Form N-CSR Trust for Advised Portfo For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21422

Trust for Advised Portfolios

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, Wisconsin 53202

(Address of principal executive offices) (Zip code)

Russell B. Simon, President

Trust for Advised Portfolios

2020 East Financial Way, Suite 100

Glendora, CA 91741

(Name and address of agent for service)

(626) 914-7395

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: September 30, 2022

Item 1. Reports to Stockholders.

| (a) |

Annual Report

September 30, 2022

Miller Income Fund

Class A LMCJX

Class C LCMNX

Class FI LMCKX

Class I LMCLX

Class IS LMCMX

Table of contents

|

Miller Income Fund |

|||||||

|

Management commentary |

1 |

||||||

|

Fund at a glance |

7 |

||||||

|

Fund expenses |

8 |

||||||

|

Fund performance |

10 |

||||||

|

Schedule of investments |

11 |

||||||

|

Statement of assets and liabilities |

15 |

||||||

|

Statement of operations |

17 |

||||||

|

Statements of changes in net assets |

18 |

||||||

|

Financial highlights |

19 |

||||||

|

Notes to financial statements |

24 |

||||||

|

Report of independent registered public accounting firm |

34 |

||||||

|

Approval of Investment Advisory agreement |

36 |

||||||

|

Additional information |

39 |

||||||

|

Privacy notice |

43 |

||||||

| Directory of fund's service providers |

Back Cover |

||||||

Miller Income Fund 2022 Annual Report

Miller Income Fund manager commentary

The Miller Income Fund's I-shares returned -29.41% versus a -14.04% return for the ICE BofA US High Yield Index for the twelve-month period ending September 30. 2022. Every market environment is unique for its own reasons, but the current one is special for the severity and persistence of negative returns across asset classes, most notably the "safest" assets.

Average Annual Total Returns and Expenses (%) — as of 9/30/20221

|

Without Sales Charges |

|||||||||||||||||||

|

1 Yr |

3 Yr |

5 Yr |

Inception2 |

||||||||||||||||

|

Class A |

-29.56 |

-2.02 |

-0.20 |

1.17 |

|||||||||||||||

|

Class C |

-30.07 |

-2.75 |

-0.92 |

0.44 |

|||||||||||||||

|

Class FI |

-29.57 |

-1.91 |

-0.15 |

1.15 |

|||||||||||||||

|

Class I |

-29.41 |

-1.76 |

0.10 |

1.43 |

|||||||||||||||

|

Class IS |

-29.28 |

-1.69 |

0.18 |

1.51 |

|||||||||||||||

|

ICE BofA US High Yield Index |

-14.04 |

-0.66 |

1.41 |

2.95 |

|||||||||||||||

|

S&P 500 Index |

-15.47 |

8.16 |

9.24 |

10.03 |

|||||||||||||||

|

With Maximum Sales Charges |

|||||||||||||||||||

|

1 Yr |

3 Yr |

5 Yr |

Inception2 |

||||||||||||||||

|

Class A |

-33.59 |

-3.93 |

-1.37 |

0.47 |

|||||||||||||||

|

Class C |

-30.73 |

-2.75 |

-0.92 |

0.44 |

|||||||||||||||

1 Performance greater than one year is annualized.

2 Fund inception was on 2/28/2014

Gross (Net) Expenses (%): Class A 1.26 (1.23); Class C 2.00 (1.97); Class FI 1.38 (1.35); Class I 1.01 (0.98), Class IS 0.94 (0.91). Miller Value Partners, LLC (the "Adviser") has agreed to waive fees and/or reimburse operating expenses (other than front-end or contingent deferred loads, taxes, interest expense, brokerage commissions, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, portfolio transaction expenses, dividends paid on short sales, extraordinary expenses such as litigation, Rule 12b-1 fees, intermediary servicing fees, or any other class-specific expenses) through January 31, 2023, so that such annual operating expenses will not exceed 0.89%, subject to recapture as described below. Separately, with respect to Class I only, the Adviser has agreed to waive fees and/or reimburse operating expenses such that the previously described annual operating expenses, plus intermediary servicing fees and other class-specific expenses, will not exceed 0.95%. Expense ratios are current to the most recent prospectus dated January 31, 2022. Net expenses are applicable to investors.

Performance shown represents past performance and is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than the original cost. Class A shares have a maximum front end sales charge of 5.75%. Class C shares have a one-year contingent deferred sales charge (CDSC) of 1.0%. If sales charges were included, performance shown would be lower. Total returns assume the reinvestment of all distributions at net asset value and the deduction of all Fund expenses. Total return figures are based on the NAV per share applied to shareholder subscriptions and redemptions, which may differ from the NAV per share disclosed in Fund shareholder reports. Performance would have been lower if fees had not been waived in various periods. Numbers may be the same due to rounding. YTD is calculated from January 1 of the reporting year. All classes of shares may not be available to all investors or through all distribution channels. For the most recent month-end information, please call 888-593-5110 or visit millervaluefunds.com.

Miller Income Fund 2022 Annual Report

1

Miller Income Fund manager commentary (cont'd)

The Bloomberg US Aggregate Bond index is comprised of investment-grade bonds in the US with a par value outstanding of at least $100 million and with at least one year until maturity. Its holdings include everything from government debt to asset-backed securities and corporate bonds, with the effective idea being a representation of the investment-grade US bond market. Prior to this year, the index only had one occasion since inception in 1976 with three consecutive calendar quarters of negative returns — the third and fourth quarters of 1979 followed by the first quarter of 1980, causing a cumulative loss of 12.6%. The past three quarters of negative performance have eclipsed that period with a total loss of 14.6%.

The last time US bonds lost value for three consecutive quarters actually marked a multi-decade turning point for inflation and the bond bear market. Is it possible that the most recent string of unprecedented bond volatility and bad returns could mark the end of a shorter bond bear market and a broader return to the centuries-long pattern of falling interest rates? No one knows, but it seems unlikely given today's fundamental backdrop. Unemployment is still at a five-decade low, and while tightening financial conditions and an economic slowdown are contributing to a pullback in asset prices and a pause in the housing market, the US still has too little housing. Soaring mortgage costs have put an interlude in home price appreciation, but home prices are still up more over the past six months than it costs to finance a house for a full year at today's 30-year fixed rate, even after the cost has risen to a two-decade high. Recent data also show that rents have gone up at the same rate over the past twelve months as it costs to finance ownership of the asset.

Moreover, while the Fed is hiking the cost of money, the lower bound of the Federal funds target rate at the time of this writing is 3.00%, and the market expects it to go to 3.75% in two weeks. It is an oversimplified but instructive exercise to compare this cost of money to the rate at which things that cost money are going up, and it suggests the Fed could still be "behind the curve." People often criticize the Fed for being "backwards-looking" and citing trailing-twelve-month figures instead of focusing on leading indicators. However, the most up-to-date (but still trailing) information is often under-reported because of the one-month measurement interval. If you just annualize the prior three one-month readings on core PCE (personal consumption expenditures), costs have been going up by more than money costs since June of 2020, when societal responses to COVID caused unemployment to hit 13%. The most recent one-month reading (August) implies annualized inflation of 6.9%, while the trailing-three-month number implies a 5.0% inflation rate, both still well above the cost of money, meaning it still makes sense for those that can afford it to borrow and spend today instead of waiting until tomorrow, meaning that inflationary pressures may still be building.

Miller Income Fund 2022 Annual Report

2

How are we adjusting the portfolio to account for these conditions? We do not change our process based upon macroeconomic backdrops or predictions; rather, we look for yield trading at compelling prices relative to its future prospects with our base case being a growing economy, which tends to be the case most of the time. A lot of the portfolio today is in smaller-capitalization stocks, which are currently trading at historic discounts to large-caps. Today's small-cap valuation discount to the market is about the same as it was at the end of 2001, which proved to be an opportune time to buy small-caps for long-term investors. We also own a handful of opportunistic credits that we believe are underfollowed and mispriced. Our marginal focus is always on eliminating our mistakes (of which we make many) and on increasing our allocation to names where we have additional evidence suggesting we are right. A longer-term review of the fund's performance history will show that forward-looking returns have always been best after periods of poor performance, and we expect that today's net asset value will eventually prove to be a good entry point. As always, we appreciate your support and remain the largest investors in the fund.

|

Bill Miller, IV, CFA, CMT October 14, 2022 |

. |

||||||

What is the Fund's investment strategy?

The Fund seeks to provide a high level of income while maintaining potential for growth. The Fund is designed for long-term investors. The Fund's investment style is flexible and intended to generate a high level of income from a wide array of sources. The investment strategy involves identifying instances where the Adviser believes the capital markets have mispriced investment opportunities and exploiting price discrepancies and inefficiencies in the market. The ability to tactically move across asset classes and up and down the capital structure is intended to allow the Fund to access the greatest yield and valuation opportunities. The portfolio managers believe that this flexible approach will allow the Fund to maintain a high level of income while also preserving the opportunity for growth over time. The Fund may depart from its principal investment strategies in response to adverse market, economic or political conditions by taking temporary defensive positions, including by investing in any type of money market instruments, short-term debt securities or cash without regard to any percentage limitations. Although the Adviser has the ability to take defensive positions, it may choose not to do so for a variety of reasons, even during volatile market conditions. The Fund is classified as "non-diversified," which means it may invest a larger percentage of its assets in a smaller number of issuers than a diversified fund.

Miller Income Fund 2022 Annual Report

3

Miller Income Fund manager commentary (cont'd)

What were the market conditions and economic environment for the period?

While every market is characterized by certain factors, the severity and persistence of negative returns across asset classes makes this market unique. The Bloomberg US Aggregate Bond Index, widely viewed as the asset class that should outperform when "riskier" asset classes are out of favor, has returned -14.6% over the past twelve months. Prior to this year since 1976, the Index has only had three consecutive calendar quarters of negative returns one time. The broader US equity indexes are down over the last twelve months, with the S&P 500 at -15.5%, the NASDAQ 100 Index at -24.7%, and the Dow Jones Industrial Average at -13.4% over the last twelve months as of September 30, 2022.

Many factors have contributed to the negative sentiment and market volatility. Inflation peaked in June 2022 and while the Consumer Price Index has modestly decreased to just over 8%, this is still a level not seen since the early 1980s. The Federal Reserve has continued to raise rates throughout the year, with three consecutive quarters of 75 basis point hikes targeting a 3.0-3.25% range. Investor uncertainty has characterized the market's bearish tone as fears of recession dominate the news feed. The geopolitical state contributes to the uncertainty with the prolonged Russian War in Ukraine, energy price concerns in Europe, and China's zero-COVID policy stifling a return to economic growth.

Discuss investment strategies and techniques used that affected Fund performance the most.

The Fund's primary goal is to generate a high level of income while preserving the potential for capital appreciation. We aim to do this by owning securities that are not only high yielding but also undervalued. If we are correct that the price does not adequately reflect the security's potential future cash flows, we hope to capture capital appreciation on top of our yield. The Fund has a flexible mandate, enabling the managers to invest up and down the capital structure in securities with the best reward/risk opportunity. The Fund is flexible to invest in undervalued income-generating securities, regardless of sector, and offers daily liquidity.

Miller Income Fund is currently allocated 75% in income-generating equities and preferreds and 25% in fixed-income securities we believe have appreciation potential. The Fund continues to have a significant allocation to small-cap stocks, which are trading historic discounts to large-caps. For context, the current small-cap valuation discount to the market is about the same as it was at the end of 2001, which proved to be an opportune time for long-term investors to buy smaller companies. Furthermore, we own select opportunistic credits that we believe are underfollowed and mispriced. We believe our focus on bottom-up,

Miller Income Fund 2022 Annual Report

4

long-term, company specific fundamentals will serve our investors well over a long-term investment horizon.

Describe portfolio activity over the period.

Miller Income Fund's turnover for the 12-month period ending September 30, 2022 was 59.4%, compared to 65.0% for the previous period. We initiated 24 new positions and eliminated 28 positions during the year. As of September 30, 2022, the Fund had 38 holdings.

Describe portfolio positioning at period end.

As of September 30, 2022, the Fund is positioned 60% in equities, 25% in Fixed Income, 10% in Real Estate, 4% in Publicly Traded Partnerships, and 1% in Preferred Equity. The Fund's top ten holdings by issuer comprises 47.1% of the portfolio compared to 46.5% in the prior year.

The ICE BofA US High Yield Index tracks the performance of below-investment grade, but not in default, U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market, and includes issues with a credit rating of BBB or below, as rated by Moody's and S&P. The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-dominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency). The CPI (Consumer Price Index) is a measure of the average change over time in the prices paid for a market basket of consumer goods and services. The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. It has been a widely followed indicator of the stock market since October 1, 1928. The NASDAQ-100 Index is a modified captialization-weighted index of the 100 largest and most active non-financial domestic and international issues listed on the NASDAQ. No security can have more than a 24% weighting. The index was developed with a base value of 125 as of February 1, 1985. Prior to December 21, 1998 the Nasdaq 100 was a cap-weighted index. The S&P 500 Index is a market capitalization-weighted index of 500 widely held common stocks. An investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Equity securities are subject to price fluctuation and possible loss of principal. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. Real estate investment trusts (REITs) are closely linked to the performance of the real estate markets. REITs are subject to illiquidity, credit and interest rate risks, and risks associated with small and mid-cap investments. Asset-backed, mortgage-backed or mortgage related securities are subject to prepayment and extension risks.

Miller Income Fund 2022 Annual Report

5

Miller Income Fund manager commentary (cont'd)

Investments in MLP securities are subject to unique risks, including the risks of MLPs and the energy sector, including the risks of declines in energy and commodity prices, decreases in energy demand, adverse weather conditions, natural or other disasters, changes in government regulation, and changes in tax laws. Short selling is a speculative strategy. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that is sold short. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks; and possible loss of principal. As interest rates rise, the value of fixed income securities falls. High yield bonds are subject to greater price volatility, illiquidity, and possibility of default. As a non-diversified Fund, it is permitted to invest a higher percentage of its assets in any one issuer than a diversified fund, which may magnify the Fund's losses from events affecting a particular issuer. Derivatives, such as options and futures, can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance.

An investor cannot invest directly in an index.

Miller Income Fund is distributed by Quasar Distributors, LLC.

Must be preceded or accompanied by a prospectus.

Miller Income Fund 2022 Annual Report

6

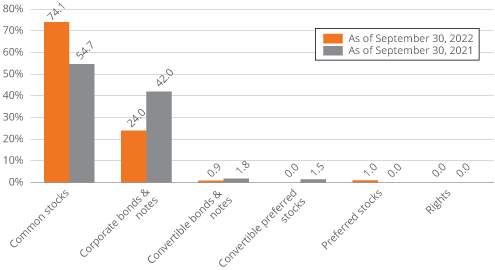

Fund at a glance (unaudited)

Investment breakdown (%) as a percent of total investments

Miller Income Fund 2022 Annual Report

7

Fund expenses (unaudited)

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on April 1, 2022 and held for the six months ended September 30, 2022.

Actual Expenses

The table below titled "Based on total actual return" provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled "Expenses Paid During the Period".

Hypothetical Example for Comparison Purposes

The table below titled "Based on hypothetical actual return" provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

Miller Income Fund 2022 Annual Report

8

Based on total actual return1

|

Actual Total Return Without Sales Charges2 |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 |

|||||||||||||||||||

|

Class A |

-23.33 |

% |

$ |

1,000.00 |

$ |

766.70 |

1.21 |

% |

$ |

5.35 |

|||||||||||||

|

Class C |

-23.67 |

1,000.00 |

763.30 |

1.96 |

8.64 |

||||||||||||||||||

|

Class FI |

-23.35 |

1,000.00 |

766.50 |

1.25 |

5.55 |

||||||||||||||||||

|

Class I |

-23.26 |

1,000.00 |

767.40 |

0.96 |

4.25 |

||||||||||||||||||

|

Class IS |

-23.23 |

1,000.00 |

767.70 |

0.90 |

3.99 |

||||||||||||||||||

Based on hypothetical actual return1

|

Hypothetical Total Return Without Sales Charges2 |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 |

|||||||||||||||||||

|

Class A |

5.00 |

% |

$ |

1,000.00 |

$ |

1,019.01 |

1.21 |

% |

$ |

6.12 |

|||||||||||||

|

Class C |

5.00 |

1,000.00 |

1,015.27 |

1.96 |

9.88 |

||||||||||||||||||

|

Class FI |

5.00 |

1,000.00 |

1,018.79 |

1.25 |

6.34 |

||||||||||||||||||

|

Class I |

5.00 |

1,000.00 |

1,020.26 |

0.96 |

4.86 |

||||||||||||||||||

|

Class IS |

5.00 |

1,000.00 |

1,020.56 |

0.90 |

4.56 |

||||||||||||||||||

1 For the six months ended September 30, 2022.

2 Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value or does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charge ("CSDC") with respect to Class C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results.

3 Expenses (net of compensating balance arrangements, fee waivers and/or expense reimbursements) are equal to each class respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 365.

Miller Income Fund 2022 Annual Report

9

Fund performance (unaudited)

Historical Performance

Value of $10,000 invested in

Class A, C and FI Shares of Miller Income Fund vs. ICE BofA US High Yield Index and S&P 500 Index† — 2/28/14 to 9/30/22

Value of $1,000,000 invested in

Class I and IS Shares of Miller Income Fund vs. ICE BofA US High Yield Index and S&P 500 Index† — 2/28/14 to 9/30/22

† Hypothetical illustration of $10,000 invested in Class A, C and FI shares and $1,000,000 invested in Class I and IS shares of Miller Income Fund on February 28, 2014 (inception date), assuming the reinvestment of all distributions, including return of capital, if any, at net asset value through September 30, 2022. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Class A shares reflect the deduction of the maximum sales charge of 5.75% at the time of investment. The hypothetical illustration also assumes a $10,000 or $1,000,000 investment, if applicable, in the ICE BofA US High Yield Index and S&P 500 Index. Please note that an investor cannot invest directly in an index.

Miller Income Fund 2022 Annual Report

10

Schedule of Investments

September 30, 2022

Miller Income Fund

|

Security |

Shares |

Value |

|||||||||

|

Common Stocks — 73.6% |

|||||||||||

|

Consumer Discretionary — 9.1% |

|||||||||||

|

Specialty Retail — 9.1% |

|||||||||||

|

Buckle Inc/The |

251,200 |

$ |

7,952,992 |

||||||||

|

Camping World Holdings, Inc. |

67,000 |

1,696,440 |

|||||||||

|

Chico's FAS Inc. * |

982,900 |

4,757,236 |

|||||||||

|

Total Consumer Discretionary |

14,406,668 |

||||||||||

|

Consumer Staples — 3.8% |

|||||||||||

|

Tobacco — 3.8% |

|||||||||||

|

British American Tobacco PLC |

165,000 |

5,944,178 |

|||||||||

|

Total Consumer Staples |

5,944,178 |

||||||||||

|

Energy — 7.0% |

|||||||||||

|

Oil, Gas & Consumable Fuels — 7.0% |

|||||||||||

|

Alliance Resource Partners LP |

276,000 |

6,320,400 |

|||||||||

|

Chesapeake Energy Corp. |

50,000 |

4,710,500 |

|||||||||

|

Total Energy |

11,030,900 |

||||||||||

|

Financials — 19.5% |

|||||||||||

|

Banks — 0.0% |

|||||||||||

|

Sberbank of Russia PJSC — ADR *(b) |

2,532,000 |

— |

|||||||||

|

Total Banks |

— |

||||||||||

|

Capital Markets — 12.2% |

|||||||||||

|

Apollo Global Management Inc. |

73,000 |

3,394,500 |

|||||||||

|

Artisan Partners Asset Management, Inc. |

63,000 |

1,696,590 |

|||||||||

|

B Riley Financial, Inc. |

87,500 |

3,895,500 |

|||||||||

|

Lazard Ltd., Class A Shares |

137,200 |

4,367,076 |

|||||||||

|

Sculptor Capital Management Inc. |

442,400 |

3,910,816 |

|||||||||

|

T Rowe Price Group, Inc. |

19,175 |

2,013,567 |

|||||||||

|

Total Capital Markets |

19,278,049 |

||||||||||

|

Consumer Finance — 3.6% |

|||||||||||

|

OneMain Holdings Inc. |

192,700 |

5,688,504 |

|||||||||

|

Diversified Financial Services — 3.7% |

|||||||||||

|

Jackson Financial, Inc. |

208,000 |

5,772,000 |

|||||||||

|

Total Financials |

30,738,553 |

||||||||||

|

Health Care — 7.6% |

|||||||||||

|

Pharmaceuticals — 7.6% |

|||||||||||

|

Organon & Co. |

205,000 |

4,797,000 |

|||||||||

|

Viatris Inc. |

851,000 |

7,250,520 |

|||||||||

|

Total Health Care |

12,047,520 |

||||||||||

Miller Income Fund 2022 Annual Report

11

Schedule of Investments (cont'd)

September 30, 2022

Miller Income Fund

|

Security |

Shares |

Value |

|||||||||||||||||

|

Industrials — 5.0% |

|||||||||||||||||||

|

Commercial Services & Supplies — 5.0% |

|||||||||||||||||||

|

Public Policy Holding Co, Inc. |

4,120,025 |

$ |

6,601,277 |

||||||||||||||||

|

Quad/Graphics Inc. * |

487,800 |

1,248,768 |

|||||||||||||||||

|

Total Industrials |

7,850,045 |

||||||||||||||||||

|

Materials — 11.9% |

|||||||||||||||||||

|

Chemicals — 4.0% |

|||||||||||||||||||

|

Chemours Co/The |

254,000 |

6,261,100 |

|||||||||||||||||

|

Construction Materials — 3.7% |

|||||||||||||||||||

|

HeidelbergCement AG |

146,000 |

5,845,094 |

|||||||||||||||||

|

Metals & Mining — 4.2% |

|||||||||||||||||||

|

Alrosa PJSC *(b) |

2,978,100 |

— |

|||||||||||||||||

|

Vale SA — ADR |

504,000 |

6,713,280 |

|||||||||||||||||

|

Total Metals & Mining |

6,713,280 |

||||||||||||||||||

|

Total Materials |

18,819,474 |

||||||||||||||||||

|

Real Estate — 9.8% |

|||||||||||||||||||

|

Equity Real Estate Investment Trusts (REITs) — 9.8% |

|||||||||||||||||||

|

CTO Realty Growth, Inc. |

360,000 |

6,746,400 |

|||||||||||||||||

|

GEO Group Inc/The * |

300,000 |

2,310,000 |

|||||||||||||||||

|

Medical Properties Trust, Inc. |

332,000 |

3,937,520 |

|||||||||||||||||

|

Simon Property Group, Inc. |

29,000 |

2,602,750 |

|||||||||||||||||

|

Total Real Estate |

15,596,670 |

||||||||||||||||||

|

Total Common Stocks (Cost — $144,049,650) |

116,434,008 |

||||||||||||||||||

|

Rate |

|||||||||||||||||||

|

Preferred Stocks — 0.9% |

|||||||||||||||||||

|

Information Technology — 0.9% |

|||||||||||||||||||

|

Software — 0.9% |

|||||||||||||||||||

|

Greenidge Generation Holdings, Inc. |

8.500 |

% |

123,250 |

1,503,650 |

|||||||||||||||

|

Total Preferred Stocks (Cost — $3,060,938) |

1,503,650 |

||||||||||||||||||

|

Maturity Date |

Face Amount |

||||||||||||||||||

|

Convertible Bond — 0.9% |

|||||||||||||||||||

|

Information Technology — 0.9% |

|||||||||||||||||||

|

Software — 0.9% |

|||||||||||||||||||

|

MicroStrategy Inc. |

0.750 |

% |

12/15/25 |

$ |

1,900,000 |

1,443,920 |

|||||||||||||

|

Total Convertible Bond (Cost — $1,900,000) |

1,443,920 |

||||||||||||||||||

|

Corporate Bonds — 23.8% |

|||||||||||||||||||

|

Communication Services — 3.5% |

|||||||||||||||||||

|

Diversified Telecommunication Services — 1.3% |

|||||||||||||||||||

|

Lumen Technologies Inc. |

7.600 |

% |

9/15/39 |

2,900,000 |

1,986,500 |

||||||||||||||

Miller Income Fund 2022 Annual Report

12

Miller Income Fund

|

Security |

Rate |

Maturity Date |

Face Amount |

Value |

|||||||||||||||

|

Radio and Television Broadcasting — 2.2% |

|||||||||||||||||||

|

iHeartCommunications, Inc. |

8.375 |

% |

5/1/27 |

$ |

4,200,000 |

$ |

3,559,500 |

||||||||||||

|

Total Communication Services |

5,546,000 |

||||||||||||||||||

|

Consumer Discretionary — 3.4% |

|||||||||||||||||||

|

Specialty Retail — 3.4% |

|||||||||||||||||||

|

Carvana Co. (a) |

10.250 |

% |

5/1/30 |

8,000,000 |

5,360,000 |

||||||||||||||

|

Total Consumer Discretionary |

5,360,000 |

||||||||||||||||||

|

Health Care — 6.8% |

|||||||||||||||||||

|

Pharmaceuticals — 6.8% |

|||||||||||||||||||

|

Columbia Care, Inc. |

9.500 |

% |

2/3/26 |

10,000,000 |

9,950,000 |

||||||||||||||

|

Endo Finance LLC (a) |

6.000 |

% |

6/30/28 |

15,352,000 |

882,740 |

||||||||||||||

|

Total Health Care |

10,832,740 |

||||||||||||||||||

|

Industrials — 7.7% |

|||||||||||||||||||

|

Commercial Services & Supplies — 7.7% |

|||||||||||||||||||

|

GEO Group Inc/The |

10.500 |

% |

6/30/28 |

8,291,000 |

8,249,545 |

||||||||||||||

|

Pitney Bowes Inc. (a) |

7.250 |

% |

3/15/29 |

6,600,000 |

3,976,500 |

||||||||||||||

|

Total Commercial Services & Supplies |

12,226,045 |

||||||||||||||||||

|

Total Industrials |

12,226,045 |

||||||||||||||||||

|

Information Technology — 2.4% |

|||||||||||||||||||

|

Software — 2.4% |

|||||||||||||||||||

|

MicroStrategy, Inc. (a) |

6.125 |

% |

6/15/28 |

4,500,000 |

3,720,938 |

||||||||||||||

|

Total Information Technology |

3,720,938 |

||||||||||||||||||

|

Total Corporate Bonds (Cost — $52,503,081) |

37,685,723 |

||||||||||||||||||

|

Shares |

|||||||||||||||||||

|

Rights — 0.0% |

|||||||||||||||||||

|

Energy — 0.0% |

|||||||||||||||||||

|

Oil, Gas & Consumable Fuels — 0.0% |

|||||||||||||||||||

|

Ultra Resources Escrow Position *(b) |

11,195 |

— |

|||||||||||||||||

|

Total Rights (Cost — $0) |

— |

||||||||||||||||||

|

Total Investments — 99.2% (Cost — $201,513,669) |

157,067,301 |

||||||||||||||||||

|

Other Assets in Excess of Liabilities — 0.8% |

1,240,538 |

||||||||||||||||||

|

Total Net Assets — 100.0% |

$ |

158,307,839 |

|||||||||||||||||

Miller Income Fund 2022 Annual Report

13

Schedule of Investments (cont'd)

September 30, 2022

Miller Income Fund

ADR — American Depositary Receipt

PJSC — Public Joint-Stock Company

PLC — Public Limited Company

LP — Limited Partnership

* Non-income producing security.

(a) Security was purchased to rule 144 under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. Unless otherwise noted, 144A securities are deemed to be liquid. At September 30, 2022, the value of these securities totaled $13,940,178 or 8.8% of net assets.

(b) Security is valued in good faith in accordance with procedures approved by the Board of Trustees (See Note 2).

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. ("MSCI") and Standard & Poor's Financial Services LLC ("S&P"). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The Accompanying Notes are an Integral Part of these Financial Statements.

Miller Income Fund 2022 Annual Report

14

Statement of assets and liabilities

September 30, 2022

|

Assets: |

|||||||

|

Investments, at value (Cost $201,513,669) |

$ |

157,067,301 |

|||||

|

Cash |

934 |

||||||

|

Investment securities sold |

1,968,960 |

||||||

|

Dividends and interest receivable |

1,228,386 |

||||||

|

Receivable for fund shares sold |

11,950 |

||||||

|

Prepaid expenses |

32,278 |

||||||

|

Total Assets |

160,309,809 |

||||||

|

Liabilities: |

|||||||

|

Payables: |

|||||||

|

Investment securities purchased |

1,155,298 |

||||||

|

Payable for fund shares repurchased |

77,233 |

||||||

|

Line of credit payable (Note 9) |

516,000 |

||||||

|

Investment management fees payable |

94,961 |

||||||

|

Service and/or distribution fees payable |

17,079 |

||||||

|

Accrued other expenses |

141,399 |

||||||

|

Total Liabilities |

2,001,970 |

||||||

|

Total Net Assets |

$ |

158,307,839 |

|||||

|

Net Assets: |

|||||||

|

Paid-in capital |

$ |

223,170,239 |

|||||

|

Total accumulated loss |

(64,862,400 |

) |

|||||

|

Total Net Assets |

$ |

158,307,839 |

|||||

The Accompanying Notes are an Integral Part of these Financial Statements.

Miller Income Fund 2022 Annual Report

15

Statement of assets and liabilities (cont'd)

September 30, 2022

|

Net Assets: |

|||||||

|

Class A |

$ |

25,881,107 |

|||||

|

Class C |

$ |

19,859,876 |

|||||

|

Class FI |

$ |

247,562 |

|||||

|

Class I |

$ |

67,042,124 |

|||||

|

Class IS |

$ |

45,277,170 |

|||||

|

Shares Outstanding: |

|||||||

|

Class A |

4,291,740 |

||||||

|

Class C |

3,293,156 |

||||||

|

Class FI |

41,068 |

||||||

|

Class I |

11,136,155 |

||||||

|

Class IS |

7,525,977 |

||||||

|

Net Asset Value: |

|||||||

|

Class A (and redemption price) |

$ |

6.03 |

|||||

|

Class C * |

$ |

6.03 |

|||||

|

Class FI (and redemption price) |

$ |

6.03 |

|||||

|

Class I (and redemption price) |

$ |

6.02 |

|||||

|

Class IS (and redemption price) |

$ |

6.02 |

|||||

|

Maximum Public Offering Price Per Share: |

|||||||

|

Class A (based on maximum initial sales charge of 5.75%) |

$ |

6.40 |

|||||

* Redemption price per share of Class C shares is NAV reduced by 1.00% CDSC if shares are redeemed within one year of purchase (See Note 3)

The Accompanying Notes are an Integral Part of these Financial Statements.

Miller Income Fund 2022 Annual Report

16

Statement of operations

For the Year Ended September 30, 2022

|

Investment Income: |

|||||||

|

Dividends and distributions (Net of foreign tax of $112,228) |

$ |

7,202,289 |

|||||

|

Return of capital Distributions (Note 2(b)) |

(623,952 |

) |

|||||

|

Net Dividends and Distributions |

6,578,337 |

||||||

|

Interest |

6,903,492 |

||||||

|

Total Investment Income |

13,481,829 |

||||||

|

Expenses: |

|||||||

|

Investment management fee (Note 3) |

1,553,834 |

||||||

|

Distribution fees (Note 5) |

379,174 |

||||||

|

Transfer agent expenses (Note 3) |

146,015 |

||||||

|

Administration fees (Note 3) |

138,380 |

||||||

|

Shareholder servicing fees (Note 5) |

99,626 |

||||||

|

Registration fees |

74,460 |

||||||

|

Shareholder reports |

35,035 |

||||||

|

Custody fees (Note 3) |

34,055 |

||||||

|

Legal fees |

27,176 |

||||||

|

Audit and tax fees |

17,782 |

||||||

|

Trustees' fees (Note 3) |

15,476 |

||||||

|

Interest expense (Note 9) |

16,087 |

||||||

|

Compliance fees (Note 3) |

13,912 |

||||||

|

Miscellaneous expenses |

9,889 |

||||||

|

Insurance |

5,063 |

||||||

|

Total Expenses |

2,565,964 |

||||||

|

Less: Fee waivers and/or expense reimbursement (Note 3) |

(96,550 |

) |

|||||

|

Net Expenses |

2,469,414 |

||||||

|

Net Investment Income |

11,012,415 |

||||||

|

Realized and Unrealized Gain (Loss) on Investments, REIT Distributions and Foreign Currency Translation (Note 2): |

|||||||

|

Net Realized Gain From: |

|||||||

|

Investment transactions |

3,044,400 |

||||||

|

REIT distributions |

1,142,845 |

||||||

|

Net Realized Gain |

4,187,245 |

||||||

|

Net Change in Unrealized appreciation (depreciation) on: |

|||||||

|

Investment transactions |

(85,078,729 |

) |

|||||

|

Foreign currency translation |

(3,503 |

) |

|||||

|

Change in Net Unrealized Appreciation (Depreciation) on Investments |

(85,082,232 |

) |

|||||

|

Net Loss on Investments, REIT Distribution and Foreign Currency Translation |

(80,894,987 |

) |

|||||

|

Decrease in Net Assets from Operations |

$ |

(69,882,572 |

) |

||||

The Accompanying Notes are an Integral Part of these Financial Statements.

Miller Income Fund 2022 Annual Report

17

Statements of changes in net assets

|

For the Years Ended September 30 |

2022 |

2021 |

|||||||||

|

Operations: |

|||||||||||

|

Net investment income |

$ |

11,012,415 |

$ |

12,432,308 |

|||||||

|

Net realized gain |

4,187,245 |

24,681,977 |

|||||||||

|

Change in unrealized appreciation/depreciation |

(85,082,232 |

) |

50,362,954 |

||||||||

|

Increase (Decrease) in Net Assets from Operations |

(69,882,572 |

) |

87,477,239 |

||||||||

|

Distributions to shareholders from (Note 5): |

|||||||||||

|

Net investment income |

(10,786,365 |

) |

(12,511,052 |

) |

|||||||

|

Return of capital |

(683,636 |

) |

(818,958 |

) |

|||||||

|

Decrease in Net Assets from Distributions to Shareholders |

(11,470,001 |

) |

(13,330,010 |

) |

|||||||

|

Fund Share Transactions (Note 6): |

|||||||||||

|

Net proceeds from sale of shares |

24,504,222 |

44,753,477 |

|||||||||

|

Reinvestment of distributions |

10,801,780 |

12,970,052 |

|||||||||

|

Cost of shares repurchased |

(51,909,299 |

) |

(51,470,476 |

) |

|||||||

|

Increase (Decrease) in Net Assets from Fund Share Transactions |

(16,603,297 |

) |

6,253,053 |

||||||||

|

Increase (Decrease) in Net Assets |

(97,955,870 |

) |

80,400,282 |

||||||||

|

Net Assets: |

|||||||||||

|

Beginning of year |

256,263,709 |

175,863,427 |

|||||||||

|

End of year |

$ |

158,307,839 |

$ |

256,263,709 |

|||||||

The Accompanying Notes are an Integral Part of these Financial Statements.

Miller Income Fund 2022 Annual Report

18

Financial highlights

For a share of each class of beneficial interest outstanding throughout each year ended September 30,

|

Class A Shares |

2022 |

2021 |

2020 |

2019 |

2018 |

||||||||||||||||||

|

Net asset value, beginning of year |

$ |

9.06 |

$ |

6.36 |

$ |

7.74 |

$ |

8.90 |

$ |

8.58 |

|||||||||||||

|

Income (loss) from operations: |

|||||||||||||||||||||||

| Net investment income1 |

0.39 |

0.44 |

0.39 |

0.48 |

0.50 |

||||||||||||||||||

|

Net realized and unrealized gain (loss) |

(3.00 |

) |

2.73 |

(1.29 |

) |

(1.03 |

) |

0.47 |

|||||||||||||||

|

Total income (loss) from operations |

(2.61 |

) |

3.17 |

(0.90 |

) |

(0.55 |

) |

0.97 |

|||||||||||||||

|

Less distributions from: |

|||||||||||||||||||||||

|

Net investment income |

(0.39 |

) |

(0.44 |

) |

(0.34 |

) |

(0.48 |

) |

(0.53 |

) |

|||||||||||||

|

Return of capital |

(0.03 |

) |

(0.03 |

) |

(0.14 |

) |

(0.13 |

) |

(0.12 |

) |

|||||||||||||

|

Total distributions: |

(0.42 |

) |

(0.47 |

) |

(0.48 |

) |

(0.61 |

) |

(0.65 |

) |

|||||||||||||

|

Net asset value, end of year |

$ |

6.03 |

$ |

9.06 |

$ |

6.36 |

$ |

7.74 |

$ |

8.90 |

|||||||||||||

|

Total return2 |

-29.56 |

% |

50.36 |

% |

-11.19 |

% |

-5.76 |

% |

11.70 |

% |

|||||||||||||

|

Net assets, end of year (000s) |

$ |

25,881 |

$ |

36,250 |

$ |

27,444 |

$ |

36,462 |

$ |

37,749 |

|||||||||||||

|

Ratios to average net assets: |

|||||||||||||||||||||||

|

Gross expenses |

1.26 |

% |

1.26 |

% |

1.31 |

% |

1.29 |

% |

1.29 |

% |

|||||||||||||

| Net expenses3,4 |

1.21 |

5 |

1.23 |

5 |

1.23 |

1.26 |

5 |

1.25 |

|||||||||||||||

|

Net investment income |

4.90 |

5.22 |

5.62 |

6.10 |

5.67 |

||||||||||||||||||

|

Portfolio turnover rate |

59 |

% |

65 |

% |

77 |

% |

61 |

% |

37 |

% |

|||||||||||||

1 Per share amounts have been calculated using the average shares method.

2 Performance figures, exclusive of sales charges, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and or/expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results.

3 Effective January 31, 2020, the Adviser agreed to waive fees and/or reimburse operating expenses, (other than front-end or contingent deferred loads, taxes, interest expense, brokerage commissions, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, portfolio transaction expenses, dividends paid on short sales, extraordinary expenses such as litigation, Rule 12b-1 fees, intermediary servicing fees, or any other class-specific expenses) through January 31, 2023, so that such annual operating expenses will not exceed 0.89%. Prior to January 31, 2020, the limit was 1.25% and established at the class level (inclusive of 12b-1 and shareholder servicing fees). See Note 3.

4 Reflects fee waivers and/or expense reimbursements.

5 Interest expenses were 0.01%, 0.02% and 0.01% for the years ended September 30, 2019, 2021 and 2022, respectively. Excluding interest, the net expense ratios were 1.25%, 1.21% and 1.20% for the years ended September 30, 2019, 2021 and 2022, respectively.

The Accompanying Notes are an Integral Part of these Financial Statements.

Miller Income Fund 2022 Annual Report

19

Financial highlights (cont'd)

For a share of each class of beneficial interest outstanding throughout each year ended September 30,

|

Class C Shares |

2022 |

2021 |

2020 |

2019 |

2018 |

||||||||||||||||||

|

Net asset value, beginning of year |

$ |

9.05 |

$ |

6.36 |

$ |

7.73 |

$ |

8.88 |

$ |

8.56 |

|||||||||||||

|

Income (loss) from operations: |

|||||||||||||||||||||||

| Net investment income1 |

0.33 |

0.38 |

0.33 |

0.43 |

0.40 |

||||||||||||||||||

|

Net realized and unrealized gain (loss) |

(3.00 |

) |

2.72 |

(1.27 |

) |

(1.02 |

) |

0.50 |

|||||||||||||||

|

Total income (loss) from operations |

(2.67 |

) |

3.10 |

(0.94 |

) |

(0.59 |

) |

0.90 |

|||||||||||||||

|

Less distributions from: |

|||||||||||||||||||||||

|

Net investment income |

(0.33 |

) |

(0.38 |

) |

(0.31 |

) |

(0.44 |

) |

(0.47 |

) |

|||||||||||||

|

Return of capital |

(0.02 |

) |

(0.03 |

) |

(0.12 |

) |

(0.12 |

) |

(0.11 |

) |

|||||||||||||

|

Total distributions: |

(0.35 |

) |

(0.41 |

) |

(0.43 |

) |

(0.56 |

) |

(0.58 |

) |

|||||||||||||

|

Net asset value, end of year |

$ |

6.03 |

$ |

9.05 |

$ |

6.36 |

$ |

7.73 |

$ |

8.88 |

|||||||||||||

|

Total return2 |

-30.07 |

% |

49.13 |

% |

-11.80 |

% |

-6.48 |

% |

11.00 |

% |

|||||||||||||

|

Net assets, end of year (000s) |

$ |

19,860 |

$ |

34,591 |

$ |

26,784 |

$ |

38,463 |

$ |

35,203 |

|||||||||||||

|

Ratios to average net assets: |

|||||||||||||||||||||||

|

Gross expenses |

2.00 |

% |

2.00 |

% |

2.05 |

% |

2.04 |

% |

2.04 |

% |

|||||||||||||

| Net expenses3,4 |

1.95 |

5 |

1.97 |

5 |

1.97 |

2.01 |

5 |

2.00 |

|||||||||||||||

|

Net investment income |

4.11 |

4.48 |

4.84 |

5.43 |

4.60 |

||||||||||||||||||

|

Portfolio turnover rate |

59 |

% |

65 |

% |

77 |

% |

61 |

% |

37 |

% |

|||||||||||||

1 Per share amounts have been calculated using the average shares method.

2 Performance figures, exclusive of CDSC, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and or/expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results.

3 Effective January 31, 2020, the Adviser agreed to waive fees and/or reimburse operating expenses, (other than front-end or contingent deferred loads, taxes, interest expense, brokerage commissions, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, portfolio transaction expenses, dividends paid on short sales, extraordinary expenses such as litigation, Rule 12b-1 fees, intermediary servicing fees, or any other class-specific expenses) through January 31, 2023, so that such annual operating expenses will not exceed 0.89%. Prior to January 31, 2020, the limit was 2.00% and established at the class level (inclusive of 12b-1 and shareholder servicing fees). See Note 3.

4 Reflects fee waivers and/or expense reimbursements.

5 Interest expenses were 0.01%, 0.02% and 0.01% for the years ended September 30, 2019, 2021 and 2022, respectively. Excluding interest, the net expense ratios were 2.00%, 1.95% and 1.94% for the years ended September 30, 2019, 2021 and 2022, respectively.

The Accompanying Notes are an Integral Part of these Financial Statements.

Miller Income Fund 2022 Annual Report

20

For a share of each class of beneficial interest outstanding throughout each year ended September 30,

|

Class FI Shares |

2022 |

2021 |

2020 |

2019 |

2018 |

||||||||||||||||||

|

Net asset value, beginning of year |

$ |

9.06 |

$ |

6.36 |

$ |

7.71 |

$ |

8.86 |

$ |

8.55 |

|||||||||||||

|

Income (loss) from operations: |

|||||||||||||||||||||||

| Net investment income1 |

0.40 |

0.43 |

0.38 |

0.43 |

0.59 |

||||||||||||||||||

|

Net realized and unrealized gain (loss) |

(3.01 |

) |

2.74 |

(1.25 |

) |

(0.98 |

) |

0.37 |

|||||||||||||||

|

Total income (loss) from operations |

(2.61 |

) |

3.17 |

(0.87 |

) |

(0.55 |

) |

0.96 |

|||||||||||||||

|

Less distributions from: |

|||||||||||||||||||||||

|

Net investment income |

(0.39 |

) |

(0.44 |

) |

(0.34 |

) |

(0.47 |

) |

(0.53 |

) |

|||||||||||||

|

Return of capital |

(0.03 |

) |

(0.03 |

) |

(0.14 |

) |

(0.13 |

) |

(0.12 |

) |

|||||||||||||

|

Total distributions: |

(0.42 |

) |

(0.47 |

) |

(0.48 |

) |

(0.60 |

) |

(0.65 |

) |

|||||||||||||

|

Net asset value, end of year |

$ |

6.03 |

$ |

9.06 |

$ |

6.36 |

$ |

7.71 |

$ |

8.86 |

|||||||||||||

|

Total return2 |

-29.57 |

% |

50.25 |

% |

-10.82 |

% |

-5.80 |

% |

11.66 |

% |

|||||||||||||

|

Net assets, end of year (000s) |

$ |

248 |

$ |

208 |

$ |

118 |

$ |

209 |

$ |

866 |

|||||||||||||

|

Ratios to average net assets: |

|||||||||||||||||||||||

|

Gross expenses |

1.28 |

% |

1.38 |

% |

1.26 |

% |

1.26 |

% |

1.36 |

% |

|||||||||||||

| Net expenses3,4 |

1.24 |

5 |

1.35 |

5 |

1.20 |

1.26 |

5 |

1.25 |

|||||||||||||||

|

Net investment income |

4.98 |

5.07 |

5.54 |

5.41 |

6.58 |

||||||||||||||||||

|

Portfolio turnover rate |

59 |

% |

65 |

% |

77 |

% |

61 |

% |

37 |

% |

|||||||||||||

1 Per share amounts have been calculated using the average shares method.

2 Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and or/expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results.

3 Effective January 31, 2020, the adviser agreed to waive fees and/or reimburse operating expenses, (other than front-end or contingent deferred loads, taxes, interest expense, brokerage commissions, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, portfolio transaction expenses, dividends paid on short sales, extraordinary expenses such as litigation, Rule 12b-1 fees, intermediary servicing fees, or any other class-specific expenses) through January 31, 2023, so that such annual operating expenses will not exceed 0.89%. Prior to January 31, 2020, the limit was 1.25% and established at the class level (inclusive of 12b-1 and shareholder servicing fees). See Note 3.

4 Reflects fee waivers and expense reimbursements, or recapture of previous waivers.

5 Interest expenses were 0.01%, 0.02% and 0.01% for the years ended September 30, 2019, 2021 and 2022, respectively. Excluding interest, the net expense ratios were 1.25%, 1.33% and 1.23% for the years ended September 30, 2019, 2021 and 2022, respectively.

The Accompanying Notes are an Integral Part of these Financial Statements.

Miller Income Fund 2022 Annual Report

21

Financial highlights (cont'd)

For a share of each class of beneficial interest outstanding throughout each year ended September 30,

|

Class I Shares |

2022 |

2021 |

2020 |

2019 |

2018 |

||||||||||||||||||

|

Net asset value, beginning of year |

$ |

9.05 |

$ |

6.35 |

$ |

7.73 |

$ |

8.89 |

$ |

8.56 |

|||||||||||||

|

Income (loss) from operations: |

|||||||||||||||||||||||

| Net investment income1 |

0.41 |

0.46 |

0.40 |

0.51 |

0.51 |

||||||||||||||||||

|

Net realized and unrealized gain (loss) |

(3.00 |

) |

2.73 |

(1.27 |

) |

(1.03 |

) |

0.49 |

|||||||||||||||

|

Total income (loss) from operations |

(2.59 |

) |

3.19 |

(0.87 |

) |

(0.52 |

) |

1.00 |

|||||||||||||||

|

Less distributions from: |

|||||||||||||||||||||||

|

Net investment income |

(0.41 |

) |

(0.46 |

) |

(0.36 |

) |

(0.50 |

) |

(0.54 |

) |

|||||||||||||

|

Return of capital |

(0.03 |

) |

(0.03 |

) |

(0.15 |

) |

(0.14 |

) |

(0.13 |

) |

|||||||||||||

|

Total distributions: |

(0.44 |

) |

(0.49 |

) |

(0.51 |

) |

(0.64 |

) |

(0.67 |

) |

|||||||||||||

|

Net asset value, end of year |

$ |

6.02 |

$ |

9.05 |

$ |

6.35 |

$ |

7.73 |

$ |

8.89 |

|||||||||||||

|

Total return2 |

-29.41 |

% |

50.82 |

% |

-10.94 |

% |

-5.48 |

% |

12.12 |

% |

|||||||||||||

|

Net assets, end of year (000s) |

$ |

67,042 |

$ |

123,349 |

$ |

80,483 |

$ |

79,411 |

$ |

68,138 |

|||||||||||||

|

Ratios to average net assets: |

|||||||||||||||||||||||

|

Gross expenses |

1.00 |

% |

1.01 |

% |

1.05 |

% |

1.03 |

% |

1.04 |

% |

|||||||||||||

| Net expenses3,4 |

0.96 |

5 |

0.98 |

5 |

0.95 |

0.96 |

5 |

0.95 |

|||||||||||||||

|

Net investment income |

5.09 |

5.48 |

5.89 |

6.47 |

5.78 |

||||||||||||||||||

|

Portfolio turnover rate |

59 |

% |

65 |

% |

77 |

% |

61 |

% |

37 |

% |

|||||||||||||

1 Per share amounts have been calculated using the average shares method.

2 Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and or/expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results.

3 Effective January 31, 2020, the Adviser agreed to waive fees and/or reimburse operating expenses, (other than front-end or contingent deferred loads, taxes, interest expense, brokerage commissions, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, portfolio transaction expenses, dividends paid on short sales, extraordinary expenses such as litigation, Rule 12b-1 fees, intermediary servicing fees, or any other class-specific expenses) through January 31, 2023, so that such annual operating expenses will not exceed 0.89%. Separately, the Adviser has agreed to waive fees and/or reimburse operating expenses such that the previously described annual operating expenses, plus intermediary servicing fees and other class-specific expenses, will not exceed 0.95% for Class I. See Note 3.

4 Reflects fee waivers and/or expense reimbursements.

5 Interest expenses were 0.01%, 0.02% and 0.01% for the years ended September 30, 2019, 2021 and 2022, respectively. Excluding interest, the net expense ratios were 0.95%, 0.96% and 0.95% for the years ended September 30, 2019, 2021 and 2022, respectively.

The Accompanying Notes are an Integral Part of these Financial Statements.

Miller Income Fund 2022 Annual Report

22

For a share of each class of beneficial interest outstanding throughout each year ended September 30,

|

Class IS Shares |

2022 |

2021 |

2020 |

2019 |

2018 |

||||||||||||||||||

|

Net asset value, beginning of year |

$ |

9.04 |

$ |

6.35 |

$ |

7.73 |

$ |

8.88 |

$ |

8.56 |

|||||||||||||

|

Income (loss) from operations: |

|||||||||||||||||||||||

| Net investment income1 |

0.42 |

0.47 |

0.41 |

0.51 |

0.50 |

||||||||||||||||||

|

Net realized and unrealized gain (loss) |

(3.00 |

) |

2.72 |

(1.28 |

) |

(1.01 |

) |

0.50 |

|||||||||||||||

|

Total income (loss) from operations |

(2.58 |

) |

3.19 |

(0.87 |

) |

(0.50 |

) |

1.00 |

|||||||||||||||

|

Less distributions from: |

|||||||||||||||||||||||

|

Net investment income |

(0.41 |

) |

(0.47 |

) |

(0.36 |

) |

(0.51 |

) |

(0.55 |

) |

|||||||||||||

|

Return of capital |

(0.03 |

) |

(0.03 |

) |

(0.15 |

) |

(0.14 |

) |

(0.13 |

) |

|||||||||||||

|

Total distributions: |

(0.44 |

) |

(0.50 |

) |

(0.51 |

) |

(0.65 |

) |

(0.68 |

) |

|||||||||||||

|

Net asset value, end of year |

$ |

6.02 |

$ |

9.04 |

$ |

6.35 |

$ |

7.73 |

$ |

8.88 |

|||||||||||||

|

Total return2 |

-29.28 |

% |

50.75 |

% |

-10.87 |

% |

-5.38 |

% |

12.21 |

% |

|||||||||||||

|

Net assets, end of year (000s) |

$ |

45,277 |

$ |

61,866 |

$ |

41,034 |

$ |

51,497 |

$ |

54,829 |

|||||||||||||

|

Ratios to average net assets: |

|||||||||||||||||||||||

|

Gross expenses |

0.94 |

% |

0.94 |

% |

0.99 |

% |

0.97 |

% |

0.98 |

% |

|||||||||||||

| Net expenses3,4 |

0.90 |

5 |

0.91 |

5 |

0.88 |

0.86 |

5 |

0.85 |

|||||||||||||||

|

Net investment income |

5.23 |

5.55 |

5.92 |

6.49 |

5.69 |

||||||||||||||||||

|

Portfolio turnover rate |

59 |

% |

65 |

% |

77 |

% |

61 |

% |

37 |

% |

|||||||||||||

1 Per share amounts have been calculated using the average shares method.

2 Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and or/expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results.

3 Effective January 31, 2020, the Adviser agreed to waive fees and/or reimburse operating expenses, (other than front-end or contingent deferred loads, taxes, interest expense, brokerage commissions, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, portfolio transaction expenses, dividends paid on short sales, extraordinary expenses such as litigation, Rule 12b-1 fees, intermediary servicing fees, or any other class-specific expenses) through January 31, 2023, so that such annual operating expenses will not exceed 0.89%. Prior to January 31, 2020, the limit was 0.85% and established at the class level (inclusive of 12b-1 and shareholder servicing fees). See Note 3.

4 Reflects fee waivers and/or expense reimbursements.

5 Interest expenses were 0.01%, 0.02% and 0.01% for the years ended September 30, 2019, 2021 and 2022, respectively. Excluding interest, the net expense ratios were 0.85%, 0.89% and 0.89% for the years ended September 30, 2019, 2021 and 2022, respectively.

The Accompanying Notes are an Integral Part of these Financial Statements.

Miller Income Fund 2022 Annual Report

23

Notes to financial statements

1. Organization

Miller Income Fund (the "Fund") is a separate non-diversified investment series of the Trust for Advised Portfolios (the "Trust"), a Delaware Statutory Trust registered under the Investment Company Act of 1940, as amended (the "1940 Act"). The Fund seeks to provide a high level of income while maintaining the potential for growth.

2. Significant accounting policies

The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles ("U.S. GAAP") for investment companies. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Topic 946. The presentation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses. Actual results may differ from those estimates.

(a) Investment valuation. Investments in securities traded on a national securities exchange are valued at the last reported sales price on the exchange on which the security is principally traded. Securities traded on the NASDAQ exchanges are valued at the NASDAQ Official Closing Price ("NOCP"). Exchange-traded securities for which no sale was reported and NASDAQ securities for which there is no NOCP are valued at the mean of the most recent quoted bid and ask prices. Long-term fixed income securities are valued using prices provided by an independent pricing service approved by the Board of Trustees. Pricing services may use various valuation methodologies, including matrix pricing and other analytical models as well as market transactions and dealer quotations. Securities for which market quotations are not readily available are valued at their estimated fair value as determined in good faith by Miller Value Partners, LLC (the "Adviser") under procedures established by and under the general supervision and responsibility of the Board.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized into three broad levels and described below:

• Level 1 — quoted prices in active markets for identical investments

Miller Income Fund 2022 Annual Report

24

• Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

• Level 3 — significant unobservable inputs, including the Fund's own assumptions in determining the fair value of investments.

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used in valuing the Fund's assets carried at fair value:

|

Description |

Quoted Prices (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total |

|||||||||||||||

|

Investments* |

|||||||||||||||||||

|

Common Stocks |

$ |

116,434,008 |

$ |

— |

$ |

— |

** |

$ |

116,434,008 |

||||||||||

|

Preferred Stocks |

1,503,650 |

— |

— |

1,503,650 |

|||||||||||||||

|

Convertible Bond |

— |

1,443,920 |

— |

1,443,920 |

|||||||||||||||

|

Corporate Bonds |

— |

37,685,723 |

— |

37,685,723 |

|||||||||||||||

|

Rights |

— |

— |

— |

*** |

— |

||||||||||||||

|

Total Investments |

$ |

117,937,658 |

$ |

39,129,643 |

$ |

— |

$ |

157,067,301 |

|||||||||||

* See Schedule of Investments for additional detailed categorizations.

** Russia's invasion of Ukraine has led to unprecedented market and policy responses of governments and regulators around the world. As a result there is no functioning or orderly market to the facilitate the liquidation of any Russian-based securities held by the Fund. As a result, the Russian securities held in the Fund are deemed illiquid and considered worthless.

*** Valued at zero.

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

|

Investments in Securities |

Common Stocks |

Convertible Preferred Stocks |

|||||||||

|

Balance at September 30, 2021 |

$ |

— |

$ |

3,758,225 |

|||||||

|

Change in unrealized appreciation (depreciation) |

(5,312,204 |

) |

(327,545 |

) |

|||||||

|

Transfer into (Transfer out of) Level 3*** |

5,312,204 |

(3,430,680 |

) |

||||||||

|

Balance at September 30, 2022 |

$ |

— |

$ |

— |

|||||||

|

Change in unrealized appreciation (depreciation) for Level 3 securities held at September 30, 2022 |

$ |

— |

$ |

— |

|||||||

*** The Stronghold Digital Mining Series A & B convertible preferred stocks were converted into common stock in December 2021. The stock is valued using current market quotations. The Russian securities were transferred to level 3 as noted above.

Miller Income Fund 2022 Annual Report

25

Notes to financial statements (cont'd)

(b) Return of capital estimates. Distributions received from the Fund's investments in Master Limited Partnerships ("MLPs") generally are comprised of income and return of capital. Distributions received from the Fund's investments in Real Estate Investment Trusts ("REITs") generally are comprised of income, realized capital gains and return of capital. It is the policy of the Fund to estimate the character of distributions received from underlying REITs and MLPs based on historical information available from each MLP or REIT and other industry sources. These estimates may subsequently be revised based on information received from the MLPs and REITs after their tax reporting periods are concluded.

(c) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on accrual basis. Dividend income is recorded on the ex-dividend date. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.

(d) Distributions to shareholders. Distributions are declared and paid on a quarterly basis. The Fund intends to distribute all of its net investment income earned each quarter and any cash received during the quarter from its investments in MLPs and REITs. The Fund intends to distribute the cash received from MLPs and REITs even if all or a portion of that cash may represent a return of capital to the Fund. Distributions of net realized gains, if any, are declared at least annually. The character of distributions made to shareholders during the period may differ from their ultimate characterization for federal income tax purposes. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from U.S. GAAP.

(e) Share class accounting. Investment income, common expenses and realized/ unrealized gains (losses) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Fees relating to a specific class are charged directly to that share class.

(f) Federal and other taxes. It is the Fund's policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the "Code"), as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing

Miller Income Fund 2022 Annual Report

26

requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund's financial statements.

Management has analyzed the Fund's tax positions taken on income tax returns for all open tax years (prior three fiscal years) and has concluded that as of September 30, 2022, no provision for income tax is required in the Fund's financial statements. The Fund's federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue. The Fund has no examination in progress and are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

3. Investment management agreement and other related party transactions

The Trust has an agreement with the Adviser to furnish investment advisory services to the Fund. Under the investment management agreement, the Fund pays an investment management fee, calculated daily and paid monthly, in accordance with the following breakpoint schedule:

|

Average Daily Net Assets |

Annual Rate |

||||||

|

First $2.5 billion |

0.700 |

% |

|||||

|

Next $5 billion |

0.675 |

||||||

|

Over $7.5 billion |

0.650 |

||||||