Form N-CSR HIGHLAND GLOBAL ALLOCATI For: Sep 30

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23369

HIGHLAND GLOBAL ALLOCATION FUND

(Exact name of registrant as specified in charter)

300 Crescent Court

Suite 700

Dallas, Texas 75201

(Address of principal executive offices)(Zip code)

NexPoint Asset Management, L.P.

300 Crescent Court

Suite 700

Dallas, Texas 75201

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (877) 665-1287

Date of fiscal year end: September 30

Date of reporting period: September 30, 2022

Table of Contents

| Item 1. | Reports to Stockholders. |

A copy of the Annual Report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”), is attached herewith.

Table of Contents

Highland Global Allocation Fund

Annual Report

September 30, 2022

Table of Contents

Highland Global Allocation Fund

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 33 | ||||

| 34 | ||||

| 39 | ||||

| 45 |

Table of Contents

Economic and market conditions change frequently.

There is no assurance that the trends described in this report will continue or commence.

Privacy Policy

We recognize and respect your privacy expectations, whether you are a visitor to our web site, a potential shareholder, a current shareholder or even a former shareholder.

Collection of Information. We may collect nonpublic personal information about you from the following sources:

| • | Account applications and other forms, which may include your name, address and social security number, written and electronic correspondence and telephone contacts; |

| • | Web site information, including any information captured through the use of “cookies”; and |

| • | Account history, including information about the transactions and balances in your accounts with us or our affiliates. |

Disclosure of Information. We may share the information we collect with our affiliates. We may also disclose this information as otherwise permitted by law. We do not sell your personal information to third parties for their independent use.

Confidentiality and Security of Information. We restrict access to nonpublic personal information about you to our employees and agents who need to know such information to provide products or services to you. We maintain physical, electronic and procedural safeguards that comply with federal standards to guard your nonpublic personal information, although you should be aware that data protection cannot be guaranteed.

A prospectus must precede or accompany this report. Please read the prospectus carefully before you invest.

Table of Contents

PORTFOLIO MANAGER COMMENTARY (unaudited)

| September 30, 2022 | Highland Global Allocation Fund | |

Performance Overview

For the twelve months ended September 30, 2022, the Highland Global Allocation Fund (the “Fund”) experienced a total market price return of 7.52% and a total NAV return of 5.31%. The Fund’s benchmark, the FTSE All World Index returned -20.14%.

Manager Discussion

The Fund’s largest investment themes during the year included REITs, Telecom, and Energy MLP’s. Market hedges and energy MLPs were among the largest contributors to the Fund’s performance. The Fund’s largest detractors included public REITs and exposure to Argentina.

TerreStar, the Fund’s largest position, was a positive contributor to performance during the year. Terrestar is a privately held, nationwide licensee of wireless spectrum, an asset that most people use every day. Spectrum is the radio frequency that carries all wireless communication signals. The Federal Communications Commission (the “FCC”), which has regulatory oversight in the space, administers spectrum for non-federal use. The FCC typically sells or assigns initial wireless spectrum licenses to market participants using an auction process. Access to spectrum may also be attained through the secondary market, which allows licensees like TerreStar to transfer, sell, or lease spectrum, in whole or in part.

We believe wireless spectrum assets, in general represent significant value, as they benefit from a favorable supply-demand dynamic: there is limited available spectrum capacity in low- and mid-tier bands; yet, demand is tied to exponential growth in wireless bandwidth usage from smartphones, HD video, data, and the Internet of Things, among other technology trends. Licenses of wireless spectrum are therefore valued on potential future “rents” derived from broadband communications against spectrum scarcity and future capacity.

TerreStar’s value is derived from two spectrum assets: a license for 1.7 GHz band spectrum covering 11 of the top 30 U.S. markets and approximately 19% of the population; and a license for 1.4 GHz band for use in wireless medical telemetry (“WMTS”), with the ability to expand into other areas. Dish owns the license covering the remaining 1.7 GHz band spectrum. TerreStar’s ownership of spectrum in key markets and with significant population coverage could make the company an attractive partner for other spectrum holders.

In 2020, TerreStar received a limited, conditional waiver from the U.S. Federal Communications Commission to allow it to offer its 1.4 GHz band spectrum for wireless medical telemetry services (“WMTS”) applications, with the potential to deploy that spectrum more broadly if certain conditions are met. This approval is subject to TerreStar meeting a number of operational deployment milestones set by the FCC. This work is ongoing.

The Fund continues to maintain an allocation to energy MLPs, which positively contributed to performance during the year. MLPs (as measured by the Alerian MLP Index, “AMZ”) returned 19.22% while the Alerian Midstream Energy Index (“AMNA”, a proxy for broader midstream performance including C-Corps) returned 11.64%. We remain constructive on the long-term outlook for midstream energy. The US operates as a low-cost producer of oil and gas, which means that we expect US production volumes and export opportunities to rebound as the sector recovers from the impacts of the pandemic. The sector has undergone a significant transformation over the past several years towards a focus on shareholder returns, corporate simplification, returns on invested capital, and a reduction in leverage. We think this renewed focus on capital discipline combined with an improving fundamental backdrop should enable the sector to create value over time.

The Fund uses short sales to protect from and/or to take advantage of quantifiable systematic and issuer-related risks. Short sales had a positive impact on performance during the period.

| Annual Report | 1 |

Table of Contents

PORTFOLIO MANAGER COMMENTARY (unaudited) (concluded)

| September 30, 2022 | Highland Global Allocation Fund | |

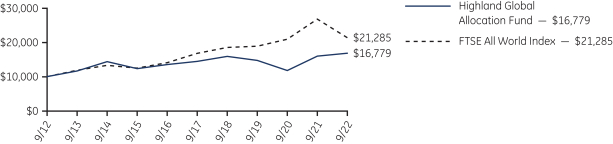

Growth of Hypothetical $10,000 Investment

| Average Annual Total Returns | ||||||||||||||||

| 1 Year | 5 Year | 10 Year | Since Inception |

|||||||||||||

| Highland Global Allocation Fund | 5.31 | % | 3.07 | % | 5.31 | % | 5.33 | % | ||||||||

| FTSE All World Index | -20.14 | % | 4.96 | % | 7.75 | % | 5.62 | % | ||||||||

Returns shown in the chart and table do not reflect taxes that a shareholder would pay on Fund distributions or on the sale of the Fund shares.

Performance results reflect the contractual waivers and/or reimbursements of fund expenses by the Advisor. Absent this limitation, performance results would have been lower. The Expense Cap expired on January 31, 2019.

Effective on February 13, 2019, the Highland Global Allocation Fund converted from an open-end fund to a closed-end fund, and began trading on the NYSE under the symbol HGLB on February 19, 2019. The performance data presented above reflects that of Class Z shares of the Fund when it was an open-end fund, HCOYX. Month-end returns since March 2019 reflect market prices. The closed-end Fund pursues the same investment objective and strategy as it did before its conversion.

The performance data quoted here represents past performance and is no guarantee of future results. Investment returns and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit our website at www.highlandfunds.com.

Stock prices may fall or fail to rise over time for several reasons, including general financial market conditions and factors related to a specific issuer or industry. The Fund invests in growth stocks that may be more volatile because they are more sensitive to market conditions. The Fund invests in mid-cap companies which may entail greater risks and less liquidity due to narrower product lines and more limited resources than larger companies. The Fund may invest in foreign securities which may cause more volatility and less liquidity due to currency changes, political instability and accounting differences. The Fund’s investments in derivatives may involve more volatility and less liquidity because of the risk that an investment may not correlate to the performance of the underlying securities.

Mutual fund investing involves risk including the possible loss of principal.

| 2 | Annual Report |

Table of Contents

| Highland Global Allocation Fund | ||

Objective

Highland Global Allocation Fund seeks to provide long-term growth of capital and future income (future income means the ability to pay dividends in the future.)

Net Assets as of September 30, 2022

$256.7 million

Portfolio Data as of September 30, 2022

The information below provides a snapshot of Highland Global Allocation Fund at the end of the reporting period. Highland Global Allocation Fund is actively managed and the composition of its portfolio will change over time. Current and future holdings are subject to risk.

| Industry Classifications as of 09/30/22(1) | % | |||

| U.S. Equity |

54.3 | |||

| U.S. Senior Loans |

12.7 | |||

| U.S. Master Limited Partnerships |

8.8 | |||

| U.S. Registered Investment Companies |

8.4 | |||

| Non-U.S. Equity |

6.6 | |||

| U.S. Warrants |

6.1 | |||

| U.S. LLC Interest |

5.2 | |||

| U.S. Rights |

3.8 | |||

| Cash Equivalent |

3.4 | |||

| U.S. Exchange-Traded Funds |

3.0 | |||

| U.S. Asset-Backed Securities |

3.0 | |||

| Non-U.S. Sovereign Bonds |

2.5 | |||

| U.S. Preferred Stock |

2.2 | |||

| Non-U.S. Registered Investment Company |

1.3 | |||

| U.S. Corporate Bonds & Notes |

1.1 | |||

| Other (each less than 1.0%) |

0.7 | |||

| Other Assets & Liabilities, Net |

(23.1 | ) | ||

| 100.0 | ||||

|

|

|

|||

| Top 10 Holdings as of 9/30/2022(%)(2)(3) | % | |||

| TerreStar Corporation (U.S. Equity) |

23.8 | |||

| TerreStar Corporation, Term Loan A 11.00%, 2/25/2022 (U.S. Senior Loans) |

7.7 | |||

| NexPoint Real Estate Finance (U.S. Equity) |

7.7 | |||

| GAF REIT (U.S. Equity) |

6.2 | |||

| Energy Transfer LP (U.S. Master Limited Partnerships) |

6.0 | |||

| NexPoint Event Driven Fund (U.S. Registered Investment Companies) |

4.1 | |||

| Texas Competitive Electric Holdings Co., LLC (U.S. Rights) |

3.8 | |||

| GAF REIT Sub II, LLC (U.S. LLC Interest) |

3.8 | |||

| Quarternorth Energy Holding Inc. (U.S. Warrants) |

3.8 | |||

| Targa Resources (Non-U.S. Equity) |

3.1 | |||

| (1) | Industry classifications are calculated as a percentage of total net assets and net of long and short positions. |

| (2) | Top 10 holdings are calculated as a percentage of total net assets. |

| (3) | The Fund’s cash equivalent holding comprised 3.4% of total net assets, but is purposely excluded from the table. |

| Annual Report | 3 |

Table of Contents

FINANCIAL STATEMENTS (unaudited)

| September 30, 2022 | Highland Global Allocation Fund | |

A guide to understanding the Fund’s financial statements

| Investment Portfolio | The Investment Portfolio details the Fund’s holdings and its market value as of the last day of the reporting period. Portfolio holdings are organized by type of asset and industry to demonstrate areas of concentration and diversification. | |

| Statement of Assets and Liabilities | This statement details the Fund’s assets, liabilities, net assets and share price for each share class as of the last day of the reporting period. Net assets are calculated by subtracting all of the Fund’s liabilities (including any unpaid expenses) from the total of the Fund’s investment and non-investment assets. The net asset value per share for each class is calculated by dividing net assets allocated to that share class by the number of shares outstanding in that class as of the last day of the reporting period. | |

| Statement of Operations | This statement reports income earned by the Fund and the expenses incurred by each Fund during the reporting period. The Statement of Operations also shows any net gain or loss the Fund realized on the sales of its holdings during the period as well as any unrealized gains or losses recognized over the period. The total of these results represents the Fund’s net increase or decrease in net assets from operations. | |

| Statements of Changes in Net Assets | This statement details how the Fund’s net assets were affected by its operating results, distributions to shareholders and shareholder transactions (e.g., subscriptions, redemptions and distribution reinvestments) during the reporting period. The Statement of Changes in Net Assets also details changes in the number of shares outstanding. | |

| Statement of Cash Flows | This statement reports net cash and foreign currency provided or used by operating, investing and financing activities and the net effect of those flows on cash and foreign currency during the period. | |

| Financial Highlights | The Financial Highlights demonstrate how the Fund’s net asset value per share was affected by the Fund’s operating results. The Financial Highlights also disclose the classes’ performance and certain key ratios (e.g., net expenses and net investment income as a percentage of average net assets). | |

| Notes to Financial Statements | These notes disclose the organizational background of the Fund, certain of their significant accounting policies (including those surrounding security valuation, income recognition and distributions to shareholders), federal tax information, fees and compensation paid to affiliates and significant risks and contingencies. | |

| 4 | Annual Report |

Table of Contents

| As of September 30, 2022 | Highland Global Allocation Fund | |

|

Shares |

Value ($) |

|||||||

| U.S. Equity - 55.5% |

||||||||

| COMMUNICATION SERVICES - 24.4% | ||||||||

| 189,945 | Telesat, Class B (a) |

1,483,470 | ||||||

| 169,531 | TerreStar Corporation (a)(b)(c)(d)(e) |

61,209,167 | ||||||

|

|

|

|||||||

| 62,692,637 | ||||||||

|

|

|

|||||||

| HEALTHCARE - 1.0% | ||||||||

| 77,700 | Aerie Pharmaceuticals, Inc. (a)(f) |

1,175,601 | ||||||

| 232,800 | Heron Therapeutics, Inc. (a)(f) |

982,416 | ||||||

| 17,200 | Patterson (f) |

413,144 | ||||||

|

|

|

|||||||

| 2,571,161 | ||||||||

|

|

|

|||||||

| INFORMATION TECHNOLOGY - 2.8% | ||||||||

| 49,809 | Salesforce Inc (a)(f) |

7,164,527 | ||||||

|

|

|

|||||||

| MATERIALS - 1.4% | ||||||||

| 730,484 | MPM Holdings, Inc. (a)(e) |

3,652,420 | ||||||

|

|

|

|||||||

| REAL ESTATE - 25.9% | ||||||||

| 56,000 | Alexandria Real Estate Equities, REIT (f) |

7,850,640 | ||||||

| 8,055 | City Office, REIT (f) |

80,309 | ||||||

| 1,146,313 | GAF REIT (a)(b)(c)(d) |

16,028,896 | ||||||

| 250,631 | Healthcare Realty Trust, REIT, Class A (f) |

5,225,657 | ||||||

| 28,692 | Independence Realty Trust, Inc., REIT (f) |

480,017 | ||||||

| 1,322,385 | NexPoint Real Estate Finance (d)(f) |

19,809,333 | ||||||

| 168,760 | NexPoint Residential Trust, Inc., REIT (d)(f) |

7,798,400 | ||||||

| 280,000 | United Development Funding IV, REIT (a)(b)(c)(d) |

260,400 | ||||||

| 77,700 | Washington Real Estate Investment Trust, REIT (f) |

1,364,412 | ||||||

| 875,255 | Whitestone, REIT, Class B (f) |

7,404,657 | ||||||

|

|

|

|||||||

| 66,302,721 | ||||||||

|

|

|

|||||||

| Total U.S. Equity |

142,383,466 | |||||||

|

|

|

|||||||

| Principal Amount ($) |

||||||||

| U.S. Senior Loans (h) - 12.7% |

||||||||

| COMMUNICATION SERVICES - 7.7% | ||||||||

| 19,996,652 | TerreStar Corporation, Term Loan A, 11.000% PIK 02/27/28 (b)(c)(d) |

19,854,675 | ||||||

|

|

|

|||||||

| REAL ESTATE - 5.0% | ||||||||

| 5,000,000 | NexPoint SFR Operating Partnership, LP, 05/24/27 (b)(c)(d) |

5,000,000 | ||||||

| 8,500,000 | NHT Operating Partnership LLC Secured Promissory Note, 02/22/27 (b)(c)(d) |

7,871,000 | ||||||

|

|

|

|||||||

| 12,871,000 | ||||||||

|

|

|

|||||||

| Total U.S. Senior Loans |

32,725,675 | |||||||

|

|

|

|||||||

|

Shares |

Value ($) |

|||||||

| U.S. Master Limited Partnerships - 8.8% |

||||||||

| ENERGY - 8.8% | ||||||||

| 1,402,440 | Energy Transfer L.P. (f) |

15,468,913 | ||||||

| 278,100 | Western Midstream Partners L.P. (f) |

6,996,996 | ||||||

|

|

|

|||||||

| Total U.S. Master Limited Partnerships |

22,465,909 | |||||||

|

|

|

|||||||

| Non-U.S. Equity - 6.6% |

||||||||

| COMMUNICATION SERVICES - 0.0% | ||||||||

| 77,866 | Grupo Clarin, Class B (a)(g) |

58,330 | ||||||

|

|

|

|||||||

| CONSUMER DISCRETIONARY - 1.0% | ||||||||

| 3,000 | MercadoLibre, Inc. (a)(f)(g) |

2,483,340 | ||||||

| 718 | Toys ‘R’ Us (a)(b)(c)(g) |

16,293 | ||||||

|

|

|

|||||||

| 2,499,633 | ||||||||

|

|

|

|||||||

| ENERGY - 3.1% | ||||||||

| 131,600 | Targa Resources (f)(g) |

7,940,744 | ||||||

| 121 | Transocean (a)(g) |

299 | ||||||

|

|

|

|||||||

| 7,941,043 | ||||||||

|

|

|

|||||||

| FINANCIALS - 0.0% | ||||||||

| 24,300 | Grupo Supervielle SA ADR (g)(i) |

42,525 | ||||||

|

|

|

|||||||

| HEALTHCARE - 0.0% | ||||||||

| 10,445 | HLS Therapeutics Inc. (g) |

68,937 | ||||||

|

|

|

|||||||

| INDUSTRIALS - 0.4% | ||||||||

| 60,593 | GL Events (g) |

881,757 | ||||||

|

|

|

|||||||

| INFORMATION TECHNOLOGY - 0.1% | ||||||||

| 46,630 | Avaya Holdings Corp. (a)(g) |

74,142 | ||||||

| 3,995 | StoneCo, Class A (a)(f)(g) |

38,072 | ||||||

|

|

|

|||||||

| 112,214 | ||||||||

|

|

|

|||||||

| UTILITIES - 2.0% | ||||||||

| 202,250 | Central Puerto ADR (a)(f)(g)(i) |

889,900 | ||||||

| 67,700 | Pampa Energia ADR (a)(f)(g) |

1,541,529 | ||||||

| 133,000 | Vistra Energy Corp. (f)(g) |

2,793,000 | ||||||

|

|

|

|||||||

| 5,224,429 | ||||||||

|

|

|

|||||||

| Total Non-U.S. Equity |

16,828,868 | |||||||

|

|

|

|||||||

| Units |

||||||||

| U.S. Warrants - 6.1% |

||||||||

| ENERGY - 6.1% | ||||||||

| 28,562 | Quarternorth Energy Holding Inc. (a) |

3,494,089 | ||||||

| 127,592 | Quarternorth Energy Holding Inc. Tranche 1, Expires 08/27/2029 (a) |

1,084,532 | ||||||

| 245,732 | Quarternorth Energy Holding Inc. Tranche 2, Expires 08/27/2029 (a) |

1,351,526 | ||||||

| 79,147 | Quarternorth Energy Holding Inc. Tranche 3, Expires 08/27/2029 (a) |

9,682,330 | ||||||

|

|

|

|||||||

| Total U.S. Warrants |

15,612,477 | |||||||

|

|

|

|||||||

| See Glossary on page 8 for abbreviations along with accompanying Notes to Financial Statements. | 5 |

Table of Contents

INVESTMENT PORTFOLIO (continued)

| As of September 30, 2022 | Highland Global Allocation Fund | |

|

Shares |

Value ($) |

|||||||

| U.S. LLC Interest - 5.2% |

||||||||

| REAL ESTATE - 5.2% | ||||||||

| 349 | GAF REIT Sub II, LLC (a)(b)(c)(d) |

9,715,224 | ||||||

| 3,789,008 | SFR WLIF III, LLC (b)(c)(d) |

3,565,226 | ||||||

|

|

|

|||||||

| Total U.S. LLC Interest |

13,280,450 | |||||||

|

|

|

|||||||

| Units |

||||||||

| U.S. Rights - 3.8% |

||||||||

| UTILITIES - 3.8% | ||||||||

| 7,905,143 | Texas Competitive Electric Holdings Co., LLC (a) |

9,881,429 | ||||||

|

|

|

|||||||

| Total U.S. Rights |

9,881,429 | |||||||

|

|

|

|||||||

| Principal Amount ($) |

||||||||

| U.S. Asset-Backed Securities - 3.0% |

||||||||

| 250,000 | CFCRE Commercial Mortgage Trust, |

187,613 | ||||||

| 7,483,175 | FREMF Mortgage Trust, |

7,499,545 | ||||||

|

|

|

|||||||

| Total U.S. Asset-Backed Securities |

7,687,158 | |||||||

|

|

|

|||||||

| Non-U.S. Sovereign Bonds - 2.5% |

||||||||

| 90,699 | Argentine Republic Government International Bond |

17,770 | ||||||

| 29,000,000 | 4.88%, 7/9/2041 (g)(k) |

6,270,655 | ||||||

|

|

|

|||||||

| Total Non-U.S. Sovereign Bonds |

6,288,425 | |||||||

|

|

|

|||||||

| Shares |

||||||||

| U.S. Preferred Stock - 2.2% |

||||||||

| HEALTHCARE - 0.9% | ||||||||

| 202,684 | Apnimed (b)(c)(l) |

2,191,014 | ||||||

|

|

|

|||||||

| REAL ESTATE - 1.4% | ||||||||

| 239,774 | Braemar Hotels & Resorts, Inc., REIT (a)(f)(l) |

3,543,859 | ||||||

|

|

|

|||||||

| Total U.S. Preferred Stock |

5,734,873 | |||||||

|

|

|

|||||||

| Principal Amount ($) |

||||||||

| U.S. Corporate Bonds & Notes - 1.1% |

||||||||

| COMMUNICATION SERVICES - 0.3% | ||||||||

| 320,615 | iHeartCommunications, Inc. |

298,051 | ||||||

| 584,493 | 8.38%, 05/01/27 |

494,444 | ||||||

|

|

|

|||||||

| 792,495 | ||||||||

|

|

|

|||||||

| Principal Amount ($) |

Value ($) |

|||||||

| ENERGY - 0.8% | ||||||||

| 2,000,000 | Exterran Energy Solutions |

2,027,140 | ||||||

|

|

|

|||||||

| Total U.S. Corporate Bonds & Notes |

2,819,635 | |||||||

|

|

|

|||||||

| Shares |

||||||||

| Non-U.S. Master Limited Partnership - 0.7% |

||||||||

| ENERGY - 0.7% | ||||||||

| 78,631 | Enterprise Products Partners (f)(g) |

1,869,845 | ||||||

|

|

|

|||||||

| Total Non-U.S. Master Limited Partnership |

1,869,845 | |||||||

|

|

|

|||||||

| Units |

||||||||

| Non-U.S. Warrants - 0.0% |

||||||||

| COMMUNICATION SERVICES - 0.0% | ||||||||

| 1,109 | iHeartCommunications, Inc., Expires 05/01/2039 (a)(g) |

9,149 | ||||||

|

|

|

|||||||

| INDUSTRIALS - 0.0% | ||||||||

| 1,260,362 | American Airlines Group, |

— | ||||||

|

|

|

|||||||

| INFORMATION TECHNOLOGY - 0.0% | ||||||||

| 38,742 | Avaya Holdings, Expires 12/18/2022 (a)(g) |

1,162 | ||||||

|

|

|

|||||||

| Total Non-U.S. Warrants |

10,311 | |||||||

|

|

|

|||||||

| Principal Amount ($) |

||||||||

| Non-U.S. Asset-Backed Security - 0.0% |

||||||||

| 246,196 | Pamco Cayman, Ltd., |

19,005 | ||||||

|

|

|

|||||||

| Total Non-U.S. Asset-Backed Security |

19,005 | |||||||

|

|

|

|||||||

| Shares |

||||||||

| U.S. Exchange-Traded Funds - 3.0% |

||||||||

| 18,065 | Direxion Daily S&P 500 Bull 3X |

967,923 | ||||||

| 47,675 | ProShares UltraPro QQQ |

921,081 | ||||||

| 206,850 | Teucrium Corn Fund (f) |

5,593,224 | ||||||

| 8,750 | VelocityShares 3x Long Silver ETN linked to the S&P GSCI Silver Index (f) |

245,000 | ||||||

|

|

|

|||||||

| Total U.S. Exchange-Traded Funds |

7,727,228 | |||||||

|

|

|

|||||||

| Non-U.S. Registered Investment Company - 1.3% |

||||||||

| 10,000 | BB Votorantim Highland Infrastructure LLC (b)(c)(d)(g) |

3,395,347 | ||||||

|

|

|

|||||||

| Total Non-U.S. Registered Investment Company |

3,395,347 | |||||||

|

|

|

|||||||

| 6 | See Glossary on page 8 for abbreviations along with accompanying Notes to Financial Statements. |

Table of Contents

INVESTMENT PORTFOLIO (concluded)

| As of September 30, 2022 | Highland Global Allocation Fund | |

|

Shares |

Value ($) |

|||||||

| U.S. Registered Investment Companies - 8.4% |

||||||||

| 334,005 | Highland Income Fund (d)(f) |

3,246,529 | ||||||

| 549,863 | NexPoint Diversified Real Estate Trust (d)(f) |

6,900,781 | ||||||

| 706,236 | NexPoint Event Driven Fund, Class Z (d) |

10,445,237 | ||||||

| 54,992 | NexPoint Merger Arbitrage Fund, Class Z (d) |

1,080,585 | ||||||

|

|

|

|||||||

| Total U.S. Registered Investment Companies |

21,673,132 | |||||||

|

|

|

|||||||

| Principal Amount ($) |

||||||||

| U.S. Repurchase Agreement - 0.0% |

||||||||

| 96,117 | Citigroup 2.980%, dated 09/30/2022 to be repurchased on 10/03/2022, repurchase price $96,141 (collateralized by U.S. Government and Treasury obligations, ranging in par value $0 - $44,334, 0.000% - 4.250%, 01/26/2023 - 05/15/2048; with total market value $98,039) (m)(n) |

96,117 | ||||||

|

|

|

|||||||

| Total U.S. Repurchase Agreement |

96,117 | |||||||

|

|

|

|||||||

| Shares |

||||||||

| U.S. Cash Equivalent - 3.4% |

||||||||

| MONEY MARKET FUND (o) - 3.4% | ||||||||

| 8,765,335 | Dreyfus Treasury Obligations Cash Management, Institutional Class 2.850% |

8,765,335 | ||||||

|

|

|

|||||||

| Total U.S. Cash Equivalent |

8,765,335 | |||||||

|

|

|

|||||||

| Total Investments - 124.3% |

319,264,685 | |||||||

|

|

|

|||||||

| (Cost $355,273,258) |

||||||||

| Securities Sold Short (p) - (1.2)% |

||||||||

| U.S. Equity - (1.2)% |

||||||||

| COMMUNICATION SERVICES - (0.9)% | ||||||||

| (9,952) | Netflix, Inc. (q) |

(2,343,099 | ) | |||||

|

|

|

|||||||

| CONSUMER STAPLES - (0.3)% | ||||||||

| (4,000) | WD-40 |

(702,960 | ) | |||||

|

|

|

|||||||

| Total U.S. Equity |

(3,046,059 | ) | ||||||

|

|

|

|||||||

| Total Securities Sold Short - (1.2)% |

(3,046,059 | ) | ||||||

|

|

|

|||||||

| Other Assets & Liabilities, Net - (23.1)% |

(59,471,008 | ) | ||||||

|

|

|

|||||||

| Net Assets - 100.0% |

256,747,618 | |||||||

|

|

|

|||||||

| (a) | Non-income producing security. |

| (b) | Securities with a total aggregate value of $129,126,247, or 50.3% of net assets, were classified as Level 3 within the three-tier fair value hierarchy. Please see Notes to Financial Statements for an explanation of this hierarchy, as well as a list of unobservable inputs used in the valuation of these instruments. |

| (c) | Represents fair value as determined by the Fund’s Board of Trustees (the “Board”), or its designee in good faith, pursuant to the policies and procedures approved by the Board. The Board considers fair valued securities to be securities for which |

| market quotations are not readily available and these securities may be valued using a combination of observable and unobservable inputs. Securities with a total aggregate value of $129,126,247, or 50.3% of net assets, were fair valued under the Fund’s valuation procedures as of September 30, 2022. Please see Notes to Financial Statements. |

| (d) | Affiliated issuer. Assets with a total aggregate fair value of $176,180,800, or 68.6% of net assets, were affiliated with the Fund as of September 30, 2022. |

| (e) | Restricted Securities. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under the policies and procedures established by the Board. Additional Information regarding such securities follows: |

| Restricted Security |

Security Type |

Acquisition Date |

Cost of Security ($) |

Fair Value at Year End ($) |

Percent of Net Assets % |

|||||||||||||||

| TerreStar Corporation |

U.S. Equity | 11/14/2014 | 48,015,562 | 61,209,167 | 23.8 | |||||||||||||||

| MPM Holdings, Inc. |

U.S. Equity | 5/15/2019 | — | 3,652,420 | 1.4 | |||||||||||||||

| (f) | All or part of this security is pledged as collateral for short sales. The fair value of the securities pledged as collateral was $101,984,473. |

| (g) | As described in the Fund’s prospectus, a company is considered to be a non-U.S. issuer if the company’s securities principally trade on a market outside of the United States, the company derives a majority of its revenues or profits outside of the United States, the company is not organized in the United States, or the company is significantly exposed to the economic fortunes and risks of regions outside the United States. |

| (h) | Senior loans (also called bank loans, leveraged loans, or floating rate loans) in which the Fund invests generally pay interest at rates which are periodically determined by reference to a base lending rate plus a spread (unless otherwise identified, all senior loans carry a variable rate of interest). These base lending rates are generally (i) the Prime Rate offered by one or more major United States banks, (ii) the lending rate offered by one or more European banks such as the London Interbank Offered Rate (“LIBOR”) or (iii) the Certificate of Deposit rate. Senior loans, while exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”), contain certain restrictions on resale and cannot be sold publicly. Senior secured floating rate loans often require prepayments from excess cash flow or permit the borrower to repay at its election. The degree to which borrowers repay, whether as a contractual requirement or at their election, cannot be predicted with accuracy. As a result, the actual remaining maturity maybe substantially less than the stated maturity shown. |

| (i) | Securities (or a portion of securities) on loan. As of September 30, 2022, the fair value of securities loaned was $88,096. The loaned securities were secured with cash and/or securities collateral of $95,920. Collateral is calculated based on prior day’s prices. |

| (j) | Securities exempt from registration under Rule 144A of the 1933 Act. These securities may only be resold in transactions exempt from registration to qualified institutional buyers. The Board has determined these investments to be liquid. At September 30, 2022, these securities amounted to $7,706,163 or 3.0% of net assets. |

| (k) | Step coupon security. Coupon rate will either increase (step-up bond) or decrease (step-down bond) at regular intervals until maturity. Interest rate shown reflects the rate currently in effect. |

| (l) | Perpetual security with no stated maturity date. |

| (m) | Tri-Party Repurchase Agreement. |

| (n) | This security was purchased with cash collateral held from securities on loan. The total value of such securities as of September 30, 2022 was $96,117. |

| (o) | Rate reported is 7 day effective yield. |

| (p) | As of September 30, 2022, $3,102,234 in cash was segregated or on deposit with the brokers to cover investments sold short and is included in “Other Assets & Liabilities, Net”. |

| (q) | No dividend payable on security sold short. |

| See Glossary on page 8 for abbreviations along with accompanying Notes to Financial Statements. | 7 |

Table of Contents

GLOSSARY: (abbreviations that may be used in the preceding statements)

| Other Abbreviations: | ||

| ADR | American Depositary Receipt | |

| LLC | Limited Liability Company | |

| LP | Limited Partnership | |

| Ltd. | Limited | |

| PIK | Payment-in-Kind | |

| REIT | Real Estate Investment Trust | |

| 8 | Annual Report |

Table of Contents

STATEMENT OF ASSETS AND LIABILITIES

| As of September 30, 2022 | Highland Global Allocation Fund | |

| ($) | ||||

| Assets |

||||

| Investments, at value† |

134,222,433 | |||

| Affiliated investments, at value (Note 10) |

176,180,800 | |||

|

|

|

|||

| Total Investments, at value |

310,403,233 | |||

| Cash equivalents (Note 2) |

8,765,335 | |||

| Repurchase agreements, at value |

96,117 | |||

| Cash |

1,400,076 | |||

| Restricted Cash — Securities Sold Short (Note 2) |

3,102,234 | |||

| Foreign currency, at value (Note 2) |

20,782 | |||

| Foreign tax reclaim receivable |

12,369 | |||

| Due from broker |

12 | |||

| Receivable for: |

||||

| Dividends and interest |

2,049,956 | |||

| Reinvested distributions |

219,648 | |||

| Prepaid expenses and other assets |

17,298 | |||

|

|

|

|||

| Total assets |

326,087,060 | |||

|

|

|

|||

| Liabilities: |

||||

| Securities sold short, at value (Proceeds from securities sold short $1,665,944 (Notes 2 and 8) |

3,046,059 | |||

| Due to broker for short sale proceeds |

65,817,531 | |||

| Payable for: |

||||

| Investments purchased |

63,585 | |||

| Collateral from securities loaned (Note 4) |

96,117 | |||

| Investment advisory and administration fees (Note 7) |

61,990 | |||

| Accounting services fees |

19,720 | |||

| Custody fees |

13,702 | |||

| Trustees fees |

132 | |||

| Transfer agent fees |

12,000 | |||

| Reports to shareholders |

10,898 | |||

| Legal fees |

144,720 | |||

| Accrued expenses and other liabilities |

52,988 | |||

|

|

|

|||

| Total liabilities |

69,339,442 | |||

|

|

|

|||

| Net Assets |

256,747,618 | |||

|

|

|

|||

| Net Assets Consist of: |

||||

| Paid-in capital |

712,521,551 | |||

| Total accumulated loss |

(455,773,933 | ) | ||

|

|

|

|||

| Net Assets |

256,747,618 | |||

|

|

|

|||

| Investments, at cost |

181,903,669 | |||

| Affiliated investments, at cost (Note 10) |

164,508,137 | |||

| Cash equivalents, at cost (Note 2) |

8,765,335 | |||

| Repurchase agreements, at cost |

96,117 | |||

| Foreign currency, at cost (Note 2) |

92,694 | |||

| † Includes market value of securities on loan |

88,096 | |||

| Common Shares |

||||

| Shares outstanding ($0.001 par value; unlimited shares authorized) |

22,343,286 | |||

| Net asset value, offering and redemption price per share |

11.49 | |||

| See accompanying Notes to Financial Statements. | 9 |

Table of Contents

| For the Year Ended September 30, 2022 | Highland Global Allocation Fund | |

| ($) | ||||

| Investment Income: |

||||

| Income: |

||||

| Dividends from unaffiliated issuers |

2,482,710 | |||

| Dividends from affiliated issuers (Note 10) |

2,922,719 | |||

| Less: Foreign taxes withheld |

(188 | ) | ||

| Securities lending income (Note 4) |

3,026 | |||

| Interest from unaffiliated issuers |

1,247,387 | |||

| Interest from affiliated issuers (Note 10) |

2,506,020 | |||

| ROC reclass from affiliated issuers (Note 10) |

(23,403 | ) | ||

|

|

|

|||

| Total income |

9,138,271 | |||

|

|

|

|||

| Expenses: |

||||

| Investment advisory (Note 7) |

1,113,685 | |||

| Accounting services fees |

185,807 | |||

| Transfer agent fees |

168,888 | |||

| Legal fees |

486,154 | |||

| Registration fees |

13,461 | |||

| Audit and tax compliance fees |

169,480 | |||

| Interest expense and commitment fees |

756,522 | |||

| Insurance |

47,210 | |||

| Trustees fees (Note 7) |

73,963 | |||

| Reports to shareholders |

59,322 | |||

| Custodian/wire agent fees |

27,450 | |||

| Dividends and fees on securities sold short (Note 2) |

19,450 | |||

| Other |

29,865 | |||

|

|

|

|||

| Total expenses before waiver and reimbursement |

3,151,257 | |||

| Less: Expenses waived or borne by the adviser and administrator |

(390,407 | ) | ||

|

|

|

|||

| Net expenses |

2,760,850 | |||

|

|

|

|||

| Net investment income |

6,377,421 | |||

|

|

|

|||

| Net Realized and Unrealized Gain (Loss) on Investments |

||||

| Net realized gain (loss) on: |

||||

| Investments from unaffiliated issuers |

(22,821,789 | ) | ||

| Investments from affiliated issuers (Note 10) |

28,931 | |||

| Securities sold short (Note 2) |

449,055 | |||

| Written options contracts (Note 3) |

1,243,043 | |||

| Foreign currency related transactions (Note 2) |

51,018 | |||

| Long-term distributions from affiliated issuers |

50,997 | |||

|

|

|

|||

| Net realized loss |

(20,998,745 | ) | ||

|

|

|

|||

| Change in unrealized appreciation (depreciation) on: |

||||

| Investments in unaffiliated issuers |

17,213,998 | |||

| Investments in affiliated issuers (Note 10) |

(3,615,889 | ) | ||

| Securities sold short (Note 2) |

16,612,583 | |||

| Foreign currency related translations (Note 2) |

(65,407 | ) | ||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) |

30,145,285 | |||

|

|

|

|||

| Net realized and unrealized gain (loss) |

9,146,540 | |||

|

|

|

|||

| Total increase in net assets resulting from operations |

15,523,961 | |||

|

|

|

|||

| 10 | See accompanying Notes to Financial Statements. |

Table of Contents

STATEMENTS OF CHANGES IN NET ASSETS

| Highland Global Allocation Fund | ||

| Year Ended September 30, 2022 ($) |

Year Ended September 30, 2021 ($) |

|||||||

| Increase (Decrease) in Net Assets Resulting from |

||||||||

| Operations: |

||||||||

| Net investment income |

6,377,421 | 8,339,845 | ||||||

| Net realized gain (loss) on investments, long-term distributions from affiliated issuers, securities sold short, written option contracts and foreign currency transactions |

(20,998,745 | ) | (62,804,936 | ) | ||||

| Net change in unrealized appreciation (depreciation) on investments, securities sold short, written option contracts and foreign currency translations |

30,145,285 | 125,565,214 | ||||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from operations |

15,523,961 | 71,100,123 | ||||||

|

|

|

|

|

|||||

| Distributions |

(7,285,771 | ) | (6,169,443 | ) | ||||

| Return of capital |

(13,622,562 | ) | (13,376,686 | ) | ||||

|

|

|

|

|

|||||

| Decrease resulting from distributions |

(20,908,333 | ) | (19,546,129 | ) | ||||

|

|

|

|

|

|||||

| Increase (decrease) in net assets from operations and distributions |

(5,384,372 | ) | 51,553,994 | |||||

|

|

|

|

|

|||||

| Share transactions: |

||||||||

| Value of distributions reinvested |

||||||||

| Shares of closed-end fund |

2,660,047 | 2,456,090 | ||||||

|

|

|

|

|

|||||

| Net increase from shares transactions |

2,660,047 | 2,456,090 | ||||||

|

|

|

|

|

|||||

| Total increase (decrease) in net assets |

(2,724,325 | ) | 54,010,084 | |||||

|

|

|

|

|

|||||

| Net Assets |

||||||||

| Beginning of year |

259,471,943 | 205,461,859 | ||||||

|

|

|

|

|

|||||

| End of year |

256,747,618 | 259,471,943 | ||||||

|

|

|

|

|

|||||

| Capital Stock Activity - Shares |

||||||||

| Shares of closed-end fund: |

||||||||

| Issued for distribution reinvested |

274,221 | 328,513 | ||||||

|

|

|

|

|

|||||

| Net increase in fund shares |

274,221 | 328,513 | ||||||

|

|

|

|

|

|||||

| See accompanying Notes to Financial Statements. | 11 |

Table of Contents

| For the Year Ended September 30, 2022 | Highland Global Allocation Fund | |

| ($) | ||||

| Cash Flows Used in Operating Activities: |

||||

| Net increase in net assets resulting from operations |

15,523,961 | |||

| Adjustments to Reconcile Net Increase in Net Assets to Net Cash Used in Operating Activities: |

||||

| Purchases of investment securities from unaffiliated issuers |

(77,839,668 | ) | ||

| Purchases of investment securities from affiliated issuers |

(60,489,558 | ) | ||

| Proceeds from disposition of investment securities from unaffiliated issuers |

54,872,366 | |||

| Proceeds from disposition of investment securities from affiliated issuers |

35,300,293 | |||

| Proceeds from return of capital of investment securities from unaffiliated issuers |

397,415 | |||

| Proceeds from return of capital of investment securities from affiliated issuers |

4,613,013 | |||

| Purchases of securities sold short |

(16,250,619 | ) | ||

| Proceeds of securities sold short |

1,998,354 | |||

| Net proceeds received on written options contracts |

1,243,043 | |||

| Amortization of premiums from unaffiliated issuers |

5,200,640 | |||

| Amortization of premiums from affiliated issuers |

(859 | ) | ||

| Net realized (gain) loss on investments from unaffiliated issuers |

22,821,789 | |||

| Net realized (gain) loss on investments from affiliated issuers |

(28,931 | ) | ||

| Net realized (gain) loss on securities sold short, written option contracts, and foreign currency related transactions |

(1,743,116 | ) | ||

| Net change in unrealized (appreciation)/depreciation on investments, securities sold short, and translation on assets and liabilities denominated in foreign currency |

(30,145,285 | ) | ||

| (Increase) Decrease in receivable for dividends and interest |

(1,152,593 | ) | ||

| (Increase) Decrease in foreign tax reclaims receivable |

54,364 | |||

| (Increase) Decrease in receivable for investments sold |

119,041 | |||

| (Increase) Decrease in due from broker |

2,233,634 | |||

| (Increase) Decrease in prepaid expenses and other assets |

638 | |||

| Increase (Decrease) in due to broker for short sale proceeds |

27,768,936 | |||

| Increase (Decrease) in payable from collateral from securities on loan |

(196,375 | ) | ||

| Increase (Decrease) in payable for investments purchased |

(143,889 | ) | ||

| Increase (Decrease) in payable for investment advisory and administration fees |

(2,193 | ) | ||

| Increase (Decrease) in payable for trustees fees |

(655 | ) | ||

| Increase (Decrease) in payable for reports to shareholders |

(12,070 | ) | ||

| Increase (Decrease) in payable for transfer agent fees |

(4,551 | ) | ||

| Increase (Decrease) in payable for legal fees and audit fees |

(119,567 | ) | ||

| Increase (Decrease) in payable for custody fees |

10,956 | |||

| Increase (Decrease) in accrued expenses and other liabilities |

28,119 | |||

|

|

|

|||

| Net cash flow used in operating activities |

(15,943,367 | ) | ||

|

|

|

|||

| Cash Flows Used In Financing Activities: |

||||

| Repurchase agreements |

196,375 | |||

| Distributions paid in cash |

(18,263,073 | ) | ||

| Increase (Decrease) in receivable for reinvested distributions |

(30,921 | ) | ||

|

|

|

|||

| Net cash flow used in financing activities |

(18,097,619 | ) | ||

|

|

|

|||

| Effect of exchange rate changes on cash |

(14,389 | ) | ||

|

|

|

|||

| Net decrease in cash |

(34,055,375 | ) | ||

|

|

|

|||

| Cash, Cash Equivalents, Restricted Cash, and Foreign Currency: |

||||

| Beginning of year |

47,343,802 | |||

|

|

|

|||

| End of year |

13,288,427 | |||

|

|

|

|||

| End of Year Cash Balances: |

||||

| Cash equivalents |

8,765,335 | |||

| Cash |

1,400,076 | |||

| Restricted Cash |

3,102,234 | |||

| Foreign currency |

20,782 | |||

|

|

|

|||

| End of year |

13,288,427 | |||

|

|

|

|||

| Supplemental disclosure of cash flow information: |

||||

| Reinvestment of distributions |

2,645,260 | |||

|

|

|

|||

| Paid in-kind interest income |

2,506,020 | |||

|

|

|

|||

| Cash paid during the year for interest expense and commitment fees |

756,522 | |||

|

|

|

|||

| 12 | See accompanying Notes to Financial Statements. |

Table of Contents

| Highland Global Allocation Fund | ||

Selected data for a share outstanding throughout each year is as follows:

| For the Years Ended September 30, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019*‡ | 2018*‡ | ||||||||||||||||

| Net Asset Value, Beginning of Year |

$ | 11.76 | $ | 9.45 | $ | 13.09 | $ | 14.63 | $ | 14.16 | ||||||||||

| Income from Investment Operations: |

||||||||||||||||||||

| Net investment income(a) |

0.29 | 0.38 | 0.43 | 0.30 | 0.54 | |||||||||||||||

| Net realized and unrealized gain (loss) |

0.38 | 2.82 | (3.00 | ) | (1.10 | ) | 0.56 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from Investment Operations |

0.67 | 3.20 | (2.57 | ) | (0.80 | ) | 1.10 | |||||||||||||

| Less Distributions Declared to shareholders: |

||||||||||||||||||||

| From net investment income |

(0.33 | ) | (0.28 | ) | (0.61 | ) | (0.20 | ) | (0.43 | ) | ||||||||||

| From return of capital |

(0.61 | ) | (0.61 | ) | (0.46 | ) | (0.54 | ) | (0.20 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions declared to shareholders |

(0.94 | ) | (0.89 | ) | (1.07 | ) | (0.74 | ) | (0.63 | ) | ||||||||||

| Net Asset Value, End of Year(b) |

$ | 11.49 | $ | 11.76 | $ | 9.45 | $ | 13.09 | $ | 14.63 | ||||||||||

| Total Return(b)(c) |

5.31 | % | 35.13 | % | (19.92 | )% | (4.40 | )% | 7.95 | % | ||||||||||

| Ratios to Average Net Assets:(d) |

||||||||||||||||||||

| Net Assets, End of Year (000’s) |

$ | 256,748 | $ | 259,472 | $ | 205,462 | $ | 296,164 | $ | 128,353 | ||||||||||

| Gross expenses(e)(f) |

1.16 | % | 1.01 | % | 1.92 | % | 2.54 | % | 2.38 | % | ||||||||||

| Net investment income |

2.34 | % | 3.48 | % | 4.06 | % | 2.11 | % | 3.73 | % | ||||||||||

| Portfolio turnover rate |

31 | % | 17 | % | 18 | % | 28 | % | 51 | % | ||||||||||

| ‡ | Reflects the financial highlights of Class Z of the open-end fund prior to the conversion. |

| * | Per share data prior to February 15, 2019 has been adjusted to give effect to an approximately 1 to 1.4217 reverse stock split as part of the conversion to a closed-end fund. (Note 1) |

| (a) | Per share data was calculated using average shares outstanding during the period. |

| (b) | The Net Asset Value per share and total return have been calculated based on net assets which include adjustments made in accordance with U.S. Generally Accepted Accounting Principles required at period end for financial reporting purposes. These figures do not necessarily reflect the Net Asset Value per share or total return experienced by the shareholder at period end. |

| (c) | Total return is based on fair value per share for periods after February 15, 2019. Distributions are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s Dividend Reinvestment Plan. Prior to February 15, 2019, total return is at net asset value assuming all distributions are reinvested. For periods with waivers/reimbursements, had the Fund’s investment adviser not waived or reimbursed a portion of expenses, total return would have been lower. |

| (d) | All ratios for the period have been annualized, unless otherwise indicated. |

| (e) | Supplemental expense ratios are shown below. |

| (f) | Includes dividends and fees on securities sold short. |

Supplemental Expense Ratios:

| For the Years Ended September 30, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||

| Net expenses (net of waiver/reimbursement, if applicable, but gross of all other expenses)(g) |

1.01 | % | 0.88 | % | 1.81 | % | 2.45 | % | 2.38 | % | ||||||||||

| Interest expense and commitment fees |

0.28 | % | 0.15 | % | 0.82 | % | 1.60 | % | 1.02 | % | ||||||||||

| Dividends and fees on securities sold short |

0.01 | % | 0.01 | % | 0.07 | % | 0.11 | % | 0.16 | % | ||||||||||

| (g) | This includes the voluntary elected waiver by the Investment Adviser during the period, which resulted in a 0.12% impact to the net expenses ratio. |

| See accompanying Notes to Financial Statements. | 13 |

Table of Contents

| September 30, 2022 | Highland Global Allocation Fund | |

Note 1. Organization

Highland Global Allocation Fund (the “Fund”) is organized as an unincorporated business trust under the laws of The Commonwealth of Massachusetts. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified, closed-end management investment company. This report covers information for the year ended September 30, 2022.

On November 8, 2018, shareholders of the Fund approved a proposal authorizing the Board of Trustees (the “Board”) of the Fund to convert the Fund from an open-end fund to a closed-end fund at a special meeting of shareholders. The Board took action to convert the Fund to a closed-end fund effective shortly after 4:00 p.m. Eastern Time on February 14, 2019 (the “Conversion Date”). The Fund also effected an approximately 1-for-1.4217 reverse stock split of the Fund’s issued and outstanding shares on February 14, 2019, thereby reducing the number of shares outstanding. Shareholders were paid cash for any fractional shares resulting from the reverse stock split. The Fund began listing its shares for trading on the New York Stock Exchange (the “NYSE”) on February 19, 2019 under the ticker symbol “HGLB”. The Fund may issue an unlimited number of common shares, par value $0.001 per share (“Common Shares”). Prior to the Conversion Date, the Fund issued Class A, Class C, and Class Y shares.

Note 2. Significant Accounting Policies

The following summarizes the significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Use of Estimates

The Fund is an investment company that follows the investment company accounting and reporting guidance of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 Financial Services — Investment Companies applicable to investment companies. The Fund’s financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”), which require NexPoint Asset Management, L.P. (formerly Highland Capital Management Fund Advisors, L.P.) (“NexPoint” or the “Investment Adviser”) to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases or decreases in net assets from operations during the reporting period. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ materially.

Valuation of Investments

Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated NexPoint as the Fund’s valuation designee to

perform the fair valuation determination for securities and other assets held by the Fund. NexPoint acting through its “Valuation Committee,” is responsible for determining the fair value of investments for which market quotations are not readily available. The Valuation Committee is comprised of officers of NexPoint and certain of NexPoint’s affiliated companies and determines fair value and oversees the calculation of the NAV. The Valuation Committee is subject to Board oversight and certain reporting and other requirements intended to provide the Board the information it needs to oversee NexPoint’s fair value determinations.

The Fund’s investments are recorded at fair value. In computing the Fund’s net assets attributable to shares, securities with readily available market quotations on the NYSE, National Association of Securities Dealers Automated Quotation (“NASDAQ”) or other nationally recognized exchange, use the closing quotations on the respective exchange for valuation of those securities. Securities for which there are no readily available market quotations will be valued pursuant to policies adopted by NexPoint and approved by the Fund’s Board. Typically, such securities will be valued at the mean between the most recently quoted bid and ask prices provided by the principal market makers. If there is more than one such principal market maker, the value shall be the average of such means. Securities without a sale price or quotations from principal market makers on the valuation day may be priced by an independent pricing service. Generally, the Fund’s loan and bond positions are not traded on exchanges and consequently are valued based on a mean of the bid and ask price from the third-party pricing services or broker-dealer sources that the Investment Adviser has determined to have the capability to provide appropriate pricing services.

Securities for which market quotations are not readily available, or for which the Fund has determined that the price received from a pricing service or broker-dealer is “stale” or otherwise does not represent fair value (such as when events materially affecting the value of securities occur between the time when market price is determined and calculation of the Fund’s net asset value (“NAV”), will be valued by the Fund at fair value, as determined by the Valuation Committee in good faith in accordance with procedures established by NexPoint and approved by the Board, taking into account factors reasonably determined to be relevant, including, but not limited to: (i) the fundamental analytical data relating to the investment; (ii) the nature and duration of restrictions on disposition of the securities; and (iii) an evaluation of the forces that influence the market in which these securities are purchased and sold. In these cases, the Fund’s NAV will reflect the affected portfolio securities’ fair value as determined in the judgment of the Valuation Committee instead of being determined by the market. Using a fair value pricing methodology to value securities may result in a value that is different from a security’s most recent sale price and from

| 14 | Annual Report |

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

| September 30, 2022 | Highland Global Allocation Fund | |

the prices used by other investment companies to calculate their NAVs. Determination of fair value is uncertain because it involves subjective judgments and estimates.

There can be no assurance that the Fund’s valuation of a security will not differ from the amount that it realizes upon the sale of such security. Those differences could have a material impact to the Fund. The NAV shown in the Fund’s financial statements may vary from the NAV published by the Fund as of its period end because portfolio securities transactions are accounted for on the trade date (rather than the day following the trade date) for financial statement purposes.

Fair Value Measurements

The Fund has performed an analysis of all existing investments and derivative instruments to determine the significance and character of inputs to their fair value determination. The levels of fair value inputs used to measure the Fund’s investments are characterized into a fair value hierarchy. Where inputs for an asset or liability fall into more than one level in the fair value hierarchy, the investment is classified in its entirety based on the lowest level input that is significant to that investment’s valuation. The three levels of the fair value hierarchy are described below:

| Level 1 — | Quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement; |

| Level 2 — | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active, but are valued based on executed trades; broker quotations that constitute an executable price; and alternative pricing sources supported by observable inputs are classified within Level 2. Level 2 inputs are either directly or indirectly observable for the asset in connection with market data at the measurement date; and |

| Level 3 — | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. In certain cases, investments classified within Level 3 may include securities for which the Fund has obtained indicative quotes from broker-dealers that do not necessarily represent prices the broker may be willing to trade on, as such quotes can be subject to material management judgment. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The Investment Adviser has established policies and procedures, as described above and approved by the Board, to ensure that valuation methodologies for investments and financial instruments that are categorized within all levels of the fair value hierarchy are fair and consistent. A Valuation

Committee has been established to provide oversight of the valuation policies, processes and procedures, and is comprised of personnel from the Investment Adviser and its affiliates. The Pricing Committee meets monthly to review the proposed valuations for investments and financial instruments and is responsible for evaluating the overall fairness and consistent application of established policies.

As of September 30, 2022, the Fund’s investments consisted of senior loans, asset-backed securities, bonds and notes, common stocks, preferred stocks, LLC interests, master limited partnerships, registered investment companies, cash equivalents, repurchase agreements, exchange-traded funds, rights, warrants, and securities sold short. The fair value of the Fund’s loans, bonds and asset-backed securities are generally based on quotes received from brokers or independent pricing services. Loans, bonds and asset-backed securities with quotes that are based on actual trades with a sufficient level of activity on or near the measurement date are classified as Level 2 assets. Senior loans, bonds and asset-backed securities that are priced using quotes derived from implied values, indicative bids, or a limited number of actual trades are classified as Level 3 assets because the inputs used by the brokers and pricing services to derive the values are not readily observable.

The fair value of the Fund’s common stocks, registered investment companies, rights and warrants that are not actively traded on national exchanges are generally priced using quotes derived from implied values, indicative bids, or a limited amount of actual trades and are classified as Level 3 assets because the inputs used by the brokers and pricing services to derive the values are not readily observable. Exchange-traded options are valued based on the last trade price on the primary exchange on which they trade. If an option does not trade, the mid-price, which is the mean of the bid and ask price, is utilized to value the option. At the end of each calendar quarter, the Investment Adviser evaluates the Level 2 and 3 assets and liabilities for changes in liquidity, including but not limited to: whether a broker is willing to execute at the quoted price, the depth and consistency of prices from third party services, and the existence of contemporaneous, observable trades in the market. Additionally, the Investment Adviser evaluates the Level 1 and 2 assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges.

Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Fund’s investments may fluctuate from period to period. Additionally, the fair value of investments may differ significantly from the values that would have been used had a ready market existed for such investments and may differ materially from the values the Fund may ultimately realize. Further, such investments may be subject to legal and other restrictions on resale or otherwise be less liquid than publicly traded securities.

| Annual Report | 15 |

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

| September 30, 2022 | Highland Global Allocation Fund | |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. A summary of the inputs used to value the Fund’s assets and liabilities as of September 30, 2022, is as follows:

| Total value at September 30, 2022 ($) |

Level 1 Quoted Price ($) |

Level 2 Significant Observable Inputs ($) |

Level 3 Significant Unobservable Inputs ($) |

|||||||||||||

| Highland Global Allocation Fund |

||||||||||||||||

| Assets |

||||||||||||||||

| U.S. Equity |

||||||||||||||||

| Communication Services |

62,692,637 | 1,483,470 | — | 61,209,167 | ||||||||||||

| Healthcare |

2,571,161 | 2,571,161 | — | — | ||||||||||||

| Information Technology |

7,164,527 | 7,164,527 | — | — | ||||||||||||

| Materials |

3,652,420 | — | 3,652,420 | — | ||||||||||||

| Real Estate |

66,302,721 | 50,013,425 | — | 16,289,296 | ||||||||||||

| U.S. Senior Loans |

||||||||||||||||

| Communication Services |

19,854,675 | — | — | 19,854,675 | ||||||||||||

| Real Estate |

12,871,000 | — | — | 12,871,000 | ||||||||||||

| U.S. Master Limited Partnerships |

||||||||||||||||

| Energy |

22,465,909 | 22,465,909 | — | — | ||||||||||||

| Non-U.S. Equity |

||||||||||||||||

| Communication Services |

58,330 | 58,330 | — | — | ||||||||||||

| Consumer Discretionary |

2,499,633 | 2,483,340 | — | 16,293 | ||||||||||||

| Energy |

7,941,043 | 7,941,043 | — | — | ||||||||||||

| Financials |

42,525 | 42,525 | — | — | ||||||||||||

| Healthcare |

68,937 | 68,937 | — | — | ||||||||||||

| Industrials |

881,757 | 881,757 | — | — | ||||||||||||

| Information Technology |

112,214 | 112,214 | — | — | ||||||||||||

| Utilities |

5,224,429 | 5,224,429 | — | — | ||||||||||||

| U.S. Warrants |

||||||||||||||||

| Energy |

15,612,477 | — | 15,612,477 | — | ||||||||||||

| U.S. LLC Interest |

13,280,450 | — | — | 13,280,450 | ||||||||||||

| U.S. Rights |

||||||||||||||||

| Utilities |

9,881,429 | — | 9,881,429 | — | ||||||||||||

| U.S. Asset-Backed Securities |

7,687,158 | — | 7,687,158 | — | ||||||||||||

| Non-U.S. Sovereign Bonds |

6,288,425 | — | 6,288,425 | — | ||||||||||||

| U.S. Preferred Stock |

||||||||||||||||

| Healthcare |

2,191,014 | — | — | 2,191,014 | ||||||||||||

| Real Estate |

3,543,859 | 3,543,859 | — | — | ||||||||||||

| U.S. Corporate Bonds & Notes |

||||||||||||||||

| Communication Services |

792,495 | — | 792,495 | — | ||||||||||||

| Energy |

2,027,140 | — | 2,027,140 | — | ||||||||||||

| Non-U.S. Master Limited Partnerships |

||||||||||||||||

| Energy |

1,869,845 | 1,869,845 | — | — | ||||||||||||

| Non-U.S. Warrants |

||||||||||||||||

| Communication Services |

9,149 | — | 9,149 | — | ||||||||||||

| Industrials |

— | — | — | — | (1) | |||||||||||

| Information Technology |

1,162 | — | 1,162 | — | ||||||||||||

| Non-U.S. Asset-Backed Security |

19,005 | — | — | 19,005 | ||||||||||||

| U.S. Exchange-Traded Funds |

7,727,228 | 7,727,228 | — | — | ||||||||||||

| Non-U.S. Registered Investment Company |

3,395,347 | — | — | 3,395,347 | ||||||||||||

| U.S. Registered Investment Companies |

21,673,132 | 21,673,132 | — | — | ||||||||||||

| U.S. Repurchase Agreement |

96,117 | 96,117 | — | — | ||||||||||||

| U.S. Cash Equivalent |

8,765,335 | 8,765,335 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets |

319,264,685 | 144,186,583 | 45,951,855 | 129,126,247 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 16 | Annual Report |

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

| September 30, 2022 | Highland Global Allocation Fund | |

| Total value at September 30, 2022 ($) |

Level 1 Quoted Price ($) |

Level 2 Significant Observable Inputs ($) |

Level 3 Significant Unobservable Inputs ($) |

|||||||||||||

| Liabilities |

||||||||||||||||

| Securities Sold Short |

||||||||||||||||

| U.S. Equity |

||||||||||||||||

| Communication Services |

(2,343,099 | ) | (2,343,099 | ) | — | — | ||||||||||

| Consumer Staples |

(702,960 | ) | (702,960 | ) | — | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Liabilities |

(3,046,059 | ) | (3,046,059 | ) | — | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

316,218,626 | 141,140,524 | 45,951,855 | 129,126,247 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | This category includes securities with a value of zero. |

The table below sets forth a summary of changes in the Fund’s assets measured at fair value using significant unobservable inputs (Level 3) for the year ended September 30, 2022.

| Balance as of September 30, 2021 $ |

Accrued Discounts (Premiums) $ |

Distribution to Return Capital $ |

Realized Gain (Loss) $ |

Net Change in Unrealized Appreciation (Depreciation) $ |

Purchases $ |

Sales $ |

Balance as of September 30, 2022 $ |

Change in Unrealized Appreciation (Depreciation) from Investments held at September 30, 2022 $ |

||||||||||||||||||||||||||||

| U.S. Equity |

||||||||||||||||||||||||||||||||||||

| Communication Services |

57,255,705 | — | — | — | 3,953,462 | — | — | 61,209,167 | 3,953,462 | |||||||||||||||||||||||||||

| Real Estate |

13,260,162 | — | (2,513,419 | ) | — | 3,227,553 | 2,315,000 | — | 16,289,296 | 3,227,553 | ||||||||||||||||||||||||||

| U.S. Senior Loans |

||||||||||||||||||||||||||||||||||||

| Communication Services |

17,895,565 | 859 | — | — | (131,490 | ) | 2,089,741 | — | 19,854,675 | (131,490 | ) | |||||||||||||||||||||||||

| Real Estate |

— | — | — | — | (629,000 | ) | 13,500,000 | — | 12,871,000 | (629,000 | ) | |||||||||||||||||||||||||

| Utilities |

235,520 | — | — | (11,753,099 | ) | 11,517,579 | — | — | — | — | ||||||||||||||||||||||||||

| Non-U.S. Equity |

||||||||||||||||||||||||||||||||||||

| Consumer Discretionary |

52,141 | — | (40,799 | ) | — | 4,951 | — | — | 16,293 | 4,951 | ||||||||||||||||||||||||||

| U.S. LLC Interest |

18,373,752 | — | (1,396,861 | ) | (289,460 | ) | 541,879 | 6,972,671 | (10,921,531 | ) | 13,280,450 | 119,462 | ||||||||||||||||||||||||

| U.S. Preferred Stock |

||||||||||||||||||||||||||||||||||||

| Healthcare |

— | — | — | — | 391,015 | 1,799,999 | — | 2,191,014 | 391,015 | |||||||||||||||||||||||||||

| Non-U.S. Asset-Backed Security |

74,799 | — | — | 21,014 | (11,139 | ) | — | (65,669 | ) | 19,005 | (11,139 | ) | ||||||||||||||||||||||||

| Non-U.S. Registered Investment Company |

3,235,150 | — | — | — | 160,197 | — | — | 3,395,347 | 160,197 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

110,382,794 | 859 | (3,951,079 | ) | (12,021,545 | ) | 19,025,007 | 26,677,411 | (10,987,200 | ) | 129,126,247 | 7,085,011 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Annual Report | 17 |

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued)

| September 30, 2022 | Highland Global Allocation Fund | |

Investments designated as Level 3 may include assets valued using quotes or indications furnished by brokers which are based on models or estimates without observable inputs and may not be executable prices. In light of the developing market conditions, the Investment Adviser continues to search for observable data points and evaluate broker quotes and indications received for portfolio investments.

For the year ended September 30, 2022, there were no transfers into or out of Level 3. Determination of fair value is uncertain because it involves subjective judgments and estimates that are unobservable.

The following is a summary of significant unobservable inputs used in the fair valuations of assets and liabilities categorized within Level 3 of the fair value hierarchy:

| Category | Fair Value at 9/30/2022 $ |

Valuation Technique | Unobservable Inputs | Input Value(s) (Arithmetic Mean) | ||||||

| U.S. Equity/Non-U.S. Equity |

77,514,756 | Multiples Analysis | Unadjusted Price/MHz-PoP | $0.09 - $0.95 ($0.515) | ||||||

| Discounted Cash Flow | Discount Rate | 13.50% - 15.50% (14.50%) | ||||||||

| Transaction Indication of Value | Enterprise Value ($ mm) | $905 | ||||||||

| Offer Price per Share | $1.10 | |||||||||

| Cost price | N/A | |||||||||

| Direct Capitalization Method | Capitalization Rates | 6.0% | ||||||||

| Net Asset Value | NAV | $62.97 | ||||||||

| Liquidation Analysis | Recovery Rate | 75% - 100.0% | ||||||||

| U.S. Senior Loans |

32,725,675 | Discounted Cash Flow | Discount Rate | 11% -11.5% (11.25%) | ||||||

| Transaction Indication of Value | Cost price | N/A | ||||||||

| Option Pricing Model | Volatilty | 50% - 60% (55%) | ||||||||

| U.S. LLC Interest |

13,280,450 | Discounted Cash Flow | Discount Rate | 4.73% - 8.93% (6.83%) | ||||||

| Transaction Indication of Value | Cost price | N/A | ||||||||

| U.S. Preferred Stock |

2,191,014 | Transaction Indication of Value | Enterprise Value ($ mm) | $144.6 - $256.3 ($197.3) | ||||||

| Option Pricing Model | Volatilty | 70% - 90% (80%) | ||||||||

| Non-U.S. Asset-Backed Security |

19,005 | Discounted Cash Flow | Discount Rate | 21.0% | ||||||

| Non-U.S. Registered Investment Company |

3,395,347 | Net Asset Value | NAV | $339.54 | ||||||

|

|

|

|||||||||

| 129,126,247 | ||||||||||

The significant unobservable inputs used in the fair value measurement of the Fund’s bank loan and asset-backed securities are: discount rate, volatility and broker quote indication of value. A Significant increase (decrease) in these inputs in isolation could result in a significantly lower (higher) fair value measurement.

The significant unobservable inputs used in the fair value measurement of the Fund’s LLC interests are: discount rate and capitalization rate. A significant increase (decrease) in any of those inputs in isolation could result in a significantly higher (lower) fair value measurement.

The significant unobservable inputs used in the fair value measurement of the Fund’s common equity securities are: unadjusted price/MHz-PoP multiple, discount rate, enterprise value, tender offer per share, and recovery rate. Significant increases (decreases) in any of those inputs in isolation could result in a significantly lower (higher) fair value measurement.

In addition to the unobservable inputs utilized for various valuation methodologies, the Investment Adviser frequently uses a combination of two or more valuation methodologies to determine fair value for a single holding. In such instances, the Investment Adviser assesses the methodologies and ascribes weightings to each methodology. The weightings ascribed to any individual methodology ranged from as low as 25% to as high as 75% as of September 30, 2022. The selection of weightings is an inherently subjective process, dependent on professional judgement. These selections may have a material impact to the concluded fair value for such holdings.

Certain Illiquid Positions Classified as Level 3