Form N-CSRS CAPITAL GROUP PRIVATE For: Apr 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-22349

Capital Group Private Client Services Funds

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2022

Gregory F. Niland

Capital Group Private Client Services Funds

5300 Robin Hood Road

Norfolk, Virginia 23513

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

|

Capital Group Core Municipal FundSM Capital Group Short-Term Municipal FundSM Capital Group California Core Municipal FundSM Capital Group California Short-Term Municipal FundSM Capital Group Core Bond FundSM

Semi-annual report for the six months ended April 30, 2022 |

Research-driven

approaches to seeking

wealth preservation

and income

Capital Group Core Municipal Fund seeks to provide current income exempt from federal income tax while preserving your investment.

Capital Group Short-Term Municipal Fund seeks to preserve your investment and secondarily to provide current income exempt from federal income tax.

Capital Group California Core Municipal Fund seeks to provide current income exempt from federal and California income taxes while preserving your investment.

Capital Group California Short-Term Municipal Fund seeks to preserve your investment and secondarily to provide current income exempt from federal and California income taxes.

Capital Group Core Bond Fund seeks to provide you with current income while preserving your investment.

Each fund is one of more than 40 offered by Capital Group, home of American Funds, one of the nation’s largest mutual fund families. For 90 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report are at net asset value. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely.

Here are the total returns on a $1,000 investment with all distributions reinvested for periods ended March 31, 2022 (the most recent calendar quarter-end), and the total annual fund operating expense ratios as of the prospectus dated January 1, 2022:

| Cumulative total returns |

Average annual total returns |

Gross | ||||||||||||||||||

| 1 year | 5 years | 10 years | Lifetime* | expense ratios | ||||||||||||||||

| Capital Group Core Municipal Fund | –3.37 | % | 1.83 | % | 1.77 | % | 2.21 | % | 0.28 | % | ||||||||||

| Capital Group Short-Term Municipal Fund | –2.72 | 1.28 | 1.09 | 1.32 | 0.31 | † | ||||||||||||||

| Capital Group California Core Municipal Fund | –3.47 | 1.54 | 1.81 | 2.19 | 0.27 | |||||||||||||||

| Capital Group California Short-Term Municipal Fund | –2.81 | 0.82 | 0.84 | 1.04 | 0.29 | |||||||||||||||

| Capital Group Core Bond Fund | –3.74 | 1.78 | 1.63 | 2.15 | 0.28 | |||||||||||||||

| * | Since April 13, 2010. |

| † | The net expense ratio for Capital Group Short-Term Municipal Fund was 0.30%. |

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. The investment adviser is currently reimbursing a portion of the expenses for Capital Group Short-Term Municipal Fund. This reimbursement will be in effect through at least January 1, 2023. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. Visit capitalgrouppcsfunds.com for more information.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Contents

| 1 | Funds’ 30-day yields and 12-month distribution rates | |

| 2 | Results at a glance | |

| Investment portfolios | ||

| 3 | Capital Group Core Municipal Fund | |

| 30 | Capital Group Short-Term Municipal Fund | |

| 45 | Capital Group California Core Municipal Fund | |

| 57 | Capital Group California Short-Term Municipal Fund | |

| 62 | Capital Group Core Bond Fund | |

| 74 | Financial statements | |

| 79 | Notes to financial statements | |

| 91 | Financial highlights |

Fellow investors:

Shown in the table below are the semi-annual returns for Capital Group Core Municipal Fund, Capital Group Short-Term Municipal Fund, Capital Group California Core Municipal Fund, Capital Group California Short-Term Municipal Fund and Capital Group Core Bond Fund for the six months ended April 30, 2022. Also shown are the results of their benchmarks and peer group averages.

On March 11, 2022, the Board of Trustees of Capital Group Private Client Services Funds unanimously determined that it would be in the best interests of three Capital Group funds to merge into three similar American Funds. Under the proposal, Capital Group Core Municipal Fund would be reorganized into Limited Term Tax-Exempt Bond Fund of America®; Capital Group Short-Term Municipal Fund into American Funds Short-Term Tax-Exempt Bond Fund®; and Capital Group Core Bond Fund into The Bond Fund of America®. The Board also determined that the interests of Capital Group bond fund shareholders would not be diluted as a result of the change. Shareholders will receive materials outlining the proposal as well as information on the affected funds. The reorganizations are not contingent on each other and, if approved by shareholders, are expected to take place later this year. More information can be found in the funds’ amended prospectus at capitalgroup.com/pcs/fund-details.html.

For additional information about the funds, their investment results, holdings and portfolio managers, visit capitalgrouppcsfunds.com. You can also access information about Capital Group’s American Funds and read our insights about the markets, retirement, saving for college, investing fundamentals and more at capitalgroup.com.

Funds’ 30-day yields and 12-month distribution rates

Below is a summary of each fund’s 30-day yield and 12-month distribution rate as of April 30, 2022. Each fund’s 30-day yield is calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula. The SEC yield reflects the rate at which each fund is earning income on its current portfolio of securities while the distribution rate reflects the funds’ past dividends paid to shareholders. Accordingly, the funds’ SEC yields and distribution rates may differ.

| SEC 30-day yield |

12-month distribution rate | |||||||

| Capital Group Core Municipal Fund | 1.77 | % | 1.15 | % | ||||

| Capital Group Short-Term Municipal Fund | 1.52 | * | 0.86 | |||||

| Capital Group California Core Municipal Fund | 1.78 | 1.20 | ||||||

| Capital Group California Short-Term Municipal Fund | 1.51 | 0.71 | ||||||

| Capital Group Core Bond Fund | 3.02 | 1.60 | ||||||

| * | The SEC 30-day yield for Capital Group Short-Term Municipal Fund is 1.71% with the fund’s reimbursement. |

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Income may be subject to state or local income taxes and/or federal alternative minimum taxes. Also, certain other income, as well as capital gain distributions, may be taxable. State tax-exempt funds are more susceptible to factors adversely affecting issuers of their state’s tax-exempt securities than a more widely diversified municipal bond fund. Refer to the funds’ prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the funds.

| Private Client Services Funds | 1 |

Results at a glance

For periods ended April 30, 2022, with all distributions reinvested

| Cumulative total returns | Average annual total returns | |||||||||||||||||||

| 6 months | 1 year | 5 years | 10 years | Lifetime1 | ||||||||||||||||

| Capital Group Core Municipal Fund | –4.96 | % | –5.26 | % | 1.38 | % | 1.53 | % | 2.06 | % | ||||||||||

| Bloomberg Municipal Short-Intermediate 1–10 years Index2 | –5.62 | –5.76 | 1.17 | 1.56 | 2.14 | |||||||||||||||

| Lipper Short-Intermediate Municipal Debt Funds Average3 | –5.10 | –5.30 | 0.85 | 1.09 | 1.58 | |||||||||||||||

| Capital Group Short-Term Municipal Fund | –3.57 | –3.78 | 1.01 | 0.97 | 1.24 | |||||||||||||||

| Bloomberg Municipal Short 1–5 Years Index2 | –4.17 | –4.20 | 0.85 | 1.03 | 1.33 | |||||||||||||||

| Lipper Short Municipal Debt Funds Average3 | –2.78 | –2.93 | 0.61 | 0.61 | 0.83 | |||||||||||||||

| Capital Group California Core Municipal Fund | –4.99 | –5.23 | 1.09 | 1.55 | 2.04 | |||||||||||||||

| Bloomberg California Short-Intermediate Municipal Index2 | –5.74 | –5.98 | 0.93 | 1.52 | 2.14 | |||||||||||||||

| Lipper California Short-Intermediate Municipal Debt Funds Average3 | –4.62 | –4.63 | 0.59 | 1.00 | 1.34 | |||||||||||||||

| Capital Group California Short-Term Municipal Fund | –3.64 | –3.88 | 0.57 | 0.70 | 0.96 | |||||||||||||||

| Bloomberg California Short Municipal Index2 | –4.13 | –4.22 | 0.65 | 0.95 | 1.27 | |||||||||||||||

| Lipper Short Municipal Debt Funds Average3 | –2.78 | –2.93 | 0.61 | 0.61 | 0.83 | |||||||||||||||

| Capital Group Core Bond Fund | –5.56 | –5.93 | 1.30 | 1.35 | 1.97 | |||||||||||||||

| Bloomberg Intermediate A+ U.S. Government/Credit Index2 | –6.06 | –6.26 | 1.09 | 1.31 | 1.97 | |||||||||||||||

| Lipper Short-Intermediate Investment Grade Debt Funds Average3 | –4.91 | –4.95 | 1.18 | 1.41 | 1.90 | |||||||||||||||

| 1 | Since April 13, 2010. |

| 2 | The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Source: Bloomberg Index Services Ltd. |

| 3 | Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Source: Refinitiv Lipper. |

Bloomberg Municipal Short-Intermediate 1–10 Years Index is a market value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to 10 years. Bloomberg Municipal Short 1–5 Years Index is a market value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to five years. Bloomberg California Short-Intermediate Municipal Index is a market value-weighted index that includes only investment-grade tax-exempt bonds that are issued from California with maturities of one to 10 years. Bloomberg California Short Municipal Index is a market value-weighted index that includes only investment-grade tax-exempt bonds that are issued from California with maturities of one to five years. Bloomberg Intermediate A+ U.S. Government/Credit Index is a market value-weighted index that tracks the total return of fixed-rate, publicly placed, dollar-denominated obligations issued by the U.S. Treasury, U.S. government agencies and quasi-federal corporations, corporate or foreign debt guaranteed by the U.S. government, and U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements, with maturities of one to 10 years, excluding BBB-rated securities.

| 2 | Private Client Services Funds |

| Capital Group Core Municipal Fund | unaudited |

| Investment portfolio April 30, 2022 | |

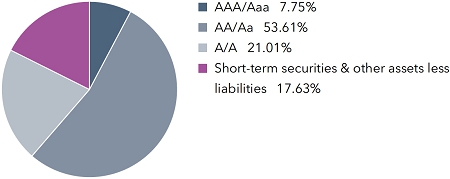

| Portfolio quality summary* | Percent of net assets |

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. |

| Bonds, notes & other debt instruments 86.09% | Principal amount (000) |

Value (000) |

||||||

| Alabama 2.48% | ||||||||

| Black Belt Energy Gas Dist., Gas Project Rev. Bonds, Series 2022-B-1, 4.00% 2053 (put 2027) | USD | 3,500 | $ | 3,561 | ||||

| Black Belt Energy Gas Dist., Gas Project Rev. Bonds (Project No. 6), Series 2021-B, 4.00% 2052 (put 2026) | 1,050 | 1,067 | ||||||

| Black Belt Energy Gas Dist., Gas Project Rev. Bonds (Project No. 7), Series 2021-C-1, 4.00% 2052 (put 2026) | 940 | 956 | ||||||

| Black Belt Energy Gas Dist., Gas Supply Prepay Rev. Bonds (Project No. 5), Series 2020-A-1, 4.00% 2049 (put 2026) | 825 | 839 | ||||||

| Black Belt Energy Gas Dist., Gas Supply Rev. Bonds, Series 2017-A, 4.00% 2047 (put 2022) | 2,050 | 2,058 | ||||||

| Black Belt Energy Gas Dist., Gas Supply Rev. Bonds, Series 2021-A, 4.00% 2051 (put 2023) | 1,000 | 1,029 | ||||||

| Federal Aid Highway Fin. Auth., Federal Highway Grant Anticipation Bonds, Series 2012, 5.00% 2023 (preref. 2022) | 100 | 101 | ||||||

| City of Homewood, G.O. Warrants, Series 2016, 5.00% 2033 (preref. 2026) | 50 | 55 | ||||||

| Housing Fin. Auth., Multi Family Housing Rev. Bonds (ECG Monrovia Project), Series 2022-A, 2.00% 2025 (put 2024) | 2,050 | 2,007 | ||||||

| City of Huntsville, Electric Rev. Bonds, Series 2017-A, 5.00% 2022 | 450 | 459 | ||||||

| City of Huntsville, Electric Rev. Bonds, Series 2017-B, 5.00% 2022 | 400 | 408 | ||||||

| Southeast Energy Auth., Commodity Supply Rev. Bonds (Project No. 1), Series 2021-A, 4.00% 2051 (put 2028) | 2,460 | 2,500 | ||||||

| Southeast Energy Auth., Commodity Supply Rev. Bonds (Project No. 2), Series 2021-B-1, 4.00% 2051 (put 2031) | 2,065 | 2,094 | ||||||

| 17,134 | ||||||||

| Alaska 0.31% | ||||||||

| Housing Fin. Corp., Collateralized Bonds (Veterans Mortgage Program), Series 2019, 4.00% 2048 | 820 | 835 | ||||||

| Housing Fin. Corp., General Mortgage Rev. Bonds, Series 2020-A, 3.25% 2044 | 850 | 846 | ||||||

| Housing Fin. Corp., General Mortgage Rev. Bonds, Series 2016-A, 3.50% 2046 | 130 | 131 | ||||||

| Housing Fin. Corp., State Capital Project Bonds, Series 2014-A, 5.00% 2032 (preref. 2023) | 230 | 240 | ||||||

| Housing Fin. Corp., State Capital Project Bonds, Series 2014-A, 5.00% 2033 (preref. 2023) | 110 | 115 | ||||||

| 2,167 | ||||||||

| Arizona 1.10% | ||||||||

| Agricultural Improvement and Power Dist., Electric System Rev. Bonds (Salt River Project), Series 2021-A, 5.00% 2028 | 295 | 332 | ||||||

| Agricultural Improvement and Power Dist., Electric System Rev. Bonds (Salt River Project), Series 2021-A, 5.00% 2029 | 370 | 422 | ||||||

| Board of Regents of the Arizona State University System, Rev. Bonds, Series 2020-A, 5.00% 2027 | 400 | 443 | ||||||

| Board of Regents of the Arizona State University System, Rev. Bonds, Series 2020-A, 5.00% 2028 | 550 | 618 | ||||||

| Board of Regents of the Arizona State University System, Rev. Bonds, Series 2020-A, 5.00% 2033 | 80 | 91 | ||||||

| Bullhead City, Excise Taxes Rev. Obligations, Series 2021-2, 1.15% 2027 | 375 | 330 | ||||||

| Coconino County Pollution Control Corp., Pollution Control Rev. Ref. Bonds, Series 2017-B, 1.65% 2039 (put 2023) | 1,500 | 1,494 | ||||||

| City of Glendale Industrial Dev. Auth., Rev. Ref. Bonds (Midwestern University), Series 2020, 5.00% 2029 | 1,000 | 1,132 | ||||||

| Industrial Dev. Auth., Education Rev. Bonds (GreatHearts Arizona Projects), Series 2021-A, 5.00% 2029 | 115 | 128 | ||||||

| Private Client Services Funds | 3 |

Capital Group Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| Arizona (continued) | ||||||||

| Industrial Dev. Auth., Rev. Bonds (Lincoln South Beltway Project), Series 2020, 5.00% 2023 | USD | 1,000 | $ | 1,039 | ||||

| Kyrene Elementary School Dist. No. 28, School Improvement Bonds (2010 Project), Series 2013-B, 4.50% 2024 (preref. 2023)1 | 55 | 57 | ||||||

| Kyrene Elementary School Dist. No. 28, School Improvement Bonds (2010 Project), Series 2013-B, 4.50% 2025 (preref. 2023)1 | 45 | 46 | ||||||

| County of Maricopa, Industrial Dev. Auth., Education Rev. Bonds (GreatHearts Arizona Projects), Series 2017-A, 5.00% 2027 | 745 | 814 | ||||||

| City of Phoenix Civic Improvement Corp., Water System Rev. Ref. Bonds, Series 2014-B, 5.00% 2024 | 115 | 121 | ||||||

| County of Pima, Industrial Dev. Auth., Rev. Bonds (Tucson Medical Center), Series 2021-A, 5.00% 2031 | 485 | 558 | ||||||

| 7,625 | ||||||||

| Arkansas 0.09% | ||||||||

| Dev. Fin. Auth., Health Care Rev. Bonds (Baptist Memorial Health Care), Series 2015-B-3, (SIFMA Municipal Swap Index + 1.55%) 1.99% 2044 (put 2022)2 | 600 | 600 | ||||||

| California 5.24% | ||||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2006-C-1, (SIFMA Municipal Swap Index + 0.90%) 1.34% 2045 (put 2023)2 | 2,205 | 2,204 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2021-C, (SIFMA Municipal Swap Index + 0.45%) 0.89% 2056 (put 2026)2 | 425 | 420 | ||||||

| Trustees of the California State University, Systemwide Rev. Bonds, Series 2017-A, 5.00% 2026 | 380 | 419 | ||||||

| Trustees of the California State University, Systemwide Rev. Bonds, Series 2016-A, 5.00% 2027 | 365 | 398 | ||||||

| Trustees of the California State University, Systemwide Rev. Bonds, Series 2016-B-2, 0.55% 2049 (put 2026) | 195 | 171 | ||||||

| Carlsbad Unified School Dist., G.O. Bonds, 2018 Election, Series 2021-B, 2.00% 2023 | 75 | 75 | ||||||

| Carlsbad Unified School Dist., G.O. Bonds, 2018 Election, Series 2021-B, 2.00% 2024 | 85 | 84 | ||||||

| Community Choice Fncg. Auth., Clean Energy Project Rev. Green Bonds, Series 2021-B-1, 4.00% 2052 (put 2031) | 2,415 | 2,452 | ||||||

| Eastern Municipal Water Dist., Water and Wastewater Rev. Ref. Bonds, Series 2021-A, 3.00% 2024 | 165 | 167 | ||||||

| Educational Facs. Auth., Rev. Bonds (University of Southern California), Series 2009-C, 5.25% 2024 (escrowed to maturity) | 35 | 37 | ||||||

| Fresno Unified School Dist., G.O. Bonds, 2016 Election, Series 2021-D, 2.00% 2023 | 105 | 105 | ||||||

| Fresno Unified School Dist., G.O. Bonds, 2016 Election, Series 2021-D, 2.00% 2024 | 50 | 49 | ||||||

| G.O. Bonds, Series 2021, 5.00% 2031 | 30 | 33 | ||||||

| G.O. Bonds, Series 2021, 5.00% 2032 | 25 | 27 | ||||||

| G.O. Bonds, Series 2021, 5.00% 2034 | 25 | 27 | ||||||

| G.O. Rev. Ref. Bonds, Series 2021, 5.00% 2023 | 1,265 | 1,313 | ||||||

| G.O. Rev. Ref. Bonds, Series 2021, 5.00% 2027 | 4,625 | 5,168 | ||||||

| G.O. Rev. Ref. Bonds, Series 2020, 5.00% 2027 | 1,000 | 1,120 | ||||||

| G.O. Rev. Ref. Bonds, Series 2021, 5.00% 2030 | 55 | 64 | ||||||

| Golden State Tobacco Securitization Corp., Enhanced Tobacco Settlement Asset-Backed Bonds, Series 2015-A, 5.00% 2040 (preref. 2025) | 120 | 129 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Kaiser Permanente), Series 2017-B, 5.00% 2029 (put 2022) | 1,000 | 1,016 | ||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Marshall Medical Center), Series 2015, 5.00% 2028 | 315 | 334 | ||||||

| Housing Fin. Agcy., Municipal Certs., Series 2021-A-1, 3.50% 2035 | 733 | 734 | ||||||

| Housing Fin. Agcy., Municipal Certs., Series 2021-A-3, 3.25% 2036 | 467 | 448 | ||||||

| Infrastructure and Econ. Dev. Bank, Rev. Ref. Bonds (Los Angeles County Museum of Art Project), Series 2021-B, 1.14% 2050 (put 2026)2 | 340 | 338 | ||||||

| Irvine Unified School Dist., Community Facs. Dist. No. 09-1, Special Tax Bonds, Series 2017-A, BAM insured, 5.00% 2025 | 250 | 267 | ||||||

| City of Jurupa, Public Fncg. Auth., Special Tax Rev. Ref. Bonds, Series 2020-A, BAM insured, 5.00% 2024 | 85 | 90 | ||||||

| City of Jurupa, Public Fncg. Auth., Special Tax Rev. Ref. Bonds, Series 2020-A, BAM insured, 4.00% 2026 | 60 | 63 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. Ref. Bonds, Series 2022-E, 5.00% 2030 | 250 | 285 | ||||||

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Bonds, Series 2020-A, 5.00% 2026 | 710 | 779 | ||||||

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Bonds, Series 2022-B, 5.00% 2032 | 180 | 213 | ||||||

| City of Los Angeles, Dept. of Water and Power, Water System Rev. Bonds, Series 2020-B, 4.00% 2026 | 605 | 640 | ||||||

| City of Los Angeles, Wastewater System Rev. Ref. Bonds, Series 2018-B, 5.00% 2027 | 625 | 696 | ||||||

| County of Los Angeles, Dev. Auth., Multi Family Housing Mortgage Rev. Bonds (Long Beach Senior Housing), Series 2022, 2.00% 2026 (put 2025) | 1,550 | 1,513 | ||||||

| County of Los Angeles, Dev. Auth., Multi Family Housing Rev. Bonds (Cantamar Villas), Series 2021-D-1, 0.30% 2025 (put 2024) | 55 | 52 | ||||||

| 4 | Private Client Services Funds |

Capital Group Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| California (continued) | ||||||||

| County of Los Angeles, Dev. Auth., Multi Family Housing Rev. Bonds (Sunny Garden Apartments), Series 2021-C-1, 0.20% 2024 (put 2023) | USD | 75 | $ | 74 | ||||

| County of Los Angeles, Metropolitan Transportation Auth., Measure R Sales Tax Rev. Bonds, Series 2016-A, 5.00% 2023 | 50 | 52 | ||||||

| County of Los Angeles, Metropolitan Transportation Auth., Measure R Sales Tax Rev. Bonds, Series 2021-A, 5.00% 2032 | 960 | 1,118 | ||||||

| Los Angeles Unified School Dist., G.O. Dedicated Unlimited Ad Valorem Property Tax Bonds, Series 2020-C, 5.00% 2025 | 640 | 688 | ||||||

| Los Angeles Unified School Dist., G.O. Dedicated Unlimited Ad Valorem Property Tax Bonds, Series 2020-C, 5.00% 2029 | 150 | 172 | ||||||

| Metropolitan Water Dist. of Southern California, Water Rev. Ref. Bonds, Series 2020-A, 5.00% 2023 | 1,500 | 1,550 | ||||||

| Municipal Fin. Auth., Senior Living Rev. Bonds (Mt. San Antonio Gardens Project), Series 2022-B-2, 2.125% 2026 | 15 | 14 | ||||||

| Murrieta Valley Unified School Dist., Public Fncg. Auth., Special Tax Rev. Bonds, Series 2016-A, 5.00% 2022 | 1,250 | 1,262 | ||||||

| Public Fin. Auth., Rev. Bonds (Henry Mayo Newhall Memorial Hospital), Series 2021-A, 4.00% 2024 | 45 | 46 | ||||||

| Public Fin. Auth., Rev. Bonds (Henry Mayo Newhall Memorial Hospital), Series 2021-A, 4.00% 2025 | 45 | 47 | ||||||

| Public Fin. Auth., Rev. Bonds (Henry Mayo Newhall Memorial Hospital), Series 2021-A, 4.00% 2026 | 45 | 47 | ||||||

| Public Fin. Auth., Rev. Bonds (Henry Mayo Newhall Memorial Hospital), Series 2021-A, 4.00% 2027 | 45 | 47 | ||||||

| Public Fin. Auth., Rev. Bonds (Henry Mayo Newhall Memorial Hospital), Series 2021-A, 4.00% 2028 | 40 | 42 | ||||||

| Public Works Board, Lease Rev. Green Bonds (Dept. of General Services, Sacramento Region New Natural Resources Headquarters), Series 2021-C, 5.00% 2032 | 1,000 | 1,155 | ||||||

| Public Works Board, Lease Rev. Ref. Bonds (Various Capital Projects), Series 2022-A, 5.00% 2028 | 655 | 736 | ||||||

| RNR School Fncg. Auth., Community Facs. Dist. No. 92-1, Special Tax Bonds, Series 2017-A, BAM insured, 5.00% 2028 | 1,000 | 1,095 | ||||||

| City of San Diego, Community Facs. Dist. No. 2 (Santaluz), Improvement Area No. 1, Special Tax Rev. Ref. Bonds, Series 2021, 4.00% 2029 | 70 | 73 | ||||||

| County of San Diego, Regional Airport Auth., Airport Rev. Ref. Bonds, Series 2020-B, 5.00% 2022 | 1,000 | 1,006 | ||||||

| County of San Diego, Water Auth., Water Rev. Ref. Green Bonds, Series 2021-B, 5.00% 2030 | 230 | 266 | ||||||

| City and County of San Francisco, G.O. Rev. Ref. Bonds, Series 2020-R-2, 5.00% 2023 | 480 | 496 | ||||||

| City of San Jose, Redev. Agcy., Tax Allocation Rev. Ref. Bonds, Series 2017-B, 5.00% 2026 | 285 | 312 | ||||||

| City of Santee, Community Facs. Dist. No. 2017-1, Special Tax Bonds (Weston Infrastructure), Series 2019, 5.00% 2022 | 135 | 136 | ||||||

| City of Santee, Community Facs. Dist. No. 2017-1, Special Tax Bonds (Weston Infrastructure), Series 2019, 5.00% 2023 | 160 | 165 | ||||||

| City of Santee, Community Facs. Dist. No. 2017-1, Special Tax Bonds (Weston Infrastructure), Series 2019, 5.00% 2024 | 170 | 178 | ||||||

| Southern California Public Power Auth., Rev. Ref. Green Bonds (Milford Wind Corridor Phase II Project), Series 2021-1, 5.00% 2023 | 65 | 67 | ||||||

| Southern California Public Power Auth., Rev. Ref. Green Bonds (Milford Wind Corridor Phase II Project), Series 2021-1, 5.00% 2024 | 20 | 21 | ||||||

| Southern California Public Power Auth., Transmission Project Rev. Bonds (Southern Transmission Project), Series 2017-A, 5.00% 2023 | 490 | 506 | ||||||

| Statewide Communities Dev. Auth., Multi Family Housing Rev. Bonds (Villa Del Sol Apartments), Series 2021-A-2, 0.39% 2023 (put 2023) | 280 | 274 | ||||||

| Statewide Communities Dev. Auth., Multi Family Housing Rev. Bonds (Washington Court Apartments), Series 2021-E, 0.22% 2023 (put 2022) | 125 | 125 | ||||||

| Statewide Communities Dev. Auth., Pollution Control Rev. Ref. Bonds (Southern California Edison Co.), Series 2006-D, 2.625% 2033 (put 2023) | 135 | 134 | ||||||

| Statewide Communities Dev. Auth., Rev. Bonds (American Baptist Homes of the West), Series 2013-A, 5.00% 2023 (preref. 2022) | 80 | 82 | ||||||

| Statewide Communities Dev. Auth., Rev. Bonds (Viamonte Senior Living 1 Project), Series 2018-B, 3.00% 2025 | 65 | 65 | ||||||

| Statewide Communities Dev. Auth., Rev. Bonds (Viamonte Senior Living 1 Project), Series 2018-B, 3.00% 2026 | 500 | 500 | ||||||

| Tobacco Securitization Auth. of Northern California, Tobacco Settlement Asset-Backed Rev. Ref. Senior Bonds (Sacramento County Tobacco Securitization Corp.), Series 2021-B-1, 0.45% 2030 | 20 | 20 | ||||||

| Tobacco Securitization Auth. of Southern California, Tobacco Settlement Asset-Backed Rev. Ref. Bonds (San Diego County Tobacco Asset Securitization Corp.), Series 2019-A, 5.00% 2030 | 180 | 197 | ||||||

| Regents of the University of California, Limited Project Rev. Bonds, Series 2022-S, 5.00% 2026 | 165 | 181 | ||||||

| Dept. of Veterans Affairs, Veterans G.O. Bonds, Series 2019-CS, 4.00% 2049 | 785 | 801 | ||||||

| Dept. of Water Resources, Water System Rev. Bonds (Central Valley Project), Series 2016-AW, 5.00% 2033 (preref. 2026) | 255 | 283 | ||||||

| Dept. of Water Resources, Water System Rev. Bonds (Central Valley Project), Series 2017-AX, 5.00% 2033 (preref. 2027) | 230 | 260 | ||||||

| 36,223 | ||||||||

| Private Client Services Funds | 5 |

Capital Group Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| Colorado 1.87% | ||||||||

| City of Arvada, Mountain Shadows Metropolitan Dist., Limited Tax G.O. Rev. Ref. and Improvement Bonds, Series 2016, 4.00% 2026 | USD | 603 | $ | 603 | ||||

| Certs. of Part., Series 2021-A, 5.00% 2028 | 495 | 560 | ||||||

| Certs. of Part., Series 2021-A, 5.00% 2029 | 1,000 | 1,143 | ||||||

| Board of Governors of the Colorado State University System, System Enterprise Rev. and Rev. Ref. Bonds, Series 2016-B, 5.00% 2041 (preref. 2027) | 140 | 155 | ||||||

| City and County of Denver, Dept. of Aviation, Airport System Rev. Bonds, Series 2019-D, 5.00% 2031 (put 2022) | 1,000 | 1,015 | ||||||

| E-470 Public Highway Auth., Rev. Bonds, Series 2021-B, (USD-SOFR x 0.67 + 0.35%) 0.537% 2039 (put 2024)2 | 285 | 279 | ||||||

| Educational and Cultural Facs. Auth., Rev. Ref. Bonds (Johnson & Wales University Project), Series 2013-B, 5.00% 2023 (escrowed to maturity) | 1,805 | 1,853 | ||||||

| Health Facs. Auth., Health Facs. Rev. and Rev. Ref. Bonds (Evangelical Lutheran Good Samaritan Society Project), Series 2015-A, 5.00% 2024 (escrowed to maturity) | 1,825 | 1,924 | ||||||

| Health Facs. Auth., Hospital Rev. Bonds (Adventist Health System/Sunbelt Obligated Group), Series 2018-A, 5.00% 2048 | 125 | 135 | ||||||

| Housing and Fin. Auth., Multi Family Housing Rev. Bonds (Wildhorse Ridge Apartments Project), Series 2022, 2.00% 2026 (put 2025) | 1,850 | 1,810 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2018-C, Class I, 4.25% 2048 | 530 | 543 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2020-B, Class I, 3.75% 2050 | 840 | 851 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2021-L, Class I, 3.25% 2051 | 1,250 | 1,241 | ||||||

| Regional Transportation Dist., Private Activity Bonds (Denver Transit Partners Eagle P3 Project), Series 2020-A, 5.00% 2029 | 70 | 75 | ||||||

| Regional Transportation Dist., Private Activity Bonds (Denver Transit Partners Eagle P3 Project), Series 2020-A, 5.00% 2029 | 40 | 43 | ||||||

| Regional Transportation Dist., Private Activity Bonds (Denver Transit Partners Eagle P3 Project), Series 2020-A, 5.00% 2030 | 150 | 162 | ||||||

| Regional Transportation Dist., Private Activity Bonds (Denver Transit Partners Eagle P3 Project), Series 2020-A, 5.00% 2030 | 35 | 38 | ||||||

| Weld County School Dist. RE-5J, G.O. Bonds, Series 2021, 5.00% 2023 | 475 | 496 | ||||||

| 12,926 | ||||||||

| Connecticut 0.79% | ||||||||

| Town of East Hartford, Housing Auth., Multi Family Housing Rev. Bonds (Veterans Terrace Project), Series 2021, 0.25% 2023 (put 2022) | 140 | 139 | ||||||

| Health and Educational Facs. Auth., Rev. Bonds (Hartford Healthcare Issue), Series 2021-A, 5.00% 2029 | 330 | 367 | ||||||

| Health and Educational Facs. Auth., Rev. Bonds (Yale University Issue), Series 2003-X-2, 0.25% 2037 (put 2024) | 910 | 869 | ||||||

| Health and Educational Facs. Auth., Rev. Bonds (Yale University Issue), Series 2014-A, 1.10% 2048 (put 2023) | 1,105 | 1,097 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2014-C-1, 4.00% 2044 | 50 | 51 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2016-A-1, 4.00% 2045 | 200 | 203 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2017-A-1, 4.00% 2047 | 1,585 | 1,609 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2017-C-1, 4.00% 2047 | 605 | 614 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2017-D-1, 4.00% 2047 | 130 | 132 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2022-A-1, 3.50% 2051 | 290 | 290 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, Series 2015-A, 3.50% 2044 | 60 | 60 | ||||||

| 5,431 | ||||||||

| Delaware 0.13% | ||||||||

| County of Harris, Metropolitan Transportation Auth., Sales and Use Tax Contractual Obligations, Series 2015-B, 5.00% 2025 | 85 | 92 | ||||||

| Health Facs. Auth., Rev. Bonds (Beebe Medical Center Project), Series 2018, 5.00% 2022 | 290 | 291 | ||||||

| Health Facs. Auth., Rev. Bonds (Beebe Medical Center Project), Series 2018, 5.00% 2023 | 200 | 206 | ||||||

| Health Facs. Auth., Rev. Bonds (Beebe Medical Center Project), Series 2018, 5.00% 2024 | 300 | 314 | ||||||

| 903 | ||||||||

| District of Columbia 0.87% | ||||||||

| G.O. Bonds, Series 2015-A, 5.00% 2032 | 1,800 | 1,916 | ||||||

| G.O. Rev. Ref. Bonds, Series 2021-E, 5.00% 2029 | 230 | 263 | ||||||

| G.O. Rev. Ref. Bonds, Series 2021-E, 5.00% 2030 | 960 | 1,112 | ||||||

| Housing Fin. Agcy., Collateralized Multi Family Housing Rev. Bonds (Kenilworth 166 Apartments Project), Series 2021, 1.25% 2025 (put 2024) | 410 | 394 | ||||||

| 6 | Private Client Services Funds |

Capital Group Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| District of Columbia (continued) | ||||||||

| Housing Fin. Agcy., Collateralized Multi Family Housing Rev. Bonds (Parcel 42 Project), Series 2022, 1.70% 2041 (put 2025) | USD | 500 | $ | 483 | ||||

| Income Tax Secured Rev. Bonds, Series 2020-A, 5.00% 2032 | 750 | 855 | ||||||

| Income Tax Secured Rev. Bonds, Series 2020-C, 5.00% 2033 | 215 | 244 | ||||||

| Rev. Ref. Bonds (National Public Radio, Inc. Issue), Series 2016, 5.00% 2028 (preref. 2028) | 50 | 55 | ||||||

| Rev. Ref. Bonds (National Public Radio, Inc. Issue), Series 2016, 5.00% 2029 (preref. 2029) | 50 | 55 | ||||||

| Washington Convention and Sports Auth., Dedicated Tax Rev. Ref. Bonds, Series 2018-A, 5.00% 2027 | 600 | 669 | ||||||

| 6,046 | ||||||||

| Florida 6.60% | ||||||||

| County of Alachua, Health Facs. Auth., Continuing Care Retirement Community Rev. Bonds (Oak Hammock at the University of Florida, Inc. Project), Series 2021, 4.00% 2022 | 20 | 20 | ||||||

| County of Brevard, Health Facs. Auth., Rev. Ref. Bonds (Health First, Inc. Project), Series 2014, 5.00% 2033 | 130 | 136 | ||||||

| County of Brevard, Housing Fncg. Auth., Multi Family Mortgage Rev. Bonds (Tropical Manor Apartments), Series 2021, 0.25% 2023 (put 2022) | 135 | 134 | ||||||

| County of Broward, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Solaris Apartments), Series 2021-B, 0.70% 2025 (put 2024) | 370 | 353 | ||||||

| Central Florida Expressway Auth., Rev. Bonds, Series 2019-B, 5.00% 2030 | 1,000 | 1,127 | ||||||

| Citizens Property Insurance Corp., Personal Lines Account/Commercial Lines Account Secured Bonds, Series 2012-A-1, 5.00% 2022 | 170 | 171 | ||||||

| City of Daytona Beach, Housing Auth., Multi Family Housing Rev. Bonds (The WM at the River Project), Series 2021-B, 1.25% 2025 (put 2024) | 605 | 582 | ||||||

| Dev. Fin. Corp., Healthcare Facs. Rev. Bonds (UF Health - Jacksonville Project), Series 2022-A, 5.00% 2033 | 1,115 | 1,215 | ||||||

| Board of Education, Public Education Capital Outlay Rev. Ref. Bonds, Series 2013-A, 5.00% 2022 | 1,000 | 1,003 | ||||||

| Board of Education, Public Education Capital Outlay Rev. Ref. Bonds, Series 2019-D, 5.00% 2023 | 120 | 124 | ||||||

| Board of Education, Public Education Capital Outlay Rev. Ref. Bonds, Series 2022-A, 5.00% 2025 | 949 | 1,022 | ||||||

| Board of Education, Public Education Capital Outlay Rev. Ref. Bonds, Series 2022-A, 5.00% 2026 | 1,000 | 1,099 | ||||||

| Greater Orlando Aviation Auth., Airport Facs. Rev. Bonds, Series 2016-B, 5.00% 2028 | 750 | 825 | ||||||

| Higher Educational Facs. Fncg. Auth., Educational Facs. Rev. Ref. Bonds (Nova Southeastern University Project), Series 2016, 5.00% 2026 | 655 | 708 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds, Series 2017-1, 4.00% 2048 | 980 | 995 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds, Series 2018-1, 4.00% 2049 | 985 | 1,002 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds, Series 2018-2, 4.25% 2050 | 985 | 1,009 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds, Series 2020-1, 3.50% 2051 | 150 | 151 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds, Series 2021-2, 3.00% 2052 | 2,230 | 2,192 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds (Special Program), Series 2015-A, 3.50% 2046 | 35 | 35 | ||||||

| Housing Fin. Corp., Multi Family Mortgage Rev. Bonds (The Canopy at West River Towers 1 & 2), Series 2022-A-2, 3.25% 2026 (put 2025) | 519 | 522 | ||||||

| Housing Fin. Corp., Multi Family Mortgage Rev. Bonds (Valencia Park Apartments), Series 2021-A, FHA insured, 0.25% 2023 (put 2022) | 630 | 620 | ||||||

| JEA, Electric System Rev. Bonds, Series 2014-A-3, 5.00% 2022 | 600 | 609 | ||||||

| JEA, Electric System Rev. Bonds, Series 2017-B, 5.00% 2026 | 500 | 547 | ||||||

| JEA, Electric System Rev. Bonds, Series 2017-B-3, 5.00% 2026 | 340 | 373 | ||||||

| JEA, Electric System Rev. Bonds, Series 2020-A-3, 5.00% 2030 | 50 | 57 | ||||||

| JEA, Electric System Rev. Bonds, Series 2021-A, 5.00% 2031 | 2,095 | 2,398 | ||||||

| JEA, Electric System Rev. Bonds, Series 2021-A-3, 5.00% 2033 | 625 | 719 | ||||||

| JEA, Water and Sewer System Rev. Bonds, Series 2020-A, 5.00% 2033 | 50 | 57 | ||||||

| County of Manatee, University Park Recreation Dist., Non-Ad Valorem Assessment Bonds, Series 2019, BAM insured, 2.50% 2024 | 280 | 278 | ||||||

| County of Manatee, University Park Recreation Dist., Non-Ad Valorem Assessment Bonds, Series 2019, BAM insured, 2.50% 2025 | 285 | 281 | ||||||

| County of Manatee, University Park Recreation Dist., Non-Ad Valorem Assessment Bonds, Series 2019, BAM insured, 2.50% 2026 | 295 | 289 | ||||||

| County of Manatee, University Park Recreation Dist., Non-Ad Valorem Assessment Bonds, Series 2019, BAM insured, 2.50% 2027 | 300 | 291 | ||||||

| County of Manatee, University Park Recreation Dist., Non-Ad Valorem Assessment Bonds, Series 2019, BAM insured, 2.50% 2028 | 305 | 293 | ||||||

| County of Manatee, University Park Recreation Dist., Non-Ad Valorem Assessment Bonds, Series 2019, BAM insured, 2.625% 2029 | 315 | 303 | ||||||

| County of Miami-Dade, Aviation Rev. Ref. Bonds, Series 2020-A, 5.00% 2025 | 1,150 | 1,230 | ||||||

| County of Miami-Dade, Expressway Auth., Toll System Rev. Bonds, Series 2014-A, BAM insured, 5.00% 2026 | 780 | 821 | ||||||

| County of Miami-Dade, Expressway Auth., Toll System Rev. Ref. Bonds, Series 2014-B, BAM insured, 5.00% 2026 | 760 | 800 | ||||||

| Private Client Services Funds | 7 |

Capital Group Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| Florida (continued) | ||||||||

| County of Miami-Dade, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Platform 3750), Series 2021, 0.25% 2024 (put 2023) | USD | 510 | $ | 495 | ||||

| County of Miami-Dade, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Sunset Bay Apartments), Series 2021, 0.25% 2023 (put 2022) | 420 | 415 | ||||||

| County of Miami-Dade, Industrial Dev. Auth., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. of Florida Project), Series 2007, 0.32% 2027 (put 2022) | 2,205 | 2,191 | ||||||

| County of Miami-Dade, Transit System Sales Surtax Rev. Bonds, Series 2012, 5.00% 2025 (preref. 2022) | 25 | 25 | ||||||

| City of Miami Beach, Health Facs. Auth., Hospital Rev. and Rev. Ref. Bonds (Mount Sinai Medical Center of Florida), Series 2014, 5.00% 2027 | 145 | 152 | ||||||

| Municipal Power Agcy., All-Requirements Power Supply Project Rev. Ref. Bonds, Series 2016-A, 5.00% 2026 | 1,000 | 1,093 | ||||||

| County of Orange, Health Facs. Auth., Health Care Facs. Rev. Ref. Bonds (Presbyterian Retirement Communities Project), Series 2016, 5.00% 2031 | 300 | 319 | ||||||

| County of Orange, Health Facs. Auth., Rev. Bonds (Presbyterian Retirement Communities Obligated Group Project), Series 2023-A, 5.00% 2029 | 320 | 335 | ||||||

| County of Orange, Health Facs. Auth., Rev. Bonds (Presbyterian Retirement Communities Obligated Group Project), Series 2023-A, 5.00% 2031 | 500 | 526 | ||||||

| County of Orange, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Dunwoodie Place Apartments), Series 2021-A, 0.20% 2024 (put 2023) | 200 | 193 | ||||||

| County of Orange, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Jernigan Gardens), Series 2020-B, 0.35% 2023 (put 2022) | 2,000 | 1,988 | ||||||

| County of Orange, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Stratford Point Apartments), Series 2021-B, 0.55% 2025 (put 2024) | 635 | 604 | ||||||

| Orlando Utilities Commission, Utility System Rev. Ref. Bonds, Series 2021-B, 1.25% 2046 (put 2028) | 1,000 | 859 | ||||||

| Orlando-Orange County Expressway Auth., Rev. Ref. Bonds, Series 2013-A, 5.00% 2032 (preref. 2023) | 1,020 | 1,054 | ||||||

| County of Palm Beach, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Christian Manor), Series 2022, 1.25% 2025 (put 2024) | 2,875 | 2,810 | ||||||

| County of Pasco, Connerton West Community Dev. Dist., Improvement Rev. Ref. Bonds, Series 2018-A-1, Assured Guaranty Municipal insured, 3.00% 2026 | 345 | 346 | ||||||

| County of Pasco, Connerton West Community Dev. Dist., Improvement Rev. Ref. Bonds, Series 2018-A-1, Assured Guaranty Municipal insured, 3.20% 2027 | 355 | 361 | ||||||

| County of Pasco, Connerton West Community Dev. Dist., Improvement Rev. Ref. Bonds, Series 2018-A-1, Assured Guaranty Municipal insured, 3.25% 2028 | 370 | 375 | ||||||

| County of Pinellas, Housing Fin. Auth., Multi Family Mortgage Backed Bonds (Jordan Park Apartments), Series 2021-B, 0.65% 2025 (put 2024) | 525 | 500 | ||||||

| County of Polk, Utility System Rev. and Rev. Ref. Bonds, Series 2013, BAM insured, 5.00% 2043 (preref. 2023) | 185 | 192 | ||||||

| City of Pompano Beach, Rev. Bonds (John Knox Village Project), Series 2015, 5.00% 2023 | 630 | 648 | ||||||

| Counties of St. Johns and Duval, Tolomato Community Dev. Dist., Rev. Ref. Bonds, Series 2018-A-1, Assured Guaranty Municipal insured, 2.625% 2024 | 1,055 | 1,051 | ||||||

| County of St. Johns, Sweetwater Creek Community Dev. Dist., Capital Improvement Rev. Ref. Bonds, Series 2019-A-1, Assured Guaranty Municipal insured, 2.00% 2022 | 340 | 340 | ||||||

| City of South Miami, Health Facs. Auth., Hospital Rev. Ref. Bonds (Baptist Health South Florida Obligated Group), Series 2017, 5.00% 2024 | 500 | 525 | ||||||

| City of Tallahassee, Energy System Rev. Ref. Bonds, Series 2020, 5.00% 2028 | 1,000 | 1,131 | ||||||

| City of Tampa, Hospital Rev. Bonds (H. Lee Moffitt Cancer Center Project), Series 2020-B, 5.00% 2028 | 215 | 239 | ||||||

| City of Tampa, Hospital Rev. Bonds (H. Lee Moffitt Cancer Center Project), Series 2020-B, 5.00% 2029 | 250 | 281 | ||||||

| City of Tampa, Hospital Rev. Bonds (H. Lee Moffitt Cancer Center Project), Series 2020-B, 5.00% 2030 | 260 | 295 | ||||||

| Dept. of Transportation, Right-of-Way Acquisition and Bridge Construction Bonds, Series 2022-A, 5.00% 2026 | 510 | 562 | ||||||

| Dept. of Transportation, Turnpike Rev. Bonds, Series 2018-A, 5.00% 2026 | 292 | 321 | ||||||

| Dept. of Transportation Fncg. Corp., Rev. Bonds, Series 2020, 5.00% 2024 | 430 | 454 | ||||||

| City of Winter Garden, Winter Garden Village at Fowler Groves Community Dev. Dist., Special Assessment Rev. Ref. Bonds, Series 2016, 3.00% 2024 | 530 | 529 | ||||||

| 45,600 | ||||||||

| Georgia 2.56% | ||||||||

| County of Appling, Dev. Auth., Pollution Control Rev. Bonds (Oglethorpe Power Corp. Scherer Project), Series 2013-A, 1.50% 2038 (put 2025) | 885 | 854 | ||||||

| City of Atlanta, Urban Residential Fin. Auth., Multi Family Housing Rev. Bonds (Sylvan Hills Senior Apartments Project), Series 2020, 0.41% 2025 (put 2023) | 285 | 274 | ||||||

| County of Burke, Dev. Auth., Pollution Control Rev. Bonds (Georgia Power Co. Plant Vogtle Project), Series 1995-5, 2.20% 2032 | 500 | 466 | ||||||

| County of Burke, Dev. Auth., Pollution Control Rev. Bonds (Georgia Power Co. Plant Vogtle Project), Series 2013, 2.925% 2053 (put 2024) | 600 | 598 | ||||||

| 8 | Private Client Services Funds |

Capital Group Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| Georgia (continued) | ||||||||

| County of Burke, Dev. Auth., Pollution Control Rev. Bonds (Oglethorpe Power Corp. Vogtle Project), Series 2013-A, 1.50% 2040 (put 2025) | USD | 685 | $ | 661 | ||||

| City of Columbus, Dev. Auth., Multi Family Housing Rev. Bonds (Highland Terrance Phase II Project), Series 2021-B, 0.34% 2025 (put 2024) | 425 | 403 | ||||||

| County of Dawson, Dev. Auth., Multi Family Housing Rev. Bonds (Peaks of Dawsonville Project), Series 2021, 0.28% 2023 | 250 | 243 | ||||||

| County of Dekalb, Housing Auth., Multi Family Housing Rev. Bonds (Columbia Village Project), Series 2021-A, 0.34% 2024 (put 2023) | 140 | 136 | ||||||

| G.O. Bonds, Series 2020-A, 5.00% 2023 | 160 | 166 | ||||||

| G.O. Rev. Ref. Bonds, Series 2016-E, 5.00% 2026 | 225 | 250 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2014-A-1, 4.00% 2044 | 155 | 157 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2015-A-1, 3.50% 2045 | 125 | 126 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2017-A, 4.00% 2047 | 350 | 355 | ||||||

| City of Lawrenceville, Housing Auth., Multi Family Housing Rev. Bonds (Hearthside Lawrenceville Project), Series 2022, 2.25% 2025 (put 2024) | 1,565 | 1,537 | ||||||

| Main Street Natural Gas, Inc., Gas Supply Rev. Bonds, Series 2018-D, (3-month USD-LIBOR x 0.67 + 0.83%) 1.134% 2048 (put 2023)2 | 155 | 154 | ||||||

| Main Street Natural Gas, Inc., Gas Supply Rev. Bonds, Series 2019-B, 4.00% 2049 (put 2024) | 980 | 1,004 | ||||||

| Main Street Natural Gas, Inc., Gas Supply Rev. Bonds, Series 2019-C, 4.00% 2050 (put 2026) | 1,500 | 1,529 | ||||||

| Main Street Natural Gas, Inc., Gas Supply Rev. Bonds, Series 2021-C, 4.00% 2052 (put 2028) | 2,305 | 2,349 | ||||||

| Main Street Natural Gas, Inc., Gas Supply Rev. Bonds, Series 2021-A, 4.00% 2052 (put 2027) | 1,000 | 1,028 | ||||||

| Municipal Electric Auth., General Resolution Projects Bonds, Series 2021-A, 5.00% 2031 | 415 | 471 | ||||||

| Municipal Electric Auth., Plant Vogtle Units 3 and 4 Project J Bonds, Series 2021-A, Assured Guaranty Municipal insured, 5.00% 2029 | 495 | 558 | ||||||

| Municipal Electric Auth., Plant Vogtle Units 3 and 4 Project J Bonds, Series 2021-A, Assured Guaranty Municipal insured, 5.00% 2030 | 430 | 489 | ||||||

| Municipal Electric Auth., Plant Vogtle Units 3 and 4 Project M Bonds, Series 2019-A, 5.00% 2029 | 120 | 133 | ||||||

| Municipal Electric Auth., Plant Vogtle Units 3 and 4 Project M Bonds, Series 2019-A, 5.00% 2030 | 115 | 127 | ||||||

| Municipal Electric Auth., Project One Bonds, Series 2019-A, 5.00% 2024 | 1,000 | 1,039 | ||||||

| Municipal Electric Auth., Project One Bonds, Series 2019-A, 5.00% 2029 | 870 | 970 | ||||||

| Municipal Electric Auth., Project One Bonds, Series 2021-A, 5.00% 2031 | 785 | 891 | ||||||

| Northwest Georgia Housing Auth., Multi Family Housing Rev. Bonds (Dallas Manor Apartments Project), Series 2021, 0.25% 2024 (put 2023) | 120 | 116 | ||||||

| City of Valdosta, Housing Auth., Multi Family Housing Rev. Bonds (TISHCO Rural Rental Housing Portfolio Project), Series 2022, 1.25% 2025 (put 2024) | 185 | 181 | ||||||

| County of Walker, Dev. Auth., Multi Family Housing Rev. Bonds (Gateway at Rossville Project), Series 2021-B, 0.46% 2024 (put 2023) | 465 | 448 | ||||||

| 17,713 | ||||||||

| Guam 0.07% | ||||||||

| Waterworks Auth., Water and Wastewater System Rev. Bonds, Series 2013, 5.25% 2024 | 450 | 463 | ||||||

| Hawaii 0.50% | ||||||||

| Airports System Rev. Bonds, Series 2018-D, 5.00% 2030 | 1,000 | 1,138 | ||||||

| City and County of Honolulu, G.O. Bonds (Honolulu Rail Transit Project), Series 2020-B, 5.00% 2031 | 2,020 | 2,320 | ||||||

| 3,458 | ||||||||

| Idaho 0.17% | ||||||||

| Health Facs. Auth., Rev. Bonds (St. Luke’s Health System Project), Series 2021-A, 5.00% 2031 | 60 | 68 | ||||||

| Health Facs. Auth., Rev. Bonds (St. Luke’s Health System Project), Series 2021-A, 5.00% 2032 | 90 | 103 | ||||||

| Housing and Fin. Assn., Grant and Rev. Anticipation Bonds (Federal Highway Trust Fund), Series 2015-A, 5.00% 2022 | 1,000 | 1,007 | ||||||

| 1,178 | ||||||||

| Illinois 5.63% | ||||||||

| Build Illinois Bonds, Sales Tax Rev. Ref. Bonds, Series 2016-D, 5.00% 2025 | 475 | 501 | ||||||

| City of Chicago, Board of Education, Unlimited Tax G.O. Bonds (Dedicated Rev.), Series 2018-A, Assured Guaranty Municipal insured, 5.00% 2023 | 1,100 | 1,144 | ||||||

| City of Chicago, Chicago Midway Airport, Rev. and Rev. Ref. Bonds, Series 2014-B, 5.00% 2028 | 500 | 518 | ||||||

| Private Client Services Funds | 9 |

Capital Group Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| Illinois (continued) | ||||||||

| City of Chicago, G.O. Rev. Ref. Bonds, Series 2020-A, 5.00% 2023 | USD | 560 | $ | 569 | ||||

| City of Chicago, Transit Auth., Capital Grant Receipts Rev. Ref. Bonds (Federal Transit Administration Section 5307 Urbanized Area Formula Funds), Series 2021, 5.00% 2024 | 65 | 68 | ||||||

| City of Chicago, Wastewater Transmission Rev. Bonds, Series 2012, Assured Guaranty Municipal insured, 5.00% 2023 | 500 | 501 | ||||||

| City of Chicago, Wastewater Transmission Rev. Project Bonds, Series 2014, 5.00% 2028 | 385 | 397 | ||||||

| City of Chicago, Water Rev. Bonds, Series 2004, 5.00% 2023 | 200 | 208 | ||||||

| City of Chicago, Water Rev. Ref. Bonds, Series 2014, 5.00% 2023 | 200 | 208 | ||||||

| City of Chicago, Water Rev. Ref. Bonds, Series 2017, 5.00% 2028 | 355 | 393 | ||||||

| County of Cook, Community College Dist. No. 508 (City Colleges of Chicago), Unlimited Tax G.O. Bonds, Series 2013, 5.00% 2023 | 200 | 207 | ||||||

| Fin. Auth., Academic Fac. Lease Rev. Bonds (Provident Group - UIUC Properties LLC - University of Illinois at Urbana-Champaign Project), Series 2019-A, 5.00% 2025 | 110 | 118 | ||||||

| Fin. Auth., Academic Fac. Lease Rev. Bonds (Provident Group - UIUC Properties LLC - University of Illinois at Urbana-Champaign Project), Series 2019-A, 5.00% 2027 | 500 | 555 | ||||||

| Fin. Auth., Academic Fac. Lease Rev. Bonds (Provident Group - UIUC Properties LLC - University of Illinois at Urbana-Champaign Project), Series 2019-A, 5.00% 2028 | 400 | 449 | ||||||

| Fin. Auth., Rev. Bonds (Advocate Health Care Network), Series 2008-A-1, 4.00% 2030 | 1,000 | 1,024 | ||||||

| Fin. Auth., Rev. Bonds (Art Institute of Chicago), Series 2016, 5.00% 2025 | 125 | 133 | ||||||

| Fin. Auth., Rev. Bonds (Art Institute of Chicago), Series 2016, 5.00% 2026 | 120 | 130 | ||||||

| Fin. Auth., Rev. Bonds (Clean Water Initiative Revolving Fund), Series 2017, 5.00% 2033 | 500 | 548 | ||||||

| Fin. Auth., Rev. Bonds (Northshore University Heathsystem), Series 2020-A, 5.00% 2033 | 280 | 313 | ||||||

| Fin. Auth., Rev. Bonds (OSF Healthcare System), Series 2015-A, 5.00% 2027 | 250 | 268 | ||||||

| Fin. Auth., Rev. Bonds (OSF Healthcare System), Series 2020-B-2, 5.00% 2050 (put 2026) | 105 | 114 | ||||||

| Fin. Auth., Rev. Bonds (Presbyterian Homes Obligated Group), Series 2016-A, 5.00% 2024 | 310 | 323 | ||||||

| Fin. Auth., Rev. Bonds (Presbyterian Homes Obligated Group), Series 2021-B, (SIFMA Municipal Swap Index + 0.70%) 1.14% 2042 (put 2026)2 | 140 | 140 | ||||||

| Fin. Auth., Rev. Bonds (Presence Health Network), Series 2016-C, 5.00% 2026 | 600 | 650 | ||||||

| Fin. Auth., Rev. Bonds (Presence Health Network), Series 2016-C, 5.00% 2028 | 400 | 440 | ||||||

| Fin. Auth., Rev. Bonds (Rush University Medical Center Obligated Group), Series 2015-A, 5.00% 2028 | 1,000 | 1,064 | ||||||

| Fin. Auth., Rev. Bonds (Rush University Medical Center Obligated Group), Series 2015-A, 5.00% 2029 | 500 | 531 | ||||||

| Fin. Auth., Rev. Bonds (The Carle Foundation), Series 2021-A, 5.00% 2029 | 800 | 898 | ||||||

| Fin. Auth., Rev. Bonds (The Carle Foundation), Series 2021-A, 5.00% 2030 | 360 | 408 | ||||||

| Fin. Auth., Rev. Bonds (University of Chicago), Series 2021-A, 5.00% 2025 | 270 | 292 | ||||||

| Fin. Auth., Rev. Ref. Bonds (Northwestern Memorial Healthcare), Series 2021-A, 5.00% 2033 | 365 | 420 | ||||||

| Fin. Auth., Rev. Ref. Bonds (OSF Healthcare System), Series 2015-A, 5.00% 2026 | 770 | 828 | ||||||

| Fin. Auth., Water Facs. Rev. Ref. Bonds (American Water Capital Corp. Project), Series 2020, 0.70% 2040 (put 2023) | 215 | 210 | ||||||

| G.O. Bonds, Series 2014, 5.00% 2022 | 110 | 110 | ||||||

| G.O. Bonds, Series 2020-B, 5.00% 2029 | 2,090 | 2,277 | ||||||

| G.O. Bonds, Series 2019-A, 5.00% 2029 | 1,000 | 1,089 | ||||||

| Housing Dev. Auth., Multi Family Housing Rev. Bonds, Series 2021-C, 0.80% 2026 | 40 | 37 | ||||||

| Housing Dev. Auth., Multi Family Housing Rev. Bonds (Concord Commons), Series 2021, 0.25% 2024 (put 2023) | 810 | 796 | ||||||

| Housing Dev. Auth., Multi Family Housing Rev. Bonds (Marshall Field Garden Apartment Homes), Series 2015, (SIFMA Municipal Swap Index + 1.00%) 1.44% 2050 (put 2025)2 | 2,000 | 2,019 | ||||||

| Housing Dev. Auth., Multi Family Housing Rev. Bonds (Terrance Senior), Series 2022, 2.375% 2025 (put 2024) | 770 | 763 | ||||||

| Housing Dev. Auth., Rev. Bonds, Series 2019-A, 4.25% 2049 | 1,290 | 1,323 | ||||||

| Housing Dev. Auth., Rev. Bonds, Series 2021-D, 3.00% 2051 | 1,640 | 1,608 | ||||||

| Metropolitan Pier and Exposition Auth., McCormick Place Expansion Project Rev. Ref. Bonds, Series 2017-B, 5.00% 2025 | 225 | 239 | ||||||

| Municipal Electric Agcy., Power Supply System Rev. Ref. Bonds, Series 2015-A, 5.00% 2027 | 1,000 | 1,072 | ||||||

| Railsplitter Tobacco Settlement Auth., Tobacco Settlement Rev. Bonds, Series 2017, 5.00% 2023 | 620 | 636 | ||||||

| Sales Tax Securitization Corp., Sales Tax Rev. Ref. Bonds, Series 2017-A, 5.00% 2024 | 1,000 | 1,043 | ||||||

| Sales Tax Securitization Corp., Sales Tax Securitization Rev. Ref. Bonds, Series 2017-A, 5.00% 2023 | 2,000 | 2,043 | ||||||

| Toll Highway Auth., Toll Highway Rev. Bonds, Series 2019-C, 5.00% 2025 | 1,180 | 1,252 | ||||||

| Toll Highway Auth., Toll Highway Rev. Bonds, Series 2015-A, 5.00% 2027 | 1,250 | 1,344 | ||||||

| Toll Highway Auth., Toll Highway Rev. Bonds, Series 2015-A, 5.00% 2028 | 1,110 | 1,191 | ||||||

| Toll Highway Auth., Toll Highway Rev. Bonds, Series 2019-C, 5.00% 2029 | 440 | 494 | ||||||

| Toll Highway Auth., Toll Highway Rev. Ref. Bonds, Series 2019-A, 5.00% 2024 | 500 | 522 | ||||||

| Toll Highway Auth., Toll Highway Rev. Ref. Bonds, Series 2019-A, 5.00% 2025 | 740 | 785 | ||||||

| Toll Highway Auth., Toll Highway Rev. Ref. Bonds, Series 2019-A, 5.00% 2028 | 635 | 707 | ||||||

| Board of Trustees of the University of Illinois, Auxiliary Facs. System Rev. Bonds, Series 2018-A, 5.00% 2025 | 135 | 144 | ||||||

| Board of Trustees of the University of Illinois, Auxiliary Facs. System Rev. Bonds, Series 2020-A, 5.00% 2028 | 1,000 | 1,103 | ||||||

| 10 | Private Client Services Funds |

Capital Group Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| Illinois (continued) | ||||||||

| Board of Trustees of the University of Illinois, Auxiliary Facs. System Rev. Ref. Bonds, Series 2005-A, National insured, 5.50% 2023 | USD | 500 | $ | 514 | ||||

| Board of Trustees of the University of Illinois, Auxiliary Facs. System Rev. Ref. Bonds, Series 2015-A, 5.00% 2026 | 1,120 | 1,191 | ||||||

| Board of Trustees of the University of Illinois, Rev. Ref. Certs. of Part., Series 2008-A, Assured Guaranty Municipal insured, 5.25% 2024 | 30 | 30 | ||||||

| 38,902 | ||||||||

| Indiana 1.32% | ||||||||

| Fin. Auth., Health System Rev. Bonds (Indiana University Health), Series 2019-C, 5.00% 2022 | 140 | 142 | ||||||

| Fin. Auth., Hospital Rev. Bonds (Community Health Network Project), Series 2012-A, 5.00% 2042 (preref. 2023) | 1,165 | 1,199 | ||||||

| Fin. Auth., State Revolving Fund Program Green Bonds, Series 2021-B, 5.00% 2028 | 575 | 645 | ||||||

| Fin. Auth., Wastewater Utility Rev. Ref. Bonds (CWA Auth. Project), Series 2021-2, 5.00% 2022 | 130 | 132 | ||||||

| Fin. Auth., Wastewater Utility Rev. Ref. Bonds (CWA Auth. Project), Series 2021-1, 5.00% 2023 | 275 | 286 | ||||||

| Fin. Auth., Wastewater Utility Rev. Ref. Bonds (CWA Auth. Project), Series 2021-2, 5.00% 2023 | 85 | 88 | ||||||

| Fin. Auth., Wastewater Utility Rev. Ref. Bonds (CWA Auth. Project), Series 2021-2, 5.00% 2027 | 335 | 375 | ||||||

| City of Franklin, Econ. Dev. and Rev. Ref. Bonds (Otterbein Homes Obligated Group), Series 2019-B, 5.00% 2023 | 30 | 31 | ||||||

| Health Fac. Fncg. Auth., Rev. Bonds (Ascension Health Subordinate Credit Group), Series 2005-A-1, 4.00% 2023 | 80 | 82 | ||||||

| Housing and Community Dev. Auth., Collateralized Rev. Bonds (RD Moving Forward Biggs Project), Series 2022, 2.00% 2025 (put 2024) | 185 | 182 | ||||||

| Housing and Community Dev. Auth., Collateralized Rev. Bonds (RD Moving Forward Justus Project), Series 2021, 0.33% 2024 (put 2023) | 710 | 691 | ||||||

| Housing and Community Dev. Auth., Single Family Mortgage Rev. Bonds, Series 2019-A, 4.25% 2048 | 1,655 | 1,696 | ||||||

| Housing and Community Dev. Auth., Single Family Mortgage Rev. Bonds, Series 2020-A, 3.75% 2049 | 150 | 152 | ||||||

| Housing and Community Dev. Auth., Single Family Mortgage Rev. Bonds, Series 2021-B, 3.00% 2050 | 110 | 108 | ||||||

| Housing and Community Dev. Auth., Single Family Mortgage Rev. Bonds, Series 2021-C-1, 3.00% 2052 | 355 | 348 | ||||||

| City of Indianapolis, Local Public Improvement Bond Bank Bonds (Indianapolis Airport Auth. Project), Series 2019-I-2, 5.00% 2026 | 340 | 366 | ||||||

| City of Indianapolis, Local Public Improvement Bond Bank Bonds (Indianapolis Airport Auth. Project), Series 2019-I-2, 5.00% 2027 | 330 | 361 | ||||||

| City of Indianapolis, Local Public Improvement Bond Bank Bonds (Indianapolis Airport Auth. Project), Series 2019-I-2, 5.00% 2028 | 435 | 483 | ||||||

| City of Indianapolis, Local Public Improvement Bond Bank Bonds (Indianapolis Airport Auth. Project), Series 2019-I-2, 5.00% 2029 | 265 | 298 | ||||||

| City of Indianapolis, Local Public Improvement Bond Bank Bonds (Indianapolis Airport Auth. Project), Series 2019-I-2, 5.00% 2030 | 435 | 493 | ||||||

| City of Kokomo, Multi Family Housing Rev. Bonds (KHA RAD I Apartments), Series 2021-A, 0.56% 2025 (put 2024) | 1,030 | 990 | ||||||

| 9,148 | ||||||||

| Iowa 0.52% | ||||||||

| Fin. Auth., Single Family Mortgage Bonds (Mortgage-Backed Securities Program), Series 2019-A, 4.00% 2047 | 760 | 776 | ||||||

| Fin. Auth., Single Family Mortgage Bonds (Mortgage-Backed Securities Program), Series 2019-D, 3.50% 2049 | 25 | 25 | ||||||

| PEFA, Inc., Gas Project Rev. Bonds, Series 2019, 5.00% 2049 (put 2026) | 2,150 | 2,270 | ||||||

| Tobacco Settlement Auth., Tobacco Settlement Asset-Backed Bonds, Series 2021-A-2, 5.00% 2031 | 320 | 353 | ||||||

| Tobacco Settlement Auth., Tobacco Settlement Asset-Backed Bonds, Series 2021-A-2, 5.00% 2033 | 135 | 148 | ||||||

| 3,572 | ||||||||

| Kansas 0.31% | ||||||||

| Johnson County Unified School Dist. No. 512, G.O. Rev. Ref. and Improvement Bonds (Shawnee Mission), Series 2015-A, 5.00% 2031 (preref. 2025) | 1,000 | 1,083 | ||||||

| Turnpike Auth., Rev. Ref. Bonds, Series 2020-A, 3.00% 2025 | 950 | 963 | ||||||

| Unified Government of Wyandotte County, Board of Public Utilities, Utility System Improvement Rev. Bonds, Series 2012-B, 5.00% 2026 (preref. 2022) | 110 | 111 | ||||||

| 2,157 | ||||||||

| Private Client Services Funds | 11 |

Capital Group Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| Kentucky 1.03% | ||||||||

| Econ. Dev. Fin. Auth., Health System Rev. Bonds (Norton Healthcare, Inc.), Capital Appreciation Bonds, Series 2000-B, National insured, 0% 2027 | USD | 1,000 | $ | 826 | ||||

| Housing Corp., Multi Family Housing Rev. Bonds (Cambridge Square Project), Series 2021, 0.30% 2024 (put 2024) | 365 | 348 | ||||||

| Housing Corp., Multi Family Housing Rev. Bonds (New Hope Properties Portfolio Project), Series 2021, 0.41% 2024 (put 2023) | 1,575 | 1,524 | ||||||

| Housing Corp., Multi Family Housing Rev. Bonds (Winterwood II Rural Housing Portfolio), Series 2021, 0.37% 2024 (put 2023) | 635 | 613 | ||||||

| County of Owen, Water Facs. Rev. Ref. Bonds (Kentucky - American Water Co. Project), Series 2019, 2.45% 2039 (put 2029) | 750 | 679 | ||||||

| Property and Buildings Commission, Commonwealth Rev. Ref. Bonds (Project No. 125), Series 2021-A, 5.00% 2022 | 170 | 172 | ||||||

| Public Energy Auth., Gas Supply Rev. Bonds, Series 2018-A, 4.00% 2048 (put 2024) | 410 | 416 | ||||||

| Public Energy Auth., Gas Supply Rev. Bonds, Series 2019-A-1, 4.00% 2049 (put 2025) | 1,180 | 1,197 | ||||||

| Public Energy Auth., Gas Supply Rev. Bonds, Series 2018-B, 4.00% 2049 (put 2025) | 185 | 189 | ||||||

| Public Energy Auth., Gas Supply Rev. Bonds, Series 2022-A-1, 4.00% 2052 (put 2030) | 855 | 871 | ||||||

| Turnpike Auth., Econ. Dev. Road Rev. Ref. Bonds (Revitalization Projects), Series 2022-A, 5.00% 2031 | 270 | 311 | ||||||

| 7,146 | ||||||||

| Louisiana 2.27% | ||||||||

| Parish of East Baton Rouge, Road and Street Improvement Sales Tax Rev. Ref. Bonds, Series 2020, Assured Guaranty Municipal insured, 5.00% 2022 | 85 | 86 | ||||||

| Parish of East Baton Rouge, Road and Street Improvement Sales Tax Rev. Ref. Bonds, Series 2020, Assured Guaranty Municipal insured, 5.00% 2026 | 1,250 | 1,365 | ||||||

| Parish of East Baton Rouge, Sewerage Commission, Multi Modal Rev. Ref. Bonds, Series 2021-A, 1.30% 2041 (put 2028) | 1,270 | 1,107 | ||||||

| Parish of East Baton Rouge, Sewerage Commission, Rev. Ref. Bonds, Series 2020-A, 5.00% 2026 | 1,135 | 1,235 | ||||||

| Gasoline and Fuels Tax Rev. Ref. Bonds, Series 2017-D-1, 0.60% 2043 (put 2023) | 2,000 | 1,978 | ||||||

| Gasoline and Fuels Tax Rev. Ref. Bonds, Series 2022-A, (USD-SOFR x 0.50 + 0.50%) 0.689% 2043 (put 2026)2 | 575 | 573 | ||||||

| Grant Anticipation Rev. Bonds, Series 2021, 5.00% 2023 | 335 | 348 | ||||||

| Housing Corp., Multi Family Housing Rev. Bonds (Arbours at Lafayette Project), Series 2021, 0.35% 2024 (put 2023) | 375 | 363 | ||||||

| Housing Corp., Multi Family Housing Rev. Bonds (Hollywood Acres and Hollywood Heights Projects), Series 2019, 0.55% 2023 | 750 | 724 | ||||||

| Housing Corp., Multi Family Housing Rev. Bonds (Mabry Place Townhomes Project), Series 2021, 0.31% 2024 (put 2023) | 215 | 208 | ||||||

| Parish of Jefferson, Sales Tax Rev. Ref. Bonds, Series 2019-B, Assured Guaranty Municipal insured, 5.00% 2027 | 1,000 | 1,116 | ||||||

| Local Government Environmental Facs. and Community Dev. Auth., Rev. Ref. Bonds (Entergy Louisiana, LLC Projects), Series 2021-A, 2.00% 2030 | 105 | 92 | ||||||

| Louisiana Stadium and Exposition Dist., Rev. Ref. Bonds, Series 2013-A, 5.00% 2022 | 1,500 | 1,509 | ||||||

| Offshore Terminal Auth., Deepwater Port Rev. Bonds (Loop LLC Project), Series 2007-A, 1.65% 2027 (put 2023) | 905 | 893 | ||||||

| Public Facs. Auth., Hospital Rev. Ref. Bonds (Lafayette General Health System Project), Series 2016-A, 5.00% 2041 (preref. 2025) | 1,000 | 1,086 | ||||||

| Parish of St. Charles, Gulf Opportunity Zone Rev. Bonds (Valero Project), Series 2010, 4.00% 2040 (put 2022) | 2,000 | 2,003 | ||||||

| Parish of St. John the Baptist, Rev. Ref. Bonds (Marathon Oil Corp. Project), Series 2017-B-1, 2.125% 2037 (put 2024) | 285 | 277 | ||||||

| City of Shreveport, Water and Sewer Rev. Bonds, Series 2019-B, Assured Guaranty Municipal insured, 3.00% 2022 | 115 | 116 | ||||||

| City of Shreveport, Water and Sewer Rev. Bonds, Series 2019-B, Assured Guaranty Municipal insured, 4.00% 2023 | 105 | 108 | ||||||

| City of Shreveport, Water and Sewer Rev. Bonds, Series 2019-B, Assured Guaranty Municipal insured, 5.00% 2024 | 80 | 85 | ||||||

| City of Shreveport, Water and Sewer Rev. Bonds, Series 2019-B, Assured Guaranty Municipal insured, 4.00% 2025 | 145 | 151 | ||||||

| City of Shreveport, Water and Sewer Rev. Bonds, Series 2019-B, Assured Guaranty Municipal insured, 5.00% 2026 | 140 | 154 | ||||||

| Tobacco Settlement Fncg. Corp., Tobacco Settlement Asset-Backed Rev. Ref. Bonds, Series 2013-A, 5.00% 2023 | 90 | 92 | ||||||

| 15,669 | ||||||||

| Maine 0.08% | ||||||||

| Housing Auth., Mortgage Purchase Bonds, Series 2017-A, 4.00% 2047 | 300 | 305 | ||||||

| Turnpike Auth., Turnpike Rev. Ref. Bonds, Series 2022, 5.00% 2031 | 195 | 227 | ||||||

| 532 | ||||||||

| 12 | Private Client Services Funds |

Capital Group Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| Maryland 1.38% | ||||||||

| County of Anne Arundel, G.O. Rev. Ref. Water and Sewer Bonds, Series 2022, 5.00% 2026 | USD | 885 | $ | 970 | ||||

| Community Dev. Administration, Dept. of Housing and Community Dev., Residential Rev. Bonds, Series 2014-C, 4.00% 2044 | 190 | 193 | ||||||

| Community Dev. Administration, Dept. of Housing and Community Dev., Residential Rev. Bonds, Series 2020-D, 3.25% 2050 | 600 | 598 | ||||||

| Community Dev. Administration, Dept. of Housing and Community Dev., Residential Rev. Bonds, Series 2021-C, 3.00% 2051 | 783 | 769 | ||||||

| G.O. Rev. Ref. Bonds, State and Local Facs. Loan of 2021, Series 2022-D-2, 4.00% 2029 | 585 | 635 | ||||||

| County of Montgomery, Housing Opportunities Commission, Single Family Housing Rev. Bonds, Series 2017-A, 4.00% 2048 | 500 | 508 | ||||||

| County of Montgomery, Housing Opportunities Commission, Single Family Housing Rev. Bonds, Series 2018-A, 4.00% 2049 | 1,355 | 1,379 | ||||||

| County of Prince George, Certs. of Part. (Behavioral Health Fac. and Capital Equipment), Series 2021, 5.00% 2024 | 165 | 175 | ||||||

| Dept. of Transportation, Consolidated Transportation Bonds, Series 2018-2, 5.00% 2026 | 1,000 | 1,104 | ||||||

| Transportation Auth., Transportation Facs. Projects Rev. Bonds, Series 2020. 5.00% 2033 | 745 | 850 | ||||||

| Washington Suburban Sanitary Dist., Consolidated Public Improvement Bonds, Series 2021, 5.00% 2030 | 2,000 | 2,335 | ||||||

| 9,516 | ||||||||

| Massachusetts 0.46% | ||||||||

| Dev. Fin. Agcy., Multi Family Housing Rev. Bonds (Salem Heights II Preservation Associates LP Issue), Series 2021-B, 0.25% 2024 (put 2023) | 180 | 175 | ||||||

| Dev. Fin. Agcy., Rev. Bonds (Mass General Brigham, Inc.), Series 2019-T-1, 1.04% 2049 (put 2026)2,3 | 235 | 235 | ||||||

| Dev. Fin. Agcy., Rev. Ref. Bonds (Berkshire Health Systems Issue), Series 2021-I, 5.00% 2024 | 615 | 650 | ||||||

| Housing Fin. Agcy., Housing Green Bonds, Series 2021-A-2, 0.30% 2023 | 50 | 48 | ||||||

| Housing Fin. Agcy., Housing Green Bonds, Series 2021-A-2, 0.40% 2024 | 65 | 62 | ||||||

| Housing Fin. Agcy., Housing Green Bonds, Series 2021-B-2, 0.75% 2025 | 55 | 52 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 169, 4.00% 2044 | 85 | 85 | ||||||

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 172, 4.00% 2045 | 235 | 238 | ||||||

| Massachusetts Bay Transportation Auth., Sales Tax Green Bond Anticipation Notes, Series 2021, 4.00% 2025 | 455 | 474 | ||||||

| Transportation Fund Rev. Ref. Bonds, Series 2021-A, 5.00% 2029 | 1,000 | 1,145 | ||||||

| 3,164 | ||||||||

| Michigan 2.66% | ||||||||

| City of Detroit, Water and Sewerage Dept., Sewage Disposal System Rev. and Rev. Ref. Bonds, Series 2012-A, 5.00% 2032 (preref. 2022) | 185 | 186 | ||||||

| Fin. Auth., Hospital Rev. and Rev. Ref. Bonds (Trinity Health Credit Group), Series 2017-A, 5.00% 2047 (preref. 2022) | 2,555 | 2,604 | ||||||

| Fin. Auth., Hospital Rev. Ref. Bonds (McLaren Health Care), Series 2015-D-1, 0.25% 2022 | 40 | 40 | ||||||

| Fin. Auth., Local Government Loan Program Rev. Bonds (Detroit Water and Sewerage Dept., Sewage Disposal System Rev. Ref. Local Project Bonds), Series 2015-C, 5.00% 2027 | 250 | 268 | ||||||

| Fin. Auth., Tobacco Settlement Asset-Backed Bonds, Series 2020-A-1, 5.00% 2026 | 105 | 112 | ||||||

| Fin. Auth., Tobacco Settlement Asset-Backed Bonds, Series 2020-A, 5.00% 2028 | 1,000 | 1,083 | ||||||

| Fin. Auth., Tobacco Settlement Asset-Backed Bonds, Series 2020-A-1, 5.00% 2029 | 205 | 224 | ||||||

| Great Lakes Water Auth., Water Supply System Rev. Bonds, Series 2020-B, 5.00% 2032 | 500 | 563 | ||||||

| Hospital Fin. Auth., Hospital Rev. Bonds (Trinity Health Credit Group), Series 2009-B, 5.00% 2048 (preref. 2022) | 615 | 617 | ||||||

| Hospital Fin. Auth., Hospital Rev. Ref. Bonds (Trinity Health Credit Group), Series 2008-C, 5.00% 2022 | 475 | 484 | ||||||

| Housing Dev. Auth., Multi Family Housing Rev. Bonds, Series 2020, 0.32% 2023 (put 2022) | 1,000 | 991 | ||||||

| Housing Dev. Auth., Rental Housing Rev. Bonds, Series 2019-A-1, 1.50% 2022 | 1,195 | 1,193 | ||||||

| Housing Dev. Auth., Rental Housing Rev. Bonds, Series 2021-A, 0.55% 2025 | 185 | 175 | ||||||

| Housing Dev. Auth., Single Family Mortgage Rev. Bonds, Series 2016-B, 3.50% 2047 | 415 | 418 | ||||||

| Housing Dev. Auth., Single Family Mortgage Rev. Bonds, Series 2017-B, 3.50% 2048 | 240 | 241 | ||||||

| Housing Dev. Auth., Single Family Mortgage Rev. Bonds, Series 2018-A, 4.00% 2048 | 565 | 575 | ||||||

| Housing Dev. Auth., Single Family Mortgage Rev. Bonds, Series 2018-C, 4.25% 2049 | 1,580 | 1,619 | ||||||

| Housing Dev. Auth., Single Family Mortgage Rev. Bonds, Series 2019-A, 4.25% 2049 | 775 | 795 | ||||||

| Housing Dev. Auth., Single Family Mortgage Rev. Bonds, Series 2020-A, 3.50% 2050 | 1,410 | 1,417 | ||||||

| Housing Dev. Auth., Single Family Mortgage Rev. Bonds, Series 2021-A, 3.00% 2052 | 2,125 | 2,090 | ||||||

| Board of Trustees of Michigan State University, Rev. Bonds, Series 2019-B, 5.00% 2023 | 300 | 307 | ||||||

| Private Client Services Funds | 13 |

Capital Group Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| Michigan (continued) | ||||||||

| Board of Trustees of Michigan State University, Rev. Bonds, Series 2019-B, 5.00% 2030 | USD | 700 | $ | 786 | ||||

| Strategic Fund, Limited Obligation Rev. Ref. Bonds (Detroit Edison Co. Pollution Control Bonds Project), Series 1995-CC, 1.45% 2030 | 1,630 | 1,358 | ||||||

| Trunk Line Fund Bonds, Series 2021-A, 5.00% 2031 | 230 | 270 | ||||||

| 18,416 | ||||||||

| Minnesota 1.31% | ||||||||

| City of Hopkins, Multi Family Housing Rev. Bonds (Raspberry Ridge Project), Series 2021, 0.26% 2024 (put 2023) | 535 | 526 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2014-B, 4.00% 2038 | 220 | 224 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2015-B, 3.50% 2046 | 575 | 578 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2017-B, 4.00% 2047 | 465 | 472 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2018-B, 4.00% 2048 | 355 | 360 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2017-E, 4.00% 2048 | 275 | 280 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2018-E, 4.25% 2049 | 1,490 | 1,528 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2019-B, 4.25% 2049 | 700 | 718 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2020-E, 3.50% 2050 | 260 | 261 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2021-B, 3.00% 2051 | 525 | 517 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2021-D, 3.00% 2052 | 1,185 | 1,167 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2021-H, 3.00% 2052 | 880 | 864 | ||||||

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2022-A, 3.00% 2052 | 350 | 343 | ||||||

| City of Mahtomedi, Multi Family Housing Rev. Bonds (Lincoln Place / Vadnais Highlands Projects), Series 2021, 0.25% 2023 (put 2022) | 300 | 299 | ||||||

| Municipal Gas Agcy., Commodity Supply Rev. Bonds, Series 2022-A, 4.00% 2052 (put 2027) | 875 | 904 | ||||||

| 9,041 | ||||||||

| Mississippi 0.54% | ||||||||

| Business Fin. Corp., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2004, 0.70% 2029 (put 2026) | 1,460 | 1,288 | ||||||

| Gaming Tax Rev. Bonds, Series 2019-A, 5.00% 2023 | 850 | 880 | ||||||

| Gaming Tax Rev. Ref. Bonds, Series 2015-E, 5.00% 2026 | 500 | 536 | ||||||

| Home Corp., Collateralized Multi Family Housing Rev. Bonds (J&A Dev. Portfolio Project I), Series 2021-1, 0.30% 2024 (put 2023) | 230 | 226 | ||||||

| Home Corp., Multi Family Housing Rev. Bonds (Southwest Village Apartments Project), Series 2022-2, 1.30% 2025 (put 2024) | 215 | 213 | ||||||

| Home Corp., Single Family Mortgage Rev. Bonds, Series 2019-A, 4.00% 2048 | 575 | 586 | ||||||

| 3,729 | ||||||||

| Missouri 0.85% | ||||||||

| Health and Educational Facs. Auth., Health Facs. Rev. Bonds (BJC Health System), Series 2021-B, 5.00% 2052 (put 2028) | 2,360 | 2,597 | ||||||

| Housing Dev. Commission, Single Family Mortgage Rev. Bonds (First Place Homeownership Loan Program), Series 2016-B, 3.50% 2041 | 1,105 | 1,115 | ||||||

| Housing Dev. Commission, Single Family Mortgage Rev. Bonds (First Place Homeownership Loan Program), Series 2017-B, 3.25% 2047 | 252 | 249 | ||||||

| Housing Dev. Commission, Single Family Mortgage Rev. Bonds (First Place Homeownership Loan Program), Series 2020-A, 3.50% 2050 | 530 | 533 | ||||||

| Housing Dev. Commission, Single Family Mortgage Rev. Bonds (First Place Homeownership Loan Program), Series 2021-A, 3.00% 2052 | 560 | 551 | ||||||

| Housing Dev. Commission, Single Family Mortgage Rev. Bonds (First Place Homeownership Loan Program), Series 2021-C, 3.25% 2052 | 185 | 184 | ||||||

| Housing Dev. Commission, Single Family Mortgage Rev. Bonds (Special Homeownership Loan Program), Series 2015-A, 3.75% 2038 | 105 | 106 | ||||||

| City of St. Louis, Airport Rev. Ref. Bonds (Lambert-St. Louis International Airport), Series 2019-C, 5.00% 2031 | 500 | 555 | ||||||

| 5,890 | ||||||||

| 14 | Private Client Services Funds |

Capital Group Core Municipal Fund

| Bonds, notes & other debt instruments (continued) | Principal amount (000) |

Value (000) |

||||||

| Montana 0.23% | ||||||||

| Board of Housing, Single Family Mortgage Bonds, Series 2016-A-2, 3.50% 2044 | USD | 105 | $ | 106 | ||||

| Board of Housing, Single Family Mortgage Bonds, Series 2020-C, 3.00% 2050 | 290 | 287 | ||||||

| Board of Housing, Single Family Mortgage Bonds, Series 2022-A, 3.00% 2052 | 1,200 | 1,177 | ||||||

| 1,570 | ||||||||

| Nebraska 0.70% | ||||||||

| Central Plains Energy Project, Gas Project Rev. Bonds (Project No. 3), Series 2012, 5.00% 2032 (preref. 2022) | 1,190 | 1,202 | ||||||

| Investment Fin. Auth., Single Family Housing Rev. Bonds, Series 2013-A, 3.00% 2043 | 10 | 10 | ||||||

| Investment Fin. Auth., Single Family Housing Rev. Bonds, Series 2014-A, 4.00% 2044 | 80 | 81 | ||||||

| Investment Fin. Auth., Single Family Housing Rev. Bonds, Series 2015-C, 3.50% 2045 | 225 | 227 | ||||||

| Investment Fin. Auth., Single Family Housing Rev. Bonds, Series 2016-C, 3.50% 2046 | 15 | 15 | ||||||

| Investment Fin. Auth., Single Family Housing Rev. Bonds, Series 2018-C, 4.00% 2048 | 1,605 | 1,634 | ||||||

| Investment Fin. Auth., Single Family Housing Rev. Bonds, Series 2018-A, 4.00% 2048 | 570 | 581 | ||||||

| Investment Fin. Auth., Single Family Housing Rev. Bonds, Series 2021-C, 3.00% 2050 | 1,100 | 1,082 | ||||||

| 4,832 | ||||||||

| Nevada 0.70% | ||||||||

| Clark County School Dist., Limited Tax G.O. School Bonds, Series 2015-D, 5.00% 2022 | 500 | 502 | ||||||

| County of Clark, Airport System Rev. Ref. Bonds (McCarran International Airport), Series 2021-A, 5.00% 2033 | 760 | 862 | ||||||

| County of Clark, Las Vegas-McCarran International Airport, Passenger Fac. Charge Rev. Ref. Bonds, Series 2019-E, 5.00% 2029 | 770 | 870 | ||||||

| County of Clark, Pollution Control Rev. Ref. Bonds (Nevada Power Co. Projects), Series 2017, 1.65% 2036 (put 2023) | 1,355 | 1,349 | ||||||

| City of Henderson, Local Improvement Dist. No. T-17 (Madeira Canyon), Limited Obligation Rev. Ref. Bonds, Series 2017, 2.00% 2023 | 420 | 415 | ||||||

| Housing Division, Multi Family Housing Rev. Bonds (Southwest Village Apartments), Series 2021, 0.47% 2024 (put 2023) | 200 | 194 | ||||||

| Las Vegas Valley Water Dist., Limited Tax G.O. Water Rev. Ref. Bonds, Series 2020-A, 5.00% 2024 | 595 | 627 | ||||||

| County of Washoe, Gas and Water Facs. Rev. Ref. Bonds (Sierra Pacific Power Co. Projects), Series 2016-B, 3.00% 2036 (put 2022) | 10 | 10 | ||||||

| 4,829 | ||||||||

| New Hampshire 0.18% | ||||||||

| Health and Education Facs. Auth., Rev. Bonds (University System of New Hampshire Issue), Series 2017-A, 5.00% 2022 | 500 | 503 | ||||||

| Health and Education Facs. Auth., Rev. Bonds (University System of New Hampshire Issue), Series 2017-A, 5.00% 2023 | 600 | 619 | ||||||

| National Fin. Auth., Municipal Certs., Series 2020-1, Class A, 4.125% 2034 | 97 | 100 | ||||||

| 1,222 | ||||||||

| New Jersey 0.97% | ||||||||

| Econ. Dev. Auth., School Facs. Construction Bonds, Series 2021-QQQ, 5.00% 2029 | 500 | 548 | ||||||