Form N-CSR Northern Lights Fund For: Nov 30

united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-23066

Northern Lights Fund Trust IV

(Exact name of registrant as specified in charter)

225 Pictoria Drive , Suite 450,Cincinnati, Ohio 45246

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-490-4300

Date of fiscal year end: 11/30

Date of reporting period: 11/30/22

Item 1. Reports to Stockholders.

|

| Inspire Global Hope ETF (BLES) |

| Inspire Small/Mid Cap ETF (ISMD) |

| Inspire Corporate Bond ETF (IBD) |

| Inspire 100 ETF (BIBL) |

| Inspire International ETF (WWJD) |

| (formerly known as Inspire International ESG ETF) |

| Inspire Tactical Balanced ETF (RISN) |

| (formerly known as Inspire Tactical Balanced ESG ETF) |

| Inspire Faithward Mid Cap Momentum ETF (GLRY) |

| (formerly known as Inspire Faithward Mid Cap Momentum ESG ETF) |

| Inspire Fidelis Multi Factor ETF (FDLS) |

| Annual Report |

| November 30, 2022 |

| 1-877-658-9473 |

| www.inspireetf.com |

INSPIRE ETF ANNUAL REPORT

| SHAREHOLDER LETTER (unaudited) |

Dear Shareholders:

We are honored and privileged to present you with the Annual Report for the Inspire Investing suite of Exchange Traded Funds (ETFs) as of November 30, 2022.

With a slowing economy, the highest inflation numbers in four decades and the Federal Reserve raising interest rates at an accelerated rate over the past year we have seen the much anticipated correction in the equity markets turn into a true bear market. Not all the headwinds are resolved, but we are exceedingly grateful to look back at 2022 and see the protection and provision that God gave us at Inspire, as well as our advisors and clients. We could not do what we do without you and we sincerely appreciate the trust you have placed in Inspire by investing in one or more of the ETFs.

BLES – Inspire Global Hope ETF

As the global economy slowed down due to high inflation and increased interest rates, BLES participated in the market correction with negative returns over the past twelve months ended November 30, 2022. BLES has a target weight of 50% US Large Cap stocks, 40% international developed markets stocks and 10% emerging markets stocks. The US markets along with the international and emerging markets all slipped into bear market territory during the year but rallied to finish the fiscal year just outside the “correction” threshold of down -10% or more. For the twelve months ended November 30, 2022, BLES was down -8.54% on a market price basis and -8.59% on the NAV. Since inception (2-27-2017) BLES has an annualized return of 8.14% on a market price basis and 8.09 on the NAV.

ISMD – Inspire Small/Mid Cap ETF

The small cap and mid cap markets actually outperformed the large cap market for the year by being down less. Even with the small cap and mid cap markets outperforming the large cap markets they fell short of positive returns. For the twelve months ended November 30, 2022, ISMD returned -4.07% on a market price basis and -3.34% on the NAV. Since inception (2-27-2017), ISMD has an annualized return of 7.36% on a market price basis and 7.49% on the NAV.

IBD – Inspire Corporate Bond ETF

The Federal Reserve jumped off the sidelines and initiated the most aggressive interest rate increase path over the past year that we have seen in quite some time as well as trimming their balance sheet at the same time. Due to rising inflation and a slowing economy, interest rates rose dramatically during the year across the yield curve manifesting in negative total returns for IBD over the past fiscal year. We believe interest rates will continue to move upward for the next 6 months but should peak in early 2023. For the twelve months ended November 30, 2022, IBD returned -9.20% on a market price basis and -9.64% on the NAV. Since inception (7-10-2017), IBD has an annualized return of 0.36% on a market price basis and 0.31% on the NAV.

1

BIBL – Inspire 100 ETF

BIBL has 100 US Large Cap positions that are capitalization weighted and is designed to give advisors and investors a biblically responsible alternative to the popular market cap weighted

funds that are so prevalent in the marketplace (i.e. SPY or VOO). BIBL suffered along with the correction in the US and global markets and suffered double-digit negative returns this year. For the twelve months ended November 30, 2022, BIBL was down -14.85% on a market price basis and -14.69% on the NAV. Since inception (10-30-2017) BIBL has an annualized return of 9.61% on a market price basis and 9.64% on the NAV.

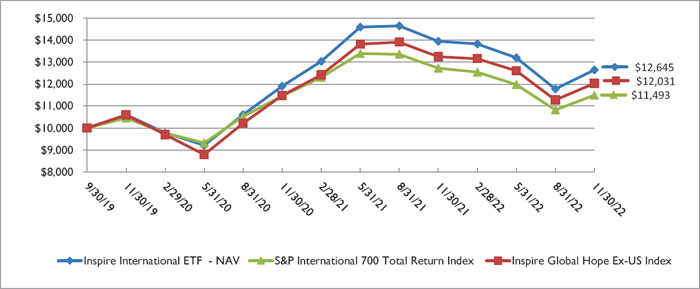

WWJD – Inspire International ETF

WWJD reached its 3rd anniversary on 9-30-2022 and holds approximately 200 stocks with an 80% exposure to international developed markets and 20% to emerging markets. Although the international and emerging markets participated in the global market correction along with the US large cap markets, the performance has been in line with expectations given the global market pullback. We believe the global economy will recover in the coming couple of years and the international and emerging markets should play a more positive role in portfolios in 2023. For the twelve months ended November 30, 2022, WWJD was down -9.34% on a market price basis and -9.32% on the NAV. Since inception (9-30-2019), WWJD has an annualized return of 7.95% on a market price basis and 7.69% on the NAV.

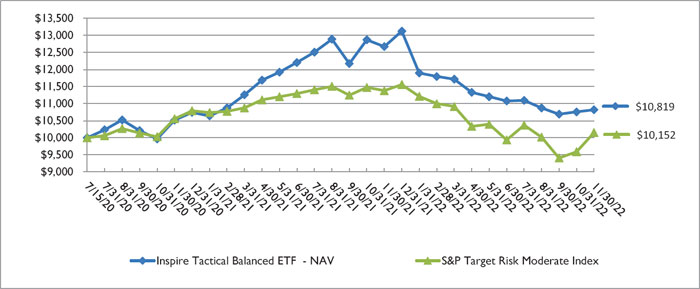

RISN – Inspire Tactical Balanced ETF

RISN was launched in the middle of the pandemic on 7-15-2020 and now has more than two full years of history. RISN holds an 80% exposure to US large cap stocks and 20% to US fixed income during normal market condition but is adjusted to a neutral allocation of 50% US large cap stocks/50% US fixed income or a conservative allocation of 20% US large cap stocks/80% US fixed income when deemed appropriate by the portfolio managers. RISN has been in a very defensive/conservative allocation most of the fiscal year due to the risk metrics seen during the market correction/bear market. It is possible for the fund to transition toward the normal market allocation targets in 2023 but that will depend on how the market and economy move in the next few months. For the twelve months ended November 30, 2022, RISN was down -14.56% on a market price basis and -14.63% on the NAV. Since inception (7-15-2020), RISN has an annualized return of 3.40% on a market price basis and 3.36% on the NAV.

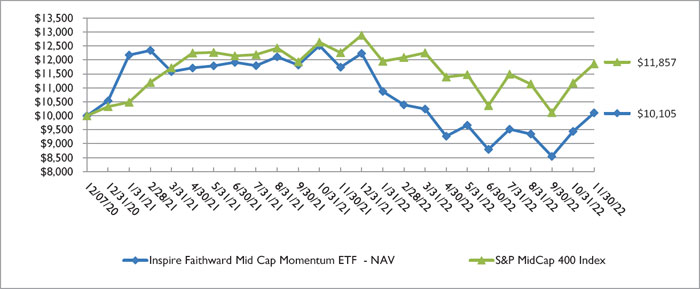

GLRY – Inspire Faithward Mid Cap Momentum ETF

GLRY was launched as an active fund in the mid cap momentum space. GLRY will hold between 35 and 45 stocks that have a market capitalization between $3 billion and $13 billion and that the portfolio managers believe have the best opportunity for outperformance in the near term. GLRY utilizes a dual screening approach that overlays a quantitative investment screening process, called FEVRR, on top of the Inspire Impact Score methodology, which identifies some of the most inspiring, biblically aligned companies in the world. The FEVRR process screens companies based on financial health, earnings trends, valuation, relative strength, and risk to find high-quality stocks with strong earning potential. For the twelve months ended November 30, 2022, GLRY was down -14.07% on a market price basis and -13.89% on the NAV. Since inception (12-07-2020), GLRY has an annualized return of 0.49% on a market price basis and 0.53% on the NAV.

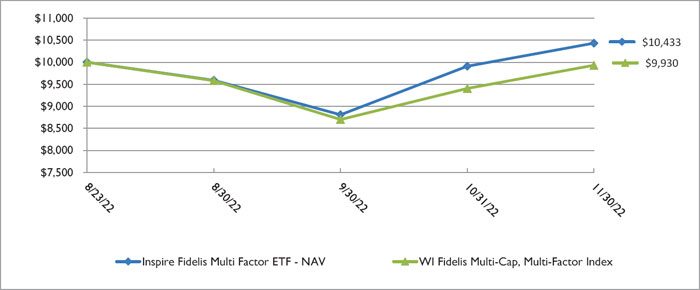

FDLS – Inspire Fidelis Multi Factor ETF

FDLS was launched on 8-23-2022 as a globally diversified fund with exposure to companies across the large cap, mid cap, small cap and micro space as well as international developed and emerging markets. FDLS holds 100 positions to replicate the holdings and weights of the WI Fidelis Multi-Cap, Multi-Factor Index. In addition to using the Inspire Impact Score as one of the factors, the index also incorporates fundamental and quantitative factor analysis to select the constituents on a quarterly rebalancing

2

schedule. Since FDLS has less than twelve months of history as of November 30, 2022, the performance since inception (8-23-2022), is 4.69% on a market price basis and 4.33% on the NAV.

Closing Comments

2022 has been another challenging year as the world saw a slowing economy, rising interest rates, high inflation and continued geo-political tensions that have brought on a global correction in the capital markets. Some believe this is a bear market that isn’t ready to go into hibernation yet. We have all been subject to some difficulties this year but we are thankful to God our Father for His provision and protection. We pray the Lord has protected and provided for you and your family and will keep you safe and healthy in the coming year. We are also grateful to be part of the mission of making a positive impact in the world through these ETFs alongside you, our brothers and sisters in Christ and fellow shareholders.

Even with the many challenges mentioned above we hope that we can return to a more normal year in 2023. The bottom line is that - God is Sovereign, and our trust is in Him, not in politicians or the markets.

Thank you again for being shareholders, but more importantly thank you for being co-workers with us in making a positive impact in the world by inspiring transformation for God’s Glory.

May the Grace and Peace of Jesus Christ our Lord be with you in 2023.

Sincerely,

Darrell Jayroe

Senior Portfolio Manager

Inspire Investing

The views in this report were those of the Author as of November 30, 2022 and may not reflect their views on the date that this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments and do not constitute investment advice.

Inspire, the Adviser, provides certain indices that the Inspire ETFs track. The indices use software that analyzes publicly available data relating to the primary business activities, products and services, philanthropy, legal activities, policies, and practices when assigning Inspire Impact Scores to a company. The securities with the highest Inspire Impact Scores are included in the indices and are equally weighted. As an ETF may not fully replicate its index, it is subject to the risk that investment management strategy may not produce the intended results. There is no guarantee that the Funds will achieve their objective, generate positive returns, or avoid losses.

Biblically Responsible Investment Risk. The Funds utilize related biblical values screening criteria in selecting its component securities. As a result of its strategy, a Funds’ exclusion of securities of certain issuers for nonfinancial reasons may cause the Fund to forgo some market opportunities available to funds that do not use these criteria. This could be due to biblically responsible companies falling out of favor with investors or failing to perform as well as companies that do not screen favorably.

3

ETF shares are not redeemable with the issuing fund other than in large creation unit aggregations. Instead, investors must buy or sell ETF Shares in the secondary market with the assistance of a stockbroker. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling. Each Fund may focus its investments in securities of a particular industry to the extent its Index does. This may cause the Funds’ net asset value to fluctuate more than that of a fund that does not focus in a particular industry.

BLES, ISMD, IBD, BIBL, WWJD and FDLS are not actively managed and the adviser will not sell shares of an equity security due to current or projected underperformance of a security, industry or sector, unless that security is removed from the index or the selling of shares of that security is otherwise required upon a rebalancing of the index as addressed in the index methodology. Tracking error may occur because of imperfect correlation between the Funds’ holdings of portfolio securities and those in the index. The use of a representative sampling approach could result in a fund holding a smaller number of securities than are in the index. To the extent the assets in the Funds are smaller, these risks will be greater.

Before investing, consider the Funds’ investment objectives, risks, charges and expenses. To obtain a prospectus which contains this and other information, call 877.658.9473, or visit http://www.inspireetf.com. Read it carefully. The Inspire ETFs are distributed by Foreside Distributors, LLC.

Inspire and Foreside Distributors, LLC are not affiliated.

4

Inspire

Global Hope ETF

PORTFOLIO REVIEW (Unaudited)

November 30, 2022

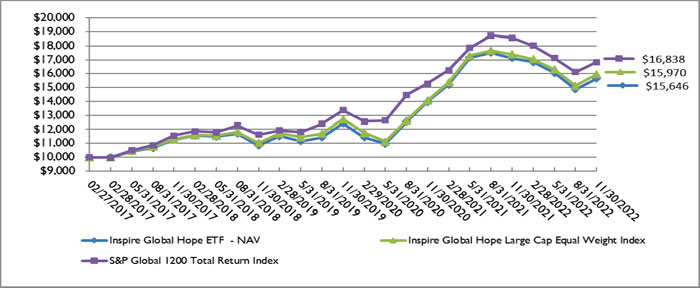

The Fund’s performance figures* for the periods ended November 30, 2022, as compared to its benchmarks:

| Annualized | ||||

| Annualized | Annualized | Since Inception** - | ||

| One Year | Three Year | Five Year | November 30, 2022 | |

| Inspire Global Hope ETF - NAV | (8.59)% | 7.99% | 6.80% | 8.09% |

| Inspire Global Hope ETF - Market Price | (8.54)% | 7.67% | 6.92% | 8.14% |

| Inspire Global Hope Large Cap Equal Weight Index *** | (8.25)% | 7.85% | 7.19% | 8.47% |

| S&P Global 1200 Total Return Index **** | (9.40)% | 8.01% | 7.81% | 9.47% |

| * | The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of the Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.inspireetf.com or by calling 1-877-658-9473. |

The Fund’s per share net asset value or NAV is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. Since November 2, 2020, market price returns are calculated using the closing price and account for distributions from the Fund. Prior to November 2, 2020, market price returns were calculated using the midpoint price and accounted for distributions from the Fund. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. The Fund’s adviser had contractually agreed to reduce its fees and/or absorb expenses of the Fund until March 31, 2022 to ensure that total annual fund operating expenses after fee waiver and/or reimbursement (exclusive of any front-end or contingent deferred loads, taxes, brokerage fees and commissions, borrowing costs (such as interest and dividend expense on securities sold short), acquired fund fees and expenses, fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses), or extraordinary expenses such as litigation) did not exceed 0.52% of average daily net assets. Effective April 1, 2022 the Fund does not have a waiver agreement in place. The fee waiver and expense reimbursements are subject to possible recoupment from the Fund by the adviser in future years (within the three years after the fees have been waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or those in place at the time of recapture. The Fund’s total annual operating expenses (gross) are 0.49% per the March 30, 2022 prospectus.

| ** | As of the commencement of operations on February 27, 2017. |

| *** | Inspire Global Hope Large Cap Equal Weight Index (BLESI) tracks the stock performance of 400 of the most inspiring large cap companies from around the globe, as determined by the adviser’s revolutionary Inspire Impact Score4 methodology which measures a company’s positive impact on the world. Under normal circumstances, the index will be comprised of 50% US large cap companies, 40% international developed large cap companies and 10% emerging market large cap companies. Inspire defines “large cap” as a market capitalization of $5B or greater. The index is equally weighted, rebalanced quarterly and calculated on a gross total return basis in United States Dollars. Investors cannot invest directly in an index. |

| **** | The S&P Global 1200 Total Return Index provides efficient exposure to the global equity market. Capturing approximately 70% of global market capitalization, it is constructed as a composite of 7 headline indices, many of which are accepted leaders in their regions. These include the S&P 500® (US), S&P Europe 350, S&P TOPIX 150 (Japan), S&P/TSX 60 (Canada), S&P/ASX All Australian 50, S&P Asia 50 and S&P Latin America 40. Investors cannot invest directly in an index. |

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, the Fund’s performance is negatively impacted by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

5

Inspire

Global Hope ETF

PORTFOLIO REVIEW (Unaudited)(Continued)

November 30, 2022

Comparison of the Change in Value of a $10,000 Investment

The Fund’s Top Sectors and Industries are as follows:

| Sectors/Industries | % of Net Assets | |||

| Oil & Gas Producers | 7.9 | % | ||

| Banking | 7.0 | % | ||

| Electric Utilities | 6.2 | % | ||

| Medical Equipment & Devices | 4.3 | % | ||

| Chemicals | 4.1 | % | ||

| Semiconductors | 3.6 | % | ||

| Metals & Mining | 3.5 | % | ||

| Insurance | 3.5 | % | ||

| Software | 3.4 | % | ||

| Technology Services | 3.3 | % | ||

| Collateral For Securities Loaned | 0.7 | % | ||

| Other Sectors | 52.0 | % | ||

| Other Assets in Excess of Liabilities | 0.5 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments in this Annual Report for a detailed listing of the Fund’s holdings.

6

Inspire

Small/Mid Cap ETF

PORTFOLIO REVIEW (Unaudited)

November 30, 2022

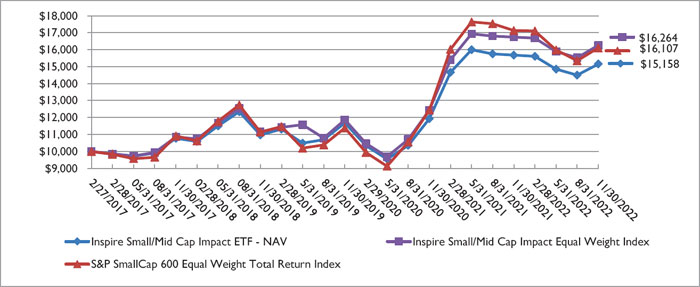

The Fund’s performance figures* for the periods ended November 30, 2022, as compared to its benchmarks:

| Annualized | ||||

| Annualized | Annualized | Since Inception** - | ||

| One Year | Three Year | Five Year | November 30, 2022 | |

| Inspire Small/Mid Cap Impact ETF - NAV | (3.34)% | 9.07% | 7.06% | 7.49% |

| Inspire Small/Mid Cap Impact ETF - Market Price | (4.07)% | 8.80% | 6.91% | 7.36% |

| Inspire Small/Mid Cap Impact Equal Weight Index *** | (2.87)% | 11.06% | 8.41% | 8.82% |

| S&P SmallCap 600 Equal Weight Total Return Index **** | (5.98)% | 12.25% | 8.09% | 8.63% |

| * | The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of the Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.inspireetf.com or by calling 1-877-658-9473. |

The Fund’s per share net asset value or NAV is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. Since November 2, 2020, market price returns are calculated using the closing price and account for distributions from the Fund. Prior to November 2, 2020, market price returns were calculated using the midpoint price and accounted for distributions from the Fund. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. The Fund’s adviser had contractually agreed to reduce its fees and/or absorb expenses of the Fund until March 31, 2022 to ensure that total annual fund operating expenses after fee waiver and/or reimbursement (exclusive of any front-end or contingent deferred loads, taxes, brokerage fees and commissions, borrowing costs (such as interest and dividend expense on securities sold short), acquired fund fees and expenses, fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses), or extraordinary expenses such as litigation) did not exceed 0.60% of average daily net assets. Effective April 1, 2022 the Fund does not have a waiver agreement in place. The fee waiver and expense reimbursements are subject to possible recoupment from the Fund by the adviser in future years (within the three years after the fees have been waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or those in place at the time of recapture. The Fund’s total annual operating expenses (gross) are 0.48% per the March 30, 2022 prospectus.

| ** | As of the commencement of operations on February 27, 2017. |

| *** | Inspire Small/Mid Cap Impact Equal Weight Index (ISMDI) tracks the stock performance of 500 of the most inspiring small and mid cap companies in the U.S., as determined by the adviser’s revolutionary Inspire Impact Score4 methodology which measures a company’s positive impact on the world. Under normal circumstances the index will be comprised of 50% U.S. mid cap companies with market cap between $2B-3.5B, and 50% U.S. small cap companies with market cap between $1B-2B. The adviser believes that companies in this “smid cap” capitalization range have the potential to deliver above average growth. The index is equally weighted, rebalanced quarterly and calculated on a gross total return basis in United States Dollars. Investors cannot invest directly in an index. |

| **** | The S&P SmallCap 600 Equal Weight Total Return Index (EWI) is the equal-weight version of the S&P SmallCap 600. The index has the same constituents as the capitalization weighted S&P SmallCap 600, but each company in the S&P SmallCap 600 EWI is allocated a fixed weight. Investors cannot invest directly in an index. |

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, the Fund’s performance is negatively impacted by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

7

Inspire

Small/Mid Cap ETF

PORTFOLIO REVIEW (Unaudited)(Continued)

November 30, 2022

Comparison of the Change in Value of a $10,000 Investment

The Fund’s Top Sectors and Industries are as follows:

| Sectors/Industries | % of Net Assets | |||

| Banking | 10.1 | % | ||

| Machinery | 4.4 | % | ||

| Semiconductors | 4.1 | % | ||

| Biotech & Pharma | 3.9 | % | ||

| Software | 3.9 | % | ||

| Chemicals | 3.8 | % | ||

| Technology Hardware | 3.8 | % | ||

| Insurance | 3.4 | % | ||

| Retail - Discretionary | 3.1 | % | ||

| Home Construction | 3.0 | % | ||

| Collateral For Securities Loaned | 0.8 | % | ||

| Other Sectors | 55.6 | % | ||

| Other Assets in Excess of Liabilities | 0.1 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments in this Annual Report for a detailed listing of the Fund’s holdings.

8

Inspire

Corporate Bond ETF

PORTFOLIO REVIEW (Unaudited)

November 30, 2022

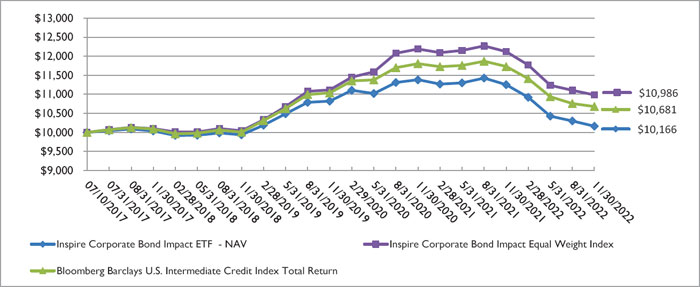

The Fund’s performance figures* for the periods ended November 30, 2022, as compared to its benchmarks:

| Annualized | ||||

| Annualized | Annualized | Since Inception** - | ||

| One Year | Three Year | Five Year | November 30, 2022 | |

| Inspire Corporate Bond Impact ETF - NAV | (9.64)% | (2.07)% | 0.26% | 0.31% |

| Inspire Corporate Bond Impact ETF - Market Price | (9.20)% | (2.05)% | 0.20% | 0.36% |

| Inspire Corporate Bond Impact Equal Weight Index *** | (9.36)% | (0.39)% | 1.69% | 1.76% |

| Bloomberg U.S. Intermediate Credit Total Return Index **** | (8.93)% | (1.08)% | 1.15% | 1.23% |

| * | The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of the Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.inspireetf.com or by calling 1-877-658-9473. |

The Fund’s per share net asset value or NAV is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. Since November 2, 2020, market price returns are calculated using the closing price and account for distributions from the Fund. Prior to November 2, 2020, market price returns were calculated using the midpoint price and accounted for distributions from the Fund. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. The Fund’s total annual operating expenses (gross) are 0.44% per the March 30, 2022 prospectus.

| ** | As of the commencement of operations on July 10, 2017. |

| *** | Inspire Corporate Bond Impact Equal Weight Index (INSP BOND) is comprised of 250 investment grade, intermediate term corporate bonds issued by some of the most inspiring large cap “blue chip” companies in the United States, as determined by Inspire’s revolutionary Inspire Impact Score methodology which measures a company’s positive impact on the world. The adviser defines “large cap” as a market capitalization of $5B or greater and “investment grade” as BBB-/Baa3 or higher. The index is equally weighted, rebalanced quarterly and calculated on a total return basis in U.S. Dollars (“USD”). Investors cannot invest directly in an index. |

| **** | The Bloomberg U.S. Intermediate Credit Total Return Index (LUICTRUU) measures the investment grade, fixed-rate, taxable corporate bond market whose maturity ranges between 1 to 9.9999 years. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers. Investors cannot invest directly in an index. |

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, the Fund’s performance is negatively impacted by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

9

Inspire

Corporate Bond ETF

PORTFOLIO REVIEW (Unaudited)(Continued)

November 30, 2022

Comparison of the Change in Value of a $10,000 Investment

The Fund’s Top Sectors and Industries are as follows:

| Sectors/Industries | % of Net Assets | |||

| Real Estate Investment Trusts | 20.0 | % | ||

| Oil & Gas Producers | 11.0 | % | ||

| Electric Utilities | 6.5 | % | ||

| Commercial Support Services | 6.3 | % | ||

| Technology Services | 6.2 | % | ||

| Electrical Equipment | 4.2 | % | ||

| Semiconductors | 3.5 | % | ||

| Oil & Gas Services & Equipment | 3.4 | % | ||

| Food | 2.9 | % | ||

| Medical Equipment & Devices | 2.8 | % | ||

| Other Sectors | 32.0 | % | ||

| Other Assets in Excess of Liabilities | 1.2 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments in this Annual Report for a detailed listing of the Fund’s holdings.

10

Inspire

100 ETF

PORTFOLIO REVIEW (Unaudited)

November 30, 2022

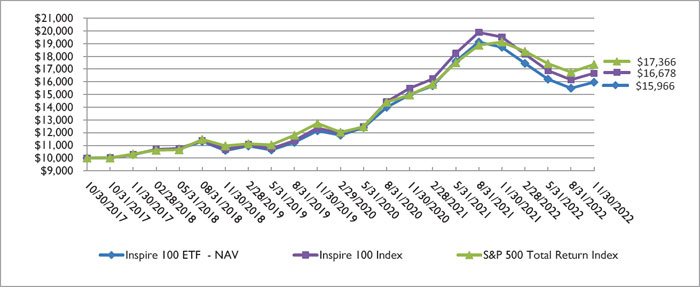

The Fund’s performance figures* for the periods ended November 30, 2022, as compared to its benchmarks:

| Annualized | ||||

| Annualized | Annualized | Since Inception** - | ||

| One Year | Three Year | Five Year | November 30, 2022 | |

| Inspire 100 ETF - NAV | (14.69)% | 9.55% | 9.21% | 9.64% |

| Inspire 100 ETF - Market Price | (14.85)% | 9.50% | 9.18% | 9.61% |

| Inspire 100 Index *** | (14.61)% | 10.50% | 10.17% | 10.58% |

| S&P 500 Total Return Index **** | (9.21)% | 10.91% | 10.98% | 11.47% |

| * | The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of the Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.inspireetf.com or by calling 1-877-658-9473. |

The Fund’s per share net asset value or NAV is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. Since November 2, 2020, market price returns are calculated using the closing price and account for distributions from the Fund. Prior to November 2, 2020, market price returns were calculated using the midpoint price and accounted for distributions from the Fund. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. The Fund’s adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund until at least March 31, 2023 to ensure that total annual fund operating expenses after fee waiver and/or reimbursement (exclusive of any front-end or contingent deferred loads, taxes, brokerage fees and commissions, borrowing costs (such as interest and dividend expense on securities sold short), acquired fund fees and expenses, fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses), or extraordinary expenses such as litigation) will not exceed 0.35% of average daily net assets. This fee waiver and expense reimbursement is subject to possible recoupment from the Fund if such recoupment does not cause the Fund’s expense ratio (after the repayment is taken into account) to exceed both: (i) the Fund’s expense cap in place at the time such expenses were waived, and (ii) the Fund’s current expense cap at the time of recoupment. This agreement may be terminated by the Board of Trustees only on 60 days’ written notice to the Fund’s adviser. The Fund’s total annual operating expenses (gross) are 0.42% per the March 30, 2022 prospectus.

| ** | As of the commencement of operations on October 30, 2017. |

| *** | The Inspire 100 Index (INSP100) is a rules based, passive index which tracks the stock performance of the one-hundred highest Inspire Impact Scoring companies in the United States with market capitalizations above $20B. The index is market-cap weighted, rebalanced annually and calculated on a total return basis in U.S. Dollars. Investors cannot invest directly in an index. |

| **** | The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark. |

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

11

Inspire

100 ETF

PORTFOLIO REVIEW (Unaudited)(Continued)

November 30, 2022

Comparison of the Change in Value of a $10,000 Investment

The Fund’s Top Sectors and Industries are as follows:

| Sectors/Industries | % of Net Assets | |||

| Technology Services | 10.9 | % | ||

| Semiconductors | 10.0 | % | ||

| Medical Equipment & Devices | 10.0 | % | ||

| Software | 8.2 | % | ||

| Commercial Support Services | 4.7 | % | ||

| Electrical Equipment | 4.6 | % | ||

| Residential Reit | 3.7 | % | ||

| Metals & Mining | 3.5 | % | ||

| Industrial Reit | 3.2 | % | ||

| Oil & Gas Producers | 3.0 | % | ||

| Other Sectors | 38.1 | % | ||

| Other Assets in Excess of Liabilities | 0.1 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments in this Annual Report for a detailed listing of the Fund’s holdings.

12

Inspire

International ETF

PORTFOLIO REVIEW (Unaudited)

November 30, 2022

The Fund’s performance figures* for the periods ended November 30, 2022, as compared to its benchmarks:

| Annualized | |||

| Annualized | Since Inception** - | ||

| One Year | Three Year | November 30, 2022 | |

| Inspire International ETF - NAV | (9.32)% | 6.04% | 7.69% |

| Inspire International ETF - Market Price | (9.34)% | 6.04% | 7.95% |

| Inspire Global Hope Ex-US Index *** | (9.18)% | 4.34% | 6.01% |

| S&P International 700 Total Return Index **** | (9.72)% | 3.22% | 4.49% |

| * | The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of the Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.inspireetf.com or by calling 1-877-658-9473. |

The Fund’s per share net asset value or NAV is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. Since November 2, 2020, market price returns are calculated using the closing price and account for distributions from the Fund. Prior to November 2, 2020, market price returns were calculated using the midpoint price and accounted for distributions from the Fund. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. The Fund’s adviser had contractually agreed to reduce its fees and/or absorb expenses of the Fund until March 31, 2022 to ensure that total annual fund operating expenses after fee waiver and/or reimbursement (exclusive of any front-end or contingent deferred loads, taxes, brokerage fees and commissions, borrowing costs (such as interest and dividend expense on securities sold short), acquired fund fees and expenses, fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses), or extraordinary expenses such as litigation) did not exceed 0.80% of average daily net assets. Effective April 1, 2022 the Fund does not have a aiver agreement in place. The fee waiver and expense reimbursements are subject to possible recoupment from the Fund by the adviser in future years (within the three years after the fees have been waived or reimbursed), if such recoupment can be achieved within the lesser of the foregoing expense limits or those in place at the time of recapture. The Fund’s total annual operating expenses (gross) are 0.69% per the March 30, 2022 prospectus.

| ** | As of the commencement of operations on September 30, 2019. |

| *** | The Inspire Global Hope Ex-US Index (IGHXUSG) intends to track the price movements of a portfolio of 150 of the most inspiring, biblically aligned large cap companies outside of the United States. The index is comprised of 80% international developed large cap companies and 20% emerging markets large cap companies. The adviser defines “large cap” as a market capitalization of $5B U.S. Dollars (“USD”) or greater. The index is equally weighted, rebalanced quarterly and calculated on a gross total return basis in USD. Investors cannot invest directly in an index. |

| **** | The S&P International 700 Total Return Index measures the non-U.S. component of the global equity market through an index that is designed to be highly liquid and efficient to replicate. The index covers all regions included in the S&P Global 1200 except for the U.S., which is represented by the S&P 500. Investors cannot invest directly in an index. |

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

13

Inspire

International ETF

PORTFOLIO REVIEW (Unaudited)(Continued)

November 30, 2022

Comparison of the Change in Value of a $10,000 Investment

The Fund’s Top Sectors and Industries are as follows:

| Sectors/Industries | % of Net Assets | |||

| Banking | 11.4 | % | ||

| Electric Utilities | 8.8 | % | ||

| Oil & Gas Producers | 7.9 | % | ||

| Metals & Mining | 5.9 | % | ||

| Chemicals | 4.7 | % | ||

| Insurance | 4.4 | % | ||

| Transportation & Logistics | 4.1 | % | ||

| Telecommunications | 3.2 | % | ||

| Real Estate Owners & Developers | 3.1 | % | ||

| Machinery | 3.1 | % | ||

| Collateral For Securities Loaned | 0.4 | % | ||

| Other Sectors | 43.0 | % | ||

| Other Assets in Excess of Liabilities | 0.0 | % * | ||

| 100.0 | % | |||

| * | Amount Less than 0.1% |

Please refer to the Schedule of Investments in this Annual Report for a detailed listing of the Fund’s holdings.

14

Inspire

Tactical Balanced ETF

PORTFOLIO REVIEW (Unaudited)

November 30, 2022

The Fund’s performance figures* for the periods ended November 30, 2022, as compared to its benchmark:

| Since Inception** - | ||

| One Year | November 30, 2022 | |

| Inspire Tactical Balanced ETF - NAV | (14.63)% | 3.36% |

| Inspire Tactical Balanced ETF - Market Price | (14.56)% | 3.40% |

| S&P Target Risk Moderate Index *** | (10.80)% | 0.64% |

| * | The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of the Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.inspireetf.com or by calling 1-877-658-9473. |

The Fund’s per share net asset value or NAV is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. Since November 2, 2020, market price returns are calculated using the closing price and account for distributions from the Fund. Prior to November 2, 2020, market price returns were calculated using the midpoint price and accounted for distributions from the Fund. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. The Fund’s total annual operating expenses (gross) are 0.71% per the March 30, 2022 prospectus.

| ** | As of the commencement of operations on July 15, 2020. |

| *** | The S&P Target Risk Moderate Index is designed to measure the performance of moderate stock-bond allocations to fixed income while seeking to increase opportunities for higher returns through equities. Investors cannot invest directly in an index. |

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

15

Inspire

Tactical Balanced ETF

PORTFOLIO REVIEW (Unaudited)(Continued)

November 30, 2022

Comparison of the Change in Value of a $10,000 Investment

The Fund’s Top Asset Types are as follows:

| Asset Type | % of Net Assets | |||

| Exchange Traded Fund | ||||

| Fixed Income | 93.6 | % | ||

| Common Stock | ||||

| Technology Services | 0.6 | % | ||

| Medical Equipment & Devices | 0.6 | % | ||

| Semiconductors | 0.6 | % | ||

| Software | 0.5 | % | ||

| Commercial Support Services | 0.3 | % | ||

| Electrical Equipment | 0.3 | % | ||

| Residential Reit | 0.2 | % | ||

| Metals & Mining | 0.2 | % | ||

| Industrial Reit | 0.2 | % | ||

| Oil & Gas Producers | 0.2 | % | ||

| Other Sectors | 1.9 | % | ||

| Other Assets in Excess of Liabilities | 0.8 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments in this Annual Report for a detailed listing of the Fund’s holdings.

16

Inspire

Faithward Mid Cap Momentum ETF

PORTFOLIO REVIEW (Unaudited)

November 30, 2022

The Fund’s performance figures* for the periods ended November 30, 2022, as compared to its benchmark:

| Since Inception** - | ||

| One Year | November 30, 2022 | |

| Inspire Faithward Mid Cap Momentum ETF - NAV | (13.89)% | 0.53% |

| Inspire Faithward Mid Cap Momentum ETF - Market Price | (14.07)% | 0.49% |

| S&P MidCap 400 Index® *** | (3.29)% | 8.98% |

| * | The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of the Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.inspireetf.com or by calling 1-877-658-9473. |

The Fund’s per share net asset value or NAV is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. The Fund’s adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund until at least March 31, 2023 to ensure that total annual fund operating expenses after fee waiver and/or reimbursement (exclusive of any front-end or contingent deferred loads, taxes, brokerage fees and commissions, borrowing costs (such as interest and dividend expense on securities sold short), acquired fund fees and expenses, fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses), or extraordinary expenses such as litigation) will not exceed 0.80% of average daily net assets. This fee waiver and expense reimbursement is subject to possible recoupment from the Fund if such recoupment does not cause the Fund’s expense ratio (after the repayment is taken into account) to exceed both: (i) the Fund’s expense cap in place at the time such expenses were waived, and (ii) the Fund’s current expense cap at the time of recoupment. This agreement may be terminated by the Board of Trustees only on 60 days’ written notice to the Fund’s adviser. The Fund’s total annual operating expenses (gross) are 1.02% per the March 30, 2022 prospectus.

| ** | As of the commencement of operations on December 7, 2020. |

| *** | The S&P MidCap 400 Index® provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500®, is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment. Investors cannot invest directly in an |

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

17

Inspire

Faithward Mid Cap Momentum ETF

PORTFOLIO REVIEW (Unaudited)(Continued)

November 30, 2022

Comparison of the Change in Value of a $10,000 Investment

The Fund’s Top Sectors and Industries are as follows:

| Sectors/Industries | % of Net Assets | |||

| Insurance | 10.3 | % | ||

| Oil & Gas Producers | 7.6 | % | ||

| Retail - Discretionary | 5.9 | % | ||

| Health Care Facilities & Services | 5.5 | % | ||

| Chemicals | 5.3 | % | ||

| Retail - Consumer Staples | 5.3 | % | ||

| Steel | 5.3 | % | ||

| Gas & Water Utilities | 5.2 | % | ||

| Semiconductors | 3.6 | % | ||

| Construction Materials | 3.0 | % | ||

| Other Sectors | 41.4 | % | ||

| Other Assets in Excess of Liabilities | 1.6 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments in this Annual Report for a detailed listing of the Fund’s holdings.

18

Inspire Fidelis Multi Factor ETF |

| PORTFOLIO REVIEW (Unaudited) |

| November 30, 2022 |

The Fund’s performance figures* for the periods ended November 30, 2022, as compared to its benchmark:

| Since Inception** - | |

| November 30, 2022 | |

| Inspire Fidelis Multi Factor ETF - NAV | 4.33% |

| Inspire Fidelis Multi Factor ETF - Market Price | 4.69% |

| WI Fidelis Multi-Cap, Multi-Factor Index *** | 4.92% |

| * | The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of the Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.inspireetf.com or by calling 1-877-658-9473. |

The Fund’s per share net asset value or NAV is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. The Fund’s total annual operating expenses (gross) are 0.85%s per the August 18, 2022 prospectus.

| ** | As of the commencement of operations on August 23, 2022. |

| *** | The WI Fidelis Multi-Cap, Multi-Factor Index tracks the performance of the 100 stocks which rank the highest within their market cap and sector based on WI Fidelis Index’s factor-based methodology. This methodology is designed to provide access to high quality companies (i.e. faith-based social impact, profitability, financial health, and growth) with market caps greater than $250M that also have value (including low volatility and higher dividend yield) and momentum (including positive earnings per share trend) characteristics. |

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

19

Inspire

Fidelis Multi Factor ETF

PORTFOLIO REVIEW (Unaudited)(Continued)

November 30, 2022

Comparison of the Change in Value of a $10,000 Investment

The Fund’s Top Sectors and Industries are as follows:

| Sectors/Industries | % of Net Assets | |||

| Banking | 8.7 | % | ||

| Technology Hardware | 8.2 | % | ||

| Semiconductors | 7.1 | % | ||

| Biotech & Pharma | 6.9 | % | ||

| Oil & Gas Producers | 6.6 | % | ||

| Retail - Discretionary | 6.6 | % | ||

| Electrical Equipment | 5.0 | % | ||

| Steel | 4.6 | % | ||

| Commercial Support Services | 4.2 | % | ||

| Software | 3.8 | % | ||

| Other Sectors | 36.3 | % | ||

| Other Assets in Excess of Liabilities | 2.0 | % | ||

| 100.0 | % | |||

Please refer to the Schedule of Investments in this Annual Report for a detailed listing of the Fund’s holdings.

20

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% | ||||||||

| AEROSPACE & DEFENSE - 1.6% | ||||||||

| 2,035 | HEICO Corporation | $ | 330,301 | |||||

| 3,216 | Safran S.A. | 393,438 | ||||||

| 865 | Teledyne Technologies, Inc.(a) | 363,387 | ||||||

| 5,002 | Textron, Inc. | 357,043 | ||||||

| 2,684 | Thales S.A. | 341,582 | ||||||

| 557 | TransDigm Group, Inc. | 350,075 | ||||||

| 2,135,826 | ||||||||

| APPAREL & TEXTILE PRODUCTS - 0.8% | ||||||||

| 3,115 | Cie Financiere Richemont S.A. | 408,344 | ||||||

| 252 | Hermes International | 404,991 | ||||||

| 63,286 | PRADA SpA | 346,378 | ||||||

| 1,159,713 | ||||||||

| ASSET MANAGEMENT - 2.0% | ||||||||

| 24,406 | 3i Group plc | 396,777 | ||||||

| 7,082 | Brookfield Asset Management, Inc., Class A | 333,894 | ||||||

| 4,048 | Charles Schwab Corporation (The) | 334,122 | ||||||

| 4,202 | Groupe Bruxelles Lambert S.A. | 335,442 | ||||||

| 20,439 | Investor A.B. | 375,742 | ||||||

| 6,500 | KKR & Company, Inc. | 337,480 | ||||||

| 1,347 | LPL Financial Holdings, Inc. | 318,848 | ||||||

| 367 | Partners Group Holding A.G. | 358,739 | ||||||

| 2,791,044 | ||||||||

| AUTOMOTIVE - 1.5% | ||||||||

| 13,072 | Cie Generale des Etablissements Michelin SCA | 363,981 | ||||||

| 6,631 | Continental A.G. | 395,732 | ||||||

| 6,033 | Denso Corporation | 328,293 | ||||||

| 1,577 | Ferrari N.V. | 351,750 | ||||||

| 209,741 | Geely Automobile Holdings Ltd. | 305,585 | ||||||

| 5,894 | Toyota Industries Corporation | 333,363 | ||||||

| 2,078,704 | ||||||||

| BANKING - 7.0% | ||||||||

| 480,916 | Bank Mandiri Persero Tbk P.T. | 323,696 | ||||||

| 992,962 | Bank Rakyat Indonesia Persero Tbk P.T. | 316,234 | ||||||

| 6,681 | Canadian Imperial Bank of Commerce | 321,792 | ||||||

See accompanying notes to financial statements.

21

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% (Continued) | ||||||||

| BANKING - 7.0% (Continued) | ||||||||

| 4,847 | Commonwealth Bank of Australia | $ | 354,872 | |||||

| 36,170 | Credit Agricole S.A. | 362,152 | ||||||

| 23,471 | Danske Bank A/S | 418,723 | ||||||

| 4,348 | East West Bancorp, Inc. | 305,273 | ||||||

| 12,733 | First Horizon Corporation | 316,415 | ||||||

| 2,226 | First Republic Bank | 284,060 | ||||||

| 45,470 | Grupo Financiero Banorte S.A.B. de C.V. | 365,007 | ||||||

| 13,949 | ICICI Bank Ltd. - ADR | 330,870 | ||||||

| 177,775 | Intesa Sanpaolo SpA | 393,039 | ||||||

| 20,327 | KakaoBank Corporation(a) | 390,484 | ||||||

| 6,207 | KBC Group N.V. | 341,068 | ||||||

| 1,660 | M&T Bank Corporation | 282,233 | ||||||

| 2,829 | Macquarie Group Ltd. | 343,179 | ||||||

| 158,781 | Malayan Banking Bhd | 308,240 | ||||||

| 15,419 | National Australia Bank Ltd. | 330,108 | ||||||

| 15,841 | OTP Bank Nyrt | 433,179 | ||||||

| 66,575 | Powszechna Kasa Oszczednosci Bank Polski S.A. | 420,666 | ||||||

| 323,612 | Public Bank Bhd | 327,579 | ||||||

| 14,572 | Regions Financial Corporation | 338,216 | ||||||

| 29,200 | Skandinaviska Enskilda Banken A.B. | 354,344 | ||||||

| 36,971 | Standard Bank Group Ltd. | 385,492 | ||||||

| 866 | SVB Financial Group(a) | 200,721 | ||||||

| 35,791 | Svenska Handelsbanken A.B., A Shares | 360,177 | ||||||

| 22,342 | Swedbank A.B., A Shares | 360,076 | ||||||

| 16,094 | United Overseas Bank Ltd. | 369,006 | ||||||

| 9,636,901 | ||||||||

| BEVERAGES - 0.5% | ||||||||

| 6,887 | Coca-Cola Europacific Partners plc | 365,631 | ||||||

| 3,351 | Monster Beverage Corporation(a) | 344,684 | ||||||

| 710,315 | ||||||||

| BIOTECH & PHARMA - 1.8% | ||||||||

| 1,442 | Alnylam Pharmaceuticals, Inc.(a) | 318,091 | ||||||

| 969 | Biohaven Ltd.(a) | 15,330 | ||||||

| 2,449 | Celltrion, Inc. | 330,540 | ||||||

See accompanying notes to financial statements.

22

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% (Continued) | ||||||||

| BIOTECH & PHARMA - 1.8% (Continued) | ||||||||

| 11,658 | Chugai Pharmaceutical Company Ltd. | $ | 305,963 | |||||

| 1,574 | CSL Ltd. | 320,644 | ||||||

| 4,708 | Horizon Therapeutics plc(a) | 472,165 | ||||||

| 4,401 | Incyte Corporation(a) | 350,628 | ||||||

| 4,225 | UCB S.A. | 337,982 | ||||||

| 2,451,343 | ||||||||

| CABLE & SATELLITE - 0.3% | ||||||||

| 3,890 | Liberty Broadband Corporation - Series A(a) | 350,878 | ||||||

| CHEMICALS - 4.1% | ||||||||

| 2,573 | Air Liquide S.A. | 370,535 | ||||||

| 5,178 | Akzo Nobel N.V. | 368,037 | ||||||

| 1,108 | Albemarle Corporation | 308,013 | ||||||

| 3,044 | CF Industries Holdings, Inc. | 329,330 | ||||||

| 1,845,839 | Chandra Asri Petrochemical Tbk P.T. | 282,123 | ||||||

| 460 | EMS-Chemie Holding A.G. | 316,940 | ||||||

| 96 | Givaudan S.A. | 321,184 | ||||||

| 2,590 | Koninklijke DSM N.V. | 330,024 | ||||||

| 3,905 | LyondellBasell Industries N.V., Class A | 331,964 | ||||||

| 6,058 | Mosaic Company (The) | 310,775 | ||||||

| 5,867 | Novozymes A/S, Class B | 336,906 | ||||||

| 3,484 | Nutrien Ltd. | 280,008 | ||||||

| 2,636 | PPG Industries, Inc. | 356,440 | ||||||

| 3,501 | RPM International, Inc. | 362,774 | ||||||

| 3,106 | Sociedad Quimica y Minera de Chile S.A., Class B | 307,356 | ||||||

| 2,998 | Symrise A.G. | 340,313 | ||||||

| 3,386 | Westlake Corporation | 364,503 | ||||||

| 5,617,225 | ||||||||

| COMMERCIAL SUPPORT SERVICES - 1.9% | ||||||||

| 753 | Cintas Corporation | 347,721 | ||||||

| 6,354 | Edenred | 347,424 | ||||||

| 4,983 | Eurofins Scientific S.E. | 344,833 | ||||||

| 2,151 | Republic Services, Inc. | 299,613 | ||||||

| 8,435 | Rollins, Inc. | 341,111 | ||||||

See accompanying notes to financial statements.

23

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% (Continued) | ||||||||

| COMMERCIAL SUPPORT SERVICES - 1.9% (Continued) | ||||||||

| 137 | SGS S.A. | $ | 318,504 | |||||

| 2,157 | Waste Connections, Inc.(b) | 311,309 | ||||||

| 1,827 | Waste Management, Inc. | 306,424 | ||||||

| 2,616,939 | ||||||||

| CONSTRUCTION MATERIALS - 2.2% | ||||||||

| 2,343 | Advanced Drainage Systems, Inc. | 227,880 | ||||||

| 1,042 | Carlisle Companies, Inc. | 274,161 | ||||||

| 8,183 | Cie de Saint-Gobain | 372,958 | ||||||

| 9,149 | CRH plc | 363,161 | ||||||

| 7,075 | Holcim Ltd. | 364,554 | ||||||

| 901 | Martin Marietta Materials, Inc. | 330,198 | ||||||

| 34,148 | Siam Cement PCL (The) - ADR | 326,561 | ||||||

| 1,456 | Sika A.G. | 364,654 | ||||||

| 1,849 | Vulcan Materials Company | 338,977 | ||||||

| 2,963,104 | ||||||||

| CONTAINERS & PACKAGING - 0.8% | ||||||||

| 27,298 | Amcor plc - ADR | 332,980 | ||||||

| 9,228 | International Paper Company | 342,543 | ||||||

| 2,616 | Packaging Corp of America | 355,489 | ||||||

| 1,031,012 | ||||||||

| DATA CENTER REIT - 0.2% | ||||||||

| 2,963 | Digital Realty Trust, Inc. | 333,219 | ||||||

| DIVERSIFIED INDUSTRIALS - 0.8% | ||||||||

| 12,013 | Alfa Laval A.B. | 340,645 | ||||||

| 2,506 | Dover Corporation | 355,727 | ||||||

| 1,614 | Illinois Tool Works, Inc. | 367,137 | ||||||

| 1,063,509 | ||||||||

| ELECTRIC UTILITIES - 6.2% | ||||||||

| 3,010,534 | AC Energy Corporation | 379,452 | ||||||

| 12,969 | AES Corporation (The) | 375,063 | ||||||

| 5,533 | Alliant Energy Corporation | 311,508 | ||||||

| 6,991 | Avangrid, Inc. | 299,005 | ||||||

| 10,431 | CenterPoint Energy, Inc. | 324,508 | ||||||

See accompanying notes to financial statements.

24

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% (Continued) | ||||||||

| ELECTRIC UTILITIES - 6.2% (Continued) | ||||||||

| 38,929 | CLP Holdings Ltd. | $ | 282,096 | |||||

| 38,087 | E.ON S.E. | 362,061 | ||||||

| 67,605 | EDP - Energias de Portugal S.A. | 318,303 | ||||||

| 14,180 | EDP Renovaveis S.A. | 325,765 | ||||||

| 7,169 | Emera, Inc. | 279,105 | ||||||

| 19,397 | Endesa S.A. | 357,707 | ||||||

| 2,765,202 | Enel Americas S.A. | 365,256 | ||||||

| 71,397 | Enel SpA | 381,905 | ||||||

| 25,456 | Engie S.A. | 385,102 | ||||||

| 2,908 | Entergy Corporation | 338,113 | ||||||

| 4,930 | Evergy, Inc. | 291,905 | ||||||

| 7,650 | Fortis, Inc.(b) | 307,897 | ||||||

| 22,324 | Fortum OYJ | 353,886 | ||||||

| 213,058 | Gulf Energy Development PCL - ADR | 321,391 | ||||||

| 31,431 | Iberdrola S.A. | 353,017 | ||||||

| 17,430 | SSE plc | 359,014 | ||||||

| 164,748 | Tenaga Nasional Bhd | 349,100 | ||||||

| 47,754 | Terna Rete Elettrica Nazionale SpA | 363,703 | ||||||

| 3,470 | Verbund A.G. | 311,100 | ||||||

| 3,276 | WEC Energy Group, Inc. | 324,783 | ||||||

| 8,420,745 | ||||||||

| ELECTRICAL EQUIPMENT - 2.1% | ||||||||

| 2,569 | AMETEK, Inc. | 365,877 | ||||||

| 4,354 | Amphenol Corporation, Class A | 350,192 | ||||||

| 15,810 | Assa Abloy A.B., Class B | 358,863 | ||||||

| 16,867 | Delta Electronics Thailand PCL | 322,602 | ||||||

| 1,652 | Generac Holdings, Inc.(a) | 174,319 | ||||||

| 1,846 | Keysight Technologies, Inc.(a) | 333,923 | ||||||

| 810 | Roper Technologies, Inc. | 355,501 | ||||||

| 1,864 | Schindler Holding A.G. | 348,946 | ||||||

| 5,347 | Trimble, Inc.(a) | 319,483 | ||||||

| 2,929,706 | ||||||||

| ENGINEERING & CONSTRUCTION - 0.7% | ||||||||

| 12,970 | Ferrovial S.A. | 345,939 | ||||||

See accompanying notes to financial statements.

25

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% (Continued) | ||||||||

| ENGINEERING & CONSTRUCTION - 0.7% (Continued) | ||||||||

| 2,294 | Quanta Services, Inc. | $ | 343,825 | |||||

| 15,589 | Sitios Latinoamerica S.A.B. de C.V.(a) | 6,950 | ||||||

| 2,654 | WSP Global, Inc. | 318,343 | ||||||

| 1,015,057 | ||||||||

| ENTERTAINMENT CONTENT - 0.3% | ||||||||

| 63,404 | Bollore S.E. | 354,079 | ||||||

| FOOD - 2.6% | ||||||||

| 10,676 | Ajinomoto Company, Inc. | 335,162 | ||||||

| 154 | Barry Callebaut A.G. | 312,947 | ||||||

| 6,241 | Campbell Soup Company | 334,954 | ||||||

| 74,635 | China Mengniu Dairy Company Ltd. | 332,528 | ||||||

| 30 | Chocoladefabriken Lindt & Spruengli A.G. | 314,488 | ||||||

| 8,946 | Conagra Brands, Inc. | 339,769 | ||||||

| 4,457 | Darling Ingredients, Inc.(a) | 320,146 | ||||||

| 82,496 | Grupo Bimbo S.A.B. de C.V. | 350,126 | ||||||

| 6,453 | Hormel Foods Corporation | 303,291 | ||||||

| 3,780 | Lamb Weston Holdings, Inc. | 328,482 | ||||||

| 108,945 | Wilmar International Ltd. | 328,251 | ||||||

| 3,600,144 | ||||||||

| FORESTRY, PAPER & WOOD PRODUCTS - 0.8% | ||||||||

| 23,409 | Stora Enso OYJ, R Shares | 340,843 | ||||||

| 35,806 | Suzano S.A. | 364,460 | ||||||

| 9,338 | UPM-Kymmene OYJ | 340,227 | ||||||

| 1,045,530 | ||||||||

| GAS & WATER UTILITIES - 1.0% | ||||||||

| 2,872 | Atmos Energy Corporation | 345,214 | ||||||

| 334,122 | Hong Kong & China Gas Company Ltd. | 284,040 | ||||||

| 12,729 | Naturgy Energy Group S.A. | 355,160 | ||||||

| 71,797 | Snam SpA | 364,147 | ||||||

| 1,348,561 | ||||||||

| HEALTH CARE FACILITIES & SERVICES - 1.6% | ||||||||

| 4,042 | Catalent, Inc.(a) | 202,625 | ||||||

| 643 | Elevance Health, Inc. | 342,668 | ||||||

See accompanying notes to financial statements.

26

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% (Continued) | ||||||||

| HEALTH CARE FACILITIES & SERVICES - 1.6% (Continued) | ||||||||

| 13,640 | Fresenius S.E. & Company KGaA | $ | 377,452 | |||||

| 1,586 | ICON plc(a) | 341,688 | ||||||

| 229,589 | IHH Healthcare Bhd | 299,543 | ||||||

| 1,610 | IQVIA Holdings, Inc.(a) | 351,012 | ||||||

| 887 | Molina Healthcare, Inc.(a) | 298,715 | ||||||

| 2,213,703 | ||||||||

| HEALTH CARE REIT - 0.5% | ||||||||

| 12,749 | Healthpeak Properties, Inc. | 334,789 | ||||||

| 7,279 | Ventas, Inc. | 338,692 | ||||||

| 673,481 | ||||||||

| HOME CONSTRUCTION - 1.0% | ||||||||

| 4,328 | DR Horton, Inc. | 372,208 | ||||||

| 683 | Geberit A.G. | 322,482 | ||||||

| 3,903 | Lennar Corporation, Class A | 342,800 | ||||||

| 73 | NVR, Inc.(a) | 338,648 | ||||||

| 1,376,138 | ||||||||

| HOUSEHOLD PRODUCTS - 1.0% | ||||||||

| 2,982 | Beiersdorf A.G. | 322,962 | ||||||

| 4,093 | Church & Dwight Company, Inc. | 335,094 | ||||||

| 14,885 | Essity A.B. - Series B | 362,395 | ||||||

| 643 | LG Household & Health Care Ltd. | 323,472 | ||||||

| 1,343,923 | ||||||||

| INDUSTRIAL REIT - 0.8% | ||||||||

| 27,807 | Goodman Group | 360,895 | ||||||

| 5,739 | Prologis, Inc. | 675,996 | ||||||

| 1,036,891 | ||||||||

| INDUSTRIAL SUPPORT SERVICES - 1.0% | ||||||||

| 6,654 | Ashtead Group plc | 399,095 | ||||||

| 6,357 | Fastenal Company | 327,449 | ||||||

| 1,078 | United Rentals, Inc.(a) | 380,566 | ||||||

| 1,133 | Watsco, Inc. | 304,754 | ||||||

| 1,411,864 | ||||||||

| INSTITUTIONAL FINANCIAL SERVICES - 1.7% | ||||||||

| 121,780 | B3 S.A. - Brasil Bolsa Balcao | 299,336 | ||||||

See accompanying notes to financial statements.

27

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% (Continued) | ||||||||

| INSTITUTIONAL FINANCIAL SERVICES - 1.7% (Continued) | ||||||||

| 2,490 | Cboe Global Markets, Inc. | $ | 315,832 | |||||

| 1,788 | Deutsche Boerse A.G. | 327,682 | ||||||

| 8,527 | Hong Kong Exchanges & Clearing Ltd. | 334,060 | ||||||

| 4,542 | Interactive Brokers Group, Inc., Class A | 364,722 | ||||||

| 3,216 | Intercontinental Exchange, Inc. | 348,325 | ||||||

| 3,491 | London Stock Exchange Group plc | 347,135 | ||||||

| 2,337,092 | ||||||||

| INSURANCE - 3.5% | ||||||||

| 4,846 | Brown & Brown, Inc. | 288,773 | ||||||

| 3,265 | Cincinnati Financial Corporation | 362,284 | ||||||

| 18,163 | Dai-ichi Life Holdings, Inc. | 334,562 | ||||||

| 636 | Fairfax Financial Holdings Ltd. | 364,903 | ||||||

| 2,038 | Intact Financial Corporation | 304,921 | ||||||

| 123,275 | Legal & General Group plc | 373,926 | ||||||

| 5,860 | Loews Corporation | 340,759 | ||||||

| 268 | Markel Corporation(a) | 355,057 | ||||||

| 12,872 | Power Corp of Canada | 323,819 | ||||||

| 30,067 | Prudential plc | 355,017 | ||||||

| 6,881 | Sampo OYJ, A Shares | 347,993 | ||||||

| 660 | Swiss Life Holding A.G. | 349,843 | ||||||

| 14,291 | Tryg A/S | 330,937 | ||||||

| 4,533 | W R Berkley Corporation | 345,777 | ||||||

| 4,778,571 | ||||||||

| INTERNET MEDIA & SERVICES - 1.4% | ||||||||

| 177 | Booking Holdings, Inc.(a) | 368,064 | ||||||

| 17,793,885 | GoTo Gojek Tokopedia Tbk P.T.(a) | 171,828 | ||||||

| 2,356 | Naspers Ltd., N Shares | 359,763 | ||||||

| 5,613 | Prosus N.V. | 365,447 | ||||||

| 3,817 | REA Group Ltd. | 319,491 | ||||||

| 29,201 | Snap, Inc., Class A(a) | 301,062 | ||||||

| 1,885,655 | ||||||||

| MACHINERY – 2.9% | ||||||||

| 32,177 | Atlas Copco A.B. | 395,864 | ||||||

| 1,788 | Caterpillar, Inc. | 422,700 | ||||||

See accompanying notes to financial statements.

28

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% (Continued) | ||||||||

| MACHINERY – 2.9% (Continued) | ||||||||

| 25,941 | CNH Industrial N.V. | $ | 412,709 | |||||

| 2,049 | FANUC Corporation | 302,192 | ||||||

| 4,857 | Graco, Inc. | 339,844 | ||||||

| 1,377 | Nordson Corporation | 325,647 | ||||||

| 1,200 | Parker-Hannifin Corporation | 358,728 | ||||||

| 21,946 | Sandvik A.B. | 399,265 | ||||||

| 707 | SMC Corporation | 316,216 | ||||||

| 1,451 | Snap-on, Inc. | 349,111 | ||||||

| 49,903 | WEG S.A. | 373,850 | ||||||

| 3,996,126 | ||||||||

| MEDICAL EQUIPMENT & DEVICES - 4.3% | ||||||||

| 1,184 | ABIOMED, Inc.(a) | 447,302 | ||||||

| 1,402 | Align Technology, Inc.(a) | 275,717 | ||||||

| 701 | Bio-Rad Laboratories, Inc., Class A(a) | 290,712 | ||||||

| 2,900 | Coloplast A/S - Series B | 338,253 | ||||||

| 3,523 | Edwards Lifesciences Corporation(a) | 272,152 | ||||||

| 2,150 | EssilorLuxottica S.A. | 397,161 | ||||||

| 4,521 | Hologic, Inc.(a) | 344,319 | ||||||

| 889 | IDEXX Laboratories, Inc.(a) | 378,598 | ||||||

| 1,271 | Insulet Corporation(a) | 380,499 | ||||||

| 1,561 | Intuitive Surgical, Inc.(a) | 422,079 | ||||||

| 267 | Mettler-Toledo International, Inc.(a) | 392,373 | ||||||

| 1,551 | Repligen Corporation(a) | 277,381 | ||||||

| 1,343 | ResMed, Inc. | 309,159 | ||||||

| 1,332 | Sonova Holding A.G. | 340,636 | ||||||

| 1,436 | Stryker Corporation | 335,866 | ||||||

| 1,082 | Waters Corporation(a) | 375,021 | ||||||

| 1,183 | West Pharmaceutical Services, Inc. | 277,603 | ||||||

| 5,854,831 | ||||||||

| METALS & MINING - 3.5% | ||||||||

| 6,844 | Agnico Eagle Mines Ltd. | 344,703 | ||||||

| 4,123 | Anglo American Platinum Ltd. | 410,200 | ||||||

| 22,554 | Antofagasta plc | 382,983 | ||||||

| 11,824 | BHP Group Ltd. | 365,347 | ||||||

See accompanying notes to financial statements.

29

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% (Continued) | ||||||||

| METALS & MINING - 3.5% (Continued) | ||||||||

| 26,896 | Fortescue Metals Group Ltd. | $ | 353,818 | |||||

| 2,430 | Franco-Nevada Corporation | 354,955 | ||||||

| 10,662 | Freeport-McMoRan, Inc. | 424,347 | ||||||

| 6,978 | Newmont Corporation | 331,246 | ||||||

| 55,077 | Norsk Hydro ASA | 405,950 | ||||||

| 4,964 | Rio Tinto Ltd. | 369,369 | ||||||

| 118,700 | South32 Ltd. | 323,903 | ||||||

| 6,506 | Southern Copper Corporation | 396,996 | ||||||

| 8,900 | Wheaton Precious Metals Corporation | 347,356 | ||||||

| 4,811,173 | ||||||||

| MULTI ASSET CLASS REIT - 0.5% | ||||||||

| 35,937 | Segro plc | 342,616 | ||||||

| 4,202 | WP Carey, Inc. | 331,118 | ||||||

| 673,734 | ||||||||

| OFFICE REIT - 0.4% | ||||||||

| 2,078 | Alexandria Real Estate Equities, Inc. | 323,358 | ||||||

| 3,883 | Boston Properties, Inc. | 279,887 | ||||||

| 603,245 | ||||||||

| OIL & GAS PRODUCERS - 7.9% | ||||||||

| 10,233 | Aker BP ASA | 355,086 | ||||||

| 9,628 | Antero Resources Corporation(a) | 351,903 | ||||||

| 8,631 | APA Corporation | 404,362 | ||||||

| 6,271 | Canadian Natural Resources Ltd. | 374,397 | ||||||

| 19,074 | Cenovus Energy, Inc. | 379,308 | ||||||

| 3,124 | Chesapeake Energy Corporation | 323,334 | ||||||

| 11,211 | Coterra Energy, Inc. | 312,899 | ||||||

| 4,886 | Devon Energy Corporation | 334,789 | ||||||

| 2,445 | Diamondback Energy, Inc. | 361,909 | ||||||

| 89,319 | ENEOS Holdings, Inc. | 301,430 | ||||||

| 27,553 | Eni SpA | 411,199 | ||||||

| 2,636 | EOG Resources, Inc. | 374,127 | ||||||

| 7,322 | EQT Corporation | 310,526 | ||||||

| 8,974 | Equinor ASA | 345,482 | ||||||

| 30,980 | Inpex Corporation | 343,938 | ||||||

See accompanying notes to financial statements.

30

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% (Continued) | ||||||||

| OIL & GAS PRODUCERS - 7.9% (Continued) | ||||||||

| 17,593 | Kinder Morgan, Inc. | $ | 336,378 | |||||

| 52,467 | MOL Hungarian Oil & Gas plc | 376,366 | ||||||

| 4,776 | Occidental Petroleum Corporation | 331,884 | ||||||

| 8,054 | OMV A.G. | 420,910 | ||||||

| 5,720 | ONEOK, Inc. | 382,782 | ||||||

| 6,410 | Ovintiv, Inc. | 357,422 | ||||||

| 27,359 | Polski Koncern Naftowy ORLEN S.A. | 398,186 | ||||||

| 69,145 | PTT Exploration & Production PCL - ADR | 369,980 | ||||||

| 64,290 | Santos Ltd. | 322,934 | ||||||

| 4,846 | Targa Resources Corporation - Series MLP | 360,494 | ||||||

| 6,256 | TotalEnergies S.E.,(b) | 393,102 | ||||||

| 5,622 | Tourmaline Oil Corporation | 342,170 | ||||||

| 2,737 | Valero Energy Corporation | 365,718 | ||||||

| 10,249 | Williams Companies, Inc. (The) | 355,640 | ||||||

| 14,242 | Woodside Energy Group Ltd. | 360,497 | ||||||

| 10,759,152 | ||||||||

| OIL & GAS SERVICES & EQUIPMENT - 0.6% | ||||||||

| 11,936 | Halliburton Company | 452,255 | ||||||

| 8,199 | Schlumberger N.V. | 422,658 | ||||||

| 874,913 | ||||||||

| PUBLISHING & BROADCASTING - 0.2% | ||||||||

| 5,583 | Liberty Media Corp-Liberty Formula One - Series A(a) | 306,898 | ||||||

| REAL ESTATE OWNERS & DEVELOPERS - 1.6% | ||||||||

| 48,703 | CK Asset Holdings Ltd. | 290,257 | ||||||

| 65,806 | Hongkong Land Holdings Ltd. | 263,882 | ||||||

| 234,807 | Sino Land Company Ltd. | 291,902 | ||||||

| 537,932 | SM Prime Holdings, Inc. | 347,114 | ||||||

| 12,997 | Sumitomo Realty & Development Company Ltd. | 349,764 | ||||||

| 137,322 | Swire Properties Ltd. | 307,318 | ||||||

| 13,765 | Vonovia S.E. | 336,883 | ||||||

| 2,187,120 | ||||||||

| RENEWABLE ENERGY - 0.7% | ||||||||

| 1,054 | Enphase Energy, Inc.(a) | 337,902 | ||||||

See accompanying notes to financial statements.

31

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% (Continued) | ||||||||

| RENEWABLE ENERGY - 0.7% (Continued) | ||||||||

| 2,211 | First Solar, Inc.(a) | $ | 381,464 | |||||

| 13,804 | Plug Power, Inc.(a) | 220,312 | ||||||

| 939,678 | ||||||||

| RESIDENTIAL REIT - 1.7% | ||||||||

| 2,455 | Camden Property Trust | 295,410 | ||||||

| 4,633 | Equity LifeStyle Properties, Inc. | 307,724 | ||||||

| 4,346 | Equity Residential | 281,882 | ||||||

| 1,208 | Essex Property Trust, Inc. | 266,219 | ||||||

| 8,651 | Invitation Homes, Inc. | 282,282 | ||||||

| 1,880 | Mid-America Apartment Communities, Inc. | 309,974 | ||||||

| 2,158 | Sun Communities, Inc. | 317,010 | ||||||

| 7,019 | UDR, Inc. | 291,078 | ||||||

| 2,351,579 | ||||||||

| RETAIL - CONSUMER STAPLES - 1.2% | ||||||||

| 15,682 | Aeon Company Ltd. | 320,604 | ||||||

| 228,864 | Cencosud S.A. | 339,198 | ||||||

| 1,218 | Dollar General Corporation | 311,418 | ||||||

| 2,165 | Dollar Tree, Inc.(a) | 325,378 | ||||||

| 15,598 | Jeronimo Martins SGPS S.A. | 344,528 | ||||||

| 1,641,126 | ||||||||

| RETAIL - DISCRETIONARY - 1.3% | ||||||||

| 136 | AutoZone, Inc.(a) | 350,744 | ||||||

| 4,409 | CarMax, Inc.(a) | 305,808 | ||||||

| 1,962 | Genuine Parts Company | 359,693 | ||||||

| 22,579 | SM Investments Corporation | 375,850 | ||||||

| 1,583 | Tractor Supply Company | 358,249 | ||||||

| 1,750,344 | ||||||||

| RETAIL REIT – 0.8% | ||||||||

| 15,897 | Kimco Realty Corporation | 364,359 | ||||||

| 5,034 | Realty Income Corporation | 317,494 | ||||||

| 3,252 | Simon Property Group, Inc. | 388,418 | ||||||

| 1,070,271 | ||||||||

| SELF-STORAGE REIT - 0.4% | ||||||||

| 1,701 | Extra Space Storage, Inc. | 273,334 | ||||||

See accompanying notes to financial statements.

32

| INSPIRE GLOBAL HOPE ETF |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 98.8% (Continued) | ||||||||

| SELF-STORAGE REIT - 0.4% (Continued) | ||||||||

| 1,001 | Public Storage | $ | 298,258 | |||||

| 571,592 | ||||||||

| SEMICONDUCTORS - 3.6% | ||||||||

| 2,093 | Analog Devices, Inc. | 359,808 | ||||||

| 705 | ASML Holding N.V. | 412,143 | ||||||

| 657 | Broadcom, Inc. | 362,027 | ||||||

| 3,487 | Entegris, Inc. | 269,510 | ||||||

| 13,622 | Infineon Technologies A.G. | 447,348 | ||||||

| 966 | KLA Corporation | 379,782 | ||||||

| 4,763 | Microchip Technology, Inc. | 377,182 | ||||||

| 808 | Monolithic Power Systems, Inc. | 308,624 | ||||||

| 1,970 | NXP Semiconductors N.V. | 346,405 | ||||||

| 4,676 | ON Semiconductor Corporation(a) | 351,635 | ||||||

| 3,409 | Skyworks Solutions, Inc. | 325,969 | ||||||

| 9,525 | STMicroelectronics N.V. | 357,808 | ||||||

| 3,884 | Teradyne, Inc. | 362,960 | ||||||

| 2,801 | Wolfspeed, Inc.(a) | 254,667 | ||||||

| 4,915,868 | ||||||||

| SOFTWARE - 3.4% | ||||||||

| 1,313 | ANSYS, Inc.(a) | 333,896 | ||||||

| 1,786 | Cadence Design Systems, Inc.(a) | 307,263 | ||||||

| 2,606 | Check Point Software Technologies Ltd.(a) | 346,156 | ||||||

| 5,207 | Cloudflare, Inc., Class A(a) | 255,872 | ||||||

| 8,706 | Dassault Systemes S.E. | 318,243 | ||||||

| 3,540 | Datadog, Inc.(a) | 268,261 | ||||||

| 5,389 | DocuSign, Inc.(a) | 253,660 | ||||||

| 5,937 | Fortinet, Inc.(a) | 315,611 | ||||||

| 1,077 | HubSpot, Inc.(a) | 326,363 | ||||||

| 1,540 | Nice Ltd.(a) | 292,065 | ||||||

| 767 | ServiceNow, Inc.(a) | 319,302 | ||||||

| 6,118 | SS&C Technologies Holdings, Inc. | 328,904 | ||||||

| 958 | Synopsys, Inc.(a) | 325,279 | ||||||