHC Commercial Mortgage Trust floater Series 2021-MHC: | |||

| Class F, 1 month U.S. LIBOR + 2.600% 2.998% 4/15/38 (a)(e)(g) | 100,000 | 97,489 | |

| Class G, 1 month U.S. LIBOR + 3.200% 3.598% 4/15/38 (a)(e)(g) | 400,000 | 386,975 | |

| MHP Commercial Mortgage Trust floater Series 2022-MHIL Class G, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 3.950% 4.2587% 1/15/27 (a)(e)(g) | 105,000 | 103,084 | |

| Morgan Stanley Capital I Trust: | |||

| Series 1998-CF1 Class G, 7.35% 7/15/32 (a)(e) | 8,078 | 8,054 | |

| Series 2011-C2: | |||

| Class D, 5.2124% 6/15/44 (a)(e) | 257,314 | 250,176 | |

| Class F, 5.2124% 6/15/44 (a)(c)(e) | 343,000 | 223,178 | |

| Class XB, 0.4322% 6/15/44 (a)(e)(f) | 5,597,531 | 21,955 | |

| Series 2011-C3: | |||

| Class C, 5.0861% 7/15/49 (a)(e) | 23,548 | 23,681 | |

| Class G, 5.0861% 7/15/49 (a)(e) | 112,000 | 59,601 | |

| Motel 6 Trust floater Series 2021-MTL6: | |||

| Class D, 1 month U.S. LIBOR + 2.100% 2.4966% 9/15/38 (a)(e)(g) | 84,100 | 82,455 | |

| Class F, 1 month U.S. LIBOR + 3.550% 3.9466% 9/15/38 (a)(e)(g) | 84,100 | 82,031 | |

| Class G, 1 month U.S. LIBOR + 4.700% 5.0966% 9/15/38 (a)(e)(g) | 206,045 | 202,382 | |

| MTN Commercial Mortgage Trust floater Series 2022-LPFL Class F, CME TERM SOFR 1 MONTH INDEX + 5.280% 5.3352% 3/15/39 (a)(e)(g) | 500,000 | 496,907 | |

| OPG Trust floater Series 2021-PORT: | |||

| Class G, 1 month U.S. LIBOR + 2.390% 2.795% 10/15/36 (a)(e)(g) | 130,000 | 123,924 | |

| Class J, 1 month U.S. LIBOR + 3.340% 3.743% 10/15/36 (a)(e)(g) | 93,000 | 90,209 | |

| PKHL Commercial Mortgage Trust floater Series 2021-MF: | |||

| Class E, 1 month U.S. LIBOR + 2.600% 2.997% 7/15/38 (a)(e)(g) | 100,000 | 96,050 | |

| Class G, 1 month U.S. LIBOR + 4.350% 4.747% 7/15/38 (a)(e)(g) | 100,000 | 96,302 | |

| Prima Capital CRE Securitization Ltd. Series 2020-8A Class C, 3% 12/1/70 (a) | 100,000 | 87,684 | |

| Providence Place Group Ltd. Partnership Series 2000-C1 Class A2, 7.75% 7/20/28 (a) | 191,456 | 215,675 | |

| SFO Commercial Mortgage Trust floater Series 2021-555 Class F, 1 month U.S. LIBOR + 3.650% 4.047% 5/15/38 (a)(e)(g) | 500,000 | 481,036 | |

| SG Commercial Mortgage Securities Trust Series 2020-COVE: | |||

| Class F, 3.7276% 3/15/37 (a)(e) | 150,000 | 133,561 | |

| Class G, 3.7276% 3/15/37 (a)(e) | 100,000 | 85,195 | |

| SLG Office Trust: | |||

| sequential payer Series 2021-OVA Class A, 2.5854% 7/15/41 (a) | 500,000 | 465,246 | |

| Series 2021-OVA Class F, 2.8506% 7/15/41 (a) | 463,000 | 376,628 | |

| SMRT Commercial Mortgage Trust floater Series 2022-MINI Class F, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 3.350% 3.652% 1/15/24 (a)(e)(g) | 168,000 | 164,669 | |

| SREIT Trust floater: | |||

| Series 2021-FLWR Class E, 1 month U.S. LIBOR + 1.920% 2.321% 7/15/36 (a)(e)(g) | 58,000 | 55,531 | |

| Series 2021-IND Class G, 1 month U.S. LIBOR + 3.260% 3.6628% 10/15/38 (a)(e)(g) | 198,000 | 189,604 | |

| Series 2021-MFP Class G, 1 month U.S. LIBOR + 2.970% 3.3704% 11/15/38 (a)(e)(g) | 126,000 | 121,309 | |

| Series 2021-MFP2: | |||

| Class F, 1 month U.S. LIBOR + 2.610% 3.0152% 11/15/36 (a)(e)(g) | 100,000 | 97,489 | |

| Class J, 1 month U.S. LIBOR + 3.910% 4.3125% 11/15/36 (a)(e)(g) | 128,000 | 125,194 | |

| STWD Trust floater sequential payer Series 2021-LIH: | |||

| Class F, 1 month U.S. LIBOR + 3.550% 3.948% 11/15/36 (a)(e)(g) | 100,000 | 97,319 | |

| Class G, 1 month U.S. LIBOR + 4.200% 4.597% 11/15/36 (a)(e)(g) | 42,000 | 41,010 | |

| TTAN floater Series 2021-MHC Class F, 1 month U.S. LIBOR + 2.900% 3.297% 3/15/38 (a)(e)(g) | 264,607 | 253,979 | |

| UBS Commercial Mortgage Trust Series 2012-C1 Class D, 5.84% 5/10/45 (a)(e) | 78,000 | 72,885 | |

| VLS Commercial Mortgage Trust sequential payer Series 2020-LAB Class A, 2.13% 10/10/42 (a) | 610,000 | 542,317 | |

| VMC Finance Ltd. floater Series 2021-HT1 Class B, 1 month U.S. LIBOR + 4.500% 4.9676% 1/18/37 (a)(e)(g) | 147,000 | 142,590 | |

| Wells Fargo Commercial Mortgage Trust Series 2012-LC5: | |||

| Class E, 4.7468% 10/15/45 (a)(e) | 114,000 | 112,143 | |

| Class F, 4.7468% 10/15/45 (a)(e) | 42,000 | 38,571 | |

| WF-RBS Commercial Mortgage Trust Series 2013-C11 Class E, 4.2381% 3/15/45 (a)(e) | 220,000 | 203,640 | |

| WP Glimcher Mall Trust Series 2015-WPG Class PR1, 3.516% 6/5/35 (a)(e) | 140,000 | 117,172 | |

| TOTAL COMMERCIAL MORTGAGE SECURITIES | |||

| (Cost $23,337,378) | 22,317,861 | ||

| Shares | Value | ||

| Common Stocks - 14.2% | |||

| CONSUMER STAPLES - 1.1% | |||

| Food Products - 1.1% | |||

| Archer Daniels Midland Co. | 57,750 | 5,212,515 | |

| Bunge Ltd. | 14,390 | 1,594,556 | |

| Darling Ingredients, Inc. (h) | 6,720 | 540,154 | |

| Wilmar International Ltd. | 74,450 | 257,837 | |

| 7,605,062 | |||

| ENERGY - 4.7% | |||

| Oil, Gas & Consumable Fuels - 4.7% | |||

| BP PLC | 1,399 | 6,858 | |

| Canadian Natural Resources Ltd. | 41,410 | 2,564,131 | |

| Chevron Corp. | 35,120 | 5,718,590 | |

| ConocoPhillips Co. | 30,800 | 3,080,000 | |

| Coterra Energy, Inc. | 53,870 | 1,452,874 | |

| Diamondback Energy, Inc. | 6,830 | 936,256 | |

| Equinor ASA | 13,620 | 508,525 | |

| Exxon Mobil Corp. | 79,810 | 6,591,508 | |

| Hess Corp. | 8,640 | 924,826 | |

| Magnolia Oil & Gas Corp. Class A | 29,760 | 703,824 | |

| Occidental Petroleum Corp. | 26,360 | 1,495,666 | |

| Petroleo Brasileiro SA - Petrobras (ON) | 135,070 | 999,751 | |

| Pioneer Natural Resources Co. | 9,760 | 2,440,293 | |

| Range Resources Corp. (h) | 81,590 | 2,478,704 | |

| Shell PLC (London) | 100,916 | 2,795,203 | |

| 32,697,009 | |||

| FINANCIALS - 0.0% | |||

| Mortgage Real Estate Investment Trusts - 0.0% | |||

| Great Ajax Corp. | 10,511 | 123,294 | |

| MATERIALS - 8.4% | |||

| Chemicals - 3.3% | |||

| Albemarle Corp. U.S. | 4,110 | 908,927 | |

| CF Industries Holdings, Inc. | 47,720 | 4,918,023 | |

| Corteva, Inc. | 67,910 | 3,903,467 | |

| FMC Corp. | 8,800 | 1,157,816 | |

| Icl Group Ltd. | 42,620 | 510,596 | |

| Nutrien Ltd. | 68,140 | 7,043,186 | |

| Sociedad Quimica y Minera de Chile SA (PN-B) sponsored ADR | 5,770 | 493,912 | |

| The Mosaic Co. | 62,780 | 4,174,870 | |

| 23,110,797 | |||

| Metals & Mining - 4.5% | |||

| Agnico Eagle Mines Ltd. (Canada) | 38,945 | 2,383,148 | |

| Alcoa Corp. | 36,880 | 3,320,306 | |

| Anglo American Platinum Ltd. ADR | 9,600 | 223,680 | |

| Anglo American PLC (United Kingdom) | 36,679 | 1,905,928 | |

| ArcelorMittal SA (Netherlands) | 26,520 | 859,596 | |

| Barrick Gold Corp. (Canada) | 64,680 | 1,586,281 | |

| Commercial Metals Co. | 21,950 | 913,559 | |

| First Quantum Minerals Ltd. | 61,400 | 2,125,659 | |

| Fortescue Metals Group Ltd. | 46,390 | 713,100 | |

| Franco-Nevada Corp. | 2,210 | 351,684 | |

| Freeport-McMoRan, Inc. | 51,950 | 2,583,993 | |

| Grupo Mexico SA de CV Series B | 40,940 | 244,940 | |

| IGO Ltd. | 72,276 | 755,519 | |

| Impala Platinum Holdings Ltd. | 23,930 | 368,338 | |

| Ivanhoe Mines Ltd. (h) | 54,430 | 507,662 | |

| Lundin Mining Corp. | 90,660 | 918,820 | |

| Newcrest Mining Ltd. | 11,377 | 229,900 | |

| Newmont Corp. | 30,790 | 2,446,266 | |

| Nucor Corp. | 3,990 | 593,114 | |

| Rio Tinto PLC | 48,777 | 3,899,554 | |

| Steel Dynamics, Inc. | 7,100 | 592,353 | |

| Teck Resources Ltd. Class B (sub. vtg.) | 7,730 | 312,131 | |

| Vale SA | 113,630 | 2,281,645 | |

| Wheaton Precious Metals Corp. | 15,940 | 758,015 | |

| 30,875,191 | |||

| Paper & Forest Products - 0.6% | |||

| Louisiana-Pacific Corp. | 4,010 | 249,101 | |

| Mondi PLC | 31,992 | 626,822 | |

| Nine Dragons Paper (Holdings) Ltd. | 132,040 | 114,656 | |

| Suzano Papel e Celulose SA | 52,900 | 612,771 | |

| Svenska Cellulosa AB SCA (B Shares) | 23,050 | 449,728 | |

| UPM-Kymmene Corp. | 39,690 | 1,302,283 | |

| West Fraser Timber Co. Ltd. | 10,720 | 882,022 | |

| 4,237,383 | |||

| TOTAL MATERIALS | 58,223,371 | ||

| TOTAL COMMON STOCKS | |||

| (Cost $77,515,191) | 98,648,736 | ||

| Preferred Stocks - 2.4% | |||

| Convertible Preferred Stocks - 0.1% | |||

| FINANCIALS - 0.1% | |||

| Mortgage Real Estate Investment Trusts - 0.1% | |||

| Great Ajax Corp. 7.25% | 16,367 | 414,576 | |

| Ready Capital Corp. 7.00% | 6,400 | 170,240 | |

| 584,816 | |||

| REAL ESTATE - 0.0% | |||

| Equity Real Estate Investment Trusts (REITs) - 0.0% | |||

| Braemar Hotels & Resorts, Inc. 5.50% | 2,700 | 49,086 | |

| RLJ Lodging Trust Series A, 1.95% | 400 | 11,020 | |

| 60,106 | |||

| TOTAL CONVERTIBLE PREFERRED STOCKS | 644,922 | ||

| Nonconvertible Preferred Stocks - 2.3% | |||

| FINANCIALS - 1.0% | |||

| Mortgage Real Estate Investment Trusts - 1.0% | |||

| Acres Commercial Realty Corp. 8.625% (e) | 300 | 7,473 | |

| AG Mortgage Investment Trust, Inc.: | |||

| 8.00% | 15,879 | 366,487 | |

| 8.25% | 500 | 11,988 | |

| Series C, 8.00% (e) | 4,100 | 94,751 | |

| AGNC Investment Corp.: | |||

| 6.125% (e) | 7,000 | 163,520 | |

| Series C, 7.00% (e) | 10,200 | 252,956 | |

| Series E, 6.50% (e) | 10,400 | 253,240 | |

| Annaly Capital Management, Inc.: | |||

| 6.75% (e) | 3,600 | 88,920 | |

| Series F, 6.95% (e) | 14,800 | 360,676 | |

| Series G, 6.50% (e) | 11,800 | 275,058 | |

| Arbor Realty Trust, Inc.: | |||

| Series D, 6.375% | 500 | 11,245 | |

| Series F, 6.25% (e) | 3,000 | 73,680 | |

| Armour Residential REIT, Inc. Series C 7.00% | 1,000 | 24,570 | |

| Cherry Hill Mortgage Investment Corp. Series A, 8.20% | 4,000 | 100,600 | |

| Chimera Investment Corp.: | |||

| 8.00% (e) | 5,000 | 124,492 | |

| Series B, 8.00% (e) | 23,587 | 589,439 | |

| Series C, 7.75% (e) | 8,700 | 211,932 | |

| Dynex Capital, Inc. Series C 6.90% (e) | 9,600 | 240,000 | |

| Ellington Financial LLC 6.75% (e) | 2,000 | 49,160 | |

| Franklin BSP Realty Trust, Inc. 7.50% | 3,000 | 70,170 | |

| Invesco Mortgage Capital, Inc.: | |||

| 7.50% (e) | 14,400 | 347,760 | |

| Series B, 7.75% (e) | 13,900 | 333,461 | |

| KKR Real Estate Finance Trust, Inc. 6.50% | 1,300 | 31,876 | |

| MFA Financial, Inc.: | |||

| 6.50% (e) | 9,300 | 211,854 | |

| Series B, 7.50% | 18,486 | 452,352 | |

| New Residential Investment Corp.: | |||

| 7.125% (e) | 6,200 | 152,706 | |

| Series A, 7.50% (e) | 17,700 | 450,642 | |

| Series C, 6.375% (e) | 8,300 | 179,280 | |

| Series D, 7.00% (e) | 2,700 | 65,394 | |

| New York Mortgage Trust, Inc. Series D, 8.00% (e) | 6,000 | 144,674 | |

| PennyMac Mortgage Investment Trust: | |||

| 6.75% | 1,300 | 29,705 | |

| 8.125% (e) | 5,700 | 148,599 | |

| Series B, 8.00% (e) | 9,300 | 241,335 | |

| Two Harbors Investment Corp.: | |||

| Series A, 8.125% (e) | 11,900 | 304,034 | |

| Series B, 7.625% (e) | 11,800 | 288,628 | |

| Series C, 7.25% (e) | 10,500 | 248,955 | |

| 7,001,612 | |||

| MATERIALS - 0.3% | |||

| Chemicals - 0.3% | |||

| Sociedad Quimica y Minera de Chile SA (PN-B) | 21,599 | 1,866,990 | |

| REAL ESTATE - 1.0% | |||

| Equity Real Estate Investment Trusts (REITs) - 1.0% | |||

| Agree Realty Corp. 4.375% | 1,300 | 25,935 | |

| Ashford Hospitality Trust, Inc.: | |||

| Series G, 7.375% | 300 | 6,750 | |

| Series H, 7.50% | 2,500 | 55,475 | |

| Series I, 7.50% | 2,500 | 54,775 | |

| Cedar Realty Trust, Inc.: | |||

| Series B, 7.25% | 2,373 | 39,843 | |

| Series C, 6.50% | 4,900 | 59,780 | |

| City Office REIT, Inc. Series A, 6.625% | 2,079 | 53,382 | |

| CTO Realty Growth, Inc. 6.375% | 1,000 | 25,150 | |

| DiamondRock Hospitality Co. 8.25% | 4,537 | 124,132 | |

| Digital Realty Trust, Inc.: | |||

| 5.25% | 900 | 22,419 | |

| Series L, 5.20% | 12,700 | 316,230 | |

| Digitalbridge Group, Inc.: | |||

| Series H, 7.125% | 7,530 | 185,840 | |

| Series I, 7.15% | 18,400 | 456,136 | |

| Series J, 7.15% | 21,100 | 523,280 | |

| Gladstone Commercial Corp.: | |||

| 6.625% | 2,400 | 60,840 | |

| Series G, 6.00% | 5,200 | 129,740 | |

| Global Medical REIT, Inc. Series A, 7.50% | 2,100 | 54,076 | |

| Global Net Lease, Inc.: | |||

| Series A, 7.25% | 9,300 | 237,336 | |

| Series B 6.875% | 2,200 | 55,110 | |

| Healthcare Trust, Inc.: | |||

| 7.125% | 2,000 | 51,180 | |

| Series A 7.375% | 2,200 | 55,990 | |

| Hudson Pacific Properties, Inc. Series C, 4.75% | 22,400 | 481,824 | |

| iStar Financial, Inc.: | |||

| Series D, 8.00% | 8,000 | 203,040 | |

| Series G, 7.65% | 10,000 | 253,000 | |

| Series I, 7.50% | 7,600 | 191,140 | |

| Kimco Realty Corp.: | |||

| 5.125% | 3,000 | 74,970 | |

| Series M, 5.25% | 5,300 | 132,288 | |

| Necessity Retail (REIT), Inc./The 7.50% | 9,100 | 236,145 | |

| Pebblebrook Hotel Trust: | |||

| 6.30% | 973 | 23,518 | |

| 6.375% | 8,200 | 202,540 | |

| Series H, 5.70% | 3,600 | 80,856 | |

| Pennsylvania (REIT): | |||

| Series B, 7.375% (h) | 4,082 | 20,818 | |

| Series D, 6.875% (h) | 2,500 | 13,625 | |

| Plymouth Industrial REIT, Inc. Series A, 7.50% | 2,500 | 63,975 | |

| PS Business Parks, Inc.: | |||

| Series X, 5.25% | 3,300 | 83,490 | |

| Series Y, 5.20% | 3,000 | 74,730 | |

| Series Z 4.875% | 10,400 | 243,152 | |

| Public Storage: | |||

| 4.00% | 4,000 | 82,560 | |

| Series F, 5.15% | 2,900 | 73,196 | |

| Series G, 5.05% | 2,900 | 73,109 | |

| Series I, 4.875% | 2,000 | 48,800 | |

| Series J, 4.70% | 4,800 | 111,600 | |

| Series K, 4.75% | 300 | 7,344 | |

| Series L, 4.625% | 19,008 | 444,027 | |

| Saul Centers, Inc. Series D, 6.125% | 1,300 | 32,487 | |

| SITE Centers Corp. 6.375% | 3,300 | 82,797 | |

| Sotherly Hotels, Inc. Series C, 7.875% (h) | 1,700 | 31,479 | |

| Spirit Realty Capital, Inc. Series A, 6.00% | 4,700 | 118,722 | |

| Summit Hotel Properties, Inc.: | |||

| Series E, 6.25% | 4,800 | 115,872 | |

| Series F, 5.875% | 2,000 | 47,108 | |

| Sunstone Hotel Investors, Inc.: | |||

| Series H, 6.125% | 3,500 | 84,385 | |

| Series I, 5.70% | 6,000 | 136,980 | |

| UMH Properties, Inc.: | |||

| Series C, 6.75% | 200 | 5,078 | |

| Series D, 6.375% | 2,300 | 58,765 | |

| Urstadt Biddle Properties, Inc.: | |||

| Series H, 6.25% | 4,500 | 113,625 | |

| Series K 5.875% | 2,000 | 50,188 | |

| Vornado Realty Trust: | |||

| Series L, 5.40% | 1,000 | 23,520 | |

| Series N, 5.25% | 4,600 | 107,088 | |

| Series O, 4.45% | 1,800 | 36,000 | |

| 6,857,240 | |||

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | 15,725,842 | ||

| TOTAL PREFERRED STOCKS | |||

| (Cost $15,715,683) | 16,370,764 | ||

| Principal Amount | Value | ||

| Bank Loan Obligations - 0.3% | |||

| COMMUNICATION SERVICES - 0.1% | |||

| Wireless Telecommunication Services - 0.1% | |||

| SBA Senior Finance II, LLC Tranche B, term loan 3 month U.S. LIBOR + 1.750% 2.21% 4/11/25 (e)(g)(i) | 273,593 | 269,908 | |

| CONSUMER DISCRETIONARY - 0.1% | |||

| Hotels, Restaurants & Leisure - 0.1% | |||

| Bally's Corp. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 3.75% 10/1/28 (e)(g)(i) | 199,500 | 198,253 | |

| BRE/Everbright M6 Borrower LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 5.000% 5.75% 9/9/26 (e)(g)(i) | 59,700 | 58,357 | |

| Caesars Resort Collection LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 3.2074% 12/22/24 (e)(g)(i) | 226,592 | 225,176 | |

| Four Seasons Holdings, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.000% 2.2086% 11/30/23 (e)(g)(i) | 99,607 | 99,187 | |

| Hilton Grand Vacations Borrower LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.000% 3.5% 8/2/28 (e)(g)(i) | 120,582 | 119,738 | |

| Playa Resorts Holding BV Tranche B, term loan 3 month U.S. LIBOR + 2.750% 3.75% 4/27/24 (e)(g)(i) | 60,409 | 58,937 | |

| 759,648 | |||

| FINANCIALS - 0.0% | |||

| Thrifts & Mortgage Finance - 0.0% | |||

| Walker & Dunlop, Inc. Tranche B 1LN, term loan CME TERM SOFR 1 MONTH + 2.250% 2.75% 12/16/28 (e)(g)(i) | 4,988 | 4,950 | |

| INDUSTRIALS - 0.0% | |||

| Commercial Services & Supplies - 0.0% | |||

| Pilot Travel Centers LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 2.000% 2.4574% 8/4/28 (e)(g)(i) | 149,250 | 146,980 | |

| INFORMATION TECHNOLOGY - 0.0% | |||

| Electronic Equipment & Components - 0.0% | |||

| Compass Power Generation LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.5% 12/20/24 (e)(g)(i) | 60,116 | 59,132 | |

| REAL ESTATE - 0.1% | |||

| Real Estate Management & Development - 0.1% | |||

| DTZ U.S. Borrower LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.750% 3.2074% 8/21/25 (e)(g)(i) | 403,767 | 397,711 | |

| TOTAL BANK LOAN OBLIGATIONS | |||

| (Cost $1,651,272) | 1,638,329 | ||

| Shares | Value | ||

| Equity Funds - 26.5% | |||

| Fidelity Commodity Strategy Central Fund (h)(j) | 16,604,906 | 102,452,270 | |

| Fidelity Real Estate Equity Central Fund (j) | 534,116 | 81,340,536 | |

| TOTAL EQUITY FUNDS | |||

| (Cost $164,888,036) | 183,792,806 | ||

| Fixed-Income Funds - 25.8% | |||

| Fidelity Floating Rate Central Fund (j) | |||

| (Cost $181,197,841) | 1,794,519 | 179,003,289 | |

| Principal Amount | Value | ||

| Preferred Securities - 0.0% | |||

| FINANCIALS - 0.0% | |||

| Thrifts & Mortgage Finance - 0.0% | |||

| Crest Clarendon Street 2002-1 Ltd. Series 2002-1A Class PS, 12/28/35 (Cost $541,765)(a)(c) | 500,000 | 10,000 | |

| Shares | Value | ||

| Money Market Funds - 4.8% | |||

| Fidelity Cash Central Fund 0.31% (k) | 31,964,610 | 31,971,003 | |

| Fidelity Securities Lending Cash Central Fund 0.31% (k)(l) | 1,423,185 | 1,423,328 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $33,394,330) | 33,394,331 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.4% | |||

| (Cost $658,457,919) | 696,347,827 | ||

| NET OTHER ASSETS (LIABILITIES) - (0.4)% | (2,490,939) | ||

| NET ASSETS - 100% | $693,856,888 |

Legend

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $30,070,718 or 4.3% of net assets.

(b) Non-income producing - Security is in default.

(c) Level 3 security

(d) Security or a portion of the security is on loan at period end.

(e) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(f) Interest Only (IO) security represents the right to receive only monthly interest payments on an underlying pool of mortgages or assets. Principal shown is the outstanding par amount of the pool as of the end of the period.

(g) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(h) Non-income producing

(i) Remaining maturities of bank loan obligations may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty.

(j) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-PORT and is available upon request or at the SEC's website at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, other than the Commodity Strategy Central Fund, is available at fidelity.com and/or institutional.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(k) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(l) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 0.31% | $6,256,970 | $272,332,366 | $246,618,333 | $6,462 | $-- | $-- | $31,971,003 | 0.1% |

| Fidelity Commodity Strategy Central Fund | 75,396,492 | 33,616,583 | 23,281,576 | -- | (27,733,696) | 44,454,467 | 102,452,270 | 17.6% |

| Fidelity Floating Rate Central Fund | 105,919,440 | 80,263,502 | 6,000,170 | 2,535,982 | (82,047) | (1,097,436) | 179,003,289 | 5.6% |

| Fidelity Real Estate Equity Central Fund | 56,106,397 | 28,049,114 | 8,133,406 | 578,114 | 24,878 | 5,293,553 | 81,340,536 | 4.8% |

| Fidelity Securities Lending Cash Central Fund 0.31% | 2,406,250 | 6,584,703 | 7,567,625 | 904 | -- | -- | 1,423,328 | 0.0% |

| Total | $246,085,549 | $420,846,268 | $291,601,110 | $3,121,462 | $(27,790,865) | $48,650,584 | $396,190,426 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of March 31, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Equities: | ||||

| Consumer Staples | $7,605,062 | $7,347,225 | $257,837 | $-- |

| Energy | 32,697,009 | 32,181,626 | 515,383 | -- |

| Financials | 7,709,722 | 7,124,906 | 584,816 | -- |

| Materials | 60,090,361 | 52,103,366 | 7,986,995 | -- |

| Real Estate | 6,917,346 | 6,857,240 | 60,106 | -- |

| Corporate Bonds | 14,124,645 | -- | 14,124,645 | -- |

| U.S. Government and Government Agency Obligations | 144,838,968 | -- | 144,838,968 | -- |

| Asset-Backed Securities | 2,208,098 | -- | 2,208,097 | 1 |

| Commercial Mortgage Securities | 22,317,861 | -- | 22,094,536 | 223,325 |

| Bank Loan Obligations | 1,638,329 | -- | 1,638,329 | -- |

| Equity Funds | 183,792,806 | 183,792,806 | -- | -- |

| Fixed-Income Funds | 179,003,289 | 179,003,289 | -- | -- |

| Preferred Securities | 10,000 | -- | -- | 10,000 |

| Money Market Funds | 33,394,331 | 33,394,331 | -- | -- |

| Total Investments in Securities: | $696,347,827 | $501,804,789 | $194,309,712 | $233,326 |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| March 31, 2022 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $1,400,615) — See accompanying schedule: Unaffiliated issuers (cost $278,977,712) | $300,157,401 | |

| Fidelity Central Funds (cost $379,480,207) | 396,190,426 | |

| Total Investment in Securities (cost $658,457,919) | $696,347,827 | |

| Cash | 232,318 | |

| Foreign currency held at value (cost $20,735) | 20,616 | |

| Receivable for investments sold | 959,158 | |

| Receivable for fund shares sold | 6,732,149 | |

| Dividends receivable | 474,296 | |

| Interest receivable | 457,621 | |

| Distributions receivable from Fidelity Central Funds | 4,526 | |

| Prepaid expenses | 183 | |

| Receivable from investment adviser for expense reductions | 674 | |

| Total assets | 705,229,368 | |

| Liabilities | ||

| Payable for investments purchased | $8,991,574 | |

| Payable for fund shares redeemed | 524,160 | |

| Accrued management fee | 277,478 | |

| Distribution and service plan fees payable | 17,736 | |

| Other affiliated payables | 76,263 | |

| Other payables and accrued expenses | 61,941 | |

| Collateral on securities loaned | 1,423,328 | |

| Total liabilities | 11,372,480 | |

| Net Assets | $693,856,888 | |

| Net Assets consist of: | ||

| Paid in capital | $881,111,272 | |

| Total accumulated earnings (loss) | (187,254,384) | |

| Net Assets | $693,856,888 | |

| Net Asset Value and Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($55,055,114 ÷ 5,672,143 shares)(a) | $9.71 | |

| Maximum offering price per share (100/96.00 of $9.71) | $10.11 | |

| Class M: | ||

| Net Asset Value and redemption price per share ($9,192,644 ÷ 945,963 shares)(a) | $9.72 | |

| Maximum offering price per share (100/96.00 of $9.72) | $10.13 | |

| Class C: | ||

| Net Asset Value and offering price per share ($8,052,655 ÷ 842,541 shares)(a) | $9.56 | |

| Strategic Real Return: | ||

| Net Asset Value, offering price and redemption price per share ($388,433,178 ÷ 39,806,801 shares) | $9.76 | |

| Class K6: | ||

| Net Asset Value, offering price and redemption price per share ($40,513,651 ÷ 4,141,901 shares) | $9.78 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($112,294,334 ÷ 11,539,479 shares) | $9.73 | |

| Class Z: | ||

| Net Asset Value, offering price and redemption price per share ($80,315,312 ÷ 8,248,220 shares) | $9.74 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended March 31, 2022 (Unaudited) | ||

| Investment Income | ||

| Dividends | $1,412,953 | |

| Interest | 3,241,420 | |

| Income from Fidelity Central Funds (including $904 from security lending) | 3,121,462 | |

| Total income | 7,775,835 | |

| Expenses | ||

| Management fee | $1,324,808 | |

| Transfer agent fees | 294,794 | |

| Distribution and service plan fees | 90,647 | |

| Accounting fees | 117,960 | |

| Custodian fees and expenses | 20,945 | |

| Independent trustees' fees and expenses | 723 | |

| Registration fees | 52,573 | |

| Audit | 53,308 | |

| Legal | 974 | |

| Interest | 82 | |

| Miscellaneous | 1,024 | |

| Total expenses before reductions | 1,957,838 | |

| Expense reductions | (150,103) | |

| Total expenses after reductions | 1,807,735 | |

| Net investment income (loss) | 5,968,100 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 1,845,371 | |

| Fidelity Central Funds | (27,790,865) | |

| Foreign currency transactions | (3,746) | |

| Total net realized gain (loss) | (25,949,240) | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 9,868,372 | |

| Fidelity Central Funds | 48,650,584 | |

| Assets and liabilities in foreign currencies | 751 | |

| Total change in net unrealized appreciation (depreciation) | 58,519,707 | |

| Net gain (loss) | 32,570,467 | |

| Net increase (decrease) in net assets resulting from operations | $38,538,567 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended March 31, 2022 (Unaudited) | Year ended September 30, 2021 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $5,968,100 | $20,665,308 |

| Net realized gain (loss) | (25,949,240) | (14,192,675) |

| Change in net unrealized appreciation (depreciation) | 58,519,707 | 44,423,711 |

| Net increase (decrease) in net assets resulting from operations | 38,538,567 | 50,896,344 |

| Distributions to shareholders | (19,713,019) | (5,972,174) |

| Share transactions - net increase (decrease) | 262,165,682 | 129,284,629 |

| Total increase (decrease) in net assets | 280,991,230 | 174,208,799 |

| Net Assets | ||

| Beginning of period | 412,865,658 | 238,656,859 |

| End of period | $693,856,888 | $412,865,658 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Strategic Real Return Fund Class A

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $9.42 | $8.07 | $8.39 | $8.88 | $8.80 | $8.81 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .103 | .568 | .257 | .216 | .266 | .170 |

| Net realized and unrealized gain (loss) | .621 | .950 | (.365) | .012 | .008C | .022 |

| Total from investment operations | .724 | 1.518 | (.108) | .228 | .274 | .192 |

| Distributions from net investment income | (.434) | (.168) | (.212) | (.293) | (.183) | (.190)D |

| Distributions from net realized gain | – | – | – | (.425) | (.011) | (.012)D |

| Total distributions | (.434) | (.168) | (.212) | (.718) | (.194) | (.202) |

| Redemption fees added to paid in capitalA | – | – | – | – | – | –E |

| Net asset value, end of period | $9.71 | $9.42 | $8.07 | $8.39 | $8.88 | $8.80 |

| Total ReturnF,G,H | 8.02% | 19.05% | (1.28)% | 2.86% | 3.15%C | 2.23% |

| Ratios to Average Net AssetsB,I,J | ||||||

| Expenses before reductions | 1.07%K | 1.11% | 1.12% | 1.10% | 1.07% | 1.08% |

| Expenses net of fee waivers, if any | .98%K | 1.00% | 1.00% | 1.09% | 1.07% | 1.08% |

| Expenses net of all reductions | .98%K | 1.00% | 1.00% | 1.09% | 1.07% | 1.07% |

| Net investment income (loss) | 2.22%K | 6.40% | 3.22% | 2.60% | 3.01% | 1.94% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $55,055 | $37,357 | $25,212 | $29,652 | $29,288 | $33,949 |

| Portfolio turnover rateL | 38%K | 13% | 47% | 19% | 23% | 24% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.01 per share. Excluding these litigation proceeds, the total return would have been 2.99%

D The amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

E Amount represents less than $.0005 per share.

F Total returns for periods of less than one year are not annualized.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Total returns do not include the effect of the sales charges.

I Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

J Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

K Annualized

L Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Strategic Real Return Fund Class M

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $9.43 | $8.07 | $8.39 | $8.89 | $8.81 | $8.82 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .103 | .567 | .257 | .215 | .264 | .168 |

| Net realized and unrealized gain (loss) | .621 | .960 | (.365) | .002 | .008C | .025 |

| Total from investment operations | .724 | 1.527 | (.108) | .217 | .272 | .193 |

| Distributions from net investment income | (.434) | (.167) | (.212) | (.292) | (.181) | (.191)D |

| Distributions from net realized gain | – | – | – | (.425) | (.011) | (.012)D |

| Total distributions | (.434) | (.167) | (.212) | (.717) | (.192) | (.203) |

| Redemption fees added to paid in capitalA | – | – | – | – | – | –E |

| Net asset value, end of period | $9.72 | $9.43 | $8.07 | $8.39 | $8.89 | $8.81 |

| Total ReturnF,G,H | 8.01% | 19.17% | (1.28)% | 2.73% | 3.12%C | 2.23% |

| Ratios to Average Net AssetsB,I,J | ||||||

| Expenses before reductions | 1.07%K | 1.12% | 1.14% | 1.12% | 1.11% | 1.11% |

| Expenses net of fee waivers, if any | .98%K | 1.00% | 1.00% | 1.10% | 1.10% | 1.10% |

| Expenses net of all reductions | .98%K | 1.00% | 1.00% | 1.10% | 1.10% | 1.10% |

| Net investment income (loss) | 2.22%K | 6.40% | 3.22% | 2.59% | 2.98% | 1.91% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $9,193 | $7,293 | $6,141 | $7,903 | $8,391 | $9,723 |

| Portfolio turnover rateL | 38%K | 13% | 47% | 19% | 23% | 24% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.01 per share. Excluding these litigation proceeds, the total return would have been 2.96%

D The amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

E Amount represents less than $.0005 per share.

F Total returns for periods of less than one year are not annualized.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Total returns do not include the effect of the sales charges.

I Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

J Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

K Annualized

L Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Strategic Real Return Fund Class C

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $9.28 | $7.95 | $8.26 | $8.77 | $8.70 | $8.71 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .067 | .491 | .195 | .151 | .197 | .102 |

| Net realized and unrealized gain (loss) | .612 | .946 | (.358) | .004 | .011C | .023 |

| Total from investment operations | .679 | 1.437 | (.163) | .155 | .208 | .125 |

| Distributions from net investment income | (.399) | (.107) | (.147) | (.240) | (.127) | (.123)D |

| Distributions from net realized gain | – | – | – | (.425) | (.011) | (.012)D |

| Total distributions | (.399) | (.107) | (.147) | (.665) | (.138) | (.135) |

| Redemption fees added to paid in capitalA | – | – | – | – | – | –E |

| Net asset value, end of period | $9.56 | $9.28 | $7.95 | $8.26 | $8.77 | $8.70 |

| Total ReturnF,G,H | 7.61% | 18.24% | (2.00)% | 1.99% | 2.41%C | 1.46% |

| Ratios to Average Net AssetsB,I,J | ||||||

| Expenses before reductions | 1.79%K | 1.88% | 1.89% | 1.86% | 1.83% | 1.84% |

| Expenses net of fee waivers, if any | 1.73%K | 1.75% | 1.75% | 1.85% | 1.83% | 1.84% |

| Expenses net of all reductions | 1.73%K | 1.75% | 1.75% | 1.85% | 1.83% | 1.84% |

| Net investment income (loss) | 1.47%K | 5.65% | 2.47% | 1.83% | 2.25% | 1.17% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $8,053 | $4,549 | $5,694 | $8,555 | $18,962 | $24,718 |

| Portfolio turnover rateL | 38%K | 13% | 47% | 19% | 23% | 24% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.01 per share. Excluding these litigation proceeds, the total return would have been 2.25%

D The amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

E Amount represents less than $.0005 per share.

F Total returns for periods of less than one year are not annualized.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Total returns do not include the effect of the contingent deferred sales charge.

I Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

J Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

K Annualized

L Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Strategic Real Return Fund

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $9.47 | $8.10 | $8.43 | $8.92 | $8.84 | $8.85 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .115 | .593 | .278 | .239 | .291 | .194 |

| Net realized and unrealized gain (loss) | .620 | .965 | (.376) | .009 | .008C | .024 |

| Total from investment operations | .735 | 1.558 | (.098) | .248 | .299 | .218 |

| Distributions from net investment income | (.445) | (.188) | (.232) | (.313) | (.208) | (.216)D |

| Distributions from net realized gain | – | – | – | (.425) | (.011) | (.012)D |

| Total distributions | (.445) | (.188) | (.232) | (.738) | (.219) | (.228) |

| Redemption fees added to paid in capitalA | – | – | – | – | – | –E |

| Net asset value, end of period | $9.76 | $9.47 | $8.10 | $8.43 | $8.92 | $8.84 |

| Total ReturnF,G | 8.10% | 19.51% | (1.14)% | 3.10% | 3.43%C | 2.52% |

| Ratios to Average Net AssetsB,H,I | ||||||

| Expenses before reductions | .78%J | .85% | .87% | .83% | .81% | .81% |

| Expenses net of fee waivers, if any | .73%J | .75% | .75% | .83% | .81% | .81% |

| Expenses net of all reductions | .73%J | .75% | .75% | .83% | .81% | .81% |

| Net investment income (loss) | 2.47%J | 6.64% | 3.47% | 2.86% | 3.27% | 2.21% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $388,433 | $236,076 | $158,896 | $197,152 | $262,063 | $476,944 |

| Portfolio turnover rateK | 38%J | 13% | 47% | 19% | 23% | 24% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.01 per share. Excluding these litigation proceeds, the total return would have been 3.27%

D The amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

E Amount represents less than $.0005 per share.

F Total returns for periods of less than one year are not annualized.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

J Annualized

K Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Strategic Real Return Fund Class K6

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | ||

| 2022 | 2021 | 2020 A | |

| Selected Per–Share Data | |||

| Net asset value, beginning of period | $9.48 | $8.11 | $8.34 |

| Income from Investment Operations | |||

| Net investment income (loss)B,C | .124 | .616 | .281 |

| Net realized and unrealized gain (loss) | .625 | .948 | (.352) |

| Total from investment operations | .749 | 1.564 | (.071) |

| Distributions from net investment income | (.449) | (.194) | (.159) |

| Distributions from net realized gain | – | – | – |

| Total distributions | (.449) | (.194) | (.159) |

| Net asset value, end of period | $9.78 | $9.48 | $8.11 |

| Total ReturnD,E | 8.25% | 19.57% | (.81)% |

| Ratios to Average Net AssetsC,F,G | |||

| Expenses before reductions | .66%H | .69% | .71%H |

| Expenses net of fee waivers, if any | .54%H | .56% | .56%H |

| Expenses net of all reductions | .54%H | .56% | .56%H |

| Net investment income (loss) | 2.66%H | 6.83% | 3.66%H |

| Supplemental Data | |||

| Net assets, end of period (000 omitted) | $40,514 | $20,606 | $6,331 |

| Portfolio turnover rateI | 38%H | 13% | 47% |

A For the period October 8, 2019 (commencement of sale of shares) through September 30, 2020.

B Calculated based on average shares outstanding during the period.

C Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Strategic Real Return Fund Class I

| Six months ended (Unaudited) March 31, | Years endedSeptember 30, | |||||

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $9.44 | $8.08 | $8.40 | $8.90 | $8.82 | $8.83 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A,B | .115 | .594 | .280 | .240 | .291 | .194 |

| Net realized and unrealized gain (loss) | .620 | .955 | (.369) | –C | .008D | .027 |

| Total from investment operations | .735 | 1.549 | (.089) | .240 | .299 | .221 |

| Distributions from net investment income | (.445) | (.189) | (.231) | (.315) | (.208) | (.219)E |

| Distributions from net realized gain | – | – | – | (.425) | (.011) | (.012)E |

| Total distributions | (.445) | (.189) | (.231) | (.740) | (.219) | (.231) |

| Redemption fees added to paid in capitalA | – | – | – | – | – | –C |

| Net asset value, end of period | $9.73 | $9.44 | $8.08 | $8.40 | $8.90 | $8.82 |

| Total ReturnF,G | 8.13% | 19.45% | (1.04)% | 3.01% | 3.44%D | 2.56% |

| Ratios to Average Net AssetsB,H,I | ||||||

| Expenses before reductions | .79%J | .83% | .83% | .81% | .79% | .80% |

| Expenses net of fee waivers, if any | .73%J | .75% | .75% | .81% | .79% | .80% |

| Expenses net of all reductions | .73%J | .75% | .75% | .81% | .79% | .80% |

| Net investment income (loss) | 2.47%J | 6.64% | 3.47% | 2.88% | 3.29% | 2.22% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $112,294 | $49,988 | $26,872 | $116,302 | $158,776 | $190,292 |

| Portfolio turnover rateK | 38%J | 13% | 47% | 19% | 23% | 24% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Amount represents less than $.0005 per share.

D Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.01 per share. Excluding these litigation proceeds, the total return would have been 3.28%

E The amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

F Total returns for periods of less than one year are not annualized.

G Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

H Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

J Annualized

K Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Strategic Real Return Fund Class Z