Form N-CSR Smead Funds Trust For: Nov 30

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22985

SMEAD FUNDS TRUST

(Exact name of registrant as specified in charter)

2777 East Camelback Road, Suite 375

Phoenix, AZ 85016

(Address of principal executive offices) (Zip code)

Cole W. Smead

Smead Capital Management, Inc.

2777 East Camelback Road, Suite 375

Phoenix, AZ 85016

Copy to:

Pamela M. Krill, Esq

Godfrey & Kahn, S.C.

833 East Michigan Street, Suite 1800

Milwaukee, WI 53202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 701-2883

Date of fiscal year end: November 30

Date of reporting period: November 30, 2022

Table of Contents

Item 1. Report to Shareholders.

(a)

2

Table of Contents

Annual Report

November 30, 2022

Investment Adviser

Smead Capital Management, Inc.

2777 East Camelback Road

Suite 375

Phoenix, AZ 85016

Phone: 877-807-4122

www.smeadfunds.com

Table of Contents

| 1 | ||||

| 7 | ||||

| 9 | ||||

| 15 | ||||

| 20 | ||||

| 24 | ||||

| 26 | ||||

| 28 | ||||

| 34 | ||||

| 46 | ||||

| BASIS FOR TRUSTEES’ APPROVAL OF |

47 | |||

| 51 | ||||

| 52 | ||||

Table of Contents

Letter to Shareholders – Smead Value Fund

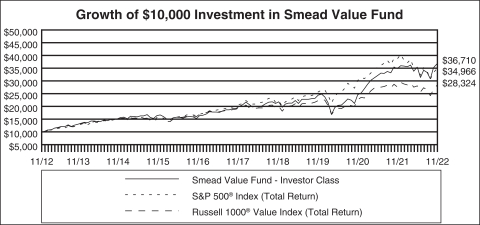

Fiscal 2022 in the Smead Value Fund (SMVLX) was especially rewarding for a number of reasons. First, we built on the gains we made in fiscal 2021. The Smead Value Fund, Investor Class, gained 5.70% versus a loss of 9.21% in the S&P 500 Index and a gain of 2.42% in the Russell 1000 Value Index. Second, we made those gains with a minimum of turnover and capital gains, while absorbing some sharp declines in meritorious companies we want to own in the future. Third, we believe we ended the year positioned to survive the remainder of the bear market in stocks, regardless of how long it lasts.

Our best-performing stocks were all oil and gas stocks. Continental Resources (CLR), Occidental Petroleum (OXY) and ConocoPhillips (COP) were our best performers. As you will see below, we have reasons to believe that owning fossil fuel production could be beneficial to our shareholders over the next decade.

The three poorest-performing stocks were Warner Bros. Discovery (WBD), Target (TGT) and eBay (EBAY). The tightening by the Federal Reserve Board to get control of inflation hit consumer/media companies hard. We also withstood a major correction in our home builder stocks. We feel that they will reward us over the next ten years as 92 million millennials get married, have children and buy houses. Those houses are unlikely to come from the nation’s existing homes (which are 45 years old on average).

Dallas Buyers Club

In one of his best movies, Matthew McConaughey plays a blue-collar guy who is quite the ladies’ man. His wide array of sexual partners quickly moved from being a badge of pride to a ticket to the scariest sexually transmitted disease of all, HIV/AIDS. A frantic quest took him to Mexico to find a medicine that was proving beneficial in slowing the progression of the disease.

Once he brought the medicine back to the U.S., he found out that he couldn’t sell the medicine to a large community of gay men with HIV/AIDS, because it had never been approved by the Food and Drug Administration. In response, a club was formed with membership dues to receive the medicine via membership in the Dallas Buyers Club. He was a blessing to those who needed the medicine.

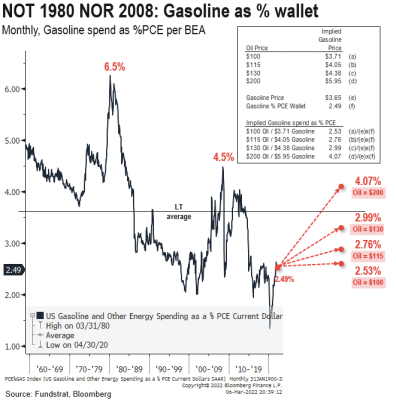

In 2022, oil prices shot all the way up to $120 per barrel as war raged in Ukraine and massive underinvestment in energy sources around the world came home to roost. Oil prices were a part of the economic disease called inflation. Even though the effect on the U.S. economy of higher oil prices has become muted in the last 20 years, it became politically expedient for President Biden to sell 200 million barrels of oil out of the Federal Government’s Strategic Petroleum Reserve. The added supply blessed gasoline buyers by bringing prices down temporarily. Numerous major oil companies took one look at refining oil without pulling it out of their reserves and formed their own Dallas Buyers Club.

1

Table of Contents

As we look out into 2023, there are many things we don’t know and a few things we think we know. We know that U.S. oil production averages around 16 million barrels per day. We know that oil and gas companies have been dissuaded from increasing oil and gas drilling as fossil fuels are treated like a pollution disease. We know that President Biden’s reserve release represented about 6.5% of U.S. oil production for about 200 days in 2022. Lastly, we know that the Strategic Petroleum Reserve must be refilled in the event that the U.S. is lured into a war somewhere around the world.

2

Table of Contents

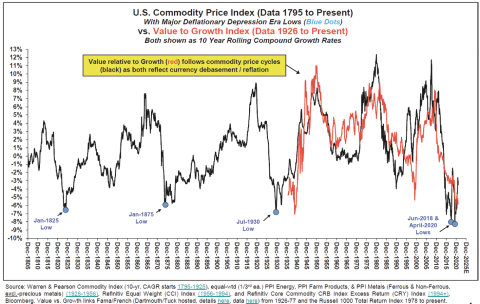

At the margin, a seller of 200 million barrels in 2022 would become one of the largest buyers of oil in 2023. As the chart below shows, oil and commodities hit a 246-year low in April 2020:

History would argue that we have years of higher oil and gas prices ahead of us, especially if the Communist government of the People’s Republic of China releases their population from its COVID-19 imprisonment and start competing on the world economic stage. Therefore, we are making every effort to over-weight our oil and gas stocks despite stock market success in 2021 and 2022.

We run a concentrated portfolio of primarily large-cap value stocks with boringly dry turnover. Thank you for participating as we work for investors who fear stock market failure.

|

| |

| William Smead Lead Portfolio Manager |

Cole Smead, CFA Co-Portfolio Manager |

3

Table of Contents

Letter to Shareholders – Smead International Value Fund

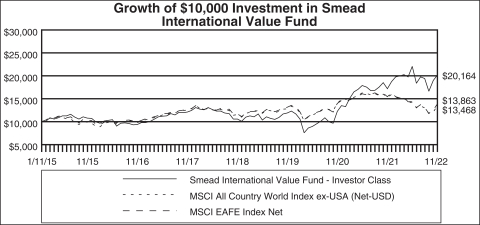

During the 2022 fiscal year, the Smead International Fund (SVXLX), Investor Class, had a gain of 17.46% versus a loss of 10.14% in the MSCI EAFE NR Index Net and a loss of 11.82% in the MSCI ACWI ex-USA NR Index.1 We are pleased that the investors of the Fund have benefited from what has transpired. The back half of the calendar year of 2022 has been more frustrating.

Our largest contributors for the fiscal year were Occidental (warrants OXY/WS US and equity OXY US), Meg Energy (MEG CN) and Cenovus (CVE CN). Energy and consumer staples were our best sector allocations. Our three largest detractors were Porsche (PAH3 GY), Persimmon (PSN LN) and IWG (IWG LN). The sectors that detracted the most were consumer discretionary and communication services.

The I Word and the R Word

The year 2022 has been notable for the number of references to the I word and the R word: Inflation and Recession. As we analyze the consequences of these words, we see that in some cases investors are acting how you’d expect and in other ways they are not. We are glad that the investing public doesn’t make perfect sense because this has been their role for the last 420 years since the Amsterdam Stock Exchange was founded in 1602.

Inflation has crept into the words of every politician, media outlet and investor dialogue. It went from being the subject of cranks and old fuddy-duddies to the word of the layman or laywoman. Inflation damages all assets in real terms. Humans begin to make different spending and capital allocation decisions based on it. For example, consumers begin to purchase non-perishable goods in advance of their need so that they can get a lower price before the prices rise. In business, companies begin to purchase higher quantities of their input. The effect of this is to hedge their future costs. We can see some of this going on in the real economy.

Historically, when inflation transforms the minds of investors, long bonds have gone to high yields and commodities have gone through the roof over time. Inflation-protecting assets became the talk of Wall Street. Stocks became hated and energy stocks became the only thing to own. We don’t see that zeitgeist in investing markets taking over yet. While Jay Powell would like to tame inflation from over 7% to lower amounts, a reduction to 5% would be the highest sustained inflation I’ve ever seen in my 39 years of life! Oil sure looks under-owned and wildly attractive to us based on how inflation hasn’t become the end-all for Wall Street yet. We like our ownership in energy companies like Occidental (OXY US), Cenovus Energy (CVE CN), MEG Energy (MEG CN) and oil tanker Frontline (FRO NO).

When it comes to recession, this is on the lips of every investor and person in the economy. It was last summer that the pool bartender at my favorite resort in Reno told me about the coming recession. Turn on any financial news and you will hear about the coming recession. In our opinion, this is the most over-played hand at the poker table. Investors particularly agree on this.

However, the economy continues to chug along. Further, in the most recent CPI and wage reports, you’ll see that workers had real wage gains as they were paid more than the inflation print. We find this to be a very dynamic economic set up globally. The recession fears are giving us great pricing in more economically-sensitive businesses. We can’t claim to know if and when these fears or the actual economic headwinds may come and subside. We just like the prices we got in brands like Canada Goose (GOOS CN),

4

Table of Contents

Pandora (PNDORA DC) and Next (NXT LN). We further like that this keeps everyone from getting more excited about higher rates in companies like BAWAG (BG AV), UniCredit (UCG IM) and Bankinter (BKT SM).

We thank you for being investors alongside us as we try to take advantage of the I and R words, inflation and recession, in investment markets.

Fear stock market failure,

|

|

| |

| Cole Smead, CFA Lead Portfolio Manager |

William Smead Co-Portfolio Manager |

| 1 | The Fund is a newly registered mutual fund and does not have a full calendar year of performance as a mutual fund. The Fund succeeded to substantially all of the assets and liabilities of the Smead International Value Fund LP, a Delaware Limited Partnership (the “Predecessor Fund”), in exchange solely for Class I1 shares of the Fund on January 11, 2022 (the “Reorganization”). Smead Private Fund Advisers, LLC, an affiliate of Smead Capital Management, Inc. (the “Adviser”), was the General Partner for the Predecessor Fund since its inception on January 12, 2015. Prior performance represents the historical performance of the Predecessor Fund, which offered partnership interests. Following the Reorganization, the Predecessor Fund was liquidated and dissolved. Please see the Fund’s Prospectus for more details. |

The information contained herein represents the opinion of Smead Capital Management, Inc. and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The statutory and summary prospectuses contain this and other information about the Funds and are available at www.smeadcap.com or by calling 877-807-4122. Read carefully before investing.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 877-807-4122.

Mutual fund investing involves risk. Principal loss is possible.

Foreign Securities Risk. Investments in securities of foreign companies involve additional risks, including less liquidity, currency rate fluctuations, political and economic instability, differences in financial reporting standards and securities market regulation, and the imposition of foreign withholding taxes.

MSCI EAFE NR Index is a broad-based, unmanaged equity market index designed to measure the equity market performance of 21 developed markets, excluding the US and Canada. An index cannot be invested in directly. This benchmark calculates reinvested dividends net of withholding taxes using Luxembourg tax rates. MSCI ACWI ex-U.S. Index

5

Table of Contents

(Net) is a free float-adjusted market capitalization index that is designed to large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 24 Emerging Markets (EM) countries. This benchmark calculates reinvested dividends net of withholding taxes using Luxembourg tax rates. One cannot invest directly in an index.

The S&P 500 Index is a broad-based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Russell 1000® Value Index measures the performance of those Russell 1000® Index companies with lower price-to-book ratios and lower forecasted growth values. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell ® is a trademark of Russell Investment Group. One cannot invest directly in an index.

The Smead Funds are distributed by UMB Distribution Services, LLC. UMB Distribution Services, and Smead Capital Management, Inc. are not affiliated.

6

Table of Contents

SMEAD FUNDS

(Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and (2) ongoing costs, including management fees, distribution (12b-1) fees, shareholder servicing fees and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds, and to compare these costs with the ongoing costs of investing in other mutual funds. The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The second and fourth columns of the following tables provide information about actual account values and actual expenses of each Class of the Funds. If you purchase Class A shares of the Funds you will pay a maximum initial sales charge of 5.75% when you invest. Class A shares and Class C shares of Smead Value Fund and the Smead International Value Fund are subject to a contingent deferred sales charge of 1.00% for purchases of $1,000,000 or more that are redeemed within eighteen months of purchase for Class A shares and redeemed within twelve months of purchase for Class C shares. In addition, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by UMB Fund Services, Inc., the Funds’ transfer agent. To the extent the Funds invest in shares of exchange-traded funds (“ETFs”) or other investment companies as part of their investment strategies, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Funds invest in addition to the expenses of the Funds. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the Examples. The Examples include, but are not limited to, advisory fees, fund administration and accounting, custody and transfer agent fees. You may use the information in the second and fourth columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the applicable number under the column entitled “Actual Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The third and fifth columns of the following tables provide information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the third and fifth columns of the table are useful in comparing

7

Table of Contents

SMEAD FUNDS

Expense Examples (Continued)

(Unaudited)

ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Smead Value Fund

| Class |

Beginning Account Value 6/1/22 |

Actual Ending Account Value 11/30/22 |

Hypothetical Ending Account Value |

Actual Expense Paid During Period(1) |

Hypothetical Expenses Paid During Period(1) |

Net Expense Ratio During Period(2) | ||||||||||||||||||||||||

| Investor Class |

$ | 1,000.00 | $ | 1,036.20 | $ | 1,019.40 | $ | 5.77 | $ | 5.72 | 1.13 | % | ||||||||||||||||||

| Class A |

1,000.00 | 1,036.00 | 1,019.30 | 5.87 | 5.82 | 1.15 | ||||||||||||||||||||||||

| Class C |

1,000.00 | 1,033.20 | 1,016.60 | 8.61 | 8.54 | 1.69 | ||||||||||||||||||||||||

| Class I1 |

1,000.00 | 1,037.50 | 1,020.61 | 4.55 | 4.51 | 0.89 | ||||||||||||||||||||||||

| Class R1 |

1,000.00 | 1,034.40 | 1,017.95 | 7.24 | 7.18 | 1.42 | ||||||||||||||||||||||||

| Class R2 |

1,000.00 | 1,034.90 | 1,018.30 | 6.89 | 6.83 | 1.35 | ||||||||||||||||||||||||

| Class Y |

1,000.00 | 1,037.70 | 1,020.86 | 4.29 | 4.26 | 0.84 | ||||||||||||||||||||||||

| (1) | Investor Class, Class A, Class C, Class I1, Class R1, Class R2 and Class Y expenses are calculated using each Class’ annualized net expense ratio (as disclosed), multiplied by the average account value over the period, and multiplied by 183/365 (to reflect the most recent one-half year period). |

| (2) | Annualized. |

Smead International Value Fund

| Class |

Beginning Account Value 6/1/22 |

Actual Ending Account Value 11/30/22 |

Hypothetical Ending Account Value |

Actual Expense Paid During Period(1) |

Hypothetical Expenses Paid During Period(1) |

Net Expense Ratio During Period(2) | ||||||||||||||||||||||||

| Investor Class |

$ | 1,000.00 | $ | 914.10 | $ | 1,017.55 | $ | 7.20 | $ | 7.59 | 1.50 | % | ||||||||||||||||||

| Class A |

1,000.00 | 913.20 | 1,016.95 | 7.77 | 8.19 | 1.62 | ||||||||||||||||||||||||

| Class C |

1,000.00 | 911.40 | 1,014.94 | 9.68 | 10.20 | 2.02 | ||||||||||||||||||||||||

| Class I1 |

1,000.00 | 914.70 | 1,018.50 | 6.29 | 6.63 | 1.31 | ||||||||||||||||||||||||

| Class Y |

1,000.00 | 915.80 | 1,019.95 | 4.90 | 5.16 | 1.02 | ||||||||||||||||||||||||

| (1) | Investor Class, Class A, Class C, Class I1 and Class Y expenses are calculated using each Class’ annualized net expense ratio (as disclosed), multiplied by the average account value over the period, and multiplied by 183/365 (to reflect the most recent one-half year period). |

| (2) | Annualized. |

8

Table of Contents

SMEAD FUNDS

(Unaudited)

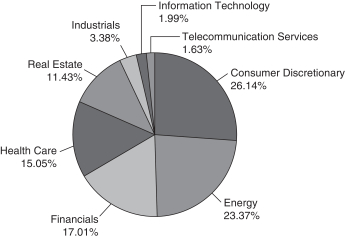

The Smead Value Fund seeks long-term capital appreciation. To achieve its investment objective, the Fund maintains approximately 25-30 companies in its portfolio and will invest in the common stocks of large capitalization U.S. companies.

Sector Breakdown

(% of Equity Investments as of November 30, 2022)

Top Ten Holdings (% of Net Assets as of November 30, 2022)

| Occidental Petroleum Corp. |

8.76% | ||||

| Merck & Co., Inc. |

6.15% | ||||

| Amgen, Inc. |

6.13% | ||||

| ConocoPhillips |

5.44% | ||||

| Simon Property Group, Inc. |

5.32% | ||||

| American Express Co. |

5.30% | ||||

| Macerich Co. (The) |

5.02% | ||||

| Lennar Corp. |

4.86% | ||||

| DR Horton, Inc. |

4.63% | ||||

| NVR, Inc. |

4.57% |

Fund holdings are subject to change at any time and should not be considered recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk.

Continued

9

Table of Contents

SMEAD FUNDS

Investment Highlights (Continued)

(Unaudited)

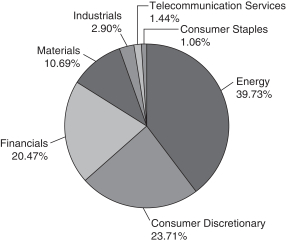

The Smead International Value Fund seeks long-term capital appreciation. To achieve its investment objective, the Fund maintains approximately 25-30 companies in its portfolio and will invest in the common stocks of large capitalization non-U.S. companies.

Sector Breakdown

(% of Equity Investments as of November 30, 2022)

Top Ten Holdings (% of Net Assets as of November 30, 2022)

| Occidental Petroleum Corp. – Warrant |

9.34% | ||||

| Occidental Petroleum Corp. |

7.63% | ||||

| Cenovus Energy, Inc. |

7.47% | ||||

| MEG Energy Corp. |

7.45% | ||||

| West Fraser Timber Co. Ltd. |

5.83% | ||||

| UniCredit SpA |

4.63% | ||||

| BAWAG Group AG |

4.63% | ||||

| Interfor Corp. |

4.49% | ||||

| Frontline Ltd. |

4.42% | ||||

| Porsche Automobil Holding SE |

4.36% |

Fund holdings are subject to change at any time and should not be considered recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk.

Continued

10

Table of Contents

SMEAD FUNDS

Investment Highlights (Continued)

(Unaudited)

Average Annual Total Returns for the period ended November 30, 2022

| Smead Value Fund |

Inception Date |

1 Year | 5 Year | 10 Year | Since Inception | ||||||||||||||||||||

| Investor Class |

1/2/2008 | 5.70% | 12.91% | 13.89% | 10.02% | ||||||||||||||||||||

| Smead Value Fund – Class A |

1/27/2014 | 5.69% | 12.94% | N/A | 9.91% | ||||||||||||||||||||

| Smead Value Fund – Class C |

4/16/2020 | 5.13% | N/A | N/A | 36.34% | ||||||||||||||||||||

| Smead Value Fund – Class I1 |

12/18/2009 | 5.99% | 13.21% | 14.19% | 10.27% | ||||||||||||||||||||

| Smead Value Fund – Class R1 |

11/25/2014 | 5.45% | 12.63% | N/A | 9.75% | ||||||||||||||||||||

| Smead Value Fund – Class R2 |

11/25/2014 | 5.57% | 13.41% | N/A | 10.03% | ||||||||||||||||||||

| Smead Value Fund – Class Y |

11/25/2014 | 6.06% | 13.35% | N/A | 10.27% | ||||||||||||||||||||

| S&P 500® Index (Total Return) |

(9.21)% | 10.98% | 13.34% | 9.29% | |||||||||||||||||||||

| Russell 1000® Value Index |

2.42% | 7.86% | 10.97% | 7.29% | |||||||||||||||||||||

Average Annual Total Returns for the period ended November 30, 2022

| Smead International Value Fund |

Inception Date(1) |

1 Year(2) | 5 Year(2) | 10 Year | Since Inception(1)(2) | ||||||||||||||||||||

| Investor Class |

1/12/2015 | 1.18% | 10.64% | N/A | 9.16% | ||||||||||||||||||||

| Smead International Value Fund – Class A |

1/12/2015 | 1.00% | 10.48% | N/A | 9.00% | ||||||||||||||||||||

| Smead International Value Fund – Class C |

1/12/2015 | 0.58% | 9.85% | N/A | 8.37% | ||||||||||||||||||||

| Smead International Value Fund – Class I1 |

1/12/2015 | 1.27% | 10.79% | N/A | 9.30% | ||||||||||||||||||||

| Smead International Value Fund – Class Y |

1/12/2015 | 1.45% | 10.95% | N/A | 9.44% | ||||||||||||||||||||

| MSCI All Country World Index ex-USA (Net-USD) |

(11.87)% | 1.48% | 4.23% | 3.85% | |||||||||||||||||||||

| MSCI EAFE Index Net |

(10.14)% | 1.85% | 4.99% | 4.23% | |||||||||||||||||||||

| (1) | On January 12, 2022 (date of the Reorganization), the Smead International Value Fund succeeded to substantially all the assets and liabilities of the Smead International Value Fund, L.P. (Predecessor Fund). Smead Private Fund Advisers, LLC, an affiliate of Smead Capital Management, Inc., the investment adviser to the Fund (the “Adviser”), served as the General Partner for the Predecessor Fund since its inception on January 12, 2015. |

| (2) | Includes the historical performance of Smead International Value Fund L.P. prior to the date of Reorganization (January 12, 2022). |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less

Continued

11

Table of Contents

SMEAD FUNDS

Investment Highlights (Continued)

(Unaudited)

than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 877-807-4122.

Investment performance for the Smead International Value Fund reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following graphs illustrate performance of hypothetical investments made in the Funds and broad-based securities indices on the Funds’ inception dates. The graphs do not reflect any future performance.

Continued

12

Table of Contents

SMEAD FUNDS

Investment Highlights (Continued)

(Unaudited)

The S&P 500® Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

Standard & Poor’s®, S&P®, S&P 500® and Standard & Poor’s 500® are trade names or trademarks of Standard & Poor’s Financial Services, LLC.

The Russell 1000® Value Index measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values.

Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group.

Continued

13

Table of Contents

SMEAD FUNDS

Investment Highlights (Continued)

(Unaudited)

The MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada. It covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI World ex - USA All Cap Index captures large, mid, small and micro cap representation across 22 of 23 Developed Markets (DM) countries* (excluding the United States). With 8,723 constituents, the index covers approximately 99% of the free float adjusted market capitalization in each country.

One cannot invest directly in an index.

Continued

14

Table of Contents

SMEAD VALUE FUND

| Schedule of Investments |

| November 30, 2022 |

| Shares |

Value | |||||||||

| COMMON STOCKS 90.50% |

||||||||||

| Banks 7.32% |

||||||||||

| Bank of America Corp. |

4,396,675 | $ | 166,414,149 | |||||||

| JPMorgan Chase & Co. |

1,179,196 | 162,941,303 | ||||||||

|

|

|

|||||||||

| 329,355,452 | ||||||||||

|

|

|

|||||||||

| Consumer Durables & Apparel 14.06% |

||||||||||

| DR Horton, Inc. |

2,419,933 | 208,114,238 | ||||||||

| Lennar Corp. – Class A |

2,490,653 | 218,754,053 | ||||||||

| NVR, Inc. (a) |

44,327 | 205,633,396 | ||||||||

|

|

|

|||||||||

| 632,501,687 | ||||||||||

|

|

|

|||||||||

| Diversified Financials 8.07% |

||||||||||

| American Express Co. |

1,513,457 | 238,505,689 | ||||||||

| Berkshire Hathaway, Inc. – Class B (a) |

159,236 | 50,732,589 | ||||||||

| Credit Acceptance Corp. (a) |

156,155 | 74,011,224 | ||||||||

|

|

|

|||||||||

| 363,249,502 | ||||||||||

|

|

|

|||||||||

| Energy 21.15% |

||||||||||

| Chevron Corp. |

688,991 | 126,298,940 | ||||||||

| ConocoPhillips |

1,980,371 | 244,595,622 | ||||||||

| Occidental Petroleum Corp. |

5,670,251 | 394,025,742 | ||||||||

| Ovintiv, Inc. |

3,347,734 | 186,669,648 | ||||||||

|

|

|

|||||||||

| 951,589,952 | ||||||||||

|

|

|

|||||||||

| Media & Entertainment 1.47% |

||||||||||

| Warner Bros Discovery, Inc. (a) |

5,815,531 | 66,297,053 | ||||||||

|

|

|

|||||||||

| Pharmaceuticals, Biotechnology & Life Sciences 13.63% |

||||||||||

| Amgen, Inc. |

963,705 | 276,005,112 | ||||||||

| Merck & Co., Inc. |

2,514,512 | 276,898,062 | ||||||||

| Pfizer, Inc. |

1,201,254 | 60,218,863 | ||||||||

|

|

|

|||||||||

| 613,122,037 | ||||||||||

|

|

|

|||||||||

| Real Estate 10.34% |

||||||||||

| Macerich Co. (The) – REIT |

17,789,366 | 225,924,948 | ||||||||

| Simon Property Group, Inc. – REIT |

2,004,830 | 239,456,895 | ||||||||

|

|

|

|||||||||

| 465,381,843 | ||||||||||

|

|

|

|||||||||

| Retailing 9.60% |

||||||||||

| eBay, Inc. |

2,782,320 | 126,428,621 | ||||||||

| Home Depot, Inc. |

387,247 | 125,464,156 | ||||||||

| Target Corp. |

1,077,648 | 180,042,651 | ||||||||

|

|

|

|||||||||

| 431,935,428 | ||||||||||

|

|

|

|||||||||

The accompanying notes are an integral part of these financial statements.

15

Table of Contents

SMEAD VALUE FUND

| Schedule of Investments (Continued) |

| November 30, 2022 |

| Shares |

Value | |||||||||

| Semiconductors & Semiconductor Equipment 1.80% |

||||||||||

| Qualcomm, Inc. |

639,611 | $ | 80,904,395 | |||||||

|

|

|

|||||||||

| Transportation 3.06% |

||||||||||

| AMERCO |

510,581 | 32,319,778 | ||||||||

| AMERCO (a) |

1,667,201 | 105,317,087 | ||||||||

|

|

|

|||||||||

| 137,636,865 | ||||||||||

|

|

|

|||||||||

| TOTAL COMMON STOCKS (Cost $3,358,422,102) |

4,071,974,214 | |||||||||

|

|

|

|||||||||

| TOTAL INVESTMENTS (Cost $3,358,422,102) 90.50% |

4,071,974,214 | |||||||||

| Other Assets in Excess of Liabilities 9.50% |

427,534,713 | |||||||||

|

|

|

|||||||||

| TOTAL NET ASSETS 100.00% |

$ | 4,499,508,927 | ||||||||

|

|

|

|||||||||

| (a) | Non-income producing security. |

| REIT | - Real Estate Investment Trust |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by Smead Capital Management, Inc. for the purpose of Industry Classification in the Schedule of Investments.

The accompanying notes are an integral part of these financial statements.

16

Table of Contents

SMEAD INTERNATIONAL VALUE FUND

| Schedule of Investments |

| November 30, 2022 |

| Shares |

Value | |||||||||

| COMMON STOCKS 87.17% |

||||||||||

| Austria 4.63% |

||||||||||

| Financials 4.63% |

||||||||||

| BAWAG Group AG (a),(b) |

66,811 | $ | 3,496,876 | |||||||

|

|

|

|||||||||

| Canada 31.20% |

||||||||||

| Consumer Discretionary 2.90% |

||||||||||

| Canada Goose Holdings, Inc. (b) |

116,702 | 2,186,292 | ||||||||

|

|

|

|||||||||

| Consumer Staples 1.02% |

||||||||||

| Alimentation Couche-Tard, Inc. |

16,974 | 773,272 | ||||||||

|

|

|

|||||||||

| Energy 16.97% |

||||||||||

| Cenovus Energy, Inc. |

283,826 | 5,644,237 | ||||||||

| MEG Energy Corp. (b) |

395,526 | 5,630,839 | ||||||||

| Whitecap Resources, Inc. |

192,918 | 1,538,869 | ||||||||

|

|

|

|||||||||

| 12,813,945 | ||||||||||

|

|

|

|||||||||

| Materials 10.31% |

||||||||||

| Interfor Corp. (b) |

180,994 | 3,390,736 | ||||||||

| West Fraser Timber Co. Ltd. |

56,251 | 4,400,052 | ||||||||

|

|

|

|||||||||

| 7,790,788 | ||||||||||

|

|

|

|||||||||

| 23,564,297 | ||||||||||

|

|

|

|||||||||

| Denmark 2.36% |

||||||||||

| Consumer Discretionary 2.36% |

||||||||||

| Pandora AS |

23,413 | 1,781,506 | ||||||||

|

|

|

|||||||||

| Germany 11.80% |

||||||||||

| Consumer Discretionary 11.80% |

||||||||||

| Bayerische Motoren Werke AG |

13,864 | 1,245,219 | ||||||||

| Dr Ing hc F Porsche AG – (Preference Shares) (b) |

9,696 | 1,101,746 | ||||||||

| Porsche Automobil Holding SE – (Preference Shares) |

54,225 | 3,292,224 | ||||||||

| Volkswagen AG – (Preference Shares) |

22,503 | 3,277,876 | ||||||||

|

|

|

|||||||||

| 8,917,065 | ||||||||||

|

|

|

|||||||||

| Italy 8.23% |

||||||||||

| Financials 8.23% |

||||||||||

| Assicurazioni Generali SpA |

151,881 | 2,715,983 | ||||||||

| UniCredit SpA |

253,985 | 3,499,201 | ||||||||

|

|

|

|||||||||

| 6,215,184 | ||||||||||

|

|

|

|||||||||

The accompanying notes are an integral part of these financial statements.

17

Table of Contents

SMEAD INTERNATIONAL VALUE FUND

| Schedule of Investments (Continued) |

| November 30, 2022 |

| Shares |

Value | |||||||||

| Netherlands 1.38% |

||||||||||

| Telecommunication Services 1.38% |

||||||||||

| Universal Music Group NV |

43,698 | $ | 1,046,857 | |||||||

|

|

|

|||||||||

| Norway 4.42% |

||||||||||

| Energy 4.42% |

||||||||||

| Frontline Ltd. |

240,464 | 3,338,874 | ||||||||

|

|

|

|||||||||

| Spain 3.39% |

||||||||||

| Financials 3.39% |

||||||||||

| Bankinter SA |

389,037 | 2,564,365 | ||||||||

|

|

|

|||||||||

| United Kingdom 12.13% |

||||||||||

| Consumer Discretionary 5.82% |

||||||||||

| Bellway PLC |

35,944 | 872,443 | ||||||||

| Berkeley Group Holdings PLC |

24,885 | 1,147,858 | ||||||||

| Next PLC |

15,892 | 1,134,072 | ||||||||

| WH Smith PLC (b) |

72,483 | 1,243,846 | ||||||||

|

|

|

|||||||||

| 4,398,219 | ||||||||||

|

|

|

|||||||||

| Industrials 2.80% |

||||||||||

| IWG PLC (b) |

1,099,483 | 2,113,068 | ||||||||

|

|

|

|||||||||

| Financials 3.51% |

||||||||||

| Lloyds Banking Group PLC |

2,099,436 | 1,208,936 | ||||||||

| NatWest Group PLC |

452,877 | 1,439,967 | ||||||||

|

|

|

|||||||||

| 2,648,903 | ||||||||||

|

|

|

|||||||||

| 9,160,190 | ||||||||||

|

|

|

|||||||||

| United States 7.63% |

||||||||||

| Energy 7.63% |

||||||||||

| Occidental Petroleum Corp. |

82,908 | 5,761,277 | ||||||||

|

|

|

|||||||||

| TOTAL COMMON STOCKS (Cost $64,101,445) |

65,846,491 | |||||||||

|

|

|

|||||||||

| WARRANTS 9.34% |

||||||||||

| United States 9.34% |

||||||||||

| Energy 9.34% |

||||||||||

| Occidental Petroleum Corp. Expiration date 8/3/2027 (b) |

148,479 | 7,052,753 | ||||||||

|

|

|

|||||||||

| TOTAL WARRANTS (Cost $2,011,078) |

7,052,753 | |||||||||

|

|

|

|||||||||

| TOTAL INVESTMENTS (Cost $66,112,523) 96.51% |

72,899,244 | |||||||||

| Other Assets in Excess of Liabilities 3.49% |

2,635,206 | |||||||||

|

|

|

|||||||||

| TOTAL NET ASSETS 100.00% |

$ | 75,534,450 | ||||||||

|

|

|

|||||||||

The accompanying notes are an integral part of these financial statements.

18

Table of Contents

SMEAD INTERNATIONAL VALUE FUND

| Schedule of Investments (Continued) |

| November 30, 2022 |

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of this security totaled $3,496,876 or 4.63% of net assets. |

| (b) | Non-income producing security. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by Smead Capital Management, Inc. for the purpose of Industry Classification in the Schedule of Investments.

The accompanying notes are an integral part of these financial statements.

19

Table of Contents

SMEAD VALUE FUND

| Statement of Assets and Liabilities |

| November 30, 2022 |

| Assets |

|||||

| Investments, at value (cost $3,358,422,102) |

$ | 4,071,974,214 | |||

| Cash |

513,571,531 | ||||

| Receivable for Fund shares sold |

4,764,557 | ||||

| Dividends and interest receivable |

11,330,317 | ||||

|

|

|

||||

| Total Assets |

4,601,640,619 | ||||

|

|

|

||||

| Liabilities |

|||||

| Payable for Fund shares redeemed |

4,980,051 | ||||

| Payable to Adviser |

2,590,490 | ||||

| Payable to Administrator |

43,655 | ||||

| Payable for investments purchased |

92,707,878 | ||||

| Payable for distribution fees |

130,028 | ||||

| Payable for shareholder servicing fees |

946,938 | ||||

| Accrued expenses and other liabilities |

732,652 | ||||

|

|

|

||||

| Total Liabilities |

102,131,692 | ||||

|

|

|

||||

| Net Assets |

$ | 4,499,508,927 | |||

|

|

|

||||

| Net Assets Consist Of: |

|||||

| Paid-in capital |

$ | 3,726,375,710 | |||

| Total distributable earnings (loss) |

773,133,217 | ||||

|

|

|

||||

| Net Assets |

$ | 4,499,508,927 | |||

|

|

|

||||

| Investor Class Shares |

|||||

| Net assets |

$ | 107,324,313 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

1,516,569 | ||||

| Net asset value, offering price and redemption price per share |

$ | 70.77 | |||

|

|

|

||||

| Class A Shares |

|||||

| Net assets |

$ | 427,615,504 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

6,097,315 | ||||

| Net asset value, offering price and redemption price per share(1) |

$ | 70.13 | |||

|

|

|

||||

| Maximum offering price per share (70.13/0.9425)(2) |

$ | 74.41 | |||

|

|

|

||||

| Class C Shares |

|||||

| Net assets |

$ | 41,043,282 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

599,882 | ||||

| Net asset value, offering price and redemption price per share(1) |

$ | 68.42 | |||

|

|

|

||||

The accompanying notes are an integral part of these financial statements.

20

Table of Contents

SMEAD VALUE FUND

| Statement of Assets and Liabilities (Continued) |

| November 30, 2022 |

| Class I1 Shares |

|||||

| Net assets |

$ | 3,531,197,928 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

49,822,841 | ||||

| Net asset value, offering price and redemption price per share |

$ | 70.88 | |||

|

|

|

||||

| Class R1 Shares |

|||||

| Net assets |

$ | 241,303 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

3,473 | ||||

| Net asset value, offering price and redemption price per share |

$ | 69.48 | |||

|

|

|

||||

| Class R2 Shares |

|||||

| Net assets |

$ | 74,174 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

1,033 | ||||

| Net asset value, offering price and redemption price per share |

$ | 71.80 | (3) | ||

|

|

|

||||

| Class Y Shares |

|||||

| Net assets |

$ | 392,012,423 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

5,520,162 | ||||

| Net asset value, offering price and redemption price per share |

$ | 71.01 | |||

|

|

|

||||

| (1) | A contingent deferred sales charge (“CDSC”) of 1.00% may be charged on shares redeemed within eighteen months of purchase for Class A shares and twelve months of purchase for Class C shares. Redemption price per share is equal to net asset value less any redemption or CDSC fees. |

| (2) | Reflects a maximum sales charge of 5.75%. |

| (3) | Calculated NAV may not equal actual NAV shown due to rounding of the Net assets and shares. |

The accompanying notes are an integral part of these financial statements.

21

Table of Contents

SMEAD INTERNATIONAL VALUE FUND

| Statement of Assets and Liabilities |

| November 30, 2022 |

| Assets |

|||||

| Investments, at value (cost $66,112,523) |

$ | 72,899,244 | |||

| Cash |

2,204,545 | ||||

| Receivable for Fund shares sold |

296,240 | ||||

| Dividends and interest receivable |

30,675 | ||||

| Other assets |

213,969 | ||||

|

|

|

||||

| Total Assets |

75,644,673 | ||||

|

|

|

||||

| Liabilities |

|||||

| Payable to Adviser |

70,261 | ||||

| Payable for distribution fees |

597 | ||||

| Payable for shareholder servicing fees |

3,808 | ||||

| Accrued expenses and other liabilities |

35,557 | ||||

|

|

|

||||

| Total Liabilities |

110,223 | ||||

|

|

|

||||

| Net Assets |

$ | 75,534,450 | |||

|

|

|

||||

| Net Assets Consist Of: |

|||||

| Paid-in capital |

$ | 71,923,612 | |||

| Total distributable earnings (loss) |

3,610,838 | ||||

|

|

|

||||

| Net Assets |

$ | 75,534,450 | |||

|

|

|

||||

| Investor Class Shares |

|||||

| Net assets |

$ | 18,865 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

378 | ||||

| Net asset value, offering price and redemption price per share |

$ | 49.91 | |||

|

|

|

||||

| Class A Shares |

|||||

| Net assets |

$ | 2,630,478 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

53,336 | ||||

| Net asset value, offering price and redemption price per share(1) |

$ | 49.32 | |||

|

|

|

||||

| Maximum offering price per share (49.32/0.9425)(2) |

$ | 52.33 | |||

|

|

|

||||

| Class C Shares |

|||||

| Net assets |

$ | 105,702 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

2,244 | ||||

| Net asset value, offering price and redemption price per share(1) |

$ | 47.10 | (3) | ||

|

|

|

||||

The accompanying notes are an integral part of these financial statements.

22

Table of Contents

SMEAD INTERNATIONAL VALUE FUND

| Statement of Assets and Liabilities (Continued) |

| November 30, 2022 |

| Class I1 Shares |

|||||

| Net assets |

$ | 39,428,112 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

782,188 | ||||

| Net asset value, offering price and redemption price per share |

$ | 50.41 | |||

|

|

|

||||

| Class Y Shares |

|||||

| Net assets |

$ | 33,351,293 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

655,057 | ||||

| Net asset value, offering price and redemption price per share |

$ | 50.91 | |||

|

|

|

||||

| (1) | A contingent deferred sales charge (“CDSC”) of 1.00% may be charged on shares redeemed within eighteen months of purchase for Class A shares and twelve months of purchase for Class C shares. Redemption price per share is equal to net asset value less any redemption or CDSC fees. |

| (2) | Reflects a maximum sales charge of 5.75%. |

| (3) | Calculated NAV may not equal actual NAV shown due to rounding of the Net assets and shares. |

The accompanying notes are an integral part of these financial statements.

23

Table of Contents

SMEAD VALUE FUND

| Statement of Operations | ||

| Year Ended November 30, 2022 | ||

| Investment Income |

|||||

| Dividend income |

$ | 70,162,751 | |||

| Interest income |

3,435,394 | ||||

|

|

|

||||

| Total Investment Income |

73,598,145 | ||||

|

|

|

||||

| Expenses |

|||||

| Management fees |

28,389,659 | ||||

| Distribution fees – Investor Class |

261,104 | ||||

| Distribution fees – Class A |

911,709 | ||||

| Distribution fees – Class C |

216,574 | ||||

| Distribution fees – Class R1 |

873 | ||||

| Distribution fees – Class R2 |

430 | ||||

| Shareholder servicing fees – Investor Class |

109,992 | ||||

| Shareholder servicing fees – Class A |

386,405 | ||||

| Shareholder servicing fees – Class C |

45,484 | ||||

| Shareholder servicing fees – Class I1 |

2,766,440 | ||||

| Shareholder servicing fees – Class R1 |

275 | ||||

| Shareholder servicing fees – Class R2 |

53 | ||||

| Administration fees |

642,796 | ||||

| Transfer agent fees and expenses |

500,134 | ||||

| Fund accounting fees |

503,530 | ||||

| Federal and state registration fees |

746,350 | ||||

| Custody fees |

159,336 | ||||

| Reports to shareholders |

244,384 | ||||

| Legal fees |

168,119 | ||||

| Audit and tax fees |

22,500 | ||||

| Trustees’ fees |

130,000 | ||||

| Recoupment of previously reimbursed expenses |

17,704 | ||||

| Other expenses |

40,851 | ||||

|

|

|

||||

| Total Expenses |

36,264,702 | ||||

|

|

|

||||

| Net Investment Income |

37,333,443 | ||||

|

|

|

||||

| Realized and Unrealized Gain on Investments |

|||||

| Net realized gain from investments |

51,416,018 | ||||

| Net realized gain from in-kind redemptions |

256,106,649 | ||||

| Change in net unrealized depreciation on investments |

(117,997,490 | ) | |||

|

|

|

||||

| Net Realized and Unrealized Gain on Investments |

189,525,177 | ||||

|

|

|

||||

| Net Increase in Net Assets from Operations |

$ | 226,858,620 | |||

|

|

|

||||

The accompanying notes are an integral part of these financial statements.

24

Table of Contents

SMEAD INTERNATIONAL VALUE FUND

| Statement of Operations | ||

| Period from January 12, 2022 (commencement of operations) to November 30, 2022 | ||

| Investment Income |

|||||

| Dividend income (net of taxes withheld of $135,516) |

$ | 1,166,063 | |||

| Interest income |

24,970 | ||||

|

|

|

||||

| Total Investment Income |

1,191,033 | ||||

|

|

|

||||

| Expenses |

|||||

| Management fees |

408,868 | ||||

| Distribution fees – Investor Class |

20 | ||||

| Distribution fees – Class A |

5,015 | ||||

| Distribution fees – Class C |

422 | ||||

| Shareholder servicing fees – Class A |

2,377 | ||||

| Shareholder servicing fees – Class C |

60 | ||||

| Shareholder servicing fees – Class I1 |

25,085 | ||||

| Administration fees |

10,907 | ||||

| Transfer agent fees and expenses |

24,258 | ||||

| Fund accounting fees |

9,544 | ||||

| Federal and state registration fees |

3,816 | ||||

| Custody fees |

34,652 | ||||

| Reports to shareholders |

30,855 | ||||

| Legal fees |

70,000 | ||||

| Audit and tax fees |

20,638 | ||||

| Trustees’ fees |

3,000 | ||||

| Other expenses |

9,011 | ||||

|

|

|

||||

| Total Expenses |

658,528 | ||||

| Expense Waiver by Adviser |

(33,480 | ) | |||

|

|

|

||||

| Net Expenses |

625,048 | ||||

|

|

|

||||

| Net Investment Income |

565,985 | ||||

|

|

|

||||

| Realized and Unrealized Gain on Investments |

|||||

| Net realized loss from investments |

(3,750,135 | ) | |||

| Foreign currency transactions |

9,092 | ||||

| Change in net unrealized appreciation on investments |

3,638,737 | ||||

| Change in net unrealized depreciation on foreign currency |

(825 | ) | |||

|

|

|

||||

| Net Realized and Unrealized Gain on Investments |

(103,131 | ) | |||

|

|

|

||||

| Net Increase in Net Assets from Operations |

$ | 462,854 | |||

|

|

|

||||

The accompanying notes are an integral part of these financial statements.

25

Table of Contents

SMEAD VALUE FUND

| Statements of Changes in Net Assets |

| Year Ended November 30, 2022 |

Year Ended November 30, 2021 | |||||||||

| From Operations |

|

|||||||||

| Net investment income |

$ | 37,333,443 | $ | 10,512,671 | ||||||

| Net realized gain from investments |

307,522,667 | 119,504,783 | ||||||||

| Change in net unrealized appreciation (depreciation) on investments |

(117,997,490 | ) | 472,600,790 | |||||||

|

|

|

|

|

|||||||

| Net increase in net assets from operations |

226,858,620 | 602,618,244 | ||||||||

|

|

|

|

|

|||||||

| From Distributions |

||||||||||

| Investor Class |

(4,255,078 | ) | (1,127,357 | ) | ||||||

| Class A |

(11,256,332 | ) | (1,572,940 | ) | ||||||

| Class C |

(682,470 | ) | (4,407 | ) | ||||||

| Class I1 |

(102,566,190 | ) | (16,339,105 | ) | ||||||

| Class R1 |

(6,379 | ) | (3,380 | ) | ||||||

| Class R2 |

(3,885 | ) | (931 | ) | ||||||

| Class Y |

(10,684,125 | ) | (1,677,290 | ) | ||||||

|

|

|

|

|

|||||||

| Net Increase (decrease) in net assets resulting from |

(129,454,459 | ) | (20,725,410 | ) | ||||||

|

|

|

|

|

|||||||

| From Capital Share Transactions |

||||||||||

| Proceeds from shares sold |

2,694,052,838 | 1,661,638,625 | ||||||||

| Issued in reinvestment of dividends |

88,737,360 | 11,207,979 | ||||||||

| Payments for shares redeemed |

(1,441,973,313 | ) | (419,159,099 | ) | ||||||

|

|

|

|

|

|||||||

| Net increase in net assets from |

1,340,816,885 | 1,253,687,505 | ||||||||

|

|

|

|

|

|||||||

| Total Increase in Net Assets |

1,438,221,046 | 1,835,580,339 | ||||||||

|

|

|

|

|

|||||||

| Net Assets |

||||||||||

| Beginning of year |

3,061,287,881 | 1,225,707,542 | ||||||||

|

|

|

|

|

|||||||

| End of year |

$ | 4,499,508,927 | $ | 3,061,287,881 | ||||||

|

|

|

|

|

|||||||

The accompanying notes are an integral part of these financial statements.

26

Table of Contents

SMEAD INTERNATIONAL VALUE FUND

| Statements of Changes in Net Assets |

| Period Ended November 30, 2022 (1) | |||||

| From Operations |

| ||||

| Net investment income |

$ | 565,985 | |||

| Net realized loss from investments and foreign currency |

(3,741,043 | ) | |||

| Change in net unrealized appreciation on investments and foreign currency |

3,637,912 | ||||

|

|

|

||||

| Net increase in net assets from operations |

462,854 | ||||

|

|

|

||||

| From Capital Share Transactions |

|||||

| Proceeds from shares sold |

79,963,231 | ||||

| Payments for shares redeemed |

(4,891,635 | ) | |||

|

|

|

||||

| Net increase in net assets from capital share transactions |

75,071,596 | ||||

|

|

|

||||

| Total Increase in Net Assets |

75,534,450 | ||||

|

|

|

||||

| Net Assets |

|||||

| Beginning of period |

— | ||||

|

|

|

||||

| End of year |

$ | 75,534,450 | |||

|

|

|

||||

| (1) | Period from January 12, 2022, date operations commenced, through November 30, 2022. |

The accompanying notes are an integral part of these financial statements.

27

Table of Contents

SMEAD VALUE FUND

| Financial Highlights | ||||

| November 30, 2022 | ||||

| Income from investment operations |

Less distributions paid | ||||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period |

Net investment income(1) |

Net realized and unrealized gain/(loss) on investments |

Total from investment operations |

Distributions from net investment income |

Distributions from net realized gain on investments |

Total distributions paid | |||||||||||||||||||||||||||||

| Investor Class |

|||||||||||||||||||||||||||||||||||

| November 30, 2022 |

$ | 69.63 | $ | 0.49 | $ | 3.35 | $ | 3.84 | $ | (0.15 | ) | $ | (2.55 | ) | $ | (2.70 | ) | ||||||||||||||||||

| November 30, 2021 |

49.68 | 0.17 | 20.49 | 20.66 | (0.35 | ) | (0.36 | ) | (0.71 | ) | |||||||||||||||||||||||||

| November 30, 2020 |

51.55 | 0.52 | (0.47 | ) | 0.05 | (0.35 | ) | (1.57 | ) | (1.92 | ) | ||||||||||||||||||||||||

| November 30, 2019 |

49.13 | 0.33 | 5.19 | 5.52 | — | (3.10 | ) | (3.10 | ) | ||||||||||||||||||||||||||

| November 30, 2018 |

47.29 | 0.19 | 3.75 | 3.94 | (0.10 | ) | (2.00 | ) | (2.10 | ) | |||||||||||||||||||||||||

| Class A |

|||||||||||||||||||||||||||||||||||

| November 30, 2022 |

69.08 | 0.50 | 3.31 | 3.81 | (0.21 | ) | (2.55 | ) | (2.76 | ) | |||||||||||||||||||||||||

| November 30, 2021 |

49.32 | 0.17 | 20.32 | 20.49 | (0.37 | ) | (0.36 | ) | (0.73 | ) | |||||||||||||||||||||||||

| November 30, 2020 |

51.20 | 0.50 | (0.45 | ) | 0.05 | (0.36 | ) | (1.57 | ) | (1.93 | ) | ||||||||||||||||||||||||

| November 30, 2019 |

48.82 | 0.33 | 5.15 | 5.48 | — | (3.10 | ) | (3.10 | ) | ||||||||||||||||||||||||||

| November 30, 2018 |

47.03 | 0.22 | 3.72 | 3.94 | (0.15 | ) | (2.00 | ) | (2.15 | ) | |||||||||||||||||||||||||

| Class C |

|||||||||||||||||||||||||||||||||||

| November 30, 2022 |

67.70 | 0.15 | 3.21 | 3.36 | (0.09 | ) | (2.55 | ) | (2.64 | ) | |||||||||||||||||||||||||

| November 30, 2021 |

48.70 | (0.18 | ) | 20.00 | 19.82 | (0.46 | ) | (0.36 | ) | (0.82 | ) | ||||||||||||||||||||||||

| November 30, 2020(5) |

36.22 | 0.08 | 12.40 | (6) | 12.48 | — | — | — | |||||||||||||||||||||||||||

| Class I1 |

|||||||||||||||||||||||||||||||||||

| November 30, 2022 |

69.74 | 0.68 | 3.35 | 4.03 | (0.34 | ) | (2.55 | ) | (2.89 | ) | |||||||||||||||||||||||||

| November 30, 2021 |

49.78 | 0.34 | 20.47 | 20.81 | (0.49 | ) | (0.36 | ) | (0.85 | ) | |||||||||||||||||||||||||

| November 30, 2020 |

51.65 | 0.62 | (0.43 | ) | 0.19 | (0.49 | ) | (1.57 | ) | (2.06 | ) | ||||||||||||||||||||||||

| November 30, 2019 |

49.10 | 0.47 | 5.19 | 5.66 | (0.01 | ) | (3.10 | ) | (3.11 | ) | |||||||||||||||||||||||||

| November 30, 2018 |

47.33 | 0.33 | 3.72 | 4.05 | (0.28 | ) | (2.00 | ) | (2.28 | ) | |||||||||||||||||||||||||

| Class R1 |

|||||||||||||||||||||||||||||||||||

| November 30, 2022 |

68.42 | 0.30 | 3.31 | 3.61 | — | (2.55 | ) | (2.55 | ) | ||||||||||||||||||||||||||

| November 30, 2021 |

48.81 | (0.03 | ) | 20.21 | 20.18 | (0.21 | ) | (0.36 | ) | (0.57 | ) | ||||||||||||||||||||||||

| November 30, 2020 |

50.46 | 0.38 | (0.46 | ) | (0.08 | ) | — | (1.57 | ) | (1.57 | ) | ||||||||||||||||||||||||

| November 30, 2019 |

48.30 | 0.19 | 5.07 | 5.26 | — | (3.10 | ) | (3.10 | ) | ||||||||||||||||||||||||||

| November 30, 2018 |

46.57 | 0.06 | 3.69 | 3.75 | (0.02 | ) | (2.00 | ) | (2.02 | ) | |||||||||||||||||||||||||

| Class R2 |

|||||||||||||||||||||||||||||||||||

| November 30, 2022 |

70.62 | 0.33 | 3.49 | 3.85 | (0.12 | ) | (2.55 | ) | (2.67 | ) | |||||||||||||||||||||||||

| November 30, 2021 |

50.43 | 0.08 | 20.75 | 20.83 | (0.28 | ) | (0.36 | ) | (0.64 | ) | |||||||||||||||||||||||||

| November 30, 2020 |

52.43 | 0.41 | (0.45 | ) | (0.04 | ) | (0.39 | ) | (1.57 | ) | (1.96 | ) | |||||||||||||||||||||||

| November 30, 2019 |

50.01 | 0.32 | 5.20 | 5.52 | — | (3.10 | ) | (3.10 | ) | ||||||||||||||||||||||||||

| November 30, 2018 |

46.73 | (0.16 | ) | 5.49 | 5.33 | (0.05 | ) | (2.00 | ) | (2.05 | ) | ||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

28

Table of Contents

| Ratio of expenses to average net assets |

Ratio of net investment income (loss) to average net assets |

|||||||||||||||||||||||||||||||||||||

| Net Asset Value, End of Period |

Total Return(2) |

Net assets at end of period (000’s) |

Before waivers and recoupment of expenses |

After waivers and recoupment of expenses |

Before waivers and recoupment of expenses |

After waivers and recoupments of expenses |

Portfolio turnover rate | |||||||||||||||||||||||||||||||

| $70.77 | 5.70 | % | $ | 107,324 | 1.19 | % | 1.19 | % | 0.73 | % | 0.73 | % | 11.15 | % | ||||||||||||||||||||||||

| 69.63 | 42.10 | % | 109,938 | 1.19 | % | 1.19 | % | 0.27 | % | 0.27 | % | 17.40 | % | |||||||||||||||||||||||||

| 49.68 | 0.09 | % | 79,894 | 1.22 | % | 1.22 | % | 1.16 | % | 1.16 | % | 40.26 | % | |||||||||||||||||||||||||

| 51.55 | 12.38 | % | 117,805 | 1.24 | % | 1.24 | % | 0.71 | % | 0.71 | % | 20.75 | % | |||||||||||||||||||||||||

| 49.13 | 8.65 | % | 136,278 | 1.24 | % | 1.26 | % | 0.43 | % | 0.41 | % | 10.98 | % | |||||||||||||||||||||||||

| 70.13 | 5.69 | % | 427,616 | 1.19 | % | 1.19 | % | 0.76 | % | 0.76 | % | 11.15 | % | |||||||||||||||||||||||||

| 69.08 | 42.11 | % | 274,607 | 1.20 | % | 1.20 | % | 0.27 | % | 0.27 | % | 17.40 | % | |||||||||||||||||||||||||

| 49.32 | 0.08 | % | 105,555 | 1.23 | % | 1.23 | % | 1.14 | % | 1.14 | % | 40.26 | % | |||||||||||||||||||||||||

| 51.20 | 12.35 | % | 119,181 | 1.24 | % | 1.24 | % | 0.72 | % | 0.72 | % | 20.75 | % | |||||||||||||||||||||||||

| 48.82 | 8.80 | % | 122,653 | 1.19 | % | 1.19 | % | 0.47 | % | 0.47 | % | 10.98 | % | |||||||||||||||||||||||||

| 68.42 | 5.13 | % | 41,043 | 1.75 | % | 1.75 | % | 0.23 | % | 0.23 | % | 11.15 | % | |||||||||||||||||||||||||

| 67.70 | 41.29 | % | 16,544 | 1.76 | % | 1.76 | % | (0.27 | )% | (0.27 | )% | 17.40 | % | |||||||||||||||||||||||||

| 48.70 | 34.46 | %(3) | 199 | 1.85 | %(4) | 1.84 | %(4) | 0.27 | %(4) | 0.28 | %(4) | 40.26 | %(3) | |||||||||||||||||||||||||

| 70.88 | 5.99 | % | 3,531,198 | 0.93 | % | 0.93 | % | 1.01 | % | 1.01 | % | 11.15 | % | |||||||||||||||||||||||||

| 69.74 | 42.43 | % | 2,417,546 | 0.93 | % | 0.93 | % | 0.54 | % | 0.54 | % | 17.40 | % | |||||||||||||||||||||||||

| 49.78 | 0.36 | % | 947,872 | 0.97 | % | 0.97 | % | 1.40 | % | 1.40 | % | 40.26 | % | |||||||||||||||||||||||||

| 51.65 | 12.67 | % | 1,066,128 | 0.97 | % | 0.97 | % | 1.00 | % | 1.00 | % | 20.75 | % | |||||||||||||||||||||||||

| 49.10 | 8.93 | % | 963,978 | 0.97 | % | 0.98 | % | 0.72 | % | 0.70 | % | 10.98 | % | |||||||||||||||||||||||||

| 69.48 | 5.45 | % | 241 | 1.49 | % | 1.49 | % | 0.46 | % | 0.46 | % | 11.15 | % | |||||||||||||||||||||||||

| 68.42 | 41.75 | % | 171 | 1.49 | % | 1.49 | % | (0.05 | )% | (0.05 | )% | 17.40 | % | |||||||||||||||||||||||||

| 48.81 | (0.18 | )% | 291 | 1.52 | % | 1.52 | % | 0.85 | % | 0.85 | % | 40.26 | % | |||||||||||||||||||||||||

| 50.46 | 12.01 | % | 872 | 1.55 | % | 1.55 | % | 0.43 | % | 0.43 | % | 20.75 | % | |||||||||||||||||||||||||

| 48.30 | 8.47 | % | 792 | 1.50 | % | 1.50 | % | 0.12 | % | 0.12 | % | 10.98 | % | |||||||||||||||||||||||||

| 71.80 | 5.57 | % | 74 | 1.38 | % | 1.38 | % | 0.49 | % | 0.49 | % | 11.15 | % | |||||||||||||||||||||||||

| 70.62 | 41.78 | % | 95 | 1.40 | % | 1.40 | % | 0.11 | % | 0.11 | % | 17.40 | % | |||||||||||||||||||||||||

| 50.43 | (0.10 | )% | 73 | 1.43 | % | 1.43 | % | 0.91 | % | 0.91 | % | 40.26 | % | |||||||||||||||||||||||||

| 52.43 | 12.12 | % | 74 | 1.44 | % | 1.44 | % | 0.66 | % | 0.66 | % | 20.75 | % | |||||||||||||||||||||||||

| 50.01 | 11.88 | % | 10 | 1.44 | % | 1.49 | % | (0.28 | )% | (0.33 | )% | 10.98 | % | |||||||||||||||||||||||||

29

Table of Contents

SMEAD VALUE FUND

| Financial Highlights (Continued) | ||||

| November 30, 2022 | ||||

| Income from investment operations |

Less distributions paid | ||||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period |

Net investment income(1) |

Net realized and unrealized gain/(loss) on investments |

Total from investment operations |

Distributions from net investment income |

Distributions from net realized gain on investments |

Total distributions paid | |||||||||||||||||||||||||||||

| Class Y |

|||||||||||||||||||||||||||||||||||

| November 30, 2022 |

$ | 69.86 | $ | 0.74 | $ | 3.36 | $ | 4.09 | $ | (0.39 | ) | $ | (2.55 | ) | $ | (2.94 | ) | ||||||||||||||||||

| November 30, 2021 |

49.86 | 0.40 | 20.51 | 20.91 | (0.55 | ) | (0.36 | ) | (0.91 | ) | |||||||||||||||||||||||||

| November 30, 2020 |

51.73 | 0.61 | (0.35 | ) | 0.26 | (0.56 | ) | (1.57 | ) | (2.13 | ) | ||||||||||||||||||||||||

| November 30, 2019 |

49.19 | 0.53 | 5.19 | 5.72 | (0.08 | ) | (3.10 | ) | (3.18 | ) | |||||||||||||||||||||||||

| November 30, 2018 |

47.40 | 0.40 | 3.73 | 4.13 | (0.34 | ) | (2.00 | ) | (2.34 | ) | |||||||||||||||||||||||||

| (1) | Based on average shares outstanding. |

| (2) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (3) | Not annualized for periods of less than one year. |

| (4) | Annualized for periods of less than one year. |

| (5) | Class C shares commenced operations on April 16, 2020. |

| (6) | The amount shown for a share outstanding throughout the year does not correspond with the change in aggregate gains and losses in the portfolio of securities during the year because of the timing of sales and purchases of fund shares in relation to fluctuating values during the year. |

The accompanying notes are an integral part of these financial statements.

30

Table of Contents

| Ratio of expenses to average net assets |

Ratio of net investment income (loss) to average net assets |

|||||||||||||||||||||||||||||||||||||

| Net Asset Value, End of Period |

Total Return(2) |

Net assets at end of period (000’s) |

Before waivers and recoupment of expenses |

After waivers and recoupment of expenses |

Before waivers and recoupment of expenses |

After waivers and recoupments of expenses |

Portfolio turnover rate | |||||||||||||||||||||||||||||||

| $71.01 | 6.06 | % | $ | 392,012 | 0.84 | % | 0.84 | % | 1.12 | % | 1.11 | % | 11.15 | % | ||||||||||||||||||||||||

| 69.86 | 42.62 | % | 242,387 | 0.84 | % | 0.84 | % | 0.63 | % | 0.62 | % | 17.40 | % | |||||||||||||||||||||||||

| 49.86 | 0.48 | % | 91,824 | 0.88 | % | 0.84 | % | 1.32 | % | 1.36 | % | 40.26 | % | |||||||||||||||||||||||||

| 51.73 | 12.81 | % | 15,443 | 0.86 | % | 0.84 | % | 1.12 | % | 1.14 | % | 20.75 | % | |||||||||||||||||||||||||

| 49.19 | 9.11 | % | 13,787 | 0.86 | % | 0.84 | % | 0.84 | % | 0.86 | % | 10.98 | % | |||||||||||||||||||||||||

31

Table of Contents

SMEAD INTERNATIONAL VALUE FUND

| Financial Highlights | ||||

| November 30, 2022 | ||||

| Income from investment operations | |||||||||||||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period |

Net investment income(2) |

Net realized and unrealized gain/(loss) on investments |

Total from investment operations |

Net Asset Value, End of Period |

Total Return(3)(4) |

Net assets at end of period (000’s) | |||||||||||||||||||||||||||||||||||||

| Investor Class |

|||||||||||||||||||||||||||||||||||||||||||

| November 30, 2022(1) |

$ | 49.33 | $ | 0.08 | $ | 0.50 | $ | 0.58 | $ | 49.91 | 1.18 | % | $ | 19 | |||||||||||||||||||||||||||||

| Class A |

|||||||||||||||||||||||||||||||||||||||||||

| November 30, 2022(1) |

48.83 | 0.33 | 0.16 | 0.49 | 49.32 | 1.00 | % | 2,630 | |||||||||||||||||||||||||||||||||||

| Class C |

|||||||||||||||||||||||||||||||||||||||||||

| November 30, 2022(1) |

46.84 | (0.14 | )(6) | 0.40 | 0.26 | 47.10 | 0.58 | % | 106 | ||||||||||||||||||||||||||||||||||

| Class I1 |

|||||||||||||||||||||||||||||||||||||||||||

| November 30, 2022(1) |

49.78 | 0.43 | 0.20 | 0.63 | 50.41 | 1.27 | % | 39,428 | |||||||||||||||||||||||||||||||||||

| Class Y |

|||||||||||||||||||||||||||||||||||||||||||

| November 30, 2022(1) |

50.18 | 0.49 | 0.24 | 0.73 | 50.91 | 1.45 | % | 33,351 | |||||||||||||||||||||||||||||||||||

| (1) | Period from January 12, 2022, date operations commenced, through November 30, 2022. |

| (2) | Based on average shares outstanding. |

| (3) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (4) | Not annualized for periods of less than one year. |

| (5) | Annualized for periods of less than one year. |

| (6) | The amount shown for a share outstanding throughout the year does not correspond with the change in aggregate gains and losses in the portfolio of securities during the year because of the timing of sales and purchases of fund shares in relation to fluctuating values during the year. |

The accompanying notes are an integral part of these financial statements.

32

Table of Contents

| Ratio of expenses to average net assets |

Ratio of net investment income (loss) to average net assets |

||||||||||||||||||||||

| Before waivers and recoupment of expenses(5) |

After waivers and recoupment of expenses(5) |

Before waivers and recoupment of expenses(5) |

After waivers and recoupments of expenses(5) |

Portfolio turnover rate(4) | |||||||||||||||||||

| 1.42% | 1.42 | % | 0.19 | % | 0.19 | % | 20.30 | % | |||||||||||||||

| 1.51% | 1.51 | % | 0.78 | % | 0.78 | % | 20.30 | % | |||||||||||||||

| 2.02% | 2.02 | % | (0.34 | )% | (0.34 | )% | 20.30 | % | |||||||||||||||

| 1.23% | 1.23 | % | 0.99 | % | 0.99 | % | 20.30 | % | |||||||||||||||

| 1.15% | 1.00 | % | 0.97 | % | 1.12 | % | 20.30 | % | |||||||||||||||

33

Table of Contents

SMEAD FUNDS

November 30, 2022

| (1) | Organization |

The Smead Value Fund and the Smead International Value Fund (each, a “Fund” and together, the “Funds”) are non-diversified series of Smead Funds Trust, a Delaware statutory trust (the “Trust”) organized on July 17, 2014. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services-Investment Companies. Each Fund’s investment objective is long-term capital appreciation. The Trust may issue an unlimited number of interests (or shares) of beneficial interest, each with a par value of $0.001. The Smead Value Fund currently offers seven classes of shares: Investor Class, Class A, Class C, Class I1, Class R1, Class R2 and Class Y shares. Class I2, Class R3 and Class R4 shares are not yet in operation and thus not currently offered by the Smead Value Fund. The Smead International Value Fund currently offers five classes of shares: Investor Class, Class A, Class C, Class I1 and Class Y shares. The Class I2 shares are not currently available for purchase. Each class of shares of the Funds has identical rights and privileges except with respect to the distribution and shareholder servicing fees, and voting rights on matters affecting a single class of shares. The classes differ principally in their respective distribution and shareholder servicing expenses. Smead Capital Management, Inc., acts as the Funds’ investment adviser (the “Adviser”).

The Smead International Value Fund succeeded to substantially all of the assets and liabilities of the Smead International Value Fund LP, a Delaware Limited Partnership, in exchange solely for Class I1 shares of the Fund on January 11, 2022 (the “Reorganization”).

In January 2022, the partners of the Smead International Value Fund, L.P. (the “International Partnership”) approved the conversion of the International Partnership into the Smead International Value Fund effective January 12, 2022. The Smead International Value Fund is a successor to the International Partnership and has substantially the same investment objectives and strategies as did the International Partnership. The conversion was accomplished through a tax-free exchange of 163,932 shares of Smead International Value Fund, for the value of $8,170,405. The investment portfolio of International Partnership with a fair value of $8,056,631, identified cost of $4,908,647 and unrealized appreciation of $3,147,984 at January 11, 2022, was the principal asset acquired by Smead International Value Fund. For financial reporting purposes, assets received and shares issued by Smead International Value Fund were recorded at fair value. However, the cost basis of the investments received from International Partnership was carried forward to align ongoing reporting of Smead International Value Fund’s realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes.

| (2) | Significant Accounting Policies |

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of the financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

34

Table of Contents

SMEAD FUNDS

Notes to Financial Statements (Continued)

November 30, 2022

| (a) | Investment Valuation |

The Funds value their investments at fair value. Each security owned by the Funds that is listed on a securities exchange is valued at its last sale price on that exchange on the date as of which assets are valued. When the security is listed on more than one exchange, the Funds will use the price of the exchange that the Funds generally consider to be the principal exchange on which the security is traded.

Fund securities listed on The NASDAQ Stock Market, Inc. (“NASDAQ”) will be valued at the NASDAQ Official Closing Price (“NOCP”), which may not necessarily represent the last sale price. If the NOCP is not available, such securities shall be valued at the last sale price on the day of valuation. If there has been no sale on such exchange or on NASDAQ on such day, the security is valued at the mean between the most recent bid and asked prices on such day. Over-the-counter securities that are not traded on NASDAQ shall be valued at the most recent trade price.

Debt securities, other than short-term instruments, are valued at the mean between the closing bid and asked prices provided by a pricing service (“Pricing Service”). If the closing bid and asked prices are not readily available, the Pricing Service may provide a price determined by matrix pricing or other analytical pricing models. Short-term debt securities, such as commercial paper, bankers’ acceptances and U.S. Treasury bills having a maturity of less than 60 days, are valued at amortized cost, which approximates fair value. If a short-term debt security has a maturity of greater than 60 days, it is valued at market price.

Redeemable securities issued by open-end, registered investment companies, including money market funds, are valued at the net asset value (“NAV”) of such companies for purchase and/or redemption orders placed on that day.

When market quotations are not readily available, any security or other asset is valued at its fair value as determined under fair value pricing procedures approved by the Trust’s Board of Trustees (the “Board of Trustees”). These fair value pricing procedures will also be used to price a security when corporate events, events in the securities market and/or world events cause the Adviser to believe that a security’s last sale price may not reflect its actual fair market value. The intended effect of using fair value pricing procedures is to ensure that the Funds are accurately priced.

The Funds’ fair value procedures considers fair valuation accounting standards that establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs used to develop the measurements of fair value. These inputs are summarized in the three broad levels listed below:

| Level 1—unadjusted | quoted prices in active markets for identical securities. |

| Level 2—other | significant observable inputs (including unadjusted quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| Level 3—significant | unobservable inputs (including a Fund’s own assumptions in determining the fair value of investments). |

35