Form N-CSRS Advisors' Inner Circle For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22920

The Advisors’ Inner Circle Fund III

(Exact name of registrant as specified in charter)

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-446-3863

Date of fiscal year end: March 31, 2022

Date of reporting period: September 30, 2021

| Item 1. | Reports to Stockholders. |

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act or 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

The Advisors’ Inner Circle Fund III

GQG Partners Emerging Markets Equity Fund

GQG Partners Global Quality Equity Fund

GQG Partners US Select Quality Equity Fund

GQG Partners Global Quality Dividend Income Fund

GQG Partners International Quality Dividend Income Fund

GQG Partners US Quality Dividend Income Fund

| SEMI-ANNUAL REPORT | SEPTEMBER 30, 2021 | |

|

Investment Adviser: GQG Partners LLC

| ||

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS FUNDS | |

| SEPTEMBER 30, 2021

|

| TABLE OF CONTENTS | ||||

| 1 | ||||

| 6 | ||||

| 11 | ||||

| 14 | ||||

| 18 | ||||

| 23 | ||||

| 26 | ||||

| 30 | ||||

| 36 | ||||

| 42 | ||||

| 57 | ||||

| 80 | ||||

| 84 | ||||

The Funds file their complete schedules of investments with the US Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT (Form N-Q for filings prior to March 31, 2020). The Funds’ Form N-Q and Form N-PORT are available on the SEC’s website at http://www.sec.gov, and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-866-362-8333; and (ii) on the SEC’s website at http://www.sec.gov.

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS SEPTEMBER 30, 2021 (Unaudited) |

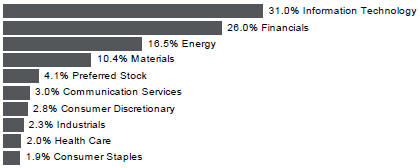

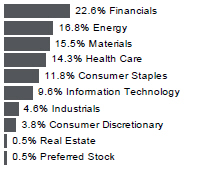

| SECTOR WEIGHTING †

|

† Percentages are based on total investments.

The accompanying notes are an integral part of the financial statements.

1

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS EMERGING MARKETS EQUITY FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued | ||||||||

| Shares | Value | |||||||

| CHINA (continued) |

||||||||

| WuXi AppTec, Cl A |

4,731,894 | $ | 111,706,515 | |||||

|

|

|

| ||||||

| 1,249,371,642 | ||||||||

|

|

|

| ||||||

| HONG KONG — 3.3% |

||||||||

| AIA Group |

4,877,710 | 56,363,228 | ||||||

| Hong Kong Exchanges & Clearing |

3,739,650 | 230,043,553 | ||||||

|

|

|

| ||||||

| 286,406,781 | ||||||||

|

|

|

| ||||||

| INDIA — 22.9% |

||||||||

| Bajaj Finance |

1,750,796 | 180,081,683 | ||||||

| Hindalco Industries |

7,046,270 | 46,234,021 | ||||||

| Housing Development Finance |

11,610,148 | 428,464,804 | ||||||

| ICICI Bank |

10,247,865 | 96,064,482 | ||||||

| Infosys |

5,244,556 | 117,857,898 | ||||||

| Infosys ADR |

19,647,039 | 437,146,618 | ||||||

| JSW Steel |

4,920,554 | 44,197,571 | ||||||

| Reliance Industries |

9,659,448 | 327,062,249 | ||||||

| State Bank of India |

21,889,344 | 132,617,744 | ||||||

| Tata Consultancy Services |

2,027,280 | 102,866,155 | ||||||

| Tata Steel |

4,858,848 | 84,237,641 | ||||||

|

|

|

| ||||||

| 1,996,830,866 | ||||||||

|

|

|

| ||||||

| INDONESIA — 0.9% |

||||||||

| Bank Central Asia |

32,003,507 | 78,090,849 | ||||||

|

|

|

| ||||||

| KAZAKHSTAN — 0.3% |

||||||||

| Kaspi.KZ JSC GDR |

285,550 | 30,586,542 | ||||||

|

|

|

| ||||||

| MEXICO — 0.0% |

||||||||

| Ternium ADR |

71,842 | 3,038,917 | ||||||

|

|

|

| ||||||

| NETHERLANDS — 4.1% |

||||||||

| ASML Holding |

474,294 | 354,328,412 | ||||||

|

|

|

| ||||||

| RUSSIA — 16.4% |

||||||||

| Gazprom PJSC |

48,470,131 | 240,370,196 | ||||||

| LUKOIL PJSC |

2,287,862 | 217,762,786 | ||||||

| MMC Norilsk Nickel PJSC |

122,544 | 36,603,707 | ||||||

| MMC Norilsk Nickel PJSC ADR |

3,689,124 | 110,378,590 | ||||||

| Polyus PJSC GDR |

1,279,686 | 105,138,746 | ||||||

| Rosneft Oil PJSC |

23,488,355 | 198,570,110 | ||||||

| Sberbank of Russia PJSC |

71,510,510 | 335,631,722 | ||||||

| Severstal PAO |

2,048,622 | 42,804,888 | ||||||

The accompanying notes are an integral part of the financial statements.

2

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS EMERGING MARKETS EQUITY FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued | ||||||||

| Shares | Value | |||||||

| RUSSIA (continued) |

||||||||

| TCS Group Holding GDR |

1,580,432 | $ | 144,311,426 | |||||

|

|

|

| ||||||

| 1,431,572,171 | ||||||||

|

|

|

| ||||||

| SOUTH AFRICA — 0.4% |

||||||||

| Capitec Bank Holdings |

264,726 | 32,029,081 | ||||||

|

|

|

| ||||||

| SOUTH KOREA — 5.0% |

||||||||

| Samsung Electronics |

5,681,348 | 351,250,746 | ||||||

| SK Telecom |

319,128 | 86,854,837 | ||||||

|

|

|

| ||||||

| 438,105,583 | ||||||||

|

|

|

| ||||||

| SPAIN — 2.1% |

||||||||

| Banco Bilbao Vizcaya Argentaria |

27,809,251 | 183,008,262 | ||||||

|

|

|

| ||||||

| TAIWAN — 6.7% |

||||||||

| Taiwan Semiconductor Manufacturing |

21,225,133 | 438,071,493 | ||||||

| Taiwan Semiconductor Manufacturing ADR |

1,332,943 | 148,823,086 | ||||||

|

|

|

| ||||||

| 586,894,579 | ||||||||

|

|

|

| ||||||

| TURKEY — 1.2% |

||||||||

| Eregli Demir ve Celik Fabrikalari |

30,359,504 | 56,756,930 | ||||||

| KOC Holding |

18,385,247 | 46,737,215 | ||||||

|

|

|

| ||||||

| 103,494,145 | ||||||||

|

|

|

| ||||||

| UNITED STATES — 9.0% |

||||||||

| Communication Services — 1.9% |

||||||||

| Facebook, Cl A * |

497,085 | 168,705,678 | ||||||

|

|

|

| ||||||

| Information Technology — 7.1% |

||||||||

| Lam Research |

356,189 | 202,724,969 | ||||||

| Monolithic Power Systems |

191,321 | 92,729,463 | ||||||

| NVIDIA |

1,589,201 | 329,218,879 | ||||||

|

|

|

| ||||||

| 624,673,311 | ||||||||

|

|

|

| ||||||

| TOTAL UNITED STATES |

793,378,989 | |||||||

|

|

|

| ||||||

| Total Common Stock |

8,088,782,511 | |||||||

|

|

|

| ||||||

| PREFERRED STOCK — 3.9% | ||||||||

| BRAZIL — 3.9% |

||||||||

| Banco Bradesco*(A) |

31,192,238 | 119,069,638 | ||||||

| Itau Unibanco Holding(A) |

14,957,300 | 79,495,570 | ||||||

The accompanying notes are an integral part of the financial statements.

3

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS EMERGING MARKETS EQUITY FUND SEPTEMBER 30, 2021 (Unaudited) |

| PREFERRED STOCK — continued | ||||||||

| Shares | Value | |||||||

| BRAZIL (continued) |

||||||||

| Petroleo Brasileiro(A) |

22,413,316 | $ | 111,883,535 | |||||

| Raizen*(A) |

24,823,931 | 32,391,519 | ||||||

|

|

|

| ||||||

| 342,840,262 | ||||||||

|

|

|

| ||||||

| Total Preferred Stock |

342,840,262 | |||||||

|

|

|

| ||||||

| Total Investments — 96.5% |

$ | 8,431,622,773 | ||||||

|

|

|

| ||||||

Percentages are based on Net Assets of $8,737,143,124.

| * | Non-income producing security. |

| (A) | There is currently no rate available. |

ADR — American Depositary Receipt

Cl — Class

GDR — Global Depositary Receipt

PJSC — Public Joint Stock Company

The accompanying notes are an integral part of the financial statements.

4

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS EMERGING MARKETS EQUITY FUND SEPTEMBER 30, 2021 (Unaudited) |

The following is a summary of the level of inputs used as of September 30, 2021, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

||||||||||||||||

| Brazil |

$ | 521,645,692 | $ | — | $ | — | $ | 521,645,692 | ||||||||

| China |

55,790,021 | 1,193,581,621 | — | 1,249,371,642 | ||||||||||||

| Hong Kong |

— | 286,406,781 | — | 286,406,781 | ||||||||||||

| India |

437,146,618 | 1,559,684,248 | — | 1,996,830,866 | ||||||||||||

| Indonesia |

— | 78,090,849 | — | 78,090,849 | ||||||||||||

| Kazakhstan |

— | 30,586,542 | — | 30,586,542 | ||||||||||||

| Mexico |

3,038,917 | — | — | 3,038,917 | ||||||||||||

| Netherlands |

— | 354,328,412 | — | 354,328,412 | ||||||||||||

| Russia |

215,517,336 | 1,216,054,835 | — | 1,431,572,171 | ||||||||||||

| South Africa |

— | 32,029,081 | — | 32,029,081 | ||||||||||||

| South Korea |

— | 438,105,583 | — | 438,105,583 | ||||||||||||

| Spain |

— | 183,008,262 | — | 183,008,262 | ||||||||||||

| Taiwan |

148,823,086 | 438,071,493 | — | 586,894,579 | ||||||||||||

| Turkey |

— | 103,494,145 | — | 103,494,145 | ||||||||||||

| United States |

793,378,989 | — | — | 793,378,989 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Common Stock |

2,175,340,659 | 5,913,441,852 | — | 8,088,782,511 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Preferred Stock |

310,448,743 | 32,391,519 | — | 342,840,262 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 2,485,789,402 | $ | 5,945,833,371 | $ | — | $ | 8,431,622,773 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

For the period ended September 30, 2021, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

5

| THE ADVISORS’ INNER CIRCLE FUND III |

GLOBAL QUALITY EQUITY FUND SEPTEMBER 30, 2021 (Unaudited) |

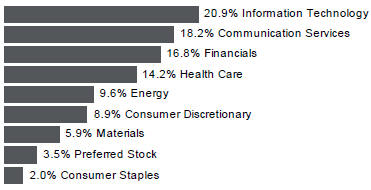

| SECTOR WEIGHTING † |

† Percentages are based on total investments.

The accompanying notes are an integral part of the financial statements.

6

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS GLOBAL QUALITY EQUITY FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued | ||||||||

| Shares | Value | |||||||

| GERMANY — 1.5% |

||||||||

| Daimler |

119,396 | $ | 10,560,711 | |||||

|

|

|

| ||||||

| LUXEMBOURG — 1.9% |

||||||||

| ArcelorMittal |

253,421 | 7,688,138 | ||||||

| ArcelorMittal ADR |

185,141 | 5,583,853 | ||||||

|

|

|

| ||||||

| 13,271,991 | ||||||||

|

|

|

| ||||||

| NETHERLANDS — 2.1% |

||||||||

| ASML Holding |

16,344 | 12,210,029 | ||||||

| ASML Holding ADR |

2,814 | 2,096,740 | ||||||

|

|

|

| ||||||

| 14,306,769 | ||||||||

|

|

|

| ||||||

| RUSSIA — 3.8% |

||||||||

| LUKOIL PJSC |

82,877 | 7,888,381 | ||||||

| Rosneft Oil PJSC |

856,303 | 7,239,169 | ||||||

| Sberbank of Russia PJSC |

2,379,292 | 11,167,112 | ||||||

|

|

|

| ||||||

| 26,294,662 | ||||||||

|

|

|

| ||||||

| SPAIN — 3.0% |

||||||||

| Banco Bilbao Vizcaya Argentaria |

1,817,804 | 11,962,680 | ||||||

| Banco Santander |

2,440,097 | 8,814,536 | ||||||

|

|

|

| ||||||

| 20,777,216 | ||||||||

|

|

|

| ||||||

| TAIWAN — 1.9% |

||||||||

| Taiwan Semiconductor Manufacturing ADR |

118,474 | 13,227,622 | ||||||

|

|

|

| ||||||

| UNITED KINGDOM — 5.2% |

||||||||

| AstraZeneca |

50,709 | 6,114,883 | ||||||

| AstraZeneca ADR |

490,128 | 29,437,088 | ||||||

|

|

|

| ||||||

| 35,551,971 | ||||||||

|

|

|

| ||||||

| UNITED STATES — 62.1% |

||||||||

| Communication Services — 17.6% |

||||||||

| Alphabet, Cl C * |

18,192 | 48,487,319 | ||||||

| Charter Communications, Cl A * |

41,169 | 29,952,918 | ||||||

| Facebook, Cl A * |

88,829 | 30,147,674 | ||||||

| Snap, Cl A * |

63,412 | 4,684,244 | ||||||

The accompanying notes are an integral part of the financial statements.

7

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS GLOBAL QUALITY EQUITY FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued | ||||||||

| Shares | Value | |||||||

| Communication Services (continued) |

||||||||

| ZoomInfo Technologies, Cl A * |

121,409 | $ | 7,429,017 | |||||

|

|

|

| ||||||

| 120,701,172 | ||||||||

|

|

|

| ||||||

| Consumer Discretionary — 7.0% |

||||||||

| Amazon.com * |

4,911 | 16,132,832 | ||||||

| Lennar, Cl A |

51,321 | 4,807,751 | ||||||

| Target |

118,383 | 27,082,479 | ||||||

|

|

|

| ||||||

| 48,023,062 | ||||||||

|

|

|

| ||||||

| Consumer Staples — 1.9% |

||||||||

| Philip Morris International |

136,209 | 12,911,251 | ||||||

|

|

|

| ||||||

| Energy — 6.0% |

||||||||

| Devon Energy |

306,963 | 10,900,256 | ||||||

| Exxon Mobil |

283,621 | 16,682,587 | ||||||

| Occidental Petroleum |

456,391 | 13,500,046 | ||||||

|

|

|

| ||||||

| 41,082,889 | ||||||||

|

|

|

| ||||||

| Financials — 7.7% |

||||||||

| Bank of America |

323,444 | 13,730,198 | ||||||

| Blackstone, Cl A |

147,517 | 17,162,128 | ||||||

| JPMorgan Chase |

21,230 | 3,475,138 | ||||||

| Morgan Stanley |

191,403 | 18,625,426 | ||||||

|

|

|

| ||||||

| 52,992,890 | ||||||||

|

|

|

| ||||||

| Health Care — 5.7% |

||||||||

| Eli Lilly |

38,792 | 8,962,892 | ||||||

| UnitedHealth Group |

76,668 | 29,957,254 | ||||||

|

|

|

| ||||||

| 38,920,146 | ||||||||

|

|

|

| ||||||

| Information Technology — 16.2% |

||||||||

| Adobe * |

23,303 | 13,416,003 | ||||||

| Microsoft |

114,777 | 32,357,932 | ||||||

| NVIDIA |

147,388 | 30,532,898 | ||||||

| salesforce.com * |

55,117 | 14,948,833 | ||||||

The accompanying notes are an integral part of the financial statements.

8

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS GLOBAL QUALITY EQUITY FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued | ||||||||

| Shares | Value | |||||||

| Information Technology (continued) |

||||||||

| Visa, Cl A |

89,496 | $ | 19,935,234 | |||||

|

|

|

| ||||||

| 111,190,900 | ||||||||

|

|

|

| ||||||

| TOTAL UNITED STATES |

425,822,310 | |||||||

|

|

|

| ||||||

| Total Common Stock |

638,324,872 | |||||||

|

|

|

| ||||||

| PREFERRED STOCK — 3.4% |

||||||||

| BRAZIL — 2.0% |

||||||||

| Itau Unibanco Holding(A) |

850,550 | 4,520,532 | ||||||

| Petroleo Brasileiro(A) |

1,810,176 | 9,036,097 | ||||||

|

|

|

| ||||||

| 13,556,629 | ||||||||

|

|

|

| ||||||

| GERMANY — 1.4% |

||||||||

| Volkswagen, 2.80% |

42,400 | 9,442,557 | ||||||

|

|

|

| ||||||

| Total Preferred Stock |

22,999,186 | |||||||

|

|

|

| ||||||

| Total Investments— 96.3% |

$ | 661,324,058 | ||||||

|

|

|

| ||||||

Percentages are based on Net Assets of $686,877,508.

| * | Non-income producing security. |

| (A) | There is currently no rate available. |

ADR — American Depositary Receipt

Cl — Class

PJSC — Public Joint Stock Company

The accompanying notes are an integral part of the financial statements.

9

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS GLOBAL QUALITY EQUITY FUND SEPTEMBER 30, 2021 (Unaudited) |

The following is a summary of the level of inputs used as of September 30, 2021, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

||||||||||||||||

| Australia |

$ | — | $ | 15,321,326 | $ | — | $ | 15,321,326 | ||||||||

| Brazil |

18,002,356 | — | — | 18,002,356 | ||||||||||||

| Canada |

6,440,130 | — | — | 6,440,130 | ||||||||||||

| China |

— | 6,410,514 | — | 6,410,514 | ||||||||||||

| Denmark |

2,220,615 | 16,951,396 | — | 19,172,011 | ||||||||||||

| France |

— | 13,165,283 | — | 13,165,283 | ||||||||||||

| Germany |

— | 10,560,711 | — | 10,560,711 | ||||||||||||

| Luxembourg |

5,583,853 | 7,688,138 | — | 13,271,991 | ||||||||||||

| Netherlands |

2,096,740 | 12,210,029 | — | 14,306,769 | ||||||||||||

| Russia |

— | 26,294,662 | — | 26,294,662 | ||||||||||||

| Spain |

— | 20,777,216 | — | 20,777,216 | ||||||||||||

| Taiwan |

13,227,622 | — | — | 13,227,622 | ||||||||||||

| United Kingdom |

29,437,088 | 6,114,883 | — | 35,551,971 | ||||||||||||

| United States |

425,822,310 | — | — | 425,822,310 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Common Stock |

502,830,714 | 135,494,158 | — | 638,324,872 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Preferred Stock |

||||||||||||||||

| Brazil |

13,556,629 | — | — | 13,556,629 | ||||||||||||

| Germany |

— | 9,442,557 | — | 9,442,557 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Preferred Stock |

13,556,629 | 9,442,557 | — | 22,999,186 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 516,387,343 | $ | 144,936,715 | $ | — | $ | 661,324,058 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

For the period ended September 30, 2021, there have been no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

10

| THE ADVISORS’ INNER CIRCLE FUND III |

US SELECT QUALITY EQUITY FUND SEPTEMBER 30, 2021 (Unaudited) |

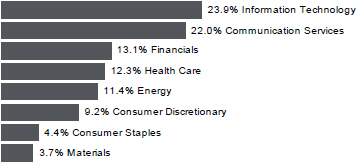

| SECTOR WEIGHTING † |

† Percentages are based on total investments.

The accompanying notes are an integral part of the financial statements.

11

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS US SELECT QUALITY EQUITY FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued |

||||||||

| Shares | Value | |||||||

| Energy — 11.1% |

||||||||

| Devon Energy |

664,942 | $ | 23,612,090 | |||||

| Exxon Mobil |

529,015 | 31,116,662 | ||||||

| Occidental Petroleum |

788,510 | 23,324,126 | ||||||

|

|

|

| ||||||

| 78,052,878 | ||||||||

|

|

|

| ||||||

| Financials — 12.6% |

||||||||

| Bank of America |

513,546 | 21,800,028 | ||||||

| Blackstone, Cl A |

263,498 | 30,655,357 | ||||||

| JPMorgan Chase |

54,623 | 8,941,239 | ||||||

| Morgan Stanley |

284,687 | 27,702,892 | ||||||

|

|

|

| ||||||

| 89,099,516 | ||||||||

|

|

|

| ||||||

| Health Care — 9.4% |

||||||||

| Eli Lilly |

59,098 | 13,654,593 | ||||||

| Johnson & Johnson |

47,734 | 7,709,041 | ||||||

| Syneos Health, Cl A * |

149,203 | 13,052,278 | ||||||

| UnitedHealth Group |

82,390 | 32,193,069 | ||||||

|

|

|

| ||||||

| 66,608,981 | ||||||||

|

|

|

| ||||||

| Information Technology — 23.1% |

||||||||

| Adobe * |

32,793 | 18,879,586 | ||||||

| Microsoft |

174,690 | 49,248,605 | ||||||

| NVIDIA |

180,369 | 37,365,242 | ||||||

| salesforce.com * |

83,449 | 22,633,038 | ||||||

| Visa, Cl A |

156,471 | 34,853,915 | ||||||

|

|

|

| ||||||

| 162,980,386 | ||||||||

|

|

|

| ||||||

| TOTAL UNITED STATES |

639,393,695 | |||||||

|

|

|

| ||||||

| Total Common Stock |

682,486,737 | |||||||

|

|

|

| ||||||

| Total Investments — 96.7% |

$ | 682,486,737 | ||||||

|

|

|

| ||||||

Percentages are based on Net Assets of $705,911,623.

| * | Non-income producing security. |

ADR — American Depositary Receipt

Cl — Class

The accompanying notes are an integral part of the financial statements.

12

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS US SELECT QUALITY EQUITY FUND SEPTEMBER 30, 2021 (Unaudited) |

As of September 30, 2021, all of the Fund’s investments were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended September 30, 2021, there have been no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

13

| THE ADVISORS’ INNER CIRCLE FUND III | QUALITY DIVIDEND INCOME FUND SEPTEMBER 30, 2021 (Unaudited) |

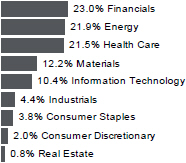

| SECTOR WEIGHTING † |

† Percentages are based on total investments.

The accompanying notes are an integral part of the financial statements.

14

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS GLOBAL QUALITY DIVIDEND INCOME FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued |

||||||||

| Shares | Value | |||||||

| GERMANY (continued) |

||||||||

| Siemens |

1,404 | $ | 229,637 | |||||

|

|

|

| ||||||

| 720,987 | ||||||||

|

|

|

| ||||||

| INDIA — 2.8% |

||||||||

| Infosys ADR |

19,411 | 431,895 | ||||||

|

|

|

| ||||||

| JAPAN — 1.5% |

||||||||

| Tokio Marine Holdings |

4,282 | 228,835 | ||||||

|

|

|

| ||||||

| LUXEMBOURG — 2.2% |

||||||||

| ArcelorMittal ADR |

11,330 | 341,713 | ||||||

|

|

|

| ||||||

| RUSSIA — 11.6% |

||||||||

| Gazprom PJSC |

64,600 | 320,883 | ||||||

| LUKOIL PJSC ADR |

2,757 | 260,978 | ||||||

| MMC Norilsk Nickel PJSC |

885 | 265,068 | ||||||

| Polyus PJSC GDR |

1,138 | 93,498 | ||||||

| Rosneft Oil PJSC |

41,227 | 348,916 | ||||||

| Sberbank of Russia PJSC |

81,132 | 379,883 | ||||||

| Severstal PAO GDR |

6,460 | 134,889 | ||||||

|

|

|

| ||||||

| 1,804,115 | ||||||||

|

|

|

| ||||||

| SINGAPORE — 0.8% |

||||||||

| Ascendas Real Estate Investment Trust ‡ |

53,775 | 118,529 | ||||||

|

|

|

| ||||||

| SPAIN — 2.4% |

||||||||

| Banco Bilbao Vizcaya Argentaria |

56,958 | 374,832 | ||||||

|

|

|

| ||||||

| SWEDEN — 0.6% |

||||||||

| Swedbank |

4,236 | 85,485 | ||||||

|

|

|

| ||||||

| SWITZERLAND — 1.6% |

||||||||

| Roche Holding |

676 | 246,908 | ||||||

|

|

|

| ||||||

| TAIWAN — 2.7% |

||||||||

| Taiwan Semiconductor Manufacturing ADR |

3,678 | 410,649 | ||||||

|

|

|

| ||||||

| UNITED KINGDOM — 4.7% |

||||||||

| AstraZeneca ADR |

12,230 | 734,534 | ||||||

|

|

|

| ||||||

| UNITED STATES — 39.5% |

||||||||

| Consumer Staples — 3.6% |

||||||||

| Coca-Cola |

5,616 | 294,672 | ||||||

The accompanying notes are an integral part of the financial statements.

15

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS GLOBAL QUALITY DIVIDEND INCOME FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued | ||||||||

| Shares | Value | |||||||

| Consumer Staples (continued) |

||||||||

| PepsiCo |

1,796 | $ | 270,136 | |||||

|

|

|

| ||||||

| 564,808 | ||||||||

|

|

|

| ||||||

| Energy — 10.3% |

||||||||

| Chevron |

3,103 | 314,799 | ||||||

| Devon Energy |

17,663 | 627,213 | ||||||

| Exxon Mobil |

11,027 | 648,608 | ||||||

|

|

|

| ||||||

| 1,590,620 | ||||||||

|

|

|

| ||||||

| Financials — 9.7% |

||||||||

| AllianceBernstein Holding (A) |

9,446 | 468,333 | ||||||

| Bank of America |

12,478 | 529,691 | ||||||

| Morgan Stanley |

5,268 | 512,629 | ||||||

|

|

|

| ||||||

| 1,510,653 | ||||||||

|

|

|

| ||||||

| Health Care — 9.6% |

||||||||

| AbbVie |

2,863 | 308,832 | ||||||

| Bristol-Myers Squibb |

6,032 | 356,913 | ||||||

| Johnson & Johnson |

2,750 | 444,125 | ||||||

| UnitedHealth Group |

986 | 385,270 | ||||||

|

|

|

| ||||||

| 1,495,140 | ||||||||

|

|

|

| ||||||

| Industrials — 1.9% |

||||||||

| L3Harris Technologies |

1,364 | 300,407 | ||||||

|

|

|

| ||||||

| Information Technology — 4.4% |

||||||||

| Broadcom |

167 | 80,983 | ||||||

| Microsoft |

2,156 | 607,820 | ||||||

|

|

|

| ||||||

| 688,803 | ||||||||

|

|

|

| ||||||

| TOTAL UNITED STATES |

6,150,431 | |||||||

|

|

|

| ||||||

| Total Common Stock |

14,808,415 | |||||||

|

|

|

| ||||||

| Total Investments — 95.4% |

$ | 14,808,415 | ||||||

|

|

|

| ||||||

Percentages are based on Net Assets of $15,527,298.

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust. |

| (A) | Security considered Master Limited Partnership. At September 30, 2021, these securities amounted to $468,333 or 3.0% of net assets. |

The accompanying notes are an integral part of the financial statements.

16

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS GLOBAL QUALITY DIVIDEND INCOME FUND SEPTEMBER 30, 2021 (Unaudited) |

ADR — American Depositary Receipt

Cl — Class

GDR — Global Depositary Receipt

PJSC — Public Joint Stock Company

The following is a summary of the level of inputs used as of September 30, 2021, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

||||||||||||||||

| Australia |

$ | — | $ | 273,597 | $ | — | $ | 273,597 | ||||||||

| Brazil |

1,353,307 | — | — | 1,353,307 | ||||||||||||

| Canada |

574,776 | — | — | 574,776 | ||||||||||||

| China |

— | 118,260 | — | 118,260 | ||||||||||||

| Denmark |

701,449 | — | — | 701,449 | ||||||||||||

| France |

— | 138,113 | — | 138,113 | ||||||||||||

| Germany |

— | 720,987 | — | 720,987 | ||||||||||||

| India |

431,895 | — | — | 431,895 | ||||||||||||

| Japan |

— | 228,835 | — | 228,835 | ||||||||||||

| Luxembourg |

341,713 | — | — | 341,713 | ||||||||||||

| Russia |

489,365 | 1,314,750 | — | 1,804,115 | ||||||||||||

| Singapore |

— | 118,529 | — | 118,529 | ||||||||||||

| Spain |

— | 374,832 | — | 374,832 | ||||||||||||

| Sweden |

— | 85,485 | — | 85,485 | ||||||||||||

| Switzerland |

— | 246,908 | — | 246,908 | ||||||||||||

| Taiwan |

410,649 | — | — | 410,649 | ||||||||||||

| United Kingdom |

734,534 | — | — | 734,534 | ||||||||||||

| United States |

6,150,431 | — | — | 6,150,431 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Common Stock |

11,188,119 | 3,620,296 | — | 14,808,415 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 11,188,119 | $ | 3,620,296 | $ | — | $ | 14,808,415 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

For the period ended September 30, 2021, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

17

| THE ADVISORS’ INNER CIRCLE FUND III | QUALITY DIVIDEND INCOME FUND SEPTEMBER 30, 2021 (Unaudited) |

| SECTOR WEIGHTING † | ||

† Percentages are based on total investments.

The accompanying notes are an integral part of the financial statements.

18

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS INTERNATIONAL QUALITY DIVIDEND INCOME FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued | ||||||||

| Shares | Value | |||||||

| DENMARK — 4.7% |

||||||||

| Novo Nordisk, Cl B |

7,525 | $ | 726,581 | |||||

|

|

|

| ||||||

| FRANCE — 5.5% |

||||||||

| BNP Paribas |

6,894 | 440,367 | ||||||

| Credit Agricole |

14,463 | 199,175 | ||||||

| Vinci |

2,085 | 216,723 | ||||||

|

|

|

| ||||||

| 856,265 | ||||||||

|

|

|

| ||||||

| GERMANY — 6.9% |

||||||||

| Daimler |

6,578 | 581,832 | ||||||

| Muenchener Rueckversicherungs-Gesellschaft in Muenchen |

714 | 194,850 | ||||||

| Siemens |

1,784 | 291,789 | ||||||

|

|

|

| ||||||

| 1,068,471 | ||||||||

|

|

|

| ||||||

| HONG KONG — 0.6% |

||||||||

| Hong Kong Exchanges & Clearing |

1,586 | 97,562 | ||||||

|

|

|

| ||||||

| INDIA — 3.4% |

||||||||

| Infosys ADR |

23,526 | 523,453 | ||||||

|

|

|

| ||||||

| JAPAN — 3.8% |

||||||||

| Inpex |

20,286 | 158,260 | ||||||

| Sumitomo Mitsui Financial Group |

5,086 | 178,186 | ||||||

| Tokio Marine Holdings |

4,647 | 248,341 | ||||||

|

|

|

| ||||||

| 584,787 | ||||||||

|

|

|

| ||||||

| LUXEMBOURG — 3.9% |

||||||||

| ArcelorMittal |

19,761 | 599,498 | ||||||

|

|

|

| ||||||

| NETHERLANDS — 0.5% |

||||||||

| Euronext |

658 | 74,514 | ||||||

|

|

|

| ||||||

| RUSSIA — 16.0% |

||||||||

| Gazprom PJSC |

126,002 | 625,881 | ||||||

| LUKOIL PJSC ADR |

5,393 | 510,501 | ||||||

| MMC Norilsk Nickel PJSC |

702 | 210,258 | ||||||

| Novolipetsk Steel PJSC GDR |

4,865 | 144,554 | ||||||

The accompanying notes are an integral part of the financial statements.

19

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS INTERNATIONAL QUALITY DIVIDEND INCOME FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued | ||||||||

| Shares | Value | |||||||

| RUSSIA (continued) |

||||||||

| Polyus PJSC GDR |

1,672 | $ | 137,371 | |||||

| Rosneft Oil PJSC |

40,112 | 339,479 | ||||||

| Sberbank of Russia PJSC ADR |

19,030 | 356,813 | ||||||

| Severstal PAO |

7,318 | 152,805 | ||||||

|

|

|

| ||||||

| 2,477,662 | ||||||||

|

|

|

| ||||||

| SINGAPORE — 0.5% |

||||||||

| Ascendas Real Estate Investment Trust ‡ |

36,087 | 79,542 | ||||||

|

|

|

| ||||||

| SOUTH KOREA — 1.8% |

||||||||

| Samsung Electronics GDR |

177 | 276,936 | ||||||

|

|

|

| ||||||

| SPAIN — 3.1% |

||||||||

| Banco Bilbao Vizcaya Argentaria ADR |

73,900 | 487,001 | ||||||

|

|

|

| ||||||

| SWEDEN — 3.7% |

||||||||

| Swedbank |

4,278 | 86,333 | ||||||

| Swedish Match |

55,739 | 488,475 | ||||||

|

|

|

| ||||||

| 574,808 | ||||||||

|

|

|

| ||||||

| SWITZERLAND — 4.1% |

||||||||

| Novartis |

2,373 | 194,155 | ||||||

| Roche Holding |

1,203 | 439,394 | ||||||

|

|

|

| ||||||

| 633,549 | ||||||||

|

|

|

| ||||||

| TAIWAN — 3.3% |

||||||||

| Taiwan Semiconductor Manufacturing ADR |

4,574 | 510,687 | ||||||

|

|

|

| ||||||

| UNITED KINGDOM — 8.0% |

||||||||

| AstraZeneca |

7,000 | 844,114 | ||||||

| British American Tobacco |

11,440 | 400,130 | ||||||

|

|

|

| ||||||

| 1,244,244 | ||||||||

|

|

|

| ||||||

| UNITED STATES — 7.0% |

||||||||

| Consumer Staples — 6.0% |

||||||||

| Philip Morris International |

9,804 | 929,321 | ||||||

|

|

|

| ||||||

The accompanying notes are an integral part of the financial statements.

20

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS INTERNATIONAL QUALITY DIVIDEND INCOME FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued | ||||||||

| Shares | Value | |||||||

| Information Technology — 1.0% |

||||||||

| Broadcom |

336 | $ | 162,937 | |||||

|

|

|

| ||||||

| TOTAL UNITED STATES |

1,092,258 | |||||||

|

|

|

| ||||||

| Total Common Stock |

||||||||

| (Cost $15,302,783) |

15,281,223 | |||||||

|

|

|

| ||||||

| PREFERRED STOCK — 0.5% | ||||||||

| GERMANY — 0.5% |

||||||||

| Volkswagen, 2.80% |

||||||||

| (Cost $79,428) |

317 | 70,597 | ||||||

|

|

|

| ||||||

| Total Investments — 99.0% |

||||||||

| (Cost $15,382,211) |

$ | 15,351,820 | ||||||

|

|

|

| ||||||

Percentages are based on Net Assets of $15,511,820.

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust. |

ADR — American Depositary Receipt

Cl — Class

GDR — Global Depositary Receipt

PJSC — Public Joint Stock Company

The accompanying notes are an integral part of the financial statements.

21

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS INTERNATIONAL QUALITY DIVIDEND INCOME FUND SEPTEMBER 30, 2021 (Unaudited) |

The following is a summary of the level of inputs used as of September 30, 2021, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

||||||||||||||||

| Australia |

$ | — | $ | 624,636 | $ | — | $ | 624,636 | ||||||||

| Belgium |

— | 356,542 | — | 356,542 | ||||||||||||

| Brazil |

1,267,177 | — | — | 1,267,177 | ||||||||||||

| Canada |

778,034 | — | — | 778,034 | ||||||||||||

| China |

— | 347,016 | — | 347,016 | ||||||||||||

| Denmark |

— | 726,581 | — | 726,581 | ||||||||||||

| France |

— | 856,265 | — | 856,265 | ||||||||||||

| Germany |

— | 1,068,471 | — | 1,068,471 | ||||||||||||

| Hong Kong |

— | 97,562 | — | 97,562 | ||||||||||||

| India |

523,453 | — | — | 523,453 | ||||||||||||

| Japan |

— | 584,787 | — | 584,787 | ||||||||||||

| Luxembourg |

— | 599,498 | — | 599,498 | ||||||||||||

| Netherlands |

— | 74,514 | — | 74,514 | ||||||||||||

| Russia |

1,149,239 | 1,328,423 | — | 2,477,662 | ||||||||||||

| Singapore |

— | 79,542 | — | 79,542 | ||||||||||||

| South Korea |

276,936 | — | — | 276,936 | ||||||||||||

| Spain |

487,001 | — | — | 487,001 | ||||||||||||

| Sweden |

— | 574,808 | — | 574,808 | ||||||||||||

| Switzerland |

— | 633,549 | — | 633,549 | ||||||||||||

| Taiwan |

510,687 | — | — | 510,687 | ||||||||||||

| United Kingdom |

— | 1,244,244 | — | 1,244,244 | ||||||||||||

| United States |

1,092,258 | — | — | 1,092,258 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Common Stock |

6,084,785 | 9,196,438 | — | 15,281,223 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Preferred Stock |

||||||||||||||||

| Germany |

— | 70,597 | — | 70,597 | ||||||||||||

|

|

|

|||||||||||||||

| Total Investments in Securities |

$ | 6,084,785 | $ | 9,267,035 | $ | — | $ | 15,351,820 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

For the period ended September 30, 2021, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

22

| THE ADVISORS’ INNER CIRCLE FUND III | DIVIDEND INCOME FUND SEPTEMBER 30, 2021 (Unaudited) |

| SECTOR WEIGHTING † |

† Percentages are based on total investments.

The accompanying notes are an integral part of the financial statements.

23

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS US QUALITY DIVIDEND INCOME FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued | ||||||||

| Shares | Value | |||||||

| Consumer Staples (continued) |

||||||||

| Coca-Cola |

8,351 | $ | 438,177 | |||||

| PepsiCo |

999 | 150,259 | ||||||

| Philip Morris International |

8,159 | 773,392 | ||||||

|

|

|

| ||||||

| 2,010,306 | ||||||||

|

|

|

| ||||||

| Energy — 16.2% |

||||||||

| Chevron |

6,454 | 654,758 | ||||||

| Devon Energy |

29,438 | 1,045,344 | ||||||

| Exxon Mobil |

14,394 | 846,655 | ||||||

|

|

|

| ||||||

| 2,546,757 | ||||||||

|

|

|

| ||||||

| Financials — 20.2% |

||||||||

| AllianceBernstein Holding (A) |

10,900 | 540,422 | ||||||

| Bank of America |

15,817 | 671,432 | ||||||

| Blackstone, Cl A |

6,290 | 731,779 | ||||||

| CME Group, Cl A |

1,409 | 272,472 | ||||||

| JPMorgan Chase |

1,868 | 305,773 | ||||||

| Morgan Stanley |

6,866 | 668,130 | ||||||

|

|

|

| ||||||

| 3,190,008 | ||||||||

|

|

|

| ||||||

| Health Care — 11.7% |

||||||||

| AbbVie |

2,703 | 291,573 | ||||||

| Bristol-Myers Squibb |

5,700 | 337,269 | ||||||

| Johnson & Johnson |

3,803 | 614,185 | ||||||

| Merck |

1,877 | 140,981 | ||||||

| UnitedHealth Group |

1,185 | 463,027 | ||||||

|

|

|

| ||||||

| 1,847,035 | ||||||||

|

|

|

| ||||||

| Industrials — 3.5% |

||||||||

| L3Harris Technologies |

1,421 | 312,961 | ||||||

| United Parcel Service, Cl B |

1,328 | 241,829 | ||||||

|

|

|

| ||||||

| 554,790 | ||||||||

|

|

|

| ||||||

| Information Technology — 8.5% |

||||||||

| Broadcom |

632 | 306,476 | ||||||

| Microsoft |

2,526 | 712,130 | ||||||

| Texas Instruments |

1,641 | 315,416 | ||||||

|

|

|

| ||||||

| 1,334,022 | ||||||||

|

|

|

| ||||||

| Materials — 2.3% |

||||||||

| Newmont |

6,670 | 362,181 | ||||||

|

|

|

| ||||||

| TOTAL UNITED STATES |

13,466,545 | |||||||

|

|

|

| ||||||

The accompanying notes are an integral part of the financial statements.

24

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS US QUALITY DIVIDEND INCOME FUND SEPTEMBER 30, 2021 (Unaudited) |

| COMMON STOCK — continued | ||||||||

| Shares | Value | |||||||

| Total Common Stock |

||||||||

| (Cost $15,097,358) |

$ | 15,229,755 | ||||||

|

|

|

| ||||||

| Total Investments — 96.7% |

||||||||

| (Cost $15,097,358) |

$ | 15,229,755 | ||||||

|

|

|

| ||||||

Percentages are based on Net Assets of $15,746,957.

| (A) | Security considered Master Limited Partnership. At September 30, 2021, these securities amounted to $540,422 or 3.4% of net assets. |

ADR — American Depositary Receipt

Cl — Class

As of September 30, 2021, all of the Fund’s investments were considered level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the period ended September 30, 2021, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements

The accompanying notes are an integral part of the financial statements.

25

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS FUNDS SEPTEMBER 30, 2021 (Unaudited) |

| STATEMENTS OF ASSETS AND LIABILITIES |

| GQG Partners Emerging Markets Equity Fund |

GQG Partners Global Quality Equity Fund |

GQG Partners US Select Quality Equity Fund | ||||||||||

| Assets: |

||||||||||||

| Investments, at Value (Cost $7,075,696,991, $574,507,131 and $569,247,573) |

$ | 8,431,622,773 | $ | 661,324,058 | $ | 682,486,737 | ||||||

| Foreign Currency, at Value (Cost $21,520,209, $1,357,168 and $–) |

21,520,199 | 1,357,167 | – | |||||||||

| Cash |

224,634,800 | 24,807,447 | 25,728,178 | |||||||||

| Receivable for Investment Securities Sold |

106,320,557 | 8,236,684 | 11,182,547 | |||||||||

| Dividend and Interest Receivable |

16,841,630 | 223,164 | 380,224 | |||||||||

| Receivable for Capital Shares Sold |

16,614,871 | 909,762 | 2,705,754 | |||||||||

| Unrealized Gain on Foreign Spot Currency Contracts |

34,276 | – | – | |||||||||

| Reclaim Receivable |

– | 244,738 | – | |||||||||

| Other Prepaid Expenses |

83,413 | 55,882 | 20,123 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Total Assets |

8,817,672,519 | 697,158,902 | 722,503,563 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Liabilities: |

||||||||||||

| Accrued Foreign Capital Gains Tax on Appreciated Securities |

61,711,015 | – | – | |||||||||

| Payable for Capital Shares Redeemed |

7,054,969 | 303,801 | 8,204 | |||||||||

| Payable to Investment Adviser |

6,650,184 | 377,756 | 250,665 | |||||||||

| Payable for Investment Securities Purchased |

3,874,663 | 9,464,713 | 16,214,156 | |||||||||

| Payable to Administrator |

239,465 | 18,823 | 19,410 | |||||||||

| Chief Compliance Officer Fees Payable |

7,315 | 122 | 161 | |||||||||

| Payable to Trustees |

2,056 | 267 | 198 | |||||||||

| Unrealized Loss on Foreign Spot Currency Contracts |

– | 7,384 | – | |||||||||

| Shareholder Servicing Fees Payable, Investor Shares |

– | 104 | – | |||||||||

| Other Accrued Expenses and Other Payables |

989,728 | 108,424 | 99,146 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Total Liabilities |

80,529,395 | 10,281,394 | 16,591,940 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Assets |

$ | 8,737,143,124 | $ | 686,877,508 | $ | 705,911,623 | ||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Assets Consist of: |

||||||||||||

| Paid-in Capital |

$ | 7,333,289,497 | $ | 604,124,551 | $ | 588,897,841 | ||||||

| Total Distributable Earnings |

1,403,853,627 | 82,752,957 | 117,013,782 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Assets |

$ | 8,737,143,124 | $ | 686,877,508 | $ | 705,911,623 | ||||||

|

|

|

|

|

|

|

|

|

| ||||

The accompanying notes are an integral part of the financial statements.

26

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS FUNDS SEPTEMBER 30, 2021 (Unaudited) |

| STATEMENTS OF ASSETS AND LIABILITIES | ||||||

| GQG Partners Emerging Markets Equity Fund |

GQG Partners Global Quality Equity Fund |

GQG Partners US Select Quality Equity Fund | ||||||||||

| Investor Shares: |

||||||||||||

| Net Assets |

$ | 166,787,807 | $ | 2,162,676 | $ | 2,198,875 | ||||||

| Outstanding Shares of beneficial interest (unlimited authorization — no par value) |

9,553,059 | 150,324 | 137,539 | |||||||||

| Net Asset Value, Offering and Redemption Price Per Share |

$17.46 | $14.39 | $15.99 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Institutional Shares: |

||||||||||||

| Net Assets |

$ | 8,499,636,880 | $ | 636,107,488 | $ | 694,602,247 | ||||||

| Outstanding Shares of beneficial interest (unlimited authorization — no par value) |

484,412,784 | 44,106,577 | 43,349,790 | |||||||||

| Net Asset Value, Offering and Redemption Price Per Share |

$17.55 | $14.42 | $16.02 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| R6 Shares: |

||||||||||||

| Net Assets |

$ | 70,718,437 | $ | 48,607,344 | $ | 9,110,501 | ||||||

| Outstanding Shares of beneficial interest (unlimited authorization — no par value) |

4,030,471 | 3,371,594 | 568,387 | |||||||||

| Net Asset Value, Offering and Redemption Price Per Share |

$17.55 | $14.42 | $16.03 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

Amounts designated as “ —” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

27

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS FUNDS SEPTEMBER 30, 2021 (Unaudited) |

| STATEMENTS OF ASSETS AND LIABILITIES | ||||||

| GQG Partners Global Quality Dividend Income Fund |

GQG Partners International Quality Dividend Income Fund |

GQG Partners U.S. Quality Dividend Income Fund | ||||||||||

| Assets: |

||||||||||||

| Investments, at Value (Cost $14,804,580, $15,382,211 and $15,097,358) |

$ | 14,808,415 | $ | 15,351,820 | $ | 15,229,755 | ||||||

| Foreign Currency, at Value (Cost $–, $8,669 and $–) |

– | 8,669 | – | |||||||||

| Cash |

518,294 | 67,080 | 958,364 | |||||||||

| Receivable for Investment Securities Sold |

424,841 | 571,994 | – | |||||||||

| Dividend and Interest Receivable |

46,916 | 57,013 | 25,832 | |||||||||

| Receivable from Investment Advisor |

13,489 | 13,132 | 15,010 | |||||||||

| Deferred Offering Costs (Note 2) |

1,711 | 1,711 | 1,711 | |||||||||

| Reclaim Receivable |

953 | 2,653 | – | |||||||||

| Unrealized Gain on Foreign Spot Currency Contracts |

474 | – | – | |||||||||

| Other Prepaid Expenses |

2,412 | 2,411 | 2,412 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Total Assets |

15,817,505 | 16,076,483 | 16,233,084 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Liabilities: |

||||||||||||

| Payable for Investment Securities Purchased |

273,035 | 547,592 | 472,347 | |||||||||

| Payable to Administrator |

5,342 | 5,342 | 5,342 | |||||||||

| Payable to Trustees |

9 | 9 | 9 | |||||||||

| Chief Compliance Officer Fees Payable |

6 | 6 | 6 | |||||||||

| Unrealized Loss on Foreign Spot Currency Contracts |

– | 372 | – | |||||||||

| Other Accrued Expenses and Other Payables |

11,815 | 11,342 | 8,423 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Total Liabilities |

290,207 | 564,663 | 486,127 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Assets |

$ | 15,527,298 | $ | 15,511,820 | $ | 15,746,957 | ||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Assets Consist of: |

||||||||||||

| Paid-in Capital |

$ | 15,501,222 | $ | 15,550,197 | $ | 15,550,197 | ||||||

| Total Distributable Earnings/(Loss) |

26,076 | (38,377 | ) | 196,760 | ||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Assets |

$ | 15,527,298 | $ | 15,511,820 | $ | 15,746,957 | ||||||

|

|

|

|

|

|

|

|

|

| ||||

The accompanying notes are an integral part of the financial statements.

28

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS FUNDS SEPTEMBER 30, 2021 (Unaudited) |

| STATEMENTS OF ASSETS AND LIABILITIES | ||||||

| GQG Partners Global Quality Dividend Income Fund |

GQG Partners International Quality Dividend Income Fund |

GQG Partners U.S. Quality Dividend Income Fund | ||||||||||

| Investor Shares: |

||||||||||||

| Net Assets |

$ | 990,037 | $ | 986,273 | $ | 1,011,168 | ||||||

| Outstanding Shares of beneficial interest (unlimited authorization — no par value) |

100,011 | 100,011 | 100,011 | |||||||||

| Net Asset Value, Offering and Redemption Price Per Share |

$9.90 | $9.86 | $10.11 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Institutional Shares: |

||||||||||||

| Net Assets |

$ | 14,537,261 | $ | 14,525,547 | $ | 14,735,789 | ||||||

| Outstanding Shares of beneficial interest (unlimited authorization — no par value) |

1,468,292 | 1,473,200 | 1,457,723 | |||||||||

| Net Asset Value, Offering and Redemption Price Per Share |

$9.90 | $9.86 | $10.11 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

Amounts designated as “ —” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

29

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS FUNDS FOR THE PERIOD OR YEAR ENDED SEPTEMBER 30, 2021 AND JULY 31, 2021

|

| STATEMENTS OF OPERATIONS |

| GQG Partners Emerging Markets Equity Fund | ||||||||

| Period Ended (Unaudited) |

Year Ended July 31, 2021 | |||||||

|

|

|

| ||||||

| Investment Income: |

||||||||

| Dividends |

$ | 65,330,986 | $ | 145,979,972 | ||||

| Interest |

2,624 | 19,811 | ||||||

| Less: Foreign Taxes Withheld |

(2,536,936 | ) | (16,471,808 | ) | ||||

|

|

|

|

|

|

| |||

| Total Investment Income |

62,796,674 | 129,527,975 | ||||||

|

|

|

|

|

|

| |||

| Expenses: |

||||||||

| Investment Advisory Fees |

13,388,759 | 61,777,382 | ||||||

| Administration Fees |

485,241 | 2,531,756 | ||||||

| Shareholder Serving Fees, Investor Shares |

52,738 | 260,007 | ||||||

| Trustees’ Fees |

6,419 | 32,239 | ||||||

| Chief Compliance Officer Fees |

3,381 | 9,943 | ||||||

| Custodian Fees |

361,990 | 1,597,867 | ||||||

| Registration and Filing Fees |

135,415 | 477,441 | ||||||

| Transfer Agent Fees |

74,812 | 420,665 | ||||||

| Legal Fees |

17,383 | 108,487 | ||||||

| Audit Fees |

6,251 | 25,361 | ||||||

| Printing Fees |

– | 188,650 | ||||||

| Other Expenses |

64,937 | 102,317 | ||||||

|

|

|

|

|

|

| |||

| Total Expenses |

14,597,326 | 67,532,115 | ||||||

|

|

|

|

|

|

| |||

| Less: |

||||||||

| Waiver of Investment Advisory Fees |

(508,262 | ) | (556,088 | ) | ||||

| Advisory Waiver Recapture - Note 5 |

544,647 | 633,046 | ||||||

| Fees Paid Indirectly |

(2,140 | ) | (18,193 | ) | ||||

|

|

|

|

|

|

| |||

| Net Expenses |

14,631,571 | 67,590,880 | ||||||

|

|

|

|

|

|

| |||

| Net Investment Income |

48,165,103 | 61,937,095 | ||||||

|

|

|

|

|

|

| |||

| Net Realized Gain (Loss) on: |

||||||||

| Investments |

(85,628,582 | ) | 395,544,724 | |||||

| Foreign Currency Transactions |

(1,833,181 | ) | (8,681,722 | ) | ||||

|

|

|

|

|

|

| |||

| Net Realized Gain (Loss) |

(87,461,763 | ) | 386,863,002 | |||||

|

|

|

|

|

|

| |||

| Net Change in Unrealized Appreciation (Depreciation) on: |

||||||||

| Investments |

(31,334,135 | ) | 406,364,273 | |||||

| Accrued Foreign Capital Gains Tax on Appreciated Securities |

(25,383,989 | ) | (23,034,369 | ) | ||||

| Foreign Currency Translation |

(872,321 | ) | 507,983 | |||||

|

|

|

|

|

|

| |||

| Net Change in Unrealized Appreciation (Depreciation) |

(57,590,445 | ) | 383,837,887 | |||||

|

|

|

|

|

|

| |||

| Net Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions |

(145,052,208 | ) | 770,700,889 | |||||

|

|

|

|

|

|

| |||

| Net Increase (Decrease) in Net Assets Resulting from Operations |

$ | (96,887,105 | ) | $ | 832,637,984 | |||

|

|

|

|

|

|

| |||

The accompanying notes are an integral part of the financial statements.

30

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS FUNDS FOR THE PERIOD OR YEAR ENDED SEPTEMBER 30, 2021 AND JULY 31, 2021 |

| STATEMENTS OF OPERATIONS |

| (1) | For the period August 1, 2021 to September 30, 2021. Effective September 23, 2021, the Fund changed its fiscal year end to March 31st (see Note 1 in the Notes to Financial Statements). |

| Amounts designated as “—” are $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements.

31

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS FUNDS FOR THE PERIOD OR YEAR ENDED SEPTEMBER 30, 2021 AND JULY 31, 2021 |

| STATEMENTS OF OPERATIONS |

| GQG Partners Global Quality Equity Fund | ||||||||

| Period Ended September 30, 2021(1) (Unaudited) |

Year Ended | |||||||

|

|

|

| ||||||

| Investment Income: |

||||||||

| Dividends |

$ | 3,686,085 | $ | 6,841,904 | ||||

| Interest |

252 | 801 | ||||||

| Less: Foreign Taxes Withheld |

(67,395 | ) | (382,851 | ) | ||||

|

|

|

|

|

|

| |||

| Total Investment Income |

3,618,942 | 6,459,854 | ||||||

|

|

|

|

|

|

| |||

| Expenses: |

||||||||

| Investment Advisory Fees |

754,841 | 2,589,327 | ||||||

| Administration Fees |

37,878 | 145,707 | ||||||

| Shareholder Serving Fees, Investor Shares |

525 | 2,319 | ||||||

| Trustees’ Fees |

477 | 1,843 | ||||||

| Chief Compliance Officer Fees |

277 | 1,987 | ||||||

| Registration and Filing Fees |

31,990 | 119,730 | ||||||

| Transfer Agent Fees |

13,193 | 77,659 | ||||||

| Custodian Fees |

12,217 | 56,178 | ||||||

| Audit Fees |

6,175 | 25,061 | ||||||

| Legal Fees |

1,298 | 6,003 | ||||||

| Printing Fees |

– | 10,746 | ||||||

| Other Expenses |

5,095 | 9,392 | ||||||

|

|

|

|

|

|

| |||

| Total Expenses |

863,966 | 3,045,952 | ||||||

|

|

|

|

|

|

| |||

| Less: |

||||||||

| Waiver of Investment Advisory Fees |

(33,111 | ) | (57,565 | ) | ||||

| Advisory Waiver Recapture - Note 5 |

36,736 | – | ||||||

| Fees Paid Indirectly |

(41 | ) | (223 | ) | ||||

|

|

|

|

|

|

| |||

| Net Expenses |

867,550 | 2,988,164 | ||||||

|

|

|

|

|

|

| |||

| Net Investment Income |

2,751,392 | 3,471,690 | ||||||

|

|

|

|

|

|

| |||

| Net Realized Gain (Loss) on: |

||||||||

| Investments |

(5,653,826 | ) | (981,838 | ) | ||||

| Foreign Currency Transactions |

(29,761 | ) | (328,813 | ) | ||||

|

|

|

|

|

|

| |||

| Net Realized Loss |

(5,683,587 | ) | (1,310,651 | ) | ||||

|

|

|

|

|

|

| |||

| Net Change in Unrealized Appreciation (Depreciation) on: |

||||||||

| Investments |

(8,515,460 | ) | 67,418,398 | |||||

| Foreign Currency Translation |

(7,317 | ) | 1,745 | |||||

|

|

|

|

|

|

| |||

| Net Change in Unrealized Appreciation (Depreciation) |

(8,522,777 | ) | 67,420,143 | |||||

|

|

|

|

|

|

| |||

| Net Realized and Unrealized Gain (Loss) on Investments and Foreign |

||||||||

| Currency Transactions |

(14,206,364 | ) | 66,109,492 | |||||

|

|

|

|

|

|

| |||

| Net Increase (Decrease) in Net Assets Resulting from Operations |

$ | (11,454,972 | ) | $ | 69,581,182 | |||

|

|

|

|

|

|

| |||

| (1) | For the period August 1, 2021 to September 30, 2021. Effective September 23, 2021, the Fund changed its fiscal year end to March 31st (see Note 1 in the Notes to Financial Statements). |

The accompanying notes are an integral part of the financial statements.

32

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS FUNDS FOR THE PERIOD OR YEAR ENDED SEPTEMBER 30, 2021 AND JULY 31, 2021 |

| STATEMENTS OF OPERATIONS |

Amounts designated as “ —” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

33

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS FUNDS FOR THE PERIOD OR YEAR ENDED SEPTEMBER 30, 2021 AND JULY 31, 2021 |

| STATEMENTS OF OPERATIONS |

| GQG Partners US Select Quality Equity Fund | ||||||||

| Period Ended (Unaudited) |

Year Ended July 31, 2021 | |||||||

|

|

|

| ||||||

| Investment Income: |

||||||||

| Dividends |

$ | 1,639,208 | $ | 6,115,812 | ||||

| Interest |

248 | 1,121 | ||||||

| Less: Foreign Taxes Withheld |

– | (32,469 | ) | |||||

|

|

|

|

|

|

| |||

| Total Investment Income |

1,639,456 | 6,084,464 | ||||||

|

|

|

|

|

|

| |||

| Expenses: |

||||||||

| Investment Advisory Fees |

531,492 | 2,125,763 | ||||||

| Administration Fees |

38,522 | 170,900 | ||||||

| Trustees’ Fees |

496 | 2,003 | ||||||

| Shareholder Serving Fees, Investor Shares |

375 | 1,645 | ||||||

| Chief Compliance Officer Fees |

284 | 2,088 | ||||||

| Registration and Filing Fees |

17,214 | 91,498 | ||||||

| Transfer Agent Fees |

13,509 | 79,191 | ||||||

| Audit Fees |

6,175 | 25,061 | ||||||

| Custodian Fees |

1,593 | 8,858 | ||||||

| Legal Fees |

1,344 | 6,946 | ||||||

| Printing Fees |

– | 8,135 | ||||||

| Other Expenses |

5,043 | 7,681 | ||||||

|

|

|

|

|

|

| |||

| Total Expenses |

616,047 | 2,529,769 | ||||||

|

|

|

|

|

|

| |||

| Less: |

||||||||

| Waiver of Investment Advisory Fees |

(214,438 | ) | (211,769 | ) | ||||

| Advisory Waiver Recapture - Note 5 |

176,735 | – | ||||||

| Fees Paid Indirectly |

(8 | ) | (71 | ) | ||||

|

|

|

|

|

|

| |||

| Net Expenses |

578,336 | 2,317,929 | ||||||

|

|

|

|

|

|

| |||

| Net Investment Income |

1,061,120 | 3,766,535 | ||||||

|

|

|

|

|

|

| |||

| Net Realized Gain (Loss) on: |

||||||||

| Investments |

(6,499,846 | ) | 6,466,282 | |||||

|

|

|

|

|

|

| |||

| Net Realized Gain (Loss) |

(6,499,846 | ) | 6,466,282 | |||||

|

|

|

|

|

|

| |||

| Net Change in Unrealized Appreciation (Depreciation) on: |

||||||||

| Investments |

(14,210,766 | ) | 101,748,985 | |||||

|

|

|

|

|

|

| |||

| Net Change in Unrealized Appreciation (Depreciation) |

(14,210,766 | ) | 101,748,985 | |||||

|

|

|

|

|

|

| |||

| Net Realized and Unrealized Gain (Loss) on Investments |

(20,710,612 | ) | 108,215,267 | |||||

|

|

|

|

|

|

| |||

| Net Increase (Decrease) in Net Assets Resulting from Operations |

$ | (19,649,492 | ) | $ | 111,981,802 | |||

|

|

|

|

|

|

| |||

| (1) | For the period August 1, 2021 to September 30, 2021. Effective September 23, 2021, the Fund changed its fiscal year end to March 31st (see Note 1 in the Notes to Financial Statements). |

Amounts designated as “ —” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

34

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS FUNDS FOR THE PERIOD ENDED SEPTEMBER 30, 2021 (Unaudited) |

| STATEMENTS OF OPERATIONS | ||

| GQG Partners Global Quality Dividend Income Fund(1) |

GQG Partners International Quality Dividend Income Fund(1) |

GQG Partners U.S. Quality Dividend Income Fund(1) | ||||||||||

| Investment Income: |

||||||||||||

| Dividends |

$ | 149,949 | $ | 169,468 | $ | 90,124 | ||||||

| Interest |

10 | 7 | 8 | |||||||||

| Less: Foreign Taxes Withheld |

(11,495 | ) | (14,170 | ) | (708 | ) | ||||||

|

|

|

|

|

|

|

|

|

| ||||

| Total Investment Income |

138,464 | 155,305 | 89,424 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Expenses: |

||||||||||||

| Investment Advisory Fees |

17,169 | 17,114 | 12,007 | |||||||||

| Administration Fees |

16,383 | 16,383 | 16,383 | |||||||||

| Trustees’ Fees |

9 | 9 | 9 | |||||||||

| Chief Compliance Officer Fees |

6 | 6 | 6 | |||||||||

| Offering Costs |

19,659 | 19,659 | 19,659 | |||||||||

| Transfer Agent Fees |

10,717 | 10,717 | 10,717 | |||||||||

| Audit Fees |

8,368 | 8,368 | 8,268 | |||||||||

| Custodian Fees |

4,243 | 4,269 | 1,813 | |||||||||

| Registration and Filing Fees |

500 | 500 | 500 | |||||||||

| Legal Fees |

26 | 26 | 26 | |||||||||

| Other Expenses |

929 | 929 | 557 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Total Expenses |

78,009 | 77,980 | 69,945 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Less: |

||||||||||||

| Waiver of Investment Advisory Fees |

(17,169 | ) | (17,114 | ) | (12,007 | ) | ||||||

| Reimbursement from Adviser |

(41,030 | ) | (40,066 | ) | (44,865 | ) | ||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Expenses |

19,810 | 20,800 | 13,073 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Investment Income |

118,654 | 134,505 | 76,351 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Realized Gain (Loss) on: |

||||||||||||

| Investments |

(93,482 | ) | (135,818 | ) | (11,988 | ) | ||||||

| Foreign Currency Transactions |

(2,302 | ) | (6,309 | ) | – | |||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Realized Loss |

(95,784 | ) | (142,127 | ) | (11,988 | ) | ||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Change in Unrealized Appreciation (Depreciation) on: |

||||||||||||

| Investments |

3,835 | (30,391 | ) | 132,397 | ||||||||

| Foreign Currency Translation |

(629 | ) | (364 | ) | – | |||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Change in Unrealized Appreciation (Depreciation) |

3,206 | (30,755 | ) | 132,397 | ||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions |

(92,578 | ) | (172,882 | ) | 120,409 | |||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Increase (Decrease) in Net Assets Resulting from Operations |

$ | 26,076 | $ | (38,377 | ) | $ | 196,760 | |||||

|

|

|

|

|

|

|

|

|

| ||||

(1) Commenced operations on June 30, 2021.

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

35

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS EMERGING MARKETS EQUITY FUND

|

(1) For the period August 1, 2021 to September 30, 2021. Effective September 23, 2021, the Fund changed its fiscal year end to March 31st (see Note 1 in the Notes to Financial Statements).

| (2) | See Note 7 in Notes to Financial Statements. |

Amounts designated as “ —” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

36

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS GLOBAL QUALITY EQUITY FUND

|

| STATEMENTS OF CHANGES IN NET ASSETS | ||||||||||||

| Period Ended | ||||||||||||

| September | ||||||||||||

| 30, 2021(1) | Year Ended | Year Ended | ||||||||||

| (Unaudited) | July 31, 2021 | July 31, 2020 | ||||||||||

| Operations: |

||||||||||||

| Net Investment Income |

$ | 2,751,392 | $ | 3,471,690 | $ | 399,863 | ||||||

| Net Realized Loss on Investments and Foreign Currency Transactions |

(5,683,587 | ) | (1,310,651 | ) | (3,157,298 | ) | ||||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Translation |

(8,522,777 | ) | 67,420,143 | 27,213,931 | ||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Increase (Decrease) in Net Assets Resulting From Operations |

(11,454,972 | ) | 69,581,182 | 24,456,496 | ||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Distributions |

||||||||||||

| Institutional Shares |

– | (397,457 | ) | (28,984 | ) | |||||||

| R6 Shares |

– | (358 | ) | (98 | ) | |||||||

|

|

|

|

|

|

|

|

|

| ||||

| Total Distributions |

– | (397,815 | ) | (29,082 | ) | |||||||

|

|

|

|

|

|

|

|

|

| ||||

| Capital Share Transactions (2): |

||||||||||||

| Investor Shares |

||||||||||||

| Issued |

185,350 | 946,932 | 829,887 | |||||||||

| Redeemed |

(2,794 | ) | (435,871 | ) | (82,432 | ) | ||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Investor Shares Transactions |

182,556 | 511,061 | 747,455 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Institutional Shares |

||||||||||||

| Issued |

40,294,633 | 432,020,577 | 170,687,747 | |||||||||

| Reinvestment of Distributions |

– | 395,333 | 28,962 | |||||||||

| Redeemed |

(4,145,369 | ) | (88,747,400 | ) | (11,336,661 | ) | ||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Institutional Shares Transactions |

36,149,264 | 343,668,510 | 159,380,048 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| R6 Shares |

||||||||||||

| Issued |

– | 49,246,709 | – | |||||||||

| Reinvestment of Distributions |

– | 358 | 98 | |||||||||

| Redeemed |

(3,200,000 | ) | – | – | ||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net R6 Shares Transactions |

(3,200,000 | ) | 49,247,067 | 98 | ||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Increase in Net Assets From Capital Share Transactions |

33,131,820 | 393,426,638 | 160,127,601 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Total Increase in Net Assets |

21,676,848 | 462,610,005 | 184,555,015 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Assets: |

||||||||||||

| Beginning of Year or Period |

665,200,660 | 202,590,655 | 18,035,640 | |||||||||

|

|

|

|

|

|

|

|

|

| ||||

| End of Year or Period |

$ | 686,877,508 | $ | 665,200,660 | $ | 202,590,655 | ||||||

|

|

|

|

|

|

|

|

|

| ||||

(1) For the period August 1, 2021 to September 30, 2021. Effective September 23, 2021, the Fund changed its fiscal year end to March 31st (see Note 1 in the Notes to Financial Statements).

(2) See Note 7 in Notes to Financial Statements.

Amounts designated as “ —” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

37

| THE ADVISORS’ INNER CIRCLE FUND III | GQG PARTNERS US SELECT QUALITY EQUITY FUND

|

| STATEMENTS OF CHANGES IN NET ASSETS | ||||||||||||

| Period Ended | ||||||||||||

| September | ||||||||||||

| 30, 2021(1) | Year Ended | Year Ended | ||||||||||

| (Unaudited) | July 31, 2021 | July 31, 2020 | ||||||||||

| Operations: |

||||||||||||

| Net Investment Income |

$ | 1,061,120 | $ | 3,766,535 | $ | 388,135 | ||||||

| Net Realized Gain (Loss) on Investments |

(6,499,846 | ) | 6,466,282 | 2,955,429 | ||||||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments |

(14,210,766 | ) | 101,748,985 | 21,793,361 | ||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Net Increase (Decrease) in Net Assets Resulting From Operations |

(19,649,492 | ) | 111,981,802 | 25,136,925 | ||||||||

|

|

|

|

|

|

|

|

|

| ||||

| Distributions |

||||||||||||

| Investor Shares |

– | (9,539 | ) | (3,115 | ) | |||||||