Form N-CSRS AB CAP FUND, INC. For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-01716

AB CAP FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: March 31, 2022

Date of reporting period: September 30, 2021

ITEM 1. REPORTS TO STOCKHOLDERS.

SEP 09.30.21

SEMI-ANNUAL REPORT

AB EMERGING MARKETS

MULTI-ASSET PORTFOLIO

As of January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, the Fund’s annual and semi-annual shareholder reports are no longer sent by mail, unless you specifically requested paper copies of the reports. Instead, the reports are made available on a website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

You may elect to receive all future reports in paper form free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call the Fund at (800) 221 5672. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary or, if you invest directly, to all AB Mutual Funds you hold.

| Investment Products Offered | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed | |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-PORT may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC 0330. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| FROM THE PRESIDENT |

|

Dear Shareholder,

We’re pleased to provide this report for the AB Emerging Markets Multi-Asset Portfolio (the “Fund”). Please review the discussion of Fund performance, the market conditions during the reporting period and the Fund’s investment strategy.

At AB, we’re striving to help our clients achieve better outcomes by:

| + | Fostering diverse perspectives that give us a distinctive approach to navigating global capital markets |

| + | Applying differentiated investment insights through a connected global research network |

| + | Embracing innovation to design better ways to invest and leading-edge mutual-fund solutions |

Whether you’re an individual investor or a multibillion-dollar institution, we’re putting our knowledge and experience to work for you every day.

For more information about AB’s comprehensive range of products and shareholder resources, please log on to www.abfunds.com.

Thank you for your investment in AB mutual funds—and for placing your trust in our firm.

Sincerely,

Onur Erzan

President and Chief Executive Officer, AB Mutual Funds

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 1 | |

SEMI-ANNUAL REPORT

November 8, 2021

This report provides management’s discussion of fund performance for the AB Emerging Markets Multi-Asset Portfolio for the semi-annual reporting period ended September 30, 2021.

The Fund’s investment objective is to maximize total return. Total return is the sum of capital appreciation and income.

NAV RETURNS AS OF SEPTEMBER 30, 2021 (unaudited)

| 6 Months | 12 Months | |||||||

| AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | ||||||||

| Class A Shares | -1.84% | 16.31% | ||||||

| Class C Shares | -2.23% | 15.38% | ||||||

| Advisor Class Shares1 | -1.62% | 16.67% | ||||||

| Class R Shares1 | -1.88% | 16.08% | ||||||

| Class K Shares1 | -1.82% | 16.37% | ||||||

| Class I Shares1 | -1.72% | 16.61% | ||||||

| Class Z Shares1 | -1.62% | 16.69% | ||||||

| MSCI EM Index (net) | -3.45% | 18.20% | ||||||

| 1 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

Please keep in mind that high, double-digit returns are highly unusual and cannot be sustained. Investors should also be aware that these returns were primarily achieved during favorable market conditions.

INVESTMENT RESULTS

The table above shows the Fund’s performance compared to its benchmark, the Morgan Stanley Capital International Emerging Markets (“MSCI EM”) Index (net), for the six- and 12-month periods ended September 30, 2021. The Fund’s benchmark is fully composed of equities, while the Fund invests in both equities and fixed income.

All share classes of the Fund outperformed the benchmark for the six-month period, before sales charges. Emerging-market debt index returns outperformed emerging-market equity returns, so the structural underweight to equities of the Fund’s multi-asset strategy contributed when measured against a pure equity benchmark. Equity and fixed-income holdings outperformed their respective equity and fixed-income benchmarks, and overall security selection within equities and fixed income contributed to absolute returns. Active currency management contributed during the period.

| 2 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

During the 12-month period, all share classes of the Fund underperformed the benchmark, before sales charges. Emerging-market debt index returns contributed on an absolute basis but lagged emerging-market equity returns, so the structural underweight to equities detracted when measured against a pure equity benchmark. Overall security selection within equities and fixed income contributed, and both categories outperformed their respective benchmarks. Active currency management also contributed during the 12-month period.

During both periods, the Fund utilized derivatives for hedging and investment purposes in the form of currency forwards and written swaptions, which added to absolute performance, while variance swaps, credit default swaps and purchased swaptions detracted; futures and total return swaps detracted for the six-month period, but added for the 12-month period; interest rate swaps added for the six-month period, but detracted for the 12-month period.

MARKET REVIEW AND INVESTMENT STRATEGY

Global equities recorded positive returns and emerging-market equities declined for the six-month period ended September 30, 2021. Accommodative monetary policy and strong company earnings growth continued to support equity markets, but bouts of volatility increased as the accelerating economic recovery triggered inflationary fears. Worsening supply-chain constraints and the negative economic impact of the coronavirus delta variant were compounded by the convergence of politically divisive budget and spending plan negotiations in the US. The likelihood of contagion from the collapse of the heavily indebted Chinese real estate developer Evergrande and a slowdown in China’s economy pushed emerging-market equities into negative territory and weighed on global risk sentiment. Equity markets remained under pressure after the US Federal Reserve turned more hawkish regarding the timing of tapering and interest-rate liftoff, and as concern grew over the US debt-ceiling crisis. Surging oil and commodity prices stoked inflationary fears, driving bond yields higher and equities sharply lower. Large-cap stocks significantly outperformed small-cap stocks on a relative basis, and despite intervals of market rotation, growth-style stocks outperformed their value-style peers.

Developed-market fixed-income market returns were mostly positive as longer-term government bond yields fell during most of the period in all regions except Europe on growth concerns from the delta variant, until August when inflation reports and central bank tapering comments started to send yields higher. Low interest rates set the stage for the continued outperformance of risk assets, led by emerging-market high-yield sovereign bonds. Developed- and emerging-market high-yield and investment-grade corporate bonds also posted strong returns. Corporate bond returns were higher in the US than in Europe, mostly because of the divergence in government yields. Emerging-market local-currency bonds had positive performance but trailed developed-market treasuries as the

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 3 | |

US dollar rose against the majority of emerging-market currencies and all major developed-market currencies except the Swiss franc. Securitized assets advanced but trailed US Treasuries. Commodity prices continued their ascent, led by the continued recovery in Brent crude oil prices.

The Fund’s Senior Investment Management Team (the “Team”) seeks to maximize total return by dynamically adjusting exposure to emerging markets by investing across asset classes. The Team’s emerging-market strategy searches for long-term growth with lower volatility. In seeking to reduce risk and provide downside protection, the Team pursues active stocks and flexible bond allocations. The Team utilizes a disciplined investment process, which draws on a rigorous quantitative research toolset with fundamental expertise across all regions and markets.

INVESTMENT POLICIES

The Fund invests at least 80% of its net assets under normal circumstances in securities of emerging-market issuers and/or the currencies of emerging-market countries. Examples of emerging-market countries include Argentina, Brazil, Chile, Croatia, Egypt, India, Indonesia, Israel, Kazakhstan, Malaysia, Mexico, the People’s Republic of China, Peru, the Philippines, Poland, Russia, South Africa, South Korea, Taiwan, Thailand, Turkey and Venezuela. The Fund may invest up to 20% of its net assets in the securities of developed-market issuers.

The Fund invests in equity securities, debt securities and currencies, and does not attempt to maintain a constant or relatively constant allocation among these asset classes. Rather, allocations among asset classes are adjusted based on the Adviser’s view of the relative attractiveness of the asset classes. These allocations are informed by the Adviser’s proprietary asset allocation tools, which are comprised of a series of volatility, correlation and expected return forecasts. The Adviser reviews potential Fund investments in each asset class holistically from a country, currency, sector and security standpoint to optimize overall portfolio construction. Under normal circumstances, the Fund will invest between 30% and 95% of its net assets in equity securities, and between 0% and 65% of its net assets in debt securities, with any remainder held in cash (including foreign currency). The Fund is not constrained based on the country, region, market capitalization, credit quality or duration of its investments and its assets may at times be concentrated in a particular country or region.

The process for selecting equity securities for the Fund is primarily bottom-up. The Adviser seeks to identify stocks that are attractive based on valuation, profitability, earnings quality, business trends, price momentum and other measures. The process for selecting debt securities

(continued on next page)

| 4 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

for the Fund is more top-down. The Adviser believes that inefficiencies in the global debt markets arise from investor emotion, market complexity and conflicting investment agendas. The Adviser combines quantitative forecasts with fundamental credit and economic research in seeking to exploit these inefficiencies. The Adviser seeks to generate returns from the Fund’s fixed-income investments through a combination of country selection, currency allocation, sector analysis and security selection. Debt securities may include those of both corporate and governmental issuers, and may include below investment-grade debt securities (“junk bonds”). The Fund may invest in debt securities with a range of maturities from short- to long-term.

The Adviser considers both quantitative and fundamental factors in adjusting the Fund’s currency exposures. In addition to the Fund’s currency exposure that results from its investments in equity and debt securities denominated in foreign currencies (and any related hedging), the Fund may hold foreign currency (or related derivatives) independently of any such investments, and may hold a currency even if the Fund does not hold any securities denominated in that currency.

The Fund may utilize derivatives, such as futures contracts, forwards and swaps, and invest in exchange-traded funds (“ETFs”) to a significant extent. Derivatives and ETFs may provide more efficient and economical exposure to market segments than direct investments, and may also be a quicker and more efficient way to alter the Fund’s exposure than buying and selling direct investments. In determining when and to what extent to enter into derivatives transactions or to invest in ETFs, the Adviser will consider factors such as the relative risks and returns expected of potential investments and the cost of such transactions. Derivatives may also be used for hedging purposes, including to hedge against interest-rate, credit and currency fluctuations. The Adviser also expects to use derivatives frequently to effectively leverage the Fund by creating aggregate exposure somewhat in excess of the Fund’s net assets. The notional value of derivatives and ETFs linked to emerging-market securities or currencies are counted towards meeting the percentage minimums and ranges set forth above, including the requirement that the Fund invest at least 80% of its net assets in the securities of emerging-market issuers and/or the currencies of emerging-market countries.

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 5 | |

DISCLOSURES AND RISKS

Benchmark Disclosure

The MSCI EM Index is unmanaged and does not reflect fees and expenses associated with the active management of a mutual fund portfolio. The MSCI EM Index (net, free float-adjusted, market capitalization weighted) represents the equity market performance of emerging markets. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI. Net returns include the reinvestment of dividends after deduction of non-US withholding tax. An investor cannot invest directly in an index or average, and their results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Emerging-Market Risk: Investments in emerging-market countries may involve more risk than investments in other foreign countries because the markets in emerging-market countries are less developed and less liquid, and because these investments may be subject to increased economic, political, regulatory or other uncertainties.

Market Risk: The value of the Fund’s assets will fluctuate as the stock, bond or currency markets fluctuate. The value of the Fund’s investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events, including public health crises (including the occurrence of a contagious disease or illness), that affect large portions of the market.

Foreign (Non-US) Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade due to adverse market, economic, political, regulatory or other factors.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Fund’s investments or reduce its returns. Emerging-market currencies may be more volatile and less liquid, and subject to significantly greater risk of currency controls and convertibility restrictions, than currencies of developed countries.

Country Concentration Risk: The Fund may not always be diversified among countries or geographic regions and the effect on the Fund’s net asset value (“NAV”) of the specific risks identified above, such as political, regulatory and currency risks, may be magnified due to concentration of the Fund’s investments in a particular country or region.

| 6 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

DISCLOSURES AND RISKS (continued)

Allocation Risk: The allocation of Fund assets among different asset classes, such as equity securities, debt securities and currencies, may have a significant effect on the Fund’s NAV when one of these asset classes is performing better or worse than others. The diversification benefits typically associated with investing in both equity and debt securities may be limited in the emerging-markets context, as movements in emerging-market equity and emerging-market debt markets may be more correlated than movements in the equity and debt markets of developed countries.

Capitalization Risk: Investments in small- and mid-capitalization companies may be more volatile than investments in large-capitalization companies. Investments in small-capitalization companies may have additional risks because these companies have limited product lines, markets or financial resources.

Interest-Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest-rate risk is generally greater for fixed-income securities with longer maturities or durations. The current historically low interest rate environment heightens the risks associated with rising interest rates.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security and accrued interest. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security.

Sovereign Debt Risk: Investments in sovereign debt obligations expose the Fund to the direct or indirect consequences of political, social and economic changes in countries that issue the obligations. Such changes may affect a foreign government’s willingness or ability to make timely payments of its obligations. In addition, no established market may exist for many sovereign debt obligations. Reduced secondary market liquidity may have an adverse effect on the market price of an instrument and the Fund’s ability to dispose of particular instruments.

Below Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (commonly known as “junk bonds”) tend to have a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 7 | |

DISCLOSURES AND RISKS (continued)

due to factors such as specific corporate developments, interest-rate sensitivity and negative perceptions of the junk bond market generally, and may be more difficult to trade than other types of securities.

Derivatives Risk: Derivatives may be difficult to price or unwind and leveraged so that small changes may produce disproportionate losses for the Fund. Derivatives, especially over-the-counter derivatives, are also subject to counterparty risk.

Leverage Risk: To the extent the Fund uses leveraging techniques, its NAV may be more volatile because leverage tends to exaggerate the effect of changes in interest rates and any increase or decrease in the value of the Fund’s investments.

Illiquid Investments Risk: Illiquid investments risk exists when certain investments are or become difficult to purchase or sell. Difficulty in selling such investments may result in sales at disadvantageous prices affecting the value of your investment in the Fund. Causes of illiquid investments risk may include low trading volumes, large positions and heavy redemptions of Fund shares. Illiquid investments risk may be higher in a rising interest-rate environment, when the value and liquidity of fixed-income securities generally decline.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results. Some of these techniques may incorporate, or rely upon, quantitative models, but there is no guarantee that these models will generate accurate forecasts, reduce risk or otherwise perform as expected.

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

An Important Note About Historical Performance

The investment return and principal value of an investment in the Fund will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.abfunds.com.

All fees and expenses related to the operation of the Fund have been deducted. NAV returns do not reflect sales charges; if sales

| 8 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

DISCLOSURES AND RISKS (continued)

charges were reflected, the Fund’s quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 4.25% maximum front-end sales charge for Class A shares and a 1% 1-year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 9 | |

HISTORICAL PERFORMANCE

AVERAGE ANNUAL RETURNS AS OF SEPTEMBER 30, 2021 (unaudited)

| NAV Returns | SEC Returns (reflects applicable |

|||||||

| CLASS A SHARES | ||||||||

| 1 Year | 16.31% | 11.38% | ||||||

| 5 Years | 6.16% | 5.25% | ||||||

| 10 Years | 4.85% | 4.39% | ||||||

| CLASS C SHARES | ||||||||

| 1 Year | 15.38% | 14.38% | ||||||

| 5 Years | 5.37% | 5.37% | ||||||

| 10 Years1 | 4.08% | 4.08% | ||||||

| ADVISOR CLASS SHARES2 | ||||||||

| 1 Year | 16.67% | 16.67% | ||||||

| 5 Years | 6.44% | 6.44% | ||||||

| 10 Years | 5.14% | 5.14% | ||||||

| CLASS R SHARES2 | ||||||||

| 1 Year | 16.08% | 16.08% | ||||||

| 5 Years | 5.92% | 5.92% | ||||||

| 10 Years | 4.61% | 4.61% | ||||||

| CLASS K SHARES2 | ||||||||

| 1 Year | 16.37% | 16.37% | ||||||

| 5 Years | 6.16% | 6.16% | ||||||

| 10 Years | 4.87% | 4.87% | ||||||

| CLASS I SHARES2 | ||||||||

| 1 Year | 16.61% | 16.61% | ||||||

| 5 Years | 6.43% | 6.43% | ||||||

| 10 Years | 5.13% | 5.13% | ||||||

| CLASS Z SHARES2 | ||||||||

| 1 Year | 16.69% | 16.69% | ||||||

| Since Inception3 | 4.91% | 4.91% | ||||||

The Fund’s prospectus fee table shows the Fund’s total annual operating expense ratios as 1.65%, 2.41%, 1.40%, 2.11%, 1.81%, 1.25% and 1.32% for Class A, Class C, Advisor Class, Class R, Class K, Class I and Class Z shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Fund’s annual operating expense ratios exclusive of expenses associated with acquired fund fees and expenses other than the advisory fees of any AB mutual funds in which the Fund may invest, interest expense and extraordinary expenses to 1.24%, 1.99%, 0.99%, 1.49%, 1.24%, 0.99% and 0.99% for Class A, Class C, Advisor Class, Class R, Class K, Class I and Class Z shares, respectively. These waivers/reimbursements may not be terminated before July 31, 2022. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

(footnotes continued on next page)

|

10 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

HISTORICAL PERFORMANCE (continued)

| 1 | Assumes conversion of Class C shares into Class A shares after eight years. |

| 2 | These share classes are offered at NAV to eligible investors and their SEC returns are the same as their NAV returns. Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| 3 | Inception date: 7/31/2017. |

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 11 | |

HISTORICAL PERFORMANCE (continued)

SEC AVERAGE ANNUAL RETURNS

AS OF THE MOST RECENT CALENDAR QUARTER-END

SEPTEMBER 30, 2021 (unaudited)

| SEC Returns (reflects applicable |

||||

| CLASS A SHARES | ||||

| 1 Year | 11.38% | |||

| 5 Years | 5.25% | |||

| 10 Years | 4.39% | |||

| CLASS C SHARES | ||||

| 1 Year | 14.38% | |||

| 5 Years | 5.37% | |||

| 10 Years1 | 4.08% | |||

| ADVISOR CLASS SHARES2 | ||||

| 1 Year | 16.67% | |||

| 5 Years | 6.44% | |||

| 10 Years | 5.14% | |||

| CLASS R SHARES2 | ||||

| 1 Year | 16.08% | |||

| 5 Years | 5.92% | |||

| 10 Years | 4.61% | |||

| CLASS K SHARES2 | ||||

| 1 Year | 16.37% | |||

| 5 Years | 6.16% | |||

| 10 Years | 4.87% | |||

| CLASS I SHARES2 | ||||

| 1 Year | 16.61% | |||

| 5 Years | 6.43% | |||

| 10 Years | 5.13% | |||

| CLASS Z SHARES2 | ||||

| 1 Year | 16.69% | |||

| Since Inception3 | 4.91% | |||

| 1 | Assumes conversion of Class C shares into Class A shares after eight years. |

| 2 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| 3 | Inception date: 7/31/2017. |

| 12 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

EXPENSE EXAMPLE

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 13 | |

EXPENSE EXAMPLE (continued)

| Beginning Account Value 4/1/2021 |

Ending Account Value 9/30/2021 |

Expenses Paid During Period* |

Annualized Expense Ratio* |

|||||||||||||

| Class A | ||||||||||||||||

| Actual |

$ | 1,000 | $ | 981.60 | $ | 6.16 | 1.24 | % | ||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,018.85 | $ | 6.28 | 1.24 | % | ||||||||

| Class C | ||||||||||||||||

| Actual |

$ | 1,000 | $ | 977.70 | $ | 9.87 | 1.99 | % | ||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,015.09 | $ | 10.05 | 1.99 | % | ||||||||

| Advisor Class | ||||||||||||||||

| Actual |

$ | 1,000 | $ | 983.80 | $ | 4.92 | 0.99 | % | ||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,020.10 | $ | 5.01 | 0.99 | % | ||||||||

| Class R | ||||||||||||||||

| Actual |

$ | 1,000 | $ | 981.20 | $ | 7.40 | 1.49 | % | ||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,017.60 | $ | 7.54 | 1.49 | % | ||||||||

| Class K | ||||||||||||||||

| Actual |

$ | 1,000 | $ | 981.80 | $ | 6.16 | 1.24 | % | ||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,018.85 | $ | 6.28 | 1.24 | % | ||||||||

| Class I | ||||||||||||||||

| Actual |

$ | 1,000 | $ | 982.80 | $ | 4.92 | 0.99 | % | ||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,020.10 | $ | 5.01 | 0.99 | % | ||||||||

| Class Z | ||||||||||||||||

| Actual |

$ | 1,000 | $ | 983.80 | $ | 4.92 | 0.99 | % | ||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,020.10 | $ | 5.01 | 0.99 | % | ||||||||

| * | Expenses are equal to the classes’ annualized expense ratios multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| ** | Assumes 5% annual return before expenses. |

|

14 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

PORTFOLIO SUMMARY

September 30, 2021 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $184.6

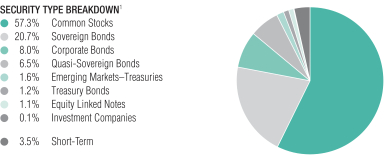

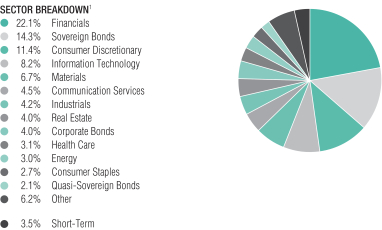

| 1 | All data are as of September 30, 2021. The Fund’s security type and sector breakdowns are expressed as a percentage of total investments (excluding security lending collateral) and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” sector weightings represent 2.1% or less in the following sectors: Emerging Markets–Treasuries, Equity Linked Notes, Funds and Investment Trusts, Treasury Bonds and Utilities. |

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 15 | |

PORTFOLIO SUMMARY (continued)

September 30, 2021 (unaudited)

TEN LARGEST HOLDINGS2

| Company | U.S. $ Value | Percent of Net Assets |

||||||

| Taiwan Semiconductor Manufacturing Co., Ltd. | $ | 4,570,741 | 2.5 | % | ||||

| Samsung Electronics Co., Ltd. | 4,066,164 | 2.2 | ||||||

| Agricultural Bank of China Ltd. – Class H | 3,426,373 | 1.9 | ||||||

| PetroChina Co., Ltd. | 3,279,491 | 1.8 | ||||||

| Hana Financial Group, Inc. | 2,992,198 | 1.6 | ||||||

| LUKOIL PJSC (Sponsored ADR) | 2,892,431 | 1.6 | ||||||

| Hon Hai Precision Industry Co., Ltd. | 2,788,262 | 1.5 | ||||||

| Egypt Government International Bond | 2,705,538 | 1.5 | ||||||

| Ukraine Government International Bond | 2,453,397 | 1.3 | ||||||

| Tencent Holdings Ltd. | 2,417,800 | 1.3 | ||||||

| $ | 31,592,395 | 17.2 | % | |||||

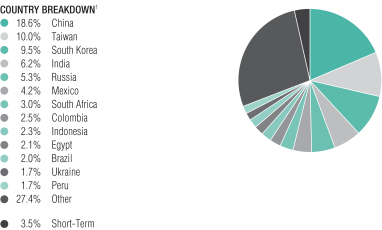

| 1 | All data are as of September 30, 2021. The Fund’s country breakdown is expressed as a percentage of total investments (excluding security lending collateral) and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” country weightings represent 1.6% or less in the following: Angola, Argentina, Australia, Azerbaijan, Bahamas, Bahrain, Chile, Czech Republic, Dominican Republic, Ecuador, El Salvador, France, Gabon, Ghana, Greece, Guatemala, Honduras, Hong Kong, Hungary, Israel, Ivory Coast, Jamaica, Japan, Kazakhstan, Kenya, Kuwait, Lebanon, Malaysia, Mongolia, Nigeria, Oman, Pakistan, Panama, Paraguay, Philippines, Poland, Qatar, Romania, Saudi Arabia, Senegal, Sri Lanka, Thailand, Trinidad & Tobago, Turkey, United Arab Emirates, United States, Uruguay, Venezuela, Vietnam and Zambia. |

| 2 | Long-term investments. |

| 16 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

PORTFOLIO OF INVESTMENTS

September 30, 2021 (unaudited)

| Company | Shares |

U.S. $ Value | ||||||||||

|

|

||||||||||||

| COMMON STOCKS – 56.4% |

| |||||||||||

| Financials – 13.8% |

| |||||||||||

| Banks – 9.1% |

||||||||||||

| Abu Dhabi Islamic Bank PJSC |

49,233 | $ | 77,395 | |||||||||

| Agricultural Bank of China Ltd. – Class H |

9,974,000 | 3,426,373 | ||||||||||

| Banco Santander Chile |

2,208,696 | 110,680 | ||||||||||

| Bank of China Ltd. – Class H |

323,000 | 114,127 | ||||||||||

| Bank of Communications Co., Ltd. – Class H |

1,044,000 | 617,940 | ||||||||||

| Capitec Bank Holdings Ltd. |

85 | 10,268 | ||||||||||

| China CITIC Bank Corp., Ltd. – Class H |

2,078,000 | 936,613 | ||||||||||

| China Construction Bank Corp. – Class H |

600,000 | 428,210 | ||||||||||

| China Everbright Bank Co., Ltd. – Class H |

326,000 | 114,750 | ||||||||||

| China Merchants Bank Co., Ltd. – Class H |

15,000 | 119,372 | ||||||||||

| Chongqing Rural Commercial Bank Co., Ltd. – Class H |

148,000 | 53,798 | ||||||||||

| Commercial Bank PSQC (The) |

68,100 | 115,009 | ||||||||||

| Grupo Financiero Banorte SAB de CV – Class O |

17,319 | 110,996 | ||||||||||

| Habib Bank Ltd. |

81,241 | 52,228 | ||||||||||

| Halyk Savings Bank of Kazakhstan JSC (GDR)(a) |

23,000 | 391,000 | ||||||||||

| Hana Financial Group, Inc. |

76,976 | 2,992,198 | ||||||||||

| HDFC Bank Ltd. |

44,723 | 954,841 | ||||||||||

| Industrial Bank Co., Ltd. – Class A |

465,960 | 1,313,939 | ||||||||||

| KB Financial Group, Inc. |

17,225 | 801,092 | ||||||||||

| Kuwait Finance House KSCP |

40,960 | 111,654 | ||||||||||

| Malayan Banking Bhd |

56,600 | 108,833 | ||||||||||

| MCB Bank Ltd. |

44,776 | 40,213 | ||||||||||

| Metropolitan Bank & Trust Co. |

678,620 | 580,285 | ||||||||||

| Postal Savings Bank of China Co., Ltd.(a) |

166,000 | 114,118 | ||||||||||

| Sberbank of Russia PJSC (Sponsored ADR) |

113,887 | 2,133,982 | ||||||||||

| Taishin Financial Holding Co., Ltd. |

90,000 | 58,263 | ||||||||||

| TCS Group Holding PLC (GDR)(a) |

10,019 | 911,043 | ||||||||||

|

|

|

|||||||||||

| 16,799,220 | ||||||||||||

|

|

|

|||||||||||

| Capital Markets – 0.4% |

||||||||||||

| China Everbright Ltd. |

78,000 | 91,645 | ||||||||||

| East Money Information Co., Ltd. – Class A |

15,900 | 84,254 | ||||||||||

| GF Securities Co., Ltd. – Class H |

60,800 | 106,026 | ||||||||||

| Korea Investment Holdings Co., Ltd. |

1,444 | 103,769 | ||||||||||

| Meritz Securities Co., Ltd. |

25,142 | 104,196 | ||||||||||

| NH Investment & Securities Co., Ltd. |

9,831 | 105,861 | ||||||||||

| Samsung Securities Co., Ltd. |

2,666 | 106,496 | ||||||||||

| Up Fintech Holding Ltd. (ADR)(b)(c) |

2,572 | 27,237 | ||||||||||

|

|

|

|||||||||||

| 729,484 | ||||||||||||

|

|

|

|||||||||||

| Consumer Finance – 0.3% |

||||||||||||

| 360 DigiTech, Inc. (ADR)(c) |

5,739 | 116,616 | ||||||||||

| Manappuram Finance Ltd. |

196,945 | 446,740 | ||||||||||

|

|

|

|||||||||||

| 563,356 | ||||||||||||

|

|

|

|||||||||||

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 17 | |

PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares |

U.S. $ Value | ||||||||||

|

|

||||||||||||

| Diversified Financial Services – 1.7% |

||||||||||||

| Chailease Holding Co., Ltd. |

28,000 | $ | 245,899 | |||||||||

| Far East Horizon Ltd. |

111,000 | 112,645 | ||||||||||

| FirstRand Ltd. |

27,992 | 119,914 | ||||||||||

| Fubon Financial Holding Co., Ltd. |

545,600 | 1,491,034 | ||||||||||

| Haci Omer Sabanci Holding AS |

747,535 | 814,731 | ||||||||||

| Piramal Enterprises Ltd. |

3,303 | 114,937 | ||||||||||

| REC Ltd. |

54,651 | 115,443 | ||||||||||

| Yuanta Financial Holding Co., Ltd. |

126,000 | 111,169 | ||||||||||

|

|

|

|||||||||||

| 3,125,772 | ||||||||||||

|

|

|

|||||||||||

| Insurance – 1.8% |

||||||||||||

| AIA Group Ltd. |

118,000 | 1,357,520 | ||||||||||

| Bupa Arabia for Cooperative Insurance Co. |

2,796 | 111,223 | ||||||||||

| Co. for Cooperative Insurance (The) |

4,509 | 103,988 | ||||||||||

| PICC Property & Casualty Co., Ltd. – Class H |

1,322,000 | 1,282,431 | ||||||||||

| Ping An Insurance Group Co. of China Ltd. – Class H |

38,000 | 259,896 | ||||||||||

| Ping An Insurance Group Co. of China, Ltd. – Class A |

28,200 | 210,750 | ||||||||||

| Powszechny Zaklad Ubezpieczen SA |

11,707 | 107,096 | ||||||||||

|

|

|

|||||||||||

| 3,432,904 | ||||||||||||

|

|

|

|||||||||||

| Thrifts & Mortgage Finance – 0.5% |

||||||||||||

| Housing Development Finance Corp., Ltd. |

24,109 | 888,009 | ||||||||||

|

|

|

|||||||||||

| 25,538,745 | ||||||||||||

|

|

|

|||||||||||

| Information Technology – 13.3% |

||||||||||||

| Electronic Equipment, Instruments & Components – 2.6% |

||||||||||||

| Hon Hai Precision Industry Co., Ltd. |

747,000 | 2,788,262 | ||||||||||

| Kingboard Holdings Ltd. |

24,500 | 110,877 | ||||||||||

| Samsung SDI Co., Ltd. |

1,820 | 1,086,031 | ||||||||||

| Sinbon Electronics Co., Ltd. |

59,000 | 496,128 | ||||||||||

| Synnex Technology International Corp. |

59,000 | 109,873 | ||||||||||

| WPG Holdings Ltd. |

62,000 | 107,403 | ||||||||||

| Zhen Ding Technology Holding Ltd. |

22,000 | 77,351 | ||||||||||

|

|

|

|||||||||||

| 4,775,925 | ||||||||||||

|

|

|

|||||||||||

| IT Services – 1.3% |

||||||||||||

| GDS Holdings Ltd. (ADR)(b)(c) |

23,072 | 1,306,106 | ||||||||||

| Infosys Ltd. (Sponsored ADR) |

26,770 | 595,632 | ||||||||||

| Network International Holdings PLC(a)(c) |

72,705 | 355,899 | ||||||||||

| Tech Mahindra Ltd. |

5,778 | 107,083 | ||||||||||

| Wipro Ltd. |

12,482 | 106,278 | ||||||||||

|

|

|

|||||||||||

| 2,470,998 | ||||||||||||

|

|

|

|||||||||||

| 18 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares |

U.S. $ Value | ||||||||||

|

|

||||||||||||

| Semiconductors & Semiconductor Equipment – 6.4% |

||||||||||||

| ASE Technology Holding Co., Ltd. |

26,000 | $ | 100,589 | |||||||||

| Daqo New Energy Corp. (ADR)(c) |

1,976 | 112,632 | ||||||||||

| Hangzhou Silan Microelectronics Co., Ltd. |

5,900 | 51,866 | ||||||||||

| MediaTek, Inc. |

69,000 | 2,220,936 | ||||||||||

| Novatek Microelectronics Corp. |

103,000 | 1,496,470 | ||||||||||

| Parade Technologies Ltd. |

2,000 | 117,071 | ||||||||||

| Realtek Semiconductor Corp. |

1,000 | 17,618 | ||||||||||

| Silergy Corp. |

1,000 | 145,454 | ||||||||||

| SK Hynix, Inc. |

10,552 | 903,318 | ||||||||||

| Taiwan Semiconductor Manufacturing Co., Ltd. |

221,000 | 4,570,741 | ||||||||||

| United Microelectronics Corp. |

898,000 | 2,035,541 | ||||||||||

|

|

|

|||||||||||

| 11,772,236 | ||||||||||||

|

|

|

|||||||||||

| Technology Hardware, Storage & Peripherals – 3.0% |

||||||||||||

| Asustek Computer, Inc. |

11,000 | 127,756 | ||||||||||

| Lenovo Group Ltd. |

108,000 | 140,964 | ||||||||||

| Samsung Electronics Co., Ltd. |

65,589 | 4,066,164 | ||||||||||

| Samsung Electronics Co., Ltd. (Preference Shares) |

20,050 | 1,169,691 | ||||||||||

|

|

|

|||||||||||

| 5,504,575 | ||||||||||||

|

|

|

|||||||||||

| 24,523,734 | ||||||||||||

|

|

|

|||||||||||

| Consumer Discretionary – 6.5% |

||||||||||||

| Auto Components – 0.1% |

||||||||||||

| Fuyao Glass Industry Group Co., Ltd. – Class H(a) |

16,800 | 89,359 | ||||||||||

| Hankook Tire & Technology Co., Ltd. |

527 | 19,098 | ||||||||||

|

|

|

|||||||||||

| 108,457 | ||||||||||||

|

|

|

|||||||||||

| Automobiles – 1.9% |

||||||||||||

| Dongfeng Motor Group Co., Ltd. – Class H |

248,000 | 220,844 | ||||||||||

| Ford Otomotiv Sanayi AS |

12,226 | 229,727 | ||||||||||

| Great Wall Motor Co., Ltd. – Class H |

28,000 | 103,027 | ||||||||||

| Kia Corp. |

32,061 | 2,165,289 | ||||||||||

| SAIC Motor Corp., Ltd. – Class A |

252,000 | 743,294 | ||||||||||

|

|

|

|||||||||||

| 3,462,181 | ||||||||||||

|

|

|

|||||||||||

| Hotels, Restaurants & Leisure – 1.6% |

||||||||||||

| Despegar.com Corp.(b)(c) |

39,050 | 469,771 | ||||||||||

| MakeMyTrip Ltd.(b)(c) |

18,147 | 493,417 | ||||||||||

| OPAP SA |

127,838 | 1,977,763 | ||||||||||

| Yum China Holdings, Inc. |

497 | 28,881 | ||||||||||

|

|

|

|||||||||||

| 2,969,832 | ||||||||||||

|

|

|

|||||||||||

| Internet & Direct Marketing Retail – 2.0% |

||||||||||||

| Alibaba Group Holding Ltd.(c) |

87,520 | 1,620,340 | ||||||||||

| JD.com, Inc. – Class A(c) |

44,970 | 1,621,274 | ||||||||||

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 19 | |

PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares |

U.S. $ Value | ||||||||||

|

|

||||||||||||

| momo.com, Inc. |

9,000 | $ | 521,608 | |||||||||

| Naspers Ltd. – Class N |

21 | 3,471 | ||||||||||

|

|

|

|||||||||||

| 3,766,693 | ||||||||||||

|

|

|

|||||||||||

| Specialty Retail – 0.4% |

||||||||||||

| Abu Dhabi National Oil Co. for Distribution PJSC |

90,252 | 102,214 | ||||||||||

| China Meidong Auto Holdings Ltd. |

3,866 | 19,453 | ||||||||||

| Jarir Marketing Co. |

1,937 | 108,094 | ||||||||||

| Topsports International Holdings Ltd.(a) |

299,000 | 339,575 | ||||||||||

| Zhongsheng Group Holdings Ltd. |

29,000 | 232,470 | ||||||||||

|

|

|

|||||||||||

| 801,806 | ||||||||||||

|

|

|

|||||||||||

| Textiles, Apparel & Luxury Goods – 0.5% |

||||||||||||

| ANTA Sports Products Ltd. |

14,000 | 264,369 | ||||||||||

| Li Ning Co., Ltd. |

29,500 | 340,009 | ||||||||||

| LVMH Moet Hennessy Louis Vuitton SE |

297 | 212,730 | ||||||||||

| Shenzhou International Group Holdings Ltd. |

6,000 | 127,341 | ||||||||||

|

|

|

|||||||||||

| 944,449 | ||||||||||||

|

|

|

|||||||||||

| 12,053,418 | ||||||||||||

|

|

|

|||||||||||

| Materials – 6.4% |

||||||||||||

| Chemicals – 0.9% |

||||||||||||

| Formosa Chemicals & Fibre Corp. |

3,000 | 8,975 | ||||||||||

| Nan Ya Plastics Corp. |

22,000 | 71,915 | ||||||||||

| Orbia Advance Corp. SAB de CV |

71,716 | 184,106 | ||||||||||

| Petronas Chemicals Group Bhd |

59,100 | 122,816 | ||||||||||

| PhosAgro PJSC (GDR)(a) |

5,685 | 126,662 | ||||||||||

| Saudi Basic Industries Corp. |

1,095 | 37,003 | ||||||||||

| Tosoh Corp. |

50,500 | 915,148 | ||||||||||

| Wanhua Chemical Group Co., Ltd. – Class A |

6,500 | 106,500 | ||||||||||

| Zhejiang Satellite Petrochemical Co., Ltd. |

16,289 | 97,818 | ||||||||||

|

|

|

|||||||||||

| 1,670,943 | ||||||||||||

|

|

|

|||||||||||

| Construction Materials – 0.3% |

||||||||||||

| ACC Ltd. |

3,714 | 112,213 | ||||||||||

| Ambuja Cements Ltd. |

20,177 | 108,516 | ||||||||||

| Taiwan Cement Corp. |

176,610 | 321,652 | ||||||||||

| UltraTech Cement Ltd. |

181 | 17,953 | ||||||||||

|

|

|

|||||||||||

| 560,334 | ||||||||||||

|

|

|

|||||||||||

| Metals & Mining – 5.2% |

||||||||||||

| African Rainbow Minerals Ltd. |

7,876 | 100,528 | ||||||||||

| Baoshan Iron & Steel Co., Ltd. – Class A |

46,800 | 62,668 | ||||||||||

| China Hongqiao Group Ltd. |

996,596 | 1,264,762 | ||||||||||

| Cia Siderurgica Nacional SA |

20,600 | 108,679 | ||||||||||

| CSN Mineracao SA |

403,300 | 471,748 | ||||||||||

| Eregli Demir ve Celik Fabrikalari TAS |

58,961 | 108,576 | ||||||||||

| Fortescue Metals Group Ltd. |

48,250 | 513,960 | ||||||||||

| Grupo Mexico SAB de CV |

27,543 | 109,524 | ||||||||||

| Hindalco Industries Ltd. |

260,550 | 1,705,628 | ||||||||||

| 20 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares |

U.S. $ Value | ||||||||||

|

|

||||||||||||

| Impala Platinum Holdings Ltd. |

59,268 | $ | 667,942 | |||||||||

| Inner Mongolia BaoTou Steel Union Co., Ltd.(c) |

103,400 | 50,349 | ||||||||||

| JSW Steel Ltd. |

12,725 | 113,638 | ||||||||||

| Kumba Iron Ore Ltd. |

3,157 | 103,723 | ||||||||||

| MMC Norilsk Nickel PJSC (ADR) |

7,237 | 216,531 | ||||||||||

| Polyus PJSC (GDR)(a) |

829 | 68,106 | ||||||||||

| POSCO |

6,057 | 1,667,847 | ||||||||||

| Rio Tinto Ltd. |

3,223 | 229,449 | ||||||||||

| Southern Copper Corp. |

1,972 | 110,708 | ||||||||||

| Tata Steel Ltd. |

98,984 | 1,699,597 | ||||||||||

| Vale SA |

7,200 | 100,799 | ||||||||||

| Vedanta Ltd. |

27,987 | 107,968 | ||||||||||

|

|

|

|||||||||||

| 9,582,730 | ||||||||||||

|

|

|

|||||||||||

| 11,814,007 | ||||||||||||

|

|

|

|||||||||||

| Energy – 4.8% |

||||||||||||

| Oil, Gas & Consumable Fuels – 4.8% |

||||||||||||

| Bharat Petroleum Corp., Ltd. |

16,874 | 97,666 | ||||||||||

| China Petroleum & Chemical Corp. |

161,100 | 110,670 | ||||||||||

| China Petroleum & Chemical Corp. – Class H |

230,000 | 113,342 | ||||||||||

| China Shenhua Energy Co., Ltd. – Class A |

33,500 | 117,277 | ||||||||||

| China Shenhua Energy Co., Ltd. – Class H |

51,000 | 118,802 | ||||||||||

| Exxaro Resources Ltd. |

9,527 | 101,877 | ||||||||||

| GS Holdings Corp. |

2,862 | 106,840 | ||||||||||

| Guanghui Energy Co., Ltd.(c) |

53,793 | 71,984 | ||||||||||

| Hindustan Petroleum Corp., Ltd. |

30,343 | 122,318 | ||||||||||

| Indian Oil Corp. Ltd. |

72,153 | 120,986 | ||||||||||

| LUKOIL PJSC (Sponsored ADR) |

30,556 | 2,892,431 | ||||||||||

| MOL Hungarian Oil & Gas PLC |

14,392 | 119,566 | ||||||||||

| PetroChina Co., Ltd. – Class H |

7,002,000 | 3,279,491 | ||||||||||

| Petroleo Brasileiro SA |

23,700 | 122,509 | ||||||||||

| Polski Koncern Naftowy ORLEN SA |

36,407 | 750,082 | ||||||||||

| Polskie Gornictwo Naftowe i Gazownictwo SA |

73,880 | 120,073 | ||||||||||

| Saudi Arabian Oil Co.(a) |

12,743 | 122,206 | ||||||||||

| Shaanxi Coal Industry Co., Ltd. |

48,500 | 110,776 | ||||||||||

| Yanzhou Coal Mining Co., Ltd. |

23,200 | 103,578 | ||||||||||

| Yanzhou Coal Mining Co., Ltd. – Class H |

60,000 | 113,144 | ||||||||||

|

|

|

|||||||||||

| 8,815,618 | ||||||||||||

|

|

|

|||||||||||

| Communication Services – 2.7% |

||||||||||||

| Diversified Telecommunication Services – 0.3% |

||||||||||||

| Chunghwa Telecom Co., Ltd. |

17,000 | 67,346 | ||||||||||

| Emirates Telecommunications Group Co. PJSC |

17,537 | 114,638 | ||||||||||

| LG Uplus Corp. |

9,024 | 113,438 | ||||||||||

| MultiChoice Group |

11,428 | 86,643 | ||||||||||

| Sarana Menara Nusantara Tbk PT |

310,000 | 28,571 | ||||||||||

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 21 | |

PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares |

U.S. $ Value | ||||||||||

|

|

||||||||||||

| Telekom Malaysia Bhd |

81,700 | $ | 111,165 | |||||||||

| Tower Bersama Infrastructure Tbk PT |

161,000 | 33,175 | ||||||||||

|

|

|

|||||||||||

| 554,976 | ||||||||||||

|

|

|

|||||||||||

| Interactive Media & Services – 2.0% |

||||||||||||

| NAVER Corp. |

3,993 | 1,295,597 | ||||||||||

| Tencent Holdings Ltd. |

40,500 | 2,417,800 | ||||||||||

| Weibo Corp. (Sponsored ADR)(c) |

1,233 | 58,555 | ||||||||||

|

|

|

|||||||||||

| 3,771,952 | ||||||||||||

|

|

|

|||||||||||

| Media – 0.1% |

||||||||||||

| Cheil Worldwide, Inc. |

5,860 | 111,924 | ||||||||||

|

|

|

|||||||||||

| Wireless Telecommunication Services – 0.3% |

||||||||||||

| America Movil SAB de CV |

37,116 | 32,852 | ||||||||||

| Globe Telecom, Inc. |

1,720 | 100,617 | ||||||||||

| PLDT, Inc. |

2,770 | 91,229 | ||||||||||

| SK Telecom Co., Ltd.(c) |

438 | 118,968 | ||||||||||

| Taiwan Mobile Co., Ltd. |

5,000 | 17,733 | ||||||||||

| Turkcell Iletisim Hizmetleri AS |

12,145 | 20,839 | ||||||||||

| Vodacom Group Ltd. |

12,162 | 116,332 | ||||||||||

|

|

|

|||||||||||

| 498,570 | ||||||||||||

|

|

|

|||||||||||

| 4,937,422 | ||||||||||||

|

|

|

|||||||||||

| Industrials – 2.2% |

||||||||||||

| Aerospace & Defense – 0.1% |

||||||||||||

| Bharat Electronics Ltd. |

41,015 | 111,142 | ||||||||||

|

|

|

|||||||||||

| Commercial Services & Supplies – 0.3% |

||||||||||||

| China Everbright Environment Group Ltd. |

149,000 | 111,968 | ||||||||||

| Sunny Friend Environmental Technology Co., Ltd. |

52,000 | 367,567 | ||||||||||

|

|

|

|||||||||||

| 479,535 | ||||||||||||

|

|

|

|||||||||||

| Electrical Equipment – 0.1% |

||||||||||||

| Havells India Ltd. |

5,877 | 108,318 | ||||||||||

| TBEA Co., Ltd. – Class A |

29,600 | 110,360 | ||||||||||

|

|

|

|||||||||||

| 218,678 | ||||||||||||

|

|

|

|||||||||||

| Industrial Conglomerates – 0.4% |

||||||||||||

| CITIC Ltd. |

95,000 | 100,580 | ||||||||||

| Industries Qatar QSC |

33,121 | 140,544 | ||||||||||

| KOC Holding AS |

42,089 | 107,056 | ||||||||||

| Refrigeration Electrical Engineering Corp.(c) |

107,680 | 306,998 | ||||||||||

| Siemens Ltd. |

1,952 | 55,878 | ||||||||||

| Sime Darby Bhd |

128,500 | 69,675 | ||||||||||

|

|

|

|||||||||||

| 780,731 | ||||||||||||

|

|

|

|||||||||||

| 22 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares |

U.S. $ Value | ||||||||||

|

|

||||||||||||

| Machinery – 0.2% |

||||||||||||

| China Yuchai International Ltd. |

23,050 | $ | 313,250 | |||||||||

| Haitian International Holdings Ltd. |

31,000 | 96,182 | ||||||||||

|

|

|

|||||||||||

| 409,432 | ||||||||||||

|

|

|

|||||||||||

| Marine – 0.2% |

||||||||||||

| COSCO SHIPPING Holdings Co., Ltd.(c) |

33,930 | 89,873 | ||||||||||

| COSCO Holdings Co., Ltd. – Class H(b)(c) |

61,100 | 92,715 | ||||||||||

| Evergreen Marine Corp. Taiwan Ltd. |

19,000 | 84,408 | ||||||||||

| Pan Ocean Co., Ltd. |

17,613 | 110,568 | ||||||||||

|

|

|

|||||||||||

| 377,564 | ||||||||||||

|

|

|

|||||||||||

| Professional Services – 0.7% |

||||||||||||

| HeadHunter Group PLC (ADR) |

25,320 | 1,235,616 | ||||||||||

|

|

|

|||||||||||

| Trading Companies & Distributors – 0.0% |

||||||||||||

| Adani Enterprises Ltd. |

889 | 17,477 | ||||||||||

|

|

|

|||||||||||

| Transportation Infrastructure – 0.2% |

||||||||||||

| China Merchants Port Holdings Co., Ltd. |

68,000 | 116,281 | ||||||||||

| International Container Terminal Services, Inc. |

29,500 | 112,772 | ||||||||||

| Shanghai International Port Group Co., Ltd. |

116,100 | 109,407 | ||||||||||

| Zhejiang Expressway Co., Ltd. – Class H |

136,000 | 112,159 | ||||||||||

|

|

|

|||||||||||

| 450,619 | ||||||||||||

|

|

|

|||||||||||

| 4,080,794 | ||||||||||||

|

|

|

|||||||||||

| Real Estate – 2.1% |

||||||||||||

| Equity Real Estate Investment Trusts (REITs) – 0.7% |

||||||||||||

| Fibra Uno Administracion SA de CV |

1,203,550 | 1,369,638 | ||||||||||

|

|

|

|||||||||||

| Real Estate Management & Development – 1.4% |

||||||||||||

| A-Living Smart City Services Co., Ltd. – Class H(a) |

262,750 | 933,086 | ||||||||||

| Agile Group Holdings Ltd. |

144,000 | 134,296 | ||||||||||

| Aldar Properties PJSC |

100,214 | 110,769 | ||||||||||

| China Aoyuan Group Ltd. |

107,000 | 56,402 | ||||||||||

| Country Garden Services Holdings Co., Ltd. |

23,000 | 181,745 | ||||||||||

| Hopson Development Holdings Ltd. |

33,400 | 118,923 | ||||||||||

| Logan Group Co. Ltd. |

10,000 | 10,436 | ||||||||||

| Longfor Properties Co., Ltd.(a) |

106,500 | 486,608 | ||||||||||

| Powerlong Real Estate Holdings Ltd. |

148,000 | 111,558 | ||||||||||

| Vincom Retail JSC(c) |

308,840 | 394,094 | ||||||||||

|

|

|

|||||||||||

| 2,537,917 | ||||||||||||

|

|

|

|||||||||||

| 3,907,555 | ||||||||||||

|

|

|

|||||||||||

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 23 | |

PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares |

U.S. $ Value | ||||||||||

|

|

||||||||||||

| Utilities – 2.0% |

||||||||||||

| Electric Utilities – 0.8% |

||||||||||||

| Centrais Eletricas Brasileiras SA |

16,100 | $ | 113,852 | |||||||||

| CEZ AS |

3,513 | 114,416 | ||||||||||

| Cia Energetica de Minas Gerais (Preference Shares) |

11,900 | 30,658 | ||||||||||

| CPFL Energia SA |

21,600 | 106,815 | ||||||||||

| Equatorial Energia SA |

161,200 | 750,387 | ||||||||||

| Manila Electric Co. |

11,230 | 65,420 | ||||||||||

| Power Grid Corp. of India Ltd. |

102,327 | 260,155 | ||||||||||

|

|

|

|||||||||||

| 1,441,703 | ||||||||||||

|

|

|

|||||||||||

| Gas Utilities – 1.2% |

||||||||||||

| Beijing Enterprises Holdings Ltd. |

14,500 | 57,877 | ||||||||||

| GAIL India Ltd. |

947,977 | 2,018,138 | ||||||||||

| Petronas Gas Bhd |

7,700 | 30,936 | ||||||||||

|

|

|

|||||||||||

| 2,106,951 | ||||||||||||

|

|

|

|||||||||||

| Independent Power and Renewable Electricity Producers – 0.0% |

||||||||||||

| NTPC Ltd. |

17,371 | 33,073 | ||||||||||

|

|

|

|||||||||||

| 3,581,727 | ||||||||||||

|

|

|

|||||||||||

| Consumer Staples – 1.3% |

||||||||||||

| Beverages – 0.4% |

||||||||||||

| Coca-Cola Femsa SAB de CV |

16,361 | 92,357 | ||||||||||

| Tsingtao Brewery Co., Ltd. – Class A |

62,100 | 771,661 | ||||||||||

|

|

|

|||||||||||

| 864,018 | ||||||||||||

|

|

|

|||||||||||

| Food & Staples Retailing – 0.3% |

||||||||||||

| Atacadao SA |

24,300 | 79,249 | ||||||||||

| Magnit PJSC (Sponsored GDR)(a) |

7,323 | 123,392 | ||||||||||

| SPAR Group Ltd. (The) |

8,230 | 107,349 | ||||||||||

| X5 Retail Group NV (GDR)(a) |

8,020 | 260,409 | ||||||||||

|

|

|

|||||||||||

| 570,399 | ||||||||||||

|

|

|

|||||||||||

| Food Products – 0.1% |

||||||||||||

| JBS SA |

18,400 | 125,251 | ||||||||||

|

|

|

|||||||||||

| Household Products – 0.4% |

||||||||||||

| C&S Paper Co., Ltd. |

268,400 | 717,163 | ||||||||||

|

|

|

|||||||||||

| Personal Products – 0.1% |

||||||||||||

| Colgate-Palmolive India Ltd. |

4,788 | 107,779 | ||||||||||

|

|

|

|||||||||||

| Tobacco – 0.0% |

||||||||||||

| Eastern Co. SAE |

75,006 | 58,402 | ||||||||||

|

|

|

|||||||||||

| 2,443,012 | ||||||||||||

|

|

|

|||||||||||

| 24 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares |

U.S. $ Value | ||||||||||

|

|

||||||||||||

| Health Care – 1.3% |

||||||||||||

| Biotechnology – 0.1% |

||||||||||||

| I-Mab (Sponsored ADR)(c) |

577 | $ | 41,827 | |||||||||

| SK Bioscience Co., Ltd.(c) |

466 | 106,463 | ||||||||||

|

|

|

|||||||||||

| 148,290 | ||||||||||||

|

|

|

|||||||||||

| Health Care Providers & Services – 0.3% |

||||||||||||

| Apollo Hospitals Enterprise Ltd. |

1,696 | 101,985 | ||||||||||

| Universal Vision Biotechnology Co., Ltd. |

45,000 | 494,538 | ||||||||||

|

|

|

|||||||||||

| 596,523 | ||||||||||||

|

|

|

|||||||||||

| Life Sciences Tools & Services – 0.1% |

||||||||||||

| Divi’s Laboratories Ltd. |

1,618 | 104,495 | ||||||||||

| Wuxi Biologics Cayman, Inc.(a)(c) |

7,000 | 113,542 | ||||||||||

|

|

|

|||||||||||

| 218,037 | ||||||||||||

|

|

|

|||||||||||

| Pharmaceuticals – 0.8% |

||||||||||||

| China Medical System Holdings Ltd. |

343,000 | 625,114 | ||||||||||

| Genomma Lab Internacional SAB de CV – Class B(c) |

434,970 | 413,023 | ||||||||||

| Richter Gedeon Nyrt |

10,720 | 293,162 | ||||||||||

| Shanghai Fosun Pharmaceutical Group Co., Ltd. – Class H |

14,500 | 74,230 | ||||||||||

|

|

|

|||||||||||

| 1,405,529 | ||||||||||||

|

|

|

|||||||||||

| 2,368,379 | ||||||||||||

|

|

|

|||||||||||

| Total Common Stocks |

104,064,411 | |||||||||||

|

|

|

|||||||||||

| Principal Amount (000) |

||||||||||||

| FIXED INCOME – 37.3% |

||||||||||||

| Sovereign Bonds – 20.3% |

||||||||||||

| Angolan Government International Bond |

U.S.$ | 979 | 991,205 | |||||||||

| 9.375%, 05/08/2048(a) |

448 | 460,824 | ||||||||||

| Argentine Republic Government International Bond |

1,789 | 653,121 | ||||||||||

| 1.00%, 07/09/2029 |

236 | 90,496 | ||||||||||

| 1.125%, 07/09/2035 |

2,792 | 910,298 | ||||||||||

| 2.00%, 01/09/2038 |

1,249 | 481,452 | ||||||||||

| 2.50%, 07/09/2041 |

210 | 76,538 | ||||||||||

| Bahamas Government International Bond |

319 | 296,670 | ||||||||||

| Bahrain Government International Bond |

200 | 198,163 | ||||||||||

| 6.00%, 09/19/2044(a) |

480 | 441,090 | ||||||||||

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 25 | |

PORTFOLIO OF INVESTMENTS (continued)

| Principal Amount (000) |

U.S. $ Value | |||||||||

|

|

||||||||||

| 6.75%, 09/20/2029(a) |

U.S.$ | 244 | $ | 261,355 | ||||||

| 7.00%, 10/12/2028(a) |

334 | 364,895 | ||||||||

| Colombia Government International Bond |

950 | 888,131 | ||||||||

| 3.25%, 04/22/2032 |

535 | 498,352 | ||||||||

| 5.00%, 06/15/2045 |

302 | 294,035 | ||||||||

| 6.125%, 01/18/2041 |

260 | 285,967 | ||||||||

| Dominican Republic International Bond |

100 | 109,206 | ||||||||

| 5.875%, 01/30/2060(a) |

377 | 368,117 | ||||||||

| 6.40%, 06/05/2049(a) |

364 | 385,453 | ||||||||

| 6.50%, 02/15/2048(a) |

298 | 318,357 | ||||||||

| Ecuador Government International Bond |

106 | 55,250 | ||||||||

| 0.50%, 07/31/2040(a) |

446 | 258,509 | ||||||||

| 1.00%, 07/31/2035(a) |

900 | 596,889 | ||||||||

| 5.00%, 07/31/2030(a) |

860 | 719,952 | ||||||||

| Egypt Government International Bond |

359 | 335,665 | ||||||||

| 5.875%, 06/11/2025(a) |

313 | 322,359 | ||||||||

| 7.30%, 09/30/2033(a) |

217 | 209,676 | ||||||||

| 7.50%, 02/16/2061(a) |

253 | 220,110 | ||||||||

| 7.60%, 03/01/2029(a) |

302 | 311,060 | ||||||||

| 7.903%, 02/21/2048(a) |

300 | 271,500 | ||||||||

| 8.15%, 11/20/2059(a) |

585 | 535,275 | ||||||||

| 8.50%, 01/31/2047(a) |

305 | 292,037 | ||||||||

| 8.875%, 05/29/2050(a) |

211 | 207,856 | ||||||||

| El Salvador Government International Bond |

87 | 67,208 | ||||||||

| 6.375%, 01/18/2027(a) |

294 | 219,765 | ||||||||

| 7.125%, 01/20/2050(a) |

938 | 647,220 | ||||||||

| 7.65%, 06/15/2035(a) |

57 | 41,610 | ||||||||

| 7.75%, 01/24/2023(a) |

63 | 53,235 | ||||||||

| 8.625%, 02/28/2029(a) |

226 | 174,585 | ||||||||

| Gabon Government International Bond |

200 | 196,475 | ||||||||

| Ghana Government International Bond |

243 | 230,850 | ||||||||

| 7.875%, 03/26/2027-02/11/2035(a) |

936 | 860,733 | ||||||||

| 8.125%, 03/26/2032(a) |

200 | 189,038 | ||||||||

| 8.627%, 06/16/2049(a) |

432 | 386,181 | ||||||||

| 8.95%, 03/26/2051(a) |

200 | 182,038 | ||||||||

| Honduras Government International Bond |

290 | 305,461 | ||||||||

| Indonesia Government International Bond |

200 | 206,225 | ||||||||

| 4.125%, 01/15/2025(a) |

380 | 415,619 | ||||||||

| 4.20%, 10/15/2050 |

340 | 376,295 | ||||||||

| 26 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

PORTFOLIO OF INVESTMENTS (continued)

| Principal Amount (000) |

U.S. $ Value | |||||||||||

|

|

||||||||||||

| Ivory Coast Government International Bond |

U.S.$ | 1,058 | $ | 1,114,405 | ||||||||

| 6.375%, 03/03/2028(a) |

295 | 324,002 | ||||||||||

| Jamaica Government International Bond |

200 | 232,788 | ||||||||||

| 8.00%, 03/15/2039 |

108 | 151,200 | ||||||||||

| Lebanon Government International Bond |

36 | 5,940 | ||||||||||

| 6.65%, 04/22/2024(a)(c)(d) |

57 | 9,405 | ||||||||||

| 6.85%, 03/23/2027(a)(c)(d) |

481 | 79,365 | ||||||||||

| Series E |

216 | 35,640 | ||||||||||

| Series G |

206 | 33,990 | ||||||||||

| 6.60%, 11/27/2026(a)(c)(d) |

170 | 28,050 | ||||||||||

| Mexico Government International Bond |

140 | 148,864 | ||||||||||

| 5.00%, 04/27/2051 |

249 | 273,091 | ||||||||||

| Mongolia Government International Bond |

200 | 209,725 | ||||||||||

| Nigeria Government International Bond |

401 | 401,501 | ||||||||||

| 6.50%, 11/28/2027(a) |

272 | 280,891 | ||||||||||

| 7.375%, 09/28/2033(a) |

363 | 365,722 | ||||||||||

| 7.625%, 11/28/2047(a) |

633 | 607,403 | ||||||||||

| 7.696%, 02/23/2038(a) |

240 | 236,295 | ||||||||||

| 8.25%, 09/28/2051(a) |

200 | 201,250 | ||||||||||

| Oman Government International Bond |

205 | 212,598 | ||||||||||

| 5.625%, 01/17/2028(a) |

211 | 219,176 | ||||||||||

| 6.50%, 03/08/2047(a) |

294 | 282,754 | ||||||||||

| 6.75%, 01/17/2048(a) |

616 | 607,261 | ||||||||||

| Pakistan Government International Bond |

325 | 325,670 | ||||||||||

| 7.375%, 04/08/2031(a) |

422 | 420,464 | ||||||||||

| Panama Bonos del Tesoro |

350 | 354,266 | ||||||||||

| Panama Government International Bond |

447 | 460,773 | ||||||||||

| 3.87%, 07/23/2060 |

290 | 283,076 | ||||||||||

| 4.00%, 09/22/2024 |

200 | 215,225 | ||||||||||

| Panama Notas del Tesoro |

400 | 426,575 | ||||||||||

| Paraguay Government International Bond |

208 | 234,039 | ||||||||||

| Perusahaan Penerbit SBSN Indonesia III |

200 | 223,413 | ||||||||||

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 27 | |

PORTFOLIO OF INVESTMENTS (continued)

| Principal Amount (000) |

U.S. $ Value | |||||||||||

|

|

||||||||||||

| Peruvian Government International Bond |

U.S.$ | 148 | $ | 122,822 | ||||||||

| Philippine Government International Bond |

281 | 276,465 | ||||||||||

| Qatar Government International Bond |

864 | 1,050,840 | ||||||||||

| 4.50%, 04/23/2028(a) |

300 | 349,837 | ||||||||||

| 5.103%, 04/23/2048(a) |

239 | 316,720 | ||||||||||

| Republic of Guatemala |

215 | 209,535 | ||||||||||

| Republic of Kenya Government International Bond |

346 | 381,205 | ||||||||||

| Republic of South Africa Government International Bond |

550 | 576,154 | ||||||||||

| 5.00%, 10/12/2046 |

460 | 405,950 | ||||||||||

| Romanian Government International Bond |

210 | 208,661 | ||||||||||

| Russian Foreign Bond – Eurobond |

800 | 1,014,150 | ||||||||||

| 5.625%, 04/04/2042(a) |

200 | 258,914 | ||||||||||

| Saudi Government International Bond |

260 | 277,940 | ||||||||||

| 4.625%, 10/04/2047(a) |

310 | 363,862 | ||||||||||

| 5.25%, 01/16/2050(a) |

201 | 259,793 | ||||||||||

| Senegal Government International Bond |

EUR | 400 | 482,250 | |||||||||

| 6.75%, 03/13/2048(a) |

U.S.$ | 200 | 201,725 | |||||||||

| Sri Lanka Government International Bond |

200 | 121,475 | ||||||||||

| 7.85%, 03/14/2029(a) |

240 | 146,070 | ||||||||||

| Turkey Government International Bond |

893 | 692,134 | ||||||||||

| Ukraine Government International Bond |

EUR | 173 | 217,278 | |||||||||

| 6.876%, 05/21/2029(a) |

U.S.$ | 284 | 287,692 | |||||||||

| 7.75%, 09/01/2023-09/01/2026(a) |

1,167 | 1,255,878 | ||||||||||

| Series GDP |

638 | 692,549 | ||||||||||

| Uruguay Government International Bond |

149 | 171,704 | ||||||||||

| 4.975%, 04/20/2055 |

17 | 21,809 | ||||||||||

| 5.10%, 06/18/2050 |

49 | 62,315 | ||||||||||

| Venezuela Government International Bond |

265 | 26,781 | ||||||||||

| 12.75%, 08/23/2022(a)(c)(d) |

564 | 56,410 | ||||||||||

| 28 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

PORTFOLIO OF INVESTMENTS (continued)

| Principal Amount (000) |

U.S. $ Value | |||||||||||

|

|

||||||||||||

| Zambia Government International Bond |

U.S.$ | 825 | $ | 635,250 | ||||||||

|

|

|

|||||||||||

| Total Sovereign Bonds |

37,411,386 | |||||||||||

|

|

|

|||||||||||

| Corporate Bonds – 7.9% |

||||||||||||

| AES Gener SA |

200 | 210,804 | ||||||||||

| AES Panama Generation Holdings SRL |

315 | 324,765 | ||||||||||

| Alfa Desarrollo SpA |

365 | 355,419 | ||||||||||

| Bangkok Bank PCL/Hong Kong |

200 | 203,345 | ||||||||||

| Bidvest Group UK PLC (The) |

365 | 365,512 | ||||||||||

| Braskem Idesa SAPI |

219 | 231,702 | ||||||||||

| Cemex SAB de CV |

251 | 254,137 | ||||||||||

| 7.375%, 06/05/2027(a) |

200 | 221,548 | ||||||||||

| Cemig Geracao e Transmissao SA |

200 | 225,750 | ||||||||||

| Central American Bottling Corp. |

135 | 138,527 | ||||||||||

| Central China Real Estate Ltd. |

260 | 158,275 | ||||||||||

| Chile Electricity Pec SpA |

446 | 363,574 | ||||||||||

| China Aoyuan Group Ltd. |

260 | 196,300 | ||||||||||

| Cia de Minas Buenaventura SAA |

216 | 212,582 | ||||||||||

| Colbun SA |

263 | 285,897 | ||||||||||

| CSN Resources SA |

287 | 283,594 | ||||||||||

| Digicel Group Holdings Ltd. |

16 | 13,343 | ||||||||||

| 8.00% (5.00% Cash and 3.00% PIK), 04/01/2025(a)(f) |

99 | 87,552 | ||||||||||

| 10.00% (8.00% Cash and 2.00% PIK), 04/01/2024(f) |

267 | 267,129 | ||||||||||

| Ecopetrol SA |

401 | 468,368 | ||||||||||

| 7.375%, 09/18/2043 |

185 | 215,294 | ||||||||||

| Embraer Netherlands Finance BV |

155 | 165,172 | ||||||||||

| abfunds.com | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO | 29 | |

PORTFOLIO OF INVESTMENTS (continued)

| Principal Amount (000) |

U.S. $ Value | |||||||||

|

|

||||||||||

| Empresa Electrica Cochrane SpA |

U.S.$ | 170 | $ | 174,566 | ||||||

| Empresas Publicas de Medellin ESP |

200 | 198,775 | ||||||||

| 8.375%, 11/08/2027 |

COP | 418,000 | 103,120 | |||||||

| Gran Tierra Energy International Holdings Ltd. |

U.S.$ | 400 | 347,908 | |||||||

| Gran Tierra Energy, Inc. |

200 | 173,282 | ||||||||

| Grupo Energia Bogota SA ESP |

268 | 301,215 | ||||||||

| Huarong Finance II Co., Ltd. |

861 | 839,475 | ||||||||

| 5.50%, 01/16/2025(a) |

427 | 421,662 | ||||||||

| Indika Energy Capital IV Pte Ltd. |

250 | 260,000 | ||||||||

| Industrias Penoles SAB de CV |

200 | 218,727 | ||||||||

| Infraestructura Energetica Nova SAB de CV |

334 | 357,338 | ||||||||

| Intercorp Financial Services, Inc. |

200 | 202,350 | ||||||||

| Intercorp Peru Ltd. |

200 | 194,750 | ||||||||

| Klabin Austria GmbH |

359 | 343,833 | ||||||||

| Kosmos Energy Ltd. |

200 | 193,663 | ||||||||

| Leviathan Bond Ltd. |

87 | 96,820 | ||||||||

| Lima Metro Line 2 Finance Ltd. |

342 | 363,762 | ||||||||

| Minejesa Capital BV |

215 | 228,499 | ||||||||

| Nexa Resources SA |

329 | 362,765 | ||||||||

| Odebrecht Holdco Finance Ltd. |

132 | 2,183 | ||||||||

| OEC Finance Ltd. |

113 | 9,797 | ||||||||

| Oleoducto Central SA |

285 | 291,733 | ||||||||

| Peru LNG SRL |

294 | 235,935 | ||||||||

| Petrobras Global Finance BV |

158 | 199,515 | ||||||||

| Prosus NV |

318 | 328,991 | ||||||||

| Scenery Journey Ltd. |

205 | 37,925 | ||||||||

| 30 | AB EMERGING MARKETS MULTI-ASSET PORTFOLIO |

abfunds.com | |

PORTFOLIO OF INVESTMENTS (continued)

| Principal Amount (000) |

U.S. $ Value | |||||||||||

|

|

||||||||||||

| SEPLAT Petroleum Development Co. PLC |

U.S.$ | 200 | $ | 208,500 | ||||||||

| SierraCol Energy Andina LLC |

200 | 196,027 | ||||||||||

| Suzano Austria GmbH |

112 | 115,169 | ||||||||||