Form N-CSRS BRAGG CAPITAL TRUST For: Nov 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21073

BRAGG CAPITAL TRUST

(Exact name of registrant as specified in charter)

11601 WILSHIRE BLVD., STE. 1200

LOS ANGELES, CALIFORNIA 90025

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) |

Copy to:

|

|

J. RICHARD ATWOOD, PRESIDENT BRAGG CAPITAL TRUST 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 |

MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 |

Registrant’s telephone number, including area code: (310) 473-0225

Date of fiscal year end: May 31

Date of reporting period: November 30, 2022

Item 1: Report to Shareholders.

| (a) | The Report to Shareholders is attached herewith. |

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

Semi-Annual Report

November 30, 2022

FPA Queens Road Small Cap Value Fund

FPA QUEENS ROAD SMALL CAP VALUE FUND

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders:

The FPA Queens Road Small Cap Value Fund ("Fund") returned 1.41% in the first half of fiscal year 2023 (May 31, 2022 to November 30, 2022), compared to a -0.25% return for the Russell 2000 Value Index in the same period. The Fund's outperformance versus the index during this most recent downturn is in line with our expectations. During times of market weakness, the fund has historically protected capital better than its benchmark and peers. We expect to outperform in down markets and trail somewhat in robust markets as a result of our diligent, disciplined, patient and conservative process.

We think of our investment process as having four pillars:

1. Balance Sheet Strength — Seek companies with strong balance sheets. We are not comfortable owning companies that have significant liabilities (debt, legal, regulatory, pension or something inherent in the business model) that could cause insolvency concerns when there's an economic, financial, or other type of crisis. We want to make sure we are invested in companies that have staying power.

2. Valuation — Normalize economic earnings over full market cycles. Primarily use free cash flow discount valuation models. Demand a margin of safety.

3. Management — Evaluate management's track record of laying out a long-term strategy and executing to achieve their stated objectives.

4. Sector and Industry Analysis — We want to own companies in growing industries with stable competitive dynamics and favorable economics. Avoid commodity industries, overly competitive industries, and invest in companies that compete in industries that have long-term growth expectations.

Market Commentary

Virtually all financial assets were down significantly through the period1. The market selloff was unsparing and hit domestic stocks, international stocks, growth stocks, value stocks, government bonds, corporate bonds and high-yield bonds. The housing market, which has been remarkably strong over the last decade, has turned significantly lower as the Federal Reserve's commitment to raising short-term rates and stamping out persistent inflation has pushed mortgage rates to highs we haven't seen since 2002.2 This spectacular rise in interest rates marks a healthy reversal to the previous cycle when persistently low interest rates and unprecedented central bank liquidity pushed the prices of virtually all financial and real assets higher.

When we buy shares in a company, we never know the real reason that a seller has decided to sell them. Bear markets tend to take on a momentum of their own and people sell because the price is down. Sometimes this is because they have leverage or liquidity issues and are forced to sell. But often it is because they are worried that the price will fall further tomorrow, regardless of their expectations of the underlying value of the investment. This is a behavioral reaction that we have profited from in the past and expect to profit from again.

1 Source: Factset

2 Federal Reserve Economic Data, 10/2022 Release.

Past performance is no guarantee, nor is it indicative, of future results.

1

FPA QUEENS ROAD SMALL CAP VALUE FUND

LETTER TO SHAREHOLDERS

(Continued)

At its most basic, our process compares a company's current price to what we expect the business to look like three to five years out. We always want to be aware of near-term headwinds. But generally, it is lower current prices and an expanding discrepancy to a company's long-term economic earnings that provides us with a margin of safety. We look for quality companies that we are confident will be worth considerably more over that time horizon and we are very comfortable buying from sellers who are afraid that the price will fall further tomorrow.

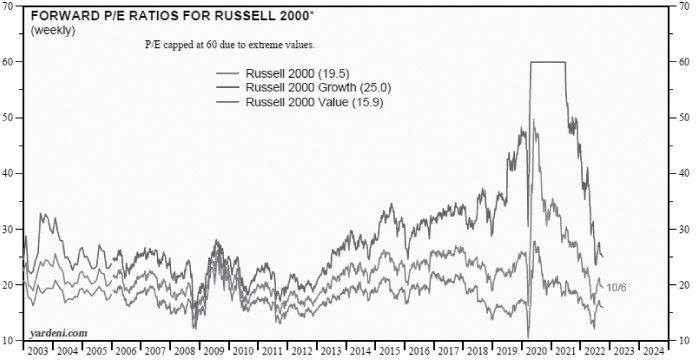

We believe current valuations are more favorable for value than for growth, and much more favorable for small caps than they are for large caps. The first chart shows that on a forward price to earnings basis, the Russell 2000 Value index trades at a significant discount to the Russell 2000 Growth index, despite the Russell 2000 Growth index significantly underperforming over the last year. The second chart shows that small-and mid-cap stocks (the S&P 600 index) are trading at the largest valuation discount to large cap stocks (the S&P 500 index) since the late 1990's tech bubble.

Weekly Forward P/E Ratios for Russell 2000 Indexes3

3 Chart Source: Yardeni Research. Weekly forward P/E ratios calculated by dividing price by 12-month (52-week) forward consensus expected operating earnings per share. Monthly data through December 2005, weekly thereafter. Source: I/B/E/S data by Refinitiv

2

FPA QUEENS ROAD SMALL CAP VALUE FUND

LETTER TO SHAREHOLDERS

(Continued)

Weekly Forward P/E Ratios for S&P 500 Indexes4

For more than 20 years, the FPA Queens Road Small Cap Value Fund has consistently offered investors a better risk-adjusted return experience over rolling 5-year periods — and that's because of the investment team's rigorous application of our four core tenets described previously.

With the recent increase in volatility across global equities — and especially domestic small-cap stocks — the FPA Queens Road Small Cap Value team is starting to see an uptick in the number of attractive investment opportunities being considered for inclusion into the portfolio. Naturally, we expect these more attractive valuations to help power potential future returns for patient investors seeking to benefit from the current market opportunity.

Quality and the Four Pillar Process

We have a preference for compounders — high-quality franchises with great balance sheets, management teams and industry tailwinds that we hope to own forever.5 Compounders don't usually come cheap, and while we are valuation conscious, we are generally willing to pay a little bit more for higher quality. While the vast majority of financial assets are down year to date, quality compounders have generally held up better.

4 Chart Source: Yardeni Research. Weekly forward P/E ratios calculated by dividing price 52-week forward consensus expected operating earnings per share. Note: Shaded pink areas are S&P 500 bear market declines of 20% or more. Yellow areas show bull markets. Source: I/B/E/S data by Refinitiv.

5 There can be no assurance the Fund will achieve its investment objectives. Past performance is no guarantee, nor is it indicative, of future results.

3

FPA QUEENS ROAD SMALL CAP VALUE FUND

LETTER TO SHAREHOLDERS

(Continued)

So, what do we mean by quality? At its most basic, quality means that we have confidence that a company's earnings and cash flows will be larger in three to five years than they are today. Different investors look at different heuristics or quantitative metrics that can describe quality. High returns on capital, high margins, organic growth, high cash conversion and low debt are all indicative of quality. But at the end of the day, we take a holistic look at our companies, sniff out the risks, seek to remain conservative and judicious, and compare the current price to our confidence in the future. Our four pillars — balance sheet strength, valuation, management, and industry analysis — guide our assessment of quality.

Historically, we believe the quality of the holdings has been a large contributor to the Fund's outperformance during market downturns. Low leverage allows companies to survive and reinvest during recessions. In our experience, strong management teams can be trusted to shepherd the company through headwinds and find new opportunities. We seek to invest in the companies that have strong competitive positions and that compete in industries with favorable economics and outlooks. In practice, it is never this easy. It is rare to find a company that sits cleanly atop each of the four pillars. And our view of the future is usually hazy at best. But when things get complicated and the future seems uncertain, the four pillars provide a framework for thinking through the next three to five years.

Trailing Twelve Months (TTM) and Semi-Annual Contributors and Detractors6

|

Contributors |

Performance Contribution |

Percent of Portfolio |

Detractors |

Performance Contribution |

Percent of Portfolio |

||||||||||||||||||

| 1H Fiscal Year 2023 | |||||||||||||||||||||||

|

Fabrinet |

1.84 |

% |

3.9 |

% |

Synaptics |

-1.07 |

% |

2.8 |

% |

||||||||||||||

|

Deckers Outdoor |

0.72 |

% |

1.8 |

% |

Owens & Minor |

-0.74 |

% |

1.2 |

% |

||||||||||||||

|

Atlas Air Worldwide |

0.53 |

% |

1.5 |

% |

InterDigital |

-0.69 |

% |

2.7 |

% |

||||||||||||||

|

RLI |

0.43 |

% |

3.1 |

% |

Concentrix |

-0.47 |

% |

2.4 |

% |

||||||||||||||

|

Science Applications International |

0.40 |

% |

1.7 |

% |

ServisFirst Bancshares |

-0.42 |

% |

5.0 |

% |

||||||||||||||

|

3.91 |

% |

12.0 |

% |

-3.39 |

% |

14.1 |

% |

||||||||||||||||

|

TTM |

|||||||||||||||||||||||

|

Fabrinet |

1.08 |

% |

3.5 |

% |

Synaptics |

-3.60 |

% |

3.5 |

% |

||||||||||||||

|

South Jersey Industries |

0.96 |

% |

2.5 |

% |

Owens & Minor |

-0.90 |

% |

1.4 |

% |

||||||||||||||

|

RLI |

0.89 |

% |

3.0 |

% |

PVH |

-0.83 |

% |

1.9 |

% |

||||||||||||||

|

American Equity Investment Life |

0.78 |

% |

4.5 |

% |

InterDigital |

-0.76 |

% |

2.9 |

% |

||||||||||||||

|

New Jersey Resources |

0.76 |

% |

2.4 |

% |

Axos Financial |

-0.67 |

% |

1.3 |

% |

||||||||||||||

|

4.48 |

% |

15.9 |

% |

-6.75 |

% |

11.0 |

% |

||||||||||||||||

6 Reflects the top five contributors and detractors to the Fund's performance based on contribution to return for the trailing twelve months ("TTM"). Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. The information provided does not reflect all positions purchased, sold or recommended during the quarter. A copy of the methodology used and a list of every holding's contribution to the overall Fund's performance during the TTM is available by contacting FPA Client Service at [email protected]. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed.

4

FPA QUEENS ROAD SMALL CAP VALUE FUND

LETTER TO SHAREHOLDERS

(Continued)

Portfolio Positioning

The fund has historically held cash as a residual of the investment process. When we cannot find companies that meet our stringent criteria, we will allow cash to build. Over a long time horizon, we would typically want to own a diversified collection of quality companies (acquired at reasonable prices) instead of cash. But we weigh this against our reluctance to sacrifice margin of safety and risk permanent impairment of capital. The Fund's current cash allocation is 12.9%, down from 14.4% at the beginning of Fiscal Year 2023.

During the period, we were marginal net buyers as we added three new positions and eliminated two holdings, added to fourteen existing positions while trimming twelve positions7.

Despite the recent volatility, most recently to the downside, we feel better about the long-term prospects for our portfolio than we have in quite some time. We do not make short term predictions on market direction. But the current valuations of the Fund's holdings, their competitive positions and our expectation of strong execution by their management teams give us confidence that over the next 3-5 years, the companies we are invested in will be worth considerably more than they are today.

As always, and as co-investors in the fund, we appreciate your trust in us to be good stewards of your investment in the fund. If you would like to discuss performance or our portfolio holdings in greater detail, please let us know.

Respectfully,

Steve Scruggs, CFA

Portfolio Manager

November 30, 2022

7 Portfolio holdings for the FPA Queens Road Small Cap Value Fund can be found in the Related Documents section of the Fund Overview page. https://fpa.com/funds/overview/fpa-queens-road-small-cap-value-fund

5

FPA QUEENS ROAD SMALL CAP VALUE FUND

LETTER TO SHAREHOLDERS

(Continued)

Important Disclosures

This update is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale of any securities, products or services discussed, and neither does it provide investment advice. Any such offer or solicitation shall only be made pursuant to the Fund's Prospectus, which supersedes the information contained herein in its entirety. This Commentary does not constitute an investment management agreement or offering circular.

The statements contained herein reflect the opinions and views of the portfolio managers as of the date written, is subject to change without notice, and may be forward-looking and/or based on current expectations, projections, and/or information currently available. Such information may not be accurate over the long-term. These views may differ from other portfolio managers and analysts of the firm as a whole and are not intended to be a forecast of future events, a guarantee of future results or investment advice.

Portfolio composition will change due to ongoing management of the Fund. References to individual securities or sectors are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio manager, the Adviser, the Sub-Adviser or the distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security or sector examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. The information and data contained herein has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

The information contained herein is not complete, may change, and is subject to, and is qualified in its entirety by, the more complete disclosures, risk factors, and other information contained in the Fund's Prospectus and Statement of Additional Information. The information is furnished as of the date shown. No representation is made with respect to its completeness or timeliness. The information is not intended to be, nor shall it be construed as, investment advice or a recommendation of any kind.

Certain statements contained in this presentation may be forward-looking and/or based on current expectations, projections, and information currently available. Actual events or results may differ from materially those we anticipate, or the actual performance of any investments described herein may differ from those reflected or contemplated in such forward-looking statements, due to various risks and uncertainties. We cannot assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Such statements may or may not be accurate over the long-term. Statistical data or references thereto were taken from sources which we deem to be reliable, but their accuracy cannot be guaranteed.

The reader is advised that the Fund's investment strategy includes active management with corresponding changes in allocations from one period of time to the next. Therefore, any data with respect to investment allocations as of a given date is of limited use and may not be reflective of the portfolio manager's more general views with respect to proper geographic, instrument and /or sector allocations. The data is presented for indicative purposes only and, as a result, may not be relied upon for any purposes whatsoever.

In making any investment decision, you must rely on your own examination of the Fund, including the risks involved in an investment. Investments mentioned herein may not be suitable for all recipients and in each case, potential investors are advised not to make any investment decision unless they have taken independent advice from an appropriately authorized advisor. An investment in any security mentioned herein does not

6

FPA QUEENS ROAD SMALL CAP VALUE FUND

LETTER TO SHAREHOLDERS

(Continued)

guarantee a positive return as securities are subject to market risks, including the potential loss of principal. You should not construe the contents of this document as legal, tax, investment or other advice or recommendations.

Fund performance presented is calculated on a total return basis, which includes the reinvestment of all income, plus realized and unrealized gains/losses, if applicable. Unless otherwise indicated, performance results are presented on a net of fees basis and reflect the deduction of, among other things: management fees, brokerage commissions, operating and administrative expenses, and accrued performance fee/allocation, if applicable.

The information provided in this presentation is based upon data existing as of the date(s) of the report and has not been audited or reviewed. While we believe the information to be accurate, it is subject in all respects to adjustments that may be made after proper review and reconciliation.

Investments, including mutual fund investments, carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Small and mid-cap stocks involve greater risks and they can fluctuate in price more than larger company stocks. Short-selling involves increased risks and transaction costs. You risk paying more for a security than you received from its sale. Groups of stocks, such as value and growth, go in and out of favor which may cause certain funds to underperform other equity funds. The value of an individual security can be more volatile than the market as a whole and can perform differently than the value of the market as a whole.

The Fund primarily invests in equity securities (common stocks, preferred stocks and convertible securities) of small-capitalization U.S. companies, defined as those with market capitalization, at the time of purchase, that is no greater than the largest market capitalization of any company included in the Russell 2000 Value Index. Investing in small companies involves special risks including, but not limited to, the following: smaller companies typically have more risk and their company stock prices are more volatile than that of large companies; their securities may be less liquid and may be thinly traded which makes it more difficult to dispose of them at prevailing market prices; these companies may be more adversely affected by poor economic or market conditions; they may have limited product lines, limited access to financial resources, and may be dependent on a limited management group; and small cap stocks may fluctuate independently of large cap stocks. All investment decisions are made at the discretion of the Portfolio Manager, in accordance with the then current Prospectus. Comparison to any index is for illustrative purposes only.

The prices of securities held by the Fund may decline in response to certain events taking place around the world, including those directly involving the companies whose securities are owned by the Fund. Securities in the Fund's portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. There is a risk that you may lose money by investing in the Fund.

Value style investing presents the risk that the holdings or securities may never reach their full market value because the market fails to recognize what the portfolio management team considers the true business value or because the portfolio management team has misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

Please refer to the Fund's Prospectus for a complete overview of the primary risks associated with the Fund.

The FPA Funds are distributed by UMB Distribution Services, LLC, 235 W. Galena Street, Milwaukee, WI, 53212.

7

FPA QUEENS ROAD SMALL CAP VALUE FUND

LETTER TO SHAREHOLDERS

(Continued)

Index / Benchmark / Category Definitions

Comparison to any index or benchmark is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. The Fund may be less diversified than the indices noted herein and may hold non-index securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund's investment strategy. Indices are unmanaged and do not reflect any commissions, transaction costs, or fees and expenses which would be incurred by an investor purchasing the underlying securities and which would reduce the performance in an actual account. You cannot invest directly in an index.

Russell 2000 Index is a small-cap stock market index of the smallest 2,000 stocks in the Russell 3000 Index.

The Russell 2000 Value Index is a subset of the Russell 2000 Index, and tracks the stocks of small domestic companies, based on total market capitalization. The Russell 2000 Value Index represents those stocks of the Russell 2000 with lower price-to-book ratios and lower relative forecasted growth rates. A total return index computes the index value based on capital gains plus cash payments such as dividends and interest.

Russell 2000 Growth Index is a subset of the Russell 2000 Index, measures the performance of the small cap growth segment of the US equity universe. It includes those Russell 2000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years).

The S&P MidCap 400 Index, more commonly known as the S&P 400, is a stock market index from S&P Dow Jones Indices. The index serves as a gauge for the U.S. mid-cap equities sector and is the most widely followed mid-cap index.

The S&P 500 Index is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States.

The S&P SmallCap 600 Index, more commonly known as the S&P 600, is a stock market index from S&P Dow Jones Indices. tracks a broad range of small-sized companies that meet specific liquidity and stability requirements.

The Global Industries Classification Standards, or GICS®, is a common global classification standard developed by S&P Dow Jones Indices and MSCI. The GICS structure consists of 11 Sectors, 24 Industry groups, 69 Industries and 158 sub-industries

Small Cap Value Companies: The term small cap describes companies with a relatively small market capitalization. A company's market capitalization is the market value of its outstanding shares. The definition for small cap varies, but generally means a company with $300 million to $2 billion in market capitalization.

Other Definitions

Earnings per share (EPS) is calculated as a company's profit divided by the outstanding shares of its common stock.

Expected earnings are an estimate for a company's future quarterly or annual earnings per share (EPS).

Forward price-to-earnings (forward P/E) is a version of the ratio of price-to-earnings (P/E) that uses forecasted earnings for the P/E calculation.

Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value.

The Price-to-Earnings ratio is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS).

8

FPA QUEENS ROAD SMALL CAP VALUE FUND

LETTER TO SHAREHOLDERS

(Continued)

The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. References to individual securities are for informational purposes only and should not be construed as recommendations to purchase or sell individual securities. While the Fund's managers believe that the Fund's holdings are value stocks, there can be no assurance that others will consider them as such. Further, investing in value stocks presents the risk that value stocks may fall out of favor with investors and underperform growth stocks during given periods.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

9

FPA QUEENS ROAD SMALL CAP VALUE FUND

PORTFOLIO SUMMARY

November 30, 2022 (Unaudited)

|

Common Stocks |

87.1 |

% |

|||||||||

|

Information Technology Services |

9.0 |

% |

|||||||||

|

Oil & Gas Services & Equipment |

7.5 |

% |

|||||||||

|

P&C Insurance |

6.4 |

% |

|||||||||

|

Technology Distributors |

6.3 |

% |

|||||||||

|

Apparel, Footwear & Accessory Design |

6.2 |

% |

|||||||||

|

Industrials |

6.2 |

% |

|||||||||

|

Life & Health Insurance |

5.6 |

% |

|||||||||

|

Banks |

5.1 |

% |

|||||||||

|

Semiconductor Devices |

4.4 |

% |

|||||||||

|

Packaged Food |

3.6 |

% |

|||||||||

|

Industrial Distribution & Rental |

3.0 |

% |

|||||||||

|

Application Software |

2.5 |

% |

|||||||||

|

Communications Equipment |

2.4 |

% |

|||||||||

|

Aircraft & Parts |

2.3 |

% |

|||||||||

|

Cement & Aggregates |

2.2 |

% |

|||||||||

|

Agricultural Machinery |

2.1 |

% |

|||||||||

|

Publishing & Broadcasting |

1.7 |

% |

|||||||||

|

Financials |

1.6 |

% |

|||||||||

|

Flow Control Equipment |

1.3 |

% |

|||||||||

|

Retailing |

1.2 |

% |

|||||||||

|

Containers & Packaging |

1.0 |

% |

|||||||||

|

Other Wholesalers |

0.9 |

% |

|||||||||

|

Basic & Diversified Chemicals |

0.9 |

% |

|||||||||

|

Health Care Supply Chain |

0.8 |

% |

|||||||||

|

Speciality Retail |

0.7 |

% |

|||||||||

|

Electrical Components |

0.7 |

% |

|||||||||

|

Internet Media |

0.6 |

% |

|||||||||

|

Real Estate Services |

0.5 |

% |

|||||||||

|

Other Commercial Services |

0.4 |

% |

|||||||||

|

Preferred Stocks |

0.0 |

% |

|||||||||

|

Short-term Investments |

12.7 |

% |

|||||||||

|

Other Assets And Liabilities, Net |

0.2 |

% |

|||||||||

|

Net Assets |

100.0 |

% |

|||||||||

10

FPA QUEENS ROAD SMALL CAP VALUE FUND

PORTFOLIO OF INVESTMENTS

November 30, 2022

(Unaudited)

|

COMMON STOCKS |

Shares |

Fair Value |

|||||||||

|

INFORMATION TECHNOLOGY SERVICES — 9.0% |

|||||||||||

|

CSG Systems International, Inc. |

156,122 |

$ |

9,654,585 |

||||||||

|

Fabrinet (Thailand)(a) |

204,357 |

27,263,267 |

|||||||||

|

Science Applications International Corp. |

82,975 |

9,136,377 |

|||||||||

|

$ |

46,054,229 |

||||||||||

|

OIL & GAS SERVICES & EQUIPMENT — 7.5% |

|||||||||||

|

New Jersey Resources Corp. |

272,460 |

$ |

13,554,885 |

||||||||

|

South Jersey Industries, Inc. |

377,898 |

13,113,060 |

|||||||||

|

UGI Corp. |

314,075 |

12,138,999 |

|||||||||

|

$ |

38,806,944 |

||||||||||

|

P&C INSURANCE — 6.4% |

|||||||||||

| Enstar Group Ltd. (Bermuda)(a) |

7,903 |

$ |

1,722,775 |

||||||||

|

Horace Mann Educators Corp. |

373,108 |

14,398,238 |

|||||||||

|

RLI Corp. |

129,811 |

16,884,517 |

|||||||||

|

$ |

33,005,530 |

||||||||||

|

TECHNOLOGY DISTRIBUTORS — 6.3% |

|||||||||||

|

Arrow Electronics, Inc.(a) |

76,065 |

$ |

8,271,308 |

||||||||

|

TD SYNNEX Corp. |

235,369 |

24,078,249 |

|||||||||

|

$ |

32,349,557 |

||||||||||

|

APPAREL, FOOTWEAR & ACCESSORY DESIGN — 6.2% |

|||||||||||

|

Carter's, Inc. |

58,772 |

$ |

4,292,707 |

||||||||

|

Deckers Outdoor Corp.(a) |

27,860 |

11,112,797 |

|||||||||

|

G-III Apparel Group Ltd.(a) |

341,416 |

7,384,828 |

|||||||||

|

PVH Corp. |

136,226 |

9,151,662 |

|||||||||

|

$ |

31,941,994 |

||||||||||

|

INDUSTRIALS — 6.2% |

|||||||||||

|

CSW Industrials, Inc. |

68,777 |

$ |

8,318,578 |

||||||||

|

Enovis Corp.(a) |

16,974 |

918,802 |

|||||||||

|

Esab Corp. |

1,941 |

91,887 |

|||||||||

|

Kimball International, Inc. Class B |

242,750 |

1,738,090 |

|||||||||

|

L B Foster Co. Class A(a) |

112,678 |

1,061,427 |

|||||||||

|

MasTec, Inc.(a) |

217,484 |

19,754,072 |

|||||||||

|

$ |

31,882,856 |

||||||||||

|

LIFE & HEALTH INSURANCE — 5.6% |

|||||||||||

|

American Equity Investment Life Holding Co. |

493,598 |

$ |

19,995,655 |

||||||||

|

CNO Financial Group, Inc. |

384,755 |

9,034,047 |

|||||||||

|

$ |

29,029,702 |

||||||||||

11

FPA QUEENS ROAD SMALL CAP VALUE FUND

PORTFOLIO OF INVESTMENTS (Continued)

November 30, 2022

(Unaudited)

|

COMMON STOCKS — Continued |

Shares |

Fair Value |

|||||||||

|

BANKS — 5.1% |

|||||||||||

|

Axos Financial, Inc.(a) |

95,615 |

$ |

3,835,118 |

||||||||

|

ServisFirst Bancshares, Inc. |

296,364 |

22,470,318 |

|||||||||

|

$ |

26,305,436 |

||||||||||

|

SEMICONDUCTOR DEVICES — 4.4% |

|||||||||||

|

Qorvo, Inc.(a) |

30,601 |

$ |

3,037,149 |

||||||||

|

Synaptics, Inc.(a) |

86,460 |

9,162,166 |

|||||||||

|

Vishay Intertechnology, Inc. |

444,634 |

10,244,368 |

|||||||||

|

$ |

22,443,683 |

||||||||||

|

PACKAGED FOOD — 3.6% |

|||||||||||

|

TreeHouse Foods, Inc.(a) |

136,116 |

$ |

6,728,214 |

||||||||

|

United Natural Foods, Inc.(a) |

250,371 |

11,937,689 |

|||||||||

|

$ |

18,665,903 |

||||||||||

|

INDUSTRIAL DISTRIBUTION & RENTAL — 3.0% |

|||||||||||

|

MSC Industrial Direct Co., Inc. Class A |

152,439 |

$ |

13,083,839 |

||||||||

|

VSE Corp. |

47,401 |

2,324,545 |

|||||||||

|

$ |

15,408,384 |

||||||||||

|

APPLICATION SOFTWARE — 2.5% |

|||||||||||

|

Concentrix Corp. |

103,872 |

$ |

12,711,855 |

||||||||

|

$ |

12,711,855 |

||||||||||

|

COMMUNICATIONS EQUIPMENT — 2.4% |

|||||||||||

|

InterDigital, Inc. |

240,918 |

$ |

12,086,856 |

||||||||

|

$ |

12,086,856 |

||||||||||

|

AIRCRAFT & PARTS — 2.3% |

|||||||||||

|

Atlas Air Worldwide Holdings, Inc.(a) |

80,949 |

$ |

8,157,231 |

||||||||

|

Ducommun, Inc.(a) |

73,372 |

3,691,345 |

|||||||||

|

$ |

11,848,576 |

||||||||||

|

CEMENT & AGGREGATES — 2.2% |

|||||||||||

|

Oshkosh Corp. |

120,597 |

$ |

11,103,366 |

||||||||

|

$ |

11,103,366 |

||||||||||

|

AGRICULTURAL MACHINERY — 2.1% |

|||||||||||

|

AGCO Corp. |

12,587 |

$ |

1,670,547 |

||||||||

|

Darling Ingredients, Inc.(a) |

124,398 |

8,935,508 |

|||||||||

|

$ |

10,606,055 |

||||||||||

|

PUBLISHING & BROADCASTING — 1.7% |

|||||||||||

|

Scholastic Corp. |

214,109 |

$ |

8,804,162 |

||||||||

|

$ |

8,804,162 |

||||||||||

12

FPA QUEENS ROAD SMALL CAP VALUE FUND

PORTFOLIO OF INVESTMENTS (Continued)

November 30, 2022

(Unaudited)

|

COMMON STOCKS — Continued |

Shares |

Fair Value |

|||||||||

|

FINANCIALS — 1.6% |

|||||||||||

|

MGIC Investment Corp. |

595,000 |

$ |

8,169,350 |

||||||||

|

$ |

8,169,350 |

||||||||||

|

FLOW CONTROL EQUIPMENT — 1.3% |

|||||||||||

|

Graco, Inc. |

94,946 |

$ |

6,643,372 |

||||||||

|

$ |

6,643,372 |

||||||||||

|

RETAILING — 1.2% |

|||||||||||

|

Sprouts Farmers Market, Inc.(a) |

186,198 |

$ |

6,392,177 |

||||||||

|

$ |

6,392,177 |

||||||||||

|

CONTAINERS & PACKAGING — 1.0% |

|||||||||||

|

Graphic Packaging Holding Co. |

231,077 |

$ |

5,310,150 |

||||||||

|

$ |

5,310,150 |

||||||||||

|

OTHER WHOLESALERS — 0.9% |

|||||||||||

|

Mativ Holdings, Inc. |

231,233 |

$ |

4,802,709 |

||||||||

|

$ |

4,802,709 |

||||||||||

|

BASIC & DIVERSIFIED CHEMICALS — 0.9% |

|||||||||||

|

Livent Corp.(a) |

169,440 |

$ |

4,742,626 |

||||||||

|

$ |

4,742,626 |

||||||||||

|

HEALTH CARE SUPPLY CHAIN — 0.8% |

|||||||||||

|

Owens & Minor, Inc. |

192,859 |

$ |

3,974,824 |

||||||||

|

$ |

3,974,824 |

||||||||||

|

SPECIALITY RETAIL — 0.7% |

|||||||||||

|

Rent-A-Center, Inc. |

150,000 |

$ |

3,613,500 |

||||||||

|

$ |

3,613,500 |

||||||||||

|

ELECTRICAL COMPONENTS — 0.7% |

|||||||||||

|

Chase Corp. |

14,303 |

$ |

1,358,785 |

||||||||

|

Littelfuse, Inc. |

8,195 |

2,020,068 |

|||||||||

|

$ |

3,378,853 |

||||||||||

|

INTERNET MEDIA — 0.6% |

|||||||||||

|

IAC, Inc.(a) |

60,654 |

$ |

3,147,336 |

||||||||

|

$ |

3,147,336 |

||||||||||

|

REAL ESTATE SERVICES — 0.5% |

|||||||||||

|

Equity Commonwealth |

88,505 |

$ |

2,397,601 |

||||||||

|

$ |

2,397,601 |

||||||||||

13

FPA QUEENS ROAD SMALL CAP VALUE FUND

PORTFOLIO OF INVESTMENTS (Continued)

November 30, 2022

(Unaudited)

|

COMMON STOCKS — Continued |

Shares or Principal Amount |

Fair Value |

|||||||||

|

OTHER COMMERCIAL SERVICES — 0.4% |

|||||||||||

|

UniFirst Corp. |

10,760 |

$ |

2,084,858 |

||||||||

|

$ |

2,084,858 |

||||||||||

| TOTAL COMMON STOCKS — 87.1% (Cost $317,418,072) |

$ |

447,712,444 |

|||||||||

|

PREFERRED STOCKS |

|||||||||||

|

INDUSTRIALS — 0.0% |

|||||||||||

|

WESCO International, Inc. — 10.625% |

6,085 |

$ |

166,729 |

||||||||

| TOTAL PREFERRED STOCKS — 0.0% (Cost $161,253) |

$ |

166,729 |

|||||||||

| TOTAL INVESTMENT SECURITIES — 87.1% (Cost $317,579,325) |

$ |

447,879,173 |

|||||||||

|

SHORT-TERM INVESTMENTS — 12.7% |

|||||||||||

|

State Street Institutional Treasury Plus Money Market Fund, 3.67%(b) |

65,498,510 |

$ |

65,498,510 |

||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $65,498,510) |

$ |

65,498,510 |

|||||||||

| TOTAL INVESTMENTS — 99.8% (Cost $383,077,835) |

$ |

513,377,683 |

|||||||||

|

Other Assets and Liabilities, net — 0.2% |

860,892 |

||||||||||

|

NET ASSETS — 100.0% |

$ |

514,238,575 |

|||||||||

(a) Non-income producing security.

(b) Represents the 7-day effective yield as of November 30, 2022.

See accompanying Notes to Financial Statements.

14

FPA QUEENS ROAD SMALL CAP VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

November 30, 2022

(Unaudited)

|

ASSETS |

|||||||

|

Investment securities — at fair value (identified cost $317,579,325) |

$ |

447,879,173 |

|||||

|

Short-term investments — at amortized cost (maturities 60 days or less) |

65,498,510 |

||||||

|

Receivable for: |

|||||||

|

Dividends and interest |

1,563,842 |

||||||

|

Capital Stock sold |

200,957 |

||||||

|

Prepaid expenses and other assets |

270 |

||||||

|

Total assets |

515,142,752 |

||||||

|

LIABILITIES |

|||||||

|

Payable for: |

|||||||

|

Capital Stock repurchased |

391,034 |

||||||

|

Advisory fees |

268,581 |

||||||

|

Accrued expenses and other liabilities |

244,562 |

||||||

|

Total liabilities |

904,177 |

||||||

|

NET ASSETS |

$ |

514,238,575 |

|||||

|

SUMMARY OF SHAREHOLDERS' EQUITY |

|||||||

|

Capital Stock — par value $0.01 per share; unlimited authorized shares; 14,907,886 outstanding shares |

$ |

149,079 |

|||||

|

Additional Paid-in Capital |

377,947,820 |

||||||

|

Distributable earnings |

136,141,676 |

||||||

|

NET ASSETS |

$ |

514,238,575 |

|||||

|

Advisor class: |

|||||||

|

Net Assets |

$ |

46,562,152 |

|||||

|

Shares outstanding, par value $0.01 per share; unlimited authorized shares |

1,352,446 |

||||||

|

Offering and redemption price per share |

$ |

34.43 |

|||||

|

Institutional Class: |

|||||||

|

Net Assets |

$ |

387,583,389 |

|||||

|

Shares outstanding, par value $0.01 per share; unlimited authorized shares |

11,234,440 |

||||||

|

Offering and redemption price per share |

$ |

34.50 |

|||||

|

Investor Class: |

|||||||

|

Net Assets |

$ |

80,093,034 |

|||||

|

Shares outstanding, par value $0.01 per share; unlimited authorized shares |

2,321,000 |

||||||

|

Offering and redemption price per share |

$ |

34.51 |

|||||

See accompanying Notes to Financial Statements.

15

FPA QUEENS ROAD SMALL CAP VALUE FUND

STATEMENT OF OPERATIONS

For the Six Months Ended November 30, 2022

(Unaudited)

|

INVESTMENT INCOME |

|||||||

|

Dividends |

$ |

4,241,662 |

|||||

|

Interest |

666,598 |

||||||

|

Total investment income |

4,908,260 |

||||||

|

EXPENSES |

|||||||

|

Advisory fees |

1,584,412 |

||||||

|

Shareholder Servicing fees: |

|||||||

|

Advisor Class |

30,661 |

||||||

|

Institutional Class |

69,014 |

||||||

|

Investor Class |

90,303 |

||||||

|

Trustee fees and expenses |

53,738 |

||||||

|

Transfer agent fees and expenses |

51,464 |

||||||

|

Reports to shareholders |

44,231 |

||||||

|

Filing fees |

42,796 |

||||||

|

Legal fees |

42,185 |

||||||

|

Audit and tax services fees |

15,315 |

||||||

|

Administrator fees |

11,278 |

||||||

|

Other professional fees |

8,338 |

||||||

|

Custodian fees |

2,079 |

||||||

|

Other |

6,289 |

||||||

|

Total expenses |

2,052,103 |

||||||

|

Net investment income |

2,856,157 |

||||||

|

NET REALIZED AND UNREALIZED GAIN (LOSS) |

|||||||

|

Net realized loss on: |

|||||||

|

Investments |

(7,409,714 |

) |

|||||

|

Net change in unrealized appreciation (depreciation) of: |

|||||||

|

Investments |

12,194,041 |

||||||

|

Net realized and unrealized gain |

4,784,327 |

||||||

|

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ |

7,640,484 |

|||||

See accompanying Notes to Financial Statements.

16

FPA QUEENS ROAD SMALL CAP VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

Six Months Ended November 30, 2022 (Unaudited) |

Year Ended May 31, 2022 |

||||||||||

|

INCREASE (DECREASE) IN NET ASSETS |

|||||||||||

|

Operations: |

|||||||||||

|

Net investment income |

$ |

2,856,157 |

$ |

1,715,301 |

|||||||

|

Net realized gain (loss) |

(7,409,714 |

) |

11,326,130 |

||||||||

|

Net change in unrealized appreciation (depreciation) |

12,194,041 |

(25,829,932 |

) |

||||||||

|

Net increase (decrease) in net assets resulting from operations |

7,640,484 |

(12,788,501 |

) |

||||||||

|

Distributions to shareholders — Advisor Class |

— |

(887,512 |

) |

||||||||

|

Distributions to shareholders — Institutional Class |

— |

(7,484,461 |

) |

||||||||

|

Distributions to shareholders — Investor Class |

— |

(1,507,183 |

) |

||||||||

|

Total distributions to shareholders |

— |

(9,879,156 |

) |

||||||||

|

Capital Stock transactions:(a) |

|||||||||||

|

Proceeds from Capital Stock sold |

41,403,640 |

204,174,367 |

|||||||||

|

Proceeds from shares issued to shareholders upon reinvestment of dividends and distributions |

— |

8,926,912 |

|||||||||

|

Cost of Capital Stock repurchased |

(32,706,736 |

) |

(189,118,949 |

) |

|||||||

|

Net increase from Capital Stock transactions |

8,696,904 |

23,982,330 |

|||||||||

|

Total change in net assets |

16,337,388 |

1,314,673 |

|||||||||

|

NET ASSETS |

|||||||||||

|

Beginning of period |

497,901,187 |

496,586,514 |

|||||||||

|

End of period |

$ |

514,238,575 |

$ |

497,901,187 |

|||||||

(a) See Note 7, Capital Stock, in the Notes to Financial Statements.

See accompanying Notes to Financial Statements.

17

FPA QUEENS ROAD SMALL CAP VALUE FUND

FINANCIAL HIGHLIGHTS

Selected Data for Each Share of Capital Stock Outstanding Throughout Each Period

|

Six Months Ended November 30, 2022 (Unaudited) |

Year Ended May 31, 2022 |

Period Ended May 31, 2021(a) |

|||||||||||||

|

Advisor Class |

|||||||||||||||

|

Per share operating performance: |

|||||||||||||||

|

Net asset vaue at beginning of period |

$ |

33.94 |

$ |

35.52 |

$ |

28.16 |

|||||||||

|

Income from investment operations: |

|||||||||||||||

|

Net investment income(b) |

0.19 |

0.10 |

0.02 |

||||||||||||

|

Net realized and unrealized gain on investment securities |

0.30 |

(0.95 |

) |

7.44 |

|||||||||||

|

Total from investment operations |

0.49 |

(0.85 |

) |

7.46 |

|||||||||||

|

Less distributions: |

|||||||||||||||

|

Dividends from net investment income |

— |

(0.12 |

) |

(0.09 |

) |

||||||||||

|

Distributions from net realized capital gains |

— |

(0.61 |

) |

(0.01 |

) |

||||||||||

|

Total distributions |

— |

(0.73 |

) |

(0.10 |

) |

||||||||||

|

Net asset value at end of period |

$ |

34.43 |

$ |

33.94 |

$ |

35.52 |

|||||||||

|

Total investment return(c) |

1.44 |

% |

(2.46 |

)% |

26.58 |

% |

|||||||||

|

Ratios/supplemental data: |

|||||||||||||||

|

Net assets, end of period (in 000's) |

$ |

46,562 |

$ |

39,219 |

$ |

724 |

|||||||||

|

Ratio of expenses to average net assets: |

|||||||||||||||

|

Before reimbursement from Adviser |

0.94 |

%(d) |

0.93 |

% |

0.90 |

%(d) |

|||||||||

|

After reimbursement from Adviser |

0.94 |

%(d) |

0.93 |

% |

0.90 |

%(d) |

|||||||||

|

Ratio of net investment income to average net assets: |

|||||||||||||||

|

Before reimbursement from Adviser |

1.17 |

%(d) |

0.28 |

% |

0.10 |

%(d) |

|||||||||

|

After reimbursement from Adviser |

1.17 |

%(d) |

0.28 |

% |

0.10 |

%(d) |

|||||||||

|

Portfolio turnover rate |

16 |

%(d) |

10 |

% |

15 |

% |

|||||||||

(a) The Advisor Class commenced operations on December 1, 2020. The data shown reflects operations for the period December 1, 2020 to May 31, 2021.

(b) Per share amount is based on average shares outstanding.

(c) Return is based on net asset value per share, adjusted for reinvestment of distributions, and does not reflect deduction of the sales charge.

(d) Annualized.

See accompanying Notes to Financial Statements.

18

FPA QUEENS ROAD SMALL CAP VALUE FUND

FINANCIAL HIGHLIGHTS

Selected Data for Each Share of Capital Stock Outstanding Throughout Each Period

|

Six Months Ended November 30, 2022 (Unaudited) |

Year Ended May 31, 2022 |

Period Ended May 31, 2021(a) |

|||||||||||||

|

Institutional Class |

|||||||||||||||

|

Per share operating performance: |

|||||||||||||||

|

Net asset value at beginning of period |

$ |

33.99 |

$ |

35.52 |

$ |

28.16 |

|||||||||

|

Income from investment operations: |

|||||||||||||||

|

Net investment income(b) |

0.20 |

0.13 |

0.02 |

||||||||||||

|

Net realized and unrealized gain on investment securities |

0.31 |

(0.94 |

) |

7.44 |

|||||||||||

|

Total from investment operations |

0.51 |

(0.81 |

) |

7.46 |

|||||||||||

|

Less distributions: |

|||||||||||||||

|

Dividends from net investment income |

— |

(0.11 |

) |

(0.09 |

) |

||||||||||

|

Distributions from net realized capital gains |

— |

(0.61 |

) |

(0.01 |

) |

||||||||||

|

Total distributions |

— |

(0.72 |

) |

(0.10 |

) |

||||||||||

|

Redemption fees |

— |

— |

— |

||||||||||||

|

Net asset value at end of period |

$ |

34.50 |

$ |

33.99 |

$ |

35.52 |

|||||||||

|

Total investment return(c) |

1.50 |

% |

(2.34 |

)% |

26.59 |

% |

|||||||||

|

Ratios/supplemental data: |

|||||||||||||||

|

Net assets, end of period (in 000's) |

$ |

387,583 |

$ |

376,221 |

$ |

301,941 |

|||||||||

|

Ratio of expenses to average net assets: |

|||||||||||||||

|

Before reimbursement from Adviser |

0.81 |

%(d) |

0.83 |

% |

0.91 |

%(d) |

|||||||||

|

After reimbursement from Adviser |

0.81 |

%(d) |

0.83 |

% |

0.89 |

%(d) |

|||||||||

|

Ratio of net investment income to average net assets: |

|||||||||||||||

|

Before reimbursement from Adviser |

1.23 |

%(d) |

0.38 |

% |

0.08 |

%(d) |

|||||||||

|

After reimbursement from Adviser |

1.23 |

%(d) |

0.38 |

% |

0.10 |

%(d) |

|||||||||

|

Portfolio turnover rate |

16 |

%(d) |

10 |

% |

15 |

% |

|||||||||

(a) The Institutional Class commenced operations on December 1, 2020. The data shown reflects operations for the period December 1, 2020 to May 31, 2021.

(b) Per share amount is based on average shares outstanding.

(c) Return is based on net asset value per share, adjusted for reinvestment of distributions, and does not reflect deduction of the sales charge.

(d) Annualized.

See accompanying Notes to Financial Statements.

19

FPA QUEENS ROAD SMALL CAP VALUE FUND

FINANCIAL HIGHLIGHTS

Selected Data for Each Share of Capital Stock Outstanding Throughout Each Period

|

Six Months Ended November 30, 2022 |

Year Ended May 31, |

||||||||||||||||||||||||||

|

(Unaudited) |

2022 |

2021 |

2020(a) |

2019(a) |

2018(a) |

||||||||||||||||||||||

|

Investor Class |

|||||||||||||||||||||||||||

|

Per share operating performance: |

|||||||||||||||||||||||||||

|

Net asset value at beginning of year |

$ |

34.03 |

$ |

35.52 |

$ |

23.22 |

$ |

23.61 |

$ |

27.32 |

$ |

25.93 |

|||||||||||||||

|

Income from investment operations: |

|||||||||||||||||||||||||||

|

Net investment income(b) |

0.17 |

0.07 |

0.06 |

0.03 |

0.05 |

0.02 |

|||||||||||||||||||||

|

Net realized and unrealized gain (loss) on investment securities |

0.31 |

(0.95 |

) |

12.34 |

0.55 |

(1.28 |

) |

1.94 |

|||||||||||||||||||

|

Total from investment operations |

0.48 |

(0.88 |

) |

12.40 |

0.58 |

(1.23 |

) |

1.96 |

|||||||||||||||||||

|

Less distributions: |

|||||||||||||||||||||||||||

|

Dividends from net investment income |

— |

— |

(0.09 |

) |

(0.01 |

) |

(0.03 |

) |

— |

||||||||||||||||||

|

Distributions from net realized capital gains |

— |

(0.61 |

) |

(0.01 |

) |

(0.96 |

) |

(2.45 |

) |

(0.57 |

) |

||||||||||||||||

|

Total distributions |

— |

(0.61 |

) |

(0.10 |

) |

(0.97 |

) |

(2.48 |

) |

(0.57 |

) |

||||||||||||||||

|

Net asset value at end of year |

$ |

34.51 |

$ |

34.03 |

$ |

35.52 |

$ |

23.22 |

$ |

23.61 |

$ |

27.32 |

|||||||||||||||

|

Total investment return(c) |

1.41 |

% |

(2.52 |

)% |

53.51 |

% |

1.89 |

% |

(4.26 |

)% |

7.55 |

% |

|||||||||||||||

|

Ratios/supplemental data: |

|||||||||||||||||||||||||||

|

Net assets, End of Period (in 000's) |

$ |

80,093 |

$ |

82,461 |

$ |

193,922 |

$ |

127,037 |

$ |

118,454 |

$ |

133,630 |

|||||||||||||||

|

Ratio of expenses to average net assets: |

|||||||||||||||||||||||||||

|

Before reimbursement from Adviser |

1.01 |

%(d) |

1.00 |

% |

1.11 |

% |

1.18 |

% |

1.18 |

% |

1.22 |

% |

|||||||||||||||

|

After reimbursement from Adviser |

1.01 |

%(d) |

1.00 |

% |

1.09 |

%(e) |

1.18 |

% |

1.18 |

% |

1.22 |

% |

|||||||||||||||

|

Ratio of net investment income to average net assets: |

|||||||||||||||||||||||||||

|

Before reimbursement from Adviser |

1.02 |

%(d) |

0.21 |

% |

0.22 |

% |

0.10 |

% |

0.20 |

% |

0.08 |

% |

|||||||||||||||

|

After reimbursement from Adviser |

1.02 |

%(d) |

0.21 |

% |

0.20 |

% |

0.10 |

% |

0.20 |

% |

0.08 |

% |

|||||||||||||||

|

Portfolio turnover rate |

16 |

%(d) |

10 |

% |

15 |

% |

24 |

% |

27 |

% |

6 |

% |

|||||||||||||||

(a) Audits performed for the fiscal years indicated by the Fund's previous auditor, Cohen & Company, Ltd.

(b) Per share amount is based on average shares outstanding.

(c) Return is based on net asset value per share, adjusted for reinvestment of distributions, and does not reflect deduction of the sales charge.

(d) Annualized

(e) Effective November 1, 2020, the Adviser has contractually agreed to limit the annual fund operating expenses to 1.04%. Prior to November 1, 2020, the Fund had a unitized fee structure that limited annual operating expenses to 1.18%.

See accompanying Notes to Financial Statements.

20

FPA QUEENS ROAD SMALL CAP VALUE FUND

NOTES TO FINANCIAL STATEMENTS

November 30, 2022

(Unaudited)

NOTE 1 — Significant Accounting Policies

The FPA Queens Road Small Cap Value Fund (the "Fund"), is a diversified managed portfolio of Bragg Capital Trust (the "Trust"), which is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management company. The Fund's investment objective is to seek long-term capital growth. The Fund invests primarily in common stocks which are believed by First Pacific Advisors, L.P. (the "Adviser") and Bragg Financial Advisors, Inc. (the "Sub-Adviser") to be undervalued and have good prospects for capital appreciation. Under normal circumstances, the Fund invests at least 80% of its assets in equity securities of companies with small market capitalization. The Fund currently defines a small market capitalization company as one whose market capitalization, at the time of purchase, is no greater than the largest market capitalization of any company included in the Russell 2000 Value Index. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

A. Security Valuation

The Fund's investments are reported at fair value as defined by accounting principles generally accepted in the United States of America, ("U.S. GAAP"). The Fund generally determines its net asset value as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open. Further discussion of valuation methods, inputs and classifications can be found under Disclosure of Fair Value Measurements.

B. Securities Transactions and Related Investment Income

Securities transactions are accounted for on the date the securities are purchased or sold. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income and expenses are recorded on an accrual basis. Market discounts and premiums on fixed income securities are amortized over the expected life of the securities using effective interest rate method. Realized gains or losses are based on the specific identification method. The books and records of the Fund are maintained in U.S. dollars as follows: (1) the foreign currency fair value of investment securities, and other assets and liabilities stated in foreign currencies, are translated using the daily spot rate; and (2) purchases, sales, income and expenses are translated at the rate of exchange prevailing on the respective dates of such transactions. The resultant exchange gains and losses are included in net realized or net unrealized gain (loss) in the statement of operations.

C. Use of Estimates

The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported. Actual results could differ from those estimates.

NOTE 2 — Risk Considerations

Investing in the Fund may involve certain risks including, but not limited to, those described below.

Market Risk: Because the values of the Fund's investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund or the Fund could underperform other investments.

Common Stocks and Other Securities: The prices of common stocks and other securities held by the Fund may decline in response to certain events taking place around the world, including; those directly involving companies whose securities are owned by the Fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency, interest rate and

21

FPA QUEENS ROAD SMALL CAP VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

(Unaudited)

commodity price fluctuations. In addition, the emphasis on a value-oriented investment approach by the Sub-Adviser generally results in the Fund's portfolio being invested primarily in medium or smaller sized companies. Smaller companies may be subject to a greater degree of change in earnings and business prospects than larger, more established companies, and smaller companies are often more reliant on key products or personnel than larger companies. Also, securities of smaller companies are traded in lower volumes than those issued by larger companies and may be more volatile than those of larger companies. The Fund's foreign investments are subject to additional risks such as, foreign markets could go down or prices of the Fund's foreign investments could go down because of unfavorable changes in foreign currency exchange rates, foreign government actions, social, economic or political instability or other factors that can adversely affect investments in foreign countries. These factors can also make foreign securities less liquid, more volatile and harder to value than U.S. securities. In light of these characteristics of smaller companies and their securities, the Fund may be subjected to greater risk than that assumed when investing in the equity securities of larger companies.

Many countries have experienced outbreaks of infectious illnesses in recent decades, including swine flu, avian influenza, SARS and, more recently, COVID-19. The global outbreak of COVID-19 in early 2020 has resulted in various disruptions, including travel and border restrictions, quarantines, supply chain disruptions, lower consumer demand and general market uncertainty. The full effects, duration and costs of the COVID-19 pandemic are impossible to predict, and the circumstances surrounding the COVID-19 pandemic will continue to evolve, including the risk of future increased rates of infection due to low vaccination rates and/or the lack of effectiveness of current vaccines against new variants. Similar consequences could arise as a result of the spread of other infectious diseases. Management will continue to monitor the impact COVID-19 has on the Fund and reflect the consequences as appropriate in the Fund's accounting and financial reporting.

NOTE 3 — Purchases and Sales of Investment Securities

Cost of purchases of investment securities (excluding short-term investments) aggregated $51,469,802 for the period ended November 30, 2022. The proceeds and cost of securities sold resulting in net realized loss of $7,409,714 aggregated $34,343,705 and $41,753,419, respectively, for the period ended November 30, 2022.

NOTE 4 — Federal Income Tax

No provision for federal income tax is required because the Fund has elected to be taxed as a "regulated investment company" under the Internal Revenue Code (the "Code") and intends to maintain this qualification and to distribute each year to its shareholders, in accordance with the minimum distribution requirements of the Code, its taxable net investment income and taxable net realized gains on investments.

The cost of investment securities held at November 30, 2022 was $318,662,042 for federal income tax purposes. Gross unrealized appreciation and depreciation for all investments at November 30, 2022, for federal income tax purposes was $135,127,837 and $5,910,706, respectively resulting in net unrealized appreciation of $129,217,131. As of and during the period ended November 30, 2022, the Fund did not have any liability for unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The statute of limitations remains open for the last 3 years, once a return is filed. No examinations are in progress at this time.

NOTE 5 — Advisory Fees and Other Affiliated Transactions

Pursuant to an investment advisory agreement (the "Advisory Agreement") with the Fund, investment advisory services are provided to the Fund by the Adviser. Effective November 1, 2020, under terms of the Advisory Agreement, the Fund pays a fee, computed daily and payable monthly at the annual rate of 0.75% of

22

FPA QUEENS ROAD SMALL CAP VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

(Unaudited)

the Fund's first $50,000,000 of average daily net assets, and 0.65% of the Fund's average daily net assets over $50,000,000. The amount due to the Adviser at November 30, 2022, in the form of Accrued Advisory Fees, was $268,581.

Pursuant to a written contract (the "Expense Limitation Agreement"), effective November 1, 2020, the Adviser has agreed to reimburse the Fund for operating expenses in excess of 0.99%, 0.89% and 1.04% of average net assets for the Advisor Class, Institutional Class and Investor Class shares, respectively, of the Fund, excluding interest, taxes, brokerage fees and commissions payable by the Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Fund invests, and extraordinary expenses, including litigation expenses, not incurred in the Fund's ordinary course of business, through February 1, 2024.

In consideration of the Adviser's agreement to limit each Fund's expenses, the Adviser may recoup amounts waived or reimbursed for a period not to exceed three years from the time in which they were waived or reimbursed. Recoupment will be made only to the extent it does not cause the Fund's ordinary operating expenses to exceed: (1) the expense limitation in effect at the time the expense was paid or absorbed; and (2) the expense limitation in effect at the time of recapture.

For the period ended November 30, 2022, the Adviser did not waive or reimburse expenses of the Fund. As of November 30, 2022 there are no expenses subject to recapture.

Sub-Advisory Agreement — Effective November 1, 2020, the Adviser and the Trust engaged the Sub- Adviser. For its services, the Sub-Adviser receives a sub-advisory fee from the Adviser. The Sub-Adviser served as the investment adviser to the Fund until November 1, 2020.

For the period ended November 30, 2022, the Fund paid aggregate fees and expenses of $53,738, to all Trustees who are not affiliated persons of the Adviser. Certain officers of the Fund are also officers of the Adviser.

NOTE 6 — Disclosure of Fair Value Measurements

The Fund uses the following methods and inputs to establish the fair value of its assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued each day at the official closing price of, or the last reported sale price on, the exchange or market on which such securities principally are traded, as of the close of business on that day. If there have been no sales that day, equity securities are generally valued at the last available bid price. Securities that are unlisted and fixed-income and convertible securities listed on a national securities exchange for which the over-the-counter ("OTC") market more accurately reflects the securities' value in the judgment of the Fund's officers, are valued at the most recent bid price. Short-term corporate notes with maturities of 60 days or less at the time of purchase are valued at amortized cost.

Securities for which representative market quotations are not readily available or are considered unreliable by the Adviser are valued as determined in good faith under procedures adopted by the authority of the Fund's Board of Trustees. Various inputs may be reviewed in order to make a good faith determination of a security's value. These inputs include, but are not limited to, the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations of investments that would have been used had greater market activity occurred.

23

FPA QUEENS ROAD SMALL CAP VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

(Unaudited)

The Fund classifies its assets based on three valuation methodologies. Level 1 values are based on quoted market prices in active markets for identical assets. Level 2 values are based on significant observable market inputs, such as quoted prices for similar assets and quoted prices in inactive markets or other market observable inputs as noted above including spreads, cash flows, financial performance, prepayments, defaults, collateral, credit enhancements, and interest rate volatility. Level 3 values are based on significant unobservable inputs that reflect the Fund's determination of assumptions that market participants might reasonably use in valuing the assets. The valuation levels are not necessarily an indication of the risk associated with investing in those securities. The following table presents the valuation levels of the Fund's investments as of November 30, 2022:

|

Investments |

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||||

|

Common Stocks |

|||||||||||||||||||

|

Information Technology Services |

$ |

46,054,229 |

— |

— |

$ |

46,054,229 |

|||||||||||||

|

Oil & Gas Services & Equipment |

38,806,944 |

— |

— |

38,806,944 |

|||||||||||||||

|

P&C Insurance |

33,005,530 |

— |

— |

33,005,530 |

|||||||||||||||

|

Technology Distributors |

32,349,557 |

— |

— |

32,349,557 |

|||||||||||||||

|

Apparel, Footwear & Accessory Design |

31,941,994 |

— |

— |

31,941,994 |

|||||||||||||||

|

Industrials |

31,882,856 |

— |

— |

31,882,856 |

|||||||||||||||

|

Life & Health Insurance |

29,029,702 |

— |

— |

29,029,702 |

|||||||||||||||

|

Banks |

26,305,436 |

— |

— |

26,305,436 |

|||||||||||||||

|

Semiconductor Devices |

22,443,683 |

— |

— |

22,443,683 |

|||||||||||||||

|

Packaged Food |

18,665,903 |

— |

— |

18,665,903 |

|||||||||||||||

|

Industrial Distribution & Rental |

15,408,384 |

— |

— |

15,408,384 |

|||||||||||||||

|

Application Software |

12,711,855 |

— |

— |

12,711,855 |

|||||||||||||||

|

Communications Equipment |

12,086,856 |

— |

— |

12,086,856 |

|||||||||||||||

|

Aircraft & Parts |

11,848,576 |

— |

— |

11,848,576 |

|||||||||||||||

|

Cement & Aggregates |

11,103,366 |

— |

— |

11,103,366 |

|||||||||||||||

|

Agricultural Machinery |

10,606,055 |

— |

— |

10,606,055 |

|||||||||||||||

|

Publishing & Broadcasting |

8,804,162 |

— |

— |

8,804,162 |

|||||||||||||||

|

Financials |

8,169,350 |

— |

— |

8,169,350 |

|||||||||||||||

|

Flow Control Equipment |

6,643,372 |

— |

— |

6,643,372 |

|||||||||||||||

|

Retailing |

6,392,177 |

— |

— |

6,392,177 |

|||||||||||||||

|

Containers & Packaging |

5,310,150 |

— |

— |

5,310,150 |

|||||||||||||||

|

Other Wholesalers |

4,802,709 |

— |

— |

4,802,709 |

|||||||||||||||

|

Basic & Diversified Chemicals |

4,742,626 |

— |

— |

4,742,626 |

|||||||||||||||

|

Health Care Supply Chain |

3,974,824 |

— |

— |

3,974,824 |

|||||||||||||||

|

Speciality Retail |

3,613,500 |

— |

— |

3,613,500 |

|||||||||||||||

|

Electrical Components |

3,378,853 |

— |

— |

3,378,853 |

|||||||||||||||

|

Internet Media |

3,147,336 |

— |

— |

3,147,336 |

|||||||||||||||

24

FPA QUEENS ROAD SMALL CAP VALUE FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

(Unaudited)

|

Investments |

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||||

|

Real Estate Services |

$ |

2,397,601 |

— |

— |

$ |

2,397,601 |

|||||||||||||

|

Other Commercial Services |

2,084,858 |

— |

— |

2,084,858 |

|||||||||||||||

|

Preferred Stocks |

|||||||||||||||||||

|

Industrials |

166,729 |

— |

— |

166,729 |

|||||||||||||||

|

Short-Term Investments |

— |

$ |

65,498,510 |

— |

65,498,510 |

||||||||||||||

|

$ |

447,879,173 |

$ |

65,498,510 |

— |

$ |

513,377,683 |

|||||||||||||

Transfers of investments between different levels of the fair value hierarchy are recorded at fair value as of the end of the reporting period. There were no significant transfers into or out of Level 3 during the period ended November 30, 2022.

The Fund did not hold derivatives as of November 30, 2022.

NOTE 7 — Capital Stock

|

Period Ended November 30, 2022 |

Year Ended May 31, 2022 |

||||||||||||||||||

|

Shares |

Amount |

Shares |

Amount |

||||||||||||||||

|

Capital Stock sold |

|||||||||||||||||||

|

Advisor Class |

404,791 |

$ |

13,229,606 |

1,511,191 |

$ |

53,586,768 |

|||||||||||||

|

Institutional Class |

603,541 |

19,648,327 |

3,449,230 |

123,162,592 |

|||||||||||||||

|

Investor Class |

263,372 |

8,525,707 |

778,313 |

27,425,007 |

|||||||||||||||

|