Form N-CSR PUTNAM INVESTMENT FUNDS For: Feb 28

| UNITED STATES SECURITIES AND EXCHANGE COMMISSION | ||

| Washington, D.C. 20549 | ||

FORM N-CSR | ||

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES | ||

| Investment Company Act file number: | (811-07237) |

| Exact name of registrant as specified in charter: | Putnam Investment Funds |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| Name and address of agent for service: | Robert T. Burns, Vice President One Post Office Square Boston, Massachusetts 02109 |

| Copy to: | Bryan Chegwidden, Esq. Ropes & Gray LLP 1211 Avenue of the Americas New York, New York 10036 |

| Registrant's telephone number, including area code: | (617) 292-1000 |

| Date of fiscal year end: | February 28, 2017 |

| Date of reporting period : | March 1, 2016 — February 28, 2017 |

Item 1. Report to Stockholders: |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |||

Putnam

Small Cap Value

Fund

Annual report

2 | 28 | 17

Consider these risks before investing: Investments in small and/or midsize companies increase the risk of greater price fluctuations. Value stocks may fail to rebound, and the market may not favor value-style investing. Stock prices may fall or fail to rise over time for several reasons, including general financial market conditions and factors related to a specific issuer or industry. You can lose money by investing in the fund.

Message from the Trustees

April 7, 2017

Dear Fellow Shareholder:

The early months of 2017 have been generally positive for investor sentiment and financial market performance. Many market indexes have achieved new record highs with relatively low volatility, in contrast to the bouts of uncertainty and turbulence that tested global financial markets in 2016. It is worth noting, however, that the exuberance that greeted the new year calmed somewhat as investors reconsidered a number of ongoing macroeconomic and political risks. In addition, many bond investors remained cautious as the potential for inflation increased.

As always, we believe investors should continue to focus on time-tested strategies: maintain a well-diversified portfolio, keep a long-term view, and do not overreact to short-term market fluctuations. To help ensure that your portfolio is aligned with your goals, we also believe it is a good idea to speak regularly with your financial advisor. In the following pages, you will find an overview of your fund’s performance for the reporting period as well as an outlook for the coming months.

We would like to take this opportunity to announce the arrival of Catharine Bond Hill and Manoj P. Singh to your fund’s Board of Trustees. Dr. Hill and Mr. Singh bring extensive professional and directorship experience to their role as Trustees, and we are pleased to welcome them.

Thank you for investing with Putnam.

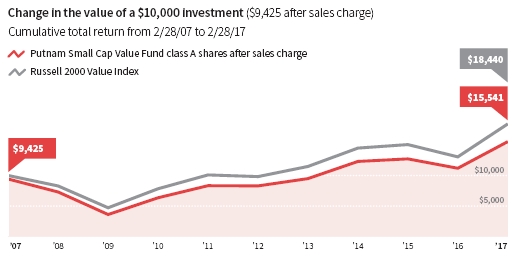

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See below and pages 8–10 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 2/28/17. See above and pages 8–10 for additional fund performance information. Index descriptions can be found on page 13.

| 2 Small Cap Value Fund |

Eric has an M.B.A. from the University of Chicago Booth School of Business and a B.S. from San Diego State University. He joined Putnam in 2000 and has been in the investment industry since 1994.

In addition to Eric, your fund is managed by David L. Diamond, CFA. Dave has a B.S. from Brown University. He served in the investment industry from 1986 to 2005, and reentered the industry when he joined Putnam in 2017.

Eric, how was the market environment for U.S. small-cap value stocks for the 12-month reporting period ended February 28, 2017?

After a few years of underperformance relative to large-cap stocks, small-cap stocks enjoyed a strong comeback during the reporting period, as the market environment improved and investors’ appetite for riskier assets rose.

When the period began, small-cap stocks were coming off a rocky start in the early weeks of 2016 that preceded the reporting period. The asset class began to rally off those lows in response to a recovery in oil prices, accommodative policies from central banks around the world, and positive U.S. economic data. Small-cap stocks surged once again within days of the United Kingdom’s surprise vote on June 23, 2016, to leave the European Union, as investors came to understand the limited effects of the decision on the U.S. economy. Typically, smaller U.S. companies have been less directly affected by events in non-U.S. markets than large U.S. multinational companies.

The U.S. presidential election added further momentum to the small-cap rally, which saw post-election gains of 18.25% by the end of the period, as measured by the fund’s benchmark,

| Small Cap Value Fund 3 |

Allocations are shown as a percentage of the fund’s net assets as of 2/28/17. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, the use of different classifications of securities for presentation purposes, and rounding. Holdings and allocations may vary over time.

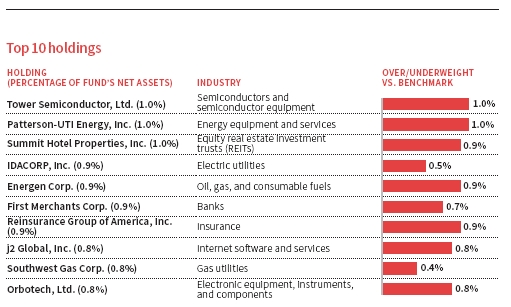

This table shows the fund’s top 10 holdings by percentage of the fund’s net assets as of 2/28/17. Short-term investments and derivatives, if any, are excluded. Holdings may vary over time.

| 4 Small Cap Value Fund |

the Russell 2000 Value Index. One significant factor contributing to the surge was President Trump’s focus on trade. Investors viewed this as favorable for the stocks of smaller companies, which typically have less international exposure and therefore might be less prone to turbulence in the global economy should the administration increase tariffs or incite a trade war. Additionally, many analysts believe Trump’s anticipated infrastructure spending, tax reform, and deregulation agenda could spur greater domestic growth, which could result in meaningful opportunities for smaller companies.

Against this backdrop, small-cap value stocks outperformed most other asset classes, including small-cap growth stocks, mid- and large-cap stocks, and the broader U.S. and international equity markets during the period All eleven sectors of the fund’s benchmark generated positive returns for the reporting period, with economically sensitive cyclicals outperforming the more defensive sectors. Financials was the best-performing sector, climbing more than 30% during the reporting period due to rising interest rates and anticipation of increased demand for lending and lower corporate tax rates under the new administration. Materials, technology, and industrials also performed well.

How did Putnam Small Cap Value Fund perform for the reporting period?

The fund delivered a strong double-digit return at net asset value for the 12 months ended February 28, 2017, outperforming its Lipper peer group average but underperforming its benchmark. Given the strength and breadth of the rally, holding transactional cash in the portfolio and not being fully invested detracted most from fund performance relative to the benchmark. Stock selection within financials was the most significant contributor to performance on an absolute and a benchmark-relative basis. This outperformance was followed by favorable stock selection in technology, transportation, and communication services. Weak stock selection in basic materials and consumer staples detracted from results relative to the benchmark.

Did you make any noteworthy changes to the fund’s asset allocation during the period?

Prior to the U.S. presidential election, the fund had underweight exposure to financials and had nearly 8% in cash. However, with what I believe to be a pro-growth administration in the White House and a Republican-controlled Congress, my outlook became more positive. The day after the election, I began putting some of the cash to work by increasing the portfolio’s exposure to financial and transportation stocks. Within days of the election result, the fund’s cash position declined to approximately 2% of total net assets as a by-product of those investment decisions. At period-end, both financials and transportation represented overweight positions relative to the benchmark.

What stocks aided performance results?

In December 2016, I bought Ichor Holdings, a leading supplier of gas and fluid delivery sub-systems serving the semiconductor capital equipment market, which came to market in an initial public offering. At that time, I believed the company could produce significant top-line growth from increased demand, had room for profit margin expansion, and could attract market share from competitors. Additionally, the stock was attractively valued at the time of purchase — trading at a price that didn’t reflect its earnings potential, in my view. The stock price has doubled since the purchase, but I

| Small Cap Value Fund 5 |

believe it remains significantly undervalued relative to a major competitor.

The fund’s position in Everyday Health rallied when J2 Global announced that it was acquiring the company for $10.50 per share on October 21, 2016. The buyout price represented a 25% premium to the prior day’s closing price. Since I believed that there was limited upside given the current valuation and, in my view, less-than-compelling growth prospects for the new company, I sold the position before the close of that month to lock in profits.

In the information technology sector, the stock of Acacia Communications rose significantly as investors came to appreciate the magnitude of the company’s DSP [digital signal processor] and optical technology advantages in the growing optical communications market. To lock in gains, I sold Acacia in the first half of the period after the stock had become fairly valued, in my opinion.

What holdings detracted most from performance results?

Our decision to not hold a position in Advanced Micro Devices, a producer of semiconductors and semiconductor equipment, detracted significantly from relative performance results, as the stock performed well during the reporting period. In the slow global economic environment that characterized the early months of the period, the company’s heavy debt load and consistent lack of profitability over a multiyear period led us to avoid the stock. With solid demand for its products, the stock rallied despite a weak balance sheet and poor cash flow generation.

The fund’s investment in Gulfport Energy underperformed when management made a surprising acquisition in December 2016 that caused the stock to sell off. We still hold the position, as I believe it’s an asset-rich oil and gas company that is trading at an attractive valuation. The stock of MDC Partners, an advertising firm, which we believed had improving business prospects and cash flows, sold off

This chart shows the fund’s largest allocation shifts, by percentage, over the past six months. Allocations are shown as a percentage of the fund’s net assets. Current period summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, the use of different classifications of securities for presentation purposes, and rounding. Holdings and allocations may vary over time.

Data in the chart reflect a new calculation methodology put into effect on 9/1/16.

| 6 Small Cap Value Fund |

when fundamentals deteriorated and profit margins eroded. The company’s challenges were amplified by the high leverage on its balance sheet. Given my deteriorating view of MDC Partners’ prospects, I sold the position before period-end.

What are your thoughts about valuations and performance potential for small-cap value stocks in 2017?

With the stock market hovering at all-time highs at period-end, confidence and optimism have returned to the U.S. markets — especially for higher-risk assets. I believe small-cap stocks continue to offer attractive long-term opportunities, but after their considerable rally, investors must be cognizant of not overpaying for that growth potential. As such, I am cautious about sectors where I believe stocks have become expensive relative to their longer-term prospects.

However, after their broad-based resurgence, small-cap stocks are beginning to behave more independently, as investors have become more discerning. This expands our stock-selection opportunities, particularly in stocks that I believe can deliver on their earnings potential. I will continue to focus on my bottom-up stock selection process by investing in quality stocks that are trading at discounts relative to their peers and that, in my opinion, have a potential catalyst for change.

Thank you, Eric, for your time and update on this fund.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

| Small Cap Value Fund 7 |

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended February 28, 2017, the end of its most recent fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R, R5, R6, and Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 2/28/17

| Annual average | Annual | Annual | Annual | |||||

| (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year | |

|

| ||||||||

| Class A (4/13/99) | ||||||||

| Before sales charge | 10.00% | 64.89% | 5.13% | 87.26% | 13.37% | 26.32% | 8.10% | 38.90% |

|

| ||||||||

| After sales charge | 9.63 | 55.41 | 4.51 | 76.49 | 12.03 | 19.06 | 5.99 | 30.91 |

|

| ||||||||

| Class B (5/3/99) | ||||||||

| Before CDSC | 9.72 | 57.74 | 4.66 | 80.21 | 12.50 | 23.46 | 7.28 | 37.80 |

|

| ||||||||

| After CDSC | 9.72 | 57.74 | 4.66 | 78.21 | 12.25 | 20.46 | 6.40 | 32.80 |

|

| ||||||||

| Class C (7/26/99) | ||||||||

| Before CDSC | 9.18 | 52.85 | 4.33 | 80.26 | 12.51 | 23.49 | 7.29 | 37.88 |

|

| ||||||||

| After CDSC | 9.18 | 52.85 | 4.33 | 80.26 | 12.51 | 23.49 | 7.29 | 36.88 |

|

| ||||||||

| Class M (3/29/00) | ||||||||

| Before sales charge | 9.45 | 56.90 | 4.61 | 82.52 | 12.79 | 24.42 | 7.55 | 38.26 |

|

| ||||||||

| After sales charge | 9.24 | 51.41 | 4.24 | 76.13 | 11.99 | 20.06 | 6.28 | 33.42 |

|

| ||||||||

| Class R (3/30/07) | ||||||||

| Net asset value | 9.72 | 60.80 | 4.86 | 84.76 | 13.06 | 25.35 | 7.82 | 38.55 |

|

| ||||||||

| Class R5 (11/1/13) | ||||||||

| Net asset value | 10.26 | 69.53 | 5.42 | 90.00 | 13.70 | 27.63 | 8.47 | 39.36 |

|

| ||||||||

| Class R6 (11/1/13) | ||||||||

| Net asset value | 10.28 | 70.00 | 5.45 | 90.52 | 13.76 | 27.89 | 8.54 | 39.54 |

|

| ||||||||

| Class Y (1/3/01) | ||||||||

| Net asset value | 10.25 | 69.13 | 5.40 | 89.55 | 13.64 | 27.30 | 8.38 | 39.30 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R, R5, R6, and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable. Performance for class R5 and R6 shares prior to their inception is derived from the historical performance of class Y shares and has not been adjusted for the lower investor servicing fees applicable to class R5 and R6 shares; had it, returns would have been higher.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance reflects conversion to class A shares after six years.

| 8 Small Cap Value Fund |

Comparative index returns For periods ended 2/28/17

| Annual average | Annual | Annual | Annual | |||||

| (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year | |

|

| ||||||||

| Russell 2000 | ||||||||

| Value Index | 10.19% | 84.40% | 6.31% | 87.75% | 13.43% | 27.28% | 8.37% | 41.29% |

|

| ||||||||

| Lipper Small-Cap | ||||||||

| Value Funds | 10.65 | 91.08 | 6.60 | 75.79 | 11.84 | 20.91 | 6.45 | 34.86 |

| category average* | ||||||||

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* Over the 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 2/28/17, there were 304, 257, 227, 141, and 53 funds, respectively, in this Lipper category.

Past performance does not indicate future results. At the end of the same time period, a $10,000 investment in the fund’s class B and C shares would have been valued at $15,774 and $15,285, respectively, and no contingent deferred sales charges would apply. A $10,000 investment in the fund’s class M shares ($9,650 after sales charge) would have been valued at $15,141. A $10,000 investment in the fund’s class R, R5, R6, and Y shares would have been valued at $16,080, $16,953, $17,000, and $16,913, respectively.

Fund price and distribution information For the 12-month period ended 2/28/17

| Distributions | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y | ||

|

| ||||||||||

| Number | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||

|

| ||||||||||

| Income | $0.115 | $0.035 | $0.038 | $0.055 | $0.084 | $0.169 | $0.179 | $0.152 | ||

|

| ||||||||||

| Capital gains | — | — | — | — | — | — | — | — | ||

|

| ||||||||||

| Total | $0.115 | $0.035 | $0.038 | $0.055 | $0.084 | $0.169 | $0.179 | $0.152 | ||

|

| ||||||||||

| Before | After | Net | Net | Before | After | Net | Net | Net | Net | |

| sales | sales | asset | asset | sales | sales | asset | asset | asset | asset | |

| Share value | charge | charge | value | value | charge | charge | value | value | value | value |

|

| ||||||||||

| 2/29/16 | $12.82 | $13.60 | $10.86 | $10.82 | $11.70 | $12.12 | $12.62 | $13.32 | $13.31 | $13.27 |

|

| ||||||||||

| 2/28/17 | 17.69 | 18.77 | 14.93 | 14.88 | 16.12 | 16.70 | 17.40 | 18.39 | 18.39 | 18.33 |

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

| Small Cap Value Fund 9 |

Fund performance as of most recent calendar quarter Total return for periods ended 3/31/17

| Annual average | Annual | Annual | Annual | |||||

| (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year | |

|

| ||||||||

| Class A (4/13/99) | ||||||||

| Before sales charge | 9.95% | 62.92% | 5.00% | 82.89% | 12.83% | 24.20% | 7.49% | 30.01% |

|

| ||||||||

| After sales charge | 9.59 | 53.55 | 4.38 | 72.38 | 11.51 | 17.06 | 5.39 | 22.53 |

|

| ||||||||

| Class B (5/3/99) | ||||||||

| Before CDSC | 9.68 | 55.98 | 4.55 | 76.03 | 11.97 | 21.43 | 6.69 | 29.08 |

|

| ||||||||

| After CDSC | 9.68 | 55.98 | 4.55 | 74.03 | 11.72 | 18.43 | 5.80 | 24.08 |

|

| ||||||||

| Class C (7/26/99) | ||||||||

| Before CDSC | 9.14 | 51.18 | 4.22 | 76.09 | 11.98 | 21.37 | 6.67 | 29.00 |

|

| ||||||||

| After CDSC | 9.14 | 51.18 | 4.22 | 76.09 | 11.98 | 21.37 | 6.67 | 28.00 |

|

| ||||||||

| Class M (3/29/00) | ||||||||

| Before sales charge | 9.41 | 55.04 | 4.48 | 78.18 | 12.25 | 22.33 | 6.95 | 29.36 |

|

| ||||||||

| After sales charge | 9.19 | 49.62 | 4.11 | 71.94 | 11.45 | 18.05 | 5.69 | 24.83 |

|

| ||||||||

| Class R (3/30/07) | ||||||||

| Net asset value | 9.68 | 58.82 | 4.73 | 80.48 | 12.53 | 23.16 | 7.19 | 29.67 |

|

| ||||||||

| Class R5 (11/1/13) | ||||||||

| Net asset value | 10.22 | 67.53 | 5.30 | 85.47 | 13.15 | 25.40 | 7.84 | 30.45 |

|

| ||||||||

| Class R6 (11/1/13) | ||||||||

| Net asset value | 10.24 | 67.99 | 5.32 | 85.98 | 13.21 | 25.73 | 7.93 | 30.62 |

|

| ||||||||

| Class Y (1/3/01) | ||||||||

| Net asset value | 10.21 | 67.14 | 5.27 | 85.03 | 13.10 | 25.15 | 7.76 | 30.37 |

See the discussion following the fund performance table on page 8 for information about the calculation of fund performance.

| 10 Small Cap Value Fund |

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y | |

|

| ||||||||

| Total annual operating expenses for the | ||||||||

| fiscal year ended 2/29/16 | 1.44%* | 2.19%* | 2.19%* | 1.94%* | 1.69%* | 1.12% | 1.02% | 1.19%* |

|

| ||||||||

| Annualized expense ratio for the | ||||||||

| six-month period ended 2/28/17† | 1.20% | 1.95% | 1.95% | 1.70% | 1.45% | 0.87% | 0.77% | 0.95% |

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Prospectus expense information also includes the impact of acquired fund fees and expenses of 0.26%, which is not included in the financial highlights or annualized expense ratios. Expenses are shown as a percentage of average net assets.

* Restated to reflect current fees resulting from a change to the fund’s investor servicing arrangements effective September 1, 2016.

† Expense ratios for each class are for the fund’s most recent fiscal half year. As a result of this, ratios may differ from expense ratios based on one-year data in the financial highlights.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in each class of the fund from 9/1/16 to 2/28/17. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y | |

|

| ||||||||

| Expenses paid per $1,000*† | $6.44 | $10.45 | $10.45 | $9.11 | $7.78 | $4.67 | $4.14 | $5.10 |

|

| ||||||||

| Ending value (after expenses) | $1,165.40 | $1,161.00 | $1,161.00 | $1,162.10 | $1,163.40 | $1,166.70 | $1,168.10 | $1,166.20 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/17. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

| Small Cap Value Fund 11 |

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended 2/28/17, use the following calculation method. To find the value of your investment on 9/1/16, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y | |

|

| ||||||||

| Expenses paid per $1,000*† | $6.01 | $9.74 | $9.74 | $8.50 | $7.25 | $4.36 | $3.86 | $4.76 |

|

| ||||||||

| Ending value (after expenses) | $1,018.84 | $1,015.12 | $1,015.12 | $1,016.36 | $1,017.60 | $1,020.48 | $1,020.98 | $1,020.08 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 2/28/17. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

| 12 Small Cap Value Fund |

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge and may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC.

Class R shares are not subject to an initial sales charge or CDSC and are only available to employer-sponsored retirement plans.

Class R5 and R6 shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are only available to employer-sponsored retirement plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

Russell 2000 Value Index is an unmanaged index of those companies in the small-cap Russell 2000 Index chosen for their value orientation.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

| Small Cap Value Fund 13 |

Other information for shareholders

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2016, are available in the Individual Investors section of putnam.com, and on the Securities and Exchange Commission (SEC) website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Form N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of February 28, 2017, Putnam employees had approximately $482,000,000 and the Trustees had approximately $136,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

| 14 Small Cap Value Fund |

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

| Small Cap Value Fund 15 |

Financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type/and industry sector, country, or state to show areas of concentration and/diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were/earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

| 16 Small Cap Value Fund |

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders

Putnam Investment Funds:

We have audited the accompanying statement of assets and liabilities of Putnam Small Cap Value Fund (the fund), a series of Putnam Investments Funds, including the fund’s portfolio, as of February 28, 2017, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of February 28, 2017, by correspondence with the custodian and brokers or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Putnam Small Cap Value Fund as of February 28, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

April 7, 2017

| Small Cap Value Fund 17 |

The fund’s portfolio 2/28/17

| COMMON STOCKS (91.3%)* | Shares | Value |

|

| ||

| Aerospace and defense (0.2%) | ||

|

| ||

| Vectrus, Inc. † | 44,970 | $1,088,724 |

|

| ||

| 1,088,724 | ||

|

| ||

| Air freight and logistics (1.0%) | ||

|

| ||

| Atlas Air Worldwide Holdings, Inc. † | 34,900 | 1,984,065 |

|

| ||

| Park-Ohio Holdings Corp. | 60,549 | 2,703,513 |

|

| ||

| 4,687,578 | ||

|

| ||

| Airlines (1.0%) | ||

|

| ||

| SkyWest, Inc. | 66,400 | 2,333,960 |

|

| ||

| Spirit Airlines, Inc. † | 48,300 | 2,521,743 |

|

| ||

| 4,855,703 | ||

|

| ||

| Auto components (2.5%) | ||

|

| ||

| Dana, Inc. | 131,700 | 2,487,813 |

|

| ||

| Goodyear Tire & Rubber Co. (The) | 69,500 | 2,435,975 |

|

| ||

| Horizon Global Corp. † | 101,212 | 1,850,155 |

|

| ||

| Modine Manufacturing Co. † | 230,500 | 2,616,175 |

|

| ||

| Stoneridge, Inc. † | 164,840 | 2,784,148 |

|

| ||

| 12,174,266 | ||

|

| ||

| Banks (18.2%) | ||

|

| ||

| Berkshire Hills Bancorp, Inc. | 90,800 | 3,209,780 |

|

| ||

| Camden National Corp. | 74,221 | 3,151,424 |

|

| ||

| Chemical Financial Corp. | 47,951 | 2,554,350 |

|

| ||

| Civista Bancshares, Inc. | 94,135 | 2,064,381 |

|

| ||

| First Bancorp | 96,400 | 2,896,820 |

|

| ||

| First Busey Corp. | 99,600 | 3,079,632 |

|

| ||

| First Connecticut Bancorp, Inc. | 93,300 | 2,253,195 |

|

| ||

| First Financial Bancorp | 98,600 | 2,736,150 |

|

| ||

| First Internet Bancorp | 94,223 | 2,897,357 |

|

| ||

| First Merchants Corp. | 111,600 | 4,477,392 |

|

| ||

| Franklin Financial Network, Inc. † | 69,364 | 2,732,942 |

|

| ||

| Fulton Financial Corp. | 173,100 | 3,310,538 |

|

| ||

| Hanmi Financial Corp. | 112,800 | 3,767,520 |

|

| ||

| IBERIABANK Corp. | 41,618 | 3,527,126 |

|

| ||

| Independent Bank Group, Inc. | 43,500 | 2,753,550 |

|

| ||

| Investors Bancorp, Inc. | 167,100 | 2,444,673 |

|

| ||

| Lakeland Financial Corp. | 38,800 | 1,761,132 |

|

| ||

| Old National Bancorp | 193,000 | 3,541,550 |

|

| ||

| Pacific Premier Bancorp, Inc. † | 74,800 | 2,992,000 |

|

| ||

| Peoples Bancorp, Inc. | 97,500 | 3,170,700 |

|

| ||

| Popular, Inc. (Puerto Rico) | 82,220 | 3,622,613 |

|

| ||

| Preferred Bank | 66,831 | 3,751,892 |

|

| ||

| Southside Bancshares, Inc. | 58,023 | 2,044,150 |

|

| ||

| Sterling Bancorp | 157,500 | 3,898,125 |

|

| ||

| Tristate Capital Holdings, Inc. † | 135,674 | 3,195,123 |

|

| ||

| United Community Banks, Inc./GA | 80,800 | 2,334,312 |

|

| ||

| Univest Corp of Pennsylvania | 93,300 | 2,598,405 |

|

| ||

| Washington Trust Bancorp, Inc. | 32,300 | 1,750,660 |

|

| ||

| 18 Small Cap Value Fund |

| COMMON STOCKS (91.3%)* cont. | Shares | Value |

|

| ||

| Banks cont. | ||

|

| ||

| Western Alliance Bancorp † | 45,700 | $2,359,948 |

|

| ||

| Wintrust Financial Corp. | 45,300 | 3,338,610 |

|

| ||

| 88,216,050 | ||

|

| ||

| Beverages (0.4%) | ||

|

| ||

| Cott Corp. (Canada) S | 183,110 | 1,951,953 |

|

| ||

| 1,951,953 | ||

|

| ||

| Biotechnology (1.3%) | ||

|

| ||

| Conatus Pharmaceuticals, Inc. † S | 286,600 | 1,395,742 |

|

| ||

| Eagle Pharmaceuticals, Inc. † | 31,100 | 2,385,059 |

|

| ||

| Emergent BioSolutions, Inc. † S | 77,185 | 2,422,065 |

|

| ||

| 6,202,866 | ||

|

| ||

| Building products (1.3%) | ||

|

| ||

| Continental Building Products, Inc. † | 91,143 | 2,228,446 |

|

| ||

| NCI Building Systems, Inc. † | 139,991 | 2,239,856 |

|

| ||

| Ply Gem Holdings, Inc. † | 100,900 | 1,755,660 |

|

| ||

| 6,223,962 | ||

|

| ||

| Capital markets (0.4%) | ||

|

| ||

| OM Asset Management PLC (United Kingdom) | 127,403 | 1,899,579 |

|

| ||

| 1,899,579 | ||

|

| ||

| Chemicals (2.1%) | ||

|

| ||

| American Vanguard Corp. | 139,300 | 2,193,975 |

|

| ||

| Ferro Corp. † | 168,400 | 2,357,600 |

|

| ||

| Innophos Holdings, Inc. | 49,300 | 2,612,407 |

|

| ||

| Kraton Corp. † | 46,400 | 1,263,472 |

|

| ||

| Minerals Technologies, Inc. | 23,197 | 1,791,968 |

|

| ||

| 10,219,422 | ||

|

| ||

| Commercial services and supplies (1.1%) | ||

|

| ||

| ACCO Brands Corp. † | 259,000 | 3,470,600 |

|

| ||

| Ennis, Inc. | 115,421 | 1,887,133 |

|

| ||

| 5,357,733 | ||

|

| ||

| Construction and engineering (2.7%) | ||

|

| ||

| Dycom Industries, Inc. † S | 24,700 | 2,029,846 |

|

| ||

| Granite Construction, Inc. | 39,500 | 2,093,895 |

|

| ||

| MasTec, Inc. † | 79,200 | 3,108,600 |

|

| ||

| Orion Group Holdings, Inc. † | 309,500 | 2,896,920 |

|

| ||

| Quanta Services, Inc. † | 79,900 | 2,981,868 |

|

| ||

| 13,111,129 | ||

|

| ||

| Construction materials (0.4%) | ||

|

| ||

| Summit Materials, Inc. Class A † | 87,436 | 2,088,846 |

|

| ||

| 2,088,846 | ||

|

| ||

| Consumer finance (1.1%) | ||

|

| ||

| Encore Capital Group, Inc. † S | 102,140 | 3,401,262 |

|

| ||

| EZCORP, Inc. Class A † | 214,100 | 1,884,080 |

|

| ||

| 5,285,342 | ||

|

| ||

| Containers and packaging (0.6%) | ||

|

| ||

| Greif, Inc. Class A | 47,200 | 2,691,816 |

|

| ||

| 2,691,816 | ||

| Small Cap Value Fund 19 |

| COMMON STOCKS (91.3%)* cont. | Shares | Value |

|

| ||

| Diversified consumer services (1.1%) | ||

|

| ||

| Carriage Services, Inc. S | 88,900 | $2,290,953 |

|

| ||

| DeVry Education Group, Inc. S | 88,200 | 2,835,630 |

|

| ||

| 5,126,583 | ||

|

| ||

| Electric utilities (2.8%) | ||

|

| ||

| ALLETE, Inc. | 51,000 | 3,427,710 |

|

| ||

| IDACORP, Inc. | 54,900 | 4,552,857 |

|

| ||

| PNM Resources, Inc. | 72,000 | 2,613,600 |

|

| ||

| Portland General Electric Co. | 65,700 | 2,978,181 |

|

| ||

| 13,572,348 | ||

|

| ||

| Electrical equipment (0.5%) | ||

|

| ||

| General Cable Corp. | 135,400 | 2,261,180 |

|

| ||

| 2,261,180 | ||

|

| ||

| Electronic equipment, instruments, and components (3.4%) | ||

|

| ||

| Anixter International, Inc. † | 30,100 | 2,507,330 |

|

| ||

| Belden, Inc. | 29,600 | 2,091,240 |

|

| ||

| Control4 Corp. † | 260,100 | 3,883,293 |

|

| ||

| Jabil Circuit, Inc. | 119,100 | 3,038,241 |

|

| ||

| Orbotech, Ltd. (Israel) † | 129,800 | 3,913,470 |

|

| ||

| Sanmina Corp. † | 25,500 | 994,500 |

|

| ||

| 16,428,074 | ||

|

| ||

| Energy equipment and services (1.2%) | ||

|

| ||

| Independence Contract Drilling, Inc. † | 173,036 | 1,029,564 |

|

| ||

| Patterson-UTI Energy, Inc. | 168,800 | 4,662,256 |

|

| ||

| 5,691,820 | ||

|

| ||

| Equity real estate investment trusts (REITs) (7.0%) | ||

|

| ||

| American Assets Trust, Inc. | 68,701 | 3,022,844 |

|

| ||

| Apartment Investment & Management Co. Class A | 47,700 | 2,219,481 |

|

| ||

| CBL & Associates Properties, Inc. | 225,800 | 2,264,774 |

|

| ||

| Clipper Realty, Inc. † S | 43,457 | 591,015 |

|

| ||

| Education Realty Trust, Inc. | 46,564 | 1,962,673 |

|

| ||

| EPR Properties | 32,500 | 2,501,200 |

|

| ||

| Equity Commonwealth † | 100,800 | 3,151,008 |

|

| ||

| iStar, Inc. † S | 255,900 | 3,081,036 |

|

| ||

| LTC Properties, Inc. | 51,300 | 2,474,712 |

|

| ||

| Paramount Group, Inc. | 126,900 | 2,211,867 |

|

| ||

| Rayonier, Inc. | 132,000 | 3,780,480 |

|

| ||

| Summit Hotel Properties, Inc. | 302,714 | 4,658,768 |

|

| ||

| Tanger Factory Outlet Centers, Inc. | 62,800 | 2,127,036 |

|

| ||

| 34,046,894 | ||

|

| ||

| Food and staples retail (0.8%) | ||

|

| ||

| SpartanNash Co. | 69,090 | 2,411,241 |

|

| ||

| SUPERVALU, Inc. † | 327,100 | 1,236,438 |

|

| ||

| 3,647,679 | ||

|

| ||

| Food products (0.9%) | ||

|

| ||

| Nomad Foods, Ltd. (United Kingdom) † | 171,200 | 1,842,112 |

|

| ||

| Sanderson Farms, Inc. S | 25,700 | 2,442,528 |

|

| ||

| 4,284,640 | ||

|

| ||

| Gas utilities (0.8%) | ||

|

| ||

| Southwest Gas Corp. | 46,700 | 3,994,251 |

|

| ||

| 3,994,251 | ||

| 20 Small Cap Value Fund |

| COMMON STOCKS (91.3%)* cont. | Shares | Value |

|

| ||

| Health-care providers and services (1.7%) | ||

|

| ||

| AMN Healthcare Services, Inc. † | 75,900 | $3,123,285 |

|

| ||

| Ensign Group, Inc. (The) | 142,071 | 2,676,618 |

|

| ||

| Fulgent Genetics, Inc. † | 218,282 | 2,477,501 |

|

| ||

| 8,277,404 | ||

|

| ||

| Hotels, restaurants, and leisure (1.9%) | ||

|

| ||

| Bloomin’ Brands, Inc. | 98,200 | 1,678,238 |

|

| ||

| Del Taco Restaurants, Inc. † S | 205,503 | 2,550,292 |

|

| ||

| Marriott Vacations Worldwide Corp. | 30,400 | 2,855,472 |

|

| ||

| Penn National Gaming, Inc. † | 155,100 | 2,244,297 |

|

| ||

| 9,328,299 | ||

|

| ||

| Household durables (0.6%) | ||

|

| ||

| Century Communities, Inc. † | 133,700 | 3,055,045 |

|

| ||

| 3,055,045 | ||

|

| ||

| Independent power and renewable electricity producers (0.2%) | ||

|

| ||

| Dynegy, Inc. † S | 127,800 | 1,027,512 |

|

| ||

| 1,027,512 | ||

|

| ||

| Insurance (5.7%) | ||

|

| ||

| American Financial Group, Inc. | 35,732 | 3,360,952 |

|

| ||

| AMERISAFE, Inc. | 42,100 | 2,707,030 |

|

| ||

| CNO Financial Group, Inc. | 100,300 | 2,097,273 |

|

| ||

| Employers Holdings, Inc. | 76,100 | 2,861,360 |

|

| ||

| Hanover Insurance Group, Inc. (The) | 26,700 | 2,403,534 |

|

| ||

| James River Group Holdings, Ltd. (Bermuda) | 57,900 | 2,490,858 |

|

| ||

| Maiden Holdings, Ltd. (Bermuda) | 132,800 | 2,051,760 |

|

| ||

| National General Holdings Corp. | 81,400 | 1,981,276 |

|

| ||

| Reinsurance Group of America, Inc. | 31,719 | 4,125,373 |

|

| ||

| Validus Holdings, Ltd. | 61,613 | 3,552,606 |

|

| ||

| 27,632,022 | ||

|

| ||

| Internet and direct marketing retail (0.2%) | ||

|

| ||

| FTD Cos., Inc. † | 40,000 | 966,400 |

|

| ||

| 966,400 | ||

|

| ||

| Internet software and services (1.5%) | ||

|

| ||

| GTT Communications, Inc. † | 117,900 | 3,289,410 |

|

| ||

| j2 Global, Inc. | 50,000 | 4,071,000 |

|

| ||

| 7,360,410 | ||

|

| ||

| IT Services (1.2%) | ||

|

| ||

| Convergys Corp. | 83,300 | 1,822,604 |

|

| ||

| Everi Holdings, Inc. † | 445,000 | 1,446,250 |

|

| ||

| Virtusa Corp. † | 80,400 | 2,493,204 |

|

| ||

| 5,762,058 | ||

|

| ||

| Leisure products (0.7%) | ||

|

| ||

| Brunswick Corp. | 53,100 | 3,180,159 |

|

| ||

| 3,180,159 | ||

|

| ||

| Life sciences tools and services (0.9%) | ||

|

| ||

| Enzo Biochem, Inc. † | 329,500 | 2,125,275 |

|

| ||

| VWR Corp. † | 72,031 | 2,024,071 |

|

| ||

| 4,149,346 | ||

| Small Cap Value Fund 21 |

| COMMON STOCKS (91.3%)* cont. | Shares | Value |

|

| ||

| Machinery (0.9%) | ||

|

| ||

| EnPro Industries, Inc. | 34,500 | $2,252,160 |

|

| ||

| Kadant, Inc. | 33,700 | 2,086,030 |

|

| ||

| 4,338,190 | ||

|

| ||

| Media (0.8%) | ||

|

| ||

| Live Nation Entertainment, Inc. † | 78,000 | 2,215,980 |

|

| ||

| Madison Square Garden Co. (The) Class A † | 9,766 | 1,751,630 |

|

| ||

| 3,967,610 | ||

|

| ||

| Metals and mining (0.6%) | ||

|

| ||

| Ferroglobe PLC (United Kingdom) | 270,395 | 2,917,562 |

|

| ||

| Ferroglobe Representation & Warranty Insurance Trust † F | 270,395 | — |

|

| ||

| 2,917,562 | ||

|

| ||

| Mortgage real estate investment trusts (REITs) (1.0%) | ||

|

| ||

| Cherry Hill Mortgage Investment Corp. | 64,338 | 1,193,470 |

|

| ||

| Redwood Trust, Inc. | 215,400 | 3,526,098 |

|

| ||

| 4,719,568 | ||

|

| ||

| Multi-utilities (0.5%) | ||

|

| ||

| Avista Corp. | 56,200 | 2,240,694 |

|

| ||

| 2,240,694 | ||

|

| ||

| Oil, gas, and consumable fuels (3.9%) | ||

|

| ||

| Aegean Marine Petroleum Network, Inc. (Greece) S | 252,015 | 2,545,352 |

|

| ||

| Callon Petroleum Co. † | 199,184 | 2,513,702 |

|

| ||

| Energen Corp. † | 85,500 | 4,488,750 |

|

| ||

| Gulfport Energy Corp. † | 102,100 | 1,770,414 |

|

| ||

| PBF Energy, Inc. Class A | 109,200 | 2,674,308 |

|

| ||

| PDC Energy, Inc. † | 42,200 | 2,852,298 |

|

| ||

| Ring Energy, Inc. † | 151,380 | 1,871,057 |

|

| ||

| 18,715,881 | ||

|

| ||

| Personal products (0.5%) | ||

|

| ||

| Edgewell Personal Care Co. † | 32,000 | 2,362,880 |

|

| ||

| 2,362,880 | ||

|

| ||

| Pharmaceuticals (0.4%) | ||

|

| ||

| Sucampo Pharmaceuticals, Inc. Class A † S | 163,400 | 1,919,950 |

|

| ||

| 1,919,950 | ||

|

| ||

| Real estate management and development (0.6%) | ||

|

| ||

| RE/MAX Holdings, Inc. Class A | 49,620 | 2,853,150 |

|

| ||

| 2,853,150 | ||

|

| ||

| Road and rail (1.7%) | ||

|

| ||

| Marten Transport, Ltd. | 96,500 | 2,369,075 |

|

| ||

| Saia, Inc. † | 62,700 | 3,031,545 |

|

| ||

| YRC Worldwide, Inc. † | 235,100 | 3,018,684 |

|

| ||

| 8,419,304 | ||

|

| ||

| Semiconductors and semiconductor equipment (5.5%) | ||

|

| ||

| Advanced Energy Industries, Inc. † | 26,500 | 1,645,650 |

|

| ||

| Exar Corp. † | 270,800 | 2,832,568 |

|

| ||

| FormFactor, Inc. † | 272,900 | 2,906,385 |

|

| ||

| Ichor Holdings, Ltd. † | 154,274 | 2,898,808 |

|

| ||

| MaxLinear, Inc. Class A † | 108,100 | 2,814,924 |

|

| ||

| Silicon Motion Technology Corp. ADR (Taiwan) | 66,100 | 2,682,999 |

|

| ||

| Teradyne, Inc. | 124,100 | 3,529,404 |

|

| ||

| 22 Small Cap Value Fund |

| COMMON STOCKS (91.3%)* cont. | Shares | Value |

|

| ||

| Semiconductors and semiconductor equipment cont. | ||

|

| ||

| Tower Semiconductor, Ltd. (Israel) † S | 206,500 | $4,739,175 |

|

| ||

| Xperi Corp. | 78,300 | 2,807,055 |

|

| ||

| 26,856,968 | ||

|

| ||

| Specialty retail (0.4%) | ||

|

| ||

| Tailored Brands, Inc. | 87,600 | 2,024,436 |

|

| ||

| 2,024,436 | ||

|

| ||

| Technology hardware, storage, and peripherals (1.4%) | ||

|

| ||

| BancTec, Inc. 144A CVR F | 160,833 | — |

|

| ||

| NCR Corp. † | 68,100 | 3,273,567 |

|

| ||

| Super Micro Computer, Inc. † | 131,000 | 3,406,000 |

|

| ||

| 6,679,567 | ||

|

| ||

| Textiles, apparel, and luxury goods (0.3%) | ||

|

| ||

| Perry Ellis International, Inc. † | 68,535 | 1,596,180 |

|

| ||

| 1,596,180 | ||

|

| ||

| Thrifts and mortgage finance (4.9%) | ||

|

| ||

| Astoria Financial Corp. | 126,100 | 2,331,589 |

|

| ||

| BofI Holding, Inc. † S | 87,100 | 2,747,134 |

|

| ||

| First Defiance Financial Corp. | 63,800 | 3,135,770 |

|

| ||

| Meta Financial Group, Inc. S | 42,400 | 3,629,440 |

|

| ||

| NMI Holdings, Inc. Class A † | 219,900 | 2,440,890 |

|

| ||

| Provident Financial Services, Inc. | 72,400 | 1,922,220 |

|

| ||

| Walker & Dunlop, Inc. † | 74,849 | 3,042,612 |

|

| ||

| Washington Federal, Inc. | 66,600 | 2,254,410 |

|

| ||

| WSFS Financial Corp. | 52,300 | 2,384,877 |

|

| ||

| 23,888,942 | ||

|

| ||

| Trading companies and distributors (0.5%) | ||

|

| ||

| BMC Stock Holdings, Inc. † S | 126,400 | 2,654,400 |

|

| ||

| 2,654,400 | ||

|

| ||

| Total common stocks (cost $345,477,626) | $442,002,375 | |

|

| ||

| INVESTMENT COMPANIES (3.1%)* | Shares | Value |

|

| ||

| Hercules Capital, Inc. S | 235,523 | $3,488,096 |

|

| ||

| Medley Capital Corp. S | 446,200 | 3,382,196 |

|

| ||

| Solar Capital, Ltd. | 134,058 | 2,985,472 |

|

| ||

| TCP Capital Corp. | 170,348 | 2,923,172 |

|

| ||

| TriplePoint Venture Growth BDC Corp. | 162,574 | 2,126,468 |

|

| ||

| Total investment companies (cost $14,390,772) | $14,905,404 | |

|

| ||

| SHORT-TERM INVESTMENTS (13.2%)* | Shares | Value |

|

| ||

| Putnam Cash Collateral Pool, LLC 0.97% d | 33,533,970 | $33,533,970 |

|

| ||

| Putnam Short Term Investment Fund 0.76% L | 30,472,680 | 30,472,680 |

|

| ||

| Total short-term investments (cost $64,006,650) | $64,006,650 | |

|

| ||

| TOTAL INVESTMENTS | ||

|

| ||

| Total investments (cost $423,875,048) | $520,914,429 | |

|

| ||

| Small Cap Value Fund 23 |

Key to holding’s abbreviations

| ADR | American Depository Receipts: represents ownership of foreign securities on deposit with a custodian bank |

| CVR | Contingent Value Rights |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from March 1, 2016 through February 28, 2017 (the reporting period). Within the following notes to the portfolio, references to “ASC 820” represent Accounting Standards Codification 820 Fair Value Measurements and Disclosures and references to “OTC”, if any, represent over-the-counter.

* Percentages indicated are based on net assets of $484,145,515.

† This security is non-income-producing.

d Affiliated company. See Notes 1 and 5 to the financial statements regarding securities lending. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

F This security is valued by Putnam Management at fair value following procedures approved by the Trustees. Securities may be classified as Level 2 or Level 3 for ASC 820 based on the securities’ valuation inputs (Note 1).

L Affiliated company (Note 5). The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

S Security on loan, in part or in entirety, at the close of the reporting period (Note 1).

144A after the name of an issuer represents securities exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

| 24 Small Cap Value Fund |

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| Valuation inputs | ||||||

|

| ||||||

| Investments in securities: | Level 1 | Level 2 | Level 3 | |||

|

| ||||||

| Common stocks*: | ||||||

|

| ||||||

| Consumer discretionary | $41,418,978 | $— | $— | |||

|

| ||||||

| Consumer staples | 12,247,152 | — | — | |||

|

| ||||||

| Energy | 24,407,701 | — | — | |||

|

| ||||||

| Financials | 151,641,503 | — | — | |||

|

| ||||||

| Health care | 20,549,566 | — | — | |||

|

| ||||||

| Industrials | 52,997,903 | — | — | |||

|

| ||||||

| Information technology | 63,087,077 | — | — ** | |||

|

| ||||||

| Materials | 17,917,646 | — | — | |||

|

| ||||||

| Real estate | 36,900,044 | — | — | |||

|

| ||||||

| Utilities | 20,834,805 | — | — | |||

|

| ||||||

| Total common stocks | 442,002,375 | — | — | |||

| Investment companies | 14,905,404 | — | — | |||

|

| ||||||

| Short-term investments | 30,472,680 | 33,533,970 | — | |||

|

| ||||||

| Totals by level | $487,380,459 | $33,533,970 | $— | |||

* Common stock classifications are presented at the sector level, which may differ from the fund’s portfolio presentation.

** Value of Level 3 security is $—.

During the reporting period, transfers within the fair value hierarchy, if any (other than certain transfers involving non-U.S. equity securities as described in Note 1), did not represent, in the aggregate, more than 1% of the fund’s net assets measured as of the end of the period. Transfers are accounted for using the end of period pricing valuation method.

At the start and close of the reporting period, Level 3 investments in securities represented less than 1% of the fund’s net assets and were not considered a significant portion of the fund’s portfolio.

The accompanying notes are an integral part of these financial statements.

| Small Cap Value Fund 25 |

Statement of assets and liabilities 2/28/17

| ASSETS | |

|

| |

| Investment in securities, at value, including $32,180,599 of securities on loan (Note 1): | |

| Unaffiliated issuers (identified cost $359,868,398) | $456,907,779 |

| Affiliated issuers (identified cost $64,006,650) (Notes 1 and 5) | 64,006,650 |

|

| |

| Dividends, interest and other receivables | 501,065 |

|

| |

| Receivable for shares of the fund sold | 1,824,779 |

|

| |

| Receivable for investments sold | 5,426,547 |

|

| |

| Prepaid assets | 64,404 |

|

| |

| Total assets | 528,731,224 |

|

| |

| LIABILITIES | |

|

| |

| Payable for investments purchased | 9,319,798 |

|

| |

| Payable for shares of the fund repurchased | 1,004,029 |

|

| |

| Payable for compensation of Manager (Note 2) | 232,275 |

|

| |

| Payable for custodian fees (Note 2) | 11,551 |

|

| |

| Payable for investor servicing fees (Note 2) | 151,579 |

|

| |

| Payable for Trustee compensation and expenses (Note 2) | 123,071 |

|

| |

| Payable for administrative services (Note 2) | 1,487 |

|

| |

| Payable for distribution fees (Note 2) | 96,812 |

|

| |

| Collateral on securities loaned, at value (Note 1) | 33,533,970 |

|

| |

| Other accrued expenses | 111,137 |

|

| |

| Total liabilities | 44,585,709 |

| Net assets | $484,145,515 |

|

| |

| REPRESENTED BY | |

|

| |

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $374,111,894 |

|

| |

| Distributions in excess of net investment income (Note 1) | — |

|

| |

| Accumulated net realized gain on investments (Note 1) | 12,994,240 |

|

| |

| Net unrealized appreciation of investments | 97,039,381 |

|

| |

| Total — Representing net assets applicable to capital shares outstanding | $484,145,515 |

|

| |

(Continued on next page)

| 26 Small Cap Value Fund |

Statement of assets and liabilities cont.

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

|

| |

| Net asset value and redemption price per class A share | |

| ($187,838,702 divided by 10,620,475 shares) | $17.69 |

|

| |

| Offering price per class A share (100/94.25 of $17.69)* | $18.77 |

|

| |

| Net asset value and offering price per class B share ($3,423,729 divided by 229,270 shares)** | $14.93 |

|

| |

| Net asset value and offering price per class C share ($22,025,325 divided by 1,479,788 shares)** | $14.88 |

|

| |

| Net asset value and redemption price per class M share ($1,482,153 divided by 91,934 shares) | $16.12 |

|

| |

| Offering price per class M share (100/96.50 of $16.12)* | $16.70 |

|

| |

| Net asset value, offering price and redemption price per class R share | |

| ($976,911 divided by 56,145 shares) | $17.40 |

|

| |

| Net asset value, offering price and redemption price per class R5 share | |

| ($469,389 divided by 25,518 shares) | $18.39 |

|

| |

| Net asset value, offering price and redemption price per class R6 share | |

| ($56,106,154 divided by 3,050,989 shares) | $18.39 |

|

| |

| Net asset value, offering price and redemption price per class Y share | |

| ($211,823,152 divided by 11,555,414 shares) | $18.33 |

* On single retail sales of less than $50,000. On sales of $50,000 or more the offering price is reduced.

** Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

The accompanying notes are an integral part of these financial statements.

| Small Cap Value Fund 27 |

Statement of operations Year ended 2/28/17

| INVESTMENT INCOME | |

|

| |

| Dividends (net of foreign tax of $51,054) | $6,295,710 |

|

| |

| Interest (including interest income of $159,907 from investments in affiliated issuers) (Note 5) | 160,004 |

|

| |

| Securities lending (net of expenses) (Notes 1 and 5) | 239,717 |

|

| |

| Total investment income | 6,695,431 |

|

| |

| EXPENSES | |

|

| |

| Compensation of Manager (Note 2) | 2,483,495 |

|

| |

| Investor servicing fees (Note 2) | 794,284 |

|

| |

| Custodian fees (Note 2) | 21,845 |

|

| |

| Trustee compensation and expenses (Note 2) | 24,487 |

|

| |

| Distribution fees (Note 2) | 629,770 |

|

| |

| Administrative services (Note 2) | 11,918 |

|

| |

| Other | 302,149 |

|

| |

| Fees waived and reimbursed by Manager (Note 2) | (3,991) |

|

| |

| Total expenses | 4,263,957 |

|

| |

| Expense reduction (Note 2) | (23,247) |

|

| |

| Net expenses | 4,240,710 |

| Net investment income | 2,454,721 |

|

| |

| Net realized gain on investments (Notes 1 and 3) | 23,148,318 |

|

| |

| Net unrealized appreciation of investments during the year | 102,886,041 |

|

| |

| Net gain on investments | 126,034,359 |

| Net increase in net assets resulting from operations | $128,489,080 |

|

| |

The accompanying notes are an integral part of these financial statements.

| 28 Small Cap Value Fund |

Statement of changes in net assets

| INCREASE (DECREASE) IN NET ASSETS | Year ended 2/28/17 | Year ended 2/29/16 |

|

| ||

| Operations | ||

|

| ||

| Net investment income | $2,454,721 | $2,738,140 |

|

| ||

| Net realized gain on investments | 23,148,318 | 3,472,455 |

|

| ||

| Net unrealized appreciation (depreciation) of investments | 102,886,041 | (50,496,419) |

|

| ||

| Net increase (decrease) in net assets resulting | ||

| from operations | 128,489,080 | (44,285,824) |

|

| ||

| Distributions to shareholders (Note 1): | ||

| From ordinary income | ||

| Net investment income | ||

|

| ||

| Class A | (1,193,020) | (1,369,833) |

|

| ||

| Class B | (7,267) | (10,630) |

|

| ||

| Class C | (53,673) | (89,971) |

|

| ||

| Class M | (4,907) | (5,928) |

|

| ||

| Class R | (5,257) | (5,700) |

|

| ||

| Class R5 | (4,383) | (151) |

|

| ||

| Class R6 | (508,691) | (156,852) |

|

| ||

| Class Y | (1,629,123) | (1,660,501) |

|

| ||

| Net realized short-term gain on investments | ||

|

| ||

| Class A | — | (268,300) |

|

| ||

| Class B | — | (5,494) |

|

| ||

| Class C | — | (34,858) |

|

| ||

| Class M | — | (2,191) |

|

| ||

| Class R | — | (1,383) |

|

| ||

| Class R5 | — | (23) |

|

| ||

| Class R6 | — | (22,461) |

|

| ||

| Class Y | — | (260,769) |

|

| ||

| From net realized long-term gain on investments | ||

| Class A | — | (6,054,715) |

|

| ||

| Class B | — | (123,974) |

|

| ||

| Class C | — | (786,641) |

|

| ||

| Class M | — | (49,460) |

|

| ||

| Class R | — | (31,219) |

|

| ||

| Class R5 | — | (522) |

|

| ||

| Class R6 | — | (506,873) |

|

| ||

| Class Y | — | (5,884,768) |

|

| ||

| From return of capital | ||

| Class A | — | (431,661) |

|

| ||

| Class B | — | (3,350) |

|

| ||

| Class C | — | (28,352) |

|

| ||

| Class M | — | (1,868) |

|

| ||

| Class R | — | (1,796) |

|

| ||

| Class R5 | — | (48) |

|

| ||

| Class R6 | — | (49,427) |

|

| ||

| Class Y | — | (523,256) |

| Increase from capital share transactions (Note 4) | 27,790,693 | 36,710,246 |

|

| ||

| Total increase (decrease) in net assets | 152,873,452 | (25,948,553) |

|

| ||

| NET ASSETS | ||

|

| ||

| Beginning of year | 331,272,063 | 357,220,616 |

|

| ||

| End of year (including distributions in excess | ||

| of net investment income of $— and undistributed net | ||

| investment income of $—, respectively) | $484,145,515 | $331,272,063 |

The accompanying notes are an integral part of these financial statements.

| Small Cap Value Fund 29 |

Financial highlights (For a common share outstanding throughout the period)

| INVESTMENT OPERATIONS | LESS DISTRIBUTIONS | RATIOS AND SUPPLEMENTAL DATA | |||||||||||||

|

| |||||||||||||||

| Ratio of net | |||||||||||||||

| Net asset | Net | Net realized | From | Ratio | investment | ||||||||||

| value, | investment | and unrealized | Total from | From | net realized | Net asset | Total return | Net assets, | of expenses | income (loss) | |||||

| beginning | income | gain (loss) | investment | net investment | gain | From | Total | Redemption | value, end | at net asset | end of period | to average | to average | Portfolio | |

| Period ended | of period | (loss)a | on investments | operations | income | on investments | return of capital | distributions | fees | of period | value (%)b | (in thousands) | net assets (%)c | net assets (%) | turnover (%) |

|

| |||||||||||||||

| Class A | |||||||||||||||

|

| |||||||||||||||

| February 28, 2017 | $12.82 | .08 | 4.91 | 4.99 | (.12) | — | — | (.12) | — | $17.69 | 38.90 | $187,839 | 1.18d | .53d | 63 |

|

| |||||||||||||||

| February 29, 2016 | 15.34 | .10 | (1.87) | (1.77) | (.13) | (.58) | (.04) | (.75) | — | 12.82 | (12.04) | 142,656 | 1.15 | .70 | 62 |

|

| |||||||||||||||

| February 28, 2015 | 15.45 | .09 | .42 | .51 | (.12) | (.50) | — | (.62) | — | 15.34 | 3.40 | 172,363 | 1.18 | .60 | 54 |

|

| |||||||||||||||

| February 28, 2014 | 12.05 | .05 | 3.51 | 3.56 | (.10) | (.06) | — | (.16) | —e | 15.45 | 29.58 | 171,473 | 1.21 | .33 | 68 |

|

| |||||||||||||||

| February 28, 2013 | 10.54 | .08 | 1.44 | 1.52 | (.01) | — | — | (.01) | —e | 12.05 | 14.40 | 133,547 | 1.28 | .71 | 64 |

|

| |||||||||||||||

| Class B | |||||||||||||||

|

| |||||||||||||||

| February 28, 2017 | $10.86 | (.03) | 4.14 | 4.11 | (.04) | — | — | (.04) | — | $14.93 | 37.80 | $3,424 | 1.93d | (.25)d | 63 |

|

| |||||||||||||||

| February 29, 2016 | 13.10 | —e | (1.59) | (1.59) | (.05) | (.58) | (.02) | (.65) | — | 10.86 | (12.68) | 2,398 | 1.90 | (.03) | 62 |

|

| |||||||||||||||

| February 28, 2015 | 13.28 | (.02) | .35 | .33 | (.01) | (.50) | — | (.51) | — | 13.10 | 2.60 | 3,398 | 1.93 | (.16) | 54 |

|

| |||||||||||||||

| February 28, 2014 | 10.39 | (.05) | 3.01 | 2.96 | (.01) | (.06) | — | (.07) | —e | 13.28 | 28.55 | 4,215 | 1.96 | (.41) | 68 |

|

| |||||||||||||||

| February 28, 2013 | 9.15 | —e | 1.24 | 1.24 | — | — | — | — | —e | 10.39 | 13.55 | 3,764 | 2.03 | (.04) | 64 |

|

| |||||||||||||||

| Class C | |||||||||||||||

|

| |||||||||||||||

| February 28, 2017 | $10.82 | (.03) | 4.13 | 4.10 | (.04) | — | — | (.04) | — | $14.88 | 37.88 | $22,025 | 1.93d | (.23)d | 63 |

|

| |||||||||||||||

| February 29, 2016 | 13.09 | (.01) | (1.60) | (1.61) | (.06) | (.58) | (.02) | (.66) | — | 10.82 | (12.78) | 15,527 | 1.90 | (.05) | 62 |

|

| |||||||||||||||

| February 28, 2015 | 13.29 | (.02) | .36 | .34 | (.04) | (.50) | — | (.54) | — | 13.09 | 2.68 | 17,701 | 1.93 | (.15) | 54 |

|

| |||||||||||||||

| February 28, 2014 | 10.41 | (.05) | 3.02 | 2.97 | (.03) | (.06) | — | (.09) | —e | 13.29 | 28.58 | 14,732 | 1.96 | (.43) | 68 |

|

| |||||||||||||||

| February 28, 2013 | 9.17 | —e | 1.24 | 1.24 | — | — | — | — | —e | 10.41 | 13.52 | 9,244 | 2.03 | (.05) | 64 |

|

| |||||||||||||||

| Class M | |||||||||||||||

|

| |||||||||||||||

| February 28, 2017 | $11.70 | —e | 4.48 | 4.48 | (.06) | — | — | (.06) | — | $16.12 | 38.26 | $1,482 | 1.68d | .03d | 63 |

|

| |||||||||||||||

| February 29, 2016 | 14.06 | .03 | (1.72) | (1.69) | (.07) | (.58) | (.02) | (.67) | — | 11.70 | (12.51) | 1,097 | 1.65 | .21 | 62 |

|

| |||||||||||||||

| February 28, 2015 | 14.22 | .01 | .38 | .39 | (.05) | (.50) | — | (.55) | — | 14.06 | 2.85 | 1,524 | 1.68 | .10 | 54 |

|

| |||||||||||||||

| February 28, 2014 | 11.11 | (.02) | 3.22 | 3.20 | (.03) | (.06) | — | (.09) | —e | 14.22 | 28.87 | 1,460 | 1.71 | (.16) | 68 |

|

| |||||||||||||||

| February 28, 2013 | 9.76 | .02 | 1.33 | 1.35 | — | — | — | — | —e | 11.11 | 13.83 | 1,294 | 1.78 | .22 | 64 |

|

| |||||||||||||||

| Class R | |||||||||||||||

|

| |||||||||||||||

| February 28, 2017 | $12.62 | .04 | 4.82 | 4.86 | (.08) | — | — | (.08) | — | $17.40 | 38.55 | $977 | 1.43d | .29d | 63 |

|

| |||||||||||||||