Form N-CSR Legg Mason ETF Investmen For: Jul 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23096

Legg Mason ETF Investment Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: July 31

Date of reporting period: July 31, 2021

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| Annual Report

|

July 31, 2021

|

LEGG MASON

SMALL-CAP QUALITY

VALUE ETF

SQLV

The Fund intends to no longer mail paper copies of the Fund’s shareholder reports like this one, unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically (“e-delivery”), you will not be affected by this change and you need not take any action. If you have not already elected e-delivery, you may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge by contacting your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Legg Mason Funds held in your account with your financial intermediary.

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks to track the investment results of an index composed of equity securities of small-capitalization companies that are traded in the United States.

Dear Shareholder,

We are pleased to provide the annual report of Legg Mason Small-Cap Quality Value ETF for the twelve-month reporting period ended July 31, 2021. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | Fund net asset value and market price, |

| • | Market insights and commentaries from our portfolio managers, and |

| • | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Patrick O’Connor

President and Chief Executive Officer - Investment Management

August 31, 2021

|

II |

Legg Mason Small-Cap Quality Value ETF |

Q. What is the Fund’s investment strategy?

A. Legg Mason Small-Cap Quality Value ETF (the “Fund”) seeks to track the investment results of an index composed of equity securities of small-capitalization companies that are traded in the United States. The Fund seeks to track the investment results of the Royce Small-Cap Quality Value Index (the “Underlying Index”) i. The Underlying Index utilizes a proprietary methodology created and sponsored by Royce & Associates, LP (“Royce”), the Fund’s subadviser. Royce is affiliated with both Legg Mason Partners Fund Advisor, LLC (“LMPFA”), the Fund’s investment manager, and the Fund. The Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, if any, in securities that compose its Underlying Index.

The Underlying Index is composed of equity securities that meet certain criteria. Using Royce’s methodology, the Underlying Index will generally favor stocks with lower than average valuation, higher than average profitability, and higher than average debt coverage (i.e., available cash flow to pay current debt obligations) as compared with other stocks included in the investment universe while maintaining a comparable risk profile.

The Underlying Index’s constituents are reconstituted quarterly. The Fund’s securities portfolio is rebalanced when the Underlying Index is reconstituted. The composition of the Underlying Index and the Fund after reconstitution and rebalancing may fluctuate and exceed the above Underlying Index limitations due to market movements and other factors. The components of the Underlying Index, and the degree to which these components represent certain sectors and industries, may change over time.

The Fund may invest up to 20% of its net assets in cash and cash equivalents; other investment companies, including exchange-traded funds; exchange-traded notes; depositary receipts; and in securities and other instruments not included in its Underlying Index but which Royce believes will help the Fund track its Underlying Index.

Q. What were the overall market conditions during the Fund’s reporting period?

A. The twelve-month reporting period ended July 31, 2021 extended the strength that U.S. small-caps have been showing since the COVID-driven bottom in March 2020. As measured respectively by the small-cap Russell 2000 Indexii and large-cap Russell 1000 Indexiii, small-cap stocks enjoyed a pronounced performance advantage, advancing 51.97% versus 37.97% for the reporting period ended July 31, 2021. Within the Russell 2000 Index, results were dominated by cyclical sectors, which accounted for five of the top six contributors for the reporting period. Industrials, Consumer Discretionary, and Financials led. Each of the Underlying Index’s eleven sectors finished the twelve-month reporting period in the black, with the smallest contributions coming from Utilities, Communication Services, and Energy. The three industries that contributed most were a notably diverse mix: banks (Financials), biotechnology (Health Care), and hotels, restaurants & leisure (Consumer Discretionary). Also interesting was the fact that only two groups detracted from performance for the period—and each came from the otherwise robust Consumer Discretionary sector: automobiles and diversified consumer services. Transportation infrastructure made the smallest contribution at the industry level.

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

1 |

Fund overview (cont’d)

The twelve-month reporting period began on a somewhat uncertain note as a highly volatile September made for a weaker market in the third quarter of 2020. Five consecutive months of positive returns came to a close in September not only for small-cap stocks but also for most of the globe’s major indexes, nearly all of which finished the month in the red. Due to strong gains in July and August, small-cap returns remained positive for the quarter; however, the Russell 2000 Index (which fell 3.34% in September) gained 4.93% for the third quarter of 2020 versus a 9.47% gain for the Russell 1000 Index. The large-cap index was boosted considerably by mega-cap names, as demonstrated by the 11.78% gain for the Russell Top 50 Indexiv for the same period.

Small-caps then rose in impressive—indeed, record-setting—fashion, finishing the calendar year with a 31.37% gain for the fourth quarter of 2020, the best quarter in the more than 40-year history of the Russell 2000 Index (and after beginning the year with the largest ever quarterly loss in the index’s history). From the depths of its March 18, 2020 low through the end of December 2020, the small-cap index rallied to a 101.33% gain. Small-cap stocks also handily outpaced large-caps—and much else—in the fourth quarter of 2020, though the Russell 1000 Index (+13.69%) and the Nasdaq Composite Indexv (+15.41%) also posted sizable advances in the quarter. While the Russell 1000 Index and Nasdaq Composite Index each reached successive peaks several times in 2020, the small-cap index did not overtake its prior all-time high from August 2018 until mid-November of 2020. The other major development in the fourth quarter of 2020 was the narrow edge for the Russell 2000 Value Indexvi over its small-cap growth counterpart, Russell 2000 Growth Indexvii, up 33.36% versus 29.61% respectively.

The first quarter of 2021 was a second consecutive strong one for the Russell 2000 Index, which advanced 12.70%. This robust result also led the small-cap index to a nearly record-setting one-year return of 94.85% through March 31, 2021, which gave investors an especially vivid sign of how thoroughly the overall U.S. equity markets have been recovering from the challenge and pain wrought by the coronavirus pandemic. The Russell 2000 Index has exceeded a 90% result only once before in its more than forty-year history, with a 97.52% gain over a year-long span in 1982-1983 (based on the index’s historical twelve-month quarter-end results). To find another comparable performance, we had to go back nearly a century to the 1930s (using the Center for Research in Security Prices 6-10 as the small-cap proxy), where there were only seven instances when small-cap returns approached or exceeded 100% for a trailing twelve-month period. We have, however, seen similarly lofty small-cap returns in the past as recently as 2009-2010.

The Russell 2000 Index took something of a breather in the second quarter of 2021, rising 4.29%, and neither setting nor approaching new records for gains or losses. In that sense, it may have seemed like a somewhat boring quarter. In contrast to the sky-high results for the Russell 2000 Index over the last two quarters, each of the major domestic indexes finished

|

2 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

the period with returns in the mid to low single digits. There was a reversal that saw large-caps outperform small-caps in the second quarter of 2021, as the Russell 2000 Index trailed the 8.54% advance for the large-cap Russell 1000 Index. However, the admittedly sizable spread between the two did little to disrupt the longer-term advantage small-caps have enjoyed over much of the last twelve months of the reporting period. And while performance may have appeared underwhelming, the second quarter of 2021 itself was a modestly above average quarter on an absolute basis. Since its inception on December 31, 1978, the average quarterly return for the Russell 2000 Index was 3.46% through June 30, 2021.

The Fund uses a passive investment approach to achieve its investment objective, and therefore made no change in investment approach in response to market conditions.

Performance review

For the twelve months ended July 31, 2021, Legg Mason Small-Cap Quality Value ETF generated a 67.77% return on a net asset value (“NAV”)viii basis and 67.91% based on its market priceix per share.

The performance table shows the Fund’s total return for the twelve months ended July 31, 2021 based on its NAV and market price as of July 31, 2021. The Fund seeks to track the investment results of the Royce Small-Cap Quality Value Index, which returned 69.67% for the same period. The Fund’s broad-based market index, the Russell 2000 Index, returned 51.97% over the same time frame. The Lipper Small-Cap Core Funds Category Averagex returned 52.83% for the same period. Please note that Lipper performance returns are based on each fund’s NAV.

| Performance Snapshot as of July 31, 2021 (unaudited) | ||||||||

| 6 months | 12 months | |||||||

| Legg Mason Small-Cap Quality Value ETF: | ||||||||

| $37.85 (NAV) |

21.56 | % | 67.77 | %*† | ||||

| $ 37.83 (Market Price) |

21.26 | % | 67.91 | %*‡ | ||||

| Royce Small-Cap Quality Value Index | 22.28 | % | 69.67 | % | ||||

| Russell 2000 Index | 7.86 | % | 51.97 | % | ||||

| Lipper Small-Cap Core Funds Category Average | 15.53 | % | 52.83 | % | ||||

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate so shares, when sold, may be worth more or less than their original cost. Performance data current to the most recent month-end is available at www.leggmason.com/etf.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the ETF. Market price returns are typically based upon the official closing price of the Fund’s shares. These returns do not represent investors’ returns had they traded shares at other times. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

3 |

Fund overview (cont’d)

Information showing the Fund’s net asset value, market price, premiums and discounts, and bid-ask spreads for various time periods is available by visiting the Fund’s website at www.leggmason.com/etf.

As of the Fund’s current prospectus dated November 25, 2020, the gross total annual fund operating expense ratio for the Fund was 0.62%.

* Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions, at NAV.

‡ Total return assumes the reinvestment of all distributions at market price, which typically is based upon the official closing price of the Fund’s shares.

Q. What were the leading contributors to performance?

A. Each of the eleven equity sectors which comprised the Underlying Index finished the twelve-month reporting period ended July 31, 2021 in the black, with the largest positive contributions coming from Financials, Industrials and Consumer Discretionary. At the industry level, banks and capital markets (both in Financials) led, followed by specialty retail (Consumer Discretionary). Relative to the Russell 2000 Index, the Underlying Index benefited from positive stock selection within the Financials sector, and both an overweighting, and to a lesser degree, positive stock selection in the Energy sector.

Additionally, the Underlying Index benefited relative to the Russell 2000 Index due to exposure to stocks with lower market capitalization within the small-cap universe.

Q. What were the leading detractors from performance?

A. Although none of the Underlying Index’s sector investments detracted from performance, investments in the Real Estate, Utilities and Consumer Staples sectors contributed the least. At the industry level, trading companies & distributors (Industrials) detracted marginally, while leisure products (Consumer Discretionary) and household products (Consumer Staples) contributed the least. Relative to the Russell 2000 Index, Information Technology was the only sector to detract, due to negative stock selection. The Underlying Index’s relative performance was also hindered by exposure to stocks with lower leverage.

Looking for additional information?

The Fund’s daily NAV is available online at www.leggmason.com/etf. The Fund is traded under the symbol “SQLV” and its closing market price is available on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-877-721-1926 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern time, for the Fund’s current NAV, market price and other information.

|

4 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

Thank you for your investment in Legg Mason Small-Cap Quality Value ETF. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Royce & Associates, LP

August 13, 2021

RISKS: Equity securities are subject to market and price fluctuations. The Fund invests primarily in small-cap stocks, which may involve considerably more risk than investing in larger-cap stocks. The Fund has significant exposure to U.S. issuers. A decrease in imports or exports, changes in trade regulations and/or an economic recession in the United States may have a material adverse effect on the U.S. economy and the securities listed on U.S. exchanges. There is no guarantee that the Fund will achieve a high degree of correlation to the index it seeks to track. The Fund does not seek to outperform the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued. If the Underlying Index is concentrated in a particular industry or industries, the Fund may focus its investments in these industries, increasing its vulnerability to market volatility. Diversification does not ensure gains or protect against market declines. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

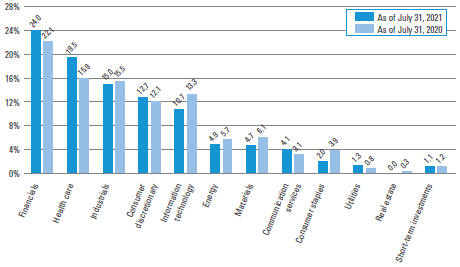

Portfolio holdings and breakdowns are as of July 31, 2021 and are subject to change and may not be representative of the portfolio managers’ current or future investments. Please refer to pages 11 through 20 for a list and percentage breakdown of the Fund’s holdings.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of July 31, 2021 were: Financials (24.0%), Health Care (19.5%), Industrials (15.0%), Consumer Discretionary (12.7%) and Information Technology (10.7%). The Fund’s composition may differ over time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. An index is a statistical composite that tracks a specified financial market, sector or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

5 |

Fund overview (cont’d)

| i | The Royce Small-Cap Quality Value Index is a proprietary index composed of small-cap stocks trading in the United States with relatively low valuations, high profitability and high debt coverage compared with the average of stocks in the investment universe. |

| ii | The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

| iii | The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000 Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 Index represents approximately 90% of the U.S. market. |

| iv | The Russell Top 50 Index is a market capitalization weighted index of the 50 largest stocks in the Russell 3000 universe of U.S.-based equities. The index can be considered a representation of mega cap stocks. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. v The Nasdaq Composite Index is a stock market index that consists of the stocks that are listed on the Nasdaq stock exchange. |

| vi | The Russell 2000 Value Index measures the performance of those Russell 2000 Index companies with lower price-to-book ratios and lower forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) |

| vii | The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities). |

| Viii | Net Asset Value (“NAV”) is calculated by subtracting total liabilities from total assets and dividing the results by the number of shares outstanding. |

| ix | Market Price is determined by supply and demand. It is the price at which an investor purchases or sells shares of the Fund. The Market Price may differ from the Fund’s NAV. |

| x | Lipper, Inc., a wholly-owned subsidiary of Refinitiv, provides independent insight on global collective investments. Returns are based on the period ended July 31, 2021 calculated among the 871 funds for the six-month period and among the 863 funds for the twelve-month period in the Fund’s Lipper category. |

|

6 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of July 31, 2021 and July 31, 2020. The composition of the Fund’s investments is subject to change at any time. |

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

7 |

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, such as brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

This example is based on an investment of $1,000 invested on February 1, 2021 and held for the six months ended July 31, 2021.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| Based on actual total return1 | Based on hypothetical total return1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Actual Total Return2 |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 |

Hypothetical Annualized Total Return |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio |

Expenses Paid During the Period3 | |||||||||||||||||||||||||||||||||||||||||

| 21.56% | $ | 1,000.00 | $ | 1,215.60 | 0.60 | % | $ | 3.30 | 5.00 | % | $1,000.00 | $ | 1,021.82 | 0.60 | % | $ | 3.01 | |||||||||||||||||||||||||||||||||

| 1 | For the six months ended July 31, 2021. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (181), then divided by 365. |

|

8 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

| Net Asset Value | ||||

| Average annual total returns1 | ||||

| Twelve Months Ended 7/31/21 | 67.77 | % | ||

| Inception* through 7/31/21 | 11.91 | |||

| Cumulative total returns1 | ||||

| Inception date of 7/12/17 through 7/31/21 | 57.76 | % | ||

| Market Price | ||||

| Average annual total returns2 | ||||

| Twelve Months Ended 7/31/21 | 67.91 | % | ||

| Inception* through 7/31/21 | 11.89 | |||

| Cumulative total returns2 | ||||

| Inception date of 7/12/17 through 7/31/21 | 57.68 | % | ||

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

Investors buy and sell shares of the Fund at market price, not NAV, in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the Fund. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and effective July 1, 2020, market price returns typically are based upon the official closing price of the Fund’s shares. Prior to July 1, 2020, market price returns generally were based upon the mid-point between the bid and ask on the Fund’s principal trading market when the Fund’s NAV was determined, which was typically 4:00 p.m. Eastern time (U.S.). Market price performance reported for periods prior to July 1, 2020 continue to reflect market prices calculated based upon the mid-point between the bid and ask on the Fund’s principal trading market typically as of 4:00 p.m. Eastern time (U.S.). These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other exchange-traded funds, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at market price. |

| * | Inception date of the Fund is July 12, 2017. |

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

9 |

Fund performance (unaudited) (cont’d)

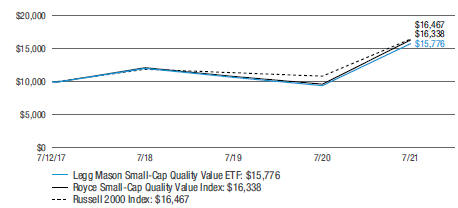

Historical performance

Value of $10,000 invested in

Legg Mason Small-Cap Quality Value ETF vs. Royce Small-Cap Quality Value Index and Russell 2000 Index† - July 12, 2017—July 31, 2021

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $10,000 invested in Legg Mason Small-Cap Quality Value ETF on July 12, 2017 (inception date), assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through July 31, 2021. The hypothetical illustration also assumes a $10,000 investment in the Royce Small-Cap Quality Value Index and the Russell 2000 Index. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund. The Royce Small-Cap Quality Value Index (the “Underlying Index”) is an index composed of equity securities that meet certain criteria – lower than average valuation, higher than average profitability and higher than average debt coverage. The Underlying Index is based on a proprietary methodology created and sponsored by Royce & Associates, LP, the Fund’s subadviser. The Russell 2000 Index measures the 2000 smallest companies in the Russell 3000 Index. The indices are not subject to the same management and trading expenses as a fund. An index is a statistical composite that tracks a specified financial market, sector, or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index. |

|

10 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

July 31, 2021

Legg Mason Small-Cap Quality Value ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||

| Common Stocks — 98.9% | ||||||||

| Communication Services — 4.1% | ||||||||

| Diversified Telecommunication Services — 0.7% |

||||||||

| Frontier Communications Parent Inc. |

3,914 | $117,068 | * | |||||

| Entertainment — 0.3% |

||||||||

| Sciplay Corp., Class A Shares |

2,973 | 47,836 | * | |||||

| Interactive Media & Services — 0.6% |

||||||||

| TrueCar Inc. |

8,734 | 45,941 | * | |||||

| Yelp Inc. |

1,620 | 60,588 | * | |||||

| Total Interactive Media & Services |

106,529 | |||||||

| Media — 2.5% |

||||||||

| AMC Networks Inc., Class A Shares |

1,224 | 61,249 | * | |||||

| Fluent Inc. |

14,141 | 35,211 | * | |||||

| Gray Television Inc. |

3,686 | 81,719 | ||||||

| Hemisphere Media Group Inc. |

3,804 | 48,349 | * | |||||

| Meredith Corp. |

2,480 | 108,227 | * | |||||

| TEGNA Inc. |

5,348 | 94,766 | ||||||

| Total Media |

429,521 | |||||||

| Total Communication Services |

700,954 | |||||||

| Consumer Discretionary — 12.7% | ||||||||

| Auto Components — 0.6% |

||||||||

| Modine Manufacturing Co. |

3,476 | 58,153 | * | |||||

| Motorcar Parts of America Inc. |

1,945 | 43,257 | * | |||||

| Total Auto Components |

101,410 | |||||||

| Diversified Consumer Services — 1.0% |

||||||||

| American Public Education Inc. |

1,703 | 50,443 | * | |||||

| Houghton Mifflin Harcourt Co. |

5,257 | 59,509 | * | |||||

| Stride Inc. |

2,172 | 66,594 | * | |||||

| Total Diversified Consumer Services |

176,546 | |||||||

| Hotels, Restaurants & Leisure — 0.3% |

||||||||

| Nathan’s Famous Inc. |

650 | 41,762 | ||||||

| Household Durables — 2.9% |

||||||||

| Bassett Furniture Industries Inc. |

1,647 | 37,519 | ||||||

| Century Communities Inc. |

953 | 66,186 | ||||||

| Ethan Allen Interiors Inc. |

2,247 | 53,411 | ||||||

| Hooker Furniture Corp. |

1,351 | 44,840 | ||||||

| La-Z-Boy Inc. |

1,843 | 61,888 | ||||||

| Taylor Morrison Home Corp., Class A Shares |

3,530 | 94,675 | * | |||||

| Tri Pointe Homes Inc. |

3,888 | 93,778 | * | |||||

See Notes to Financial Statements.

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

11 |

Schedule of investments (cont’d)

July 31, 2021

Legg Mason Small-Cap Quality Value ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||

| Household Durables — continued |

||||||||

| VOXX International Corp. |

3,022 | $ | 34,511 | * | ||||

| ZAGG Inc. CVR |

8,902 | 801 | (a)(b) | |||||

| Total Household Durables |

487,609 | |||||||

| Internet & Direct Marketing Retail — 1.6% |

||||||||

| PetMed Express Inc. |

1,727 | 54,210 | ||||||

| Shutterstock Inc. |

822 | 89,179 | ||||||

| Stamps.com Inc. |

368 | 120,248 | * | |||||

| Total Internet & Direct Marketing Retail |

263,637 | |||||||

| Leisure Products — 0.6% |

||||||||

| Nautilus Inc. |

2,477 | 35,793 | * | |||||

| Smith & Wesson Brands Inc. |

2,752 | 64,534 | ||||||

| Total Leisure Products |

100,327 | |||||||

| Media — 0.4% |

||||||||

| Entravision Communications Corp., Class A Shares |

12,031 | 73,991 | ||||||

| Specialty Retail — 3.7% |

||||||||

| Aaron’s Co. Inc. |

1,934 | 55,835 | ||||||

| Big 5 Sporting Goods Corp. |

1,993 | 43,686 | ||||||

| Camping World Holdings Inc., Class A Shares |

2,693 | 105,996 | ||||||

| Conn’s Inc. |

2,400 | 53,376 | * | |||||

| JOANN Inc. |

4,145 | 64,082 | ||||||

| MarineMax Inc. |

1,419 | 76,328 | * | |||||

| OneWater Marine Inc., Class A Shares |

1,162 | 54,591 | ||||||

| Shoe Carnival Inc. |

1,898 | 63,963 | ||||||

| Sportsman’s Warehouse Holdings Inc. |

3,323 | 58,717 | * | |||||

| Zumiez Inc. |

1,318 | 57,531 | * | |||||

| Total Specialty Retail |

634,105 | |||||||

| Textiles, Apparel & Luxury Goods — 1.6% |

||||||||

| Fossil Group Inc. |

4,329 | 54,632 | * | |||||

| G-III Apparel Group Ltd |

2,237 | 66,797 | * | |||||

| Kontoor Brands Inc. |

1,386 | 76,756 | ||||||

| Wolverine World Wide Inc. |

2,285 | 76,639 | ||||||

| Total Textiles, Apparel & Luxury Goods |

274,824 | |||||||

| Total Consumer Discretionary |

2,154,211 | |||||||

| Consumer Staples — 2.0% | ||||||||

| Household Products — 0.2% |

||||||||

| Oil-Dri Corp. of America |

1,261 | 44,854 | ||||||

| Personal Products — 1.2% |

||||||||

| BellRing Brands Inc., Class A Shares |

1,981 | 65,512 | * | |||||

See Notes to Financial Statements.

|

12 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

Legg Mason Small-Cap Quality Value ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||

| Personal Products — continued |

||||||||

| Nu Skin Enterprises Inc. , Class A Shares |

1,517 | $ | 81,448 | |||||

| USANA Health Sciences Inc. |

609 | 58,019 | * | |||||

| Total Personal Products |

204,979 | |||||||

| Tobacco — 0.6% |

||||||||

| Vector Group Ltd. |

7,338 | 98,035 | ||||||

| Total Consumer Staples |

347,868 | |||||||

| Energy — 4.9% | ||||||||

| Energy Equipment & Services — 0.6% |

||||||||

| Helix Energy Solutions Group Inc. |

10,908 | 45,268 | * | |||||

| Newpark Resources Inc. |

14,095 | 45,527 | * | |||||

| Total Energy Equipment & Services |

90,795 | |||||||

| Oil, Gas & Consumable Fuels — 4.3% |

||||||||

| Antero Resources Corp. |

8,514 | 115,790 | * | |||||

| Berry Corp. |

9,567 | 53,097 | ||||||

| Centrus Energy Corp., Class A Shares |

1,230 | 28,524 | * | |||||

| CONSOL Energy Inc. |

3,802 | 79,880 | * | |||||

| International Seaways Inc. |

6,194 | 101,891 | ||||||

| Peabody Energy Corp. |

13,036 | 152,652 | * | |||||

| Renewable Energy Group Inc. |

1,186 | 72,642 | * | |||||

| World Fuel Services Corp. |

3,873 | 133,464 | ||||||

| Total Oil, Gas & Consumable Fuels |

737,940 | |||||||

| Total Energy |

828,735 | |||||||

| Financials — 24.0% | ||||||||

| Banks — 7.0% |

||||||||

| ACNB Corp. |

1,750 | 48,878 | ||||||

| Associated Banc-Corp. |

4,758 | 94,209 | ||||||

| Civista Bancshares Inc. |

2,112 | 48,344 | ||||||

| CNB Financial Corp. |

2,223 | 51,262 | ||||||

| Customers Bancorp Inc. |

1,492 | 54,040 | * | |||||

| Farmers National Banc Corp. |

3,142 | 48,230 | ||||||

| Financial Institutions Inc. |

1,868 | 54,994 | ||||||

| HBT Financial Inc. |

4,686 | 76,569 | ||||||

| Hilltop Holdings Inc. |

2,174 | 68,872 | ||||||

| Horizon Bancorp Inc. |

3,648 | 60,958 | ||||||

| Independent Bank Corp. |

2,511 | 52,806 | ||||||

| Macatawa Bank Corp. |

5,401 | 44,936 | ||||||

| Mercantile Bank Corp. |

1,869 | 58,406 | ||||||

| Northeast Bank |

1,278 | 40,781 | ||||||

| Northrim BanCorp Inc. |

1,032 | 42,126 | ||||||

| Orrstown Financial Services Inc. |

1,884 | 43,426 | ||||||

See Notes to Financial Statements.

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

13 |

Schedule of investments (cont’d)

July 31, 2021

Legg Mason Small-Cap Quality Value ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||

| Banks — continued |

||||||||

| Parke Bancorp Inc. |

2,356 | $ | 47,026 | |||||

| Peoples Financial Services Corp. |

1,190 | 51,051 | ||||||

| South Plains Financial Inc. |

2,180 | 50,140 | ||||||

| Umpqua Holdings Corp. |

5,810 | 109,635 | ||||||

| Unity Bancorp Inc. |

1,867 | 41,466 | ||||||

| Total Banks |

1,188,155 | |||||||

| Capital Markets — 5.5% |

||||||||

| Artisan Partners Asset Management Inc., Class A Shares |

2,056 | 98,873 | ||||||

| B Riley Financial Inc. |

1,369 | 92,490 | ||||||

| Brightsphere Investment Group Inc. |

3,058 | 76,419 | ||||||

| Cowen Inc., Class A Shares |

2,233 | 89,275 | ||||||

| Crescent Capital BDC Inc. |

3,554 | 65,394 | ||||||

| Diamond Hill Investment Group Inc. |

373 | 64,249 | ||||||

| Donnelley Financial Solutions Inc. |

1,756 | 56,561 | * | |||||

| Federated Hermes Inc., Class B Shares |

3,218 | 104,392 | ||||||

| GAMCO Investors Inc., Class A Shares |

2,282 | 61,477 | ||||||

| Oppenheimer Holdings Inc., Class A Shares |

1,342 | 60,323 | ||||||

| Victory Capital Holdings Inc., Class A Shares |

2,348 | 71,591 | ||||||

| Virtu Financial Inc., Class A Shares |

3,642 | 93,745 | ||||||

| Total Capital Markets |

934,789 | |||||||

| Diversified Financial Services — 0.5% |

||||||||

| Cannae Holdings Inc. |

2,317 | 77,040 | * | |||||

| Insurance — 7.3% |

||||||||

| American Equity Investment Life Holding Co. |

3,928 | 126,049 | ||||||

| American National Group Inc. |

815 | 134,459 | ||||||

| CNO Financial Group Inc. |

3,375 | 77,085 | ||||||

| Donegal Group Inc., Class A Shares |

4,385 | 67,836 | ||||||

| Genworth Financial Inc., Class A Shares |

33,958 | 113,420 | * | |||||

| Investors Title Co. |

341 | 56,787 | ||||||

| Mercury General Corp. |

1,909 | 116,124 | ||||||

| National Western Life Group Inc., Class A Shares |

365 | 75,880 | ||||||

| Safety Insurance Group Inc. |

986 | 75,547 | ||||||

| State Auto Financial Corp. |

3,798 | 189,900 | ||||||

| Stewart Information Services Corp. |

1,389 | 81,965 | ||||||

| Tiptree Inc. |

5,769 | 55,440 | ||||||

| White Mountains Insurance Group Ltd. |

72 | 81,473 | ||||||

| Total Insurance |

1,251,965 | |||||||

| Thrifts & Mortgage Finance — 3.7% |

||||||||

| Flagstar Bancorp Inc. |

2,369 | 108,405 | ||||||

| FS Bancorp Inc. |

1,216 | 42,293 | ||||||

See Notes to Financial Statements.

|

14 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

Legg Mason Small-Cap Quality Value ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||

| Thrifts & Mortgage Finance — continued |

||||||||

| Hingham Institution For Savings The |

167 | $ | 49,933 | |||||

| Merchants Bancorp |

1,557 | 57,049 | ||||||

| NMI Holdings Inc., Class A Shares |

2,834 | 62,405 | * | |||||

| Premier Financial Corp. |

2,249 | 60,228 | ||||||

| Radian Group Inc. |

4,571 | 103,213 | ||||||

| Southern Missouri Bancorp Inc. |

1,063 | 47,707 | ||||||

| Timberland Bancorp Inc. |

1,606 | 46,189 | ||||||

| Waterstone Financial Inc. |

2,977 | 58,736 | ||||||

| Total Thrifts & Mortgage Finance |

636,158 | |||||||

| Total Financials |

4,088,107 | |||||||

| Health Care — 19.5% | ||||||||

| Biotechnology — 4.7% |

||||||||

| Anika Therapeutics Inc. |

908 | 36,438 | * | |||||

| Arcus Biosciences Inc. |

1,878 | 58,988 | * | |||||

| Blueprint Medicines Corp. |

700 | 61,509 | * | |||||

| Catalyst Pharmaceuticals Inc. |

6,786 | 39,630 | * | |||||

| Coherus Biosciences Inc. |

2,951 | 38,511 | * | |||||

| CytomX Therapeutics Inc. |

4,533 | 24,524 | * | |||||

| Eagle Pharmaceuticals Inc. |

1,223 | 56,869 | * | |||||

| Emergent BioSolutions Inc. |

1,145 | 75,455 | * | |||||

| Ideaya Biosciences Inc. |

1,575 | 38,588 | * | |||||

| Ironwood Pharmaceuticals Inc. |

4,191 | 55,615 | * | |||||

| MEI Pharma Inc. |

6,989 | 18,870 | * | |||||

| Myriad Genetics Inc. |

2,095 | 66,265 | * | |||||

| Puma Biotechnology Inc. |

2,867 | 21,560 | * | |||||

| Sage Therapeutics Inc. |

888 | 38,832 | * | |||||

| Sangamo Therapeutics Inc. |

3,731 | 35,743 | * | |||||

| Surface Oncology Inc. |

4,117 | 24,743 | * | |||||

| Translate Bio Inc. |

2,283 | 63,102 | * | |||||

| Vanda Pharmaceuticals Inc. |

2,659 | 43,368 | * | |||||

| Total Biotechnology |

798,610 | |||||||

| Health Care Equipment & Supplies — 7.1% |

||||||||

| Accuray Inc. |

8,534 | 34,989 | * | |||||

| AngioDynamics Inc. |

1,837 | 48,919 | * | |||||

| Atrion Corp. |

83 | 52,202 | ||||||

| Bioventus Inc. |

3,178 | 49,545 | * | |||||

| Co-Diagnostics Inc. |

3,481 | 35,193 | * | |||||

| Heska Corp. |

218 | 52,473 | * | |||||

| ICU Medical Inc. |

352 | 71,558 | * | |||||

| Inari Medical Inc. |

383 | 34,390 | * | |||||

See Notes to Financial Statements.

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

15 |

Schedule of investments (cont’d)

July 31, 2021

Legg Mason Small-Cap Quality Value ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||

| Health Care Equipment & Supplies — continued |

||||||||

| Inogen Inc. |

741 | $ | 59,110 | * | ||||

| iRadimed Corp. |

970 | 32,650 | * | |||||

| LeMaitre Vascular Inc. |

878 | 47,816 | ||||||

| Meridian Bioscience Inc. |

2,621 | 53,731 | * | |||||

| Merit Medical Systems Inc. |

1,053 | 73,805 | * | |||||

| Mesa Laboratories Inc. |

188 | 55,368 | ||||||

| Natus Medical Inc. |

1,872 | 49,982 | * | |||||

| Neogen Corp. |

1,274 | 55,495 | * | |||||

| NuVasive Inc. |

1,019 | 65,165 | * | |||||

| OraSure Technologies Inc. |

4,231 | 49,883 | * | |||||

| Orthofix Medical Inc. |

1,200 | 47,688 | * | |||||

| Quidel Corp. |

735 | 103,980 | * | |||||

| Retractable Technologies Inc. |

2,280 | 26,836 | * | |||||

| Surmodics Inc. |

655 | 36,097 | * | |||||

| Tactile Systems Technology Inc. |

664 | 32,523 | * | |||||

| Utah Medical Products Inc. |

490 | 43,806 | ||||||

| Total Health Care Equipment & Supplies |

1,213,204 | |||||||

| Health Care Providers & Services — 3.0% |

||||||||

| Apria Inc. |

3,417 | 107,738 | * | |||||

| Fulgent Genetics Inc. |

718 | 66,235 | * | |||||

| MEDNAX Inc. |

2,439 | 71,024 | * | |||||

| ModivCare Inc. |

422 | 71,740 | * | |||||

| National HealthCare Corp. |

1,027 | 79,747 | ||||||

| Tivity Health Inc. |

2,071 | 51,941 | * | |||||

| US Physical Therapy Inc. |

484 | 57,189 | ||||||

| Total Health Care Providers & Services |

505,614 | |||||||

| Health Care Technology — 0.9% |

||||||||

| Computer Programs & Systems Inc. |

1,471 | 46,439 | ||||||

| HealthStream Inc. |

2,073 | 60,552 | * | |||||

| NextGen Healthcare Inc. |

3,322 | 53,883 | * | |||||

| Total Health Care Technology |

160,874 | |||||||

| Pharmaceuticals — 3.8% |

||||||||

| Amphastar Pharmaceuticals Inc. |

2,397 | 50,217 | * | |||||

| ANI Pharmaceuticals Inc. |

1,235 | 41,904 | * | |||||

| Atea Pharmaceuticals Inc. |

2,298 | 57,542 | * | |||||

| BioDelivery Sciences International Inc. |

9,291 | 34,934 | * | |||||

| Collegium Pharmaceutical Inc. |

2,226 | 55,405 | * | |||||

| Corcept Therapeutics Inc. |

2,723 | 56,557 | * | |||||

| Innoviva Inc. |

5,453 | 77,323 | * | |||||

| Pacira BioSciences Inc. |

909 | 53,586 | * | |||||

See Notes to Financial Statements.

|

16 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

Legg Mason Small-Cap Quality Value ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||

| Pharmaceuticals — continued |

||||||||

| Phibro Animal Health Corp., Class A Shares |

2,084 | $ | 49,328 | |||||

| Prestige Consumer Healthcare Inc. |

1,452 | 76,303 | * | |||||

| SIGA Technologies Inc. |

6,529 | 41,590 | * | |||||

| Supernus Pharmaceuticals Inc. |

2,083 | 54,845 | * | |||||

| Total Pharmaceuticals |

649,534 | |||||||

| Total Health Care |

3,327,836 | |||||||

| Industrials — 15.0% | ||||||||

| Aerospace & Defense — 1.1% |

||||||||

| Aerojet Rocketdyne Holdings Inc. |

2,109 | 99,502 | ||||||

| Parsons Corp. |

2,240 | 86,509 | * | |||||

| Total Aerospace & Defense |

186,011 | |||||||

| Air Freight & Logistics — 0.4% |

||||||||

| Atlas Air Worldwide Holdings Inc. |

1,153 | 77,216 | * | |||||

| Building Products — 0.7% |

||||||||

| Apogee Enterprises Inc. |

1,761 | 69,859 | ||||||

| Quanex Building Products Corp. |

2,276 | 56,536 | ||||||

| Total Building Products |

126,395 | |||||||

| Commercial Services & Supplies — 2.6% |

||||||||

| ABM Industries Inc. |

2,095 | 97,397 | ||||||

| Civeo Corp. |

2,969 | 64,457 | * | |||||

| Ennis Inc. |

2,939 | 58,104 | ||||||

| Healthcare Services Group Inc. |

2,784 | 72,662 | ||||||

| Herman Miller Inc. |

1,712 | 73,873 | ||||||

| HNI Corp. |

1,878 | 70,049 | ||||||

| Total Commercial Services & Supplies |

436,542 | |||||||

| Construction & Engineering — 2.3% |

||||||||

| Comfort Systems USA Inc. |

921 | 68,845 | ||||||

| Dycom Industries Inc. |

911 | 63,223 | * | |||||

| Granite Construction Inc. |

2,035 | 78,185 | ||||||

| MYR Group Inc. |

711 | 67,993 | * | |||||

| Northwest Pipe Co. |

1,352 | 38,410 | * | |||||

| Primoris Services Corp. |

2,422 | 72,418 | ||||||

| Total Construction & Engineering |

389,074 | |||||||

| Electrical Equipment — 0.5% |

||||||||

| LSI Industries Inc. |

5,490 | 41,340 | ||||||

| Powell Industries Inc. |

1,646 | 47,882 | ||||||

| Total Electrical Equipment |

89,222 | |||||||

| Machinery — 2.8% |

||||||||

| Astec Industries Inc. |

955 | 58,551 | ||||||

| Greenbrier Cos. Inc. |

1,731 | 74,087 | ||||||

See Notes to Financial Statements.

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

17 |

Schedule of investments (cont’d)

July 31, 2021

Legg Mason Small-Cap Quality Value ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||

| Machinery — continued |

||||||||

| Hillenbrand Inc. |

2,036 | $ | 92,231 | |||||

| Hurco Cos. Inc. |

1,171 | 39,744 | ||||||

| Miller Industries Inc. |

1,344 | 50,413 | ||||||

| Mueller Industries Inc. |

1,705 | 73,997 | ||||||

| Terex Corp. |

1,683 | 80,649 | ||||||

| Total Machinery |

469,672 | |||||||

| Professional Services — 2.5% |

||||||||

| GP Strategies Corp. |

2,849 | 57,977 | * | |||||

| Kelly Services Inc., Class A Shares |

3,377 | 74,024 | * | |||||

| Kforce Inc. |

1,048 | 65,427 | ||||||

| Resources Connection Inc. |

4,126 | 63,912 | ||||||

| TriNet Group Inc. |

1,168 | 96,920 | * | |||||

| TrueBlue Inc. |

2,356 | 64,060 | * | |||||

| Total Professional Services |

422,320 | |||||||

| Road & Rail — 0.4% |

||||||||

| ArcBest Corp. |

1,223 | 72,292 | ||||||

| Trading Companies & Distributors — 1.7% |

||||||||

| Boise Cascade Co. |

1,509 | 77,185 | ||||||

| NOW Inc. |

6,597 | 65,112 | * | |||||

| Rush Enterprises Inc., Class A Shares |

2,001 | 94,027 | ||||||

| Titan Machinery Inc. |

1,903 | 54,293 | * | |||||

| Total Trading Companies & Distributors |

290,617 | |||||||

| Total Industrials |

2,559,361 | |||||||

| Information Technology — 10.7% | ||||||||

| Communications Equipment — 1.0% |

||||||||

| Digi International Inc. |

2,455 | 50,769 | * | |||||

| NETGEAR Inc. |

1,438 | 49,252 | * | |||||

| NetScout Systems Inc. |

2,516 | 72,360 | * | |||||

| Total Communications Equipment |

172,381 | |||||||

| Electronic Equipment, Instruments & Components — 4.2% |

||||||||

| Benchmark Electronics Inc. |

2,508 | 66,211 | ||||||

| Daktronics Inc. |

7,591 | 46,381 | * | |||||

| Insight Enterprises Inc. |

898 | 90,141 | * | |||||

| Kimball Electronics Inc. |

2,569 | 52,382 | * | |||||

| Methode Electronics Inc. |

1,445 | 69,114 | ||||||

| Plexus Corp. |

779 | 70,359 | * | |||||

| Sanmina Corp. |

2,275 | 87,406 | * | |||||

| ScanSource Inc. |

2,481 | 68,451 | * | |||||

See Notes to Financial Statements.

|

18 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

Legg Mason Small-Cap Quality Value ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||

| Electronic Equipment, Instruments & Components — continued |

||||||||

| TTM Technologies Inc. |

5,220 | $ | 73,028 | * | ||||

| Vishay Intertechnology Inc. |

3,868 | 85,599 | ||||||

| Total Electronic Equipment, Instruments & Components |

709,072 | |||||||

| IT Services — 1.7% |

||||||||

| BM Technologies Inc. |

334 | 3,350 | * | |||||

| CSG Systems International Inc. |

1,682 | 76,295 | ||||||

| ExlService Holdings Inc. |

627 | 70,989 | * | |||||

| Hackett Group Inc. |

2,881 | 51,628 | ||||||

| Sykes Enterprises Inc. |

1,633 | 87,627 | * | |||||

| Total IT Services |

289,889 | |||||||

| Semiconductors & Semiconductor Equipment — 0.8% |

||||||||

| Cirrus Logic Inc. |

1,002 | 82,755 | * | |||||

| NVE Corp. |

766 | 57,504 | ||||||

| Total Semiconductors & Semiconductor Equipment |

140,259 | |||||||

| Software — 2.7% |

||||||||

| A10 Networks Inc. |

3,759 | 48,002 | * | |||||

| CommVault Systems Inc. |

730 | 55,181 | * | |||||

| Intelligent Systems Corp. |

860 | 29,059 | * | |||||

| InterDigital Inc. |

907 | 59,762 | ||||||

| Progress Software Corp. |

1,502 | 68,476 | ||||||

| Qualys Inc. |

562 | 57,077 | * | |||||

| Verint Systems Inc. |

1,592 | 67,931 | * | |||||

| Xperi Holding Corp. |

3,731 | 77,493 | ||||||

| Total Software |

462,981 | |||||||

| Technology Hardware, Storage & Peripherals — 0.3% |

||||||||

| Avid Technology Inc. |

1,097 | 41,017 | * | |||||

| Total Information Technology |

1,815,599 | |||||||

| Materials — 4.7% | ||||||||

| Chemicals — 1.5% |

||||||||

| American Vanguard Corp. |

2,742 | 45,270 | ||||||

| Minerals Technologies Inc. |

901 | 72,278 | ||||||

| Tredegar Corp. |

5,454 | 71,284 | ||||||

| Valhi Inc. |

2,751 | 67,785 | ||||||

| Total Chemicals |

256,617 | |||||||

| Metals & Mining — 1.3% |

||||||||

| Commercial Metals Co. |

3,008 | 98,663 | ||||||

| Haynes International Inc. |

1,459 | 55,048 | ||||||

| SunCoke Energy Inc. |

8,718 | 67,390 | ||||||

| Total Metals & Mining |

221,101 | |||||||

See Notes to Financial Statements.

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

19 |

Schedule of investments (cont’d)

July 31, 2021

Legg Mason Small-Cap Quality Value ETF

(Percentages shown based on Fund net assets)

| Security | Shares | Value | ||||||||||||||

| Paper & Forest Products — 1.9% |

||||||||||||||||

| Clearwater Paper Corp. |

2,131 | $ | 62,843 | * | ||||||||||||

| Domtar Corp. |

1,919 | 105,372 | * | |||||||||||||

| Glatfelter Corp. |

4,548 | 69,266 | ||||||||||||||

| Schweitzer-Mauduit International Inc. |

1,968 | 77,402 | ||||||||||||||

| Total Paper & Forest Products |

314,883 | |||||||||||||||

| Total Materials |

|

792,601 | ||||||||||||||

| Utilities — 1.3% | ||||||||||||||||

| Electric Utilities — 1.3% |

||||||||||||||||

| Hawaiian Electric Industries Inc. |

2,445 | 105,966 | ||||||||||||||

| IDACORP Inc. |

1,062 | 111,988 | ||||||||||||||

| Total Utilities |

|

217,954 | ||||||||||||||

| Total Common Stocks (Cost — $15,077,689) |

|

16,833,226 | ||||||||||||||

| Rate | Maturity Date |

Face Amount |

||||||||||||||

| Corporate Bonds & Notes — 0.0%†† | ||||||||||||||||

| Financials — 0.0%†† | ||||||||||||||||

| Capital Markets — 0.0%†† |

||||||||||||||||

| GAMCO Investors Inc., Subordinated Notes, Step bond (4.000% to 6/15/22 then 5.000%) |

4.000 | % | 6/15/23 | $ | 5,000 | 5,000 | ||||||||||

| Total Investments before Short-Term Investments (Cost — $15,082,689) |

|

16,838,226 | ||||||||||||||

| Shares | ||||||||||||||||

| Short-Term Investments — 1.1% | ||||||||||||||||

| Dreyfus Treasury Cash Management, Institutional Class (Cost — $195,245) |

0.010 | % | 195,245 | 195,245 | ||||||||||||

| Total Investments — 100.0% (Cost — $15,277,934) |

|

17,033,471 | ||||||||||||||

| Liabilities in Excess of Other Assets — (0.0)%†† |

|

(2,393 | ) | |||||||||||||

| Total Net Assets — 100.0% |

|

$ | 17,031,078 | |||||||||||||

| †† | Represents less than 0.1%. |

| * | Non-income producing security. |

| (a) | Security is valued in good faith in accordance with procedures approved by the Board of Trustees (Note 1). |

| (b) | Security is valued using significant unobservable inputs (Note 1). |

| Abbreviation(s) used in this schedule: | ||

| CVR | — Contingent Value Rights | |

See Notes to Financial Statements.

|

20 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

Statement of assets and liabilities

July 31, 2021

| Assets: | ||||

| Investments, at value (Cost — $15,277,934) |

$ | 17,033,471 | ||

| Dividends and interest receivable |

6,194 | |||

| Total Assets |

17,039,665 | |||

| Liabilities: | ||||

| Investment management fee payable |

8,587 | |||

| Total Liabilities |

8,587 | |||

| Total Net Assets | $ | 17,031,078 | ||

| Net Assets: | ||||

| Par value (Note 5) |

$ | 5 | ||

| Paid-in capital in excess of par value |

18,611,373 | |||

| Total distributable earnings (loss) |

(1,580,300) | |||

| Total Net Assets | $ | 17,031,078 | ||

| Shares Outstanding | 450,000 | |||

| Net Asset Value | $37.85 | |||

See Notes to Financial Statements.

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

21 |

For the Year Ended July 31, 2021

| Investment Income: | ||||

| Dividends |

$ | 243,511 | ||

| Interest |

47 | |||

| Total Investment Income |

243,558 | |||

| Expenses: | ||||

| Investment management fee (Note 2) |

84,628 | |||

| Interest expense |

2 | |||

| Total Expenses |

84,630 | |||

| Net Investment Income | 158,928 | |||

| Realized and Unrealized Gain on Investments (Notes 1 and 3): | ||||

| Net Realized Gain From Investment Transactions |

4,272,828 | |||

| Change in Net Unrealized Appreciation (Depreciation) From Investments |

2,429,356 | |||

| Net Gain on Investments | 6,702,184 | |||

| Increase in Net Assets From Operations | $ | 6,861,112 | ||

See Notes to Financial Statements.

|

22 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

Statements of changes in net assets

| For the Years Ended July 31, | 2021 | 2020 | ||||||

| Operations: | ||||||||

| Net investment income |

$ | 158,928 | $ | 161,698 | ||||

| Net realized gain (loss) |

4,272,828 | (1,422,025) | ||||||

| Change in net unrealized appreciation (depreciation) |

2,429,356 | (256,013) | ||||||

| Increase (Decrease) in Net Assets From Operations |

6,861,112 | (1,516,340) | ||||||

| Distributions to Shareholders From (Note 1): | ||||||||

| Total distributable earnings |

(142,575) | (157,180) | ||||||

| Decrease in Net Assets From Distributions to Shareholders |

(142,575) | (157,180) | ||||||

| Fund Share Transactions (Note 5): | ||||||||

| Net proceeds from sale of shares (350,000 and 350,000 shares issued, respectively) |

10,982,654 | 9,197,480 | ||||||

| Cost of shares repurchased (400,000 and 250,000 shares repurchased, respectively) |

(12,071,990) | (6,605,552) | ||||||

| Increase (Decrease) in Net Assets From Fund Share Transactions |

(1,089,336) | 2,591,928 | ||||||

| Increase in Net Assets |

5,629,201 | 918,408 | ||||||

| Net Assets: | ||||||||

| Beginning of year |

11,401,877 | 10,483,469 | ||||||

| End of year |

$ | 17,031,078 | $ | 11,401,877 | ||||

See Notes to Financial Statements.

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

23 |

| For a share of beneficial interest outstanding throughout each year ended July 31, unless otherwise noted: |

||||||||||||||||||||

| 20211 | 20201 | 20191 | 20181 | 20171,2 | ||||||||||||||||

| Net asset value, beginning of year | $22.80 | $26.21 | $30.06 | $24.95 | $25.14 | |||||||||||||||

| Income (loss) from operations: | ||||||||||||||||||||

| Net investment income (loss) |

0.35 | 0.35 | 0.35 | 0.31 | (0.00) | 3 | ||||||||||||||

| Net realized and unrealized gain (loss) |

15.03 | (3.42) | (3.77) | 4.91 | (0.19) | |||||||||||||||

| Total income (loss) from operations |

15.38 | (3.07) | (3.42) | 5.22 | (0.19) | |||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income |

(0.33) | (0.34) | (0.43) | (0.11) | — | |||||||||||||||

| Total distributions |

(0.33) | (0.34) | (0.43) | (0.11) | — | |||||||||||||||

| Net asset value, end of year | $37.85 | $22.80 | $26.21 | $30.06 | $24.95 | |||||||||||||||

| Total return, based on NAV4 |

67.77 | % | (11.71) | % | (11.29) | % | 20.97 | % | (0.76) | % | ||||||||||

| Net assets, end of year (000s) | $17,031 | $11,402 | $10,483 | $4,509 | $2,495 | |||||||||||||||

| Ratios to average net assets: | ||||||||||||||||||||

| Gross expenses |

0.60 | % | 0.60 | % | 0.60 | % | 0.60 | % | 0.60 | %5 | ||||||||||

| Net expenses |

0.60 | 0.60 | 0.60 | 0.60 | 0.60 | 5 | ||||||||||||||

| Net investment income (loss) |

1.13 | 1.46 | 1.30 | 1.12 | (0.29 | )5 | ||||||||||||||

| Portfolio turnover rate6 | 99 | % | 95 | % | 87 | % | 80 | % | 0 | % | ||||||||||

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the period July 12, 2017 (inception date) to July 31, 2017. |

| 3 | Amount represents less than $0.005 per share. |

| 4 | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. The total return calculation assumes that distributions are reinvested at NAV. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 5 | Annualized. |

| 6 | Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

See Notes to Financial Statements.

|

24 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

1. Organization and significant accounting policies

Legg Mason Small-Cap Quality Value ETF (the “Fund”) is a separate diversified investment series of Legg Mason ETF Investment Trust (the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

The Fund is an exchange-traded fund (“ETF”). ETFs are funds that trade like other publicly-traded securities. The Fund is designed to track an index. Similar to shares of an index mutual fund, each share of the Fund represents an ownership interest in an underlying portfolio of securities intended to track an index. Unlike shares of a mutual fund, which can be bought from and redeemed by the issuing fund by all shareholders at a price based on net asset value (“NAV”), shares of the Fund may be directly purchased from and redeemed by the Fund at NAV solely by certain large institutional investors who have entered into agreements with the Fund’s distributor (“Authorized Participants”). Also unlike shares of a mutual fund, shares of the Fund are listed on a national securities exchange and trade in the secondary market at market prices that change throughout the day.

Shares of the Fund are listed and traded at market prices on NASDAQ. The market price for the Fund’s shares may be different from the Fund’s NAV. The Fund issues and redeems shares at NAV only in blocks of a specified number of shares or multiples thereof (“Creation Units”). Only Authorized Participants may purchase or redeem Creation Units directly with the Fund at NAV. Creation Units are issued and redeemed principally in-kind (although under some circumstances its shares are created and redeemed partially for cash). Except when aggregated in Creation Units, shares of the Fund are not redeemable securities.

Shareholders who are not Authorized Participants may not redeem shares directly from the Fund at NAV.

The Fund seeks to track the investment results of the Royce Small-Cap Quality Value Index (the “Underlying Index”). The Underlying Index utilizes a proprietary methodology created and sponsored by Royce & Associates, LP (“Royce”), the Fund’s subadviser.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

25 |

Notes to financial statements (cont’d)

techniques and methodologies. The independent third party pricing services typically use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Investments in open-end funds are valued at the closing net asset value per share of each fund on the day of valuation. When the Fund holds securities or other assets that are denominated in a foreign currency, the Fund will use the currency exchange rates, generally determined as of 4:00 p.m. (London Time). If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Trustees.

The Board of Trustees is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Global Fund Valuation Committee (formerly known as Legg Mason North Atlantic Fund Valuation Committee prior to March 1, 2021) (the “Valuation Committee”). The Valuation Committee, pursuant to the policies adopted by the Board of Trustees, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Board of Trustees. When determining the reliability of third party pricing information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Trustees, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to the Board of Trustees quarterly.

|

26 |

Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

| • | Level 1 — quoted prices in active markets for identical investments |

| • | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

| ASSETS | ||||||||||||||||

| Description | Quoted Prices (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||

| Long-Term Investments†: | ||||||||||||||||

| Common Stocks: |

||||||||||||||||

| Consumer Discretionary |

$ | 2,153,410 | — | $ | 801 | $ | 2,154,211 | |||||||||

| Other Common Stocks |

14,679,015 | — | — | 14,679,015 | ||||||||||||

| Corporate Bonds & Notes |

— | $ | 5,000 | — | 5,000 | |||||||||||

| Total Long-Term Investments | 16,832,425 | 5,000 | 801 | 16,838,226 | ||||||||||||

| Short-Term Investments† | 195,245 | — | — | 195,245 | ||||||||||||

| Total Investments | $ | 17,027,670 | $ | 5,000 | $ | 801 | $ | 17,033,471 | ||||||||

| † | See Schedule of Investments for additional detailed categorizations. |

(b) Foreign investment risks. The Fund’s investments in foreign securities may involve risks not present in domestic investments. Since securities may be denominated in foreign currencies, may require settlement in foreign currencies or may pay interest or dividends in foreign currencies, changes in the relationship of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Fund. Foreign investments may also subject the Fund to foreign government exchange restrictions, expropriation, taxation or other political, social or economic developments, all of which affect the market and/or credit risk of the investments.

| Legg Mason Small-Cap Quality Value ETF 2021 Annual Report |

27 |

Notes to financial statements (cont’d)

(c) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income (including interest income from payment-in-kind securities), adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. Foreign dividend income is recorded on the ex-dividend date or as soon as practicable after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.

(d) Distributions to shareholders. Distributions from net investment income of the Fund, if any, are declared and paid on a quarterly basis. Distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(e) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of July 31, 2021, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.