Form N-CSR/A Miller Investment Trust For: Oct 31

united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22131

Miller Investment Trust

(Exact name of registrant as specified in charter)

20 William Street Wellesley, MA 02481

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 781-416-4000

Date of fiscal year end: 10/31

Date of reporting period:10/31/21

Refile to update Items 4 and 11 (b).

Item 1. Reports to Stockholders.

|

| Miller Convertible Bond Fund |

| Miller Convertible Plus Fund |

| Miller Intermediate Bond Fund |

| Annual Report |

| October 31, 2021 |

| 877- 441- 4434 |

| www.MillerFamilyofFunds.com |

| Investment Advisor |

| Wellesley Asset Management, Inc. |

| The Wellesley Office Park |

| 20 William Street, Suite 310 |

| Wellesley, MA 02481 |

| 781-416-4000 |

| This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of Miller Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. |

| Distributed by Northern Lights Distributors, LLC. Member FINRA |

Dear Fellow Shareholder,

This annual report of the Miller family of funds provides an overview of mutual fund performance for the 12-month period ending October 31, 2021 (“the Reporting Period”) and provides insights into the convertible market, factors that influenced performance over the last year and what investors may expect going forward.

During the reporting period, all share classes of the mutual funds in the Miller family of funds outperformed bonds but underperformed stocks. Similarly, since inception all share classes have outperformed the Bloomberg Barclays US Aggregate Index, while all share classes have underperformed the S&P 500 Total Return Index. Investors must keep in mind that unlike many convertible managers who run equity-like convertible bond strategies, the Miller convertible funds strive to be a more conservative fixed income strategy. As such, historically in equity bull markets we may lag peers, but outperform in equity bear markets. The funds’ performance for the one year ending October 31, 2021 and since inception is as follows:

| One Year Ended | Annualized Since | |

| Miller Convertible Bond Fund | October 31, 2021 | Inception |

| I shares (MCIFX) | 11.04% | 6.91% (12/27/07) |

| A shares (MCFAX.LW) | 10.54% | 6.35% (12/27/07) |

| C shares (MCFCX) | 9.99% | 6.59% (12/01/09) |

| Annualized Since | ||

| Miller Convertible Plus Fund | Inception | |

| I shares (MCPIX) | 8.05% | 8.15% (12/31/14) |

| Annualized Since | ||

| Miller Intermediate Bond Fund | Inception | |

| I shares (MIFIX) | 10.83% | 5.72% (12/31/14) |

The funds’ total net assets under management for the period ended 10/31/2021 were as follows:

| Miller Convertible Bond Fund | $973,805,773 |

| Miller Convertible Plus Fund | $119,886,449 |

| Miller Intermediate Bond Fund | $127,660,494 |

1

Convertible Market Review

For the year ending October 31, 2021, the Bloomberg Barclays US Aggregate Bond Index was down 0.48% while the S&P 500 Total Return Index was up 42.91%. Convertible performance was buoyed by the strength of underlying equities and tighter credit spreads. Higher interest rates and lower volatility offset gains attributable to the previously mentioned factors. Note the following definitions:

| ● | The Bloomberg/Barclays US Aggregate Bond Index represents most investment grade bonds traded in the United States |

| ● | The S&P 500 Total Return Index is a cap-weighted index of 500 common stocks and is regarded as a leading proxy for the US stock market |

| ● | A credit spread is the difference in yield between a U.S. Treasury bond and a debt security with the same maturity but of lesser quality |

Please note that Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses, or sales charges.

The fiscal year started with a bang, as equities responded positively to early November election results. From there it was off to the races with strong equity markets, characterized by low volatility and very small drawdowns. Interest rates experienced a bumpy ride in the beginning of this year as strong economic data and concerns over inflation caused the 10-year Treasury bond yield to more than double to 1.60%. Equity markets continued to march higher until the month of September. Concerns about the sizes of fiscal stimulus packages and worries about inflation caused equity markets to fall almost 5% during the month. It was also during this time the stock market had its first drawdown greater than 5% during our fiscal year. In October it became clear there would be some paring back of the fiscal stimulus packages. Equity markets responded by recuperating September’s losses and ending the fiscal year at all-time highs.

Despite some treasury yield turbulence, the investing environment remained supportive for U.S. equity markets. As the number of COVID-19 cases dropped, the economy began to reopen. With economic numbers improving, corporate earnings continued to beat analyst’s estimates. The CBOE Volatility Index, or VIX, a measure of short-term equity volatility, started the year above 35 and ended at 16, reflecting the calm investing environment. Corporate credit spreads continued to tighten throughout the year despite the rise in government interest rates. Investment grade credit spreads improved by 30 basis points while high yield spreads saw a staggering improvement of 200 basis points. This led to significant outperformance by high yield convertibles (up 72%) when compared to investment grade convertibles (up 17%). The combination of higher equity prices and higher rates provided the ideal backdrop for convertible issuance. Over the fiscal year, more money was raised in the convertible market than in any year going back to 2008.

2

Miller Convertible Bond Fund

Over the last year, the Miller Convertible Bond Fund outperformed the Bloomberg Barclays US Aggregate Bond Index. The combination of higher rates and higher stock prices led to the fund’s outperformance compared to the Bloomberg Barclays US Aggregate Bond Index.

The fund’s position in Innovated Industrial Properties, Inc. (1.65% weight) produced a gain of 122%. On the negative side, the fund’s position in Newmont Mining (1.37% weight) resulted in 16.1% loss.

The fund is well diversified with 79 positions. Ford Motor Company is the largest holding representing 3.17% of the fund’s assets. During the reporting period, the market moved higher in an orderly fashion. As a result, the Fund’s largest monthly drawdown, or peak to trough decline, was only 1.66%.

Miller Convertible Plus Fund

The Miller Convertible Plus Fund also outperformed the Bloomberg Barclays US Aggregate Bond Index and underperformed the S&P 500 Total Return Index. Similar to the Miller Convertible Fund, higher interest rates and higher stock prices led to outperformance versus the Bloomberg Barclays US Aggregate Bond Index.

The Miller Convertible Plus Fund’s top performing position was Smart Global Holdings Inc. (3.74% weight) which returned 66%. The Fund’s worst position was in a NASDAQ put option which was used as a portfolio hedge. The NASDAQ 100 Stock Index NDX US 12/17/21 P13000 (0.10% weight) resulted in a 96% loss.

The fund remains well diversified with 49 positions, the largest which accounts for 4.96% of assets. The Miller Convertible Plus Fund is often the most volatile in the Miller family of funds because of leverage. As a result, the largest monthly drawdown over the fiscal year in the fund was 5.87%.

Miller Intermediate Bond Fund

The Miller Intermediate Bond Fund outperformed the Bloomberg Barclays US Aggregate Bond. In a period of rising interest rates, the fund’s shorter duration led to outperformance relative to the Bloomberg Barclays US Aggregate Bond Index.

The Intermediate Bond Fund’s best performing position was Smart Global Holdings Inc. (1.17% weight) which gained 66%. The Fund’s worst performing position was Trip Advisor Inc. (2.39% weight) which lost 9.83%.

The Intermediate Bond Fund has 54 positions. Ford Motor Company is the largest position representing 2.98% of the fund’s assets. The fund’s largest drawdown for the reporting period was 1.15%.

3

Convertible Bond Strategy Review

We remain committed to the same strategy we have utilized since Wellesley Asset Management was founded in 1991. It is important to note that we do not change our investment strategy regardless of the current investment climate. Our investment focus is to buy convertible bonds and notes (no convertible preferreds, mandatory preferreds, or other convertible structures) which typically offer the return of the majority of principal within seven years of issuance when purchased at or near par value. Before making an investment, we perform a thorough analysis of a company’s balance sheet and income statement. We seek to invest in profitable companies and avoid companies with large debt loads. While we usually invest with the idea of holding bonds until the next liquidity date (maturity, put or call), we consider selling or reducing our exposure if one of the following scenarios occur:

| ● | An issuer’s credit quality deteriorates |

| ● | The bond loses its favorable risk/reward characteristics due to price appreciation |

| ● | We perceive an opportunity to increase portfolio diversification |

| ● | We believe more attractive investments are available. |

One of our key risk management practices involves careful limits on prices we pay to avoid purchasing convertibles trading at prices substantially above par, or which have material negative yields to the next liquidity date. Such investment discipline seeks to reduce exposure to many equity-sensitive convertibles. In the first half of 2021 we reduced equity risk in our portfolios by selling appreciated securities and redeploying those assets into bonds trading closer to their par value. As a result, distributions from our funds were larger than normal in the first half of the year. Profit taking is a normal part of our investment process as we seek to reduce equity risk in our portfolios. While our performance tends to lag broader equity indices in rising markets, we seek to preserve capital in falling stock markets. Our holdings span the convertible market, from investment-grade to small-cap, with a broad distribution among varied industries. Many of our rated convertible bonds are investment grade and a large percentage of the bonds are not rated.

New Issuance

Primary issuance continued on a record setting pace over the last year. Higher equity prices and interest rates created an ideal environment for companies to issue convertibles. About $91 billion of new paper came to market over the last year which was more than any full year since 2008. Below is a sampling of some of the new issues that met the strategy’s investing criteria and found their way into various portfolios (weightings as of October 31, 2021):

| ● | Greenbrier Companies Inc. (2.99% weight), a manufacturer of railroad freight car equipment |

| ● | Halozyme Therapeutics, Inc. (2.88% weight), a developer of drug delivery systems for biologics |

| ● | Ford Motor Company (3.33% weight), a manufacturer of automobiles |

4

Summary

Over the last year, equity investors have been beneficiaries of strong returns with little volatility. Even more unusual is that investors have not had to endure any steep drawdowns in the process. The bulls have plenty to cheer about. Coming out of the Covid-19 crisis, the earnings growth rates of many corporations have been impressive. Combined with a dovish Federal Reserve and “Goldilocks” economic numbers have given the bulls plenty to be excited about going into 2022.

The bears are focused on valuations as P/E’s continue to move higher. In addition, with the passage of the infrastructure package and an upcoming vote on the Build Back Better Act, the bears are concerned that substantial fiscal stimulus together with endless easy money from Central Banks could ignite persistent inflation.

Fortunately, we invest in convertible bonds with asymmetric return profiles and issued by companies with healthy balance sheets which allow investors to stay invested during periods of high valuations or market downturns.

For more detailed and timely information on our funds and Wellesley Asset Management, please visit our website at www.wellesleyassetmanagement.com where you can access quarterly commentaries and fund fact sheets. As always, we thank you for your continued trust and confidence in our management. We look forward to helping you achieve your future goals.

Sincerely,

Greg

Miller, Portfolio Manager

Michael Miller, Portfolio Manager

2444-NLD-11192021

5

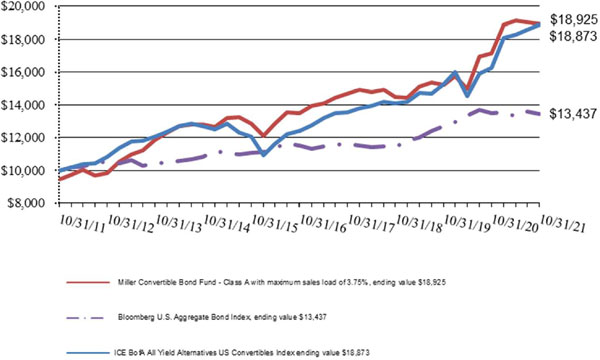

| Miller Convertible Bond Fund Class A |

| GROWTH OF A $10,000 INVESTMENT (Unaudited) |

| Since Inception through October 31, 2021 |

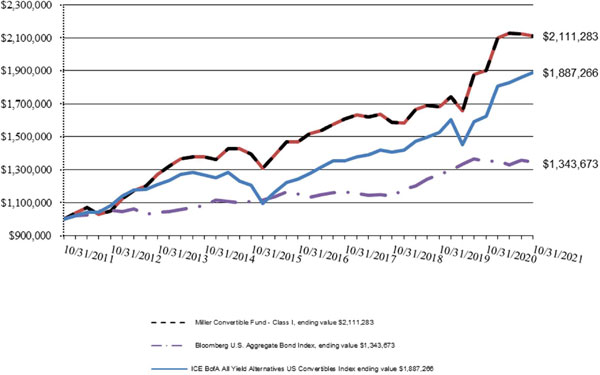

| Miller Convertible Bond Fund Class I |

| GROWTH OF A $1,000,000 INVESTMENT (Unaudited) |

| Since Inception through October 31, 2021 |

6

Total Returns as of October 31, 2021

| Annualized | |||||

| Since Inception * | Since Inception ** | ||||

| One Year | Five Years | Ten Years | (Class A & I) | (Class C) | |

| Miller Convertible Bond Fund: | |||||

| Class A, without sales charge | 10.54% | 6.98% | 7.23% | 6.35% | — |

| Class A, with sales charge of 3.75% | 4.19% | 5.73% | 6.59% | 5.89% | — |

| Class I | 11.04% | 7.50% | 7.76% | 6.91% | — |

| Class C | 9.99% | 6.42% | 6.68% | — | 6.59% |

| Bloomberg U.S. Aggregate Bond Index | (0.48)% | 3.10% | 3.00% | 3.99% | 3.51% |

| ICE BofA All Yield Alternatives US Convertibles Index | 15.97% | 8.74% | 6.56% | 6.01% | 6.74% |

| * | Class A and Class I shares commenced operations on December 27, 2007. |

| ** | Class C shares commenced operations on December 1, 2009. |

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of prices of U.S. dollar-denominated, fixed-rate, taxable, investment grade fixed-income securities with remaining maturities of one year and longer. The Index includes Treasury, government, corporate, mortgage-backed, commercial mortgage-backed and asset-backed securities.

The ICE BofA All Yield Alternatives US Convertibles Index tracks the performance of U.S. dollar denominated convertible debt.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions and the payment of the maximum 3.75% sales charge. Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. Total returns would have been lower had the adviser not waived a portion of its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total gross annual operating expenses, per its prospectus dated March 1, 2021, as supplemented on July 8, 2021, including the indirect expenses of underlying funds, are 1.50%, 1.00%, and 2.00% for Class A shares, Class I shares, and Class C shares, respectively. For performance information current to the most recent month-end, please call 877-441-4434.

7

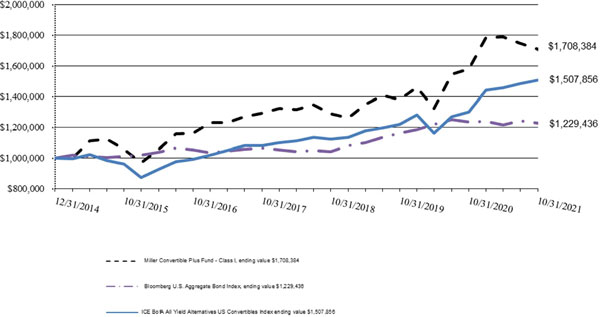

| Miller Convertible Plus Fund Class I |

| GROWTH OF A $1,000,000 INVESTMENT (Unaudited) |

| Since Inception through October 31, 2021 |

Total Returns as of October 31, 2021

| Annualized | |||

| One Year | Five Years | Since Inception* | |

| Miller Convertible Plus Fund: | |||

| Class I | 8.05% | 7.99% | 8.15% |

| Bloomberg U.S. Aggregate Bond Index | (0.48)% | 3.10% | 3.07% |

| ICE BofA All Yield Alternatives US Convertibles Index | 15.97% | 8.74% | 6.19% |

| * | Class I shares commenced operations on December 31, 2014. |

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of prices of U.S. dollar-denominated, fixed-rate, taxable, investment grade fixed-income securities with remaining maturities of one year and longer. The Index includes Treasury, government, corporate, mortgage-backed, commercial mortgage-backed and asset-backed securities.

The ICE BofA All Yield Alternatives US Convertibles Index tracks the performance of U.S. dollar denominated convertible debt.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. Total returns would have been lower had the adviser not waived a portion of its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total gross annual operating expenses, per its prospectus dated March 1, 2021, including the indirect expenses of underlying funds, is 2.97% for Class I shares. For performance information current to the most recent month-end, please call 877-441-4434.

8

| Miller Intermediate Bond Fund Class I |

| GROWTH OF A $1,000,000 INVESTMENT (Unaudited) |

| Since Inception through October 31, 2021 |

Total Returns as of October 31, 2021

| Annualized | |||

| One Year | Five Years | Since Inception* | |

| Miller Intermediate Bond Fund: | |||

| Class I | 10.83% | 5.68% | 5.72% |

| Bloomberg U.S. Aggregate Bond Index | (0.48)% | 3.10% | 3.07% |

| * | Class I shares commenced operations on December 31, 2014. |

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of prices of U.S. dollar-denominated, fixed-rate, taxable, investment grade fixed-income securities with remaining maturities of one year and longer. The Index includes Treasury, government, corporate, mortgage-backed, commercial mortgage-backed and asset-backed securities.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions and . Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. Total returns would have been lower had the adviser not waived a portion of its fees and reimbursed a portion of the Fund’s expenses. The Fund’s total gross annual operating expenses, per its prospectus dated March 1, 2021, including indirect expenses of underlying funds, is 1.06% for Class I shares. For performance information current to the most recent month-end, please call 877-441-4434.

9

| MILLER CONVERTIBLE BOND FUND |

| SCHEDULE OF INVESTMENTS |

| October 31, 2021 |

| Shares | Fair Value | |||||||||||

| COMMON STOCKS — 0.1% | ||||||||||||

| ASSET MANAGEMENT - 0.1% | ||||||||||||

| 88,200 | Acropolis Infrastructure Acquisition Corporation(a) | $ | 879,354 | |||||||||

| 44,000 | TortoiseEcofin Acquisition Corporation III(a) | 437,800 | ||||||||||

| 1,317,154 | ||||||||||||

| TOTAL COMMON STOCKS (Cost $1,322,000) | 1,317,154 | |||||||||||

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | ||||||||||

| CONVERTIBLE BONDS — 96.6% | ||||||||||||

| AEROSPACE & DEFENSE — 0.2% | ||||||||||||

| 2,000,000 | Kaman Corporation | 3.2500 | 05/01/24 | 2,032,600 | ||||||||

| ASSET MANAGEMENT — 0.0%(b) | ||||||||||||

| 100,000 | Ares Capital Corporation | 4.6250 | 03/01/24 | 114,130 | ||||||||

| 100,000 | New Mountain Finance Corporation | 5.7500 | 08/15/23 | 107,505 | ||||||||

| 221,635 | ||||||||||||

| AUTOMOTIVE — 3.2% | ||||||||||||

| 26,000,000 | Ford Motor Company(c),(d) | — | 03/15/26 | 30,885,059 | ||||||||

| BANKING — 0.8% | ||||||||||||

| 8,000,000 | Hope Bancorp, Inc. | 2.0000 | 05/15/38 | 7,835,044 | ||||||||

| BASIC INDUSTRY — 0.2% | ||||||||||||

| 2,000,000 | Dow, Inc. - Bank of America Finance LLC Synthetic(f) | 2.6410 | 06/18/24 | 2,128,600 | ||||||||

| BEVERAGES — 0.0%(b) | ||||||||||||

| 100,000 | PepsiCo, Inc. - Citigroup Global Markets Holdings, Inc. Synthetic(f) | 1.4930 | 12/30/27 | 95,660 | ||||||||

| BIOTECH & PHARMA — 18.2% | ||||||||||||

| 17,400,000 | AbbVie, Inc. - Goldman Sachs Finance Corp. Synthetic(f) | 1.4700 | 02/03/28 | 16,352,520 | ||||||||

| 10,000,000 | AbbVie, Inc. - Goldman Sachs Finance Corp. Synthetic(f) | 1.9900 | 05/01/28 | 9,703,000 | ||||||||

| 16,000,000 | BioMarin Pharmaceutical, Inc. | 1.2500 | 05/15/27 | 16,179,625 | ||||||||

| 17,000,000 | Bristol-Myers Squibb Co. - Wells Fargo Finance, LLC. Synthetic(f) | 2.3100 | 11/01/24 | 17,588,200 | ||||||||

| 30,000,000 | Halozyme Therapeutics, Inc.(c) | 0.2500 | 03/01/27 | 26,688,799 | ||||||||

| 25,000,000 | Jazz Investments I Ltd. | 1.5000 | 08/15/24 | 25,468,750 | ||||||||

The accompanying notes are an integral part of these financial statements.

10

| MILLER CONVERTIBLE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| CONVERTIBLE BONDS — 96.6% (Continued) | ||||||||||||

| BIOTECH & PHARMA — 18.2% (Continued) | ||||||||||||

| 18,000,000 | Johnson & Johnson - Citigroup Global Markets Holdings, Inc. Synthetic(f) | 1.7920 | 06/30/27 | $ | 18,414,000 | |||||||

| 100,000 | Johnson & Johnson - Citigroup Global Markets Holdings, Inc. Synthetic(f) | 1.5470 | 10/25/27 | 96,690 | ||||||||

| 100,000 | Ligand Pharmaceuticals, Inc. | 0.7500 | 05/15/23 | 101,187 | ||||||||

| 7,300,000 | Merck & Co., Inc. - Goldman Sachs Financial Corp. Synthetic(f) | 1.5700 | 02/24/28 | 7,393,440 | ||||||||

| 13,886,000 | Merck & Co., Inc. UBS Group AG Synthetic(f) | 1.7721 | 05/25/28 | 14,469,212 | ||||||||

| 100,000 | Pacira BioSciences, Inc. | 2.3750 | 04/01/22 | 103,012 | ||||||||

| 22,000,000 | Pacira BioSciences, Inc. | 0.7500 | 08/01/25 | 23,147,983 | ||||||||

| 1,000,000 | Supernus Pharmaceuticals, Inc. | 0.6250 | 04/01/23 | 994,375 | ||||||||

| 176,700,793 | ||||||||||||

| CABLE & SATELLITE — 2.7% | ||||||||||||

| 100,000 | Charter Communications, Inc. - Bank of America Finance LLC Synthetic(f) | 1.7700 | 09/01/22 | 117,900 | ||||||||

| 26,000,000 | Liberty Broadband Corp. Synthetic(c),(f) | 1.2500 | 09/30/50 | 26,005,382 | ||||||||

| 26,123,282 | ||||||||||||

| CONSUMER SERVICES — 2.3% | ||||||||||||

| 22,000,000 | Stride, Inc. | 1.1250 | 09/01/27 | 22,088,000 | ||||||||

| DIVERSIFIED INDUSTRIALS — 1.0% | ||||||||||||

| 100,000 | 3M Co. - Citigroup Global Markets Holdings, Inc. Synthetic(f) | 1.4930 | 12/30/27 | 93,510 | ||||||||

| 10,000,000 | 3M Co. - Citigroup Global Markets Holdings, Inc. Synthetic(f) | 2.1030 | 04/20/28 | 9,348,000 | ||||||||

| 9,441,510 | ||||||||||||

| ELECTRICAL EQUIPMENT — 3.7% | ||||||||||||

| 9,000,000 | OSI Systems, Inc. | 1.2500 | 09/01/22 | 9,331,927 | ||||||||

| 18,000,000 | SMART Global Holdings, Inc. | 2.2500 | 02/15/26 | 26,865,000 | ||||||||

| 36,196,927 | ||||||||||||

| ENTERTAINMENT CONTENT — 0.2% | ||||||||||||

| 2,000,000 | IMAX Corporation(c) | 0.5000 | 04/01/26 | 1,984,481 | ||||||||

| FOOD — 1.2% | ||||||||||||

| 12,000,000 | The Kraft Heinz Co. - Citigroup Global Markets Holdings, Inc. Synthetic(f) | 1.7920 | 06/30/27 | 11,834,400 | ||||||||

| HEALTH CARE FACILITIES & SERVICES — 2.4% | ||||||||||||

| 19,000,000 | PetIQ, Inc. | 4.0000 | 06/01/26 | 22,974,800 | ||||||||

The accompanying notes are an integral part of these financial statements.

11

| MILLER CONVERTIBLE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| CONVERTIBLE BONDS — 96.6% (Continued) | ||||||||||||

| INSTITUTIONAL FINANCIAL SERVICES — 0.0%(b) | ||||||||||||

| 100,000 | Voya Financial, Inc. - Bank of America Finance LLC Synthetic(f) | 3.1425 | 05/01/23 | $ | 112,800 | |||||||

| INSURANCE — 2.3% | ||||||||||||

| 22,500,000 | Berkshire Hathaway, Inc. - Barclays Bank PLC Synthetic(f) | 1.8652 | 04/14/28 | 22,000,500 | ||||||||

| INTERNET MEDIA & SERVICES— 6.0% | ||||||||||||

| 14,050,000 | Amazon.com, Inc.- JPMorgan Chase Financial Co., LLC Synthetic(f) | 3.5900 | 04/21/23 | 21,615,925 | ||||||||

| 7,000,000 | Google, Inc. - Bank of America Finance LLC Synthetic(f) | 3.6429 | 09/28/23 | 13,649,300 | ||||||||

| 21,000,000 | TripAdvisor, Inc.(c) | 0.2500 | 04/01/26 | 18,874,906 | ||||||||

| 5,000,000 | Twitter, Inc.(c),(d) | — | 03/15/26 | 4,607,287 | ||||||||

| 58,747,418 | ||||||||||||

| LEISURE FACILITIES & SERVICES — 7.9% | ||||||||||||

| 22,000,000 | Cheesecake Factory, Inc. | 0.3750 | 06/15/26 | 20,050,523 | ||||||||

| 15,000,000 | Cracker Barrel Old Country Store, Inc.(c) | 0.6250 | 06/15/26 | 14,725,609 | ||||||||

| 22,000,000 | DraftKings, Inc.(c),(d) | — | 03/15/28 | 19,292,703 | ||||||||

| 14,500,000 | McDonald’s Corp. - Credit Suisse AG Synthetic(f) | 1.9200 | 05/28/27 | 15,354,050 | ||||||||

| 7,000,000 | Vail Resorts, Inc.(c),(d) | — | 01/01/26 | 7,740,229 | ||||||||

| 77,163,114 | ||||||||||||

| LEISURE PRODUCTS — 5.4% | ||||||||||||

| 13,000,000 | D.R. Horton, Inc. - Barclays Bank PLC Synthetic(f) | 3.8900 | 09/26/23 | 22,072,700 | ||||||||

| 16,360,000 | LCI Industries(c) | 1.1250 | 05/15/26 | 17,281,275 | ||||||||

| 10,000,000 | Winnebago Industries Inc | 1.5000 | 04/01/25 | 12,857,848 | ||||||||

| 52,211,823 | ||||||||||||

| MEDICAL EQUIPMENT & DEVICES — 3.6% | ||||||||||||

| 29,000,000 | Haemonetics Corporation(c),(d) | — | 03/01/26 | 25,464,164 | ||||||||

| 10,000,000 | NuVasive, Inc. | 0.3750 | 03/15/25 | 9,475,000 | ||||||||

| 34,939,164 | ||||||||||||

| METALS & MINING — 1.7% | ||||||||||||

| 17,000,000 | Century Aluminum Company(c) | 2.7500 | 05/01/28 | 16,920,262 | ||||||||

| 100,000 | Newmont Mining Corp. - Barclays Bank PLC Synthetic(f) | 3.9200 | 10/30/23 | 145,850 | ||||||||

| 17,066,112 | ||||||||||||

| OIL & GAS — 3.3% | ||||||||||||

| 27,000,000 | Chevron Corporation - Bank of America Finance LLC Synthetic(f) | 1.9500 | 10/27/28 | 27,099,900 | ||||||||

The accompanying notes are an integral part of these financial statements.

12

| MILLER CONVERTIBLE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| CONVERTIBLE BONDS — 96.6% (Continued) | ||||||||||||

| OIL & GAS — 3.3% (Continued) | ||||||||||||

| 4,462,000 | Exxon Mobil Corp. - Citigroup Global Markets Holdings, Inc. Synthetic(f) | 1.5490 | 11/24/27 | $ | 4,920,247 | |||||||

| 32,020,147 | ||||||||||||

| REAL ESTATE INVESTMENT TRUSTS — 1.6% | ||||||||||||

| 4,000,000 | IIP Operating Partnership, L.P.(c) | 3.7500 | 02/21/24 | 16,030,000 | ||||||||

| RENEWABLE ENERGY — 1.4% | ||||||||||||

| 12,500,000 | Enphase Energy, Inc.(c),(d) | — | 03/01/26 | 13,589,158 | ||||||||

| 100,000 | Green Plains, Inc. | 2.2500 | 03/15/27 | 142,000 | ||||||||

| 13,731,158 | ||||||||||||

| RETAIL - DISCRETIONARY — 0.1% | ||||||||||||

| 1,000,000 | Guess?, Inc. | 2.0000 | 04/15/24 | 1,110,000 | ||||||||

| SEMICONDUCTORS — 2.5% | ||||||||||||

| 24,000,000 | Vishay Intertechnology, Inc. | 2.2500 | 06/15/25 | 24,434,400 | ||||||||

| SOFTWARE — 3.2% | ||||||||||||

| 10,000,000 | Akamai Technologies, Inc. | 0.3750 | 09/01/27 | 11,018,750 | ||||||||

| 7,000,000 | Microsoft Corp. - Morgan Stanley Finance, LLC. Synthetic(f) | 2.3773 | 10/25/24 | 12,572,350 | ||||||||

| 7,000,000 | Mitek Systems, Inc.(c) | 0.7500 | 02/01/26 | 7,921,719 | ||||||||

| 31,512,819 | ||||||||||||

| SPECIALTY FINANCE — 0.1% | ||||||||||||

| 100,000 | MFA Financial, Inc. | 6.2500 | 06/15/24 | 103,750 | ||||||||

| 100,000 | PennyMac Corporation(c) | 5.5000 | 03/15/26 | 103,500 | ||||||||

| 1,000,000 | Redwood Trust, Inc. | 5.6250 | 07/15/24 | 1,048,800 | ||||||||

| 1,256,050 | ||||||||||||

| TECHNOLOGY HARDWARE — 2.6% | ||||||||||||

| 7,000,000 | Apple, Inc. - JPMorgan Chase Financial Co., LLC Synthetic(f) | 3.8700 | 10/16/23 | 16,326,800 | ||||||||

| 8,000,000 | InterDigital, Inc. | 2.0000 | 06/01/24 | 8,665,000 | ||||||||

| 100,000 | Lumentum Holdings, Inc. | 0.5000 | 12/15/26 | 109,250 | ||||||||

| 25,101,050 | ||||||||||||

| TECHNOLOGY SERVICES — 6.9% | ||||||||||||

| 15,000,000 | Euronet Worldwide, Inc. | 0.7500 | 03/15/49 | 16,254,133 | ||||||||

The accompanying notes are an integral part of these financial statements.

13

| MILLER CONVERTIBLE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| CONVERTIBLE BONDS — 96.6% (Continued) | ||||||||||||

| TECHNOLOGY SERVICES — 6.9% (Continued) | ||||||||||||

| 1,000,000 | Insight Enterprises, Inc. | 0.7500 | 02/15/25 | $ | 1,457,250 | |||||||

| 19,000,000 | International Business Machines Corporation - Credit Suisse AG Synthetic(f) | 1.8775 | 07/03/28 | 17,605,400 | ||||||||

| 8,000,000 | International Business Machines Corporation - JPMorgan Chase Financial Company, LLC Synthetic(f) | 1.0200 | 06/29/28 | 7,631,200 | ||||||||

| 23,000,000 | Parsons Corporation | 0.2500 | 08/15/25 | 23,441,032 | ||||||||

| 100,000 | Visa, Inc. - Barclays Bank PLC Synthetic(f) | 1.2800 | 02/18/25 | 109,880 | ||||||||

| 66,498,895 | ||||||||||||

| TRANSPORTATION & LOGISTICS — 6.2% | ||||||||||||

| 12,309,000 | Air Transport Services Group, Inc. | 1.1250 | 10/15/24 | 13,078,312 | ||||||||

| 26,000,000 | JetBlue Airways Corporation(c) | 0.5000 | 04/01/26 | 25,095,625 | ||||||||

| 24,000,000 | Spirit Airlines, Inc. | 1.0000 | 05/15/26 | 21,705,600 | ||||||||

| 59,879,537 | ||||||||||||

| TRANSPORTATION EQUIPMENT — 5.7% | ||||||||||||

| 391,000 | Greenbrier Companies, Inc. | 2.8750 | 02/01/24 | 394,660 | ||||||||

| 27,000,000 | Greenbrier Companies, Inc.(c) | 2.8750 | 04/15/28 | 28,164,927 | ||||||||

| 25,000,000 | Meritor, Inc. | 3.2500 | 10/15/37 | 27,258,087 | ||||||||

| 55,817,674 | ||||||||||||

| WHOLESALE - CONSUMER STAPLES — 0.0%(b) | ||||||||||||

| 100,000 | Chefs’ Warehouse, Inc. | 1.8750 | 12/01/24 | 110,380 | ||||||||

| TOTAL CONVERTIBLE BONDS (Cost $883,035,675) | 940,285,832 | |||||||||||

| U.S. GOVERNMENT & AGENCIES — 0.0%(b) | ||||||||||||

| U.S. TREASURY OBLIGATIONS — 0.0%(b) | ||||||||||||

| 100,000 | United States Treasury Note | 0.6250 | 03/31/27 | 96,725 | ||||||||

| TOTAL U.S. GOVERNMENT & AGENCIES (Cost $99,282) | ||||||||||||

The accompanying notes are an integral part of these financial statements.

14

| MILLER CONVERTIBLE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| Shares | Fair Value | |||||||

| SHORT-TERM INVESTMENTS — 3.1% | ||||||||

| MONEY MARKET FUND - 3.1% | ||||||||

| 30,409,467 | BlackRock Liquidity Funds T-Fund, Institutional Class, 0.01%(e) | $ | 30,409,467 | |||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $30,409,467) | ||||||||

| TOTAL INVESTMENTS - 99.8% (Cost $914,866,424) | $ | 972,109,178 | ||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES- 0.2% | 1,696,595 | |||||||

| NET ASSETS - 100.0% | $ | 973,805,773 | ||||||

| LLC | - Limited Liability Company |

| LP | - Limited Partnership |

| LTD | - Limited Company |

| PLC | - Public Limited Company |

| REIT | - Real Estate Investment Trust |

| (a) | Non-income producing security. |

| (b) | Percentage rounds to less than 0.1%. |

| (c) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. |

| (d) | Zero coupon bond. |

| (e) | Rate disclosed is the seven-day effective yield as of October 31, 2021. |

| (f) | Interest rate represents the comparable yield on the contingent payment debt instruments. |

| PORTFOLIO ANALYSIS | ||||

| As of October 31, 2021 | ||||

| % of Net | ||||

| Sector | Assets | |||

| Health Care | 24.1 | % | ||

| Consumer Discretionary | 18.9 | % | ||

| Technology | 18.8 | % | ||

| Industrial | 16.8 | % | ||

| Communications | 5.3 | % | ||

| Energy | 4.7 | % | ||

| Financial | 3.3 | % | ||

| Materials | 2.0 | % | ||

| Real Estate | 1.6 | % | ||

| Consumer Staples | 1.2 | % | ||

| U.S. Treasury Obligations | 0.0 | % | ||

| Short-Term Investments | 3.1 | % | ||

| Other Assets in Excess of Liabilities | 0.2 | % | ||

| 100.0 | % | |||

The accompanying notes are an integral part of these financial statements.

15

| MILLER CONVERTIBLE PLUS FUND |

| SCHEDULE OF INVESTMENTS |

| October 31, 2021 |

| Shares | Fair Value | |||||||||||

| COMMON STOCKS — 1.6% | ||||||||||||

| AUTOMOTIVE - 1.6% | ||||||||||||

| 34,000 | General Motors Company(a) | $ | 1,850,620 | |||||||||

| TOTAL COMMON STOCKS (Cost $1,800,300) | ||||||||||||

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | ||||||||||

| CONVERTIBLE BONDS — 142.2% | ||||||||||||

| AEROSPACE & DEFENSE — 1.7% | ||||||||||||

| 2,000,000 | Kaman Corporation | 3.2500 | 05/01/24 | 2,032,600 | ||||||||

| AUTOMOTIVE — 5.0% | ||||||||||||

| 5,000,000 | Ford Motor Company(b),(c) | — | 03/15/26 | 5,939,434 | ||||||||

| BASIC INDUSTRY — 0.9% | ||||||||||||

| 1,000,000 | Dow, Inc. - Bank of America Finance LLC Synthetic(e) | 2.6410 | 06/18/24 | 1,064,300 | ||||||||

| BIOTECH & PHARMA — 29.2% | ||||||||||||

| 5,000,000 | AbbVie, Inc. - Goldman Sachs Finance Corp. Synthetic(e) | 1.9900 | 05/01/28 | 4,851,500 | ||||||||

| 4,300,000 | BioMarin Pharmaceutical, Inc. | 1.2500 | 05/15/27 | 4,348,274 | ||||||||

| 4,500,000 | Bristol-Myers Squibb Co. - Wells Fargo Finance, LLC. Synthetic(e) | 2.3100 | 11/01/24 | 4,655,700 | ||||||||

| 5,600,000 | Halozyme Therapeutics, Inc.(b) | 0.2500 | 03/01/27 | 4,981,909 | ||||||||

| 4,100,000 | Jazz Investments I Ltd. | 1.5000 | 08/15/24 | 4,176,875 | ||||||||

| 3,000,000 | Johnson & Johnson - Citigroup Global Markets Holdings, Inc. Synthetic(e) | 1.5470 | 10/25/27 | 2,900,700 | ||||||||

| 4,700,000 | Merck & Co., Inc. UBS Group AG Synthetic(e) | 1.7721 | 05/25/28 | 4,897,400 | ||||||||

| 4,000,000 | Pacira BioSciences, Inc. | 0.7500 | 08/01/25 | 4,208,724 | ||||||||

| 35,021,082 | ||||||||||||

| CABLE & SATELLITE — 3.9% | ||||||||||||

| 4,700,000 | Liberty Broadband Corp. Synthetic(b),(e) | 1.2500 | 09/30/50 | 4,700,973 | ||||||||

| CONSUMER SERVICES — 3.8% | ||||||||||||

| 4,500,000 | Stride, Inc. | 1.1250 | 09/01/27 | 4,518,000 | ||||||||

| ELECTRICAL EQUIPMENT — 4.6% | ||||||||||||

| 1,000,000 | OSI Systems, Inc. | 1.2500 | 09/01/22 | 1,036,881 | ||||||||

| 3,000,000 | SMART Global Holdings, Inc. | 2.2500 | 02/15/26 | 4,477,500 | ||||||||

| 5,514,381 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

16

| MILLER CONVERTIBLE PLUS FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| CONVERTIBLE BONDS — 142.2% (Continued) | ||||||||||||

| ENTERTAINMENT CONTENT — 1.1% | ||||||||||||

| 1,325,000 | IMAX Corporation(b) | 0.5000 | 04/01/26 | $ | 1,314,719 | |||||||

| HEALTH CARE FACILITIES & SERVICES — 3.5% | ||||||||||||

| 3,500,000 | PetIQ, Inc. | 4.0000 | 06/01/26 | 4,232,200 | ||||||||

| INTERNET MEDIA & SERVICES — 10.0% | ||||||||||||

| 2,050,000 | Amazon.com, Inc.- JPMorgan Chase Financial Co., LLC Synthetic(e) | 3.5900 | 04/21/23 | 3,153,925 | ||||||||

| 1,500,000 | Google, Inc. - Bank of America Finance LLC Synthetic(e) | 3.6429 | 09/28/23 | 2,924,850 | ||||||||

| 3,500,000 | TripAdvisor, Inc.(b) | 0.2500 | 04/01/26 | 3,145,818 | ||||||||

| 3,000,000 | Twitter, Inc.(b),(c) | — | 03/15/26 | 2,764,372 | ||||||||

| 11,988,965 | ||||||||||||

| LEISURE FACILITIES & SERVICES 13.4% | ||||||||||||

| 4,500,000 | Cheesecake Factory, Inc. (The) | 0.3750 | 06/15/26 | 4,101,243 | ||||||||

| 4,350,000 | Cracker Barrel Old Country Store, Inc.(b) | 0.6250 | 06/15/26 | 4,270,427 | ||||||||

| 4,500,000 | DraftKings, Inc.(b),(c) | — | 03/15/28 | 3,946,235 | ||||||||

| 2,500,000 | McDonald’s Corp. - Credit Suisse AG Synthetic(e) | 1.9200 | 05/28/27 | 2,647,250 | ||||||||

| 1,000,000 | Vail Resorts, Inc.(b),(c) | — | 01/01/26 | 1,105,747 | ||||||||

| 16,070,902 | ||||||||||||

| LEISURE PRODUCTS — 7.6% | ||||||||||||

| 2,200,000 | D.R. Horton, Inc. - Barclays Bank PLC Synthetic(e) | 3.8900 | 09/26/23 | 3,735,380 | ||||||||

| 3,500,000 | LCI Industries(b) | 1.1250 | 05/15/26 | 3,697,094 | ||||||||

| 1,300,000 | Winnebago Industries Inc | 1.5000 | 04/01/25 | 1,671,520 | ||||||||

| 9,103,994 | ||||||||||||

| MEDICAL EQUIPMENT & DEVICES — 4.0% | ||||||||||||

| 5,500,000 | Haemonetics Corporation(b),(c) | — | 03/01/26 | 4,829,410 | ||||||||

| METALS & MINING — 3.7% | ||||||||||||

| 4,500,000 | Century Aluminum Company(b) | 2.7500 | 05/01/28 | 4,478,893 | ||||||||

The accompanying notes are an integral part of these financial statements.

17

| MILLER CONVERTIBLE PLUS FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| CONVERTIBLE BONDS 142.2% (Continued) | ||||||||||||

| OIL & GAS 6.7% | ||||||||||||

| 4,600,000 | Chevron Corporation - Bank of America Finance LLC Synthetic(e) | 1.9500 | 10/27/28 | $ | 4,617,020 | |||||||

| 3,100,000 | Exxon Mobil Corp. - Citigroup Global Markets Holdings, Inc. Synthetic(e) | 1.5490 | 11/24/27 | 3,418,370 | ||||||||

| 8,035,390 | ||||||||||||

| RENEWABLE ENERGY — 1.8% | ||||||||||||

| 2,000,000 | Enphase Energy, Inc.(b),(c) | — | 03/01/26 | 2,174,265 | ||||||||

| SEMICONDUCTORS — 3.8% | ||||||||||||

| 4,500,000 | Vishay Intertechnology, Inc. | 2.2500 | 06/15/25 | 4,581,450 | ||||||||

| SOFTWARE — 4.2% | ||||||||||||

| 1,600,000 | Akamai Technologies, Inc. | 0.3750 | 09/01/27 | 1,763,000 | ||||||||

| 1,200,000 | Microsoft Corp. - Morgan Stanley Finance, LLC. Synthetic(e) | 2.3773 | 10/25/24 | 2,155,260 | ||||||||

| 1,000,000 | Mitek Systems, Inc.(b) | 0.7500 | 02/01/26 | 1,131,674 | ||||||||

| 5,049,934 | ||||||||||||

| TECHNOLOGY HARDWARE — 4.0% | ||||||||||||

| 1,450,000 | Apple, Inc. - JPMorgan Chase Financial Co., LLC Synthetic(e) | 3.8700 | 10/16/23 | 3,381,980 | ||||||||

| 1,289,000 | InterDigital, Inc. | 2.0000 | 06/01/24 | 1,396,148 | ||||||||

| 4,778,128 | ||||||||||||

| TECHNOLOGY SERVICES — 9.4% | ||||||||||||

| 1,900,000 | Euronet Worldwide, Inc. | 0.7500 | 03/15/49 | 2,058,857 | ||||||||

| 5,000,000 | International Business Machines Corporation - Credit Suisse AG Synthetic(e) | 1.8775 | 07/03/28 | 4,633,000 | ||||||||

| 4,500,000 | Parsons Corporation | 0.2500 | 08/15/25 | 4,586,289 | ||||||||

| 11,278,146 | ||||||||||||

| TRANSPORTATION & LOGISTICS — 11.7% | ||||||||||||

| 4,385,000 | Air Transport Services Group, Inc. | 1.1250 | 10/15/24 | 4,659,062 | ||||||||

| 5,000,000 | JetBlue Airways Corporation(b) | 0.5000 | 04/01/26 | 4,826,082 | ||||||||

| 5,000,000 | Spirit Airlines, Inc. | 1.0000 | 05/15/26 | 4,522,000 | ||||||||

| 14,007,144 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

18

| MILLER CONVERTIBLE PLUS FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| Principal | Coupon Rate | |||||||||||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||||||||||

| TRANSPORTATION EQUIPMENT — 8.2% | ||||||||||||||||||||

| 4,700,000 | Greenbrier Companies, Inc.(b) | 2.8750 | 04/15/28 | $ | 4,902,784 | |||||||||||||||

| 4,500,000 | Meritor, Inc. | 3.2500 | 10/15/37 | 4,906,456 | ||||||||||||||||

| 9,809,240 | ||||||||||||||||||||

| TOTAL CONVERTIBLE BONDS (Cost $163,250,342) | 170,523,550 | |||||||||||||||||||

| Expiration | ||||||||||||||||||||

| Contracts(d) | Date | Exercise Price | Notional Value | |||||||||||||||||

| EQUITY OPTIONS PURCHASED (a) - 0.2% | ||||||||||||||||||||

| PUT OPTIONS PURCHASED - 0.2% | ||||||||||||||||||||

| 360 | General Motors Company | 01/20/2023 | $ | 50 | $ | 1,959,480 | 207,720 | |||||||||||||

| TOTAL PUT OPTIONS PURCHASED (Cost - $458,980) | ||||||||||||||||||||

| TOTAL EQUITY OPTIONS PURCHASED (Cost - $458,980) | 207,720 | |||||||||||||||||||

| Contracts(d) | ||||||||||||||||||||

| INDEX OPTIONS PURCHASED (a) - 0.1% | ||||||||||||||||||||

| PUT OPTIONS PURCHASED - 0.1% | ||||||||||||||||||||

| 37 | NASDAQ 100 Index | 12/17/2021 | 13,000 | 58,646,739 | 116,550 | |||||||||||||||

| 32 | S&P 500 Index | 01/21/2022 | 3,850 | 14,737,216 | 75,360 | |||||||||||||||

| TOTAL PUT OPTIONS PURCHASED (Cost - $3,996,138) | 191,910 | |||||||||||||||||||

| TOTAL INDEX OPTIONS PURCHASED (Cost - $3,996,138) | 191,910 | |||||||||||||||||||

| TOTAL INVESTMENTS - 144.1% (Cost $169,505,760) | $ | 172,773,800 | ||||||||||||||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (44.1)% | (52,887,351 | ) | ||||||||||||||||||

| NET ASSETS - 100.0% | $ | 119,886,449 | ||||||||||||||||||

| LLC | - Limited Liability Company |

| LTD | - Limited Company |

| PLC | - Public Limited Company |

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. |

| (c) | Zero coupon bond. |

| (d) | Each contract is equivalent to one futures contract. |

| (e) | Interest rate represents the comparable yield on the contingent payment debt instruments. |

The accompanying notes are an integral part of these financial statements.

19

| MILLER CONVERTIBLE PLUS FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| PORTFOLIO ANALYSIS | ||||

| As of October 31, 2021 | ||||

| % of Net | ||||

| Sector | Assets | |||

| Health Care | 36.8 | % | ||

| Consumer Discretionary | 31.3 | % | ||

| Technology | 26.5 | % | ||

| Industrial | 26.2 | % | ||

| Communications | 9.9 | % | ||

| Energy | 8.5 | % | ||

| Materials | 4.6 | % | ||

| Options | 0.3 | % | ||

| Liabilities in Excess of Other Assets | (44.1 | )% | ||

| 100.0 | % | |||

The accompanying notes are an integral part of these financial statements.

20

| MILLER INTERMEDIATE BOND FUND |

| SCHEDULE OF INVESTMENTS |

| October 31, 2021 |

| Shares | Fair Value | |||||||||||

| COMMON STOCKS — 1.1% | ||||||||||||

| ASSET MANAGEMENT - 1.1% | ||||||||||||

| 100,000 | Acropolis Infrastructure Acquisition Corporation(a) | $ | 997,000 | |||||||||

| 44,000 | TortoiseEcofin Acquisition Corporation III(a) | 437,800 | ||||||||||

| 1,434,800 | ||||||||||||

| TOTAL COMMON STOCKS (Cost $1,440,000) | 1,434,800 | |||||||||||

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| CONVERTIBLE BONDS — 92.6% | ||||||||||||

| AEROSPACE & DEFENSE — 0.8% | ||||||||||||

| 1,000,000 | Kaman Corporation | 3.2500 | 05/01/24 | 1,016,300 | ||||||||

| ASSET MANAGEMENT — 1.3% | ||||||||||||

| 1,500,000 | New Mountain Finance Corporation | 5.7500 | 08/15/23 | 1,612,575 | ||||||||

| AUTOMOTIVE — 3.0% | ||||||||||||

| 3,200,000 | Ford Motor Company(b),(c) | — | 03/15/26 | 3,801,238 | ||||||||

| BANKING — 2.3% | ||||||||||||

| 3,000,000 | Hope Bancorp, Inc. | 2.0000 | 05/15/38 | 2,938,141 | ||||||||

| BASIC INDUSTRY — 0.8% | ||||||||||||

| 1,000,000 | Dow, Inc. - Bank of America Finance LLC Synthetic(e) | 2.6410 | 06/18/24 | 1,064,300 | ||||||||

| BIOTECH & PHARMA — 18.4% | ||||||||||||

| 3,800,000 | AbbVie, Inc. - Goldman Sachs Finance Corp. Synthetic(e) | 1.4700 | 02/03/28 | 3,571,240 | ||||||||

| 2,900,000 | BioMarin Pharmaceutical, Inc. | 1.2500 | 05/15/27 | 2,932,557 | ||||||||

| 2,014,000 | Bristol-Myers Squibb Co. - Wells Fargo Finance, LLC. Synthetic(e) | 2.3100 | 11/01/24 | 2,083,684 | ||||||||

| 3,900,000 | Halozyme Therapeutics, Inc.(b) | 0.2500 | 03/01/27 | 3,469,544 | ||||||||

| 3,100,000 | Jazz Investments I Ltd. | 1.5000 | 08/15/24 | 3,158,125 | ||||||||

| 1,400,000 | Johnson & Johnson - Citigroup Global Markets Holdings, Inc. Synthetic(e) | 1.7920 | 06/30/27 | 1,432,200 | ||||||||

| 1,000,000 | Johnson & Johnson - Citigroup Global Markets Holdings, Inc. Synthetic(e) | 1.5470 | 10/25/27 | 966,900 | ||||||||

| 2,800,000 | Merck & Co., Inc. - Goldman Sachs Financial Corp. Synthetic(e) | 1.5700 | 02/24/28 | 2,835,840 | ||||||||

| 2,000,000 | Pacira BioSciences, Inc. | 0.7500 | 08/01/25 | 2,104,362 | ||||||||

The accompanying notes are an integral part of these financial statements.

21

| MILLER INTERMEDIATE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| CONVERTIBLE BONDS — 92.6% (Continued) | ||||||||||||

| BIOTECH & PHARMA — 18.4% (Continued) | ||||||||||||

| 1,000,000 | Supernus Pharmaceuticals, Inc. | 0.6250 | 04/01/23 | $ | 994,375 | |||||||

| 23,548,827 | ||||||||||||

| CABLE & SATELLITE — 2.4% | ||||||||||||

| 3,000,000 | Liberty Broadband Corp. Synthetic(b),(e) | 1.2500 | 09/30/50 | 3,000,621 | ||||||||

| CONSUMER SERVICES — 2.6% | ||||||||||||

| 3,300,000 | Stride, Inc. | 1.1250 | 09/01/27 | 3,313,200 | ||||||||

| DIVERSIFIED INDUSTRIALS — 1.9% | ||||||||||||

| 2,600,000 | 3M Co. - Citigroup Global Markets Holdings, Inc. Synthetic(e) | 2.1030 | 04/20/28 | 2,430,480 | ||||||||

| ELECTRICAL EQUIPMENT — 2.0% | ||||||||||||

| 1,000,000 | OSI Systems, Inc. | 1.2500 | 09/01/22 | 1,036,881 | ||||||||

| 1,000,000 | SMART Global Holdings, Inc. | 2.2500 | 02/15/26 | 1,492,500 | ||||||||

| 2,529,381 | ||||||||||||

| ENTERTAINMENT CONTENT — 0.8% | ||||||||||||

| 1,000,000 | IMAX Corporation(b) | 0.5000 | 04/01/26 | 992,240 | ||||||||

| HEALTH CARE FACILITIES & SERVICES — 1.9% | ||||||||||||

| 2,000,000 | PetIQ, Inc. | 4.0000 | 06/01/26 | 2,418,400 | ||||||||

| INSURANCE — 2.5% | ||||||||||||

| 3,200,000 | Berkshire Hathaway, Inc. - Barclays Bank PLC Synthetic(e) | 1.8652 | 04/14/28 | 3,128,960 | ||||||||

| INTERNET MEDIA & SERVICES — 4.5% | ||||||||||||

| 500,000 | Amazon.com, Inc.- JPMorgan Chase Financial Co., LLC Synthetic(e) | 3.5900 | 04/21/23 | 769,250 | ||||||||

| 500,000 | Google, Inc. - Bank of America Finance LLC Synthetic(e) | 3.6429 | 09/28/23 | 974,950 | ||||||||

| 3,400,000 | TripAdvisor, Inc.(b) | 0.2500 | 04/01/26 | 3,055,937 | ||||||||

| 1,000,000 | Twitter, Inc.(b),(c) | — | 03/15/26 | 921,458 | ||||||||

| 5,721,595 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

22

| MILLER INTERMEDIATE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| CONVERTIBLE BONDS — 92.6% (Continued) | ||||||||||||

| LEISURE FACILITIES & SERVICES — 7.3% | ||||||||||||

| 3,300,000 | Cheesecake Factory, Inc. | 0.3750 | 06/15/26 | $ | 3,007,578 | |||||||

| 2,900,000 | Cracker Barrel Old Country Store, Inc.(b) | 0.6250 | 06/15/26 | 2,846,951 | ||||||||

| 2,500,000 | DraftKings, Inc.(b),(c) | — | 03/15/28 | 2,192,353 | ||||||||

| 1,245,000 | McDonald’s Corp. - Credit Suisse AG Synthetic(e) | 1.9200 | 05/28/27 | 1,318,331 | ||||||||

| 9,365,213 | ||||||||||||

| LEISURE PRODUCTS — 3.2% | ||||||||||||

| 700,000 | D.R. Horton, Inc. - Barclays Bank PLC Synthetic(e) | 3.8900 | 09/26/23 | 1,188,530 | ||||||||

| 2,700,000 | LCI Industries(b) | 1.1250 | 05/15/26 | 2,852,044 | ||||||||

| 4,040,574 | ||||||||||||

| MEDICAL EQUIPMENT & DEVICES — 4.2% | ||||||||||||

| 3,900,000 | Haemonetics Corporation(b),(c) | — | 03/01/26 | 3,424,491 | ||||||||

| 2,000,000 | NuVasive, Inc. | 0.3750 | 03/15/25 | 1,895,000 | ||||||||

| 5,319,491 | ||||||||||||

| METALS & MINING — 2.1% | ||||||||||||

| 2,700,000 | Century Aluminum Company(b) | 2.7500 | 05/01/28 | 2,687,336 | ||||||||

| OIL & GAS — 3.6% | ||||||||||||

| 3,500,000 | Chevron Corporation - Bank of America Finance LLC Synthetic(e) | 1.9500 | 10/27/28 | 3,512,950 | ||||||||

| 1,000,000 | Exxon Mobil Corp. - Citigroup Global Markets Holdings, Inc. Synthetic(e) | 1.5490 | 11/24/27 | 1,102,700 | ||||||||

| 4,615,650 | ||||||||||||

| RENEWABLE ENERGY — 1.7% | ||||||||||||

| 2,000,000 | Enphase Energy, Inc.(b),(c) | — | 03/01/26 | 2,174,265 | ||||||||

| SEMICONDUCTORS — 2.3% | ||||||||||||

| 2,900,000 | Vishay Intertechnology, Inc. | 2.2500 | 06/15/25 | 2,952,490 | ||||||||

| SOFTWARE — 0.4% | ||||||||||||

| 500,000 | Akamai Technologies, Inc. | 0.3750 | 09/01/27 | 550,938 | ||||||||

| SPECIALTY FINANCE — 1.9% | ||||||||||||

| 2,400,000 | PennyMac Corporation(b) | 5.5000 | 03/15/26 | 2,484,000 | ||||||||

The accompanying notes are an integral part of these financial statements.

23

| MILLER INTERMEDIATE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| CONVERTIBLE BONDS — 92.6% (Continued) | ||||||||||||

| TECHNOLOGY HARDWARE — 2.2% | ||||||||||||

| 300,000 | Apple, Inc. - JPMorgan Chase Financial Co., LLC Synthetic(e) | 3.8700 | 10/16/23 | $ | 699,720 | |||||||

| 2,000,000 | InterDigital, Inc. | 2.0000 | 06/01/24 | 2,166,250 | ||||||||

| 2,865,970 | ||||||||||||

| TECHNOLOGY SERVICES — 5.8% | ||||||||||||

| 1,000,000 | Euronet Worldwide, Inc. | 0.7500 | 03/15/49 | 1,083,609 | ||||||||

| 3,000,000 | International Business Machines Corporation - JPMorgan Chase Financial Company, LLC Synthetic(e) | 1.0200 | 06/29/28 | 2,861,700 | ||||||||

| 3,300,000 | Parsons Corporation | 0.2500 | 08/15/25 | 3,363,279 | ||||||||

| 100,000 | Visa, Inc. - Barclays Bank PLC Synthetic(e) | 1.2800 | 02/18/25 | 109,880 | ||||||||

| 7,418,468 | ||||||||||||

| TRANSPORTATION & LOGISTICS — 7.2% | ||||||||||||

| 2,800,000 | Air Transport Services Group, Inc. | 1.1250 | 10/15/24 | 2,975,000 | ||||||||

| 3,200,000 | JetBlue Airways Corporation(b) | 0.5000 | 04/01/26 | 3,088,692 | ||||||||

| 3,400,000 | Spirit Airlines, Inc. | 1.0000 | 05/15/26 | 3,074,960 | ||||||||

| 9,138,652 | ||||||||||||

| TRANSPORTATION EQUIPMENT — 5.5% | ||||||||||||

| 3,300,000 | Greenbrier Companies, Inc.(b) | 2.8750 | 04/15/28 | 3,442,380 | ||||||||

| 3,300,000 | Meritor, Inc. | 3.2500 | 10/15/37 | 3,598,067 | ||||||||

| 7,040,447 | ||||||||||||

| TOTAL CONVERTIBLE BONDS (Cost $116,454,489) | 118,169,752 | |||||||||||

| U.S. GOVERNMENT & AGENCIES — 1.5% | ||||||||||||

| U.S. TREASURY OBLIGATIONS — 1.5% | ||||||||||||

| 2,000,000 | United States Treasury Note | 0.6250 | 03/31/27 | 1,934,492 | ||||||||

| TOTAL U.S. GOVERNMENT & AGENCIES (Cost $1,985,641) | ||||||||||||

| Shares | ||||||||||||

| SHORT-TERM INVESTMENTS — 4.6% | ||||||||||||

| MONEY MARKET FUNDS - 4.6% | ||||||||||||

| 5,876,972 | BlackRock Liquidity Funds T-Fund, Institutional Class, 0.01%(d) | 5,876,972 | ||||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $5,876,972) | ||||||||||||

The accompanying notes are an integral part of these financial statements.

24

| MILLER INTERMEDIATE BOND FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2021 |

| TOTAL INVESTMENTS - 99.8% (Cost $125,757,102) | $ | 127,416,016 | |||

| OTHER ASSETS IN EXCESS OF LIABILITIES - 0.2% | 244,478 | ||||

| NET ASSETS - 100.0% | $ | 127,660,494 |

| LLC | - Limited Liability Company |

| LTD | - Limited Company |

| PLC | - Public Limited Company |

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. |

| (c) | Zero coupon bond. |

| (d) | Rate disclosed is the seven-day effective yield as of October 31, 2021. |

| (e) | Interest rate represents the comparable yield on the contingent payment debt instruments. |

| PORTFOLIO ANALYSIS | ||||

| As of October 31, 2021 | ||||

| % of Net | ||||

| Sector | Assets | |||

| Health Care | 24.5 | % | ||

| Industrial | 17.4 | % | ||

| Consumer Discretionary | 16.1 | % | ||

| Technology | 12.2 | % | ||

| Financial | 9.1 | % | ||

| Communications | 6.2 | % | ||

| Energy | 5.3 | % | ||

| Materials | 2.9 | % | ||

| U.S. Treasury Obligations | 1.5 | % | ||

| Short-Term Investments | 4.6 | % | ||

| Other Assets in Excess of Liabilities | 0.2 | % | ||

| 100.0 | % | |||

The accompanying notes are an integral part of these financial statements.

25

| Miller Funds |

| STATEMENTS OF ASSETS AND LIABILITIES |

| October 31, 2021 |

| Miller | Miller | Miller | ||||||||||

| Convertible | Convertible | Intermediate | ||||||||||

| Bond Fund | Plus Fund | Bond Fund | ||||||||||

| Assets: | ||||||||||||

| Investments in Securities at Cost | $ | 914,866,424 | $ | 169,505,760 | $ | 125,757,102 | ||||||

| Investments in Securities at Fair Value | $ | 972,109,178 | $ | 172,773,800 | $ | 127,416,016 | ||||||

| Segregated Cash - Deposit with Broker for Options | — | 1,701,110 | — | |||||||||

| Segregated Cash - Collateral for Loan | — | 13,385 | — | |||||||||

| Receivable for Securities Sold | — | 392,831 | — | |||||||||

| Receivable for Fund Shares Sold | 1,078,297 | 94,855 | 7,867 | |||||||||

| Interest and Dividend Receivable | 1,863,989 | 380,004 | 308,789 | |||||||||

| Prepaid Expenses and Other Assets | 64,220 | 16,406 | 24,473 | |||||||||

| Total Assets | 975,115,684 | 175,372,391 | 127,757,145 | |||||||||

| Liabilities: | ||||||||||||

| Line of Credit Payable | — | 55,000,000 | — | |||||||||

| Accrued Advisory Fees | 614,083 | 155,608 | 65,333 | |||||||||

| Due to Custodian | — | 148,630 | ||||||||||

| Interest Payable | — | 98,011 | — | |||||||||

| Accrued Distribution Fees | 68,182 | — | — | |||||||||

| Payable for Fund Shares Redeemed | 388,862 | 17,907 | — | |||||||||

| Accrued Expenses and Other Liabilities | 238,784 | 65,786 | 31,318 | |||||||||

| Total Liabilities | 1,309,911 | 55,485,942 | 96,651 | |||||||||

| Net Assets | $ | 973,805,773 | $ | 119,886,449 | $ | 127,660,494 | ||||||

| Composition of Net Assets: | ||||||||||||

| At October 31, 2021, Net Assets consisted of: | ||||||||||||

| Paid-in-Capital | $ | 883,996,224 | $ | 106,565,416 | $ | 122,789,454 | ||||||

| Accumulated Earnings | 89,809,549 | 13,321,033 | 4,871,040 | |||||||||

| Net Assets | $ | 973,805,773 | $ | 119,886,449 | $ | 127,660,494 | ||||||

| Net Asset Value Per Share | ||||||||||||

| Class A Shares | ||||||||||||

| Net Assets | $ | 40,582,353 | ||||||||||

| Shares of Beneficial Interest Outstanding (no par value; unlimited shares authorized) | 2,792,132 | |||||||||||

| Net Asset Value and Redemption Price per Share | $ | 14.53 | ||||||||||

| Maximum Offering Price Per Share (Includes a Maximum Sales Charge of 3.75%) | $ | 15.10 | ||||||||||

| Class I Shares | ||||||||||||

| Net Assets | $ | 873,183,820 | $ | 119,886,449 | $ | 127,660,494 | ||||||

| Shares of Beneficial Interest Outstanding (no par value; unlimited shares authorized) | 60,277,128 | 4,617,372 | 7,285,743 | |||||||||

| Net Asset Value, Offering and Redemption Price per Share | $ | 14.49 | $ | 25.96 | $ | 17.52 | ||||||

| Class C Shares | ||||||||||||

| Net Assets | $ | 60,039,600 | ||||||||||

| Shares of Beneficial Interest Outstanding (no par value; unlimited shares authorized) | 4,175,441 | |||||||||||

| Net Asset Value, Offering and Redemption Price per Share | $ | 14.38 | ||||||||||

The accompanying notes are an integral part of these financial statements.

26

| Miller Funds |

| STATEMENTS OF OPERATIONS |

| For the Year Ended October 31, 2021 |

| Miller | Miller | Miller | ||||||||||

| Convertible | Convertible | Intermediate | ||||||||||

| Bond Fund | Plus Fund | Bond Fund | ||||||||||

| Investment Income: | ||||||||||||

| Interest Income | $ | 8,828,487 | $ | 1,844,626 | $ | 1,312,433 | ||||||

| Dividend Income | 1,065,339 | 166,801 | 108,481 | |||||||||

| Total Investment Income | 9,893,826 | 2,011,427 | 1,420,914 | |||||||||

| Expenses: | ||||||||||||

| Investment Advisory Fees | 6,812,275 | 1,767,826 | 799,867 | |||||||||

| Distribution Fees (Class A) | 280,264 | — | — | |||||||||

| Distribution Fees (Class C) | 618,554 | — | — | |||||||||

| Third Party Administrative Services Fees | 598,824 | 79,900 | 51,719 | |||||||||

| Administration Fees | 327,898 | 68,375 | 58,355 | |||||||||

| Trustees’ Fees | 188,582 | 33,311 | 21,724 | |||||||||

| Transfer Agent Fees | 209,685 | 27,269 | 24,999 | |||||||||

| Audit Fees | 114,390 | 18,570 | 8,241 | |||||||||

| Custodian Fees | 101,777 | 38,314 | 20,668 | |||||||||

| Registration and Filing Fees | 86,301 | 28,310 | 28,976 | |||||||||

| Printing Expense | 60,686 | 8,673 | 7,428 | |||||||||

| Legal Fees | 65,626 | 8,789 | 6,603 | |||||||||

| Insurance Expense | 65,329 | 13,930 | 7,887 | |||||||||

| Chief Compliance Officer Fees | 41,811 | 6,818 | 4,373 | |||||||||

| Interest Expense | — | 826,585 | — | |||||||||

| Miscellaneous Expenses | 29,708 | 4,073 | 3,979 | |||||||||

| Total Expenses | 9,601,710 | 2,930,743 | 1,044,819 | |||||||||

| Plus (Less): Expenses Recaptured (Fees Waived) by Adviser | — | 406,183 | (30,326 | ) | ||||||||

| Net Expenses | 9,601,710 | 3,336,926 | 1,014,493 | |||||||||

| Net Investment Income (Loss) | 292,116 | (1,325,499 | ) | 406,421 | ||||||||

| Net Realized and Unrealized Gain (Loss) on Investments: | ||||||||||||

| Net Realized Gain (Loss) on: | ||||||||||||

| Investments | 71,907,455 | 26,252,762 | 9,365,156 | |||||||||

| Purchased Options | — | (7,043,144 | ) | — | ||||||||

| Written Options | — | (1,308 | ) | — | ||||||||

| Total Net Realized Gain | 71,907,455 | 19,208,310 | 9,365,156 | |||||||||

| Net Change in Unrealized Appreciation (Depreciation) on: | ||||||||||||

| Investments | 10,759,156 | (3,411,237 | ) | (1,657,728 | ) | |||||||

| Purchased Options | — | (4,317,333 | ) | — | ||||||||

| Total Net Change in Unrealized Appreciation (Depreciation) | 10,759,156 | (7,728,570 | ) | (1,657,728 | ) | |||||||

| Net Realized and Unrealized Gain on Investments | 82,666,611 | 11,479,740 | 7,707,428 | |||||||||

| Net Increase in Net Assets Resulting From Operations | $ | 82,958,727 | $ | 10,154,241 | $ | 8,113,849 | ||||||

The accompanying notes are an integral part of these financial statements.

27

| Miller Convertible Bond Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| Year | Year | |||||||

| Ended | Ended | |||||||

| October 31, 2021 | October 31, 2020 | |||||||

| Operations: | ||||||||

| Net Investment Income | $ | 292,116 | $ | 5,373,540 | ||||

| Net Realized Gain on Investments | 71,907,455 | 43,864,824 | ||||||

| Net Change in Unrealized Appreciation on Investments | 10,759,156 | 25,608,037 | ||||||

| Net Increase in Net Assets Resulting From Operations | 82,958,727 | 74,846,401 | ||||||

| Distributions to Shareholders From: | ||||||||

| Total Distributions Paid | ||||||||

| Class A ($0.69 and $0.31 per share, respectively) | (2,752,370 | ) | (1,415,858 | ) | ||||

| Class I ($0.77 and $0.39 per share, respectively) | (40,527,256 | ) | (17,950,880 | ) | ||||

| Class C ($0.62 and $0.25 per share, respectively) | (2,634,187 | ) | (1,163,625 | ) | ||||

| Total Distributions to Shareholders | (45,913,813 | ) | (20,530,363 | ) | ||||

| Beneficial Interest Transactions: | ||||||||

| Class A | ||||||||

| Proceeds from Shares Issued | 12,744,154 | 10,866,686 | ||||||

| Distributions Reinvested | 2,506,175 | 1,299,096 | ||||||

| Cost of Shares Redeemed | (30,807,101 | ) | (31,912,638 | ) | ||||

| Total Class A Shares | (15,556,772 | ) | (19,746,856 | ) | ||||

| Class I | ||||||||

| Proceeds from Shares Issued | 324,079,338 | 225,951,524 | ||||||

| Distributions Reinvested | 30,588,176 | 13,064,107 | ||||||

| Cost of Shares Redeemed | (131,553,593 | ) | (304,816,582 | ) | ||||

| Total Class I Shares | 223,113,921 | (65,800,951 | ) | |||||

| Class C | ||||||||

| Proceeds from Shares Issued | 3,573,063 | 5,184,777 | ||||||

| Distributions Reinvested | 2,306,927 | 1,036,425 | ||||||

| Cost of Shares Redeemed | (8,253,160 | ) | (14,327,153 | ) | ||||

| Total Class C Shares | (2,373,170 | ) | (8,105,951 | ) | ||||

| Total Beneficial Interest Transactions | 205,183,979 | (93,653,758 | ) | |||||

| Increase (Decrease) in Net Assets | 242,228,893 | (39,337,720 | ) | |||||

| Net Assets: | ||||||||

| Beginning of Year | 731,576,880 | 770,914,600 | ||||||

| End of Year | $ | 973,805,773 | $ | 731,576,880 | ||||

| SHARE ACTIVITY | ||||||||

| Class A: | ||||||||

| Shares Issued | 857,178 | 866,118 | ||||||

| Shares Reinvested | 170,245 | 100,185 | ||||||

| Shares Redeemed | (2,109,778 | ) | (2,539,236 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (1,082,355 | ) | (1,572,933 | ) | ||||

| Class I: | ||||||||

| Shares Issued | 22,118,138 | 17,402,997 | ||||||

| Shares Reinvested | 2,085,030 | 1,008,737 | ||||||

| Shares Redeemed | (8,960,786 | ) | (24,392,483 | ) | ||||

| Net increase (decrease) in shares of beneficial interest outstanding | 15,242,382 | (5,980,749 | ) | |||||

| Class C: | ||||||||

| Shares Issued | 244,462 | 413,651 | ||||||

| Shares Reinvested | 158,228 | 79,800 | ||||||

| Shares Redeemed | (564,544 | ) | (1,137,729 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (161,854 | ) | (644,278 | ) | ||||

The accompanying notes are an integral part of these financial statements.

28

| Miller Convertible Plus Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| Year | Year | |||||||

| Ended | Ended | |||||||

| October 31, 2021 | October 31, 2020 | |||||||

| Operations: | ||||||||

| Net Investment Income (Loss) | $ | (1,325,499 | ) | $ | 16,503 | |||

| Net Realized Gain on Investments, Options | 19,208,310 | 9,559,881 | ||||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Options | (7,728,570 | ) | 5,378,925 | |||||

| Net Increase in Net Assets Resulting From Operations | 10,154,241 | 14,955,309 | ||||||

| Total Distributions Paid | ||||||||

| Class I ($2.13 and $0.42 per share, respectively) | (9,953,438 | ) | (2,047,227 | ) | ||||

| Total Distributions to Shareholders | (9,953,438 | ) | (2,047,227 | ) | ||||

| Beneficial Interest Transactions: | ||||||||

| Class I | ||||||||

| Proceeds from Shares Issued | 20,024,819 | 10,921,430 | ||||||

| Distributions Reinvested | 9,597,199 | 1,981,817 | ||||||

| Cost of Shares Redeemed | (28,879,054 | ) | (24,278,153 | ) | ||||

| Total Class I Shares | 742,964 | (11,374,906 | ) | |||||

| Increase in Net Assets | 943,767 | 1,533,176 | ||||||

| Net Assets: | ||||||||

| Beginning of Year | 118,942,682 | 117,409,506 | ||||||

| End of Year | $ | 119,886,449 | $ | 118,942,682 | ||||

| SHARE ACTIVITY | ||||||||

| Class I: | ||||||||

| Shares Issued | 721,399 | 437,170 | ||||||

| Shares Reinvested | 351,256 | 83,256 | ||||||

| Shares Redeemed | (1,040,071 | ) | (1,028,830 | ) | ||||

| Net increase (decrease) in shares of beneficial interest outstanding | 32,584 | (508,404 | ) | |||||

The accompanying notes are an integral part of these financial statements.

29

| Miller Intermediate Bond Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| Year | Year | |||||||

| Ended | Ended | |||||||

| October 31, 2021 | October 31, 2020 | |||||||

| Operations: | ||||||||

| Net Investment Income | $ | 406,421 | $ | 1,323,676 | ||||

| Net Realized Gain on Investments | 9,365,156 | 3,390,299 | ||||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments | (1,657,728 | ) | 500,018 | |||||

| Net Increase in Net Assets Resulting From Operations | 8,113,849 | 5,213,993 | ||||||

| Total Distributions Paid Class I ($0.91 and $0.62 per share, respectively) | (5,066,335 | ) | (3,441,879 | ) | ||||

| Total Distributions to Shareholders | (5,066,335 | ) | (3,441,879 | ) | ||||

| Beneficial Interest Transactions: | ||||||||

| Class I | ||||||||

| Proceeds from Shares Issued | 68,613,283 | 11,400,206 | ||||||

| Distributions Reinvested | 4,736,801 | 3,311,173 | ||||||

| Cost of Shares Redeemed | (25,295,493 | ) | (55,817,609 | ) | ||||

| Total Class I Shares | 48,054,591 | (41,106,230 | ) | |||||

| Total Beneficial Interest Transactions | 48,054,591 | (41,106,230 | ) | |||||

| Increase (Decrease) in Net Assets | 51,102,105 | (39,334,116 | ) | |||||

| Net Assets: | ||||||||

| Beginning of Year | 76,558,389 | 115,892,505 | ||||||

| End of Year | $ | 127,660,494 | $ | 76,558,389 | ||||

| SHARE ACTIVITY | ||||||||

| Class I: | ||||||||

| Shares Issued | 3,838,503 | 699,252 | ||||||

| Shares Reinvested | 268,987 | 206,290 | ||||||

| Shares Redeemed | (1,421,515 | ) | (3,508,141 | ) | ||||

| Net increase (decrease) in shares of beneficial interest outstanding | 2,685,975 | (2,602,599 | ) | |||||

The accompanying notes are an integral part of these financial statements.

30

| Miller Convertible Plus Fund |

| STATEMENT OF CASH FLOWS |

| For the Year Ended October 31, 2021 |

| Cash flows from operating activities: | ||||

| Net increase in net assets resulting from operations | $ | 10,154,241 | ||

| Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: | ||||

| Purchases of investments and options | (267,642,594 | ) | ||

| Proceeds from sales of investments and options | 278,617,232 | |||

| Purchases of short term investments, net | (779,191 | ) | ||

| Net realized gain from investments | (19,208,310 | ) | ||

| Net change in unrealized appreciation (depreciation) from investments | 7,728,570 | |||

| Net accretion of discounts | (377,747 | ) | ||

| Changes in assets and liabilities (Increase)/decrease in assets: | ||||

| Dividend and interest receivable | 226,594 | |||

| Receivable for securities sold | (392,831 | ) | ||

| Prepaid expenses and other assets | 1,300 | |||

| Increase/(decrease) in liabilities: | ||||

| Interest payable | 37,276 | |||

| Accrued advisory fees | (32,033 | ) | ||

| Accrued expenses and other liabilities | 21,672 | |||

| Net cash provided by operating activities | 8,354,179 | |||

| Cash flows from financing activities: | ||||

| Proceeds from revolving credit line payable to bank | 31,000,000 | |||

| Repayment of borrowings under revolving credit line payable | (29,000,000 | ) | ||

| Proceeds from shares sold | 20,084,964 | |||

| Payment on shares redeemed | (28,861,147 | ) | ||

| Cash distributions paid | (356,239 | ) | ||

| Net cash used in financing activities | (7,132,422 | ) | ||

| Net increase in cash | 1,221,757 | |||

| Cash & Restricted Cash at beginning of year | 492,738 | |||

| Cash & Restricted Cash at end of year | $ | 1,714,495 | ||

| Cash | — | |||

| Restricted Cash | ||||

| Segregated Cash - Deposit with Broker for Options | 1,701,110 | |||

| Segregated Cash - Collateral for Loan | 13,385 | |||

| Total Cash and Restricted Cash | $ | 1,714,495 | ||

| Noncash or supplementary financing activities consist of: | ||||

| Noncash financing activities not including herein consists of: | ||||

| Reinvestment of dividends | $ | 9,597,199 | ||

| Interest paid | $ | 789,309 | ||

The accompanying notes are an integral part of the financial statements.

31

| Miller Convertible Bond Fund | |||||||

| FINANCIAL HIGHLIGHTS | |||||||

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year presented.

| Class A | ||||||||||||||||||||

| Year Ended October 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Net Asset Value, Beginning of Year | $ | 13.78 | $ | 12.56 | $ | 12.42 | $ | 13.19 | $ | 12.53 | ||||||||||

| Increase (decrease) from operations: | ||||||||||||||||||||

| Net investment income (loss) (a) | (0.05 | ) | 0.05 | 0.10 | 0.20 | 0.72 | ||||||||||||||

| Net gain (loss) from securities (both realized and unrealized) | 1.49 | 1.48 | 0.54 | (0.38 | ) | 0.36 | ||||||||||||||

| Total from operations | 1.44 | 1.53 | 0.64 | (0.18 | ) | 1.08 | ||||||||||||||

| Distributions to shareholders from: | ||||||||||||||||||||

| Net investment income | (0.64 | ) | (0.31 | ) | (0.29 | ) | (0.38 | ) | (0.42 | ) | ||||||||||

| Net realized gain | (0.05 | ) | — | (0.21 | ) | (0.21 | ) | — | ||||||||||||

| Total distributions | (0.69 | ) | (0.31 | ) | (0.50 | ) | (0.59 | ) | (0.42 | ) | ||||||||||

| Net Asset Value, End of Year | $ | 14.53 | $ | 13.78 | $ | 12.56 | $ | 12.42 | $ | 13.19 | ||||||||||

| Total Return (b) | 10.54 | % | 12.33 | % | 5.37 | % | (1.50 | )% | 8.72 | % | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net assets, end of year (in 000’s) | $ | 40,582 | $ | 53,385 | $ | 68,437 | $ | 91,985 | $ | 109,900 | ||||||||||

| Ratio of expenses to average net assets | 1.46 | % | 1.49 | % | 1.47 | % | 1.44 | % | 1.45 | % | ||||||||||

| Ratio of net investment income (loss) to average net assets | (0.36 | )% | 0.40 | % | 0.80 | % | 1.53 | % | 5.55 | % | ||||||||||

| Portfolio turnover rate | 98 | % | 94 | % | 81 | % | 107 | % | 79 | % | ||||||||||

| (a) | Per share amounts are calculated using the daily average shares method, which more appropriately presents the per share data for the year. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, excluding the effect of sales loads. Total returns for periods less than one year are not annualized. |

The accompanying notes are an integral part of the financial statements.

32

| Miller Convertible Bond Fund |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year presented.

| Class I | ||||||||||||||||||||

| Year Ended October 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Net Asset Value, Beginning of Year | $ | 13.75 | $ | 12.55 | $ | 12.41 | $ | 13.19 | $ | 12.53 | ||||||||||

| Increase (decrease) from operations: | ||||||||||||||||||||

| Net investment income (a) | 0.02 | 0.12 | 0.16 | 0.27 | 0.78 | |||||||||||||||

| Net gain (loss) from securities (both realized and unrealized) | 1.49 | 1.47 | 0.54 | (0.40 | ) | 0.36 | ||||||||||||||

| Total from operations | 1.51 | 1.59 | 0.70 | (0.13 | ) | 1.14 | ||||||||||||||

| Distributions to shareholders from: | ||||||||||||||||||||

| Net investment income | (0.72 | ) | (0.39 | ) | (0.35 | ) | (0.44 | ) | (0.48 | ) | ||||||||||

| Net realized gain | (0.05 | ) | — | (0.21 | ) | (0.21 | ) | — | ||||||||||||

| Total distributions | (0.77 | ) | (0.39 | ) | (0.56 | ) | (0.65 | ) | (0.48 | ) | ||||||||||

| Net Asset Value, End of Year | $ | 14.49 | $ | 13.75 | $ | 12.55 | $ | 12.41 | $ | 13.19 | ||||||||||

| Total Return (b) | 11.04 | % | 12.93 | % | 5.90 | % | (1.08 | )% | 9.27 | % | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net assets, end of year (in 000’s) | $ | 873,184 | $ | 619,010 | $ | 640,466 | $ | 821,772 | $ | 781,823 | ||||||||||

| Ratio of expenses to average net assets | 0.96 | % | 0.99 | % | 0.97 | % | 0.94 | % | 0.95 | % | ||||||||||

| Ratio of net investment income to average net assets | 0.13 | % | 0.89 | % | 1.30 | % | 2.09 | % | 6.06 | % | ||||||||||

| Portfolio turnover rate | 98 | % | 94 | % | 81 | % | 107 | % | 79 | % | ||||||||||

| (a) | Per share amounts are calculated using the daily average shares method, which more appropriately presents the per share data for the year. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, excluding the effect o sales loads. Total returns for periods less than one year are not annualized. |

The accompanying notes are an integral part of the financial statements.

33

| Miller Convertible Bond Fund |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year presented.

| Class C | ||||||||||||||||||||

| Year Ended October 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Net Asset Value, Beginning of Year | $ | 13.64 | $ | 12.45 | $ | 12.31 | $ | 13.10 | $ | 12.45 | ||||||||||

| Increase (decrease) from operations: | ||||||||||||||||||||

| Net investment income (loss) (a) | (0.13 | ) | (0.01 | ) | 0.04 | 0.14 | 0.65 | |||||||||||||

| Net gain (loss) from securities (both realized and unrealized) | 1.49 | 1.45 | 0.54 | (0.39 | ) | 0.35 | ||||||||||||||

| Total from operations | 1.36 | 1.44 | 0.58 | (0.25 | ) | 1.00 | ||||||||||||||

| Distributions to shareholders from: | ||||||||||||||||||||

| Net investment income | (0.57 | ) | (0.25 | ) | (0.23 | ) | (0.33 | ) | (0.35 | ) | ||||||||||

| Net realized gain | (0.05 | ) | — | (0.21 | ) | (0.21 | ) | — | ||||||||||||

| Total distributions | (0.62 | ) | (0.25 | ) | (0.44 | ) | (0.54 | ) | (0.35 | ) | ||||||||||

| Net Asset Value, End of Year | $ | 14.38 | $ | 13.64 | $ | 12.45 | $ | 12.31 | $ | 13.10 | ||||||||||

| Total Return (b) | 9.99 | % | 11.68 | % | 4.92 | % | (2.04 | )% | 8.14 | % | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net assets, end of year (in 000’s) | $ | 60,040 | $ | 59,182 | $ | 62,012 | $ | 64,832 | $ | 71,406 | ||||||||||

| Ratio of expenses to average net assets | 1.96 | % | 1.99 | % | 1.97 | % | 1.94 | % | 1.95 | % | ||||||||||