Form N-CSR NORTHERN LIGHTS FUND For: Sep 30

united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22655

Northern Lights Fund Trust III

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450 Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Eric Kane

80 Arkay Drive, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2600

Date of fiscal year end: 9/30

Date of reporting period: 9/30/21

Item 1. Reports to Stockholders.

Class N Shares (LIONX)

Class I Shares (LIOTX)

ANNUAL REPORT

SEPTEMBER 30, 2021

| Advised by: | |

| Horizon Capital Management, Inc. | |

| 106 Valerie Drive | |

| Lafayette, Louisiana 70508 | |

| www.LIONX.net | |

| 1-866-787-8355 |

Distributed by Northern Lights Distributors, LLC

Member FINRA

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer to buy shares of the Issachar Fund. Such offering is made only by prospectus, which includes details as to offering price and other material information.

| Horizon Capital Management, Inc. |

| Issachar Fund Manager: Dexter P. Lyons |

| 106 Valerie Drive. Lafayette, LA 70508 |

| [email protected] . 337-983-0676 . Fax 983-0672 . www.IssacharFund.com |

| Dear Valued Issachar Fund Shareholders, | September 30, 2021 |

Welcome to my eighth annual Issachar Fund (LIONX/LIOTX) shareholder report for the 12 months ended September 30, 2021. Issachar distributed $ 0.99/share in dividends on December 18, 2020. Issachar was primarily invested in growth stocks, but the Fund moved to a cash position at the end of the fiscal year as risk increased. We could be headed for a severe correction in the market, so cash is an excellent position to hold. I believe Issachar will continue to achieve its objective of seeking moderate capital appreciation consistent with capital preservation.

From 10/1/20 to 9/30/21, Issachar had a loss of -2.94%, while the IQ Hedge Multi-Strategy Index had a gain of 5.34%. I am not pleased with the performance, and I expect to do better. While Issachar is a mutual fund, it is managed like a hedge fund. Issachar can go to cash or hedge positions during periods of perceived higher risk, and Issachar can be fully invested during periods of perceived lower risk. Many mutual funds and indexes assume a fully invested position regardless of whether we are in a high -risk bear market or recession. I do not plan to “ride out” a significant decline in the market. Instead, my goal is to step aside and wait for risk to subside before getting in. I believe that avoiding life-changing losses is the key to long-term financial success.

For the 2020 calendar year, Issachar finished with a gain of 26.19%, outperforming the IQ Hedge Multi-Strategy Index’s gain of 6.26%. Issachar avoided the COVID crash and was able to take advantage of the growth stock rally that ensued in 2020 and continued into early 2021. COVID did not have a measurable impact on past performance, nor do I expect it will in the future. The Fed expanded its balance sheet in 2020 to an unprecedented level trying to combat COVID, and a lot of that excess money ended up in the stock market. I expect growth stocks to come back in favor soon, and hopefully, we will finish 2021 on a positive note. However, I can only attempt to manage risk since the market provides the return.

In the 12 months ended 9/30/21, Issachar held positions mostly in growth stocks with accelerating earning and sales and strong technical chart patterns. I follow all positions intra-day and seek appropriate action if the stocks are not performing as expected. I try to position Issachar according to my conviction level and manage the day-to-day price volatility commensurate with my expected return.

I believe risk has been elevated, so I prefer to sit patiently on the sidelines and let the market tell me when to get back in. The Fed said that inflation might not be “transitory” and may be with us for a while. The market does not like inflation and higher rates as stocks were being sold on above-average volume. The Biden agenda of higher taxes and more irresponsible deficit spending to transform America into a socialistic country is not sitting well with the market. I am a free-market capitalist, and I believe we will win in the end, but the economy and the stock market may have to endure some pain before it gets better. Grace & Peace to Everyone!

|

| Dexter Lyons |

| Issachar Fund, Portfolio Manager |

Thank You for Your Trust and Business, and May God Bless You and Your Family!

May the Grace of the Lord Jesus be with everyone. (Revelation 22:21)

Portfolio holdings are subject to change at any time and should not be considered investment advice. Past performance is no guarantee of future results. The IQ Hedge Multi-Strategy Index seeks to replicate the risk-adjusted return characteristics of the collective hedge funds using various hedge fund investment styles, including long/short equity, global macro, market neutral, event-driven, fixed income arbitrage, and emerging markets. Investments cannot be made in an index. Unmanaged index returns do not reflect any fees, expenses, or sales charges. Index returns assume reinvestment of dividends. NLD Review Code: 5651-NLD-10/21/2021.

1

ISSACHAR FUND

PORTFOLIO REVIEW (Unaudited)

September 30, 2021

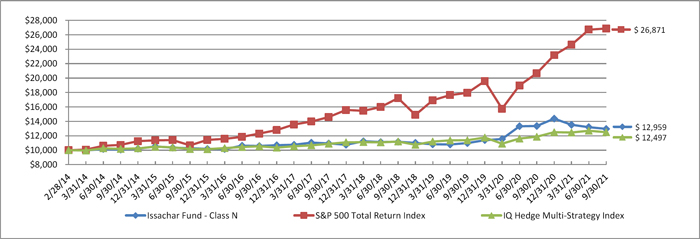

The Fund’s performance figures* for the period ended September 30, 2021, as compared to its benchmark:

| One Year | Five Year | Since Inception ** | Since Inception *** | |

| Issachar Fund - Class N | (2.94)% | 4.13% | 3.48% | N/A |

| Issachar Fund - Class I | N/A | N/A | N/A | (14.84)% |

| S&P 500 Total Return Index | 11.46% | 6.36% | 13.92% | 12.07% |

| IQ Hedge Multi-Strategy Index | 5.34% | 3.47% | 2.99% | (2.49)% |

Comparision of the Change in Value of a $10,000 Investment

| * | The performance data quoted here represents past performance. The performance comparison includes reinvestment of all dividends and capital gains. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The Class N returns are calculated using the traded net asset value at the beginning of the year. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance figures for periods greater than 1 year are annualized. The Fund’s total annual operating expenses before and after waiver are 2.56% and 1.97%, respectively, for Class N shares and 2.31% and 1.72%, respectively, for Class I shares, per the February 1, 2021 Prospectus. The Fund’s adviser, Horizon Capital Management, Inc. (the “Adviser” or “HCM”) has contractually agreed to waive management fees and to make payments to limit Fund expenses, at least until February 1, 2022, so that the total annual operating expenses (excluding: (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions, (iii) acquired fund fees and expenses; (iv) borrowing costs (such as interest and dividend expense on securities sold short); (v) taxes; and (vi) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees, contractual indemnification of Fund service providers (other than the Adviser))) of the Fund do not exceed 1.90% of average daily net assets attributable to Class N shares and 1.65% of average daily net assets attributable to Class I shares. These fee waivers and expense reimbursements are subject to possible recoupment from the Fund within three years after the fees have been waived or reimbursed, if such recoupment can be achieved within the lesser of the foregoing expense limits or the expense limits in place at the time of recapture. This agreement may be terminated only by the Board of Trustees on 60 days’ written notice to the Adviser. Absent this agreement, the performance shown would have been lower. For performance information current to the most recent month-end, please call toll-free 1-866-787-8355. |

| ** | Inception date is February 28, 2014. |

| *** | Inception date is February 22, 2021. |

The IQ Hedge Multi-Strategy Index (the “IQ Index”) seeks to replicate the risk-adjusted return characteristics of the collective hedge funds using various hedge fund investment styles, including long/short equity, global macro, market neutral, event-driven, fixed income arbitrage and emerging markets. The components of the IQ Index are actively managed funds which feature a similarly flexible management style to that of the Fund, unlike the S&P 500 Index, which assumes a “buy and hold” posture. Investors may not invest in the Index directly; unlike the Fund’s returns, the Index does not reflect any fees or expenses.

| Portfolio Composition as of September 30, 2021 | % of Net Assets | |||

| Short-Term Investment | 77.4 | % | ||

| Other Assets in Excess of Liabilities - Net | 22.6 | % | ||

| 100.0 | % | |||

Please refer to the Portfolio of Investment in this shareholder report for a detailed listing of the Fund’s holdings.

2

ISSACHAR FUND

PORTFOLIO OF INVESTMENT

September 30, 2021

| Shares | Fair Value | |||||||

| SHORT - TERM INVESTMENT - 77.4% | ||||||||

| MONEY MARKET FUND - 77.4% | ||||||||

| 27,784,707 | Fidelity Institutional Money Market Fund - Government Portfolio - Class I, 0.01% * (Cost - $27,784,707) | $ | 27,784,707 | |||||

| TOTAL INVESTMENT - 77.4% (Cost - $27,784,707) | $ | 27,784,707 | ||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES - NET - 22.6% | 8,093,205 | |||||||

| NET ASSETS - 100.0% | $ | 35,877,912 | ||||||

| * | Money Market Fund; interest rate reflects seven-day effective yield on September 30, 2021. |

See accompanying notes to financial statements.

3

| ISSACHAR FUND |

| STATEMENT OF ASSETS AND LIABILITIES |

| September 30, 2021 |

| ASSETS | ||||

| Investment securities: | ||||

| At cost | $ | 27,784,707 | ||

| At fair value | $ | 27,784,707 | ||

| Receivable for securities sold | 8,141,447 | |||

| Receivable for Fund shares sold | 31,990 | |||

| Dividend and interest receivable | 8,003 | |||

| Prepaid expenses and other assets | 24,012 | |||

| TOTAL ASSETS | 35,990,159 | |||

| LIABILITIES | ||||

| Investment advisory fees payable, net | 26,542 | |||

| Distribution (12b-1) fees payable | 4,041 | |||

| Payable for Fund shares redeemed | 56,143 | |||

| Accrued audit fees | 19,391 | |||

| Payable to related parties | 4,407 | |||

| Accrued expenses | 1,723 | |||

| TOTAL LIABILITIES | 112,247 | |||

| NET ASSETS | $ | 35,877,912 | ||

| Net Assets Consist Of: | ||||

| Paid in capital ($0 par value, unlimited shares authorized) | $ | 38,584,049 | ||

| Accumulated losses | (2,706,137 | ) | ||

| NET ASSETS | $ | 35,877,912 | ||

| Net Asset Value Per Share: | ||||

| Class N Shares: | ||||

| Net Assets | $ | 18,324,083 | ||

| Shares of beneficial interest outstanding | 1,665,346 | |||

| Net Asset Value (Net Assets/Shares Outstanding), Redemption Price per share and Offering Price per share | $ | 11.00 | ||

| Class I Shares*: | ||||

| Net Assets | $ | 17,553,829 | ||

| Shares of beneficial interest outstanding | 1,593,177 | |||

| Net Asset Value (Net Assets/Shares Outstanding), Redemption Price per share and Offering Price per share | $ | 11.02 | ||

| * | Issachar Fund Class I shares inception date is February 22, 2021. |

See accompanying notes to financial statements.

4

| ISSACHAR FUND |

| STATEMENT OF OPERATIONS |

| For the Year Ended September 30, 2021 |

| INVESTMENT INCOME | ||||

| Dividends (net of $7,644 foreign tax withheld) | $ | 446,619 | ||

| Interest | 1,732 | |||

| TOTAL INVESTMENT INCOME | 448,351 | |||

| EXPENSES | ||||

| Investment advisory fees | 483,737 | |||

| Distribution (12b-1) fees | 97,913 | |||

| Administrative services fees | 62,427 | |||

| Transfer agent fees | 50,660 | |||

| Accounting services fees | 37,016 | |||

| Registration fees | 36,752 | |||

| Custodian fees | 24,948 | |||

| Audit fees | 21,393 | |||

| Compliance officer fees | 18,022 | |||

| Trustees’ fees and expenses | 11,069 | |||

| Legal fees | 9,869 | |||

| Printing and postage expenses | 6,117 | |||

| Insurance expense | 3,174 | |||

| Other expenses | 6,738 | |||

| TOTAL EXPENSES | 869,835 | |||

| Less: Fees waived by the advisor | (20,628 | ) | ||

| NET EXPENSES | 849,207 | |||

| NET INVESTMENT LOSS | (400,856 | ) | ||

| REALIZED AND UNREALIZED GAIN (LOSS) | ||||

| Net Realized Gain (Loss) on: | ||||

| Investments | (2,472,635 | ) | ||

| Foreign currency transactions | 443 | |||

| (2,472,192 | ) | |||

| Net Change in Unrealized Depreciation on: | ||||

| Foreign currency translations | (19 | ) | ||

| NET REALIZED AND UNREALIZED LOSS | (2,472,211 | ) | ||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (2,873,067 | ) | |

See accompanying notes to financial statements.

5

| ISSACHAR FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| Year Ended | Year Ended | |||||||

| September 30, 2021 | September 30, 2020 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment loss | $ | (400,856 | ) | $ | (269,484 | ) | ||

| Net realized gain (loss) from investments, swap contracts and foreign currency transactions | (2,472,192 | ) | 4,134,778 | |||||

| Net change in unrealized depreciation on swap contracts and foreign currency translations | (19 | ) | (12,081 | ) | ||||

| Net increase (decrease) in net assets resulting from operations | (2,873,067 | ) | 3,853,213 | |||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| From return of capital | (241,709 | ) | — | |||||

| Total distributions paid - Class N | (3,506,691 | ) | (7,504 | ) | ||||

| Net decrease in net assets from distributions to shareholders | (3,748,400 | ) | (7,504 | ) | ||||

| FROM SHARES OF BENEFICIAL INTEREST | ||||||||

| Proceeds from shares sold: | ||||||||

| Class N | 26,937,187 | 36,832,775 | ||||||

| Class I * | 23,175,598 | — | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders: | ||||||||

| Class N | 3,339,698 | 6,825 | ||||||

| Class I * | — | — | ||||||

| Payments for shares redeemed: | ||||||||

| Class N | (51,696,347 | ) | (6,710,599 | ) | ||||

| Class I * | (3,864,455 | ) | — | |||||

| Net increase (decrease) in net assets from shares of beneficial interest | (2,108,319 | ) | 30,129,001 | |||||

| TOTAL INCREASE (DECREASE) IN NET ASSETS | (8,729,786 | ) | 33,974,710 | |||||

| NET ASSETS | ||||||||

| Beginning of Year | 44,607,698 | 10,632,988 | ||||||

| End of Year | $ | 35,877,912 | $ | 44,607,698 | ||||

| SHARE ACTIVITY | ||||||||

| Class N: | ||||||||

| Shares sold | 2,146,740 | 3,148,596 | ||||||

| Shares reinvested | 273,074 | 660 | ||||||

| Shares redeemed | (4,396,645 | ) | (561,631 | ) | ||||

| Net increase (decrease) in shares of beneficial interest outstanding | (1,976,831 | ) | 2,587,625 | |||||

| Class I*: | ||||||||

| Shares sold | 1,931,186 | — | ||||||

| Shares reinvested | — | — | ||||||

| Shares redeemed | (338,009 | ) | — | |||||

| Net increase in shares of beneficial interest outstanding | 1,593,177 | — | ||||||

| * | Issachar Class I shares inception date is February 22, 2021. |

See accompanying notes to financial statements.

6

| ISSACHAR FUND |

| FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year Presented

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2019 | September 30, 2018 | September 30, 2017 | ||||||||||||||||

| Class N | Class N | Class N | Class N | Class N | ||||||||||||||||

| Net asset value, beginning of year | $ | 12.25 | $ | 10.08 | $ | 10.36 | $ | 10.34 | $ | 10.18 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment loss (1) | (0.10 | ) | (0.13 | ) | (0.02 | ) | (0.09 | ) | (0.14 | ) | ||||||||||

| Net realized and unrealized gain (loss) | (0.16 | ) | 2.31 | (0.15 | ) | 0.30 | 0.48 | |||||||||||||

| Total from investment operations | (0.26 | ) | 2.18 | (0.17 | ) | 0.21 | 0.34 | |||||||||||||

| Distributions to shareholders | ||||||||||||||||||||

| From net investment income | — | (0.01 | ) | (0.03 | ) | (0.08 | ) | (0.18 | ) | |||||||||||

| From net realized gains | (0.93 | ) | — | (0.08 | ) | (0.11 | ) | — | ||||||||||||

| From return of capital | (0.06 | ) | — | — | — | — | ||||||||||||||

| Total distributions to shareholders | (0.99 | ) | (0.01 | ) | (0.11 | ) | (0.19 | ) | (0.18 | ) | ||||||||||

| Net asset value, end of year | $ | 11.00 | $ | 12.25 | $ | 10.08 | $ | 10.36 | $ | 10.34 | ||||||||||

| Total return (3) | (2.94 | )% | 21.61 | % | (1.67 | )% | 2.12 | % | 3.31 | % | ||||||||||

| Net assets, end of year (000s) | $ | 18,324 | $ | 44,608 | $ | 10,633 | $ | 13,805 | $ | 13,490 | ||||||||||

| Ratio of gross expenses to average net assets (4,5) | 1.82 | % | 2.49 | % | 3.50 | % | 3.54 | % | 3.10 | % | ||||||||||

| Ratio of net expenses to average net assets (5) | 1.78 | % (7) | 1.70 | % | 2.20 | % (6) | 2.30 | % | 2.30 | % | ||||||||||

| Ratio of net investment loss to average net assets (5) | (0.79 | )% | (1.13 | )% | (0.17 | )% | (0.87 | )% | (1.38 | )% | ||||||||||

| Portfolio Turnover Rate (8) | 2842 | % | 2704 | % | 1581 | % | 3108 | % | 779 | % | ||||||||||

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (2) | Realized and unrealized gain (loss) per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with aggregate gains and losses in the Statement of Operations due to the timing of share transactions for the period. |

| (3) | Total return assumes all reinvestment of dividends, if any, and represents the aggregate total return based on net asset value. Total returns would have been lower absent fee waivers and reimbursed expenses. |

| (4) | Represents the ratio of expenses to average net assets absent fees waived and/or expenses reimbursed by the advisor. |

| (5) | The ratios shown do not include the Fund’s proportionate shares of the expenses of the underlying funds and swaps in which the Fund invests. |

| (6) | Effective July 18, 2019, the operating expense limitation was reduced to 1.70% from 2.30% |

| (7) | Effective February 1, 2021, the operating expense limitation was increased to 1.90% from 1.70% |

| (8) | The portfolio turnover rate excludes investments whose maturities or expiration dates at the time of acquisition were one year or less. For this reason all money market funds that were traded throughout the period are excluded from the calculation. The timing of the Fund’s limited amount of purchases and sales of long term securities produced the resulting portfolio turnover percentage, which appears inflated due to the nature of the calculation. Had the Fund’s core investments been included in the calculation, the turnover calculation would have been much lower. |

See accompanying notes to financial statements.

7

| ISSACHAR FUND |

| FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout The Period Presented

| Period Ended | ||||

| September 30, 2021 * | ||||

| Class I | ||||

| Net asset value, beginning of period | $ | 12.94 | ||

| Activity from investment operations: | ||||

| Net investment loss (1) | (0.07 | ) | ||

| Net realized and unrealized loss (2) | (1.85 | ) | ||

| Total from investment operations | (1.92 | ) | ||

| Net asset value, end of period | $ | 11.02 | ||

| Total return (3,4) | (14.84 | )% | ||

| Net assets, end of period (000s) | $ | 17,554 | ||

| Ratio of gross expenses to average net assets (5,6,7) | 1.70 | % | ||

| Ratio of net expenses to average net assets (5,7) | 1.65 | % | ||

| Ratio of net investment loss to average net assets (5,7) | (0.99 | )% | ||

| Portfolio Turnover Rate (4,8) | 2842 | % | ||

| * | The Issachar Fund Class I shares inception date is February 22, 2021. |

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (2) | Realized and unrealized gain (loss) per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with aggregate gains and losses in the Statement of Operations due to the timing of share transactions for the period. |

| (3) | Total return assumes all reinvestment of dividends, if any, and represents the aggregate total return based on net asset value. Total returns would have been lower absent fee waivers and reimbursed expenses. |

| (4) | Not annualized. |

| (5) | Annualized. |

| (6) | Represents the ratio of expenses to average net assets absent fees waived and/or expenses reimbursed by the advisor. |

| (7) | The ratios shown do not include the Fund’s proportionate shares of the expenses of the underlying funds in which the Fund invests. |

| (8) | The portfolio turnover rate excludes investments whose maturities or expiration dates at the time of acquisition were one year or less. For this reason all money market funds that were traded throughout the period are excluded from the calculation. The timing of the Fund’s limited amount of purchases and sales of long term securities produced the resulting portfolio turnover percentage, which appears inflated due to the nature of the calculation. Had the Fund’s core investments been included in the calculation, the turnover calculation would have been much lower. |

8

ISSACHAR FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2021

| 1. | ORGANIZATION |

The Issachar Fund (the ’‘Fund’’) is a series of shares of beneficial interest of Northern Lights Fund Trust III (the “Trust”), a Delaware statutory trust organized on December 5, 2011. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the ’’1940 Act’’). The Fund currently offers Class N and Class I shares. Class N shares commenced operations on February 28, 2014. Class I shares commenced operations on February 22, 2021. The Fund is a diversified fund. The investment objective of the Fund is moderate capital appreciation consistent with capital preservation.

Shares of the Fund, when issued, are fully paid, nonassessable, fully transferable, redeemable at the option of the shareholder and have equal dividend and liquidity rights. Each class of the Fund represents an interest in the same assets of the Fund and the classes are identical except for differences in their distribution charges. Both classes have equal voting privileges except that Class N shares has exclusive voting rights with respect to its service and/or distribution plan. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (’‘GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services – Investment Companies” and Accounting Standards Update (“ASU”) 2013-08.

Securities Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price (“NOCP”). If the NOCP is not available, such securities shall be valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the current bid and ask prices. Debt securities (other than short-term obligations) are valued each day by an independent pricing service approved by the Trust’s Board of Trustees (the “Board”) using methods which include current market quotations from a major market maker in the securities and based on methods which include the consideration of yields or prices of securities of comparable quality, coupon, maturity and type. Swap transactions are valued through an independent pricing service or at fair value based on daily price reporting from the swap counterparty based on the proprietary index. The independent pricing service does not distinguish between smaller-sized bond positions known as “odd lots” and larger institutional-sized bond positions known as “round lots”. The Fund may fair value a particular bond if the advisor does not believe that the round lot value provided by the independent pricing service reflects fair value of the Fund’s holding. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost, which approximates fair value.

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board. The Board has delegated execution of these procedures to a fair value committee composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor. The committee may also enlist third party consultants such as a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value. The Board reviews and ratifies the execution of this process and the resultant fair value prices at least quarterly to assure the process produces reliable results.

9

ISSACHAR FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2021

Valuation of Investment Funds – The Fund may invest in portfolios of open-end or closed-end investment companies (the “Underlying Funds”). The Underlying Funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value to the methods established by the board of directors of the Underlying Funds.

Open-end investment companies are valued at their respective net asset values as reported by such investment companies. The shares of many closed-end investment companies, after their initial public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or market premium on shares of any closed-end investment company purchased by the Fund will not change.

Fair Valuation Process – As noted above, the fair value committee is composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor. The applicable investments are valued collectively via inputs from each of these groups. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source); (ii) securities for which, in the judgment of the advisor, the prices or values available do not represent the fair value of the instrument. Factors which may cause the advisor to make such a judgment include, but are not limited to, the following: only a bid price or an ask price is available; the spread between bid and ask prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to the Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private investments or non-traded securities are valued via inputs from the advisor based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If the advisor is unable to obtain a current bid from such independent dealers or other independent parties, the fair value committee shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure the fair value of all of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for

10

ISSACHAR FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2021

example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of September 30, 2021, for the Fund’s investments measured at fair value:

| Assets* | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Short-Term Investment | $ | 27,784,707 | $ | — | $ | — | $ | 27,784,707 | ||||||||

| Total | $ | 27,784,707 | $ | — | $ | — | $ | 27,784,707 | ||||||||

| * | Refer to the Portfolio of Investment for classifications. |

The Fund did not hold any Level 3 securities during the year. There were no transfers between levels during the year.

Security Transactions and Related Income – Security transactions are accounted for on the trade date. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Dividends and Distributions to Shareholders – Dividends from net investment income, if any, are declared and paid quarterly and distributions from net realized capital gains if any, are declared and paid annually. Dividends and distributions to shareholders are recorded on the ex-dividend date and are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (e.g., deferred losses, capital loss carryforwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. These reclassifications have no effect on net assets, results from operations or net asset values per share of the Fund.

Exchange Traded Funds – The Fund may invest in exchange traded funds (“ETFs”). ETFs are a type of fund that are bought and sold on a securities exchange. An ETF trades like common stock and represents a fixed portfolio of securities. The Fund may purchase an ETF to gain exposure to a portion of the U.S. or a foreign market. The risks of owning an ETF generally reflect the risks of owning the underlying securities in which the ETF invests, although the lack of liquidity on an ETF could result in it being more volatile. Additionally, ETFs have fees and expenses that reduce their value.

Expenses – Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund. Expenses, which are not readily identifiable to a specific fund, are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of the funds in the Trust.

Swap Agreements – The Fund is subject to equity price risk in the normal course of pursuing its investment objective. The Fund may hold equities subject to equity price risk. The Fund may enter into various swap transactions for investment purposes or to manage interest rate, equity, foreign exchange (currency) or credit risk. These would be two party contracts entered into primarily to exchange the returns (or differentials in rates of returns) earned or realized on particular pre-determined investments or instruments.

11

ISSACHAR FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2021

The gross returns to be exchanged or “swapped” between parties are calculated with respect to a notional amount, i.e., the return on or increase in value of a particular dollar amount invested at a particular interest rate, in a particular foreign currency, or in a “basket” of securities representing a particular index or market segment. Changes in the value of swap agreements are recognized as unrealized gains or losses in the Statement of Operations by “marking to market” on a daily basis to reflect the value of the swap agreement at the end of each trading day. Payments received or paid at the beginning of the agreement are reflected as such on the Statement of Assets and Liabilities and may be referred to as upfront payments. The Fund amortizes upfront payments and/or accrue for the fixed payment stream on swap agreements on a daily basis with the net amount recorded as a component of unrealized gain or loss on the Statement of Operations. A liquidation payment received or made at the termination of the swap agreement will first be offset against the due to broker-swap contract balance outstanding at the time the position is liquidated, with the remainder being recorded as a realized gain or loss on the Statement of Operations. The Fund maintains a cash balance as collateral to secure its obligations under the swaps. Entering into these agreements involves, to varying degrees, lack of liquidity and elements of credit, market, and counterparty risk in excess of amounts recognized on the Statement of Assets and Liabilities. The Fund’s maximum risk of loss from counterparty credit risk is the discounted net value of the cash flows to be received from the counterparty over the contract’s remaining life, to the extent that amount is positive. The Fund did not have any open swap contracts as of September 30, 2021 or during the period October 1, 2020 through September 30, 2021.

Market Risk – Market risk is the risk that changes in interest rates, foreign exchange rates or equity prices will affect the positions held by the Fund. The Fund is exposed to market risk on financial instruments that are valued at market prices as disclosed in the Portfolio of Investments. The prices of derivative instruments, including options, forwards and futures prices, can be highly volatile. Price movements of derivative contracts in which the Fund’s assets may be invested are influenced by, among other things, interest rates, changing supply and demand relationships, trade, fiscal, monetary and exchange control programs and policies of governments, and national and international political and economic events and policies. The Fund is exposed to market risk on derivative contracts in that the Fund may not be able to readily dispose of its holdings when it chooses and also that the price obtained on disposal is below that at which the investment is included in the Fund’s financial statements. All financial instruments are recognized at fair value, and all changes in market conditions directly affect net income through changes in unrealized gains or losses as reflected on the Statement of Operations. The Fund’s investments in derivative instruments are exposed to market risk and are disclosed in the Portfolio of Investments. The Fund did not have any derivative instruments as of September 30, 2021 or during the period October 1, 2020 through September 30, 2021.

Credit Risk – Credit risk relates to the ability of the issuer to meet interest and principal payments, or both, as they come due. In general, lower-grade, higher-yield bonds are subject to credit risk to a greater extent than lower-yield, higher-quality bonds.

Counterparty Risk – Counterparty risk is the risk that the counterparty to a financial instrument will cause a financial loss for the Fund by failing to discharge an obligation. A concentration of counterparty risk can exist in that the part of a Fund’s cash can be held at the broker.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the risk of loss due to these warranties and indemnities appears to be remote.

12

ISSACHAR FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2021

| 3. | INVESTMENT TRANSACTIONS |

For the year ended September 30, 2021, cost of purchases and proceeds from sales of portfolio securities, excluding short-term investments, amounted to $660,630,154 and $658,156,413, respectively.

| 4. | AGGREGATE TAX UNREALIZED APPRECIATION AND DEPRECIATION |

At September 30, 2021 the aggregate cost for federal tax purposes, which differs from fair value by net unrealized appreciation (depreciation) of securities, is as follows:

| Net Unrealized | ||||||||||||||

| Gross Unrealized | Gross Unrealized | Appreciation | ||||||||||||

| Tax Cost | Appreciation | Depreciation | (Depreciation) | |||||||||||

| $ | 27,784,707 | $ | — | $ | — | $ | — | |||||||

| 5. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

Horizon Capital Management, Inc. serves as the Fund’s investment advisor (the “Advisor”).

Pursuant to an investment advisory agreement with the Trust, on behalf of the Fund, the Advisor, under the oversight of the Board, directs the daily operations of the Fund and supervises the performance of administrative and professional services provided by others. As compensation for its services and the related expenses borne by the Advisor, the Fund pays the Advisor a management fee, computed and incurred daily and paid monthly, at an annual rate of 1.00% of the Fund’s average daily net assets.

Effective February 1, 2021, pursuant to a written agreement (the “Waiver Agreement”) the Advisor has agreed to waive its fees and/or reimburse the Fund’s operating expenses at least through February 1, 2022, so that the total annual operating expenses (exclusive of any front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expense on securities sold short), taxes and extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees, contractual indemnification of Fund service providers (other than the Advisor))) of the Fund do not exceed 1.90% of average daily net assets attributable to Class N shares and 1.65% of average daily net assets attributable to Class I shares (the “Expense Limitation”). Prior to February 1, 2021, the Fund’s total annual operating expenses did not exceed 1.70% of average daily net assets for Class N shares. During the year ended September 30, 2021, the Advisor earned advisory fees of $483,737 and waived fees and/or reimbursed expenses in the amount of $20,628 pursuant to the Waiver Agreement. The fees paid to the Advisor are reviewed annually by the Board.

If the Advisor waives any fee or reimburses any expense pursuant to the Waiver Agreement, and the Fund’s operating expenses are subsequently less than the Expense Limitation, the Advisor shall be entitled to reimbursement by the Fund for such waived fees or reimbursed expenses provided that such reimbursement does not cause the Fund’s expenses to exceed the Expense Limitation in place at the time of the waiver or reimbursement. If Fund operating expenses subsequently exceed the Expense Limitation, the reimbursements shall be suspended.

The Advisor may seek reimbursement only for expenses waived or paid by it during the three years prior to such reimbursement; provided, however, that such expenses may only be reimbursed to the extent they were waived or paid after the date of the Waiver Agreement (or any similar agreement). The Board may terminate these expense reimbursement arrangements at any time. Cumulative waived expenses subject to recapture pursuant to the aforementioned conditions, as of September 30, 2021, will expire on:

| September 30, 2022 | $ | 168,511 | ||

| September 30, 2023 | $ | 188,782 | ||

| September 30, 2024 | $ | 20,628 |

13

ISSACHAR FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2021

The Trust, on behalf of the Fund, has adopted the Trust’s Master Distribution and Shareholder Servicing Plan (the “Plan”). The Plan provides that a monthly service and/or distribution fee is calculated by the Fund at an annual rate of up to 0.25% of its average daily net assets attributable to Class N shares and is paid to Northern Lights Distributors, LLC (the “Distributor”) to provide compensation for ongoing shareholder servicing and distribution-related activities or services and/or maintenance of the Fund’s shareholder accounts not otherwise required to be provided by the Advisor. For the year ended September 30, 2021, the Fund incurred $97,913 in total fees under the Plan.

The Distributor acts as the Fund’s principal underwriter in a continuous public offering of the Fund shares. During the year ended September 30, 2021, the Distributor received no underwriting commissions.

In addition, certain affiliates of the Distributor provide services to the Fund as follows:

Ultimus Fund Solutions, LLC (“UFS”), an affiliate of the Distributor, provides administration, fund accounting, and transfer agent services to the Trust. Pursuant to separate servicing agreements with UFS, the Fund pays UFS customary fees for providing administration, fund accounting and transfer agency services to the Trust. Certain officers of the Trust are also officers of UFS, and are not paid any fees directly by the Fund for serving in such capacities.

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of UFS and the Distributor, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives customary fees from the Fund.

Blu Giant, LLC (“Blu Giant”), an affiliate of UFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Fund.

| 6. | FEDERAL INCOME TAXES NOTE |

It is the Fund’s policy to qualify as a regulated investment company by complying with the provisions of Subchapter M of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all of its taxable income and net realized gains to shareholders. Therefore, no federal income tax provision is required.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for the open tax years of 2018 through 2020, or expected to be taken in the Fund’s September 30, 2021 tax returns. The Fund identifies its major tax jurisdictions as U.S. federal, Ohio and foreign jurisdictions where the Fund makes significant investments. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

| 7. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS |

The tax character of distributions paid during the years ended September 30, 2021 and September 30, 2020 was as follows:

| Fiscal Year Ended | Fiscal Year Ended | |||||||

| September 30, 2021 | September 30, 2020 | |||||||

| Ordinary Income | $ | 3,506,691 | $ | 7,504 | ||||

| Return of Capital | 241,709 | — | ||||||

| $ | 3,748,400 | $ | 7,504 | |||||

14

ISSACHAR FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2021

As of September 30, 2021, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Post October Loss | Capital Loss | Unrealized | Total | |||||||||||

| and | Carry | Appreciation/ | Accumulated | |||||||||||

| Late Year Loss | Forwards | (Depreciation) | Earnings/(Deficit) | |||||||||||

| $ | (2,105,092 | ) | $ | (601,026 | ) | $ | (19 | ) | $ | (2,706,137 | ) | |||

Late year losses incurred after December 31 within the fiscal year are deemed to arise on the first business day of the following fiscal year for tax purposes. The Fund incurred and elected to defer such late year losses of $ 96,756.

Capital losses incurred after October 31 within the fiscal year are deemed to arise on the first business day of the following fiscal year for tax purposes. The Fund incurred and elected to defer such capital losses of $2,008,336.

At September 30, 2021, the Fund had capital loss carry forwards for federal income tax purposes available to offset future capital gains:

| Non-Expriring | ||||||

| Short-Term | Total | |||||

| $ | 601,026 | $ | 601,026 | |||

Permanent book and tax differences, primarily attributable to the book/tax basis treatment of net operating losses and reclassification of Fund distributions resulted in reclassifications for the Fund for the fiscal year ended September 30, 2021 as follows:

| Paid | ||||||

| in | Accumulated | |||||

| Capital | Earnings (Losses) | |||||

| $ | (408,639 | ) | $ | 408,639 | ||

| 8. | UNDERLYING INVESTMENT IN OTHER INVESTMENT COMPANIES |

The Fund currently seeks to achieve its investment objective by investing a portion of its assets in Fidelity Institutional Money Market Fund – Government Portfolio- Class I, a registered open-end investment company (“Fidelity”). The Fund may redeem its investment from Fidelity at any time if the Advisor determines that it is in the best interest of the Fund and its shareholders to do so.

The performance of the Fund will be directly affected by the performance of Fidelity. The annual reports of Fidelity, along with the report of the independent registered public accounting firm is included in Fidelity’s N-CSR available at “www.sec.gov” or on the website “www.Fidelity.com”. As of September 30, 2021, the percentage of the Fund’s net assets invested in Fidelity was 77.4%.

| 9. | CONTROL OWNERSHIP |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates presumption of control of the fund under Section 2(a)(9) of the 1940 Act. As of September 30, 2021, Constellation Trust Company (for the benefit of its customers) held approximately 26.7% of the voting securities and SEI Private Trust held 27.7% of the voting securities of the Fund.

15

| 9. | SUBSEQUENT EVENTS |

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial issues were issued. Management has determined that no events or transactions occurred requiring adjustment or disclosure in the financial statements.

16

Report of Independent Registered Public Accounting Firm

To

the Board of Trustees of Northern Lights Fund Trust III

and the Shareholders of Issachar Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Issachar Fund (the Fund), including the portfolio of investment, as of September 30, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the related notes to the financial statements (collectively, the financial statements), and the financial highlights for each of the five years in the period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of September 30, 2021, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of investments owned as of September 30, 2021, by correspondence with the custodians. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/s/ RSM US LLP

We have served as the auditor of the Horizon Capital Management investment company since 2014.

Denver, Colorado

November 29, 2021

17

ISSACHAR FUND

EXPENSE EXAMPLES (Unaudited)

September 30, 2021

As a shareholder of the Fund, you incur ongoing costs, including management fees; distribution and/or service (12b-1) fees, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ’‘Expenses Paid During the Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning | Ending | Expenses Paid | Expense Ratio | |

| Account Value | Account Value | During Period | During the Period | |

| Actual | 4/1/21 | 9/30/21 | 4/1/21-9/30/21* | 4/1/21-9/30/21 |

| Issachar Fund – Class N | $1,000.00 | $ 958.20 | $ 9.33 | 1.90% |

| Issachar Fund – Class I | $1,000.00 | $ 959.90 | $ 8.11 | 1.65% |

| Beginning | Ending | Expenses Paid | Expense Ratio | |

| Hypothetical | Account Value | Account Value | During Period | During the Period |

| (5% return before expenses) | 4/1/21 | 9/30/21 | 4/1/21-9/30/21* | 4/1/21-9/30/21 |

| Issachar Fund – Class N | $1,000.00 | $ 1,015.54 | $ 9.60 | 1.90% |

| Issachar Fund – Class I | $1,000.00 | $1,016.80 | $ 8.34 | 1.65% |

| * | Expenses are equal to the average account value over the period, multiplied by the Fund’s annualized expense ratio, multiplied by the number of days in the period (183) divided by the number of days in the fiscal year (365). |

18

| ISSACHAR FUND |

| SUPPLEMENTAL INFORMATION (Unaudited) |

| September 30, 2021 |

The Trustees and officers of the Trust, together with information as to their principal business occupations during the past five years and other information, are shown below. The business address of each Trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. All correspondence to the Trustees and Officers should be directed to c/o Ultimus Fund Solutions, LLC, P.O. Box 541150, Omaha, NE 68154.

| Independent Trustees | |||||

| Name,

Address, Year of Birth |

Position(s)

Held with Registrant |

Length

of Service and Term |

Principal

Occupation(s) During Past 5 Years |

Number

of Funds Overseen In The Fund Complex* |

Other

Directorships Held During Past 5 Years** |

| Patricia

Luscombe 1961 |

Trustee | Since January 2015, Indefinite | Managing Director of the Valuations and Opinions Group, Lincoln International LLC (since August 2007). | 1 | Northern Lights Fund Trust III (for series not affiliated with the Fund since 2015); Monetta Mutual Funds (since November 2015). |

| John

V. Palancia 1954 |

Trustee, Chairman | Trustee, since February 2012, Indefinite; Chairman of the Board since May 2014. | Retired (since 2011); Formerly, Director of Global Futures Operations Control, Merrill Lynch, Pierce, Fenner & Smith, Inc. (1975-2011). | 1 | Northern Lights Fund Trust III (for series not affiliated with the Fund since 2012); Northern Lights Fund Trust (since 2011); Northern Lights Variable Trust (since 2011); Alternative Strategies Fund (since 2012). |

| Mark

H. Taylor 1964 |

Trustee, Chairman of the Audit Committee | Since February 2012, Indefinite | Director, Lynn Pippenger School of Accountancy, Muma College of Business, University of South Florida (since August 2019); Chair, Department of Accountancy and Andrew D. Braden Professor of Accounting and Auditing, Weatherhead School of Management, Case Western Reserve University (2009-2019); Vice President-Finance, American Accounting Association (2017-2020); President, Auditing Section of the American Accounting Association (2012-15); AICPA Auditing Standards Board Member (2009-2012). Former AcademicFellow, United States Securities and Exchange Commission (2005-2006). | 1 | Northern Lights Fund Trust III (for series not affiliated with the Fund since 2012); Northern Lights Fund Trust (since 2007); Northern Lights Variable Trust (since 2007); Alternative Strategies Fund (since June 2010). |

| Jeffery

D. Young 1956 |

Trustee | Since January 2015, Indefinite | Co-owner and Vice President, Latin America Agriculture Development Corp. (since May 2015); Formerly Asst. Vice President -Transportation Systems, Union Pacific Railroad Company (June 1976 to April 2014); President, Celeritas Rail Consulting (since June 2014). | 1 | Northern Lights Fund Trust III (for series not affiliated with the Fund since 2015). |

| * | As of September 30, 2021, the Trust was comprised of 32 active portfolios managed by 16 unaffiliated investment advisers. The term “Fund Complex” applies only to the Fund. The Fund does not hold itself out as related to any other series within the Trust for investment purposes, nor does it share the same investment adviser with any other series. |

| ** | Only includes directorships held within the past 5 years in a company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934 or subject to the requirements of Section 15(d) of the Securities Exchange Act of 1934, or any company registered as an investment company under the 1940 Act. |

9/30/21-NLFT III-v3

19

| ISSACHAR FUND |

| SUPPLEMENTAL INFORMATION (Unaudited)(Continued) |

| September 30, 2021 |

Officers of the Trust

| Name,

Address, Year of Birth |

Position(s)

Held with Registrant |

Length

of Service and Term |

Principal Occupation(s) During Past 5 Years |

| Richard

Malinowski 1983 |

President | Since August 2017, indefinite | Senior Vice President and Senior Managing Counsel, Ultimus Fund Solutions, LLC, (since 2020); Senior Vice President Legal Administration, Gemini Fund Services, LLC (2017-2020); Vice President and Counsel (2016-2017) and AVP and Staff Attorney (2012-2016). |

| Brian

Curley 1970 |

Treasurer | Since February 2013, indefinite | Vice President, Ultimus Fund Solutions, LLC (since 2015), Assistant Vice President, Gemini Fund Services, LLC (2012-2014); Senior Controller of Fund Treasury, The Goldman Sachs Group, Inc. (2008-2012); Senior Associate of Fund Administration, Morgan Stanley (1999-2008). |

| Eric

Kane 1981 |

Secretary | Since November 2013, indefinite | Vice President and Managing Counsel, Ultimus Fund Solutions, LLC (since 2020); Vice President and Counsel, Gemini Fund Services, LLC (2017-2020), Assistant Vice President, Gemini Fund Services, LLC (2014-2017), Staff Attorney, Gemini Fund Services, LLC (2013-2014), Law Clerk, Gemini Fund Services, LLC (2009-2013), Legal Intern, NASDAQ OMX (2011), Hedge Fund Administrator, Gemini Fund Services, LLC (2008), Mutual Fund Accountant/Corporate Action Specialist, Gemini Fund Services, LLC (2006-2008). |

| William

Kimme 1962 |

Chief Compliance Officer | Since February 2012, indefinite | Senior Compliance Officer of Northern Lights Compliance Services, LLC (since 2011); Due Diligence and Compliance Consultant, Mick & Associates (2009-2011); Assistant Director, FINRA (2000-2009). |

The Fund’s Statement of Additional Information includes additional information about the Trustees and is available free of charge, upon request, by calling toll-free at 1-866-787-8355.

9/30/21-NLFT III-v3

20

| PRIVACY NOTICE | Rev. February 2014 |

NORTHERN LIGHTS FUND TRUST III

| FACTS | WHAT DOES NORTHERN LIGHTS FUND TRUST III DO WITH YOUR PERSONAL INFORMATION? |

Why?

|

Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

What?

|

The types of personal information we collect and share depend on the product or service you have with us. This information can include:

■ Social Security number and income

■ assets, account transfers and transaction history

■ investment experience and risk tolerance

When you are no longer our customer, we continue to share your information as described in this notice. |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Northern Lights Fund Trust III chooses to share and whether you can limit this sharing. |

| Reasons we can share your personal information | Does

Northern Lights Fund Trust III share? |

Can you limit this sharing? |

For our everyday business purposes– such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus |

YES | NO |

For our marketing purposes– to offer our products and services to you |

NO | We don’t share |

| For joint marketing with other financial companies | NO | We don’t share |

For our affiliates’ everyday business purposes– information about your transactions and experiences |

NO | We don’t share |

For our affiliates’ everyday business purposes– information about your creditworthiness |

NO | We don’t share |

| For our affiliates to market to you | NO | We don’t share |

| For nonaffiliates to market to you | NO | We don’t share |

| Questions? | Call (402) 493-4603 |

21

| Page 2 |

| What we do | |

| How does Northern Lights Fund Trust III protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings.

Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does Northern Lights Fund Trust III collect my personal information? | We collect your personal information, for example, when you

■ open an account or give us contact information

■ provide account information or give us your income information

■ make deposits or withdrawals from your account

We also collect your personal information from other companies. |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only

■ sharing for affiliates’ everyday business purposes—information about your creditworthiness

■ affiliates from using your information to market to you

■ sharing for nonaffiliates to market to you

State laws and individual companies may give you additional rights to limit sharing. |

| Definitions | |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies.

■ Northern Lights Fund Trust III does not share with our affiliates. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies.

■ Northern Lights Fund Trust III does not share with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you.

■ Northern Lights Fund Trust III doesn’t jointly market. |

22

PROXY VOTING POLICY

Information regarding how the Fund voted proxies relating to portfolio securities for the most recent twelve month period ended June 30 as well as a description of the policies and procedures that the Fund uses to determine how to vote proxies is available without charge, upon request, by calling 1-866-787-8355 or by referring to the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

PORTFOLIO HOLDINGS

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT, within sixty days after the end of the period. Form N-PORT reports are available at the SEC’s website at www.sec.gov.

| INVESTMENT ADVISOR | |

| Horizon Capital Management, Inc. | |

| 106 Valerie Drive | |

| Lafayette, LA 70508 | |

| ADMINISTRATOR | |

| Ultimus Fund Solutions, LLC | |

| 225 Pictoria Drive, Suite 450 | |

| Cincinatti, OH 45246 | IF-AR21 |

(a) Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

(b) Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. Not applicable

Item 2. Code of Ethics.

(a) As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(b) For purposes of this item, “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote:

| (1) | Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| (2) | Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant; |

(3) Compliance with applicable governmental laws, rules, and regulations;

| (4) | The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and |

(5) Accountability for adherence to the code.

(c) Amendments: During the period covered by the report, there have not been any amendments to the provisions of the code of ethics.

(d) Waivers: During the period covered by the report, the registrant has not granted any express or implicit waivers from the provisions of the code of ethics.

(e) The Code of Ethics is not posted on Registrant’ website.

(f) A copy of the Code of Ethics is attached as an exhibit.

Item 3. Audit Committee Financial Expert.

(a)(1)ii The Registrant’s board of trustees has determined that Mark H. Taylor is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Taylor is independent for purposes of this Item 3.

(a)(2) Not applicable.

(a)(3) In this regard, no member of the audit committee was identified as having all of the required technical attributes identified in instruction 2 (b) to item 3 of Form N-CSR to qualify as an “audit committee financial expert,” whether through the type of specialized education or experience required by that instruction. At this time, the board believes the experience provided by each member of the audit committee collectively offers the fund adequate oversight by its audit committee given the fund’s level of financial complexity. The board will from time to time reexamine such belief.

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees |

2021 - $16,000

2020 - $16,000

2019 - $15,500

2018 - $14,850

2017 - $14,500

2016 - $14,000

| (b) | Audit-Related Fees |

2021 - None

2020 - None

2019 - None

2018 - None

2017 - None

2016 - None

| (c) | Tax Fees |

2021 - $3,400

2020 - $3,400

2019 - $3,300

2018 - $3,250

2017 - $3,000

2016 - $2,750

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

| (d) | All Other Fees |

2021 - None

2020 - None

2019 - None

2018 - None

2017 - None

2016 - None

| (e) | (1) Audit Committee’s Pre-Approval Policies |

The registrant’s Audit Committee is required to pre-approve all audit services and, when appropriate, any non-audit services (including audit-related, tax and all other services) to the registrant. The registrant’s Audit Committee also is required to pre-approve, when appropriate, any non-audit services (including audit-related, tax and all other services) to its adviser, or any entity controlling, controlled by or under common control with the adviser that provides ongoing services to the registrant, to the extent that the services may be determined to have an impact on the operations or financial reporting of the registrant. Services are reviewed on an engagement by engagement basis by the Audit Committee.

| (2) | Percentages of Services Approved by the Audit Committee |

2016 2017 2018 2019 2020 2021

Audit-Related Fees: 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Tax Fees: 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

All Other Fees: 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

| (f) | During the audit of registrant's financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant's engagement were attributed to work performed by persons other than the principal accountant's full-time, permanent employees. |

| (g) | The aggregate non-audit fees billed by the registrant's accountant for services rendered to the registrant, and rendered to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant: |

2021- None

2020 - None

2019 - None

2018 - None

2017 - None

2016 - None

(h) The registrant's audit committee has considered whether the provision of non-audit services to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant, that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, is compatible with maintaining the principal accountant's independence.

Item 5. Audit Committee of Listed Companies. Not applicable to open-end investment companies.

Item 6. Schedule of Investments. Schedule of investments in securities of unaffiliated issuers is included under Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Funds. Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies. Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Funds. Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders. None

Item 11. Controls and Procedures.

(a) Based on an evaluation of the Registrant’s disclosure controls and procedures as of a date within 90 days of filing date of this Form N-CSR, the principal executive officer and principal financial officer of the Registrant have concluded that the disclosure controls and procedures of the Registrant are reasonably designed to ensure that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported by the filing date, including that information required to be disclosed is accumulated and communicated to the Registrant’s management, including the Registrant’s principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure.

(b) There were no significant changes in the Registrant’s internal control over financial reporting that occurred during the Registrant’s last fiscal half-year that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.