Form N-CSR PROFESSIONALLY MANAGED For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-05037)

Professionally Managed Portfolios

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Jason Hadler

Professionally Managed Portfolios

c/o U.S. Bank Global Fund Services

777 E. Wisconsin Avenue

Milwaukee, WI 53202

(Name and address of agent for service)

777 E. Wisconsin Avenue

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1523

Registrant's telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

Item 1. Report to Stockholders.

|

(a)

|

|

ANNUAL REPORT • MARCH 31, 2023

Hodges Fund

Small Cap Fund

Small Intrinsic Value Fund

Blue Chip Equity Income Fund

www.hodgesfunds.com

Hodges Capital — Managing Equity Funds Since 1992

Table of Contents

|

Shareholder Letter

|

1

|

|

|

Sector Allocations

|

8

|

|

|

Schedules of Investments

|

15

|

|

|

Statements of Assets and Liabilities

|

22

|

|

|

Statements of Operations

|

23

|

|

|

Statements of Changes in Net Assets

|

24

|

|

|

Financial Highlights

|

28

|

|

|

Notes to Financial Statements

|

33

|

|

|

Report of Independent Registered Public Accounting Firm

|

42

|

|

|

Expense Examples

|

43

|

|

|

Trustees and Executive Officers

|

45

|

|

|

Statement Regarding Liquidity Risk Management Program

|

48

|

|

|

Additional Information

|

49

|

|

|

Privacy Notice

|

51

|

Hodges Mutual Funds

Dear Board of Directors:

The past twelve months have proven to be volatile for U.S. stocks as market sentiment shifts daily between pricing in a hard, soft, or emergency landing for the economy. The S&P

500 declined by 7.73%, and the NASDAQ Composite was down 11.30% in the one year ending March 31, 2023, reflecting weakness in mega-cap tech stocks in 2022. As measured by the Russell 2000, small-caps fell 11.61% over the past year, lagging due to

their cyclical sensitivity and exposure to regional banks. Value stocks have underperformed growth in recent months as economic uncertainty and tighter credit conditions have created an expectation that interest rates may stabilize and could contract

by year-end if economic conditions worsen. While turbulence surrounding bank failures and systemic risk to financial markets is unsettling, we are pleased to report that the performance of three Hodges Mutual Funds exceeded their benchmarks for the

twelve months ending March 31, 2023. Positive relative performance in several of our fund strategies was attributed to our steadfast focus on companies with sound business fundamentals and reasonable valuations.

It has been a whole year since the Fed started its tightening cycle, and capital markets have at least partially priced in one of the most anticipated recessions in the past forty

years. However, there is still ample uncertainty regarding the trajectory of interest rates and the prospects for changing economic conditions in the months ahead. In our opinion, the first-quarter relief rally in many mega-cap tech stocks has been a

function of a false flight to safety based on the anticipation that softer economic conditions could result in lower rates and higher valuations for growth stocks in the second half of 2023. We view the broad contraction in PE multiples relative to

current interest rates over the past year as warranted. According to the most recent data published by FactSet, the S&P 500 is trading at approximately 17.8X forward earnings estimates compared to 19.5X a year ago and 21.2X at the beginning of

2022. The inverse of the current S&P 500 PE multiple reflects an earnings yield of 5.56%, which was still above the 10-year Treasury yield of 3.56% at the quarter-end. The big macro questions are now; Not if, but how much will the U.S. economy

contract, and to what degree will it drag on corporate earnings and cash flow? We would point out that many businesses have spent the last six months cutting costs, scrutinizing capital expenditures, tightening supply chains, and cautiously managing

inventories in anticipation of a slowdown. However, the inevitable contraction in bank lending and tighter credit will be challenging for businesses and industries dependent on accessing easy credit.

This sometimes creates opportunities for companies with conservative balance sheets, low-cost operations, and ample liquidity to weather a downturn. Our investment team’s recent

discussions with public company management teams over the past few months suggest that labor costs are stabilizing. Many other input costs have also been moderated in recent months. Consumer spending increased last year due to excess savings built up

during the pandemic but appears more challenging in 2023. The housing market has cooled down due to higher mortgage rates but does not appear to be overbuilt. The most recent Purchasing Managers Index (PMI), which measures the direction of economic

trends in manufacturing and service sectors, fell below 46.3, a reading that has historically occurred during or just before a recession. Although the odds of a recession have risen this year, we believe many facets of manufacturing could undergo a

renaissance over the next several years due to onshoring and nearshoring supply chains and an increase in infrastructure-related spending. It is also important to note that not every economic slowdown looks the same, and not every business will be

affected the same by potential macro headwinds. In this environment, active portfolio management becomes essential to navigate quickly changing business conditions across many sectors. Furthermore, an economic slowdown and tighter credit conditions

favor stocks with solid balance sheets whose underlying assets can produce stable cash flow and earnings. With this in mind, the Hodges Capital Management investment team has positioned our portfolios to benefit from shifting economic trends and

secular and structural changes across different industries.

As we look at the balance of 2023, our portfolios remain laser-focused on fundamental investing and individual stock selection. Our investing approach involves spending little time

predicting short-term fluctuations in interest rates, foreign currencies, or commodity prices. Instead, we pay close attention to how prices and, more importantly, the pricing power that our portfolio companies exhibit within the goods and services

they produce. For many businesses, tighter credit conditions and a slowdown in demand could adversely impact profit margins and revenues in the months ahead. As a result, the investment team at Hodges Capital is rigorously looking for bargains in

businesses that we believe are well-run and control their destiny by relying on ingenuity and well-calculated business decisions rather than day-to-day momentum in the economy or stock market. Despite challenging macro conditions, we are

overweighting our portfolios with growth and value stocks that can create shareholder value.

During this time of ambiguity, investors in the Hodges Funds can be assured that we are not changing our core investment discipline, designed to seek out quality companies running

great businesses with excellent management teams trading at reasonable prices. Furthermore, we see this as an ideal environment for active portfolio managers to carefully select individual stocks that we believe can generate long-term value for

shareholders.

1

Hodges Mutual Funds

Returns (Retail Class) as of 03/31/2023:

|

Since

|

|||||

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

Inception

|

|

|

Hodges Fund

|

|||||

|

(HDPMX) 10/09/1992

|

-12.44%

|

36.33%

|

3.18%

|

8.72%

|

9.17%

|

|

S&P 500® Index

|

-7.73%

|

18.60%

|

11.19%

|

12.24%

|

10.06%

|

|

Hodges Small Cap Fund

|

|||||

|

(HDPSX) 12/18/2007

|

-4.68%

|

34.12%

|

7.18%

|

8.28%

|

8.98%

|

|

Russell 2000® Return Index

|

-11.61%

|

17.51%

|

4.71%

|

8.04%

|

7.33%

|

|

Hodges Small Intrinsic Value Fund

|

|||||

|

(HDSVX) 12/26/2013

|

-5.92%

|

38.98%

|

8.01%

|

—

|

8.25%

|

|

Russell 2000® Value Return Index

|

-12.96%

|

21.01%

|

4.55%

|

—

|

5.68%

|

|

Russell 2000® Index

|

-11.61%

|

17.51%

|

4.71%

|

—

|

6.27%

|

|

Hodges Blue Chip Equity Income Fund

|

|||||

|

(HDPBX) 09/10/2009

|

-4.96%

|

20.49%

|

10.53%

|

11.29%

|

10.97%

|

|

Russell 1000® Index

|

-8.39%

|

18.55%

|

10.87%

|

12.01%

|

12.76%

|

|

Average Annualized

|

|

HDPSX

|

HDPMX

|

HDSVX

|

HDPBX

|

||

|

Gross Expense Ratio

|

1.38%

|

1.35%

|

2.05%

|

1.49%

|

|

|

Net Expense Ratio

|

1.36%*

|

1.17%*

|

1.29%*

|

1.30%*

|

|

*

|

The Advisor has contractually agreed to reduce its fees at least until July 31, 2023. This figure excludes Acquired Fund Fees and Expenses, interest, taxes, and extraordinary expenses. The

Advisor is permitted, with Board approval, to be reimbursed for fee reduction and/or expense payments made in the prior three years from the date the fees were waived and/or expenses were paid. Please see prospectus for details.

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an

investor’s shares, when redeemed, may be worth more or less than their original cost. The current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by

calling 866-811-0224. The Funds impose a 1.00% redemption fee on shares held for thirty days or less (60 days or less for Institutional Class shares). Performance data quoted does not reflect the redemption fee. If reflected, total returns would be

reduced. See the Financial Highlights in this report for the most current expense ratios.

2

Hodges Mutual Funds

Hodges Fund (HDPMX)

The Hodges Fund’s twelve-month return amounted to a loss of 12.44% compared to a loss of 7.73% for the S&P 500 Index. Lackluster performance was attributed to a handful of

consumer discretionary, materials, healthcare, and technology stocks. The Hodges Fund’s turnover was elevated over the past year to exploit prevailing market conditions. We have upgraded many portfolio holdings into stocks that we believe offer

above-average returns relative to their downside risks over the next twelve to eighteen months.

The Hodges Fund’s portfolio managers remain laser-focused on investments where we have the highest conviction based on fundamentals and relative valuations. The number of positions

held in the Fund decreased to 40 from 43 a the same time a year ago. On March 31, 2023, the top ten holdings represented 44.61% of the Fund’s holdings. They included Matador Resources Co (MTDR), Uber Technologies (UBER), Texas Pacific Land Corp

(TPL), On Holding (ONON), On Semiconductor (ON), Encore Wire Corp (WIRE), Cleveland-Cliffs Inc (CLF), Chesapeake Energy Corp (CHK), Cinemark Holdings (CNK), and Eagle Materials Inc (EXP).

Hodges Fund vs S&P 500® Index

As of 03/31/2023

3

Hodges Mutual Funds

Hodges Small Cap Fund (HDPSX)

The Small Cap Fund’s one-year performance as of March 31, 2023, amounted to a loss of 4.68% compared to a loss of 11.61% for the Russell 2000 Index during the same period. Although

small-caps have been underperforming large-cap stocks this year, we view the current risk-reward for holding quality small-cap stocks as attractive. While small-cap stocks tend to experience greater volatility during market turmoil, we expect this

segment to generate above-average relative risk-adjusted returns over the long term.

The Hodges Small Cap Fund remains well diversified across industrials, transportation, healthcare, technology, and consumer-related names, which we expect to contribute to the Fund’s

long-term performance. The Fund recently took profits in several stocks that appeared overvalued relative to their underlying fundamentals and established new positions with an attractive risk/reward profile. The Fund had a total of 51 positions on

March 31, 2023. The top ten holdings amounted to 37.05% of the Fund’s holdings and included Eagle Materials Inc (EXP), Matador Resources (MTDR), SM Energy Co (SM), Taylor Morrison Home Corp (TMHC), On Holding (ONON), Texas Pacific Land Corp (TPL),

Cleveland-Cliffs Inc (CLF), Vista Outdoor (VSTO), Hilltop Holdings Inc (HTH), and Encore Wire Corp (WIRE).

Hodges Small Cap Fund vs Russell 2000® Return Index

As of 03/31/2023

4

Hodges Mutual Funds

Hodges Small Intrinsic Value Fund (HDSVX)

Over the last twelve months, the Hodges Small Intrinsic Value Fund experienced a loss of 5.92% compared to a loss of 12.96% for the Russell 2000 Value Index. The Fund’s solid relative

performance over the past year was attributed to several of the Fund’s material, consumer staples, and industrial stocks. The Fund held 49 positions on March 31, 2023. The top 10 holdings, excluding cash, represented 32.11% of the Fund’s holdings and

included Eagle Materials Inc (EXP), Triumph Financial Inc (TFIN), Taylor Morrison Home Corp (TMHC), Builders FirstSource (BLDR), Brunswick Corp (BC), Chord Energy Corp (CHRD), Vista Outdoor Inc (VSTO), Cleveland-Cliffs Inc (CLF), Home Bancshares Inc

(HOMB), and Treehouse Foods Inc (THS).

Hodges Small Intrinsic Value Fund vs

Russell 2000® Value Return Index & Russell 2000® Index

As of 03/31/2023

5

Hodges Mutual Funds

Hodges Blue Chip Equity Income Fund (HDPBX)

The Hodges Blue Chip Equity Income Fund experienced a negative annualized return of 4.96% compared to a loss of 8.39% for the Russell 1000 Index. Positive relative performance was

attributed to sector allocation among energy and technology names. Although large-cap stocks have held up better than small and mid-cap stocks during the recent sell-off, we see the current investing landscape as offering plenty of attractive,

high-quality dividend-paying stocks with solid upside potential. We expect underleveraged balance sheets and corporate profits across most blue-chip stocks to support stable dividends over the next several years. The Blue Chip Equity Income Fund

remains well-diversified in companies that we believe can generate above-average income and total returns on a risk-adjusted basis. The Fund held 27 positions on March 31, 2023. The top ten holdings represented 49.15% of the Fund’s holdings and

included Apple Inc (AAPL), Microsoft Corp (MSFT), Deere & Co (DE), Exxon Mobil Corp (XOM), Tesla (TSLA), Texas Instruments Inc (TXN), Novo Nordisk (NVO), Nvidia (NVDA), PepsiCo Inc (PEP), and Costco Wholesale (COST).

Hodges Blue Chip Equity Income Fund vs Russell 1000® Index

As of 03/31/2023

6

Hodges Mutual Funds

In conclusion, we remain optimistic regarding the long-term investment opportunities surrounding the Hodges Mutual Funds. By offering four distinct mutual fund strategies covering

most segments of the domestic equity market, we can serve most financial advisors’ and individual investors’ diverse needs. Our entire investment team is rigorously studying companies, meeting with management teams, observing trends, and navigating

today’s ever-changing financial markets. Feel free to contact us directly if we can address any specific questions.

Sincerely,

|

|

|

|

Craig Hodges

|

|

Eric Marshall, CFA

|

|

Co-Portfolio Manager

|

Co-Portfolio Manager

|

|

|

|

|

|

Gary Bradshaw

|

Chris Terry, CFA

|

Derek Maupin

|

|

Co-Portfolio Manager

|

Co-Portfolio Manager

|

Co-Portfolio Manager

|

The above discussion is based on the opinions of Eric Marshall, CFA, and is subject to change. It is not intended to be a forecast of future events, a guarantee of future results,

and is not a recommendation to buy or sell any security. Portfolio composition and company ownership in the Hodges Funds are subject to daily change.

Must be preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and currency risks and

differences in accounting methods. These risks are greater for investments in emerging markets. Options and future contracts have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly

predict the direction of securities prices, interest rates and currency exchange rates. These risks may be greater than risks associated with more traditional investments. Short sales of securities involve the risk that losses may exceed the original

amount invested. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities. Investments in small and medium capitalization companies involve additional risks such

as limited liquidity and greater volatility. Funds that are non-diversified are more exposed to individual stock volatility than a diversified fund. Investments in companies that demonstrate special situations or turnarounds, meaning companies that

have experienced significant business problems but are believed to have favorable prospects for recovery, involve greater risk.

Value investing carries the risk that the market will not recognize a security’s inherent value for a long time, or that a stock judged to be undervalued may be appropriately priced

or overvalued.

Diversification does not assure a profit or protect against a loss in a declining market.

Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The S&P 500 Index is a broad-based unmanaged index of 500 stocks that is widely recognized as representative of the equity market in general. The Russell 1000 Index is a subset of the Russell 3000

Index and consists of the 1,000 largest companies comprising over 90% of the total market capitalization of all listed stocks. The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000

Index, as ranked by market capitalization. The Russell 2500 Index consists of the smallest 2,500 companies in a group of 3,000 U.S. companies in the Russell 3000 Index, as ranked by market capitalization. The Russell 3000 Index is a stock index

consisting of the 3000 largest publicly listed companies, representing about 98% of the total capitalization of the entire U.S. stock market. You cannot invest directly in an index. The Russell 2000 Value Index measures the performance of small-cap

value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2000 Value Index is constructed to provide a comprehensive and unbiased barometer for

the small-cap value segment. The Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set and that the represented companies continue to reflect value

characteristics.

Cash Flow: A revenue or expense stream that changes a cash account over a given period.

Price/earnings (P/E): The most common measure of how expensive a stock is.

Earnings Growth is not a measure of the Fund’s future performance.

Hodges Capital Management is the Advisor to the Hodges Funds.

Hodges Funds are distributed by Quasar Distributors LLC.

7

Hodges Mutual Funds

|

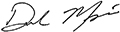

SECTOR ALLOCATIONS At March 31, 2023 (Unaudited)

|

(as a percentage of net assets)

Hodges Fund

(HDPMX)

Small Cap Fund

(HDPSX & HDSIX)

1 Other assets in excess of liabilities.

8

Hodges Mutual Funds

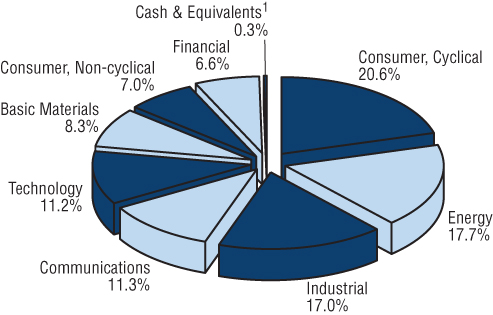

|

SECTOR ALLOCATIONS At March 31, 2023 (Unaudited)

|

(as a percentage of net assets)

Small Intrinsic Value Fund

(HDSVX)

Blue Chip Equity Income Fund

(HDPBX)

1 Other assets in excess of liabilities.

9

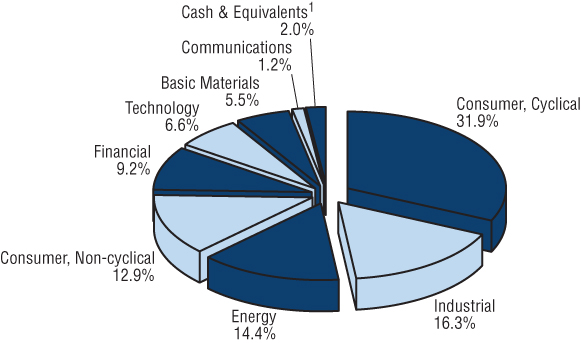

Hodges Fund (Unaudited)

Value of $10,000 vs. S&P 500® Index

Annualized Returns for the periods ended March 31, 2023

|

Since Inception

|

Ending Value

|

|||||

|

One Year

|

Three Year

|

Five Year

|

Ten Year

|

(10/9/92)

|

(3/31/2023)

|

|

|

Hodges Fund

|

-12.44%

|

36.33%

|

3.18%

|

8.72%

|

9.17%

|

$23,063

|

|

S&P 500® Index

|

-7.73%

|

18.60%

|

11.19%

|

12.24%

|

10.06%

|

31,736

|

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2013, and is not intended to imply any future performance. The returns shown do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains,

dividends, and return of capital, if applicable, for a Fund and dividends for an index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an

investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by

calling (866) 811-0224.

The Fund imposes a 1.00% redemption fee on Retail shares held for less than 30 days. Performance does not reflect the redemption fee. If reflected, total returns would be reduced.

10

Small Cap Fund – Retail Class (Unaudited)

Value of $10,000 vs. Russell 2000® Index

Annualized Returns for the periods ended March 31, 2023

|

Since Inception

|

Ending Value

|

|||||

|

One Year

|

Three Year

|

Five Year

|

Ten Year

|

(12/18/07)

|

(3/31/2023)

|

|

|

Small Cap Fund – Retail Class

|

-4.68%

|

34.12%

|

7.18%

|

8.28%

|

8.98%

|

$22,148

|

|

Russell 2000® Index

|

-11.61%

|

17.51%

|

4.71%

|

8.04%

|

7.33%

|

21,661

|

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2013, and is not intended to imply any future performance. The returns shown do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains,

dividends, and return of capital, if applicable, for a Fund and dividends for an index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an

investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by

calling (866) 811-0224.

The Fund imposes a 1.00% redemption fee on Retail shares held for less than 30 days. Performance does not reflect the redemption fee. If reflected, total returns would be reduced.

11

Small Cap Fund – Institutional Class (Unaudited)

Value of $1,000,000 vs. Russell 2000® Index

Annualized Returns for the periods ended March 31, 2023

|

Since Inception

|

Ending Value

|

|||||

|

One Year

|

Three Year

|

Five Year

|

Ten Year

|

(12/12/08)

|

(3/31/2023)

|

|

|

Small Cap Fund – Institutional Class

|

-4.40%

|

34.50%

|

7.45%

|

8.58%

|

14.73%

|

$2,278,527

|

|

Russell 2000® Index

|

-11.61%

|

17.51%

|

4.71%

|

8.04%

|

11.39%

|

2,166,070

|

This chart illustrates the performance of a hypothetical $1,000,000 investment made on March 31, 2013, and is not intended to imply any future performance. The returns shown do not reflect the deduction

of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital

gains, dividends, and return of capital, if applicable, for a Fund and dividends for an index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an

investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by

calling (866) 811-0224.

The Fund imposes a 1.00% redemption fee on Institutional shares held for less than 60 days. Performance does not reflect the redemption fee. If reflected, total returns would be

reduced.

12

Small Intrinsic Value Fund (Unaudited)

Value of $10,000 vs. Russell 2000® Index & Russell 2000® Value Index

Annualized Returns for the periods ended March 31, 2023

|

Since Inception

|

Ending Value

|

||||

|

One Year

|

Three Year

|

Five Year

|

(12/26/13)

|

(3/31/2023)

|

|

|

Small Intrinsic Value Fund

|

-5.92%

|

38.98%

|

8.01%

|

8.25%

|

$20,843

|

|

Russell 2000® Index

|

-11.61%

|

17.51%

|

4.71%

|

6.27%

|

17,559

|

|

Russell 2000® Value Index

|

-12.96%

|

21.01%

|

4.55%

|

5.68%

|

16,677

|

This chart illustrates the performance of a hypothetical $10,000 investment made on December 26, 2013, and is not intended to imply any future performance. The returns shown do not reflect the deduction

of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital

gains, dividends, and return of capital, if applicable, for a Fund and dividends for an index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an

investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by

calling (866) 811-0224.

The Fund imposes a 1.00% redemption fee on Retail shares held for less than 30 days. Performance does not reflect the redemption fee. If reflected, total returns would be reduced.

13

Blue Chip Equity Income Fund (Unaudited)

Value of $10,000 vs. Russell 1000® Index

Annualized Returns for the periods ended March 31, 2023

|

Since Inception

|

Ending Value

|

|||||

|

One Year

|

Three Year

|

Five Year

|

Ten Year

|

(9/10/09)

|

(3/31/2023)

|

|

|

Blue Chip Equity Income Fund

|

-4.96%

|

20.49%

|

10.53%

|

11.29%

|

10.97%

|

$29,147

|

|

Russell 1000® Index

|

-8.39%

|

18.55%

|

10.87%

|

12.01%

|

12.76%

|

31,095

|

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2013, and is not intended to imply any future performance. The returns shown do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains,

dividends, and return of capital, if applicable, for a Fund and dividends for an index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an

investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by

calling (866) 811-0224.

The Fund imposes a 1.00% redemption fee on Retail shares held for less than 30 days. Performance does not reflect the redemption fee. If reflected, total returns would be reduced.

14

Hodges Fund

|

SCHEDULE OF INVESTMENTS at March 31, 2023

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS: 96.5%

|

|||||||

|

Aerospace & Defense: 2.3%

|

|||||||

|

100,000

|

Spirit AeroSystems

|

||||||

|

Holdings, Inc. – Class A

|

$

|

3,453,000

|

|||||

|

Airlines: 0.8%

|

|||||||

|

116,063

|

Frontier Group Holdings, Inc. 1

|

1,142,060

|

|||||

|

Apparel: 4.5%

|

|||||||

|

220,000

|

On Holding AG – Class A 1

|

6,826,600

|

|||||

|

Auto Manufacturers: 2.5%

|

|||||||

|

75,000

|

General Motors Co.

|

2,751,000

|

|||||

|

5,000

|

Tesla, Inc. 1

|

1,037,300

|

|||||

|

3,788,300

|

|||||||

|

Banks: 2.9%

|

|||||||

|

40,000

|

Comerica, Inc.

|

1,736,800

|

|||||

|

25,000

|

Cullen/Frost Bankers, Inc.

|

2,633,500

|

|||||

|

4,370,300

|

|||||||

|

Building Materials: 6.7%

|

|||||||

|

75,000

|

The AZEK Co., Inc. – Class A 1

|

1,765,500

|

|||||

|

45,000

|

Builders FirstSource, Inc. 1

|

3,995,100

|

|||||

|

30,000

|

Eagle Materials, Inc.

|

4,402,500

|

|||||

|

10,163,100

|

|||||||

|

Commercial Services: 3.9%

|

|||||||

|

400,000

|

The GEO Group, Inc. 1

|

3,156,000

|

|||||

|

150,000

|

Toast, Inc. – Class A 1

|

2,662,500

|

|||||

|

5,818,500

|

|||||||

|

Computers: 1.6%

|

|||||||

|

100,000

|

NCR Corp. 1

|

2,359,000

|

|||||

|

Diversified Financial Services: 2.4%

|

|||||||

|

70,000

|

The Charles Schwab Corp.

|

3,666,600

|

|||||

|

Electrical Components & Equipment: 4.3%

|

|||||||

|

35,000

|

Encore Wire Corp.

|

6,486,550

|

|||||

|

Electronics: 2.5%

|

|||||||

|

100,000

|

Coherent Corp. 1

|

3,808,000

|

|||||

|

Entertainment: 2.9%

|

|||||||

|

300,000

|

Cinemark Holdings, Inc. 1

|

4,437,000

|

|||||

|

Healthcare Products: 1.7%

|

|||||||

|

750,000

|

ViewRay, Inc. 1

|

2,595,000

|

|||||

|

Internet: 10.4%

|

|||||||

|

100,000

|

Revolve Group, Inc. – Class A 1

|

2,630,000

|

|||||

|

500,000

|

Solo Brands, Inc. – Class A 1

|

3,590,000

|

|||||

|

300,000

|

Uber Technologies, Inc. 1

|

9,510,000

|

|||||

|

15,730,000

|

|||||||

|

Iron & Steel: 5.6%

|

|||||||

|

350,000

|

Cleveland-Cliffs, Inc. 1

|

6,415,500

|

|||||

|

40,000

|

Commercial Metals Co.

|

1,956,000

|

|||||

|

8,371,500

|

|||||||

|

Leisure Time: 7.7%

|

|||||||

|

250,000

|

Norwegian Cruise Line Holdings Ltd. 1

|

3,362,500

|

|||||

|

200,000

|

Topgolf Callaway Brands Corp. 1

|

4,324,000

|

|||||

|

140,000

|

Vista Outdoor, Inc. 1

|

3,879,400

|

|||||

|

11,565,900

|

|||||||

|

Lodging: 1.9%

|

|||||||

|

25,000

|

Wynn Resorts Ltd. 1

|

2,797,750

|

|||||

|

Mining: 2.7%

|

|||||||

|

100,000

|

Freeport-McMoRan, Inc.

|

4,091,000

|

|||||

|

Oil & Gas Drilling: 2.1%

|

|||||||

|

500,000

|

Transocean Ltd. 1

|

3,180,000

|

|||||

|

Oil Companies Exploration & Production: 9.8%

|

|||||||

|

70,000

|

Chesapeake Energy Corp.

|

5,322,800

|

|||||

|

200,000

|

Matador Resources Co.

|

9,530,000

|

|||||

|

14,852,800

|

|||||||

|

Oil Field Services: 0.7%

|

|||||||

|

150,000

|

ProPetro Holding Corp. 1

|

1,078,500

|

|||||

|

Pharmaceuticals: 0.8%

|

|||||||

|

75,000

|

Takeda Pharmaceutical Co Ltd. 1

|

1,236,000

|

|||||

|

Private Equity: 1.3%

|

|||||||

|

200,000

|

P10, Inc. – Class A

|

2,022,000

|

|||||

|

Semiconductors: 6.4%

|

|||||||

|

50,000

|

Micron Technology, Inc.

|

3,017,000

|

|||||

|

80,000

|

ON Semiconductor Corp. 1

|

6,585,600

|

|||||

|

9,602,600

|

|||||||

|

Software: 1.8%

|

|||||||

|

619,923

|

Upland Software, Inc. 1

|

2,665,669

|

|||||

|

Telecommunications: 0.9%

|

|||||||

|

40,000

|

Corning, Inc.

|

1,411,200

|

|||||

|

Textiles: 0.3%

|

|||||||

|

564,641

|

The Dixie Group, Inc. 1

|

429,127

|

|||||

|

U.S. Royalty Trusts: 5.1%

|

|||||||

|

4,500

|

Texas Pacific Land Corp.

|

7,654,590

|

|||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $115,987,214)

|

145,602,646

|

||||||

The accompanying notes are an integral part of these financial statements.

15

Hodges Fund

|

SCHEDULE OF INVESTMENTS at March 31, 2023 (Continued)

|

|

Notional

|

|||||||||||

|

Shares

|

Amount

|

Value

|

|||||||||

|

CALL OPTIONS PURCHASED: 3.2%

|

|||||||||||

|

Machinery – Diversified: 1.2%

|

|||||||||||

|

1,000

|

AGCO Corp.,

|

||||||||||

|

Expiration:

|

|||||||||||

|

May 2023,

|

|||||||||||

|

Exercise Price:

$120.00

|

|||||||||||

|

$

|

13,520,000

|

$

|

1,830,000

|

||||||||

|

Pharmaceuticals: 0.6%

|

|||||||||||

|

250

|

Novo Nordisk A/S,

|

||||||||||

|

Expiration:

|

|||||||||||

|

June 2023,

|

|||||||||||

|

Exercise Price:

$125.00

|

|||||||||||

|

3,978,500

|

913,750

|

||||||||||

|

Semiconductors: 1.4%

|

|||||||||||

|

250

|

NVIDIA Corp.,

|

||||||||||

|

Expiration:

|

|||||||||||

|

June 2023,

|

|||||||||||

|

Exercise Price:

$200.00

|

|||||||||||

|

6,944,250

|

2,090,625

|

||||||||||

|

TOTAL CALL OPTIONS PURCHASED

|

|||||||||||

|

(Cost $3,883,810)

|

4,834,375

|

||||||||||

|

TOTAL INVESTMENTS IN SECURITIES: 99.7%

|

|||||||||||

|

(Cost $119,871,024)

|

150,437,021

|

||||||||||

|

Other Assets in Excess of Liabilities: 0.3%

|

498,460

|

||||||||||

|

TOTAL NET ASSETS: 100.0%

|

$

|

150,935,481

|

|||||||||

|

1

|

Non-income producing security.

|

The accompanying notes are an integral part of these financial statements.

16

Small Cap Fund

|

SCHEDULE OF INVESTMENTS at March 31, 2023

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS: 98.0%

|

|||||||

|

Airlines: 3.2%

|

|||||||

|

60,000

|

Alaska Air Group, Inc. 1

|

$

|

2,517,600

|

||||

|

275,000

|

Frontier Group Holdings, Inc. 1

|

2,706,000

|

|||||

|

25,000

|

Spirit Airlines, Inc.

|

429,250

|

|||||

|

5,652,850

|

|||||||

|

Apparel: 3.5%

|

|||||||

|

200,000

|

On Holding AG – Class A 1

|

6,206,000

|

|||||

|

Apparel & Shoe Retail: 2.1%

|

|||||||

|

150,000

|

Shoe Carnival, Inc.

|

3,847,500

|

|||||

|

Automobile: 2.1%

|

|||||||

|

17,000

|

Group 1 Automotive, Inc.

|

3,849,140

|

|||||

|

Banks: 7.9%

|

|||||||

|

60,000

|

Comerica, Inc.

|

2,605,200

|

|||||

|

25,000

|

Cullen/Frost Bankers, Inc.

|

2,633,500

|

|||||

|

180,000

|

Hilltop Holdings, Inc.

|

5,340,600

|

|||||

|

57,000

|

Prosperity Bancshares, Inc.

|

3,506,640

|

|||||

|

14,085,940

|

|||||||

|

Building Materials: 5.0%

|

|||||||

|

60,000

|

Eagle Materials, Inc.

|

8,805,000

|

|||||

|

Commercial Services: 3.4%

|

|||||||

|

75,000

|

Lawson Products, Inc. 1

|

3,409,500

|

|||||

|

150,000

|

Toast, Inc. – Class A 1

|

2,662,500

|

|||||

|

6,072,000

|

|||||||

|

Computers: 1.5%

|

|||||||

|

110,000

|

NCR Corp. 1

|

2,594,900

|

|||||

|

Electrical Components & Equipment: 2.9%

|

|||||||

|

28,000

|

Encore Wire Corp.

|

5,189,240

|

|||||

|

Electronics: 3.6%

|

|||||||

|

50,000

|

Avnet, Inc.

|

2,260,000

|

|||||

|

170,000

|

Kimball Electronics, Inc. 1

|

4,097,000

|

|||||

|

6,357,000

|

|||||||

|

Entertainment: 2.5%

|

|||||||

|

300,000

|

Cinemark Holdings, Inc. 1

|

4,437,000

|

|||||

|

Food: 3.9%

|

|||||||

|

100,000

|

Sprouts Farmers Market, Inc. 1

|

3,503,000

|

|||||

|

450,000

|

SunOpta, Inc. 1

|

3,465,000

|

|||||

|

6,968,000

|

|||||||

|

Healthcare Products: 5.6%

|

|||||||

|

150,000

|

Bausch + Lomb Corp. 1

|

2,611,500

|

|||||

|

130,000

|

Inmode Ltd. 1

|

4,154,800

|

|||||

|

50,000

|

STAAR Surgical Co. 1

|

3,197,500

|

|||||

|

9,963,800

|

|||||||

|

Home Builders: 4.0%

|

|||||||

|

185,000

|

Taylor Morrison Home Corp. 1

|

7,078,100

|

|||||

|

Home Furnishings: 4.7%

|

|||||||

|

140,000

|

Ethan Allen Interiors, Inc.

|

3,844,400

|

|||||

|

60,000

|

The Lovesac Co. 1

|

1,734,000

|

|||||

|

11,000

|

RH 1

|

2,679,050

|

|||||

|

8,257,450

|

|||||||

|

Insurance: 1.3%

|

|||||||

|

45,868

|

Goosehead Insurance, Inc. – Class A 1

|

2,394,310

|

|||||

|

Internet: 0.9%

|

|||||||

|

60,000

|

Revolve Group, Inc. – Class A 1

|

1,578,000

|

|||||

|

Iron & Steel: 5.5%

|

|||||||

|

320,000

|

Cleveland-Cliffs, Inc. 1

|

5,865,600

|

|||||

|

80,000

|

Commercial Metals Co.

|

3,912,000

|

|||||

|

9,777,600

|

|||||||

|

Leisure Time: 5.5%

|

|||||||

|

30,000

|

Brunswick Corp.

|

2,460,000

|

|||||

|

125,000

|

Norwegian Cruise Line Holdings Ltd. 1

|

1,681,250

|

|||||

|

200,000

|

Vista Outdoor, Inc. 1

|

5,542,000

|

|||||

|

9,683,250

|

|||||||

|

Lodging: 1.6%

|

|||||||

|

45,000

|

Boyd Gaming Corp.

|

2,885,400

|

|||||

|

Machinery – Diversified: 1.0%

|

|||||||

|

10,000

|

Alamo Group, Inc.

|

1,841,600

|

|||||

|

Oil Companies Exploration & Production: 11.0%

|

|||||||

|

175,000

|

Matador Resources Co.

|

8,338,750

|

|||||

|

350,000

|

Permian Resources Corp. – Class A

|

3,675,000

|

|||||

|

265,000

|

SM Energy Co.

|

7,462,400

|

|||||

|

19,476,150

|

|||||||

|

Packaging & Containers: 2.2%

|

|||||||

|

150,000

|

Graphic Packaging Holding Co.

|

3,823,500

|

|||||

|

Restaurants: 1.2%

|

|||||||

|

20,000

|

Texas Roadhouse, Inc.

|

2,161,200

|

|||||

|

Semiconductors: 4.8%

|

|||||||

|

45,000

|

Diodes, Inc. 1

|

4,174,200

|

|||||

|

40,000

|

Kulicke & Soffa Industries, Inc.

|

2,107,600

|

|||||

|

35,000

|

Silicon Motion

|

||||||

|

Technology Corp. – ADR

|

2,293,200

|

||||||

|

8,575,000

|

|||||||

|

Software: 0.3%

|

|||||||

|

120,000

|

Upland Software, Inc. 1

|

516,000

|

|||||

|

Sporting Goods: 1.5%

|

|||||||

|

40,000

|

Academy Sports & Outdoors, Inc.

|

2,610,000

|

|||||

The accompanying notes are an integral part of these financial statements.

17

Small Cap Fund

|

SCHEDULE OF INVESTMENTS at March 31, 2023 (Continued)

|

|

Shares

|

Value

|

||||||

|

Telecommunications: 0.3%

|

|||||||

|

70,000

|

DZS, Inc. 1

|

$

|

552,300

|

||||

|

Transportation: 1.6%

|

|||||||

|

40,000

|

Kirby Corp. 1

|

2,787,999

|

|||||

|

U.S. Royalty Trusts: 3.4%

|

|||||||

|

3,500

|

Texas Pacific Land Corp.

|

5,953,570

|

|||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $117,918,114)

|

173,979,799

|

||||||

|

TOTAL INVESTMENTS IN SECURITIES: 98.0%

|

|||||||

|

(Cost $117,918,114)

|

173,979,799

|

||||||

|

Other Assets in Excess of Liabilities: 2.0%

|

3,565,057

|

||||||

|

TOTAL NET ASSETS: 100.0%

|

$

|

177,544,856

|

|||||

ADR – American Depositary Receipt

|

1

|

Non-income producing security.

|

The accompanying notes are an integral part of these financial statements.

18

Small Intrinsic Value Fund

|

SCHEDULE OF INVESTMENTS at March 31, 2023

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS: 96.5%

|

|||||||

|

Apparel & Shoe Retail: 2.1%

|

|||||||

|

31,000

|

Shoe Carnival, Inc.

|

$

|

795,150

|

||||

|

Banks: 13.3%

|

|||||||

|

9,500

|

BancFirst Corp.

|

789,450

|

|||||

|

32,000

|

Hilltop Holdings, Inc.

|

949,440

|

|||||

|

48,000

|

Home Bancshares, Inc.

|

1,042,080

|

|||||

|

19,000

|

Texas Capital BancShares, Inc. 1

|

930,240

|

|||||

|

24,000

|

Triumph Bancorp, Inc. 1

|

1,393,440

|

|||||

|

5,104,650

|

|||||||

|

Beverages: 1.4%

|

|||||||

|

138,000

|

Farmer Brothers Co. 1

|

532,680

|

|||||

|

Building Materials: 7.4%

|

|||||||

|

13,500

|

Builders FirstSource, Inc. 1

|

1,198,530

|

|||||

|

11,100

|

Eagle Materials, Inc.

|

1,628,925

|

|||||

|

2,827,455

|

|||||||

|

Chemicals: 2.2%

|

|||||||

|

20,800

|

AZZ, Inc.

|

857,792

|

|||||

|

Commercial Services: 4.7%

|

|||||||

|

30,000

|

European Wax Center, Inc. – Class A

|

570,000

|

|||||

|

4,100

|

Herc Holdings, Inc.

|

466,990

|

|||||

|

150,000

|

Research Solutions, Inc. 1

|

301,500

|

|||||

|

58,200

|

The GEO Group, Inc. 1

|

459,198

|

|||||

|

1,797,688

|

|||||||

|

Computers: 1.8%

|

|||||||

|

28,700

|

NCR Corp. 1

|

677,033

|

|||||

|

Electrical Components & Equipment: 1.9%

|

|||||||

|

4,000

|

Encore Wire Corp.

|

741,320

|

|||||

|

Electronics: 1.9%

|

|||||||

|

30,000

|

Kimball Electronics, Inc. 1

|

723,000

|

|||||

|

Engineering & Construction: 1.1%

|

|||||||

|

50,000

|

Southland Holdings, Inc. 1

|

420,000

|

|||||

|

Entertainment: 2.3%

|

|||||||

|

60,900

|

Cinemark Holdings, Inc. 1

|

900,711

|

|||||

|

Food: 8.2%

|

|||||||

|

8,500

|

John B Sanfilippo & Son, Inc.

|

823,820

|

|||||

|

11,500

|

Sprouts Farmers Market, Inc. 1

|

402,845

|

|||||

|

114,500

|

SunOpta, Inc. 1

|

881,650

|

|||||

|

20,500

|

TreeHouse Foods, Inc. 1

|

1,033,815

|

|||||

|

3,142,130

|

|||||||

|

Healthcare Products: 2.0%

|

|||||||

|

44,100

|

Bausch + Lomb Corp. 1

|

767,781

|

|||||

|

Home Builders: 3.2%

|

|||||||

|

32,000

|

Taylor Morrison Home Corp. 1

|

1,224,320

|

|||||

|

Home Furnishings: 4.1%

|

|||||||

|

36,000

|

Ethan Allen Interiors, Inc.

|

988,560

|

|||||

|

19,350

|

Sleep Number Corp. 1

|

588,434

|

|||||

|

1,576,994

|

|||||||

|

Insurance: 3.1%

|

|||||||

|

18,000

|

Horace Mann Educators Corp.

|

602,640

|

|||||

|

40,000

|

Tiptree, Inc.

|

582,800

|

|||||

|

1,185,440

|

|||||||

|

Internet: 2.8%

|

|||||||

|

75,000

|

CarParts.com, Inc. 1

|

400,500

|

|||||

|

93,000

|

Solo Brands, Inc. – Class A 1

|

667,740

|

|||||

|

1,068,240

|

|||||||

|

Iron & Steel: 4.5%

|

|||||||

|

58,000

|

Cleveland-Cliffs, Inc. 1

|

1,063,140

|

|||||

|

13,465

|

Commercial Metals Co.

|

658,438

|

|||||

|

1,721,578

|

|||||||

|

Leisure Time: 5.9%

|

|||||||

|

14,000

|

Brunswick Corp.

|

1,148,000

|

|||||

|

40,000

|

Vista Outdoor, Inc. 1

|

1,108,400

|

|||||

|

2,256,400

|

|||||||

|

Machinery – Diversified: 3.0%

|

|||||||

|

100,100

|

GrafTech International Ltd.

|

486,486

|

|||||

|

20,100

|

Ichor Holdings Ltd. 1

|

658,074

|

|||||

|

1,144,560

|

|||||||

|

Oil Companies Exploration & Production: 7.5%

|

|||||||

|

12,000

|

Chesapeake Energy Corp.

|

912,480

|

|||||

|

8,500

|

Chord Energy Corp.

|

1,144,100

|

|||||

|

35,000

|

HighPeak Energy, Inc.

|

805,000

|

|||||

|

2,861,580

|

|||||||

|

Oil Field Services: 2.0%

|

|||||||

|

105,000

|

ProPetro Holding Corp. 1

|

754,950

|

|||||

|

Pharmaceuticals: 1.1%

|

|||||||

|

18,100

|

Organon & Co.

|

425,712

|

|||||

|

Private Equity: 0.9%

|

|||||||

|

35,000

|

P10, Inc. – Class A

|

353,850

|

|||||

|

Real Estate: 2.0%

|

|||||||

|

38,000

|

Stratus Properties, Inc.

|

760,000

|

|||||

|

Semiconductors: 3.8%

|

|||||||

|

10,800

|

Diodes, Inc. 1

|

1,001,808

|

|||||

|

28,000

|

Photronics, Inc. 1

|

464,240

|

|||||

|

1,466,048

|

|||||||

|

Telecommunications: 2.3%

|

|||||||

|

26,100

|

Aviat Networks, Inc. 1

|

899,405

|

|||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $33,048,131)

|

36,986,467

|

||||||

The accompanying notes are an integral part of these financial statements.

19

Small Intrinsic Value Fund

|

SCHEDULE OF INVESTMENTS at March 31, 2023 (Continued)

|

|

Shares

|

Value

|

||||||

|

WARRANTS: 0.1%

|

|||||||

|

25,000

|

Southland Holdings, Inc.,

|

||||||

|

Expiration:

|

|||||||

|

September 2026 1

|

$

|

19,749

|

|||||

|

TOTAL WARRANTS

|

|||||||

|

(Cost $15,185)

|

19,749

|

||||||

|

TOTAL INVESTMENTS IN SECURITIES: 96.5%

|

|||||||

|

(Cost $33,063,316)

|

37,006,216

|

||||||

|

Other Assets in Excess of Liabilities: 3.5%

|

1,367,856

|

||||||

|

TOTAL NET ASSETS: 100.0%

|

$

|

38,374,072

|

|||||

|

1

|

Non-income producing security.

|

The accompanying notes are an integral part of these financial statements.

20

Blue Chip Equity Income Fund

|

SCHEDULE OF INVESTMENTS at March 31, 2023

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS: 97.5%

|

|||||||

|

Auto Manufacturers: 4.5%

|

|||||||

|

6,000

|

Tesla, Inc. 1

|

$

|

1,244,760

|

||||

|

Banks: 6.8%

|

|||||||

|

3,000

|

The Goldman Sachs Group, Inc.

|

981,330

|

|||||

|

7,000

|

JPMorgan Chase & Co.

|

912,170

|

|||||

|

1,893,500

|

|||||||

|

Beverages: 3.9%

|

|||||||

|

6,000

|

PepsiCo, Inc.

|

1,093,800

|

|||||

|

Building Products Retail: 5.9%

|

|||||||

|

3,250

|

The Home Depot, Inc.

|

959,140

|

|||||

|

3,500

|

Lowe’s Companies, Inc.

|

699,895

|

|||||

|

1,659,035

|

|||||||

|

Computers: 7.1%

|

|||||||

|

12,000

|

Apple, Inc.

|

1,978,800

|

|||||

|

Discount Retail: 3.6%

|

|||||||

|

2,000

|

Costco Wholesale Corp.

|

993,740

|

|||||

|

Diversified Financial Services: 3.5%

|

|||||||

|

6,000

|

American Express Co.

|

989,700

|

|||||

|

Insurance: 2.8%

|

|||||||

|

4,000

|

Chubb Ltd.

|

776,720

|

|||||

|

Internet: 3.0%

|

|||||||

|

8,000

|

Amazon.com, Inc. 1

|

826,320

|

|||||

|

Machinery – Diversified: 5.9%

|

|||||||

|

4,000

|

Deere & Co.

|

1,651,520

|

|||||

|

Oil Companies Exploration & Production: 1.8%

|

|||||||

|

5,000

|

ConocoPhillips

|

496,050

|

|||||

|

Oil Companies Integrated: 5.9%

|

|||||||

|

15,000

|

Exxon Mobil Corp.

|

1,644,900

|

|||||

|

Oil Refining & Marketing: 2.9%

|

|||||||

|

8,000

|

Phillips 66

|

811,040

|

|||||

|

Pharmaceuticals: 9.9%

|

|||||||

|

5,000

|

AbbVie, Inc.

|

796,850

|

|||||

|

8,000

|

Merck & Co., Inc.

|

851,120

|

|||||

|

7,000

|

Novo Nordisk A/S – Class A

|

1,113,980

|

|||||

|

2,761,950

|

|||||||

|

Pipelines: 3.4%

|

|||||||

|

15,000

|

ONEOK, Inc.

|

953,100

|

|||||

|

Semiconductors: 11.3%

|

|||||||

|

4,000

|

NVIDIA Corp.

|

1,111,080

|

|||||

|

10,000

|

Taiwan Semiconductor

|

||||||

|

Manufacturing Co. Ltd. – ADR

|

930,200

|

||||||

|

6,000

|

Texas Instruments, Inc.

|

1,116,060

|

|||||

|

3,157,340

|

|||||||

|

Software: 8.6%

|

|||||||

|

8,000

|

Activision Blizzard, Inc.

|

684,720

|

|||||

|

6,000

|

Microsoft Corp.

|

1,729,800

|

|||||

|

2,414,520

|

|||||||

|

Transportation: 6.7%

|

|||||||

|

4,500

|

Union Pacific Corp.

|

905,670

|

|||||

|

5,000

|

United Parcel Service, Inc. – Class B

|

969,950

|

|||||

|

1,875,620

|

|||||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $18,047,661)

|

27,222,415

|

||||||

|

TOTAL INVESTMENTS IN SECURITIES: 97.5%

|

|||||||

|

(Cost $18,047,661)

|

27,222,415

|

||||||

|

Other Assets in Excess of Liabilities: 2.5%

|

706,858

|

||||||

|

TOTAL NET ASSETS: 100.0%

|

$

|

27,929,273

|

|||||

ADR – American Depositary Receipt

|

1

|

Non-income producing security.

|

The accompanying notes are an integral part of these financial statements.

21

Hodges Mutual Funds

|

STATEMENTS OF ASSETS AND LIABILITIES at March 31, 2023

|

|

|

Small

|

Blue Chip

|

||||||||||||||

|

|

Small Cap

|

Intrinsic

|

Equity

|

|||||||||||||

|

|

Hodges Fund

|

Fund

|

Value Fund

|

Income Fund

|

||||||||||||

|

ASSETS

|

||||||||||||||||

|

Investments in unaffiliated securities, at value

|

$

|

150,437,021

|

$

|

173,979,799

|

$

|

37,006,216

|

$

|

27,222,415

|

||||||||

|

(Cost $119,871,024, $117,918,114, $33,063,316, and $18,047,661)

|

||||||||||||||||

|

Cash

|

1,853,415

|

502,862

|

2,184,653

|

307,218

|

||||||||||||

|

Receivables:

|

||||||||||||||||

|

Investment securities sold

|

1,085,292

|

4,666,024

|

—

|

448,456

|

||||||||||||

|

Fund shares sold

|

11,324

|

42,682

|

51,924

|

474

|

||||||||||||

|

Dividends and interest

|

39,599

|

134,850

|

11,504

|

27,730

|

||||||||||||

|

Prepaid expenses

|

14,657

|

23,424

|

20,044

|

11,648

|

||||||||||||

|

Total assets

|

153,441,308

|

179,349,641

|

39,274,341

|

28,017,941

|

||||||||||||

|

LIABILITIES

|

||||||||||||||||

|

Payables:

|

||||||||||||||||

|

Investment securities purchased

|

2,185,903

|

1,383,931

|

811,012

|

—

|

||||||||||||

|

Fund shares redeemed

|

2,050

|

72,183

|

14,635

|

2,772

|

||||||||||||

|

Investment advisory fees

|

82,209

|

148,503

|

17,581

|

8,059

|

||||||||||||

|

Fund administration fees

|

12,161

|

16,786

|

969

|

4,029

|

||||||||||||

|

Fund accounting fees

|

6,885

|

10,032

|

137

|

1,450

|

||||||||||||

|

Distribution fees

|

130,629

|

73,527

|

22,015

|

18,410

|

||||||||||||

|

Audit fees

|

25,797

|

25,804

|

23,800

|

23,800

|

||||||||||||

|

Transfer agent fees

|

6,954

|

7,536

|

2,859

|

3,216

|

||||||||||||

|

Custody fees

|

1,455

|

1,987

|

1,152

|

909

|

||||||||||||

|

Chief Compliance Officer fees

|

1,875

|

1,874

|

1,875

|

1,875

|

||||||||||||

|

Trustee fees

|

3,555

|

3,665

|

3,178

|

3,296

|

||||||||||||

|

Distribution to shareholders

|

—

|

—

|

—

|

6,664

|

||||||||||||

|

Sub-transfer agent fees

|

8,443

|

21,894

|

695

|

1,483

|

||||||||||||

|

Other accrued expenses

|

37,911

|

37,063

|

361

|

12,705

|

||||||||||||

|

Total liabilities

|

2,505,827

|

1,804,785

|

900,269

|

88,668

|

||||||||||||

|

NET ASSETS

|

$

|

150,935,481

|

$

|

177,544,856

|

$

|

38,374,072

|

$

|

27,929,273

|

||||||||

|

COMPONENTS OF NET ASSETS

|

||||||||||||||||

|

Paid-in capital

|

$

|

120,509,748

|

$

|

114,680,488

|

$

|

34,590,599

|

$

|

19,534,540

|

||||||||

|

Total distributable (accumulated) earnings (losses)

|

30,425,733

|

62,864,368

|

3,783,473

|

8,394,733

|

||||||||||||

|

Total net assets

|

$

|

150,935,481

|

$

|

177,544,856

|

$

|

38,374,072

|

$

|

27,929,273

|

||||||||

|

Net Asset Value (unlimited shares authorized):

|

||||||||||||||||

|

Retail Class:

|

||||||||||||||||

|

Net assets

|

$

|

150,935,481

|

$

|

139,428,303

|

$

|

38,374,072

|

$

|

27,929,273

|

||||||||

|

Shares of beneficial interest issued and outstanding

|

2,937,950

|

7,280,106

|

2,285,467

|

1,550,521

|

||||||||||||

|

Net asset value, offering price, and redemption price per share

|

$

|

51.37

|

$

|

19.15

|

$

|

16.79

|

$

|

18.01

|

||||||||

|

Institutional Class:

|

||||||||||||||||

|

Net assets

|

$

|

—

|

$

|

38,116,553

|

$

|

—

|

$

|

—

|

||||||||

|

Shares of beneficial interest issued and outstanding

|

—

|

1,863,474

|

—

|

—

|

||||||||||||

|

Net asset value, offering price, and redemption price per share

|

$

|

—

|

$

|

20.45

|

$

|

—

|

$

|

—

|

||||||||

The accompanying notes are an integral part of these financial statements.

22

Hodges Mutual Funds

|

STATEMENTS OF OPERATIONS For the Year Ended March 31,

2023

|

|

|

Small

|

Blue Chip

|

||||||||||||||

|

|

Small Cap

|

Intrinsic

|

Equity

|

|||||||||||||

|

|

Hodges Fund

|

Fund

|

Value Fund

|

Income Fund

|

||||||||||||

|

INVESTMENT INCOME

|

||||||||||||||||

|

Dividends from unaffiliated securities

|

$

|

1,334,770

|

$

|

2,513,930

|

$

|

498,070

|

$

|

573,966

|

||||||||

|

(net of $-, $95, $-, and $3,316 foreign withholding tax, respectively)

|

||||||||||||||||

|

Other income

|

1,340

|

1,363

|

1,183

|

1,194

|

||||||||||||

|

Total investment income

|

1,336,110

|

2,515,293

|

499,253

|

575,160

|

||||||||||||

|

EXPENSES

|

||||||||||||||||

|

Investment advisory fees

|

1,276,349

|

1,571,966

|

209,848

|

176,025

|

||||||||||||

|

Distribution fees – Retail Class

|

375,397

|

360,227

|

61,720

|

67,702

|

||||||||||||

|

Fund administration fees

|

79,188

|

105,308

|

20,956

|

26,018

|

||||||||||||

|

Sub-transfer agent fees

|

70,409

|

157,654

|

8,406

|

8,024

|

||||||||||||

|

Fund accounting fees

|

45,526

|

65,706

|

6,979

|

10,003

|

||||||||||||

|

Transfer agent fees

|

43,391

|

47,247

|

19,135

|

19,563

|

||||||||||||

|

Miscellaneous expenses

|

30,770

|

26,882

|

12,667

|

14,151

|

||||||||||||

|

Registration expenses

|

25,711

|

43,171

|

22,404

|

20,263

|

||||||||||||

|

Audit fees

|

23,644

|

23,644

|

23,645

|

23,645

|

||||||||||||

|

Reports to shareholders

|

22,630

|

23,239

|

3,962

|

4,002

|

||||||||||||

|

Trustees fees

|

19,772

|

20,562

|

17,784

|

17,945

|

||||||||||||

|

Chief Compliance Officer fees

|

11,250

|

11,250

|

11,250

|

11,250

|

||||||||||||

|

Interest expense

|

12,074

|

2,135

|

—

|

75

|

||||||||||||

|

Legal fees

|

8,208

|

8,207

|

8,207

|

8,207

|

||||||||||||

|

Custody fees

|

6,625

|

10,320

|

6,629

|

5,456

|

||||||||||||

|

Insurance expenses

|

6,009

|

5,946

|

5,206

|

5,359

|

||||||||||||

|

Total expenses

|

2,056,953

|

2,483,464

|

438,798

|

417,688

|

||||||||||||

|

Less: fees waived

|

(285,080

|

)

|

—

|

(120,325

|

)

|

(65,638

|

)

|

|||||||||

|

Net expenses

|

1,771,873

|

2,483,464

|

318,473

|

352,050

|

||||||||||||

|

Net investment income (loss)

|

(435,763

|

)

|

31,829

|

180,780

|

223,110

|

|||||||||||

|

|

||||||||||||||||

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS

|

||||||||||||||||

|

Net realized gain (loss) on transactions from:

|

||||||||||||||||

|

Unaffiliated investments

|

2,116,282

|

10,493,744

|

(3,954

|

)

|

(780,034

|

)

|

||||||||||

|

Affiliated investments

|

(10,437

|

)

|

—

|

—

|

—

|

|||||||||||

|

Options written

|

191,699

|

—

|

—

|

—

|

||||||||||||

|

Net realized gain (loss)

|

2,297,544

|

10,493,744

|

(3,954

|

)

|

(780,034

|

)

|

||||||||||

|

Net change in unrealized appreciation/depreciation on:

|

||||||||||||||||

|

Unaffiliated investments

|

(22,860,120

|

)

|

(21,028,141

|

)

|

(930,891

|

)

|

(1,073,740

|

)

|

||||||||

|

Affiliated investments

|

(2,791,232

|

)

|

—

|

—

|

—

|

|||||||||||

|

Options written

|

(180,123

|

)

|

9,010

|

—

|

—

|

|||||||||||

|

Net unrealized appreciation/depreciation

|

(25,831,475

|

)

|

(21,019,131

|

)

|

(930,891

|

)

|

(1,073,740

|

)

|

||||||||

|

Net realized and unrealized gain (loss) on investments

|

(23,533,931

|

)

|

(10,525,387

|

)

|

(934,845

|

)

|

(1,853,774

|

)

|

||||||||

|

Net increase (decrease) in net

|

||||||||||||||||

|

assets resulting from operations

|

$

|

(23,969,694

|

)

|

$

|

(10,493,558

|

)

|

$

|

(754,065

|

)

|

$

|

(1,630,664

|

)

|

||||

The accompanying notes are an integral part of these financial statements.

23

Hodges Fund

|

STATEMENTS OF CHANGES IN NET ASSETS

|

|

|

Year Ended

|

Year Ended

|

||||||

|

|

March 31, 2023

|

March 31, 2022

|

||||||

|

INCREASE (DECREASE) IN NET ASSETS FROM:

|

||||||||

|

|

||||||||

|

OPERATIONS

|

||||||||

|

Net investment income (loss)

|

$

|

(435,763

|

)