Form N-CSR FAIRHOLME FUNDS INC For: Nov 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-09607

Fairholme Funds, Inc.

(Exact name of registrant as specified in charter)

2601 NE 2nd Avenue

Miami, FL 33137

(Address of principal executive offices) (Zip code)

Bruce R. Berkowitz

2601 NE 2nd Avenue

Miami, FL 33137

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-866-202-2263

Date of fiscal year end: November 30

Date of reporting period: November 30, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Reports to Shareholders of each Fund are attached herewith.

FAIRHOLME FUNDS, INC.

The Fairholme Fund (FAIRX)

Seeking long-term growth of capital

The Fairholme Focused Income Fund (FOCIX)

Seeking current income

The Fairholme Allocation Fund (FAAFX)

Seeking long-term total return

Annual Report

November 30, 2019

Managed by Fairholme Capital Management

(866) 202-2263 • fairholmefunds.com

FAIRHOLME FUNDS, INC.

November 30, 2019

| Page | ||||

| MANAGEMENT DISCUSSION & ANALYSIS FUND PERFORMANCE: |

||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 11 | ||||

| THE FAIRHOLME FUND: |

||||

| 12 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| THE FAIRHOLME FOCUSED INCOME FUND: |

||||

| 19 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| THE FAIRHOLME ALLOCATION FUND: |

||||

| 26 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 42 | ||||

| 43 | ||||

2

FAIRHOLME FUNDS, INC.

FUND PERFORMANCE (unaudited)

November 30, 2009 — November 30, 2019

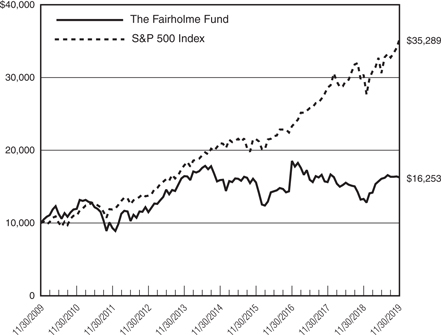

THE FAIRHOLME FUND VS. THE S&P 500 INDEX

INITIAL INVESTMENT OF $10,000

The Fairholme Fund (“The Fairholme Fund”) commenced operations on December 29, 1999. The chart above presents the performance of a $10,000 investment for up to ten years to the latest annual period ending November 30, 2019.

The following notes pertain to the chart above as well as to the performance table included in the Management Discussion & Analysis Report. Performance information in this report represents past performance and is not a guarantee of future results. The investment return and principal value of an investment in The Fairholme Fund will fluctuate, so that an investor’s shares when redeemed may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted within. The performance information does not reflect the taxes an investor would pay on distributions from The Fairholme Fund or upon redemption of shares of The Fairholme Fund. Most recent month-end performance and answers to any questions you may have can be obtained by calling Shareholder Services at 1-866-202-2263.

Data for both the S&P 500 Index and The Fairholme Fund are presented assuming all dividends and distributions have been reinvested and do not reflect any taxes that might have been incurred by a shareholder as a result of The Fairholme Fund distributions. The S&P 500 Index is a widely recognized, unmanaged index of 500 of the largest companies in the United States as measured by market capitalization and does not reflect any investment management fees or transaction expenses, nor the effects of taxes, fees or other charges.

3

FAIRHOLME FUNDS, INC.

FUND PERFORMANCE (unaudited)

Inception through November 30, 2019

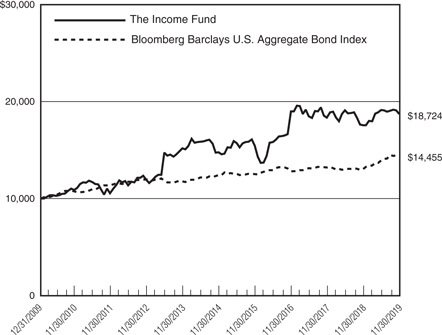

THE INCOME FUND VS.

The BLOOMBERG BARCLAYS U.S. AGGREGATE BOND INDEX

INITIAL INVESTMENT OF $10,000

The Fairholme Focused Income Fund (“The Income Fund”) commenced operations on December 31, 2009. The chart above presents the performance of a $10,000 investment from inception to the latest annual period ending November 30, 2019.

The following notes pertain to the chart above as well as to the performance table included in the Management Discussion & Analysis Report. Performance information in this report represents past performance and is not a guarantee of future results. The investment return and principal value of an investment in The Income Fund will fluctuate, so that an investor’s shares when redeemed may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted within. The performance information does not reflect the taxes an investor would pay on distributions from The Income Fund or upon redemption of shares of The Income Fund. Most recent month-end performance and answers to any questions you may have can be obtained by calling Shareholder Services at 1-866-202-2263.

Data for both the Bloomberg Barclays U.S. Aggregate Bond Index and The Income Fund are presented assuming all dividends and distributions have been reinvested and do not reflect any taxes that might have been incurred by a shareholder as a result of The Income Fund distributions. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, and includes Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities (agency and non-agency). The Bloomberg Barclays U.S. Aggregate Bond Index does not reflect any investment management fees or transaction expenses, nor the effects of taxes, fees, or other charges.

4

FAIRHOLME FUNDS, INC.

FUND PERFORMANCE (unaudited)

Inception through November 30, 2019

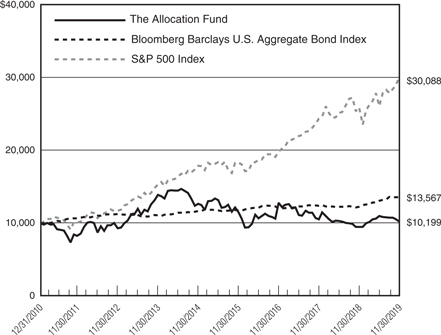

THE ALLOCATION FUND VS. The BLOOMBERG BARCLAYS U.S.

AGGREGATE BOND INDEX AND THE S&P 500 INDEX

INITIAL INVESTMENT OF $10,000

The Fairholme Allocation Fund (“The Allocation Fund”) commenced operations on December 31, 2010. The chart above presents the performance of a $10,000 investment from inception to the latest annual period ending November 30, 2019.

The following notes pertain to the chart above as well as to the performance table included in the Management Discussion & Analysis Report. Performance information in this report represents past performance and is not a guarantee of future results. The investment return and principal value of an investment in The Allocation Fund will fluctuate, so that an investor’s shares when redeemed may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted within. The performance information does not reflect the taxes an investor would pay on distributions from The Allocation Fund or upon redemption of shares of The Allocation Fund. Most recent month-end performance and answers to any questions you may have can be obtained by calling Shareholder Services at 1-866-202-2263.

Data for the Bloomberg Barclays U.S. Aggregate Bond Index, the S&P 500 Index and The Allocation Fund are presented assuming all dividends and distributions have been reinvested and do not reflect any taxes that might have been incurred by a shareholder as a result of The Allocation Fund distributions. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, and includes Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities (agency and non-agency). The S&P 500 Index is a widely recognized, unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. These index returns do not reflect any investment management fees or transaction expenses, nor the effects of taxes, fees or other charges.

5

FAIRHOLME FUNDS, INC.

MANAGEMENT DISCUSSION & ANALYSIS

For the Fiscal Year Ended November 30, 2019

The Fairholme Fund, The Income Fund, and The Allocation Fund (each a “Fund” and collectively, the “Funds”) shares outstanding and unaudited net asset value per share (“NAV”) at November 30, 2019, the end of the Funds’ fiscal year, and NAVs at other pertinent dates, were as follows:

| 11/30/2019 Shares Outstanding |

11/30/2019 NAV (unaudited) |

05/31/2019 NAV (audited) |

11/30/2018 NAV (unaudited) | |||||||||||||||

| The Fairholme Fund |

55,059,022 | $19.19 | $18.97 | $16.05 | ||||||||||||||

| The Income Fund |

17,529,966 | $10.23 | $10.61 | $ 9.88 | ||||||||||||||

| The Allocation Fund |

8,423,476 | $ 7.00 | $ 7.53 | $ 6.58 | ||||||||||||||

At December 31, 2019, the unaudited NAVs of The Fairholme Fund, The Income Fund, and The Allocation Fund were $19.83, $10.28, and $7.20, respectively.

Performance figures below are shown for the Funds’ fiscal year ended November 30, 2019, and do not match calendar year figures for the period ended December 31, 2019, cited in the Portfolio Manager’s report.

| The Fairholme Fund |

Six Months |

One Year |

Five Years |

Ten Years |

Fifteen Years |

Since Inception 12/29/1999 |

||||||||||||||||||||||||||||||||||||||

| Cumulative: |

||||||||||||||||||||||||||||||||||||||||||||

| The Fairholme Fund |

1.16 | % | 22.20 | % | 2.36 | % | 62.52 | % | 135.62 | % | 446.08% | |||||||||||||||||||||||||||||||||

| S&P 500 Index |

15.26 | % | 16.11 | % | 68.34 | % | 252.90 | % | 265.54 | % | 215.97% | |||||||||||||||||||||||||||||||||

| Annualized: |

||||||||||||||||||||||||||||||||||||||||||||

| The Fairholme Fund |

22.20 | % | 0.47 | % | 4.98 | % | 5.88 | % | 8.89% | |||||||||||||||||||||||||||||||||||

| S&P 500 Index |

16.11 | % | 10.98 | % | 13.44 | % | 9.03 | % | 5.94% | |||||||||||||||||||||||||||||||||||

For the six months ended November 30, 2019, The Fairholme Fund was outperformed by the S&P 500 Index (“S&P 500”) by 14.1 percentage points, while over the last year The Fairholme Fund outperformed the S&P 500 by 6.09 percentage points. From inception, The Fairholme Fund outperformed the S&P 500 by 2.95 percentage points per annum, or on a cumulative basis, 230.11 percentage points over nineteen years and eleven months.

| The Income Fund |

Six Months |

One Year |

Five Year |

Since Inception 12/31/2009 |

||||||||||||||||||||||||

| Cumulative: |

||||||||||||||||||||||||||||

| The Income Fund |

-2.22 | % | 6.49 | % | 26.63 | % | 87.24 | % | ||||||||||||||||||||

| Bloomberg Barclays Bond Index |

3.81 | % | 10.79 | % | 16.40 | % | 44.55 | % | ||||||||||||||||||||

| Annualized: |

||||||||||||||||||||||||||||

| The Income Fund |

6.49 | % | 4.83 | % | 6.53 | % | ||||||||||||||||||||||

| Bloomberg Barclays Bond Index |

10.79 | % | 3.08 | % | 3.79 | % | ||||||||||||||||||||||

6

FAIRHOLME FUNDS, INC.

MANAGEMENT DISCUSSION & ANALYSIS (continued)

For the Fiscal Year Ended November 30, 2019

For the six months ended November 30, 2019, The Income Fund was outperformed by the Bloomberg Barclays U.S. Aggregate Bond Index (“Bloomberg Barclays Bond Index”) by 6.03 percentage points, while over the last year The Income Fund was outperformed by the Bloomberg Barclays Bond Index by 4.30 percentage points. From inception, The Income Fund outperformed the Bloomberg Barclays Bond Index by 2.74 percentage points per annum, or on a cumulative basis, 42.69 percentage points over nine years and eleven months.

| The Allocation Fund Performance to 11/30/2019 (Unaudited) |

Six Months |

One Year |

Five Year |

Since Inception 12/31/2010 |

||||||||||||||||||||||||

| Cumulative: |

||||||||||||||||||||||||||||

| The Allocation Fund |

-7.04 | % | 7.61 | % | -19.39 | % | 1.98 | % | ||||||||||||||||||||

| Bloomberg Barclays Bond Index |

3.81 | % | 10.79 | % | 16.40 | % | 35.67 | % | ||||||||||||||||||||

| S&P 500 Index |

15.26 | % | 16.11 | % | 68.34 | % | 200.88 | % | ||||||||||||||||||||

| Annualized: |

||||||||||||||||||||||||||||

| The Allocation Fund |

7.61 | % | -4.22 | % | 0.22 | % | ||||||||||||||||||||||

| Bloomberg Barclays Bond Index |

10.79 | % | 3.08 | % | 3.48 | % | ||||||||||||||||||||||

| S&P 500 Index |

16.11 | % | 10.98 | % | 13.15 | % | ||||||||||||||||||||||

For the six months ended November 30, 2019, The Allocation Fund was outperformed by the Bloomberg Barclays Bond Index and the S&P 500 by 10.85 and 22.30 percentage points, respectively, while over the last year The Allocation Fund was outperformed by the Bloomberg Barclays Bond Index by 3.18 percentage points and outperformed the S&P 500 by 8.50 percentage points. From inception, The Allocation Fund was outperformed by the Bloomberg Barclays Bond Index and the S&P 500 by 3.26 and 12.93 percentage points per annum, respectively, or on a cumulative basis, 33.69 and 198.90 percentage points over eight years and eleven months.

Fairholme Capital Management, L.L.C. (the “Manager”) believes performance over shorter periods is likely to be less meaningful than performance over longer periods. Investors are cautioned not to rely on short-term results. The fact that securities increase or decline in value does not always indicate that the Manager believes these securities to be more or less attractive — in fact, the Manager believes that some price increases present selling opportunities and some price declines present buying opportunities.

Further, shareholders should note that the S&P 500 and the Bloomberg Barclays Bond Index are unmanaged indices incurring no fees, expenses, or tax effects and are shown solely to compare the Funds’ performance to that of unmanaged and diversified indices of securities. Shareholders are also cautioned that it is possible that some securities mentioned in this discussion may no longer be held by a Fund subsequent to the end of the fiscal period, and that a Fund may have made new investments that are not yet required to be disclosed. It is the Funds’ general policy not to disclose portfolio holdings other than when required by relevant law or regulation. Portfolio holdings are subject to change without notice.

Not all Fund portfolio dispositions or additions are material, and, while the Funds and the Manager have long-term objectives, it is possible that a security sold or purchased in one period will be purchased or sold in a subsequent period. Generally, the Manager determines to buy and sell based on its estimates of the, respectively, relative intrinsic values and the Manager’s assessment of certain attractive characteristics of a company, general market conditions and expected future returns of an investment.

The Manager invests each Fund’s assets in securities to the extent the Manager finds reasonable investment opportunities in accordance with the Fund’s respective investment strategies, policies and restrictions, as stated in the Fund’s Prospectus and may invest a significant portion of each Fund’s assets in cash. The Manager views liquidity as a strategic advantage. At November 30, 2019, cash and cash equivalents (consisting of cash, commercial

7

FAIRHOLME FUNDS, INC.

MANAGEMENT DISCUSSION & ANALYSIS (continued)

For the Fiscal Year Ended November 30, 2019

paper, deposit accounts, U.S. Treasury Bills, and money-market funds) represented 41.3%, 86.9%, and 67.5% of The Fairholme Fund, The Income Fund, and The Allocation Fund total assets, respectively. Since inception, the Funds have held varying levels of cash and cash equivalents for periods without, in the Manager’s view, negatively influencing performance.

Each Fund is considered to be “non-diversified” under the Investment Company Act of 1940. Accordingly, each Fund can invest a greater percentage of its assets in fewer securities than a diversified fund, and can invest a significant portion of cash and liquid assets held by the Fund in one or more higher-risk securities at any time, including periods when a market is weak or a particular security declines sharply. The Funds may also have a greater percentage of assets invested in a particular sector than a diversified fund, exposing the Funds to the risk of an unanticipated event or condition and risks affecting a single company, sector or security.

The commentaries below provide details of each Fund’s portfolio holdings by issuer and sector, as well as reporting the most significant positive and negative performance by investment for the fiscal year ended November 30, 2019.

The most significant gains in each of the Funds’ portfolios related to positive developments in the Real Estate Management and Development, Mortgage Finance, and Metals & Mining sectors. Investments in the Retail Department Stores, Oil & Natural Gas Exploration and Leisure Products sectors saw some losses during the fiscal year.

The Manager made no changes to the core investment strategies and techniques it employed during the fiscal year ended November 30, 2019.

For the fiscal year ended November 30, 2019, The Fairholme Fund investments that were the biggest contributors to positive performance were the St. Joe Co. (“Joe”), Imperial Metals Corp. (“Imperial”), Federal Home Loan Mortgage Corp. (“Freddie”), and Federal National Mortgage Association (“Fannie”). There weren’t any significant contributors to negative performance during the period. The following charts show the top holdings by issuer and sector in descending order of net assets as of November 30, 2019.

| The Fairholme Fund Top Holdings by Issuer* (% of Net Assets) |

The Fairholme Fund Top Sectors (% of Net Assets) |

|||||||||||||

| The St. Joe Co. |

39.9% | Cash and Cash Equivalents** | 41.3% | |||||||||||

| Federal Home Loan Mortgage Corp. |

8.9% | Real Estate Management & Development | 39.9% | |||||||||||

| Federal National Mortgage Association |

8.9% | Mortgage Finance | 17.8% | |||||||||||

| Imperial Metals Corp. |

0.8% | Metals & Mining | 0.8% | |||||||||||

| Vista Outdoor, Inc. |

0.1% | Leisure Products | 0.1% | |||||||||||

| Sears Holdings Corp. |

0.1% | Retail Department Store | 0.1% | |||||||||||

|

|

|

|

|

|||||||||||

| 58.7% | 100.0% | |||||||||||||

|

|

|

|

|

|||||||||||

| * | Excludes cash, U.S. Treasury Bills, commercial paper, and money market funds. |

| ** | Includes cash, U.S. Treasury Bills, commercial paper, and money market funds. |

8

FAIRHOLME FUNDS, INC.

MANAGEMENT DISCUSSION & ANALYSIS (continued)

For the Fiscal Year Ended November 30, 2019

For the fiscal year ended November 30, 2019, The Income Fund investments that were the biggest contributors to positive performance were Imperial and Freddie. The biggest contributor to negative performance during the period was investment in Chesapeake Energy Corp. The following charts show the top holdings by issuer and sector in descending order of net assets as of November 30, 2019.

| The Income Fund Top Holdings by Issuer* (% of Net Assets) |

The Income Fund Top Sectors (% of Net Assets) |

|||||||||||||||

| Federal Home Loan Mortgage Corp. |

4.2% | Cash and Cash Equivalents** | 86.9% | |||||||||||||

| The Goldman Sachs Group, Inc. |

2.7% | Mortgage Finance | 4.2% | |||||||||||||

| GMAC Capital Trust I, Inc. |

1.8% | Diversified Banks | 3.0% | |||||||||||||

| Chesapeake Energy Corp. |

1.3% | Capital Markets | 2.7% | |||||||||||||

| Bank of America Corp. |

1.2% | Consumer Finance | 1.8% | |||||||||||||

| JP Morgan Chase & Co. |

1.1% | Oil & Natural Gas Exploration | 1.3% | |||||||||||||

| Wells Fargo & Co. |

0.7% | Retail Department Stores | 0.1% | |||||||||||||

| Sears Holdings Corp. |

0.1% | |||||||||||||||

|

|

|

|

|

|||||||||||||

| 13.1% | 100.0% | |||||||||||||||

|

|

|

|

|

|||||||||||||

| * | Excludes cash, U.S. Treasury Bills, commercial paper, and money market funds. |

| ** | Includes cash, U.S. Treasury Bills, commercial paper, and money market funds. |

For the fiscal year ended November 30, 2019, The Allocation Fund investments that were the biggest contributors to positive performance were Freddie, Fannie, Joe, and Imperial. The biggest contributor to negative performance during the period was investment in Chesapeake Energy Corp. The following charts show the top holdings by issuer and sector in descending order of net assets as of November 30, 2019.

| The Allocation Fund Top Holdings by Issuer* (% of Net Assets) |

The Allocation Fund Top Sectors (% of Net Assets) |

|||||||||||||||

| The St. Joe Co. |

10.9% | Cash and Cash Equivalents** | 67.5% | |||||||||||||

| Federal Home Loan Mortgage Corp. |

7.9% | Mortgage Finance | 15.7% | |||||||||||||

| Federal National Mortgage Association |

7.8% | Real Estate Management & Development | 10.9% | |||||||||||||

| Imperial Metals Corp. |

4.8% | Metals & Mining | 4.8% | |||||||||||||

| Chesapeake Energy Corp. |

1.2% | Oil & Natural Gas Exploration | 1.2% | |||||||||||||

|

|

|

|

|

|||||||||||||

| 32.6% | 100.1% | |||||||||||||||

|

|

|

|

|

|||||||||||||

| * | Excludes cash, U.S. Treasury Bills, commercial paper, and money market funds. |

| ** | Includes cash, U.S. Treasury Bills, commercial paper, and money market funds. |

The Manager views the ability to focus on fewer investments than a diversified fund as a strategic advantage. However, such a strategy may negatively influence long-term performance.

A more complete discussion and description of the principal risks of investing in the Funds can be found in the Funds’ Prospectus and Statement of Additional Information.

Large cash inflows or outflows may adversely affect the Funds’ performance. Such flows are monitored and actions deemed appropriate by the Manager are contemplated for when such flows could negatively impact performance.

9

FAIRHOLME FUNDS, INC.

MANAGEMENT DISCUSSION & ANALYSIS (continued)

For the Fiscal Year Ended November 30, 2019

Since inception, the Funds have been advised by the Manager. Bruce Berkowitz, both the Chief Investment Officer of the Manager and Chairman of the Funds’ Board of Directors (the “Board” or the “Directors”), and his affiliates beneficially own an aggregate 10,784,408, 6,691,382, and 4,382,931 shares of The Fairholme Fund, The Income Fund, and The Allocation Fund, respectively, at November 30, 2019. While there is no requirement that Mr. Berkowitz own shares of the Funds, such holdings are believed to help align the interests of the Manager with the interests of the shareholders.

The Board, including the Independent Directors, continues to believe that it is in the best interests of the Funds to have Mr. Berkowitz serve as Chairman of the Board given: his long-term relative performance; his experience, commitment, and significant personal investment in the Funds; the present composition of the Board; and current rules and regulations. A Director and Officers of the Funds are also Officers of the Manager. Nevertheless, at November 30, 2019, a majority of Directors were independent of the Manager, no stock option or restricted stock plans exist, Officers received no direct compensation from the Funds, and the Director affiliated with the Manager received no compensation for being a Director.

For more complete information about the Funds, or to obtain a current Prospectus, please visit www.fairholmefunds.com or call Shareholder Services at (866) 202-2263.

10

FAIRHOLME FUNDS, INC.

For the Six Month Period from June 1, 2019

through November 30, 2019 (unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs including, but not limited to, transaction fees at some broker-dealers, custodial fees for retirement accounts, redemption fees (on The Fairholme Fund and The Allocation Fund shares redeemed or exchanged within 60 days of purchase), and wire transfer fees; and (2) ongoing costs including, but not limited to, management fees paid to the Manager. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

These examples are based on an investment of $1,000 invested in the Funds at June 1, 2019, and held for the entire six month period ending November 30, 2019.

Actual Expenses

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you had invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return for the period presented. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses that you paid for the period presented. However, you may use this information to compare ongoing costs of investing in the Funds with the ongoing costs of investing in other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees (if any), or other direct costs. Therefore, the second line of the tables is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your total costs would be higher.

| Beginning Account Value June 1, 2019 |

Ending Account Value November 30, 2019 |

Annualized Expense Ratio* |

Expenses Paid During the Period June 1, 2019 Through November 30, 2019** | |||||||||||||||||

| The Fairholme Fund |

||||||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,011.60 | 0.81 | % | $ | 4.08 | ||||||||||||

| Hypothetical |

$ | 1,000.00 | $ | 1,021.01 | 0.81 | % | $ | 4.10 | ||||||||||||

| The Income Fund |

||||||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 977.80 | 0.82 | % | $ | 4.07 | ||||||||||||

| Hypothetical |

$ | 1,000.00 | $ | 1,020.96 | 0.82 | % | $ | 4.15 | ||||||||||||

| The Allocation Fund |

||||||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 929.60 | 0.82 | % | $ | 3.97 | ||||||||||||

| Hypothetical |

$ | 1,000.00 | $ | 1,020.96 | 0.82 | % | $ | 4.15 | ||||||||||||

| * | Effective January 1, 2018, the Manager has agreed to waive, on a voluntary basis, a portion of the management fee of The Fairholme Fund, The Income Fund and The Allocation Fund to the extent necessary to limit the management fee paid to the Manager by The Fairholme Fund, The Income Fund and The Allocation Fund, respectively, to an annual rate of 0.80% of that Fund’s daily average net asset value. This undertaking may be terminated by the Manager upon 60 days’ written notice to the applicable Fund. |

| ** | Expenses are equal to each Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183 days/365 days (to reflect the one-half year period). |

11

THE FAIRHOLME FUND

November 30, 2019

The accompanying notes are an integral part of the financial statements.

12

THE FAIRHOLME FUND

SCHEDULE OF INVESTMENTS (continued)

November 30, 2019

The accompanying notes are an integral part of the financial statements.

13

THE FAIRHOLME FUND

SCHEDULE OF INVESTMENTS (continued)

November 30, 2019

| (a) | Non-income producing security. |

| (b) | Affiliated Company. See Note 8. |

| (c) | Variable rate security. Rates shown are the effective rates as of November 30, 2019. |

| (d) | Security in default and no interest was accrued as of November 30, 2019. |

| (e) | Restricted security as set forth in Rule 144(a) under the Securities Act of 1933. The value of these investments totals $376,420,433, which represents 35.63% of The Fairholme Fund’s net assets. |

| (f) | Rates shown are the effective yields based on the purchase price. The calculation assumes the security is held to maturity. |

| (g) | Annualized based on the 1-day yield as of November 30, 2019. |

The accompanying notes are an integral part of the financial statements.

14

THE FAIRHOLME FUND

STATEMENT OF ASSETS & LIABILITIES

November 30, 2019

| Assets |

||||

| Investments, at Fair Value: |

||||

| Unaffiliated Issuers (Cost — $611,526,290) |

$ | 626,659,090 | ||

| Affiliated Issuers (Cost — $657,834,109) |

430,739,480 | |||

| Interest Receivable |

181,235 | |||

| Receivable for Capital Shares Sold |

10,388 | |||

|

|

|

|||

| Total Assets |

1,057,590,193 | |||

|

|

|

|||

| Liabilities |

||||

| Accrued Management Fees |

689,013 | |||

| Payable for Capital Shares Redeemed |

360,640 | |||

|

|

|

|||

| Total Liabilities |

1,049,653 | |||

|

|

|

|||

| NET ASSETS |

$ | 1,056,540,540 | ||

|

|

|

|||

| Net Assets Consist of: |

||||

| Paid-In Capital |

$ | 2,008,134,487 | ||

| Total Accumulated Losses |

(951,593,947 | ) | ||

|

|

|

|||

| NET ASSETS |

$ | 1,056,540,540 | ||

|

|

|

|||

| Shares of Common Stock Outstanding* ($0.0001 par value) |

55,059,022 | |||

|

|

|

|||

| Net Asset Value, Offering and Redemption Price Per Share ($1,056,540,540 / 55,059,022 shares) |

$ | 19.19 | ||

|

|

|

|||

* 700,000,000 shares authorized in total.

The accompanying notes are an integral part of the financial statements.

15

THE FAIRHOLME FUND

| For the Fiscal Year Ended November 30, 2019 |

||||||||||||||||||||||||

| Investment Income |

||||||||||||||||||||||||

| Interest — Unaffiliated Issuers |

$ | 10,120,431 | ||||||||||||||||||||||

| Interest — Affiliated Issuers |

7,897,101 | |||||||||||||||||||||||

| Dividends — Unaffiliated Issuers |

158,400 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total Investment Income |

18,175,932 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Expenses |

||||||||||||||||||||||||

| Management Fees |

10,940,735 | |||||||||||||||||||||||

| Legal Expenses |

44,395 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total Expenses |

10,985,130 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Less: Voluntary Reduction of Management Fees |

(2,188,147 | ) | ||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Net Expenses |

8,796,983 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Net Investment Income |

9,378,949 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Realized and Unrealized Gain on Investments, Foreign |

||||||||||||||||||||||||

| Currency Related Transactions and Redemption In-Kind |

||||||||||||||||||||||||

| Net Realized Gain on Investments and Foreign Currency |

||||||||||||||||||||||||

| Related Transactions* |

||||||||||||||||||||||||

| Unaffiliated Issuers |

3,272,103 | |||||||||||||||||||||||

| Affiliated Issuers |

1,335 | |||||||||||||||||||||||

| Net Realized Gain on Redemption In-Kind |

||||||||||||||||||||||||

| Unaffiliated Issuers |

1,021,307 | |||||||||||||||||||||||

| Affiliated Issuers |

313,156 | |||||||||||||||||||||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Related Translations |

202,650,238 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Net Realized and Unrealized Gain on Investments, Foreign Currency Related Transactions and Redemption In-Kind |

207,258,139 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| NET INCREASE IN NET ASSETS FROM OPERATIONS |

$ | 216,637,088 | ||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

* Realized gain includes $5,666,801 related to amounts received from a class action settlement for a security previously held by the Fund.

The accompanying notes are an integral part of the financial statements.

16

THE FAIRHOLME FUND

STATEMENTS OF CHANGES IN NET ASSETS

| For the Fiscal Year Ended November 30, 2019 |

For the Fiscal Year Ended November 30, 2018 |

|||||||||||||||||||||||||||||||||||||||

| CHANGES IN NET ASSETS |

||||||||||||||||||||||||||||||||||||||||

| From Operations |

||||||||||||||||||||||||||||||||||||||||

| Net Investment Income |

$ | 9,378,949 | $ | 23,034,554 | ||||||||||||||||||||||||||||||||||||

| Net Realized Gain (Loss) on Investments, Redemption In-Kind and Foreign Currency Related Transactions |

4,607,901 | (745,845,681 | ) | |||||||||||||||||||||||||||||||||||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Related Translations |

202,650,238 | 524,777,058 | ||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Net Increase (Decrease) in Net Assets from Operations |

216,637,088 | (198,034,069 | ) | |||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| From Dividends and Distributions to Shareholders |

||||||||||||||||||||||||||||||||||||||||

| Net Decrease in Net Assets from Dividends and Distributions |

(22,052,477 | ) | (24,854,774 | ) | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| From Capital Share Transactions |

||||||||||||||||||||||||||||||||||||||||

| Proceeds from Sale of Shares |

27,873,325 | 90,282,215 | ||||||||||||||||||||||||||||||||||||||

| Shares Issued in Reinvestment of Dividends and Distributions |

20,660,229 | 23,181,634 | ||||||||||||||||||||||||||||||||||||||

| Redemption Fees |

37,027 | 33,620 | ||||||||||||||||||||||||||||||||||||||

| Cost of Shares Redeemed |

(238,279,392 | ) | (697,223,062 | ) | ||||||||||||||||||||||||||||||||||||

| Cost of Shares Redeemed In-Kind |

(13,200,907 | ) | — | |||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Net Decrease in Net Assets from Shareholder Activity |

(202,909,718 | ) | (583,725,593 | ) | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| NET ASSETS |

||||||||||||||||||||||||||||||||||||||||

| Net Decrease in Net Assets |

(8,325,107 | ) | (806,614,436 | ) | ||||||||||||||||||||||||||||||||||||

| Net Assets at Beginning of Year |

1,064,865,647 | 1,871,480,083 | ||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Net Assets at End of Year |

$ | 1,056,540,540 | $ | 1,064,865,647 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| SHARES TRANSACTIONS |

||||||||||||||||||||||||||||||||||||||||

| Issued |

1,583,280 | 4,864,645 | ||||||||||||||||||||||||||||||||||||||

| Reinvested |

1,352,111 | 1,184,549 | ||||||||||||||||||||||||||||||||||||||

| Redeemed |

(13,466,927 | ) | (37,685,937 | ) | ||||||||||||||||||||||||||||||||||||

| Redeemed In-Kind |

(761,812 | ) | — | |||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Net Decrease in Shares |

(11,293,348 | ) | (31,636,743 | ) | ||||||||||||||||||||||||||||||||||||

| Shares Outstanding at Beginning of Year |

66,352,370 | 97,989,113 | ||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

| Shares Outstanding at End of Year |

55,059,022 | 66,352,370 | ||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of the financial statements.

17

THE FAIRHOLME FUND

| For the Fiscal Year Ended November 30, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| PER SHARE OPERATING PERFORMANCE |

||||||||||||||||||||

| NET ASSET VALUE, BEGINNING OF YEAR |

$16.05 | $19.10 | $24.26 | $34.24 | $37.96 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Investment Operations |

||||||||||||||||||||

| Net Investment Income(1) |

0.16 | 0.29 | 0.23 | 0.33 | 0.46 | |||||||||||||||

| Net Realized and Unrealized Gain (Loss) on Investments |

3.32 | (3.08 | ) | (3.81 | ) | 2.60 | (1.10 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from Investment Operations |

3.48 | (2.79 | ) | (3.58 | ) | 2.93 | (0.64 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends and Distributions |

||||||||||||||||||||

| From Net Investment Income |

(0.34 | ) | (0.26 | ) | (0.40 | ) | (0.60 | ) | — | |||||||||||

| From Realized Capital Gains |

— | — | (1.18 | ) | (12.31 | ) | (3.08 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Dividends and Distributions |

(0.34 | ) | (0.26 | ) | (1.58 | ) | (12.91 | ) | (3.08 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Redemption Fees(1) |

0.00 | (2) | 0.00 | (2) | 0.00 | (2) | 0.00 | (2) | 0.00 | (2) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET ASSET VALUE, END OF YEAR |

$19.19 | $16.05 | $19.10 | $24.26 | $34.24 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL RETURN |

22.20 | % | (14.85 | )% | (15.64 | )% | 18.93 | % | (1.95 | )% | ||||||||||

| Ratio/Supplemental Data |

||||||||||||||||||||

| Net Assets, End of Year (in 000’s) |

$1,056,541 | $1,064,866 | $1,871,480 | $3,155,709 | $4,612,354 | |||||||||||||||

| Ratio of Gross Expenses to Average Net Assets |

1.00 | %(3) | 1.00 | % | 1.02 | %(4) | 1.02 | %(4) | 1.03 | %(5) | ||||||||||

| Ratio of Net Expenses to Average Net Assets |

0.80 | %(3)(6) | 0.82 | %(6) | 1.02 | %(4) | 1.02 | %(4) | 1.03 | %(5) | ||||||||||

| Ratio of Net Investment Income (Loss) to Average Net Assets |

0.86 | % | 1.57 | % | 1.14 | % | 1.79 | % | 1.31 | % | ||||||||||

| Portfolio Turnover Rate |

8.05 | % | 16.29 | % | 6.57 | % | 19.19 | % | 40.46 | % | ||||||||||

| (1) | Based on average shares outstanding. |

| (2) | Redemption fees represent less than $0.01. |

| (3) | Less than 0.01% is attributable to legal expenses incurred outside of the 1.00% management fee. |

| (4) | 0.02% is attributable to legal expenses incurred outside of the 1.00% management fee. |

| (5) | 0.03% is attributable to legal expenses incurred outside of the 1.00% management fee and less than 0.01% is attributable to registration fees and miscellaneous expenses incurred outside of the 1.00% management fee. |

| (6) | Effective January 1, 2018, the Manager has agreed to waive, on a voluntary basis, a portion of the management fee of The Fairholme Fund to the extent necessary to limit the management fee paid to the Manager by The Fairholme Fund to an annual rate of 0.80% of the daily average net asset value of The Fairholme Fund. |

The accompanying notes are an integral part of the financial statements.

18

THE FAIRHOLME FOCUSED INCOME FUND

November 30, 2019

The accompanying notes are an integral part of the financial statements.

19

THE FAIRHOLME FOCUSED INCOME FUND

SCHEDULE OF INVESTMENTS (continued)

November 30, 2019

The accompanying notes are an integral part of the financial statements.

20

THE FAIRHOLME FOCUSED INCOME FUND

SCHEDULE OF INVESTMENTS (continued)

November 30, 2019

| (a) | Variable rate security. Rates shown are the effective rates as of November 30, 2019. |

| (b) | Non-income producing security. |

| (c) | Restricted security as set forth in Rule 144A under the Securities Act of 1933. The value of these investments totals $104,481, which represents 0.06% of The Income Fund’s net assets. |

| (d) | Security is perpetual in nature and has no stated maturity date. |

| (e) | Floating rate security. Rate shown is the effective rate as of November 30, 2019. |

| (f) | Security is a fix-to-float security, which carries a fixed coupon until a certain date, upon which it switches to a floating rate. Rate shown is the fixed rate. |

| (g) | Security in default and no interest was accrued as of November 30, 2019. |

| (h) | Rates shown are the effective yields based on the purchase price. The calculation assumes the security is held to maturity. |

| (i) | Restricted security as set forth in Rule 144(a) under the Securities Act of 1933. The value of these investments totals $144,394,248, which represents 80.51% of The Income Fund’s net assets. |

| (j) | Annualized based on the 1-day yield as of November 30, 2019. |

The accompanying notes are an integral part of the financial statements.

21

THE FAIRHOLME FOCUSED INCOME FUND

STATEMENT OF ASSETS & LIABILITIES

November 30, 2019

| Assets |

||||

| Investments, at Fair Value (Cost — $198,222,008) |

$ | 179,291,247 | ||

| Interest Receivable |

103,784 | |||

| Receivable for Investments Sold |

124,514 | |||

|

|

|

|||

| Total Assets

|

179,519,545 | |||

|

|

|

|||

| Liabilities |

||||

| Accrued Management Fees |

118,476 | |||

| Payable for Capital Shares Redeemed |

50,000 | |||

|

|

|

|||

| Total Liabilities |

168,476 | |||

|

|

|

|||

|

NET ASSETS

|

$ | 179,351,069 | ||

|

|

|

|||

|

Net Assets Consist of: |

||||

| Paid-In Capital |

$ | 203,668,681 | ||

| Total Accumulated Losses |

(24,317,612 | ) | ||

|

|

|

|||

|

NET ASSETS

|

$ | 179,351,069 | ||

|

|

|

|||

| Shares of Common Stock Outstanding* ($0.0001 par value) |

17,529,966 | |||

|

|

|

|||

| Net Asset Value, Offering and Redemption Price Per Share ($179,351,069 / 17,529,966 shares) |

$ | 10.23 | ||

|

|

|

|||

* 200,000,000 shares authorized in total.

The accompanying notes are an integral part of the financial statements.

22

THE FAIRHOLME FOCUSED INCOME FUND

| For the Fiscal Year Ended November 30, 2019 |

||||||||||||||||||||||||

| Investment Income |

||||||||||||||||||||||||

| Interest |

$ | 5,769,326 | ||||||||||||||||||||||

| Dividends |

1,273,406 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total Investment Income |

7,042,732 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Expenses |

||||||||||||||||||||||||

| Management Fees |

1,874,109 | |||||||||||||||||||||||

| Legal Expenses |

39,410 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total Expenses |

1,913,519 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Less: Voluntary Reduction of Management Fees |

(374,822 | ) | ||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Net Expenses |

1,538,697 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Net Investment Income |

5,504,035 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Realized and Unrealized Gain on Investments |

||||||||||||||||||||||||

| Net Realized Gain on Investments |

1,878,813 | |||||||||||||||||||||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments |

4,512,746 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Net Realized and Unrealized Gain on Investments |

6,391,559 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| NET INCREASE IN NET ASSETS FROM OPERATIONS |

$ |

11,895,594 |

| |||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

The accompanying notes are an integral part of the financial statements.

23

THE FAIRHOLME FOCUSED INCOME FUND

STATEMENTS OF CHANGES IN NET ASSETS

| For the Fiscal Year Ended November 30, 2019 |

For the Fiscal Year Ended November 30, 2018 |

|||||||||||||||||||||||||||||||||||||||||||||||

| CHANGES IN NET ASSETS |

||||||||||||||||||||||||||||||||||||||||||||||||

| From Operations |

||||||||||||||||||||||||||||||||||||||||||||||||

| Net Investment Income |

$ | 5,504,035 | $ | 10,275,115 | ||||||||||||||||||||||||||||||||||||||||||||

| Net Realized Gain (Loss) on Investments |

1,878,813 | (7,956,448 | ) | |||||||||||||||||||||||||||||||||||||||||||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments and |

||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign Currency Related Translations |

4,512,746 | (11,226,394 | ) | |||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| Net Increase (Decrease) in Net Assets from Operations |

11,895,594 | (8,907,727 | ) | |||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| From Dividends and Distributions to Shareholders |

||||||||||||||||||||||||||||||||||||||||||||||||

| Net Decrease in Net Assets from Dividends and Distributions |

(5,286,649 | ) | (20,470,612 | ) | ||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| From Capital Share Transactions |

||||||||||||||||||||||||||||||||||||||||||||||||

| Proceeds from Sale of Shares |

9,617,338 | 82,350,172 | ||||||||||||||||||||||||||||||||||||||||||||||

| Shares Issued in Reinvestment of Dividends and Distributions |

4,659,430 | 18,536,050 | ||||||||||||||||||||||||||||||||||||||||||||||

| Cost of Shares Redeemed |

(30,034,524 | ) | (106,440,303 | ) | ||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| Net Decrease in Net Assets from Shareholder Activity |

(15,757,756 | ) | (5,554,081 | ) | ||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| NET ASSETS |

||||||||||||||||||||||||||||||||||||||||||||||||

| Net Decrease in Net Assets |

(9,148,811 | ) | (34,932,420 | ) | ||||||||||||||||||||||||||||||||||||||||||||

| Net Assets at Beginning of Year |

188,499,880 | 223,432,300 | ||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| Net Assets at End of Year |

$ | 179,351,069 | $ | 188,499,880 | ||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| SHARES TRANSACTIONS |

||||||||||||||||||||||||||||||||||||||||||||||||

| Issued |

939,727 | 7,580,742 | ||||||||||||||||||||||||||||||||||||||||||||||

| Reinvested |

451,601 | 1,734,291 | ||||||||||||||||||||||||||||||||||||||||||||||

| Redeemed |

(2,932,519 | ) | (9,968,013 | ) | ||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| Net Decrease in Shares |

(1,541,191 | ) | (652,980 | ) | ||||||||||||||||||||||||||||||||||||||||||||

| Shares Outstanding at Beginning of Year |

19,071,157 | 19,724,137 | ||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| Shares Outstanding at End of Year |

17,529,966 | 19,071,157 | ||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of the financial statements.

24

THE FAIRHOLME FOCUSED INCOME FUND

| For the Fiscal Year Ended November 30, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| PER SHARE OPERATING PERFORMANCE |

||||||||||||||||||||

| NET ASSET VALUE, BEGINNING OF YEAR |

$9.88 | $11.33 | $12.38 | $10.72 | $10.82 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Investment Operations |

||||||||||||||||||||

| Net Investment Income(1) |

0.30 | 0.49 | 0.60 | 0.57 | 0.45 | |||||||||||||||

| Net Realized and Unrealized Gain (Loss) on Investments |

0.34 | (0.91 | ) | (0.99 | ) | 1.72 | 0.03 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from Investment Operations |

0.64 | (0.42 | ) | (0.39 | ) | 2.29 | 0.48 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends and Distributions |

||||||||||||||||||||

| From Net Investment Income |

(0.29 | ) | (0.51 | ) | (0.61 | ) | (0.56 | ) | (0.43 | ) | ||||||||||

| From Realized Capital Gains |

— | (0.52 | ) | (0.05 | ) | (0.07 | ) | (0.15 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Dividends and Distributions |

(0.29 | ) | (1.03 | ) | (0.66 | ) | (0.63 | ) | (0.58 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET ASSET VALUE, END OF YEAR |

$10.23 | $9.88 | $11.33 | $12.38 | $10.72 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL RETURN |

6.49 | % | (4.19 | )% | (3.35 | )% | 22.77 | % | 4.60 | % | ||||||||||

| Ratio/Supplemental Data |

||||||||||||||||||||

| Net Assets, End of Year (in 000’s) |

$179,351 | $188,500 | $223,432 | $240,195 | $243,072 | |||||||||||||||

| Ratio of Gross Expenses to Average Net Assets: |

1.02 | %(2) | 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | ||||||||||

| Ratio of Net Expenses to Average Net Assets |

0.82 | %(2)(3) | 0.82 | %(3) | 1.00 | % | 1.00 | % | 1.00 | % | ||||||||||

| Ratio of Net Investment Income to Average Net Assets |

2.94 | % | 4.56 | % | 5.02 | % | 5.48 | % | 4.14 | % | ||||||||||

| Portfolio Turnover Rate |

16.70 | % | 45.78 | % | 36.05 | % | 28.81 | % | 67.05 | % | ||||||||||

| (1) | Based on average shares outstanding. |

| (2) | 0.02% is attributable to legal expenses incurred outside the management fee. |

| (3) | Effective January 1, 2018, the Manager has agreed to waive, on a voluntary basis, a portion of the management fee of The Income Fund to the extent necessary to limit the management fee paid to the Manager by The Income Fund to an annual rate of 0.80% of the daily average net asset value of The Income Fund. |

The accompanying notes are an integral part of the financial statements.

25

THE FAIRHOLME ALLOCATION FUND

November 30, 2019

The accompanying notes are an integral part of the financial statements.

26

THE FAIRHOLME ALLOCATION FUND

SCHEDULE OF INVESTMENTS (continued)

November 30, 2019

| (a) | Non-income producing security. |

| (b) | Restricted/controlled security. The value of this security totals $6,404,630, which represents 10.86% of The Allocation Fund’s net assets. Information related to this security is as follows: |

| Shares |

Issuer |

Acquisition Date(s) |

Acquisition Cost |

11/30/2019 Carrying Value Per Unit | ||||||||

| 348,267 |

The St. Joe Co. | 08/09/2017-09/01/2017 | $ | 6,615,792 | $18.39 | |||||||

| (c) | Variable rate security. Rates shown are the effective rates as of November 30, 2019. |

| (d) | Restricted security as set forth in Rule 144(a) under the Securities Act of 1933. The value of these investments totals $34,663,812, which represents 58.77% of The Allocation Fund’s net assets. |

| (e) | Rates shown are the effective yields based on the purchase price. The calculation assumes the security is held to maturity. |

| (f) | Annualized based on the 1-day yield as of November 30, 2019. |

The accompanying notes are an integral part of the financial statements.

27

THE FAIRHOLME ALLOCATION FUND

STATEMENT OF ASSETS & LIABILITIES

November 30, 2019

| Assets |

||||

| Investments, at Fair Value (Cost — $78,817,674) |

$ | 59,004,844 | ||

| Interest Receivable |

17,383 | |||

|

|

|

|||

| Total Assets |

59,022,227 | |||

|

|

|

|||

| Liabilities |

||||

| Accrued Management Fees |

39,100 | |||

|

|

|

|||

| Total Liabilities |

39,100 | |||

|

|

|

|||

| NET ASSETS |

$ | 58,983,127 | ||

|

|

|

|||

| Net Assets Consist of: |

||||

| Paid-In Capital |

$ | 126,234,356 | ||

| Total Accumulated Losses |

(67,251,229 | ) | ||

|

|

|

|||

| NET ASSETS |

$ | 58,983,127 | ||

|

|

|

|||

| Shares of Common Stock Outstanding* ($0.0001 par value) |

8,423,476 | |||

|

|

|

|||

| Net Asset Value, Offering and Redemption Price Per Share ($58,983,127 / 8,423,476 shares) |

$ | 7.00 | ||

|

|

|

* 200,000,000 shares authorized in total.

The accompanying notes are an integral part of the financial statements.

28

THE FAIRHOLME ALLOCATION FUND

| For the Fiscal Year Ended November 30, 2019 |

||||||||||||||||

| Investment Income |

||||||||||||||||

| Interest |

$ | 1,168,430 | ||||||||||||||

| Dividends |

298,741 | |||||||||||||||

|

|

|

|||||||||||||||

| Total Investment Income |

1,467,171 | |||||||||||||||

|

|

|

|||||||||||||||

| Expenses |

||||||||||||||||

| Management Fees |

721,273 | |||||||||||||||

| Legal Expenses |

15,218 | |||||||||||||||

|

|

|

|||||||||||||||

| Total Expenses |

736,491 | |||||||||||||||

|

|

|

|||||||||||||||

| Less: Voluntary Reduction of Management Fees |

(144,255 | ) | ||||||||||||||

|

|

|

|||||||||||||||

| Net Expenses |

592,236 | |||||||||||||||

|

|

|

|||||||||||||||

| Net Investment Income |

874,935 | |||||||||||||||

|

|

|

|||||||||||||||

| Realized and Unrealized Gain on Investments, Redemption In-Kind and Foreign Currency Related Transactions |

||||||||||||||||

| Net Realized Gain on Investments and Foreign Currency Related Transactions |

363,076 | |||||||||||||||

| Net Realized Gain on Redemption In-Kind |

1,061,539 | |||||||||||||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Related Translations |

3,765,875 | |||||||||||||||

|

|

|

|||||||||||||||

| Net Realized and Unrealized Gain on Investments, Redemption In-Kind and Foreign Currency Related Transactions |

5,190,490 | |||||||||||||||

|

|

|

|||||||||||||||

| NET INCREASE IN NET ASSETS FROM OPERATIONS |

$ | 6,065,425 | ||||||||||||||

|

|

|

|||||||||||||||

The accompanying notes are an integral part of the financial statements.

29

THE FAIRHOLME ALLOCATION FUND

STATEMENTS OF CHANGES IN NET ASSETS

| For the Fiscal Year Ended November 30, 2019 |

For the Fiscal Year Ended November 30, 2018 |

|||||||

| CHANGES IN NET ASSETS |

||||||||

| From Operations |

||||||||

| Net Investment Income |

$ | 874,935 | $ | 1,223,907 | ||||

| Net Realized Gain (Loss) on Investments, Redemption In-Kind and Foreign Currency Related Transactions |

1,424,615 | (48,412,833 | ) | |||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Related Translations |

3,765,875 | 38,497,966 | ||||||

|

|

|

|

|

|||||

| Net Increase (Decrease) in Net Assets from Operations |

6,065,425 | (8,690,960 | ) | |||||

|

|

|

|

|

|||||

| From Dividends and Distributions to Shareholders |

||||||||

| Net Decrease in Net Assets from Dividends and Distributions |

(791,785 | ) | (1,817,020 | ) | ||||

|

|

|

|

|

|||||

| From Capital Share Transactions |

||||||||

| Proceeds from Sale of Shares |

1,417,681 | 1,433,796 | ||||||

| Shares Issued in Reinvestment of Dividends and Distributions |

757,745 | 1,779,557 | ||||||

| Redemption Fees |

2,187 | 285 | ||||||

| Cost of Shares Redeemed |

(16,966,140 | ) | (34,508,769 | ) | ||||

| Cost of Shares Redeemed In-Kind |

(3,889,024 | ) | — | |||||

|

|

|

|

|

|||||

| Net Decrease in Net Assets from Shareholder Activity |

(18,677,551 | ) | (31,295,131 | ) | ||||

|

|

|

|

|

|||||

| NET ASSETS |

||||||||

| Net Decrease in Net Assets |

(13,403,911 | ) | (41,803,111 | ) | ||||

| Net Assets at Beginning of Year |

72,387,038 | 114,190,149 | ||||||

|

|

|

|

|

|||||

| Net Assets at End of Year |

$ | 58,983,127 | $ | 72,387,038 | ||||

|

|

|

|

|

|||||

| SHARES TRANSACTIONS |

||||||||

| Issued |

202,579 | 197,013 | ||||||

| Reinvested |

118,029 | 234,152 | ||||||

| Redeemed |

(2,229,510 | ) | (4,778,281 | ) | ||||

| Redeemed In-Kind |

(675,384 | ) | — | |||||

|

|

|

|

|

|||||

| Net Decrease in Shares |

(2,584,286 | ) | (4,347,116 | ) | ||||

| Shares Outstanding at Beginning of Year |

11,007,762 | 15,354,878 | ||||||

|

|

|

|

|

|||||

| Shares Outstanding at End of Year |

8,423,476 | 11,007,762 | ||||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the financial statements.

30

THE FAIRHOLME ALLOCATION FUND

| For the Fiscal Year Ended November 30, | ||||||||||||||||||||

| 2019 |

2018 |

2017 |

2016 |

2015 |

||||||||||||||||

| PER SHARE OPERATING PERFORMANCE |

||||||||||||||||||||

| NET ASSET VALUE, BEGINNING OF YEAR |

$6.58 | $7.44 | $9.65 | $10.40 | $12.57 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Investment Operations |

||||||||||||||||||||

| Net Investment Income(1) |

0.09 | 0.09 | 0.10 | 0.14 | 0.35 | |||||||||||||||

| Net Realized and Unrealized Gain (Loss) on Investments |

0.40 | (0.83 | ) | (1.71 | ) | 0.75 | (1.38 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from Investment Operations |

0.49 | (0.74 | ) | (1.61 | ) | 0.89 | (1.03 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends and Distributions |

||||||||||||||||||||

| From Net Investment Income |

(0.07 | ) | (0.12 | ) | (0.17 | ) | (0.31 | ) | — | |||||||||||

| From Realized Capital Gains |

— | — | (0.43 | ) | (1.33 | ) | (1.14 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Dividends and Distributions |

(0.07 | ) | (0.12 | ) | (0.60 | ) | (1.64 | ) | (1.14 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Redemption Fees(1) |

0.00 | (2) | 0.00 | (2) | 0.00 | (2) | 0.00 | (2) | 0.00 | (2) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET ASSET VALUE, END OF YEAR |

$7.00 | $6.58 | $7.44 | $9.65 | $10.40 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL RETURN |

7.61 | % | (10.18 | )% | (17.59 | )% | 11.06 | % | (8.88 | )% | ||||||||||

| Ratio/Supplemental Data |

||||||||||||||||||||

| Net Assets, End of Year (in 000’s) |

$ | 58,983 | $ | 72,387 | $ | 114,190 | $ | 259,501 | $ | 297,527 | ||||||||||

| Ratio of Gross Expenses to Average Net Assets: |

1.02 | %(3) | 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | ||||||||||

| Ratio of Net Expenses to Average Net Assets |

0.82 | %(3)(4) | 0.82 | %(4) | 1.00 | % | 1.00 | % | 1.00 | % | ||||||||||

| Ratio of Net Investment Income (Loss) to Average Net Assets |

1.21 | % | 1.32 | % | 1.19 | % | 1.81 | % | 3.09 | % | ||||||||||

| Portfolio Turnover Rate |

15.58 | % | 23.52 | % | 31.01 | % | 13.65 | % | 39.24 | % | ||||||||||

| (1) | Based on average shares outstanding. |

| (2) | Redemption fees represent less than $0.01. |

| (3) | 0.02% is attributable to legal expenses incurred outside the management fee. |

| (4) | Effective January 1, 2018, the Manager has agreed to waive, on a voluntary basis, a portion of the management fee of The Allocation Fund to the extent necessary to limit the management fee paid to the Manager by The Allocation Fund to an annual rate of 0.80% of the daily average net asset value of The Allocation Fund. |

The accompanying notes are an integral part of the financial statements.

31

FAIRHOLME FUNDS, INC.

November 30, 2019

Note 1. Organization

Fairholme Funds, Inc. (the “Company”), a Maryland corporation, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company’s Articles of Incorporation permit the Board of Directors of the Company (the “Board” or the “Directors”) to issue 1,100,000,000 shares of common stock at $.0001 par value. 700,000,000 shares have been allocated to The Fairholme Fund (“The Fairholme Fund”), 200,000,000 shares have been allocated to The Fairholme Focused Income Fund (“The Income Fund”), and 200,000,000 shares have been allocated to The Fairholme Allocation Fund (“The Allocation Fund”). The Fairholme Fund, The Income Fund, and The Allocation Fund (each a “Fund” and collectively the “Funds”) are non-diversified funds. The Funds may have a greater percentage of their assets invested in particular securities than a diversified fund, exposing the Funds to the risk of unanticipated industry conditions as well as risks specific to a single company or the securities of a single company. Each Fund has different objectives, capitalizations, and considerations that may or may not lead to differing compositions of issuers, securities within an issuer, and cash levels within each Fund. The Board has the power to designate one or more separate and distinct series and/or classes of shares of common stock and to classify or reclassify any unissued shares with respect to such series.

The Fairholme Fund’s investment objective is to provide long-term growth of capital. Under normal circumstances, The Fairholme Fund seeks to achieve its investment objective by investing in a focused portfolio of equity and fixed-income securities. The proportion of The Fairholme Fund’s assets invested in each type of asset class will vary from time to time based upon Fairholme Capital Management, L.L.C.’s (the “Manager”) assessment of general market and economic conditions. The Fairholme Fund may invest in, and may shift frequently among, the asset classes and market sectors. The equity securities in which The Fairholme Fund may invest include common and preferred stock (including convertible preferred stock), partnership interests, business trust shares, interests in real estate investment trusts (“REITs”), rights and warrants to subscribe for the purchase of equity securities, and depository receipts. The Fairholme Fund may invest in equity securities without regard to the jurisdictions in which the issuers of the securities are organized or situated and without regard to the market capitalizations or sectors of such issuers. The fixed-income securities in which The Fairholme Fund may invest include U.S. corporate debt securities, non-U.S. corporate debt securities, bank debt (including bank loans and participations), U.S. government and agency debt securities (including U.S. Treasury bills), short-term debt obligations of foreign governments, and foreign money market instruments. Except for its investments in short-term debt obligations of foreign governments, The Fairholme Fund may invest in fixed-income securities regardless of maturity or the rating of the issuer of the security. The Fairholme Fund may also invest in “special situations” to achieve its objective. “Special situation” investments may include equity securities or fixed-income securities, such as corporate debt, which may be in a distressed position as a result of economic or company specific developments. Although The Fairholme Fund normally holds a focused portfolio of equity and fixed-income securities, The Fairholme Fund is not required to be fully invested in such securities and may maintain a significant portion of its total assets in cash and securities generally considered to be cash equivalents. The Manager serves as investment adviser to The Fairholme Fund.

The Income Fund’s investment objective is to seek current income. Under normal circumstances, The Income Fund seeks to achieve its investment objective by investing in a focused portfolio of cash distributing securities. To maintain maximum flexibility, the securities in which The Income Fund may invest include corporate bonds and other corporate debt securities of issuers in the U.S. and foreign countries, bank debt (including bank loans and loan participations), government and agency debt securities of the U.S. and foreign countries (including U.S. Treasury bills), convertible bonds and other convertible securities, and equity securities, including preferred and common stock and interests in REITs. Although The Income Fund normally holds a focused portfolio of securities, The Income Fund is not required to be fully invested in such securities and may maintain a significant portion of its total assets in cash and securities generally considered to be cash equivalents. The Manager serves as investment adviser to The Income Fund.

The Allocation Fund’s investment objective is to seek long-term total return. Under normal circumstances, The Allocation Fund seeks to achieve its investment objective by investing opportunistically in a focused portfolio of investments in the equity, fixed-income and cash, and cash-equivalent asset classes. The proportion of The Allocation Fund’s portfolio invested

32

FAIRHOLME FUNDS, INC.

NOTES TO FINANCIAL STATEMENTS (continued)

November 30, 2019

in each asset class will vary from time to time based on the Manager’s assessment of relative fundamental values of securities and other investments in the asset class, the attractiveness of investment opportunities within each asset class, general market and economic conditions, and expected future returns of other investment opportunities. The Allocation Fund seeks to capitalize on anticipated fluctuations in the financial markets by changing the mix of its holdings in the targeted asset classes. The Allocation Fund may maintain a significant portion of its assets in cash and cash-equivalent securities and investments. The Manager serves as investment adviser to The Allocation Fund.

There is no guarantee that the Funds will meet their respective objectives.

Note 2. Significant Accounting Policies

As investment companies, the Funds follow the investment company accounting and reporting guidance, which is part of U.S. generally accepted accounting principles (“U.S. GAAP”). The Funds’ investments are reported at fair value as defined by U.S. GAAP. The Funds calculate their net asset values as soon as practicable following the close of regular trading on the New York Stock Exchange (currently 4:00 p.m. Eastern Time) on each day the New York Stock Exchange is open.

New Accounting Pronouncements: To improve the effectiveness of fair value disclosure requirements, the Financial Accounting Standards Board issued Accounting Standard Update (ASU) 2018-13, Fair Value Measurement Disclosure Framework –Changes to the Disclosure Requirements for Fair Value Measurement (ASU 2018-13), which adds, removes, and modifies certain aspects relating to fair value disclosure. ASU 2018-13 is effective for interim and annual reporting periods beginning after December 15, 2019; early adoption of the additions relating to ASU 2018-13 is not required, even if early adoption is elected for the removals and modifications under ASU 2018-13. Management has early adopted the removals and modifications set forth in ASU 2018-13 in these financial statements and has not early adopted the additions set forth in ASU 2018-13.

A description of the valuation techniques applied to the Funds’ securities measured at fair value on a recurring basis follows:

Security Valuation:

Equity securities (common and preferred stocks): Securities traded on a national securities exchange or reported on the NASDAQ national market are generally valued at the official closing price, or at the last reported sale price on the exchange or market on which the securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. To the extent these securities are actively traded and valuation adjustments are not applied, they are classified in Level 1 of the fair value hierarchy. If these securities are not actively traded, they are classified in Level 2. Subject to the oversight of the Board, the Manager may determine the fair valuation of a security when market quotations are insufficient or not readily available, when securities are determined to be illiquid or restricted, or when in the judgment of the Manager the prices or values available do not represent the fair value of the instrument. In these situations, if the inputs are observable, the valuation will be classified in Level 2 of the fair value hierarchy, otherwise they would be classified in Level 3.

Fixed-income securities (U.S. government obligations, corporate bonds, convertible bonds, and asset backed securities): The fair value of fixed-income securities is determined using market quotations when readily available, but may also be estimated by various methods when no such market quotations exist and when the Manager believes these other methods reflect the fair value of such securities. These methods may consider recently executed transactions in securities of the issuer or comparable issuers and market price valuations from independent pricing services and/or brokers (where observable). Where the Manager deems it appropriate to do so (such as when independent prices are unavailable or not deemed to be representative of fair value) fixed income securities will be fair valued in good faith following consideration by, and conclusion of, the Manager’s Valuation and Liquidity Risk Management Committee. As of November 30, 2019, fixed-income securities are valued by the Manager utilizing observable market prices on the day of valuation or the average bid of independent broker/dealer quotes and/or the average of valuations from independent pricing services. Although fixed-income securities are classified in Level 2 of the fair value hierarchy at November 30, 2019, in instances where significant unobservable inputs are used, they would be classified in Level 3.

33

FAIRHOLME FUNDS, INC.

NOTES TO FINANCIAL STATEMENTS (continued)

November 30, 2019

Open-end mutual funds: Investments in open-end mutual funds including money market funds are valued at their closing net asset value each business day and are classified in Level 1 of the fair value hierarchy.

Short-term securities: Investments in securities with maturities of less than sixty days when acquired, or which subsequently are within sixty days of maturity, shall be valued at prices supplied by an independent pricing source or by one of the Funds’ pricing agents based on broker or dealer supplied valuations or matrix pricing. To the extent the inputs are observable and timely, the values would be classified in Level 2 of the fair value hierarchy.