Form N-CSRS CANTOR FITZGERALD SUSTAI For: Sep 30

united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-23773

Cantor Fitzgerald Sustainable Infrastructure Fund

(Exact name of registrant as specified in charter)

110 E. 59th Street, New York, NY 10022

(Address of principal executive offices) (Zip code)

Corporation Services Company

251 Little Falls Drive, Wilmington, Delaware 19808 __________

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 915-1722

Date of fiscal year end: 3/31

Date of reporting period: 9/30/2022

Item 1. Reports to Stockholders.

| (a) |

Electronic Reports Disclosure

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will not be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary (such as a broker-dealer, registered investment adviser, or bank). Instead, the reports will be made available on the Fund’s website (www.cantorinfrastructurefund.com), and you will be notified electronically or by mail, depending on your elections, each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper, free of charge. If you invest directly with the Fund, you can call the Fund toll-free at 855-9-CANTOR / 855-922-6867 or visit https://www.cantorinfrastructurefund.com/ and select “Login” followed by “Investor Access” to inform the Fund that you wish to start receiving paper copies of your shareholder reports. If you invest through a financial intermediary, you can contact your financial intermediary to request that you start to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund sponsor if you invest directly with a fund.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by: (i) calling the Fund toll-free at 855-9-CANTOR / 855-922-6867 or visiting https://www.cantorinfrastructurefund.com/ and select “Login” followed by “Investor Access”, if you invest directly with the Fund, or (ii) contacting your financial intermediary, if you invest through a financial intermediary. Please note that not all financial intermediaries offer this service.

| 2 |

Table of Contents

| Shareholder Letter | 4 | |

| Portfolio Review | 10 | |

| Schedule of Investments | 11 | |

| Statement of Operations | 13 | |

| Statement of Assets and Liabilities | 14 | |

| Statement of Changes in Net Assets | 15 | |

| Financial Highlights | 16 | |

| Notes to Financial Statements | 17 | |

| Additional Information | 27 | |

| Privacy Policy | 29 |

| Cantor Fitzgerald Sustainable Infrastructure Fund | 3 |

Dear Shareholders:

We are pleased to present the semi annual report for Cantor Fitzgerald Sustainable Infrastructure Fund (“Fund”) covering the period from June 30, 2022, through September 30, 2022.

The Fund is a continuously offered, non-diversified, closed end interval fund registered under the Investment Company Act of 1940, as amended, that commenced operations on June 30, 2022. The Fund strategically invests in a portfolio of infrastructure securities and seeks to invest in issuers that are helping to address certain United Nations Sustainable Development Goals.

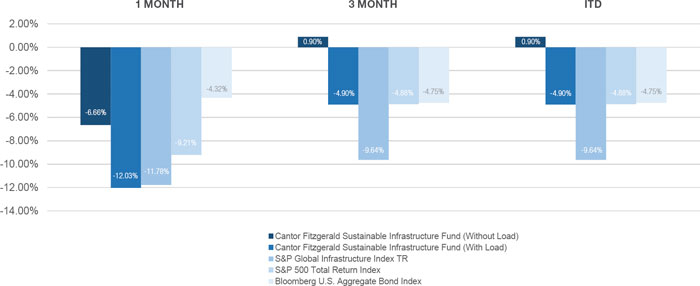

During the quarterly period ending September 30, 2022, the Fund’s load-waived Class A shares (NASDAQ: CAFIX) delivered a total return of 0.90% compared to the Standard & Poor’s (“S&P”) Global Infrastructure Index, which returned -9.64% (without deduction for fees, expenses or taxes). The resulting Fund outperformance versus the benchmark was 10.54% for the period.1

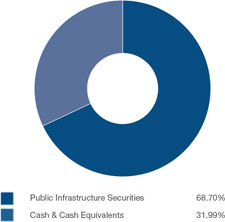

As of September 30, 2022, 67.7% of the Fund’s net assets were invested in infrastructure holdings with the remaining 32.3% of net assets in short-term instruments and cash.

The overall stock market’s strong start to the third quarter reversed course following Federal Reserve Chair Jerome Powell’s hawkish comments at the annual Jackson Hole conference in late August. Central banks around the world also raised rates during the period in a global policy response. Global yields moved sharply higher, the U.S. dollar’s rally continued, and oil prices declined amid slowing global growth. Notwithstanding the decline in infrastructure stocks during this volatile period for equities broadly, the Fund’s portfolio management team delivered significant outperformance versus the benchmark.

Several listed infrastructure subsectors drove the negative index returns during the quarter. Generally, utility subsectors were adversely impacted by rising interest rates - U.S. water utilities declined as higher growth utilities like these tend to lag in rising rate environments; gas utilities were weak due to concerns over both elevated commodity prices as well as rising interest rates; and electric utilities came under pressure despite their defensive characteristics. High growth/high-multiple U.S. tower and data center companies were adversely impacted during the period due to tighter monetary policy and rising rates experiencing a reversion to the mean, and transportation-related sectors were mixed.

The portfolio management team has actively positioned the Fund with more defensive allocations. We remain overweight utilities and energy infrastructure and underweight transportation. At the regional level, we are limiting European exposure due to elevated regional economic challenges. Specific contributors to outperformance during the period included Constellation Energy Corporation, EQT Corporation and Cheniere Energy Inc.

We expect elevated inflation and higher interest rates to persist in the near term although the pace of interest rate increases is expected to slow as inflation starts to moderate. This environment, combined with continued central bank tightening, will likely put increasing pressure on earnings and economic activity in general although the infrastructure sector has often shown positive performance in inflationary environments. We have positioned the portfolio in this context and are strategically adding exposure to investments that we believe have attractive growth and income potential even in an anemic economic environment primarily due to one or more of three global megatrends: digital transformation, decarbonization, and the improvement of aging infrastructure.

We believe the Fund is well positioned to benefit from the enduring and fundamental needs of today’s global population and deliver on its stated investment objective through measured and mindful infrastructure investing.

We value your trust and confidence and thank you for your continued support.

Sincerely,

Michael D. Underhill

Co-Portfolio Manager, Cantor Fitzgerald Sustainable Infrastructure Fund

Chris A. Milner

Investment Committee Member, Cantor Fitzgerald Sustainable Infrastructure Fund

Managing Director, Cantor Fitzgerald

| 4 |

Performance Metrics1

As of September 30, 2022 (Unaudited)

| 1 | The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted above. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Fund performance based on load-waived Class A shares and does not reflect any sales charge but does reflect management fees and other expenses. The maximum sales charge for Class A shares is 5.75%. If the data reflected the deduction of such charges, the performance would be lower. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For current performance information, visit www.cantorinfrastructurefund.com. |

Due to financial statement adjustments, performance information presented herein for the Fund may differ from the Fund’s financial highlights, which are prepared in accordance with U.S. GAAP. Such differences generally are attributable to valuation adjustments to certain of the Fund’s investments, which are reflected in the financial statements.

Inception Date: June 30, 2022

Gross Expense Ratio: 4.49% Net Expense Ratio: 3.00% (inclusive of estimated Acquired Fund Fees & Expenses)

The Adviser and the Fund have entered into an expense limitation and reimbursement agreement to the extent that they exceed 2.50% per annum of the Fund’s average daily net assets (the Expense Limitation). In consideration of the Adviser’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Adviser in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable not more than three years from the date in which they were incurred; and (2) the reimbursement may not be made if it would cause the lesser of the Expense Limitation in place at the time of waiver or at the time of reimbursement to be exceeded. The Expense Limitation Agreement will remain in effect at least until June 30, 2024, unless and until the Board approves its modification or termination. This agreement may be terminated only by the Fund’s Board on 60 days’ written notice to the Adviser.

| Cantor Fitzgerald Sustainable Infrastructure Fund | 5 |

| Portfolio Holdings | |

| As of September 30, 2022 (Unaudited) |

| SECURITY DESCRIPTION | TYPE | COUNTRY | % OF TOTAL NET ASSETS |

| Cash & Cash Equivalents | 31.99% | ||

| Cheniere Energy, Inc. | Energy | United States | 5.70% |

| NextEra Energy, Inc. | Utilities | United States | 4.47% |

| Constellation Energy Corp. | Utilities | United States | 4.04% |

| NRG Energy, Inc. | Utilities | United States | 3.64% |

| EQT Corp. | Energy | United States | 3.28% |

| Exelon Corp. | Utilities | United States | 3.26% |

| TC Energy Corp. | Energy | Canada | 3.24% |

| Sempra Energy | Utilities | United States | 2.86% |

| Enbridge, Inc. | Energy | Canada | 2.86% |

| AES Corp. | Utilities | United States | 2.77% |

| Brookfield Infrastructure Partners, LLC | Utilities | Canada | 2.41% |

| American Water Works Co., Inc. | Utilities | United States | 2.26% |

| DT Midstream, Inc. | Energy | United States | 2.19% |

| Evoqua Water Technologies Corp. | Industrials | United States | 2.17% |

| Waste Management, Inc. | Industrials | United States | 2.15% |

| Williams Companies, Inc. | Energy | United States | 2.13% |

| Essential Utilities, Inc. | Utilities | United States | 1.98% |

| Edison International | Utilities | United States | 1.74% |

| FirstEnergy Corp. | Utilities | United States | 1.70% |

| SBA Communications Corp., A | Communications | United States | 1.65% |

| Public Service Enterprise Group, Inc. | Utilities | United States | 1.61% |

| Nisource, Inc. | Utilities | United States | 1.48% |

| CMS Energy Corp. | Utilities | United States | 1.46% |

| Entergy Corp. | Utilities | United States | 1.10% |

| Digital Realty Trust, Inc. | Digital Infrastructure | United States | 1.08% |

| DTE Energy Co. | Utilities | United States | 1.03% |

| Atmos Energy Corp. | Utilities | United States | 0.99% |

| RWE AG | Utilities | Germany | 0.90% |

| Iberdrola SA | Utilities | Spain | 0.80% |

| Vistra Energy Corp. | Utilities | United States | 0.63% |

| American Electric Power Company | Utilities | United States | 0.43% |

| TOTAL | 100% |

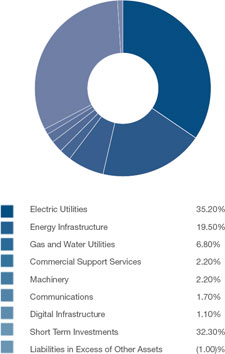

Portfolio Exposure (Unaudited)

ASSET TYPE

INFRASTRUCTURE TYPE

As a percent of net assets. Allocations are subject to change.

The holdings are presented to illustrate the diversity of areas in which the Fund may invest and may not be representative of the Fund’s future investments. Portfolio holdings are subject to change and should not be considered investment advice.

Under normal market conditions and once the Fund reaches scale, the Adviser and Sub-Adviser intend to pursue an allocation of approximately 70% of its assets in private institutional infrastructure investment funds and to invest approximately 30% of its assets in publicly traded equity and debt securities of infrastructure-related companies, both domestic and foreign, primarily denominated in U.S. dollars.

| 6 |

Investment Management Team (Unaudited)

ADVISER

|

Cantor Fitzgerald Investment Advisors, L.P. (the “Adviser”) serves as the adviser to the Fund and is a wholly-owned subsidiary of Cantor Fitzgerald, L.P. (together with its affiliates, “Cantor Fitzgerald”) and a division of Cantor Fitzgerald Asset Management, which provides investment management, asset management and advisory services to investors in global fixed income, equity, and real assets markets through the use of mutual funds, exchange traded funds, interval funds, separately managed accounts, core real estate funds, opportunity zone funds and other private investment vehicles. |

CANTOR FITZGERALD

A Tradition of Excellence Since 1945

| Global Footprint | Expansive Team |

| More than 160 offices in 22 countries | Over 12,000 employees worldwide |

| Primary Dealer | Investment Grade |

| One of the 24 primary dealers authorized to transact business with the Federal Reserve Bank of New York | Maintains an investment-grade credit rating by Standard & Poor’s and Fitch |

| Real Assets Expertise | |

| Over $140 billion in real assets-related transactions in 20211 |

| 1 | Includes originated debt and non-originated debt placement transactions. |

Cantor refers to Cantor Fitzgerald, L.P., its subsidiaries, including Cantor Fitzgerald & Co., and its affiliates including BGC Partners (NASDAQ:BGCP) and Newmark (NASDAQ:NMRK). The Adviser is a wholly- owned subsidiary of Cantor.

SUB-ADVISER

|

Capital Innovations, LLC (the “Sub-Adviser”) is a private investment firm specializing in private and public market real assets strategies including infrastructure, real estate, and natural resources. The Sub-Adviser was founded in 2007 to enable investors to benefit form the transition to a resource constrained economy. |

A Real Assets Specialist

| Infrastructure Expertise | Sustainability Focused |

| Advised on or invested in more than $9 billion of infrastructure opportunities in both public and private markets | Incorporated sustainability and environmental, social, and governance (“ESG”) standards into their investment process since inception |

| Time-Tested Approach | Experienced Team |

| Experience through multiple market cycles and economic environments | Decades of infrastructure, real assets and portfolio management experience |

| Cantor Fitzgerald Sustainable Infrastructure Fund | 7 |

Glossary (Unaudited)

NASDAQ: An electronic stock market listing over 5,000 companies. The NASAQ stock market comprises two separate markets, namely the Nasdaq National Market, which trades large, active securities and the NASDAQ Capital Market that trades emerging growth companies.

S&P 500 Total Return Index: The Standard & Poor’s index calculated on a total return basis. This index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large cap segment of the market, with over 80% coverage of U.S. equities, it also serves as a proxy for the total market. The total return calculation provides investors with a price plus gross cash dividend return. Gross cash dividends are applied on the ex date of the dividend.

S&P Global Infrastructure Index TR: This index tracks 75 publicly traded companies from around the world representing the listed infrastructure industry while maintaining liquidity and tradability. To create diversified exposure, the index includes three distinct infrastructure clusters: energy, transportation, and utilities.

Bloomberg U.S. Aggregate Bond Index: A broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Investors frequently use the index as a stand-in for measuring the performance of the US bond market.

| 8 |

Important Disclosures (Unaudited)

The information contained herein is not an offer to sell or a solicitation of an offer to buy the securities described herein. Such an offer or solicitation can be made only through the prospectus relating to the offering, which is always controlling and supersedes the information contained herein in its entirety. The prospectus may be obtained by calling (855) 9-CANTOR / (855) 922-6867.

The Fund defines an infrastructure company as a company that derives at least 50% of its revenues or profits from, or devotes at least 50% of its assets to, the ownership, management, development, construction, renovation, enhancement, or operation of infrastructure assets or the provision of services to companies engaged in such activities. Infrastructure assets may include, among other asset types, regulated assets (such as electricity generation, transmission and distribution facilities, gas transportation and distribution systems, water distribution, and wastewater collection and processing facilities), transportation assets (such as toll roads, airports, seaports, railway lines, intermodal facilities), renewable power generation (wind, solar and hydropower) and communications assets (including broadcast and wireless towers, fiber, data centers, distributed network systems and satellite networks).

Investing involves risk, including loss of principal. There is no guarantee that the Fund will meet its investment objective. There is no guarantee that any investing strategy will be successful. The Fund is a closed-end investment company.

ESG and sustainable investing may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, ESG and Sustainable investing strategies may rely on certain values-based criteria to eliminate exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating. There is no assurance that employing ESG and sustainable strategies will result in more favorable investment performance.

The Fund is subject to the risks associated with investment in infrastructure-related companies. Risks associated with infrastructure-related companies include: (a) realized revenue volume may be significantly lower than projected and/or there will be cost overruns; (b) infrastructure project sponsors will alter their terms making a project no longer economical; (c) macroeconomic factors such as low gross domestic product growth or high nominal interest rates will raise the average cost of infrastructure funding; (d) government

regulation may affect rates charged to infrastructure customers; (e) government budgetary constraints will impact infrastructure projects; (f) special tariffs will be imposed; and (g) changes in tax laws, regulatory policies or accounting standards could be unfavorable. Other risks include environmental damage due to a company’s operations or an accident, a natural disaster, changes in market sentiment towards infrastructure and terrorist acts. Any of these events could cause the value of the Fund’s investments in infrastructure-related companies to decline.

By investing in the Fund, a shareholder will not be deemed to be an investor in any underlying fund and will not have the ability to exercise any rights attributable to an investor in any such underlying fund related to their investment. The Fund’s investment in Private Investment Funds will require it to bear a pro rata share of the vehicles’ expenses, including management and performance fees. Also, once an investment is made in a Private Investment Fund, neither the Adviser nor any Sub-Adviser will be able to exercise control over investment decisions made by the Private Investment Fund. The Fund may invest in securities of other investment companies, including ETFs. The Fund will indirectly bear its proportionate share of any management fees and other expenses paid by investment companies in which it invests, in addition to the management fees (and other expenses) paid by the Fund.

| Cantor Fitzgerald Sustainable Infrastructure Fund | 9 |

Cantor

Fitzgerald Sustainable Infrastructure Fund

Portfolio Review (Unaudited)

September 30, 2022

Average Annual Total Return through September 30, 2022*, as compared to its benchmark:

| Inception*** | |

| through | |

| September 30, | |

| 2022 | |

| Cantor Fitzgerald Sustainable Infrastructure Fund Class A | 0.90% |

| Cantor Fitzgerald Sustainable Infrastructure Fund Class A with load | -4.90% |

| S&P Global Infrastructure Index** | -9.64% |

| * | The performance data quoted here represents past performance. The performance comparison includes reinvestment of all dividends and capital gains and has been adjusted for the Class A maximum applicable sales charge of 5.75%. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance figures for periods greater than 1 year are annualized. The Fund’s adviser has contractually agreed to reduce its fees and to reimburse expenses at least until June 30, 2024. The Fund’s total annual operating expense, before fee waiver and/or reimbursements, is 4.49% for Class A shares per the most recent prospectus. After fee waivers and/or reimbursements, the Fund’s net operating expense is 3.00%. The Fund’s total annual fund operating expenses after fee waiver and/or reimbursement (including all organizational and offering expenses, but excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) will not exceed 2.50% of average daily net assets attributable to Class A, per the most recent prospectus. For performance information current to the most recent month-end, please call toll-free 1-855-9-CANTOR. |

| ** | The S&P Global Infrastructure Index is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability. You cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. |

| **** | Inception date is June 30, 2022. |

| Holdings by Industry as of September 30, 2022 | % of Net Assets | |||

| Electric Utilities | 35.2 | % | ||

| Energy Infrastructure | 19.5 | % | ||

| Gas & Water Utilities | 6.8 | % | ||

| Commercial Support Services | 2.2 | % | ||

| Machinery | 2.2 | % | ||

| Communications | 1.7 | % | ||

| Digital Infrastructure | 1.1 | % | ||

| Short-Term Investments | 32.3 | % | ||

| Liabilities in Excess of Other Assets | (1.0 | )% | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments in this semi-annual report for a detailed listing of the Fund’s holdings.

| 10 |

| Cantor Fitzgerald Sustainable Infrastructure Fund |

| Schedule of Investments (Unaudited) |

| September 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 68.7% | ||||||||

| COMMERCIAL SUPPORT SERVICES - 2.2% | ||||||||

| 800 | Waste Management, Inc. | $ | 128,168 | |||||

| DIGITAL INFRASTRUCTURE - 1.1% | ||||||||

| 650 | Digital Realty Trust, Inc. | 64,467 | ||||||

| ELECTRIC UTILITIES - 35.2% | ||||||||

| 7,300 | AES Corporation (The) | 164,980 | ||||||

| 300 | American Electric Power Company, Inc. | 25,935 | ||||||

| 4,000 | Brookfield Infrastructure Partners, LP | 143,600 | ||||||

| 1,500 | CMS Energy Corporation | 87,360 | ||||||

| 2,900 | Constellation Energy Corporation | 241,251 | ||||||

| 535 | DTE Energy Company | 61,552 | ||||||

| 1,830 | Edison International | 103,541 | ||||||

| 650 | Entergy Corporation | 65,410 | ||||||

| 5,200 | Exelon Corp. | 194,792 | ||||||

| 2,745 | FirstEnergy Corporation | 101,565 | ||||||

| 1,275 | Iberdrola S.A. - ADR | 47,443 | ||||||

| 3,400 | NextEra Energy, Inc. | 266,594 | ||||||

| 5,680 | NRG Energy, Inc. | 217,374 | ||||||

| 1,705 | Public Service Enterprise Group, Inc. | 95,872 | ||||||

| 1,465 | RWE A.G. - ADR | 53,736 | ||||||

| 1,140 | Sempra Energy | 170,932 | ||||||

| 1,800 | Vistra Corporation | 37,800 | ||||||

| 2,079,737 | ||||||||

| GAS & WATER UTILITIES - 6.8% | ||||||||

| 1,035 | American Water Works Company, Inc. | 134,715 | ||||||

| 580 | Atmos Energy Corporation | 59,073 | ||||||

| 2,860 | Essential Utilities, Inc. | 118,347 | ||||||

| 3,500 | NiSource, Inc. | 88,165 | ||||||

| 400,300 | ||||||||

| COMMUNICATIONS - 1.7% | ||||||||

| 345 | SBA Communications Corp., A | 98,204 | ||||||

| MACHINERY - 2.2% | ||||||||

| 3,915 | Evoqua Water Technologies Corporation(a) | 129,469 | ||||||

| ENERGY INFRASTRUCTURE - 19.5% | ||||||||

| 2,050 | Cheniere Energy, Inc. | 340,116 | ||||||

| 2,520 | DT Midstream, Inc. | 130,763 | ||||||

| 4,600 | Enbridge, Inc. | 170,660 | ||||||

| 4,800 | EQT Corporation | 195,600 | ||||||

| 4,800 | TC Energy Corporation | 193,392 | ||||||

| 4,440 | Williams Companies, Inc. (The) | 127,117 | ||||||

| 1,157,648 | ||||||||

| TOTAL COMMON STOCKS (Cost $4,056,831) | 4,057,993 | |||||||

The accompanying notes are an integral part of these financial statements.

| Cantor Fitzgerald Sustainable Infrastructure Fund | 11 |

| Cantor Fitzgerald Sustainable Infrastructure Fund |

| Schedule of Investments (Unaudited)(Continued) |

| September 30, 2022 |

| Shares | Fair Value | |||||||

| SHORT-TERM INVESTMENTS — 32.3% | ||||||||

| MONEY MARKET FUNDS - 32.3% | ||||||||

| 1,908,566 | Morgan Stanley Institutional Liquidity Funds, Institutional Class, 2.81% (Cost $1,908,566)(b) | $ | 1,908,566 | |||||

| TOTAL INVESTMENTS - 101.0% (Cost $5,965,397) | $ | 5,966,559 | ||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (1.0)% | (57,885 | ) | ||||||

| NET ASSETS - 100.0% | $ | 5,908,674 | ||||||

ADR - American Depositary Receipt

LP - Limited Partnership

REIT - Real Estate Investment Trust

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of September 30, 2022. |

The accompanying notes are an integral part of these financial statements.

| 12 |

| Cantor Fitzgerald Sustainable Infrastructure Fund |

| Statement of Operations (Unaudited) |

| September 30, 2022 |

| Assets | ||||

| Investments in securities at fair value (cost $5,965,397) | $ | 5,966,559 | ||

| Cash | 70 | |||

| Dividends receivable | 11,075 | |||

| Receivable from Adviser | 25,335 | |||

| Prepaid Offering Costs | 125,251 | |||

| Prepaid expenses | 7,275 | |||

| Total Assets | 6,135,565 | |||

| Liabilities | ||||

| Payable for shareholder servicing fees, Class A | 1,254 | |||

| Payable to Administrator | 16,382 | |||

| Payable to trustees | 17,382 | |||

| Accrued Offering Costs | 133,387 | |||

| Other accrued expenses | 58,486 | |||

| Total Liabilities | 226,891 | |||

| Net Assets | $ | 5,908,674 | ||

| Net Assets consist of: | ||||

| Paid-in capital | 5,902,304 | |||

| Accumulated earnings | 6,370 | |||

| Net Assets | $ | 5,908,674 | ||

| Shares outstanding (unlimited number of shares authorized, no par value) | 585,563 | |||

| Net asset value and redemption price per share | $ | 10.09 | ||

| Maximum offering price per share (net asset value plus maximum sales charge of 5.75%) | $ | 10.71 | ||

The accompanying notes are an integral part of these financial statements.

| Cantor Fitzgerald Sustainable Infrastructure Fund | 13 |

| Cantor Fitzgerald Sustainable Infrastructure Fund |

| Statement of Assets and Liabilities (Unaudited) |

| For the period ended September 30, 2022(a) |

| Investment Income | ||||

| Dividend income (net of foreign taxes withheld of $773) | $ | 40,569 | ||

| Total investment income | 40,569 | |||

| Expenses | ||||

| Legal fees | 25,553 | |||

| Investment Adviser fees | 21,121 | |||

| Transfer agent fees | 19,773 | |||

| Administration fees | 17,855 | |||

| Trustee fees | 17,382 | |||

| Audit and tax preparation fees | 12,469 | |||

| Compliance service fees | 10,000 | |||

| Offering costs | 8,136 | |||

| Printing and postage expenses | 7,109 | |||

| Custodian fees | 6,931 | |||

| Insurance expenses | 6,900 | |||

| Fund accounting fees | 4,630 | |||

| Shareholder servicing fees, Class A | 3,520 | |||

| Miscellaneous expenses | 11,153 | |||

| Total expenses | 172,532 | |||

| Fees contractually waived by Adviser | (137,289 | ) | ||

| Net operating expenses | 35,243 | |||

| Net investment income | 5,326 | |||

| Net Realized and Change in Unrealized Gain (Loss) on Investments | ||||

| Net realized loss on: | ||||

| Foreign currency translations | (91 | ) | ||

| Net change in unrealized appreciation (depreciation) on: | ||||

| Investment securities transactions | 1,162 | |||

| Foreign currency translations | (27 | ) | ||

| Net realized and change in unrealized gain on investments | 1,044 | |||

| Net increase in net assets resulting from operations | $ | 6,370 | ||

| (a) | The Fund commenced operations on June 30, 2022. |

The accompanying notes are an integral part of these financial statements.

| 14 |

| Cantor Fitzgerald Sustainable Infrastructure Fund |

| Statement of Changes in Net Assets |

| For the Period | ||||

| Ended | ||||

| September 30, | ||||

| 2022(a) | ||||

| (Unaudited) | ||||

| Increase (Decrease) in Net Assets due to: | ||||

| Operations | ||||

| Net investment income | $ | 5,326 | ||

| Net realized loss on investment securities transactions and foreign currency translations | (91 | ) | ||

| Net change in unrealized appreciation of investment securities and foreign currency translations | 1,135 | |||

| Net increase in net assets resulting from operations | 6,370 | |||

| Capital Transactions | ||||

| Proceeds from shares sold | 5,902,304 | |||

| Net increase in net assets resulting from capital transactions | 5,902,304 | |||

| Total Increase in Net Assets | 5,908,674 | |||

| Net Assets | ||||

| End of period | $ | 5,908,674 | ||

| Share Transactions | ||||

| Shares sold | 585,563 | |||

| Net increase in shares outstanding | 585,563 | |||

| (a) | For the period June 30, 2022 (commencement of operations) to September 30, 2022. |

The accompanying notes are an integral part of these financial statements.

| Cantor Fitzgerald Sustainable Infrastructure Fund | 15 |

| Cantor Fitzgerald Sustainable Infrastructure Fund |

| Financial Highlights |

| (For a share outstanding during the period) |

| For the Period | ||||

| Ended | ||||

| September 30, | ||||

| 2022(a) | ||||

| (Unaudited) | ||||

| Selected Per Share Data | ||||

| Net asset value, beginning of period | $ | 10.00 | ||

| Investment operations: | ||||

| Net investment income(b) | 0.01 | |||

| Net realized and unrealized gain (loss) on investments | 0.08 | |||

| Total from investment operations | 0.09 | |||

| Net asset value, end of period | $ | 10.09 | ||

| Total Return(c) | 0.90 | % (d) | ||

| Ratios and Supplemental Data: | ||||

| Net assets, end of period (000 omitted) | $ | 5,909 | ||

| Ratio of expenses to average net assets after expense waiver | 2.50 | % (e) | ||

| Ratio of expenses to average net assets before expense waiver | 12.24 | % (e) | ||

| Ratio of net investment income to average net assets after expense waiver | 0.38 | % (e) | ||

| Portfolio turnover rate | 0 | % (d) | ||

| (a) | For the period June 30, 2022 (commencement of operations) to September 30, 2022. |

| (b) | Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (c) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (d) | Not annualized. |

| (e) | Annualized. |

The accompanying notes are an integral part of these financial statements.

| 16 |

Cantor

Fitzgerald Sustainable Infrastructure Fund

Notes to Financial Statements (Unaudited)

September 30, 2022

| 1. | ORGANIZATION |

Cantor Fitzgerald Sustainable Infrastructure Fund (the “Fund”) was organized as a Delaware statutory trust on December 16, 2021 and is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a continuously offered, non-diversified, closed-end management investment company. The Fund is an interval fund that will provide limited liquidity by offering to make quarterly repurchases of shares at net asset value (“NAV”), which will be calculated on a daily basis. The Fund’s investment objective is to maximize total return, with an emphasis on current income, while seeking to invest in issuers that are helping to address certain United Nations Sustainable Development Goals (“SDGs”) through their products and services.

The Fund currently offers Class A shares. Class A shares commenced operations on June 30, 2022. Class A shares are offered at net asset value plus a maximum sales charge of 5.75%.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 946 “Financial Services – Investment Companies”.

Securities Valuation – The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board. The Board has delegated execution of these procedures to the Adviser as its valuation designee (the “Valuation Designee”). The Board may also enlist third party consultants such a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist the Valuation Designee in determining a security-specific fair value. The Board is responsible for reviewing and approving fair value methodologies utilized by the Valuation Designee, which approval shall be based upon whether the Valuation Designee followed the valuation procedures established by the Board.

Valuation of Public Securities – Readily marketable portfolio securities listed on a public exchange are valued at their current market values determined on the basis of market quotations obtained from independent pricing services approved by the Board. Such quotes typically utilize official closing prices, generally the last sale price, reported to the applicable securities exchange if readily available. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined as reflected by the exchange representing the principal market for such securities. Securities trading on NASDAQ are valued at NASDAQ official closing price.

If market or dealer quotations are not readily available or deemed unreliable, the Adviser will determine in good faith, the fair value of such securities. For securities that are fair valued in the ordinary course of Fund operations, the Board has designated the performance of fair value determinations to the Adviser as valuation designee, subject to the Board’s oversight. The Adviser has established a Valuation Committee to help oversee the implementation of procedures for fair value determinations. In determining the fair value of a security for which there are no readily available market or dealer quotations, the Adviser and the Valuation Committee, will take into account all reasonably available information that may be relevant to a particular security including, but not limited to: pricing history, current market level, supply and demand of the respective security; the enterprise value of the portfolio company; the portfolio company’s ability to make payments and its earnings and discounted cash flow, comparison to the values and current pricing of publicly traded

| Cantor Fitzgerald Sustainable Infrastructure Fund | 17 |

Cantor

Fitzgerald Sustainable Infrastructure Fund

Notes to Financial Statements (Unaudited)(Continued)

September 30, 2022

securities that have comparable characteristics; comparison to publicly traded securities including factors such as yield, maturity, and credit quality; knowledge of historical market information with respect to the security; fundamental analytical data, such as periodic financial statements, and other factors or information relevant to the security, issuer, or market. Fair valuation involves subjective judgments, and it is possible that the fair value determined for a security may differ materially from the value that could be realized upon the sale of the security.

Valuation of Private Investment Funds – The Fund’s allocation to Private Investment Funds generally includes open end private institutional infrastructure investment funds that invest in the ownership, management, development, construction, renovation, enhancement, or operation of infrastructure assets or the provision of services to companies engaged in such activities. The Private Investment Funds have generally adopted valuation practices consistent with the valuation standards and techniques established by the FASB Auditing Standards Codification.

The sponsors or agents of the Private Investment Funds measure their investment assets at fair value and report a NAV per share no less frequently than quarterly (“Sponsor NAV”). Such Sponsor NAVs are reviewed by the Adviser upon receipt and subsequently applied to the Fund’s NAV following consultation with the Private Investment Fund sponsor, if necessary. In between receipt of Sponsor NAVs, where applicable, the value of each Private Investment Fund is adjusted daily by the change in a proprietary index (the “Index”) that the Fund’s Board has deemed representative of the private infrastructure market. This process is applied daily to each respective Private Investment Fund until the receipt of the next Sponsor NAV. The Index seeks to reflect market conditions of the broader private infrastructure market in an effort to ensure any such changes in market conditions are reflected in the NAV of the Fund. The Index incorporates data from third-party data providers and broad securities indices (the “Index Constituents”). The Index is monitored by the Adviser on a regular basis, and the Adviser will consult with the Valuation Committee if monitoring suggests a modification to the Index Constituents or other change(s) to the Index to better reflect market conditions. Further, in the event that a Sponsor NAV is not provided by a Private Investment Fund following the conclusion of such Private Investment Fund’s valuation period, the Adviser shall inform the Valuation Committee and a meeting may be called to determine fair value.

The valuations of the Private Investment Funds have a considerable impact on the Fund’s NAV as, under normal market conditions, a significant portion of the Fund’s assets will be invested in Private Investment Funds. Market and dealer quotations are generally not readily available for the Private Investment Funds in which the Fund invests, and as such, the Fund utilizes Sponsor NAVs or other valuation methodologies when determining the fair value of the Private Investment Funds. The Fund may also use a third party valuation specialist to assist in determining fair value of the Private Investment Funds held in the Fund’s portfolio.

Assets and liabilities initially expressed in foreign currencies will be converted into U.S. Dollars using foreign exchange rates provided by a recognized pricing service.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurement. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

| 18 |

Cantor

Fitzgerald Sustainable Infrastructure Fund

Notes to Financial Statements (Unaudited)(Continued)

September 30, 2022

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of September 30, 2022 for the Fund’s assets and liabilities measured at fair value:

| Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks | $ | 4,057,993 | $ | — | $ | — | $ | 4,057,993 | ||||||||

| Short-Term Investments | 1,908,566 | — | — | 1,908,566 | ||||||||||||

| Total | $ | 5,966,559 | $ | — | $ | — | $ | 5,966,559 | ||||||||

The Fund did not hold any Level 2 or Level 3 securities during the period.

Investments Valued at NAV – ASC 820 permits a reporting entity to measure the fair value of an investment fund that does not have a readily determinable fair value based on the NAV per share, or its equivalent, of the investment fund as a practical expedient, without further adjustment, unless it is probable that the investment would be sold at a value significantly different than the NAV. If the practical expedient NAV is not as of the reporting entity’s measurement date, then the NAV should be adjusted to reflect any significant events that may change the valuation. In using the NAV as a practical expedient, certain attributes of the investment that may impact its fair value are not considered in measuring fair value. Attributes of those investments include the investment strategies of the investment and may also include, but are not limited to, restrictions on the investor’s ability to redeem its investments at the measurement date and any unfunded commitments. The Fund is permitted to invest in alternative investments that do not have a readily determinable fair value and, as such, has elected to use the NAV as calculated on the reporting entity’s measurement date as the fair value of the investment.

Adjustments to the NAV provided by the Portfolio Fund Manager would be considered if the practical expedient NAV was not as of the Fund’s measurement date; if it was probable that the alternative investment would be sold at a value materially different than the reported expedient NAV; or if it was determined by the Fund’s Valuation Procedures that the private investment is not being reported at fair value.

As of September 30, 2022, the Fund did not hold any investments valued at NAV.

Security Transactions and Related Income – Security transactions are accounted for on a trade date basis. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Dividends and Distributions to Shareholders – Dividends from net investment income, if any, are declared and paid at least quarterly. Distributable net realized capital gains, if any, are declared and distributed annually. Dividends from net investment income and distributions from net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (i.e., deferred losses, capital loss carry forwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. Dividends and distributions to shareholders are recorded on the ex-dividend date.

| Cantor Fitzgerald Sustainable Infrastructure Fund | 19 |

Cantor

Fitzgerald Sustainable Infrastructure Fund

Notes to Financial Statements (Unaudited)(Continued)

September 30, 2022

Organization and Offering Costs – Organization costs of the Trust were paid by the Adviser under the investment advisory agreement as discussed in Note 4, while offering costs consisting of the initial prospectus and registration of the Fund will be paid by the Fund and amortized over the first 12 months of operations.

Fund Expenses – The Fund bears all expenses incurred in the course of its operations, including, but not limited to, the following: all fees and expenses of Portfolio Funds in which the Fund invests (“acquired fund fees”), management fees, fees and expenses associated with any credit facility, legal fees, administrator fees, audit and tax preparation fees, custodial fees, transfer agency fees, registration expenses, expenses of the Board and other administrative expenses. Certain of these operating expenses are subject to an expense limitation agreement (the “Expense Limitation Agreement” as further discussed in Note 4). Expenses are recorded on an accrual basis. Closing costs associated with the purchase of Portfolio Funds and Direct Investments are included in the cost of the investment.

Foreign Currency Transactions – All assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the rate of exchange of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities and income and expenses are translated at the rate of exchange quoted on the respective date that such transactions are recorded. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Federal Income Taxes – The Fund intends to continue to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and will distribute all of its taxable income, if any, to shareholders. Accordingly, no provision for federal income taxes is required in the financial statements.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken in the Fund’s March 31, 2023 year-end tax return. The Fund identifies its major tax jurisdictions as U.S. federal, Ohio, and foreign jurisdictions where the Fund may make significant investments. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Indemnification – The Trust indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the risk of loss due to these warranties and indemnities appears to be remote.

| 3. | INVESTMENT TRANSACTIONS AND ASSOCIATED RISKS |

For the period ended September 30, 2022 cost of purchases and proceeds from sales of portfolio securities, other than short-term investments, amounted to $4,056,830 and $0, respectively.

Associated Risks – During the normal course of business, the Fund may purchase, sell or hold various securities, which may result in certain risks, the amount of which is not apparent from the financial statements.

Market Risk – An investment in the Fund’s shares is subject to investment risk, including the possible loss of the entire principal amount invested. An investment in the Fund’s shares represents an indirect investment in the securities owned by the Fund. The value of these securities, like other market investments, may move up or down, sometimes rapidly and unpredictably.

| 20 |

Cantor

Fitzgerald Sustainable Infrastructure Fund

Notes to Financial Statements (Unaudited)(Continued)

September 30, 2022

Pandemic Risk – An outbreak of infectious respiratory illness caused by a novel coronavirus known as COVID-19 has resulted in travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of and delays in healthcare service preparation and delivery, prolonged quarantines, cancellations, supply chain disruptions, and lower consumer demand, as well as general concern and uncertainty. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many countries or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. In addition, the impact of infectious illnesses in emerging market countries may be greater due to generally less established healthcare systems. Public health crises caused by the COVID-19 outbreak, or other infectious diseases, may exacerbate other pre-existing political, social and economic risks in certain countries or globally. As such, issuers of infrastructure securities with operations, productions, offices, and/or personnel in (or other exposure to) areas affected by diseases outbreaks may experience significant disruptions to their business and/or holdings. The extent to which COVID-19 or other infectious diseases will affect the Fund, the Fund’s service providers and/or such issuer’s operations and results will depend on future developments, which are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of COVID-19 and the actions taken to contain COVID-19. The duration of the COVID-19 outbreak cannot be determined with certainty.

Private Investment Fund Risk – The Fund’s investment in Private Investment Funds will require it to bear a pro rata share of the vehicles’ expenses, including management and performance fees. The fees the Fund pays to invest in a Private Investment Fund may be higher than if the manager of the Private Investment Fund managed the Fund’s assets directly. The performance fees charged by certain Private Investment Funds may create an incentive for its manager to make investments that are riskier and/or more speculative than those it might have made in the absence of a performance fee. Furthermore, Private Investment Funds, like the other Underlying Funds in which the Fund may invest, are subject to specific risks, depending on the nature of the vehicle, and also may employ leverage such that their returns are more than one times that of their benchmark, which could amplify losses suffered by the Fund when compared to unleveraged investments. Shareholders of the Private Investment Funds are not entitled to the protections of the Investment Company Act of 1940, as amended (the “1940 Act”). For example, Private Investment Funds need not have independent boards, shareholder approval of advisory contracts may not be required, the Private Investment Funds may utilize leverage and may engage in joint transactions with affiliates. These characteristics present additional risks for shareholders.

Liquidity Risk – There currently is no secondary market for the Fund’s shares and the Adviser does not expect that a secondary market will develop. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at NAV. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. The Fund’s investments also are subject to liquidity risk. Liquidity risk exists when particular investments of the Fund would be difficult to purchase or sell, possibly preventing the Fund from selling such illiquid securities at an advantageous time or price, or possibly requiring the Fund to dispose of other investments at unfavorable times or prices in order to satisfy its obligations.

Infrastructure Industry Risk – The Fund is subject to the risks associated with investment in infrastructure-related companies. Risks associated with infrastructure-related companies include: (a) realized revenue volume may be significantly lower than projected and/or there will be cost overruns; (b) infrastructure project sponsors will alter their terms making a project no longer economical; (c) macroeconomic factors such as low gross domestic product (“GDP”) growth or high nominal interest rates will raise the average cost of infrastructure funding; (d) government regulation may affect rates charged to infrastructure customers; (e) government budgetary constraints will impact infrastructure projects; (f) special tariffs will be imposed; and (g) changes in tax laws, regulatory policies or accounting standards could be unfavorable. Other risks include environmental damage due to a company’s operations or an accident, a natural disaster, changes in market sentiment towards infrastructure and terrorist acts. Any of these events could cause the value of the Fund’s investments in infrastructure-related companies to decline.

Underlying Funds Risk – The Underlying Funds in which the Fund may invest are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. As a result, the cost of investing in the Fund will be higher than the cost of investing directly in the Underlying Funds and also may be higher than other funds that invest directly in securities. The Underlying Funds are subject to specific risks, depending on the nature of the specific Underlying Fund.

| Cantor Fitzgerald Sustainable Infrastructure Fund | 21 |

Cantor

Fitzgerald Sustainable Infrastructure Fund

Notes to Financial Statements (Unaudited)(Continued)

September 30, 2022

Lack of Control Over Private Investment Funds and Other Portfolio Investments – Once the Adviser has selected a Private Investment Fund or Other Investment Vehicle, the Adviser will have no control over the investment decisions made by any such Underlying Fund. Although the Fund and the Adviser will regularly evaluate each Underlying Fund and its manager to determine whether their respective investment programs are consistent with the Fund’s investment objective, the Adviser will not have any control over the investments made by any Underlying Fund. Even though the Underlying Funds are subject to certain constraints, the managers may change aspects of their investment strategies. The managers may do so at any time (for example, such change may occur immediately after providing the Adviser with the quarterly unaudited financial information for a Private Investment Fund). The Adviser may reallocate the Fund’s investments among the Underlying Funds, but the Adviser’s ability to do so may be constrained by the withdrawal limitations imposed by the Underlying Funds, which may prevent the Fund from reacting rapidly to market changes should an Underlying Fund fail to effect portfolio changes consistent with such market changes and the demands of the Adviser. Such withdrawal limitations may also restrict the Adviser’s ability to terminate investments in Underlying Funds that are poorly performing or have otherwise had adverse changes. The Adviser will be dependent on information provided by the Underlying Fund, including quarterly unaudited financial statements, which if inaccurate, could adversely affect the Adviser’s ability to manage the Fund’s investment portfolio in accordance with its investment objective. By investing in the Fund, a shareholder will not be deemed to be an investor in any Underlying Fund and will not have the ability to exercise any rights attributable to an investor in any such Underlying Fund related to their investment.

Use of Leverage by the Fund – Although the Fund has the option to borrow, there are significant risks that may be assumed in connection with such borrowings. Investors in the Fund should consider the various risks of financial leverage, including, without limitation, the matters described below. There is no assurance that a leveraging strategy would be successful. Financial leverage involves risks and special considerations for shareholders including: (i) the likelihood of greater volatility of NAV of the shares than a comparable portfolio without leverage; (ii) the risk that fluctuations in interest rates on borrowings and short-term debt that the Fund must pay will reduce the return to the shareholders; (iii) the effect of financial leverage in a market experiencing rising interest rates, which would likely cause a greater decline in the NAV of the shares than if the Fund were not leveraged; and (iv) the potential for an increase in operating costs, which may reduce the Fund’s total return.

Use of Leverage by Underlying Funds – In addition to any borrowing utilized by the Fund, the Underlying Funds in which the Fund invests may utilize financial leverage, subject to the limitations of their charters and operative documents. In the case of Private Investment Funds, such Funds are not subject to the limitations imposed by the 1940 Act regarding the use of leverage with respect to which registered investment companies, including the Fund, are subject. In that regard, the Fund intends to limit its borrowing to an amount that does not exceed 33 1/3% of the Fund’s gross asset value. Leverage by Underlying Funds and/or the Fund has the effect of potentially increasing losses.

Valuation of Private Investment Funds – The Private Investment Funds are not publicly traded and the Fund may consider information provided by the institutional asset manager of each respective Private Investment Fund to determine the estimated value of the Fund’s investment therein. The valuation provided by an institutional asset manager as of a specific date may vary from the actual sale price that may be obtained if such investment were sold to a third party. To determine the estimated value of the Fund’s investment in Private Investment Funds, the Adviser considers, among other things, information provided by the Private Investment Funds, including quarterly unaudited financial statements, which if inaccurate could adversely affect the Adviser’s ability to value accurately the Fund’s shares. Private Investment Funds that invest primarily in publicly traded securities are more easily valued.

ESG Investing Risk – The Fund intends to screen out particular companies and industries pursuant to certain criteria established by the Sub-Adviser, and to incorporate ESG investment insights into its portfolio construction process. The Fund may forego certain investment opportunities by screening out certain companies and industries. The Fund’s results may be lower than other funds that do not apply certain exclusionary screens or use different ESG criteria to screen out certain companies or industries. The Fund’s incorporation of ESG investment insights may affect the Fund’s exposure to certain companies or industries. The Fund’s results may be lower than other funds that do not consider ESG characteristics or use a different methodology to identify and/or incorporate ESG characteristics. Further, investors may differ in their views of what constitutes positive or negative ESG characteristics of a security. As a result, the Fund may

| 22 |

Cantor

Fitzgerald Sustainable Infrastructure Fund

Notes to Financial Statements (Unaudited)(Continued)

September 30, 2022

invest in securities that do not reflect the beliefs of any particular investor. In addition, the Fund may not be successful in its objectives related to ESG. There is no guarantee that these objectives will be achieved, and ESG-related assessments are at the discretion of the Adviser and Sub-Adviser. The Adviser and Sub-Adviser are dependent upon certain information and data from third party providers of ESG research, which may be incomplete, inaccurate or unavailable. As a result, there is a risk that the Adviser and Sub-Adviser may incorrectly assess a security or issuer. There is also a risk that the Adviser and Sub-Adviser may not apply the relevant ESG criteria correctly or that the Fund could have indirect exposure to issuers who do not meet the relevant ESG criteria used by the Fund. Neither the Fund, the Adviser, nor the Sub-Adviser make any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of such ESG assessment. There may be limitations with respect to availability of ESG data in certain sectors, as well as limited availability of investments with positive ESG assessments in certain sectors. The evaluation of ESG criteria is subjective and may change over time.

Preferred Securities Risk – Preferred securities are subject to credit risk and interest rate risk. Interest rate risk is, in general, the risk that the price of a preferred security falls when interest rates rise. Securities with longer maturities tend to be more sensitive to interest rate changes. Credit risk is the risk that an issuer of a security may not be able to make principal and interest or dividend payments on the security as they become due. Holders of preferred securities may not receive dividends, or the payment can be deferred for some period of time. In bankruptcy, creditors are generally paid before the holders of preferred securities.

Convertible Securities Risk – Convertible securities are typically issued as bonds or preferred shares with the option to convert to equities. As a result, convertible securities are a hybrid that have characteristics of both bonds and common stocks and are subject to risks associated with both debt securities and equity securities. The market value of bonds and preferred shares tend to decline as interest rates increase. Fixed income and preferred securities also are subject to credit risk, which is the risk that an issuer of a security may not be able to make principal and interest or dividend payments as due. Convertible securities may have characteristics similar to common stocks especially when their conversion value is higher than their value as a bond. The price of equity securities into which a convertible security may convert may fall because of economic or political changes. Stock prices in general may decline over short or even extended periods of time. Additionally, the value of the embedded conversion option may be difficult to value and evaluate because the option does not trade separately from the convertible security.

Fixed Income Risk – Typically, a rise in interest rates causes a decline in the value of fixed income securities. Fixed income securities are also subject to default risk.

Foreign Securities and Emerging Markets Risk – The Fund may have investments in foreign securities. Foreign securities have investment risks different from those associated with domestic securities. Changes in foreign economies and political climates are more likely to affect the Fund with investments in foreign securities than another fund that invests exclusively in domestic securities. The value of foreign currency denominated securities or foreign currency contracts is affected by the value of the local currency relative to the U.S. dollar. There may be less government supervision of foreign markets, resulting in non-uniform accounting practices and less publicly available information about issuers of foreign securities.

The Fund may also invest in emerging markets, which are markets of countries in the initial stages of industrialization and have low per capita income. In addition to the risks of foreign securities in general, countries in emerging markets are more volatile and can have relatively unstable governments, social and legal systems that do not protect shareholders, economies based on only a few industries, and securities markets that trade a small number of issues which could reduce liquidity.

Leveraging Risk – The use of leverage, such as borrowing money to purchase securities, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses.

Credit Risk – Issuers of debt securities may not make scheduled interest and principal payments, resulting in losses to the Fund. In addition, the credit quality of securities held may be lowered if an issuer’s financial condition changes.

| Cantor Fitzgerald Sustainable Infrastructure Fund | 23 |

Cantor

Fitzgerald Sustainable Infrastructure Fund

Notes to Financial Statements (Unaudited)(Continued)

September 30, 2022

| 4. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

Cantor Fitzgerald Investment Advisors, L.P. serves as the Fund’s investment adviser (the “Adviser”). Pursuant to an investment advisory agreement with the Trust, on behalf of the Fund, the Adviser, under the oversight of the Board, directs the daily operations of the Fund and supervises the performance of administrative and professional services provided by others. As compensation for its services and the related expenses borne by the Adviser, the Fund pays the Adviser a management fee, computed and accrued daily and paid monthly, at an annual rate of 1.50% of the Fund’s average daily net assets. For the period ended September 30, 2022 the Adviser earned $21,121 in advisory fees.

The Adviser has engaged Capital Innovations, LLC (the “Sub-Adviser”), a registered investment adviser under the Advisers Act, to provide ongoing research, recommendations, and day-to-day portfolio management with respect to the Fund’s investment portfolio. Sub-advisory services are provided to the Fund pursuant to an agreement between the Adviser and the Sub-Adviser. Under the terms of the Sub-Advisory Agreement, the Adviser compensates the Sub-Adviser based on a portion of the Fund’s average daily net assets that have been allocated to the Sub-Adviser to manage. Fees paid to the Sub-Adviser are not an expense of the Fund. Pursuant to the Sub-Advisory Agreement, the Adviser pays the Sub-Adviser a monthly management fee computed at the annual rate of 0.35% of the Fund’s daily net assets. The Sub-Adviser is currently receiving the reduced fee rate of 0.15% per the Sub-Adviser Agreement.

Pursuant to a written contract (the “Expense Limitation Agreement”), the Adviser has agreed, at least until June 30, 2024, to waive a portion of its advisory fee and has agreed to reimburse the Fund for other expenses to the extent necessary so that the total expenses incurred by the Fund (including all organizational and offering expenses, but excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 2.50% per annum of the Fund’s average daily net assets for Class A shares (the “expense limitation”). For the period ended September 30, 2022 the Adviser waived fees and reimbursed expenses in the amount of $137,289 pursuant to the Expense Limitation Agreement.

In consideration of the Adviser’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Adviser in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) the reimbursement will be made only for fees and expenses incurred not more than three years from the date in which they were incurred; and (2) the reimbursement may not be made if it would cause the lesser of the Expense Limitation in place at the time of waiver or at the time of reimbursement to be exceeded.

The Expense Limitation Agreement will remain in effect, at least until June 30, 2024, unless and until the Board approves its modification or termination. This agreement may be terminated only by the Board on 60 days written notice to the Adviser. After June 30, 2024, the Expense Limitation Agreement may be renewed at the Adviser’s discretion.

The distributor of the Fund is Ultimus Fund Distributors, LLC (the “Distributor”). The Board has adopted, on behalf of the Fund, a Shareholder Services Plan under which the Fund may compensate financial industry professionals for providing ongoing services in respect of clients with whom they have distributed shares of the Fund. Under the Shareholder Services Plan, the Fund may pay 0.25% per year of its average daily net assets of each of Class A shares for such services. For the period ended September 30, 2022, the Fund incurred shareholder servicing fees of $3,520 for Class A.

The Distributor acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s Class A shares. For the period ended September 30, 2022 the Distributor received $13,696 in underwriting commissions for sales of Class A shares, of which $2,026 was retained by the principal underwriter or other affiliated broker-dealers.

| 24 |

Cantor

Fitzgerald Sustainable Infrastructure Fund

Notes to Financial Statements (Unaudited)(Continued)

September 30, 2022

In addition, certain affiliates of the Distributor provide services to the Fund as follows:

Ultimus Fund Solutions, LLC (“UFS”)

UFS, an affiliate of the Distributor, provides administration, fund accounting, and transfer agent services to the Trust. Pursuant to a separate servicing agreement with UFS, the Fund pays UFS customary fees for providing administration, fund accounting and transfer agency services to the Fund. Certain officers of the Trust are also officers of UFS and are not paid any fees directly by the Fund for serving in such capacities.

Employees of PINE Advisor Solutions, LLC (“PINE”) serve as officers of the Fund. PINE receives a monthly fee for the services provided to the Fund. The Fund also reimburses PINE for certain out-of-pocket expenses incurred on the Fund’s behalf.

Blu Giant, LLC (“Blu Giant”)

Blu Giant, an affiliate of UFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Fund.

| 5. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

The Statement of Assets and Liabilities represents cost of investment securities for financial reporting purposes. Aggregate cost for federal tax purposes is $5,965,397 for the Fund and differs from market value by net unrealized appreciation (depreciation) consisting of:

| Gross unrealized appreciation: | $ | 243,466 | ||

| Gross unrealized depreciation: | (242,304 | ) | ||

| Net unrealized appreciation: | $ | 1,162 |

| 6. | BENEFICIAL OWNERSHIP |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the Fund, under Section 2(a)(9) of the 1940 Act. As of September 30, 2022, Cantor Fitzgerald Investment Advisors LP held 87.10% of the voting securities and may be deemed to control the Fund.

| 7. | UNDERLYING INVESTMENT IN OTHER INVESTMENT COMPANIES |

The Fund currently seeks to achieve its investment objectives by investing its assets in underlying funds. As of September 30, 2022, the percentage of the Fund’s net assets invested in the Morgan Stanley Institutional Liquidity Funds, Institutional Class was 32.3%. (the “Security”). The Fund may sell its investments in this Security at any time if the Adviser determines that it is in the best interest of the Fund and its shareholders to do so.

The performance of the Fund will be directly affected by the performance of this investment. The annual report of the Security, along with the report of the independent registered public accounting firm is included in the respective Security’s N-CSR’s available at www.sec.gov.

| Cantor Fitzgerald Sustainable Infrastructure Fund | 25 |

Cantor

Fitzgerald Sustainable Infrastructure Fund

Notes to Financial Statements (Unaudited)(Continued)

September 30, 2022

| 8. | REPURCHASE OFFERS |

Pursuant to Rule 23c-3 under the Investment Company Act of 1940, as amended, the Fund offers shareholders on a quarterly basis the option of redeeming shares, at net asset value, of no less than 5% and no more than 25% of the shares outstanding. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer, although each shareholder will have the right to require the Fund to purchase up to and including 5% of such shareholder’s shares in each quarterly repurchase. Limited liquidity will be provided to shareholders only through the Fund’s quarterly repurchases.

The Fund expects to begin conducting its quarterly repurchase offers for outstanding shares during the fourth quarter of 2022.

| 9. | SUBSEQUENT EVENTS |

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has determined that no events or transactions occurred requiring adjustment or disclosure in the financial statements with the exception of a tender offer.

| 26 |

Cantor

Fitzgerald Sustainable Infrastructure Fund

Additional Information (Unaudited)

September 30, 2022

Investment Advisory Agreement with the Adviser

In connection with the Board meeting held on March 11, 2022, the Board, including a majority of the Independent Trustees, discussed the approval of a management agreement between the Trust and the Adviser, with respect to the Fund (the “Investment Advisory Agreement”).