Form N-CSR Ultimus Managers Trust For: May 31

| OMB APPROVAL |

|

OMB Number: 3235-0570

Expires: July 31, 2022

Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22680 |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

David K. James, esq.

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246_ |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 |

| Date of fiscal year end: | May 31 | |

| Date of reporting period: | May 31, 2021 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| (a) |

Institutional Class (ADLVX)

ANNUAL REPORT

May 31, 2021

Managed

by

Adler Asset Management, LLC

For

information or assistance in opening an account,

please call toll-free 1-800-408-4682.

| ADLER VALUE FUND | |

| LETTER TO SHAREHOLDERS (Unaudited) | June 15, 2021 |

Dear Shareholder,

In mid-August 2018, the Adler Value Fund (the “Fund”) commenced operations. Adler Asset Management, LLC (the “Adviser”) is the Fund’s investment adviser. For the annual period ended May 31, 2021, the Fund’s total return was 55.78%. During the same period, the total return of the S&P 500 Value Index was 39.84%.

Equity markets are anticipating a strong economic recovery as post-pandemic re-opening progresses throughout the United States. Wall Street’s focus remains on the economic recovery bolstered by a robust earnings outlook validated by an approximately 50% year-over-year increase in 2021 first quarter earnings. The market’s focus on value stocks evolved into a rotation as investors sought our cyclical sectors with earnings momentum. While Federal Reserve officials stress that inflation pressures should prove temporary, inflation continues to be a market worry. Persistently positive economic data has helped keep inflationary concerns in check despite increases in commodity, consumer, and producer prices.

Investment Approach

In selecting investments for the Fund, the Adviser uses a focused-value strategy to invest in companies that, in its opinion, appear to be undervalued by the equity market but where catalysts exist, in the opinion of the Adviser, to close these valuation gaps. The Adviser seeks to exploit perceived market misjudgments in pricing by buying equity securities that appear to be undervalued because of a temporary aversion to these out-of-favor issuers.

The Adviser maintains a watch list of companies and reviews each company’s financial condition and prospects, including: expected future earnings; cash flow; the ability and willingness to return capital to shareholders; competitive position; quality of the business franchise; and the reputation, experience, and competence of a company’s management and board of directors. The Adviser considers these factors both while the company is on the watch list and also at the time of purchase. Not all companies, at the time of purchase, are on the Adviser’s watch list, and a company may be added to the Fund’s portfolio following a precipitating event.

When added to the Fund’s portfolio, a company will generally be trading at a significant discount to its 52-week or all-time high. The Adviser’s contrarian approach, buying what it believes are fundamentally sound companies that are out-of-favor with the market, is industry, sector and market capitalization agnostic, and typically involves the securities of fewer than thirty issuers.

Performance for the Annual Period

The Adviser believes the reasons for Fund’s outperformance for the annual period include:

| ● | Disciplined stock selection. The Adviser’s decision to sell is driven by a Company’s realization of catalysts rather than movement in its stock price. As a result, the Adviser focuses on the Fund holdings’ fundamental developments to assess investment decisions. This approach has allowed the Fund to continue to capture the upside potential of the Fund’s holdings. |

1

| ● | Effective use of call option purchases. Call options purchased near the market’s nadir in the Spring of 2020 were largely exercised, rather than sold. This approach has allowed the Fund to continue to capture the upside potential of the Fund’s holdings. |

Portfolio Developments

Meredith and Bayer are two Fund holdings:

| ● | Meredith (MDP) recently announced the sale of its television stations. Post-transaction, MDP will focus on its digital and print media businesses and will carry a much-reduced debt. Subsequently, MDP announced an unsolicited proposal from a second party to acquire its television stations. MDP re-affirmed the original transaction with the original buyer after the price was increased. MDP’s stock has been a strong performer for the Fund. |

| ● | Bayer (BAYRY) is a life sciences company focused on health care and nutrition. Bayer’s legal challenges with its Monsanto acquisition have been well-documented. The Adviser purchased Bayer American Depositary Receipts (“ADRs”) for the Fund after the Monsanto acquisition and the related legal exposure became known. Bayer continues to face setbacks with this glyphosate litigation. Its ADR continues to trade around the Fund’s average cost of the holding. The Adviser believes the resolution of this litigation is a key catalyst for Bayer’s re-valuation. |

In closing, I want to thank shareholders for their confidence in the Fund’s Adviser. The Adviser continues to assess companies that fit the Fund’s investment approach.

David Adler

Adler Asset Management, LLC

June 15, 2021

2

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-800-408-4682.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit the Fund’s website at www.adlervaluefund.com or call 1-800-408-4682 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. For a complete list of securities held by the Fund as of May 31, 2021, please see the Schedule of Investments section of the semi-annual report. The opinions of the Fund’s adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements, include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

3

| ADLER VALUE FUND |

| PERFORMANCE INFORMATION |

| May 31, 2021 (Unaudited) |

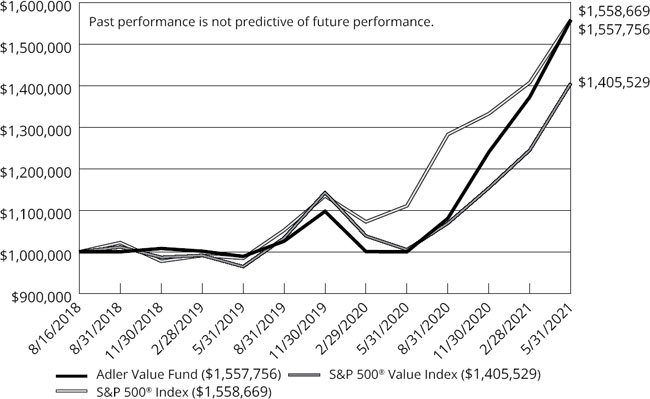

Comparison

of the Change in Value of a $1,000,000 Investment in

Adler Value Fund - Institutional Class vs. the S&P 500® Value Index*

and the S&P 500® Index*

| Average

Annual Total Returns (for the periods ended May 31, 2021) | |||||

| Since | |||||

| 1 Year | Inception(b) | ||||

| Adler Value Fund - Institutional Class (a) | 55.78% | 17.22% | |||

| S&P 500® Value Index (c) | 39.84% | 12.98% | |||

| S&P 500® Index (c) | 40.32% | 17.25% | |||

| (a) | The total returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. |

| (b) | The Fund commenced operations on August 16, 2018. |

| (c) | The S&P 500® Index is a market capitalization weighted index of 500 large companies that is widely used as a barometer of U.S. stock market performance. The S&P 500® Value Index measures value stocks drawn from the S&P 500® Index. Value is measured using three factors: the ratios of book value, earnings, and sales to price. Both indices are unmanaged and shown for illustration purposes only. An investor cannot invest in an index and their returns are not indicative of the performance of any specific investment. |

| * | Effective July 20, 2020, the S&P 500® Value Index became the Fund’s primary benchmark instead of the S&P® 500 Index. The S&P 500® Value Index is a better comparison for the Fund’s portfolio holdings. |

4

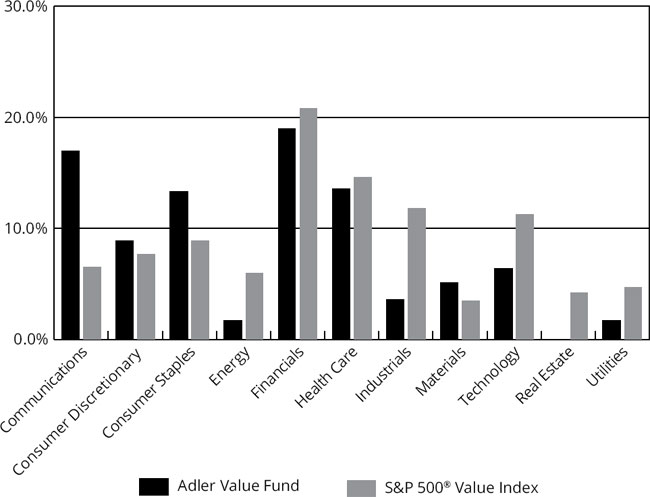

| ADLER VALUE FUND |

| PORTFOLIO INFORMATION |

| May 31, 2021 (Unaudited) |

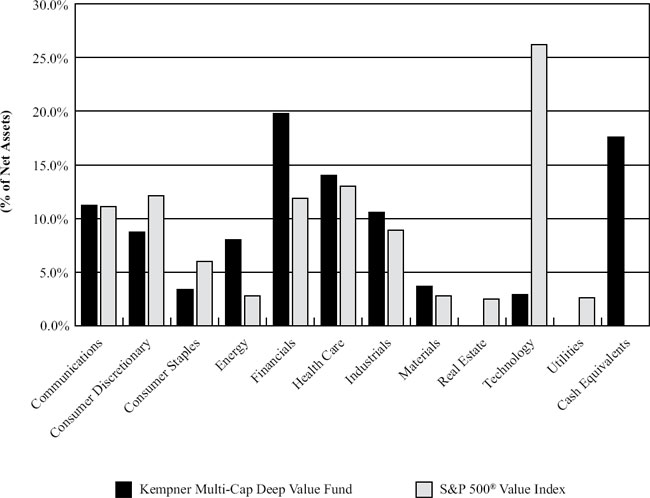

Sector

Diversification

(% of Net Assets)

| Top 10 Equity Holdings | ||

| % of Net | ||

| Security Description | Assets | |

| Meredith Corporation | 6.2% | |

| Big Lots, Inc. | 5.9% | |

| iHeartMedia, Inc. - Class A | 5.4% | |

| Valvoline, Inc. | 5.0% | |

| Charles Schwab Corporation (The) | 4.9% | |

| Veoneer, Inc. | 4.7% | |

| Aflac, Inc. | 4.0% | |

| Citigroup, Inc. | 3.9% | |

| Spectrum Brands Holdings, Inc. | 3.8% | |

| Equitable Holdings, Inc. | 3.6% | |

5

| ADLER VALUE FUND |

| SCHEDULE OF INVESTMENTS |

| May 31, 2021 |

| COMMON STOCKS — 88.5% | Shares | Value | ||||||

| Communications — 17.0% | ||||||||

| Cable & Satellite — 2.2% | ||||||||

| Altice USA, Inc. - Class A (a) | 1,300 | $ | 46,878 | |||||

| Comcast Corporation - Class A | 600 | 34,404 | ||||||

| 81,282 | ||||||||

| Entertainment Content — 3.2% | ||||||||

| ViacomCBS, Inc. - Class B | 2,900 | 123,018 | ||||||

| Publishing & Broadcasting — 11.6% | ||||||||

| iHeartMedia, Inc. - Class A (a) | 8,800 | 204,248 | ||||||

| Meredith Corporation (a) | 7,000 | 235,760 | ||||||

| 440,008 | ||||||||

| Consumer Discretionary — 8.9% | ||||||||

| Automotive — 4.7% | ||||||||

| Veoneer, Inc. (a) | 7,600 | 179,892 | ||||||

| Leisure Facilities & Services — 4.2% | ||||||||

| Jack in the Box, Inc. | 900 | 102,240 | ||||||

| Starbucks Corporation | 500 | 56,940 | ||||||

| 159,180 | ||||||||

| Consumer Staples — 13.3% | ||||||||

| Beverages — 3.6% | ||||||||

| Diageo plc - ADR | 700 | 135,275 | ||||||

| Household Products — 3.8% | ||||||||

| Spectrum Brands Holdings, Inc. | 1,600 | 142,224 | ||||||

| Retail - Consumer Staples — 5.9% | ||||||||

| Big Lots, Inc. | 3,700 | 225,478 | ||||||

| Energy — 1.7% | ||||||||

| Oil & Gas Producers — 1.7% | ||||||||

| ConocoPhillips | 1,168 | 65,104 | ||||||

| Financials — 17.2% | ||||||||

| Asset Management — 4.9% | ||||||||

| Charles Schwab Corporation (The) | 2,500 | 184,625 | ||||||

| Banking — 4.7% | ||||||||

| Citigroup, Inc. | 1,900 | 149,549 | ||||||

| U.S. Bancorp | 500 | 30,390 | ||||||

| 179,939 | ||||||||

6

| ADLER VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 88.5% (Continued) | Shares | Value | ||||||

| Financials — 17.2% (Continued) | ||||||||

| Insurance — 7.6% | ||||||||

| Aflac, Inc. | 2,700 | $ | 153,036 | |||||

| Equitable Holdings, Inc. | 4,300 | 136,525 | ||||||

| 289,561 | ||||||||

| Health Care — 13.6% | ||||||||

| Biotech & Pharma — 10.5% | ||||||||

| Bayer AG - ADR | 6,700 | 107,401 | ||||||

| Bristol-Myers Squibb Company | 1,500 | 98,580 | ||||||

| Pfizer, Inc. | 2,300 | 89,079 | ||||||

| Viatris, Inc. | 6,935 | 105,689 | ||||||

| 400,749 | ||||||||

| Health Care Facilities & Services — 3.1% | ||||||||

| Cigna Corporation | 450 | 116,483 | ||||||

| Industrials — 3.6% | ||||||||

| Aerospace & Defense — 1.2% | ||||||||

| Raytheon Technologies Corporation | 500 | 44,355 | ||||||

| Industrial Support Services — 2.4% | ||||||||

| Grainger (W.W.), Inc. | 200 | 92,432 | ||||||

| Materials — 5.1% | ||||||||

| Chemicals — 5.1% | ||||||||

| Valvoline, Inc. | 5,800 | 191,400 | ||||||

| Technology — 6.4% | ||||||||

| Technology Hardware — 3.2% | ||||||||

| Diebold Nixdorf, Inc. (a) | 9,100 | 123,214 | ||||||

| Technology Services — 3.2% | ||||||||

| MultiPlan Corporation (a) | 14,300 | 120,692 | ||||||

| Utilities — 1.7% | ||||||||

| Electric Utilities — 1.7% | ||||||||

| PG&E Corporation (a) | 6,200 | 62,868 | ||||||

| Total Common Stocks (Cost $2,224,596) | $ | 3,357,779 | ||||||

7

| ADLER VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| PREFERRED STOCKS — 1.8% | Shares | Value | ||||||

| Financials — 1.8% | ||||||||

| Banking — 1.8% | ||||||||

| Itau Unibanco Holding S.A. - ADR (Cost $61,928) | 12,400 | $ | 70,680 | |||||

| Strike | Notional | |||||||||||||||

| PURCHASED OPTION CONTRACTS — 2.5% | Price | Contracts | Value | Value | ||||||||||||

| Call Option Contracts — 2.5% | ||||||||||||||||

| Big Lots, Inc., 06/18/21 | $ | 62.50 | 30 | $ | 182,820 | $ | 4,800 | |||||||||

| Bristol-Myers Squibb Company, 01/21/22 | 62.50 | 25 | 164,300 | 13,975 | ||||||||||||

| Bristol-Myers Squibb Company, 06/17/22 | 65.00 | 15 | 98,580 | 8,175 | ||||||||||||

| Diebold Nixdorf, Inc., 08/20/21 | 12.50 | 5 | 6,770 | 1,063 | ||||||||||||

| Diebold Nixdorf, Inc., 01/21/22 | 12.50 | 20 | 27,080 | 6,600 | ||||||||||||

| iHeartMedia, Inc. - Class A, 10/15/21 | 20.00 | 10 | 23,210 | 4,500 | ||||||||||||

| Itau Unibanco Holding S.A. - ADR, 01/20/23 | 4.50 | 10 | 5,700 | 1,600 | ||||||||||||

| Itau Unibanco Holding S.A. - ADR, 01/20/23 | 5.00 | 20 | 11,400 | 2,600 | ||||||||||||

| MultiPlan Corporation, 01/21/22 | 7.50 | 20 | 16,880 | 4,000 | ||||||||||||

| Pfizer, Inc., 07/16/21 | 37.00 | 10 | 38,730 | 4,000 | ||||||||||||

| Pfizer, Inc., 01/21/22 | 37.00 | 20 | 77,460 | 6,400 | ||||||||||||

| PG&E Corporation, 01/21/22 | 10.00 | 10 | 10,140 | 1,480 | ||||||||||||

| PG&E Corporation, 01/21/22 | 12.00 | 10 | 10,140 | 740 | ||||||||||||

| Veoneer, Inc., 11/19/21 | 25.00 | 20 | 47,340 | 6,250 | ||||||||||||

| ViacomCBS, Inc. - Class B, 01/22/22 | 40.00 | 30 | 127,260 | 21,450 | ||||||||||||

| Viatris, Inc., 01/21/22 | 15.00 | 15 | 22,860 | 2,550 | ||||||||||||

| Viatris, Inc., 01/21/22 | 12.50 | 10 | 15,240 | 3,420 | ||||||||||||

| Viatris, Inc., 01/21/22 | 20.00 | 20 | 30,480 | 800 | ||||||||||||

| Total Purchased Option Contracts (Cost $88,142) | $ | 916,390 | $ | 94,403 | ||||||||||||

8

| ADLER VALUE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| MONEY MARKET FUNDS — 7.2% | Shares | Value | ||||||

| JPMorgan 100% U.S. Treasury Securities Money Market Fund - Institutional Class, 0.01% (b) (Cost $273,518) | 273,518 | $ | 273,518 | |||||

| Investments at Value — 100.0% (Cost $2,648,184) | $ | 3,796,380 | ||||||

| Liabilities in Excess of Other Assets — 0.0% (c) | (1,690 | ) | ||||||

| Net Assets — 100.0% | $ | 3,794,690 | ||||||

ADR - American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of May 31, 2021. |

| (c) | Percentage rounds to less than 0.1%. |

See accompanying notes to financial statements.

9

| ADLER VALUE FUND |

| STATEMENT OF ASSETS AND LIABILITIES |

| May 31, 2021 |

| ASSETS | ||||

| Investments in securities: | ||||

| At cost | $ | 2,648,184 | ||

| At value (Note 2) | $ | 3,796,380 | ||

| Receivable for capital shares sold | 5,250 | |||

| Receivable from Adviser (Note 4) | 8,636 | |||

| Dividends receivable | 6,429 | |||

| Tax reclaims receivable | 341 | |||

| Other assets | 2,372 | |||

| Total assets | 3,819,408 | |||

| LIABILITIES | ||||

| Payable to administrator (Note 4) | 14,058 | |||

| Other accrued expenses | 10,660 | |||

| Total liabilities | 24,718 | |||

| NET ASSETS | $ | 3,794,690 | ||

| NET ASSETS CONSIST OF: | ||||

| Paid-in capital | $ | 2,647,558 | ||

| Accumulated earnings | 1,147,132 | |||

| NET ASSETS | $ | 3,794,690 | ||

| PRICING OF INSTITUTIONAL SHARES (Note 2) | ||||

| Net assets applicable to Institutional Shares | $ | 3,794,690 | ||

| Shares of Institutional Shares outstanding (no par value, unlimited number of shares authorized) | 124,414 | |||

| Net asset value, offering and redemption price per share (Note 2) | $ | 30.50 |

See accompanying notes to financial statements.

10

| ADLER VALUE FUND |

| STATEMENT OF OPERATIONS |

| For the Year Ended May 31, 2021 |

| INVESTMENT INCOME | ||||

| Dividends | $ | 39,143 | ||

| Foreign withholding tax on dividends | (1,261 | ) | ||

| Total investment income | 37,882 | |||

| EXPENSES | ||||

| Fund accounting fees (Note 4) | 28,500 | |||

| Administration fees (Note 4) | 28,250 | |||

| Legal fees | 26,420 | |||

| Investment advisory fees (Note 4) | 24,969 | |||

| Audit and tax services fees | 16,900 | |||

| Trustees’ fees and expenses (Note 4) | 16,750 | |||

| Registration and filing fees | 14,920 | |||

| Transfer agent fees (Note 4) | 12,000 | |||

| Compliance fees (Note 4) | 12,000 | |||

| Custodian and bank service fees | 10,549 | |||

| Postage and supplies | 4,567 | |||

| Printing of shareholder reports | 3,387 | |||

| Insurance expense | 3,145 | |||

| Other expenses | 8,597 | |||

| Total expenses | 210,954 | |||

| Less fee reductions and expense reimbursements by the Adviser (Note 4) | (179,743 | ) | ||

| Net expenses | 31,211 | |||

| NET INVESTMENT INCOME | 6,671 | |||

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | ||||

| Net realized losses on investments transactions | (3,828 | ) | ||

| Net change in unrealized appreciation (depreciation) on investments | 1,190,419 | |||

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | 1,186,591 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 1,193,262 |

See accompanying notes to financial statements.

11

| ADLER VALUE FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| Year Ended | Period Ended | Period Ended | ||||||||||

| May 31, | May 31, | July 31, | ||||||||||

| 2021 | 2020 (a) | 2019 (b) | ||||||||||

| FROM OPERATIONS | ||||||||||||

| Net investment income | $ | 6,671 | $ | 35,659 | $ | 10,351 | ||||||

| Net realized losses from investment transactions | (3,828 | ) | (1,793 | ) | — | |||||||

| Net change in unrealized appreciation (depreciation) on investments | 1,190,419 | (61,173 | ) | 18,950 | ||||||||

| Net increase (decrease) in net assets resulting from operations | 1,193,262 | (27,307 | ) | 29,301 | ||||||||

| DISTRIBUTIONS TO SHAREHOLDERS (NOTE 2) | ||||||||||||

| Institutional Shares | (33,750 | ) | (14,521 | ) | — | |||||||

| FROM CAPITAL SHARE TRANSACTIONS | ||||||||||||

| Institutional Shares | ||||||||||||

| Proceeds from shares sold | 1,143,090 | 39,000 | 1,417,374 | |||||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 33,750 | 14,521 | — | |||||||||

| Payments for shares redeemed | (30 | ) | — | — | ||||||||

| Net increase in Institutional Shares net assets from capital share transactions | 1,176,810 | 53,521 | 1,417,374 | |||||||||

| TOTAL INCREASE IN NET ASSETS | 2,336,322 | 11,693 | 1,446,675 | |||||||||

| NET ASSETS | ||||||||||||

| Beginning of period | 1,458,368 | 1,446,675 | — | |||||||||

| End of period | $ | 3,794,690 | $ | 1,458,368 | $ | 1,446,675 | ||||||

| CAPITAL SHARES ACTIVITY | ||||||||||||

| Institutional Shares | ||||||||||||

| Shares sold | 49,491 | 2,051 | 70,866 | |||||||||

| Shares reinvested | 1,359 | 648 | — | |||||||||

| Shares redeemed | (1 | ) | — | — | ||||||||

| Net increase in shares outstanding | 50,849 | 2,699 | 70,866 | |||||||||

| Shares outstanding, beginning of period | 73,565 | 70,866 | — | |||||||||

| Shares outstanding, end of period | 124,414 | 73,565 | 70,866 | |||||||||

| (a) | Fund changed fiscal year to May 31. |

| (b) | Represents the period from the commencement of operations (August 16, 2018) through July 31, 2019. |

See accompanying notes to financial statements.

12

| ADLER VALUE FUND |

| INSTITUTIONAL SHARES |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period

| Year Ended | Period Ended | Period Ended | ||||||||||

| May 31, | May 31, | July 31, | ||||||||||

| 2021 | 2020 (a) | 2019 (b) | ||||||||||

| Net asset value at beginning of period | $ | 19.82 | $ | 20.41 | $ | 20.00 | ||||||

| Income (loss) from investment operations: | ||||||||||||

| Net investment income | 0.07 | (c) | 0.49 | (d) | 0.15 | |||||||

| Net realized and unrealized gains (losses) on investments | 10.92 | (0.88 | ) | 0.26 | ||||||||

| Total from investment operations | 10.99 | (0.39 | ) | 0.41 | ||||||||

| Less distributions from: | ||||||||||||

| Net investment income | (0.31 | ) | (0.20 | ) | — | |||||||

| Net asset value at end of period | $ | 30.50 | $ | 19.82 | $ | 20.41 | ||||||

| Total return (e) | 55.78 | % | (2.01 | %) (f) | 2.05 | % (f) | ||||||

| Net assets at end of period (000’s) | $ | 3,795 | $ | 1,458 | $ | 1,447 | ||||||

| Ratios/supplementary data: | ||||||||||||

| Ratio of total expenses to average net assets | 8.42 | % | 13.01 | % (g) | 11.82 | % (g) | ||||||

| Ratio of net expenses to average net assets (h) | 1.25 | % | 1.25 | % (g) | 1.26 | % (g)(i) | ||||||

| Ratio of net investment income to average net assets (h) | 0.27 | % | 2.93 | % (d)(g) | 0.81 | % (g) | ||||||

| Portfolio turnover rate | 0 | % (j) | 4 | % (f) | 0 | % | ||||||

| (a) | Fund changed fiscal year to May 31. |

| (b) | Represents the period from the commencement of operations (August 16, 2018) through July 31, 2019. |

| (c) | Per share net investment income has been determined on the basis of average number of shares outstanding during the period. |

| (d) | During the period ended May 31, 2020, the Fund received a large special dividend distribution from NortonLifeLock, Inc. Had the Fund not received this special dividend distribution, the net investment income per share and ratio of net investment income to average net assets would have been $0.33 and 1.97%(g) lower, respectively. |

| (e) | Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced fees and reimbursed expenses (Note 4). |

| (f) | Not annualized. |

| (g) | Annualized. |

| (h) | Ratio was determined after advisory fee reductions and expense reimbursements (Note 4). |

| (i) | Includes federal excise taxes of 0.01% of average net assets with respect to the period ended July 31, 2019. |

| (j) | Percentage rounds to less than 1%. |

See accompanying notes to financial statements.

13

| ADLER VALUE FUND |

| NOTES TO FINANCIAL STATEMENTS |

| May 31, 2021 |

| 1. | Organization |

Adler Value Fund (the “Fund”) is a non-diversified series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report.

The investment objective of the Fund is to seek to achieve long-term growth of capital.

The Fund currently offers one class of shares: Institutional Class shares (sold without any sales loads or distribution fees and subject to a $1,000,000 initial investment requirement). As of May 31, 2021, the Investor Class shares (to be sold without any sales loads, but subject to a distribution fee of up to 0.25% of Investor Class’ average daily net assets and subject to a $2,500 initial investment requirement) are not currently offered. When both classes are offered, each share class will represent an ownership interest in the same investment portfolio.

| 2. | Significant Accounting Policies |

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.” The following is a summary of the Fund’s significant accounting policies used in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Securities valuation – The Fund values its portfolio securities at market value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern Time) on each day the NYSE is open for business. The Fund generally values its listed securities on the basis of the security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted mean price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. Option contracts are valued at the closing price on the exchanges on which they are primarily traded; if no closing price is available at the time of valuation, the option will be valued at the mean of the closing bid and ask prices for that day. Investments representing shares of money market funds and other open-end investment companies not traded on an exchange are valued at their net asset value (“NAV”) as reported by such companies. When using a quoted price and when the market is considered active, the security will be classified as Level 1 within the fair value hierarchy (see next page). In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with procedures established by and under the general supervision of the Board of Trustees of the Trust (the “Board”). Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any

14

| ADLER VALUE FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s NAV may differ from quoted or published prices for the same securities.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| ● | Level 1 – quoted prices in active markets for identical securities |

| ● | Level 2 – other significant observable inputs |

| ● | Level 3 – significant unobservable inputs |

The inputs or methods used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the Fund’s investments based on the inputs used to value the investments as of May 31, 2021:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Common Stocks | $ | 3,357,779 | $ | — | $ | — | $ | 3,357,779 | ||||||||

| Preferred Stocks | 70,680 | — | — | 70,680 | ||||||||||||

| Purchased Option Contracts | 72,490 | 21,913 | — | 94,403 | ||||||||||||

| Money Market Funds | 273,518 | — | — | 273,518 | ||||||||||||

| Total | $ | 3,774,467 | $ | 21,913 | $ | — | $ | 3,796,380 | ||||||||

Refer to the Fund’s Schedule of Investments for a listing of the common stocks by sector and industry type. The Fund did not have any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of or during the year ended May 31, 2021.

Share valuation – The NAV per share of each class of the Fund is calculated daily by dividing the total value of the assets attributable to that class, less liabilities attributable to that class, by the number of shares outstanding of that class. The offering price and redemption price per share of each class of the Fund is equal to the NAV per share of such class.

Investment income – Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair value of the security received. Interest income is accrued as earned. Withholding taxes on foreign dividends, if any, have been recorded in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

15

| ADLER VALUE FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

Investment transactions – Investment transactions are accounted for on the trade date. Realized gains and losses on investments sold are determined on a specific identification basis.

Common expenses – Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on the relative net assets of each series, the number of series in the Trust, or the nature of the services performed and the relative applicability to each series.

Distributions to shareholders – Distributions to shareholders arising from net investment income and realized capital gains, if any, are declared and paid annually to shareholders. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. For the periods ended May 31, 2021 and 2020, the tax character of distributions paid to shareholders was ordinary income. There were no distributions paid to shareholders during the period ended July 31, 2019.

Purchased option contracts – The Fund may use option contracts in any manner consistent with its investment objectives and as long as its use is consistent with relevant provisions of the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund may use options for speculative purposes as well as for the purpose of seeking to reduce the overall investment risk that would otherwise be associated with the securities in which the Fund invests. When the Fund purchases a call or put option, an amount equal to the total premium (the premium plus the commission) paid by the Fund is recorded as an asset on the Fund’s Statement of Assets and Liabilities and is subsequently marked-to-market daily. Premiums paid in the purchase of options which expire are treated as realized losses. Premiums paid in the purchase of call options which are exercised increase the cost of the security purchased. Premiums paid in the purchase of put options which are exercised decrease the proceeds used to calculate the realized capital gain or loss on the sale of the security.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increase (decrease) in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal income tax – The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

16

| ADLER VALUE FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year amounts equal to at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the 12 months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of May 31, 2021:

| Tax cost of portfolio investments | $ | 2,648,184 | ||

| Gross unrealized appreciation | $ | 1,174,161 | ||

| Gross unrealized depreciation | (25,965 | ) | ||

| Net unrealized appreciation | 1,148,196 | |||

| Undistributed ordinary income | 4,557 | |||

| Capital loss carryforward | (5,621 | ) | ||

| Accumulated earnings | $ | 1,147,132 |

As of May 31, 2021, the Fund had a long-term capital loss carryforward of $5,621 for federal income tax purposes, which may be carried forward indefinitely. This capital loss carryforward is available to offset net realized gains in future years, thereby reducing future taxable gains.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for all open tax periods (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Fund identifies its major tax jurisdiction as U.S. federal.

| 3. | Investment Transactions |

During the year ended May 31, 2021, cost of purchases and proceeds from sales of investment securities, other than short-term investments, were $1,034,423 and $12, respectively.

| 4. | Transactions with Related Parties |

INVESTMENT ADVISORY AGREEMENT

The Fund’s investments are managed by Adler Asset Management, LLC (the “Adviser”) pursuant to the terms of an Investment Advisory Agreement. Under the Investment Advisory Agreement, the Fund pays the Adviser an investment advisory fee, computed and accrued daily and paid monthly, at the annual rate of 1.00% of its average daily net assets.

Pursuant to an Expense Limitation Agreement (“ELA”) between the Fund and the Adviser, the Adviser has agreed, until December 1, 2021, to reduce its investment advisory fees and reimburse other expenses to limit total annual operating expenses (exclusive of brokerage costs; taxes; interest; borrowing costs such as interest and dividends expenses on securities sold short; costs to organize the Fund; acquired fund fees and expenses; and extraordinary

17

| ADLER VALUE FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

expenses such as litigation and merger or reorganization costs and other expenses not incurred in the ordinary course of the Fund’s business) to an amount not exceeding 1.25% of the Fund’s average daily net assets of the Institutional Class shares. Accordingly, during the year ended May 31, 2021, the Adviser did not collect any of its investment advisory fees and reimbursed other operating expenses totaling $154,774.

Under the terms of the ELA, investment advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided that the repayments do not cause the Fund’s total annual operating expenses to exceed the lesser of (i) the expense limitation then in effect, if any, and (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. As of May 31, 2021, the Adviser may seek recoupment of investment advisory fee reductions and expense reimbursements no later than the dates as stated below:

| July 31, 2022 | $ | 134,855 | ||

| May 31, 2023 | 142,930 | |||

| May 31, 2024 | 179,743 | |||

| Total | $ | 457,528 |

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting, compliance and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies, and certain costs related to the pricing of the Fund’s portfolio securities.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also officers of Ultimus and are not paid by the Fund for serving in such capacities.

TRUSTEE COMPENSATION

Each member of the Board (a “Trustee”) who is not an “interested person” of the Trust (“Independent Trustee”) receives a $1,300 annual retainer from the Fund, paid quarterly, except for the Board Chairperson who receives a $1,500 annual retainer from the Fund, paid quarterly. Each Independent Trustee also receives from the Fund a fee of $500 for each Board meeting attended plus reimbursement for travel and other meeting-related expenses.

18

| ADLER VALUE FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

PRINCIPAL HOLDER OF FUND SHARES

As of May 31, 2021, the following shareholder owned of record 25% or more of the outstanding shares of the Fund:

| NAME OF RECORD OWNER | % Ownership | |

| David R. Adler | 53% |

A beneficial owner of 25% or more of the Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

| 5. | Derivative Transactions |

The location on the Statement of Assets and Liabilities of the derivative positions of the Fund are as follows:

| Average | ||||||||||||||||

| Fair Value | Monthly | |||||||||||||||

| Notional Value | ||||||||||||||||

| During the | ||||||||||||||||

| Type of | Asset | Liability | Year Ended | |||||||||||||

| Derivative | Risk | Location | Derivatives | Derivatives | May 31, 2021* | |||||||||||

| Equity call options purchased | Equity | Investments in securities at value | $ | 94,403 | $ | — | $ | 335,424 | ||||||||

| * | The average monthly notional value generally represents the Fund’s derivative activity throughout the year. |

Realized and unrealized gains and losses associated with transactions in derivative instruments for the Fund during the year ended May 31, 2021 are recorded in the following locations on the Statement of Operations:

| Change in | ||||||||||||||

| Unrealized | ||||||||||||||

| Type of | Realized | Appreciation | ||||||||||||

| Derivative | Risk | Location | Losses | Location | (Depreciation) | |||||||||

| Equity call options purchased | Equity | Net realized losses on investment transactions | $ | (3,824 | ) | Net change in unrealized appreciation (depreciation) on investments | $ | (26,445 | ) | |||||

19

| ADLER VALUE FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| 6. | Contingencies and Commitments |

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations, warranties, and general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

| 7. | Subsequent Events |

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

20

| ADLER VALUE FUND |

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

To the Board of Trustees of Ultimus Managers

Trust and the Shareholders of Adler Value Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Adler Value Fund, a series of shares of beneficial interest in Ultimus Managers Trust (the “Fund”), including the schedule of investments, as of May 31, 2021, and the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights as presented in the table below, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of May 31, 2021, and the results of its operations for the year then ended, and the changes in its net assets and its financial highlights as presented in the table below, in conformity with accounting principles generally accepted in the United States of America.

| Statements of Changes in Net Assets and | |

| Fund | Financial Highlights Presented |

| Adler Value Fund | For the year ended May 31, 2021, the period from August 1, 2019 through May 31, 2020, and the period from August 16, 2018 (commencement of operations) to July 31, 2019 |

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

21

| ADLER VALUE FUND |

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM (Continued) |

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2021 by correspondence with the custodian and broker. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the Ultimus Managers Trust since 2013.

Philadelphia, Pennsylvania

July 23, 2021

22

| ADLER VALUE FUND |

| ABOUT YOUR FUND’S EXPENSES (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent period (December 1, 2020) and held until the end of the period (May 31, 2021).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge sales loads.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Fund’s expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

23

| ADLER VALUE FUND |

| ABOUT YOUR FUND’S EXPENSES (Unaudited) (Continued) |

| Beginning | Ending | |||||||

| Account Value | Account Value | Expenses | ||||||

| December 1, | May 31, | Net Expense | Paid During | |||||

| Institutional Class | 2020 | 2021 | Ratio(a) | Period(b) | ||||

| Based on Actual Fund Return | $1,000.00 | $1,256.10 | 1.25% | $7.03 | ||||

| Based on Hypothetical 5%Return (before expenses) | $1,000.00 | $1,018.70 | 1.25% | $6.29 |

| (a) | Annualized, based on the Fund’s most recent one-half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized net expense ratio multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

24

| ADLER VALUE FUND |

| OTHER INFORMATION (Unaudited) |

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling 1-800-408-4682, or on the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling 1-800-408-4682, or on the SEC’s website at www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. These filings are available upon request by calling 1-800-408-4682. Furthermore, you may obtain a copy of the filings on the SEC’s website at www.sec.gov.

| FEDERAL TAX INFORMATION (Unaudited) |

Qualified Dividend Income – The Fund designates 100%, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction – Corporate shareholders are generally entitled to take the dividends received deduction on the portion of a Fund’s dividend distribution that qualifies under tax law. For the Fund’s fiscal year ended May 31, 2021, 100% of ordinary income dividends qualifies for the corporate dividends received deduction.

25

| ADLER VALUE FUND |

| BOARD OF TRUSTEES AND EXECUTIVE OFFICERS (Unaudited) |

The Board has overall responsibility for management of the Trust’s affairs. The Trustees serve during the lifetime of the Trust and until its termination, or until death, resignation, retirement, or removal. The Trustees, in turn, elect the officers of the Fund to actively supervise their day-to-day operations. The officers have been elected for an annual term. Each Trustee’s and officer’s address is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. The following are the Trustees and executive officers of the Fund:

| Name

and Year of Birth |

Length of Time Served |

Position(s) Held with Trust |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Trust Overseen by Trustee |

Directorships of Public Companies Held by Trustee During Past 5 Years |

| Interested Trustees: | |||||

| Dave

R. Carson* Year of Birth: 1958 |

Since 2013 | Trustee and Vice President (January 2021 to present)

Principal Executive Officer (April 2017 to January 2021)

President (October 2013 to present)

Vice President (April 2013 to October 2013) |

SVP, Client Strategies of Ultimus Fund Solutions, LLC (2013 to present); President, Unified Series Trust (2016 to present) and Trustee (2020 to present); President, Centaur Mutual Funds Trust (2018 to present); Chief Compliance Officer, FSI Low Beta Absolute Return Fund (2013 to 2016) | 15 | Interested Trustee of Unified Series Trust (25 Funds) |

| Independent Trustees: | |||||

| Janine

L. Cohen Year of Birth: 1952 |

Since January 2016 | Chairperson (October 2019 to present)

Trustee (January 2016 to present) |

Retired (2013) financial services executive | 15 | None |

26

| ADLER VALUE FUND |

| BOARD OF TRUSTEES AND EXECUTIVE OFFICERS (Unaudited) (Continued) |

| Name

and Year of Birth |

Length of Time Served |

Position(s) Held with Trust |

Principal Occupation(s) During Past 5 Years |

Number of Funds in Trust Overseen by Trustee |

Directorships of Public Companies Held by Trustee During Past 5 Years |

| Independent Trustees (Continued): | |||||

| David

M. Deptula Year of Birth: 1958 |

Since June 2012 | Trustee | Vice President of Legal and Special Projects at Dayton Freight Lines, Inc. since 2016; Vice President of Tax Treasury at The Standard Register Inc. (formerly The Standard Register Company) from 2011 to 2016 | 15 | None |

| Robert

E. Morrison Year of Birth: 1957 |

Since June 2019 | Trustee | Senior Vice President and National Practice Lead for Investment, Huntington National Bank/Huntington Private Bank (2014 to present) | 15 | None |

| Clifford

N. Schireson Year of Birth: 1953 |

Since June 2019 | Trustee | Founder of Schireson Consulting, LLC (2017 to present); Director of Institutional Services for Brandes Investment Partners, LP (2004-2017) | 15 | Trustee of the San Diego City Employees’ Retirement System (2019 to present) |

| Jacqueline

A. Williams Year of Birth: 1954 |

Since June 2019 | Trustee | Managing Member of Custom Strategy Consulting, LLC (2017 to present); Managing Director of Global Investment Research (2005 to 2017), Cambridge Associates, LLC | 15 | None |

| * | Mr. Carson is considered an “interested person” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act, as amended, because of his relationship with the Trust’s administrator and transfer agent. |

27

| ADLER VALUE FUND |

| BOARD OF TRUSTEES AND EXECUTIVE OFFICERS (Unaudited) (Continued) |

| Name

and Year of Birth |

Length of Time Served |

Position(s) Held with Trust |

Principal Occupation(s) During Past 5 Years |

| Executive Officers: | |||

| Todd

E. Heim Year of Birth: 1967 |

Since 2014 | Principal Executive Officer and President (January 2021 to present)

Vice President (2014 to January 2021) |

VP, Relationship Management of Ultimus Fund Solutions, LLC (2018 to present); Client Implementation Manager and AVP of Ultimus Fund Solutions, LLC (2014 to 2018); Naval Flight Officer in the United States Navy (May 1989 to June 2017) |

| Jennifer

L. Leamer Year of Birth: 1976 |

Since 2014 | Treasurer (October 2014 to present)

Assistant Treasurer (April 2014 to October 2014) |

SVP, Fund Accounting of Ultimus Fund Solutions, LLC (2014 to present) |

| Daniel

D. Bauer Year of Birth: 1977 |

Since 2016 | Assistant Treasurer (April 2016 to present) | AVP, Fund Accounting (September 2015 to present) of Ultimus Fund Solutions, LLC |

| David

K. James Year of Birth: 1970 |

Since 2021 | Secretary (July 2021 to present) | EVP, Chief Legal and Risk Officer of Ultimus Fund Solutions, LLC (2018 to present); Managing Director and Managing Counsel at State Street Bank and Trust Company (2009 to 2018) |

| Natalie

S. Anderson Year of Birth: 1975 |

Since 2016 | Assistant Secretary (April 2016 to present) | Manager, Legal Administration (July 2016 to present) and Paralegal (January 2015 to June 2016) of Ultimus Fund Solutions, LLC |

| Gweneth

K. Gosselink Year of Birth: 1955 |

Since 2020 | Chief Compliance Officer (January 2020 to present) | AVP, Compliance Officer of Ultimus Fund Solutions, LLC (December 2019 to present); CCO Consultant at GKG Consulting, LLC (December 2019 to present); Chief Operating Office and CCO at Miles Capital, Inc. (June 2013 to December 2019) |

28

| ADLER VALUE FUND |

| BOARD OF TRUSTEES AND EXECUTIVE OFFICERS (Unaudited) (Continued) |

| Name

and Year of Birth |

Length of Time Served |

Position(s) Held with Trust |

Principal Occupation(s) During Past 5 Years |

| Executive Officers (Continued): | |||

Martin R. Dean Year of Birth: 1963 |

Since 2016 | Assistant Chief Compliance Officer (January 2020 to present)

Interim Chief Compliance Officer (October 2019 to January 2020)

Assistant Chief Compliance Officer (January 2016 to 2017) |

SVP, Head of Fund Compliance of Ultimus Fund Solutions, LLC (2016 to present) |

Additional information about members of the Board and executive officers is available in the Fund’s Statement of Additional Information (“SAI”). To obtain a free copy of the SAI, please call 1-800-408-4682.

29

| ADLER VALUE FUND |

| DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited) |

The Board of Trustees (the “Board”), including the Independent Trustees voting separately, has reviewed and approved the continuance of the Fund’s Investment Advisory Agreement (the “Agreement”) with Adler Asset Management, LLC (the “Adviser”) for an additional one-year term. The Board approved the Agreement at meeting held on January 19-21, 2021, at which all of the Trustee were present.

In deciding whether to approve the continuation of the Adler Advisory Agreement, the Board recalled its review of the materials related to the Adler Fund and Adler throughout the preceding twelve months and its numerous discussions with Trust Management and Adler about the operations and performance of the Adler Fund during that period. The Board further considered those materials and discussions and other numerous factors, including the following:

The nature, extent, and quality of the services provided by the Adviser. In this regard, the Board reviewed the services being provided by Adler to the Adler Fund including, without limitation, its investment advisory services since the Adler Fund’s inception, Adler’s compliance policies and procedures, and its compliance program. After reviewing the foregoing information and further information in the Adler Memorandum (e.g., descriptions of its business and Form ADV), the Board concluded that the quality, extent, and nature of the services provided by Adler were satisfactory and adequate for the Adler Fund.

The investment performance of the Adler Fund. In this regard, the Board compared the performance of the Adler Fund with the performance of its benchmark index, the custom peer group and Morningstar category. The Board also considered the consistency of Adler’s management with the Adler Fund’s investment objective and policies. The Board noted that the Adler Fund had outperformed its benchmark, the S&P 500 Value Total Return Stock Index, for the since inception and one-year periods. The Board also noted that the Adler Fund had outperformed its custom peer group and Morningstar category (Large Cap Value Funds Under $50 Million, True No-Load) for the since inception and one-year periods. Following additional discussion of the investment performance of the Adler Fund, Adler’s experience in managing mutual funds and separate accounts, Adler’s historical investment performance, and other factors, the Board concluded that the investment performance of the Adler Fund has been satisfactory.

The costs of the services provided and profits realized by Adler and its affiliates from its relationship with the Adler Fund. In this regard, the Board considered Adler’s staffing, personnel, and methods of operations; the education and experience of its personnel; compliance program, policies, and procedures; financial condition and the level of commitment to the Adler Fund, and, generally, Adler’s advisory business; the asset level of the Adler Fund; and the overall expenses of the Adler Fund, including the advisory fee. The Board considered the Adler ELA and considered Adler’s current and past fee reductions and expense reimbursements for the Adler Fund. The Board further took into account Adler’s commitment to continue the Adler ELA until at least December 1, 2021.

30

| ADLER VALUE FUND |

| DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited) (Continued) |

The Board also considered potential benefits for Adler in managing the Adler Fund, including promotion of Adler’s name. The Board compared the Adler Fund’s advisory fee and overall expense ratio to the average and median advisory fees and expense ratios for its custom peer group and Morningstar category (Large Cap Value Funds Under $50 Million, True No-Load). In considering the comparison in fees and expense ratios between the Adler Fund and other comparable funds, the Board looked at the differences in types of funds being compared, the style of investment management, the size of the Adler Fund, and the nature of the investment strategy. The Board noted that the Adler Fund’s advisory fee of 1.00% was higher than the average and median advisory fee for the Adler Fund’s custom peer group and Morningstar category, but less than the highest advisory fee in the Adler Fund’s custom peer group and Morningstar category. The Board also considered Adler’s commitment to limit the Adler Fund’s expenses under the Adler ELA. The Board further noted that the overall expense ratio for the Adler Fund of 1.25% was higher than the average and median expense ratio for the other funds in the Adler Fund’s custom peer group and Morningstar category, but lower than the highest expense ratio in the Adler Fund’s custom peer group and Morningstar category. The Board also considered the differences in the investment style of certain of the peer funds as compared to the investment strategy and style used by Adler in managing the portfolio of the Adler Fund. Following these comparisons and considerations and upon further consideration and discussion of the foregoing, the Board concluded that for the Adler Fund, the advisory fees to be paid to Adler by the Fund are fair and reasonable.

The extent to which economies of scale would be realized as the Adler Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Adler Fund’s investors. In this regard, the Board considered that the Adler Fund’s fee arrangements with Adler involve both the advisory fee and the Adler ELA. The Board determined that while the advisory fee rate remained the same as asset levels increased, the shareholders of the Adler Fund have experienced benefits from the Adler ELA and will continue to experience benefits from the Adler ELA until the Adler Fund assets grow to a level where its expenses otherwise fall below the expense limit. Following further discussion of the Adler Fund’s asset level, expectations for growth, and level of fees, the Board determined that the Adler Fund’s fee arrangements with Adler would continue to provide benefits. The Board also determined that the fee arrangements were fair and reasonable in relation to the nature and quality of services being provided by Adler, given the Adler Fund’s projected asset levels for the next year.

Brokerage and portfolio transactions. In this regard, the Board considered Adler’s trading policies, procedures, and performance in seeking best execution for its clients, including the Adler Fund. The Board also considered the historical portfolio turnover rate for the Adler Fund; the process by which evaluations are made of the overall reasonableness of commissions paid; the process by which Adler evaluates best execution; the method and basis for selecting and evaluating the broker-dealers used; and any anticipated allocation of portfolio business to persons affiliated with Adler. After further review and discussion, the Board determined that Adler’s practices regarding brokerage and portfolio transactions were satisfactory.

31

| ADLER VALUE FUND |

| DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited) (Continued) |

Possible conflicts of interest. In evaluating the possibility for conflicts of interest, the Board considered such matters as the experience and abilities of the advisory personnel assigned to the Adler Fund, Adler’s process for allocating trades among the Adler Fund and potential future clients with similar types of investment objectives and strategies, and the substance and administration of Adler’s Code of Ethics. Following further consideration and discussion, the Board found for the Adler Fund that Adler’s standards and practices relating to the identification and mitigation of potential conflicts of interests were satisfactory.

After further discussion of the factors noted above and in reliance on the information provided by Adler and Trust Management, and taking into account the totality of all the factors discussed and information presented at this Meeting and previous Meetings, the Board indicated its agreement to approve the continuance of the Adler Advisory Agreement and to approve the continuance of the Adler ELA. It was noted that in the Trustees’ deliberations regarding the approval of renewal the Adler Advisory Agreement, the Trustees did not identify any particular information or factor that was all-important or controlling, and that each individual Trustee may have attributed different weights to the various factors listed above.

32

This page intentionally left blank.

ADLER-AR-21

EVOLUTIONARY TREE INNOVATORS FUND

(INVNX)

Annual Report

May 31, 2021

| EVOLUTIONARY TREE INNOVATORS FUND | |

| LETTER TO SHAREHOLDERS (Unaudited) | May 31, 2021 |

Dear Fellow Shareholders,

Given this is our first fiscal year-end letter, we welcome you as a new shareholder to the Evolutionary Tree Innovators Fund (the “Fund”). We will touch briefly on our investment approach, why we focus on innovation and not short-term market moves, and conclude by providing a brief performance update for the fiscal year ended May 31.

How Our Approach Enables Investors to Benefit from the Power of Innovation

Everyone senses the power of innovation in their lives but struggles to find appropriate ways to invest in innovative businesses driving change. The Evolutionary Tree Innovators Fund was launched to provide an attractive pathway for investing in profound innovation and secular trends, or evolutionary shifts as we call them. The Fund and its adviser apply an innovation and evolution-focused framework to investing. We believe the development of innovation and its resultant pattern of evolutionary change is the primary engine of growth for companies, industries, and the economy—and, in turn, is the underlying driver of long-term wealth creation.

The Fund seeks to identify important innovations that are driving secular growth and evolutionary shifts for companies, industries, and the economy, and own the leading innovators at the forefront. The Fund defines evolutionary shift as when an industry shifts from an old generation (of a product, service, or business model) over to a “next generation” or new offering that provides advantages versus the “old way” of doing things. The Fund invests in a focused portfolio of 25-35 quality innovative businesses.

Examples of innovations that we believe contribute to sustainable growth include technological innovation, product innovation, service or experience innovation, process or cost innovation, and/or business model innovation. In addition to contributing to sustaining growth for leading innovative businesses, new innovations may also enable innovators to take market share, create competitive advantage, and/or enhance profitability over time. Innovation is the root cause of value creation.

Why We Focus on Innovation, Not on Short-term Movements in the Markets or the Economy

The Evolutionary Tree Innovators Fund is meant for investors that are seeking capital appreciation over the long term. We define long term as sticking with your investments for many years. In the context of this long-term investing mindset, we believe that trying to predict short-term movements in the economy or the markets is largely futile and often counter-productive. As such, we believe shifting the focus toward identifying specific innovations creating positive impact for users and sustaining growth is a more repeatable process for adding value. Focus on innovation and ignore the short-term market chatter.

Looking at investing from an innovation-focused vantage-point, we strongly believe the current economic environment is highly conducive to a steady stream of important and profound innovations across the economy, particularly with industry after industry becoming tech-enabled through digital transformation. We describe the current era we

1

live in as the Age of Innovation. It is the Fund’s mission to own a high-quality collection of leading and emerging innovators that may benefit from these dynamics. Our increasingly intellectual capital-based economy is generating a growing number of innovative businesses in a variety of industries, most notably in technology, life sciences, fintech, and digital consumer spaces.

Investment Results and Contributors and Detractors to Performance

Evolutionary Tree Innovators Fund (INVNX) launched in early September 2020, so the investment results are very short term. The Fund is a long-term focused strategy with a time horizon that is measured in years (typically 3-7 years). As such, short-term performance is less meaningful than long-term results.

Despite a pullback in growth and innovation-oriented stocks in recent months, the Fund has delivered strong absolute investment returns since launch (September 9, 2020) and through May 31, 2021 of 27.30% and relative results that compare favorably with large-cap growth style indices which are generally up about 21% over this same period. Given that the Fund’s stated benchmark, the S&P 500 Index, includes both growth and value-oriented stocks, it has delivered similar strong results (+25.08%) from the time of the Fund’s launch and through the end of its fiscal year, as cyclicals and “re-opening trades” have recently served as tailwinds to that index and headwinds to the growth style. So-called re-opening trades are those stocks that investors believe may potentially benefit from the re-opening of the economy as the population gets vaccinated. We believe the benefits of the re-opening trade will be short lived, while secular growers and innovators—which we focus on—can sustain growth for longer, as we describe in more detail below.

The top three contributors to performance in the period were HubSpot, Roku, and Sea Limited. Contributors were generally companies providing cloud-based enterprise applications or digital consumer and e-commerce services, which have benefited from the shifts to the cloud and e-commerce. The top three detractors were Sarepta, nCino, and Farfetch. The primary detractors were life science companies. We do not believe a change in administration will alter their long-term prospects. Both political parties support healthcare innovation, especially for diseases with few alternatives, where we tend to focus. We continue to have confidence in Sarepta and other healthcare holdings, as well as nCino (a leading cloud software provider) and Farfetch (the leader in e-marketplaces for luxury brands).

Secular Growth in a Rising Rate Environment

Recently, market participants have expressed concern over rising inflation expectations leading to higher interest rates, thus raising input costs, crimping margins, and potentially impacting valuations for some companies. Interest rates have been too low for too long, and we believe it’s a healthy dynamic for rates to move to more normalized levels. Additionally, innovative companies, if truly differentiated, have pricing power enabling them to pass along any increase in input costs from inflation to their customers, ultimately protecting their margin structure. We believe this dynamic holds true for the companies in the Fund.

2

Stick with Secular Growers Versus Chasing the “Re-Opening Trade”

While investors are focused on the topic du jour of the “re-opening trade,” we remain focused on longer-term opportunities represented in the Fund, which are multi-year in nature and driven by the adoption of innovations and secular trends. These are the types of opportunities that will not only benefit from a strengthening economy but can also grow for years beyond that.

We believe the “re-opening trade” is short-term by nature and will play out in less than a year. In fact, many of the cyclical stocks have already rebounded nearly to levels seen in 2019, despite the fact that many of these industries will take longer to get back to even. And then, once cyclical industries get back to pre-COVID levels, many of these industries will slow dramatically. As they are not secular growers, they lack the fuel to sustain above-average growth beyond the initial rebound. Eventually, in our opinion, investors will look beyond cyclicals and return to the secular growers.

Rather than relying on the typical short-term trading approach of shifting from one group of stocks to another group—say from “COVID stocks” to “re-opening stocks” for example–we remain consistent in staying focused on our long-term approach of owning companies that meet our eight criteria and are positioned to grow over a multi-year period. The eight criteria we use to identify and evaluate quality innovators include the following characteristics: 1) Benefits from evolutionary shift driven by secular trends and innovation, 2) Large market opportunity with room for growth, 3) Attractive industry structure and dynamics, 4) Industry leader with strong innovation pipeline, 5) Multiple layers of competitive advantage, 6) Strong business model and financial position, 7) Exceptional talent with a unique culture, and 8) Logical valuation based on long-term drivers and economics. We believe quality innovative businesses—both leading and emerging innovators—are best able to drive value creation when you stick with them over many years, as their innovations gain adoption over time.

Thanks for joining the growing community of investors embracing innovation investing and the Evolutionary Tree Innovators Fund. We wish you all the best,

Thomas Ricketts, CFA

Portfolio Manager

3

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance data quoted. An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-833-517-1010 and a copy can be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets and specific holdings. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. For a complete list of securities held by the Fund as of May 31, 2021, please see the Schedule of Investments section of this Report. The opinions of the Fund’s Adviser with respect to those securities may change at any time.